UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22652

First Trust Variable Insurance Trust

(Exact name of registrant as specified in charter)

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Address of principal executive offices) (Zip code)

W. Scott Jardine, Esq.

First Trust Portfolios L.P.

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Name and address of agent for service)

Registrant's telephone number, including area code: 630-765-8000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

(a) The Report to Shareholders is attached herewith.

(b)

First Trust Variable Insurance Trust

Annual Report

For the Year Ended

December 31, 2021

First Trust Variable Insurance Trust

Annual Report

December 31, 2021

Caution Regarding Forward-Looking Statements

This report contains certain forward-looking statements within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements regarding the goals, beliefs, plans or current expectations of First Trust Advisors L.P. (“First Trust” or the “Advisor”), Energy Income Partners, LLC (“EIP” or the “Sub-Advisor”), and/or Stonebridge Advisors LLC (“Stonebridge” or the “Sub-Advisor”) and their respective representatives, taking into account the information currently available to them. Forward-looking statements include all statements that do not relate solely to current or historical fact. For example, forward-looking statements include the use of words such as “anticipate,” “estimate,” “intend,” “expect,” “believe,” “plan,” “may,” “should,” “would” or other words that convey uncertainty of future events or outcomes.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of any series of First Trust Variable Insurance Trust (the “Trust”) to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. When evaluating the information included in this report, you are cautioned not to place undue reliance on these forward-looking statements, which reflect the judgment of the Advisor and/or Sub-Advisor and their respective representatives only as of the date hereof. We undertake no obligation to publicly revise or update these forward-looking statements to reflect events and circumstances that arise after the date hereof.

Performance and Risk Disclosure

There is no assurance that any series (individually called a “Fund” and collectively the “Funds”) of the Trust will achieve its investment objectives. Each Fund is subject to market risk, which is the possibility that the market values of securities owned by the Fund will decline and that the value of the Fund’s shares may therefore be less than what you paid for them. Accordingly, you can lose money by investing in a Fund. See “Risk Considerations” in the Additional Information section of this report for a discussion of certain other risks of investing in the Funds.

Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. For the most recent month-end performance figures, please visit www.ftportfolios.com or speak with your financial advisor. Investment returns and net asset value will fluctuate and Fund shares, when sold, may be worth more or less than their original cost.

The Advisor may also periodically provide additional information on Fund performance on each Fund’s web page at www.ftportfolios.com.

How to Read This Report

This report contains information that may help you evaluate your investment. It includes details about each Fund and presents data and analysis that provide insight into each Fund’s performance.

By reading the portfolio commentary by the portfolio management team of each Fund, you may obtain an understanding of how the market environment affected each Fund’s performance. The statistical information that follows may help you understand each Fund’s performance compared to that of relevant market benchmarks.

It is important to keep in mind that the opinions expressed by personnel of the Advisor and/or Sub-Advisors are just that: informed opinions. They should not be considered to be promises or advice. The opinions, like the statistics, cover the period through the date on the cover of this report. The material risks of investing in each Fund are spelled out in the prospectus, the statement of additional information, this report and other Fund regulatory filings.

First Trust Variable Insurance Trust

Annual Letter from the Chairman and CEO

December 31, 2021

First Trust is pleased to provide you with the annual report for the First Trust Variable Insurance Trust (the “Funds”), which contains detailed information about the Funds for the twelve months ended December 31, 2021.

Being that this is a year-end review, I would like to touch on the state of the business climate and securities markets in the U.S. The two biggest stories in 2021 were clearly the ongoing fight against the coronavirus (“COVID-19”) pandemic and the surge in the rate of inflation, which I believe is a byproduct of that fight. The COVID-19 pandemic is closing in on its second anniversary and it continues to curb economic activity in the U.S. and abroad. It is nearly as challenging today as it was at its peak in 2020.

The emergence of the Omicron variant in the latter half of 2021 was particularly disappointing because we had been making some inroads into fully reopening the U.S. economy until its arrival. Americans were dining out. Airline travel was picking up and people were even taking cruises again. We have learned that the Omicron variant, while seemingly not as dangerous as its predecessor, the Delta variant, at least in terms of the number of deaths to date, is still extremely contagious, especially for those individuals who have not been vaccinated. The U.S. federal government has funneled trillions of dollars of stimulus and subsidies into the financial system to mitigate the economic fallout from the pandemic. That level of support is unprecedented and has likely fueled much of the surge in inflation, as measured by the Consumer Price Index (“CPI”). The standard definition for inflation is “too many dollars chasing too few goods.” The explosion of the U.S. money supply has easily overwhelmed the volume of goods available to consumers. Global supply chain bottlenecks, including the backlog of container ships at ports in Southern California, have also contributed to the shortages of goods. In December 2021, the trailing 12-month rate on the CPI was 7.0%, up from 1.4% last December, according to the U.S. Bureau of Labor Statistics. The last time inflation was this elevated was in 1982.

Since the onset of COVID-19, companies and millions of employees have scrambled to adapt to the new normal of working remotely, typically from home. What an amazing thing to watch. While opinions may vary, it has become evident that the workplace culture has probably changed forever. According to Barron’s magazine, we should look for more of a hybrid arrangement moving forward that would entail workers being at the office for three days a week and home for two. I do not believe that the stock and bond markets would have performed nearly as well over the past two years had U.S. businesses not overcome the adversity brought their way by COVID-19. Oh, and the trillions of dollars from the government. In 2021, the S&P 500® Index posted a total return of 28.71%, and that came on the heels of an 18.40% gain in 2020, according to Bloomberg. From 1926-2021 (a span of 96 years), the S&P 500® Index posted an average annual total return of 10.44%, according to Morningstar/Ibbotson Associates. Investors should relish these outsized returns. Bond investors have earned more modest total returns over the past two years. Bond returns were higher for most bond categories in 2020 due to the artificially depressed yield on the 10-Year Treasury Note (“T-Note”). The 10-Year T-Note yield trended higher in 2021, putting some pressure on bond prices. Expect the Federal Reserve to tighten monetary policy by raising short-term interest rates. It could begin as early as March 2022. While the markets could experience some near-term pain, I believe normalizing interest rates and bond yields will prove to be a healthy and necessary transition for the markets long-term.

Thank you for giving First Trust the opportunity to play a role in your financial future. We value our relationship with you and will report on the Funds again in six months.

Sincerely,

James A. Bowen

Chairman of the Board of Trustees

Chief Executive Officer of First Trust Advisors L.P.

Portfolio Commentary and Performance Summary

First Trust/Dow Jones Dividend & Income Allocation Portfolio

Annual Report

December 31, 2021 (Unaudited)

Advisor

First Trust Advisors L.P. (“First Trust”) is a registered investment advisor based in Wheaton, IL and is the investment advisor to First Trust/Dow Jones Dividend & Income Allocation Portfolio (the “Fund”). In this capacity, First Trust is responsible for the selection and ongoing monitoring of the securities in the Fund’s portfolio and certain other services necessary for the management of the Fund.

Portfolio Management Team

Daniel J. Lindquist, Chairman of the Investment Committee and Managing Director, First Trust

David G. McGarel, Chief Investment Officer, Chief Operating Officer and Managing Director, First Trust

Jon C. Erickson, Senior Vice President, First Trust

Roger F. Testin, Senior Vice President, First Trust

Todd Larson, Senior Vice President, First Trust

Chris A. Peterson, Senior Vice President, First Trust

Eric Maisel, Senior Vice President, First Trust

First Trust/Dow Jones Dividend & Income Allocation Portfolio

For the year ended December 31, 2021, the Fund’s Class I Shares returned 12.25% versus 11.73% for the Blended Benchmark: 50% Russell 3000® Index and 50% Bloomberg U.S Corporate Investment-Grade Index. As of December 31, 2021, the total investments for the Fund were allocated as follows: Equities, 58.1% and Fixed Income, 41.9%.

Equities Commentary

U.S. equities pushed higher in 2021 as the Russell 3000® Index returned 25.66%, outperforming the previous year’s 20.89% return. Diminishing coronavirus (“COVID-19”) fears, a dovish policy commitment on the part of the Federal Reserve (the “Fed”), and the passage of aggressive fiscal stimulus, raised economists’ estimates for economic growth. U.S. equities rallied in the first quarter of 2021 propelling the Russell 3000® Index 6.35% higher by the end of March. All industries posted positive performance during the first quarter of 2021 with the Energy, Financials, and Basic Materials sectors at the top. U.S. equities continued their ascent in the second quarter of 2021, driven by an exceptionally strong first quarter earnings season and a resurgent macroeconomic backdrop in the wake of COVID-19. Dovish monetary policy largely continued to be a tailwind for stocks despite modest changes in messaging on the part of the Fed in response to rising inflation, which resulted in short-term volatility. By quarter’s end, the Russell 3000® Index had earned investors a sizable 8.24% return. After gaining ground in July and August, U.S. equities experienced increased volatility late in the third quarter due to anxiety about potential Fed tapering of asset purchases and fears of financial contagion after the Chinese real estate firm Evergrande failed to make its U.S. dollar debt payments. The August payroll report, released in September 2021, was underwhelming with 235,000 jobs added to non-farm payrolls during the month. By quarter’s end, the Russell 3000® Index returned -0.10%, producing the weakest quarter of 2021. During the fourth quarter, U.S. equities were headed back up as strong third quarter earnings, solid economic growth, and the passage of fiscal stimulus in the form of a trillion-dollar infrastructure bill lifted sentiment. Although the U.S. market did experience volatility in December 2021 due to worries that higher inflation would result in tighter Fed policy, equities eventually looked past the Fed’s announced acceleration in asset purchase tapering. The Real Estate and Technology industries led the performance with Basic Materials, Consumer Staples, and Utilities following close behind, with all five industries posting a double-digit return for the fourth quarter. The Russell 3000® Index returned 9.28%, posting the best quarterly performance of 2021.

