UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22671

AB MULTI-MANAGER ALTERNATIVE FUND, INC.

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Joseph J. Mantineo

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: March 31, 2019

Date of reporting period: September 30, 2018

ITEM 1. REPORTS TO STOCKHOLDERS.

SEP 09.30.18

SEMI-ANNUAL REPORT

AB MULTI-MANAGER ALTERNATIVE FUND

| | |

| |

| Investment Products Offered | | • Are Not FDIC Insured • May Lose Value • Are Not Bank Guaranteed |

Investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at www.abfunds.com or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

This shareholder report must be preceded or accompanied by the Fund’s prospectus for individuals who are not current shareholders of the Fund.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit AB’s website at www.abfunds.com, or go to the Securities and Exchange Commission’s (the “Commission”) website at www.sec.gov, or call AB at (800) 227 4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year. The Fund’s portfolio holdings reports are available on the Commission’s website at www.sec.gov. The Fund’s portfolio holdings reports may also be reviewed and copied at the Commission’s Public Reference Room in Washington, DC; information on the operation of the Public Reference Room may be obtained by calling (800) SEC 0330. AB publishes full portfolio holdings for the Fund monthly at www.abfunds.com.

Sanford C. Bernstein & Company LLC (SCB) and AllianceBernstein Investments, Inc. (ABI) are the distributors of the AB family of mutual funds. SCB and ABI are members of FINRA and are affiliates of AllianceBernstein L.P., the Adviser of the funds.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

SEMI-ANNUAL REPORT

November 15, 2018

This report provides certain performance data for AB Multi-Manager Alternative Fund (the “Fund”) for the semi-annual reporting period ended September 30, 2018.

The Fund’s investment objective is to seek long-term capital appreciation.

RETURNS AS OF SEPTEMBER 30, 2018 (unaudited)

| | | | | | | | |

| | | 6 Months | | | 12 Months | |

| AB MULTI-MANAGER ALTERNATIVE FUND | | | 0.80% | | | | 1.53% | |

| Benchmark: HFRI FOF Composite Index | | | 0.89% | | | | 3.25% | |

| MSCI World Index (net) | | | 6.80% | | | | 11.24% | |

| S&P 500 Index | | | 11.41% | | | | 17.91% | |

| Bloomberg Barclays US Aggregate Index | | | -0.14% | | | | -1.22% | |

INVESTMENT RESULTS

The table above provides performance data for the Fund and its benchmark, the HFRI Fund of Funds (“HFRI FOF”) Composite Index, for the six- and 12-month periods ended September 30, 2018. The table also includes the performance of the Morgan Stanley Capital International (“MSCI”) World Index (net), the Standard and Poor’s (“S&P”) 500 Index and the Bloomberg Barclays US Aggregate Index.

The Fund underperformed the HFRI FOF Composite Index, the MSCI World Index (net) and the S&P 500 Index, but outperformed the Bloomberg Barclays US Aggregate Index, during both periods.

The six-month period was an environment of low monthly volatility, with only modest changes from month to month. Low volatility was a consistent pattern within global bond markets; however, non-US equity markets, particularly Asia, generated negative returns and elevated volatility levels. Therefore, investments in hedge funds with exposure to Asian equity markets detracted. In some cases, the exposures were directional, i.e. long equities, and in other cases the positions were more relative value, such as long equities in China versus short equities in the US.

On a broader scale, the Fund benefited from positive absolute performance across the Long/Short Equity, Credit/Distressed and Event Driven Underlying Portfolios, while Multi-Strategy was the only notable detractor; Global Macro was flat. While the Long/Short Equity Underlying Portfolios with exposure to Asia and emerging-equity markets were a headwind to performance, Underlying Portfolios with exposures to US and, more broadly,

| | |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 1 |

global markets, fared much better. The credit-focused Underlying Portfolios managed a positive contribution despite headwinds for the global credit markets from rising interest rates. In fact, the performance of all of the core Credit/Distressed Underlying Portfolios was positive, led by investments in distressed and short-duration high-yielding credit instruments. Event Driven had a successful period with five of the six core Underlying Portfolios positively contributing, the sole outlier producing only a marginal loss due to the performance of hedging positions, rather than the assets held on the long side. The top Event Driven contributors were led by a diverse group of equity and fixed-income positions undergoing meaningful corporate events that unlocked value during the period. The losses within Multi-Strategy were tied primarily to volatility in Asian markets, with relative value positioning long Chinese equities underperforming against shorts across the rest of Asia.

The majority of the underperformance during the 12-month period occurred during the first half of the period. Global Macro was the sole absolute negative contributor; Underlying Portfolios with exposures to select emerging markets, such as Argentina and South Africa, were the largest detractors. The Long/Short Equity allocation was the top contributor, including a positive contribution during the time of high volatility between January and March 2018, but with a more notable shortcoming during the equity rally towards the end of 2017. Several Underlying Portfolios showed strong stock selection in January during the rising market, but also showed meaningful capital preservation during the downside volatility in February and March, from a combination of short stock selection and significant exposure to put options held throughout the period, which helped returns as markets fell. During the October through December period however, poor stock selection across sector-specific funds in energy, health care and technology detracted. Similar to the six-month period, most of the Credit/Distressed Underlying Portfolios contributed, with gains diversified across distressed, high yield and structured credits. The sole negative contributor was positioned significantly net short through hedges across multiple asset classes, negating the gains from the long credit positions. The Event Driven allocation was small and therefore only modestly contributed to returns. Multi-Strategy also contributed, albeit more modestly, from gains across equities, fixed income, mergers and macro-trading strategies.

For both periods, the Fund utilized total return swaps for hedging and investment purposes which had no material impact on absolute performance.

As a result of changes to the Fund’s investment policies that were effective July 31, 2018, including changes to allow for greater direct investment in securities and other financial instruments (in addition to investment in hedge funds), the portfolio composition is expected to evolve over time. However, the changes in investment policies had only a limited impact on the Fund’s performance for the period ended September 30, 2018.

| | |

| 2 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

MARKET REVIEW AND INVESTMENT STRATEGY

US stocks outperformed their non-US counterparts during the six-month period ended September 30, 2018. US indices advanced to record highs, amid continued economic strength and strong corporate earnings. Conversely, emerging-market equities fell on the back of a stronger US dollar, rising US interest rates, and fears that financial turmoil in countries such as Turkey and Argentina would spread to other markets. From a style perspective, growth stocks outperformed value stocks. Performance was mixed in terms of market capitalization. Trade wars dominated market-related headlines, while political instability in Europe also weighed on investor sentiment.

Fixed-income markets had mixed performance. Global high yield outperformed the flat returns of developed-market treasuries, while emerging-market local-currency government bonds and investment-grade securities ended the period lower. Emerging-market debt sectors generally sold off. The US Federal Reserve hiked interest rates twice and increased forward guidance, while the European Central Bank started to scale back its asset purchases. Elsewhere, markets responded positively when the Chinese central bank took steps to stop further depreciation of the yuan.

INVESTMENT POLICIES

There can be no assurance that the Fund will achieve its investment objective, be able to structure its investments as anticipated, or that its returns will be positive over any period of time. The Fund is not intended as a complete investment program for investors.

The Fund seeks to achieve its investment objective primarily by allocating its assets among investments in a diversified portfolio of private investment vehicles commonly referred to as hedge funds (“Underlying Portfolios”). The Fund will invest primarily in Underlying Portfolios pursuing the following strategies: Long/Short Equity, Event Driven, Credit/Distressed, Emerging Markets, Global Macro and Multi-Strategy. For more information on these strategies, please see “Consolidated Portfolio of Investments” on pages 8-18. As a secondary strategy, the Fund will generally also make direct investments in securities and other financial instruments. For more information regarding the Fund’s risks, please see “Disclosures and Risks” on pages 4-6 and “Note E—Risks Involved in Investing in the Fund” of the Notes to Consolidated Financial Statements on pages 35-37.

| | |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 3 |

DISCLOSURES AND RISKS

Benchmark Disclosure

All indices are unmanaged and do not reflect fees and expenses associated with the active management of a mutual fund portfolio. The HFRI FOF Composite Index is an equal-weighted performance index that includes over 650 constituent funds of hedge funds that report their monthly net-of-fee returns to Hedge Fund Research, have at least $50 million under management and have been actively trading for at least 12 months. The MSCI World Index (net, free float-adjusted, market capitalization weighted) represents the equity market performance of developed markets. The S&P 500® Index includes 500 US stocks and is a common representation of the performance of the overall US stock market. The Bloomberg Barclays US Aggregate Index represents the performance of securities within the US investment-grade fixed-rate bond market, with index components for government and corporate securities, mortgage pass-through securities, asset-backed securities and commercial mortgage-backed securities. MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices, any securities or financial products. This report is not approved, reviewed or produced by MSCI. Net returns include the reinvestment of dividends after deduction of non-US withholding tax. An investor cannot invest directly in an index, and its results are not indicative of the performance for any specific investment, including the Fund.

A Word about Risk

An investment in the Fund’s shares may be speculative in that it involves a high degree of risk and should not constitute a complete investment program. Before making an investment decision, you should carefully consider the following risk factors, together with the other information contained in the prospectus. At any point in time, an investment in the Fund’s shares may be worth less than the original amount invested, even after taking into account the distributions paid, if any, and the ability of shareholders to reinvest distributions. If any of the risks discussed below occurs, the Fund’s results of operations could be materially and adversely affected. If this were to happen, the price of Fund shares could decline significantly and you could lose all or a part of your investment.

