UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-22680 | |

| Ultimus Managers Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio | | 45246 |

| (Address of principal executive offices) | | (Zip code) |

Karen Jacoppo-Wood

| Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246 |

| (Name and address of agent for service) |

| Registrant’s telephone number, including area code: | (513) 587-3400 | |

| Date of fiscal year end: | August 31 | |

| | | |

| Date of reporting period: | August 31, 2024 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

Blue Current Global Dividend Fund

Institutional Class (BCGDX)

Annual Shareholder Report - August 31, 2024

This annual shareholder report contains important information about Blue Current Global Dividend Fund (the "Fund") for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at https://bluecurrentfunds.com/downloads/. You can also request this information by contacting us at (800) 514-3583.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $112 | 0.99% |

How did the Fund perform during the reporting period?

One of the key strengths of our Fund’s strategy is its unconstrainted ability to identify top-performing companies and brands worldwide that consistently reward shareholders through dividends. This all-weather approach has demonstrated resilience over time, allowing our investment team to capitalize on opportunities across various regions of the world and throughout the business cycle.

Over the trailing 12-month period, the technology sector emerged as the largest contributor to the Fund’s performance. Within this sector, our investments in dividend-paying companies positioned to benefit from the adoption of artificial intelligence, such as Broadcom and Taiwan Semiconductor, led the way. Over the period, the valuations of these companies expanded while their dividend yields contracted, resulting in select profit taking. Additionally, we increased our exposure to key financial institutions, including Mitsubishi Financial Group and JP Morgan. Financials should benefit from a steepening yield curve as the US Federal Reserve lowers short-term interest rates. Our investments in the consumer staples sector also performed well during the 12-month period with Walmart being a strong outlier in the sector. Investors were attracted to the company’s strengthening competitive position versus Amazon. Across these sectors, we were fortunate that several of our larger positions made substantial positive contributions to the Fund's overall return.

Moreover, we effectively mitigated downside risk by appropriately sizing our investments that are more reliant on economic factors to grow revenue and earnings. This approach to portfolio management yielded good results over the period by preventing the Fund from taking sizable losses when the economic data went against our thesis. Throughout the period, we have continued to shrink the number of positions and take profits in investments where we believe valuations are elevated.

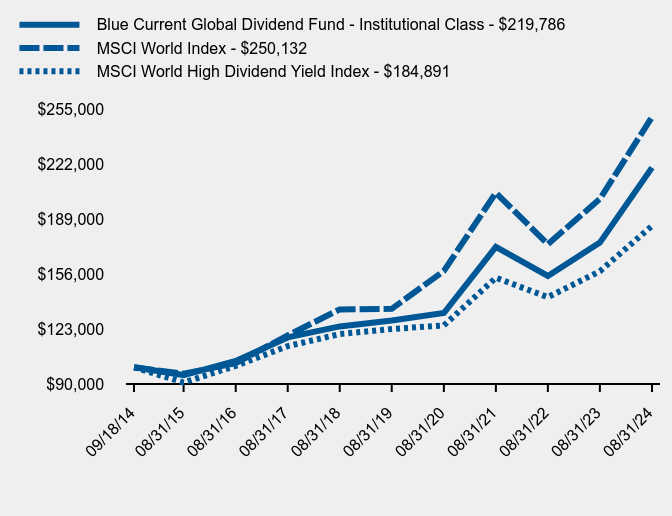

How has the Fund performed since inception?

Total Return Based on $100,000 Investment

| Blue Current Global Dividend Fund - Institutional Class | MSCI World Index | MSCI World High Dividend Yield Index |

|---|

| 09/18/14 | $100,000 | $100,000 | $100,000 |

| 08/31/15 | $95,352 | $96,120 | $90,898 |

| 08/31/16 | $103,857 | $102,544 | $100,871 |

| 08/31/17 | $117,951 | $119,141 | $112,712 |

| 08/31/18 | $124,533 | $134,754 | $119,963 |

| 08/31/19 | $128,153 | $135,106 | $122,986 |

| 08/31/20 | $132,587 | $157,784 | $125,159 |

| 08/31/21 | $172,245 | $204,748 | $153,755 |

| 08/31/22 | $154,805 | $173,882 | $142,089 |

| 08/31/23 | $174,831 | $201,015 | $157,645 |

| 08/31/24 | $219,786 | $250,132 | $184,891 |

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (September 18, 2014) |

|---|

| Blue Current Global Dividend Fund - Institutional Class | 25.71% | 11.39% | 8.24% |

| MSCI World Index | 24.43% | 13.11% | 9.65% |

| MSCI World High Dividend Yield Index | 17.28% | 8.50% | 6.37% |

Past performance does not guarantee future results. Call (800) 514-3583 or visit https://bluecurrentfunds.com/downloads/ for current month-end performance.

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -1.3% |

| Materials | 0.9% |

| Communications | 3.2% |

| Consumer Discretionary | 4.8% |

| Money Market Funds | 5.3% |

| Energy | 8.0% |

| Health Care | 12.2% |

| Technology | 13.0% |

| Industrials | 15.1% |

| Consumer Staples | 15.6% |

| Financials | 23.2% |

- Net Assets$76,424,124

- Number of Portfolio Holdings40

- Advisory Fee (net of waivers)$371,077

- Portfolio Turnover46%

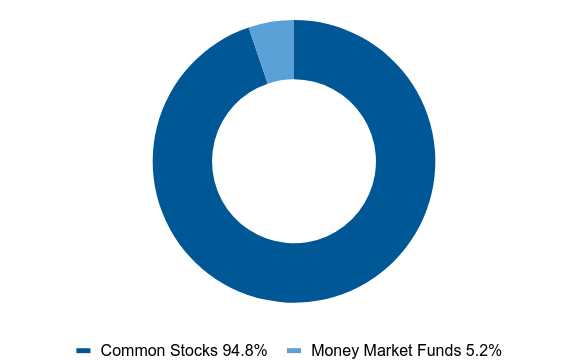

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 94.8% |

| Money Market Funds | 5.2% |

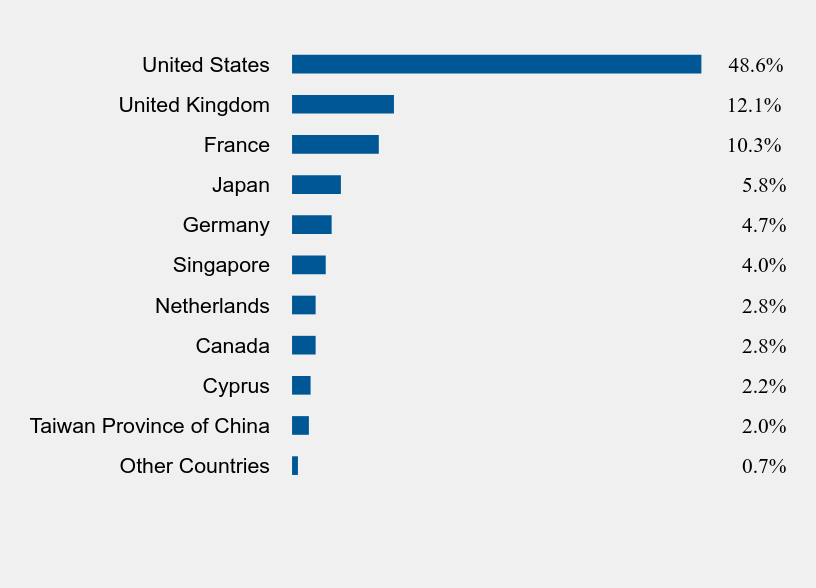

Country Weighting (% of net assets)

| Value | Value |

|---|

| Other Countries | 0.7% |

| Taiwan Province of China | 2.0% |

| Cyprus | 2.2% |

| Canada | 2.8% |

| Netherlands | 2.8% |

| Singapore | 4.0% |

| Germany | 4.7% |

| Japan | 5.8% |

| France | 10.3% |

| United Kingdom | 12.1% |

| United States | 48.6% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| RTX Corporation | 4.6% |

| Morgan Stanley | 3.6% |

| Walmart, Inc. | 3.6% |

| Coca-Cola Company (The) | 3.6% |

| Hitachi Ltd. - ADR | 3.4% |

| Targa Resources Corporation | 3.2% |

| Merck & Company, Inc. | 3.1% |

| Broadcom, Inc. | 3.1% |

| Coca-Cola Europacific Partners plc | 3.0% |

| AstraZeneca plc - ADR | 3.0% |

No material changes occurred during the year ended August 31, 2024.

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://bluecurrentfunds.com/downloads/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Blue Current Global Dividend Fund - Institutional Class (BCGDX)

Annual Shareholder Report - August 31, 2024

Marshfield Concentrated Opportunity Fund

Annual Shareholder Report - August 31, 2024

This annual shareholder report contains important information about Marshfield Concentrated Opportunity Fund (the "Fund") for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at https://marshfieldfunds.com/fund-documents/. You can also request this information by contacting us at (855) 691-5288.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Marshfield Concentrated Opportunity Fund | $111 | 0.99% |

How did the Fund perform during the reporting period?

