UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number_811-22641

__Franklin Alternative Strategies Funds

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code: 650 312-2000

Date of fiscal year end: 5/31

Date of reporting period: 11/30/16

Item 1. Reports to Stockholders.

| |

| Contents | |

| Semiannual Report | |

| Franklin K2 Alternative Strategies Fund | 3 |

| Performance Summary | 7 |

| Your Fund’s Expenses | 9 |

| Consolidated Financial Highlights and Consolidated | |

| Statement of Investments | 10 |

| Consolidated Financial Statements | 72 |

| Notes to Consolidated Financial Statements | 76 |

| Shareholder Information | 92 |

Visit franklintempleton.com for fund updates, to access your account, or to find helpful financial planning tools.

2 Semiannual Report

franklintempleton.com

Semiannual Report

Franklin K2 Alternative Strategies Fund

This semiannual report for Franklin K2 Alternative Strategies Fund covers the period ended November 30, 2016.

Your Fund’s Goal and Main Investments

The Fund seeks capital appreciation with lower volatility relative to the broad equity markets. The Fund seeks to achieve its investment goal by allocating its assets across multiple non-traditional or “alternative” strategies, including but not limited to relative value, long short equity, global macro and event driven. The Fund is structured as a multi-manager fund, meaning the Fund’s assets are independently managed by multiple investment managers (subadvisors), while the Fund’s investment manager retains overall responsibility for the Fund’s investments. The Fund may invest in a wide range of securities and other investments including, but not limited to: equity securities including common stocks, preferred stocks, convertible securities, rights and warrants, private and registered investment vehicles and exchange-traded funds (ETFs); and debt securities including bonds, notes, debentures, banker’s acceptances and commercial paper; loans and loan participations; and mortgage-backed or other asset-backed securities, including collateralized debt obligations; as well as derivatives, commodities and currencies.

Performance Overview

The Fund’s Class A shares delivered a +1.90% cumulative total return for the six months under review. For comparison, the Fund’s primary benchmark, the BofA Merrill Lynch 3-Month U.S. Treasury Bill (T-Bill) Index, which tracks the performance of short-term U.S. government securities with a remaining term to final maturity of less than three months, posted a +0.18% total return for the same period.1 Also for comparison, the Fund’s secondary benchmark, the HFRX Global Hedge Fund Index, which is designed to be representative of the overall composition of the hedge fund universe, generated a +2.68% total return for the same period.2 You can find more of the Fund’s performance data in the Performance Summary beginning on page 7.

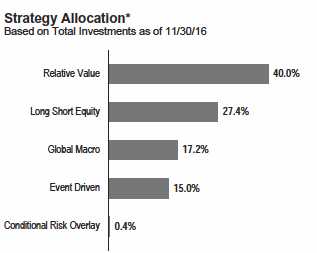

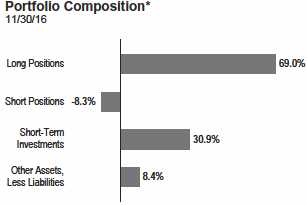

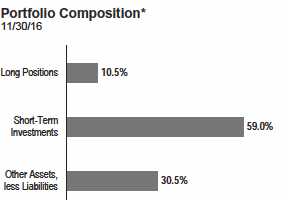

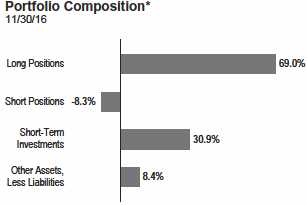

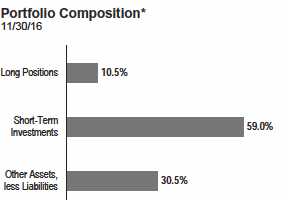

*Figures represent the net Fund exposure and include certain derivatives held in the portfolio (or their underlying reference assets) or unsettled trades and may not total 100% or may be negative due to rounding, use of any derivatives or other factors.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Economic and Market Overview

The global economy expanded during the six months under review. In this environment, global developed and emerging market stocks, as measured by the MSCI All Country World Index, rose. Global markets were aided by accommodative monetary policies of various central banks, an improvement in commodity prices, generally encouraging economic data across regions, expectations of higher interest rates and inflation in the U.S. driven by hopes of expansionary fiscal policies under the new U.S. President Donald Trump, and an Organization of the Petroleum Exporting Countries deal to curb oil production. However, the impact of these factors was partially offset by global economic concerns, the U.K.’s historic referendum to leave the European Union (also known as “Brexit”), uncertainty

1. Source: Morningstar.

2. Source: FactSet. Hedge Fund Research, Inc. — www.hedgefundresearch.com. The HFRX Global Hedge Fund Index is being used under license from Hedge Fund

Research, Inc., which does not endorse or approve of any of the contents of this report.

The indexes are unmanaged and include reinvestment of any income or distributions. They do not reflect any fees, expenses or sales charges. One cannot invest directly in an

index, and an index is not representative of the Fund’s portfolio. Unlike most asset class indexes, HFR Index returns reflect fees and expenses.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Consolidated Statement of Investments (SOI).

The Consolidated SOI begins on page 15.

franklintempleton.com

Semiannual Report 3

FRANKLIN K2 ALTERNATIVE STRATEGIES FUND

about the U.S. Federal Reserve’s (Fed’s) timing for raising interest rates and worries about the health of European banks.

The U.S. economy strengthened during the six months under review. The economy grew at a faster pace in 2016’s third quarter compared to the second quarter, mainly due to personal consumption expenditure, exports, private inventory investment, federal government spending and nonresidential fixed investment. Although the Fed kept its target interest rate unchanged during the review period, and lowered its forecast for 2016 U.S. economic growth at the September meeting, it maintained its stance that the case for a U.S. interest rate increase had strengthened. Further, the Fed Chair Janet Yellen, at her testimony to the Congress’ Joint Economic Committee in November, set the stage for an interest rate hike in December, as long as data continued to provide evidence of economic resilience.

In Europe, the U.K.’s economy moderated in the third quarter, supported by growth in services. Immediate effects of the Brexit vote in June materialized as U.K. stocks initially declined, the pound sterling hit a three-decade low amid intensified selling and the U.K.’s credit rating was downgraded. In the eurozone, despite investors’ concerns about banking sector weakness, low corporate earnings and post-Brexit political repercussions, some regions benefited due to rising consumer spending, resulting from a cheaper euro, low inflation and signs of sustained economic growth. The eurozone’s economic growth held steady in the third quarter from the second quarter, while the region’s annual inflation rate rose to its highest level since April 2014 toward period-end. The European Central Bank cut its benchmark interest rate and expanded its massive bond-buying program in August 2016 to boost the region’s growth.

In Asia, Japan’s economic growth slowed in the second quarter compared to the first quarter, amid falling exports and weak corporate investment. However, the Japanese economy grew significantly in the third quarter, largely due to a rise in exports. After announcing additional monetary easing measures in July, the Bank of Japan, at its September meeting, overhauled its monetary stimulus program to adjust Japanese government bond purchases with the aim of keeping the 10-year rate near the current level of 0%.

In emerging markets, economic growth generally moderated during the review period. Although the pace of contraction in Brazil’s economy had slowed in 2016’s second quarter, third-quarter gross domestic product declined faster than in the second quarter, despite improved business sentiment near the end of August with the expected impeachment of President Dilma Rousseff. Russia’s economic contraction continued to ease in 2016’s third quarter. The Bank of Russia reduced its key interest rates in June and September in an attempt to revive its economy. China’s economy grew at a stable rate in 2016’s third quarter, and remained within the government’s targeted range. The People’s Bank of China weakened its currency during the review period as the U.S. dollar strengthened. Elsewhere, India’s economic growth marginally increased from July to September due to slower private consumption growth and increasing government spending. Overall, emerging market stocks, as measured by the MSCI Emerging Markets Index, rose for the review period.

Investment Strategy

We manage the Fund using a multi-manager approach. While we are responsible for the Fund’s overall investments, we allocate assets to multiple subadvisors, each of whom independently manages a separate portion of the Fund’s portfolio in accordance with some or all of the following strategies: long short equity, relative value, event driven and global macro. We allocate the Fund’s assets among these strategies utilizing a top-down approach, generating the Fund’s strategy weightings by taking into account market conditions, risk factors, diversification, liquidity, transparency, and availability of various subadvisors and other investment options, among other things. The allocations to specific subadvisors may change from time to time based upon our assessment of their correlations to various markets and to each other, their risk profiles and return expectations. Long short equity strategies generally seek to produce returns from investments in the equity markets by taking long and short positions in stocks and common stock indexes (through the use of derivatives or ETFs). Relative value strategies encompass a wide range of investment techniques that are intended to profit from pricing inefficiencies. Event driven strategies generally invest in securities of companies undergoing significant corporate events. Global macro strategies generally focus on broad-based economic opportunities across numerous markets and investments.

