UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number_811-22641

__Franklin Alternative Strategies Funds

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code: 650 312-2000

Date of fiscal year end: 5/31

Date of reporting period: 11/30/15

Item 1. Reports to Stockholders.

| Contents | |

| Semiannual Report | |

| Franklin K2 Alternative Strategies Fund | 3 |

| Performance Summary | 7 |

| Your Fund’s Expenses | 10 |

| Consolidated Financial Highlights and Consolidated | |

| Statement of Investments | 12 |

| Consolidated Financial Statements | 71 |

| Notes to Consolidated Financial Statements | 75 |

| Shareholder Information | 91 |

Visit franklintempleton.com for fund updates, to access your account, or to find helpful financial planning tools.

2 Semiannual Report

franklintempleton.com

Semiannual Report

Franklin K2 Alternative Strategies Fund

This semiannual report for Franklin K2 Alternative Strategies Fund covers the period ended November 30, 2015.

Your Fund’s Goal and Main Investments

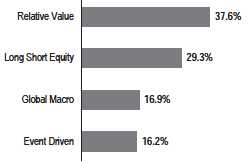

The Fund seeks capital appreciation with lower volatility relative to the broad equity markets. The Fund seeks to achieve its investment goal by allocating its assets across multiple non-traditional or “alternative” strategies, including but not limited to relative value, long short equity, global macro and event driven. The Fund is structured as a multi-manager fund, meaning the Fund’s assets are independently managed by multiple investment managers (subadvisors), while the Fund’s investment manager retains overall responsibility for the Fund’s investments. The Fund may invest in a wide range of securities and other investments including, but not limited to: equity securities including common stocks, preferred stocks, convertible securities, rights and warrants, private and registered investment vehicles and exchange-traded funds (ETFs); and debt securities including bonds, notes, debentures, banker’s acceptances and commercial paper; loans and loan participations; and mortgage-backed or other asset-backed securities, including collateralized debt obligations; as well as derivatives, commodities and currencies.

Performance Overview

The Fund’s Class A shares had a -2.24% cumulative total return for the six months under review. For comparison, the Fund’s primary benchmark, the BofA Merrill Lynch 3-Month U.S. Treasury Bill (T-Bill) Index, which tracks the performance of short-term U.S. government securities with a remaining term to final maturity of less than three months, posted a +0.01% total return.1 Also for comparison, the Fund’s secondary benchmark, the HFRX Global Hedge Fund Index, which is designed to be representative of the overall composition of the hedge fund universe, had a -4.77% total return.2 You can find more of the Fund’s performance data in the Performance Summary beginning on page 7.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Strategy Allocation

Based on Total Investments as of 11/30/15

Economic and Market Overview

The global economy expanded moderately during the six months under review although growth slowed in some countries. As measured by the MSCI World Index, stocks in global developed markets declined overall during the period. Weighing on global stocks were worries about China’s slowing economy and tumbling stock market, declining commodity prices, geopolitical tensions between Russia and Turkey, and ongoing uncertainty over the U.S. Federal Reserve’s (Fed’s) timing for raising interest rates. Conversely, stocks gained as economic data in the U.S. and certain eurozone countries improved, Greece reached an agreement with its creditors, certain global central banks sought to boost their respective economies and the Fed kept the federal funds target rate unchanged. For the reporting period, oil prices declined sharply largely due to increased global supply and reduced global demand. Gold and other commodity prices also fell. The U.S. dollar appreciated against most currencies during the period, which reduced returns of many foreign assets in U.S. dollar terms.

1. Source: Morningstar.

2. Source: FactSet. Hedge Fund Research, Inc. – www.hedgefundresearch.com.The HFRX Global Hedge Fund Index is being used under license from Hedge Fund

Research, Inc., which does not endorse or approve of any of the contents of this report.

The indexes are unmanaged and include reinvestment of any income or distributions. One cannot invest directly in an index, and an index is not representative of the Fund’s

portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Consolidated Statement of Investments (SOI).

The Consolidated SOI begins on page 17.

franklintempleton.com

Semiannual Report 3

FRANKLIN K2 ALTERNATIVE STRATEGIES FUND

Amid healthy consumer spending, U.S. economic growth strengthened in the second quarter. The third quarter was less robust as businesses cut back on inventories, exports slowed, and state and local governments reduced their spending. Although global financial markets anticipated a Fed interest rate increase, the Fed kept interest rates unchanged. It said it expected moderate economic expansion but would monitor developments domestically and abroad. The Fed’s October meeting minutes indicated most members acknowledged the possibility of an interest rate increase at their next meeting in December.

Outside the U.S., the U.K. economy’s growth slowed in the third quarter following slight second-quarter growth spurred by the service sector. Weak construction and manufacturing results hampered third-quarter expansion. In the eurozone, despite investor concerns about China’s moderating economy and geopolitical tensions between Russia and Turkey, the region generally benefited during the period from lower oil prices, a weaker euro that supported exports, the European Central Bank’s (ECB’s) accommodative policy, an improved 2015 eurozone growth forecast, and expectations of further ECB stimulus.

After a decline in the second quarter of 2015, Japan’s economy expanded in the third quarter as capital expenditures improved. The Bank of Japan took several actions during the reporting period, including maintaining its monetary policy, lowering its economic growth and inflation forecasts, and increasing its purchases of longer-term debt.

In emerging markets, economic growth generally moderated. At the beginning of the reporting period, Greece’s economic and financial woes weighed on investor sentiment although the country and its creditors reached an agreement for a third bailout package in July. In China, the government’s intervention to cool domestic stock market speculation and its effective currency devaluation led to a severe slump in emerging market stocks from June through August. In October, emerging market equities gained after China expanded its monetary and fiscal stimulus to support its economy, though they retreated in November amid other concerns. In Brazil, falling prices for energy and other commodities coincided with an economic recession, rising unemployment and political uncertainty, leading to equity weakness and currency depreciation. Central bank actions varied across emerging markets during the six months under review, as some banks raised interest rates in response to rising inflation and weakening currencies, while others lowered interest rates to promote economic growth. In the recent global environment, emerging market stocks, as measured by the MSCI Emerging Markets Index, fell significantly for the six-month period.

Investment Strategy

We manage the Fund using a multi-manager approach. While we are responsible for the Fund’s overall investments, we allocate assets to multiple subadvisors, each of whom independently manages a separate portion of the Fund’s portfolio in accordance with some or all of the following strategies: long short equity, relative value, event driven and global macro. We allocate the Fund’s assets among these strategies utilizing a top-down approach, generating the Fund’s strategy weightings by taking into account market conditions, risk factors, diversification, liquidity, transparency, and availability of various subadvisors and other investment options, among other things. The allocations to specific subadvisors may change from time to time based upon our assessment of their correlations to various markets and to each other, their risk profiles and return expectations. Long short equity strategies generally seek to produce returns from investments in the equity markets by taking long and short positions in stocks and common stock indexes (through the use of derivatives or ETFs). Relative value strategies encompass a wide range of investment techniques that are intended to profit from pricing inefficiencies. Event driven strategies generally invest in securities of companies undergoing significant corporate events. Global macro strategies generally focus on broad-based economic opportunities across numerous markets and investments.

The Fund may take long and/or short positions in a wide range of asset classes, including equities, fixed income, commodities and currencies, among others. Long positions benefit from an increase in the price of the underlying instrument or asset class, while short positions benefit from a decrease in that price. The Fund may use derivatives for hedging and nonhedging (investment) purposes. Such derivative investments may include futures contracts, swaps, options and currency forward contracts. The Fund may engage in active and frequent trading as part of its investment strategies.

What is a futures contract?

A futures contract is an agreement between the Fund and a counterparty made through a U.S. or foreign futures exchange to buy or sell an underlying instrument or asset at a specific price on a future date.

What is a swap agreement?

A swap agreement, such as an equity total return swap, is a contract between the Fund and a counterparty to exchange on a future date the returns, or differentials in return, that would have been earned or realized if a notional amount were invested in specific instruments.

4 Semiannual Report

franklintempleton.com

FRANKLIN K2 ALTERNATIVE STRATEGIES FUND

A credit default swap, or CDS, is an agreement between two parties whereby the buyer receives credit protection from the seller. The buyer makes periodic payments over the term of the agreement in return for a payment by the seller in the event of a default or other credit event.

An interest rate swap is an agreement between two parties to exchange interest rate obligations, generally one based on an interest rate fixed to maturity and the other based on an interest rate that changes in accordance with changes in a designated benchmark (for example, LIBOR, prime, commercial paper or other benchmarks).

What is an option?

An option is a contract to buy or sell a specific financial product known as the option’s underlying instrument at a specific price. The buyer of an option has the right, but not the obligation, to buy or sell the underlying instrument at or until a specified expiration date. Conversely, the seller (writer) of an option who opens a transaction is obligated to buy or sell the underlying instrument should the option holder exercise that right.

What is a currency forward contract?

A currency forward contract is an agreement between the Fund and a counterparty to buy or sell a foreign currency at a specific exchange rate on a future date.

