UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number_811-22641

__Franklin Alternative Strategies Funds

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code: 650 312-2000

Date of fiscal year end: 5/31

Date of reporting period: 11/30/14

Item 1. Reports to Stockholders.

Franklin Templeton Investments

Gain From Our Perspective®

At Franklin Templeton Investments, we’re dedicated to one goal: delivering exceptional asset management for our clients. By bringing together multiple, world-class investment teams in a single firm, we’re able to offer specialized expertise across styles and asset classes, all supported by the strength and resources of one of the world’s largest asset managers. This has helped us to become a trusted partner to individual and institutional investors across the globe.

Focus on Investment Excellence

At the core of our firm, you’ll find multiple independent investment teams—each with a focused area of expertise—from traditional to alternative strategies and multi-asset solutions. And because our portfolio groups operate autonomously, their strategies can be combined to deliver true style and asset class diversification.

All of our investment teams share a common commitment to excellence grounded in rigorous, fundamental research and robust, disciplined risk management. Decade after decade, our consistent, research-driven processes have helped Franklin Templeton earn an impressive record of strong, long-term results.

Global Perspective Shaped by Local Expertise

In today’s complex and interconnected world, smart investing demands a global perspective. Franklin Templeton pioneered international investing over 60 years ago, and our expertise in emerging markets spans more than a quarter of a century. Today, our investment professionals are on the ground across the globe, spotting investment ideas and potential risks firsthand. These locally based teams bring in-depth understanding of local companies, economies and cultural nuances, and share their best thinking across our global research network.

Strength and Experience

Franklin Templeton is a global leader in asset management serving clients in over 150 countries.1 We run our business with the same prudence we apply to asset management, staying focused on delivering relevant investment solutions, strong long-term results and reliable, personal service. This approach, focused on putting clients first, has helped us to become one of the most trusted names in financial services.

1. As of 12/31/13. Clients are represented by the total number of shareholder accounts.

Not FDIC Insured | May Lose Value | No Bank Guarantee

| |

| Contents | |

| |

| Shareholder Letter | 1 |

| Semiannual Report | |

| Franklin K2 Alternative Strategies Fund | 3 |

| Performance Summary | 7 |

| Your Fund’s Expenses | 10 |

| Consolidated Financial Highlights and | |

| Consolidated Statement of Investments | 12 |

| Consolidated Financial Statements | 68 |

| Notes to Consolidated Financial | |

| Statements | 72 |

| Shareholder Information | 87 |

| |

| |

| |

| |

| franklintempleton.com | |

Semiannual Report

Franklin K2 Alternative Strategies Fund

We are pleased to bring you Franklin K2 Alternative Strategies Fund’s semiannual report for the period ended November 30, 2014.

Your Fund’s Goal and Main Investments

The Fund seeks capital appreciation with lower volatility relative to the broad equity markets. The Fund seeks to achieve its investment goal by allocating its assets across multiple non-traditional or “alternative” strategies, including but not limited to long short equity, relative value, event driven and global macro. The Fund is structured as a multi-manager fund, meaning the Fund’s assets are independently managed by multiple investment managers (subadvisors), while the Fund’s investment manager retains overall responsibility for the Fund’s investments. The Fund may invest in a wide range of securities and other investments including, but not limited to: equity securities including common stocks, preferred stocks, convertible securities, rights and warrants, private and registered investment vehicles and exchange-traded funds (ETFs); and debt securities including bonds, notes, debentures, banker’s acceptances and commercial paper; loans and loan participations; and mortgage-backed or other asset-backed securities, including collateralized debt obligations; as well as derivatives, commodities and currencies.

Performance Overview

For the six months under review, the Fund’s Class A shares delivered a +2.63% cumulative total return. For comparison, the Fund’s primary benchmark, the BofA Merrill Lynch 3 Month U.S. Treasury Bill Index, which tracks the performance of short-term U.S. government securities with a remaining term to final maturity of less than three months, produced a +0.02% total return.1 Also for comparison, the Fund’s secondary benchmark, the HFRX Global Hedge Fund Index, which is designed to be representative of the overall composition of the hedge fund universe, had a -0.65% total return.2 You can find more of the Fund’s performance data in the Performance Summary beginning on page 7.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

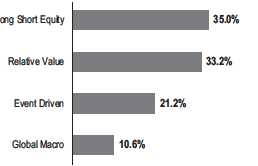

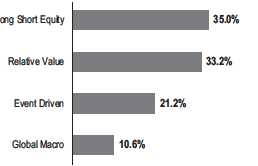

Strategy Allocation

Based on Total Investments as of 11/30/14

Economic and Market Overview

The global economy grew moderately during the six months under review as many developed markets continued to recover and many emerging markets continued to expand. U.S. economic growth trends were generally encouraging during the period. Economic activity improved in the third quarter of 2014, resulting largely from increased consumer spending, business investments, federal defense spending and a narrower trade deficit. The U.S. Federal Reserve Board (Fed) ended its asset purchase program in October, after gradually reducing its purchases during the six-month period, based on its view that underlying economic strength could support ongoing progress in labor market conditions. The Fed reaffirmed it would maintain its near-zero interest rate policy for a “considerable time” and stated its actions to normalize monetary policy remained dependent on economic performance.

Outside the U.S., the U.K. economy grew relatively well, supported by the services and manufacturing sectors. U.K. gross domestic product (GDP) continued to expand in the third

1. Source: Morningstar

2. Source: FactSet. Hedge Fund Research, Inc. – www.hedgefundresearch.com. The HFRX Global Hedge Fund Index is being used under license from Hedge Fund

Research, Inc., which does not endorse or approve of any of the contents of this report.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Consolidated Statement of Investments (SOI).

The Consolidated SOI begins on page 17.

franklintempleton.com

Semiannual Report 3

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

quarter. In the eurozone, economic growth remained subdued as concerns persisted about the potential negative effects on growth from fundamental economic and labor market issues, as well as the crisis in Ukraine. In June, the European Central Bank (ECB) reduced its main interest rate and for the first time set a negative deposit rate; the ECB reduced both rates again in September. The ECB broadened its monetary easing stance by implementing an asset purchase program to prevent deflation and stimulate the economy.

In Japan, second- and third-quarter GDP contractions indicated the economy was in a recession. However, private consumption and exports improved in the third quarter. In October, the Bank of Japan expanded its stimulus measures amid weak domestic demand following a sales tax hike and as substantially lower crude oil prices exerted further downward pressure on inflation. In November, Prime Minister Shinzo Abe called an early parliamentary election and postponed a second sales tax increase scheduled for October 2015, as he sought to expand the mandate for his economic policies.

In several emerging markets, economic growth moderated in the third quarter. However, Brazil exited recession as government spending prior to presidential elections drove third-quarter GDP growth. Emerging market equities, as measured by the MSCI Emerging Markets Index, ended the six-month period relatively flat, amid headwinds such as soft domestic demand and weak exports in several countries, as well as concerns about the timing of U.S. interest rate increases and geopolitical tensions in certain regions. Many emerging market currencies depreciated against the U.S. dollar, leading central banks in several countries to raise interest rates in an effort to curb inflation and support their currencies. Several other central banks lowered interest rates to promote economic growth. After implementing monetary stimulus measures to support specific sectors, China’s central bank increased its efforts to bolster the economy by cutting its benchmark interest rates for the first time since July 2012.

As measured by the MSCI World Index, stocks in global developed markets advanced overall during the six-month period amid a generally accommodative monetary policy environment, continued strength in corporate earnings and signs of an economic recovery. Global government and corporate bonds performed well in local currency terms as interest rates in many developed market countries remained at historical lows. However, the U.S.

dollar’s appreciation against most currencies led these bonds to post losses in U.S. dollar terms. Commodity prices overall ended lower for the period, as measured by the Bloomberg Commodity Index, driven by steep declines in crude oil prices resulting from weak global demand growth and strong world supply.3 Gold prices declined amid benign global inflation and a strong U.S. dollar.

|

| Subadvisors |

| 11/30/14 |

| |

| Long Short Equity |

| Chilton Investment Company, LLC |

| Impala Asset Management, LLC |

| Independence Capital Asset Partners, LLC |

| Jennison Associates, LLC |

| Wellington Management Company, LLP |

| Event Driven |

| P. Schoenfeld Asset Management L.P. |

| York Registered Holdings, L.P. |

| Relative Value |

| Basso Capital Management, L.P. |

| Chatham Asset Management, LLC |

| Lazard Asset Management, LLC |

| Loomis Sayles & Company, L.P. |

| Global Macro |

| Graham Capital Management, L.P. |

Investment Strategy

We manage the Fund using a multi-manager approach. While we are responsible for the Fund’s overall investments, we allocate assets to multiple subadvisors, each of whom independently manages a separate portion of the Fund’s portfolio in accordance with some or all of the following strategies: long short equity, relative value, event driven and global macro. We allocate the Fund’s assets among these strategies utilizing a top-down approach, generating the Fund’s strategy weightings by taking into account market conditions, risk factors, diversification, liquidity, transparency, and availability of various sub-advisors and other investment options, among other things. The allocations to specific subadvisors may change from time to time based upon our assessment of their correlations to various markets and to each other, their risk profiles and return expectations. Long short equity strategies generally seek to produce returns from investments in the global equity markets by taking

3. Prior to 7/1/14, the index was known as the Dow Jones-UBS Commodity Index.

The indexes are unmanaged and include reinvestment of any income or distributions. One cannot invest directly in an index, and an index is not representative of the

Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information

| |

| 4 Semiannual Report | franklintempleton.com |

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

long and short positions in stocks and common stock indexes (through the use of derivatives or through a short position in an ETF). Relative value strategies encompass a wide range of investment techniques that are intended to profit from pricing inefficiencies. Event driven strategies generally invest in securities of companies undergoing corporate events. Global macro strategies generally focus on broad-based economic opportunities across numerous markets and investments.

