UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22696

Victory Portfolios II

(Exact name of registrant as specified in charter)

| | 4900 Tiedeman Road, 4th Floor, Brooklyn, Ohio | 44144 | |

| | (Address of principal executive offices) | (Zip code) | |

Citi Fund Services Ohio, Inc., 4400 Easton Commons, Suite 200, Columbus, OH 43219

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-539-3863

Date of fiscal year end: June 30

Date of reporting period: December 31, 2020

Item 1. Reports to Stockholders.

December 31, 2020

Semi Annual Report

Victory US 500 Enhanced Volatility Wtd Index Fund

Victory Market Neutral Income Fund

As permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Victory Funds' shareholder reports may no longer be sent by mail, unless you specifically request paper copies of the reports from the Victory Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on www.VictoryFunds.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change, and you need not take any action.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your reports. If you invest directly with the Victory Funds, you can call 800-539-3863 (800-235-8396 for Member Class) or send an e-mail request to TA.Processing@FISGlobal.com. Your election to receive reports in paper will apply to all Victory Funds you hold directly or through your financial intermediary.

www.vcm.com

News, Information And Education 24 Hours A Day, 7 Days A Week

The Victory Funds site gives fund shareholders, prospective shareholders, and investment professionals a convenient way to access fund information, get guidance, and track fund performance anywhere they can access the Internet. The site includes:

• Detailed performance records

• Daily share prices

• The latest fund news

• Investment resources to help you become a better investor

• A section dedicated to investment professionals

Whether you're a potential investor searching for the fund that matches your investment philosophy, a seasoned investor interested in planning tools, or an investment professional, www.vcm.com has what you seek. Visit us anytime. We're always open.

Table of Contents

Financial Statements | |

Victory US 500 Enhanced Volatility Wtd

Index Fund | |

Investment Objectives & Portfolio Holdings | | | 3 | | |

Schedule of Portfolio Investments | | | 5-16 | | |

Statement of Assets and Liabilities | | | 34 | | |

Statement of Operations | | | 35 | | |

Statements of Changes in Net Assets | | | 36-37 | | |

Financial Highlights | | | 38-39 | | |

Victory Market Neutral Income Fund | |

Investment Objectives & Portfolio Holdings | | | 4 | | |

Schedule of Portfolio Investments | | | 17-33 | | |

Statement of Assets and Liabilities | | | 34 | | |

Statement of Operations | | | 35 | | |

Statements of Changes in Net Assets | | | 36-37 | | |

Financial Highlights | | | 40-41 | | |

Notes to Financial Statements | | | 42 | | |

Supplemental Information | | | 54 | | |

Proxy Voting and Portfolio Holdings Information | | | 54 | | |

Expense Examples | | | 54 | | |

Advisory Contract Approval | | | 55 | | |

Privacy Policy (inside back cover) | | | |

IRA DISTRIBUTION WITHHOLDING DISCLOSURE

We generally must withhold federal income tax at a rate of 10% of the taxable portion of your distribution and, if you live in a state that requires state income tax withholding, at your state's tax rate. However, you may elect not to have withholding apply or to have income tax withheld at a higher rate. Any withholding election that you make will apply to any subsequent distribution unless and until you change or revoke the election. If you wish to make a withholding election, or change or revoke a prior withholding election, call 800-539-3863 (800-235-8396 for Member Class) and form W-4P (OMB No. 1545-0074 withholding certificate for pension or annuity payments) will be electronically sent.

If you do not have a withholding election in place by the date of a distribution, federal income tax will be withheld from the taxable portion of your distribution at a rate of 10%. If you must pay estimated taxes, you may be subject to estimated tax penalties if your estimated tax payments are not sufficient and sufficient tax is not withheld from your distribution.

For more specific information, please consult your tax adviser.

1

The Victory Funds are distributed by Victory Capital Services, Inc. Victory Capital Management Inc. is the investment adviser to the Funds and receives fees from the Funds for performing services for the Funds.

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus of the Victory Funds.

For additional information about any Victory Fund, including fees, expenses, and risks, view our prospectus online at www.vcm.com or call 800-539-3863 (800-235-8396 for Member Class). Read it carefully before you invest or send money.

The information in this semi annual report is based on data obtained from recognized services and sources and is believed to be reliable. Any opinions, projections, or recommendations in this report are subject to change without notice and are not intended as individual investment advice. Past investment performance of the Funds, markets or securities mentioned herein should not be considered to be indicative of future results.

• NOT FDIC INSURED • NO BANK GUARANTEE

• MAY LOSE VALUE

Call Victory at:

800-539-FUND (800-539-3863)

800-235-8396 for Member Class

Visit our website at:

www.vcm.com

2

Victory Portfolios II

Victory US 500 Enhanced Volatility Wtd Index Fund | | December 31, 2020 | |

(Unaudited)

Investment Objective & Portfolio Holdings:

Victory US 500 Enhanced Volatility Wtd Index Fund seeks to provide investment results that track the performance of the Nasdaq Victory US Large Cap 500 Long/Cash Volatility Weighted Index before fees and expenses.

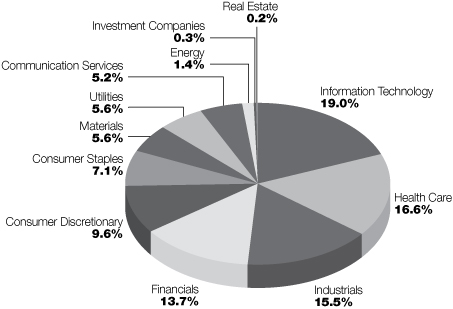

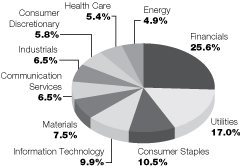

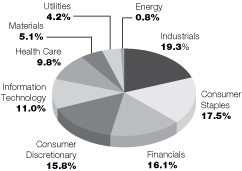

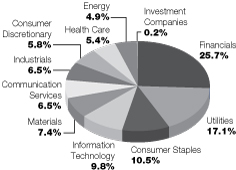

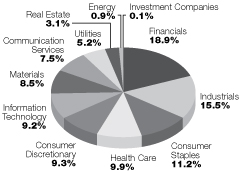

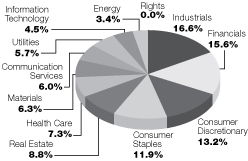

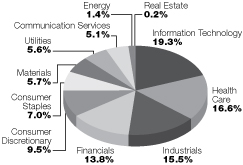

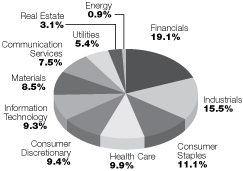

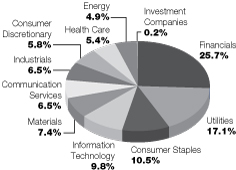

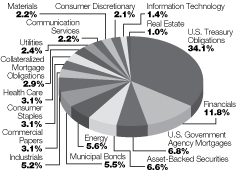

Sector Allocation*:

December 31, 2020

(% of Net Assets)

* Does not include futures, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

Refer to the Schedule of Portfolio Investments for a complete list of securities.

Percentages are of the net assets of the Fund and may not equal 100%.

3

Victory Portfolios II

Victory Market Neutral Income Fund | | December 31, 2020 | |

(Unaudited)

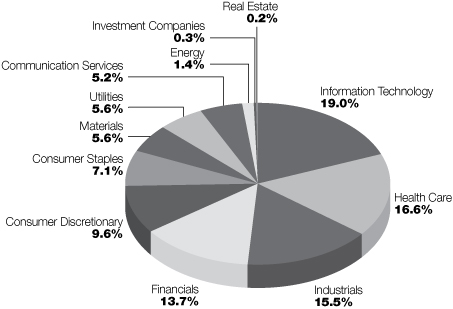

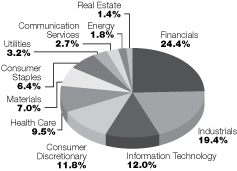

Investment Objective & Portfolio Holdings:

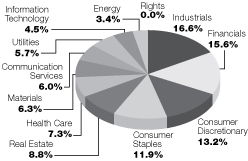

Victory Market Neutral Income Fund objective is high current income.