Subadvisors

11/30/15

Long Short Equity

Chilton Investment Company, LLC

Impala Asset Management, LLC

Jennison Associates, LLC

Wellington Management Company, LLP

Relative Value

Basso Capital Management, L.P.

Chatham Asset Management, LLC

Lazard Asset Management, LLC

Loomis Sayles & Company, L.P.

Event Driven

P. Schoenfeld Asset Management L.P.

York Registered Holdings, L.P.

Global Macro

EMSO Partners Limited

Graham Capital Management, L.P.

Manager’s Discussion

Two of the four strategies in which the Fund’s assets were allocated, global macro and long short equity, provided positive performance for the period. However, the event driven and relative value strategies declined during the review period, and the Fund’s overall performance was negative.

Our relative value strategy managers were Basso Capital Management, Chatham Asset Management, Lazard Asset Management and Loomis Sayles & Company. While Basso delivered a positive return, the other managers declined for the period, largely due to a notable high yield bond sell-off in the second half of 2015. For Basso, certain corporate bonds in the technology sector benefited returns, as did some consumer noncyclical equity and preferred equity positions. In contrast, certain technology stock positions weighed on performance. Two of Chatham’s corporate bonds, one in the consumer noncyclical sector and one in the financials sector, notably detracted from performance. However, a number of consumer non-cyclical bond positions made positive contributions to returns. For Lazard, long convertible bond positions in renewable energy declined due to increased investor concerns on solar companies. However, since these were set up as convertible arbitrage trades, the losses were partially offset by gains from corresponding short equity positions. For Loomis Sayles, energy sector corporate bonds generally hindered performance. Overall, the relative value strategy managers have noted that the sell-off in late 2015 and increasing volatility provided what they viewed as more robust opportunities. Areas of interest for individual managers included convertibles in Asia, sector differentiation in the broader credit and equity markets, and lower quality issues for high yield bonds.

The Fund’s event driven strategy managers were P. Schoenfeld Asset Management and York Registered Holdings. The managers experienced negative results during the period. As is typical in the event driven space, contributors and detractors tend to be from diverse events, including mergers, restructurings and other corporate events. For P. Schoenfeld, certain basic materials and energy stock positions weighed on performance. A pharmaceutical stock, which had previously been an acquisition target, also detracted from returns. In contrast, select equity swap positions in the basic materials and communications sectors benefited performance. For York, consumer non-cyclical positions declined due to disappointing earnings announcements, restructuring charges and exposure to China’s slowing economy. On the other hand, several equity holdings in the consumer non-cyclical sector rallied with the broader market and added value. Looking forward, both managers expect a robust event driven opportunity set to continue, driven by a combination of corporate need for growth and a potential for increased defaults.

Graham Capital Management and EMSO Partners Limited represented our global macro exposure. EMSO delivered positive performance, while Graham modestly detracted from returns. EMSO benefited from long exposure in Greek and Argentine sovereign bonds. Long exposure in Greece performed

franklintempleton.com

Semiannual Report 5

FRANKLIN K2 ALTERNATIVE STRATEGIES FUND

well throughout the period due to the resolution of the debt crisis and an election that solidified the Syriza party’s power, which stabilized the government. Speculation about further quantitative easing in Europe also helped a rally in Greek bonds. Argentine bonds also performed well due to the anticipation of elections in October and November yielding a new president to replace scandal-plagued Cristina Fernandez de Kirchner. The bonds rallied further when Mauricio Macri, seen as the most pro-market presidential candidate, won the election. Graham suffered losses during the period. Among detractors was short commodity positioning in agricultural commodities in June, which suffered from a price rally due to extreme rain in the Midwest diminishing U.S. crop yields. Graham also experienced significant losses in August and September from long equity positioning, which suffered during the steep market sell-off. The asset manager did not participate in October’s equity market rebound because it had shifted from long to slightly short net positioning in equities.

The Fund’s long short equity strategy managers were Chilton Investment Company, Impala Asset Management, Jennison Associates and Wellington Management Company. Chilton and Wellington contributed positive performance for the period, while Impala’s return was relatively flat. Jennison, which focused on the health care sector, posted negative results given elevated concerns about high valuations and drug pricing practices. For Chilton, select consumer cyclical stocks reported quarterly earnings that exceeded analyst expectations and aided performance. In contrast, select industrials holdings adversely affected results, as one was downgraded in a research report and another reported lower volume in its transportation business. Among the equity positions of Wellington, which focuses on the technology sector, an announced acquisition and positive quarterly earnings surprises notably contributed to performance. Conversely, select holdings with significant revenue exposure in China were challenged by investor concerns about the country’s slowing growth. For Jennison, certain long holdings in pharmaceuticals and biotechnology declined as a U.S. presidential candidate’s comments about regulating drug prices weighed on the industry. In addition, company-specific concerns hampered performance of individual biotechnology and pharmaceutical positions. However, select pharmaceutical long holdings posted gains and helped results, including one company that reported successful results from a Phase 3 trial of a pipeline drug. Among areas the long short equity strategy managers found attractive at period-end were housing/materials, biotechnology, electronic payments and auto parts.

Thank you for your participation in Franklin K2 Alternative Strategies Fund. We look forward to continuing to serve your investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of November 30, 2015, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

6 Semiannual Report

franklintempleton.com

FRANKLIN K2 ALTERNATIVE STRATEGIES FUND

Performance Summary as of November 30, 2015

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| Net Asset Value | ||||||

| Share Class (Symbol) | 11/30/15 | 5/31/15 | Change | |||

| A (FAAAX) | $ | 10.91 | $ | 11.16 | -$ | 0.25 |

| C (FASCX) | $ | 10.80 | $ | 11.09 | -$ | 0.29 |

| R (FSKKX) | $ | 10.84 | $ | 11.15 | -$ | 0.31 |

| R6 (FASRX) | $ | 10.95 | $ | 11.18 | -$ | 0.23 |

| Advisor (FABZX) | $ | 10.94 | $ | 11.18 | -$ | 0.24 |

franklintempleton.com

Semiannual Report 7

| FRANKLIN K2 ALTERNATIVE STRATEGIES FUND |

| PERFORMANCE SUMMARY |

Performance as of 11/30/151

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only;

Class R/R6/Advisor Class: no sales charges.

| Average Annual | Total Annual Operating Expenses6 | |||||||||||

| Cumulative | Average Annual | Value of $10,000 | Total Return | |||||||||

| Share Class | Total Return2 | Total Return3 | Investment4 | (12/31/15 | )5 | (with waiver) | (without waiver) | |||||

| A | 2.85 | % | 3.49 | % | ||||||||

| 6-Month | -2.24 | % | -7.85 | % | $ | 9,215 | ||||||

| 1-Year | +0.52 | % | -5.29 | % | $ | 9,471 | -5.86 | % | ||||

| Since Inception (10/11/13) | +10.20 | % | +1.79 | % | $ | 10,387 | +1.29 | % | ||||

| C | 3.60 | % | 4.24 | % | ||||||||

| 6-Month | -2.61 | % | -3.59 | % | $ | 9,641 | ||||||

| 1-Year | -0.22 | % | -1.22 | % | $ | 9,878 | -1.82 | % | ||||

| Since Inception (10/11/13) | +8.68 | % | +3.97 | % | $ | 10,868 | +3.34 | % | ||||

| R | 3.10 | % | 3.74 | % | ||||||||

| 6-Month | -2.78 | % | -2.78 | % | $ | 9,722 | ||||||

| 1-Year | -0.18 | % | -0.18 | % | $ | 9,982 | -0.76 | % | ||||

| Since Inception (10/11/13) | +9.23 | % | +4.22 | % | $ | 10,923 | +3.61 | % | ||||

| R6 | 2.51 | % | 3.15 | % | ||||||||

| 6-Month | -2.06 | % | -2.06 | % | $ | 9,794 | ||||||

| 1-Year | +0.79 | % | +0.79 | % | $ | 10,079 | +0.24 | % | ||||

| Since Inception (10/11/13) | +10.90 | % | +4.96 | % | $ | 11,090 | +4.36 | % | ||||

| Advisor | 2.60 | % | 3.24 | % | ||||||||

| 6-Month | -2.15 | % | -2.15 | % | $ | 9,785 | ||||||

| 1-Year | +0.86 | % | +0.86 | % | $ | 10,086 | +0.19 | % | ||||

| Since Inception (10/11/13) | +10.87 | % | +4.95 | % | $ | 11,087 | +4.33 | % | ||||

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 9 for Performance Summary footnotes.