We invest with the goal of outperforming, not belonging. We eschew the current darlings of the stock market in favor of our own independent assessment of what makes for a good company and a good price at which to buy it. Our strategy and discipline involve a high degree of patience and the willingness to hold cash, even as the market surges ahead. We do not place any weight whatsoever on what other market participants are buying or on what the S&P 500 holds. We only invest in industries we understand well and that have competitive attributes that allow for the capture of economic rents and in companies that are well-positioned to capture such rents.

While we invest bottom-up and try to avoid producing narratives around short-term performance, there are a few story arcs that can help explain the Fund’s performance over the past year. The two industries with the greatest positive impact on the Fund’s performance were property/casualty insurance and retailing, both auto parts and apparel. Insurance benefited from a hard market, with excellent pricing redounding to the particular benefit of disciplined companies. Our retail holdings tend to be “all weather” and resilient. The laggards in our portfolio included transportation/logistics companies and, not surprisingly, cash. Supply chain issues that arose during the pandemic provoked a “chain reaction” in which companies first bulked up and then right-sized their inventory. This reduced demand for transport services. Cash returned a perfectly adequate 5%, but that, naturally, could not keep up with an ebullient market, nor did we expect it to.

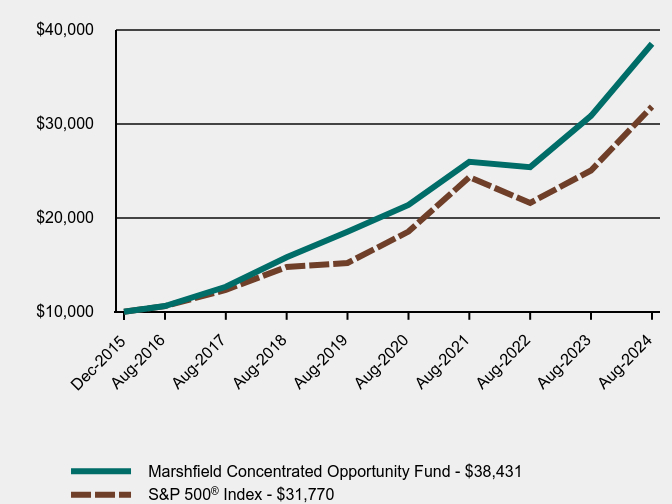

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| Marshfield Concentrated Opportunity Fund | S&P 500® Index |

|---|

| Dec-2015 | $10,000 | $10,000 |

| Aug-2016 | $10,610 | $10,604 |

| Aug-2017 | $12,655 | $12,326 |

| Aug-2018 | $15,781 | $14,749 |

| Aug-2019 | $18,483 | $15,180 |

| Aug-2020 | $21,342 | $18,510 |

| Aug-2021 | $25,919 | $24,279 |

| Aug-2022 | $25,345 | $21,553 |

| Aug-2023 | $30,784 | $24,989 |

| Aug-2024 | $38,431 | $31,770 |

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception (December 29, 2015) |

|---|

| Marshfield Concentrated Opportunity Fund | 24.84% | 15.77% | 16.79% |

S&P 500® Index | 27.14% | 15.92% | 14.26% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$955,960,890

- Number of Portfolio Holdings18

- Advisory Fee (net of waivers)$6,265,358

- Portfolio Turnover25%

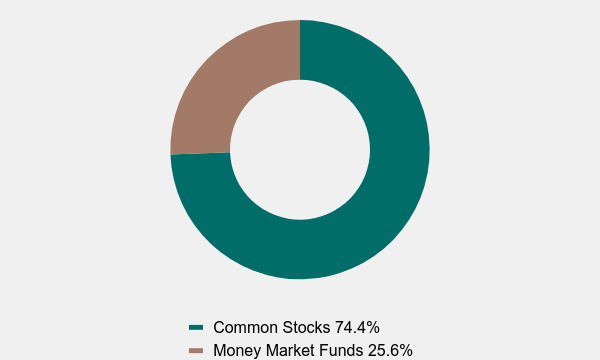

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 74.4% |

| Money Market Funds | 25.6% |

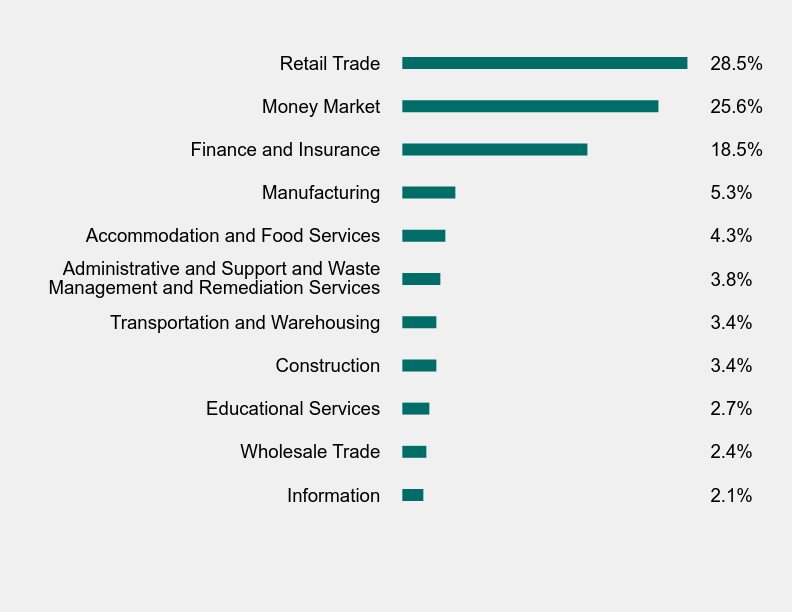

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Information | 2.1% |

| Wholesale Trade | 2.4% |

| Educational Services | 2.7% |

| Construction | 3.4% |

| Transportation and Warehousing | 3.4% |

| Administrative and Support and Waste Management and Remediation Services | 3.8% |

| Accommodation and Food Services | 4.3% |

| Manufacturing | 5.3% |

| Finance and Insurance | 18.5% |

| Money Market | 25.6% |

| Retail Trade | 28.5% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Ross Stores, Inc. | 9.2% |

| AutoZone, Inc. | 9.2% |

| Arch Capital Group Ltd. | 6.6% |

| O'Reilly Automotive, Inc. | 6.0% |

| Cummins, Inc. | 5.3% |

| Mastercard, Inc. - Class A | 4.5% |

| Domino's Pizza, Inc. | 4.3% |

| TJX Companies, Inc. (The) | 4.1% |

| Visa, Inc. - Class A | 4.0% |

| Moody's Corporation | 3.8% |

No material changes occurred during the year ended August 31, 2024.

Marshfield Concentrated Opportunity Fund (MRFOX)

Annual Shareholder Report - August 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://marshfieldfunds.com/fund-documents/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Annual Shareholder Report - August 31, 2024

This annual shareholder report contains important information about Meehan Focus Fund (the "Fund") for the period of September 1, 2023 to August 31, 2024. You can find additional information about the Fund at www.meehanmutualfunds.com. You can also request this information by contacting us at (866) 884-5968.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Meehan Focus Fund | $115 | 1.00% |

How did the Fund perform during the reporting period?

For the 12 months ended August 31, 2024, the Fund returned 30.65%, outpacing the 27.14% return of its benchmark, the S&P 500 Index. It was a solid 12 months for stocks overall as continued economic growth, low unemployment, and a return to consistent corporate earnings growth supported the market.

The Fund saw strong performance across multiple sectors. Large capitalization technology stocks, including long-term holdings Microsoft and Broadcom and recent addition NVIDIA, led the way spurred on by enthusiasm for artificial intelligence-related themes. Robust returns from industrials (United Rentals, Johnson Controls); consumer discretionary (Williams-Sonoma, Lennar); financials (Berkshire Hathaway, BlackRock, Blackstone); and bio-technology (Vertex) all contributed to the Fund’s outperformance over the past 12 months.

Detractors from the Fund’s overall performance during the reporting period included two health care stocks, CVS Health and Bristol-Myers Squibb, which were sold from the Fund’s portfolio. Current holdings, including agricultural equipment manufacturer Deere, home improvement retailer Lowe’s and credit card issuer Visa, also detracted from performance.