The Fund may take long and/or short positions in a wide range of asset classes, including equities, fixed income, commodities and currencies, among others. Long positions benefit from an increase in the price of the underlying instrument or asset class, while short positions benefit from a decrease in that price. The Fund may use derivatives for hedging and nonhedging (investment) purposes. Such derivative investments may include futures contracts, swaps, options and currency forward contracts. The Fund may engage in active and frequent trading as part of its investment strategies.

What is a futures contract?

A futures contract is an agreement between the Fund and a counterparty made through a U.S. or foreign futures exchange to buy or sell an underlying instrument or asset at a specific price on a future date.

4 Semiannual Report

franklintempleton.com

FRANKLIN K2 ALTERNATIVE STRATEGIES FUND

What are swap agreements?

Swap agreements, such as interest rate, currency and credit default swaps, are contracts between the Fund and another party (the swap counterparty). In a basic swap transaction, the Fund agrees with the swap counterparty to exchange the returns (or differentials in rates of return) earned or realized on a particular “notional amount” of underlying instruments. The notional amount is the set amount selected by the parties as the basis on which to calculate the obligations that they have agreed to exchange. The parties typically do not actually exchange the notional amount. Instead, they agree to exchange the returns that would be earned or realized if the notional amount were invested in given instruments or at given interest rates.

What is an option?

An option is a contract to buy or sell a specific financial product known as the option’s underlying instrument at a specific price. The buyer of an option has the right, but not the obligation, to buy or sell the underlying instrument at or until a specified expiration date. Conversely, the seller (“writer”) of an option who opens a transaction is obligated to buy or sell the underlying instrument should the option holder exercise that right.

What is a currency forward contract?

A currency forward contract is an agreement between the Fund and a counterparty to buy or sell a foreign currency in exchange for another currency at a specific exchange rate on a future date.

Manager’s Discussion

The Fund generated fairly consistent positive performance for the six-month review period, with October the only month showing a performance decline. Among the four underlying strategies, relative value delivered the most robust performance. The event driven and long short equity strategies also contributed positively to returns, while the global macro strategy modestly detracted from Fund performance. A conditional risk overlay was active during the review period, and it hindered the Fund’s results as financial markets trended up amid increased investor risk appetite.

What is a conditional risk overlay (CRO) strategy?

From time to time, the Fund’s Investment Manager may implement its CRO Strategy, which seeks to neutralize certain market sensitivities that may exist in the Fund. The CRO Strategy involves investing in derivatives or other instruments in an effort to provide a hedge against negative market events. When implemented, the strategy will reduce the Fund’s ability to benefit from positive market movements

The Fund’s long short equity strategy subadvisors were Chilton Investment, Impala Asset Management, Jennison Associates, Portland Hill Capital and Wellington Management. Impala, a subadvisor focused on global cyclical equities, provided the

largest positive contribution to returns. Jennison and Portland Hill modestly benefited results. In contrast, Chilton, a U.S.-focused subadvisor, hindered performance, as did technology-focused Wellington to a lesser extent. Overall, basic materials, industrials and technology positions benefited performance, while equity indexes detracted from results.

A significant individual contributor was a long position in a Canada-based metals and mining company. Rising metallurgical coal prices in parts of the review period supported the company’s stock price. In addition, an analyst report highlighted improved pricing dynamics for the company’s steelmaking coal business, and the company’s chief financial officer noted that the company would seek to reduce its debt load, with the goal of securing an investment-grade credit rating. Conversely, short positions in equity indexes such as the Standard & Poor’s 500® Index (S&P 500®) impaired results as equities generally rallied during the review period.

All relative value strategy subadvisors delivered positive returns, with the largest contribution to performance provided by a subadvisor focused on high yield credit. Communications, basic materials and energy positions aided performance. In contrast, hedges in the form of equity indexes, including the S&P 500, detracted from relative performance.

Looking at individual positions, a U.S. newspaper and magazine publisher aided results as the company completed a debt exchange in August that substantially reduced interest expenses, benefiting the company’s capital structure. A bond issued by a

|

| Subadvisors |

| 11/30/16 |

| |

| Long Short Equity |

| Chilton Investment Company, LLC |

| Impala Asset Management LLC |

| Jennison Associates, LLC |

| Portland Hill Capital LLP |

| Wellington Management Company, LLP |

| Relative Value |

| Basso Capital Management, L.P. |

| Chatham Asset Management, LLC |

| Lazard Asset Management, LLC |

| Loomis Sayles & Company, L.P. |

| Event Driven |

| Halcyon Arbitrage IC Management LP |

| P. Schoenfeld Asset Management L.P. |

| York Registered Holdings, L.P. |

| Global Macro |

| Emso Asset Management Limited |

| Graham Capital Management, L.P. |

franklintempleton.com

Semiannual Report 5

FRANKLIN K2 ALTERNATIVE STRATEGIES FUND

steel company also strengthened returns after the company announced healthy earnings and a larger-than-expected equity offering that would further deleverage the company’s capital structure. The underlying subadvisor believed there was persistent performance potential and increased its long position in the issuer. Conversely, equity index positions tended to weigh on performance. For example, S&P 500 Index options hindered returns as U.S. equities advanced for the review period.

In June, we allocated to Halcyon Arbitrage IC Management, a new event driven subadvisor. This adjustment provided the event-driven strategy with more exposure to merger and acquisition activity. Contributors tended to come from the technology, consumer cyclical and health care sectors, while hedges through equity indexes dampened returns as risk assets generally gained over the period.

A position in a biopharmaceuticals company, which specializes in treating serious diseases, gained after a large global pharmaceutical company announced that it would acquire the company for an amount exceeding industry expectations. A communications company also strengthened performance after announcing plans for a wireless product. The subadvisor holding the position continued to believe this company would benefit from its larger footprint and secular shifts toward broadband adoption. In contrast, a long position in a global pharmaceuticals company detracted from returns amid investor concerns over potential controls on drug pricing power and focus from politicians during the U.S. election cycle.

Graham Capital Management and Emso Asset Management represented our global macro exposure. Graham, which follows a quantitative, trend-following model, experienced negative results in the review period, and the global macro strategy overall modestly detracted from performance. However, the other strategy subadvisor, emerging-markets focused Emso, delivered gains.

Energy positions for systematic subadvisor Graham Capital Management hindered performance, particularly long positions in Brent crude oil and gas when oil prices waned during parts of the review period. In the agricultural space, returns were weakened by long positions in soy beans and soy meal. In contrast, emerging markets-focused discretionary subadvisor Emso Asset Management’s long positions in a quasi-sovereign oil producer’s credit in Brazil contributed positively to results. For systematic subadvisor Graham Capital Management, a long position in a U.S. small-capitalization stock index benefited returns as the equity space rallied following the election of Donald Trump as president, as the markets anticipate large tax cuts and infrastructure spending, which may boost U.S. growth and inflation. Short positioning in the British pound and subadvisor positioning in interest-rate derivatives also contributed positively to results.

Thank you for your participation in Franklin K2 Alternative Strategies Fund. We look forward to continuing to serve your investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of November 30, 2016, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

6 Semiannual Report

franklintempleton.com

FRANKLIN K2 ALTERNATIVE STRATEGIES FUND

Performance Summary as of November 30, 2016

The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

Performance as of 11/30/161

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 5.75% and the minimum is 0%. Class A: 5.75% maximum initial sales charge; Advisor Class: no sales charges. For other share classes, visit franklintempleton.com.

| | | | |

| | Cumulative | | Average Annual | |

| Share Class | Total Return2 | | Total Return3 | |

| A | | | | |

| 6-Month | +1.90 | % | -3.93 | % |

| 1-Year | +0.17 | % | -5.62 | % |

| 3-Year | +7.91 | % | +0.58 | % |

| Since Inception (10/11/13) | +10.39 | % | +1.27 | % |

| Advisor | | | | |

| 6-Month | +1.98 | % | +1.98 | % |

| 1-Year | +0.40 | % | +0.40 | % |

| 3-Year | +8.81 | % | +2.85 | % |

| Since Inception (10/11/13) | +11.31 | % | +3.48 | % |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 8 for Performance Summary footnotes.

franklintempleton.com

Semiannual Report 7

FRANKLIN K2 ALTERNATIVE STRATEGIES FUND

PERFORMANCE SUMMARY

| | | | |

| Total Annual Operating Expenses4 | | | |

| Share Class | With Waiver | | Without Waiver | |

| A | 2.88 | % | 3.40 | % |

| Advisor | 2.63 | % | 3.15 | % |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. The market values of securities owned by the Fund will go up or down, sometimes rapidly or

unpredictably. The Fund’s performance depends on the manager’s skill in selecting, overseeing, and allocating Fund assets to the subadvisors. The Fund is

actively managed and could experience losses if the investment manager’s and subadvisors’ judgment about particular investments made for the Fund’s portfo-

lio prove to be incorrect. Some subadvisors may have little or no experience managing the assets of a registered investment company. Foreign investments are

subject to greater investment risk such as political, economic, credit and information risks as well as risk of currency fluctuations. Investments in derivatives

involve costs and create economic leverage, which may result in significant volatility and cause the Fund to participate in losses (as well as gains) that signifi-

cantly exceed the Fund’s initial investment. Lower rated or high yield debt securities involve greater credit risk, including the possibility of default or bankruptcy.