8 Semiannual Report

franklintempleton.com

| FRANKLIN K2 ALTERNATIVE STRATEGIES FUND |

| PERFORMANCE SUMMARY |

All investments involve risks, including possible loss of principal. The market values of securities owned by the Fund will go up or down, sometimes rapidly or unpredictably. The Fund’s performance depends on the manager’s skill in selecting, overseeing and allocating fund assets. The Fund is actively managed and could experience losses if the investment manager’s and subadvisors’ judgment about particular investments made for the Fund’s portfolio prove to be incorrect. Some subadvisors may have little or no experience managing the assets of a registered investment company. Foreign investments are subject to greater investment risk such as political, economic, credit and information risks as well as risk of currency fluctuations. Investments in derivatives involve costs and can create economic leverage, which may result in significant volatility and cause the Fund to participate in losses (as well as gains) that significantly exceed the Fund’s initial investment. Currency management strategies could result in losses to the Fund if currencies do not perform as the investment manager or subadvisor expects. Lower rated or high yield debt securities involve greater credit risk, including the possibility of default or bankruptcy. The Fund may make short sales of securities, which involves the risk that losses may exceed the original amount invested. Merger arbitrage investments risk loss if a proposed reorganization in which the Fund invests is renegotiated or terminated. Liquidity risk exists when securities have become more difficult to sell at the price at which the Fund has valued the securities. The Fund’s prospectus also includes a description of the main investment risks.

Class C: Class R: Class R6: Advisor Class: | These shares have higher annual fees and expenses than Class A shares. Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. Shares are available to certain eligible investors as described in the prospectus. Shares are available to certain eligible investors as described in the prospectus. |

1. The Fund has an expense reduction contractually guaranteed through at least 9/30/16 and a fee waiver related to the management fee paid by a subsidiary. The transfer

agent has contractually agreed to waive or limit its transfer agency fees for Class R6 shares of the Fund so that transfer agency fees for that class do not exceed 0.01% until

9/30/16. Fund investment results reflect the expense reduction, fee waiver and fee cap, to the extent applicable; without these reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been

annualized.

4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

6. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to

become higher than the figures shown.

franklintempleton.com

Semiannual Report 9

FRANKLIN K2 ALTERNATIVE STRATEGIES FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

1. Divide your account value by $1,000.

If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6.

2. Multiply the result by the number under the heading “Expenses Paid During Period.”

If Expenses Paid During Period were $7.50, then 8.6 × $7.50 = $64.50.

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

10 Semiannual Report

franklintempleton.com

FRANKLIN K2 ALTERNATIVE STRATEGIES FUND

YOUR FUND’S EXPENSES

| Beginning Account | Ending Account | Expenses Paid During | ||||

| Share Class | Value 6/1/15 | Value 11/30/15 | Period* 6/1/15–11/30/15 | |||

| A | ||||||

| Actual | $ | 1,000 | $ | 977.60 | $ | 14.29 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,010.55 | $ | 14.53 |

| C | ||||||

| Actual | $ | 1,000 | $ | 973.90 | $ | 17.86 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,006.90 | $ | 18.16 |

| R | ||||||

| Actual | $ | 1,000 | $ | 972.20 | $ | 15.38 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,009.40 | $ | 15.67 |

| R6 | ||||||

| Actual | $ | 1,000 | $ | 979.40 | $ | 12.57 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,012.30 | $ | 12.78 |

| Advisor | ||||||

| Actual | $ | 1,000 | $ | 978.50 | $ | 12.96 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,011.90 | $ | 13.18 |

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 2.89%;

C: 3.62%; R: 3.12%; R6: 2.54% and Advisor: 2.62%), multiplied by the average account value over the period, multiplied by 183/366 to reflect

the one-half year period.

franklintempleton.com

Semiannual Report

11

| FRANKLIN ALTERNATIVE STRATEGIES FUNDS | |||||||||

| Consolidated Financial Highlights | |||||||||

| Franklin K2 Alternative Strategies Fund | |||||||||

| Period Ended | Year End May 31, | ||||||||

| November 30, 2015 | |||||||||

| (unaudited) | 2015 | 2014 | a | ||||||

| Class A | |||||||||

| Per share operating performance | |||||||||

| (for a share outstanding throughout the period) | |||||||||

| Net asset value, beginning of period | $ | 11.16 | $ | 10.64 | $ | 10.00 | |||

| Income from investment operationsb: | |||||||||

| Net investment income (loss)c | (0.04 | ) | (0.11 | ) | (0.02 | ) | |||

| Net realized and unrealized gains (losses) | (0.21 | ) | 0.70 | 0.70 | |||||

| Total from investment operations | (0.25 | ) | 0.59 | 0.68 | |||||

| Less distributions from net investment income | — | (0.07 | ) | (0.04 | ) | ||||

| Net asset value, end of period | $ | 10.91 | $ | 11.16 | $ | 10.64 | |||

| Total returnd | (2.24 | )% | 5.53 | % | 6.82 | % | |||

| Ratios to average net assetse | |||||||||

| Expenses before waiver, payments by affiliates and expense reductionf | 3.25 | % | 3.40 | % | 3.33 | % | |||

| Expenses net of waiver, payments by affiliates and expense reductionf | 2.89 | %g | 2.99 | %g | 2.83 | % | |||

| Expenses incurred in connection with securities sold short | 0.67 | % | 0.65 | % | 0.56 | % | |||

| Net investment income (loss) | (0.73 | )% | (0.95 | )% | (0.35 | )% | |||

| Supplemental data | |||||||||

| Net assets, end of period (000’s) | $ | 193,529 | $ | 148,991 | $ | 96,889 | |||

| Portfolio turnover rate | 118.20 | % | 295.81 | % | 181.06 | % | |||

aFor the period October 11, 2013 (commencement of operations) to May 31, 2014.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales

and repurchases of Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fIncludes dividend and/or interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the

periods presented. See Note 1(g).

gBenefit of expense reduction rounds to less than 0.01%.

12 Semiannual Report | The accompanying notes are an integral part of these consolidated financial statements. franklintempleton.com

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

CONSOLIDATED FINANCIAL HIGHLIGHTS

| Franklin K2 Alternative Strategies Fund (continued) | |||||||||

| Period Ended | Year End May 31, | ||||||||

| November 30, 2015 | |||||||||

| (unaudited) | 2015 | 2014 | a | ||||||

| Class C | |||||||||

| Per share operating performance | |||||||||

| (for a share outstanding throughout the period) | |||||||||

| Net asset value, beginning of period | $ | 11.09 | $ | 10.60 | $ | 10.00 | |||

| Income from investment operationsb: | |||||||||

| Net investment income (loss)c | (0.08 | ) | (0.17 | ) | (0.08 | ) | |||

| Net realized and unrealized gains (losses) | (0.21 | ) | 0.69 | 0.72 | |||||

| Total from investment operations | (0.29 | ) | 0.52 | 0.64 | |||||

| Less distributions from net investment income | — | (0.03 | ) | (0.04 | ) | ||||

| Net asset value, end of period | $ | 10.80 | $ | 11.09 | $ | 10.60 | |||

| Total returnd | (2.61 | )% | 4.87 | % | 6.42 | % | |||

| Ratios to average net assetse | |||||||||

| Expenses before waiver, payments by affiliates and expense reductionf | 3.98 | % | 4.04 | % | 4.03 | % | |||

| Expenses net of waiver, payments by affiliates and expense reductionf | 3.62 | %g | 3.63 | %g | 3.53 | % | |||

| Expenses incurred in connection with securities sold short | 0.67 | % | 0.65 | % | 0.56 | % | |||

| Net investment income (loss) | (1.46 | )% | (1.59 | )% | (1.05 | )% | |||

| Supplemental data | |||||||||

| Net assets, end of period (000’s) | $ | 73,222 | $ | 37,937 | $ | 16,618 | |||

| Portfolio turnover rate | 118.20 | % | 295.81 | % | 181.06 | % | |||

aFor the period October 11, 2013 (commencement of operations) to May 31, 2014.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales

and repurchases of Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fIncludes dividend and/or interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the

periods presented. See Note 1(g).

gBenefit of expense reduction rounds to less than 0.01%.

franklintempleton.com The accompanying notes are an integral part of these consolidated financial statements. | Semiannual Report 13

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

CONSOLIDATED FINANCIAL HIGHLIGHTS

| Franklin K2 Alternative Strategies Fund (continued) | |||||||||

| Period Ended | Year End May 31, | ||||||||

| November 30, 2015 | |||||||||

| (unaudited) | 2015 | 2014 | a | ||||||

| Class R | |||||||||

| Per share operating performance | |||||||||

| (for a share outstanding throughout the period) | |||||||||

| Net asset value, beginning of period | $ | 11.15 | $ | 10.62 | $ | 10.00 | |||

| Income from investment operationsb: | |||||||||

| Net investment income (loss)c | (0.07 | ) | (0.16 | ) | (0.05 | ) | |||

| Net realized and unrealized gains (losses) | (0.24 | ) | 0.73 | 0.71 | |||||

| Total from investment operations | (0.31 | ) | 0.57 | 0.66 | |||||

| Less distributions from net investment income | — | (0.04 | ) | (0.04 | ) | ||||

| Net asset value, end of period | $ | 10.84 | $ | 11.15 | $ | 10.62 | |||

| Total returnd | (2.78 | )% | 5.39 | % | 6.62 | % | |||

| Ratios to average net assetse | |||||||||

| Expenses before waiver, payments by affiliates and expense reductionf | 3.48 | % | 3.57 | % | 3.63 | % | |||

| Expenses net of waiver, payments by affiliates and expense reductionf | 3.12 | %g | 3.16 | %g | 3.13 | % | |||

| Expenses incurred in connection with securities sold short | 0.67 | % | 0.65 | % | 0.56 | % | |||

| Net investment income (loss) | (0.96 | )% | (1.12 | )% | (0.65 | )% | |||

| Supplemental data | |||||||||

| Net assets, end of period (000’s) | $ | 334 | $ | 9,173 | $ | 11,660 | |||

| Portfolio turnover rate | 118.20 | % | 295.81 | % | 181.06 | % | |||

aFor the period October 11, 2013 (commencement of operations) to May 31, 2014.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales

and repurchases of Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fIncludes dividend and/or interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the

periods presented. See Note 1(g).

gBenefit of expense reduction rounds to less than 0.01%.