Investment in this Fund is highly speculative and involves substantial risk, including loss of principal, and therefore may not be suitable for all investors.

General Risk Factors: Underlying Portfolios and the Fund’s direct investments may exhibit high volatility, and investors may lose all or substantially all of their investment. Investments by Underlying Portfolios and

| | |

| 4 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

DISCLOSURES AND RISKS (continued)

the Fund in illiquid assets and foreign markets and the use of short sales, options, leverage, futures, swaps and other derivative instruments may create special risks and substantially increase the impact and likelihood of adverse price movements. Interests in Underlying Portfolios are subject to limitations on transferability and are illiquid, and no secondary market for interests typically exists or is likely to develop. Underlying Portfolios are typically not registered with securities regulators and are therefore generally subject to little or no regulatory oversight. Performance compensation payable to an Underlying Portfolio investment advisor may create an incentive to make riskier or more speculative investments. Underlying Portfolios typically charge higher fees than many other types of investments, which can offset trading profits, if any. There can be no assurance that any Underlying Portfolio will achieve its investment objectives.

Tax Risks: The Fund intends to be treated as a regulated investment company (“RIC”) under the Internal Revenue Code. However, in order to qualify as a RIC and also to avoid having to pay an “excise tax,” the Fund will be subject to certain limitations on its investments and operations, including a requirement that a specified proportion of its income come from qualifying sources, an asset diversification requirement and minimum distribution requirements. Satisfaction of the various requirements requires significant support and information from the Underlying Portfolios, and such support and information may not be available, sufficient, verifiable, or provided on a timely basis.

Limited Liquidity: The Fund’s shares are not listed on any securities exchange or traded in any other market, and are subject to substantial restrictions on transfer. Although the Fund has offered to repurchase shares on a quarterly basis, such periodic repurchase offers are at the sole discretion of the Fund’s Board of Trustees, and there is no assurance that these repurchase offers will continue. It will normally be four to six months between the time an investor tenders shares for repurchase (i.e., requests that the Fund repurchase shares as part of a repurchase offer) and the investor’s receipt of any cash proceeds associated with the repurchase.

Fund of Funds Considerations: The Fund will have no control rights over and limited transparency into the investment programs of the Underlying Portfolios in which it invests. In valuing the Fund’s holdings, the Investment Manager will generally rely on financial information provided by Underlying Portfolios, which may be unaudited, estimated and/or may not involve third parties. The Fund’s investment opportunities may be limited as a result of withdrawal terms or anticipated liquidity needs (e.g., withdrawal restrictions imposed by underlying hedge funds may delay, preclude or involve expense in connection with portfolio adjustments by the Investment Manager).

| | |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 5 |

DISCLOSURES AND RISKS (continued)

These risks are fully discussed in the Fund’s prospectus. As with all investments, you may lose money by investing in the Fund.

An Important Note About Historical Performance

The performance shown in this report represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. All fees and expenses related to the operation of the Fund have been deducted. Performance assumes reinvestment of distributions and does not account for taxes.

| | |

| 6 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

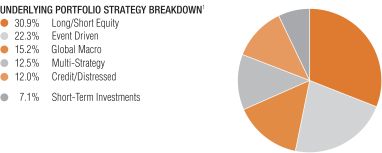

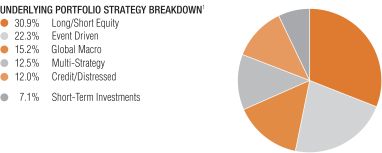

PORTFOLIO SUMMARY

September 30, 2018 (unaudited)

Net Assets ($mil): $1,092.2

| 1 | All data are as of September 30, 2018. The Fund’s portfolio strategy breakdown is based on the Adviser’s internal classification and is expressed as a percentage of total investment exposure, including exposure from derivatives (see “Consolidated Portfolio of Investments” section of the report for additional details). |

| | |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 7 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS

September 30, 2018 (unaudited)

| | | | | | | | | | | | | | |

Underlying

Portfolios | | Shares | | | Fair Value ($) | | | % Net

Assets | | | Liquidity* |

| | | | | | |

Long/Short Equity |

Aravt Global Fund Ltd. | | | 6,380 | | | $ | 7,349,684 | | | | 0.7 | % | | Semi-Annual |

Coatue Offshore Fund, Ltd. | | | 185,720 | | | | 42,913,860 | | | | 3.9 | | | Quarterly |

Darsana Overseas Fund Ltd. | | | 20,362 | | | | 27,750,681 | | | | 2.5 | | | Quarterly |

Janchor Partners Pan-Asian Fund | | | 216,000 | | | | 26,929,095 | | | | 2.5 | | | Triennially |

Luminus Energy Partners, Ltd. | | | 20,077 | | | | 45,849,984 | | | | 4.2 | | | Quarterly |

Nokota Capital Offshore Fund, Ltd. | | | 10,303 | | | | 18,669,612 | | | | 1.7 | | | Quarterly |

PFM Healthcare Offshore Fund, Ltd. | | | 53,049 | | | | 55,751,570 | | | | 5.1 | | | Quarterly |

Sheffield International Partners, Ltd. | | | 7,500 | | | | 9,031,336 | | | | 0.8 | | | Anniversary |

The Children’s Investment Fund | | | 190,000 | | | | 24,747,500 | | | | 2.3 | | | Triennially |

Think Investments Offshore Ltd. | | | 24,771 | | | | 34,390,743 | | | | 3.2 | | | Semi-Annual |

Two Creeks Capital Offshore Fund, Ltd. | | | 18,290 | | | | 22,201,624 | | | | 2.0 | | | Quarterly |

Tybourne Equity (Offshore) Fund | | | 26,550 | | | | 43,703,753 | | | | 4.0 | | | Quarterly |

| | | | | | | | | | | | | | |

Total | | | | | | | 359,289,442 | | | | 32.9 | | | |

| | | | | | | | | | | | | | |

|

Event Driven |

Empyrean Capital Overseas Fund, Ltd. | | | 38,781 | | | | 48,972,764 | | | | 4.5 | | | Quarterly |

Fir Tree International Value Fund, Ltd. | | | 46 | | | | 2,194,168 | | | | 0.2 | | | Biennially |

Governors Lane Offshore Fund Ltd. | | | 27,548 | | | | 31,130,539 | | | | 2.9 | | | Quarterly |

Indaba Capital Partners (Cayman), LP | | | 22,572 | | | | 26,447,161 | | | | 2.4 | | | Quarterly |

Lion Point International, Ltd. | | | 36,002 | | | | 37,046,639 | | | | 3.4 | | | Semi-Annual |

| | |

| 8 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | | | |

Underlying

Portfolios | | Shares | | | Fair Value ($) | | | % Net

Assets | | | Liquidity* |

| | | | | | |

Luxor Capital Partners Offshore Liquidating SPV, Ltd. | | | 2,410 | | | $ | 2,711,300 | | | | 0.2 | % | | At Fund’s Discretion |

Senator Global Opportunity Offshore Fund II Ltd. | | | 32,208 | | | | 37,213,007 | | | | 3.4 | | | Quarterly |

Starboard Leaders Fund LP. | | | 6,466 | | | | 7,582,225 | | | | 0.7 | | | At Fund’s Discretion |

| | | | | | | | | | | | | | |

Total | | | | | | | 193,297,803 | | | | 17.7 | | | |

| | | | | | | | | | | | | | |

|

Global Macro |

Alphadyne International Fund, Ltd. | | | 65,000 | | | | 66,848,692 | | | | 6.1 | | | Quarterly |

Brevan Howard AS Macro Fund Limited | | | 280,000 | | | | 28,008,400 | | | | 2.6 | | | Monthly |

Graticule Asia Macro Fund Ltd. | | | 33,000 | | | | 30,726,544 | | | | 2.8 | | | Quarterly |

Light Sky Macro Offshore Fund Ltd. | | | 20,000 | | | | 18,200,580 | | | | 1.7 | | | Quarterly |

Rokos Global Macro Fund Limited | | | 401,922 | | | | 24,019,745 | | | | 2.2 | | | Monthly |

Spinnaker GEM Holdings Ltd. | | | 67,220 | | | | 8,962,049 | | | | 0.8 | | | Annual |

| | | | | | | | | | | | | | |

Total | | | | | | | 176,766,010 | | | | 16.2 | | | |

| | | | | | | | | | | | | | |

|

Credit/Distressed |

Caius Capital International Fund | | | 35,000 | | | | 35,303,519 | | | | 3.2 | | | Quarterly |

King Street Capital, Ltd. | | | 194,074 | | | | 33,359,120 | | | | 3.0 | | | Quarterly |

Panning Overseas Fund, Ltd. | | | 1,768 | | | | 1,828,901 | | | | 0.2 | | | Quarterly |

Silver Point Capital Offshore Fund, Ltd. | | | 3,520 | | | | 55,320,694 | | | | 5.1 | | | Annual |

Warlander Offshore Fund, Ltd. | | | 15,001 | | | | 13,349,370 | | | | 1.2 | | | Quarterly |

Wingspan Overseas Fund, Ltd. | | | 953 | | | | 638,227 | | | | 0.1 | | | Fund in Liquidation |

| | | | | | | | | | | | | | |

Total | | | | | | | 139,799,831 | | | | 12.8 | | | |

| | | | | | | | | | | | | | |

| | |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 9 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | | | |

Underlying

Portfolios | | Shares | | | Fair Value ($) | | | % Net

Assets | | | Liquidity* |

| | | | | | |

|

Multi-Strategy |

Elliott International Limited | | | 23,648 | | | $ | 32,747,977 | | | | 3.0 | % | | Quarterly |