The Fund may take long and/or short positions in a wide range of asset classes, including equities, fixed income, commodities and currencies, among others. Long positions benefit from an increase in the price of the underlying instrument or asset class, while short positions benefit from a decrease in that price. The Fund may use derivatives for hedging and nonhedging (investment) purposes. Such derivative investments may include futures contracts, swaps, options and currency forward contracts. The Fund may engage in active and frequent trading as part of its investment strategies.

What is a futures contract?

A futures contract, or a future, is an agreement between the Fund and a counterparty made through a U.S. or foreign futures exchange to buy or sell an asset at a specific price on a future date.

What is a swap agreement?

A swap agreement, such as an equity total return swap, is a contract between the Fund and a counterparty to exchange on a future date the returns, or differentials in rates of return, that would have been earned or realized if a notional amount were invested in specific instruments.

A credit default swap, or CDS, is an agreement between two parties whereby the buyer receives credit protection from the seller. The buyer makes periodic payments over the term of the agreement in return for a payment by the seller in the event of a default or other credit event.

What is an option?

An option is a contract to buy or sell a specific financial product known as the option’s underlying instrument at a specific price. The buyer of an option has the right, but not the obligation, to buy or sell the underlying instrument at or until a specified expiration date. Conversely, the seller (writer) of an option who opens a transaction is obligated to buy or sell the underlying instrument should the option holder exercise that right.

What is a currency forward contract?

A currency forward contract, or a currency forward, is an agreement between the Fund and a counterparty to buy or sell a foreign currency at a specific exchange rate on a future date.

Manager’s Discussion

Three of the four strategies in which the Fund’s assets were allocated contributed to absolute performance for the period, led by long short equity and global macro. The event driven strategy allocation also showed a gain. In contrast, The Fund’s relative value investments declined modestly.

The Fund’s long short equity strategy managers were Chilton Investment Co., Impala Asset Management, Independence Capital Asset Partners, Jennison Associates and Wellington Management Co. All five subadvisors contributed positive performance for the period, led by the health care specialist and technology-focused managers. Performance drivers for the strategy included exposure to biotechnology, pharmaceutical, chemical, commercial and retail stocks. Meaningful detractors from performance included consumer non-cyclical (e.g., food processing and personal products) equities, as well as equity index hedges through positions in ETFs. Net and gross exposures within the long short strategy remained relatively unchanged as managers were optimistic about the longer term performance potential for equity markets despite shorter term macroeconomic and geopolitical concerns.

Our global macro strategy manager was Graham Capital Management. The manager performed positively over the period, as a rally in the U.S. dollar benefited its trend-following strategy. Key contributors included short exposures to the euro and the Japanese yen achieved through currency forwards. Strong trends in currency price moves contributed to aggressive selling in currencies other than the U.S. dollar. In commodities-related trades, the strengthening U.S. dollar and other market factors, such as oversupply, led to declines for many commodities during 2014’s third quarter. Graham Capital implemented trades that sought to exploit these trends, which resulted in strong gains. Losses arose primarily from equity and fixed income exposures.

The Fund’s event driven strategy managers were P. Schoenfeld Asset Management and York Registered Holdings. A variety of event-driven company catalysts benefited performance for both subadvisors during the period, particularly in the technology, media and telecommunications sectors, where consolidation and significant levels of corporate activity continued. Starting in the fall, a rise in broad market volatility, falling energy prices, and increased political scrutiny related to so-called tax inversion strategies contributed to a significant widening of deal spreads and several notable announced mergers and acquisitions deals that failed to reach completion, which served to pare some of the managers’ earlier gains. In a tax inversion, a U.S. company seeks to acquire a non-U.S. company so it can move its

franklintempleton.com

Semiannual Report 5

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

headquarters abroad to a lower tax nation. Portfolio hedges were also a detractor for the period, given the overall rising equity markets.

Our relative value strategy managers were Basso Capital Management, Chatham Asset Management, Lazard Asset Management and Loomis Sayles & Co. In aggregate, the strategy declined for the period, with three of the four subadvisors posting losses. Overall, hedged bond positions supported performance, given that credit markets were broadly weaker because of increasing concerns about the timing of possible U.S. interest rate hikes. Other key contributors included gains from structured credit, distressed and currency-focused trading strategies. In contrast, the strategy’s investments in investment-grade corporate bonds, government sponsored enterprises and high yield corporate bonds detracted.

Thank you for your participation in Franklin K2 Alternative Strategies Fund. We look forward to continuing to serve your investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of November 30, 2014, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

David C. Saunders has been involved in the investment and trading of financial instruments since 1983. He has worked at Tucker Anthony & R.L. Day as an equity trader; First Boston Corp. as Vice President on the equity block trading desk; WaterStreet Capital, a hedge fund, as Head Trader; Tiger Management, as Head Trader; WorldSec Securities as President and ABN Amro Inc. as a Senior Managing Director. He co-founded K2 Advisors in 1994.

William A. Douglass III began his career at Donaldson, Lufkin and Jenrette Securities, where he worked in equity sales. In 1991, Mr. Douglass joined Tiedemann International Research, Ltd. (“TIR”) (Tokyo) as Director of Sales. He returned to the U.S. in 1992 to become Director of Sales for TIR’s North American operation, where he co-managed the firm’s U.S. business until April 1994. He co-founded K2 Advisors in 1994.

Brooks Ritchey is a senior managing director and head of portfolio construction for K2 Advisors. He is also a senior vice president and director of investment solutions for the Franklin Templeton Solutions division. Since 1987, Mr. Ritchey has successfully managed multi-asset mutual fund and hedge fund portfolios during his employment with organizations including Steinhardt Partners, Citibank, Finch Asset Management, Paribas, AIG and ING. Mr. Ritchey joined K2 Advisors in 2005.

Robert Christian is a senior managing director and head of research for K2 Advisors, which he joined in 2010.

Mr. Christian worked at Graham Capital Management, L.P., from 1998 to 2003 as a portfolio manager and researcher of quantitative-based trading strategies. At Julius Baer Investment Management from 2003 to 2005, he was the head of Macro Strategies. From 2005 to 2010, he worked at FRM Americas LLC where he was the Global Head of Directional Trading Strategies and portfolio advisor to numerous funds.

6 Semiannual Report

franklintempleton.com

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

Performance Summary as of November 30, 2014

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | |

| Net Asset Value1 | | | | | | |

| |

| Share Class (Symbol) | | 11/30/14 | | 5/31/14 | | Change |

| A (FAAAX) | $ | 10.92 | $ | 10.64 | +$ | 0.28 |

| C (FASCX) | $ | 10.85 | $ | 10.60 | +$ | 0.25 |

| R (FSKKX) | $ | 10.90 | $ | 10.62 | +$ | 0.28 |

| R6 (FASRX) | $ | 10.96 | $ | 10.66 | +$ | 0.30 |

| Advisor (FABZX) | $ | 10.95 | $ | 10.65 | +$ | 0.30 |

franklintempleton.com

Semiannual Report 7

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

PERFORMANCE SUMMARY

Performance as of 11/30/142

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only;

Class R/R6/Advisor Class: no sales charges.