Currency management strategies could result in losses to the Fund if currencies do not perform as the investment manager or subadvisor expects. The Fund

may make short sales of securities, which involves the risk that losses may exceed the original amount invested. Merger arbitrage investments risk loss if a pro-

posed reorganization in which the Fund invests is renegotiated or terminated. Liquidity risk exists when securities have become more difficult to sell, or are

unable to be sold, at the price at which they have been valued. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has an expense reduction contractually guaranteed through 9/30/17 and a fee waiver related to the management fee paid by a subsidiary. Fund investment

results reflect the expense reduction and fee waiver; without these reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not

been annualized.

4. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Consolidated Financial Highlights

sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

8 Semiannual Report

franklintempleton.com

FRANKLIN K2 ALTERNATIVE STRATEGIES FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | |

| | | | | | | Actual | | Hypothetical | | |

| | | | | (actual return after expenses) | | (5% annual return before expenses) | | |

| | | | | | | Expenses | | | | Expenses | Net | |

| | | Beginning | | Ending | | Paid During | | Ending | | Paid During | Annualized | |

| Share | | Account | | Account | | Period | | Account | | Period | Expense | |

| Class | | Value 6/1/16 | | Value 11/30/16 | | 6/1/16–11/30/161,2 | | Value 11/30/16 | | 6/1/16–11/30/161,2 | Ratio2 | |

| A | $ | 1,000 | $ | 1,019.00 | $ | 13.92 | $ | 1,011.28 | $ | 13.87 | 2.75 | % |

| C | $ | 1,000 | $ | 1,015.30 | $ | 17.43 | $ | 1,007.77 | $ | 17.36 | 3.45 | % |

| R | $ | 1,000 | $ | 1,017.90 | $ | 15.18 | $ | 1,010.03 | $ | 15.12 | 3.00 | % |

| R6 | $ | 1,000 | $ | 1,019.80 | $ | 12.20 | $ | 1,012.99 | $ | 12.16 | 2.41 | % |

| Advisor | $ | 1,000 | $ | 1,019.80 | $ | 12.66 | $ | 1,012.53 | $ | 12.61 | 2.50 | % |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above–in the far right column–multiplied by the simple average account value over

the period indicated, and then multiplied by 183/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

franklintempleton.com

Semiannual Report 9

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

| | | | | | | | | | | | |

| Consolidated Financial Highlights | | | | | | | | | | | | |

| Franklin K2 Alternative Strategies Fund | | | | | | | | | | | | |

| | | Six Months Ended | | | Year Ended May 31, | | | | |

| | | November 30, 2016 | | | | | | | | | | |

| | | (unaudited) | | | 2016 | | | 2015 | | | 2014 | a |

| Class A | | | | | | | | | | | | |

| Per share operating performance | | | | | | | | | | | | |

| (for a share outstanding throughout the period) | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 10.55 | | $ | 11.16 | | $ | 10.64 | | $ | 10.00 | |

| Income from investment operationsb: | | | | | | | | | | | | |

| Net investment income (loss)c | | (0.01 | ) | | (0.05 | ) | | (0.11 | ) | | (0.02 | ) |

| Net realized and unrealized gains (losses) | | 0.21 | | | (0.38 | ) | | 0.70 | | | 0.70 | |

| Total from investment operations | | 0.20 | | | (0.43 | ) | | 0.59 | | | 0.68 | |

| Less distributions from: | | | | | | | | | | | | |

| Net investment income | | — | | | (0.14 | ) | | (0.07 | ) | | (0.04 | ) |

| Net realized gains | | — | | | (0.04 | ) | | — | | | — | |

| Total distributions | | — | | | (0.18 | ) | | (0.07 | ) | | (0.04 | ) |

| Net asset value, end of period | $ | 10.75 | | $ | 10.55 | | $ | 11.16 | | $ | 10.64 | |

| |

| Total returnd | | 1.90 | % | | (3.89 | )% | | 5.53 | % | | 6.82 | % |

| |

| Ratios to average net assetse | | | | | | | | | | | | |

| Expenses before waiver, payments by affiliates and expense | | | | | | | | | | | | |

| reductionf | | 3.09 | % | | 3.22 | % | | 3.40 | % | | 3.33 | % |

| Expenses net of waiver, payments by affiliates and expense | | | | | | | | | | | | |

| reductionf | | 2.75 | %g | | 2.88 | %g | | 2.99 | %g | | 2.83 | % |

| Expenses incurred in connection with securities | | | | | | | | | | | | |

| sold short | | 0.55 | % | | 0.67 | % | | 0.65 | % | | 0.56 | % |

| Net investment income (loss) | | (0.10 | )% | | (0.44 | )% | | (0.95 | )% | | (0.35 | )% |

| |

| Supplemental data | | | | | | | | | | | | |

| Net assets, end of period (000’s) | $ | 142,705 | | $ | 177,412 | | $ | 148,991 | | $ | 96,889 | |

| Portfolio turnover rate | | 105.92 | % | | 229.90 | % | | 295.81 | % | | 181.06 | % |

aFor the period October 11, 2013 (commencement of operations) to May 31, 2014.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales

and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fIncludes dividend and/or interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the

periods presented. See Note 1(f).

gBenefit of expense reduction rounds to less than 0.01%.

10 Semiannual Report | The accompanying notes are an integral part of these financial statements.

franklintempleton.com

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

CONSOLIDATED FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | |

| Franklin K2 Alternative Strategies Fund (continued) | | | | | | | | | | | | |

| | | Six Months Ended | | | Year Ended May 31, | |

| | | November 30, 2016 | | | | | | | | | | |

| | | (unaudited) | | | 2016 | | | 2015 | | | 2014 | a |

| Class C | | | | | | | | | | | | |

| Per share operating performance | | | | | | | | | | | | |

| (for a share outstanding throughout the period) | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 10.45 | | $ | 11.09 | | $ | 10.60 | | $ | 10.00 | |

| Income from investment operationsb: | | | | | | | | | | | | |

| Net investment income (loss)c | | (0.04 | ) | | (0.12 | ) | | (0.17 | ) | | (0.08 | ) |

| Net realized and unrealized gains (losses) | | 0.20 | | | (0.39 | ) | | 0.69 | | | 0.72 | |

| Total from investment operations | | 0.16 | | | (0.51 | ) | | 0.52 | | | 0.64 | |

| Less distributions from: | | | | | | | | | | | | |

| Net investment income | | — | | | (0.09 | ) | | (0.03 | ) | | (0.04 | ) |

| Net realized gains | | — | | | (0.04 | ) | | — | | | — | |

| Total distributions | | — | | | (0.13 | ) | | (0.03 | ) | | (0.04 | ) |

| Net asset value, end of period | $ | 10.61 | | $ | 10.45 | | $ | 11.09 | | $ | 10.60 | |

| |

| Total returnd | | 1.53 | % | | (4.62 | )% | | 4.87 | % | | 6.42 | % |

| |

| Ratios to average net assetse | | | | | | | | | | | | |

| Expenses before waiver, payments by affiliates and expense reductionf | | 3.79 | % | | 3.96 | % | | 4.04 | % | | 4.03 | % |

| Expenses net of waiver, payments by affiliates and expense reductionf | | 3.45 | %g | | 3.62 | %g | | 3.63 | %g | | 3.53 | % |

| Expenses incurred in connection with securities sold short | | 0.55 | % | | 0.67 | % | | 0.65 | % | | 0.56 | % |

| Net investment income (loss) | | (0.80 | )% | | (1.18 | )% | | (1.59 | )% | | (1.05 | )% |

| |

| Supplemental data | | | | | | | | | | | | |

| Net assets, end of period (000’s) | $ | 61,465 | | $ | 71,154 | | $ | 37,937 | | $ | 16,618 | |

| Portfolio turnover rate | | 105.92 | % | | 229.90 | % | | 295.81 | % | | 181.06 | % |

aFor the period October 11, 2013 (commencement of operations) to May 31, 2014.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales

and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fIncludes dividend and/or interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the

periods presented. See Note 1(f).

gBenefit of expense reduction rounds to less than 0.01%.

franklintempleton.com

The accompanying notes are an integral part of these financial statements. | Semiannual Report 11

