UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number 811-22678

Salient MF Trust

(Exact name of registrant as specified in charter)

4265 SAN FELIPE, 8TH FLOOR, HOUSTON, TX 77027

(Address of principal executive offices) (Zip code)

| | |

With a copy to: |

| John A. Blaisdell | | George J. Zornada |

| Salient MF Trust | | K & L Gates LLP |

| 4265 San Felipe, 8th Floor | | State Street Financial Center |

| Houston, TX 77027 | | One Lincoln Street |

| (Name and address of agent for service) | | Boston, MA 02111-2950 |

| | (617) 261-3231 |

Registrant’s telephone number, including area code: 713-993-4675

Date of fiscal year end: 12/31/15

Date of reporting period: 12/31/15

Item 1. Reports to Stockholders.

TABLE OF CONTENTS

This report is submitted for the general information of the shareholders of the Funds. It is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus, which includes information regarding the Funds’ risks, objectives, fees and expenses, experience of their management and other information.

Shareholder Update | December 31, 2015

| | |

| A MESSAGE FROM: | | John A. Blaisdell |

| | Chief Executive Officer |

Dear Shareholder:

The importance of a diversified portfolio has never been more evident after a year of slow growth and high levels of volatility across markets globally. As we enter 2016, we anticipate investors may face many of the same concerns. We believe traditional stock and bond portfolios are generally not adaptive or resilient enough in challenging markets. At Salient, we have assembled portfolio management teams to oversee investment strategies designed to serve as the essential building blocks of efficient and effective portfolios.

A slowdown in growth, namely from China, reverberated through markets during the latter half of the year. Many of the gains in the U.S. equity market were erased by year-end and the falling price of oil was regularly in the headlines. These concerns did not dissuade the Federal Reserve in December from embarking on the first of several outlined interest rate increases. Investors had few safe havens in 2015, and 2016 is expected to generate similarly low returns.

In the second half of 2015, Salient completed the integration of Forward Management, LLC. After the acquisition in June, the combined firm aligned investment teams and strategies. Our platform includes over 50 investment professionals in offices located in Houston, San Francisco and Newport Beach. Products span a range of asset classes, including master limited partnerships (MLPs), real estate, fixed income, credit and managed futures. In November, we announced that the combined organization will operate as Salient and unveiled a new logo and branding that reflects qualities that we believe differentiate our firm. In 2016, we will unveil a redesigned SalientPartners.com website.

In closing, I want to thank you, our shareholders, for the opportunity to be your investment partner. We will strive to keep earning your trust as we continue to advance and evolve our capabilities.

Sincerely,

John A. Blaisdell

Chief Executive Officer

Salient

1

RISKS

There are risks involved with investing, including loss of principal. Past performance does not guarantee future results, share prices will fluctuate and you may have a gain or loss when you redeem shares.

Alternative strategies typically are subject to increased risk and loss of principal. Consequently, investments such as mutual funds which focus on alternative strategies are not suitable for all investors.

Diversification does not assure profit or protect against risk.

Volatility is a statistical measure of the dispersion of returns for a given security or market index.

2

Shareholder Update | December 31, 2015

| | |

| A MESSAGE FROM: | | Lee Partridge, CAIA, CFA |

| | Chief Investment Officer |

Dear Shareholder:

Markets ended 2015 with low returns across the board as a number of woes plagued investors. Many key data points demonstrate that the market is more pessimistic about growth than what the Federal Reserve’s decision to raise interest rates in December suggests. Growth concerns also plagued China and Europe, and along with the divergence of Central Bank policy, spawned headwinds for investors. As we enter 2016, we are faced with a number of challenges that will likely result in another year of low returns.

2015 Summary

The S&P 500 Index generated a 1.38% return in 2015, marking the worst year of performance since 2008. The gain was driven entirely by dividends paid to investors, which offset a modest price decline of -0.7%. Consumer discretionary stocks led the market, closing up 10.11% for the year, while consumer staple stocks increased 6.6%. Energy stocks were the biggest detractor (-21.12%) followed by materials stocks (-8.38%). Small cap stocks, as represented by the Russell 2000 Index, posted a -4.41% loss for the year.

The dollar advanced 9.26% versus a trade-weighted basket of foreign currencies as the euro lost -10.22% versus the greenback. Japanese equities, as measured by the Tokyo Stock Price Index, gained 12.06% while German stocks, as measured by the German Stock Index (DAX), advanced 9.56% over the course of the year (in their respective currencies). Emerging market stocks continued to fare poorly as the MSCI Emerging Markets Index tumbled -14.83% during the year.

High yield bonds finished the year down -4.47%, as measured by the Barclays U.S. Corporate High-Yield Bond Index, while core fixed income returns were up 0.55%, as measured by Barclays U.S. Aggregate Bond Index. We note that during the third round of the Federal Reserve’s quantitative easing program in 2013, corporate high yield issuance reached current cycle highs. We would typically expect to see a distressed cycle occur three to five years following peak issuance, which would fall into calendar years 2016-2018. 2015 represented the first negative return posted by high yield bonds since the 2008 financial crisis.

The yield on the 10-year U.S. Treasury note rose a modest 0.1% over the course of the year despite the Federal Reserve’s decision to raise short-term interest rates at its December Federal Open Market Committee meeting. We believe the low nominal yields on longer dated U.S. Treasury securities reflect market sentiment with respect to muted growth prospects and nascent inflation concerns for the U.S. specifically and for the global economy more generally.

2016 Outlook

As we approach the eighth year of this current market expansion, we would like to share our thoughts on market positioning, which includes an underweight to risk assets, including stocks and credit-sensitive bonds, in favor of safe haven assets like developed sovereign debt as well as more market neutral strategies.

| | 1. | We believe the headwind of a rising dollar will likely diminish the competitiveness of the U.S. export sector, reduce profits from foreign operations and challenge emerging market companies that externally finance their operations in dollars with principal revenue sources denominated in their home currencies. The Federal Reserve’s tightening of short-term interest rates will likely further strengthen the dollar. |

3

| | 2. | In addition to the currency-related challenges noted above, the continued price decline in natural resources and slowing demand from China represent meaningful challenges for a number of emerging market economies. Furthermore, nearly all emerging market economies have shifted from accumulating to dispersing foreign exchange reserves. |

| | 3. | The decline in both nominal and real interest rates continues to paint a troubling picture of global deflationary pressure and low capital market returns. |

| | 4. | The sharp decline in energy prices witnessed last year has created stress in both stock and bond markets. Following the peak debt issuance in 2013 and the first half of 2014, many energy companies may be forced to restructure balance sheets and consider strategic options as their asset bases have eroded. |

| | 5. | Global debt remains at record highs and exceeds the 2007 levels that resulted in the financial crisis of 2008. The methods for dealing with overindebtedness—increasing taxes, decreasing expenditures, growing out of it, inflating out of it or restructuring it—seem either unpalatable or undoable. |

Despite this laundry list of woes, we entered 2016 with the S&P 500 trading at 18.26 times its trailing 12-month earnings while the federal funds target rate hovers between 0.25% and 0.50%, high yield bond yields have crept up to 8.74%, 10-year U.S. Treasurys yield a modest 2.27% and the price of West Texas Intermediate crude oil closed the year out at $37.04 per barrel.

With such little margin of safety from a valuation perspective, we encourage investors to consider the level of risk embedded in their portfolios and the sources of that risk.

We are humbled by the trust you have placed with us as investors and remain grateful for the opportunities you have given to us.

Sincerely,

Lee Partridge, CAIA, CFA

Chief Investment Officer

Salient

4

RISKS

There are risks involved with investing, including loss of principal. Past performance does not guarantee future results, share prices will fluctuate and you may have a gain or loss when you redeem shares.

10-year U.S. Treasury is a debt obligation issued by the U.S. Treasury that has a term of more than one year but not more than 10 years.

Barclays U.S. Aggregate Bond Index represents securities that are U.S. domestic, taxable and dollar denominated. The index covers the U.S. investment-grade, fixed-rate bond market, with index components for government and corporate securities, mortgage pass-through securities and asset-backed securities.

Barclays U.S. Corporate High-Yield Bond Index covers the USD-denominated, noninvestment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch and S&P is Ba1/BB+/BB+ or below.

Federal funds target rate is the overnight lending rate that the Federal Open Market Committee seeks to obtain through money markets in an effort to achieve the maximum rate of economic growth.

German Stock Index (DAX) is a stock index that represents 30 of the largest and most liquid German companies that trade on the Frankfurt Exchange.

Margin of safety (safety margin) is the difference between the intrinsic value of a stock and its market price.

MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets.

Quantitative easing refers to a form of monetary policy used to stimulate an economy where interest rates are either at, or close to, zero.

Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index. The Russell 3000 Index represents approximately 98% of the investable U.S. equity market.