A portfolio factor attribution reveals the largest factor exposures were small size, value, and dividend yield. Dividend yield and value were the best performing factors in 2021, while momentum and size were the worst performing factors. Quality and low volatility performed in-line with the market. The equity portion of the Fund’s portfolio was hindered by an overweight to small size factor exposure but benefited from dividend yield and value. These combined exposures contributed to the portfolio’s in-line performance.

The equity portion of the Fund has a quarterly rebalance in early January, April, July, and October. The selection process is focused on identifying stocks exhibiting dividend strength, capital strength and price stability. This process resulted in overweight positions in the Financials, Industrials, and Basic Materials sectors, while the Technology and Health Care sectors were underweight.

The Industrials, Consumer Discretionary, Telecommunications, and Financials sectors had a positive total attribution effect (allocation effect combined with selection effect), while the Technology, Energy, and Basic Materials sectors had a negative effect. The Financials and Consumer Discretionary sectors had a positive allocation effect while the Technology, Industrials, and Energy sectors had a negative effect. The Industrials sector had a positive selection effect while the Financials sector had a negative effect. The equity portion of the Fund was hindered by a negative allocation effect but was countered by a positive selection effect.

Portfolio Commentary and Performance Summary (Continued)

First Trust/Dow Jones Dividend & Income Allocation Portfolio (Continued)

Annual Report

December 31, 2021 (Unaudited)

The Industrials sector was the largest overall contributor to relative performance. The Fund was overweight the underperforming industry in the Benchmark, which led to a negative allocation effect but had a larger positive selection effect. Industrial positions in the Fund included Old Dominion Freight Line Inc., Tetra Tech, Inc., A.O. Smith Corp, Accenture PLC, and The Sherwin-Williams Co. The Consumer Discretionary, Financials, and Telecommunications sectors also contributed to positive relative performance. Some of the Fund’s holdings included Consumer Discretionary names Pool Corp., Tractor Supply Co., Costco Wholesale Corp., Financials names First American Financial Corp., Raymond James Financial, Inc., Houlihan Lokey, Inc., and Telecommunications name Cisco Systems, Inc., all which posted over 40% returns in 2021.

The Information Technology sector was the biggest detractor from relative performance. The Fund was underweight the outperforming industry in the Russell 3000® benchmark, which led to a negative allocation effect. The Fund also had a negative selection effect. Some of the Technology positions included Intuit, Inc., Microsoft Corp., Power Integrations, Inc., Texas Instruments, Inc., and Intel Corp., among others. The Energy and Basic Materials sectors also detracted from relative performance. The Fund had a negative allocation effect due to having no exposure to the Energy sector, the best performing industry in the Russell 3000® benchmark in 2021, while the Basic Materials sector detracted due to selection effect.

The Fund’s top five contributors to performance were ServisFirst Bancshares, Inc., Old Dominion Freight Line, Inc., Tractor Supply Co., Intuit Inc., and A.O. Smith Corp. The top five detractors from performance were Activision Blizzard Inc., The Western Union Co., Skyworks Solutions, Inc., ManTech International Corp., and The Best Buy Co., Inc.

Heading into 2022, the economy is currently in the expansion phase, after the recession and recovery caused by economic lockdowns from the global COVID-19 pandemic. Historically, small size and value are two of the top performing factors in the expansion portion of the business cycle. The equity portion of the portfolio currently has significant loading to both factors and has significant capital appreciation opportunities if the economy remains strong and the Fed remains accommodative despite rate increases.

Fixed Income Commentary

The investment-grade credit market came into 2021 with a positive view on the fundamental credit quality of high-grade issuers, but also with a heightened fear that the interest rate rise caused by a reopening economy might become disorderly. As the reopening proceeded, lower-rated credit outperformed. Investors became increasingly comfortable that the return to economic growth which was putting upward pressure on interest rates would in turn support credit spread tightening for lower-rated credits – those whose spreads had not yet normalized from the depths of the COVID-19 selloff the previous year. This theme of “credit spread cushion”, along with periodic risk flares from the Delta, and later, Omicron variants proved decisive in explaining return performance over the balance of the year. Periods of COVID-19-induced risk-off saw interest rates and equity markets fall, and credit spreads widen. As the market gained confidence and once again looked past near-term challenges to the longer-term reality that the economy was recovering far more quickly than most had expected – thus supporting corporate profitability and consumer spending – markets returned to risk-on. Importantly, a Fed that stubbornly clung to an extremely accommodative monetary policy kept interest rates well-behaved after the initial first quarter selloff. For example, the 10-Year U.S. Treasury yield never regained the yearly high reached on March 31, 2021 – having started the year at 0.92%, it reached 1.74% on March 31, 2021, but then ended the year at 1.54% without retesting the March level. This dampening of interest rate volatility supported credit spreads. It took the late November confluence of the Fed’s hawkish pivot, a heavy new issue supply calendar, and reduced fund inflows to cause another spike in credit spreads – but the second half of December 2021 saw yet another period of strength as positive fundamentals once again became the market’s focus.

For the 12-month period ended December 31, 2021, corporate bonds outperformed Treasuries by 161 basis points (“bps”). As measured by the Bloomberg U.S. Corporate Investment-Grade Index, spreads tightened by 4 bps to 92 bps at year-end. Investment-grade corporate bonds had a negative total return for the period, however, as the modest tightening in credit spreads and the carry provided by corporate bonds failed to offset the year’s increase in interest rates.

The fixed-income portion of the Fund seeks to provide income along with preservation of capital. To accomplish this, the selection process is primarily value oriented, strongly emphasizes downside protection and focuses on free cash flow, leverage, interest coverage and revenue growth rates. This process resulted in overweight positions in Banking, Electric Utilities, and Communications bonds, while Technology, Consumer Non-Cyclical, and Real Estate Investment Trusts (“REITs”) were the largest underweights.

With its bias toward “blue-chip” issuers, the total return for the bond portion of the Fund modestly underperformed the Bloomberg U.S. Corporate Investment-Grade Index. Yield curve changes contributed to relative performance. Treasury yields increased as the economy reopened and as the Fed pivoted away from its belief that inflation would prove transitory. At the Fed’s December 2021 meeting, the Fed announced an accelerated pace of asset purchase tapering and a more hawkish path for hiking its policy rate. The portfolio maintained a duration underweight throughout the year, partially via hedging interest rate exposure with U.S. Treasury

Portfolio Commentary and Performance Summary (Continued)

First Trust/Dow Jones Dividend & Income Allocation Portfolio (Continued)

Annual Report

December 31, 2021 (Unaudited)

futures contracts. Among credit quality and maturity cohorts, an overweight in mid- and low BBB-rated credits, along with active bets in the 10- and 20-year maturity buckets, added the most to relative performance.

Among the 18 fixed-income industry groups, allocations to Banking, Electric, and Capital Goods added the most to relative returns. Allocations to Consumer Non- Cyclical, Energy, and REITs, by contrast, reduced relative returns. Overall, the allocation effect modestly reduced relative performance. Within these industries, credit selection in Technology, Capital Goods, and Consumer Cyclical had the greatest positive impacts, while credit selection within Banking, Energy, and Communications reduced relative returns. Overall, credit selection within these industries reduced relative performance. Issuer allocation reduced relative performance, with overweights to U.S. Treasuries, Bank of America, and JPMorgan Chase having the greatest positive impact on relative returns. Security selection reduced relative return, with selection among bonds of Dell, Oracle Corp., and Southern California Edison Co. contributing the most to relative returns.

As we begin 2022, we continue to have a positive outlook for credit spreads. With the Fed having finally begun to normalize monetary policy, we anticipate higher interest rates and a steeper yield curve. Both factors should help U.S. investment grade credit, though should the normalization of interest rates become a disorderly selloff, then credit spreads would likely initially widen – especially if interest rate volatility spills over into equity markets. Our expectation for continued U.S. economic growth during 2022 should help support corporate profitability and cash flow. Foreign demand for U.S. fixed income should also benefit investment grade credit due to its yield advantage over much of the global investment grade market which continues to trade at, or close to, negative yields. That said, valuations are no longer cheap – making selectivity critical. Accordingly, our focus for the Fund will be on our process -- and on issuers and sectors with credit profiles well suited to weather the upcoming challenges.