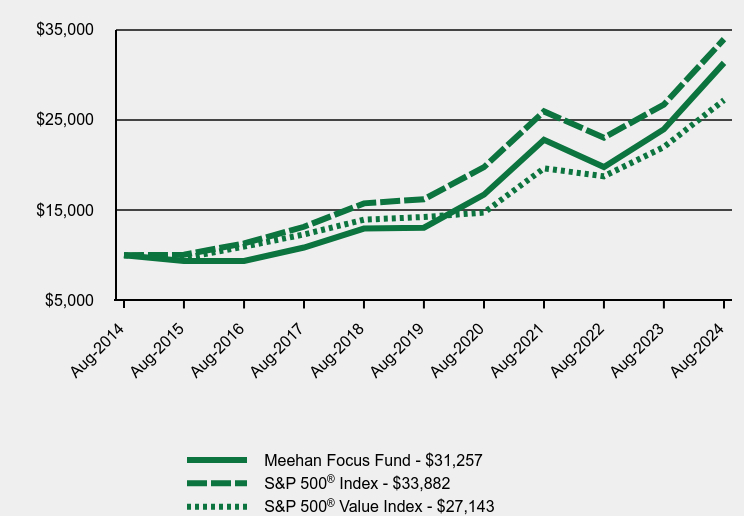

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Meehan Focus Fund | S&P 500® Index | S&P 500® Value Index |

|---|

| Aug-2014 | $10,000 | $10,000 | $10,000 |

| Aug-2015 | $9,373 | $10,048 | $9,673 |

| Aug-2016 | $9,368 | $11,309 | $10,946 |

| Aug-2017 | $10,849 | $13,145 | $12,298 |

| Aug-2018 | $12,947 | $15,730 | $13,927 |

| Aug-2019 | $13,046 | $16,189 | $14,225 |

| Aug-2020 | $16,700 | $19,740 | $14,714 |

| Aug-2021 | $22,754 | $25,893 | $19,605 |

| Aug-2022 | $19,743 | $22,986 | $18,721 |

| Aug-2023 | $23,924 | $26,650 | $21,956 |

| Aug-2024 | $31,257 | $33,882 | $27,143 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Meehan Focus Fund | 30.65% | 19.10% | 12.07% |

S&P 500® Index | 27.14% | 15.92% | 12.98% |

S&P 500® Value Index | 23.63% | 13.80% | 10.50% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$153,316,077

- Number of Portfolio Holdings25

- Advisory Fee (net of waivers)$986,535

- Portfolio Turnover5%

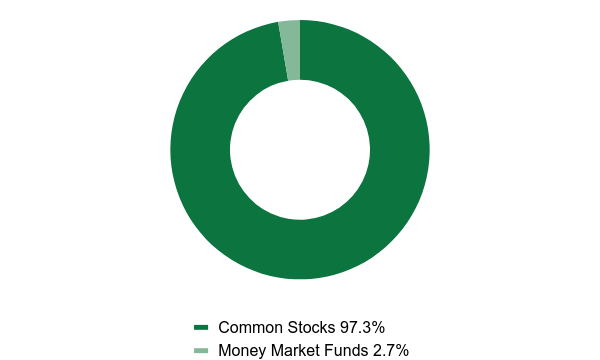

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 97.3% |

| Money Market Funds | 2.7% |

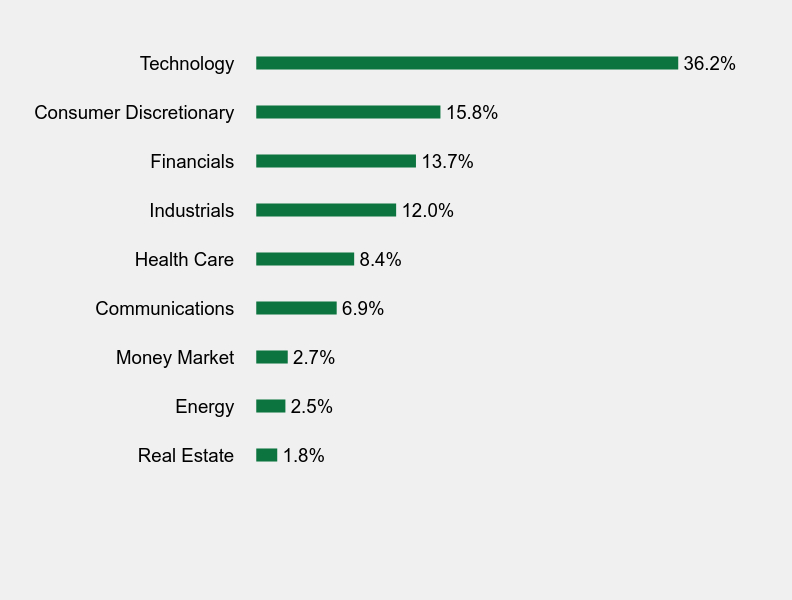

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Real Estate | 1.8% |

| Energy | 2.5% |

| Money Market | 2.7% |

| Communications | 6.9% |

| Health Care | 8.4% |

| Industrials | 12.0% |

| Financials | 13.7% |

| Consumer Discretionary | 15.8% |

| Technology | 36.2% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Microsoft Corporation | 9.6% |

| Apple, Inc. | 9.2% |

| United Rentals, Inc. | 8.2% |

| Berkshire Hathaway, Inc. - Class B | 8.1% |

| Alphabet, Inc. - Classes A & C | 6.9% |

| Lowe's Companies, Inc. | 6.7% |

| Broadcom, Inc. | 6.6% |

| Amazon.com, Inc. | 4.8% |

| Vertex Pharmaceuticals, Inc. | 4.8% |

| Applied Materials, Inc. | 4.6% |

No material changes occurred during the year ended August 31, 2024.

Meehan Focus Fund (MEFOX)

Annual Shareholder Report - August 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (www.meehanmutualfunds.com), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Item 2. Code of Ethics.

As of the end of the period covered by this report, the registrant has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. Pursuant to Item 12(a)(1), a copy of registrant’s code of ethics is filed as an exhibit to this Form N-CSR. During the period covered by this report, the code of ethics has not been amended, and the registrant has not granted any waivers, including implicit waivers, from the provisions of the code of ethics.

Item 3. Audit Committee Financial Expert.

The registrant’s board of trustees has determined that the registrant has at least one audit committee financial expert serving on its audit committee. The name of the audit committee financial expert is Janine L. Cohen. Ms. Cohen is “independent” for purposes of this Item.

Item 4. Principal Accountant Fees and Services.

| (a) | Audit Fees. The aggregate fees billed for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or for services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements were $43,800 and $40,500 with respect to the registrant’s fiscal years ended August 31, 2024 and 2023, respectively. |

| (b) | Audit-Related Fees. No fees were billed in either of the last two fiscal years for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item. |

| (c) | Tax Fees. The aggregate fees billed for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning were $10,200 and $10,000 with respect to the registrant’s fiscal years ended August 31, 2024 and 2023, respectively. The services comprising these fees are the preparation of the registrant’s federal income and excise tax returns. |

| (d) | All Other Fees. No fees were billed in either of the last two fiscal years for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item. |

| (e)(1) | The audit committee has not adopted pre-approval policies and procedures described in paragraph (c)(7) of Rule 2-01 of Regulation S-X. |

| (e)(2) | None of the services described in paragraph (b) through (d) of this Item were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

| (f) | Less than 50% of hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees. |

| (g) | During the fiscal years ended August 31, 2024 and 2023, aggregate non-audit fees of $10,200 and $10,000, respectively, were billed by the registrant’s accountant for services rendered to the registrant. No non-audit fees were billed in either of the last two fiscal years by the registrant’s accountant for services rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant. |

| (h) | The principal accountant has not provided any non-audit services to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant. |

Item 5. Audit Committee of Listed Registrants.

Not applicable

Item 6. Investments.

(a) The Registrant(s) schedule(s) of investments is included in the Financial Statements under Item 7 of this form.

(b) Not applicable

| Item 7. | Financial Statements and Financial Highlights for Open-End Management Investment Companies |

(a)

BLUE CURRENT GLOBAL DIVIDEND FUND

INSTITUTIONAL CLASS (BCGDX)

Financial Statements

August 31, 2024

BLUE CURRENT GLOBAL DIVIDEND FUND

SCHEDULE OF INVESTMENTS

August 31, 2024

| COMMON STOCKS — 96.0% | | Shares | | | Value | |

| Communications — 3.2% | | | | | | | | |

| Internet Media & Services — 1.6% | | | | | | | | |

| Meta Platforms, Inc. - Class A | | | 2,400 | | | $ | 1,251,144 | |

| | | | | | | | | |

| Telecommunications — 1.6% | | | | | | | | |

| Singapore Telecommunications Ltd. | | | 500,000 | | | | 1,199,117 | |

| | | | | | | | | |

| Consumer Discretionary — 4.8% | | | | | | | | |

| Home Construction — 2.3% | | | | | | | | |

| Lennar Corporation - Class A | | | 9,900 | | | | 1,802,394 | |

| | | | | | | | | |

| Retail - Discretionary — 2.5% | | | | | | | | |

| Dick’s Sporting Goods, Inc. | | | 8,000 | | | | 1,895,680 | |

| | | | | | | | | |

| Consumer Staples — 15.6% | | | | | | | | |

| Beverages — 6.6% | | | | | | | | |

| Coca-Cola Company (The) | | | 37,635 | | | | 2,727,408 | |

| Coca-Cola Europacific Partners plc | | | 28,730 | | | | 2,312,478 | |

| | | | | | | | 5,039,886 | |

| Food — 2.6% | | | | | | | | |

| Danone S.A. | | | 28,000 | | | | 1,945,313 | |

| | | | | | | | | |

| Retail - Consumer Staples — 6.4% | | | | | | | | |

| Koninklijke Ahold Delhaize N.V. | | | 62,700 | | | | 2,157,035 | |

| Walmart, Inc. | | | 35,550 | | | | 2,745,526 | |

| | | | | | | | 4,902,561 | |

| Energy — 8.0% | | | | | | | | |

| Oil & Gas Producers — 6.6% | | | | | | | | |

| BP plc | | | 267,000 | | | | 1,511,464 | |

| Shell plc - ADR | | | 15,180 | | | | 1,087,799 | |

| Targa Resources Corporation | | | 16,560 | | | | 2,432,664 | |

| | | | | | | | 5,031,927 | |

| Oil & Gas Services & Equipment — 1.4% | | | | | | | | |

| Schlumberger Ltd. | | | 24,350 | | | | 1,071,156 | |

| | | | | | | | | |

| Financials — 23.2% | | | | | | | | |

| Banking — 15.3% | | | | | | | | |

| BNP Paribas S.A. | | | 25,600 | | | | 1,770,397 | |

| DBS Group Holdings Ltd. - ADR | | | 16,794 | | | | 1,866,485 | |

| JPMorgan Chase & Company | | | 9,611 | | | | 2,160,553 | |

| Mitsubishi UFJ Financial Group, Inc. - ADR | | | 177,000 | | | | 1,863,810 | |

BLUE CURRENT GLOBAL DIVIDEND FUND

SCHEDULE OF INVESTMENTS (Continued)