Myriad Opportunities Offshore Fund Limited | | | 48,797 | | | | 57,755,779 | | | | 5.3 | | | Quarterly |

| | | | | | | | | | | | | | |

Total | | | | | | | 90,503,756 | | | | 8.3 | | | |

| | | | | | | | | | | | | | |

Total Underlying Portfolios

(cost $827,860,139) | | | | | | | 959,656,842 | | | | 87.9 | | | |

| | | | | | | | | | | | | | |

|

Short-Term Investments |

Investment Companies | | | |

AB Fixed Income Shares, Inc.—Government Money Market Portfolio—Class AB, 1.98%(a)(b)(c)

(cost $82,250,000) | | | 82,250,000 | | | | 82,250,000 | | | | 7.5 | | | |

| | | | | | | | | | | | | | |

| | | | |

Total Investments

(cost $910,110,139) | | | | | | | 1,041,906,842 | | | | 95.4 | | | |

Other assets less liabilities | | | | | | | 50,263,456 | | | | 4.6 | | | |

| | | | | | | | | | | | | | |

| | | | |

Net Assets | | | | | | $ | 1,092,170,298 | | | | 100.0 | % | | |

| | | | | | | | | | | | | | |

TOTAL RETURN SWAPS (see Note C)

| | | | | | | | | | | | | | | | | | | | | | | | |

Counterparty &

Referenced

Obligation | | # of Shares

or Units | | | Rate Paid/

Received | | Payment

Frequency | | Notional

Amount

(000) | | | Maturity

Date | | | Unrealized

Appreciation/

(Depreciation) | |

Receive Total Return on Reference Obligation | |

Barclays Bank PLC | |

BCCFHI2P | | | 49,038 | | | 0.02% | | Quarterly | | | USD | | | | 9,820 | | | | 10/15/19 | | | $ | 76,997 | |

BXCS1673 | | | 5,682 | | | 0.30% | | Quarterly | | | USD | | | | 3,345 | | | | 10/15/19 | | | | 31,754 | |

Citibank, NA

FX G10 Value PPP (C) Index(1) | | | 74,026 | | | 0.30% | | Quarterly | | | USD | | | | 12,743 | | | | 10/15/19 | | | | 40,593 | |

Goldman Sachs International | |

Cross Asset Trend Basket Series 2 10% Volatility Target ER Strategy | | | 101,055 | | | 0.00% | | Quarterly | | | USD | | | | 11,611 | | | | 10/15/19 | | | | (16,522 | ) |

GSGLEURA | | | 257,206 | | | 3 Month

EURIBOR

Minus 0.60% | | Quarterly | | | EUR | | | | 27,800 | | | | 8/15/19 | | | | 74,511 | |

GSISM49E(2) | | | 217,990 | | | 0.00% | | Quarterly | | | USD | | | | 22,187 | | | | 10/15/19 | | | | 16,569 | |

| | |

| 10 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

Counterparty &

Referenced

Obligation | | # of Shares

or Units | | | Rate Paid/

Received | | Payment

Frequency | | Notional

Amount

(000) | | | Maturity

Date | | | Unrealized

Appreciation/

(Depreciation) | |

RP Equity Carry Series 01 Excess Return Strategy | | | 77,830 | | | 0.00% | | Quarterly | | | USD | | | | 9,632 | | | | 10/15/19 | | | $ | (5,775 | ) |

JPMorgan Chase Bank, NA | |

JMABRCGA | | | 13,384 | | | 0.50% | | Quarterly | | | USD | | | | 3,824 | | | | 10/15/19 | | | | 24,277 | |

JMABRCX1 | | | 147,816 | | | 0.18% | | Quarterly | | | USD | | | | 28,143 | | | | 10/15/19 | | | | 8,687 | |

JMABRG34 | | | 3,988 | | | 0.60% | | Quarterly | | | USD | | | | 7,029 | | | | 10/15/19 | | | | (65,813 | ) |

JPABSAA1 | | | 101,626 | | | 0.00% | | Quarterly | | | USD | | | | 10,303 | | | | 10/31/19 | | | | (213 | ) |

JPMZRMR1 | | | 54,342 | | | 0.00% | | Quarterly | | | USD | | | | 8,492 | | | | 10/15/19 | | | | 16,846 | |

JPQCRMFA(3) | | | 194,127 | | | 0.00% | | Quarterly | | | USD | | | | 19,138 | | | | 10/15/19 | | | | 22,344 | |

Morgan Stanley Capital Services, LLC | |

Aetna, Inc. | | | 9,510 | | | LIBOR Plus

0.30% | | Maturity | | | USD | | | | 1,954 | | | | 12/11/19 | | | | (26,631 | ) |

Andeavor | | | 12,490 | | | LIBOR Plus

0.30% | | Maturity | | | USD | | | | 1,949 | | | | 12/11/19 | | | | (33,365 | ) |

Avista Corp. | | | 37,940 | | | LIBOR Plus

0.30% | | Maturity | | | USD | | | | 1,954 | | | | 12/11/19 | | | | (37,423 | ) |

Bemis Co., Inc. | | | 40,030 | | | LIBOR Plus

0.30% | | Maturity | | | USD | | | | 1,955 | | | | 12/11/19 | | | | (10,116 | ) |

CA, Inc. | | | 44,480 | | | LIBOR Plus

0.30% | | Maturity | | | USD | | | | 1,959 | | | | 12/11/19 | | | | 3,976 | |

Connecticut Water SVC Inc. | | | 6,023 | | | LIBOR Plus

0.30% | | Maturity | | | USD | | | | 414 | | | | 12/11/19 | | | | 3,933 | |

Enbridge Income Fund Holdings, Inc. | | | 75,810 | | | CDOR Plus

0.40% | | Maturity | | | CAD | | | | 2,382 | | | | 12/11/19 | | | | (2,910 | ) |

EnerCare, Inc. | | | 83,810 | | | CDOR Plus

0.40% | | Maturity | | | CAD | | | | 2,425 | | | | 12/11/19 | | | | (36 | ) |

Energen Corp. | | | 22,557 | | | LIBOR Plus

0.30% | | Maturity | | | USD | | | | 1,823 | | | | 12/11/19 | | | | 119,429 | |

Express Scripts Holding Co. | | | 20,390 | | | LIBOR Plus

0.30% | | Maturity | | | USD | | | | 1,951 | | | | 12/11/19 | | | | (15,316 | ) |

FCB Financial Holdings | | | 40,570 | | | LIBOR Plus

0.30% | | Maturity | | | USD | | | | 1,959 | | | | 12/11/19 | | | | (37,348 | ) |

Gemalto | | | 27,550 | | | EURIBOR

Plus 0.50% | | Maturity | | | EUR | | | | 1,381 | | | | 12/11/19 | | | | 2,334 | |

Integrated Device Technology, Inc. | | | 41,520 | | | LIBOR Plus

0.30% | | Maturity | | | USD | | | | 1,956 | | | | 12/11/19 | | | | (4,904 | ) |

Kapstone Paper and Packaging | | | 57,160 | | | LIBOR Plus

0.30% | | Maturity | | | USD | | | | 1,952 | | | | 12/11/19 | | | | (9,614 | ) |

LINDE AG | | | 7,949 | | | EURIBOR

Plus 0.50% | | Maturity | | | EUR | | | | 1,541 | | | | 12/11/19 | | | | 83,943 | |

Luxottica Group Spa | | | 29,970 | | | EURIBOR

Plus 0.50% | | Maturity | | | EUR | | | | 1,675 | | | | 12/11/19 | | | | 91,209 | |

| | |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 11 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

Counterparty &

Referenced

Obligation | | # of Shares

or Units | | | Rate Paid/

Received | | Payment

Frequency | | Notional

Amount

(000) | | | Maturity

Date | | | Unrealized

Appreciation/

(Depreciation) | |

MSABFLSU | | | 75,934 | | | 0.65% | | Quarterly | | | USD | | | | 7,093 | | | | 10/15/19 | | | $ | 1,978 | |

MSABSLSU | | | 32,426 | | | 1.20% | | Quarterly | | | USD | | | | 3,038 | | | | 10/15/19 | | | | 13,820 | |

MSCBGABG(4) | | | 99,616 | | | 0.30% | | Quarterly | | | USD | | | | 16,457 | | | | 10/15/19 | | | | 30,830 | |

MSCBRMF4 | | | 31,511 | | | 0.60% | | Quarterly | | | USD | | | | 6,306 | | | | 10/15/19 | | | | (30,353 | ) |

MSCBVB3U | | | 17,242 | | | 0.50% | | Quarterly | | | USD | | | | 11,836 | | | | 10/15/19 | | | | 36,880 | |

NEX Group PLC | | | 142,010 | | | LIBOR Plus

0.50% | | Maturity | | | GBP | | | | 1,478 | | | | 12/11/19 | | | | (86,664 | ) |

NxStage Medical Inc. | | | 56,830 | | | LIBOR Plus

0.30% | | Maturity | | | USD | | | | 1,618 | | | | 12/11/19 | | | | (34,160 | ) |

Ocean Rig UDW Inc. | | | 56,213 | | | LIBOR Plus

0.30% | | Maturity | | | USD | | | | 1,799 | | | | 12/11/19 | | | | 145,982 | |

Oclaro, Inc. | | | 180,160 | | | LIBOR Plus

0.30% | | Maturity | | | USD | | | | 1,635 | | | | 12/11/19 | | | | (25,499 | ) |

