UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File number 811-22698

KraneShares Trust

(Exact name of registrant as specified in charter)

1270 Avenue of the Americas

22ndFloor

New York, New York, 10020

(Address of principal executive offices) (Zip code)

Jonathan Krane

KraneShares Trust

1270 Avenue of the Americas

22ndFloor

New York, New York, 10020

(Name and address of agent for service)

Copy to:

Stacy L. Fuller

K&L Gates LLP

1601 K Street NW

Washington, DC 20006-1600

Registrant’s telephone number, including area code: (855) 857-2638

Date of fiscal year end: March 31, 2019

Date of reporting period: March 31, 2019

| Item 1. | Reports to Stockholders. |

The Registrant’s schedules as of the close of the reporting period, as set forth in §§ 210.12-12 through 210.12-14 of Regulation S-X [17 CFR §§ 210-12.12-12.14], are attached hereto.

| | | Annual Report KraneShares CICC China Leaders 100 Index ETF (Formerly, KraneShares Zacks New China ETF) KraneShares CSI China Internet ETF KraneShares Bosera MSCI China A Share ETF KraneShares E Fund China Commercial Paper ETF KraneShares MSCI All China Index ETF (Formerly, KraneShares FTSE Emerging Market Plus ETF) KraneShares MSCI One Belt One Road Index ETF KraneShares Emerging Markets Consumer Technology Index ETF KraneShares MSCI China Environment Index ETF KraneShares Electric Vehicles and Future Mobility Index ETF KraneShares MSCI All China Health Care Index ETF KraneShares CCBS China Corporate High Yield Bond USD Index ETF KraneShares Emerging Markets Healthcare Index ETF Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund (if you hold your Fund shares directly with the Fund) or from your financial intermediary, such as a broker-dealer or bank (if you hold your Fund shares through a financial intermediary). Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you hold your Fund shares directly with the Fund, you may elect to receive shareholder reports and other communications electronically from the Fund by contacting the Fund at 855-857-2638 or, if you hold your Fund shares through a financial intermediary, contacting your financial intermediary. You may elect to receive all future reports in paper free of charge. If you hold your Fund shares directly with the Fund, you can inform the Fund that you wish to continue receiving paper copies of your shareholder reports at 855-857-2638 or, if you hold your Fund shares through a financial intermediary, contacting your financial intermediary. Your election to receive reports in paper will apply to all of the KraneShares Funds you hold directly with series of the Trust or through your financial intermediary, as applicable. March 31, 2019 |

Table of Contents

| Management Discussion of Fund Performance (Unaudited) | | 1 |

| Schedules of Investments | | |

| KraneShares CICC China Leaders 100 Index ETF | | 30 |

| KraneShares CSI China Internet ETF | | 34 |

| KraneShares Bosera MSCI China A Share ETF | | 37 |

| KraneShares E Fund China Commercial Paper ETF | | 44 |

| KraneShares MSCI All China Index ETF | | 48 |

| KraneShares MSCI One Belt One Road Index ETF | | 57 |

| KraneShares Emerging Markets Consumer Technology Index ETF | | 62 |

| KraneShares MSCI China Environment Index ETF | | 66 |

| KraneShares Electric Vehicles and Future Mobility Index ETF | | 69 |

| KraneShares MSCI All China Health Care Index ETF | | 73 |

| KraneShares CCBS China Corporate High Yield Bond USD Index ETF | | 75 |

| KraneShares Emerging MarketsHealthcare Index ETF | | 79 |

| Statements of Assets and Liabilities | | 82 |

| Statements of Operations | | 86 |

| Statements of Changes in Net Assets | | 90 |

| Financial Highlights | | 102 |

| Notes to Financial Statements | | 106 |

| Report of Independent Registered Public Accounting Firm | | 130 |

| Trustees and Officers of the Trust (Unaudited) | | 133 |

| Disclosure of Fund Expenses (Unaudited) | | 135 |

| Notice to Shareholders (Unaudited) | | 137 |

| Supplemental Information (Unaudited) | | 139 |

The Funds file their complete schedules of Fund holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT within sixty days after the end of the period. The Funds’ Form N-PORT reports are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that KraneShares Trust uses to determine how to vote proxies relating to Fund securities, as well as information relating to how the Funds voted proxies relating to Fund securities during the most recent 12-month year ended June 30, are available (i) without charge, upon request, by calling 855-857-2638; and (ii) on the Commission’s website at http://www.sec.gov.

Fund shares may only be purchased or redeemed from a Fund in large Creation Unit aggregations. Investors who cannot transact in Creation Units of a Fund’s shares must buy or sell Fund shares in the secondary market at their market price, which may be at a premium or discount to a Fund’s net asset value, with the assistance of a broker. In doing so, the investor may incur brokerage commissions and may pay more than net asset value when buying Fund shares and receive less than net asset value when selling Fund shares.

Management Discussion of Fund Performance (Unaudited)

Dear Shareholders:

We are pleased to send you the Annual Report for KraneShares exchange-traded funds (“ETFs”) for the 12-month period ended March 31, 2019.

For the period, the ETFs delivered the following total returns:

| Fund | | Return* | | Underlying

Index

Return** | | Morningstar

Peer Group

Median | |

| KraneShares Bosera MSCI China A Share ETF (KBA) | | | -4.01%· | | | -5.77% | (a) | | | -6.40% | (1) | |

| KraneShares CICC China Leaders 100 Index ETF (KFYP) | | | -0.62%· | | | -0.83% | (b) | | | -6.40% | (1) | |

| KraneShares CSI China Internet ETF (KWEB) | | | -20.44%· | | | -19.88% | (c) | | | -6.40% | (1) | |

| KraneShares MSCI All China Index ETF (KALL) | | | -3.52%· | | | -3.13% | (d) | | | -6.40% | (1) | |

| KraneShares MSCI China Environment Index ETF (KGRN) | | | -13.28%· | | | -12.50% | (e) | | | -6.40% | (1) | |

| KraneShares MSCI All China Health Care Index ETF (KURE) | | | -15.99%· | | | -16.71% | (f) | | | -6.40% | (1) | |

| KraneShares MSCI One Belt One Road Index ETF (OBOR) | | | -4.94%· | | | -3.76% | (g) | | | -9.31% | (2) | |

| KraneShares Emerging Markets Consumer Technology Index ETF (KEMQ) | | | -13.37%· | | | -12.79% | (h) | | | -9.31% | (2) | |

| KraneShares Electric Vehicles and Future Mobility Index ETF (KARS) | | | -10.19%· | | | -10.55% | (i) | | | 0.04% | (3) | |

| KraneShares E Fund China Commercial Paper ETF (KCNY) | | | -2.52%· | | | -2.54% | (j) | | | 0.70% | (4) | |

| KraneSahres CCBS China Corporate High Yield Bond USD Index ETF (KCCB) | | | 5.72%^ | | | 8.84% | (k) | | | N/A | | |

KraneShares Emerging Market Healthcare

Index ETF (KMED) | | | -10.47%^ | | | -10.75% | (l) | | | N/A | | |

For comparison, below are the returns of broad-based U.S. and international market indexes, including emerging market and China indexes. The indexes provide measures of the broad market performance of U.S. and international equities, including emerging market and China equities.

| Index | | One-Year

Return** | |

| S&P 500 Index | | 9.50% | |

| JPMorgan EMBI Global Core Index | | 3.96% | |

| MSCI Emerging Markets Index | | -7.41% | |

| MSCI China All Shares Index | | -6.82% | |

We are encouraged by the steady progress being made by China to increase access to local Mainland Chinese markets for international investors, as well as by the heightened demand and awareness of these markets by the global investor community.

| • | We believe that China will continue to grow and be an essential element of a well-designed investment portfolio. |

| • | We believe that investors should have low-cost, transparent tools to obtain exposure to Chinese equity and fixed income markets. |

| • | We are dedicated to helping investors obtain more complete passive market exposures and more balanced investment portfolios. |

Thank you for investing with us.

Jonathan Krane, CEO

March 31, 2019

Management Discussion of Fund Performance (Unaudited)(continued)

____________

| * | Return based on net asset value as of March 31, 2019 |

| ** | Return as of March 31, 2019. Indices are unmanaged and do not include the effect of fees. One cannot invest directly in an index. |

| • | Return for one-year period |

| ^ | Return period since Fund inception (less than one-year period) |

| | | Morning Star

Peer Group Median | | Morningstar Peer Group Name |

| (1) | | -6.40% | | U.S. Fund China Region |

| (2) | | -9.31% | | U.S. Fund Diversified Emerging Markets |

| (3) | | 0.04% | | U.S. Fund Industrials |

| (4) | | 0.70% | | U.S. Fund Emerging Markets Bond |

(a) The underlying index for KraneShares Bosera MSCI China A Share ETF.

(b) The underlying index for KraneShares CICC China Leaders 100 Index ETF.

(c) The underlying index for KraneShares CSI China Internet ETF.