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

CONSOLIDATED FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | |

| Franklin K2 Alternative Strategies Fund (continued) | | | | | | | | | | | | |

| | | Six Months Ended | | | Year Ended May 31, | |

| | | November 30, 2016 | | | | | | | | | | |

| | | (unaudited) | | | 2016 | | | 2015 | | | 2014 | a |

| Class R | | | | | | | | | | | | |

| Per share operating performance | | | | | | | | | | | | |

| (for a share outstanding throughout the period) | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 10.61 | | $ | 11.15 | | $ | 10.62 | | $ | 10.00 | |

| Income from investment operationsb: | | | | | | | | | | | | |

| Net investment income (loss)c | | (0.02 | ) | | (0.10 | ) | | (0.16 | ) | | (0.05 | ) |

| Net realized and unrealized gains (losses) | | 0.21 | | | (0.40 | ) | | 0.73 | | | 0.71 | |

| Total from investment operations | | 0.19 | | | (0.50 | ) | | 0.57 | | | 0.66 | |

| Less distributions from: | | | | | | | | | | | | |

| Net investment income | | — | | | — | | | (0.04 | ) | | (0.04 | ) |

| Net realized gains | | — | | | (0.04 | ) | | — | | | — | |

| Total distributions | | — | | | (0.04 | ) | | (0.04 | ) | | (0.04 | ) |

| Net asset value, end of period | $ | 10.80 | | $ | 10.61 | | $ | 11.15 | | $ | 10.62 | |

| |

| Total returnd | | 1.79 | % | | (4.51 | )% | | 5.39 | % | | 6.62 | % |

| |

| Ratios to average net assetse | | | | | | | | | | | | |

| Expenses before waiver, payments by affiliates and expense reductionf | | 3.34 | % | | 3.46 | % | | 3.57 | % | | 3.63 | % |

| Expenses net of waiver, payments by affiliates and expense reductionf | | 3.00 | %g | | 3.12 | %g | | 3.16 | %g | | 3.13 | % |

| Expenses incurred in connection with securities sold short | | 0.55 | % | | 0.67 | % | | 0.65 | % | | 0.56 | % |

| Net investment income (loss) | | (0.35 | )% | | (0.68 | )% | | (1.12 | )% | | (0.65 | )% |

| |

| Supplemental data | | | | | | | | | | | | |

| Net assets, end of period (000’s) | $ | 495 | | $ | 341 | | $ | 9,173 | | $ | 11,660 | |

| Portfolio turnover rate | | 105.92 | % | | 229.90 | % | | 295.81 | % | | 181.06 | % |

aFor the period October 11, 2013 (commencement of operations) to May 31, 2014.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales

and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fIncludes dividend and/or interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the

periods presented. See Note 1(f).

gBenefit of expense reduction rounds to less than 0.01%.

12 Semiannual Report | The accompanying notes are an integral part of these financial statements.

franklintempleton.com

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

CONSOLIDATED FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | |

| Franklin K2 Alternative Strategies Fund (continued) | | | | | | | | | | | | |

| | | Six Months Ended | | | | | | Year Ended May 31, | | | | |

| | | November 30, 2016 | | | | | | | | | | |

| | | (unaudited) | | | 2016 | | | 2015 | | | 2014 | a |

| Class R6 | | | | | | | | | | | | |

| Per share operating performance | | | | | | | | | | | | |

| (for a share outstanding throughout the period) | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 10.59 | | $ | 11.18 | | $ | 10.66 | | $ | 10.00 | |

| Income from investment operationsb: | | | | | | | | | | | | |

| Net investment income (loss)c | | 0.01 | | | (0.01 | ) | | (0.08 | ) | | (0.01 | ) |

| Net realized and unrealized gains (losses) | | 0.20 | | | (0.37 | ) | | 0.70 | | | 0.71 | |

| Total from investment operations | | 0.21 | | | (0.38 | ) | | 0.62 | | | 0.70 | |

| Less distributions from: | | | | | | | | | | | | |

| Net investment income | | — | | | (0.17 | ) | | (0.10 | ) | | (0.04 | ) |

| Net realized gains | | — | | | (0.04 | ) | | — | | | — | |

| Total distributions | | — | | | (0.21 | ) | | (0.10 | ) | | (0.04 | ) |

| Net asset value, end of period | $ | 10.80 | | $ | 10.59 | | $ | 11.18 | | $ | 10.66 | |

| |

| Total returnd | | 1.98 | % | | (3.45 | )% | | 5.80 | % | | 7.02 | % |

| |

| Ratios to average net assetse | | | | | | | | | | | | |

| Expenses before waiver, payments by affiliates and expense | | | | | | | | | | | | |

| reductionf | | 2.75 | % | | 2.87 | % | | 2.98 | % | | 3.19 | % |

| Expenses net of waiver, payments by affiliates and expense | | | | | | | | | | | | |

| reductionf | | 2.41 | %g | | 2.53 | %g | | 2.60 | %g | | 2.69 | % |

| Expenses incurred in connection with securities sold short | | 0.55 | % | | 0.67 | % | | 0.65 | % | | 0.56 | % |

| Net investment income (loss) | | 0.24 | % | | (0.09 | )% | | (0.56 | )% | | (0.21 | )% |

| |

| Supplemental data | | | | | | | | | | | | |

| Net assets, end of period (000’s) | $ | 257,955 | | $ | 265,517 | | $ | 239,754 | | $ | 215,526 | |

| Portfolio turnover rate | | 105.92 | % | | 229.90 | % | | 295.81 | % | | 181.06 | % |

aFor the period October 11, 2013 (commencement of operations) to May 31, 2014.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales

and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fIncludes dividend and/or interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the

periods presented. See Note 1(f).

gBenefit of expense reduction rounds to less than 0.01%.

franklintempleton.com

The accompanying notes are an integral part of these financial statements. | Semiannual Report 13

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

CONSOLIDATED FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | |

| Franklin K2 Alternative Strategies Fund (continued) | | | | | | | | | | | | |

| | | Six Months Ended | | | Year Ended May 31, | |

| | | November 30, 2016 | | | | | | | | | | |

| | | (unaudited) | | | 2016 | | | 2015 | | | 2014 | a |

| Advisor Class | | | | | | | | | | | | |

| Per share operating performance | | | | | | | | | | | | |

| (for a share outstanding throughout the period) | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 10.58 | | $ | 11.18 | | $ | 10.65 | | $ | 10.00 | |

| Income from investment operationsb: | | | | | | | | | | | | |

| Net investment income (loss)c | | 0.01 | | | (0.02 | ) | | (0.02 | ) | | (0.02 | ) |

| Net realized and unrealized gains (losses) | | 0.20 | | | (0.38 | ) | | 0.64 | | | 0.71 | |

| Total from investment operations | | 0.21 | | | (0.40 | ) | | 0.62 | | | 0.69 | |

| Less distributions from: | | | | | | | | | | | | |

| Net investment income | | — | | | (0.16 | ) | | (0.09 | ) | | (0.04 | ) |

| Net realized gains | | — | | | (0.04 | ) | | — | | | — | |

| Total distributions | | — | | | (0.20 | ) | | (0.09 | ) | | (0.04 | ) |

| Net asset value, end of period | $ | 10.79 | | $ | 10.58 | | $ | 11.18 | | $ | 10.65 | |

| |

| Total returnd | | 1.98 | % | | (3.58 | )% | | 5.88 | % | | 6.92 | % |

| |

| Ratios to average net assetse | | | | | | | | | | | | |

| Expenses before waiver, payments by affiliates and expense reductionf | | 2.84 | % | | 2.96 | % | | 3.07 | % | | 3.21 | % |

| Expenses net of waiver, payments by affiliates and expense reductionf | | 2.50 | %g | | 2.62 | %g | | 2.66 | %g | | 2.71 | % |

| Expenses incurred in connection with securities sold short | | 0.55 | % | | 0.67 | % | | 0.65 | % | | 0.56 | % |

| Net investment income (loss) | | 0.15 | % | | (0.18 | )% | | (0.62 | )% | | (0.23 | )% |

| |

| Supplemental data | | | | | | | | | | | | |

| Net assets, end of period (000’s) | $ | 648,675 | | $ | 722,216 | | $ | 329,139 | | $ | 54,593 | |

| Portfolio turnover rate | | 105.92 | % | | 229.90 | % | | 295.81 | % | | 181.06 | % |

aFor the period October 11, 2013 (commencement of operations) to May 31, 2014.

bThe amount shown for a share outstanding throughout the period may not correlate with the Consolidated Statement of Operations for the period due to the timing of sales

and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fIncludes dividend and/or interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the

periods presented. See Note 1(f).

gBenefit of expense reduction rounds to less than 0.01%.