14 Semiannual Report | The accompanying notes are an integral part of these consolidated financial statements. franklintempleton.com

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

CONSOLIDATED FINANCIAL HIGHLIGHTS

| Franklin K2 Alternative Strategies Fund (continued) | |||||||||

| Period Ended | Year End May 31, | ||||||||

| November 30, 2015 | |||||||||

| (unaudited) | 2015 | 2014 | a | ||||||

| Class R6 | |||||||||

| Per share operating performance | |||||||||

| (for a share outstanding throughout the period) | |||||||||

| Net asset value, beginning of period | $ | 11.18 | $ | 10.66 | $ | 10.00 | |||

| Income from investment operationsb: | |||||||||

| Net investment income (loss)c | (0.02 | ) | (0.08 | ) | (0.01 | ) | |||

| Net realized and unrealized gains (losses) | (0.21 | ) | 0.70 | 0.71 | |||||

| Total from investment operations | (0.23 | ) | 0.62 | 0.70 | |||||

| Less distributions from net investment income | — | (0.10 | ) | (0.04 | ) | ||||

| Net asset value, end of period | $ | 10.95 | $ | 11.18 | $ | 10.66 | |||

| Total returnd | (2.06 | )% | 5.80 | % | 7.02 | % | |||

| Ratios to average net assetse | |||||||||

| Expenses before waiver, payments by affiliates and expense reductionf | 2.90 | % | 2.98 | % | 3.19 | % | |||

| Expenses net of waiver, payments by affiliates and expense reductionf | 2.54 | %g | 2.60 | %g | 2.69 | % | |||

| Expenses incurred in connection with securities sold short | 0.67 | % | 0.65 | % | 0.56 | % | |||

| Net investment income (loss) | (0.38 | )% | (0.56 | )% | (0.21 | )% | |||

| Supplemental data | |||||||||

| Net assets, end of period (000’s) | $ | 261,042 | $ | 239,754 | $ | 215,526 | |||

| Portfolio turnover rate | 118.20 | % | 295.81 | % | 181.06 | % | |||

aFor the period October 11, 2013 (commencement of operations) to May 31, 2014.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales

and repurchases of Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fIncludes dividend and/or interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the

periods presented. See Note 1(g).

gBenefit of expense reduction less than 0.01%.

franklintempleton.com The accompanying notes are an integral part of these consolidated financial statements. | Semiannual Report 15

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

CONSOLIDATED FINANCIAL HIGHLIGHTS

| Franklin K2 Alternative Strategies Fund (continued) | |||||||||

| Period Ended | Year End May 31, | ||||||||

| November 30, 2015 | |||||||||

| (unaudited) | 2015 | 2014 | a | ||||||

| Advisor Class | |||||||||

| Per share operating performance | |||||||||

| (for a share outstanding throughout the period) | |||||||||

| Net asset value, beginning of period | $ | 11.18 | $ | 10.65 | $ | 10.00 | |||

| Income from investment operationsb: | |||||||||

| Net investment income (loss)c | (0.02 | ) | (0.02 | ) | (0.02 | ) | |||

| Net realized and unrealized gains (losses) | (0.22 | ) | 0.64 | 0.71 | |||||

| Total from investment operations | (0.24 | ) | 0.62 | 0.69 | |||||

| Less distributions from net investment income | — | (0.09 | ) | (0.04 | ) | ||||

| Net asset value, end of period | $ | 10.94 | $ | 11.18 | $ | 10.65 | |||

| Total returnd | (2.15 | )% | 5.88 | % | 6.92 | % | |||

| Ratios to average net assetse | |||||||||

| Expenses before waiver, payments by affiliates and expense reductionf | 2.98 | % | 3.07 | % | 3.21 | % | |||

| Expenses net of waiver, payments by affiliates and expense reductionf | 2.62 | %g | 2.66 | %g | 2.71 | % | |||

| Expenses incurred in connection with securities sold short | 0.67 | % | 0.65 | % | 0.56 | % | |||

| Net investment income (loss) | (0.46 | )% | (0.62 | )% | (0.23 | )% | |||

| Supplemental data | |||||||||

| Net assets, end of period (000’s) | $ | 646,012 | $ | 329,139 | $ | 54,593 | |||

| Portfolio turnover rate | 118.20 | % | 295.81 | % | 181.06 | % | |||

aFor the period October 11, 2013 (commencement of operations) to May 31, 2014.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales

and repurchases of Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fIncludes dividend and/or interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the

periods presented. See Note 1(g).

gBenefit of expense reduction less than 0.01%.

16 Semiannual Report | The accompanying notes are an integral part of these consolidated financial statements. franklintempleton.com

FRANKLIN K2 ALTERNATIVE STRATEGIES FUNDS

Consolidated Statement of Investments, November 30, 2015 (unaudited)