Portfolio Commentary and Performance Summary (Continued)

First Trust/Dow Jones Dividend & Income Allocation Portfolio (Continued)

Annual Report

December 31, 2021 (Unaudited)

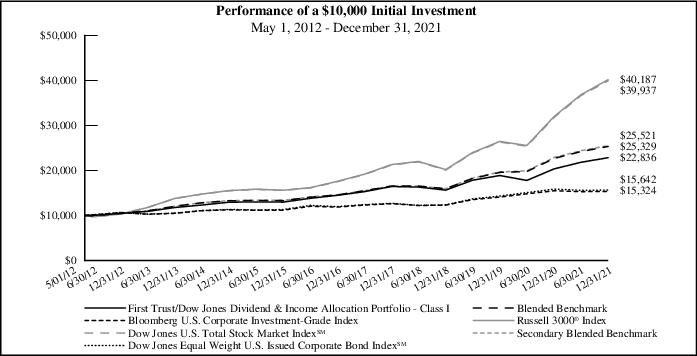

| Return Comparison | | | |

| | | Average Annual

Total Returns |

| | 1 Year

Ended

12/31/21 | 5 Years

Ended

12/31/21 | Inception

(5/1/12)

to 12/31/21 |

| Fund Performance | | | |

| First Trust/Dow Jones Dividend & Income Allocation Portfolio - Class I | 12.25% | 9.54% | 8.92% |

| Index Performance | | | |

| Blended Benchmark(1) | 11.73% | 11.72% | 10.09% |

| Bloomberg U.S. Corporate Investment-Grade Index(2) | -1.03% | 5.26% | 4.52% |

| Russell 3000® Index(3) | 25.66% | 17.97% | 15.47% |

| Secondary Blended Benchmark(4) | 11.54% | 11.83% | 10.17% |

| Dow Jones Equal Weight U.S. Issued Corporate Bond IndexSM(5) | -1.35% | 5.49% | 4.73% |

| Dow Jones U.S. Total Stock Market IndexSM(6) | 25.66% | 17.92% | 15.39% |

| Return Comparison | | | |

| | | Average Annual

Total Returns |

| | 1 Year

Ended

12/31/21 | 5 Years

Ended

12/31/21 | Inception

(5/1/14)

to 12/31/21 |

| Fund Performance | | | |

| First Trust/Dow Jones Dividend & Income Allocation Portfolio - Class II | 12.50 % | 9.82% | 8.99% |

| Index Performance | | | |

| Blended Benchmark(1) | 11.73% | 11.72% | 9.69% |

| Bloomberg U.S. Corporate Investment-Grade Index(2) | -1.03% | 5.26% | 4.49% |

| Russell 3000® Index(3) | 25.66% | 17.97% | 14.64% |

| Secondary Blended Benchmark(4) | 11.54% | 11.83% | 9.79% |

| Dow Jones Equal Weight U.S. Issued Corporate Bond IndexSM(5) | -1.35% | 5.49% | 4.73% |

| Dow Jones U.S. Total Stock Market IndexSM(6) | 25.66% | 17.92% | 14.57% |

The returns for the Fund do not reflect the deduction of expenses associated with variable products, such as mortality and expense risk charges, separate account charges, and sales charges or the effect of taxes. These expenses would reduce the overall returns shown.

| (1) | The Blended Benchmark returns are a 50/50 split between the Russell 3000® Index and the Bloomberg U.S. Corporate Investment-Grade Index returns. The Blended Benchmark returns are calculated by using the monthly return of the two indices during each period shown above. At the beginning of each month the two indices are rebalanced to a 50-50 ratio to account for divergence from that ratio that occurred during the course of each month. The monthly returns are then compounded for each period shown above, giving the performance for the Blended Benchmark for each period shown above. |

| (2) | Bloomberg U.S. Corporate Investment-Grade Index measures the performance of investment grade U.S. corporate bonds. The index includes all publicly issued, dollar-denominated corporate bonds with a minimum of $250 million par outstanding that are investment grade-rated (Baa3/BBB- or higher). The index excludes bonds having less than one year to final maturity as well as floating rate bonds, non-registered private placements, structured notes, hybrids, and convertible securities. (Bloomberg). (The index reflects no deduction for fees, expenses or taxes). |

| (3) | The Russell 3000® Index is composed of 3,000 large U.S. companies, as determined by market capitalization. This index represents approximately 98% of the investable U.S. equity market. (Bloomberg). (The index reflects no deduction for fees, expenses or taxes). |

| (4) | The Secondary Blended Benchmark return is a 50/50 split between the Dow Jones U.S. Total Stock Market IndexSM and the Dow Jones Equal Weight U.S. Issued Corporate Bond IndexSM returns. The Secondary Blended Benchmark returns are calculated by using the monthly return of the two indices during each period shown above. At the beginning of each month the two indices are rebalanced to a 50-50 ratio to account for divergence from that ratio that occurred during the course of each month. The monthly returns are then compounded for each period shown above, giving the performance for the Secondary Blended Benchmark for each period shown above. |

| (5) | The Dow Jones Equal Weight U.S. Issued Corporate Bond IndexSM measures the return of readily tradable, high-grade U.S. corporate bonds. The index includes an equally weighted basket of 96 recently issued investment-grade corporate bonds with laddered maturities. (The index reflects no deduction for fees, expenses or taxes). |

| (6) | The Dow Jones U.S. Total Stock Market IndexSM measures all U.S. equity securities that have readily available prices. (The index reflects no deduction for fees, expenses or taxes). |

Portfolio Commentary and Performance Summary (Continued)

First Trust/Dow Jones Dividend & Income Allocation Portfolio (Continued)

Annual Report

December 31, 2021 (Unaudited)

Portfolio Commentary and Performance Summary (Continued)

First Trust/Dow Jones Dividend & Income Allocation Portfolio (Continued)

Annual Report

December 31, 2021 (Unaudited)

| Credit Quality(7) | % of Total

Fixed-Income

Investments |

| AAA | 3.5% |

| AA- | 9.5 |

| A+ | 7.9 |

| A | 15.9 |

| A- | 10.0 |

| BBB+ | 15.9 |

| BBB | 19.1 |

| BBB- | 15.9 |

| A-1 (Short-term) | 0.6 |

| NR | 1.7 |

| Total | 100.0% |

| Top Equity Holdings | % of Total

Investments |

| A.O. Smith Corp. | 0.5% |

| Pool Corp. | 0.5 |

| Accenture PLC, Class A | 0.5 |

| UnitedHealth Group, Inc. | 0.5 |

| Home Depot (The), Inc. | 0.5 |

| Costco Wholesale Corp. | 0.5 |

| Sherwin-Williams (The) Co. | 0.5 |

| Zoetis, Inc. | 0.5 |

| Old Dominion Freight Line, Inc. | 0.5 |

| Church & Dwight Co., Inc. | 0.5 |

| Total | 5.0% |

| Top Fixed-Income Holdings by Issuer | % of Total

Investments |

| United States Treasury | 2.4% |

| Citigroup, Inc. | 2.4 |

| JPMorgan Chase & Co. | 2.1 |

| Bank of America Corp. | 2.1 |

| Goldman Sachs Group (The), Inc. | 1.9 |

| Morgan Stanley | 1.7 |

| Charter Communications Operating LLC/Charter Communications Operating Capital | 1.1 |

| CVS Health Corp. | 1.0 |

| AT&T, Inc. | 1.0 |

| General Motors Financial Co., Inc. | 1.0 |

| Total | 16.7% |

| Sector Allocation | % of Total

Investments |

| Common Stocks | |

| Financials | 17.7% |

| Industrials | 14.1 |

| Information Technology | 6.7 |

| Consumer Discretionary | 6.3 |

| Health Care | 4.4 |

| Materials | 4.3 |

| Consumer Staples | 3.9 |

| Utilities | 0.4 |

| Communication Services | 0.3 |

| Total Common Stocks | 58.1% |

| Corporate Bonds and Notes | |

| Financials | 12.3 |

| Utilities | 4.6 |

| Health Care | 4.4 |

| Communication Services | 4.1 |

| Information Technology | 2.9 |

| Industrials | 2.2 |

| Energy | 2.2 |

| Consumer Staples | 1.1 |

| Consumer Discretionary | 0.5 |

| Materials | 0.4 |

| Real Estate | 0.2 |

| Total Corporate Bonds and Notes | 34.9% |

| Foreign Corporate Bonds and Notes | |

| Financials | 2.7 |

| Energy | 0.8 |

| Health Care | 0.3 |

| Industrials | 0.3 |

| Consumer Discretionary | 0.2 |

| Information Technology | 0.1 |

| Materials | 0.1 |

| Communication Services | 0.1 |

| Total Foreign Corporate Bonds and Notes | 4.6% |

| U.S. Government Bonds and Notes | 1.9% |

| U.S. Treasury Bills | 0.5% |

| Total | 100.0% |

| Fund Allocation | % of Net Assets |

| Common Stocks | 57.7% |

| Corporate Bonds and Notes | 34.6 |

| Foreign Corporate Bonds and Notes | 4.6 |

| U.S. Government Bonds and Notes | 1.9 |

| U.S. Treasury Bills | 0.5 |

| Net Other Assets and Liabilities(8) | 0.7 |

| Total | 100.0% |

| (7) | The credit quality and ratings information presented above reflect the ratings assigned by one or more nationally recognized statistical rating organizations (NRSROs), including Standard & Poor’s Ratings Group, a division of the McGraw Hill Companies, Inc., Moody’s Investors Service, Inc., Fitch Ratings or a comparably rated NRSRO. For situations in which a security is rated by more than one NRSRO and the ratings are not equivalent, the highest rating is used. Sub-investment grade ratings are those rated BB+/Ba1 or lower. Investment grade ratings are those rated BBB-/Baa3 or higher. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change. |

| (8) | Includes variation margin on futures. |

Portfolio Commentary and Performance Summary (Continued)