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | Average Annual | | Total Annual Operating Expenses7 | |

| | | Cumulative | | | Average Annual | | | Value of $10,000 | | Total Return | | | | | |

| Share Class | | Total Return3 | | | Total Return4 | | | Investment5 | | (12/31/14 | )6 | (with waiver) | | (without waiver) | |

| A | | | | | | | | | | | | 2.82 | % | 3.71 | % |

| 6-Month | | +2.63 | % 1 | | -3.28 | % | | $9,672 | | | | | | | |

| 1-Year | | +7.16 | % | | +1.04 | % | | $10,104 | | +-1.12 | % | | | | |

| Since Inception (10/11/13) | | +9.63 | % | | +2.92 | % | | $10,333 | | 2.46 | % | | | | |

| C | | | | | | | | | | | | 3.52 | % | 4.41 | % |

| 6-Month | | +2.36 | %1 | | +1.36 | % | | $10,136 | | | | | | | |

| 1-Year | | +6.48 | % | | 5.48 | % | | $10,548 | | +3.20 | % | | | | |

| Since Inception (10/11/13) | | +8.93 | % | | +7.81 | % | | $10,893 | | +6.89 | % | | | | |

| R | | | | | | | | | | | | 3.02 | % | 3.91 | % |

| 6-Month | | +2.64 | %1 | | +2.64 | % | | $10,264 | | | | | | | |

| 1-Year | | +6.97 | % | | +6.97 | % | | $10,697 | | +4.63 | % | | | | |

| Since Inception (10/11/13) | | +9.43 | % | | +8.25 | % | | $10,943 | | +7.33 | % | | | | |

| R6 | | | | | | | | | | | | 2.45 | % | 3.34 | % |

| 6-Month | | +2.81 | %1 | | +2.81 | % | | $10,281 | | | | | | | |

| 1-Year | | +7.56 | % | | +7.56 | % | | $10,756 | | +5.25 | % | | | | |

| Since Inception (10/11/13) | | +10.03 | % | | +8.77 | % | | $11,003 | | +7.86 | % | | | | |

| Advisor | | | | | | | | | | | | 2.52 | % | 3.41 | % |

| 6-Month | | +2.82 | %1 | | +2.82 | % | | $10,282 | | | | | | | |

| 1-Year | | +7.46 | % | | +7.46 | % | | $10,746 | | +5.23 | % | | | | |

| Since Inception (10/11/13) | | +9.93 | % | | +8.68 | % | | $10,993 | | +7.84 | % | | | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

8 Semiannual Report

franklintempleton.com

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

PERFORMANCE SUMMARY

All investments involve risks, including possible loss of principal. The market values of securities owned by the Fund will go up or down, sometimes rapidly or unpredictably. The Fund’s performance depends on the manager’s skill in selecting, overseeing and allocating fund assets. The Fund is actively managed and could experience losses if the investment manager’s and subadvisors’ judgments about particular investments made for the Fund’s portfolio prove to be incorrect. Some subadvisors may have little or no experience managing the asset of a registered investment company. Foreign investments are subject to greater investment risk such as political, economic, credit and information risks as well as risk of currency fluctuations. Investments in derivatives involve costs and create economic leverage, which may result in significant volatility and cause the Fund to participate in losses (as well as gains) that significantly exceed the Fund’s initial investment. Lower rated or high yield debt securities involve greater credit risk, including the possibility of default or bankruptcy. The Fund may make short sales of securities, which involves the risk that losses may exceed the original amount invested. Merger arbitrage investments risk loss if a proposed reorganization in which the Fund invests is renegotiated or terminated. Liquidity risk exists when securities have become more difficult to sell at the price they have been valued. The Fund may invest in investment funds, which may be more costly than investing in the underlying securities directly. The Fund’s prospectus also includes a description of the main investment risks.

| |

| Class C: | These shares have higher annual fees and expenses than Class A shares. |

| Class R: | Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

| Class R6: | Shares are available to certain eligible investors as described in the prospectus. |

| Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. Price and total return information is based on net asset values calculated for shareholder transactions. Certain adjustments were made to the net assets of the Fund at 11/30/14 for financial reporting purposes, and as a result, the net asset values for shareholder transactions and the total returns based on those net asset values differ from the adjusted net asset values and total returns reported in the Financial Highlights.

2. The Fund has an expense reduction contractually guaranteed through at least 9/30/15 and a fee waiver related to the management fee paid by a subsidiary. Fund investment results reflect the expense reduction and fee waiver, to the extent applicable; without these reductions, the results would have been lower.

3. Cumulative total return represents the change in value of an investment over the periods indicated.

4. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized. 5. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

6. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

7. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

franklintempleton.com

Semiannual Report 9

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

1. Divide your account value by $1,000.

If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6.

2. Multiply the result by the number under the heading “Expenses Paid During Period.”

If Expenses Paid During Period were $7.50, then 8.6 × $7.50 = $64.50.

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

10 Semiannual Report

franklintempleton.com

| | | | | | |

| | | | | FRANKLIN ALTERNATIVE STRATEGIES FUNDS |

| | | | | | | YOUR FUND’S EXPENSES |

| |

| |

| |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Share Class | | Value 6/1/14 | | Value 11/30/14 | | Period* 6/1/14–11/30/14 |

| A | | | | | | |

| Actual | $ | 1,000 | $ | 1,026.40 | $ | 15.95 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,009.33 | $ | 15.82 |

| C | | | | | | |

| Actual | $ | 1,000 | $ | 1,023.60 | $ | 18.92 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,006.37 | $ | 18.76 |

| R | | | | | | |

| Actual | $ | 1,000 | $ | 1,026.40 | $ | 16.66 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,008.62 | $ | 16.52 |

| R6 | | | | | | |

| Actual | $ | 1,000 | $ | 1,028.10 | $ | 13.93 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,011.33 | $ | 13.82 |

| Advisor | | | | | | |

| Actual | $ | 1,000 | $ | 1,028.20 | $ | 14.13 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,011.13 | $ | 14.02 |

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 3.14%; C: 3.73%; R: 3.28%; R6: 2.74% and Advisor: 2.78%), multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period.

franklintempleton.com

Semiannual Report

11

| | | | | | |

| FRANKLIN ALTERNATIVE STRATEGIES FUNDS | | | | | | |

| |

| |

| Consolidated Financial Highlights | | | | | | |

| Franklin K2 Alternative Strategies Fund | | | | | | |

| | | Period Ended | | | | |

| | | November 30, 2014 | | | Period Ended | |

| | | (unaudited) | | | May 31, 2014a | |

| Class A | | | | | | |

| Per share operating performance | | | | | | |

| (for a share outstanding throughout the period) | | | | | | |

| Net asset value, beginning of period | $ | 10.64 | | $ | 10.00 | |

| Income from investment operationsb: | | | | | | |

| Net investment income (loss)c | | (0.06 | ) | | (0.02 | ) |

| Net realized and unrealized gains (losses) | | 0.33 | | | 0.70 | |

| Total from investment operations | | 0.27 | | | 0.68 | |

| Less distributions from net investment income | | — | | | (0.04 | ) |

| Net asset value, end of period | $ | 10.91 | | $ | 10.64 | |

| |

| Total returnd | | 2.54 | % | | 6.82 | % |

| |

| Ratios to average net assetse | | | | | | |

| Expenses before waiver, payments by affiliates and expense reductionf | | 3.52 | %g,h | | 3.33 | % |

| Expenses net of waiver, payments by affiliates and expense reductionf | | 3.14 | %g,h | | 2.83 | % |

| Expenses incurred in connection with securities sold short | | 0.70 | % | | 0.56 | % |

| Net investment income (loss) | | (1.17 | )%g | | (0.35 | )% |

| |

| Supplemental data | | | | | | |

| Net assets, end of period (000’s) | $ | 96,189 | | $ | 96,889 | |

| Portfolio turnover rate | | 154.61 | % | | 181.06 | % |

aFor the period October 11, 2013 (commencement of operations) to May 31, 2014.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales

and repurchases of Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fIncludes dividend and interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the

periods presented. See Note 1(f).

gRatios are adjusted to exclude the effects of annualization for non-recurring expenses.

hBenefit of expense reduction rounds to less than 0.01%.