(d) The underlying index for KraneShares MSCI All China Index ETF.

(e) The underlying index for KraneShares MSCI China Environment Index ETF.

(f) The underlying index for KraneShares MSCI All China Health Care Index ETF.

(g) The underlying index for KraneShares MSCI One Belt One Road Index ETF.

(h) The underlying index for KraneShares Emerging Markets Consumer Technology Index ETF.

(i) The underlying index for KraneShares Electric Vehicles and Future Mobility Index ETF.

(j) The underlying index for KraneShares E Fund China Commercial Paper ETF.

(k) The underlying index for KraneShares CCBS China Corporate High Yield Bond USD Index ETF.

(l) The underlying index for KraneShares Emerging Market Healthcare Index ETF.

TheS&P 500 Index is a market capitalization weighted composite index of 500 large-cap U.S. companies.

TheMSCI China All Shares Indexcaptures large and mid-cap representation across China A-shares, B-shares, H-shares, Red-chips, P-chips and foreign listings (e.g. American Depository Receipts, “ADR”s). The index aims to reflect the opportunity set of China share classes listed in Hong Kong, Shanghai, Shenzhen and outside of China.

TheJPMorgan EMBI Global Core Index is a broad, diverse U.S. dollar denominated emerging markets debt benchmark that tracks the total return of actively traded debt instruments in emerging market countries.

TheMSCI Emerging Markets Indexis a free-float adjusted market capitalization index that is designed to measure equity market performance of emerging markets.

TheMorningstar Fund China RegionCategory portfolios invest almost exclusively in stocks from China, Taiwan, and Hong Kong. These portfolios invest at least 70% of total assets in equities and invest at least 75% of stock assets in one specific region or a combination of China, Taiwan, and/ or Hong Kong.

TheMorningstar Fund Diversified Emerging Markets Category portfolios tend to divide their assets among 20 or more nations, although they tend to focus on the emerging markets of Asia and Latin America rather than on those of the Middle East, Africa, or Europe. These portfolios invest predominantly in emerging market equities, but some funds also invest in both equities and fixed income investments from emerging markets.

Management Discussion of Fund Performance (Unaudited)(continued)

TheMorningstar Fund Emerging Markets Bond portfolios invest more than 65% of their assets in foreign bonds from developing countries. The largest portion of the emerging-markets bond market comes from Latin America, followed by Eastern Europe. Africa, the Middle East, and Asia make up the rest.

TheMorningstar Fund IndustrialsCategory portfolios seek capital appreciation by investing in equity securities of U.S. or non-U.S. companies that are engaged in services related to cyclical industries. This includes and is not limited to companies in aerospace and defense, automotive, chemicals, construction, environmental services, machinery, paper and transportation.

Management Discussion of Fund Performance (Unaudited)(continued)

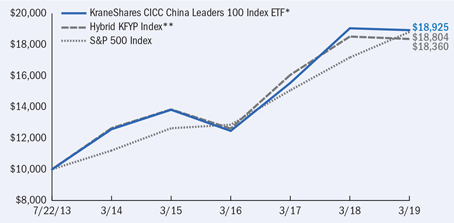

KraneShares CICC China Leaders 100 Index ETF

The KraneShares CICC China Leaders 100 Index ETF (the ‘‘Fund’’) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the CSI CICC Select 100 Index (the ‘‘Underlying Index’’).

The Underlying Index takes a smart-beta approach to systematically investing in companies listed in Mainland China. The strategy is based on China International Capital Corporation (“CICC”)’s latest research on China’s capital markets. This quantitative approach reflects CICC’s top down and bottom up research process, seeking to deliver the 100 leading companies in Mainland China.

China review

In the fiscal year from April 1, 2018 through March 31, 2019, global equity markets faced two main challenges, each of which materially affected the performance of the Fund: an uncertain rate cycle from the U.S. Federal Reserve (“Fed”) and trade tensions between the U.S. and China. Trade tensions initially had an outsized negative impact on Chinese equities compared to the U.S., however, by the end of December 2018, U.S. equities experienced a steep decline exacerbated by hawkish Fed comments. This volatility in U.S. markets caused the Fed to forgo raising rates for the foreseeable future accompanied by a temporary trade truce between the U.S. and China. Both Chinese and U.S. equity markets rebounded sharply in January 2019 and have since continued to climb, though trade concerns and global equity market volatility still lingers.

We see two key positive developments for the opening up of China’s capital markets:

| • | On February 28, 2019, MSCI made a larger than expected China A-Share inclusion announcement. MSCI will increase the inclusion factor of China A-Shares in their Global Standard Indexes from 5% to 20% in 2019. |

| • | On April 1, 2019, Bloomberg Barclays began including renminbi (“RMB”)-denominated bonds issued by the Chinese government and policy banks into their Global Aggregate Index, tracked by $2.5 trillion in assets. |

China Capital Market Overview

| • | China’s equity market, as measured by the MSCI China All Shares Index, was down for the period, returning -6.4%, while China’s currency, the RMB depreciated 6.9% against the U.S. dollar. |

| • | The best performing sectors across China’s equity markets included Communication Services (+16.38%), Energy (+4.84%) and Utilities (+3.74%). |

| • | The worst performing sectors across China’s equity markets were Health Care (-20.32%), Consumer Discretionary (-17.58%) and Materials (-16.74%). |

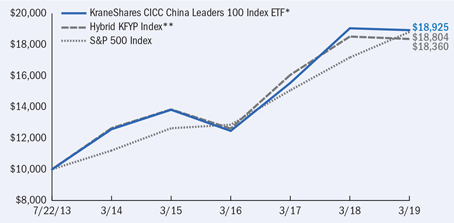

By the Fund’s fiscal year end on March 31, 2019 (the ‘‘reporting period’’), the NAV of the Fund decreased 0.62% for the year, while the Underlying Index decreased 0.83%.

The Fund held 32% of the portfolio in the Financials Sector and 20% in the Consumer Discretionary Sector.

Management Discussion of Fund Performance (Unaudited)(continued)

KraneShares CICC China Leaders 100 Index ETF(concluded)

Growth of a $10,000 Investment‡

(at Net Asset Value)‡

AVERAGE TOTAL RETURN FOR THE PERIOD ENDED MARCH 31, 2019*

| | | One Year

Return | | Three Year

Return | | Five Year

Return | | Annualized

Inception to Date | |

| | | Net

Asset

Value | | Market

Price^ | | Net

Asset

Value | | Market

Price^ | | Net

Asset

Value | | Market

Price^ | | Net

Asset

Value | | Market

Price^ | |

KraneShares CICC China

Leaders 100 Index ETF | | | -0.62% | | | -1.97%‡ | | | 14.94%‡ | | | 15.45%‡ | | | 8.53%‡ | | | 7.83%‡ | | | 11.86%‡ | | | 11.31%‡ | |

| Hybrid KFYP Index (Net)** | | | N/A | | | -0.83%‡ | | | N/A | | | 13.32%‡ | | | N/A | | | 7.75%‡ | | | N/A | | | 11.26%‡ | |

| S&P 500 Index | | | N/A | | | 9.50%‡ | | | N/A | | | 13.51%‡ | | | N/A | | | 10.91%‡ | | | N/A | | | 11.73%‡ | |

| * | The Fund commenced operations on July 22, 2013. |

| ** | The Hybrid KFYP Index (Net) consists of the CSI China Overseas Five Year Plan Index from the inception of the Fund through May 31, 2016, the Zacks New China Index from June 1, 2016 through November 1, 2018, and the CSI CICC Select 100 Index going forward. From June 1, 2016 to November 1, 2018, the Fund sought to provide investment results that, before fees and expenses, corresponded generally to the price and yield performance of the Zacks New China Index. Prior to June 1, 2016, the Fund was known as the KraneShares CSI New China ETF and sought to provide investment results that, before fees and expenses, corresponded generally to the price and yield performance of the CSI Overseas China Five-Year Plan Index. Hybrid KFYP Index (Net) Reflects reinvested dividends net of withholding taxes, but reflects no deduction for fees, expenses, or other taxes. |

| ^ | The “Market Price” of the Funds generally is determined using the midpoint between the highest bid and the lowest offer on the stock exchange on which the Shares of the Funds are listed for trading, as of the time that the Funds’ NAV is calculated. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost. Current performance may be lower or higher than the performance data quoted. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. For performance data current to the most recent month end, please call 855-857-2638 or visit www.kraneshares.com. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. As stated in the Fund’s prospectus, the Fund’s operating expense ratio is 0.71%. Please note that one cannot invest directly in an unmanaged index. There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities. For further information on the Fund’s objectives, risks, and strategies, see the Fund’s prospectus. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Management Discussion of Fund Performance (Unaudited)(continued)

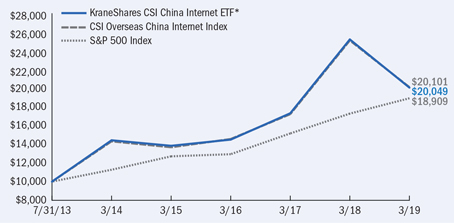

KraneShares CSI China Internet ETF

The KraneShares CSI China Internet ETF (the ‘‘Fund’’) seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the CSI Overseas China Internet Index (the ‘‘Underlying Index’’).