| Franklin K2 Alternative Strategies Fund | ||||

| Country | Shares/Warrants | Value | ||

| Common Stocks and Other Equity Interests 36.1% | ||||

| Aerospace & Defense 1.1% | ||||

| Northrop Grumman Corp | United States | 2,353 | $ | 438,505 |

| aPrecision Castparts Corp | United States | 36,542 | 8,460,935 | |

| a,bTransDigm Group Inc | United States | 15,474 | 3,630,664 | |

| 12,530,104 | ||||

| Air Freight & Logistics 0.4% | ||||

| aFedEx Corp | United States | 27,725 | 4,395,521 | |

| Airlines 0.2% | ||||

| bAir Canada | Canada | 16,105 | 125,782 | |

| b,c,dAMR Corp., Contingent Distribution | United States | 3,268 | — | |

| a,eDelta Air Lines Inc | United States | 46,830 | 2,175,722 | |

| b,fWizz Air Holdings PLC, 144A | Switzerland | 16,236 | 431,838 | |

| 2,733,342 | ||||

| Auto Components 0.1% | ||||

| b,fEuropcar Groupe SA, 144A | France | 52,650 | 661,129 | |

| Hota Industrial Manufacturing Co. Ltd | Taiwan | 51,000 | 196,863 | |

| Johnson Controls Inc | United States | 18,029 | 829,334 | |

| 1,687,326 | ||||

| Automobiles 0.4% | ||||

| Daimler AG | Germany | 10,430 | 933,706 | |

| bPeugeot SA | France | 194,851 | 3,481,247 | |

| a,bTesla Motors Inc | United States | 1,525 | 351,146 | |

| 4,766,099 | ||||

| Banks 0.0%† | ||||

| b,fABN AMRO Group NV, 144A | Netherlands | 5,022 | 105,483 | |

| Bank of America Corp | United States | 8,897 | 155,075 | |

| KBC Groep NV | Belgium | 1,950 | 116,405 | |

| 376,963 | ||||

| Beverages 0.6% | ||||

| aBrown-Forman Corp., B | United States | 20,559 | 2,108,120 | |

| Davide Campari-Milano SpA | Italy | 111,885 | 982,930 | |

| Heineken NV | Netherlands | 31,444 | 2,795,967 | |

| a,bMonster Beverage Corp | United States | 6,697 | 1,035,423 | |

| 6,922,440 | ||||

| Biotechnology 2.4% | ||||

| bAdaptimmune Therapeutics PLC, ADR | United States | 6,971 | 63,018 | |

| bAduro Biotech Inc | United States | 5,798 | 179,680 | |

| a,bAgios Pharmaceuticals Inc | United States | 2,321 | 149,913 | |

| a,bAlexion Pharmaceuticals Inc | United States | 10,647 | 1,899,851 | |

| a,bAlnylam Pharmaceuticals Inc | United States | 14,266 | 1,484,520 | |

| bAmicus Therapeutics Inc | United States | 24,281 | 260,535 | |

| bApplied Genetic Technologies Corp | United States | 12,072 | 205,707 | |

| aBaxalta Inc | United States | 44,804 | 1,540,362 | |

| bBioCryst Pharmaceuticals Inc | United States | 16,081 | 170,619 | |

| a,bBiogen Idec Inc | United States | 5,059 | 1,451,225 | |

| a,bBioMarin Pharmaceutical Inc | United States | 33,007 | 3,147,878 | |

| bBluebird Bio Inc | United States | 7,446 | 660,832 | |

| bCara Therapeutics Inc | United States | 7,545 | 124,870 | |

| a,bCelgene Corp | United States | 19,650 | 2,150,692 |

franklintempleton.com

Semiannual Report

17

| FRANKLIN ALTERNATIVE STRATEGIES FUNDS |

| CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED) |

| Franklin K2 Alternative Strategies Fund (continued) | ||||

| Country | Shares/Warrants | Value | ||

| Common Stocks and Other Equity Interests (continued) | ||||

| Biotechnology (continued) | ||||

| bChimerix Inc | United States | 10,468 | $ | 422,907 |

| bCoherus Biosciences Inc | United States | 6,196 | 188,173 | |

| bDBV Technologies SA, ADR | France | 7,201 | 251,099 | |

| bDimension Therapeutics Inc | United States | 6,007 | 90,345 | |

| bDyax Corp | United States | 7,797 | 262,447 | |

| bEPIRUS Biopharmaceuticals Inc | United States | 29,450 | 143,421 | |

| bEpizyme Inc | United States | 11,704 | 188,551 | |

| bExelixis Inc | United States | 83,321 | 476,596 | |

| bFibrocell Science Inc | United States | 33,821 | 199,544 | |

| bFlexion Therapeutics Inc | United States | 9,318 | 181,142 | |

| aGilead Sciences Inc | United States | 8,052 | 853,190 | |

| bGlobal Blood Therapeutics Inc | United States | 4,283 | 201,130 | |

| bImmune Design Corp | United States | 2,878 | 60,237 | |

| a,bIncyte Corp. Ltd | United States | 23,376 | 2,670,474 | |

| bInotek Pharmaceuticals Corp | United States | 20,812 | 249,536 | |

| bInsmed Inc | United States | 15,519 | 253,115 | |

| bInvitae Corp | United States | 476 | 3,660 | |

| bKindred Biosciences Inc | United States | 9,857 | 39,329 | |

| bMacroGenics Inc | United States | 3,412 | 117,987 | |

| bMedgenics Inc | Israel | 23,215 | 160,648 | |

| bMirati Therapeutics Inc | United States | 959 | 36,471 | |

| bNatera Inc | United States | 9,137 | 81,228 | |

| bNeurocrine Biosciences Inc | United States | 6,361 | 345,848 | |

| bNexvet Biopharma PLC | Ireland | 259 | 1,023 | |

| bNivalis Therapeutics Inc | United States | 2,935 | 24,360 | |

| bOtonomy Inc | United States | 16,573 | 437,361 | |

| a,bOvaScience Inc | United States | 27,910 | 263,191 | |

| PDL BioPharma Inc | United States | 2,000 | 7,570 | |

| bPortola Pharmaceuticals Inc | United States | 11,960 | 593,336 | |

| bProQR Therapeutics NV | Netherlands | 5,425 | 56,528 | |

| bProthena Corp. PLC | Ireland | 7,156 | 504,784 | |

| bPTC Therapeutics Inc | United States | 12,794 | 384,332 | |

| bRadius Health Inc | United States | 3,522 | 214,173 | |

| bRegeneron Pharmaceuticals Inc | United States | 2,836 | 1,544,202 | |

| bREGENXBIO Inc | United States | 2,238 | 53,645 | |

| bRetrophin Inc | United States | 10,248 | 229,043 | |

| bSarepta Therapeutics Inc | United States | 8,387 | 308,306 | |

| bSeres Therapeutics Inc | United States | 4,765 | 170,730 | |

| bTesaro Inc | United States | 13,565 | 692,358 | |

| bTrevena Inc | United States | 8,832 | 111,195 | |

| bUltragenyx Pharmaceutical Inc | United States | 10,319 | 1,014,564 | |

| a,bVertex Pharmaceuticals Inc | United States | 6,185 | 800,092 | |

| 28,377,573 | ||||

| Capital Markets 0.2% | ||||

| aSEI Investments Co | United States | 49,822 | 2,709,819 | |

| Chemicals 1.7% | ||||

| aAir Products & Chemicals Inc | United States | 25,686 | 3,516,156 | |

| AirBoss of America Corp | Canada | 2,042 | 29,129 | |

| Akzo Nobel NV | Netherlands | 20,915 | 1,487,615 | |

| LyondellBasell Industries NV, A | United States | 20,709 | 1,984,336 | |

| aPPG Industries Inc | United States | 9,121 | 964,455 | |

18 Semiannual Report

franklintempleton.com

| FRANKLIN ALTERNATIVE STRATEGIES FUNDS |

| CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED) |

| Franklin K2 Alternative Strategies Fund (continued) | ||||

| Country | Shares/Warrants | Value | ||

| Common Stocks and Other Equity Interests (continued) | ||||

| Chemicals (continued) | ||||

| aThe Sherwin-Williams Co | United States | 19,508 | $ | 5,385,574 |

| a,bWR Grace & Co | United States | 66,613 | 6,542,729 | |

| 19,909,994 | ||||

| Commercial Services & Supplies 0.2% | ||||

| bAtento SA | Spain | 64,855 | 712,757 | |

| Edenred | France | 37,201 | 770,959 | |

| West Corp | United States | 18,610 | 474,555 | |

| 1,958,271 | ||||

| Communications Equipment 0.4% | ||||

| bAlcatel-Lucent | France | 31,275 | 123,186 | |

| bArista Networks Inc | United States | 2,905 | 213,576 | |

| a,bCiena Corp | United States | 37,340 | 934,994 | |

| aCisco Systems Inc | United States | 37,850 | 1,031,412 | |

| bNetScout Systems Inc | United States | 5,550 | 183,705 | |

| aNokia Corp., ADR | Finland | 53,061 | 382,570 | |

| Nokia OYJ, A | Finland | 130,347 | 941,300 | |

| QUALCOMM Inc | United States | 17,420 | 849,922 | |

| bRuckus Wireless Inc | United States | 30,370 | 347,736 | |

| 5,008,401 | ||||

| Construction & Engineering 0.1% | ||||

| Fluor Corp | United States | 15,363 | 746,642 | |

| Construction Materials 0.8% | ||||

| Buzzi Unicem SpA | Italy | 97,033 | 1,743,863 | |

| a,bCemex SAB de CV, ADR | Mexico | 16,481 | 103,830 | |

| aEagle Materials Inc | United States | 17,571 | 1,213,805 | |

| Italcementi SpA | Italy | 166,729 | 1,807,370 | |

| aMartin Marietta Materials Inc | United States | 28,659 | 4,510,926 | |

| 9,379,794 | ||||

| Consumer Finance 0.3% | ||||