14 Semiannual Report | The accompanying notes are an integral part of these financial statements.

franklintempleton.com

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

Consolidated Statement of Investments, November 30, 2016 (unaudited)

| | | | |

| Franklin K2 Alternative Strategies Fund | | | | |

| | Country | Shares/Warrants | | Value |

| Common Stocks and Other Equity Interests 32.5% | | | | |

| Aerospace & Defense 0.1% | | | | |

| B/E Aerospace Inc | United States | 21,029 | $ | 1,262,581 |

| United Technologies Corp | United States | 729 | | 78,528 |

| | | | | 1,341,109 |

| Air Freight & Logistics 0.2% | | | | |

| a FedEx Corp | United States | 13,662 | | 2,618,596 |

| Airlines 0.4% | | | | |

| Copa Holdings SA | Panama | 3,036 | | 269,810 |

| a Delta Air Lines Inc | United States | 36,249 | | 1,746,477 |

| a,b Hawaiian Holdings Inc | United States | 5,338 | | 274,106 |

| a,b Latam Airlines, ADR | Chile | 23,337 | | 202,565 |

| Southwest Airlines Co | United States | 21,651 | | 1,009,153 |

| b United Continental Holdings Inc | United States | 12,940 | | 892,213 |

| b Virgin America Inc | United States | 2,400 | | 135,600 |

| | | | | 4,529,924 |

| Auto Components 0.1% | | | | |

| Adient PLC | United States | 28,713 | | 1,537,868 |

| Delphi Automotive PLC | United Kingdom | 476 | | 30,464 |

| | | | | 1,568,332 |

| Automobiles 0.2% | | | | |

| General Motors Co | United States | 1,544 | | 53,314 |

| a Harley-Davidson Inc | United States | 19,656 | | 1,196,854 |

| b Peugeot SA | France | 20,062 | | 295,977 |

| b Tesla Motors Inc | United States | 4,028 | | 762,816 |

| | | | | 2,308,961 |

| Banks 0.1% | | | | |

| Barclays PLC, ADR | United Kingdom | 108,406 | | 292,910 |

| BB&T Corp | United States | 1,399 | | 63,305 |

| b Israel Discount Bank Ltd | Israel | 64,119 | | 130,872 |

| JPMorgan Chase & Co | United States | 2,656 | | 212,932 |

| PNC Financial Services Group Inc | United States | 794 | | 87,769 |

| US Bancorp | United States | 1,400 | | 69,468 |

| Wells Fargo & Co | United States | 3,534 | | 187,019 |

| | | | | 1,044,275 |

| Beverages 0.8% | | | | |

| a Anheuser-Busch InBev SA/NV, ADR | Belgium | 24,130 | | 2,491,905 |

| a Brown-Forman Corp., B | United States | 48,078 | | 2,180,337 |

| Coca-Cola Co | United States | 3,433 | | 138,522 |

| Constellation Brands Inc., A | United States | 319 | | 48,214 |

| Davide Campari-Milano SpA | Italy | 189,757 | | 1,830,136 |

| Heineken NV | Netherlands | 11,205 | | 839,844 |

| Molson Coors Brewing Co | United States | 11,842 | | 1,160,871 |

| PepsiCo Inc | United States | 1,266 | | 126,727 |

| | | | | 8,816,556 |

| Biotechnology 2.4% | | | | |

| b ACADIA Pharmaceuticals Inc | United States | 32,494 | | 877,013 |

| b Aeglea BioTherapeutics Inc | United States | 13,829 | | 71,496 |

| a,b Agios Pharmaceuticals Inc | United States | 2,859 | | 166,422 |

| a,b Alexion Pharmaceuticals Inc | United States | 12,919 | | 1,583,740 |

franklintempleton.com

Semiannual Report 15

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED)

| | | | |

| Franklin K2 Alternative Strategies Fund (continued) | | | | |

| |

| | Country | Shares/Warrants | | Value |

| Common Stocks and Other Equity Interests (continued) | | | | |

| Biotechnology (continued) | | | | |

| b Amicus Therapeutics Inc | United States | 79,676 | $ | 476,463 |

| b ARIAD Pharmaceuticals Inc | United States | 27,941 | | 376,645 |

| b Audentes Therapeutics Inc | United States | 5,590 | | 91,844 |

| b Avexis Inc | United States | 3,345 | | 197,756 |

| b BioCryst Pharmaceuticals Inc | United States | 19,513 | | 109,078 |

| b Biogen Inc | United States | 5,786 | | 1,701,489 |

| b BioMarin Pharmaceutical Inc | United States | 36,544 | | 3,129,263 |

| b Bluebird Bio Inc | United States | 16,058 | | 969,100 |

| b Celgene Corp | United States | 24,700 | | 2,927,197 |

| b Clovis Oncology Inc | United States | 12,173 | | 417,169 |

| b Corvus Pharmaceuticals Inc | United States | 4,562 | | 70,392 |

| b DBV Technologies SA, ADR | France | 8,052 | | 294,059 |

| b Epizyme Inc | United States | 32,473 | | 360,450 |

| b Exelixis Inc | United States | 26,863 | | 454,522 |

| a,b Incyte Corp. Ltd | United States | 20,357 | | 2,082,318 |

| b Inotek Pharmaceuticals Corp | United States | 25,253 | | 161,619 |

| b Insmed Inc | United States | 18,832 | | 257,057 |

| b Kite Pharma Inc | United States | 10,484 | | 533,950 |

| b MacroGenics Inc | United States | 4,141 | | 107,376 |

| b Mast Therapeutics Inc., wts., 6/14/18 | United States | 68,920 | | 138 |

| b Medgenics Inc | United States | 26,026 | | 133,774 |

| b Natera Inc | United States | 11,086 | | 133,032 |

| b Neurocrine Biosciences Inc | United States | 6,544 | | 303,969 |

| b Otonomy Inc | United States | 20,111 | | 341,887 |

| b OvaScience Inc | United States | 33,867 | | 113,454 |

| b ProQR Therapeutics NV | Netherlands | 37,569 | | 159,668 |

| b Proteostasis Therapeutics Inc | United States | 36,072 | | 379,838 |

| b Prothena Corp. PLC | Ireland | 8,682 | | 512,412 |

| b Ra Pharmaceuticals Inc | United States | 3,379 | | 44,231 |

| b Radius Health Inc | United States | 4,274 | | 227,462 |

| b Regeneron Pharmaceuticals Inc | United States | 3,442 | | 1,305,344 |

| b REGENXBIO Inc | United States | 2,716 | | 60,431 |

| b Retrophin Inc | United States | 12,435 | | 254,544 |

| b Sage Therapeutics Inc | United States | 14,259 | | 714,519 |

| a,b Sarepta Therapeutics Inc | United States | 10,290 | | 352,535 |

| a Shire PLC, ADR | United States | 12,955 | | 2,261,943 |

| b Syndax Pharmaceuticals Inc | United States | 2,165 | | 20,957 |

| b Tesaro Inc | United States | 5,354 | | 726,484 |

| b Trevena Inc | United States | 10,717 | | 58,729 |

| b Ultragenyx Pharmaceutical Inc | United States | 9,639 | | 754,637 |

| b Vertex Pharmaceuticals Inc | United States | 3,649 | | 297,795 |

| | | | | 26,574,201 |

| Building Products 0.0%† | | | | |

| a AO Smith Corp | United States | 6,172 | | 300,144 |

| Johnson Controls International PLC | United States | 2,103 | | 94,593 |

| | | | | 394,737 |

| Capital Markets 0.3% | | | | |

| a Moody’s Corp | United States | 23,172 | | 2,328,786 |

| a SEI Investments Co | United States | 29,367 | | 1,385,535 |

| | | | | 3,714,321 |

16 Semiannual Report

franklintempleton.com

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED)

| | | | |

| Franklin K2 Alternative Strategies Fund (continued) | | | | |

| |

| | Country | Shares/Warrants | | Value |

| Common Stocks and Other Equity Interests (continued) | | | | |

| Chemicals 1.1% | | | | |

| Axalta Coating Systems Ltd | United States | 11,216 | $ | 296,327 |

| Croda International PLC | United Kingdom | 21,384 | | 872,772 |

| E. I. du Pont de Nemours & Co | United States | 941 | | 69,267 |

| b Ingevity Corp | United States | 32,929 | | 1,724,492 |

| PPG Industries Inc | United States | 344 | | 33,000 |

| a Sherwin-Williams Co | United States | 21,516 | | 5,780,704 |

| a Syngenta AG, ADR | Switzerland | 23,169 | | 1,770,575 |

| Trinseo SA | United States | 23,791 | | 1,392,963 |

| | | | | 11,940,100 |

| Commercial Services & Supplies 0.4% | | | | |

| b Atento SA | Spain | 81,572 | | 693,362 |

| Edenred | France | 30,138 | | 635,481 |

| G&K Services Inc., A | United States | 7,570 | | 726,115 |

| b Gategroup Holding AG | Switzerland | 36,384 | | 1,823,673 |

| West Corp | United States | 18,356 | | 437,974 |

| | | | | 4,316,605 |

| Communications Equipment 0.3% | | | | |

| b Arista Networks Inc | United States | 9,040 | | 857,083 |

| b Ciena Corp | United States | 32,152 | | 689,660 |

| b Oclaro Inc | United States | 128,070 | | 1,144,946 |

| b Quantenna Communications Inc | United States | 7,700 | | 146,223 |

| | | | | 2,837,912 |

| Construction & Engineering 0.1% | | | | |

| a Fluor Corp | United States | 10,997 | | 588,449 |

| Construction Materials 0.3% | | | | |

| Buzzi Unicem SpA | Italy | 20,495 | | 435,519 |

| HeidelbergCement AG | Germany | 7,994 | | 716,853 |

| a Martin Marietta Materials Inc | United States | 6,096 | | 1,337,767 |

| b Summit Materials Inc., A | United States | 16,740 | | 397,910 |

| | | | | 2,888,049 |

| Containers & Packaging 0.1% | | | | |

| Ball Corp | United States | 17,085 | | 1,282,400 |

| International Paper Co | United States | 891 | | 43,409 |

| WestRock Co | United States | 528 | | 27,034 |

| | | | | 1,352,843 |

| Diversified Consumer Services 0.1% | | | | |

| b LifeLock Inc | United States | 25,543 | | 608,179 |

| Sotheby’s | United States | 5,074 | | 198,190 |

| | | | | 806,369 |

| Diversified Financial Services 0.0%† | | | | |

| b ECN Capital Corp | Canada | 16,284 | | 36,610 |

| Diversified Telecommunication Services 0.6% | | | | |

| AT&T Inc | United States | 1,688 | | 65,207 |

| CenturyLink Inc | United States | 8,848 | | 208,105 |

| b Level 3 Communications Inc | United States | 48,924 | | 2,694,245 |

| b ORBCOMM Inc | United States | 17,540 | | 147,511 |

franklintempleton.com

Semiannual Report 17

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED)