First Trust Multi Income Allocation Portfolio

Annual Report

December 31, 2021 (Unaudited)

Advisor

First Trust is a registered investment advisor based in Wheaton, IL and is the investment advisor to the First Trust Multi Income Allocation Portfolio (the “Fund”). In this capacity, First Trust is responsible for the selection and ongoing monitoring of the securities in the Fund’s portfolio and certain other services necessary for the management of the Fund. First Trust manages the Fund’s fixed income investments, as well as a portion of the Fund’s equity investments.

Sub-Advisors

Stonebridge Advisors LLC (“Stonebridge” or a “Sub-Advisor”) is a sub-advisor to the Fund and is a registered investment advisor based in Wilton, CT. Stonebridge specializes in the management of preferred securities and North American equity income securities.

Energy Income Partners, LLC (“EIP” or “Sub-Advisor”) is a sub-advisor to the Fund and is a registered investment advisor based in Westport, CT. EIP was founded in 2003 to provide professional asset management services in publicly traded, energy-related infrastructure companies with above average dividend payout ratios operating pipelines and related storage and handling facilities, electric power transmission and distribution as well as long contracted or regulated power generation from renewables and other sources. The corporate structure of the portfolio companies include C-corporations, partnerships and energy infrastructure and real estate investment trusts (“REITs”).

Portfolio Management Team

First Trust

Daniel J. Lindquist, Chairman of the Investment Committee and Managing Director, First Trust

David G. McGarel, Chief Investment Officer, Chief Operating Officer and Managing Director, First Trust

Jon C. Erickson, Senior Vice President, First Trust

Roger F. Testin, Senior Vice President, First Trust

William Housey, Senior Vice President, First Trust

Chris A. Peterson, Senior Vice President, First Trust

Todd Larson, Senior Vice President, First Trust

James Snyder, Senior Vice President, First Trust

Jeremiah Charles, Senior Vice President, First Trust

Stonebridge

Scott Fleming, Portfolio Manager, President and Chief Investment Officer of Stonebridge

Robert Wolf, Senior Portfolio Manager and Senior Vice President of Stonebridge

EIP

James J. Murchie, Co-Portfolio Manager, Co-Founder, Principal and CEO of EIP

Eva Pao, Co-Portfolio Manager, Co-Founder, Principal of EIP

John Tysseland, Co-Portfolio Manager, Principal of EIP

First Trust Multi Income Allocation Portfolio

For the year ended December 31, 2021, the Fund’s Class I Shares returned 12.69% versus 8.75% for the Broad Blended Benchmark (60% Bloomberg U.S. Aggregate Bond Index and 40% Russell 3000® Index), 18.24% for the Asset Class Blended Benchmark (15% Dow Jones U.S. Select Dividend Index; 8% ICE BofA Fixed Rate Preferred Securities Index; 15% Alerian MLP Index; 15% S&P U.S. REIT Index; 8% ICE BofA U.S. High Yield Index; 15% S&P/LSTA Leveraged Loan Index; 8% Bloomberg U.S. Corporate Investment-Grade Index; 8% ICE BofA U.S. MBS Index; and 8% ICE BofA U.S. Inflation-Linked Treasury Index).

The Fund invests in nine asset classes which are: dividend-paying stocks, preferred stocks, energy infrastructure companies and master limited partnerships (“MLPs”), real estate investment trusts (“REITs”), high yield or “junk” bonds, floating-rate loans, corporate bonds, mortgage-backed securities (“MBS”) and Treasury Inflation Protected Securities (“TIPS”). The weight assigned to each asset class is determined on a quarterly basis. As of December 31, 2021, the MLPs were the highest-weighted asset class, while the MBS asset class was the lowest-weighted asset class. As of December 31, 2021, the Fund held approximately 2.7% in cash. The following asset classes had the most positive impact on the overall Fund performance for the year: REITs, dividend-paying stocks and MLPs, while the following asset classes had the largest negative impact on the overall Fund performance: Corporate Bonds and MBS.

Portfolio Commentary and Performance Summary (Continued)

First Trust Multi Income Allocation Portfolio (Continued)

Annual Report

December 31, 2021 (Unaudited)

Dividend-paying stocks returned 25.71% (Gross of Fees) for the year ended December 31, 2021 and represented 18.0% of the portfolio as of December 31, 2021. U.S. equities, as measured by the Russell 3000® Index, posted strong gains in 2021 returning 25.66% as the economy recovered from the pandemic. On a factor basis, value stocks dominated, with most of that relative performance versus more expensive names coming from the first quarter of 2021 as the value trade continued from the 2020 rebound. Quality names also performed well, performing best in the fourth quarter of 2021 relative to lower quality names, in what was the worst relative quarter for value, as investors began to worry about degrading economic indicators and rising inflation. Size (small cap) as a factor underperformed over the year, performing well during the value trade in the first quarter of 2021 but fading in the second half of the year as investors became increasingly defensive. Dividend payers in the Russell 3000® Index outperformed non-payers significantly over the year. On a sector basis, a strong positive selection effect among dividend paying Information Technology names constituted the bulk of performance. Selection was also strong in names in the Health Care and Industrials sectors. The portfolio was underweight a lagging Communications Services sector but poor selection effect among those names detracted from performance. Negative selection in names in the Financials and Materials sectors also hurt relative performance.

The preferred securities returned 4.97% (Gross of Fees) for the year ended December 31, 2021 and represented 6.6% of the portfolio as of December 31, 2021. The preferred market was supported by relatively high yields and fundamentally sound credit metrics in an environment in which accommodative monetary and fiscal stimulus supported risk assets for most of the year. With interest rates rising during the period, the Fund primarily benefited from security selection within non-investment grade securities, non-U.S. bank contingent convertible capital securities and investment grade securities with a bias towards shorter duration and variable rate securities.

The energy infrastructure companies and MLPs asset class returned 25.55% (Gross of Fees) for the year ended December 31, 2021 and represented 18.2% of the portfolio as of December 31, 2021. The performance of this asset class outperformed the overall performance of the Fund. Outperformance reflects our diversified approach to investing in non-cyclical energy infrastructure. Specifically, positions in a pipeline company, a renewable developer, and MLPs were among the largest contributors to performance for this asset class for the period.

REITs returned 34.96% (Gross of Fees) for the year ended December 31, 2021 and represented 13.2% of the portfolio as of December 31, 2021. The rise in consumer prices due to supply chain breakdowns, labor shortages and an increase in demand after widespread lockdowns has benefitted REITs as they tend to outperform the market during periods of moderate and high inflation. Many of the REIT industries outperformed the broader market in 2021, with Industrial REITs, Residential REITs and Retail REITs finishing the year as the best performing industries. The REIT sleeve’s lack of exposure to Hotel & Resort REITs resulted in a positive allocation effect, though low exposure in Residential and Retail REITs was a major contributor to the underperformance. Stock selection within the Retail and Health Care REITs industries caused the largest drag on relative performance. The portfolio did however benefit from positive stock selections within the Residential REITs industry. The best performing REITs in the portfolio by contribution to total return were Life Storage Inc., Mid-America Apartment Communities, Inc. and Extra Space Storage, Inc. The worst performing REITs in the portfolio were Omega Healthcare Investors, Inc., SBA Communications Corp. and SL Green Realty Corp.