The Underlying Index is designed to measure the performance of the investable universe of publicly traded China-based companies whose primary business or businesses are in the Internet and Internet-related sectors (‘‘China Internet Companies’’), as defined by the index sponsor, China Securities Index Co., Ltd. (‘‘CSI’’).

China review

In the fiscal year from April 1, 2018 through March 31, 2019, global equity markets faced two main challenges, each of which materially affected the performance of the Fund: an uncertain rate cycle from the U.S. Federal Reserve (“Fed”) and trade tensions between the U.S. and China. Trade tensions initially had an outsized negative impact on Chinese equities compared to the U.S., however, by the end of December 2018, U.S. equities experienced a steep decline exacerbated by hawkish Fed comments. This volatility in U.S. markets caused the Fed to forgo raising rates for the foreseeable future accompanied by a temporary trade truce between the U.S. and China. Both Chinese and U.S. equity markets rebounded sharply in January 2019 and have since continued to climb, though trade concerns and global equity market volatility still lingers.

We see two key positive developments for the opening up of China’s capital markets:

| • | On February 28, 2019, MSCI made a larger than expected China A-Share inclusion announcement. MSCI will increase the inclusion factor of China A-Shares in their Global Standard Indexes from 5% to 20% in 2019. |

| • | On April 1, 2019, Bloomberg Barclays began including renminbi (“RMB”)-denominated bonds issued by the Chinese government and policy banks into their Global Aggregate Index, tracked by $2.5 trillion in assets. |

China Capital Market Overview

| • | China’s equity market, as measured by the MSCI China All Shares Index, was down for the period, returning -6.4%, while China’s currency, the RMB depreciated 6.9% against the U.S. dollar. |

| • | The best performing sectors across China’s equity markets included Communication Services (+16.38%), Energy (+4.84%) and Utilities (+3.74%). |

| • | The worst performing sectors across China’s equity markets were Health Care (-20.32%), Consumer Discretionary (-17.58%) and Materials (-16.74%). |

By the Fund’s fiscal year end on March 31, 2019 (the ‘‘reporting period’’), the NAV of the Fund decreased 20.44% for the year, while the Underlying Index decreased 19.88%.

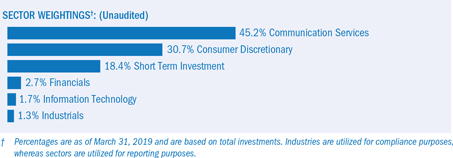

The Fund held 55% of the portfolio in the Global Communication Services Sector and 38% in the Consumer Discretionary Sector.

Management Discussion of Fund Performance (Unaudited)(continued)

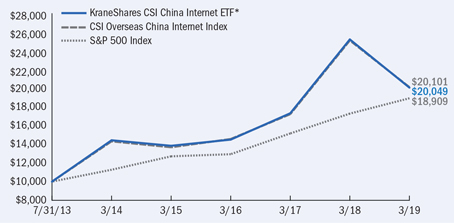

KraneShares CSI China Internet ETF(concluded)

Growth of a $10,000 Investment‡

(at Net Asset Value)‡

AVERAGE TOTAL RETURN FOR THE PERIOD ENDED MARCH 31, 2019*

| | | One Year

Return | | Three Year

Return | | Five Year

Return | | Annualized

Inception to Date | |

| | | Net

Asset

Value | | Market

Price^ | | Net

Asset

Value | | Market

Price^ | | Net Asset

Value | | Market

Price^ | | Net

Asset

Value | | Market Price^ | |

KraneShares CSI

China Internet ETF | | | -20.44% | | | -20.53%‡ | | | 11.46%‡ | | | 11.35%‡ | | | 6.82%‡ | | | 6.78%‡ | | | 13.06%‡ | | | 13.07%‡ | |

CSI Overseas China

Internet Index | | | N/A | | | -19.88%‡ | | | N/A | | | 11.37%‡ | | | N/A | | | 7.04%‡ | | | N/A | | | 13.11%‡ | |

| S&P 500 Index | | | N/A | | | 9.50%‡ | | | N/A | | | 13.51%‡ | | | N/A | | | 10.91%‡ | | | N/A | | | 11.89%‡ | |

| * | The Fund commenced operations on July 31, 2013. |

| ^ | The “Market Price” of the Funds generally is determined using the midpoint between the highest bid and the lowest offer on the stock exchange on which the Shares of the Funds are listed for trading, as of the time that the Funds’ NAV is calculated. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost. Current performance may be lower or higher than the performance data quoted. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. For performance data current to the most recent month end, please call 855-857-2638 or visit www.kraneshares.com. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. As stated in the Fund’s prospectus, the Fund’s operating expense ratio is 0.70%. Please note that one cannot invest directly in an unmanaged index. There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities. For further information on the Fund’s objectives, risks, and strategies, see the Fund’s prospectus. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Management Discussion of Fund Performance (Unaudited)(continued)

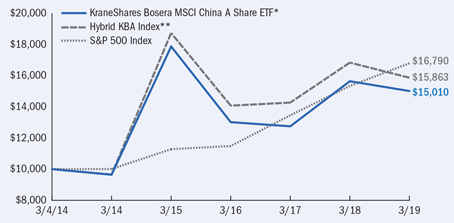

KraneShares Bosera MSCI China A Share ETF

The KraneShares Bosera MSCI China A Share ETF (the ‘‘Fund’’) seeks to provide investment results that, before fees and expenses, correspond to the price and yield performance of the MSCI China A Inclusion Index (the ‘‘Underlying Index’’).

The Underlying Index is designed to track the progressive partial inclusion of A shares in the MSCI Emerging Markets Index over time. The index is designed for global investors accessing the A shares market using the Stock Connect framework and is calculated using China A Stock Connect listings based on the offshore renminbi (“RMB”) exchange rate (CNH).

China Review

In the fiscal year from April 1, 2018 through March 31, 2019, global equity markets faced two main challenges, each of which materially affected the performance of the Fund: an uncertain rate cycle from the U.S. Federal Reserve (“Fed”) and tensions between the U.S. and China. Trade tensions initially had an outsized negative impact on Chinese equities compared to the U.S. However, by the end of December 2018, U.S. equities experienced a steep decline exacerbated by hawkish Fed comments. This volatility in U.S. markets caused the Fed to forgo raising rates for the foreseeable future accompanied by a temporary trade truce between the U.S. and China. Both Chinese and U.S. equity markets rebounded sharply in January 2019 and have since continued to climb, though trade concerns and global equity market volatility still lingers.

We see two key positive developments for the opening up of China’s capital markets:

| • | On February 28, 2019, MSCI made a larger than expected China A-Share inclusion announcement. MSCI will increase the inclusion factor of China A-Shares in their Global Standard Indexes from 5% to 20% in 2019. |

| • | On April 1, 2019, Bloomberg Barclays began including RMB-denominated bonds issued by the Chinese government and policy banks into their Global Aggregate Index, tracked by $2.5 trillion in assets. |

China Capital Market Overview

| • | China’s equity market, as measured by the MSCI China All Shares Index, was down for the period, returning -6.4%, while China’s currency, the RMB depreciated 6.9% against the U.S. dollar. |

| • | The best performing sectors across China’s equity markets included Communication Services (+16.38%), Energy (+4.84%) and Utilities (+3.74%). |

| • | The worst performing sectors across China’s equity markets were Health Care (-20.32%), Consumer Discretionary (-17.58%) and Materials (-16.74%). |

By the Fund’s fiscal year end on March 31, 2019 (the ‘‘reporting period’’), the NAV of the Fund decreased 4.01% for the year, while the Underlying Index decreased 5.77%.

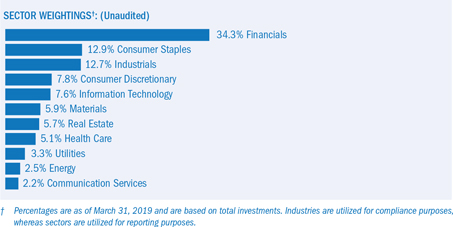

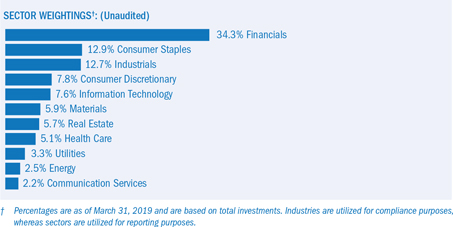

The Fund held 34% of the portfolio in the Financials Sector and 13% in the Consumer Staples Sector.