S&P 500 Index is an unmanaged index of 500 common stocks chosen to reflect the industries in the U.S. economy.

Tokyo Stock Price Index (TOPIX) is a capitalization-weighted index that measures stock prices on the Tokyo Stock Exchange.

Valuation is the process of determining the value of an asset or company based on earnings and the market value of assets.

One cannot invest directly in an index.

Lee Partridge has earned the right to use the Chartered Financial Analyst designation. CFA Institute marks are trademarks owned by CFA Institute.

Salient is the trade name for Salient Partners, L.P., which together with its subsidiaries provides asset management and advisory services. This information is being provided solely for educational purposes

5

and is not an offer to sell or solicitation of an offer to buy an interest in any investment fund. Any such offer or solicitation may only be made by means of a confidential private offering memorandum or prospectus relating to a particular fund and only in a manner consistent with federal and applicable state securities laws.

Forward Funds are distributed by Forward Securities, LLC.

Not FDIC Insured | No Bank Guarantee | May Lose Value

©2016 Salient. All rights reserved.

The discussions concerning the funds included in this shareholder report may contain certain forward-looking statements about the factors that may affect performance of the funds in the future, including the portfolio managers’ outlook regarding economic, market, political and other factors relevant to investment performance. These statements are based on the portfolio managers’ expectations concerning certain future events and their expected impact on the funds, and are current only through the date on the cover of this report. Forward-looking statements are inherently uncertain and are not intended to predict the future performance of the funds. Actual events may cause adjustments in the portfolio managers’ strategies from those currently expected to be employed, and the outlook of the portfolio managers is subject to change.

6

| | |

| | Salient Risk Parity Fund Management Discussion of Fund Performance - Letter to Shareholders |

Dear Fellow Shareholders:1

The Salient Risk Parity Fund (the “Fund”) finished 2015 down 10.88% (Class I) with the bulk of the pullback coming from long commodity exposure. Long exposures to sovereign debt and tilts from the Fund’s momentum sleeve contributed to performance but were not enough to overcome the pullback from commodities.

| | | | | | | | | | | | | | | | | | |

| Share Class | | Commencement

Date | | Net Performance

without Sales Charge | | 60/40 Index2 Return | | MSCI AC World

Index2 Return | | Barclays Aggregate

Bond Index2 Return |

| | | 2015 | | Average

Annual

Since Inception | | 2015 | | Average

Annual Since

Inception

of Fund

Share

Class | | 2015 | | Average

Annual Since

Inception

of Fund

Share

Class | | 2015 | | Average Annual Since Inception

of Fund

Share Class |

| | | | | | | | | | | | | | | | | | | |

| Class A (SRPAX) | | 11/15/2012 | | -11.18% | | -0.49% | | -0.96% | | 6.49% | | -2.36% | | 9.78% | | 0.55% | | 1.34% |

| Class C (SRPCX) | | 10/01/2012 | | -11.86% | | -1.76% | | -0.96% | | 5.39% | | -2.36% | | 7.85% | | 0.55% | | 1.38% |

| Class I (SRPFX) | | 07/09/2012 | | -10.88% | | -0.35% | | -0.96% | | 6.60% | | -2.36% | | 9.79% | | 0.55% | | 1.57% |

| | | | | | | | | | | | | | | |

| Share Class | | Commencement

Date | | Net Performance with

Maximum Sales Charge |

| | | 2015 | | Since Inception |

| | | | | | | | | | |

| Class A (SRPAX) | | 11/15/2012 | | -16.08% | | 2.28% |

| Class C (SRPCX) | | 10/01/2012 | | -12.63% | | -1.76% |

Sources: Salient Advisors, L.P. and Bloomberg, December 31, 2015.

Returns above are as of December 31, 2015.

Performance data quoted represents past performance and does not guarantee future results. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than that shown. Returns with sales charge reflect the deduction of current maximum front end sales charge of 5.50% for Class A shares, and the maximum contingent deferred sales charge of 1.00% which is applied to Class C shares. All returns reflect reinvestment of all dividend and capital gain distributions. To obtain performance information current to the most recent month-end please call 866-667-9228. The total annual gross and net operating expense ratios for the Fund, based on the current Fund prospectus dated April 30, 2015, are as follows: Class A shares are 1.63% and 1.60%, respectively, Class C shares are 2.38% and 2.35%, respectively, and Class I shares are 1.38% and 1.35%, respectively. The adviser has contractually agreed to waive fees and/or reimburse expenses to maintain the Fund’s total operating expenses at 1.55% for Class A, 2.30% for Class C and 1.30% for Class I shares, excluding certain expenses, until July 31, 2016. Returns shown in the tables do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

1 Certain statements in this letter are forward-looking statements. The forward-looking statements and other views expressed herein are those of the portfolio managers and the Fund as of the date of this letter. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein. There can be no assurance that the Fund will achieve its investment objectives. The value of the Fund will fluctuate with the value of the underlying securities.

2 The 60/40 Index represents an allocation of 60% MSCI AC World Index (Equities), 40% Barclays Aggregate Bond Index (Bonds)—formerly the Lehman Aggregate Bond Index through Nov. 2008. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The Barclays Capital U.S. Aggregate Bond Index is a composite comprised of the Barclays Capital U.S. Intermediate Government/Credit Index and the Barclay Capital Mortgage-Backed Securities Index. All issues in the index are rated investment grade or higher, have a least one year to maturity, and have an outstanding par value of at least $100 million. Note that the Fund’s allocation may differ substantially from 60% equities and 40% stocks. The index returns are from 7/9/2012 onwards (Class I shares) and from 10/1/2012 (Class C shares) and from 11/15/2012 (Class A shares). One cannot invest directly in an index. Index performance does not reflect the deduction of fees and expenses.

7

Annual Update

The slide in energy prices that began in the third quarter of 2014 continued through 2015 and placed mounting pressure on international equity and credit markets. Even though the US Federal Reserve raised short-term rates for the first time in nearly a decade, other central banks around the world increased their stimulus efforts. Long positions in sovereign debt ended up being one of the few investments that produced a positive return in 2015. The MSCI ACWI index lost 2.36% while the Barclays HY Credit index fell 4.47% and the Continuous Commodity Index fell 15.22%.

Consistent with the negative returns generated by three of the four major asset classes included in the opportunity set, the Fund generated a negative return over the course of the year. Momentum tilts helped mitigate the loss by reducing commodity exposure and increasing exposure to sovereign debt. Unfortunately, these gains were overshadowed by the magnitude of the pullback in commodities. While we believe that commodities play an important role in the portfolio because they can perform well in an environment with a high degree of surprise inflation, growth concerns and more general disinflation caused this asset class to lag. The sovereign debt exposures in the portfolio did not counterbalance the negative return generated by these commodities. Risk Parity maintains balanced exposure to asset classes that respond to different economic environments in order to create a portfolio that can perform across changing economic regimes. Even though risk parity would likely lag allocation approaches without commodity exposure in 2015, we believe in the benefits of maintaining exposure to the asset class in a long-term asset allocation framework.

Fund Contribution

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Equities | | | Commodities | | | Rates | | | Credit | | | Momentum | | | Total | |

| 2015 | | | -1.46 | % | | | -13.47 | % | | | 1.88 | % | | | -1.41 | % | | | 3.54 | % | | | -10.88 | % |

| Jan 15 | | | 0.21 | % | | | -2.49 | % | | | 4.35 | % | | | 0.00 | % | | | 2.96 | % | | | 5.03 | % |

| Feb 15 | | | 2.19 | % | | | -0.12 | % | | | -2.60 | % | | | 0.00 | % | | | -1.03 | % | | | -1.56 | % |

| Mar 15 | | | -0.11 | % | | | -2.37 | % | | | 1.15 | % | | | 0.09 | % | | | 2.30 | % | | | 1.06 | % |

| Apr 15 | | | 0.93 | % | | | 2.86 | % | | | -1.66 | % | | | 0.06 | % | | | -1.99 | % | | | 0.21 | % |

| May 15 | | | 0.04 | % | | | -1.27 | % | | | -0.42 | % | | | -0.20 | % | | | 1.01 | % | | | -0.84 | % |

| Jun 15 | | | -1.05 | % | | | 0.93 | % | | | -1.88 | % | | | -1.06 | % | | | -2.84 | % | | | -5.89 | % |

| Jul 15 | | | -0.19 | % | | | -4.65 | % | | | 2.11 | % | | | 1.11 | % | | | 3.52 | % | | | 1.90 | % |

| Aug 15 | | | -3.43 | % | | | -0.56 | % | | | 0.29 | % | | | -1.24 | % | | | -1.53 | % | | | -6.48 | % |

| Sep 15 | | | -1.23 | % | | | -1.13 | % | | | 1.98 | % | | | -2.14 | % | | | -0.88 | % | | | -3.40 | % |

| Oct 15 | | | 2.42 | % | | | -0.69 | % | | | -0.61 | % | | | 3.65 | % | | | 0.58 | % | | | 5.35 | % |

| Nov 15 | | | -0.33 | % | | | -3.88 | % | | | -0.35 | % | | | -0.07 | % | | | 2.67 | % | | | -1.96 | % |

| Dec 15 | | | -1.02 | % | | | -0.50 | % | | | -0.13 | % | | | -1.33 | % | | | -1.09 | % | | | -4.06 | % |

8

Looking at the monthly contribution from each sleeve to fund performance provides insight into how the strategy is designed to operate. With the exception of December, every month had some sleeves contributing to performance while others detracted. This is what we expect to see in a diversified portfolio. Uncorrelated asset classes should produce their gains and losses at different times. As long as these asset classes provide positive returns and/or enough diversification benefit over time, we believe that maintaining balanced risk exposure should lead to enhanced efficiency or increased returns for the targeted level of risk.

