UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

| Investment Company Act file number | 811-22680 | |

| Ultimus Managers Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

Karen Jacoppo-Wood

| Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246_ |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (513) 587-3400 | |

| Date of fiscal year end: | December 31 | |

| | | |

| Date of reporting period: | December 31, 2023 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

Westwood Salient MLP & Energy Infrastructure Fund

| Annual Report | December 31, 2023 |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | Investment Adviser: |

| | Westwood Management Corp. |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| WESTWOOD SALIENT MLP & ENERGY INFRASTRUCTURE FUND |

| |

| |

| TABLE OF CONTENTS |

| Shareholder Letter | 1 |

| Schedules of Investments | 10 |

| Statement of Assets and Liabilities | 13 |

| Statement of Operations | 15 |

| Statements of Changes in Net Assets | 16 |

| Financial Highlights | 18 |

| Notes to Financial Statements | 22 |

| Report of Independent Registered Public Accounting Firm | 35 |

| Liquidity Risk Management Program | 36 |

| About Your Fund’s Expenses | 37 |

| Other Information | 39 |

| Trustees and Officers of Ultimus Managers Trust | 40 |

| WESTWOOD SALIENT MLP & ENERGY INFRASTRUCTURE FUND (Unaudited) |

| |

December 31, 2023

Dear Shareholders,

Fed Flips Dovish While Global and U.S. Outlook Remain Questionable

The first half of 2023 was certainly an example of equity resilience, even through a major banking liquidity event, which by many accounts, could have gone much worse. Stocks even defied the summer doldrums, pushing higher into late July. Late summer finally brought a pullback in both stocks and fixed income, leaving investors with low expectations going into the fourth quarter as both markets reached their lows for the year near the end of October as investor sentiment and confidence continued to weaken. But as better-than-feared Q3 earnings results started to flood in, sentiment shifted. Resilience in the domestic jobs market and relatively stable home prices also helped buoy consumers’ confidence, which fueled better-than-expected consumer spending and economic growth late in the year. At the same time, inflation data softened faster than expectations and an abrupt shift in the Federal Reserve’s (Fed’s) messaging and interest rate trajectory led investors quickly back into the credit and debt markets in a big way.

As the year closed, the idea of a “soft landing” or perhaps no recession at all gained momentum, with the smart money betting on the first rate cut in March or May of 2024 (we believe March may be too aggressive). The broad-based rally to close 2023 certainly indicated that investor sentiment had shifted to positive territory, as volatility fell and many stocks — not just the mega-cap growth Magnificent Seven — achieved new highs. With 2023 firmly in the rear-view mirror, we now see that S&P 500 returns for the past five years are at 15.69%, well in excess of historical norms. Investors would be wise to note that what goes up typically comes down, often much quicker than we’d like.

And despite 40-year highs in interest rates, slowing/diverging global economies (and monetary policies), ongoing and new conflict abroad, and sticky above-trend prices, domestic consumers and investors have continued to (mostly) thrive, at least according to headline data. That statement comes with a bevy of caveats, but all-in-all, the capital markets are still pricing in a goldilocks scenario complete with a reduction in rates sooner rather than later. Whether that perfect scenario materializes or not is a debate for later.

As a result, we’ve experienced one of the more substantial rallies in the normally diverging stock and bond markets in recent years. In the bond market, after causing much pain for investors in the first 10 months of the year, the yield on the 10-year U.S. Treasury ended the year roughly where it started at about 3.9%. In the stock market, after some volatility, the S&P 500 ended the year ahead by about 25%.

Investors are certainly behaving more like it’s the beginning (expansion portion) of an economic cycle versus one that may be ending. At the time of writing, traders are already pricing in a near 75% chance that rates will fall at least 50 basis points (bps) by July 2024. That would mean that the 25 bps hike the Fed made at its meeting last July would be its last. It also suggests that market participants expect economic conditions to slow enough to move the inflationary needle.

In its November meeting, the Central Bank left its benchmark interest rate unchanged at a range of 5.25% to 5.50%, which was enough to appease dovish bulls. It went a step further in its final meeting in 2023 as Chairman Powell verbalized that its “policy rate is likely at or near its peak for this tightening cycle,” prompting even more buying across major stock and bond indexes.

Given the knowledge at hand, we are taking a slightly less optimistic stance versus the consensus on rate reductions, but believe the Federal Open Market Committee (FOMC) may still be able to pull off an increasingly difficult feat. The question on our minds now centers around what it would take to motivate the Fed to reverse course so quickly with inflation still far above trend. Logic denotes a dramatic economic downturn as the most probable trigger, but that theory counters the widely held “soft-landing” belief. Perhaps now you realize our minor conundrum. The economic resilience noted in 2023 was also fed in large by consumers’ continued drawdowns of excess savings stemming from the COVID-19 pandemic. Their actions were largely justified by relatively stable home values and more favorable

| WESTWOOD SALIENT MLP & ENERGY INFRASTRUCTURE FUND (Unaudited) |

| |

home equity (loan-to-value) ratios than the typical American experienced just ahead of the Great Recession. Any pronounced destabilization or correction of housing prices or a major riff in the labor market could have potentially nasty effects on what we feel is an overly confident environment.

The Tale of the Tape

The S&P 500 has produced a positive return in 67 of the past 93 years; over those years, markets have only produced two consecutive down years 11 times. This supports the theory that stocks generally fall faster than they rise and don’t tend to have multiple consecutive down years (that theory has a 12%-win rate). Put simply, 2023 wasn’t a good year to bet bearish.

For U.S. stocks, the technology sector, centered around artificial intelligence as a catalyst, has been leading the charge for much of the year, with a narrow group of major tech companies reporting robust earnings, and thus driving their stock prices higher. But they were not completely alone, as growth companies at large surged with continued “risk-on” sentiment, as evidenced by the 42.69% (2023) return in the Russell 1000 Growth Index. Conversely, traditional sectors like utilities and real estate have experienced sluggish growth due to increasing interest rates and have thus underperformed. Overall, equity strength reflects the relatively strong earnings of a fair number of constituent companies. Market volatility remained rather tame throughout the year, also suggesting investor confidence in the longevity of the current economic expansion. We are a little less optimistic that volatility will remain low in the coming quarters.

Within the economy, U.S. consumer-price index (CPI) readings fell to the 3% range as the year closed, showing the slowest rate of increase since 2021 and leading to hope that the inflation monster may have finally been slain. Consumer sentiment continued to decline, though spending in the critical holiday season seemed to be elevated over previous years. Consumer debt levels remain elevated, though, and high interest rates on that consumer debt could spell trouble for this critical component of the economy.

The “Powell Pivot” sent bonds on a furious rally to close out the year. Bonds were looking to log a third consecutive year of negative returns until the end of October, when the Treasury decided to issue more short-term T-Bills as opposed to longer-dated bonds. This, followed by Fed Chairman Powell’s statements on November 1 that were interpreted as dovish — moving their stance from “higher for longer” to a more accommodative position — caused the bond market to rally to the end of the year.

Ten-year Treasury yields touched 5% intraday in late October, but then plunged over 100 bps to close the year at 3.88%. Two-year Treasuries fell nearly as much, as they had reached a peak of 5.19% in mid-October, falling to 4.23% to end the year. After advancing to nearly a 5% yield in the third quarter, 10-year Treasury bond yields turned sharply lower during the fourth quarter and finished 2023 in roughly the same place as they began, at 3.88%. For the quarter, most of the Treasury curve rallied with the 2-year yield down 79 bps and 30-year bonds down 67 bps. The substantial decline in real yields — the inflation-adjusted cost of borrowing — drove most of the steep drop in nominal yields, largely due to investor expectations for future Fed easing.

Corporate credit also advanced in the fourth quarter, as investment grade bonds added 8.15%, while high yield bonds gained 7.17%. The spread between corporate and Treasury yields declined in the quarter, indicating optimism about defaults and continued economic gains into the new year. Overall, the broad market Bloomberg U.S. Aggregate Bond Index gained 6.82% for the quarter, ending the year with a positive return of 5.53%.

Most global fixed-income assets lost ground over the quarter but remained above recent troughs. Volatility in the debt sector remains elevated and its future is heavily dependent on how the Fed plays its hand into 2024. Over the last three months, U.S. Treasury yields also moved higher (prices lower) across all segments of the yield curve, particularly one- and two-month bills. And though volatility may persist, there could be a tremendous intermediate-term opportunity for fixed-income investors here.

| WESTWOOD SALIENT MLP & ENERGY INFRASTRUCTURE FUND (Unaudited) |

| |

After two-quarters of a gross domestic product (GDP) contraction in mid-2023, GDP readings have remained positive, though they continue to slow as rates continue to be highly restrictive. U.S. GDP increased at an annualized rate of 2.1% in Q2, down just 0.1 percentage point from the 2.2% rise in the year’s first three months. The largest increases for the second quarter were in nonresidential fixed investment (purchases of both nonresidential structures and equipment and software), consumer spending, and state and local government spending. These gains offset reductions in exports and residential fixed investments (purchases of private residential structures and residential equipment that property owners use for rentals). The marginal decline in the GDP growth rate for the second quarter compared to the first three months of the year was due to slowdowns in consumer and federal government spending, as well as a decrease in exports.