High-yield bonds returned 3.56% (Gross of Fees) for the year ended December 31, 2021 and represented 8.6% of the portfolio as of December 31, 2021. High-yield bond spreads over U.S. Treasuries entered the year at T+387 basis points (“bps”), remained relatively rangebound throughout 2021 and ended the year at T+311 bps, well below the historic average (the long-term average spread over U.S. Treasuries is T+555 bps, December 1997 – December 2021). For the 12-month period ended December 31, 2021, high-yield funds experienced cumulative outflows totaling approximately $13.6 billion, which compares to inflows totaling $44.8 billion in 2020. Within the high-yield bond market, higher quality BB rated issues underperformed with a 4.19% return compared to 4.96% for B’s and 10.26% for CCC’s for the year. The high-yield bond default rate for the 12-month period ended December 31, 2021 within the JP Morgan High-Yield Bond Universe decreased to 0.27% from 6.17% entering the year, which is the lowest default rate we have dating back to March 1999. The current default rate is well below the long-term average default rate of 3.16% (March 1999 – December 2021). One of the most significant market developments during the fourth quarter of 2021 was the Federal Reserve’s (the “Fed”) pivot away from its belief that inflation would prove transitory. The Fed conceded that while inflation may initially have been limited to areas tied to the reopening of the economy and supply chain, it has now both broadened and accelerated.

Floating-rate loans returned 3.82% (Gross of Fees) for the year ended December 31, 2021 and represented 15.3% of the portfolio as of December 31, 2021. Senior loan spreads over 3-month London Inter-Bank Offered Rate (“LIBOR”) entered the year at L+475, remained relatively stable and ended the year at L+428, well below the historic average (the long-term average spread over 3-month LIBOR is L+514 bps, December 1997 – December 2021). The benchmark rate for senior loan coupons, 3-month LIBOR, entered the year at 0.24%, fell to 0.12% as of July 30, 2021, and ended the year at 0.21%. We believe that as the Fed begins to increase the Federal Funds target rate to mitigate higher inflation, benchmark rates for the senior loan asset class will follow suit leading to potentially

Portfolio Commentary and Performance Summary (Continued)

First Trust Multi Income Allocation Portfolio (Continued)

Annual Report

December 31, 2021 (Unaudited)

higher nominal yields. As a result of market expectations for higher inflation and future Fed rate hikes, the senior loan asset class experienced persistent inflows from retail investors. For the 12-month period ended December 31, 2021 inflows totaled approximately $45.4 billion, which compares to outflows of $27.0 billion in 2020.

Corporate bonds returned -1.57% (Gross of Fees) and represented 6.7% of the portfolio as of December 31, 2021. Over the course of 2021, financial markets responded to continued progress in the economic recovery from the pandemic. The persistence of supply chain disruptions and rising inflation eventually caused the Fed to pivot from its “transitory” narrative to a policy stance of needing to withdraw monetary accommodation. In response, Treasury yields increased, ending the year materially higher. The 5-year yield ended at 1.26%, 90 bps higher and the 10-year yield ended at 1.51%, 60 bps higher. The influence on returns from higher yields outweighed the positive effects from a strong environment for corporate credit. In general, growth in corporate earnings was robust, balance sheets were firm, and inflows were steady for corporate bond funds and ETFs. These factors contributed to an improvement in credit spreads even as yields were higher. The Bloomberg U.S. Corporate Index ended the year with a yield of 2.33% and an option-adjusted spread of 92 bps.

The MBS asset class returned -0.35% (Gross of Fees) for the year ended December 31, 2021 and represented 6.6% of the portfolio as of December 31, 2021. This compared quite favorably versus the ICE BofA US Mortgage Backed Securities Index, which returned -1.21% for the year. Generally, the sleeve maintained less duration than its benchmark, which aided the performance of the asset class as interest rates across the curve rose over the year. Given our outlook on the broader bond markets, including Fed policy surrounding taper and inflation, we plan to continue to actively manage the Fund versus the Index from duration and asset allocation standpoints. To the extent the curve sees a large bear steepening, likely due to inflationary pressures, treasury supply or volatility, we will look to take advantage of higher longer maturity yields and potentially wider spreads

TIPS returned 5.96% (Gross of Fees) and represented 6.8% of the portfolio as of December 31, 2021. The environment of rising inflation was very supportive of U.S. Treasury-Inflation Protected Securities (TIPS) in 2021. The Consumer Price Index (“CPI”) reached a high of 7.0% in December 2021, up from 1.4% in January. That was the highest reading for the CPI since 1982. Rising inflation is a negative condition for nominal Treasury bonds but is positive for TIPS. As a result, TIPS outperformed nominal Treasury bonds with the ICE BofA US Inflation-Linked Treasury Index returning 6.03% compared to -2.38% for the ICE BofA US Treasury Index.

Investment Climate

At this time one year ago, we discussed the potential for the U.S. economy to fully reopen at some point in 2021 following the expedited approval process of the two initial COVID-19 vaccines, which later tallied three, by the U.S. Food and Drug Administration. While the reopening of the economy was looking more feasible as we entered the second half of 2021, those prospects faded with the onset of the Omicron variant, which turned out to be more easily transmissible than the Delta variant that came before it. As things stand heading into 2022, the silver lining is that the Omicron variant appears to be less dangerous (in regard to deaths and hospitalizations) than the Delta variant, especially for those individuals who have been vaccinated and received a booster shot. The bad news is that the COVID-19 pandemic, now nearly two years old, continues to be a disruptive force worldwide.

Suffice it to say, the most unintended consequence of the trillions of dollars of subsidies and stimulus payments funneled into the U.S. economy by the federal government to help mitigate the fallout from COVID-19 is robust inflation. It was likely unintended due to the fact that significant portions of the U.S. economy were not fully reopened, making it challenging to accurately forecast where consumer sentiment would stand. One key measure of inflation is the CPI. The CPI stood at 7.0% on a trailing 12-month basis in December 2021, up from 1.4% in December 2020, according to data from the U.S. Bureau of Labor Statistics. The CPI has not been this elevated since 1982. The definition of inflation is “too many dollars chasing too few goods.” Consumers and businesses spent a lot of the cash they were given by the government, as expected, but the amount of goods available to purchase with said cash were not commensurate with the explosive expansion of the money supply. Hence, higher inflation. The global supply-chain bottlenecks contributed to the shortfall in goods, in our opinion. This is where the Fed comes in.

Fed Chairman Jerome Powell has changed his expectations on inflation from characterizing it as transitory to it being more persistent in nature. In the hopes of keeping inflation from becoming entrenched, the Fed announced it will expedite the tapering of its monthly bond buying program as of December 2021. This program has been successful at pushing down intermediate and longer maturity bond yields and keeping them artificially low to help stimulate economic activity. The Fed will reduce its purchases of Treasuries and mortgage-backed securities by $30 billion per month. At that pace, it should be done buying bonds in the open market by the end of March 2022. It also foresees hiking short-term interest rates three times in 2022. The Federal Funds target rate (upper bound) is currently at 0.25%. Its 40-year average (dating back to 1982 when inflation was as high as it is today) is 3.99%.

Portfolio Commentary and Performance Summary (Continued)

First Trust Multi Income Allocation Portfolio (Continued)

Annual Report

December 31, 2021 (Unaudited)

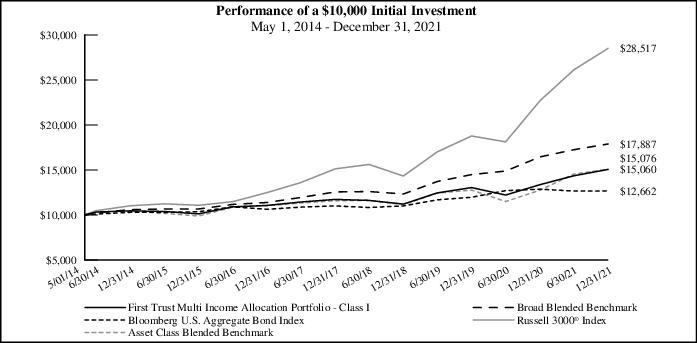

| Return Comparison | | | |

| | | Average Annual

Total Returns |

| | 1 Year

Ended

12/31/21 | 5 Years

Ended

12/31/21 | Inception

(5/1/14)

to 12/31/21 |

| Fund Performance | | | |

| First Trust Multi Income Allocation Portfolio - Class I | 12.69% | 6.37% | 5.48% |

| First Trust Multi Income Allocation Portfolio - Class II | 13.07% | 6.64% | 5.74% |

| Index Performance | | | |

| Broad Blended Benchmark(1) | 8.75% | 9.46% | 7.88% |

| Bloomberg U.S. Aggregate Bond Index(2) | -1.54% | 3.57% | 3.13% |

| Russell 3000® Index(3) | 25.66% | 17.97% | 14.64% |

| Asset Class Blended Benchmark(4) | 18.24% | 6.45% | 5.50% |

The returns for the Fund do not reflect the deduction of expenses associated with variable products, such as mortality and expense risk charges, separate account charges, and sales charges or the effect of taxes. These expenses would reduce the overall returns shown.