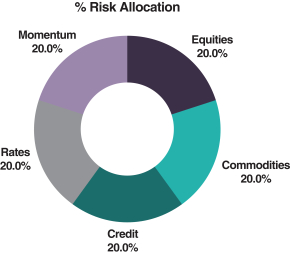

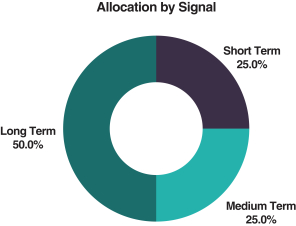

The Fund’s allocation as of December 31, 2015 is shown in the pie charts below:

The data displayed in pie charts have been rounded to the nearest whole number for illustrative purposes only. Allocations are subject to change. Dollar allocation represents the percentage of the Fund’s total net exposure

Source: Salient Advisors, L.P., December 31, 2015.

Investment Strategies and Techniques

The Fund seeks long term capital appreciation. The Fund seeks to achieve this goal by constructing a portfolio that balances equal risk exposure to a set of equities, commodities, interest rates, and momentum. While equities, commodities, and interest rates are asset classes, momentum is a strategy that trades the same underlying assets used in our long-only equity, commodity, and interest rate sleeves on a long/short basis. The momentum strategy buys exposure (i.e. “goes long”) assets that have appreciated in the past year and sells exposure (i.e. “goes short”) assets that have depreciated. Risk is measured in terms of a statistic called covariance, which measures the degree to which assets have moved together historically.

Salient Advisors, L.P. (the “Adviser” or “Salient”) uses a mathematical approach in seeking to achieve the investment objective of the Fund. Using this approach, Salient determines the type, quantity, and mix of investment positions that the Fund should hold in order to achieve equal risk across asset classes/strategies and, to the degree possible, within the asset classes as well. The Adviser does not invest the assets of the Fund in securities or financial instruments based on its view of the investment merit of a particular security or instrument. In addition, the Adviser does not conduct conventional research or analysis, forecast market movements, or take defensive positions apart from those resulting from the systematic allocation to momentum.

9

The Fund’s top five positions based on risk contribution as of December 31, 2015 are shown below:

| | |

| Top 5 Positions by Risk |

| Position | | % Risk |

| S&P 500 | | 14.6% |

| CAC 40 | | 10.1% |

| 10 Yr Gilt | | 9.2% |

| AEX | | 8.9% |

| 10 Yr US Treasury | | 7.5% |

The calculation of risk contribution is based on modern portfolio theory’s calculation of portfolio risk and the contribution of a portfolio’s underlying assets to the portfolio risk are based on the dollar weights, standard deviation, and correlation as calculated by Salient Advisors, L.P.

Allocations are subject to change. Data displayed here has been rounded to the nearest tenth for illustrative purposes only. The specific securities identified are not representative of all securities purchased or held by the Fund, and it should not be assumed that the investment in the securities was or will be profitable. Source: Salient Advisors, L.P., December 31, 2015.

Under normal conditions the Fund seeks to invest in derivatives that create economic leverage and whose performance is expected to correspond to the performance of the underlying asset classes without investing directly in those asset classes. Using derivatives allows us to gain more exposure to the asset classes than investing in more traditional assets such as stocks and bonds would allow. The performance of derivative instruments is tied to the performance of an underlying currency, security, index, commodity or other asset. In addition to risks relating to their underlying assets, the use of derivatives may include other, possibly greater, risks. Derivatives involve costs, may be volatile, and may involve a small initial investment relative to the risk assumed. Risks associated with the use of derivatives may include counterparty, margin, leverage, correlation, liquidity, tax, market, interest rate and management risks, as well as the risk of potential increased regulation of swaps and other derivatives. Derivatives may also be more difficult to purchase, sell or value than other investments. The Fund may lose more than the cash amount invested on investments in derivatives. Each of these risks is typically greater for the Fund than mutual funds that do not use derivatives to implement their investment strategy.

2016 Macro Update

Markets ended 2015 with low returns across the board as a number of woes plagued investors. Many key data points demonstrate that the market is more pessimistic about growth than what the Federal Reserve’s December action suggests. The combination of growth concerns that beset China and Europe coupled with the divergence of Central Bank policy spawned headwinds for investors during the year. As we enter 2016, we are faced with a number of challenges that will likely result in another year of low returns.

The S&P 500 Index generated a 1.37% return in 2015, marking the worst year of performance since 2008. The gain was driven entirely by dividends paid to investors, which offset a modest price decline of 0.7%. Consumer discretionary stocks led the market, closing up 10.11% for the year, while consumer staple stocks increased 6.6%. Energy stocks were the biggest detractor -21.12% followed by materials stocks -8.38%. Small cap stocks, as represented by the Russell 2000 Index, posted a 4.41% loss for the year.

The dollar advanced 9.26% versus a trade-weighted basket of foreign currencies as the euro lost 10.22% versus the greenback. Japanese equities, as measured by the Tokyo Stock Price Index, gained 12.06% while German stocks, as measured by the German Stock Index, advanced 9.56% over

10

the course of the year (in their respective currencies). Emerging market stocks continued to fare poorly as the MSCI Emerging Markets Index tumbled 14.83% during the year.

High yield bonds finished the year down 4.47%, as measured by the Barclays U.S. Corporate High Yield Bond Index, while core fixed income returns were up 0.55%, as measured by Barclays U.S. Aggregate Bond Index. We note that during the third round of the Federal Reserve’s quantitative easing program in 2013, corporate high yield issuance reached current cycle highs. We would typically expect to see a distressed cycle occur three to five years following peak issuance, which would fall into calendar years 2016-2018. 2015 represented the first negative return posted by high yield bonds since the 2008 financial crisis.

The yield on the 10-year U.S. Treasury note rose a modest 0.1% over the course of the year despite the Federal Reserve’s decision to raise short-term interest rates at its December Federal Open Market Committee meeting. We believe the low nominal yields on longer dated U.S. Treasury securities reflect market sentiment with respect to muted growth prospects and nascent inflation concerns for the U.S. specifically and for the global economy more generally.

As we approach the eighth year of this current market expansion, we would like to provide you with our thoughts on market positioning, which include an underweight to risk assets, including stocks and credit-sensitive bonds, in favor of safe haven assets like developed sovereign debt as well as more market neutral strategies.

| | 1. | We believe the headwind of a rising dollar will likely diminish the competitiveness of the U.S. export sector, reduce profits from foreign operations and challenge emerging market companies that externally finance their operations in dollars with principal revenue sources denominated in their home currencies. The Federal Reserve’s tightening of short-term interest rates will likely further strengthen the dollar. |

| | 2. | In addition to the currency-related challenges noted above, the continued price decline in natural resources and slowing demand from China represent meaningful challenges for a number of emerging market economies. Furthermore, nearly all emerging market economies have shifted from accumulating to dispersing foreign exchange reserves. |

| | 3. | The decline in both nominal and real interest rates continues to paint a troubling picture of global deflationary pressure and low capital market returns. |

| | 4. | The sharp decline in energy prices witnessed last year has created stress in both stock and bond markets. Following the peak debt issuance in 2013 and the first half of 2014, many energy companies may be forced to restructure balance sheets and consider strategic options as their asset bases have eroded. |

| | 5. | Global debt remains at record highs and exceeds the 2007 levels that resulted in the financial crisis of 2008. The methods for dealing with over indebtedness—increasing taxes, decreasing expenditures, growing out of it, inflating out of it or restructuring it—seem either unpalatable or undoable. |

Despite this laundry list of woes, we entered 2016 with the S&P 500 trading at 18.26 times its trailing 12 month’s earnings while the federal funds target rate hovers between 0.25% and 0.50%, high yield bond yields have crept up to 8.74%, 10-year U.S. Treasury’s yield a modest 2.27% and the price of West Texas Intermediate crude oil closed the year out at $37.04 per barrel.