Domestic price pressures remain, but what was a hot energy market over the summer has begun to cool (metaphorically and actually) as fall takes hold. This has helped reduce overall inflationary effects on consumers. The CPI rose 0.6% in August, following a monthly increase of 0.2% in July. The CPI was up 3.7% year-over-year, up from the 3.2% annual rise in July. September prices increased 0.4% on the month and 3.7% from a year ago, while core prices were up 0.3% for the month and 4.1% on a 12-month basis. Long-term inflationary trends have been moving lower, especially at the core, but headline CPI has been a bit more stubborn. Falling fuel and natural gas prices should help non-core readings going into 2024.

With Q3 earnings reported, 80% of S&P 500 constituents surpassed earnings per share (EPS) expectations vs. S&P Capital IQ Estimates, up 1% from Q2 (79%), up 3% from Q1 (77%) and well above Q4 2022 (68%). Year-over-year, the S&P 500 recorded an EPS growth rate of 13.9%, increasing significantly from 4.3% in Q2 and 2.6% in Q1. The strongest growth year-over-year since Q3 2022. Communication Services was the highest performing sector year-over-year, recording a 63.0% growth rate. The sector dethroned Consumer Discretionary, which had been the highest growth sector the last two quarters.

The Road Ahead

An increasingly accommodative Fed rate trajectory can certainly be considered a bullish tailwind for 2024. At this point, it’s clear that interest rates have plateaued and easing financial conditions are already making their way into the markets. Core inflation can continue to push lower, with prices for shelter/housing and energy falling as U.S. production ramps up and global demand softens — all good things at a macro level. But from a valuation perspective, we must remember that interest rate cuts have thus far been telegraphed by the FOMC and already priced (or overpriced) into the market.

Overall, consumers seem optimistic, but many have depleted savings and are increasingly levered with high-rate credit card debt. And while easing inflation is good for consumers, it reduces pricing power and margin growth for companies. Earnings growth should be accelerating into 2024 — coming off a low base in 2023 — and economic growth has been stronger than expected, driven by better real income growth and still-low unemployment. With ongoing concerns about employment and wage growth, the result may mean slower GDP growth overall in 2024 and 2025.

It appears that the earnings contraction is already behind us, with earnings likely bottoming in the third quarter of 2023. Another important milestone to note is that the S&P hit its all-time high almost two years ago, in early January 2022 (which technically marked the starting point of that year’s bear market). Two years is a long time to remain below the previous all-time high, unless we are in a recession. Looking at all bear markets historically, stocks have taken a median of 48 months (about four years) to travel back to their preceding peak. But bear markets that do not include a recession like we experienced in 2022 have historically taken only 11 months to recover. The question now will be just how accommodative the Fed will get and what impact geopolitical risks and the coming election will have on market behavior.

| WESTWOOD SALIENT MLP & ENERGY INFRASTRUCTURE FUND (Unaudited) |

| |

All in all, we remain cautiously optimistic, the same sentiment noted as we entered 2023, but current opportunities are obviously far different.

Investors must remain vigilant, agile and active. We believe that a highly tactical, vertical approach will likely yield the best returns, as we expect a continued increase in market dislocations and further divergence of the correlations that market participants have observed over the last decade or so. We still believe that recession isn’t completely off the table, but the U.S. economy has a very high probability of experiencing slower growth, increased labor market deterioration, and subsequently, lower inflation as we move into 2024. Fixed income is likely to continue to benefit, with a focus on high quality, investment-grade paper across most durations. We are still of the opinion that high-yield paper offers less advantageous risk/reward at this point and would remain underweight to that sector.

Given recent economic data and Fed commentary, markets have priced out any rate cuts later this year and data suggests a prolonged plateau in rates, with perhaps one more high of 25 bps. We are less optimistic that rates will fall sooner than later and don’t see a decline in rates occurring until the back half of 2024. Oddly enough, investors remain optimistic about riskier, high-yield debt as yield spreads remain relatively tame. That could be a trap for investors if the economy does turn more sour than expected. Our current outlook suggests investors may best benefit from eventual rate declines by moving further out on the curve (increasing duration) with a focus on high-quality corporate and government credit.

We expect U.S. growth to slow to 1.9% year-over-year in 2024 and further down to 1.4% in 2025, down from an estimated 2.4% in 2023. Higher interest rates, tighter monetary policy and a slowing labor market should continue to detract from the overall economy and financial system. Economists also expect U.S. consumer spending to begin to slow more meaningfully in 2024 and 2025, driven by a cooling labor market, which weighs on real disposable income, and elevated rates putting further pressure on debt service costs. Among the bright spots: Business investment should finally turn positive in the second half of 2024 after two years of decline.

Emerging markets present a mixed economic picture, with expansion in India, Indonesia and the Philippines offset by tepid growth in China, which has disappointed on post-pandemic reopening recovery and growth expectations. We see fairly stable but less robust growth in China, but we expect the government to respond with policies to stimulate the economy.

As economic growth decelerates and the probability of a recession increases, quality characteristics, which are a key attribute of our strategies, are likely to be an important driver of excess returns. We remained focused on stocks’ returns to shareholders in the form of dividends and stock buybacks as important factors in our analysis, especially in a difficult market environment. We continue to favor companies with pricing power to manage through an inflationary environment, either to reduce the impact of input costs or to pass those costs on to their customers.

The current market environment continues to produce dislocations concerning valuation and increased levels of fundamental skepticism that play to our strength. Now, more than ever, highly tactical and surgical investment techniques, with properly hedged and balanced allocations, will be needed to reduce volatility and produce alpha. As it has for over 30 years, our investment process continues to seek out mispriced opportunities where fundamental analysis can uncover value being missed in the current market environment while maintaining a strong culture of risk management with a focus on mitigating potential downside risks.

Thank you for your trust.

Sincerely,

The Investment Team,

Westwood Funds

| WESTWOOD SALIENT MLP & ENERGY INFRASTRUCTURE FUND (Unaudited) |

| |

Westwood Salient MLP & Energy Infrastructure Fund

The performance of the Westwood Salient MLP & Energy Infrastructure Fund for the period ended December 31, 2023, was as follows:

| | 6 Months | Fiscal Year |

| Westwood Salient MLP & Energy Infrastructure Fund – Institutional Shares (SMLPX) | 8.19% | 13.97% |

| Westwood Salient MLP & Energy Infrastructure Fund – A Shares (SMAPX)* | 8.00% | 13.75% |

| Westwood Salient MLP & Energy Infrastructure Fund – C Shares (SMFPX) | 7.78% | 13.12% |

| Westwood Salient MLP & Energy Infrastructure Fund – Ultra Shares (SMRPX) | 8.22% | 14.22% |

| Alerian Midstream Energy Select Index | 9.10% | 15.79% |

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. The Adviser has contractually agreed to waive fees and reimburse expenses until April 30, 2024.

The Fund underperformed the benchmark, delivering returns of 13.97% (I Shares) in the period while the benchmark returned 15.79%. The energy infrastructure industry had an eventful 2023. Consolidation and economic fears marked the first five months of the year, while growth and strong fundamentals resulted in a strong finish through fiscal year end in December.

First quarter market dynamics were driven by macro-oil expectations and the fear of an impending recession. During the past two recessions, in 2009 and 2020, oil demand declined globally. Investor fear of a recession in 2023 led to a 20%+ oil price correction peak to trough during the first quarter of the year. We would note that global demand doesn’t always decline during a U.S. recession; for example, in 2001 and 1991, global demand actually grew while the U.S. was in recession. Fortunately for the energy markets, OPEC+ continued to reiterate their commitment to keeping oil prices stable, and, on April 2, 2023, the cartel left no doubt of its commitment as it cut production by 1.15 million barrels per day (mmbpd). The move surprised many, but frankly, we believed at the time that the data was indicating the market was 1-2 mmbpd oversupplied. The 1.15 mmbpd cut, plus Russia’s extension of its 500,000-bpd cut from earlier in the year and a unilateral, additional 1.0 mmbpd cut from Saudi Arabia, led to a strong rebound in oil prices during the second quarter. Looking ahead, we believe that oil prices at $70 to $90 are very supportive of the U.S. energy industry and, at the same time, are not overly onerous for consumers.