| (1) | The Broad Blended Benchmark returns are split between the Bloomberg U.S. Aggregate Bond Index (60%) and the Russell 3000® Index (40%). The Broad Blended Benchmark returns are calculated by using the monthly return of the two indices during each month shown above. At the beginning of each month the two indices are rebalanced to a 60% and 40% ratio, respectively, to account for divergence from that ratio that occurred during the course of each month. The monthly returns are then compounded for each period shown above, giving the performance for the Broad Blended Benchmark for each period shown above. |

| (2) | The Bloomberg U.S. Aggregate Bond Index represents the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. Bonds included in the index are U.S. dollar denominated; have a fixed rate coupon; carry an investment-grade rating; have at least one year to final maturity; and meet certain criteria for minimum amount of outstanding par value. (The index reflects no deduction for fees, expenses or taxes). |

| (3) | The Russell 3000® Index is composed of 3,000 large U.S. companies, as determined by market capitalization. This index represents approximately 98% of the investable U.S. equity market. (Bloomberg). (The index reflects no deduction for fees, expenses or taxes). |

| (4) | The Asset Class Blended Benchmark is weighted to include nine indexes: Dow Jones U.S. Select Dividend TM Index (15%), ICE BofA Fixed Rate Preferred Securities Index (8%), Alerian MLP Index (15%), S&P U.S. REIT Index (15%), ICE BofA U.S. High Yield Index (8%), S&P/LSTA Leveraged Loan Index (15%), Bloomberg U.S. Corporate Investment-Grade Index (8%), ICE BofA U.S. MBS Index (8%), and ICE BofA U.S. Inflation-Linked Treasury Index (8%).The Asset Class Benchmark returns are calculated by using the monthly return of the nine indices during each period shown above. At the beginning of each month the nine indices are rebalanced to a 15%, 8%, 15%, 15%, 8%, 15%, 8%, 8% and 8% ratio, respectively, to account for divergence from that ratio that occurred during the course of each month. The monthly returns are then compounded for each period shown above, giving the performance for the Asset Class Blended Benchmark for each period shown above. |

Portfolio Commentary and Performance Summary (Continued)

First Trust Multi Income Allocation Portfolio (Continued)

Annual Report

December 31, 2021 (Unaudited)

| Top Ten Holdings | % of Total

Investments |

| First Trust Senior Loan ETF | 15.3% |

| First Trust Tactical High Yield ETF | 8.6 |

| iShares iBoxx $ Investment Grade Corporate Bond ETF | 5.4 |

| First Trust Preferred Securities and Income ETF | 5.0 |

| First Trust Low Duration Opportunities ETF | 4.9 |

| First Trust Institutional Preferred Securities and Income ETF | 1.7 |

| Enterprise Products Partners, L.P. | 1.5 |

| Magellan Midstream Partners, L.P. | 1.4 |

| iShares Trust iShares 1-5 Year Investment Grade Corporate Bond ETF | 1.4 |

| Public Service Enterprise Group, Inc. | 1.0 |

| Total | 46.2% |

| Sector Allocation | % of Total

Investments |

| Exchange-Traded Funds | 42.3% |

| Common Stocks | |

| Utilities | 8.8 |

| Information Technology | 5.0 |

| Energy | 3.9 |

| Health Care | 2.8 |

| Industrials | 2.6 |

| Consumer Discretionary | 2.2 |

| Financials | 2.2 |

| Consumer Staples | 0.8 |

| Materials | 0.6 |

| Communication Services | 0.4 |

| Total Common Stocks | 29.3% |

| Real Estate Investment Trusts | |

| Financials | 13.2 |

| Total Real Estate Investment Trusts | 13.2% |

| U.S. Government Bonds and Notes | 7.0% |

| Master Limited Partnerships | |

| Energy | 5.4 |

| Utilities | 1.0 |

| Materials | 0.5 |

| Total Master Limited Partnerships | 6.9% |

| U.S. Government Agency Mortgage-Backed Securities | 1.3% |

| Mortgage-Backed Securities | 0.0% * |

| Total | 100.0% |

| * | Amount is less than 0.1%. |

Portfolio Commentary and Performance Summary (Continued)

First Trust Dorsey Wright Tactical Core Portfolio

Annual Report

December 31, 2021 (Unaudited)

Advisor

First Trust is a registered investment advisor based in Wheaton, IL and is the investment advisor to First Trust Dorsey Wright Tactical Core Portfolio (the “Fund”). In this capacity, First Trust is responsible for the selection and ongoing monitoring of the securities in the Fund’s portfolio and certain other services necessary for the management of the Fund.

Portfolio Management Team

Daniel J. Lindquist, Chairman of the Investment Committee and Managing Director, First Trust

David G. McGarel, Chief Investment Officer, Chief Operating Officer and Managing Director, First Trust

Jon C. Erickson, Senior Vice President, First Trust

Roger F. Testin, Senior Vice President, First Trust

Todd Larson, Senior Vice President, First Trust

Chris A. Peterson, Senior Vice President, First Trust

Eric R. Maisel, Senior Vice President, First Trust

First Trust Dorsey Wright Tactical Core Portfolio

For the year ended December 31, 2021, the Fund’s Class I Shares returned 13.87% versus 15.86% for the Broad Blended Benchmark: 60% S&P 500® Index and 40% Bloomberg U.S. Aggregate Bond Index.

The Fund seeks to provide total return. The Fund seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its net assets (including any investment borrowings) in exchange-traded funds (“ETFs”) and cash and cash equivalents that comprise the Dorsey Wright Tactical Tilt Moderate Core Index (the “Index”). It is expected that a majority of the ETFs in which the Fund invests will be advised by First Trust.

The Index is owned and was developed by Dorsey, Wright & Associates (the “Index Provider”). The Index is constructed pursuant to the Index Provider’s proprietary methodology, which takes into account the performance of four distinct asset classes relative to one another. The Index is designed to strategically allocate its investments among (i) domestic equity securities; (ii) international equity securities; (iii) fixed income securities; and (iv) cash and cash equivalents. The Index will gain exposure to the first three asset classes by investing in ETFs that invest in such assets. The Index Provider has retained Nasdaq, Inc. (“Nasdaq”) to calculate and maintain the Index.

The Index will utilize the Dynamic Asset Level Investing (“DALI”) asset allocation process developed by the Index Provider in order to allocate assets over the four asset classes. The asset class allocations are determined using a relative strength methodology that is based upon each asset class’s market performance and characteristics that offer the greatest potential to outperform the other asset classes at a given time. Relative strength is a momentum technique that relies on unbiased, unemotional, and objective data, rather than biased forecasting and subjective research. Relative strength is a way of recording historic performance patterns, and the Index Provider uses relative strength signals as a trend indicator for current momentum trends of each asset class against the others.

Performance Review

There were no changes to the allocations for the four asset classes in 2021, and at the end of 2021, the Fund had the following allocations: domestic equity securities (73.0%), international equity securities (4.9%), fixed income securities (19.6%), and cash equivalents (2.5%). In 2021, the Fund was overweight equities relative to the Broad Blended Benchmark which resulted in a positive allocation impact. The Fund’s equity holdings lagged the performance of the S&P 500® Index and the largest detracting holdings were the First Trust Nasdaq Oil & Gas ETF and the First Trust Small Cap Value AlphaDEX® Fund. The Fund’s largest contributing holdings to performance in 2021 were the First Trust NASDAQ-100-Technology Sector Index Fund and the First Trust Small Cap Growth AlphaDEX® Fund.

Portfolio Commentary and Performance Summary (Continued)

First Trust Dorsey Wright Tactical Core Portfolio (Continued)

Annual Report

December 31, 2021 (Unaudited)

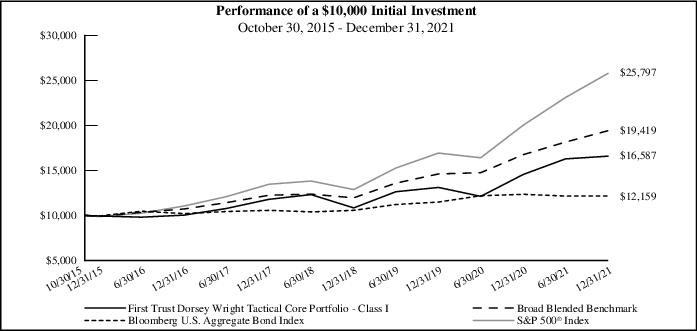

| Return Comparison | | | |

| | | Average Annual

Total Returns |

| | 1 Year

Ended

12/31/21 | 5 Years

Ended

12/31/21 | Inception

(10/30/15)

to 12/31/21 |

| Fund Performance | | | |

| First Trust Dorsey Wright Tactical Core Portfolio - Class I | 13.87% | 10.57% | 8.55% |

| First Trust Dorsey Wright Tactical Core Portfolio - Class II | 13.84% | 10.75% | 8.69% |

| Index Performance | | | |

| Broad Blended Benchmark(1) | 15.86% | 12.62% | 11.36% |

| Bloomberg U.S. Aggregate Bond Index(2) | -1.54% | 3.57% | 3.22% |

| S&P 500® Index(3) | 28.71% | 18.47% | 16.60% |

The returns for the Fund do not reflect the deduction of expenses associated with variable products, such as mortality and expense risk charges, separate account charges, and sales charges or the effect of taxes. These expenses would reduce the overall returns shown.