With such little margin of safety from a valuation perspective, we encourage investors to consider the level of risk embedded in their portfolios and the sources of that risk.

We are humbled by the trust you have placed with us as investors and remain grateful for the opportunities you have given to us.

11

Summary

The Salient Risk Parity Fund is designed to take advantage of the increased potential return efficiency that stems from diversification. By balancing our exposure, we believe that we are creating a diversified portfolio that has the potential to deliver improved risk-adjusted returns through time. We believe that the merits of a diversified approach become more evident over longer holding periods as economic regimes shift and different asset classes outperform. We thank you for your investment in the Fund and look forward to 2016.

We look forward to providing regular updates in the future on our progress in executing the Fund’s business plan. Please visit our website at www.salientfunds.com for the latest updates.

Please note that this letter, including the financial information herein, is made available to shareholders of the Fund for their information. It is not a prospectus, circular or representation intended for use in the purchase or sale of shares of the Fund or of any securities mentioned herein.

Sincerely,

Lee Partridge

Chief Investment Officer

Roberto M. Croce, Ph.D.

Director of Quantitative Research

12

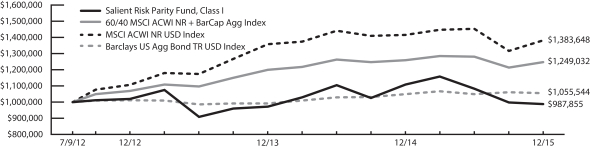

Salient Risk Parity Fund

|

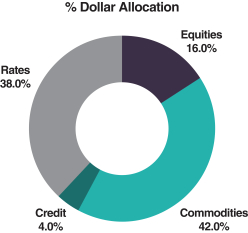

| Value of a $1,000,000 Investment |

|

The charts above represent a historical since inception performance comparison of a hypothetical $1,000,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains in the Fund.

The performance data quoted here represents past performance. Past performance is no guarantee of future results. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end please call 866-667-9228.

The performance above reflects any fee waivers that have been in effect during the applicable periods, as well as any expense reimbursements that have periodically been made. Absent such waivers and reimbursements, returns would have been lower. Currently, contractual fee waivers are in effect for the Fund through July 31, 2016.

The 60/40 Index represents an allocation of 60% MSCI AC World Index (Equities), 40% Barclays Aggregate Bond Index (Bonds) - formerly the Lehman Aggregate Bond Index through Nov. 2008. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The Barclays Capital U.S. Aggregate Bond Index is a composite comprised of the Barclays Capital U.S. Intermediate Government/Credit Index and the Barclay Capital Mortgage-Backed Securities Index. All issues in the index are rated investment grade or higher, have a least one year to maturity, and have an outstanding par value of at least $100 million. Note that the Fund’s allocation may differ substantially from 60% equities and 40% bonds. The index returns are from 7/9/2012 onwards (Class I shares) and from 10/1/2012 (Class C shares) and from 11/15/2012 (Class A shares). One cannot invest directly in an index.

13

| | |

| | Salient Trend Fund Management Discussion of Fund Performance - Letter to Shareholders |

Dear Fellow Shareholders:1

The Salient Trend Fund (the “Fund”) finished 2015 down 0.33% (Class I). This brings the inception to date annualized return to 11.67%. With the Fund’s three-year anniversary occurring on January 2, 2016, we are pleased that the Fund has behaved the way we intended in its conception, delivering positive returns that are lowly correlated with major asset classes.

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Share Class | | Commencement

Date | | Net Performance

without Sales Charge | | Barclay BTOP50 Index2 Return |

| | | 2015 | | Average Annual

Since Inception | | 2015 | | Average Annual

Since Inception of

Fund Share Class |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Class A (SPTAX) | | 3/28/2013 | | | | -0.52% | | | | | 9.96% | | | | | -1.41% | | | | | 3.42% | |

| Class C (SPTCX) | | 3/28/2013 | | | | -1.21% | | | | | 9.12% | | | | | -1.41% | | | | | 3.42% | |

| Class I (SPTIX) | | 1/2/2013 | | | | -0.33% | | | | | 11.67% | | | | | -1.41% | | | | | 3.60% | |

| | | | | | | | | | | | | | | |

| Share Class | | Commencement

Date | | Net Performance with

Maximum Sales Charge |

| | | 2015 | | Since Inception |

| | | | | | | | | | | | | | |

| Class A (SPTAX) | | 3/28/2013 | | | | -5.97% | | | | | 7.73% | |

| Class C (SPTCX) | | 3/28/2013 | | | | -2.16% | | | | | 9.12% | |

Sources: Salient Advisors, LP and Barclay Hedge, December 31, 2015.

Returns above are as of December 31, 2015.

Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal values will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than that shown. Returns with sales charge reflect the deduction of current maximum front end sales charge of 5.50% for Class A shares, and the maximum contingent deferred sales charge of 1.00% which is applied to Class C shares. All returns reflect reinvestment of all dividend and capital gain distributions. To obtain performance information current to the most recent month-end please call 866-667-9228. The total annual gross and net operating expense ratios for the Fund, based on the current Fund prospectus dated April 30, 2015, are as follows: Class A shares are 1.99% and 1.73%, respectively, Class C shares are 2.74% and 2.48%, respectively, and Class I shares are 1.74% and 1.48%, respectively. The adviser has contractually agreed to waive fees and/or reimburse expenses to maintain the Fund’s total operating expenses at 1.55% for Class A, 2.30% for Class C and 1.30% for Class I shares, excluding certain expenses, until July 31, 2016. Returns do not reflect the taxes that investors may pay on distributions or the sale of shares.

1 Certain statements in this letter are forward-looking statements. The forward-looking statements and other views expressed herein are those of the portfolio managers and the Fund as of the date of this letter. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein. There can be no assurance that the Fund will achieve its investment objectives. The value of the Fund will fluctuate with the value of the underlying securities.

2 The Barclay BTOP50 Index seeks to replicate the overall composition of the managed futures industry with regard to trading style and overall market exposure. To be included in the BTOP50, the trading advisors must be: open for investment, willing to provide daily returns, at least two years of trading activity, and the advisors must have at least three years of operating history. The BTOP50 portfolio is equally weighted among the selected programs at the beginning of each calendar year and is rebalanced annually. The BTOP50 consists of a subset of the advisors who make up the managed futures industry, whereas the Fund is a single advisor. The index returns are from 3/28/2013 onwards (For Class A and C share comparisons) and from 1/2/2013 onwards (for Class I share comparison). One cannot invest directly in an index. Index Performance does not reflect the deduction of fees and expenses.

14

Annual Update

In our semi-annual letter we described how the Fund has met our objective of providing a diversifying portfolio building block. We believe that prudent investors should seek to maximize diversification in their portfolios and adhere to a long-term diversified approach. Unfortunately, many investors forgo diversification during strong equity markets in favor of a more concentrated portfolio. By the end of 2015, markets reminded investors of their potential risks, highlighting the need for uncorrelated exposures like Trend.

Since inception, the Fund (Class I) has produced an 11.67% annualized return with a 0.15 correlation to the S&P 500,3 a 0.04 correlation to the Barclays High Yield Index,4 and a -0.55 correlation to the Continuous Commodity Index.5 The Fund shifted to a short position in energy markets in September of 2014 and remained short throughout 2015 while falling oil prices put mounting pressure on financial markets. This highlights the Fund’s ability to pick up on changes in sentiment and potential to provide relief from drivers of stress in many portfolios.

The Fund entered 2015 broadly long equities and rates and short commodities. Halfway through the year, the exposure to equities and rates was cut in half. The Fund ended the year with net short exposure to equity markets, short exposure to commodities, and long exposure to rates. The changes in exposure stem entirely from our systematic approach to trend-following, not from subjective predictions on market returns. We believe that our systematic approach to trend-following adapts to changes in market sentiment without the need for market forecasts. During the second half of 2015 we saw the Fund’s net equity exposure flip between short and long, reflecting the growing uncertainty in the market. The fact that our signals for many equity markets are on an edge between long and short leaves the Fund poised to position itself for the next prolonged trend in equity markets, be it bullish or bearish.