While the first quarter was macro driven, the second quarter saw positive company-level developments, which helped the group rally through quarter-end. First, legislation to complete the long-delayed Mountain Valley Pipeline (MVP) was included in the debt ceiling bill (aka, Fiscal Responsibility Act of 2023). The legislation directed the U.S. Army Corps of Engineers to issue remaining water crossing permits within 21 days of passage. With permits issued, the MVP pipeline can complete construction by year-end. The second big development during the quarter happened on Mother’s Day, when Oneok (OKE) agreed to acquire Magellan Midstream Partners, L.P. (MMP) for a 22% premium to the prior close. Consideration for the deal was $25.00 in cash and 0.667 shares of OKE for every unit of MMP owned. This was a surprise marriage to us, as MMP operates in the crude and refined products markets while OKE is one of the major players in the natural gas liquids (NGL) value chain. Strategically, it makes sense in terms of diversifying OKE’s operations, and perhaps more importantly, it could provide the company with a long-sought entry into NGL exports since MMP has crude oil export facilities along the Gulf Coast that may be expandable to include NGLs. Investors frequently ask us if we believe this is the beginning of an M&A wave, and our answer is that we’ve been in a consolidation wave for a few years now, but it is very difficult to predict when or if large-scale transactions will take place going forward.

| WESTWOOD SALIENT MLP & ENERGY INFRASTRUCTURE FUND (Unaudited) |

| |

The third quarter was somewhat of a continuation of the second quarter, with additional acquisitions and divestiture (A&D) announcements from 1) TC Energy, 2) Crestwood & Energy Transfer, 3) Holly Energy Partners and 4) Enbridge. Some announcements were met with investor skepticism while others were viewed favorably.

| 1) | In late July, TC Energy Corp (TRP) sold a 40% stake in its Columbia Gas System for CAD $5.2 billion to fund its capital program, but the sale was viewed negatively by investors who expected a higher valuation multiple, causing the stock to fall about 7% over the next two days. About a week later, the company then announced plans to spin off its liquids business into a separate company by mid-2024, which investors again viewed skeptically as an inability to sell the assets, and the stock once again sold off 7% to 8% over the subsequent two days. |

| 2) | A mere two weeks after the TRP news, Energy Transfer LP (ET) announced an all-equity, no premium acquisition of Crestwood Equity Partners on August 16. This transaction was viewed positively by investors, as it showed ET’s management being disciplined and not overpaying, sending ET’s stock up almost 12% by the end of the quarter. ET was one of the Fund’s largest holdings throughout the year, and we continue to have confidence that ET management can continue to deliver value to shareholders as we look forward into 2024 and beyond. |

| 3) | Also on August 16, Holly Energy Partners (HEP) agreed to be acquired by parent company HF Sinclair in a taxable corporate simplification transaction. The Fund did not have a position in HEP at that time. |

| 4) | Finally, in the largest transaction of the quarter, Enbridge (ENB) announced on September 5 it would acquire three gas utilities from Dominion Energy for CAD $19 billion, expanding ENB’s utility franchise but issuing discounted shares and seeing its stock price stagnate around the offering price through quarter-end. The Fund increased its holdings in ENB during the quarter to take advantage of the decline in stock price. |

Finally, in October, we were once again reminded about the importance of energy security as the world witnessed the unspeakable acts of terrorism upon Israel by Hamas. We have already seen a significant humanitarian and geopolitical impact in the region, and it does not seem that there will be a quick resolution. We are not experts on Middle East politics, so we won’t comment on the potential long-term implications to others, but many have asked about the near-term ramifications for oil and natural gas. Natural gas production in the region is much more impacted than crude oil. There is a large natural gas basin, the Levant, in the eastern Mediterranean Sea off the coast of Israel with two meaningful zones, Tamar and Leviathan, both of which are operated by Chevron. Following the attack, Israel ordered Chevron to shut down the Tamar field, which is only about 12 miles from the Gaza Strip. This field produces roughly 1 billion cubic feet per day (Bcf/d), which is not very meaningful in the context of about 400 Bcf/d of global production. Some European markets did see price spikes in the immediate aftermath of the production halt, but natural gas prices are lower today than they were in September. Israel produces a very small amount of crude oil (~5,000 bpd), so there is not an apparent threat to global oil supply demand balances. However, if this ongoing war turns into a regional conflict that pulls in Iran, oil supply could be severely impacted.

The MLP and Energy Infrastructure Fund (SMLPX) returned 13.97% for the trailing year ending December 31, 2023. The Fund was about 1.82% below the benchmark return of 15.79%. For the period, negative attribution was driven by the Fund’s overweight to the renewables, which generated a negative 317 bps of attribution for the portfolio. The negative performance from renewables was somewhat offset by the Fund’s overweight to Gathering & Processing and LNG, and underweight to Natural Gas Pipelines. Positive attribution was 143 bps, 87 bps and 99 bps from each of those sectors, respectively.

Focusing on individual securities, the largest positive attributor was the Fund’s overweight in Equitrans Midstream (ETRN), which delivered 79 bps of positive attribution to the portfolio. ETRN is the owner of the MVP pipeline, and the stock was up 65% for the year as investors became more confident that the project would be completed.

| WESTWOOD SALIENT MLP & ENERGY INFRASTRUCTURE FUND (Unaudited) |

| |

Additionally, the Fund’s underweight to TC Energy (TRP) also generated positive attribution of 65 basis points (bps) for the portfolio. We believe that high leverage and negative free cashflow generation were the main drivers of underperformance for the company during 2023.

Performance detractors during the year were the Fund’s overweight allocation to SolarEdge and Enphase, both renewable solar companies. The solar industry experienced a significant slowdown in 2023 as higher interest rates made the funding of solar projects meaningfully more expensive and difficult. SolarEdge detracted 133 bps, and Enphase detracted 81 bps to the portfolio. While we’re disappointed by the performance of the Fund’s energy allocation in general, we continue to believe that the secular opportunities in renewable energy will remain robust in the years ahead.

As we look forward to 2024 and beyond, we remain constructive on the energy infrastructure industry as the industry remains capital disciplined, focused on shareholder returns and positioned for future oil and gas volume growth. The industry today is generating ~6% in dividend yields, growing dividends at about 5% per year and repurchasing about 1% of outstanding stock on an annual basis. We believe these metrics will allow for healthy compounded value creation in the coming years.

Disclosures

To determine if a Fund is an appropriate investment for you, carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and other information can be found in the Fund’s prospectus, which may be obtained by calling 1.877.386.3944. Read the prospectus carefully before investing or sending money.

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month end are available by calling 1.877.386.3944.

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus, visit the Fund’s website at westwoodfunds.com or call 1.877.386.3944, and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Fund is distributed by Ultimus Fund Distributors, LLC.

The Letter to Shareholders seeks to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Fund that are discussed in the Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolios of the Fund, may be sold at any time, and may no longer be held by the Fund. For a complete list of securities held by the Fund as of December 31, 2023, please see the Schedules of Investments section of this Report. The opinions of the Fund’s adviser with respect to those securities may change at any time.

Statements in the Letter to Shareholders that reflect projections or expectations for future financial or economic performance of the Fund and the market in general and statements of the Fund’s plans and objectives for future operations are forward-looking statements. No assurance can be given that actual results or events will not differ materially from those projected, estimated, assumed, or anticipated in any such forward-looking statements. Important factors that could result in such differences, in addition to factors noted with such forward-looking statements include, without limitation, general economic conditions, such as inflation, recession, and interest rates. Past performance is not a guarantee of future results.

| WESTWOOD SALIENT MLP & ENERGY INFRASTRUCTURE FUND (Unaudited) |

| |

Alerian Midstream Energy Select Index (AMEIX) is a composite of North American midstream energy infrastructure companies that are engaged in activities involving energy commodities. The capped, float-adjusted, capitalization-weighted index is disseminated in real time on a price-return basis.

Alpha is the measure of risk-adjusted performance.

Compound Annual Growth Rate is the rate of return that would be required for an investment to grow from its beginning balance to its ending balance, assuming the profits are reinvested at the end of each year of the investment’s lifespan.

FTSE EPRA Nareit Developed Index is designed to track the performance of listed real estate companies and REITs worldwide.

HFRX Equity Hedge Index comprises private funds with strategies that maintain both long and short positions primarily in equity securities and equity derivatives.

ICE BofA Fixed Rate Preferred Securities Index consists of investment-grade, fixed and fixed-to-floating rate U.S. dollar-denominated preferred securities.

MSCI World Index is a free float-adjusted market capitalization index designed to measure equity market performance in the global developed markets.

Russell 2500 Value measures the performance of the small to mid-cap value segment of the U.S. equity universe. It includes those Russell 2500 companies with lower price-to-book ratio and lower forecasted growth values.