Management Discussion of Fund Performance (Unaudited)(continued)

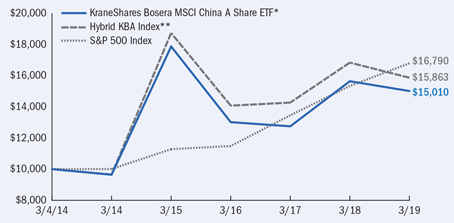

KraneShares Bosera MSCI China A Share ETF(continued)

Growth of a $10,000 Investment‡

(at Net Asset Value)‡

AVERAGE TOTAL RETURN FOR THE PERIOD ENDED MARCH 31, 2019*

| | | One Year

Return | | Three Year

Return | | Five Year

Return | | Annualized

Inception to Date | |

| | | Net

Asset

Value | | Market

Price^ | | Net

Asset Value | | Market

Price^ | | Net Asset

Value | | Market

Price^ | | Net

Asset

Value | | Market

Price^ | |

KraneShares Bosera

MSCI China A

Share ETF | | | -4.01% | | | -5.30%‡ | | | 4.88%‡ | | | 4.99%‡ | | | 9.26%‡ | | | 9.11%‡ | | | 8.34%‡ | | | 8.37%‡ | |

| Hybrid KBA Index** | | | N/A | | | -5.77%‡ | | | N/A | | | 4.08%‡ | | | N/A | | | 10.45%‡ | | | N/A | | | 9.52%‡ | |

| S&P 500 Index | | | N/A | | | 9.50%‡ | | | N/A | | | 13.51%‡ | | | N/A | | | 10.91%‡ | | | N/A | | | 10.75%‡ | |

| * | The Fund commenced operations on March 4, 2014. |

| ** | The Hybrid KBA Index consists of the MSCI China A Index from the inception of the Fund through October 23, 2014, the MSCI China A International Index from October 23, 2014 through December 26, 2017 and the MSCI China A Inclusion Index going forward. From October 23, 2014 through December 26, 2017, the Fund sought investment results that, before fees and expenses, corresponded to the price and yield performance of the MSCI China A International Index. Prior to October 23, 2014, the Fund sought investment results that, before fees and expenses, corresponded to the price and yield performance of the MSCI China A Index. |

| ^ | The “Market Price” of the Funds generally is determined using the midpoint between the highest bid and the lowest offer on the stock exchange on which the Shares of the Funds are listed for trading, as of the time that the Funds’ NAV is calculated. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost. Current performance may be lower or higher than the performance data quoted. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. For performance data current to the most recent month end, please call 855-857-2638 or visit www.kraneshares.com. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. As stated in the Fund’s prospectus, as supplemented, the Fund’s gross operating expense ratio is 0.80% and its net expense ratio is 0.60% due to an Expense Limitation Agreement whereby the Fund’s investment manager, Krane Funds Advisors, LLC, has contractually agreed to reduce its management fee to 0.20% of the Fund’s average daily net assets until October 4, 2019. Please note that one cannot invest directly in an unmanaged index. There are no assurances that the Fund

Management Discussion of Fund Performance (Unaudited)(continued)

KraneShares Bosera MSCI China A Share ETF(concluded)

will meet its stated objectives. The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities. For further information on the Fund’s objectives, risks, and strategies, see the Fund’s prospectus. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Management Discussion of Fund Performance (Unaudited)(continued)

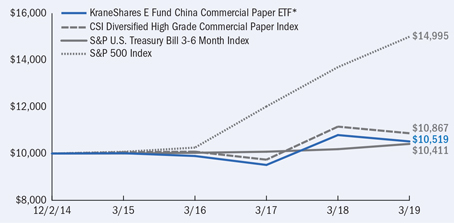

KraneShares E Fund China Commercial Paper ETF

The KraneShares E Fund China Commercial Paper ETF (the ‘‘Fund’’) seeks to provide investment results that, before fees and expenses, correspond to the price and yield performance of the CSI Diversified High Grade Commercial Paper Index (the ‘‘Underlying Index’’).

The Underlying Index seeks to deliver a diversified basket of investment-grade (according to a Chinese ratings organization) on-shore renminbi (“RMB”)-denominated commercial paper issued by sovereign, quasi-sovereign and corporate issuers in the People’s Republic of China and traded in the inter-bank bond market. A commercial paper issue must have at least RMB ¥600 million outstanding and a remaining term to final maturity of no more than one year (365 days) and no less than one month (31 days).

China Review

In the fiscal year from April 1, 2018 through March 31, 2019, global equity markets faced two main challenges, each of which materially affected the performance of the Fund: an uncertain rate cycle from the U.S. Federal Reserve (“Fed”) and trade tensions between the U.S. and China. Trade tensions initially had an outsized negative impact on Chinese equities compared to the U.S., however, by the end of December 2018, U.S. equities experienced a steep decline exacerbated by hawkish Fed comments. This volatility in U.S. markets caused the Fed to forgo raising rates for the foreseeable future accompanied by a temporary trade truce between the U.S. and China. Both Chinese and U.S. equity markets rebounded sharply in January 2019 and have since continued to climb, though trade concerns and global equity market volatility still lingers.

We see two key positive developments for the opening up of China’s capital markets:

| • | On February 28, 2019, MSCI made a larger than expected China A-Share inclusion announcement. MSCI will increase the inclusion factor of China A-Shares in their Global Standard Indexes from 5% to 20% in 2019. |

| • | On April 1, 2019, Bloomberg Barclays began including RMB-denominated bonds issued by the Chinese government and policy banks into their Global Aggregate Index, tracked by $2.5 trillion in assets. |

China Capital Market Overview

| • | China’s equity market, as measured by the MSCI China All Shares Index, was down for the period, returning -6.4%, while China’s currency, the RMB depreciated 6.9% against the U.S. dollar. |

| • | The best performing sectors across China’s equity markets included Communication Services (+16.38%), Energy (+4.84%) and Utilities (+3.74%). |

| • | The worst performing sectors across China’s equity markets were Health Care (-20.32%), Consumer Discretionary (-17.58%) and Materials (-16.74%). |

By the Fund’s fiscal year end on March 31, 2019 (the ‘‘reporting period’’), the NAV of the Fund decreased 2.52% for the year, while the Underlying Index decreased 2.54%.

Yields in Mainland China’s Interbank Bond Market were comparable to yields in the United States Bonds. Short term yields on one-year maturities were 2.44% in China and 2.39% in the United States.

Management Discussion of Fund Performance (Unaudited)(continued)

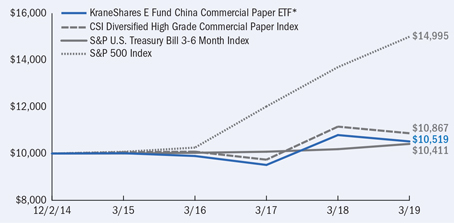

KraneShares E Fund China Commercial Paper ETF(concluded)

Growth of a $10,000 Investment‡

(at Net Asset Value)‡

AVERAGE ANNUAL TOTAL RETURN FOR THE PERIOD ENDED MARCH 31, 2019*

| | | One Year

Return | | Three Year

Return | | Annualized

Inception to Date | |

| | | Net Asset

Value | | Market

Price^ | | Net Asset

Value | | Market

Price^ | | Net Asset

Value | | Market

Price^ | |

KraneShares E Fund China

Commercial Paper ETF | | | -2.52% | | | -2.38%‡ | | | 2.06%‡ | | | 2.03%‡ | | | 1.18%‡ | | | 1.13%‡ | |

CSI Diversified High Grade

Commercial Paper Index | | | N/A | | | -2.54%‡ | | | N/A | | | 2.54%‡ | | | N/A | | | 1.94%‡ | |

S&P U.S. Treasury Bill 3-6

Month Index** | | | N/A | | | 2.21%‡ | | | N/A | | | 1.25%‡ | | | N/A | | | 0.94%‡ | |

| S&P 500 Index | | | N/A | | | 9.50%‡ | | | N/A | | | 13.51%‡ | | | N/A | | | 9.81%‡ | |

| * | The Fund commenced operations on December 2, 2014. |

| ** | Index added to provide a fixed income benchmark for fixed income funds. |

| ^ | The “Market Price” of the Funds generally is determined using the midpoint between the highest bid and the lowest offer on the stock exchange on which the Shares of the Funds are listed for trading, as of the time that the Funds’ NAV is calculated. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost. Current performance may be lower or higher than the performance data quoted. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. For performance data current to the most recent month end, please call 855-857-2638 or visit www.kraneshares.com. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. As stated in the Fund’s prospectus, the Fund’s gross operating expense ratio is 0.74% and its net expense ratio is 0.62% due to an Expense Limitation Agreement whereby the Fund’s investment manager, Krane Funds Advisors, LLC, has contractually agreed to reduce its management fee by 0.12% of the Fund’s average daily net assets until October 4, 2019. Please note that one cannot invest directly in an unmanaged index. There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities. For further information on the Fund’s objectives, risks, and strategies, see the Fund’s prospectus. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Management Discussion of Fund Performance (Unaudited)(continued)

KraneShares MSCI All China Index ETF

The KraneShares MSCI All China Index ETF (the ‘‘Fund’’) seeks to provide investment results that, before fees and expenses, correspond to the price and yield performance of the MSCI China All Shares Index (the ‘‘Underlying Index’’).