Fund Contribution

| | | | | | | | | | | | | | | | |

| | | Equities | | | Commodities | | | Rates | | | Total | |

2015 | | | -3.87 | % | | | 1.52 | % | | | 1.98 | % | | | -0.33 | % |

| Jan 15 | | | -0.09 | % | | | 0.27 | % | | | 6.70 | % | | | 6.88 | % |

| Feb 15 | | | 4.10 | % | | | -6.58 | % | | | -2.31 | % | | | -4.79 | % |

| Mar 15 | | | 0.00 | % | | | 4.48 | % | | | 0.63 | % | | | 5.12 | % |

| Apr 15 | | | 1.18 | % | | | -6.34 | % | | | -1.67 | % | | | -6.83 | % |

| May 15 | | | 0.50 | % | | | 1.65 | % | | | -1.05 | % | | | 1.10 | % |

| Jun 15 | | | -3.78 | % | | | -1.67 | % | | | -1.38 | % | | | -6.83 | % |

| Jul 15 | | | 0.36 | % | | | 5.49 | % | | | 1.13 | % | | | 6.98 | % |

| Aug 15 | | | -3.26 | % | | | -0.69 | % | | | 0.11 | % | | | -3.85 | % |

| Sep 15 | | | -2.76 | % | | | 1.19 | % | | | 1.05 | % | | | -0.52 | % |

| Oct 15 | | | 0.85 | % | | | -0.95 | % | | | -0.34 | % | | | -0.44 | % |

| Nov 15 | | | 1.49 | % | | | 6.29 | % | | | -0.41 | % | | | 7.37 | % |

| Dec 15 | | | -2.77 | % | | | -0.02 | % | | | -0.16 | % | | | -2.94 | % |

3 S&P 500 Index is a stock market index based on the common stock prices of 500 top publicly traded American companies.

4 Barclays High Yield Index is a U.S. Aggregate index that is comprised of fixed-rate, publicly issued, non-investment grade debt.

5 Continuous Commodity Index is made up of 17 commodities whose futures trade on U.S. Exchanges. The index is a broad measure of overall commodity price trends. There are six component groups: Energy, Grains, Industrials, Precious Metals, Livestock and Softs. Equal weighting is used for both arithmetic averaging of an individual commodity months and for geometric averaging of the 17 commodity averages.

15

Since Fund positions shift long and short based on market sentiment, we view the contributions from different asset classes to fund performance as reflections of sentiment in those asset classes. For example, this year the Fund was broadly short commodities allowing for a positive contribution from the asset class even though long-only commodity exposure would have produced negative returns. In November, the Fund saw a positive contribution from Equities even though the MSCI All Country World Index was down 83 bps due to the Fund’s exposure shifting short equity markets. These examples illustrate why the Fund produces low correlations to the very asset classes in which it operates and how it delivers a diversifying return stream.

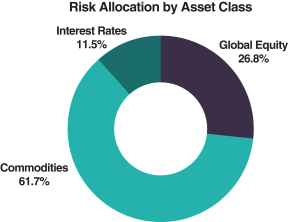

The Fund’s risk allocation as of December 31, 2015 is shown in the pie charts below:

The data displayed in the pie charts have been rounded to the nearest tenth for illustrative purposes only. Allocations are subject to change.

Source: Salient Advisors, L.P., December 31, 2015.

Investment Strategies and Techniques

The Fund seeks long term capital appreciation with low correlation to traditional core equity and bond market exposures. The Fund seeks to achieve this goal by constructing a portfolio that captures short, medium and long term return trends. The Fund can invest in equities, commodities, interest rates, and currencies. Risk is measured in terms of a statistic called covariance, which measures the degree to which assets have moved together historically.

The Fund’s top five long and short positions based on risk contribution as of December 31, 2015 are shown below:

| | |

| Long Positions |

| Holding | | % Risk

Allcocation |

| 10 Yr Euro-Bund | | 4.1% |

| 10 Yr Canadian Treasury | | 2.6% |

| DAX | | 2.1% |

| CAC 40 | | 2.1% |

| TOPIX | | 1.9% |

| | |

| Short Positions |

| Holding | | % Risk

Allocation |

| Brent Oil | | 4.7% |

| Silver | | 4.5% |

| Zinc | | 4.5% |

| Crude Oil | | 4.2% |

| Cattle | | 4.1% |

Allocations are subject to change. Data displayed here has been rounded to the nearest tenth for illustrative purposes only. The specific securities identified are not representative of all securities purchased or held by the Fund, and it should not be assumed that the investment in the securities was or will be profitable. Source: Salient Advisors, L.P., December 31, 2015.

16

Under normal market conditions the Fund seeks to invest in derivatives that create economic leverage and whose performance is expected to correspond to the performance of the underlying asset classes, without investing directly in those asset classes. Using derivatives allows us to gain more exposure to the asset classes than investing in more traditional assets such as stocks and bonds would allow. The performance of derivative instruments is tied to the performance of an underlying currency, security, index, commodity or other asset. In addition to risks relating to their underlying assets, the use of derivatives may include other, possibly greater, risks. Derivatives involve costs, may be volatile, and may involve a small initial investment relative to the risk assumed. Risks associated with the use of derivatives may include counterparty, margin, leverage, correlation, liquidity, tax, market, interest rate and management risks, as well as the risk of potential increased regulation of swaps and other derivatives. Derivatives may also be more difficult to purchase, sell or value than other investments. The Fund may lose more than the cash amount invested on investments in derivatives. Each of these risks is typically greater for the Fund than mutual funds that do not use derivatives to implement their investment strategy.

2016 Macro Update

Markets ended 2015 with low returns across the board as a number of woes plagued investors. Many key data points demonstrate that the market is more pessimistic about growth than what the Federal Reserve’s December action suggests. The combination of growth concerns that beset China and Europe coupled with the divergence of Central Bank policy spawned headwinds for investors during the year. As we enter 2016, we are faced with a number of challenges that will likely result in another year of low returns.

The S&P 500 Index generated a 1.37% return in 2015, marking the worst year of performance since 2008. The gain was driven entirely by dividends paid to investors, which offset a modest price decline of 0.7%. Consumer discretionary stocks led the market, closing up 10.11% for the year, while consumer staple stocks increased 6.6%. Energy stocks were the biggest detractor 21.12% followed by materials stocks 8.38%. Small cap stocks, as represented by the Russell 2000 Index, posted a 4.41% loss for the year.

The dollar advanced 9.26% versus a trade-weighted basket of foreign currencies as the euro lost 10.22% versus the greenback. Japanese equities, as measured by the Tokyo Stock Price Index, gained 12.06% while German stocks, as measured by the German Stock Index, advanced 9.56% over the course of the year (in their respective currencies). Emerging market stocks continued to fare poorly as the MSCI Emerging Markets Index tumbled 14.83% during the year.

High yield bonds finished the year down 4.47%, as measured by the Barclays U.S. Corporate High Yield Bond Index, while core fixed income returns were up 0.55%, as measured by Barclays U.S. Aggregate Bond Index. We note that during the third round of the Federal Reserve’s quantitative easing program in 2013, corporate high yield issuance reached current cycle highs. We would typically expect to see a distressed cycle occur three to five years following peak issuance, which would fall into calendar years 2016-2018. 2015 represented the first negative return posted by high yield bonds since the 2008 financial crisis.

The yield on the 10-year U.S. Treasury note rose a modest 0.1% over the course of the year despite the Federal Reserve’s decision to raise short-term interest rates at its December Federal Open Market Committee meeting. We believe the low nominal yields on longer dated U.S. Treasury securities reflect market sentiment with respect to muted growth prospects and nascent inflation concerns for the U.S. specifically and for the global economy more generally.

17

As we approach the eighth year of this current market expansion, we would like to provide you with our thoughts on market positioning, which include an underweight to risk assets, including stocks and credit-sensitive bonds, in favor of safe haven assets like developed sovereign debt as well as more market neutral strategies.

| | 1. | We believe the headwind of a rising dollar will likely diminish the competitiveness of the U.S. export sector, reduce profits from foreign operations and challenge emerging market companies that externally finance their operations in dollars with principal revenue sources denominated in their home currencies. The Federal Reserve’s tightening of short-term interest rates will likely further strengthen the dollar. |

| | 2. | In addition to the currency-related challenges noted above, the continued price decline in natural resources and slowing demand from China represent meaningful challenges for a number of emerging market economies. Furthermore, nearly all emerging market economies have shifted from accumulating to dispersing foreign exchange reserves. |

| | 3. | The decline in both nominal and real interest rates continues to paint a troubling picture of global deflationary pressure and low capital market returns. |

| | 4. | The sharp decline in energy prices witnessed last year has created stress in both stock and bond markets. Following the peak debt issuance in 2013 and the first half of 2014, many energy companies may be forced to restructure balance sheets and consider strategic options as their asset bases have eroded. |

| | 5. | Global debt remains at record highs and exceeds the 2007 levels that resulted in the financial crisis of 2008. The methods for dealing with overindebtedness—increasing taxes, decreasing expenditures, growing out of it, inflating out of it or restructuring it—seem either unpalatable or undoable. |

Despite this laundry list of woes, we entered 2016 with the S&P 500 trading at 18.26 times its trailing 12 month’s earnings while the federal funds target rate hovers between 0.25% and 0.50%, high yield bond yields have crept up to 8.74%, 10-year U.S. Treasurys yield a modest 2.27% and the price of West Texas Intermediate crude oil closed the year out at $37.04 per barrel.