| COMMON STOCKS — 96.0% (Continued) | | Shares | | | Value | |

| Financials — 23.2% (Continued) | | | | | | | | |

| Banking — 15.3% (Continued) | | | | | | | | |

| National Bank of Canada | | | 23,000 | | | $ | 2,107,463 | |

| Truist Financial Corporation | | | 43,000 | | | | 1,911,780 | |

| | | | | | | | 11,680,488 | |

| Institutional Financial Services — 3.6% | | | | | | | | |

| Morgan Stanley | | | 26,700 | | | | 2,766,387 | |

| | | | | | | | | |

| Insurance — 4.3% | | | | | | | | |

| Allianz SE - ADR | | | 26,000 | | | | 806,000 | |

| Allianz SE | | | 4,200 | | | | 1,304,540 | |

| AXA S.A. | | | 30,000 | | | | 1,141,585 | |

| | | | | | | | 3,252,125 | |

| Health Care — 12.2% | | | | | | | | |

| Biotech & Pharma — 9.4% | | | | | | | | |

| AstraZeneca plc - ADR | | | 26,300 | | | | 2,304,406 | |

| Johnson & Johnson | | | 11,862 | | | | 1,967,432 | |

| Merck & Company, Inc. | | | 19,800 | | | | 2,345,310 | |

| Novo Nordisk A/S - ADR | | | 3,970 | | | | 552,465 | |

| | | | | | | | 7,169,613 | |

| Health Care Facilities & Services — 2.8% | | | | | | | | |

| HCA Healthcare, Inc. | | | 5,500 | | | | 2,175,745 | |

| | | | | | | | | |

| Industrials — 15.1% | | | | | | | | |

| Aerospace & Defense — 7.5% | | | | | | | | |

| RTX Corporation | | | 28,295 | | | | 3,489,905 | |

| Thales S.A. | | | 13,600 | | | | 2,284,571 | |

| | | | | | | | 5,774,476 | |

| Diversified Industrials — 3.4% | | | | | | | | |

| Hitachi Ltd. - ADR | | | 52,500 | | | | 2,571,450 | |

| | | | | | | | | |

| Transportation & Logistics — 4.2% | | | | | | | | |

| Deutsche Post AG | | | 35,000 | | | | 1,518,944 | |

| Frontline plc - ADR | | | 69,000 | | | | 1,665,660 | |

| | | | | | | | 3,184,604 | |

| Materials — 0.9% | | | | | | | | |

| Chemicals — 0.9% | | | | | | | | |

| Air Liquide S.A. | | | 3,759 | | | | 701,494 | |

BLUE CURRENT GLOBAL DIVIDEND FUND

SCHEDULE OF INVESTMENTS (Continued)

| COMMON STOCKS — 96.0% (Continued) | | Shares | | | Value | |

| Technology — 13.0% | | | | | | | | |

| Semiconductors — 7.5% | | | | | | | | |

| Broadcom, Inc. | | | 14,350 | | | $ | 2,336,467 | |

| QUALCOMM, Inc. | | | 10,384 | | | | 1,820,315 | |

| Taiwan Semiconductor Manufacturing Company Ltd. - ADR | | | 9,000 | | | | 1,545,300 | |

| | | | | | | | 5,702,082 | |

| Software — 2.9% | | | | | | | | |

| Microsoft Corporation | | | 5,420 | | | | 2,260,899 | |

| | | | | | | | | |

| Technology Services — 2.6% | | | | | | | | |

| RELX plc - ADR | | | 43,000 | | | | 2,006,380 | |

| | | | | | | | | |

| Total Common Stocks (Cost $49,574,923) | | | | | | $ | 73,384,921 | |

| MONEY MARKET FUNDS — 5.3% | | Shares | | | Value | |

| First American Government Obligations Fund - Class Z, 5.18% (a) (Cost $4,033,514) | | | 4,033,514 | | | $ | 4,033,514 | |

| | | | | | | | | |

| Investments at Value — 101.3% (Cost $53,608,437) | | | | | | $ | 77,418,435 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (1.3%) | | | | | | | (994,311 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 76,424,124 | |

A/S - Aktieselskab

ADR - American Depositary Receipt

AG - Atkiengesellschaft

N.V. - Naamloze Vennootschap

plc - Public Limited Company

S.A. - Societe Anonyme

SE - Societe Europaea

| (a) | The rate shown is the 7-day effective yield as of August 31, 2024. |

See accompanying notes to financial statements.

BLUE CURRENT GLOBAL DIVIDEND FUND

SUMMARY OF COMMON STOCKS BY COUNTRY

August 31, 2024 (Unaudited)

Country | | Value | | | % of

Net Assets | |

| United States | | $ | 37,160,765 | | | | 48.6 | % |

| United Kingdom | | | 9,222,527 | | | | 12.1 | % |

| France | | | 7,843,360 | | | | 10.3 | % |

| Japan | | | 4,435,260 | | | | 5.8 | % |

| Germany | | | 3,629,484 | | | | 4.7 | % |

| Singapore | | | 3,065,602 | | | | 4.0 | % |

| Netherlands | | | 2,157,035 | | | | 2.8 | % |

| Canada | | | 2,107,463 | | | | 2.8 | % |

| Cyprus | | | 1,665,660 | | | | 2.2 | % |

| Taiwan Province of China | | | 1,545,300 | | | | 2.0 | % |

| Denmark | | | 552,465 | | | | 0.7 | % |

| | | $ | 73,384,921 | | | | 96.0 | % |

See accompanying notes to financial statements.

BLUE CURRENT GLOBAL DIVIDEND FUND

STATEMENT OF ASSETS AND LIABILITIES

August 31, 2024

| ASSETS | | | |

| Investments in securities: | | | | |

| At cost | | $ | 53,608,437 | |

| At value (Note 2) | | $ | 77,418,435 | |

| Dividends receivable | | | 164,634 | |

| Tax reclaims receivable | | | 92,092 | |

| Other assets | | | 11,128 | |

| Total assets | | | 77,686,289 | |

| | | | | |

| LIABILITIES | | | | |

| Payable for capital shares redeemed | | | 38,171 | |

| Payable for investment securities purchased | | | 1,146,702 | |

| Foreign currency payable (Cost $46,024) | | | 19,851 | |

| Payable to Adviser (Note 4) | | | 35,344 | |

| Payable to administrator (Note 4) | | | 13,790 | |

| Other accrued expenses | | | 8,307 | |

| Total liabilities | | | 1,262,165 | |

| | | | | |

| CONTINGENCIES AND COMMITMENTS (Note 6) | | | — | |

| | | | | |

| NET ASSETS | | $ | 76,424,124 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Paid-in capital | | $ | 50,805,214 | |

| Distributable earnings | | | 25,618,910 | |

| NET ASSETS | | $ | 76,424,124 | |

| | | | | |

| PRICING OF INSTITUTIONAL SHARES (Note 1) | | | | |

| Net assets applicable to Institutional Shares | | $ | 76,424,124 | |

Shares of Institutional Shares outstanding

(unlimited number of shares authorized, no par value) | | | 4,668,013 | |

| | | | | |

| Net asset value, offering and redemption price per share (a) (Note 2) | | $ | 16.37 | |

| (a) | Redemption fee may apply to redemptions of shares held for 7 days or less. |

See accompanying notes to financial statements.