| a,bSynchrony Financial | United States | 105,706 | 3,364,622 | |

| Diversified Financial Services 0.4% | ||||

| Cerved Information Solutions SpA | Italy | 39,604 | 299,181 | |

| aMoody’s Corp | United States | 36,985 | 3,813,893 | |

| aMSCI Inc | United States | 13,955 | 978,525 | |

| Voya Financial Inc | United States | 2,400 | 97,680 | |

| 5,189,279 | ||||

| Diversified Telecommunication Services 0.1% | ||||

| Swisscom AG | Switzerland | 2,151 | 1,059,977 | |

| b,eTelecom Italia SpA | Italy | 24,847 | 32,132 | |

| Telecom Italia SpA, RSP | Italy | 137,677 | 158,554 | |

| 1,250,663 | ||||

| Electric Utilities 0.1% | ||||

| Pepco Holdings Inc | United States | 25,550 | 655,869 | |

| Electrical Equipment 0.0%† | ||||

| bSolarCity Corp | United States | 6,489 | 186,624 | |

franklintempleton.com

Semiannual Report

19

| FRANKLIN ALTERNATIVE STRATEGIES FUNDS |

| CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED) |

| Franklin K2 Alternative Strategies Fund (continued) | ||||

| Country | Shares/Warrants | Value | ||

| Common Stocks and Other Equity Interests (continued) | ||||

| Energy Equipment & Services 0.6% | ||||

| aBaker Hughes Inc | United States | 74,814 | $ | 4,045,193 |

| bCameron International Corp | United States | 45,616 | 3,115,117 | |

| Halliburton Co | United States | 991 | 39,491 | |

| 7,199,801 | ||||

| Food & Staples Retailing 0.6% | ||||

| aCostco Wholesale Corp | United States | 33,756 | 5,448,894 | |

| aCVS Health Corp | United States | 12,436 | 1,170,103 | |

| 6,618,997 | ||||

| Food Products 0.9% | ||||

| aThe Kraft Heinz Co | United States | 85,389 | 6,292,315 | |

| Lindt & Spruengli AG | Switzerland | 66 | 4,765,972 | |

| 11,058,287 | ||||

| Health Care Equipment & Supplies 1.3% | ||||

| bAlere Inc | United States | 15,257 | 629,656 | |

| Baxter International Inc | United States | 91,978 | 3,462,972 | |

| aBecton Dickinson and Co | United States | 30,059 | 4,516,365 | |

| a,bDerma Sciences Inc | United States | 13,030 | 58,374 | |

| bDexCom Inc | United States | 8,621 | 732,958 | |

| bGenMark Diagnostics Inc | United States | 25,179 | 200,677 | |

| a,bIDEXX Laboratories Inc | United States | 51,704 | 3,661,677 | |

| bInnocoll AG, ADR | Germany | 3,853 | 29,244 | |

| Medtronic PLC | United States | 21,464 | 1,617,098 | |

| bNovadaq Technologies Inc | Canada | 16,778 | 204,356 | |

| bTearLab Corp | United States | 61,366 | 91,435 | |

| 15,204,812 | ||||

| Health Care Providers & Services 1.6% | ||||

| bAcadia Healthcare Co. Inc | United States | 10,364 | 715,220 | |

| aAetna Inc | United States | 14,107 | 1,449,494 | |

| b,fAttendo AB, 144A | Sweden | 5,155 | 41,373 | |

| Celesio AG | Germany | 61,856 | 1,641,032 | |

| a,bCentene Corp | United States | 18,679 | 1,078,712 | |

| aCigna Corp | United States | 27,941 | 3,771,476 | |

| bCommunity Health Systems Inc | United States | 27,875 | 237 | |

| bDaVita HealthCare Partners Inc | United States | 7,796 | 569,420 | |

| a,bHCA Holdings Inc | United States | 4,608 | 313,621 | |

| bHealth Net Inc | United States | 22,836 | 1,444,605 | |

| aHumana Inc | United States | 25,769 | 4,346,200 | |

| bMolina Healthcare Inc | United States | 7,376 | 444,478 | |

| a,bPremier Inc., A | United States | 3,712 | 127,544 | |

| bSurgery Partners Inc | United States | 5,956 | 113,819 | |

| aUnitedHealth Group Inc | United States | 13,810 | 1,556,525 | |

| aUniversal Health Services Inc., B | United States | 6,265 | 761,323 | |

| 18,375,079 | ||||

| Health Care Technology 0.0%† | ||||

| bIMS Health Holdings Inc | United States | 11,545 | 320,027 | |

| bMedAssets Inc | United States | 6,569 | 197,924 | |

| 517,951 | ||||

20 Semiannual Report

franklintempleton.com

| FRANKLIN ALTERNATIVE STRATEGIES FUNDS |

| CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED) |

| Franklin K2 Alternative Strategies Fund (continued) | ||||

| Country | Shares/Warrants | Value | ||

| Common Stocks and Other Equity Interests (continued) | ||||

| Hotels, Restaurants & Leisure 1.9% | ||||

| a,bBuffalo Wild Wings Inc | United States | 25,263 | $ | 4,048,143 |

| Carnival Corp | United States | 57,803 | 2,920,786 | |

| a,bChipotle Mexican Grill Inc | United States | 1,771 | 1,026,383 | |

| aDomino’s Pizza Inc | United States | 30,033 | 3,227,647 | |

| aLas Vegas Sands Corp | United States | 10,558 | 465,185 | |

| aSonic Corp | United States | 142,172 | 4,131,518 | |

| aStarbucks Corp | United States | 76,029 | 4,667,420 | |

| Starwood Hotels & Resorts Worldwide Inc | United States | 18,059 | 1,297,359 | |

| 21,784,441 | ||||

| Household Durables 0.7% | ||||

| a,bCalAtlantic Group Inc | United States | 50,378 | 2,120,914 | |

| D.R. Horton Inc | United States | 13,452 | 434,634 | |

| bHovnanian Enterprises Inc | United States | 2,423 | 4,434 | |

| a,bJarden Corp | United States | 33,122 | 1,546,135 | |

| bMohawk Industries Inc | United States | 8,422 | 1,606,244 | |

| aPulteGroup Inc | United States | 45,168 | 879,872 | |

| Sony Corp., ADR | Japan | 42,941 | 1,113,031 | |

| 7,705,264 | ||||

| Industrial Conglomerates 0.3% | ||||

| CK Hutchison Holdings Ltd | Hong Kong | 73,940 | 969,852 | |

| Danaher Corp | United States | 26,574 | 2,561,468 | |

| 3,531,320 | ||||

| Insurance 0.2% | ||||

| aChubb Corp | United States | 16,967 | 2,214,703 | |

| Internet & Catalog Retail 0.8% | ||||

| a,bAmazon.com Inc | United States | 6,856 | 4,557,869 | |

| aExpedia Inc | United States | 7,915 | 974,416 | |

| Travelport Worldwide Ltd | United States | 6 | 80 | |

| a,bTripAdvisor Inc | United States | 11,365 | 936,135 | |

| a,bWayfair Inc., A | United States | 75,249 | 2,852,689 | |

| 9,321,189 | ||||

| Internet Software & Services 1.0% | ||||

| a,bAkamai Technologies Inc | United States | 15,405 | 887,482 | |

| a,bAlibaba Group Holding Ltd., ADR | China | 14,175 | 1,191,834 | |

| a,bAlphabet Inc., A | United States | 890 | 678,936 | |

| a,bAlphabet Inc., C | United States | 1,051 | 780,473 | |

| a,bBenefitfocus Inc | United States | 14,810 | 600,101 | |

| a,bCoStar Group Inc | United States | 5,295 | 1,107,926 | |

| bDemandware Inc | United States | 4,500 | 230,175 | |

| a,beBay Inc | United States | 14,335 | 424,173 | |

| bEnvestnet Inc | United States | 5 | 162 | |

| a,bFacebook Inc | United States | 9,039 | 942,225 | |

| bMarketo Inc | United States | 13,650 | 413,186 | |

| Tencent Holdings Ltd | China | 13,400 | 266,671 | |

| bTwitter Inc | United States | 1,665 | 42,291 | |

| a,bVeriSign Inc | United States | 6,655 | 595,223 | |

| bYahoo! Inc | United States | 111,891 | 3,783,035 | |

| bZillow Group Inc., A | United States | 2,940 | 76,528 | |

franklintempleton.com

Semiannual Report

21

| FRANKLIN ALTERNATIVE STRATEGIES FUNDS |

| CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED) |

| Franklin K2 Alternative Strategies Fund (continued) | ||||

| Country | Shares/Warrants | Value | ||

| Common Stocks and Other Equity Interests (continued) | ||||

| Internet Software & Services (continued) | ||||

| bZillow Group Inc., C | United States | 5,580 | $ | 137,547 |

| 12,157,968 | ||||

| IT Services 3.3% | ||||

| Accenture PLC, A | United States | 16,460 | 1,764,841 | |

| a,bAlliance Data Systems Corp | United States | 6,945 | 1,992,173 | |

| Amdocs Ltd | United States | 43,106 | 2,438,506 | |

| aAutomatic Data Processing Inc | United States | 26,810 | 2,312,631 | |

| a,bCardtronics Inc | United States | 35,210 | 1,324,248 | |

| a,bCognizant Technology Solutions Corp., A | United States | 19,650 | 1,268,997 | |

| a,bEPAM Systems Inc | United States | 7,500 | 590,475 | |

| bEuronet Worldwide Inc | United States | 7,697 | 598,211 | |

| EVERTEC Inc | Puerto Rico | 38,575 | 662,719 | |

| a,bExlService Holdings Inc | United States | 81,260 | 3,800,530 | |

| Fidelity National Information Services Inc | United States | 2,138 | 136,127 | |