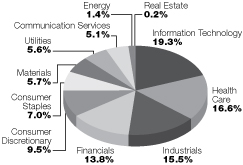

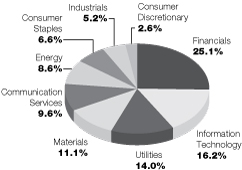

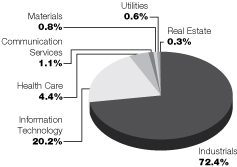

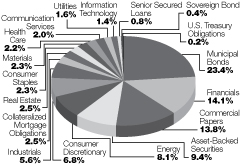

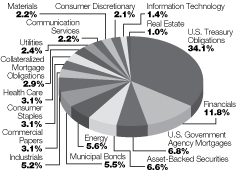

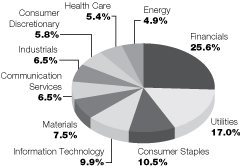

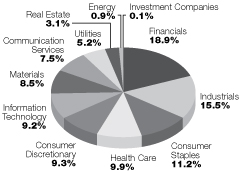

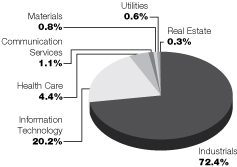

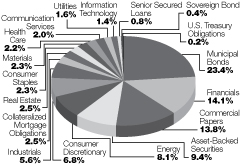

Sector Allocation*:

December 31, 2020

(% of Net Assets)

* Does not include futures, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

Refer to the Schedule of Portfolio Investments for a complete list of securities.

Percentages are of the net assets of the Fund and may not equal 100%.

4

Victory Portfolios II

Victory US 500 Enhanced Volatility Wtd Index Fund | | Schedule of Portfolio Investments

December 31, 2020 | |

(Unaudited)

Security Description | | Shares | | Value | |

Common Stocks (99.5%) | |

Communication Services (5.2%): | |

Activision Blizzard, Inc. | | | 1,796 | | | $ | 166,759 | | |

Alphabet, Inc., Class A (a) | | | 94 | | | | 164,748 | | |

Altice USA, Inc., Class A (a) (b) | | | 4,384 | | | | 166,022 | | |

ANGI Homeservices, Inc., Class A (a) (b) | | | 6,236 | | | | 82,284 | | |

AT&T, Inc. | | | 5,251 | | | | 151,019 | | |

Cable One, Inc. | | | 68 | | | | 151,485 | | |

CenturyLink, Inc. (b) | | | 9,877 | | | | 96,301 | | |

Charter Communications, Inc., Class A (a) | | | 276 | | | | 182,588 | | |

Comcast Corp., Class A | | | 3,343 | | | | 175,173 | | |

Discovery, Inc., Class A (a) (b) | | | 5,210 | | | | 156,769 | | |

DISH Network Corp., Class A (a) | | | 2,530 | | | | 81,820 | | |

Electronic Arts, Inc. | | | 1,172 | | | | 168,299 | | |

Facebook, Inc., Class A (a) | | | 441 | | | | 120,464 | | |

Fox Corp., Class A | | | 4,256 | | | | 123,935 | | |

Liberty Broadband Corp., Class C (a) | | | 1,099 | | | | 174,049 | | |

Netflix, Inc. (a) | | | 247 | | | | 133,560 | | |

Omnicom Group, Inc. | | | 2,282 | | | | 142,328 | | |

Sirius XM Holdings, Inc. (b) | | | 22,750 | | | | 144,918 | | |

Take-Two Interactive Software, Inc. (a) | | | 818 | | | | 169,972 | | |

The Interpublic Group of Cos., Inc. | | | 5,613 | | | | 132,018 | | |

The New York Times Co., Class A | | | 3,315 | | | | 171,618 | | |

T-Mobile U.S., Inc. (a) | | | 1,179 | | | | 158,988 | | |

Verizon Communications, Inc. | | | 3,741 | | | | 219,783 | | |

ViacomCBS, Inc., Class B | | | 2,721 | | | | 101,384 | | |

| | | | 3,536,284 | | |

Consumer Discretionary (9.6%): | |

Advance Auto Parts, Inc. | | | 751 | | | | 118,290 | | |

Amazon.com, Inc. (a) | | | 47 | | | | 153,076 | | |

Aptiv PLC | | | 883 | | | | 115,046 | | |

AutoZone, Inc. (a) | | | 112 | | | | 132,769 | | |

Best Buy Co., Inc. | | | 987 | | | | 98,493 | | |

Booking Holdings, Inc. (a) | | | 61 | | | | 135,863 | | |

BorgWarner, Inc. | | | 2,810 | | | | 108,578 | | |

Bright Horizons Family Solutions, Inc. (a) | | | 662 | | | | 114,519 | | |

CarMax, Inc. (a) | | | 905 | | | | 85,486 | | |

Chegg, Inc. (a) | | | 1,273 | | | | 114,990 | | |

Chipotle Mexican Grill, Inc. (a) | | | 87 | | | | 120,644 | | |

D.R. Horton, Inc. | | | 1,368 | | | | 94,283 | | |

Dollar General Corp. | | | 907 | | | | 190,742 | | |

Dollar Tree, Inc. (a) | | | 1,255 | | | | 135,590 | | |

Domino's Pizza, Inc. | | | 315 | | | | 120,790 | | |

eBay, Inc. | | | 3,060 | | | | 153,765 | | |

Etsy, Inc. (a) | | | 720 | | | | 128,095 | | |

Floor & Decor Holdings, Inc., Class A (a) | | | 1,207 | | | | 112,070 | | |

Garmin Ltd. | | | 1,456 | | | | 174,224 | | |

General Motors Co. | | | 3,135 | | | | 130,542 | | |

Gentex Corp. | | | 5,340 | | | | 181,187 | | |

See notes to financial statements.

5

Victory Portfolios II

Victory US 500 Enhanced Volatility Wtd Index Fund | | Schedule of Portfolio Investments — continued

December 31, 2020 | |

(Unaudited)

Security Description | | Shares | | Value | |

Genuine Parts Co. | | | 1,141 | | | $ | 114,591 | | |

Hasbro, Inc. | | | 1,296 | | | | 121,228 | | |

Hilton Worldwide Holdings, Inc. | | | 1,264 | | | | 140,633 | | |

Las Vegas Sands Corp. (c) | | | 1,910 | | | | 113,836 | | |

Lear Corp. | | | 847 | | | | 134,698 | | |

Lennar Corp., Class A | | | 1,111 | | | | 84,692 | | |

LKQ Corp. (a) | | | 2,661 | | | | 93,774 | | |

Lowe's Cos., Inc. | | | 681 | | | | 109,307 | | |

Marriott International, Inc., Class A | | | 830 | | | | 109,494 | | |

McDonald's Corp. | | | 631 | | | | 135,400 | | |

MGM Resorts International | | | 2,581 | | | | 81,327 | | |

Mohawk Industries, Inc. (a) | | | 822 | | | | 115,861 | | |

NIKE, Inc., Class B | | | 1,218 | | | | 172,310 | | |

NVR, Inc. (a) | | | 22 | | | | 89,757 | | |

O'Reilly Automotive, Inc. (a) | | | 280 | | | | 126,720 | | |

Pool Corp. | | | 397 | | | | 147,882 | | |

PulteGroup, Inc. | | | 1,903 | | | | 82,057 | | |

Ross Stores, Inc. | | | 1,113 | | | | 136,688 | | |

Service Corp. International | | | 2,863 | | | | 140,574 | | |

Starbucks Corp. | | | 1,435 | | | | 153,515 | | |

Target Corp. (c) | | | 972 | | | | 171,587 | | |

Tesla, Inc. (a) | | | 136 | | | | 95,971 | | |

The Home Depot, Inc. | | | 442 | | | | 117,404 | | |

The TJX Cos., Inc. | | | 2,042 | | | | 139,448 | | |

Tractor Supply Co. | | | 1,007 | | | | 141,565 | | |

Ulta Beauty, Inc. (a) | | | 377 | | | | 108,259 | | |

Vail Resorts, Inc. | | | 520 | | | | 145,059 | | |

VF Corp. | | | 1,490 | | | | 127,261 | | |

Whirlpool Corp. | | | 500 | | | | 90,245 | | |

Williams-Sonoma, Inc. | | | 959 | | | | 97,665 | | |

Yum! Brands, Inc. | | | 1,294 | | | | 140,477 | | |

| | | | 6,498,327 | | |

Consumer Staples (7.1%): | |

Archer-Daniels-Midland Co. | | | 3,163 | | | | 159,447 | | |

Brown-Forman Corp., Class B | | | 1,956 | | | | 155,365 | | |

Campbell Soup Co. | | | 3,432 | | | | 165,938 | | |

Casey's General Stores, Inc. | | | 722 | | | | 128,964 | | |

Church & Dwight Co., Inc. | | | 1,816 | | | | 158,410 | | |

Colgate-Palmolive Co. | | | 2,185 | | | | 186,839 | | |

Conagra Brands, Inc. | | | 3,889 | | | | 141,015 | | |

Costco Wholesale Corp. | | | 578 | | | | 217,779 | | |

General Mills, Inc. | | | 2,873 | | | | 168,933 | | |

Herbalife Nutrition Ltd. (a) | | | 2,094 | | | | 100,617 | | |

Hormel Foods Corp. | | | 3,682 | | | | 171,619 | | |

Kellogg Co. | | | 2,501 | | | | 155,637 | | |

Kimberly-Clark Corp. | | | 1,151 | | | | 155,189 | | |

Lamb Weston Holdings, Inc. | | | 1,564 | | | | 123,149 | | |

McCormick & Co., Inc. | | | 1,429 | | | | 136,612 | | |

Mondelez International, Inc., Class A | | | 2,773 | | | | 162,137 | | |

Monster Beverage Corp. (a) | | | 1,895 | | | | 175,250 | | |

See notes to financial statements.