| | | | |

| Franklin K2 Alternative Strategies Fund (continued) | | | | |

| |

| | Country | Shares/Warrants | | Value |

| Common Stocks and Other Equity Interests (continued) | | | | |

| Diversified Telecommunication Services (continued) | | | | |

| SFR Group SA | France | 45,273 | $ | 1,143,905 |

| Telecom Italia SpA | Italy | 3,776,043 | | 2,357,201 |

| Verizon Communications Inc | United States | 3,009 | | 150,149 |

| | | | | 6,766,323 |

| Electric Utilities 0.0%† | | | | |

| Exelon Corp | United States | 1,932 | | 62,809 |

| NextEra Energy Inc | United States | 949 | | 108,404 |

| PG&E Corp | United States | 2,093 | | 123,069 |

| | | | | 294,282 |

| Electronic Equipment, Instruments & Components 0.7% | | | | |

| b Coherent Inc | United States | 3,443 | | 449,311 |

| Ingram Micro Inc., A | United States | 106,586 | | 3,990,580 |

| b Itron Inc | United States | 10,530 | | 676,026 |

| Largan Precision Co. Ltd | Taiwan | 2,650 | | 306,796 |

| Tongda Group Holdings Ltd | Hong Kong | 1,170,000 | | 343,918 |

| a,b VeriFone Systems Inc | United States | 92,216 | | 1,557,528 |

| | | | | 7,324,159 |

| Energy Equipment & Services 0.4% | | | | |

| b FMC Technologies Inc | United States | 135,214 | | 4,632,431 |

| Halliburton Co | United States | 1,876 | | 99,597 |

| | | | | 4,732,028 |

| Food & Staples Retailing 0.7% | | | | |

| a Casey’s General Stores Inc | United States | 33,546 | | 4,040,616 |

| Costco Wholesale Corp | United States | 17,327 | | 2,600,956 |

| CVS Health Corp | United States | 646 | | 49,671 |

| Kroger Co | United States | 1,675 | | 54,102 |

| a,b,d Rite Aid Corp | United States | 86,884 | | 691,597 |

| | | | | 7,436,942 |

| Food Products 0.6% | | | | |

| The Hershey Co | United States | 16,281 | | 1,573,396 |

| Lindt & Spruengli AG | Switzerland | 63 | | 3,662,762 |

| Mead Johnson Nutrition Co | United States | 618 | | 44,551 |

| a,b The WhiteWave Foods Co | United States | 33,812 | | 1,862,703 |

| | | | | 7,143,412 |

| Health Care Equipment & Supplies 1.2% | | | | |

| b Alere Inc | United States | 10,104 | | 401,331 |

| a Becton Dickinson and Co | United States | 13,842 | | 2,340,682 |

| b Boston Scientific Corp | United States | 32,213 | | 659,078 |

| DENTSPLY SIRONA Inc | United States | 13,167 | | 766,056 |

| b Derma Sciences Inc | United States | 15,810 | | 75,888 |

| b DexCom Inc | United States | 9,788 | | 639,059 |

| b Edwards Lifesciences Corp | United States | 1,497 | | 124,026 |

| b GenMark Diagnostics Inc | United States | 27,031 | | 314,100 |

| a,b IDEXX Laboratories Inc | United States | 17,940 | | 2,110,641 |

| b iRhythm Technologies Inc | United States | 1,485 | | 45,293 |

| Medtronic PLC | United States | 309 | | 22,560 |

| Smith & Nephew PLC | United Kingdom | 72,763 | | 1,026,036 |

18 Semiannual Report

franklintempleton.com

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED)

| | | | |

| Franklin K2 Alternative Strategies Fund (continued) | | | | |

| |

| | Country | Shares/Warrants | | Value |

| Common Stocks and Other Equity Interests (continued) | | | | |

| Health Care Equipment & Supplies (continued) | | | | |

| a St. Jude Medical Inc | United States | 64,738 | $ | 5,127,250 |

| b TearLab Corp | United States | 56,223 | | 30,360 |

| | | | | 13,682,360 |

| Health Care Providers & Services 1.2% | | | | |

| b Acadia Healthcare Co. Inc | United States | 10,301 | | 391,541 |

| a Aetna Inc | United States | 16,373 | | 2,142,243 |

| Celesio AG | Germany | 61,856 | | 1,661,897 |

| b Centene Corp | United States | 13,078 | | 753,685 |

| Cigna Corp | United States | 8,876 | | 1,195,952 |

| b Envision Healthcare Holdings Inc | United States | 28,049 | | 637,273 |

| a Humana Inc | United States | 14,599 | | 3,104,332 |

| a UnitedHealth Group Inc | United States | 16,758 | | 2,653,127 |

| Universal Health Services Inc., B | United States | 2,346 | | 288,605 |

| | | | | 12,828,655 |

| Health Care Technology 0.0%† | | | | |

| b Tabula Rasa HealthCare Inc | United States | 4,863 | | 67,498 |

| Hotels, Restaurants & Leisure 0.6% | | | | |

| Carnival Corp | United States | 26,863 | | 1,381,027 |

| a Domino’s Pizza Inc | United States | 12,047 | | 2,024,378 |

| Hilton Worldwide Holdings Inc | United States | 2,693 | | 67,513 |

| McDonald’s Corp | United States | 718 | | 85,636 |

| a Sonic Corp | United States | 43,947 | | 1,147,017 |

| Wynn Resorts Ltd | United States | 2,645 | | 269,764 |

| Yum! Brands Inc | United States | 21,824 | | 1,383,423 |

| | | | | 6,358,758 |

| Household Durables 0.1% | | | | |

| a CalAtlantic Group Inc | United States | 23,441 | | 782,695 |

| Harman International Industries Inc | United States | 5,583 | | 610,612 |

| Whirlpool Corp | United States | 213 | | 34,600 |

| | | | | 1,427,907 |

| Independent Power & Renewable Electricity Producers 0.0%† | | | | |

| TerraForm Global Inc., A | United States | 92,129 | | 350,090 |

| Industrial Conglomerates 0.1% | | | | |

| General Electric Co | United States | 4,562 | | 140,327 |

| Honeywell International Inc | United States | 662 | | 75,428 |

| Roper Technologies Inc | United States | 550 | | 99,610 |

| Smiths Group PLC | United Kingdom | 17,888 | | 315,804 |

| | | | | 631,169 |

| Insurance 0.4% | | | | |

| Chubb Ltd | United States | 487 | | 62,336 |

| Delta Lloyd NV | Netherlands | 157,293 | | 905,719 |

| Endurance Specialty Holdings | United States | 20,266 | | 1,868,525 |

| MetLife Inc | United States | 1,240 | | 68,213 |

| RSA Insurance Group PLC | United Kingdom | 44,331 | | 299,800 |

| a W.R. Berkley Corp | United States | 20,475 | | 1,265,150 |

| | | | | 4,469,743 |

franklintempleton.com

Semiannual Report 19

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED)