The Underlying Index seeks to track the equity market performance of companies based in China and listed in Mainland China, Hong Kong, and the United States. Companies available for inclusion must be headquartered in China and meet the market capitalization minimums required by the MSCI Global Investable Market Indexes Methodology.

China Review

In the fiscal year from April 1, 2018 through March 31, 2019, global equity markets faced two main challenges, each of which materially affected the performance of the Fund: an uncertain rate cycle from the U.S. Federal Reserve (“Fed”) and trade tensions between the U.S. and China. Trade tensions initially had an outsized negative impact on Chinese equities compared to the U.S., however, by the end of December 2018, U.S. equities experienced a steep decline exacerbated by hawkish Fed comments. This volatility in U.S. markets caused the Fed to forgo raising rates for the foreseeable future accompanied by a temporary trade truce between the U.S. and China. Both Chinese and U.S. equity markets rebounded sharply in January 2019 and have since continued to climb, though trade concerns and global equity market volatility still lingers.

We see two key positive developments for the opening up of China’s capital markets:

| • | On February 28, 2019, MSCI made a larger than expected China A-Share inclusion announcement. MSCI will increase the inclusion factor of China A-Shares in their Global Standard Indexes from 5% to 20% in 2019. |

| • | On April 1, 2019, Bloomberg Barclays began including renminbi (“RMB”)-denominated bonds issued by the Chinese government and policy banks into their Global Aggregate Index, tracked by $2.5 trillion in assets. |

China capital market overview

| • | China’s equity market, as measured by the MSCI China All Shares Index, was down for the period, returning -6.4%, while China’s currency, the RMB depreciated 6.9% against the U.S. dollar. |

| • | The best performing sectors across China’s equity markets included Communication Services (+16.38%), Energy (+4.84%) and Utilities (+3.74%). |

| • | The worst performing sectors across China’s equity markets were Health Care (-20.32%), Consumer Discretionary (-17.58%) and Materials (-16.74%). |

By the Fund’s fiscal year end on March 31, 2019 (the ‘‘reporting period’’), the NAV of the Fund decreased 3.52% for the year, while the Underlying Index decreased 3.13%.

The Fund held 23% of the portfolio in the Financials Sector and 19% in the Communication Services Sector.

Management Discussion of Fund Performance (Unaudited)(continued)

KraneShares MSCI All China Index ETF(continued)

Growth of a $10,000 Investment‡

(at Net Asset Value)‡

AVERAGE TOTAL RETURN FOR THE PERIOD ENDED MARCH 31, 2019*

| | | One Year

Return | | Three Year

Return | | Annualized

Inception to Date | |

| | | Net Asset

Value | | Market

Price^ | | Net Asset

Value | | Market

Price^ | | Net Asset

Value | | Market Price^ | |

KraneShares MSCI All

China Index ETF | | | -3.52% | | | -3.84%‡ | | | 9.01%‡ | | | 9.10%‡ | | | 3.32%‡ | | | 3.62%‡ | |

FTSE Emerging incl. China

Overseas non-R/QFII

GDP Weighted Index /

MSCI China All Shares

Index** | | | N/A | | | -4.16%‡ | | | N/A | | | 9.24%‡ | | | N/A | | | 3.89%‡ | |

| S&P 500 Index | | | N/A | | | 9.50%‡ | | | N/A | | | 13.51%‡ | | | N/A | | | 9.91%‡ | |

| * | The Fund commenced operations on February 12, 2015. |

| ** | The FTSE Emerging incl. China Overseas non-R/QFII GDP Weighted Index / MSCI China All Shares Index consists of the FTSE Emerging incl. China Overseas non-R/QFII GDP Weighted Index from the inception of the Fund through July 31, 2018, and the MSCI China All Shares Index going forward. Prior to July 31, 2018, the Fund was known as the KraneShares FTSE Emerging Markets Plus ETF and sought to provide investment results that, before fees and expenses, corresponded generally to the price and yield performance of the FTSE Emerging incl. China Overseas non-R/QFII GDP Weighted Index. |

| ^ | The “Market Price” of the Funds generally is determined using the midpoint between the highest bid and the lowest offer on the stock exchange on which the Shares of the Funds are listed for trading, as of the time that the Funds’ NAV is calculated. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost. Current performance may be lower or higher than the performance data quoted. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. For performance data current to the most recent month end, please call 855-857-2638 or visit www.kraneshares.com. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. As stated in the Fund’s prospectus, as supplemented, the Fund’s operating expense ratio is 0.72. Please note that one cannot invest directly in an unmanaged index. There

Management Discussion of Fund Performance (Unaudited)(continued)

KraneShares MSCI All China Index ETF(concluded)

are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities. For further information on the Fund’s objectives, risks, and strategies, see the Fund’s prospectus. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Management Discussion of Fund Performance (Unaudited)(continued)

The KraneShares MSCI One Belt One Road Index ETF

The KraneShares MSCI One Belt One Road Index ETF (the ‘‘Fund’’) seeks to provide investment results that, before fees and expenses, correspond to the price and yield performance of the MSCI Global China Infrastructure Exposure Index (the ‘‘Underlying Index’’).

The Underlying Index is designed to represent the performance of listed companies within Developed, Emerging and Frontier markets whose revenues are likely to benefit from China infrastructure development from within a specified set of industries relevant to what has become known as the ‘One Belt, One Road’ (“OBOR”) investment program and development strategy promoted by China.

China Review

In the fiscal year from April 1, 2018 through March 31, 2019, global equity markets faced two main challenges, each of which materially affected the performance of the Fund: an uncertain rate cycle from the U.S. Federal Reserve (“Fed”) and trade tensions between the U.S. and China. Trade tensions initially had an outsized negative impact on Chinese equities compared to the U.S., however, by the end of December 2018, U.S. equities experienced a steep decline exacerbated by hawkish Fed comments. This volatility in U.S. markets caused the Fed to forgo raising rates for the foreseeable future accompanied by a temporary trade truce between the U.S. and China. Both Chinese and U.S. equity markets rebounded sharply in January 2019 and have since continued to climb, though trade concerns and global equity market volatility still lingers.

We see two key positive developments for the opening up of China’s capital markets:

| • | On February 28, 2019, MSCI made a larger than expected China A-Share inclusion announcement. MSCI will increase the inclusion factor of China A-Shares in their Global Standard Indexes from 5% to 20% in 2019. |

| • | On April 1, 2019, Bloomberg Barclays began including renminbi (“RMB”)-denominated bonds issued by the Chinese government and policy banks into their Global Aggregate Index, tracked by $2.5 trillion in assets. |

China Capital Market Overview

| • | China’s equity market, as measured by the MSCI China All Shares Index, was down for the period, returning -6.4%, while China’s currency, the RMB depreciated 6.9% against the U.S. dollar. |

| • | The best performing sectors across China’s equity markets included Communication Services (+16.38%), Energy (+4.84%) and Utilities (+3.74%). |

| • | The worst performing sectors across China’s equity markets were Health Care (-20.32%), Consumer Discretionary (-17.58%) and Materials (-16.74%). |

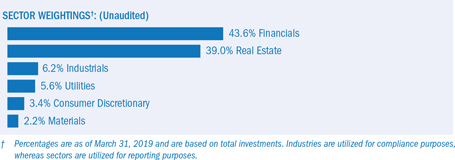

By the Fund’s fiscal year end on March 31, 2019 (the ‘‘reporting period’’), the NAV of the Fund decreased 4.94% for the year, while the Underlying Index decreased 3.76%.

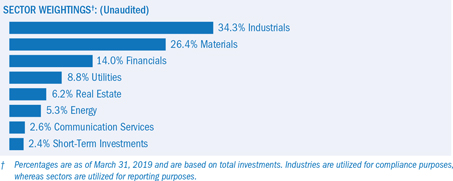

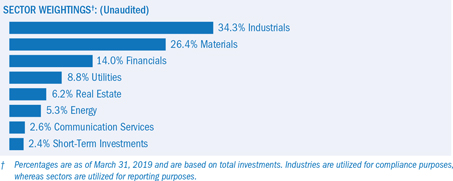

The Fund held 34% of the portfolio in the Industrials Sector and 30% in the Materials Sector.