Orbotech Ltd. | | | 32,240 | | | LIBOR Plus

0.30% | | Maturity | | | USD | | | | 1,964 | | | | 12/11/19 | | | | (49,108 | ) |

Pinnacle Entertainment Inc. | | | 9,563 | | | LIBOR Plus

0.30% | | Maturity | | | USD | | | | 319 | | | | 12/11/19 | | | | 2,816 | |

Rockwell Collins Inc. | | | 13,930 | | | LIBOR Plus

0.30% | | Maturity | | | USD | | | | 1,960 | | | | 12/11/19 | | | | (4,246 | ) |

Scana Corp. | | | 36,410 | | | LIBOR Plus

0.30% | | Maturity | | | USD | | | | 1,297 | | | | 12/11/19 | | | | 117,724 | |

Shire PLC | | | 33,135 | | | LIBOR Plus

0.50% | | Maturity | | | GBP | | | | 1,488 | | | | 12/11/19 | | | | 56,734 | |

Sprint Corp. | | | 218,100 | | | LIBOR Plus

0.30% | | Maturity | | | USD | | | | 1,400 | | | | 12/11/19 | | | | 25,674 | |

Pay Total Return on Reference Obligation | |

Goldman Sachs International | |

STOXX Europe 600 | | | 72,495 | | | 3 Month

EURIBOR

Plus 0.14% | | Quarterly | | | EUR | | | | 14,014 | | | | 8/15/19 | | | | 201,934 | |

Morgan Stanley Capital Services, LLC | |

Amcor Ltd. | | | 204,153 | | | 1 Month

BBSW | | Maturity | | | AUD | | | | 2,772 | | | | 12/11/19 | | | | (14,817 | ) |

Cigna Corp. | | | 4,962 | | | LIBOR Plus

0.30% | | Maturity | | | USD | | | | 997 | | | | 12/11/19 | | | | (36,075 | ) |

CME Group, Inc. | | | 6,305 | | | LIBOR Plus

0.30% | | Maturity | | | USD | | | | 1,084 | | | | 12/11/19 | | | | 11,732 | |

CVS Health Corp. | | | 7,967 | | | LIBOR Plus

0.30% | | Maturity | | | USD | | | | 625 | | | | 12/11/19 | | | | (1,922 | ) |

Diamondback Energy, Inc. | | | 14,531 | | | LIBOR Minus

0.06% | | Maturity | | | USD | | | | 1,844 | | | | 12/11/19 | | | | (119,421 | ) |

Dominion Energy, Inc. | | | 24,358 | | | LIBOR Minus

0.06% | | Maturity | | | USD | | | | 1,737 | | | | 12/11/19 | | | | 26,186 | |

Enbridge Income Fund Holdings, Inc. | | | 55,720 | | | CDOR Plus

1.63% | | Maturity | | | CAD | | | | 2,334 | | | | 12/11/19 | | | | 9,230 | |

| | |

| 12 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

Counterparty &

Referenced

Obligation | | # of Shares

or Units | | | Rate Paid/

Received | | Payment

Frequency | | Notional

Amount

(000) | | | Maturity

Date | | | Unrealized

Appreciation/

(Depreciation) | |

Essilor International Cie Generale d’Optique SA | | | 13,816 | | | EURIBOR

Plus 0.50% | | Maturity | | | EUR | | | | 1,682 | | | | 12/11/19 | | | $ | (91,581 | ) |

KLA-Tencor Corp. | | | 8,060 | | | LIBOR Minus

0.06% | | Maturity | | | USD | | | | 830 | | | | 12/11/19 | | | | 10,512 | |

Lumentum Holdings Inc. | | | 11,458 | | | LIBOR Minus

0.06% | | Maturity | | | USD | | | | 686 | | | | 12/11/19 | | | | (707 | ) |

Marathon Petroleum Corp. | | | 19,852 | | | LIBOR Plus

0.30% | | Maturity | | | USD | | | | 1,670 | | | | 12/11/19 | | | | 84,018 | |

Penn National Gaming Inc. | | | 3,975 | | | LIBOR Minus

0.06% | | Maturity | | | USD | | | | 128 | | | | 12/11/19 | | | | (2,614 | ) |

Praxair Inc. | | | 12,241 | | | LIBOR Plus

0.30% | | Maturity | | | USD | | | | 1,935 | | | | 12/11/19 | | | | (30,676 | ) |

Synovus Financial Corp. | | | 42,801 | | | LIBOR Minus

0.06% | | Maturity | | | USD | | | | 1,996 | | | | 12/11/19 | | | | 37,483 | |

T-Mobile US, Inc. | | | 22,377 | | | LIBOR Minus

0.06% | | Maturity | | | USD | | | | 1,521 | | | | 12/11/19 | | | | (48,221 | ) |

Takeda Pharmaceutical Co., Ltd. | | | 27,800 | | | LIBOR Plus

0.40% | | Maturity | | | JPY | | | | 132,526 | | | | 12/11/19 | | | | (44,951 | ) |

Transocean Ltd. | | | 90,660 | | | LIBOR Minus

0.06% | | Maturity | | | USD | | | | 1,120 | | | | 12/11/19 | | | | (144,008 | ) |

United Technologies Corp. | | | 5,227 | | | LIBOR Plus

0.30% | | Maturity | | | USD | | | | 726 | | | | 12/11/19 | | | | (4,741 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | $ | 395,185 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | Affiliated investments. |

| (b) | The rate shown represents the 7-day yield as of period end. |

| (c) | To obtain a copy of the fund’s shareholder report, please go to the Securities and Exchange Commission’s website at www.sec.gov, or call AB at (800) 227-4618. |

| * | The investment strategies and liquidity of the Underlying Portfolios in which the Fund invests are as follows: |

Long/Short Equity Underlying Portfolios seek to buy securities with the expectation that they will increase in value (called “going long”) and sell securities short in the expectation that they will decrease in value (“going short”). Underlying Portfolios within this strategy are generally subject to 30 – 120 day redemption notice periods. The majority of the Underlying Portfolios are no longer subject to initial lockups. Certain Underlying Portfolios have lock up periods of up to three years.

Event Driven Underlying Portfolios seek to take advantage of information inefficiencies resulting from a particular corporate event, such as a takeover, liquidation, bankruptcy, tender offer, buyback, spin-off, exchange offer, merger or other type of corporate reorganization. Underlying Portfolios within this strategy are generally subject to 60 – 90 day redemption notice periods. Certain Underlying Portfolios may have lock up periods of up to two years.

Credit/Distressed Underlying Portfolios invest in a variety of fixed income and other securities, including bonds (corporate and government), bank debt, asset-backed financial instruments, mortgage-backed securities and mezzanine and distressed securities, as well as securities of distressed companies and high

| | |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 13 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

yield securities. Underlying Portfolios within this strategy are generally subject to 60 – 90 day redemption notice periods. Certain Underlying Portfolios may have lock up periods of up to three years.

Multi-Strategy Underlying Portfolios invest across multiple strategies, including long/short equity, event driven, global macro, credit/distressed and emerging markets, in which the investment process is predicated on movements in underlying economic variables and the impact these variables have on equity, fixed income, currency, commodity and other financial instrument markets. Underlying Portfolios within this strategy are generally subject to 30 – 60 day redemption notice periods. Certain Underlying Portfolios may have lock up periods of up to two years.

Global Macro Underlying Portfolios aim to identify and exploit imbalances in global economics and asset classes, typically utilizing macroeconomic and technical market factors rather than “bottom-up” individual security analysis. The Underlying Portfolios within this strategy are subject to 30 – 90 day redemption notice periods. Certain Underlying Portfolios have a lock up period of one year.

The Fund may also make direct investments in securities (other than securities of Underlying Portfolios), options, futures, options on futures, swap contracts, or other derivative or financial instruments.

Currency Abbreviations:

AUD – Australian Dollar

CAD – Canadian Dollar

EUR – Euro

GBP – Great British Pound

JPY – Japanese Yen

USD – United States Dollar

Glossary:

BBSW – Bank Bill Swap Reference Rate (Australia)

CDOR – Canadian Dealer Offered Rate

EURIBOR – Euro Interbank Offered Rate

LIBOR – London Interbank Offered Rates

| (1) | The following table represents the basket holdings underlying the total return swap with CIFXPPD2 as of September 30, 2018. |

| | | | | | | | |

| Security Description | | Notional Amount

as of 9/30/18 | | | Percent of

Basket’s Value | |

USD/CHF | | $ | 7,645,836 | | | | 59.8 | % |

USD/CAD | | | (5,097,224 | ) | | | (39.9 | )% |

USD/EUR | | | (5,097,224 | ) | | | (39.9 | )% |

USD/NOK | | | 5,097,224 | | | | 39.9 | % |

USD/JPY | | | (2,548,612 | ) | | | (19.9 | )% |

| (2) | The following table represents the 50 largest (long/short) equity basket holdings underlying the total return swap with GSISM49E as of September 30, 2018. |