S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure the performance of the broad domestic stock market through changes in the aggregate market value of 500 stocks representing all major industries.

| WESTWOOD SALIENT MLP & ENERGY INFRASTRUCTURE FUND (Unaudited) |

| |

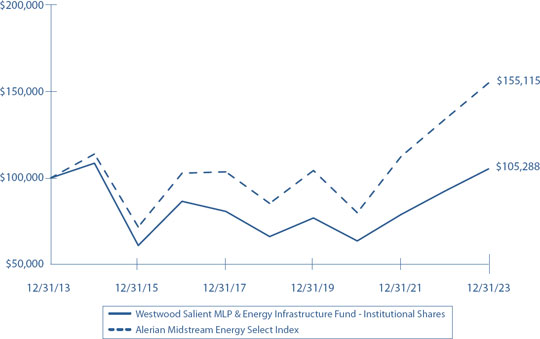

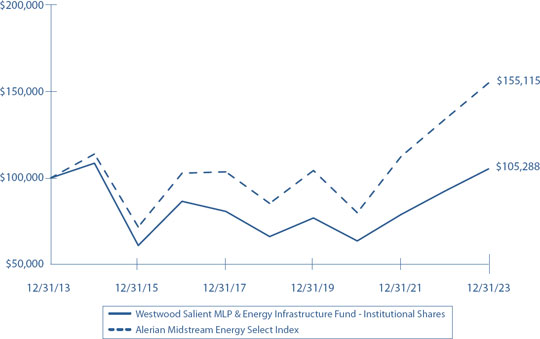

Comparison of the Change in Value of a $100,000 Investment in Westwood Salient MLP & Energy

Infrastructure Fund - Institutional Shares (a) versus the Alerian Midstream Energy Select Index

Average Annual Total Returns (b)

(for the years ended December 31, 2023) |

| | | | | Since Inception |

| | 1 Year | 5 Year | 10 Year | (1/4/2016) |

| Institutional Shares | 13.97% | 9.78% | 0.52% | N/A |

| A Class Shares with sales charge | 10.29% | 8.32% | -0.26% | N/A |

| A Class Shares without sales charge | 13.75% | 9.55% | 0.31% | N/A |

| C Class Shares with CDSC | 12.12% | 8.73% | -0.46% | N/A |

| C Class Shares without CDSC | 13.12% | 8.73% | -0.46% | N/A |

| Ultra Shares | 14.22% | 9.90% | N/A | 7.10% |

| Alerian Midstream Energy Select Index | 15.79% | 12.71% | 4.49% | 10.07% |

| (a) | The graph is based on Institutional Shares. Performance for A Class Shares would have been lower because it is subject to a maximum front-end sales charge of 4.00% (effective December 29, 2023; prior to December 29, 2023 the maximum front-end sales charge was 3.00%) and additional annual distribution expenses of 0.25%. Performance for C Class Shares and Ultra Shares would vary due to differences in fee structures. |

| (b) | The Fund’s total returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. If the Adviser had not limited certain expenses, the Fund’s total return would have been lower. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change because it is actively managed and should not be considered recommendations to buy individual securities. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

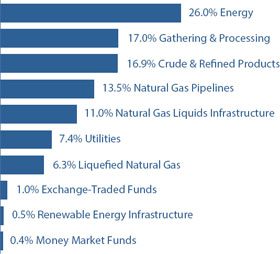

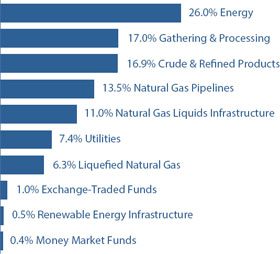

| WESTWOOD SALIENT MLP & ENERGY INFRASTRUCTURE FUND |

| DECEMBER 31, 2023 |

| |

| Sector Weightings (Unaudited)† |

| † | Percentages are based on total investments. |

| SCHEDULE OF INVESTMENTS |

| MASTER LIMITED PARTNERSHIPS — 35.0% (a) |

| | | Shares | | | Value | |

| Crude & Refined Products — 13.2% | | | | | | | | |

| Genesis Energy, L.P. | | | 2,292,518 | | | $ | 26,547,358 | |

| MPLX, L.P. | | | 864,230 | | | | 31,734,526 | |

| Plains GP Holdings, L.P. - Class A (b) | | | 3,727,101 | | | | 59,447,261 | |

| | | | | | | | 117,729,145 | |

| Energy — 11.7% | | | | | | | | |

| EMG Utica I Offshore Co-Investment, L.P. *(c)(d)(e) | | | 16,000,000 | | | | 15,345,343 | |

| Energy Transfer, L.P. | | | 6,308,506 | | | | 87,057,383 | |

| Kimbell Royalty Partners, L.P. (b) | | | 148,200 | | | | 2,230,410 | |

| | | | | | | | 104,633,136 | |

| Gathering & Processing — 4.2% | | | | | | | | |

| Hess Midstream, L.P. - Class A | | | 613,016 | | | | 19,389,696 | |

| Western Midstream Partners, L.P. | | | 634,258 | | | | 18,558,389 | |

| | | | | | | | 37,948,085 | |

| Utilities — 5.9% | | | | | | | | |

| Enterprise Products Partners, L.P. | | | 1,631,707 | | | | 42,995,480 | |

| NextEra Energy Partners, L.P. | | | 302,569 | | | | 9,201,123 | |

| | | | | | | | 52,196,603 | |

| | | | | | | | | |

| Total Master Limited Partnerships | | | | | | | | |

| (Cost $218,242,420) | | | | | | $ | 312,506,969 | |

| | | | | | | | | |

| MLP RELATED COMPANIES — 63.6% | | | | | | | | |

| Crude & Refined Products — 3.7% | | | | | | | | |

| Enbridge, Inc. | | | 260,935 | | | | 9,398,879 | |

| Gibson Energy, Inc. | | | 1,542,531 | | | | 23,435,360 | |

| | | | | | | | 32,834,239 | |

| MLP RELATED COMPANIES — continued |

| | | Shares | | | Value | |

| Energy — 14.3% | | | | | | | | |

| Antero Resources Corporation (b) | | | 249,099 | | | $ | 5,649,565 | |

| Array Technologies, Inc. (b) | | | 235,703 | | | | 3,959,810 | |

| Atlantica Sustainable Infrastructure plc | | | 420,685 | | | | 9,044,728 | |

| Diamondback Energy, Inc. | | | 58,281 | | | | 9,038,217 | |

| DT Midstream, Inc. | | | 421,628 | | | | 23,105,214 | |

| Enphase Energy, Inc. (b) | | | 39,306 | | | | 5,193,895 | |

| EOG Resources, Inc. | | | 74,083 | | | | 8,960,339 | |

| Hess Corporation (f) | | | 63,505 | | | | 9,154,881 | |

| Kinetik Holdings, Inc. | | | 692,261 | | | | 23,121,517 | |

| NextDecade Corporation (b) | | | 382,930 | | | | 1,826,576 | |

| Pembina Pipeline Corporation | | | 623,456 | | | | 21,459,356 | |

| Shoals Technologies Group, Inc. - Class A (b) | | | 288,745 | | | | 4,487,097 | |

| Viper Energy, Inc. (b) | | | 72,161 | | | | 2,264,412 | |

| | | | | | | | 127,265,607 | |

| Gathering & Processing — 12.7% | | | | | | | | |

| Antero Midstream Corporation | | | 1,815,225 | | | | 22,744,769 | |

| EnLink Midstream, LLC (b) | | | 1,397,949 | | | | 16,999,060 | |

| Targa Resources Corporation | | | 852,426 | | | | 74,050,247 | |

| | | | | | | | 113,794,076 | |

| Liquefied Natural Gas — 6.3% | | | | | | | | |

| Cheniere Energy, Inc. | | | 328,900 | | | | 56,146,519 | |

| | | | | | | | | |

| Natural Gas Liquids Infrastructure — 11.0% | | | | | | | | |

| Keyera Corporation | | | 620,796 | | | | 15,007,205 | |

| ONEOK, Inc. | | | 888,355 | | | | 62,380,287 | |

| Pembina Pipeline Corporation | | | 602,429 | | | | 20,742,214 | |

| | | | | | | | 98,129,706 | |

| Natural Gas Pipelines — 13.5% | | | | | | | | |

| Equitrans Midstream Corporation | | | 4,051,080 | | | | 41,239,994 | |

| Kinder Morgan, Inc. (f) | | | 1,283,930 | | | | 21,343,694 | |

| TC Energy Corporation | | | 129,214 | | | | 5,050,975 | |

| Williams Companies, Inc. (The) | | | 1,530,750 | | | | 53,316,023 | |

| | | | | | | | 120,950,686 | |

| Renewable Energy Infrastructure — 0.6% | | | | | | | | |

| First Solar, Inc. (b) | | | 29,052 | | | | 5,005,079 | |

| | | | | | | | | |

| Utilities — 1.5% | | | | | | | | |

| Clearway Energy, Inc. - Class C | | | 335,248 | | | | 9,195,853 | |

| Fluence Energy, Inc. - Class A (b) | | | 184,185 | | | | 4,392,812 | |

| | | | | | | | 13,588,665 | |

| | | | | | | | | |

| Total MLP Related Companies | | | | | | | | |

| (Cost $385,176,612) | | | | | | $ | 567,714,577 | |

The accompanying notes are an integral part of the financial statements.

| WESTWOOD SALIENT MLP & ENERGY INFRASTRUCTURE FUND |

| DECEMBER 31, 2023 |

| |

| SPECIAL PURPOSE ACQUISITION COMPANIES — 0.0% (g) |

| | | Shares | | | Value | |

| Renewable Energy Infrastructure — 0.0% (g) | | | | | | | | |

TortoiseEcofin Acquisition Corporation III - Founder Shares (b)(c)(d)(e)