| | | | |

| Franklin K2 Alternative Strategies Fund (continued) | | | | |

| |

| | Country | Shares/Warrants | | Value |

| Common Stocks and Other Equity Interests (continued) | | | | |

| Internet & Direct Marketing Retail 0.8% | | | | |

| a,b Amazon.com Inc | United States | 2,329 | $ | 1,748,078 |

| a Expedia Inc | United States | 12,826 | | 1,591,065 |

| a,b Netflix Inc | United States | 7,890 | | 923,130 |

| b The Priceline Group Inc | United States | 724 | | 1,088,664 |

| a,b TripAdvisor Inc | United States | 15,751 | | 760,458 |

| a,b Wayfair Inc., A | United States | 61,446 | | 2,239,707 |

| | | | | 8,351,102 |

| Internet Software & Services 2.4% | | | | |

| b Akamai Technologies Inc | United States | 14,218 | | 948,340 |

| a,b Alibaba Group Holding Ltd., ADR | China | 16,552 | | 1,556,219 |

| a,b Alphabet Inc., A | United States | 1,284 | | 996,230 |

| a,b Alphabet Inc., C | United States | 1,306 | | 990,000 |

| b Baidu Inc., ADR | China | 2,300 | | 383,985 |

| b Benefitfocus Inc | United States | 11,353 | | 309,937 |

| a,b eBay Inc | United States | 37,281 | | 1,036,785 |

| a,b Facebook Inc | United States | 37,309 | | 4,418,132 |

| b GrubHub Inc | United States | 17,100 | | 633,213 |

| j2 Global Inc | United States | 10,688 | | 785,675 |

| b Just Eat PLC | United Kingdom | 93,564 | | 685,431 |

| a,b LinkedIn Corp., A | United States | 47,074 | | 9,190,728 |

| Tencent Holdings Ltd | China | 17,600 | | 439,518 |

| b VeriSign Inc | United States | 11,079 | | 873,579 |

| a,b Yahoo! Inc | United States | 74,499 | | 3,055,949 |

| b Zillow Group Inc., A | United States | 8,017 | | 281,797 |

| b Zillow Group Inc., C | United States | 17,102 | | 614,304 |

| | | | | 27,199,822 |

| IT Services 3.2% | | | | |

| Accenture PLC, A | United States | 8,972 | | 1,071,526 |

| a Alliance Data Systems Corp | United States | 14,062 | | 3,217,104 |

| a Automatic Data Processing Inc | United States | 25,230 | | 2,422,585 |

| b Blackhawk Network Holdings Inc | United States | 9,800 | | 352,800 |

| a Cardtronics PLC, A | United States | 19,967 | | 987,767 |

| a,b Cognizant Technology Solutions Corp., A | United States | 23,186 | | 1,277,085 |

| a Computer Sciences Corp | United States | 17 | | 1,031 |

| a,b EPAM Systems Inc | United States | 15,489 | | 1,020,725 |

| a,b ExlService Holdings Inc | United States | 55,867 | | 2,657,035 |

| b FleetCor Technologies Inc | United States | 11,700 | | 1,747,278 |

| b Genpact Ltd | United States | 106,065 | | 2,538,135 |

| a Global Payments Inc | United States | 52,238 | | 3,580,915 |

| a MasterCard Inc., A | United States | 33,266 | | 3,399,785 |

| b,e Nets AS, 144A | Denmark | 25,555 | | 436,816 |

| a,b PayPal Holdings Inc | United States | 63,675 | | 2,501,154 |

| Total System Services Inc | United States | 26,000 | | 1,279,720 |

| a,b Vantiv Inc., A | United States | 20,986 | | 1,184,240 |

| Visa Inc., A | United States | 29,356 | | 2,269,806 |

| a,b WEX Inc | United States | 24,187 | | 2,672,905 |

| e Worldpay Group PLC, 144A | United Kingdom | 112,257 | | 378,109 |

| | | | | 34,996,521 |

20 Semiannual Report

franklintempleton.com

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED)

| | | | |

| Franklin K2 Alternative Strategies Fund (continued) | | | | |

| |

| | Country | Shares/Warrants | | Value |

| Common Stocks and Other Equity Interests (continued) | | | | |

| Life Sciences Tools & Services 0.6% | | | | |

| Gerresheimer AG | Germany | 23,577 | $ | 1,720,429 |

| b Illumina Inc | United States | 7,574 | | 1,008,402 |

| a,b Mettler-Toledo International Inc | United States | 1,732 | | 713,619 |

| b NanoString Technologies Inc | United States | 5,354 | | 117,788 |

| Thermo Fisher Scientific Inc | United States | 20,432 | | 2,862,728 |

| | | | | 6,422,966 |

| Machinery 0.2% | | | | |

| a Caterpillar Inc | United States | 10,249 | | 979,395 |

| Dover Corp | United States | 735 | | 53,368 |

| b KUKA AG | Germany | 5,169 | | 577,967 |

| b Manitowoc Foodservice Inc | United States | 7,180 | | 127,373 |

| Trinity Industries Inc | United States | 17,228 | | 478,766 |

| | | | | 2,216,869 |

| Marine 0.2% | | | | |

| Irish Continental Group PLC | Ireland | 410,345 | | 1,817,899 |

| Media 1.3% | | | | |

| a,b Carmike Cinemas Inc | United States | 63,881 | | 2,159,178 |

| a CBS Corp., B | United States | 16,258 | | 987,186 |

| a,b Charter Communications Inc., A | United States | 3,698 | | 1,018,096 |

| Comcast Corp., A | United States | 938 | | 65,200 |

| a,b Dish Network Corp., A | United States | 37,297 | | 2,142,713 |

| Entertainment One Ltd | Canada | 112,518 | | 309,019 |

| ITV PLC | United Kingdom | 293,248 | | 616,414 |

| b Liberty Global PLC LiLAC, A | United Kingdom | 11,067 | | 238,826 |

| b Liberty Global PLC LiLAC, C | United Kingdom | 3,003 | | 63,574 |

| b Liberty Global PLC, A | United Kingdom | 32,966 | | 1,032,495 |

| b Liberty Global PLC, C | United Kingdom | 24,352 | | 741,518 |

| b Live Nation Entertainment Inc | United States | 4,173 | | 115,509 |

| b Postmedia Network Canada Corp | Canada | 666,338 | | 327,390 |

| Stroeer SE & Co. KGaA | Germany | 44,132 | | 1,673,548 |

| Time Warner Inc | United States | 4,798 | | 440,552 |

| Walt Disney Co | United States | 22,400 | | 2,220,288 |

| | | | | 14,151,506 |

| Metals & Mining 1.4% | | | | |

| Boliden AB | Sweden | 38,793 | | 1,001,918 |

| First Quantum Minerals Ltd | Canada | 60,371 | | 689,415 |

| a Freeport-McMoRan Inc | United States | 114,823 | | 1,762,533 |

| a Newmont Mining Corp | United States | 49,258 | | 1,597,930 |

| Teck Resources Ltd | Canada | 247,226 | | 6,264,707 |

| ThyssenKrupp AG | Germany | 51,931 | | 1,178,937 |

| a United States Steel Corp | United States | 72,509 | | 2,344,941 |

| Voestalpine AG | Austria | 21,316 | | 807,768 |

| | | | | 15,648,149 |

| Multi-Utilities 0.0%† | | | | |

| Sempra Energy | United States | 1,098 | | 109,580 |

| Oil, Gas & Consumable Fuels 0.6% | | | | |

| Chevron Corp | United States | 1,001 | | 111,672 |

| DHT Holdings Inc | United States | 55,300 | | 196,315 |

franklintempleton.com

Semiannual Report 21

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED)