BLUE CURRENT GLOBAL DIVIDEND FUND

STATEMENT OF OPERATIONS

For the Year Ended August 31, 2024

| INVESTMENT INCOME | | | |

| Dividends | | $ | 2,038,394 | |

| Foreign withholding taxes on dividends | | | (115,541 | ) |

| Tax reclaims received | | | 135,177 | |

| Total investment income | | | 2,058,030 | |

| | | | | |

| EXPENSES | | | | |

| Management fees (Note 4) | | | 672,079 | |

| Administration fees (Note 4) | | | 72,242 | |

| Fund accounting fees (Note 4) | | | 46,165 | |

| Legal fees | | | 27,191 | |

| Custodian and bank service fees | | | 21,056 | |

| Trustees’ fees and expenses (Note 4) | | | 20,575 | |

| Registration and filing fees | | | 20,061 | |

| Transfer agent fees (Note 4) | | | 20,023 | |

| Audit and tax services fees | | | 17,932 | |

| Shareholder reporting expenses | | | 12,417 | |

| Compliance fees and expenses (Note 4) | | | 12,159 | |

| Pricing fees | | | 4,348 | |

| Postage and supplies | | | 4,311 | |

| Insurance expense | | | 3,105 | |

| Other expenses | | | 19,417 | |

| Total expenses | | | 973,081 | |

| Fee reductions by the Adviser (Note 4) | | | (301,002 | ) |

| Net expenses | | | 672,079 | |

| | | | | |

| NET INVESTMENT INCOME | | | 1,385,951 | |

| | | | | |

| REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS AND FOREIGN CURRENCIES | | | | |

| Net realized gains (losses) from: | | | | |

| Investments | | | 2,462,465 | |

| Foreign currency transactions (Note 2) | | | (2,935 | ) |

| Net change in unrealized appreciation (depreciation) on: | | | | |

| Investments | | | 12,088,225 | |

| Foreign currency translations (Note 2) | | | 21,316 | |

| NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS AND FOREIGN CURRENCIES | | | 14,569,071 | |

| | | | | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 15,955,022 | |

See accompanying notes to financial statements.

BLUE CURRENT GLOBAL DIVIDEND FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Year Ended

August 31,

2024 | | | Year Ended

August 31,

2023 | |

| FROM OPERATIONS | | | | | | | | |

| Net investment income | | $ | 1,385,951 | | | $ | 1,252,877 | |

| Net realized gains (losses) from: | | | | | | | | |

| Investments | | | 2,462,465 | | | | (830,014 | ) |

| Foreign currency transactions | | | (2,935 | ) | | | (19,754 | ) |

| Net change in unrealized appreciation (depreciation) on: | | | | | | | | |

| Investments | | | 12,088,225 | | | | 6,482,263 | |

| Foreign currency translations | | | 21,316 | | | | 9,714 | |

| Net increase in net assets from operations | | | 15,955,022 | | | | 6,895,086 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Institutional Shares | | | (1,409,877 | ) | | | (2,877,521 | ) |

| | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Institutional Shares | | | | | | | | |

| Proceeds from shares sold | | | 8,323,226 | | | | 13,681,146 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 839,254 | | | | 1,931,129 | |

| Proceeds from redemption fees collected (Note 2) | | | 132 | | | | 2,099 | |

| Payments for shares redeemed | | | (10,088,101 | ) | | | (8,113,526 | ) |

| Net increase (decrease) in Institutional Shares net assets from capital share transactions | | | (925,489 | ) | | | 7,500,848 | |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 13,619,656 | | | | 11,518,413 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 62,804,468 | | | | 51,286,055 | |

| End of year | | $ | 76,424,124 | | | $ | 62,804,468 | |

| | | | | | | | | |

| CAPITAL SHARES ACTIVITY | | | | | | | | |

| Shares sold | | | 586,525 | | | | 1,067,000 | |

| Shares reinvested | | | 57,375 | | | | 154,015 | |

| Shares redeemed | | | (702,405 | ) | | | (631,425 | ) |

| Net increase (decrease) in shares outstanding | | | (58,505 | ) | | | 589,590 | |

| Shares outstanding, beginning of year | | | 4,726,518 | | | | 4,136,928 | |

| Shares outstanding, end of year | | | 4,668,013 | | | | 4,726,518 | |

See accompanying notes to financial statements.

BLUE CURRENT GLOBAL DIVIDEND FUND

INSTITUTIONAL SHARES

FINANCIAL HIGHLIGHTS

Per Share Data for a Share Outstanding Throughout Each Year

| | | Year Ended

August 31,

2024 | | | Year Ended

August 31,

2023 | | | Year Ended

August 31,

2022 | | | Year Ended

August 31,

2021 | | | Year Ended

August 31,

2020 | |

| Net asset value at beginning of year | | $ | 13.29 | | | $ | 12.40 | | | $ | 15.06 | | | $ | 11.74 | | | $ | 11.62 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.29 | | | | 0.28 | | | | 0.48 | | | | 0.17 | | | | 0.24 | |

| Net realized and unrealized gains (losses) on investments and foreign currencies | | | 3.09 | | | | 1.28 | | | | (1.88 | ) | | | 3.32 | | | | 0.16 | (a) |

| Total from investment operations | | | 3.38 | | | | 1.56 | | | | (1.40 | ) | | | 3.49 | | | | 0.40 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.30 | ) | | | (0.28 | ) | | | (0.49 | ) | | | (0.17 | ) | | | (0.20 | ) |

| Net realized gains | | | — | | | | (0.39 | ) | | | (0.77 | ) | | | — | | | | (0.08 | ) |

| Total distributions | | | (0.30 | ) | | | (0.67 | ) | | | (1.26 | ) | | | (0.17 | ) | | | (0.28 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Proceeds from redemption fees collected (Note 2) | | | 0.00 | (b) | | | 0.00 | (b) | | | 0.00 | (b) | | | — | | | | 0.00 | (b) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value at end of year | | $ | 16.37 | | | $ | 13.29 | | | $ | 12.40 | | | $ | 15.06 | | | $ | 11.74 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total return (c) | | | 25.71 | % | | | 12.94 | % | | | (10.12 | %) | | | 29.91 | % | | | 3.46 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Net assets at end of year (000’s) | | $ | 76,424 | | | $ | 62,804 | | | $ | 51,286 | | | $ | 52,031 | | | $ | 42,039 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/supplementary data: | | | | | | | | | | | | | | | | | | | | |

| Ratio of total expenses to average net assets | | | 1.43 | % | | | 1.48 | % | | | 1.49 | % | | | 1.48 | % | | | 1.48 | % |

| Ratio of net expenses to average net assets (d) | | | 0.99 | % | | | 0.99 | % | | | 0.99 | % | | | 0.99 | % | | | 0.99 | % |

| Ratio of net investment income to average net assets (d) | | | 2.04 | % | | | 2.18 | % | | | 3.43 | % | | | 1.27 | % | | | 1.94 | % |

| Portfolio turnover rate | | | 46 | % | | | 60 | % | | | 60 | % | | | 53 | % | | | 66 | % |

| (a) | Represents a balancing figure from other amounts in the financial highlights table that captures all other changes affecting net asset value per share. This per share amount does not correlate to the aggregate of net realized and unrealized losses on the Statement of Operations for the same period. |

| (b) | Amount rounds to less than $0.01 per share. |

| (c) | Total return is a measure of the change in value of an investment in the Fund over periods covered, which assumes any dividends and capital gain distributions are reinvested in shares of the Fund. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. The total returns would be lower if the Adviser had not reduced management fees (Note 4). |

| (d) | Ratio was determined after management fee reductions by the Adviser (Note 4). |

See accompanying notes to financial statements.

BLUE CURRENT GLOBAL DIVIDEND FUND

NOTES TO FINANCIAL STATEMENTS

August 31, 2024

1. Organization

Blue Current Global Dividend Fund (the “Fund”) is a diversified series of Ultimus Managers Trust (the “Trust”), an open-end investment company established as an Ohio business trust under a Declaration of Trust dated February 28, 2012. Other series of the Trust are not incorporated in this report.

The investment objective of the Fund is to seek current income and capital appreciation.

The Fund currently offers one class of shares: Institutional Class shares (sold without any sales loads or distribution fees and subject to a $100,000 initial investment requirement).

2. Significant Accounting Policies

The following is a summary of the Fund’s significant accounting policies. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Fund follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification Topic 946, “Financial Services – Investment Companies.”

Regulatory update – Tailored Shareholder Reports for Mutual Funds and Exchange-Traded Funds (“ETFs”) – Effective January 24, 2023, the Securities and Exchange Commission (the “SEC”) adopted rule and form amendments to require mutual funds and ETFs to transmit concise and visually engaging streamlined annual and semiannual reports to shareholders that highlight key information. Other information, including financial statements, will no longer appear in a streamlined shareholder report but must be available online, delivered free of charge upon request, and filed on a semiannual basis on Form N-CSR. The rule and form amendments have a compliance date of July 24, 2024. The Fund has implemented the rule and form requirements, as applicable, and is currently adhering to the requirements.