| (1) | The Broad Blended Benchmark return is split between the Bloomberg U.S. Aggregate Bond Index (40%) and the S&P 500® Index (60%). The Broad Blended Benchmark returns are calculated by using the monthly return of the two indices during each period shown above. At the beginning of each month the two indices are rebalanced to a 40% and 60% ratio, respectively, to account for divergence from that ratio that occurred during the course of each month. The monthly returns are then compounded for each period shown above, giving the performance for the Broad Blended Benchmark for each period shown above. |

| (2) | The Bloomberg U.S. Aggregate Bond Index represents the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. Bonds included in the index are U.S. dollar denominated; have a fixed rate coupon; carry an investment-grade rating; have at least one year to final maturity; and meet certain criteria for minimum amount of outstanding par value. (The index reflects no deduction for fees, expenses or taxes). |

| (3) | The S&P 500® Index is an unmanaged index of 500 stocks used to measure large-cap U.S. stock market performance. (The index reflects no deduction for fees, expenses or taxes). |

Portfolio Commentary and Performance Summary (Continued)

First Trust Dorsey Wright Tactical Core Portfolio (Continued)

Annual Report

December 31, 2021 (Unaudited)

| Top Ten Holdings | % of Total

Investments |

| First Trust Small Cap Growth AlphaDEX® Fund | 9.7% |

| First Trust Nasdaq Oil & Gas ETF | 9.7 |

| First Trust Mid Cap Growth AlphaDEX® Fund | 9.6 |

| First Trust NASDAQ-100-Technology Sector Index Fund | 9.3 |

| First Trust Industrials/Producer Durables AlphaDEX® Fund | 9.3 |

| First Trust Nasdaq Transportation ETF | 9.1 |

| First Trust Mid Cap Value AlphaDEX® Fund | 9.1 |

| First Trust Consumer Discretionary AlphaDEX® Fund | 9.0 |

| iShares Core U.S. Aggregate Bond ETF | 6.1 |

| SPDR Bloomberg High Yield Bond ETF | 3.6 |

| Total | 84.5% |

Portfolio Commentary and Performance Summary (Continued)

First Trust Capital Strength Portfolio

Annual Report

December 31, 2021 (Unaudited)

Advisor

First Trust is a registered investment advisor based in Wheaton, IL and is the investment advisor to First Trust Capital Strength Portfolio (the “Fund”). In this capacity, First Trust is responsible for the selection and ongoing monitoring of the securities in the Fund’s portfolio and certain other services necessary for the management of the Fund.

Portfolio Management Team

Daniel J. Lindquist, Chairman of the Investment Committee and Managing Director, First Trust

David G. McGarel, Chief Investment Officer, Chief Operating Officer and Managing Director, First Trust

Jon C. Erickson, Senior Vice President, First Trust

Roger F. Testin, Senior Vice President, First Trust

Chris A. Peterson, Senior Vice President, First Trust

First Trust Capital Strength Portfolio

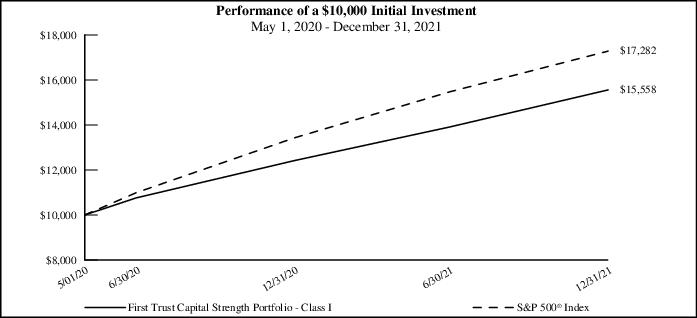

For the year ended December 31, 2021, the Fund’s Class I Shares returned 25.29% versus 28.71% for the S&P 500® Index.

The Fund seeks investment results that correspond generally to the price and yield (before the Fund’s fees and expenses) of an equity index called The Capital Strength IndexSM (the “Index”). The Fund will normally invest at least 80% of its net assets (including investment borrowings) in the common stocks and real estate investment trusts that comprise the Index. The Index seeks to provide exposure to well-capitalized companies with strong market positions that have the potential to provide their stockholders with a greater degree of stability and performance over time. The Index is rebalanced and reconstituted quarterly and the Fund will make corresponding changes to its portfolio shortly after the Index changes are made public.

For the year ended December 31, 2021, the Fund lagged the broad market, resembling the relative performance of the two most dominant factor exposures in the Fund. Low Volatility and Quality both mildly underperformed the Index during the period despite a strong fourth quarter from both factors. Fund underperformance was also largely driven by sector allocation. The Fund held an overweight position in the Consumer Staples and Industrials sectors which were two of the three worst performing sectors in the Index. The Fund also held underweight positions in the Energy and Real Estate sectors which, although representing a small portion of the Index, were the two best performing sectors in the Index for 2021. Stock selection effects were overall neutral with outperformance within Information Technology and underperformance within Financials.

| Return Comparison | | |

| | | Average Annual

Total Returns |

| | 1 Year Ended

12/31/21 | Inception (5/1/20)

to 12/31/21 |

| Fund Performance | | |

| First Trust Capital Strength Portfolio - Class I | 25.29% | 30.33% |

| First Trust Capital Strength Portfolio - Class II | 25.60% | 30.62% |

| Index Performance | | |

| S&P 500® Index(1) | 28.71% | 38.81% |

The returns for the Fund do not reflect the deduction of expenses associated with variable products, such as mortality and expense risk charges, separate account charges, and sales charges or the effect of taxes. These expenses would reduce the overall returns shown.

| (1) | The S&P 500® Index is an unmanaged index of 500 stocks used to measure large-cap U.S. stock market performance. (The index reflects no deduction for fees, expenses or taxes). |

Portfolio Commentary and Performance Summary (Continued)

First Trust Capital Strength Portfolio (Continued)

Annual Report

December 31, 2021 (Unaudited)

| Top Ten Holdings | % of Total

Investments |

| Broadcom, Inc. | 2.4% |

| Costco Wholesale Corp. | 2.3 |

| Keysight Technologies, Inc. | 2.3 |

| Accenture PLC, Class A | 2.2 |

| Zoetis, Inc. | 2.2 |

| Abbott Laboratories | 2.2 |

| Home Depot (The), Inc. | 2.2 |

| UnitedHealth Group, Inc. | 2.2 |

| Intuit, Inc. | 2.1 |

| Automatic Data Processing, Inc. | 2.1 |

| Total | 22.2% |

| Sector Allocation | % of Total

Investments |

| Information Technology | 25.4% |

| Health Care | 18.3 |

| Industrials | 17.2 |

| Consumer Staples | 16.5 |

| Financials | 11.3 |

| Consumer Discretionary | 5.5 |

| Materials | 3.9 |

| Communication Services | 1.9 |

| Total | 100.0% |

Portfolio Commentary and Performance Summary (Continued)

First Trust International Developed Capital Strength Portfolio

Annual Report

December 31, 2021 (Unaudited)

Advisor

First Trust is a registered investment advisor based in Wheaton, IL and is the investment advisor to First Trust International Developed Capital Strength Portfolio (the “Fund”). In this capacity, First Trust is responsible for the selection and ongoing monitoring of the securities in the Fund’s portfolio and certain other services necessary for the management of the Fund.

Portfolio Management Team

Daniel J. Lindquist, Chairman of the Investment Committee and Managing Director, First Trust

David G. McGarel, Chief Investment Officer, Chief Operating Officer and Managing Director, First Trust

Jon C. Erickson, Senior Vice President, First Trust

Roger F. Testin, Senior Vice President, First Trust

Chris A. Peterson, Senior Vice President, First Trust

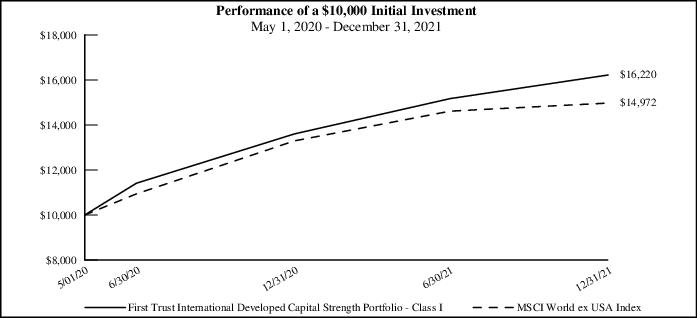

First Trust International Developed Capital Strength Portfolio

For the year ended December 31, 2021, the Fund’s Class I Shares returned 19.24% versus 12.62% for the MSCI World ex USA Index.