| | | | |

| Franklin K2 Alternative Strategies Fund (continued) | | | | |

| |

| | Country | Shares/Warrants | | Value |

| Common Stocks and Other Equity Interests (continued) | | | | |

| Oil, Gas & Consumable Fuels (continued) | | | | |

| Encana Corp | Canada | 4,163 | $ | 52,454 |

| EQT Corp | United States | 406 | | 28,452 |

| Exxon Mobil Corp | United States | 2,622 | | 228,901 |

| Golar LNG Ltd | Bermuda | 1,384 | | 33,770 |

| b Halcon Resources Corp | United States | 7,948 | | 75,586 |

| b Halcon Resources Corp., wts., 9/09/20 | United States | 2,159 | | 5,376 |

| Hess Corp | United States | 10,920 | | 611,083 |

| b InterOil Corp | Singapore | 24,093 | | 1,170,920 |

| Kinder Morgan Inc | United States | 2,467 | | 54,767 |

| a,b Kinder Morgan Inc., wts., 5/25/17 | United States | 52,317 | | 340 |

| b Pacific Exploration and Production Corp | Colombia | 4,655 | | 183,144 |

| b PDC Energy Inc | United States | 407 | | 30,301 |

| SM Energy Co | United States | 4,547 | | 181,243 |

| a Spectra Energy Corp | United States | 29,112 | | 1,192,136 |

| TonenGeneral Sekiyu K.K | Japan | 120,264 | | 1,144,771 |

| Valero Energy Corp | United States | 322 | | 19,822 |

| Western Refining Inc | United States | 32,730 | | 1,174,025 |

| b Whiting Petroleum Corp | United States | 18,987 | | 232,021 |

| | | | | 6,727,099 |

| Paper & Forest Products 0.3% | | | | |

| b Canfor Corp | Canada | 188,794 | | 2,064,605 |

| West Fraser Timber Co. Ltd | Canada | 39,190 | | 1,397,163 |

| | | | | 3,461,768 |

| Pharmaceuticals 1.1% | | | | |

| b Aerie Pharmaceuticals Inc | United States | 41,896 | | 1,556,436 |

| b Allergan PLC | United States | 21,559 | | 4,188,914 |

| b Assembly Biosciences Inc | United States | 29,400 | | 377,790 |

| AstraZeneca PLC, ADR | United Kingdom | 18,988 | | 496,346 |

| a Bristol-Myers Squibb Co | United States | 26,998 | | 1,523,767 |

| b,e Cassiopea SpA, 144A | Italy | 4,184 | | 119,343 |

| b Dermira Inc | United States | 16,370 | | 523,513 |

| Eli Lilly & Co | United States | 24,924 | | 1,672,899 |

| a,b Flex Pharma Inc | United States | 3,355 | | 20,633 |

| b GW Pharmaceuticals PLC, ADR | United Kingdom | 2,409 | | 268,965 |

| Hikma Pharmaceuticals PLC | United Kingdom | 10,168 | | 216,405 |

| b Intra-Cellular Therapies Inc | United States | 22,475 | | 313,302 |

| Johnson & Johnson | United States | 2,146 | | 238,850 |

| b Ocular Therapeutix Inc | United States | 42,865 | | 398,216 |

| Pfizer Inc | United States | 4,507 | | 144,855 |

| b Steadymed Ltd | Israel | 7,603 | | 25,850 |

| | | | | 12,086,084 |

| Professional Services 0.8% | | | | |

| a Equifax Inc | United States | 9,951 | | 1,138,892 |

| Experian PLC | Ireland | 61,716 | | 1,166,012 |

| b Huron Consulting Group Inc | United States | 21,939 | | 1,157,282 |

| a ManpowerGroup Inc | United States | 6,503 | | 555,421 |

| a Robert Half International Inc | United States | 24,817 | | 1,113,539 |

| a,b TransUnion | United States | 38,184 | | 1,139,029 |

| b TriNet Group Inc | United States | 50,415 | | 1,271,970 |

22 Semiannual Report

franklintempleton.com

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED)

| | | | |

| Franklin K2 Alternative Strategies Fund (continued) | | | | |

| |

| | Country | Shares/Warrants | | Value |

| Common Stocks and Other Equity Interests (continued) | | | | |

| Professional Services (continued) | | | | |

| a,b WageWorks Inc | United States | 20,007 | $ | 1,477,517 |

| | | | | 9,019,662 |

| Real Estate Management & Development 0.1% | | | | |

| b CBRE Group Inc., A | United States | 27,744 | | 805,686 |

| Grand City Properties SA | Germany | 32,078 | | 535,806 |

| | | | | 1,341,492 |

| Road & Rail 0.7% | | | | |

| a CSX Corp | United States | 63,216 | | 2,263,765 |

| a Kansas City Southern | United States | 23,829 | | 2,113,871 |

| b Old Dominion Freight Line Inc | United States | 15,253 | | 1,331,587 |

| a Union Pacific Corp | United States | 21,535 | | 2,182,141 |

| | | | | 7,891,364 |

| Semiconductors & Semiconductor Equipment 0.9% | | | | |

| b Advanced Process Systems Corp | South Korea | 441 | | 9,072 |

| Advanced Semiconductor Engineering Inc | Taiwan | 170,000 | | 182,678 |

| Analog Devices Inc | United States | 10,207 | | 757,768 |

| Broadcom Ltd | Singapore | 3,565 | | 607,797 |

| b Cavium Inc | United States | 13,896 | | 792,489 |

| Cypress Semiconductor Corp | United States | 5,483 | | 61,684 |

| Intel Corp | United States | 1,498 | | 51,981 |

| b MaxLinear Inc., A | United States | 9,900 | | 202,257 |

| a Microchip Technology Inc | United States | 10,231 | | 677,087 |

| b Micron Technology Inc | United States | 30,717 | | 599,903 |

| a NVIDIA Corp | United States | 10,612 | | 978,426 |

| b NXP Semiconductors NV | Netherlands | 21,560 | | 2,137,674 |

| QUALCOMM Inc | United States | 15,705 | | 1,069,982 |

| b Semiconductor Manufacturing International Corp | China | 4,195,000 | | 567,878 |

| b Siltronic AG | Germany | 1,871 | | 75,066 |

| a Taiwan Semiconductor Manufacturing Co. Ltd., ADR | Taiwan | 20,159 | | 598,521 |

| Win Semiconductors Corp | Taiwan | 85,471 | | 243,222 |

| | | | | 9,613,485 |

| Software 1.1% | | | | |

| Activision Blizzard Inc | United States | 24,963 | | 913,895 |

| a,b Adobe Systems Inc | United States | 5,910 | | 607,607 |

| Atlassian Corp. PLC | Australia | 12,900 | | 350,106 |

| Blackbaud Inc | United States | 6,600 | | 414,348 |

| b BroadSoft Inc | United States | 4,934 | | 204,761 |

| b Guidewire Software Inc | United States | 14,561 | | 811,193 |

| b HubSpot Inc | United States | 9,266 | | 519,823 |

| a Intuit Inc | United States | 5,700 | | 647,976 |

| Mentor Graphics Corp | United States | 22,456 | | 820,767 |

| Microsoft Corp | United States | 77,573 | | 4,674,549 |

| Mobileye NV | Israel | 6,706 | | 249,664 |

| Oracle Corp | United States | 2,280 | | 91,633 |

| b Paylocity Holding Corp | United States | 8,400 | | 278,124 |

| b Proofpoint Inc | United States | 2,860 | | 220,249 |

| b Red Hat Inc | United States | 2,223 | | 175,862 |

| a,b Salesforce.com Inc | United States | 11,579 | | 833,688 |

| b ServiceNow Inc | United States | 2,987 | | 248,369 |

franklintempleton.com

Semiannual Report 23

FRANKLIN ALTERNATIVE STRATEGIES FUNDS

CONSOLIDATED STATEMENT OF INVESTMENTS (UNAUDITED)

| | | | |

| Franklin K2 Alternative Strategies Fund (continued) | | | | |

| |

| | Country | Shares/Warrants | | Value |

| Common Stocks and Other Equity Interests (continued) | | | | |

| Software (continued) | | | | |

| Square Enix Holdings Co. Ltd | Japan | 11,638 | $ | 293,277 |

| | | | | 12,355,891 |

| Specialty Retail 1.9% | | | | |

| a,b AutoNation Inc | United States | 116,791 | | 5,215,886 |

| a,b Autozone Inc | United States | 6,331 | | 4,958,313 |

| b Cabela’s Inc | United States | 51,086 | | 3,179,593 |

| CST Brands Inc | United States | 8,135 | | 390,724 |

| a Foot Locker Inc | United States | 15,255 | | 1,093,326 |

| Home Depot Inc | United States | 41,343 | | 5,349,784 |

| a,b MarineMax Inc | United States | 42,883 | | 806,200 |

| b Sports Direct International PLC | United Kingdom | 155,760 | | 615,845 |

| | | | | 21,609,671 |

| Technology Hardware, Storage & Peripherals 0.6% | | | | |

| Apple Inc | United States | 6,394 | | 706,665 |

| a Hewlett Packard Enterprise Co | United States | 55,891 | | 1,330,206 |

| b Pure Storage Inc., A | United States | 101,117 | | 1,410,582 |

| Samsung Electronics Co. Ltd | South Korea | 686 | | 1,024,555 |

| Seagate Technology PLC | United States | 45,193 | | 1,812,239 |

| Western Digital Corp | United States | 9,615 | | 612,091 |

| | | | | 6,896,338 |

| Textiles, Apparel & Luxury Goods 0.2% | | | | |

| Michael Kors Holdings Ltd | United States | 19,385 | | 901,209 |

| Moncler SpA | Italy | 23,079 | | 375,221 |

| a NIKE Inc., B | United States | 13,178 | | 659,822 |

| | | | | 1,936,252 |

| Tobacco 0.5% | | | | |

| Altria Group Inc | United States | 787 | | 50,313 |

| Philip Morris International Inc | United States | 692 | | 61,090 |

| Reynolds American Inc | United States | 95,365 | | 5,159,246 |

| | | | | 5,270,649 |

| Trading Companies & Distributors 0.0%† | | | | |

| Air Lease Corp | United States | 4,692 | | 168,255 |

| Brenntag AG | Germany | 386 | | 20,318 |

| b Herc Holdings Inc | United States | 7,920 | | 314,741 |

| | | | | 503,314 |

| Wireless Telecommunication Services 0.0%† | | | | |

| NTT DoCoMo Inc | Japan | 16,700 | | 383,032 |

| Total Common Stocks and Other Equity Interests | | | | |

| (Cost $326,256,862) | | | | 361,201,790 |

| Exchange Traded Funds (Cost $364,552) 0.0%† | | | | |

| SPDR S&P Bank ETF | United States | 9,954 | | 409,607 |

| Convertible Preferred Stocks 0.7% | | | | |

| Electric Utilities 0.0%† | | | | |