6

Victory Portfolios II

Victory US 500 Enhanced Volatility Wtd Index Fund | | Schedule of Portfolio Investments — continued

December 31, 2020 | |

(Unaudited)

Security Description | | Shares | | Value | |

PepsiCo, Inc. | | | 1,066 | | | $ | 158,088 | | |

Philip Morris International, Inc. | | | 1,777 | | | | 147,118 | | |

Sysco Corp. | | | 1,366 | | | | 101,439 | | |

The Boston Beer Co., Inc., Class A (a) | | | 118 | | | | 117,326 | | |

The Clorox Co. | | | 837 | | | | 169,007 | | |

The Coca-Cola Co. | | | 3,308 | | | | 181,410 | | |

The Estee Lauder Cos., Inc., Class A | | | 612 | | | | 162,908 | | |

The Hershey Co. | | | 985 | | | | 150,045 | | |

The J.M. Smucker Co. | | | 1,430 | | | | 165,308 | | |

The Kroger Co. | | | 5,124 | | | | 162,738 | | |

The Procter & Gamble Co. | | | 1,214 | | | | 168,916 | | |

Tyson Foods, Inc., Class A | | | 1,801 | | | | 116,056 | | |

Walgreens Boots Alliance, Inc. | | | 3,270 | | | | 130,408 | | |

Walmart, Inc. | | | 1,288 | | | | 185,665 | | |

| | | | 4,779,332 | | |

Energy (1.4%): | |

Cabot Oil & Gas Corp. | | | 5,736 | | | | 93,382 | | |

Cheniere Energy, Inc. (a) | | | 2,035 | | | | 122,162 | | |

ConocoPhillips | | | 2,130 | | | | 85,179 | | |

EOG Resources, Inc. | | | 1,774 | | | | 88,469 | | |

Exxon Mobil Corp. | | | 2,842 | | | | 117,147 | | |

Kinder Morgan, Inc. | | | 7,246 | | | | 99,053 | | |

ONEOK, Inc. | | | 2,167 | | | | 83,169 | | |

Pioneer Natural Resources Co. | | | 708 | | | | 80,634 | | |

The Williams Cos., Inc. | | | 4,126 | | | | 82,726 | | |

Valero Energy Corp. | | | 1,487 | | | | 84,120 | | |

| | | | 936,041 | | |

Financials (13.7%): | |

Aflac, Inc. | | | 2,648 | | | | 117,757 | | |

Ally Financial, Inc. | | | 3,180 | | | | 113,399 | | |

American Express Co. | | | 890 | | | | 107,610 | | |

Ameriprise Financial, Inc. | | | 504 | | | | 97,942 | | |

Arch Capital Group Ltd. (a) | | | 3,111 | | | | 112,214 | | |

Ares Management Corp., Class A | | | 2,601 | | | | 122,377 | | |

Arthur J. Gallagher & Co. | | | 1,282 | | | | 158,596 | | |

Assurant, Inc. | | | 923 | | | | 125,731 | | |

Athene Holding Ltd., Class A (a) | | | 1,829 | | | | 78,903 | | |

Bank of America Corp. | | | 3,770 | | | | 114,269 | | |

Berkshire Hathaway, Inc., Class B (a) | | | 730 | | | | 169,265 | | |

BlackRock, Inc., Class A | | | 195 | | | | 140,700 | | |

Brown & Brown, Inc. | | | 3,143 | | | | 149,010 | | |

Cboe Global Markets, Inc. | | | 1,410 | | | | 131,299 | | |

Chubb Ltd. | | | 943 | | | | 145,147 | | |

Cincinnati Financial Corp. | | | 1,240 | | | | 108,339 | | |

Citigroup, Inc. | | | 1,623 | | | | 100,074 | | |

Citizens Financial Group, Inc. | | | 2,913 | | | | 104,169 | | |

CME Group, Inc. | | | 667 | | | | 121,427 | | |

Commerce Bancshares, Inc. | | | 2,021 | | | | 132,780 | | |

Credit Acceptance Corp. (a) (b) | | | 223 | | | | 77,189 | | |

See notes to financial statements.

7

Victory Portfolios II

Victory US 500 Enhanced Volatility Wtd Index Fund | | Schedule of Portfolio Investments — continued

December 31, 2020 | |

(Unaudited)

Security Description | | Shares | | Value | |

Discover Financial Services | | | 1,245 | | | $ | 112,710 | | |

Erie Indemnity Co., Class A (b) | | | 533 | | | | 130,905 | | |

Everest Re Group Ltd. | | | 522 | | | | 122,195 | | |

FactSet Research Systems, Inc. | | | 354 | | | | 117,705 | | |

Fidelity National Financial, Inc. | | | 3,109 | | | | 121,531 | | |

Fifth Third Bancorp | | | 3,695 | | | | 101,871 | | |

First Republic Bank | | | 1,040 | | | | 152,806 | | |

Franklin Resources, Inc. (b) | | | 5,163 | | | | 129,023 | | |

Globe Life, Inc. | | | 1,271 | | | | 120,694 | | |

Huntington Bancshares, Inc. | | | 9,604 | | | | 121,299 | | |

Interactive Brokers Group, Inc. | | | 2,261 | | | | 137,740 | | |

Intercontinental Exchange, Inc. | | | 1,367 | | | | 157,601 | | |

JPMorgan Chase & Co. | | | 1,042 | | | | 132,407 | | |

KeyCorp | | | 6,149 | | | | 100,905 | | |

KKR & Co., Inc. | | | 2,861 | | | | 115,842 | | |

Lincoln National Corp. | | | 1,661 | | | | 83,565 | | |

LPL Financial Holdings, Inc. | | | 1,030 | | | | 107,347 | | |

M&T Bank Corp. | | | 947 | | | | 120,553 | | |

Markel Corp. (a) | | | 101 | | | | 104,363 | | |

MarketAxess Holdings, Inc. | | | 257 | | | | 146,634 | | |

Marsh & McLennan Cos., Inc. | | | 1,328 | | | | 155,376 | | |

MetLife, Inc. | | | 2,445 | | | | 114,793 | | |

Moody's Corp. | | | 371 | | | | 107,679 | | |

Morgan Stanley | | | 1,865 | | | | 127,808 | | |

Morningstar, Inc. | | | 1,110 | | | | 257,043 | | |

MSCI, Inc. | | | 289 | | | | 129,047 | | |

Nasdaq, Inc. | | | 978 | | | | 129,820 | | |

Northern Trust Corp. | | | 1,327 | | | | 123,597 | | |

Principal Financial Group, Inc. | | | 2,055 | | | | 101,949 | | |

Raymond James Financial, Inc. | | | 1,278 | | | | 122,266 | | |

Regions Financial Corp. | | | 7,088 | | | | 114,259 | | |

RenaissanceRe Holdings Ltd. | | | 705 | | | | 116,903 | | |

S&P Global, Inc. | | | 326 | | | | 107,166 | | |

SEI Investments Co. | | | 2,355 | | | | 135,342 | | |

State Street Corp. | | | 1,431 | | | | 104,148 | | |

SVB Financial Group (a) | | | 337 | | | | 130,699 | | |

Synchrony Financial | | | 2,987 | | | | 103,679 | | |

T. Rowe Price Group, Inc. | | | 841 | | | | 127,319 | | |

The Allstate Corp. | | | 1,369 | | | | 150,494 | | |

The Bank of New York Mellon Corp. | | | 3,213 | | | | 136,360 | | |

The Blackstone Group, Inc., Class A | | | 1,970 | | | | 127,676 | | |

The Charles Schwab Corp. | | | 3,002 | | | | 159,226 | | |

The Goldman Sachs Group, Inc. | | | 521 | | | | 137,393 | | |

The Hartford Financial Services Group, Inc. | | | 2,134 | | | | 104,523 | | |

The PNC Financial Services Group, Inc. | | | 882 | | | | 131,418 | | |

The Progressive Corp. | | | 1,621 | | | | 160,283 | | |

The Travelers Cos., Inc. | | | 995 | | | | 139,668 | | |

Tradeweb Markets, Inc., Class A (b) | | | 2,362 | | | | 147,507 | | |

Truist Financial Corp. | | | 2,187 | | | | 104,823 | | |

U.S. Bancorp | | | 2,679 | | | | 124,815 | | |

See notes to financial statements.