Securities valuation – The Fund values its portfolio securities including common stocks at fair value as of the close of regular trading on the New York Stock Exchange (the “NYSE”) (normally 4:00 p.m. Eastern Time) on each day the NYSE is open for business. The Fund generally values its listed securities on the basis of the security’s last sale price on the security’s primary exchange, if available, otherwise at the exchange’s most recently quoted mean price. NASDAQ-listed securities are valued at the NASDAQ Official Closing Price. Investments representing shares of other open-end investment companies, other than exchange-traded funds, if any, but including money market funds, are valued at their net asset value (“NAV”) as reported by such companies. When using a quoted price and when the market is considered active, the security will be classified as Level 1 within the fair value hierarchy (see below). In the event that market quotations are not readily available or are considered unreliable due to market or other events, the Fund values its securities and other assets at fair value as determined by Edge Capital Group, LLC (the “Adviser”),

BLUE CURRENT GLOBAL DIVIDEND FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

as the Fund’s valuation designee, in accordance with procedures adopted by the Board of Trustees (the “Board”) pursuant to Rule 2a-5 under the Investment Company Act of 1940, as amended (the “1940 Act”). Under these procedures, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used. Unavailable or unreliable market quotes may be due to the following factors: a substantial bid-ask spread; infrequent sales resulting in stale prices; insufficient trading volume; small trade sizes; a temporary lapse in any reliable pricing source; and actions of the securities or futures markets, such as the suspension or limitation of trading. As a result, the prices of securities used to calculate the Fund’s NAV may differ from quoted or published prices for the same securities. Securities traded on foreign exchanges are typically fair valued by an independent pricing service and translated from the local currency into U.S. dollars using currency exchange rates supplied by an independent pricing service. GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair value measurements.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| ● | Level 1 – quoted prices in active markets for identical securities |

| ● | Level 2 – other significant observable inputs |

| ● | Level 3 – significant unobservable inputs |

The inputs or methods used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

The Fund’s foreign equity securities actively traded in foreign markets may be classified as Level 2 despite the availability of closing prices because such securities are typically fair valued by an independent pricing service. The Board has authorized the Fund to retain an independent pricing service to determine the fair value of its foreign securities because the value of such securities may be materially affected by events occurring before the Fund’s pricing time but after the close of the primary markets or exchanges on which such foreign securities are traded. These intervening events might be country-specific (e.g., natural disaster, economic or political developments, interest rate change); issuer specific (e.g., earnings report or merger announcement); or U.S. market-specific (such as a significant movement in the U.S. market that is deemed to affect the value of foreign securities). The pricing service uses an automated system that incorporates a model based on multiple parameters, including a security’s local closing price, relevant general

BLUE CURRENT GLOBAL DIVIDEND FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

and sector indices, currency fluctuations, trading in depositary receipts and futures, if applicable, and/or research valuations by its staff, in determining what it believes is the fair value of the securities.

The following is a summary of the Fund’s investments based on the inputs used to value the investments as of August 31, 2024:

| Investments in Securities: | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 57,850,461 | | | $ | 15,534,460 | | | $ | — | | | $ | 73,384,921 | |

| Money Market Funds | | | 4,033,514 | | | | — | | | | — | | | | 4,033,514 | |

| Total | | $ | 61,883,975 | | | $ | 15,534,460 | | | $ | — | | | $ | 77,418,435 | |

| | | | | | | | | | | | | | | | | |

Refer to the Fund’s Schedule of Investments for a listing of the common stocks by sector and industry type. The Fund did not have any assets or liabilities that were measured at fair value on a recurring basis using significant unobservable inputs (Level 3) as of or during the year ended August 31, 2024.

Foreign currency translation – Securities and other assets and liabilities denominated in or expected to settle in foreign currencies are translated into U.S. dollars based on exchange rates on the following basis:

| A. | The fair values of investment securities and other assets and liabilities are translated as of the close of the NYSE each day. |

| B. | Purchases and sales of investment securities and income and expenses are translated at the rate of exchange prevailing as of 4:00 p.m. Eastern Time on the respective date of such transactions. |

| C. | The Fund does not isolate that portion of the results of operations caused by changes in foreign exchange rates on investments from those caused by changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gains or losses on investments. |

Reported net realized foreign exchange gains or losses arise from 1) purchases and sales of foreign currencies, 2) currency gains or losses realized between the trade and settlement dates on securities transactions and 3) the difference between the amounts of dividends and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Reported net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities that result from changes in exchange rates.

The Fund may be subject to foreign taxes related to foreign income received, capital gain on the sale of securities and certain foreign currency transactions (a portion of which may be reclaimable). All foreign taxes are recorded in accordance with the applicable regulations and rates that exist in the foreign jurisdictions in which the Fund invests.

BLUE CURRENT GLOBAL DIVIDEND FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

Share valuation – The NAV per share of the Fund is calculated daily by dividing the total value of the assets, less liabilities, by the number of shares outstanding. The offering price and redemption price per share of the Fund is equal to the NAV per share, except that shareholders of the Fund are subject to a redemption fee equal to 2.00% of the value of Fund shares redeemed within 7 days of purchase, excluding involuntary redemptions of accounts that fall below the minimum investment amount or the redemption of Fund shares representing reinvested dividends, capital gain distributions, or capital appreciation. During the years ended August 31, 2024 and 2023, proceeds from redemption fees, recorded in capital, totaled $132 and $2,099, respectively.

Investment income – Dividend income is recorded on the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair value of the security received. Interest income is accrued as earned. The Fund may invest in real estate investment trusts (“REITs”) that pay distributions to their shareholders based on available funds from operations. It is common for these distributions to exceed the REIT’s taxable earnings and profits resulting in the excess portion of such distribution to be designated as return of capital. Distributions received from REITs are generally recorded as dividend income and, if necessary, are reclassified annually in accordance with tax information provided by the underlying REITs. The Fund may also invest in master limited partnerships (“MLPs”) whose distributions generally are comprised of ordinary income, capital gains and return of capital from the MLP. For financial statement purposes, the Fund records all income received as ordinary income. This amount may be subsequently revised based on information received from the MLPs after their tax reporting periods are concluded, as the actual character of these distributions is not known until after the fiscal year end of the Fund. Withholding taxes on foreign dividends have been recorded for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Investment transactions – Investment transactions are accounted for on the trade date. Realized gains and losses on investments sold are determined on a specific identification basis.

Common expenses – Common expenses of the Trust are allocated among the Fund and the other series of the Trust based on the relative net assets of each series, the number of series in the Trust, or the nature of the services performed and the relative applicability to each series.

Distributions to shareholders – Distributions to shareholders arising from net investment income are declared and paid quarterly to shareholders. Net realized capital gains, if any, are distributed at least annually. The amount of distributions from net investment income and net realized capital gains are determined in accordance with federal income tax

BLUE CURRENT GLOBAL DIVIDEND FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

regulations, which may differ from GAAP. Dividends and distributions to shareholders are recorded on the ex-dividend date. The tax character of distributions paid during the years ended August 31, 2024 and 2023 was as follows:

| Year Ended | | Ordinary

Income | | | Long-Term

Capital Gains | | | Total

Distributions | |

| August 31, 2024 | | $ | 1,409,877 | | | $ | — | | | $ | 1,409,877 | |

| August 31, 2023 | | $ | 1,231,192 | | | $ | 1,646,329 | | | $ | 2,877,521 | |

| | | | | | | | | | | | | |

On September 30, 2024, the Fund distributed an ordinary income dividend of $0.0477 per share to shareholders of record on September 27, 2024.

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities, each as of the date of the financial statements, and the reported amounts of increase (decrease) in net assets from operations during the reporting period. Actual results could differ from those estimates.

Federal income tax – The Fund has qualified and intends to continue to qualify as a regulated investment company under the Internal Revenue Code of 1986, as amended (the “Code”). Qualification generally will relieve the Fund of liability for federal income taxes to the extent 100% of its net investment income and net realized capital gains are distributed in accordance with the Code.

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also the Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the 12 months ended October 31) plus undistributed amounts from prior years.

The following information is computed on a tax basis for each item as of August 31, 2024:

| Tax cost of investments | | $ | 53,606,780 | |

| Gross unrealized appreciation | | $ | 23,906,104 | |

| Gross unrealized depreciation | | | (94,449 | ) |

| Net unrealized appreciation on investments | | | 23,811,655 | |

| Net unrealized appreciation on foreign currency translation | | | 29,349 | |

| Undistributed ordinary income | | | 145,411 | |

| Undistributed long-term capital gains | | | 1,632,495 | |

| Distributable earnings | | $ | 25,618,910 | |

| | | | | |

BLUE CURRENT GLOBAL DIVIDEND FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

The difference between the federal income tax cost of investments and the financial cost is due to certain timing differences in the recognition of capital gains or losses under income tax regulations and GAAP. These “book/tax” differences are temporary in nature and are primarily due to the tax deferral of losses on wash sales and the tax treatment of the cost of securities received as in-kind subscriptions at the inception of the Fund.

During the year ended August 31, 2024, the Fund utilized $829,970 of short-term capital loss carryforwards against current year realized capital gains.

The Fund recognizes the tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has reviewed the Fund’s tax positions for all open tax years (generally, three years) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements. The Fund identifies its major tax jurisdiction as U.S. federal.

The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax on the Statement of Operations. During the year ended August 31, 2024, the Fund did not incur any interest or penalties.

3. Investment Transactions

During the year ended August 31, 2024, cost of purchases and proceeds from sales of investment securities, other than short-term investments, were $30,953,866 and $29,320,335, respectively.

4. Transactions with Related Parties

INVESTMENT ADVISORY AGREEMENT

The Fund’s investments are managed by the Adviser pursuant to the terms of an Investment Advisory Agreement. Under the Investment Advisory Agreement, the Fund pays the Adviser a management fee, computed and accrued daily and paid monthly, at the annual rate of 0.99% of its average daily net assets.