| bGartner Inc | United States | 3,600 | 335,880 | |

| bGenpact Ltd | United States | 135,975 | 3,426,570 | |

| aGlobal Payments Inc | United States | 18,030 | 1,277,426 | |

| aHeartland Payment Systems Inc | United States | 44,760 | 3,551,258 | |

| aMasterCard Inc., A | United States | 31,573 | 3,091,628 | |

| a,bPayPal Holdings Inc | United States | 38,555 | 1,359,449 | |

| bSyntel Inc | United States | 1,500 | 72,645 | |

| a,bVantiv Inc., A | United States | 25,275 | 1,332,245 | |

| a,bVeriFone Systems Inc | United States | 68,750 | 1,971,750 | |

| aVisa Inc., A | United States | 28,075 | 2,218,206 | |

| a,bWEX Inc | United States | 25,897 | 2,441,310 | |

| b,fWorldpay Group PLC, 144A | United Kingdom | 62,471 | 281,320 | |

| 38,249,145 | ||||

| Leisure Products 0.0%† | ||||

| bJAKKS Pacific Inc | United States | 1,830 | 15,061 | |

| Life Sciences Tools & Services 0.4% | ||||

| bFluidigm Corp | United States | 12,600 | 143,262 | |

| a,bIllumina Inc | United States | 7,604 | 1,398,376 | |

| bSequenom Inc | United States | 69,498 | 123,706 | |

| aThermo Fisher Scientific Inc | United States | 18,141 | 2,510,714 | |

| a,bWuXi Pharmatech Cayman Inc., ADR | China | 23,425 | 1,070,523 | |

| 5,246,581 | ||||

| Machinery 0.0%† | ||||

| bNavistar International Corp | United States | 802 | 11,637 | |

| Marine 0.2% | ||||

| Irish Continental Group PLC | Ireland | 335,601 | 1,896,992 | |

| Media 1.9% | ||||

| CBS Corp., B | United States | 19,277 | 973,103 | |

| a,b,eCharter Communications Inc., A, | United States | 3,315 | 621,098 | |

| a,bDish Network Corp., A | United States | 40,301 | 2,527,276 | |

| bImax Corp | Canada | 8,645 | 327,473 | |

| bLiberty Global PLC LiLAC, A | United Kingdom | 5,227 | 196,274 | |

| bLiberty Global PLC LiLAC, C | United Kingdom | 1,299 | 50,947 | |

| bLiberty Global PLC, A | United Kingdom | 9,692 | 411,038 | |

| bLiberty Global PLC, C | United Kingdom | 25,990 | 1,065,590 | |

22 Semiannual Report

franklintempleton.com

| FRANKLIN ALTERNATIVE STRATEGIES FUNDS |

| CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED) |

| Franklin K2 Alternative Strategies Fund (continued) | ||||

| Country | Shares/Warrants | Value | ||

| Common Stocks and Other Equity Interests (continued) | ||||

| Media (continued) | ||||

| a,bLiberty Media Corp., C | United States | 75,706 | $ | 2,960,105 |

| bMarkit Ltd | United States | 31,635 | 933,232 | |

| aNews Corp., B | United States | 88,318 | 1,277,078 | |

| SES SA, IDR | Luxembourg | 24,396 | 677,122 | |

| aTime Warner Cable Inc | United States | 37,427 | 6,915,387 | |

| aThe Walt Disney Co | United States | 34,680 | 3,935,139 | |

| 22,870,862 | ||||

| Metals & Mining 0.1% | ||||

| bImpala Platinum Holdings Ltd | South Africa | 137,721 | 301,241 | |

| ThyssenKrupp AG | Germany | 51,931 | 1,105,306 | |

| 1,406,547 | ||||

| Multi-Utilities 0.0%† | ||||

| TECO Energy Inc | United States | 8,849 | 232,906 | |

| Oil, Gas & Consumable Fuels 0.2% | ||||

| Chesapeake Energy Corp | United States | 2,006 | 10,572 | |

| bCobalt International Energy Inc | United States | 1,106 | 8,151 | |

| bKinder Morgan Inc., wts., 5/25/17 | United States | 23,443 | 7,033 | |

| aOccidental Petroleum Corp | United States | 30,075 | 2,273,369 | |

| bSolazyme Inc | United States | 20,274 | 66,904 | |

| 2,366,029 | ||||

| Paper & Forest Products 0.1% | ||||

| bCanfor Corp | Canada | 82,929 | 1,293,505 | |

| Pharmaceuticals 2.5% | ||||

| bAerie Pharmaceuticals Inc | United States | 34,526 | 947,393 | |

| b,eAllergan PLC | United States | 34,787 | 10,919,291 | |

| bANI Pharmaceuticals Inc | United States | 1,910 | 83,696 | |

| a,bAratana Therapeutics Inc | United States | 26,435 | 154,909 | |

| bAssembly Biosciences Inc | United States | 24,228 | 238,161 | |

| aAstraZeneca PLC, ADR | United Kingdom | 47,988 | 1,633,991 | |

| aBristol-Myers Squibb Co | United States | 36,003 | 2,412,561 | |

| b,fCassiopea SpA, 144A | Italy | 4,129 | 139,660 | |

| bDermira Inc | United States | 5,583 | 172,012 | |

| Eli Lilly & Co | United States | 9,266 | 760,183 | |

| bEndo International PLC | United States | 4,833 | 297,133 | |

| bFlex Pharma Inc | United States | 3,708 | 44,867 | |

| bIntersect ENT Inc | United States | 3,795 | 74,800 | |

| bIntra-Cellular Therapies Inc | United States | 12,126 | 646,680 | |

| Ipsen SA | France | 26,606 | 1,708,273 | |

| bJazz Pharmaceuticals PLC | United States | 3,204 | 469,674 | |

| a,bThe Medicines Co | United States | 16,418 | 689,720 | |

| Novartis AG, ADR | Switzerland | 4,713 | 401,736 | |

| Novo Nordisk AS, ADR | Denmark | 9,019 | 495,774 | |

| bOcular Therapeutix Inc | United States | 8,086 | 76,655 | |

| a,bPacira Pharmaceuticals Inc | United States | 13,578 | 879,176 | |

| Perrigo Co. PLC | United States | 7,855 | 1,173,459 | |

| Pfizer Inc | United States | 79,729 | 2,612,719 | |

| bSCYNEXIS Inc | United States | 5,486 | 37,195 | |

| Shire PLC, ADR | Ireland | 10,675 | 2,224,243 | |

| bSteadymed Ltd | Israel | 6,266 | 19,801 | |

franklintempleton.com

Semiannual Report

23

| FRANKLIN ALTERNATIVE STRATEGIES FUNDS |

| CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED) |

| Franklin K2 Alternative Strategies Fund (continued) | ||||

| Country | Shares/Warrants | Value | ||

| Common Stocks and Other Equity Interests (continued) | ||||

| Pharmaceuticals (continued) | ||||

| Theravance Inc | United States | 16,834 | $ | 155,715 |

| bWave Life Sciences Pte Ltd | United States | 2,830 | 45,988 | |

| 29,515,465 | ||||

| Professional Services 1.1% | ||||

| aEquifax Inc | United States | 13,485 | 1,503,577 | |

| Experian PLC | United Kingdom | 75,854 | 1,406,333 | |

| bFTI Consulting Inc | United States | 18,050 | 674,709 | |

| a,bHuron Consulting Group Inc | United States | 41,530 | 2,409,155 | |

| Korn/Ferry International | United States | 1,244 | 45,779 | |

| aManpowerGroup Inc | United States | 13,370 | 1,207,044 | |

| Nielsen Holdings PLC | United States | 18,850 | 879,918 | |

| aRobert Half International Inc | United States | 8,425 | 431,191 | |

| SThree PLC | United Kingdom | 81,933 | 403,822 | |

| aTowers Watson & Co., A | United States | 9,600 | 1,291,296 | |

| bTransUnion | United States | 7,300 | 186,661 | |

| bTriNet Group Inc | United States | 20,510 | 405,073 | |

| a,bVerisk Analytics Inc | United States | 10,545 | 790,348 | |

| a,bWageWorks Inc | United States | 23,035 | 979,909 | |

| 12,614,815 | ||||

| Real Estate Investment Trusts (REITs) 0.2% | ||||

| aApollo Commercial Real Estate Finance Inc | United States | 1,493 | 26,202 | |