8

Victory Portfolios II

Victory US 500 Enhanced Volatility Wtd Index Fund | | Schedule of Portfolio Investments — continued

December 31, 2020 | |

(Unaudited)

Security Description | | Shares | | Value | |

Voya Financial, Inc. | | | 2,226 | | | $ | 130,911 | | |

W.R. Berkley Corp. | | | 1,881 | | | | 124,936 | | |

Wells Fargo & Co. | | | 3,852 | | | | 116,253 | | |

| | | | 9,271,072 | | |

Health Care (16.6%): | |

Abbott Laboratories | | | 1,311 | | | | 143,541 | | |

AbbVie, Inc. | | | 1,762 | | | | 188,798 | | |

ABIOMED, Inc. (a) | | | 424 | | | | 137,461 | | |

Agilent Technologies, Inc. | | | 1,537 | | | | 182,119 | | |

Alexion Pharmaceuticals, Inc. (a) | | | 1,321 | | | | 206,394 | | |

Align Technology, Inc. (a) | | | 299 | | | | 159,780 | | |

Amedisys, Inc. (a) | | | 469 | | | | 137,572 | | |

AmerisourceBergen Corp. | | | 1,372 | | | | 134,127 | | |

Amgen, Inc. | | | 592 | | | | 136,113 | | |

Anthem, Inc. | | | 369 | | | | 118,482 | | |

Avantor, Inc. (a) | | | 3,893 | | | | 109,588 | | |

Baxter International, Inc. | | | 1,722 | | | | 138,173 | | |

Becton, Dickinson & Co. | | | 636 | | | | 159,140 | | |

Biogen, Inc. (a) | | | 431 | | | | 105,535 | | |

BioMarin Pharmaceutical, Inc. (a) | | | 1,263 | | | | 110,752 | | |

Bio-Rad Laboratories, Inc., Class A (a) | | | 297 | | | | 173,133 | | |

Bio-Techne Corp. | | | 615 | | | | 195,293 | | |

Boston Scientific Corp. (a) | | | 3,155 | | | | 113,422 | | |

Catalent, Inc. (a) | | | 1,162 | | | | 120,929 | | |

Centene Corp. (a) | | | 1,732 | | | | 103,972 | | |

Cerner Corp. | | | 2,455 | | | | 192,668 | | |

Charles River Laboratories International, Inc. (a) | | | 513 | | | | 128,178 | | |

Chemed Corp. | | | 257 | | | | 136,881 | | |

Cigna Corp. | | | 618 | | | | 128,655 | | |

CRISPR Therapeutics AG (a) | | | 1,048 | | | | 160,459 | | |

CVS Health Corp. | | | 2,403 | | | | 164,125 | | |

Danaher Corp. | | | 832 | | | | 184,820 | | |

DaVita, Inc. (a) | | | 1,606 | | | | 188,544 | | |

DexCom, Inc. (a) | | | 258 | | | | 95,388 | | |

Edwards Lifesciences Corp. (a) | | | 1,520 | | | | 138,670 | | |

Eli Lilly & Co. | | | 959 | | | | 161,918 | | |

Encompass Health Corp. | | | 2,022 | | | | 167,199 | | |

Exelixis, Inc. (a) | | | 4,818 | | | | 96,697 | | |

HCA Healthcare, Inc. | | | 676 | | | | 111,175 | | |

Henry Schein, Inc. (a) | | | 2,005 | | | | 134,054 | | |

Hologic, Inc. (a) | | | 2,096 | | | | 152,652 | | |

Horizon Therapeutics PLC (a) | | | 1,407 | | | | 102,922 | | |

Humana, Inc. | | | 264 | | | | 108,311 | | |

IDEXX Laboratories, Inc. (a) | | | 372 | | | | 185,952 | | |

Illumina, Inc. (a) | | | 374 | | | | 138,380 | | |

Insulet Corp. (a) | | | 571 | | | | 145,965 | | |

Intuitive Surgical, Inc. (a) | | | 172 | | | | 140,713 | | |

Ionis Pharmaceuticals, Inc. (a) | | | 2,560 | | | | 144,742 | | |

IQVIA Holdings, Inc. (a) | | | 688 | | | | 123,269 | | |

Jazz Pharmaceuticals PLC (a) | | | 937 | | | | 154,652 | | |

See notes to financial statements.

9

Victory Portfolios II

Victory US 500 Enhanced Volatility Wtd Index Fund | | Schedule of Portfolio Investments — continued

December 31, 2020 | |

(Unaudited)

Security Description | | Shares | | Value | |

Johnson & Johnson (c) | | | 1,205 | | | $ | 189,643 | | |

Laboratory Corp. of America Holdings (a) | | | 605 | | | | 123,148 | | |

LHC Group, Inc. (a) | | | 541 | | | | 115,406 | | |

Masimo Corp. (a) | | | 708 | | | | 190,012 | | |

McKesson Corp. | | | 806 | | | | 140,180 | | |

Medtronic PLC | | | 1,286 | | | | 150,642 | | |

Merck & Co., Inc. | | | 2,063 | | | | 168,753 | | |

Mettler-Toledo International, Inc. (a) | | | 144 | | | | 164,114 | | |

Molina Healthcare, Inc. (a) | | | 589 | | | | 125,269 | | |

Neurocrine Biosciences, Inc. (a) | | | 1,170 | | | | 112,145 | | |

Novocure Ltd. (a) | | | 1,225 | | | | 211,973 | | |

Penumbra, Inc. (a) (b) | | | 597 | | | | 104,475 | | |

PerkinElmer, Inc. | | | 1,364 | | | | 195,734 | | |

Perrigo Co. PLC | | | 2,402 | | | | 107,417 | | |

Pfizer, Inc. | | | 4,640 | | | | 170,798 | | |

PRA Health Sciences, Inc. (a) | | | 1,006 | | | | 126,193 | | |

Quest Diagnostics, Inc. | | | 1,218 | | | | 145,149 | | |

Quidel Corp. (a) | | | 408 | | | | 73,297 | | |

Regeneron Pharmaceuticals, Inc. (a) | | | 221 | | | | 106,767 | | |

Repligen Corp. (a) | | | 791 | | | | 151,579 | | |

ResMed, Inc. | | | 626 | | | | 133,063 | | |

Stryker Corp. | | | 577 | | | | 141,388 | | |

Syneos Health, Inc. (a) | | | 1,384 | | | | 94,292 | | |

Teleflex, Inc. | | | 328 | | | | 134,995 | | |

The Cooper Cos., Inc. | | | 455 | | | | 165,311 | | |

Thermo Fisher Scientific, Inc. | | | 373 | | | | 173,736 | | |

UnitedHealth Group, Inc. | | | 372 | | | | 130,453 | | |

Universal Health Services, Inc., Class B | | | 770 | | | | 105,875 | | |

Veeva Systems, Inc., Class A (a) | | | 446 | | | | 121,424 | | |

Vertex Pharmaceuticals, Inc. (a) | | | 496 | | | | 117,225 | | |

Waters Corp. (a) | | | 652 | | | | 161,318 | | |

West Pharmaceutical Services, Inc. | | | 527 | | | | 149,304 | | |

Zimmer Biomet Holdings, Inc. | | | 810 | | | | 124,813 | | |

Zoetis, Inc. | | | 895 | | | | 148,123 | | |

| | | | 11,235,327 | | |

Industrials (15.5%): | |

3M Co. | | | 911 | | | | 159,234 | | |

Allegion PLC | | | 1,211 | | | | 140,936 | | |

AMERCO, Inc. | | | 352 | | | | 159,793 | | |

AMETEK, Inc. | | | 1,195 | | | | 144,522 | | |

AO Smith Corp. | | | 3,114 | | | | 170,709 | | |

C.H. Robinson Worldwide, Inc. | | | 1,899 | | | | 178,259 | | |

Carlisle Cos., Inc. | | | 923 | | | | 144,154 | | |

Caterpillar, Inc. | | | 906 | | | | 164,910 | | |

Cintas Corp. | | | 321 | | | | 113,461 | | |

Copart, Inc. (a) | | | 1,223 | | | | 155,627 | | |

CoStar Group, Inc. (a) (c) | | | 149 | | | | 137,718 | | |

CSX Corp. | | | 1,569 | | | | 142,387 | | |

Cummins, Inc. | | | 615 | | | | 139,667 | | |

Deere & Co. | | | 581 | | | | 156,318 | | |

See notes to financial statements.