| | | | | | | | | | | | |

| Security Description | | Shares | | | Notional Amount

as of 9/30/18 | | | Percent of

Basket’s Value | |

Apple, Inc. | | | (3,645 | ) | | $ | (822,786 | ) | | | (3.7 | )% |

Microsoft Corp. | | | (6,685 | ) | | | (764,535 | ) | | | (3.4 | )% |

Amazon.com, Inc. | | | (282 | ) | | | (565,628 | ) | | | (2.5 | )% |

JPMorgan Chase & Co. | | | (3,118 | ) | | | (351,861 | ) | | | (1.6 | )% |

Alphabet, Inc. | | | (274 | ) | | | (330,162 | ) | | | (1.5 | )% |

Exxon Mobil Corp. | | | (3,406 | ) | | | (289,555 | ) | | | (1.3 | )% |

Johnson & Johnson | | | (1,920 | ) | | | (265,335 | ) | | | (1.2 | )% |

Bank of America Corp. | | | (8,822 | ) | | | (259,888 | ) | | | (1.2 | )% |

Berkshire Hathaway, Inc. | | | (1,171 | ) | | | (250,755 | ) | | | (1.1 | )% |

Visa, Inc. | | | (1,636 | ) | | | (245,523 | ) | | | (1.1 | )% |

Nestle SA | | | (2,865 | ) | | | (238,746 | ) | | | (1.1 | )% |

Facebook, Inc. | | | (1,438 | ) | | | (236,447 | ) | | | (1.1 | )% |

| | |

| 14 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| Security Description | | Shares | | | Notional Amount

as of 9/30/18 | | | Percent of

Basket’s Value | |

Alphabet, Inc. | | | (198 | ) | | $ | (235,779 | ) | | | (1.1 | )% |

UnitedHealth Group, Inc. | | | (880 | ) | | | (234,143 | ) | | | (1.1 | )% |

AT&T, Inc. | | | (6,651 | ) | | | (223,324 | ) | | | (1.0 | )% |

Wells Fargo & Co. | | | (4,240 | ) | | | (222,835 | ) | | | (1.0 | )% |

Home Depot, Inc./The | | | (1,056 | ) | | | (218,846 | ) | | | (1.0 | )% |

Chevron Corp. | | | (1,750 | ) | | | (214,006 | ) | | | (1.0 | )% |

Cisco Systems, Inc. | | | (4,307 | ) | | | (209,540 | ) | | | (0.9 | )% |

WellCare Health Plans, Inc. | | | 617 | | | | 197,766 | | | | 0.9 | % |

Mastercard, Inc. | | | (849 | ) | | | (189,028 | ) | | | (0.9 | )% |

Boeing Co./The | | | (507 | ) | | | (188,506 | ) | | | (0.8 | )% |

F5 Networks, Inc. | | | 933 | | | | 185,978 | | | | 0.8 | % |

Universal Health Services, Inc. | | | 1,438 | | | | 183,793 | | | | 0.8 | % |

Jazz Pharmaceuticals PLC | | | 1,080 | | | | 181,639 | | | | 0.8 | % |

ResMed, Inc. | | | 1,558 | | | | 179,646 | | | | 0.8 | % |

AGNC Investment Corp. | | | 9,609 | | | | 179,010 | | | | 0.8 | % |

Textron, Inc. | | | 2,465 | | | | 176,183 | | | | 0.8 | % |

ANSYS, Inc. | | | 936 | | | | 174,793 | | | | 0.8 | % |

Total System Services, Inc. | | | 1,766 | | | | 174,381 | | | | 0.8 | % |

Twenty-First Century Fox, Inc. | | | 3,805 | | | | 174,326 | | | | 0.8 | % |

Annaly Capital Management, Inc. | | | 16,962 | | | | 173,522 | | | | 0.8 | % |

Novartis AG | | | (1,996 | ) | | | (171,562 | ) | | | (0.8 | )% |

L3 Technologies, Inc. | | | 807 | | | | 171,504 | | | | 0.8 | % |

Coca-Cola Co./The | | | (3,702 | ) | | | (171,008 | ) | | | (0.8 | )% |

Expeditors International of Wa | | | 2,321 | | | | 170,634 | | | | 0.8 | % |

Rockwell Collins, Inc. | | | 1,208 | | | | 169,674 | | | | 0.8 | % |

Synopsys, Inc. | | | 1,719 | | | | 169,530 | | | | 0.8 | % |

Hormel Foods Corp | | | 4,287 | | | | 168,892 | | | | 0.8 | % |

Broadridge Financial Solutions | | | 1,277 | | | | 168,445 | | | | 0.8 | % |

Citigroup, Inc. | | | (2,335 | ) | | | (167,537 | ) | | | (0.8 | )% |

Clorox Co./The | | | 1,113 | | | | 167,367 | | | | 0.8 | % |

Intel Corp. | | | (3,531 | ) | | | (166,957 | ) | | | (0.8 | )% |

Repsol SA | | | 8,380 | | | | 166,919 | | | | 0.8 | % |

Archer-Daniels-Midland Co. | | | 3,301 | | | | 165,918 | | | | 0.7 | % |

Church & Dwight Co., Inc. | | | 2,774 | | | | 164,686 | | | | 0.7 | % |

Centene Corp. | | | 1,131 | | | | 163,760 | | | | 0.7 | % |

CenterPoint Energy, Inc. | | | 5,880 | | | | 162,569 | | | | 0.7 | % |

Citizens Financial Group, Inc. | | | 4,201 | | | | 162,032 | | | | 0.7 | % |

Public Service Enterprise Group | | | 3,063 | | | | 161,684 | | | | 0.7 | % |

Other | | | 664,691 | | | | 9,573,732 | | | | 43.1 | % |

| (3) | The following table represents the 50 largest (long/short) equity basket holdings underlying the total return swap with JPQCRMFA as of September 30, 2018. |

| | | | | | | | | | | | |

| Security Description | | Shares | | | Notional Amount

as of 9/30/18 | | | Percent of

Basket’s Value | |

ABIOMED, Inc. | | | 258 | | | $ | 116,125 | | | | 0.6 | % |

Alexion Pharmaceuticals, Inc. | | | (821 | ) | | | (114,155 | ) | | | (0.6 | )% |

thyssenkrupp AG | | | (4,359 | ) | | | (109,959 | ) | | | (0.6 | )% |

Shopify, Inc. | | | (656 | ) | | | (107,873 | ) | | | (0.6 | )% |

SES SA | | | (4,906 | ) | | | (107,605 | ) | | | (0.6 | )% |

Concho Resources, Inc. | | | (704 | ) | | | (107,529 | ) | | | (0.6 | )% |

Komatsu Ltd. | | | (3,525 | ) | | | (107,163 | ) | | | (0.6 | )% |

Bausch Health Cos, Inc. | | | 4,137 | | | | 106,295 | | | | 0.6 | % |

John Wood Group PLC | | | (105 | ) | | | (105,830 | ) | | | (0.6 | )% |

| | |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 15 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| Security Description | | Shares | | | Notional Amount

as of 9/30/18 | | | Percent of

Basket’s Value | |

Yakult Honsha Co. Ltd. | | | (1,292 | ) | | $ | (105,774 | ) | | | (0.6 | )% |

Konica Minolta, Inc. | | | 9,952 | | | | 105,751 | | | | 0.6 | % |

Under Armour, Inc. | | | (4,980 | ) | | | (105,674 | ) | | | (0.6 | )% |

Activision Blizzard, Inc. | | | (1,268 | ) | | | (105,485 | ) | | | (0.6 | )% |

Daifuku Co. Ltd. | | | (2,070 | ) | | | (105,436 | ) | | | (0.6 | )% |

AIA Group Ltd. | | | (11,805 | ) | | | (105,400 | ) | | | (0.6 | )% |

Marubeni Corp. | | | 11,513 | | | | 105,322 | | | | 0.5 | % |

Vistra Energy Corp. | | | 4,233 | | | | 105,314 | | | | 0.5 | % |

Vertex Pharmaceuticals, Inc. | | | (543 | ) | | | (104,737 | ) | | | (0.5 | )% |

Parsley Energy, Inc. | | | (3,570 | ) | | | (104,413 | ) | | | (0.5 | )% |

Ono Pharmaceutical Co. Ltd. | | | (3,687 | ) | | | (104,270 | ) | | | (0.5 | )% |

Under Armour, Inc. | | | (5,351 | ) | | | (104,127 | ) | | | (0.5 | )% |

Juniper Networks, Inc. | | | 3,472 | | | | 104,045 | | | | 0.5 | % |

Porsche Automobil Holding SE | | | 1,542 | | | | 103,790 | | | | 0.5 | % |

Symantec Corp. | | | (4,871 | ) | | | (103,658 | ) | | | (0.5 | )% |

Baker Hughes a GE Co. | | | (3,063 | ) | | | (103,615 | ) | | | (0.5 | )% |

Alkermes PLC | | | (2,436 | ) | | | (103,388 | ) | | | (0.5 | )% |

ConocoPhillips | | | 1,335 | | | | 103,327 | | | | 0.5 | % |

Netflix, Inc. | | | (276 | ) | | | (103,322 | ) | | | (0.5 | )% |

Keyence Corp. | | | (178 | ) | | | (103,017 | ) | | | (0.5 | )% |

TechnipFMC PLC | | | (3,295 | ) | | | (102,980 | ) | | | (0.5 | )% |

Sprint Corp. | | | (15,737 | ) | | | (102,922 | ) | | | (0.5 | )% |

Cooper Cos, Inc./The | | | 371 | | | | 102,882 | | | | 0.5 | % |

Occidental Petroleum Corp. | | | 1,249 | | | | 102,654 | | | | 0.5 | % |

Oracle Corp. | | | (1,991 | ) | | | (102,649 | ) | | | (0.5 | )% |

Reckitt Benckiser Group PLC | | | (11 | ) | | | (102,558 | ) | | | (0.5 | )% |

Nintendo Co. Ltd. | | | (281 | ) | | | (102,519 | ) | | | (0.5 | )% |

Liberty Global PLC | | | (3,540 | ) | | | (102,426 | ) | | | (0.5 | )% |

Fortinet, Inc. | | | 1,110 | | | | 102,391 | | | | 0.5 | % |

Lululemon Athletica, Inc. | | | 629 | | | | 102,281 | | | | 0.5 | % |

Encana Corp. | | | (7,799 | ) | | | (102,274 | ) | | | (0.5 | )% |

Computershare Ltd. | | | 7,094 | | | | 102,242 | | | | 0.5 | % |

Electronic Arts, Inc. | | | (848 | ) | | | (102,202 | ) | | | (0.5 | )% |

Methanex Corp. | | | 1,294 | | | | 102,162 | | | | 0.5 | % |

Broadcom, Inc. | | | (413 | ) | | | (101,906 | ) | | | (0.5 | )% |

Autodesk, Inc. | | | (652 | ) | | | (101,853 | ) | | | (0.5 | )% |

Brookfield Property REIT, Inc. | | | 4,861 | | | | 101,748 | | | | 0.5 | % |

Take(Two Interactive Software | | | (737 | ) | | | (101,668 | ) | | | (0.5 | )% |