With such little margin of safety from a valuation perspective, we encourage investors to consider the level of risk embedded in their portfolios and the sources of that risk.

We are humbled by the trust you have placed with us as investors and remain grateful for the opportunities you have given to us.

Summary

As our track record gets longer, we are pleased to see the Salient Trend Fund delivering the type of return stream that we targeted in our initial design. We are singularly focused on providing investors with an impactful portfolio building block. We believe the need for diversifying exposure is becoming more evident as market risks rise. It is exceedingly difficult to predict when markets will experience corrections. Having exposure to adaptive allocations like Trend can provide tilts that pick up on changes in market sentiment. We believe the Salient Trend Fund is the impactful portfolio tool that we desired to create and look forward to 2016.

We look forward to providing regular updates in the future on our progress in executing the Fund’s business plan. Please visit our website at www.salientfunds.com for the latest updates.

18

Please note that this letter, including the financial information herein, is made available to shareholders of the Fund for their information. It is not a prospectus, circular or representation intended for use in the purchase or sale of shares of the Fund or of any securities mentioned herein.

Sincerely,

Lee Partridge

Chief Investment Officer

19

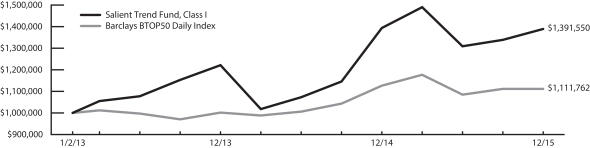

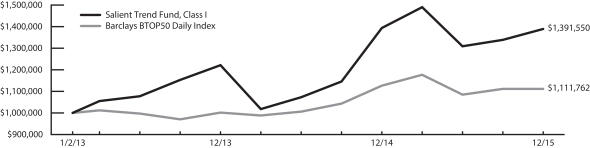

Salient Trend Fund

|

| Value of a $1,000,000 Investment |

|

The charts above represent a historical since inception performance comparison of a hypothetical $1,000,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains in the Fund.

The performance data quoted here represents past performance. Past performance is no guarantee of future results. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end please call 866-667-9228.

The performance above reflects any fee waivers that have been in effect during the applicable periods, as well as any expense reimbursements that have periodically been made. Absent such waivers and reimbursements, returns would have been lower. Currently, contractual fee waivers are in effect for the Fund through July 31, 2016.

The Barclay BTOP50 Index: seeks to replicate the overall composition of the managed futures industry with regard to trading style and overall market exposure. To be included in the BTOP50, the trading advisors must be: open for investment, willing to provide daily returns, at least two years of trading activity, and the advisors must have at least three years of operating history. The BTOP50 portfolio is equally weighted among the selected programs at the beginning of each calendar year and is rebalanced annually. The BTOP50 consists of a subset of the advisors who make up the managed futures industry, whereas the Fund is a single advisor. The index returns are from 3/27/2013 onwards (For Class A and C share comparisons) and from 1/2/2013 onwards (for Class I share comparison). One cannot invest directly in an index.

20

| | |

| | Salient MLP & Energy Infrastructure Fund II Management Discussion of Fund Performance - Letter to Shareholders |

Dear Fellow Shareholders:1

We are pleased to provide the annual report of the Salient MLP & Energy Infrastructure Fund II (the “Fund”) for the year ended December 31, 2015, though we are certainly not pleased with our performance. The Master Limited Partnership (“MLP”) sector finished a difficult 2015 down 32.6% as represented by the Alerian MLP Index (“AMZ”).2 MLP performance was severely impacted by investor concerns over how MLPs would maintain cash flows in what is proving to be a sustained challenging commodity price environment. By the end of the year, West Texas Intermediate (WTI) prices had declined near the 2009 lows while Brent crude was trading at an 11-year low. The midstream companies and MLPs that comprise our portfolio were not immune to the downturn despite the fact that the majority of their cash flows are fee-based and not directly impacted by the price of the underlying commodity.

As of December 31, 2015, the Fund had total net assets of $894.0 million and a NAV per share of $7.07 for Class I.

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Share Class | | Commencement

Date | | Net Performance

without Sales Charge | | Alerian MLP Index Return |

| | | 2015 | | Average Annual

Since Inception | | 2015 | | Average Annual

Since Inception of

Fund Share Class |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Class A (SMAPX) | | 12/21/2012 | | | | -44.10% | | | | | -7.10% | | | | | -32.59% | | | | | -3.60% | |

| Class C (SMFPX) | | 1/8/2013 | | | | -44.50% | | | | | -8.85% | | | | | -32.59% | | | | | -5.22% | |

| Class I (SMLPX) | | 9/19/2012 | | | | -43.95% | | | | | -5.76% | | | | | -32.59% | | | | | -4.09% | |

| | | | | | | | | | | | | | | |

| Share Class | | Commencement

Date | | Net Performance with

Maximum Sales Charge |

| | | 2015 | | Since Inception |

| | | | | | | | | | | | | | |

| Class A (SMAPX) | | 12/21/2012 | | | | -47.16% | | | | | -8.83% | |

| Class C (SMFPX) | | 1/8/2013 | | | | -45.03% | | | | | -8.85% | |

Sources: Salient Capital Advisors, LLC, Alerian, December 31, 2015.

Returns above are as of December 31, 2015.

Performance data quoted here represents past performance. Past performance is no guarantee of future results. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. Returns with sales charge reflect the deduction of current maximum front end sales charge of 5.50% for Class A shares, and the maximum contingent deferred sales charge of 1.00% which is applied to Class C shares. All returns reflect reinvestment of all dividend and capital gain distributions. To obtain performance information current to the most recent month-end please call 866-667-9228. The total annual operating expense ratios for the Fund, based on the current Fund prospectus dated April 30, 2015, are as follows: Class A shares are 1.41%, Class C shares are 2.16% and Class I shares are 1.16%. The adviser has contractually agreed to waive fees and/or reimburse expenses to maintain the Fund’s total operating expenses at 1.55% for Class A, 2.30% for Class C and 1.30% for Class I shares, excluding certain expenses, until July 31, 2016. Returns do not reflect the taxes that investors may pay on Fund distributions or the sale of Fund shares.

1 Certain statements in this letter are forward-looking statements. The forward-looking statements and other views expressed herein are those of the portfolio managers and the Fund as of the date of this letter. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein. There can be no assurance that the Fund will achieve its investment objectives. The value of the Fund will fluctuate with the value of the underlying securities.

2 Alerian MLP Index (AMZ) is a composite of the 50 most prominent energy MLPs that provides investors with a comprehensive benchmark for this emerging asset class. An investor may not invest directly in an index. Index performance does not reflect the deduction of fees and expenses.

21

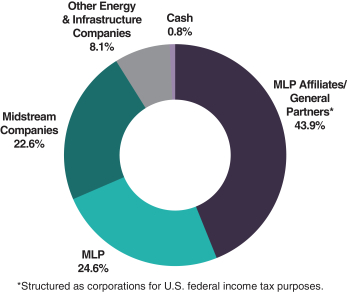

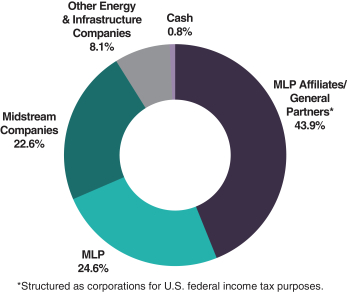

The Fund’s ownership structure and holdings at December 31, 2015 are shown below:

Ownership Structure3,4

For Quarter Ending December 31, 2015

Top 10 Holdings3,4

For Quarter Ending December 31, 2015

| | | | | | |

| Company Name | | Ticker | | Allocation | |

| Enbridge Energy Management, L.L.C. | | EEQ | | | 7.9 | % |

| The Williams Companies, Inc. | | WMB | | | 7.6 | % |

| Plains GP Holdings, L.P. | | PAGP | | | 7.3 | % |

| ONEOK, Inc. | | OKE | | | 6.7 | % |

| Spectra Energy Corp. | | SE | | | 6.2 | % |

| Tallgrass Energy GP, LP | | TEGP | | | 5.9 | % |

| EnLink Midstream LLC | | ENLC | | | 5.4 | % |

| SemGroup Corporation | | SEMG | | | 5.0 | % |

| Macquarie Infrastructure Company LLC | | MIC | | | 4.9 | % |

| VTTI Energy Partners LP | | VTTI | | | 4.7 | % |

3 Data displayed here has been rounded to the nearest tenth for illustrative purposes only. The specific securities identified are not representative of all of the securities purchased or held by the Fund, and it should not be assumed that the investment in the securities identified was or will be profitable. Cash includes cash equivalents and unsettled security positions. Allocations are subject to change.