(Cost $315) | | | 104,850 | | | $ | 315 | |

| | | | | | | | | |

| EXCHANGE-TRADED FUNDS — 1.0% | | | | | | | | |

SPDR S&P Oil & Gas Exploration & Production ETF (b)

(Cost $8,851,354) | | | 64,070 | | | $ | 8,771,824 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 0.4% | | | | | | | | |

First American Government Obligations Fund - Class U, 5.23% (h)

(Cost $3,598,808) | | | 3,598,808 | | | $ | 3,598,808 | |

| | | | | | | | | |

| Investments at Value — 100.0% | | | | | | | | |

| (Cost $615,869,509) | | | | | | $ | 892,592,493 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets— (0.0%) (g) | | | | | | | (354,401 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 892,238,092 | |

plc - Public Limited Company

| * | EMG Utica I Offshore Co-Investment, L.P. is a Co-Investment of MarkWest Utica EMG, LLC. |

| (a) | The security is considered a non-income producing security as any distributions received during the last 12 months (if applicable) are treated as return of capital per Generally Accepted Accounting Principles. |

| (b) | Non-income producing security. |

| (c) | These securities are exempt from registration under the Securities Act of 1933 and are subject to legal restrictions on resale. These securities generally may be resold in transactions exempt from registration, normally to qualified institutional buyers, or to the public if the securities are subsequently registered. |

| (d) | Security determined to be illiquid under the procedures approved by the Fund’s Board of Trustees and represents 1.7% of net assets. |

| (e) | Level 3 security in accordance with fair value hierarchy. |

| (f) | All or a portion of the security covers a written call option. |

| (g) | Percentage rounds to less than 0.1%. |

| (h) | The rate shown is the 7-day effective yield as of December 31, 2023. |

The accompanying notes are an integral part of the financial statements.

| WESTWOOD SALIENT MLP & ENERGY INFRASTRUCTURE FUND |

| DECEMBER 31, 2023 |

| |

| SCHEDULE OF OPEN WRITTEN OPTION CONTRACTS |

| WRITTEN OPTION CONTRACTS |

| | | | | | | | | | | | Value of | |

| | | Strike Price | | | Contracts | | | Notional Value | | | Options | |

| Call Option Contracts | | | | | | | | | | | | | | | | |

| Hess Midstream, L.P., 01/19/24 | | $ | 32.00 | | | | 1,727 | | | $ | 5,462,501 | | | $ | 77,715 | |

| Kinder Morgan, Inc., 01/19/24 | | | 18.00 | | | | 11,854 | | | | 20,910,456 | | | | 177,810 | |

| Total Written Option Contracts | | | | | | | | | | | | | | | | |

| (Premiums $334,585) | | | | | | | | | | $ | 26,372,957 | | | $ | 255,525 | |

The average monthly notional value of written option contracts during the year ended December 31, 2023 was $155,836,026.

The accompanying notes are an integral part of the financial statements.

| WESTWOOD SALIENT MLP & ENERGY INFRASTRUCTURE FUND |

| DECEMBER 31, 2023 |

| |

| |

| STATEMENT OF ASSETS AND LIABILITIES |

| ASSETS | | | |

| Investments in securities: | | | | |

| At cost | | $ | 615,869,509 | |

| At value (Note 2) | | $ | 892,592,493 | |

| Cash | | | 260,358 | |

| Receivable for capital shares sold | | | 610,608 | |

| Receivable for investment securities sold | | | 1,739,687 | |

| Dividends and interest receivable | | | 966,994 | |

| Other assets | | | 293,953 | |

| Total assets | | | 896,464,093 | |

| LIABILITIES | | | | |

| Written call options, at value (Notes 1 & 4) (premiums received $334,585) | | | 255,525 | |

| Payable for capital shares redeemed | | | 310,873 | |

| Payable for investment securities purchased | | | 2,673,344 | |

| Payable to Adviser, net of waivers (Note 4) | | | 371,212 | |

| Payable to administrator (Note 4) | | | 32,594 | |

| Payable for tax expense (Note 2) | | | 300,000 | |

| Accrued administrative servicing fees — Institutional Shares (Note 4) | | | 122,149 | |

| Accrued administrative servicing fees — A Class Shares | | | 24,921 | |

| Accrued administrative servicing fees — C Class Shares | | | 2,762 | |

| Payable for distribution fees — A Class Shares (Note 4) | | | 62,219 | |

| Payable for distribution fees — C Class Shares (Note 4) | | | 33,776 | |

| Other accrued expenses | | | 36,626 | |

| Total liabilities | | | 4,226,001 | |

| | | | | |

| NET ASSETS | | $ | 892,238,092 | |

| NET ASSETS CONSIST OF: | | | | |

| Paid-in capital | | $ | 1,291,939,527 | |

| Accumulated deficit | | | (399,701,435 | ) |

| NET ASSETS | | $ | 892,238,092 | |

The accompanying notes are an integral part of the financial statements.

| WESTWOOD SALIENT MLP & ENERGY INFRASTRUCTURE FUND |

| DECEMBER 31, 2023 |

| |

| |

| STATEMENT OF ASSETS AND LIABILITIES |

| NET ASSET VALUE PER SHARE: | | | |

| INSTITUTIONAL SHARES | | | | |

| Net assets applicable to Institutional Shares | | $ | 739,541,959 | |

| Institutional Shares of beneficial interest outstanding | | | 94,397,832 | |

| Net asset value, offering price and redemption price per share (Note 1) | | $ | 7.83 | * |

| A CLASS SHARES | | | | |

| Net assets applicable to A Class Shares | | $ | 134,627,428 | |

| A Class Shares of beneficial interest outstanding | | | 17,078,256 | |

| Net asset value and redemption price per share (Note 1) | | $ | 7.88 | * |

| Maximum sales charge | | | 4.00 | % |

| Maximum offering price per share | | $ | 8.21 | * |

| C CLASS SHARES | | | | |

| Net assets applicable to C Class Shares | | $ | 13,741,178 | |

| C Class Shares of beneficial interest outstanding | | | 1,751,583 | |

| Net asset value, offering price and redemption price per share (Note 1) | | $ | 7.85 | |

| ULTRA SHARES | | | | |

| Net assets applicable to Ultra Shares | | $ | 4,327,527 | |

| Ultra Shares of beneficial interest outstanding | | | 552,254 | |

| Net asset value, offering price and redemption price per share (Note 1) | | $ | 7.84 | |

| * | Includes adjustments in accordance with accounting principals generally accepted in the United States and, consequently, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

The accompanying notes are an integral part of the financial statements.

| WESTWOOD SALIENT MLP & ENERGY INFRASTRUCTURE FUND |

| FOR THE YEAR ENDED DECEMBER 31, 2023 |

| |

| |

| STATEMENT OF OPERATIONS |

| INVESTMENT INCOME | | | | |

| Distributions from master limited partnerships | | $ | 19,939,537 | |

| Less return of capital on distributions | | | (19,939,537 | ) |

| Dividends from master limited partnership related companies (net of foreign withholding tax of $1,344,029) | | | 31,102,659 | |

| Less return of capital on dividends | | | (9,165,521 | ) |

| Dividend income | | | 457,113 | |

| Interest income | | | 2 | |

| Total investment income | | | 22,394,253 | |

| | | | | |

| EXPENSES | | | | |

| Investment management fees (Note 4) | | | 8,141,323 | |

| Administrative service plan fees - Institutional Shares (Note 4) | | | 641,419 | |

| Administrative service plan fees - A Class Shares (Note 4) | | | 114,007 | |

| Administrative service plan fees - C Class Shares (Note 4) | | | 9,880 | |

| Distribution fees - A Class Shares (Note 4) | | | 347,520 | |

| Distribution fees - C Class Shares (Note 4) | | | 148,807 | |

| Administration fees (Note 4) | | | 353,870 | |

| Tax expense (Note 2) | | | 348,777 | |

| Registration and filing fees | | | 143,950 | |

| Legal fees | | | 100,967 | |

| Trustees’ fees and expenses (Note 4) | | | 71,249 | |

| Audit and tax service fees | | | 59,826 | |

| Insurance expense | | | 41,281 | |

| Custody fees | | | 33,840 | |

| Transfer agent fees (Note 4) | | | 30,590 | |

| Borrowing costs (Note 2) | | | 32,996 | |

| Compliance fees and expenses (Note 4) | | | 17,675 | |

| Other expenses | | | 239,102 | |

| Total expenses | | | 10,877,079 | |

| Tax expense reimbursements by Adviser (Note 2) | | | (332,497 | ) |

| Net expenses | | | 10,544,582 | |

| | | | | |

| NET INVESTMENT INCOME | | | 11,849,671 | |

| | | | | |

| REALIZED AND UNREALIZED GAINS ON INVESTMENTS, FOREIGN CURRENCIES AND OPTIONS | | | | |

| Net realized gains from investment transactions and foreign currency transactions | | | 74,141,222 | |

| Net realized gains from written option contracts (Note 5) | | | 8,691,149 | |

| Net change in unrealized appreciation (depreciation) on investment transactions and foreign currency translations | | | 21,636,278 | |

| Net change in unrealized appreciation (depreciation) on written option contracts | | | 79,060 | |

| NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS, FOREIGN CURRENCIES AND OPTIONS | | | 104,547,709 | |

| | | | | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 116,397,380 | |

The accompanying notes are an integral part of the financial statements.