Management Discussion of Fund Performance (Unaudited)(continued)

The KraneShares MSCI One Belt One Road Index ETF(concluded)

Growth of a $10,000 Investment‡

(at Net Asset Value)‡

AVERAGE TOTAL RETURN FOR THE PERIOD ENDED MARCH 31, 2019*

| | | One Year

Return | | Annualized

Inception to Date | |

| | | Net Asset

Value | | Market

Price^ | | Net Asset

Value | | Market

Price^ | |

| KraneShares MSCI One Belt One Road Index ETF | | | -4.94% | | | -6.46%‡ | | | -1.54%‡ | | | -1.56%‡ | |

| MSCI Global China Infrastructure Exposure Index | | | N/A | | | -3.76%‡ | | | N/A | | | -0.50%‡ | |

| S&P 500 Index | | | N/A | | | 9.50%‡ | | | N/A | | | 11.52%‡ | |

| * | The Fund commenced operations on September 7, 2017. |

| ^ | The “Market Price” of the Funds generally is determined using the midpoint between the highest bid and the lowest offer on the stock exchange on which the Shares of the Funds are listed for trading, as of the time that the Funds’ NAV is calculated. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost. Current performance may be lower or higher than the performance data quoted. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. For performance data current to the most recent month end, please call 855-857-2638 or visit www.kraneshares.com. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. As stated in the Fund’s prospectus, as supplemented, the Fund’s operating expense ratio is 0.80%. Please note that one cannot invest directly in an unmanaged index. There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities. For further information on the Fund’s objectives, risks, and strategies, see the Fund’s prospectus. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Management Discussion of Fund Performance (Unaudited)(continued)

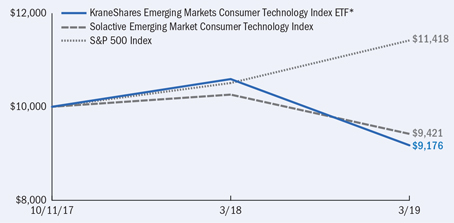

KraneShares Emerging Markets Consumer Technology Index ETF

The KraneShares Emerging Markets Consumer Technology Index ETF (the ‘‘Fund’’) seeks to provide investment results that, before fees and expenses, correspond to the price and yield performance of the Solactive Emerging Market Consumer Technology Index (the ‘‘Underlying Index’’).

The Underlying Index selects companies from 26 eligible countries in emerging markets whose primary business or businesses are internet retail, internet software/services, purchase, payment processing, or software for internet and E-Commerce transactions.

China review

In the fiscal year from April 1, 2018 through March 31, 2019, global equity markets faced two main challenges, each of which materially affected the performance of the Fund: an uncertain rate cycle from the U.S. Federal Reserve (“Fed”) and trade tensions between the U.S. and China. Trade tensions initially had an outsized negative impact on Chinese equities compared to the U.S., however, by the end of December 2018, U.S. equities experienced a steep decline exacerbated by hawkish Fed comments. This volatility in U.S. markets caused the Fed to forgo raising rates for the foreseeable future accompanied by a temporary trade truce between the U.S. and China. Both Chinese and U.S. equity markets rebounded sharply in January 2019 and have since continued to climb, though trade concerns and global equity market volatility still lingers.

We see two key positive developments for the opening up of China’s capital markets:

| • | On February 28, 2019, MSCI made a larger than expected China A-Share inclusion announcement. MSCI will increase the inclusion factor of China A-Shares in their Global Standard Indexes from 5% to 20% in 2019. |

| • | On April 1, 2019, Bloomberg Barclays began including renminbi (“RMB”)-denominated bonds issued by the Chinese government and policy banks into their Global Aggregate Index, tracked by $2.5 trillion in assets. |

China Capital Market Overview

| • | China’s equity market, as measured by the MSCI China All Shares Index, was down for the period, returning -6.4%, while China’s currency, the RMB depreciated 6.9% against the U.S. dollar. |

| • | The best performing sectors across China’s equity markets included Communication Services (+16.38%), Energy (+4.84%) and Utilities (+3.74%). |

| • | The worst performing sectors across China’s equity markets were Health Care (-20.32%), Consumer Discretionary (-17.58%) and Materials (-16.74%). |

By the Fund’s fiscal year end on March 31, 2019 (the ‘‘reporting period’’), the NAV of the Fund decreased 13.37% for the year, while the Underlying Index decreased 12.79%.

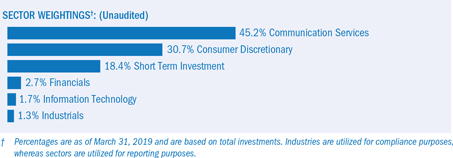

The Fund held 52% of the portfolio in the Communication Services Sector and 38% in the Consumer Discretionary Sector.

Management Discussion of Fund Performance (Unaudited)(continued)

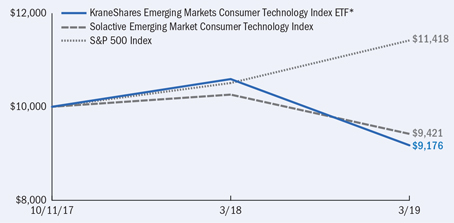

KraneShares Emerging Markets Consumer Technology Index ETF(concluded)

Growth of a $10,000 Investment‡

(at Net Asset Value)‡

AVERAGE TOTAL RETURN FOR THE PERIOD ENDED MARCH 31, 2019*

| | | One Year

Return | | Annualized

Inception to Date | |

| | | Net Asset

Value | | Market

Price^ | | Net Asset

Value | | Market

Price^ | |

KraneShares Emerging Markets Consumer

Technology Index ETF | | | -13.37% | | | -13.99%‡ | | | -5.68%‡ | | | -5.51%‡ | |

Solactive Emerging Market Consumer

Technology Index | | | N/A | | | -12.79%‡ | | | N/A | | | -3.98%‡ | |

| S&P 500 Index | | | N/A | | | 9.50%‡ | | | N/A | | | 9.45%‡ | |

| * | The Fund commenced operations on October 11, 2017. |

| ^ | The “Market Price” of the Funds generally is determined using the midpoint between the highest bid and the lowest offer on the stock exchange on which the Shares of the Funds are listed for trading, as of the time that the Funds’ NAV is calculated. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost. Current performance may be lower or higher than the performance data quoted. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. For performance data current to the most recent month end, please call 855-857-2638 or visit www.kraneshares.com. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. As stated in the Fund’s prospectus, as supplemented, the Fund’s operating expense ratio is 0.79%. Please note that one cannot invest directly in an unmanaged index. There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities. For further information on the Fund’s objectives, risks, and strategies, see the Fund’s prospectus. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Management Discussion of Fund Performance (Unaudited)(continued)

KraneShares MSCI China Environment Index ETF

The KraneShares MSCI China Environment Index (the ‘‘Fund’’) seeks to provide investment results that, before fees and expenses, correspond to the price and yield performance of the MSCI China IMI Environment 10/40 Index (the ‘‘Underlying Index’’).

��

The Underlying Index is comprised of securities that derive at least 50% of their revenues from environmentally beneficial products and services. The Index is based on five key Clean Technology environmental themes: Alternative Energy, Sustainable Water, Green Building, Pollution Prevention and Energy Efficiency. The Index aims to serve as a benchmark for investors seeking exposure to Chinese companies that focus on contributing to a more environmentally sustainable economy by making efficient use of scarce natural resources or by mitigating the impact of environmental degradation. Constituent selection is based on data from MSCI Environment, Social, and Governance (“ESG”).

China Review

In the fiscal year from April 1, 2018 through March 31, 2019, global equity markets faced two main challenges, each of which materially affected the performance of the Fund: an uncertain rate cycle from the U.S. Federal Reserve (“Fed”) and trade tensions between the U.S. and China. Trade tensions initially had an outsized negative impact on Chinese equities compared to the U.S., however, by the end of December 2018, U.S. equities experienced a steep decline exacerbated by hawkish Fed comments. This volatility in U.S. markets caused the Fed to forgo raising rates for the foreseeable future accompanied by a temporary trade truce between the U.S. and China. Both Chinese and U.S. equity markets rebounded sharply in January 2019 and have since continued to climb, though trade concerns and global equity market volatility still lingers.

We see two key positive developments for the opening up of China’s capital markets:

| • | On February 28, 2019, MSCI made a larger than expected China A-Share inclusion announcement. MSCI will increase the inclusion factor of China A-Shares in their Global Standard Indexes from 5% to 20% in 2019. |

| • | On April 1, 2019, Bloomberg Barclays began including renminbi (“RMB”)-denominated bonds issued by the Chinese government and policy banks into their Global Aggregate Index, tracked by $2.5 trillion in assets. |

China Capital Market Overview

| • | China’s equity market, as measured by the MSCI China All Shares Index, was down for the period, returning -6.4%, while China’s currency, the RMB depreciated 6.9% against the U.S. dollar. |

| • | The best performing sectors across China’s equity markets included Communication Services (+16.38%), Energy (+4.84%) and Utilities (+3.74%). |

| • | The worst performing sectors across China’s equity markets were Health Care (-20.32%), Consumer Discretionary (-17.58%) and Materials (-16.74%). |

By the Fund’s fiscal year end on March 31, 2019 (the ‘‘reporting period’’), the NAV of the Fund decreased 13.28% for the period, while the Underlying Index decreased 12.50%.