10

Victory Portfolios II

Victory US 500 Enhanced Volatility Wtd Index Fund | | Schedule of Portfolio Investments — continued

December 31, 2020 | |

(Unaudited)

Security Description | | Shares | | Value | |

Dover Corp. | | | 1,081 | | | $ | 136,476 | | |

Eaton Corp. PLC | | | 1,043 | | | | 125,306 | | |

Emerson Electric Co. | | | 1,501 | | | | 120,635 | | |

Enphase Energy, Inc. (a) | | | 716 | | | | 125,637 | | |

Equifax, Inc. | | | 830 | | | | 160,057 | | |

Expeditors International of Washington, Inc. | | | 1,998 | | | | 190,030 | | |

Fastenal Co. | | | 3,069 | | | | 149,859 | | |

FedEx Corp. | | | 476 | | | | 123,579 | | |

Fortive Corp. | | | 1,996 | | | | 141,357 | | |

Fortune Brands Home & Security, Inc. | | | 1,147 | | | | 98,321 | | |

Generac Holdings, Inc. (a) | | | 582 | | | | 132,353 | | |

General Dynamics Corp. | | | 939 | | | | 139,742 | | |

General Electric Co. | | | 14,434 | | | | 155,887 | | |

Graco, Inc. | | | 2,307 | | | | 166,911 | | |

HEICO Corp. | | | 903 | | | | 119,557 | | |

Honeywell International, Inc. | | | 753 | | | | 160,163 | | |

Howmet Aerospace, Inc. (a) | | | 4,352 | | | | 124,206 | | |

Hubbell, Inc. | | | 838 | | | | 131,390 | | |

IAA, Inc. (a) | | | 1,928 | | | | 125,281 | | |

IDEX Corp. | | | 832 | | | | 165,734 | | |

Illinois Tool Works, Inc. | | | 661 | | | | 134,765 | | |

J.B. Hunt Transport Services, Inc. | | | 998 | | | | 136,377 | | |

Jacobs Engineering Group, Inc. | | | 1,480 | | | | 161,261 | | |

Johnson Controls International PLC | | | 3,254 | | | | 151,604 | | |

Kansas City Southern | | | 605 | | | | 123,499 | | |

Knight-Swift Transportation Holdings, Inc. | | | 3,188 | | | | 133,322 | | |

L3Harris Technologies, Inc. | | | 754 | | | | 142,522 | | |

Lennox International, Inc. | | | 515 | | | | 141,095 | | |

Lockheed Martin Corp. | | | 343 | | | | 121,758 | | |

Masco Corp. | | | 2,342 | | | | 128,646 | | |

Nordson Corp. | | | 587 | | | | 117,958 | | |

Norfolk Southern Corp. | | | 542 | | | | 128,785 | | |

Northrop Grumman Corp. | | | 410 | | | | 124,935 | | |

Old Dominion Freight Line, Inc. | | | 670 | | | | 130,771 | | |

PACCAR, Inc. | | | 1,842 | | | | 158,928 | | |

Parker-Hannifin Corp. | | | 454 | | | | 123,674 | | |

Quanta Services, Inc. | | | 2,251 | | | | 162,117 | | |

Republic Services, Inc. (c) | | | 1,716 | | | | 165,251 | | |

Rockwell Automation, Inc. | | | 492 | | | | 123,399 | | |

Rollins, Inc. | | | 4,396 | | | | 171,751 | | |

Roper Technologies, Inc. | | | 329 | | | | 141,829 | | |

Snap-on, Inc. | | | 786 | | | | 134,516 | | |

Southwest Airlines Co. | | | 2,409 | | | | 112,283 | | |

Stanley Black & Decker, Inc. | | | 539 | | | | 96,244 | | |

Teledyne Technologies, Inc. (a) | | | 349 | | | | 136,801 | | |

Textron, Inc. | | | 2,108 | | | | 101,880 | | |

The Toro Co. | | | 1,996 | | | | 189,301 | | |

Trane Technologies PLC | | | 1,051 | | | | 152,563 | | |

TransDigm Group, Inc. (a) | | | 154 | | | | 95,303 | | |

TransUnion | | | 1,427 | | | | 141,587 | | |

See notes to financial statements.

11

Victory Portfolios II

Victory US 500 Enhanced Volatility Wtd Index Fund | | Schedule of Portfolio Investments — continued

December 31, 2020 | |

(Unaudited)

Security Description | | Shares | | Value | |

Trex Co., Inc. (a) | | | 1,197 | | | $ | 100,213 | | |

Union Pacific Corp. | | | 695 | | | | 144,712 | | |

United Parcel Service, Inc., Class B | | | 850 | | | | 143,140 | | |

United Rentals, Inc. (a) | | | 476 | | | | 110,389 | | |

Verisk Analytics, Inc. | | | 782 | | | | 162,335 | | |

W.W. Grainger, Inc. | | | 359 | | | | 146,594 | | |

Waste Management, Inc. | | | 1,403 | | | | 165,456 | | |

Watsco, Inc. | | | 632 | | | | 143,180 | | |

Westinghouse Air Brake Technologies Corp. | | | 1,586 | | | | 116,095 | | |

XPO Logistics, Inc. (a) | | | 896 | | | | 106,803 | | |

Xylem, Inc. | | | 1,497 | | | | 152,380 | | |

| | | | 10,476,198 | | |

Information Technology (19.0%): | |

Accenture PLC, Class A | | | 570 | | | | 148,890 | | |

Adobe, Inc. (a) | | | 235 | | | | 117,528 | | |

Advanced Micro Devices, Inc. (a) | | | 1,029 | | | | 94,370 | | |

Akamai Technologies, Inc. (a) | | | 1,332 | | | | 139,847 | | |

Amphenol Corp., Class A | | | 1,246 | | | | 162,939 | | |

Analog Devices, Inc. | | | 941 | | | | 139,014 | | |

ANSYS, Inc. (a) | | | 370 | | | | 134,606 | | |

Apple, Inc. | | | 1,005 | | | | 133,353 | | |

Applied Materials, Inc. | | | 1,554 | | | | 134,110 | | |

Arista Networks, Inc. (a) | | | 538 | | | | 156,327 | | |

Aspen Technology, Inc. (a) | | | 803 | | | | 104,591 | | |

Autodesk, Inc. (a) | | | 461 | | | | 140,762 | | |

Automatic Data Processing, Inc. | | | 893 | | | | 157,347 | | |

Black Knight, Inc. (a) | | | 1,990 | | | | 175,816 | | |

Booz Allen Hamilton Holding Corp. | | | 1,818 | | | | 158,493 | | |

Broadcom, Inc. | | | 311 | | | | 136,171 | | |

Broadridge Financial Solutions, Inc. | | | 1,126 | | | | 172,503 | | |

Cadence Design Systems, Inc. (a) | | | 1,149 | | | | 156,758 | | |

CDW Corp. | | | 991 | | | | 130,604 | | |

Ceridian HCM Holding, Inc. (a) | | | 1,186 | | | | 126,380 | | |

Ciena Corp. (a) | | | 2,339 | | | | 123,616 | | |

Cisco Systems, Inc. | | | 3,133 | | | | 140,202 | | |

Citrix Systems, Inc. | | | 971 | | | | 126,327 | | |

Cognex Corp. | | | 1,456 | | | | 116,895 | | |

Cognizant Technology Solutions Corp., Class A | | | 1,697 | | | | 139,069 | | |

Corning, Inc. | | | 3,367 | | | | 121,212 | | |

Datadog, Inc., Class A (a) | | | 1,076 | | | | 105,921 | | |

Dell Technologies, Inc., Class C (a) | | | 1,639 | | | | 120,122 | | |

Dolby Laboratories, Inc., Class A | | | 1,888 | | | | 183,382 | | |

Dropbox, Inc., Class A (a) | | | 5,117 | | | | 113,546 | | |

Entegris, Inc. | | | 1,609 | | | | 154,625 | | |

EPAM Systems, Inc. (a) | | | 320 | | | | 114,672 | | |

F5 Networks, Inc. (a) | | | 1,062 | | | | 186,848 | | |

Fair Isaac Corp. (a) | | | 229 | | | | 117,028 | | |

Fidelity National Information Services, Inc. | | | 836 | | | | 118,261 | | |

First Solar, Inc. (a) | | | 1,330 | | | | 131,564 | | |

Fiserv, Inc. (a) | | | 1,216 | | | | 138,454 | | |

FleetCor Technologies, Inc. (a) | | | 431 | | | | 117,590 | | |

See notes to financial statements.