| WESTWOOD SALIENT MLP & ENERGY INFRASTRUCTURE FUND(a) |

| |

| |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Year Ended | | | Year Ended | |

| | | December 31, | | | December 31, | |

| | | 2023 | | | 2022 | |

| FROM OPERATIONS | | | | | | | | |

| Net investment income | | $ | 11,849,671 | | | $ | 4,192,893 | |

| Net realized gains on investments, written options, and foreign currency transactions | | | 82,832,371 | | | | 3,431,642 | |

| Net change in unrealized appreciation (depreciation) on investments, written options, and foreign currency translations | | | 21,715,338 | | | | 106,655,035 | |

| Net increase in net assets resulting from operations | | | 116,397,380 | | | | 114,279,570 | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From distributable earnings | | | | | | | | |

| Institutional Shares | | | (27,341,988 | ) | | | — | |

| A Class Shares | | | (4,936,471 | ) | | | — | |

| C Class Shares | | | (460,833 | ) | | | — | |

| Ultra Shares | | | (847,726 | ) | | | — | |

| From return of capital | | | | | | | | |

| Institutional Shares | | | (16,281,710 | ) | | | (32,026,521 | ) |

| A Class Shares | | | (2,957,920 | ) | | | (5,015,402 | ) |

| C Class Shares | | | (277,766 | ) | | | (573,190 | ) |

| Ultra Shares | | | (488,726 | ) | | | (1,453,169 | ) |

| Total distributions | | | (53,593,140 | ) | | | (39,068,282 | ) |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Institutional Shares | | | | | | | | |

| Issued | | | 119,568,014 | | | | 326,083,981 | |

| Reinvestment of dividends | | | 38,786,838 | | | | 28,139,077 | |

| Redeemed | | | (250,245,155 | ) | | | (207,307,366 | ) |

| Net increase (decrease) from Institutional Shares capital share transactions | | | (91,890,303 | ) | | | 146,915,692 | |

| A Class Shares | | | | | | | | |

| Issued | | | 7,283,399 | | | | 27,097,263 | |

| Proceeds from shares issued in connection with acquisition from Plan of Reorganization (Note 8) | | | — | | | | 161,677,813 | |

| Reinvestment of dividends | | | 7,558,882 | | | | 4,811,951 | |

| Redeemed | | | (40,811,580 | ) | | | (137,702,835 | ) |

| Net increase (decrease) from A Class Shares capital share transactions | | | (25,969,299 | ) | | | 55,884,192 | |

| C Class Shares | | | | | | | | |

| Issued | | | 361,392 | | | | 1,630,960 | |

| Reinvestment of dividends | | | 726,366 | | | | 564,938 | |

| Redeemed | | | (4,082,510 | ) | | | (6,447,136 | ) |

| Net decrease from C Class Shares capital share transactions | | | (2,994,752 | ) | | | (4,251,238 | ) |

| Ultra Shares | | | | | | | | |

| Issued | | | 53,597 | | | | 1,425,412 | |

| Reinvestment of dividends | | | 595,134 | | | | 572,600 | |

| Redeemed | | | (27,961,154 | ) | | | (4,533,909 | ) |

| Net decrease from Ultra Shares capital share transactions | | | (27,312,423 | ) | | | (2,535,897 | ) |

| Net increase (decrease) in net assets from capital share transactions | | | (148,166,777 | ) | | | 196,012,749 | |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | (85,362,537 | ) | | | 271,224,037 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 977,600,629 | | | | 706,376,592 | |

| End of year | | $ | 892,238,092 | | | $ | 977,600,629 | |

Amounts designated as “—” are either $0 or have been rounded to $0.

| (a) | Prior to November 18, 2022, Westwood Salient MLP & Energy Infrastructure Fund was known as Salient MLP & Energy Infrastructure Fund. |

The accompanying notes are an integral part of the financial statements.

| WESTWOOD SALIENT MLP & ENERGY INFRASTRUCTURE FUND(a) |

| |

| |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Year Ended | | | Year Ended | |

| | | December 31, | | | December 31, | |

| | | 2023 | | | 2022 | |

| CAPITAL SHARES ACTIVITY | | | | | | | | |

| Institutional Shares | | | | | | | | |

| Sold | | | 15,987,827 | | | | 44,603,290 | |

| Issued in reinvestment of dividends to shareholders | | | 5,260,813 | | | | 3,777,997 | |

| Redeemed | | | (33,706,817 | ) | | | (28,712,439 | ) |

| Net increase (decrease) in shares outstanding | | | (12,458,177 | ) | | | 19,668,848 | |

| Shares outstanding at beginning of year | | | 106,856,009 | | | | 87,187,161 | |

| Shares outstanding at end of year | | | 94,397,832 | | | | 106,856,009 | |

| | | | | | | | | |

| A Class Shares | | | | | | | | |

| Sold | | | 967,455 | | | | 3,635,503 | |

| Proceeds from shares issued in connection with acquisition from Plan of Reorganization (Note 8) | | | — | | | | 21,251,027 | |

| Issued in reinvestment of dividends to shareholders | | | 1,018,471 | | | | 641,659 | |

| Redeemed | | | (5,538,192 | ) | | | (18,980,423 | ) |

| Net increase (decrease) in shares outstanding | | | (3,552,266 | ) | | | 6,547,766 | |

| Shares outstanding at beginning of year | | | 20,630,522 | | | | 14,082,756 | |

| Shares outstanding at end of year | | | 17,078,256 | | | | 20,630,522 | |

| | | | | | | | | |

| C Class Shares | | | | | | | | |

| Sold | | | 47,319 | | | | 225,461 | |

| Issued in reinvestment of dividends to shareholders | | | 98,343 | | | | 76,445 | |

| Redeemed | | | (543,165 | ) | | | (878,720 | ) |

| Net decrease in shares outstanding | | | (397,503 | ) | | | (576,814 | ) |

| Shares outstanding at beginning of year | | | 2,149,086 | | | | 2,725,900 | |

| Shares outstanding at end of year | | | 1,751,583 | | | | 2,149,086 | |

| | | | | | | | | |

| Ultra Shares | | | | | | | | |

| Sold | | | 7,111 | | | | 199,506 | |

| Issued in reinvestment of dividends to shareholders | | | 80,958 | | | | 77,005 | |

| Redeemed | | | (3,741,953 | ) | | | (627,149 | ) |

| Net decrease in shares outstanding | | | (3,653,884 | ) | | | (350,638 | ) |

| Shares outstanding at beginning of year | | | 4,206,138 | | | | 4,556,776 | |

| Shares outstanding at end of year | | | 552,254 | | | | 4,206,138 | |

Amounts designated as “—” are $0 or rounded to $0.

| (a) | Prior to November 18, 2022, Westwood Salient MLP & Energy Infrastructure Fund was known as Salient MLP & Energy Infrastructure Fund. |

The accompanying notes are an integral part of the financial statements.

| WESTWOOD SALIENT MLP & ENERGY INFRASTRUCTURE FUND(1) |

| |

| |

| FINANCIAL HIGHLIGHTS |

SELECTED PER SHARE DATA & RATIOS FOR A SHARE OUTSTANDING THROUGHOUT EACH YEAR

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| Institutional Shares (2) | | December 31, 2023* | | | December 31, 2022 | | | December 31, 2021 | | | December 31, 2020 | | | December 31, 2019 | |

| Net asset value at beginning of year | | $ | 7.30 | | | $ | 6.50 | | | $ | 5.50 | | | $ | 7.05 | | | $ | 6.34 | |

| Net investment income (loss) (a) | | | 0.10 | | | | 0.04 | | | | (0.02 | ) | | | 0.08 | | | | 0.04 | |

| Net realized and unrealized gains (losses) on investments | | | 0.88 | | | | 1.08 | | | | 1.34 | | | | (1.31 | ) | | | 0.99 | |

| Total from investment operations | | | 0.98 | | | | 1.12 | | | | 1.32 | | | | (1.23 | ) | | | 1.03 | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.28 | ) | | | — | | | | — | | | | — | | | | (0.18 | ) |

| Return of capital | | | (0.17 | ) | | | (0.32 | ) | | | (0.32 | ) | | | (0.32 | ) | | | (0.14 | ) |

| Total distributions | | | (0.45 | ) | | | (0.32 | ) | | | (0.32 | ) | | | (0.32 | ) | | | (0.32 | ) |

| Tax expense reimbursements by Adviser (Note 2) | | | — | (3) | | | — | | | | — | | | | — | | | | — | |

| Net asset value at end of year | | $ | 7.83 | | | $ | 7.30 | | | $ | 6.50 | | | $ | 5.50 | | | $ | 7.05 | |

| Total return (b) | | | 13.97 | % | | | 17.22 | % | | | 24.11 | % | | | (17.32 | )% | | | 16.33 | % |

| Net assets at end of year (in 000s) | | $ | 739,542 | | | $ | 779,843 | | | $ | 566,980 | | | $ | 393,743 | | | $ | 617,790 | |

| Ratio of total net expenses to average net assets (including tax expense/benefit) (c) | | | 1.11 | % | | | 1.35 | % (d) | | | 1.29 | % | | | 1.30 | % | | | 1.26 | % |

| Ratio of total net expenses to average net assets (excluding tax expense/benefit) (c) | | | 1.11 | % | | | 1.35 | % (d) | | | 1.29 | % | | | 1.30 | % | | | 1.24 | % |

| Ratio of total gross expenses to average net assets (including tax expense/benefit) | | | 1.15 | % | | | 1.35 | % | | | 1.27 | % | | | 1.33 | % | | | 1.24 | % |

| Ratio of net investment income (loss) to average net assets (c) | | | 1.36 | % | | | 0.52 | % | | | (0.27 | )% | | | 1.55 | % | | | 0.50 | % |

| Portfolio turnover rate (e) | | | 91 | % | | | 86 | % | | | 248 | % | | | 260 | % | | | 66 | % |