12 Semiannual Report | The accompanying notes are an integral part of these consolidated financial statements. franklintempleton.com

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

CONSOLIDATED FINANCIAL HIGHLIGHTS

| | | | | | |

| Franklin K2 Alternative Strategies Fund (continued) | | | | | | |

| | | Period Ended | | | | |

| | | November 30, 2014 | | | Period Ended | |

| | | (unaudited) | | | May 31, 2014a | |

| Class C | | | | | | |

| Per share operating performance | | | | | | |

| (for a share outstanding throughout the period) | | | | | | |

| Net asset value, beginning of period | $ | 10.60 | | $ | 10.00 | |

| Income from investment operationsb: | | | | | | |

| Net investment income (loss)c | | (0.09 | ) | | (0.08 | ) |

| Net realized and unrealized gains (losses) | | 0.32 | | | 0.72 | |

| Total from investment operations | | 0.23 | | | 0.64 | |

| Less distributions from net investment income | | — | | | (0.04 | ) |

| Net asset value, end of period | $ | 10.83 | | $ | 10.60 | |

| |

| Total returnd | | 2.17 | % | | 6.42 | % |

| |

| Ratios to average net assetse | | | | | | |

| Expenses before waiver, payments by affiliates and expense reductionf | | 4.11 | %g,h | | 4.03 | % |

| Expenses net of waiver, payments by affiliates and expense reductionf | | 3.73 | %g,h | | 3.53 | % |

| Expenses incurred in connection with securities sold short | | 0.70 | % | | 0.56 | % |

| Net investment income (loss) | | (1.76 | )%g | | (1.05 | )% |

| |

| Supplemental data | | | | | | |

| Net assets, end of period (000’s) | $ | 25,351 | | $ | 16,618 | |

| Portfolio turnover rate | | 154.61 | % | | 181.06 | % |

aFor the period October 11, 2013 (commencement of operations) to May 31, 2014.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales

and repurchases of Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fIncludes dividend and interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the

periods presented. See Note 1(f).

gRatios are adjusted to exclude the effects of annualization for non-recurring expenses.

hBenefit of expense reduction rounds to less than 0.01%.

franklintempleton.com The accompanying notes are an integral part of these consolidated financial statements. | Semiannual Report 13

| | | | | | |

| FRANKLIN ALTERNATIVE STRATEGIES FUNDS | | | | | | |

| CONSOLIDATED FINANCIAL HIGHLIGHTS | | | | | | |

| |

| |

| Franklin K2 Alternative Strategies Fund (continued) | | | | | | |

| | | Period Ended | | | | |

| | | November 30, 2014 | | | Period Ended | |

| | | (unaudited) | | | May 31, 2014a | |

| Class R | | | | | | |

| Per share operating performance | | | | | | |

| (for a share outstanding throughout the period) | | | | | | |

| Net asset value, beginning of period | $ | 10.62 | | $ | 10.00 | |

| Income from investment operationsb: | | | | | | |

| Net investment income (loss)c | | (0.07 | ) | | (0.05 | ) |

| Net realized and unrealized gains (losses) | | 0.33 | | | 0.71 | |

| Total from investment operations | | 0.26 | | | 0.66 | |

| Less distributions from net investment income | | — | | | (0.04 | ) |

| Net asset value, end of period | $ | 10.88 | | $ | 10.62 | |

| |

| Total returnd | | 2.45 | % | | 6.62 | % |

| |

| Ratios to average net assetse | | | | | | |

| Expenses before waiver, payments by affiliates and expense reductionf | | 3.66 | %g,h | | 3.63 | % |

| Expenses net of waiver, payments by affiliates and expense reductionf | | 3.28 | %g,h | | 3.13 | % |

| Expenses incurred in connection with securities sold short | | 0.70 | % | | 0.56 | % |

| Net investment income (loss) | | (1.31 | )%g | | (0.65 | )% |

| |

| Supplemental data | | | | | | |

| Net assets, end of period (000’s) | $ | 12,197 | | $ | 11,660 | |

| Portfolio turnover rate | | 154.61 | % | | 181.06 | % |

aFor the period October 11, 2013 (commencement of operations) to May 31, 2014.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales

and repurchases of Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fIncludes dividend and interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the

periods presented. See Note 1(f).

gRatios are adjusted to exclude the effects of annualization for non-recurring expenses.

hBenefit of expense reduction rounds to less than 0.01%.

14 Semiannual Report | The accompanying notes are an integral part of these consolidated financial statements. franklintempleton.com

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

CONSOLIDATED FINANCIAL HIGHLIGHTS

| | | | | | |

| Franklin K2 Alternative Strategies Fund (continued) | | | | | | |

| | | Period Ended | | | | |

| | | November 30, 2014 | | | Period Ended | |

| | | (unaudited) | | | May 31, 2014a | |

| Class R6 | | | | | | |

| Per share operating performance | | | | | | |

| (for a share outstanding throughout the period) | | | | | | |

| Net asset value, beginning of period | $ | 10.66 | | $ | 10.00 | |

| Income from investment operationsb: | | | | | | |

| Net investment income (loss)c | | (0.04 | ) | | (0.01 | ) |

| Net realized and unrealized gains (losses) | | 0.32 | | | 0.71 | |

| Total from investment operations | | 0.28 | | | 0.70 | |

| Less distributions from net investment income | | — | | | (0.04 | ) |

| Net asset value, end of period | $ | 10.94 | | $ | 10.66 | |

| |

| Total returnd | | 2.63 | % | | 7.02 | % |

| |

| Ratios to average net assetse | | | | | | |

| Expenses before waiver, payments by affiliates and expense reductionf | | 3.12 | %g,h | | 3.19 | % |

| Expenses net of waiver, payments by affiliates and expense reductionf | | 2.74 | %g,h | | 2.69 | % |

| Expenses incurred in connection with securities sold short | | 0.70 | % | | 0.56 | % |

| Net investment income (loss) | | (0.77 | )%g | | (0.21 | )% |

| |

| Supplemental data | | | | | | |

| Net assets, end of period (000’s) | $ | 221,474 | | $ | 215,526 | |

| Portfolio turnover rate | | 154.61 | % | | 181.06 | % |

aFor the period October 11, 2013 (commencement of operations) to May 31, 2014.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales

and repurchases of Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fIncludes dividend and interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the

periods presented. See Note 1(f).

gRatios are adjusted to exclude the effects of annualization for non-recurring expenses.

hBenefit of expense reduction rounds to less than 0.01%.

franklintempleton.com The accompanying notes are an integral part of these consolidated financial statements. | Semiannual Report 15

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

CONSOLIDATED FINANCIAL HIGHLIGHTS

| | | | | | |

| Franklin K2 Alternative Strategies Fund (continued) | | | | | | |

| | | Period Ended | | | | |

| | | November 30, 2014 | | | Period Ended | |

| | | (unaudited) | | | May 31, 2014a | |

| Advisor Class | | | | | | |

| Per share operating performance | | | | | | |

| (for a share outstanding throughout the period) | | | | | | |

| Net asset value, beginning of period | $ | 10.65 | | $ | 10.00 | |

| Income from investment operationsb: | | | | | | |

| Net investment income (loss)c | | (0.04 | ) | | (0.02 | ) |

| Net realized and unrealized gains (losses) | | 0.33 | | | 0.71 | |

| Total from investment operations | | 0.29 | | | 0.69 | |

| Less distributions from net investment income | | — | | | (0.04 | ) |

| Net asset value, end of period | $ | 10.94 | | $ | 10.65 | |

| |

| Total returnd | | 2.72 | % | | 6.92 | % |

| |

| Ratios to average net assetse | | | | | | |

| Expenses before waiver, payments by affiliates and expense reductionf | | 3.16 | %g,h | | 3.21 | % |

| Expenses net of waiver, payments by affiliates and expense reductionf | | 2.78 | %g,h | | 2.71 | % |

| Expenses incurred in connection with securities sold short | | 0.70 | % | | 0.56 | % |

| Net investment income (loss) | | (0.81 | )%g | | (0.23 | )% |

| |

| Supplemental data | | | | | | |

| Net assets, end of period (000’s) | $ | 143,434 | | $ | 54,593 | |

| Portfolio turnover rate | | 154.61 | % | | 181.06 | % |

aFor the period October 11, 2013 (commencement of operations) to May 31, 2014.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales

and repurchases of Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fIncludes dividend and interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the

periods presented. See Note 1(f).

gRatios are adjusted to exclude the effects of annualization for non-recurring expenses.

hBenefit of expense reduction rounds to less than 0.01%.