Veeva Systems, Inc. | | | 933 | | | | 101,582 | | | | 0.5 | % |

SCOR SE | | | 2,185 | | | | 101,418 | | | | 0.5 | % |

American Airlines Group, Inc. | | | (2,453 | ) | | | (101,383 | ) | | | (0.5 | )% |

Other | | | 104,536 | | | | 3,745,092 | | | | 19.5 | % |

| (4) | The following table represents the 50 largest (long/short) equity basket holdings underlying the total return swap with MSCBGABG as of September 30, 2018. |

| | | | | | | | | | | | |

| Security Description | | Shares | | | Notional Amount

as of 9/30/18 | | | Percent of

Basket’s Value | |

Tesla Inc | | | (967 | ) | | $ | (256,148 | ) | | | (1.6 | )% |

Liberty Global PLC | | | (8,934 | ) | | | (251,581 | ) | | | (1.5 | )% |

Sempra Energy | | | (1,944 | ) | | | (221,126 | ) | | | (1.3 | )% |

ABIOMED Inc | | | 467 | | | | 210,046 | | | | 1.3 | % |

PG&E Corp | | | (4,520 | ) | | | (207,952 | ) | | | (1.3 | )% |

Liberty Global PLC | | | (7,147 | ) | | | (206,765 | ) | | | (1.3 | )% |

| | |

| 16 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

| Security Description | | Shares | | | Notional Amount

as of 9/30/18 | | | Percent of

Basket’s Value | |

Barrick Gold Corp | | | (17,092 | ) | | $ | (189,188 | ) | | | (1.1 | )% |

United Therapeutics Corp | | | 1,462 | | | | 187,012 | | | | 1.1 | % |

Nektar Therapeutics | | | 3,038 | | | | 185,198 | | | | 1.1 | % |

Cenovus Energy Inc | | | (18,222 | ) | | | (183,071 | ) | | | (1.1 | )% |

RioCan Real Estate Investment | | | 9,562 | | | | 182,791 | | | | 1.1 | % |

H&R Real Estate Investment Tru | | | 11,810 | | | | 181,769 | | | | 1.1 | % |

Crown Castle International Cor | | | (1,573 | ) | | | (175,157 | ) | | | (1.1 | )% |

DENTSPLY SIRONA Inc | | | (4,536 | ) | | | (171,183 | ) | | | (1.0 | )% |

Interpublic Group of Cos Inc/T | | | 7,473 | | | | 170,903 | | | | 1.0 | % |

Brookfield Property REIT Inc | | | 8,065 | | | | 168,792 | | | | 1.0 | % |

SmartCentres Real Estate Inves | | | 7,034 | | | | 166,236 | | | | 1.0 | % |

Arconic Inc | | | (7,437 | ) | | | (163,681 | ) | | | (1.0 | )% |

General Electric Co | | | (14,149 | ) | | | (159,740 | ) | | | (1.0 | )% |

Liberty Media Corp-Liberty For | | | (4,260 | ) | | | (158,421 | ) | | | (1.0 | )% |

Oracle Corp | | | (3,004 | ) | | | (154,892 | ) | | | (0.9 | )% |

Metro Inc | | | 4,856 | | | | 151,133 | | | | 0.9 | % |

Equinix Inc | | | (342 | ) | | | (148,165 | ) | | | (0.9 | )% |

Mattel Inc | | | (9,329 | ) | | | (146,467 | ) | | | (0.9 | )% |

Charles Schwab Corp/The | | | (2,962 | ) | | | (145,576 | ) | | | (0.9 | )% |

Facebook Inc | | | (884 | ) | | | (145,329 | ) | | | (0.9 | )% |

Seagate Technology PLC | | | 3,003 | | | | 142,213 | | | | 0.9 | % |

Walmart Inc | | | (1,509 | ) | | | (141,735 | ) | | | (0.9 | )% |

Alnylam Pharmaceuticals Inc | | | (1,619 | ) | | | (141,735 | ) | | | (0.9 | )% |

Concho Resources Inc | | | (889 | ) | | | (135,799 | ) | | | (0.8 | )% |

Hologic Inc | | | 3,206 | | | | 131,396 | | | | 0.8 | % |

Costco Wholesale Corp | | | 556 | | | | 130,687 | | | | 0.8 | % |

Live Nation Entertainment Inc | | | (2,364 | ) | | | (128,742 | ) | | | (0.8 | )% |

Philip Morris International In | | | (1,576 | ) | | | (128,511 | ) | | | (0.8 | )% |

JPMorgan Chase & Co | | | (1,135 | ) | | | (128,082 | ) | | | (0.8 | )% |

Robert Half International Inc | | | 1,801 | | | | 126,780 | | | | 0.8 | % |

Under Armour Inc | | | (6,489 | ) | | | (126,268 | ) | | | (0.8 | )% |

AGNC Investment Corp | | | 6,733 | | | | 125,428 | | | | 0.8 | % |

HollyFrontier Corp | | | 1,792 | | | | 125,263 | | | | 0.8 | % |

AES Corp/VA | | | 8,899 | | | | 124,587 | | | | 0.8 | % |

American Express Co | | | (1,168 | ) | | | (124,356 | ) | | | (0.8 | )% |

Arrow Electronics Inc | | | 1,686 | | | | 124,257 | | | | 0.8 | % |

MercadoLibre Inc | | | (363 | ) | | | (123,614 | ) | | | (0.7 | )% |

Valero Energy Corp | | | 1,082 | | | | 123,053 | | | | 0.7 | % |

Inter Pipeline Ltd | | | 7,046 | | | | 122,262 | | | | 0.7 | % |

Leggett & Platt Inc | | | 2,772 | | | | 121,388 | | | | 0.7 | % |

F5 Networks Inc | | | 607 | | | | 120,992 | | | | 0.7 | % |

Honeywell International Inc | | | (754 | ) | | | (120,118 | ) | | | (0.7 | )% |

ON Semiconductor Corp | | | 6,492 | | | | 119,640 | | | | 0.7 | % |

Cardinal Health Inc | | | (2,212 | ) | | | (119,442 | ) | | | (0.7 | )% |

Other | | | (418,494 | ) | | | 1,059,316 | | | | 6.4 | % |

See notes to financial statements.

| | |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 17 |

CONSOLIDATED STATEMENT OF ASSETS & LIABILITIES

September 30, 2018 (unaudited)

| | | | |

| Assets | |

Investments in unaffiliated Underlying Portfolios, at value

(cost $827,860,139) | | $ | 959,656,842 | |

Investments in affiliated Underlying Portfolios, at value

(cost $82,250,000) | | | 82,250,000 | |

Cash | | | 76,862,863 | |

Cash collateral due from broker | | | 32,342 | |

Foreign currencies, at value (cost $802,949) | | | 797,036 | |

Investment in Underlying Portfolios paid in advance

(see Note A2) | | | 15,000,000 | |

Receivable for investments sold | | | 10,143,103 | |

Unrealized appreciation on total return swaps | | | 1,430,935 | |

Affiliated dividends receivable | | | 142,025 | |

Deferred offering expense | | | 33,917 | |

| | | | |

Total assets | | | 1,146,349,063 | |

| | | | |

| Liabilities | |

Payable for shares of beneficial interest redeemed | | | 45,017,860 | |

Subscriptions received in advance | | | 6,078,850 | |

Unrealized depreciation on total return swaps | | | 1,035,750 | |

Management fee payable | | | 940,020 | |

Cash collateral due to broker | | | 451,408 | |

Administrative fee payable | | | 127,033 | |

Transfer Agent fee payable | | | 18,968 | |

Payable for terminated total return swaps | | | 5,594 | |

Accrued expenses | | | 503,282 | |

| | | | |

Total liabilities | | | 54,178,765 | |

| | | | |

Net Assets | | $ | 1,092,170,298 | |

| | | | |

| Composition of Net Assets | |

Shares of beneficial interest, at par | | $ | 96,722 | |

Additional paid-in capital | | | 1,057,793,490 | |

Distributable earnings | | | 34,280,086 | |

| | | | |

Net Assets | | $ | 1,092,170,298 | |

| | | | |

Shares of beneficial interest outstanding—unlimited shares authorized, with par value of $.001 (based on 96,722,054 shares outstanding) | | $ | 11.29 | |

| | | | |

See notes to consolidated financial statements.