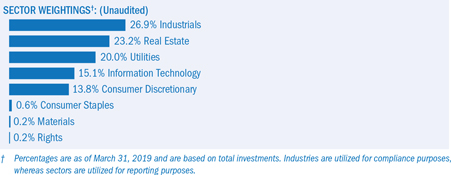

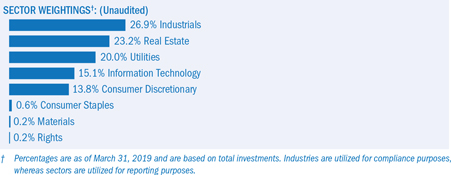

The Fund held 27% of the portfolio in the Industrials Sector and 23% in the Real Estate Sector.

Management Discussion of Fund Performance (Unaudited)(continued)

KraneShares MSCI China Environment Index ETF(concluded)

Growth of a $10,000 Investment‡

(at Net Asset Value)‡

AVERAGE TOTAL RETURN FOR THE PERIOD ENDED MARCH 31, 2019*

| | | One Year Return | | Annualized

Inception to Date | |

| | | Net Asset

Value | | Market

Price^ | | Net Asset

Value | | Market

Price^ | |

| KraneShares MSCI China Environment Index | | | -13.28% | | | -14.78%‡ | | | -12.09%‡ | | | -12.19%‡ | |

| MSCI China IMI Environment 10/40 Index | | | N/A | | | -12.50%‡ | | | N/A | | | -11.41%‡ | |

| S&P 500 Index | | | N/A | | | 9.50%‡ | | | N/A | | | 9.59%‡ | |

| * | The Fund commenced operations on October 12, 2017. |

| ^ | The “Market Price” of the Funds generally is determined using the midpoint between the highest bid and the lowest offer on the stock exchange on which the Shares of the Funds are listed for trading, as of the time that the Funds’ NAV is calculated. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost. Current performance may be lower or higher than the performance data quoted. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. For performance data current to the most recent month end, please call 855-857-2638 or visit www.kraneshares.com. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. As stated in the Fund’s prospectus, as supplemented, the Fund’s gross operating expense ratio is 0.79%. Please note that one cannot invest directly in an unmanaged index. There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities. For further information on the Fund’s objectives, risks, and strategies, see the Fund’s prospectus. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Management Discussion of Fund Performance (Unaudited)(continued)

KraneShares Electric Vehicles and Future Mobility Index ETF

The KraneShares Electric Vehicles and Future Mobility Index ETF (the ‘‘Fund’’) seeks to provide investment results that, before fees and expenses, correspond to the price and yield performance of the Solactive Electric Vehicles and Future Mobility Index (the ‘‘Underlying Index’’).

The Underlying Index is designed to track the performance of companies engaged in the production of electric vehicles and/or their components, or engaged in other initiatives that may change the future of mobility. The Index includes issuers engaged in the electric vehicle production, autonomous driving, shared mobility, lithium and/or copper production, lithium-ion/lead acid batteries, hydrogen fuel cell manufacturing and/or electric infrastructure businesses.

China review

In the fiscal year from April 1, 2018 through March 31, 2019, global equity markets faced two main challenges, each of which materially affected the performance of the Fund: an uncertain rate cycle from the U.S. Federal Reserve (“Fed”) and trade tensions between the U.S. and China. Trade tensions initially had an outsized negative impact on Chinese equities compared to the U.S., however, by the end of December 2018, U.S. equities experienced a steep decline exacerbated by hawkish Fed comments. This volatility in U.S. markets caused the Fed to forgo raising rates for the foreseeable future accompanied by a temporary trade truce between the U.S. and China. Both Chinese and U.S. equity markets rebounded sharply in January 2019 and have since continued to climb, though trade concerns and global equity market volatility still lingers.

We see two key positive developments for the opening up of China’s capital markets:

| • | On February 28, 2019, MSCI made a larger than expected China A-Share inclusion announcement. MSCI will increase the inclusion factor of China A-Shares in their Global Standard Indexes from 5% to 20% in 2019. |

| • | On April 1, 2019, Bloomberg Barclays began including renminbi (“RMB”)-denominated bonds issued by the Chinese government and policy banks into their Global Aggregate Index, tracked by $2.5 trillion in assets. |

China Capital Market Overview

| • | China’s equity market, as measured by the MSCI China All Shares Index, was down for the period, returning -6.4%, while China’s currency, the RMB depreciated 6.9% against the U.S. dollar. |

| • | The best performing sectors across China’s equity markets included Communication Services (+16.38%), Energy (+4.84%) and Utilities (+3.74%). |

| • | The worst performing sectors across China’s equity markets were Health Care (-20.32%), Consumer Discretionary (-17.58%) and Materials (-16.74%). |

By the Fund’s fiscal year end on March 31, 2019 (the ‘‘reporting period’’), the NAV of the Fund decreased 10.19% for the year, while the Underlying Index decreased 10.55%.

The Fund held 39% of the portfolio in the Consumer Discretionary Sector and 36% in the Information Technology Sector.

Management Discussion of Fund Performance (Unaudited)(continued)

KraneShares Electric Vehicles and Future Mobility Index(concluded)

Growth of a $10,000 Investment‡

(at Net Asset Value)‡

AVERAGE TOTAL RETURN FOR THE PERIOD ENDED MARCH 31, 2019*

| | | One Year

Return | | Annualized

Inception to Date | |

| | | Net Asset

Value | | Market

Price^ | | Net Asset

Value | | Market

Price^ | |

KraneShares Electric Vehicles and Future

Mobility Index ETF | | | -10.19% | | | -10.78%‡ | | | -13.76%‡ | | | -13.38%‡ | |

Solactive Electric Vehicles and Future Mobility

Index | | | N/A | | | -10.55%‡ | | | N/A | | | -14.35%‡ | |

| S&P 500 Index | | | N/A | | | 9.50%‡ | | | N/A | | | 3.13%‡ | |

| * | The Fund commenced operations on January 18, 2018. |

| ^ | The “Market Price” of the Funds generally is determined using the midpoint between the highest bid and the lowest offer on the stock exchange on which the Shares of the Funds are listed for trading, as of the time that the Funds’ NAV is calculated. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost. Current performance may be lower or higher than the performance data quoted. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. For performance data current to the most recent month end, please call 855-857-2638 or visit www.kraneshares.com. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. As stated in the Fund’s prospectus, the Fund’s operating expense ratio is 0.70%. Please note that one cannot invest directly in an unmanaged index. There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities. For further information on the Fund’s objectives, risks, and strategies, see the Fund’s prospectus. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Management Discussion of Fund Performance (Unaudited)(continued)

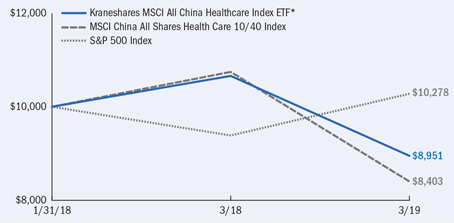

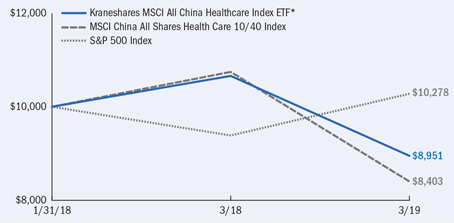

KraneShares MSCI All China Health Care Index ETF

The KraneShares MSCI All China Health Care Index ETF (the ‘‘Fund’’) seeks to provide investment results that, before fees and expenses, correspond to the price and yield performance of the MSCI China All Shares Health Care 10/40 Index (the ‘‘Underlying Index’’).

The Underlying Index is a free float adjusted market capitalization weighted index designed to track the equity market performance of Chinese companies engaged in the health care sector. The securities in the Index include all types of publicly issued shares of Chinese issuers, which are listed in Mainland China, Hong Kong and United States. Issuers eligible for inclusion must be classified under the Global Industry Classification Standard as engaged in the healthcare sector. The issuers included in the Underlying Index may include small-cap, mid-cap and large-cap companies.

China Review

In the fiscal year from April 1, 2018 through March 31, 2019, global equity markets faced two main challenges, each of which materially affected the performance of the Fund: an uncertain rate cycle from the U.S. Federal Reserve (“Fed”) and trade tensions between the U.S. and China. Trade tensions initially had an outsized negative impact on Chinese equities compared to the U.S., however, by the end of December 2018, U.S. equities experienced a steep decline exacerbated by hawkish Fed comments. This volatility in U.S. markets caused the Fed to forgo raising rates for the foreseeable future accompanied by a temporary trade truce between the U.S. and China. Both Chinese and U.S. equity markets rebounded sharply in January 2019 and have since continued to climb, though trade concerns and global equity market volatility still lingers.