4 Source: Salient Capital Advisors, LLC, December 31, 2015.

22

For the year ended December 31, 2015, the top and bottom contributors to the Fund’s performance were as follows:

| | | | | | | | | | | | | | | | | | | | |

| | | Top 5 Contributors to Fund Performance | |

| | | Security | | Ticker | | Return | | Fund

Contribution |

| | | 1 | | | Macquarie Infrastructure Company LLC | | MIC | | | | 7.1 | % | | | | 0.20 | % |

| | | 2 | | | Shell Midstream Partners, L.P. | | SHLX | | | | 5.4 | % | | | | 0.10 | % |

| | | 3 | | | Dynagas LNG Partners, LP | | DLNG | | | | 20.5 | % | | | | 0.04 | % |

| | | 4 | | | MarkWest Energy Partners, L.P. | | MWE | | | | 4.6 | % | | | | 0.03 | % |

| | | 5 | | | PBF Logistics LP | | PBFX | | | | 6.5 | % | | | | 0.02 | % |

|

| | | Bottom 5 Contributors to Fund Performance | |

| | | Security | | Ticker | | Return | | Fund

Contribution |

| | | 1 | | | Targa Resources Corp. | | TRGP | | | | -73.8 | % | | | | -5.34 | % |

| | | 2 | | | Plains GP Holdings, L.P., Class A | | PAGP | | | | -60.3 | % | | | | -4.76 | % |

| | | 3 | | | Kinder Morgan, Inc. | | KMI | | | | -58.0 | % | | | | -4.46 | % |

| | | 4 | | | EnLink Midstream LLC | | ENLC | | | | -56.2 | % | | | | -2.87 | % |

| | | 5 | | | SemGroup Corporation | | SEMG | | | | -54.8 | % | | | | -2.80 | % |

Source: Salient Capital Advisors, LLC, December 31, 2015.

For illustrative purposes only. Past performance is not indicative of future results. Numbers have been rounded for illustrative purposes.

Market Review

The AMZ index finished 2015 with the second worst performance in its history, which was a -36.9% return for 2008.5 In short, 2015 was a terrible year.

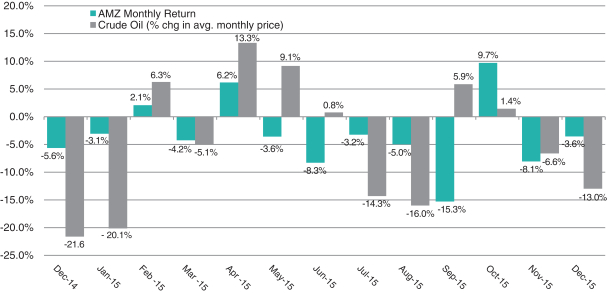

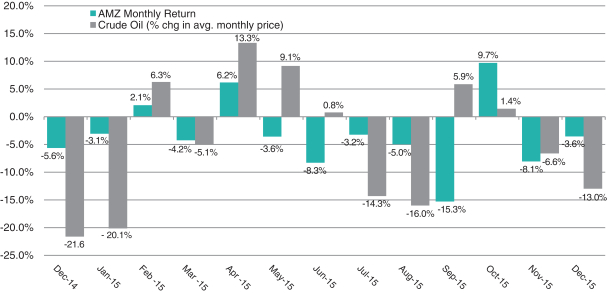

Subsequent to the Organization of Petroleum Exporting Countries’ Thanksgiving 2014 decision to hold its production quota at 30 mmbbl/d and to “let the market” decide the price of crude,6 it seems that MLP investors’ fortunes have been inextricably tied to the price of crude oil whether the MLP handled crude oil or not. The chart on the following page compares the monthly total return of the AMZ to the change in the average monthly price of crude oil. Note that AMZ returns were negative in all six of the months where the average monthly crude oil price was less than the prior month’s average price.

5 Alerian, December 2015.

6 Bloomberg, December 2015.

23

As Crude Oil Goes, So Go MLPs

Source: FactSet, Alerian, December 2015. For illustrative purposes only. Past performance is not necessarily indicative of how the index will perform in the future. The index reflects the reinvestment of dividends and income and does not reflect deductions for fees, expenses, or taxes. The index is unmanaged and is not available for direct investment.

Investors were concerned that over-supply in the global crude oil markets were estimated to be anywhere from 500 mbpd to 2.5 mmbpd vs. global demand of ~ 94 mmbpd would persist and a “lower for longer” commodity price environment could be the new normal.7 The fear was that chronically low commodity prices would choke off spending by Exploration & Production companies (“E&P”) into developing new locations. Eventually production volumes would decline resulting in reduced MLP cash flows and perhaps more importantly reduced demand for new energy infrastructure.

Interestingly, crude oil production volumes continued to grow through the first four months of the year despite a dramatic decline in the number of operating drilling rigs. Crude oil production peaked in April at 9.585 mmbpd, the highest level since May 1972.8 Since April, US crude oil production has fallen less than 200 mbpd despite rig counts that continue to dwindle. We believe that E&P companies are being more selective in determining their drilling portfolios and only going forward with the most promising areas. Also, technological advances have made it possible for a single rig to drill wells in multiple areas, this has the potential effect of significantly improving economics in most cases. This appears to be particularly true in the Permian Basin in west Texas and the main reason why it is the one shale basin where there is potential for production volumes to be higher in 2016 as opposed to 2015.

Just as US production was starting to decline, crude prices began edging higher and the AMZ entered June down only 3% for the year.9 However, June saw three major macro events that, in combination, not only strangled the rally in crude oil prices but sent crude prices crashing to fresh six year lows by December. The first was the dramatic 25% drop in the Chinese stock market that month. Investors worried that the Chinese economy could be headed to a hard landing thus reducing demand for crude oil. Secondly, the Greek saga played out. Would Greece finally be forced from the euro currency? While the drama unfolded, investors moved into the US dollar strengthening it. As crude prices are

7 Mbpd = thousands of barrels per day, Mmbpd = millions of barrels per day

8 Bloomberg, November 2015.

9 Alerian, November 2015.

24

denominated in US dollars, a stronger dollar is bearish for oil prices. Lastly, the United Nations/United States negotiations with Iran were finalized which would allow Iran to export its crude oil.10 Iran has claimed it can increase its production approximately 1 mmbpd within a year of getting its sanctions lifted which would just add to the currently over-supplied global crude markets.11

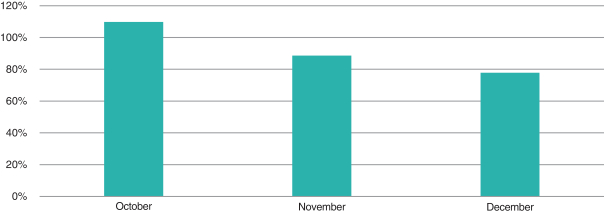

With macro indicators increasingly pointing to a prolonged commodity price slump, MLPs began scaling back capital expenditures (“capex”) and growth outlooks which accelerated selling in the space. We saw a semi-rally in October as investors received the final distributions for the year.

MLPs are currently caught in a vicious cycle where the elevated cost of equity is making issuing units a non-starter. With a need for capital, MLPs then turn to the debt markets only to find that non-investment grade yield spreads (especially in the energy space) have widened considerably in recent months making project financing more expensive.12

We believe that some degree of reason will return to the space in 2016. In our opinion, a key catalyst will be that investors regain confidence that the overwhelming majority of midstream MLPs will be able to maintain distributions and continue with drop-downs.13 The typical no/slow growth midstream MLP has historically traded at around an 8% yield.14,15 Currently, that same MLP yields about 11%.15,16 We expect to see some mean reversion as investors adjust to potentially lower growth in distributions but given the elevated current yields, investors are compensated while they wait.17,18

Summary

We remain confident in our strategy and our long-term investment philosophy remains focused on quality MLPs and Midstream Companies that have the potential to achieve above average distribution growth which, we believe, leads to potentially higher long-term returns for investors. However, we believe that we are entering a period of heightened volatility where investors will likely place a premium on safety and predictability rather than focusing mainly on dividend growth potential. Fortunately, we do not believe that the two characteristics are mutually exclusive. It is our opinion that successful MLPs achieve above average distribution growth in no small part because their operations allow them to outperform in both rising and falling macro commodity price environments. Being disciplined and sticking to our focus on choosing quality names using our “bottom up” stock selection approach will be more important than ever as the recent weakness in MLPs has potentially created an opportunity to build positions in names that are well positioned to weather the current volatility and emerge even stronger going forward.

10 Bloomberg, July 2015.

11 Bloomberg, November 2015.

12 Yield Spread—the difference in yields between two instruments. A widening spread means that the riskier instrument (in this case a bond issued by an energy company or MLP) has become relatively more expensive (i.e. investors are demanding more yield to hold).