| | |

| 18 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

CONSOLIDATED STATEMENT OF OPERATIONS

Six Months Ended September 30, 2018 (unaudited)

| | | | | | | | |

| Investment Income | | | | | | | | |

Dividends—Affiliated issuers | | | | | | $ | 548,872 | |

| | | | | | | | |

| Expenses | | | | | | | | |

Management fee (see Note B) | | $ | 8,620,987 | | | | | |

Custodian | | | 243,466 | | | | | |

Administrative | | | 167,867 | | | | | |

Credit facility fees | | | 151,300 | | | | | |

Transfer agency | | | 115,946 | | | | | |

Trustees’ fees | | | 69,218 | | | | | |

Legal | | | 65,643 | | | | | |

Audit and tax | | | 55,916 | | | | | |

Registration fees | | | 47,953 | | | | | |

Printing | | | 36,773 | | | | | |

Amortization of offering expenses | | | 3,083 | | | | | |

Miscellaneous | | | 126,659 | | | | | |

| | | | | | | | |

Total expenses before interest expense | | | 9,704,811 | | | | | |

Interest expense | | | 10,315 | | | | | |

| | | | | | | | |

Total expenses | | | 9,715,126 | | | | | |

Less: expenses waived and reimbursed by the Investment Manager (see Note B) | | | (1,952,261 | ) | | | | |

| | | | | | | | |

Net expenses | | | | | | | 7,762,865 | |

| | | | | | | | |

Net investment loss | | | | | | | (7,213,993 | ) |

| | | | | | | | |

| Realized and Unrealized Gain (Loss) on Investment and Foreign Currency Transactions | | | | | | | | |

Net realized gain (loss) on: | | | | | | | | |

Investment transactions | | | | | | | 56,597,128 | |

Swaps | | | | | | | 44,553 | |

Foreign currency transactions | | | | | | | (12,453 | ) |

Net change in unrealized appreciation/depreciation of: | | | | | | | | |

Investments | | | | | | | (39,920,195 | ) |

Swaps | | | | | | | 395,185 | |

Foreign currency denominated assets and liabilities | | | | | | | (5,913 | ) |

| | | | | | | | |

Net gain on investment and foreign currency transactions | | | | | | | 17,098,305 | |

| | | | | | | | |

Net Increase in Net Assets from Operations | | | | | | $ | 9,884,312 | |

| | | | | | | | |

See notes to consolidated financial statements.

| | |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 19 |

CONSOLIDATED STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | Six Months Ended

September 30,

2018

(unaudited) | | | Year Ended

March 31,

2018 | |

| Increase (Decrease) in Net Assets from Operations | | | | | | | | |

Net investment loss | | $ | (7,213,993 | ) | | $ | (20,469,210 | ) |

Net realized gain on investment and foreign currency transactions | | | 56,629,228 | | | | 47,070,125 | |

Net change in unrealized appreciation/depreciation of investments and foreign currency denominated assets and liabilities | | | (39,530,923 | ) | | | 26,237,629 | |

| | | | | | | | |

Net increase in net assets from operations | | | 9,884,312 | | | | 52,838,544 | |

Distributions to shareholders | | | – 0 | – | | | (12,605,284 | ) |

Return of capital | | | – 0 | – | | | (2,494,217 | ) |

| Transactions in Shares of Beneficial Interest | | | | | | | | |

Net decrease (see Note D) | | | (72,773,842 | ) | | | (131,497,085 | ) |

| | | | | | | | |

Total decrease | | | (62,889,530 | ) | | | (93,758,042 | ) |

| Net Assets | | | | | | | | |

Beginning of period | | | 1,155,059,828 | | | | 1,248,817,870 | |

| | | | | | | | |

End of period | | $ | 1,092,170,298 | | | $ | 1,155,059,828 | |

| | | | | | | | |

See notes to consolidated financial statements.

| | |

| 20 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

CONSOLIDATED STATEMENT OF CASH FLOWS

for the six months ended September 30, 2018 (unaudited)

| | | | | | | | |

| Cash flows from operating activities | | | | | | | | |

Net increase in net assets from operations | | | | | | $ | 9,884,312 | |

| Reconciliation of net increase in net assets from operations to net increase in cash from operating activities | | | | | | | | |

Purchases of Underlying Portfolio shares | | $ | (153,900,000 | ) | | | | |

Purchases of short-term investments | | | (215,000,000 | ) | | | | |

Sales of Underlying Portfolio shares | | | 367,420,930 | | | | | |

Proceeds from disposition of short-term investments | | | 150,050,000 | | | | | |

Net realized gain on investment transactions and foreign currency transactions | | | (56,629,228 | ) | | | | |

Net change in unrealized appreciation/depreciation on investments in Underlying Portfolio shares | | | 39,530,923 | | | | | |

Increase in receivable for investments sold | | | (6,996,600 | ) | | | | |

Increase in affiliated dividends receivable | | | (122,269 | ) | | | | |

Increase in investments in Underlying Portfolios paid in advance | | | (13,200,000 | ) | | | | |

Increase in cash collateral due from broker | | | (32,342 | ) | | | | |

Increase in payable for investments purchased | | | 45,023,454 | | | | | |

Increase in cash collateral due to broker | | | 451,408 | | | | | |

Decrease in management fee payable | | | (552,417 | ) | | | | |

Increase in administrative fee payable | | | 578 | | | | | |

Increase in Transfer Agent fee payable | | | 30 | | | | | |

Increase in accrued expenses | | | 105,668 | | | | | |

Increase in offering expenses payable | | | 3,083 | | | | | |

Proceeds on swaps, net | | | 44,553 | | | | | |

| | | | | | | | |

Total adjustments | | | | | | | 156,197,771 | |

| | | | | | | | |

Net cash provided by (used in) from operating activities | | | | | | | 166,082,083 | |

| Cash flows from financing activities | | | | | | | | |

Subscriptions, including change in subscriptions received in advance | | | 19,699,966 | | | | | |

Redemptions, net of payable for shares of beneficial interest redeemed | | | (114,133,812 | ) | | | | |

| | | | | | | | |

Net cash provided by (used in) from financing activities | | | | | | | (94,433,846 | ) |

Effect of exchange rate on cash | | | | | | | (18,366 | ) |

| | | | | | | | |

Net increase in cash | | | | | | | 71,629,871 | |

Cash at beginning of period | | | | | | | 6,030,028 | |

| | | | | | | | |

Cash at end of period | | | | | | $ | 77,659,899 | |

| | | | | | | | |

| Supplemental disclosure of cash flow information | | | | | | | | |

Interest expense paid during the period | | $ | 10,315 | | | | | |

See notes to consolidated financial statements.

| | |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 21 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2018 (unaudited)

NOTE A

Significant Accounting Policies

AB Multi-Manager Alternative Fund (the “Fund”) is a statutory trust formed under the laws of the State of Delaware and registered under the Investment Company Act of 1940 as a diversified, closed-end management investment company. The Fund commenced operations on October 1, 2012. The Fund’s investment objective is to seek long-term capital appreciation. There can be no assurance that the Fund will achieve its investment objective, be able to structure its investments as anticipated, or that its returns will be positive over any period of time. The Fund is not intended as a complete investment program for investors. The Fund seeks to achieve its investment objective primarily by allocating its assets among investments in private investment vehicles (“Underlying Portfolios”), commonly referred to as hedge funds, that are managed by unaffiliated asset managers that employ a broad range of investment strategies. As a secondary strategy, the Fund will generally also make direct investments in securities and other financial instruments. As part of the Fund’s investment strategy, the Fund seeks exposure to commodities and commodities-related instruments and derivatives primarily through investments in AB Multi-Manager Alternative Fund (Cayman), Ltd., a wholly-owned subsidiary of the Fund organized under the laws of the Cayman Islands (the “Subsidiary”). The Fund is the sole shareholder of the Subsidiary and it is intended that the Fund will remain the sole shareholder and will continue to control the Subsidiary. Under the Articles of Association of the Subsidiary, shares issued by the Subsidiary confer upon a shareholder the right to receive notice of, to attend and to vote at general meetings of the Subsidiary and shall confer upon the shareholder rights in a winding-up or repayment of capital and the right to participate in the profits or assets of the Subsidiary. As of September 30, 2018, net assets of the Fund were $1,092,170,298, of which $10,089,368, or approximately 1%, represented the Fund’s ownership of all issued shares and voting rights of the Subsidiary. This report presents the consolidated financial statements of AB Multi-Manager Alternative Fund and the Subsidiary. All intercompany transactions and balances have been eliminated in consolidation.

The consolidated financial statements have been prepared in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) which require management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities in the consolidated financial statements and amounts of income and expenses during the reporting period. Actual results could differ from those estimates. The Fund is an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies. The following is a summary of significant accounting policies followed by the Fund.

| | |

| 22 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

1. Valuation of Investments

The Fund’s Board of Trustees (the “Board”) has approved pricing and valuation policies and procedures pursuant to which the Fund’s investments in Underlying Portfolios are valued at fair value (the “Valuation Procedures”). Among other matters, the Valuation Procedures set forth the Fund’s valuation policies and the mechanisms and processes to be employed on a monthly basis to implement such policies. In accordance with the Valuation Procedures, fair value of an Underlying Portfolio as of each valuation time ordinarily is the value determined as of such month-end for each Underlying Portfolio in accordance with the Underlying Portfolio’s valuation policies and reported at the time of the Fund’s valuation. Open end mutual funds are valued at the closing net asset value per share.