The Fund seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its net assets (including investment borrowings) in the common stocks that comprise The International Developed Capital Strength IndexSM (the “Index”). The Index seeks to provide exposure to well-capitalized non-U.S. companies in developed markets with strong market positions that have the potential to provide their stockholders with a greater degree of stability and performance over time. The Fund may invest in securities of any market capitalization. The Index is rebalanced and reconstituted semi-annually and the Fund will make corresponding changes to its portfolio shortly after the Index changes are made public.

For the year ended December 31, 2021, the Fund outperformed the Index by a healthy margin, particularly in the back half of the year when the quality and low volatility factors were super effective. Stock selection was particularly strong throughout the year, especially within the Health Care and Industrials sectors which were the two sectors that contributed the most to the Fund’s total return. The Fund also benefited from sector allocation as it held underweight positions in the Communication Services and Utilities sectors which were the two worst performing sectors in the Index during the same period. An underweight position in the best-performing Energy sector and poor stock selection within the Communication Services sector detracted from the Fund’s outperformance. On a country basis, the Fund benefited from an overweight allocation to Sweden and an underweight allocation to Japan. Stock selection within Japan was the greatest detractor from relative outperformance in the Fund during the period as three of the four bottom contributing stocks to the Fund’s return came from Japan. The Fund also outperformed due to strong stock selection in Switzerland, the United Kingdom and Australia.

| Return Comparison | | |

| | | Average Annual

Total Returns |

| | 1 Year Ended

12/31/21 | Inception (5/1/20)

to 12/31/21 |

| Fund Performance | | |

| First Trust International Developed Capital Strength Portfolio - Class I | 19.24% | 33.63% |

| First Trust International Developed Capital Strength Portfolio - Class II | 19.44% | 33.93% |

| Index Performance | | |

| MSCI World ex USA Index(1) | 12.62% | 27.36% |

The returns for the Fund do not reflect the deduction of expenses associated with variable products, such as mortality and expense risk charges, separate account charges, and sales charges or the effect of taxes. These expenses would reduce the overall returns shown.

| (1) | The MSCI World ex USA Index includes developed markets and is designed to provide a broad measure of stock performance throughout the world, with the exception of U.S.-based companies. |

Portfolio Commentary and Performance Summary (Continued)

First Trust International Developed Capital Strength Portfolio (Continued)

Annual Report

December 31, 2021 (Unaudited)

| Top Ten Holdings | % of Total

Investments |

| Sika AG | 2.4% |

| Ferguson PLC | 2.3 |

| Goodman Group | 2.3 |

| Hermes International | 2.2 |

| Sonic Healthcare Ltd. | 2.2 |

| Merck KGaA | 2.2 |

| SGS S.A. | 2.2 |

| Nestle S.A. | 2.1 |

| Capgemini SE | 2.1 |

| GlaxoSmithKline PLC | 2.1 |

| Total | 22.1% |

| Sector Allocation | % of Total

Investments |

| Industrials | 32.2% |

| Health Care | 18.2 |

| Consumer Staples | 13.9 |

| Financials | 11.4 |

| Information Technology | 11.4 |

| Consumer Discretionary | 6.3 |

| Materials | 4.3 |

| Real Estate | 2.3 |

| Total | 100.0% |

First Trust Variable Insurance Trust

Understanding Your Fund Expenses

December 31, 2021 (Unaudited)

As a shareholder of First Trust Dow/Jones Dividend & Income Allocation Portfolio, First Trust Multi Income Allocation Portfolio, First Trust Dorsey Wright Tactical Core Portfolio, First Trust Capital Strength Portfolio or First Trust International Developed Capital Strength Portfolio (each a “Fund” and collectively, the “Funds”), you incur two types of costs: (1) transaction costs; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, if any, and other Fund expenses. This Example is intended to help you understand your ongoing costs of investing in the Funds and to compare these costs with the ongoing costs of investing in other funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held through the six-month period ended December 31, 2021.

Actual Expenses

The first three columns of the table below provide information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the third column under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this six-month period.

Hypothetical Example for Comparison Purposes

The next three columns of the table below provide information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not each Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads) or contingent deferred sales charges. Therefore, the hypothetical section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Actual Expenses | | Hypothetical

(5% Return Before Expenses) |

| | Beginning

Account

Value

7/1/2021 | Ending

Account

Value

12/31/2021 | Expenses Paid

During Period

7/1/2021 -

12/31/2021 (a) | Beginning

Account

Value

7/1/2021 | | Ending

Account

Value

12/31/2021 | Expenses Paid

During Period

7/1/2021 -

12/31/2021 (a) | Annualized

Expense

Ratios (b) |

First Trust/Dow Jones Dividend

& Income Allocation Portfolio |

Class I

| $ 1,000.00 | $ 1,047.10 | $ 6.14 | $ 1,000.00 | | $ 1,019.21 | $ 6.06 | 1.19% |

Class II

| $ 1,000.00 | $ 1,049.10 | $ 4.85 | $ 1,000.00 | | $ 1,020.47 | $ 4.79 | 0.94% |

First Trust Multi Income Allocation

Portfolio (c) |

Class I

| $ 1,000.00 | $ 1,049.40 | $ 4.29 | $ 1,000.00 | | $ 1,021.02 | $ 4.23 | 0.83% |

Class II

| $ 1,000.00 | $ 1,050.80 | $ 3.00 | $ 1,000.00 | | $ 1,022.28 | $ 2.96 | 0.58% |

First Trust Dorsey Wright Tactical

Core Portfolio (c) |

Class I

| $ 1,000.00 | $ 1,018.50 | $ 3.66 | $ 1,000.00 | | $ 1,021.58 | $ 3.67 | 0.72% |

Class II

| $ 1,000.00 | $ 1,019.40 | $ 2.39 | $ 1,000.00 | | $ 1,022.84 | $ 2.40 | 0.47% |

First Trust Variable Insurance Trust

Understanding Your Fund Expenses (Continued)

December 31, 2021 (Unaudited)

| | | Actual Expenses | | Hypothetical

(5% Return Before Expenses) |

| | Beginning

Account

Value

7/1/2021 | Ending

Account

Value

12/31/2021 | Expenses Paid

During Period

7/1/2021 -

12/31/2021 (a) | Beginning

Account

Value

7/1/2021 | | Ending

Account

Value

12/31/2021 | Expenses Paid

During Period

7/1/2021 -

12/31/2021 (a) | Annualized

Expense

Ratios (b) |

| First Trust Capital Strength Portfolio |

Class I

| $ 1,000.00 | $ 1,118.20 | $ 5.87 | $ 1,000.00 | | $ 1,019.66 | $ 5.60 | 1.10% |

Class II

| $ 1,000.00 | $ 1,119.70 | $ 4.54 | $ 1,000.00 | | $ 1,020.92 | $ 4.33 | 0.85% |

First Trust International Developed

Capital Strength Portfolio |

Class I

| $ 1,000.00 | $ 1,069.30 | $ 6.26 | $ 1,000.00 | | $ 1,019.16 | $ 6.11 | 1.20% |

Class II

| $ 1,000.00 | $ 1,070.60 | $ 4.96 | $ 1,000.00 | | $ 1,020.42 | $ 4.84 | 0.95% |

| (a) | Expenses are equal to the annualized expense ratios as indicated in the table multiplied by the average account value over the period (July 1, 2021 through December 31, 2021), multiplied by 184/365 (to reflect the six-month period). |

| (b) | These expense ratios reflect expense caps. First Trust Multi Income Allocation Portfolio expense ratios reflect an additional waiver. See Note 3 in the Notes to Financial Statements. |

| (c) | Annualized expense ratio and expenses paid during the six-month period do not include fees and expenses of the underlying funds in which the Fund invests. |

First Trust/Dow Jones Dividend & Income Allocation Portfolio

Portfolio of Investments

December 31, 2021

| Shares | | Description | | Value |

| COMMON STOCKS – 57.6% |

| | | Aerospace & Defense – 1.6% | | |

| 21,103 | | General Dynamics Corp.

| | $4,399,342 |

| 21,427 | | Huntington Ingalls Industries, Inc.

| | 4,001,278 |

| 11,987 | | Lockheed Martin Corp.

| | 4,260,300 |

| 11,486 | | Northrop Grumman Corp.

| | 4,445,886 |

| | | | | 17,106,806 |

| | | Air Freight & Logistics – 1.2% | | |

| 47,549 | | CH Robinson Worldwide, Inc.

| | 5,117,699 |

| 34,725 | | Expeditors International of Washington, Inc.

| | 4,663,220 |

| 22,640 | | Forward Air Corp.

| | 2,741,478 |

| | | | | 12,522,397 |

| | | Auto Components – 0.4% | | |

| 125,432 | | Gentex Corp.

| | 4,371,305 |

| | | Banks – 6.0% | | |

| 91,282 | | Cathay General Bancorp

| | 3,924,213 |

| 62,336 | | Commerce Bancshares, Inc.

| | 4,284,977 |

| 50,392 | | Community Bank System, Inc.

| | 3,753,196 |

| 152,331 | | CVB Financial Corp.

| | 3,261,407 |