16 Semiannual Report | The accompanying notes are an integral part of these consolidated financial statements. franklintempleton.com

| | | | |

| | FRANKLIN ALTERNATIVE STRATEGIES FUNDS | |

| |

| |

| |

| |

| Consolidated Statement of Investments, November 30, 2014 (unaudited) | | | |

| |

| Franklin K2 Alternative Strategies Fund | | | | |

| | Country | Shares | | Value |

| Common Stocks and Other Equity Interests 50.5% | | | | |

| Aerospace & Defense 0.8% | | | | |

| AAR Corp | United States | 500 | $ | 12,815 |

| a,bB/E Aerospace Inc | United States | 15,811 | | 1,231,202 |

| aThe Boeing Co | United States | 3,867 | | 519,570 |

| bFinmeccanica SpA | Italy | 20,987 | | 203,723 |

| General Dynamics Corp | United States | 6,310 | | 917,222 |

| aTransDigm Group Inc | United States | 5,613 | | 1,110,195 |

| | | | | 3,994,727 |

| Air Freight & Logistics 0.5% | | | | |

| aFedEx Corp | United States | 9,799 | | 1,745,986 |

| aUnited Parcel Service Inc., B | United States | 8,992 | | 988,400 |

| | | | | 2,734,386 |

| Airlines 1.8% | | | | |

| bAir Canada, B | Canada | 7,986 | | 78,093 |

| bAir France-KLM | France | 13,094 | | 138,121 |

| aAmerican Airlines Group Inc | United States | 63,932 | | 3,102,620 |

| b,c,dAMR Corp., Contingent Distribution | United States | 3,268 | | — |

| aDelta Air Lines Inc | United States | 55,754 | | 2,602,039 |

| bInternational Consolidated Airlines Group SA | United Kingdom | 114,836 | | 821,712 |

| bSpirit Airlines Inc | United States | 4,050 | | 334,894 |

| bUnited Continental Holdings Inc | United States | 34,595 | | 2,118,252 |

| | | | | 9,195,731 |

| Auto Components 0.3% | | | | |

| bTRW Automotive Holdings Corp | United States | 12,245 | | 1,266,133 |

| Automobiles 0.6% | | | | |

| Ford Motor Co | United States | 122,436 | | 1,925,918 |

| General Motors Co | United States | 6,838 | | 228,594 |

| aHarley-Davidson Inc | United States | 10,028 | | 698,751 |

| bTesla Motors Inc | United States | 1,295 | | 316,654 |

| | | | | 3,169,917 |

| Banks 0.6% | | | | |

| bBanca Popolare dell’Emilia Romagna Societa Cooperativa | Italy | 20,849 | | 147,895 |