13 Drop-down – when an MLP’s general partner sells (drops down) cash-flow producing assets to its underlying MLP. Typically, given valuation multiples for these two entities are such that the transaction can be structured so the cash flows are accretive to both parties.

14 Alerian, June 2006—November 2015.

15 The referenced yield is not representative of the Fund’s yield.

16 Alerian, November 2015.

17 Current Yield – the annual income (interest or dividends) divided by the current price of the security. This measure looks at the current price of a bond instead of its face value and represents the return an investor would expect if he or she purchased the bond and held it for a year. This measure is not an accurate reflection of the actual return that an investor will receive in all cases because bond and stock prices are constantly changing due to market factors.

18 Mean reversion – a theory suggesting that prices and returns eventually move back towards the mean or average.

25

Please visit our website at www.salientfunds.com for the latest updates. Note that this letter, including the financial information herein, is made available to shareholders of the Fund for their information. It is not a prospectus, circular or representation intended for use in the purchase or sale of the Fund or of any securities mentioned in this letter.

Sincerely,

Gregory A. Reid

President, Salient MLP Complex

Salient Capital Advisors, LLC

26

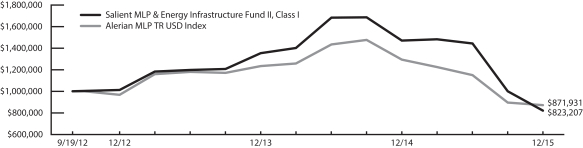

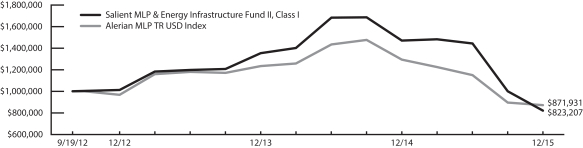

Salient MLP & Energy Infrastructure Fund II

|

| Value of a $1,000,000 Investment |

|

The charts above represent a historical since inception performance comparison of a hypothetical $1,000,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains in the Fund.

The performance data quoted here represents past performance. Past performance is no guarantee of future results. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end please call 866-667-9228.

The performance above reflects any fee waivers that have been in effect during the applicable periods, as well as any expense reimbursements that have periodically been made. Absent such waivers and reimbursements, returns would have been lower. Currently, contractual fee waivers are in effect for the Fund through July 31, 2016.

Alerian MLP Index (AMZ) is a composite of the 50 most prominent energy MLPs that provides investors with a comprehensive benchmark for this emerging asset class.

An investor may not invest directly in an index. Index performance does not reflect the deduction of fees and expenses.

27

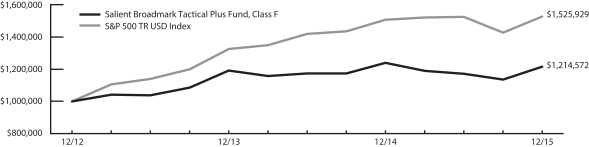

| | |

| | Salient Broadmark Tactical Plus Fund Management Discussion of Fund Performance - Letter to Shareholders |

Dear Fellow Shareholders:1

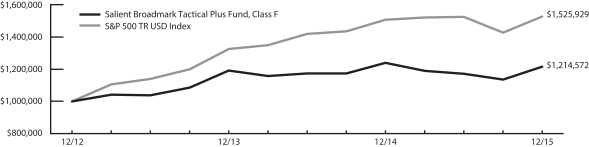

For the year ended December 31, 2015, the Salient Broadmark Tactical Plus Fund’s Class I shares returned -2.42%, slightly underperforming its primary benchmark, the S&P 500 Index, which returned 1.38%, and its peer group, the Morningstar Long/Short Equity Index, which returned -2.02%.

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Share Class | | Commencement

Date | | Net Performance

without Sales Charge | | S&P 500

Index2 Return |

| | | 2015 | | Average Annual

Since Inception | | 2015 | | Average Annual

Since Inception of

Fund Share Class |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Class A (SBTAX) | | 12/31/2012 | | | | -2.59% | | | | | 6.09% | | | | | 1.38% | | | | | 15.13% | |

| Class C (SBTCX) | | 12/31/2012 | | | | -3.35% | | | | | 5.30% | | | | | 1.38% | | | | | 15.13% | |

| Class I (SBTIX) | | 12/31/2012 | | | | -2.42% | | | | | 6.33% | | | | | 1.38% | | | | | 15.13% | |

| Class F (BTPIX) | | 12/31/2012 | | | | -2.00% | | | | | 6.69% | | | | | 1.38% | | | | | 15.13% | |

| | | | | | | | | | | | | | | |

| Share Class | | Commencement

Date | | Net Performance with

Maximum Sales Charge |

| | | 2015 | | Since Inception |

| | | | | | | | | | | | | | |

| Class A (SPTAX) | | 12/31/2012 | | | | -7.95% | | | | | 4.12% | |

| Class C (SPTCX) | | 12/31/2012 | | | | -4.30% | | | | | 5.30% | |

Sources: Salient Advisors, LP and Barclay Hedge, December 31, 2015.

Returns above are as of December 31, 2015.

Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal values will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than that shown. Returns with sales charge reflect the deduction of current maximum front end sales charge of 5.50% for Class A shares, and the maximum contingent deferred sales charge of 1.00% which is applied to Class C shares. All returns reflect reinvestment of all dividend and capital gain distributions. To obtain performance information current to the most recent month-end please call 866-667-9228. The total annual gross and net operating expense ratios for the Fund based on the current Fund prospectus dated April 30, 2015, are as follows: Class A shares are 4.85% and 2.22% respectively, Class C shares are 77.50% and 2.97% respectively, Class I shares are 4.74% and 1.97% respectively and Class F shares are 3.10% and 1.66% respectively. The adviser has contractually agreed to waive fees and/or reimburse expenses to maintain the Fund’s total operating expenses at 2.05% for Class A, 2.80% for Class C, 1.80% for Class I shares and 1.49% for Class F shares excluding certain expenses. This waiver of fees and/or reimbursement of expenses expire on July 31, 2016 for Class A, Class C and Class I, and expires on the third anniversary of the closing of the reorganization for Class F. Returns do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

Class A/C/I shares of the Fund commenced operations on December 15, 2014. The returns prior to that date are those of the predecessor fund’s Institutional Class shares, which commenced operations on December 31, 2012. Performance for the period from 12/31/2012 to 12/12/2014 reflects the gross performance of the Institutional Class shares of the predecessor fund adjusted to apply the fees and anticipated expenses of Class A/C/I shares of the Fund. All share classes of the Fund are invested in the same portfolio of securities and returns only differ to the extent that fees and expenses of the classes are different.

1 Certain statements in this letter are forward-looking statements. The forward-looking statements and other views expressed herein are those of the portfolio managers and the Fund as of the date of this letter. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein. There can be no assurance that the Fund will achieve its investment objectives. The value of the Fund will fluctuate with the value of the underlying securities.

2 The S&P 500 (TR) Index is a widely recognized, unmanaged index of 500 of the largest companies in the United States as measured by market capitalization. The S&P 500 Index assumes reinvestment of all dividends and distributions. Because indices cannot be invested in directly, the returns of the S&P 500 Index do not reflect a deduction for fees, expenses or taxes.

28

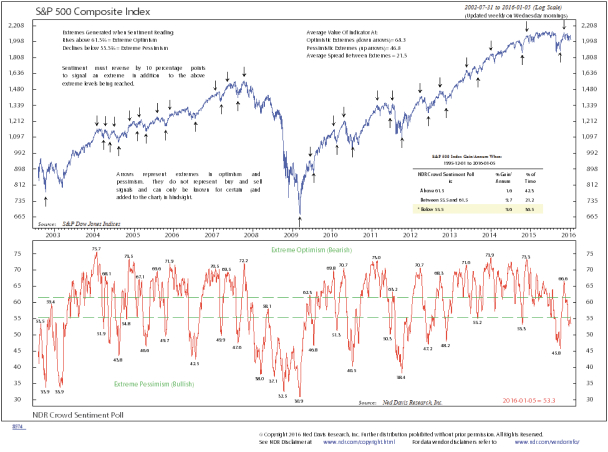

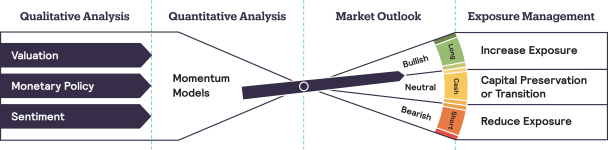

Annual Update

The market environment experienced in 2015 was historically the most challenging for our strategy. 2015 was a flat year in the equity markets with low volatility through the first seven months of the year. For the period of August through the end of the year, performance relative to the S&P 500 Index improved as volatility picked up.

The Fund performed as expected given the flat performance of the overall equity markets. With this strategy, excess returns are generated from the management of the exposure rather than security selection.