On a monthly basis, the Fund generally uses the net asset value (“NAV”), provided by the Underlying Portfolios, to determine the fair value of all Underlying Portfolios which (a) do not have readily determinable fair values and (b) either have the attributes of an investment company or prepare their financial statements consistent with measurement principles of an investment company. As a general matter, the fair value of the Fund’s interest in an Underlying Portfolio represents the amount that the Fund could reasonably expect to receive from an Underlying Portfolio if its interest were redeemed at the time of valuation. In the unlikely event that an Underlying Portfolio does not report a month-end value to the Fund on a timely basis, the Fund would determine the fair value of such Underlying Portfolio based on the most recent value reported by the Underlying Portfolio, and any other relevant information available at the time the Fund values its portfolio. In making a fair value determination, the Fund will consider all appropriate information reasonably available to it at the time and that AllianceBernstein L.P. (the “Investment Manager”) believes to be reliable. The Fund may consider factors such as, among others: (i) the price at which recent subscriptions for or redemptions of the Underlying Portfolio’s interests were effected; (ii) information provided to the Fund by the manager of an Underlying Portfolio, or the failure to provide such information as the Underlying Portfolio manager agreed to provide in the Underlying Portfolio’s offering materials or other agreements with the Fund; (iii) relevant news and other sources; and (iv) market events. In addition, when an Underlying Portfolio imposes extraordinary restrictions on redemptions, or when there have been no recent subscriptions for Underlying Portfolio interests, the Fund may determine that it is appropriate to apply a discount to the NAV reported by the Underlying Portfolio. The use of different factors and estimation methodologies could have a significant effect on the estimated fair value and could be material to the consolidated financial statements.

| | |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 23 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

Swaps and other derivatives are valued daily, primarily using independent pricing services, independent pricing models using market inputs, as well as third party broker-dealers or counterparties. Open end mutual funds are valued at the closing net asset value per share, while exchange traded funds are valued at the closing market price per share.

The Investment Manager has established a Valuation Committee (the “Committee”) made up of representatives of portfolio management, fund accounting, compliance and risk management which operates under the Valuation Procedures and is responsible for overseeing the pricing and valuation of all securities held in the Fund. The Committee’s responsibilities include: 1) fair value determinations (and oversight of any third parties to whom any responsibility for fair value determinations is delegated), and 2) regular monitoring of the Valuation Procedures and modification or enhancement of the Valuation Procedures (or recommendation of the modification of the Valuation Procedures) as the Committee believes appropriate. Prior to investing in any Underlying Portfolio, and periodically thereafter, the Investment Manager will conduct a due diligence review of the valuation methodology utilized by the Underlying Portfolio. In addition, there are several processes outside of the pricing process that are used to monitor valuation issues including: 1) performance and performance attribution reports are monitored for anomalous impacts based upon benchmark performance, and 2) portfolio managers review all portfolios for performance and analytics.

U.S. GAAP establishes a framework for measuring fair value, and a three-level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s own assumptions about the assumptions that market participants would use in pricing the asset or liability based on the best information available in the circumstances. Each investment is assigned a level based upon the observability of the inputs which are significant to the overall valuation. The three-tier hierarchy of inputs is summarized below.

| | • | | Level 1—quoted prices in active markets for identical investments |

| | • | | Level 2—other significant observable inputs |

| | • | | Level 3—significant unobservable inputs |

The fair value of debt instruments, such as bonds, and over-the-counter derivatives is generally based on market price quotations, recently executed market transactions (where observable) or industry recognized

| | |

| 24 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

modeling techniques and are generally classified as Level 2. Pricing vendor inputs to Level 2 valuations may include quoted prices for similar investments in active markets, interest rate curves, coupon rates, currency rates, yield curves, option adjusted spreads, default rates, credit spreads and other unique security features in order to estimate the relevant cash flows which is then discounted to calculate fair values. If these inputs are unobservable and significant to the fair value, these investments will be classified as Level 3. In addition, non-agency rated investments are classified as Level 3.

In May 2015, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2015-07, Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or its equivalent), as an amendment to Accounting Standards Codification (ASC) 820, Fair Value Measurement. The amendments in this ASU apply to reporting entities that elect to measure the fair value of an investment using the net asset value per share (or its equivalent) practical expedient, as the Fund does for its investments in Underlying Portfolios. The amendments in this ASU remove the requirement to categorize within the fair value hierarchy, as described above, all investments for which fair value is measured using the net asset value per share practical expedient.

Valuations reflected in this report are as of the report date. As a result, changes in valuation due to market events and/or issuer related events after the report date and prior to issuance of the report are not reflected herein.

The following table summarizes the valuation of the Fund’s investments by the above fair value hierarchy levels as of September 30, 2018:

| | | | | | | | | | | | | | | | |

Investments in Securities: | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | |

Short-Term Investments: | | | | | | | | | | | | | | | | |

Investment Companies | | $ | 82,250,000 | | | $ | – 0 | – | | $ | – 0 | – | | $ | 82,250,000 | |

Investments valued at NAV** | | | | | | | | | | | | | | | 959,656,842 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | | 82,250,000 | | | | – 0 | – | | | – 0 | – | | | 1,041,906,842 | |

Other Financial Instruments(a): | | | | | | | | | | | | | | | | |

Assets: | |

Total Return Swaps | | | – 0 | – | | | 1,430,935 | | | | – 0 | – | | | 1,430,935 | |

Liabilities: | |

Total Return Swaps | | | – 0 | – | | | (1,035,750 | ) | | | – 0 | – | | | (1,035,750 | ) |

| | | | | | | | | | | | | | | | |

Total(b) | | $ | 82,250,000 | | | $ | 395,185 | | | $ | – 0 | – | | $ | 1,042,302,027 | |

| | | | | | | | | | | | | | | | |

| (a) | Other financial instruments are derivative instruments, such as futures, forwards and swaps, which are valued at the unrealized appreciation/(depreciation) on the instrument. Other financial instruments may also include swaps with upfront premiums, options written and swaptions written which are valued at market value. |

| (b) | There were no transfers between any levels during the reporting period. |

| | |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 25 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

| ** | In May 2015, the Financial Accounting Standards Board issued an Accounting Standards Update, ASU 2015-07 (the “ASU”) which removes the requirement to categorize within the fair value hierarchy all investments for which fair value is measured using the net asset value per share practical expedient. The ASU is effective for annual periods beginning after December 15, 2015 and interim periods within those annual periods, with application of the amendments noted above retrospectively to all periods presented. The retrospective approach requires that an investment for which fair value is measured using the net asset value per share practical expedient be removed from the fair value hierarchy in all periods presented herein. Accordingly, the total investments of the Underlying Portfolios with a fair value of $959,656,842 have not been categorized in the fair value hierarchy. |

The Fund recognizes all transfers between levels of the fair value hierarchy assuming the financial instruments were transferred at the beginning of the reporting period.

2. Cash Committed

As of September 30, 2018, the Fund has committed to purchase the following Underlying Portfolios for effective date October 1, 2018:

| | |

Underlying Portfolios | | Amount Committed |

Indaba Capital Partners (Cayman), L.P* | | $ 15,000,000 |

| * | Investments paid in advance amounted to $15,000,000. |

3. Currency Translation

Assets and liabilities denominated in foreign currencies and commitments under forward currency exchange contracts are translated into U.S. dollars at the mean of the quoted bid and ask prices of such currencies against the U.S. dollar. Purchases and sales of portfolio securities are translated into U.S. dollars at the rates of exchange prevailing when such securities were acquired or sold. Income and expenses are translated into U.S. dollars at rates of exchange prevailing when accrued.

Net realized gain or loss on foreign currency transactions represents foreign exchange gains and losses from sales and maturities of foreign fixed income investments, holding of foreign currencies, currency gains or losses realized between the trade and settlement dates on foreign investment transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent amounts actually received or paid. Net unrealized currency gains and losses from valuing foreign currency denominated assets and liabilities at period end exchange rates are reflected as a component of net unrealized appreciation or depreciation of foreign currency denominated assets and liabilities.

4. Taxes

It is the Fund’s policy to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its investment company taxable income and net realized gains, if any, to

| | |

| 26 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

shareholders. Therefore, no provisions for federal income or excise taxes are required. The Fund intends to continue to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986 as they apply to regulated investment companies. By so complying, the Fund will not be subject to federal and state income taxes to the extent that all of its income is distributed.

In accordance with U.S. GAAP requirements regarding accounting for uncertainties in income taxes, management has analyzed the Fund’s tax positions taken or expected to be taken on federal and state income tax returns for all open tax years (the current and the prior three tax years) and has concluded that no provision for income tax is required in the Fund’s consolidated financial statements.

5. Investment Income and Investment Transactions

Income and capital gain distributions, if any, are recorded on the ex-dividend date. Investment transactions are accounted for on the trade date or effective date. Investment gains and losses are determined on the identified cost basis.

6. Expenses

Expenses included in the accompanying consolidated statements of operations do not include any expenses of the Underlying Portfolios.

7. Dividends and Distributions

Dividends and distributions to shareholders, if any, are recorded on the ex-dividend date. Income dividends and capital gains distributions are determined in accordance with federal tax regulations and may differ from those determined in accordance with U.S. GAAP. To the extent these differences are permanent, such amounts are reclassified within the capital accounts based on their federal tax basis treatment; temporary differences do not require such reclassification.

8. Offering Expenses

Offering expenses of $37,000 were deferred and amortized on a straight line basis over a one year period starting from September 21, 2018 (Subsidiary’s commencement of operations).

NOTE B

Management Fee and Other Transactions with Affiliates