| bBanca Popolare di Milano Scarl | Italy | 171,178 | | 125,262 |

| bBanco Popolare Societa Cooperativa | Italy | 8,981 | | 123,951 |

| aCitigroup Inc | United States | 2,676 | | 144,424 |

| b,eCommerzbank AG | Germany | 53,164 | | 814,131 |

| HSBC Holdings PLC, ADR | United Kingdom | 146 | | 7,264 |

| aWells Fargo & Co | United States | 27,010 | | 1,471,505 |

| | | | | 2,834,432 |

| Beverages 1.2% | | | | |

| aAnheuser-Busch InBev NV, ADR | Belgium | 23,723 | | 2,775,354 |

| aBrown-Forman Corp., B | United States | 10,566 | | 1,025,430 |

| a,bConstellation Brands Inc., A | United States | 11,286 | | 1,087,971 |

| Cott Corp | Canada | 10,924 | | 71,552 |

| Molson Coors Brewing Co., B | United States | 16,074 | | 1,243,324 |

| | | | | 6,203,631 |

| Biotechnology 3.1% | | | | |

| bACADIA Pharmaceuticals Inc | United States | 9,858 | | 294,458 |

| bAcceleron Pharma Inc | United States | 4,208 | | 163,018 |

franklintempleton.com

Semiannual Report

17

|

| FRANKLIN ALTERNATIVE STRATEGIES FUNDS |

| CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED) |

| | | | |

| Franklin K2 Alternative Strategies Fund (continued) | | | | |

| |

| | Country | Shares | | Value |

| Common Stocks and Other Equity Interests (continued) | | | | |

| Biotechnology (continued) | | | | |

| bAcorda Therapeutics Inc | United States | 2,895 | $ | 105,523 |

| a,bAgios Pharmaceuticals Inc | United States | 1,367 | | 137,807 |

| bAlder Biopharmaceuticals Inc | United States | 8,553 | | 139,585 |

| a,bAlexion Pharmaceuticals Inc | United States | 7,221 | | 1,407,373 |

| a,bAlnylam Pharmaceuticals Inc | United States | 8,391 | | 843,715 |

| bAmicus Therapeutics Inc | United States | 6,326 | | 50,165 |

| bApplied Genetic Technologies Corp | United States | 7,102 | | 143,389 |

| bAtara Biotherapeutics Inc | United States | 2,576 | | 69,552 |

| bAuspex Pharmaceuticals Inc | United States | 2,306 | | 55,874 |

| bAvalanche Biotechnologies Inc | United States | 847 | | 33,448 |

| a,bBiogen Idec Inc | United States | 2,572 | | 791,379 |

| a,bBioMarin Pharmaceutical Inc | United States | 19,415 | | 1,741,914 |

| bBluebird Bio Inc | United States | 4,887 | | 201,491 |

| bCalithera Biosciences Inc | United States | 4,721 | | 50,373 |

| bCara Therapeutics Inc | United States | 2,414 | | 22,305 |

| a,bCelgene Corp | United States | 11,959 | | 1,359,619 |

| a,bCelldex Therapeutics Inc | United States | 16,729 | | 339,264 |

| bChimerix Inc | United States | 4,173 | | 147,057 |

| bDyax Corp | United States | 13,953 | | 195,900 |

| bEagle Pharmaceuticals Inc | United States | 5,481 | | 69,115 |

| bFibrocell Science Inc | United States | 18,623 | | 50,282 |

| bFlexion Therapeutics Inc | United States | 908 | | 15,572 |

| a,bGilead Sciences Inc | United States | 6,970 | | 699,230 |

| a,bIncyte Corp. Ltd | United States | 17,378 | | 1,312,908 |

| bInsmed Inc | United States | 5,544 | | 78,226 |

| a,bIntercept Pharmaceuticals Inc | United States | 4,179 | | 600,648 |

| a,bIsis Pharmaceuticals Inc | United States | 16,004 | | 828,847 |

| bKindred Biosciences Inc | United States | 16,117 | | 155,046 |

| bKite Pharma Inc | United States | 844 | | 35,431 |

| a,bKYTHERA Biopharmaceuticals Inc | United States | 1,961 | | 75,008 |

| bMacroGenics Inc | United States | 976 | | 27,582 |

| bMedgenics Inc | United States | 7,179 | | 29,649 |

| bOtonomy Inc | United States | 9,748 | | 234,049 |

| a,bOvaScience Inc | United States | 10,135 | | 256,010 |

| bPortola Pharmaceuticals Inc | United States | 7,034 | | 197,796 |

| bProQR Therapeutics NV | Netherlands | 3,191 | | 48,407 |

| bProthena Corp. PLC | Ireland | 5,141 | | 124,618 |

| bReceptos Inc | United States | 3,045 | | 411,989 |

| bRegeneron Pharmaceuticals Inc | United States | 619 | | 257,572 |

| bRegulus Therapeutics Inc | United States | 4,353 | | 81,575 |

| bRetrophin Inc | United States | 3,467 | | 35,017 |

| a,bSangamo BioSciences Inc | United States | 14,594 | | 176,296 |

| a,bSynta Pharmaceuticals Corp | United States | 28,797 | | 91,287 |

| bTG Therapeutics Inc | United States | 4,487 | | 66,946 |

| bUltragenyx Pharmaceutical Inc | United States | 6,070 | | 264,591 |

| bVascular Biogenics Ltd | Israel | 5,673 | | 35,428 |

| bVerastem Inc | United States | 4,253 | | 39,553 |

| a,bVertex Pharmaceuticals Inc | United States | 8,121 | | 957,304 |

| bZafgen Inc | United States | 1,687 | | 39,830 |

| | | | | 15,589,021 |

18 Semiannual Report

franklintempleton.com

|

| FRANKLIN ALTERNATIVE STRATEGIES FUNDS |

| CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED) |

| | | | |

| Franklin K2 Alternative Strategies Fund (continued) | | | | |

| |

| | Country | Shares | | Value |

| Common Stocks and Other Equity Interests (continued) | | | | |

| Building Products 0.4% | | | | |

| aFortune Brands Home & Security Inc | United States | 34,439 | $ | 1,547,000 |

| Sanitec Corp | Finland | 20,961 | | 269,855 |

| | | | | 1,816,855 |

| Capital Markets 0.3% | | | | |

| Lazard Ltd., A | United States | 14,637 | | 754,098 |

| aNorthStar Asset Management Group Inc | United States | 36,372 | | 761,994 |

| SEI Investments Co | United States | 3,000 | | 118,890 |

| | | | | 1,634,982 |

| Chemicals 2.5% | | | | |

| aAir Products & Chemicals Inc | United States | 17,189 | | 2,472,294 |

| Akzo Nobel NV | Netherlands | 31,303 | | 2,164,427 |

| The Dow Chemical Co | United States | 30,032 | | 1,461,657 |

| aEcolab Inc | United States | 11,584 | | 1,262,077 |

| aFMC Corp | United States | 8,897 | | 483,997 |

| Rockwood Holdings Inc | United States | 5,118 | | 398,948 |

| aThe Sherwin-Williams Co | United States | 5,887 | | 1,441,491 |

| Tronox Ltd., A | United States | 500 | | 11,275 |

| a,bWR Grace & Co | United States | 30,056 | | 2,887,480 |

| | | | | 12,583,646 |

| Commercial Services & Supplies 0.6% | | | | |

| bAtento SA | Luxembourg | 13,600 | | 150,008 |

| Edenred | France | 21,822 | | 629,782 |

| bMetalico Inc | United States | 114,883 | | 43,943 |

| Mitie Group PLC | United Kingdom | 70,328 | | 308,210 |

| Tyco International Ltd | United States | 36,831 | | 1,580,050 |

| West Corp | United States | 1,670 | | 52,171 |

| | | | | 2,764,164 |

| Communications Equipment 0.4% | | | | |

| bAruba Networks Inc | United States | 6,850 | | 128,164 |

| aCisco Systems Inc | United States | 24,259 | | 670,519 |

| a,bF5 Networks Inc | United States | 1,065 | | 137,587 |

| QUALCOMM Inc | United States | 4,220 | | 307,638 |

| bRuckus Wireless Inc | United States | 11,500 | | 131,790 |

| bSonus Networks Inc | United States | 152,700 | | 564,990 |

| | | | | 1,940,688 |

| Construction & Engineering 0.1% | | | | |

| Chicago Bridge & Iron Co. NV | United States | 2,693 | | 134,731 |

| Fluor Corp | United States | 9,412 | | 583,450 |

| | | | | 718,181 |

| Construction Materials 0.1% | | | | |

| aVulcan Materials Co | United States | 5,131 | | 339,159 |

| Consumer Finance 0.0%† | | | | |

| bAlly Financial Inc | United States | 1,737 | | 41,306 |

| Containers & Packaging 0.1% | | | | |

| a,bCrown Holdings Inc | United States | 7,345 | | 363,577 |

| bGraphic Packaging Holding Co | United States | 9,095 | | 113,233 |

| | | | | 476,810 |

franklintempleton.com

Semiannual Report

19

|

| FRANKLIN ALTERNATIVE STRATEGIES FUNDS |

| CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED) |

| | | | |

| Franklin K2 Alternative Strategies Fund (continued) | | | | |

| |

| | Country | Shares | | Value |

| Common Stocks and Other Equity Interests (continued) | | | | |

| Diversified Consumer Services 0.1% | | | | |

| bCambian Group PLC | United Kingdom | 6,702 | $ | 25,157 |

| Sotheby’s | United States | 7,231 | | 292,205 |

| | | | | 317,362 |

| Diversified Financial Services 0.5% | | | | |

| aCME Group Inc | United States | 6,011 | | 508,771 |

| aMoody’s Corp | United States | 13,283 | | 1,341,716 |

| aMSCI Inc | United States | 9,810 | | 474,411 |

| Voya Financial Inc | United States | 4,660 | | 195,161 |

| | | | | 2,520,059 |

| Diversified Telecommunication Services 0.5% | | | | |

| Koninklijke KPN NV | Netherlands | 312,598 | | 1,038,705 |

| a,bLevel 3 Communications Inc | United States | 19,110 | | 955,500 |

| bTelecom Italia SpA | Italy | 147,192 | | 165,962 |

| Telecom Italia SpA | Italy | 137,677 | | 122,079 |

| | | | | 2,282,246 |

| Electrical Equipment 0.1% | | | | |

| aRockwell Automation Inc | United States | 2,333 | | 269,252 |

| Electronic Equipment, Instruments & Components 0.1% | | | | |

| bInvenSense Inc | United States | 3,400 | | 49,266 |

| TE Connectivity Ltd | United States | 7,400 | | 475,080 |

| bTTM Technologies Inc | United States | 3,368 | | 22,768 |