We see two key positive developments for the opening up of China’s capital markets:

| • | On February 28, 2019, MSCI made a larger than expected China A-Share inclusion announcement. MSCI will increase the inclusion factor of China A-Shares in their Global Standard Indexes from 5% to 20% in 2019. |

| • | On April 1, 2019, Bloomberg Barclays began including renminbi (“RMB”)-denominated bonds issued by the Chinese government and policy banks into their Global Aggregate Index, tracked by $2.5 trillion in assets. |

China Capital Market Overview

| • | China’s equity market, as measured by the MSCI China All Shares Index, was down for the period, returning -6.4%, while China’s currency, the RMB depreciated 6.9% against the U.S. dollar. |

| • | The best performing sectors across China’s equity markets included Communication Services (+16.38%), Energy (+4.84%) and Utilities (+3.74%). |

| • | The worst performing sectors across China’s equity markets were Health Care (-20.32%), Consumer Discretionary (-17.58%) and Materials (-16.74%). |

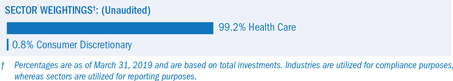

By the Fund’s fiscal year end on March 31, 2019 (the ‘‘reporting period’’), the NAV of the Fund decreased 15.99% for the year, while the Underlying Index decreased 16.71%.

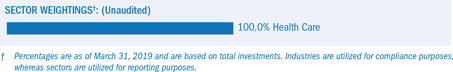

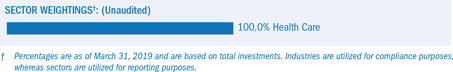

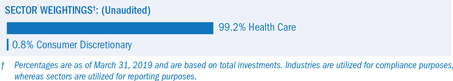

The Fund held 100% of the portfolio in the Health Care Sector.

Management Discussion of Fund Performance (Unaudited)(continued)

KraneShares MSCI All China Health Care Index ETF(concluded)

Growth of a $10,000 Investment‡

(at Net Asset Value)‡

AVERAGE TOTAL RETURN FOR THE PERIOD ENDED MARCH 31, 2019*

| | | One Year

Return | | Annualized

Inception to Date | |

| | | Net Asset

Value | | Market

Price^ | | Net Asset

Value | | Market

Price^ | |

KraneShares MSCI All China Health Care

Index ETF | | | -15.99% | | | -18.03%‡ | | | -9.03%‡ | | | -9.51%‡ | |

MSCI China All Shares Health

Care 10/40 Index | | | N/A | | | -16.71%‡ | | | N/A | | | 9.10%‡ | |

| S&P 500 Index | | | N/A | | | 9.50%‡ | | | N/A | | | 2.39%‡ | |

| * | The Fund commenced operations on January 31, 2018. |

| ^ | The “Market Price” of the Funds generally is determined using the midpoint between the highest bid and the lowest offer on the stock exchange on which the Shares of the Funds are listed for trading, as of the time that the Funds’ NAV is calculated. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost. Current performance may be lower or higher than the performance data quoted. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. For performance data current to the most recent month end, please call 855-857-2638 or visit www.kraneshares.com. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. As stated in the Fund’s prospectus, the Fund’s operating expense ratio is 0.82%. Please note that one cannot invest directly in an unmanaged index. There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities. For further information on the Fund’s objectives, risks, and strategies, see the Fund’s prospectus. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Management Discussion of Fund Performance (Unaudited)(continued)

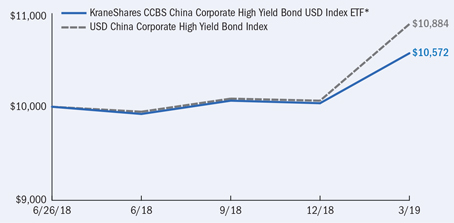

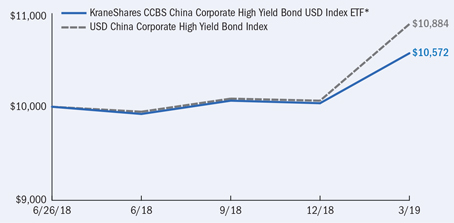

KraneShares CCBS China Corporate High Yield Bond USD Index ETF

The KraneShares CCBS China Corporate High Yield Bond USD Index ETF (the ‘‘Fund’’) seeks to provide investment results that, before fees and expenses, correspond to the price and yield performance of the Solactive USD China Corporate High Yield Bond Index (the ‘‘Underlying Index’’).

The Underlying Index seeks to track the performance of outstanding high yield debt securities denominated in U.S. dollars issued by Chinese companies. For purposes of the Underlying Index, Chinese companies include companies that conduct the majority of their business activities in, are headquartered in or have the majority of their business assets, profits, or revenues in China or Hong Kong as determined by the index provider, Solactive, AG (“Index Provider”).

China review

In the fiscal year from April 1, 2018 through March 31, 2019, global equity markets faced two main challenges, each of which materially affected the performance of the Fund: an uncertain rate cycle from the U.S. Federal Reserve (“Fed”) and trade tensions between the U.S. and China. Trade tensions initially had an outsized negative impact on Chinese equities compared to the U.S., however, by the end of December 2018, U.S. equities experienced a steep decline exacerbated by hawkish Fed comments. This volatility in U.S. markets caused the Fed to forgo raising rates for the foreseeable future accompanied by a temporary trade truce between the U.S. and China. Both Chinese and U.S. equity markets rebounded sharply in January 2019 and have since continued to climb, though trade concerns and global equity market volatility still lingers.

We see two key positive developments for the opening up of China’s capital markets:

| • | On February 28, 2019, MSCI made a larger than expected China A-Share inclusion announcement. MSCI will increase the inclusion factor of China A-Shares in their Global Standard Indexes from 5% to 20% in 2019. |

| • | On April 1, 2019, Bloomberg Barclays began including renminbi (“RMB”)-denominated bonds issued by the Chinese government and policy banks into their Global Aggregate Index, tracked by $2.5 trillion in assets. |

China Capital Market Overview

| • | China’s equity market, as measured by the MSCI China All Shares Index, was down for the period, returning -6.4%, while China’s currency, the RMB depreciated 6.9% against the U.S. dollar. |

| • | The best performing sectors across China’s equity markets included Communication Services (+16.38%), Energy (+4.84%) and Utilities (+3.74%). |

| • | The worst performing sectors across China’s equity markets were Health Care (-20.32%), Consumer Discretionary (-17.58%) and Materials (-16.74%). |

From the Fund’s inception on June 28, 2018 to the Fund’s fiscal year end on March 31, 2019 (the ‘‘reporting period’’), the NAV of the Fund rose 5.72% for the period, while the Underlying Index rose 8.84%.

New issuance of USD denominated high yield bonds also remained strong in China, increasing from a total amount of around $50 billion in 2017 to over $250 billion in 2018.

Management Discussion of Fund Performance (Unaudited)(continued)

KraneShares CCBS China Corporate High Yield Bond USD Index ETF(concluded)

Growth of a $10,000 Investment‡

(at Net Asset Value)‡

AVERAGE TOTAL RETURN FOR THE PERIOD ENDED MARCH 31, 2019*

| | | Cumulative Inception to Date | |

| | | Net Asset

Value | | Market

Price^ | |

| KraneShares CCBS China Corporate High Yield Bond USD Index ETF | | | 5.72% | | | 5.99%‡ | |

| Solactive USD China Corporate High Yield Bond Index | | | N/A | | | 8.84%‡ | |

| Lipper China Region Funds Classification | | | N/A | | | -1.24%‡ | |

| * | The Fund commenced operations on June 26, 2018. |

| ^ | The “Market Price” of the Funds generally is determined using the midpoint between the highest bid and the lowest offer on the stock exchange on which the Shares of the Funds are listed for trading, as of the time that the Funds’ NAV is calculated. |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost. Current performance may be lower or higher than the performance data quoted. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. For performance data current to the most recent month end, please call 855-857-2638 or visit www.kraneshares.com. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. As stated in the Fund’s prospectus, the Fund’s operating expense ratio is 0.69%. Please note that one cannot invest directly in an unmanaged index. There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities. For further information on the Fund’s objectives, risks, and strategies, see the Fund’s prospectus. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Management Discussion of Fund Performance (Unaudited)(continued)

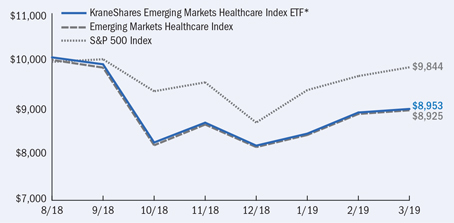

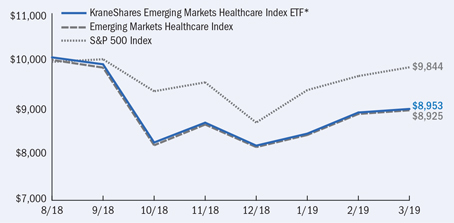

KraneShares Emerging Market Healthcare Index ETF

The KraneShares Emerging Markets Healthcare Index ETF (the ‘‘Fund’’) seeks to provide investment results that, before fees and expenses, correspond to the price and yield performance of the Solactive Emerging Markets Healthcare Index (the ‘‘Underlying Index’’).