Amounts designated as “—” are either $0.00 or have been rounded to $0.00.

| (a) | Per share net income (loss) has been determined on the basis of average number of shares outstanding during the period. |

| (b) | Total return is a measure of the change in value of an investment in the Fund over the period covered. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any or the redemption of Fund shares. The total returns would be lower if the Adviser had not reduced investment management fees and/or reimbursed expenses for the year ended December 31, 2020 (Note 4). |

| (c) | Ratio was determined after investment management fee reductions and/or reimbursed expenses for the year ended December 31, 2020 (Note 4). |

| (d) | Net expense ratio exceeded the expense limitation during the year ended December 31, 2022 due to reorganization expenses (Note 8). |

| (e) | Portfolio turnover rate is calculated on the basis of the Fund as a whole without distinguishing between classes of shares issued. |

| (1) | Prior to November 18, 2022, Westwood Salient MLP & Energy Infrastructure Fund was known as Salient MLP & Energy Infrastructure Fund. |

| (2) | Prior to November 18, 2022, Institutional Shares were I Share Class. |

| (3) | The Adviser reimbursed the Fund $332,497 for losses incurred from tax expenses for the year ended December 31, 2023 the net impact to the Fund was less than $0.005 per share. |

| * | Includes adjustments in accordance with accounting principals generally accepted in the United States and, consequently, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

The accompanying notes are an integral part of the financial statements.

| WESTWOOD SALIENT MLP & ENERGY INFRASTRUCTURE FUND(1) |

| |

| |

| FINANCIAL HIGHLIGHTS |

SELECTED PER SHARE DATA & RATIOS FOR A SHARE OUTSTANDING THROUGHOUT EACH YEAR

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| A Class Shares | | December 31, 2023* | | | December 31, 2022 | | | December 31, 2021 | | | December 31, 2020 | | | December 31, 2019 | |

| Net asset value at beginning of year | | $ | 7.34 | | | $ | 6.53 | | | $ | 5.53 | | | $ | 7.07 | | | $ | 6.36 | |

| Net investment income (loss) (a) | | | 0.08 | | | | 0.02 | | | | (0.03 | ) | | | 0.07 | | | | 0.02 | |

| Net realized and unrealized gains (losses) on investments | | | 0.89 | | | | 1.09 | | | | 1.34 | | | | (1.31 | ) | | | 1.00 | |

| Total from investment operations | | | 0.97 | | | | 1.11 | | | | 1.31 | | | | (1.24 | ) | | | 1.02 | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.27 | ) | | | — | | | | — | | | | — | | | | (0.17 | ) |

| Return of capital | | | (0.16 | ) | | | (0.30 | ) | | | (0.31 | ) | | | (0.30 | ) | | | (0.14 | ) |

| Total distributions | | | (0.43 | ) | | | (0.30 | ) | | | (0.31 | ) | | | (0.30 | ) | | | (0.31 | ) |

| Tax expense reimbursements by Adviser (Note 2) | | | — | (2) | | | — | | | | — | | | | — | | | | — | |

| Net asset value at end of year | | $ | 7.88 | | | $ | 7.34 | | | $ | 6.53 | | | $ | 5.53 | | | $ | 7.07 | |

| Total return (b) | | | 13.75 | % | | | 17.00 | % | | | 23.74 | % | | | (17.43 | )% | | | 16.03 | % |

| Net assets at end of year (in 000s) | | $ | 134,627 | | | $ | 151,353 | | | $ | 92,027 | | | $ | 63,681 | | | $ | 110,549 | |

| Ratio of total net expenses to average net assets (including tax expense/benefit) (c) | | | 1.36 | % | | | 1.61 | % (d) | | | 1.50 | % | | | 1.55 | % | | | 1.47 | % |

| Ratio of total net expenses to average net assets (excluding tax expense/benefit) (c) | | | 1.36 | % | | | 1.61 | % (d) | | | 1.50 | % | | | 1.55 | % | | | 1.49 | % |

| Ratio of total gross expenses to average net assets (including tax expense/benefit) | | | 1.40 | % | | | 1.61 | % | | | 1.50 | % | | | 1.56 | % | | | 1.47 | % |

| Ratio of net investment income (loss) to average net assets (c) | | | 1.12 | % | | | 0.23 | % | | | (0.42 | )% | | | 1.29 | % | | | 0.24 | % |

| Portfolio turnover rate (e) | | | 91 | % | | | 86 | % | | | 248 | % | | | 260 | % | | | 66 | % |

Amounts designated as “—” are either $0.00 or have been rounded to $0.00.

| (a) | Per share net income (loss) has been determined on the basis of average number of shares outstanding during the period. |

| (b) | Total return is a measure of the change in value of an investment in the Fund over the period covered. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any or the redemption of Fund shares. The total returns would be lower if the Adviser had not reduced investment management fees and/or reimbursed expenses for the year ended December 31, 2020 (Note 4). |

| (c) | Ratio was determined after investment management fee reductions and/or reimbursed expenses for the year ended December 31, 2020 (Note 4). |

| (d) | Net expense ratio exceeded the expense limitation during the year ended December 31, 2022 due to reorganization expenses (Note 8). |

| (e) | Portfolio turnover rate is calculated on the basis of the Fund as a whole without distinguishing between classes of shares issued. |

| (1) | Prior to November 18, 2022, Westwood Salient MLP & Energy Infrastructure Fund was known as Salient MLP & Energy Infrastructure Fund. |

| (2) | The Adviser reimbursed the Fund $332,497 for losses incurred from tax expenses for the year ended December 31, 2023 the net impact to the Fund was less than $0.005 per share. |

| * | Includes adjustments in accordance with accounting principals generally accepted in the United States and, consequently, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

The accompanying notes are an integral part of the financial statements.

| WESTWOOD SALIENT MLP & ENERGY INFRASTRUCTURE FUND(1) |

| |

| |

| FINANCIAL HIGHLIGHTS |

SELECTED PER SHARE DATA & RATIOS FOR A SHARE OUTSTANDING THROUGHOUT EACH YEAR

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| C Class Shares | | December 31, 2023 | | | December 31, 2022 | | | December 31, 2021 | | | December 31, 2020 | | | December 31, 2019 | |

| Net asset value at beginning of year | | $ | 7.30 | | | $ | 6.50 | | | $ | 5.50 | | | $ | 7.02 | | | $ | 6.32 | |

| Net investment income (loss) (a) | | | 0.03 | | | | (0.03 | ) | | | (0.08 | ) | | | 0.03 | | | | (0.03 | ) (b) |

| Net realized and unrealized gains (losses) on investments | | | 0.90 | | | | 1.07 | | | | 1.34 | | | | (1.31 | ) | | | 0.98 | |

| Total from investment operations | | | 0.93 | | | | 1.04 | | | | 1.26 | | | | (1.28 | ) | | | 0.95 | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.24 | ) | | | — | | | | — | | | | — | | | | (0.14 | ) |

| Return of capital | | | (0.14 | ) | | | (0.24 | ) | | | (0.26 | ) | | | (0.24 | ) | | | (0.11 | ) |

| Total distributions | | | (0.38 | ) | | | (0.24 | ) | | | (0.26 | ) | | | (0.24 | ) | | | (0.25 | ) |

| Tax expense reimbursements by Adviser (Note 2) | | | — | (2) | | | — | | | | — | | | | — | | | | — | |

| Net asset value at end of year | | $ | 7.85 | | | $ | 7.30 | | | $ | 6.50 | | | $ | 5.50 | | | $ | 7.02 | |

| Total return (c) | | | 13.12 | % | | | 15.98 | % | | | 22.91 | % | | | (18.16 | )% | | | 15.15 | % |

| Net assets at end of year (in 000s) | | $ | 13,741 | | | $ | 15,694 | | | $ | 17,726 | | | $ | 20,468 | | | $ | 37,346 | |

| Ratio of total net expenses to average net assets (including tax expense/benefit) (d) | | | 2.09 | % | | | 2.34 | % (e) | | | 2.29 | % | | | 2.30 | % | | | 2.22 | % |

| Ratio of total net expenses to average net assets (excluding tax expense/benefit) (d) | | | 2.09 | % | | | 2.34 | % (e) | | | 2.29 | % | | | 2.30 | % | | | 2.24 | % |

| Ratio of total gross expenses to average net assets (including tax expense/benefit) | | | 2.13 | % | | | 2.34 | % | | | 2.26 | % | | | 2.32 | % | | | 2.22 | % |

| Ratio of net investment income (loss) to average net assets (d) | | | 0.37 | % | | | (0.47 | )% | | | (1.26 | )% | | | 0.57 | % | | | (0.48 | )% |

| Portfolio turnover rate (f) | | | 91 | % | | | 86 | % | | | 248 | % | | | 260 | % | | | 66 | % |