| | | | | 547,114 |

| Energy Equipment & Services 0.4% | | | | |

| Amec Foster Wheeler PLC, ADR | United Kingdom | 12,208 | | 176,657 |

| Baker Hughes Inc | United States | 5,183 | | 295,431 |

| a,bDresser-Rand Group Inc | United States | 13,652 | | 1,107,314 |

| bFMSA Holdings Inc | United States | 2,528 | | 24,168 |

| Schlumberger Ltd | United States | 4,472 | | 384,368 |

| | | | | 1,987,938 |

| Food & Staples Retailing 1.0% | | | | |

| aCostco Wholesale Corp | United States | 19,800 | | 2,813,976 |

| CVS Caremark Corp | United States | 593 | | 54,176 |

| The Kroger Co | United States | 16,187 | | 968,630 |

| aSafeway Inc | United States | 34,665 | | 1,207,729 |

| Wal-Mart Stores Inc | United States | 405 | | 35,454 |

| Whole Foods Market Inc | United States | 281 | | 13,777 |

| | | | | 5,093,742 |

| Food Products 0.6% | | | | |

| Cranswick PLC | United Kingdom | 9,128 | | 210,438 |

| bDiamond Foods Inc | United States | 5,845 | | 174,123 |

| Greencore Group PLC | Ireland | 28,973 | | 133,227 |

| Lindt & Spruengli AG | Switzerland | 23 | | 1,374,641 |

| Mead Johnson Nutrition Co., A | United States | 9,312 | | 966,958 |

| | | | | 2,859,387 |

20 Semiannual Report

franklintempleton.com

|

| FRANKLIN ALTERNATIVE STRATEGIES FUNDS |

| CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED) |

| | | | |

| Franklin K2 Alternative Strategies Fund (continued) | | | | |

| |

| | Country | Shares | | Value |

| Common Stocks and Other Equity Interests (continued) | | | | |

| Health Care Equipment & Supplies 2.0% | | | | |

| aBecton Dickinson and Co | United States | 13,454 | $ | 1,888,000 |

| a,bCareFusion Corp | United States | 11,966 | | 708,028 |

| The Cooper Cos. Inc | United States | 680 | | 114,852 |

| Covidien PLC | United States | 48,968 | | 4,945,768 |

| bDBV Technologies SA, ADR | France | 3,229 | | 81,888 |

| a,bDerma Sciences Inc | United States | 10,080 | | 82,757 |

| bGenMark Diagnostics Inc | United States | 19,684 | | 223,610 |

| bInnocoll AG, ADR | Germany | 2,953 | | 22,915 |

| bInspireMD Inc | United Kingdom | 17,279 | | 16,588 |

| aMedtronic Inc | United States | 22,509 | | 1,662,740 |

| bNevro Corp | United States | 471 | | 12,712 |

| bNovadaq Technologies Inc | Canada | 9,870 | | 141,635 |

| bTandem Diabetes Care Inc | United States | 486 | | 6,867 |

| bTornier NV | United States | 2,247 | | 59,972 |

| | | | | 9,968,332 |

| Health Care Providers & Services 1.3% | | | | |

| bAcadia Healthcare Co. Inc | United States | 5,892 | | 365,363 |

| Celesio AG | Germany | 39,660 | | 1,322,764 |

| a,bCentene Corp | United States | 5,495 | | 542,741 |

| aCigna Corp | United States | 3,653 | | 375,857 |

| bCommunity Health Systems Inc | United States | 27,875 | | 836 |

| bEnvision Healthcare Holdings Inc | United States | 6,854 | | 242,357 |

| a,bHCA Holdings Inc | United States | 21,736 | | 1,514,782 |

| McKesson Corp | United States | 3,072 | | 647,455 |

| bMolina Healthcare Inc | United States | 3,610 | | 184,543 |

| Omnicare Inc | United States | 9,658 | | 679,151 |

| a,bPremier Inc., A | United States | 2,184 | | 74,300 |

| aUnitedHealth Group Inc | United States | 2,407 | | 237,402 |

| aUniversal Health Services Inc., B | United States | 3,685 | | 385,525 |

| | | | | 6,573,076 |

| Health Care Technology 0.1% | | | | |

| bCastlight Health Inc | United States | 2,233 | | 27,756 |

| bCerner Corp | United States | 2,406 | | 154,947 |

| bIMS Health Holdings Inc | United States | 7,220 | | 180,500 |

| | | | | 363,203 |

| Hotels, Restaurants & Leisure 2.9% | | | | |

| bBloomin’ Brands Inc | United States | 23,406 | | 532,955 |

| Brinker International Inc | United States | 10,386 | | 585,043 |

| a,bBuffalo Wild Wings Inc | United States | 5,311 | | 903,985 |

| Carnival Corp | United States | 19,261 | | 850,566 |

| Cracker Barrel Old Country Store Inc | United States | 4,890 | | 625,969 |

| aDomino’s Pizza Inc | United States | 16,402 | | 1,539,328 |

| Extended Stay America Inc | United States | 10,457 | | 194,500 |

| aInternational Game Technology | United States | 50,975 | | 868,104 |

| Jack in the Box Inc | United States | 1,833 | | 136,559 |

| a,bLife Time Fitness Inc | United States | 11,115 | | 615,549 |

| Marriott International Inc., A | United States | 20,722 | | 1,632,686 |

| bMultimedia Games Holding Co. Inc | United States | 9,953 | | 361,194 |

| Sonic Corp | United States | 11,732 | | 318,993 |

franklintempleton.com

Semiannual Report

21

|

| FRANKLIN ALTERNATIVE STRATEGIES FUNDS |

| CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED) |

| | | | |

| Franklin K2 Alternative Strategies Fund (continued) | | | | |

| |

| | Country | Shares | | Value |

| Common Stocks and Other Equity Interests (continued) | | | | |

| Hotels, Restaurants & Leisure (continued) | | | | |

| Starbucks Corp | United States | 2,372 | $ | 192,630 |

| Starwood Hotels & Resorts Worldwide Inc | United States | 1,663 | | 131,377 |

| Tim Hortons Inc | United States | 2,952 | | 249,739 |

| Vail Resorts Inc | United States | 2,851 | | 249,862 |

| aWyndham Worldwide Corp | United States | 33,561 | | 2,797,645 |

| Wynn Macau Ltd | China | 65,300 | | 213,038 |

| aWynn Resorts Ltd | United States | 5,937 | | 1,060,408 |

| aYum! Brands Inc | United States | 5,623 | | 434,377 |

| bZoe’s Kitchen Inc | United States | 1,808 | | 57,187 |

| | | | | 14,551,694 |

| Household Durables 1.1% | | | | |

| biRobot Corp | United States | 4,400 | | 160,248 |

| Lennar Corp., A | United States | 31,194 | | 1,473,605 |

| MDC Holdings Inc | United States | 4,892 | | 128,709 |

| bMeritage Homes Corp | United States | 8,170 | | 320,427 |

| a,bNVR Inc | United States | 981 | | 1,234,755 |

| PulteGroup Inc | United States | 26,034 | | 563,115 |

| aThe Ryland Group Inc | United States | 29,829 | | 1,167,209 |

| a,bTempur Sealy International Inc | United States | 6,084 | | 347,092 |

| bWilliam Lyon Homes, A | United States | 1,866 | | 38,402 |

| | | | | 5,433,562 |

| Household Products 0.2% | | | | |

| Church & Dwight Co. Inc | United States | 10,087 | | 773,774 |

| Industrial Conglomerates 0.3% | | | | |

| aDanaher Corp | United States | 18,606 | | 1,554,717 |

| Insurance 0.1% | | | | |

| aAmerican International Group Inc | United States | 7,588 | | 415,822 |

| Internet & Catalog Retail 0.5% | | | | |

| a,bAmazon.com Inc | United States | 1,505 | | 509,653 |

| Expedia Inc | United States | 1,900 | | 165,509 |

| a,bHomeAway Inc | United States | 13,025 | | 408,464 |

| a,bLiberty Ventures, A | United States | 12,066 | | 442,098 |

| b,eNetflix Inc | United States | 370 | | 128,239 |

| Travelport Worldwide Ltd | Bermuda | 36,100 | | 626,335 |

| a,bTripAdvisor Inc | United States | 4,886 | | 359,854 |

| | | | | 2,640,152 |

| Internet Software & Services 2.2% | | | | |

| a,bAkamai Technologies Inc | United States | 7,420 | | 479,406 |

| bAlibaba Group Holding Ltd., ADR | China | 24,286 | | 2,711,289 |

| bBaidu Inc., ADR | China | 4,082 | | 1,000,539 |

| bBankrate Inc | United States | 19,415 | | 226,961 |

| bBenefitfocus Inc | United States | 8,500 | | 230,265 |

| bCoStar Group Inc | United States | 2,000 | | 340,520 |

| a,beBay Inc | United States | 9,315 | | 511,207 |

| aEquifax Inc | United States | 10,885 | | 865,902 |

| Equinix Inc | United States | 2,686 | | 610,179 |

| a,bGoogle Inc., A | United States | 365 | | 200,414 |

| a,bGoogle Inc., C | United States | 465 | | 251,951 |

22 Semiannual Report

franklintempleton.com

|

| FRANKLIN ALTERNATIVE STRATEGIES FUNDS |

| CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED) |

| | | | |

| Franklin K2 Alternative Strategies Fund (continued) | | | | |

| |

| | Country | Shares | | Value |

| Common Stocks and Other Equity Interests (continued) | | | | |

| Internet Software & Services (continued) | | | | |

| bJust Eat PLC | United Kingdom | 18,749 | $ | 102,606 |

| bMarketo Inc | United States | 5,800 | | 185,368 |

| bQihoo 360 Technology Co. Ltd., ADR | China | 1,000 | | 74,330 |

| bVeriSign Inc | United States | 5,140 | | 308,914 |

| bWeb.com Group Inc | United States | 6,970 | | 118,281 |

| bXoom Corp | United States | 14,900 | | 208,749 |

| bYahoo! Inc | United States | 46,760 | | 2,419,362 |

| bYelp Inc | United States | 5,695 | | 325,128 |

| | | | | 11,171,371 |

| IT Services 2.7% | | | | |

| Accenture PLC, A | United States | 9,060 | | 782,150 |

| a,bAlliance Data Systems Corp | United States | 1,745 | | 498,843 |

| aAutomatic Data Processing Inc | United States | 10,585 | | 906,499 |

| a,bCardtronics Inc | United States | 14,420 | | 564,687 |

| a,bCognizant Technology Solutions Corp., A | United States | 11,805 | | 637,352 |