12

Victory Portfolios II

Victory US 500 Enhanced Volatility Wtd Index Fund | | Schedule of Portfolio Investments — continued

December 31, 2020 | |

(Unaudited)

Security Description | | Shares | | Value | |

Fortinet, Inc. (a) | | | 789 | | | $ | 117,190 | | |

Gartner, Inc. (a) | | | 906 | | | | 145,132 | | |

Genpact Ltd. | | | 2,757 | | | | 114,030 | | |

Global Payments, Inc. | | | 580 | | | | 124,944 | | |

HP, Inc. | | | 5,143 | | | | 126,466 | | |

Intel Corp. | | | 2,066 | | | | 102,928 | | |

International Business Machines Corp. | | | 1,134 | | | | 142,748 | | |

Intuit, Inc. | | | 349 | | | | 132,568 | | |

IPG Photonics Corp. (a) | | | 652 | | | | 145,911 | | |

Jack Henry & Associates, Inc. | | | 868 | | | | 140,607 | | |

Juniper Networks, Inc. | | | 6,414 | | | | 144,379 | | |

Keysight Technologies, Inc. (a) | | | 1,276 | | | | 168,547 | | |

KLA Corp. | | | 457 | | | | 118,322 | | |

Lam Research Corp. | | | 264 | | | | 124,679 | | |

Leidos Holdings, Inc. | | | 1,417 | | | | 148,955 | | |

Marvell Technology Group Ltd. | | | 2,818 | | | | 133,968 | | |

Mastercard, Inc., Class A | | | 329 | | | | 117,433 | | |

Microchip Technology, Inc. | | | 826 | | | | 114,079 | | |

Micron Technology, Inc. (a) | | | 2,156 | | | | 162,088 | | |

Microsoft Corp. (c) | | | 579 | | | | 128,781 | | |

MKS Instruments, Inc. | | | 770 | | | | 115,847 | | |

Monolithic Power Systems, Inc. | | | 353 | | | | 129,279 | | |

Motorola Solutions, Inc. | | | 822 | | | | 139,789 | | |

NetApp, Inc. | | | 2,340 | | | | 155,002 | | |

NortonLifeLock, Inc. | | | 4,345 | | | | 90,289 | | |

Nuance Communications, Inc. (a) (b) | | | 4,293 | | | | 189,278 | | |

NVIDIA Corp. | | | 190 | | | | 99,218 | | |

Oracle Corp. | | | 2,354 | | | | 152,280 | | |

Paychex, Inc. | | | 1,485 | | | | 138,372 | | |

Paycom Software, Inc. (a) | | | 289 | | | | 130,700 | | |

Paylocity Holding Corp. (a) | | | 656 | | | | 135,077 | | |

PayPal Holdings, Inc. (a) | | | 562 | | | | 131,620 | | |

PTC, Inc. (a) | | | 1,418 | | | | 169,607 | | |

Qorvo, Inc. (a) | | | 807 | | | | 134,180 | | |

QUALCOMM, Inc. | | | 937 | | | | 142,743 | | |

salesforce.com, Inc. (a) | | | 400 | | | | 89,012 | | |

Seagate Technology PLC (b) | | | 2,722 | | | | 169,200 | | |

ServiceNow, Inc. (a) (c) | | | 240 | | | | 132,103 | | |

Skyworks Solutions, Inc. | | | 717 | | | | 109,615 | | |

SolarWinds Corp. (a) | | | 5,387 | | | | 80,536 | | |

Square, Inc., Class A (a) | | | 507 | | | | 110,343 | | |

SS&C Technologies Holdings, Inc. | | | 1,923 | | | | 139,898 | | |

SYNNEX Corp. | | | 1,517 | | | | 123,544 | | |

Synopsys, Inc. (a) | | | 628 | | | | 162,803 | | |

Teradyne, Inc. | | | 1,260 | | | | 151,061 | | |

Texas Instruments, Inc. | | | 908 | | | | 149,030 | | |

The Trade Desk, Inc., Class A (a) | | | 168 | | | | 134,568 | | |

The Western Union Co. | | | 5,583 | | | | 122,491 | | |

Trimble, Inc. (a) | | | 1,975 | | | | 131,871 | | |

Tyler Technologies, Inc. (a) | | | 471 | | | | 205,602 | | |

Universal Display Corp. | | | 599 | | | | 137,650 | | |

VeriSign, Inc. (a) | | | 659 | | | | 142,608 | | |

See notes to financial statements.

13

Victory Portfolios II

Victory US 500 Enhanced Volatility Wtd Index Fund | | Schedule of Portfolio Investments — continued

December 31, 2020 | |

(Unaudited)

Security Description | | Shares | | Value | |

Visa, Inc., Class A | | | 619 | | | $ | 135,394 | | |

VMware, Inc., Class A (a) (b) | | | 891 | | | | 124,972 | | |

WEX, Inc. (a) | | | 455 | | | | 92,606 | | |

Xilinx, Inc. | | | 1,209 | | | | 171,399 | | |

Zebra Technologies Corp. (a) | | | 409 | | | | 157,191 | | |

Zoom Video Communications, Inc., Class A (a) | | | 264 | | | | 89,052 | | |

| | | | 12,959,328 | | |

Materials (5.6%): | |

Air Products & Chemicals, Inc. | | | 450 | | | | 122,949 | | |

Albemarle Corp. | | | 1,077 | | | | 158,879 | | |

AptarGroup, Inc. | | | 1,397 | | | | 191,235 | | |

Avery Dennison Corp. | | | 1,003 | | | | 155,575 | | |

Ball Corp. | | | 1,766 | | | | 164,556 | | |

Berry Global Group, Inc. (a) | | | 2,441 | | | | 137,160 | | |

Celanese Corp. | | | 1,029 | | | | 133,708 | | |

CF Industries Holdings, Inc. | | | 3,021 | | | | 116,943 | | |

Corteva, Inc. | | | 3,797 | | | | 147,020 | | |

Crown Holdings, Inc. (a) | | | 1,465 | | | | 146,793 | | |

Eastman Chemical Co. | | | 1,534 | | | | 153,830 | | |

FMC Corp. | | | 1,002 | | | | 115,160 | | |

International Flavors & Fragrances, Inc. (b) | | | 1,087 | | | | 118,309 | | |

International Paper Co. | | | 3,022 | | | | 150,254 | | |

LyondellBasell Industries NV, Class A | | | 1,246 | | | | 114,208 | | |

Martin Marietta Materials, Inc. | | | 504 | | | | 143,121 | | |

Newmont Corp. | | | 1,844 | | | | 110,437 | | |

Nucor Corp. | | | 2,561 | | | | 136,220 | | |

Packaging Corp. of America | | | 1,226 | | | | 169,078 | | |

PPG Industries, Inc. | | | 1,075 | | | | 155,037 | | |

Reliance Steel & Aluminum Co. | | | 1,154 | | | | 138,191 | | |

Royal Gold, Inc. | | | 730 | | | | 77,643 | | |

RPM International, Inc. | | | 1,477 | | | | 134,082 | | |

The Scotts Miracle-Gro Co. | | | 637 | | | | 126,852 | | |

The Sherwin-Williams Co. | | | 193 | | | | 141,838 | | |

Vulcan Materials Co. | | | 884 | | | | 131,106 | | |

Westlake Chemical Corp. | | | 1,394 | | | | 113,750 | | |

Westrock Co. | | | 2,819 | | | | 122,711 | | |

| | | | 3,826,645 | | |

Real Estate (0.2%): | |

CBRE Group, Inc., Class A (a) | | | 1,971 | | | | 123,621 | | |

Utilities (5.6%): | |

Alliant Energy Corp. | | | 2,655 | | | | 136,812 | | |

Ameren Corp. (b) | | | 1,593 | | | | 124,350 | | |

American Electric Power Co., Inc. (c) | | | 1,810 | | | | 150,719 | | |

American Water Works Co., Inc. | | | 903 | | | | 138,584 | | |

Atmos Energy Corp. | | | 1,358 | | | | 129,594 | | |

CMS Energy Corp. | | | 2,351 | | | | 143,434 | | |

Consolidated Edison, Inc. (c) | | | 1,876 | | | | 135,579 | | |

Dominion Energy, Inc. | | | 1,533 | | | | 115,282 | | |

DTE Energy Co. | | | 980 | | | | 118,982 | | |

Duke Energy Corp. (c) | | | 1,670 | | | | 152,904 | | |

See notes to financial statements.