Amounts designated as “—” are either $0.00 or have been rounded to $0.00.

| (a) | Per share net income (loss) has been determined on the basis of average number of shares outstanding during the period. |

| (b) | The amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and redemptions of Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund. |

| (c) | Total return is a measure of the change in value of an investment in the Fund over the period covered. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any or the redemption of Fund shares. The total returns would be lower if the Adviser had not reduced investment management fees and/or reimbursed expenses for the year ended December 31, 2020 (Note 4). |

| (d) | Ratio was determined after investment management fee reductions and/or reimbursed expenses for the year ended December 31, 2020 (Note 4). |

| (e) | Net expense ratio exceeded the expense limitation during the year ended December 31, 2022 due to reorganization expenses (Note 8). |

| (f) | Portfolio turnover rate is calculated on the basis of the Fund as a whole without distinguishing between classes of shares issued. |

| (1) | Prior to November 18, 2022, Westwood Salient MLP & Energy Infrastructure Fund was known as Salient MLP & Energy Infrastructure Fund. |

| (2) | The Adviser reimbursed the Fund $332,497 for losses incurred from tax expenses for the year ended December 31, 2023 the net impact to the Fund was less than $0.005 per share. |

The accompanying notes are an integral part of the financial statements.

| WESTWOOD SALIENT MLP & ENERGY INFRASTRUCTURE FUND(1) |

| |

| |

| FINANCIAL HIGHLIGHTS |

SELECTED PER SHARE DATA & RATIOS FOR A SHARE OUTSTANDING THROUGHOUT EACH YEAR

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| Ultra Shares (2) | | December 31, 2023 | | | December 31, 2022 | | | December 31, 2021 | | | December 31, 2020 | | | December 31, 2019 | |

| Net asset value at beginning of year | | $ | 7.30 | | | $ | 6.51 | | | $ | 5.50 | | | $ | 7.05 | | | $ | 6.34 | |

| Net investment income (loss) (a) | | | 0.11 | | | | 0.04 | | | | (0.01 | ) | | | 0.08 | | | | 0.04 | |

| Net realized and unrealized gains (losses) on investments | | | 0.89 | | | | 1.08 | | | | 1.35 | | | | (1.31 | ) | | | 0.99 | |

| Total from investment operations | | | 1.00 | | | | 1.12 | | | | 1.34 | | | | (1.23 | ) | | | 1.03 | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.29 | ) | | | — | | | | — | | | | — | | | | (0.18 | ) |

| Return of capital | | | (0.17 | ) | | | (0.33 | ) | | | (0.33 | ) | | | (0.32 | ) | | | (0.14 | ) |

| Total distributions | | | (0.46 | ) | | | (0.33 | ) | | | (0.33 | ) | | | (0.32 | ) | | | (0.32 | ) |

| Tax expense reimbursements by Adviser (Note 2) | | | — | (3) | | | — | | | | — | | | | — | | | | — | |

| Net asset value at end of year | | $ | 7.84 | | | $ | 7.30 | | | $ | 6.51 | | | $ | 5.50 | | | $ | 7.05 | |

| Total return (b) . | | | 14.22 | % | | | 17.12 | % | | | 24.41 | % | | | (17.27 | )% | | | 16.42 | % |

| Net assets at end of year (in 000s) | | $ | 4,328 | | | $ | 30,710 | | | $ | 29,645 | | | $ | 32,949 | | | $ | 23,879 | |

| Ratio of total net expenses to average net assets (including tax expense/benefit) (c) | | | 1.03 | % | | | 1.27 | % (d) | | | 1.20 | % | | | 1.26 | % | | | 1.16 | % |

| Ratio of total net expenses to average net assets (excluding tax expense/benefit) (c) | | | 1.02 | % | | | 1.27 | % (d) | | | 1.20 | % | | | 1.26 | % | | | 1.18 | % |

| Ratio of total gross expenses to average net assets (including tax expense/benefit) | | | 1.06 | % | | | 1.27 | % | | | 1.20 | % | | | 1.26 | % | | | 1.16 | % |

| Ratio of net investment income (loss) to average net assets (c) | | | 1.42 | % | | | 0.59 | % | | | (0.19 | )% | | | 1.62 | % | | | 0.59 | % |

| Portfolio turnover rate (e) | | | 91 | % | | | 86 | % | | | 248 | % | | | 260 | % | | | 66 | % |

Amounts designated as “—” are either $0.00 or have been rounded to $0.00.

| (a) | Per share net income (loss) has been determined on the basis of average number of shares outstanding during the period. |

| (b) | Total return is a measure of the change in value of an investment in the Fund over the period covered. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any or the redemption of Fund shares. The total returns would be lower if the Adviser had not reduced investment management fees and/or reimbursed expenses for the year ended December 31, 2020 (Note 4). |

| (c) | Ratio was determined after investment management fee reductions and/or reimbursed expenses for the year ended December 31, 2020 (Note 4). |

| (d) | Net expense ratio exceeded the expense limitation during the year ended December 31, 2022 due to reorganization expenses (Note 8). |

| (e) | Portfolio turnover rate is calculated on the basis of the Fund as a whole without distinguishing between classes of shares issued. |

| (1) | Prior to November 18, 2022, Westwood Salient MLP & Energy Infrastructure Fund was known as Salient MLP & Energy Infrastructure Fund. |

| (2) | Prior to November 18, 2022, Ultra Shares were R6 Share Class. |

| (3) | The Adviser reimbursed the Fund $332,497 for losses incurred from tax expenses for the year ended December 31, 2023 the net impact to the Fund was less than $0.005 per share. |

The accompanying notes are an integral part of the financial statements.

| WESTWOOD SALIENT MLP & ENERGY INFRASTRUCTURE FUND |

| |

| |

| NOTES TO FINANCIAL STATEMENTS |

1. Organization

Westwood Salient MLP & Energy Infrastructure Fund (the “Fund”) is a series of Ultimus Managers Trust (the “Trust”), an open-end investment company established as an Ohio business trust under a Declaration of Trust dated February 28, 2012. The Trust is registered under the Investment Company Act of 1940, as amended, (the “1940 Act”). Other series of the Trust are not included in this report.

Salient Midstream & MLP Fund, formerly a series of Salient MF Trust (“Predecessor Salient MF Trust”), was reorganized into the Fund on November 18, 2022 pursuant to an Agreement and Plan of Reorganization dated June 27, 2022.

The Fund is an open-end, non-diversified fund that seeks to maximize total return (capital appreciation and income).

As of December 31, 2023, the Fund offers Institutional Shares, A Class Shares, C Class Shares and Ultra Shares.

Institutional Shares are sold without any sales loads, but subject to an administrative services plan fee of up to 0.10% requiring a $100,000 minimum investment and offered exclusively to certain retirement plans established for the benefit of employees of the Westwood Management Corporation (the “Adviser” or “Westwood”) or its affiliates; defined benefit retirement plans, endowments or foundations; banks and trust companies or law firms acting as trustee or manager for trust accounts; investors who purchase through asset-based fee programs available through financial intermediaries; and insurance companies.

A Class Shares (sold with a maximum sales charge of 4.00% (effective December 29, 2023; prior to December 29, 2023 the maximum sale charge was 3.00%) and a 12b-1 services plan fee up to 0.25% of the average daily net assets attributable to A Class Shares), require a $1,000 minimum investment. A Class Shares are also subject to an administrative services plan fee of up to 0.10% of the average daily net assets attributable A Class Shares of the Fund. A Class Shares purchases of $250,000 or more may be subject to a contingent deferred sales charge (“CDSC”) of 1.00% if redeemed within 18 months of purchase.

C Class Shares, which are sold without any sales loads, but subject to a 12b-1 services plan fee (up to 1.00% of the average daily net assets attributable to C Class Shares), require a $1,000 minimum investment. C Class Shares are also subject to an administrative services plan fee of up to 0.10% of the average daily net assets attributable to C Class Shares. C Class Shares may be subject to a CDSC fee of 1.00% if redeemed within 12 months of purchase. C Class Shares automatically convert to A Class Shares after being held for 10 years.