| a,bEPAM Systems Inc | United States | 6,010 | | 306,690 |

| bEuronet Worldwide Inc | United States | 600 | | 34,842 |

| EVERTEC Inc | United States | 20,865 | | 459,865 |

| a,bExlService Holdings Inc | United States | 32,885 | | 921,767 |

| bFleetCor Technologies Inc | United States | 8,892 | | 1,350,606 |

| aForrester Research Inc | United States | 8,300 | | 329,593 |

| bGartner Inc | United States | 1,225 | | 104,713 |

| bGenpact Ltd | United States | 58,190 | | 1,048,584 |

| aGlobal Payments Inc | United States | 6,400 | | 552,704 |

| aHeartland Payment Systems Inc | United States | 17,235 | | 939,652 |

| aMasterCard Inc., A | United States | 13,894 | | 1,212,807 |

| QIWI PLC, ADR | Russia | 7,225 | | 201,144 |

| a,bVantiv Inc., A | United States | 16,025 | | 540,683 |

| bVeriFone Systems Inc | United States | 10,445 | | 372,469 |

| aVisa Inc., A | United States | 2,445 | | 631,275 |

| a,bWEX Inc | United States | 8,267 | | 934,832 |

| | | | | 13,331,757 |

| Leisure Equipment & Products 0.3% | | | | |

| Brunswick Corp | United States | 11,966 | | 594,471 |

| aPolaris Industries Inc | United States | 4,489 | | 703,471 |

| | | | | 1,297,942 |

| Life Sciences Tools & Services 0.5% | | | | |

| bFluidigm Corp | United States | 7,411 | | 228,481 |

| bGenfit | France | 3,102 | | 153,838 |

| a,bIllumina Inc | United States | 3,620 | | 691,022 |

| aThermo Fisher Scientific Inc | United States | 7,176 | | 927,785 |

| a,bWuXi Pharmatech Cayman Inc., ADR | China | 7,171 | | 246,037 |

| | | | | 2,247,163 |

| Machinery 0.6% | | | | |

| Airtac International Group | Taiwan | 19,000 | | 171,290 |

| MAN SE | Germany | 470 | | 53,607 |

| aPall Corp | United States | 14,145 | | 1,359,476 |

| aThe Timken Co | United States | 21,585 | | 923,622 |

franklintempleton.com

Semiannual Report

23

|

| FRANKLIN ALTERNATIVE STRATEGIES FUNDS |

| CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED) |

| | | | |

| Franklin K2 Alternative Strategies Fund (continued) | | | | |

| |

| | Country | Shares | | Value |

| Common Stocks and Other Equity Interests (continued) | | | | |

| Machinery (continued) | | | | |

| aThe Toro Co | United States | 9,056 | $ | 594,798 |

| | | | | 3,102,793 |

| Marine 0.2% | | | | |

| American Shipping ASA | Norway | 8,218 | | 49,306 |

| Irish Continental Group PLC | Ireland | 219,470 | | 846,704 |

| | | | | 896,010 |

| Media 4.1% | | | | |

| aCBS Corp., B | United States | 29,035 | | 1,593,441 |

| bCharter Communications Inc., A | United States | 2,262 | | 383,861 |

| aComcast Corp., A | United States | 25,878 | | 1,476,081 |

| a,bDIRECTV | United States | 28,033 | | 2,458,774 |

| a,bDISH Network Corp., A | United States | 34,929 | | 2,773,712 |

| bImax Corp | Canada | 21,125 | | 662,903 |

| bLiberty Broadband Corp., A | United States | 4,217 | | 231,260 |

| a,bLiberty Broadband Corp., C | United States | 7,123 | | 387,491 |

| bLiberty Global PLC, A | United Kingdom | 33,572 | | 1,745,408 |

| bLiberty Global PLC, C | United Kingdom | 14,480 | | 722,842 |

| a,bLiberty Media Corp., A | United States | 27,102 | | 996,541 |

| a,bLiberty Media Corp., C | United States | 31,055 | | 1,134,439 |

| bThe Madison Square Garden Co., A | United States | 1,704 | | 124,460 |

| bMarkit Ltd | United States | 13,900 | | 353,477 |

| aTime Warner Cable Inc | United States | 17,433 | | 2,602,398 |

| aTime Warner Inc | United States | 9,272 | | 789,233 |

| Twenty-First Century Fox Inc., A | United States | 8,600 | | 316,480 |

| aThe Walt Disney Co | United States | 21,113 | | 1,953,164 |

| | | | | 20,705,965 |

| Metals & Mining 0.4% | | | | |

| a,bAk Steel Holding Corp | United States | 50,411 | | 298,433 |

| bB2Gold Corp | Canada | 55,310 | | 89,049 |

| bImpala Platinum Holdings Ltd | South Africa | 18,953 | | 137,985 |

| Newmont Mining Corp | United States | 11,984 | | 220,506 |

| bStillwater Mining Co | United States | 3,378 | | 44,353 |

| bThompson Creek Metals Co. Inc | United States | 68,241 | | 115,327 |

| ThyssenKrupp AG | Germany | 36,895 | | 976,859 |

| | | | | 1,882,512 |

| Multiline Retail 1.1% | | | | |

| b,eDollar General Corp | United States | 31,776 | | 2,120,730 |

| aFamily Dollar Stores Inc | United States | 26,425 | | 2,088,896 |

| aMacy’s Inc | United States | 19,241 | | 1,248,934 |

| | | | | 5,458,560 |

| Oil, Gas & Consumable Fuels 0.6% | | | | |

| b,eCheniere Energy Inc | United States | 12,198 | | 804,946 |

| Exxon Mobil Corp | United States | 318 | | 28,792 |

| bForest Oil Corp | United States | 67,300 | | 38,361 |

| Kinder Morgan Inc | United States | 3,622 | | 149,770 |

| Marathon Petroleum Corp | United States | 11,064 | | 996,756 |

| aOccidental Petroleum Corp | United States | 3,712 | | 296,106 |

24 Semiannual Report

franklintempleton.com

|

| FRANKLIN ALTERNATIVE STRATEGIES FUNDS |

| CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED) |

| | | | |

| Franklin K2 Alternative Strategies Fund (continued) | | | | |

| |

| | Country | Shares | | Value |

| Common Stocks and Other Equity Interests (continued) | | | | |

| Oil, Gas & Consumable Fuels (continued) | | | | |

| Statoil ASA, ADR | Norway | 354 | $ | 6,765 |

| aThe Williams Cos. Inc | United States | 10,962 | | 567,283 |

| | | | | 2,888,779 |

| Paper & Forest Products 0.4% | | | | |

| bCanfor Corp | Canada | 35,586 | | 855,334 |

| bLouisiana-Pacific Corp | United States | 76,644 | | 1,168,054 |

| | | | | 2,023,388 |

| Pharmaceuticals 4.2% | | | | |

| AbbVie Inc | United States | 4,613 | | 319,220 |

| bActavis PLC | United States | 21,670 | | 5,864,119 |

| bAerie Pharmaceuticals Inc | United States | 14,432 | | 380,572 |

| aAllergan Inc | United States | 27,062 | | 5,788,291 |

| a,bAratana Therapeutics Inc | United States | 15,549 | | 206,024 |

| bAssembly Biosciences Inc | United States | 4,828 | | 40,072 |

| AstraZeneca PLC, ADR | United Kingdom | 8,356 | | 619,765 |

| bAvanir Pharmaceuticals Inc | United States | 8,394 | | 125,238 |

| a,bBioDelivery Sciences International Inc | United States | 15,217 | | 233,581 |

| aBristol-Myers Squibb Co | United States | 10,780 | | 636,559 |

| bDermira Inc | United States | 2,584 | | 44,574 |

| Eli Lilly & Co | United States | 4,792 | | 326,431 |

| bEndo International PLC | Ireland | 8,024 | | 587,116 |

| bFlamel Technologies SA, ADR | France | 7,729 | | 110,447 |

| bFoamix Pharmaceuticals Ltd | Israel | 5,318 | | 28,292 |

| GlaxoSmithKline PLC, ADR | United Kingdom | 1,097 | | 50,956 |

| bGW Pharmaceuticals PLC, ADR | United Kingdom | 1,912 | | 148,046 |

| bIntersect ENT Inc | United States | 296 | | 5,121 |

| bJazz Pharmaceuticals PLC | United States | 1,885 | | 333,815 |

| Johnson & Johnson | United States | 443 | | 47,955 |

| a,bThe Medicines Co | United States | 9,657 | | 258,904 |

| bMediwound Ltd | Israel | 1,897 | | 11,211 |

| Novo Nordisk AS, ADR | Denmark | 5,304 | | 241,120 |

| a,bPacira Pharmaceuticals Inc | United States | 8,956 | | 841,237 |

| Perrigo Co. PLC | United States | 3,041 | | 487,138 |

| Pfizer Inc | United States | 1,000 | | 31,150 |

| bRevance Therapeutics Inc | United States | 827 | | 13,596 |

| Roche Holding AG | Switzerland | 3,103 | | 929,856 |

| bSalix Pharmaceuticals Ltd | United States | 5,417 | | 556,272 |

| Shire PLC, ADR | Ireland | 2,964 | | 633,110 |

| bTetraphase Pharmaceuticals Inc | United States | 9,882 | | 260,885 |

| bValeant Pharmaceuticals International Inc | United States | 3,245 | | 471,985 |

| a,bXenoPort Inc | United States | 4,799 | | 42,711 |

| Zoetis Inc | United States | 11,008 | | 494,589 |

| bZS Pharma Inc | United States | 1,055 | | 45,323 |

| | | | | 21,215,281 |

| Professional Services 0.8% | | | | |

| Experian PLC | United Kingdom | 31,398 | | 497,465 |

| a,bHuron Consulting Group Inc | United States | 11,535 | | 797,761 |

| aManpowerGroup Inc | United States | 7,920 | | 529,531 |

franklintempleton.com

Semiannual Report

25

|

| FRANKLIN ALTERNATIVE STRATEGIES FUNDS |

| CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED) |

| | | | |

| Franklin K2 Alternative Strategies Fund (continued) | | | | |

| |

| | Country | Shares | | Value |

| Common Stocks and Other Equity Interests (continued) | | | | |

| Professional Services (continued) | | | | |

| Nielsen NV | United States | 14,883 | $ | 621,663 |

| aRobert Half International Inc | United States | 8,860 | | 503,159 |

| SThree PLC | United Kingdom | 80,547 | | 392,111 |

| bVerisk Analytics Inc., A | United States | 2,335 | | 144,723 |

| bWageWorks Inc | United States | 7,550 | | 441,071 |

| | | | | 3,927,484 |

| Real Estate Investment Trusts (REITs) 0.8% | | | | |

| Columbia Property Trust Inc | United States | 6,565 | | 165,438 |

| bEquity Commonwealth | United States | 4,967 | | 126,311 |

| The Macerich Co | United States | 1,152 | | 91,100 |

| aMid-America Apartment Communities Inc | United States | 14,464 | | 1,065,418 |

| aNorthStar Realty Finance Corp | United States | 32,846 | | 600,096 |

| aRyman Hospitality Properties Inc | United States | 6,133 | | 319,407 |

| aSpirit Realty Capital Inc | United States | 69,901 | | 818,541 |

| Sunstone Hotel Investors Inc | United States | 6,457 | | 103,377 |

| aTanger Factory Outlet Centers Inc | United States | 7,242 | | 264,912 |

| Ventas Inc | United States | 1,170 | | 83,714 |

| aWP Carey Inc | United States | 1,788 | | 121,834 |

| | | | | 3,760,148 |