| BioMed Realty Trust Inc | United States | 46,634 | 1,094,500 | |

| Gramercy Property Trust Inc | United States | 75 | 1,792 | |

| Iron Mountain Inc | United States | 15,200 | 422,256 | |

| RAIT Financial Trust | United States | 5,889 | 25,441 | |

| bStrategic Hotels & Resorts Inc | United States | 74,815 | 1,059,380 | |

| 2,629,571 | ||||

| Real Estate Management & Development 0.0%† | ||||

| bForest City Enterprises Inc., A | United States | 939 | 20,883 | |

| Road & Rail 0.7% | ||||

| CSX Corp | United States | 72,082 | 2,049,291 | |

| aNorfolk Southern Corp | United States | 13,732 | 1,305,364 | |

| bSwift Transportation Co | United States | 35,514 | 567,158 | |

| aUnion Pacific Corp | United States | 47,766 | 4,009,956 | |

| 7,931,769 | ||||

| Semiconductors & Semiconductor Equipment 1.9% | ||||

| Advanced Semiconductor Engineering Inc | Taiwan | 187,000 | 196,785 | |

| Altera Corp | United States | 83,821 | 4,425,749 | |

| Avago Technologies Ltd | Singapore | 2,800 | 365,260 | |

| aBroadcom Corp., A | United States | 126,858 | 6,930,253 | |

| aCypress Semiconductor Corp | United States | 104,450 | 1,130,149 | |

| Globalwafers Co. Ltd | Taiwan | 90,678 | 215,291 | |

| bInotera Memories Inc | Taiwan | 297,000 | 201,081 | |

| KLA-Tencor Corp | United States | 19,890 | 1,322,088 | |

| Maxim Integrated Products Inc | United States | 35,104 | 1,360,982 | |

| bNXP Semiconductors NV | Netherlands | 15,452 | 1,444,144 | |

| bON Semiconductor Corp | United States | 126,600 | 1,387,536 | |

| bPMC-Sierra Inc | United States | 117,361 | 1,388,381 | |

| bSiltronic AG | Germany | 5,964 | 149,718 | |

24 Semiannual Report

franklintempleton.com

| FRANKLIN ALTERNATIVE STRATEGIES FUNDS |

| CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED) |

| Franklin K2 Alternative Strategies Fund (continued) | ||||

| Country | Shares/Warrants | Value | ||

| Common Stocks and Other Equity Interests (continued) | ||||

| Semiconductors & Semiconductor Equipment (continued) | ||||

| Sino-American Silicon Products Inc | Taiwan | 143,000 | $ | 191,882 |

| Sumco Corp | Japan | 75,200 | 797,816 | |

| bSunEdison Semiconductor Ltd | United States | 29,935 | 285,879 | |

| Win Semiconductors Corp | Taiwan | 135,000 | 207,616 | |

| 22,000,610 | ||||

| Software 0.9% | ||||

| aActivision Blizzard Inc | United States | 18,355 | 691,249 | |

| bAdobe Systems Inc | United States | 6,270 | 573,454 | |

| bCitrix Systems Inc | United States | 1,747 | 133,942 | |

| bGuidewire Software Inc | United States | 2,375 | 140,909 | |

| bHubSpot Inc | United States | 8,085 | 438,288 | |

| aIntuit Inc | United States | 7,345 | 735,969 | |

| aMicrosoft Corp | United States | 23,850 | 1,296,248 | |

| bPaylocity Holding Corp | United States | 1,000 | 43,940 | |

| bRed Hat Inc | United States | 6,957 | 566,369 | |

| bSalesforce.com Inc | United States | 12,503 | 996,364 | |

| bServiceNow Inc | United States | 700 | 60,907 | |

| Solera Holdings Inc | United States | 42,976 | 2,309,530 | |

| SS&C Technologies Holdings Inc | United States | 6,085 | 437,512 | |

| bTake-Two Interactive Software Inc | United States | 13,494 | 477,283 | |

| a,bVerint Systems Inc | United States | 19,855 | 930,207 | |

| b,eVMware Inc., A | United States | 3,200 | 196,512 | |

| 10,028,683 | ||||

| Specialty Retail 1.9% | ||||

| bAutoNation Inc | United States | 42,748 | 2,732,452 | |

| a,bAutozone Inc | United States | 5,735 | 4,494,921 | |

| aThe Home Depot Inc | United States | 46,639 | 6,244,029 | |

| Inditex SA | Spain | 39,418 | 1,418,495 | |

| aLowe’s Cos. Inc | United States | 19,587 | 1,500,364 | |

| a,bMarineMax Inc | United States | 26,248 | 476,401 | |

| aMonro Muffler Brake Inc | United States | 17,835 | 1,320,504 | |

| a,bO’Reilly Automotive Inc | United States | 8,972 | 2,367,442 | |

| a,eStaples Inc | United States | 99,775 | 1,204,284 | |

| 21,758,892 | ||||

| Technology Hardware, Storage & Peripherals 0.6% | ||||

| EMC Corp | United States | 116,938 | 2,963,209 | |

| aHewlett Packard Enterprise Co | United States | 63,334 | 941,143 | |

| a,bNCR Corp | United States | 82,633 | 2,240,180 | |

| a,bNimble Storage Inc | United States | 12,255 | 128,310 | |

| bPure Storage Inc., A | United States | 25,100 | 324,041 | |

| bViolin Memory Inc | United States | 15,244 | 19,970 | |

| Western Digital Corp | United States | 7,500 | 468,075 | |

| 7,084,928 | ||||

| Textiles, Apparel & Luxury Goods 0.5% | ||||

| Luxottica Group SpA | Italy | 13,024 | 871,037 | |

| Moncler SpA | Italy | 62,088 | 945,935 | |

| aNIKE Inc., B | United States | 30,656 | 4,055,176 | |

| bSkechers USA. Inc., A | United States | 15,253 | 460,641 | |

| 6,332,789 | ||||

franklintempleton.com

Semiannual Report

25

| FRANKLIN ALTERNATIVE STRATEGIES FUNDS |

| CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED) |

| Franklin K2 Alternative Strategies Fund (continued) | ||||

| Country | Shares/Warrants | Value | ||

| Common Stocks and Other Equity Interests (continued) | ||||

| Wireless Telecommunication Services 0.2% | ||||

| NTT DoCoMo Inc | Japan | 36,700 | $ | 694,050 |

| a,bT-Mobile U.S. Inc | United States | 38,796 | 1,377,258 | |

| 2,071,308 | ||||

| Total Common Stocks and Other Equity Interests | ||||

| (Cost $394,668,794) | 423,418,136 | |||

| Exchange Traded Funds 0.2% | ||||

| Financial Select Sector SPDR Fund | United States | 8,477 | 208,195 | |

| iShares MSCI Emerging Markets ETF | United States | 8,908 | 302,783 | |

| SPDR S&P Oil & Gas Exploration & Production ETF | United States | 35,755 | 1,327,583 | |

| Total Exchange Traded Funds (Cost $1,884,415) | 1,838,561 | |||

| Convertible Preferred Stocks 0.5% | ||||

| Capital Markets 0.0%† | ||||

| a,fCowen Group Inc., cvt. pfd., 144A, Series A, 5.625% | United States | 470 | 404,611 | |

| Food Products 0.2% | ||||

| Bunge Ltd., cvt. pfd., 4.875% | United States | 4,466 | 414,311 | |

| aPost Holdings Inc., cvt. pfd., 2.50% | United States | 13,932 | 1,830,316 | |

| 2,244,627 | ||||

| Multi-Utilities 0.0%† | ||||

| Dominion Resources Inc., cvt. pfd., | ||||

| 6.375% | United States | 1,155 | 55,948 | |

| Series A, 6.125% | United States | 137 | 7,348 | |

| 63,296 | ||||

| Oil, Gas & Consumable Fuels 0.2% | ||||

| Chesapeake Energy Corp., cvt. pfd., 5.75% | United States | 341 | 97,185 | |

| bKinder Morgan Inc., cvt. pfd., Series A, 9.75% | United States | 42,363 | 1,859,736 | |

| 1,956,921 | ||||

| Tobacco 0.1% | ||||

| aUniversal Corp., cvt. pfd., 6.75% | United States | 1,068 | 1,353,957 | |

| Total Convertible Preferred Stocks (Cost $5,691,617) | 6,023,412 | |||

| Preferred Stocks 0.3% | ||||

| Consumer Finance 0.0%† | ||||

| fAlly Financial Inc., pfd., 144A, Series G, 7.00% | United States | 202 | 204,411 | |

| Diversified Telecommunication Services 0.0%† | ||||

| Iridium Communications Inc., pfd., 7.00% | United States | 4,063 | 390,048 | |

| Machinery 0.0%† | ||||

| MAN SE, pfd., zero cpn | Germany | 3,542 | 347,284 | |

| Multi-Utilities 0.1% | ||||

| bBlack Hills Corp., pfd., 7.75% | United States | 7,601 | 398,673 | |

| Pharmaceuticals 0.2% | ||||

| Allergan PLC, pfd., 5.50% | United States | 2,120 | 2,220,318 | |

| Total Preferred Stocks (Cost $3,546,136) | 3,560,734 |

26 Semiannual Report

franklintempleton.com

| FRANKLIN ALTERNATIVE STRATEGIES FUNDS |

| CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED) |

| Franklin K2 Alternative Strategies Fund (continued) | |||||

| Principal | |||||

| Country | Amount* | Value | |||

| Convertible Bonds 8.9% | |||||

| Aerospace & Defense 0.1% | |||||

| aAAR Corp., senior note, Series B, 2.25%, 3/01/16 | United States | 781,000 | $ | 783,929 | |

| Air Freight & Logistics 0.0%† | |||||

| Atlas Air Worldwide Holdings Inc., senior note, 2.25%, 6/01/22 | United States | 496,000 | 421,600 | ||

| Biotechnology 0.7% | |||||

| gAblynx NV, senior note, Reg S, Series ABLX, 3.25%, 5/27/20 | Belgium | 200,000 | EUR | 272,272 | |

| aAcorda Therapeutics Inc., senior note, 1.75%, 6/15/21 | United States | 1,070,000 | 1,167,637 | ||

| AMAG Pharmaceuticals Inc., senior note, 2.50%, 2/15/19 | United States | 543,000 | 644,473 | ||

| BioMarin Pharmaceutical Inc., senior sub. note, | |||||

| 0.75%, 10/15/18 | United States | 1,258,000 | 1,550,485 | ||

| 1.50%, 10/15/20 | United States | 70,000 | 89,469 | ||

| Clovis Oncology Inc., senior note, 2.50%, 9/15/21 | United States | 330,000 | 268,537 | ||

| aExelixis Inc., senior sub. note, 4.25%, 8/15/19 | United States | 784,000 | 935,410 | ||

| fIronwood Pharmaceuticals Inc., senior note, 144A, 2.25%, 6/15/22 | United States | 465,000 | 449,597 | ||

| aLigand Pharmaceuticals Inc., senior note, 0.75%, 8/15/19 | United States | 1,171,000 | 1,803,340 | ||

| aPDL BioPharma Inc., senior note, 4.00%, 2/01/18 | United States | 481,000 | 387,506 | ||

| fPTC Therapeutics Inc., senior note, 144A, 3.00%, 8/15/22 | United States | 182,000 | 162,549 | ||