14

Victory Portfolios II

Victory US 500 Enhanced Volatility Wtd Index Fund | | Schedule of Portfolio Investments — continued

December 31, 2020 | |

(Unaudited)

Security Description | | Shares | | Value | |

Edison International | | | 2,344 | | | $ | 147,250 | | |

Entergy Corp. | | | 1,189 | | | | 118,710 | | |

Essential Utilities, Inc. | | | 2,667 | | | | 126,122 | | |

Evergy, Inc. (c) | | | 2,068 | | | | 114,795 | | |

Eversource Energy (c) | | | 1,414 | | | | 122,325 | | |

Exelon Corp. | | | 3,038 | | | | 128,264 | | |

FirstEnergy Corp. | | | 3,656 | | | | 111,910 | | |

NextEra Energy, Inc. (c) | | | 1,918 | | | | 147,974 | | |

NRG Energy, Inc. | | | 3,419 | | | | 128,384 | | |

Pinnacle West Capital Corp. | | | 1,717 | | | | 137,274 | | |

PPL Corp. | | | 4,221 | | | | 119,032 | | |

Public Service Enterprise Group, Inc. | | | 2,623 | | | | 152,920 | | |

Sempra Energy | | | 951 | | | | 121,167 | | |

The AES Corp. | | | 5,282 | | | | 124,127 | | |

The Southern Co. (c) | | | 2,248 | | | | 138,095 | | |

UGI Corp. | | | 3,183 | | | | 111,278 | | |

Vistra Corp. | | | 5,738 | | | | 112,809 | | |

WEC Energy Group, Inc. (c) | | | 1,357 | | | | 124,885 | | |

Xcel Energy, Inc. (c) | | | 2,032 | | | | 135,473 | | |

| | | | 3,769,034 | | |

Total Common Stocks (Cost $48,254,390) | | | 67,411,209 | | |

Investment Companies (0.3%) | |

BlackRock Liquidity Funds T-Fund, Institutional Class, 0.02% (d) | | | 205,931 | | | | 205,931 | | |

Total Investment Companies (Cost $205,931) | | | 205,931 | | |

Collateral for Securities Loaned^ (2.5%) | |

BlackRock Liquidity Funds TempFund Portfolio, Institutional Class, 0.08% (d) | | | 29,337 | | | | 29,337 | | |

Fidelity Investments Money Market Government Portfolio I Shares, 0.01% (d) | | | 1,007,906 | | | | 1,007,906 | | |

Goldman Sachs Financial Square Prime Obligations Fund, Institutional

Class, 0.04% (d) | | | 14,641 | | | | 14,641 | | |

JPMorgan Prime Money Market Fund, Capital Class, 0.12% (d) | | | 116,741 | | | | 116,741 | | |

Morgan Stanley Institutional Liquidity Prime Portfolio, Institutional

Class, 0.09% (d) | | | 524,889 | | | | 524,889 | | |

Total Collateral for Securities Loaned (Cost $1,693,514) | | | 1,693,514 | | |

Total Investments (Cost $50,153,835) — 102.3% | | | 69,310,654 | | |

Liabilities in excess of other assets — (2.3)% | | | (1,563,224 | ) | |

NET ASSETS — 100.00% | | $ | 67,747,430 | | |

^ Purchased with cash collateral from securities on loan.

(a) Non-income producing security.

(b) All or a portion of this security is on loan.

(c) All or a portion of this security has been segregated as collateral for derivative instruments.

(d) Rate disclosed is the daily yield on December 31, 2020.

PLC — Public Limited Company

See notes to financial statements.

15

Victory Portfolios II

Victory US 500 Enhanced Volatility Wtd Index Fund | | Schedule of Portfolio Investments — continued

December 31, 2020 | |

(Unaudited)

Futures Contracts Purchased

| | | Number of

Contracts | | Expiration

Date | | Notional

Amount | | Value | | Unrealized

Appreciation

(Depreciation) | |

E-Mini S&P 500 Futures | | | 2 | | | 3/19/21 | | $ | 365,471 | | | $ | 374,880 | | | $ | 9,409 | | |

| | | Total unrealized appreciation | | | | | | | | | | | | $ | 9,409 | | |

| | | Total unrealized depreciation | | | | | | | | | | | | | — | | |

| | | Total net unrealized appreciation (depreciation) | | | | | | | | | | | | $ | 9,409 | | |

See notes to financial statements.

16

Victory Portfolios II

Victory Market Neutral Income Fund | | Schedule of Portfolio Investments

December 31, 2020 | |

(Unaudited)

Security Description | | Shares | | Value | |

Common Stocks (83.3%) | |

Australia (1.3%): | |

Communication Services (0.2%): | |

Telstra Corp. Ltd. | | | 534,637 | | | $ | 1,227,616 | | |

Financials (0.4%): | |

Insurance Australia Group Ltd. | | | 249,104 | | | | 903,843 | | |

National Australia Bank Ltd. | | | 56,154 | | | | 978,792 | | |

| | | | 1,882,635 | | |

Materials (0.7%): | |

BHP Group Ltd. | | | 31,028 | | | | 1,013,632 | | |

Fortescue Metals Group Ltd. | | | 55,555 | | | | 1,003,264 | | |

Rio Tinto Ltd. | | | 15,723 | | | | 1,382,439 | | |

| | | | 3,399,335 | | |

| | | | 6,509,586 | | |

Austria (0.3%): | |

Energy (0.1%): | |

OMV AG | | | 17,119 | | | | 683,698 | | |

Financials (0.2%): | |

Erste Group Bank AG (a) | | | 26,534 | | | | 808,195 | | |

| | | | 1,491,893 | | |

Bermuda (0.3%): | |

Industrials (0.3%): | |

Triton International Ltd. | | | 28,800 | | | | 1,397,088 | | |

Brazil (0.7%): | |

Consumer Discretionary (0.1%): | |

Petrobras Distribuidora SA | | | 131,600 | | | | 561,646 | | |

Financials (0.2%): | |

BB Seguridade Participacoes SA | | | 155,000 | | | | 887,147 | | |

Industrials (0.1%): | |

CCR SA | | | 195,200 | | | | 507,853 | | |

Utilities (0.3%): | |

Centrais Eletricas Brasileiras SA | | | 63,500 | | | | 452,096 | | |

Engie Brasil Energia SA | | | 112,100 | | | | 952,312 | | |

| | | | 1,404,408 | | |

| | | | 3,361,054 | | |

Canada (2.0%): | |

Communication Services (0.5%): | |

BCE, Inc. (b) (c) | | | 22,287 | | | | 953,156 | | |

Shaw Communications, Inc., Class B (b) | | | 48,096 | | | | 844,240 | | |

TELUS Corp. (b) (c) | | | 51,346 | | | | 1,017,076 | | |

| | | | 2,814,472 | | |

See notes to financial statements.