Pursuant to an Expense Limitation Agreement between the Fund and the Adviser (the “ELA”), the Adviser had agreed, until January 1, 2026, to reduce its management fees and reimburse other expenses to limit total annual operating expenses (exclusive of brokerage costs; taxes; interest; borrowing costs such as interest and dividend expenses on securities sold short; costs to organize the Fund; acquired fund fees and expenses; and extraordinary expenses such as litigation and merger or reorganization costs and other expenses not incurred in the ordinary course of the Fund’s business) to an amount not exceeding 0.99% of the average daily net assets of the Institutional Class shares. Accordingly, under the ELA, the Adviser reduced its management fees in the amount of $301,002 during the year ended August 31, 2024.

BLUE CURRENT GLOBAL DIVIDEND FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

Under the terms of the ELA, management fee reductions and expense reimbursements by the Adviser are subject to repayment by the Fund for a period of 3 years after such fees and expenses were incurred, provided that the repayments do not cause the Fund’s total annual operating expenses to exceed the lesser of (i) the expense limitation then in effect, if any, and (ii) the expense limitation in effect at the time the expenses to be repaid were incurred. As of August 31, 2024, the Adviser may seek recoupment of investment advisory fee reductions in the amount of $838,501 no later than the dates stated below:

| | | | | |

| August 31, 2025 | | $ | 259,923 | |

| August 31, 2026 | | | 277,576 | |

| August 31, 2027 | | | 301,002 | |

| Total | | $ | 838,501 | |

| | | | | |

OTHER SERVICE PROVIDERS

Ultimus Fund Solutions, LLC (“Ultimus”) provides administration, fund accounting, and transfer agency services to the Fund. The Fund pays Ultimus fees in accordance with the agreements for such services. In addition, the Fund pays out-of-pocket expenses including, but not limited to, postage, supplies, and certain costs related to the pricing of the Fund’s portfolio securities.

Under the terms of a Consulting Agreement with the Trust, Northern Lights Compliance Services, LLC (“NLCS”) provides a Chief Compliance Officer and an Anti-Money Laundering Officer to the Trust, as well as related compliance services. Under the terms of the agreement, NLCS receives fees from the Fund. NLCS is a wholly-owned subsidiary of Ultimus.

Under the terms of a Distribution Agreement with the Trust, Ultimus Fund Distributors, LLC (the “Distributor”) serves as principal underwriter to the Fund. The Distributor is a wholly-owned subsidiary of Ultimus. The Distributor is compensated by the Adviser (not the Fund) for acting as principal underwriter.

Certain officers of the Trust are also officers of Ultimus and are not paid by the Fund for serving in such capacities.

TRUSTEE COMPENSATION

Each member of the Board (a “Trustee”) who is not an “interested person” (as defined by the 1940 Act, as amended) of the Trust (“Independent Trustee”) receives an annual retainer and meeting fees, plus reimbursements for travel and other meeting-related expenses.

BLUE CURRENT GLOBAL DIVIDEND FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

PRINCIPAL HOLDER OF FUND SHARES

As of August 31, 2024, the following shareholder owned of record 25% or more of the outstanding shares of the Fund:

| Name of Record Owner | | % Ownership |

| Pershing, LLC (for the benefit of multiple shareholders) | | 68% |

| | | |

A beneficial owner of 25% or more of the Fund’s outstanding shares may be considered a controlling person. The shareholder’s vote could have a more significant effect on matters presented at a shareholders’ meeting.

5. Foreign Investment Risk

Compared with investing in the U.S., investing in foreign markets involves a greater degree and variety of risk. Investors in foreign markets may face delayed settlements, currency controls, and adverse economic developments as well as higher overall transaction costs. In addition, fluctuations in the U.S. dollar’s value versus other currencies may erode or reverse gains or increase losses from investments denominated in foreign currencies. Foreign governments may expropriate assets, impose capital or currency controls, impose punitive taxes, impose limits on ownership or nationalize a company or industry. Any of these actions could have a severe effect on security prices and impair an investor’s ability to bring its capital or income back to the U.S. The value of foreign securities may be affected by incomplete, less frequent, or inaccurate financial information about their issuers, social upheavals, or political actions ranging from tax code changes to government collapse. Foreign companies may also receive less coverage by market analysts than U.S. companies and may be subject to different reporting standards or regulatory requirements than those applicable to U.S. companies.

6. Contingencies and Commitments

The Fund indemnifies the Trust’s officers and Trustees for certain liabilities that might arise from their performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations, warranties, and general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

7. Subsequent Events

The Fund is required to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statement of Assets and Liabilities. For non-recognized subsequent events that must be

BLUE CURRENT GLOBAL DIVIDEND FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

disclosed to keep the financial statements from being misleading, the Fund is required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no such events other than the ordinary income dividend distributed to shareholders on September 30, 2024, as discussed in Note 2.

BLUE CURRENT GLOBAL DIVIDEND FUND

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

To the Shareholders of Blue Current Global Dividend Fund and

Board of Trustees of Ultimus Managers Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Blue Current Global Dividend Fund (the “Fund”), a series of Ultimus Managers Trust, as of August 31, 2024, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of August 31, 2024, the results of its operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of August 31, 2024, by correspondence with the custodian and broker; when replies were not received from brokers, we performed other auditing procedures. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

BLUE CURRENT GLOBAL DIVIDEND FUND

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

We have served as the Fund’s auditor since 2014.

COHEN & COMPANY, LTD.

Philadelphia, Pennsylvania

October 29, 2024

BLUE CURRENT GLOBAL DIVIDEND FUND

OTHER INFORMATION (Unaudited)

A description of the policies and procedures that the Fund uses to vote proxies relating to portfolio securities is available without charge upon request by calling 1-800-514-3583, or on the SEC’s website at www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is also available without charge upon request by calling 1-800-514-3583, or on the SEC’s website at www.sec.gov.

The Trust files a complete listing of portfolio holdings for the Fund with the SEC as of the end of the first and third quarters of each fiscal year an exhibit to Form N-PORT. These filings are available upon request by calling 1-800-514-3583. Furthermore, you may obtain a copy of the filings on the SEC’s website at www.sec.gov and on the Fund’s website www.bluecurrentfunds.com.

OTHER FEDERAL TAX INFORMATION (Unaudited)

Qualified Dividend Income – The Fund designates 100% of its ordinary income dividends, or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue code, as qualified dividend income eligible for the reduced tax rate.

Dividends Received Deduction – Corporate shareholders are generally entitled to take the dividends received deduction on the portion of the Fund’s dividend distributions that qualifies under tax law. For the fiscal year ended August 31, 2024, 46.91% of ordinary income dividends qualified for the corporate dividends received deduction.

This page intentionally left blank.

Financial Statements

August 31, 2024

MARSHFIELD CONCENTRATED OPPORTUNITY FUND

SCHEDULE OF INVESTMENTS

August 31, 2024

| COMMON STOCKS — 74.4% | | Shares | | | Value | |

| Accommodation and Food Services — 4.3% | | | | | | | | |

| Restaurants and Other Eating Places — 4.3% | | | | | | | | |

| Domino’s Pizza, Inc. | | | 99,398 | | | $ | 41,171,645 | |

| | | | | | | | | |

| Administrative and Support and Waste Management and Remediation Services — 3.8% | | | | | | | | |

| Credit Bureaus — 3.8% | | | | | | | | |

| Moody’s Corporation | | | 74,009 | | | | 36,097,150 | |

| | | | | | | | | |

| Construction — 3.4% | | | | | | | | |

| Residential Building Construction — 3.4% | | | | | | | | |

| NVR, Inc. (a) | | | 3,535 | | | | 32,424,646 | |

| | | | | | | | | |

| Educational Services — 2.7% | | | | | | | | |

| Colleges, Universities, and Professional Schools — 2.7% | | | | | | | | |

| Strategic Education, Inc. | | | 267,444 | | | | 25,808,346 | |

| | | | | | | | | |

| Finance and Insurance — 18.5% | | | | | | | | |

| Direct Insurance (except Life, Health, and Medical) Carriers — 10.0% | | | | | | | | |

| Arch Capital Group Ltd. (a) | | | 554,437 | | | | 62,701,280 | |

| Progressive Corporation (The) | | | 129,356 | | | | 32,623,583 | |

| | | | | | | | 95,324,863 | |

| Financial Transactions Processing, Reserve, and Clearinghouse Activities — 8.5% | | | | | | | | |

| Mastercard, Inc. - Class A | | | 89,111 | | | | 43,070,911 | |

| Visa, Inc. - Class A | | | 138,932 | | | | 38,396,637 | |

| | | | | | | | 81,467,548 | |

| Information — 2.1% | | | | | | | | |

| Motion Picture and Video Production — 2.1% | | | | | | | | |

| Walt Disney Company (The) | | | 224,321 | | | | 20,274,132 | |

| | | | | | | | | |

| Manufacturing — 5.3% | | | | | | | | |

| Engine, Turbine, and Power Transmission Equipment — 5.3% | | | | | | | | |

| Cummins, Inc. | | | 161,436 | | | | 50,505,253 | |

MARSHFIELD CONCENTRATED OPPORTUNITY FUND

SCHEDULE OF INVESTMENTS (Continued)

| COMMON STOCKS — 74.4% (Continued) | | Shares | | | Value | |

| Retail Trade — 28.5% | | | | | | | | |

| Automotive Parts and Accessories Retailers — 15.2% | | | | | | | | |

| AutoZone, Inc. (a) | | | 27,565 | | | $ | 87,697,496 | |

| O’Reilly Automotive, Inc. (a) | | | 50,838 | | | | 57,445,415 | |

| | | | | | | | 145,142,911 | |

| Clothing and Clothing Accessories Retailers — 13.3% | | | | | | | | |

| Ross Stores, Inc. | | | 583,154 | | | | 87,828,824 | |

| TJX Companies, Inc. (The) | | | 339,018 | | | | 39,756,641 | |

| | | | | | | | 127,585,465 | |

| Transportation and Warehousing — 3.4% | | | | | | | | |

| Freight Transportation Arrangement — 3.4% | | | | | | | | |

| Expeditors International of Washington, Inc. | | | 267,119 | | | | 32,965,156 | |

| | | | | | | | | |

| Wholesale Trade — 2.4% | | | | | | | | |

| Industrial Supplies Merchant Wholesalers — 2.4% | | | | | | | | |

| Fastenal Company | | | 335,230 | | | | 22,889,504 | |

| | | | | | | | | |

| Total Common Stocks (Cost $468,481,531) | | | | | | $ | 711,656,619 | |

| MONEY MARKET FUNDS — 25.6% | | Shares | | | Value | |

Goldman Sachs Financial Square Funds – Treasury Instruments Fund -

Institutional Shares, 5.13% (b) | | | 120,045,084 | | | $ | 120,045,084 | |

| Vanguard Treasury Money Market Fund - Investor Shares, 5.25% (b) | | | 124,396,798 | | | | 124,396,798 | |

| Total Money Market Funds (Cost $244,441,882) | | | | | | $ | 244,441,882 | |

| | | | | | | | | |

| Investments at Value — 100.0% (Cost $712,923,413) | | | | | | $ | 956,098,501 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (0.0%) (c) | | | | | | | (137,611 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 955,960,890 | |

| (a) | Non-income producing security. |

| (b) | The rate shown is the 7-day effective yield as of August 31, 2024. |

| (c) | Percentage rounds to less than 0.1%. |

See accompanying notes to financial statements.

MARSHFIELD CONCENTRATED OPPORTUNITY FUND

STATEMENT OF ASSETS AND LIABILITIES

August 31, 2024

| ASSETS | | | |

| Investments in securities: | | | | |

| At cost | | $ | 712,923,413 | |

| At value (Note 2) | | $ | 956,098,501 | |

| Receivable for capital shares sold | | | 1,951,676 | |

| Dividends receivable | | | 1,592,585 | |

| Other assets | | | 43,444 | |

| Total assets | | | 959,686,206 | |

| | | | | |

| LIABILITIES | | | | |

| Payable for capital shares redeemed | | | 386,415 | |

| Payable for investment securities purchased | | | 2,526,616 | |

| Payable to Adviser (Note 4) | | | 671,262 | |

| Payable to administrator (Note 4) | | | 70,120 | |

| Other accrued expenses | | | 70,903 | |

| Total liabilities | | | 3,725,316 | |

| | | | | |

| CONTINGENCIES AND COMMITMENTS (Note 5) | | | — | |

| | | | | |

| NET ASSETS | | $ | 955,960,890 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Paid-in capital | | $ | 674,419,569 | |

| Distributable earnings | | | 281,541,321 | |

| NET ASSETS | | $ | 955,960,890 | |

| | | | | |

Shares of beneficial interest outstanding

(unlimited number of shares authorized, no par value) | | | 29,248,465 | |

| | | | | |

| Net asset value, offering price and redemption price per share (Note 2) | | $ | 32.68 | |

See accompanying notes to financial statements.

MARSHFIELD CONCENTRATED OPPORTUNITY FUND

STATEMENT OF OPERATIONS

For the Year Ended August 31, 2024

| INVESTMENT INCOME | | | |

| Dividend income | | $ | 12,816,250 | |

| | | | | |

| EXPENSES | | | | |

| Management fees (Note 4) | | | 6,993,735 | |

| Administration fees (Note 4) | | | 459,808 | |

| Registration and filing fees | | | 108,729 | |

| Fund accounting fees (Note 4) | | | 96,136 | |

| Custody and bank service fees | | | 74,028 | |

| Compliance fees and expenses (Note 4) | | | 72,927 | |

| Transfer agent fees (Note 4) | | | 70,416 | |

| Legal fees | | | 30,107 | |

| Postage and supplies | | | 28,751 | |

| Trustees’ fees and expenses (Note 4) | | | 20,575 | |

| Shareholder reporting expenses | | | 20,509 | |

| Audit and tax services fees | | | 16,932 | |

| Insurance expense | | | 6,229 | |

| Other expenses | | | 17,703 | |

| Total expenses | | | 8,016,585 | |

| Less fee reductions by the Adviser (Note 4) | | | (728,377 | ) |

| Net expenses | | | 7,288,208 | |

| | | | | |

| NET INVESTMENT INCOME | | | 5,528,042 | |

| | | | | |

| REALIZED AND UNREALIZED GAINS ON INVESTMENTS | | | | |

| Net realized gains from investment transactions | | | 33,765,364 | |

| Net change in unrealized appreciation (depreciation) on investments | | | 121,214,943 | |

| NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS | | | 154,980,307 | |

| | | | | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 160,508,349 | |

See accompanying notes to financial statements.

MARSHFIELD CONCENTRATED OPPORTUNITY FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Year Ended

August 31,

2024 | | | Year Ended

August 31,

2023 | |

| FROM OPERATIONS | | | | | | | | |

| Net investment income | | $ | 5,528,042 | | | $ | 2,528,395 | |

| Net realized gains from investment transactions | | | 33,765,364 | | | | 3,540 | |

| Net change in unrealized appreciation (depreciation) on investments | | | 121,214,943 | | | | 73,206,553 | |

| Net increase in net assets resulting from operations | | | 160,508,349 | | | | 75,738,488 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS (Note 2) | | | (2,918,097 | ) | | | (1,316,545 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 377,045,578 | | | | 210,124,396 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 2,835,203 | | | | 1,285,302 | |

| Proceeds from redemption fees collected (Note 2) | | | 195,521 | | | | 167,152 | |

| Payments for shares redeemed | | | (114,746,208 | ) | | | (64,534,655 | ) |

| Net increase in net assets from capital share transactions | | | 265,330,094 | | | | 147,042,195 | |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 422,920,346 | | | | 221,464,138 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 533,040,544 | | | | 311,576,406 | |

| End of year | | $ | 955,960,890 | | | $ | 533,040,544 | |

| | | | | | | | | |

| CAPITAL SHARES ACTIVITY | | | | | | | | |

| Shares sold | | | 12,767,207 | | | | 8,504,444 | |

| Shares reinvested | | | 101,802 | | | | 53,733 | |

| Shares redeemed | | | (3,891,223 | ) | | | (2,627,359 | ) |

| Net increase in shares outstanding | | | 8,977,786 | | | | 5,930,818 | |

| Shares outstanding at beginning of year | | | 20,270,679 | | | | 14,339,861 | |

| Shares outstanding at end of year | | | 29,248,465 | | | | 20,270,679 | |

See accompanying notes to financial statements.

MARSHFIELD CONCENTRATED OPPORTUNITY FUND

FINANCIAL HIGHLIGHTS

Per Share Data for a Share Outstanding Throughout Each Year

| | | Year Ended

August 31,

2024 | | | Year Ended

August 31, 2023 | | | Year Ended

August 31,

2022 | | | Year Ended

August 31,

2021 | | | Year Ended

August 31,

2020 | |

| Net asset value at beginning of year | | $ | 26.30 | | | $ | 21.73 | | | $ | 23.76 | | | $ | 20.10 | | | $ | 17.65 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.19 | | | | 0.13 | | | | (0.01 | ) | | | (0.06 | ) | | | (0.02 | ) |

| Net realized and unrealized gains (losses) on investments | | | 6.31 | | | | 4.51 | | | | (0.46 | ) | | | 4.27 | | | | 2.72 | |

| Total from investment operations | | | 6.50 | | | | 4.64 | | | | (0.47 | ) | | | 4.21 | | | | 2.70 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.13 | ) | | | (0.03 | ) | | | — | | | | — | | | | (0.02 | ) |

| Net realized gains | | | — | | | | (0.05 | ) | | | (1.56 | ) | | | (0.56 | ) | | | (0.24 | ) |

| Total distributions | | | (0.13 | ) | | | (0.08 | ) | | | (1.56 | ) | | | (0.56 | ) | | | (0.26 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Proceeds from redemption fees collected (Note 2) | | | 0.01 | | | | 0.01 | | | | 0.00 | (a) | | | 0.01 | | | | 0.01 | |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value at end of year | | $ | 32.68 | | | $ | 26.30 | | | $ | 21.73 | | | $ | 23.76 | | | $ | 20.10 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total return (b) | | | 24.84 | % | | | 21.46 | % | | | (2.21 | %) | | | 21.44 | % | | | 15.47 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Net assets at end of year (000’s) | | $ | 955,961 | | | $ | 533,041 | | | $ | 311,576 | | | $ | 286,116 | | | $ | 202,381 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/supplementary data: | | | | | | | | | | | | | | | | | | | | |