17

Victory Portfolios II

Victory Market Neutral Income Fund | | Schedule of Portfolio Investments — continued

December 31, 2020 | |

(Unaudited)

Security Description | | Shares | | Value | |

Energy (0.4%): | |

Canadian Natural Resources Ltd. | | | 21,806 | | | $ | 524,119 | | |

Enbridge, Inc. | | | 21,649 | | | | 692,489 | | |

Pembina Pipeline Corp. (c) | | | 16,131 | | | | 381,506 | | |

TC Energy Corp. | | | 14,356 | | | | 583,738 | | |

| | | | 2,181,852 | | |

Financials (0.5%): | |

Great-West Lifeco, Inc. | | | 33,531 | | | | 799,612 | | |

Power Corp. of Canada (c) | | | 28,756 | | | | 660,437 | | |

The Bank of Nova Scotia | | | 18,047 | | | | 975,590 | | |

| | | | 2,435,639 | | |

Materials (0.2%): | |

Nutrien Ltd. (c) | | | 20,452 | | | | 984,113 | | |

Utilities (0.4%): | |

Algonquin Power & Utilities Corp. (c) | | | 54,392 | | | | 895,350 | | |

Emera, Inc. | | | 22,214 | | | | 944,274 | | |

| | | | 1,839,624 | | |

| | | | 10,255,700 | | |

Chile (0.3%): | |

Utilities (0.3%): | |

Colbun SA | | | 4,779,035 | | | | 844,797 | | |

Enel Americas SA | | | 4,739,068 | | | | 773,599 | | |

| | | | 1,618,396 | | |

China (3.1%): | |

Energy (0.4%): | |

China Petroleum & Chemical Corp., Class H | | | 2,182,000 | | | | 971,764 | | |

China Shenhua Energy Co. Ltd., Class H | | | 635,500 | | | | 1,197,948 | | |

| | | | 2,169,712 | | |

Financials (2.2%): | |

Agricultural Bank of China Ltd., Class H (b) | | | 3,820,000 | | | | 1,399,089 | | |

Bank of China Ltd., Class H (b) | | | 4,350,000 | | | | 1,472,321 | | |

Bank of Communications Co. Ltd., Class H | | | 2,516,000 | | | | 1,330,909 | | |

China CITIC Bank Corp. Ltd., Class H | | | 2,737,000 | | | | 1,162,673 | | |

China Everbright Bank Co. Ltd., Class H | | | 2,367,000 | | | | 902,759 | | |

China Minsheng Banking Corp. Ltd., Class H (c) | | | 2,427,000 | | | | 1,383,552 | | |

GF Securities Co. Ltd., Class H | | | 682,600 | | | | 965,152 | | |

Industrial & Commercial Bank of China Ltd., Class H | | | 2,478,000 | | | | 1,592,141 | | |

PICC Property & Casualty Co. Ltd., Class H | | | 1,078,000 | | | | 815,550 | | |

| | | | 11,024,146 | | |

Information Technology (0.1%): | |

China Railway Signal & Communication Corp. Ltd., Class H (d) | | | 2,298,000 | | | | 771,448 | | |

See notes to financial statements.

18

Victory Portfolios II

Victory Market Neutral Income Fund | | Schedule of Portfolio Investments — continued

December 31, 2020 | |

(Unaudited)

Security Description | | Shares | | Value | |

Utilities (0.4%): | |

CGN Power Co. Ltd., Class H (d) | | | 5,370,000 | | | $ | 1,158,064 | | |

Huaneng Power International, Inc., Class H | | | 1,832,000 | | | | 668,761 | | |

| | | | 1,826,825 | | |

| | | | 15,792,131 | | |

Czech Republic (0.5%): | |

Financials (0.2%): | |

Komercni Banka A/S (a) | | | 39,563 | | | | 1,211,511 | | |

Utilities (0.3%): | |

CEZ A/S (b) | | | 57,457 | | | | 1,380,169 | | |

| | | | 2,591,680 | | |

Egypt (0.2%): | |

Consumer Staples (0.2%): | |

Eastern Co. SAE | | | 1,048,250 | | | | 871,232 | | |

Finland (0.8%): | |

Financials (0.2%): | |

Nordea Bank Abp (a) | | | 111,226 | | | | 911,962 | | |

Information Technology (0.1%): | |

Nokia Oyj (a) | | | 158,339 | | | | 611,478 | | |

Materials (0.3%): | |

UPM-Kymmene Oyj | | | 34,741 | | | | 1,295,383 | | |

Utilities (0.2%): | |

Fortum Oyj | | | 41,246 | | | | 996,381 | | |

| | | | 3,815,204 | | |

France (1.4%): | |

Communication Services (0.4%): | |

Orange SA | | | 99,548 | | | | 1,184,970 | | |

Publicis Groupe SA | | | 19,359 | | | | 962,045 | | |

| | | | 2,147,015 | | |

Consumer Discretionary (0.2%): | |

Sodexo SA | | | 9,276 | | | | 784,405 | | |

Financials (0.5%): | |

BNP Paribas SA (a) | | | 14,839 | | | | 783,283 | | |

CNP Assurances | | | 34,444 | | | | 559,541 | | |

Credit Agricole SA | | | 63,266 | | | | 799,702 | | |

Natixis SA (a) | | | 148,181 | | | | 507,680 | | |

| | | | 2,650,206 | | |

Industrials (0.3%): | |

Alstom SA (a) | | | 15,546 | | | | 885,373 | | |

Bouygues SA | | | 16,105 | | | | 662,281 | | |

| | | | 1,547,654 | | |

| | | | 7,129,280 | | |

See notes to financial statements.

19

Victory Portfolios II

Victory Market Neutral Income Fund | | Schedule of Portfolio Investments — continued

December 31, 2020 | |

(Unaudited)

Security Description | | Shares | | Value | |

Germany (1.0%): | |

Consumer Discretionary (0.2%): | |

Bayerische Motoren Werke AG | | | 10,238 | | | $ | 903,455 | | |

Materials (0.4%): | |

BASF SE | | | 13,385 | | | | 1,057,851 | | |

Evonik Industries AG | | | 28,011 | | | | 915,409 | | |

| | | | 1,973,260 | | |

Utilities (0.4%): | |

E.ON SE | | | 95,285 | | | | 1,054,979 | | |

Uniper SE (c) | | | 34,146 | | | | 1,183,002 | | |

| | | | 2,237,981 | | |

| | | | 5,114,696 | | |

Hong Kong (1.7%): | |

Consumer Staples (0.2%): | |

WH Group Ltd. (d) | | | 1,007,500 | | | | 844,869 | | |

Energy (0.1%): | |

CNOOC Ltd. | | | 622,000 | | | | 570,655 | | |

Financials (0.3%): | |

Hang Seng Bank Ltd. | | | 77,600 | | | | 1,339,269 | | |

Industrials (0.2%): | |

CK Hutchison Holdings Ltd. | | | 159,500 | | | | 1,113,638 | | |

Real Estate (0.5%): | |

Henderson Land Development Co. Ltd. | | | 322,000 | | | | 1,250,899 | | |

Sino Land Co. Ltd. | | | 918,000 | | | | 1,194,646 | | |

| | | | 2,445,545 | | |

Utilities (0.4%): | |

CK Infrastructure Holdings Ltd. | | | 193,500 | | | | 1,039,206 | | |

Power Assets Holdings Ltd. (b) | | | 236,000 | | | | 1,278,131 | | |

| | | | 2,317,337 | | |

| | | | 8,631,313 | | |

Hungary (0.2%): | |

Energy (0.2%): | |

MOL Hungarian Oil & Gas PLC (a) | | | 137,904 | | | | 1,018,453 | | |

India (1.3%): | |

Communication Services (0.3%): | |

Indus Towers Ltd. | | | 191,067 | | | | 602,897 | | |

Sun TV Network Ltd. | | | 113,363 | | | | 747,795 | | |

| | | | 1,350,692 | | |

Consumer Discretionary (0.2%): | |

Bajaj Auto Ltd. | | | 20,683 | | | | 976,264 | | |

Consumer Staples (0.2%): | |

ITC Ltd. | | | 301,756 | | | | 864,238 | | |

See notes to financial statements.

20

Victory Portfolios II

Victory Market Neutral Income Fund | | Schedule of Portfolio Investments — continued

December 31, 2020 | |

(Unaudited)

Security Description | | Shares | | Value | |

Energy (0.1%): | |

Hindustan Petroleum Corp. Ltd. | | | 240,875 | | | $ | 718,882 | | |

Financials (0.2%): | |

Power Finance Corp. Ltd. | | | 498,446 | | | | 780,249 | | |

Industrials (0.1%): | |

Bharat Electronics Ltd. | | | 419,367 | | | | 690,342 | | |

Utilities (0.2%): | |

Torrent Power Ltd. | | | 211,805 | | | | 921,023 | | |

| | | | 6,301,690 | | |

Indonesia (0.6%): | |

Communication Services (0.2%): | |

PT Telkom Indonesia Persero Tbk | | | 4,155,500 | | | | 980,419 | | |

Consumer Staples (0.1%): | |

PT Gudang Garam Tbk (a) | | | 206,900 | | | | 604,360 | | |

Energy (0.3%): | |

PT Adaro Energy Tbk | | | 7,195,300 | | | | 733,799 | | |

PT United Tractors Tbk | | | 382,500 | | | | 725,468 | | |

| | | | 1,459,267 | | |

| | | | 3,044,046 | | |

Ireland (0.5%): | |

Industrials (0.2%): | |

Eaton Corp. PLC | | | 8,882 | | | | 1,067,084 | | |

Information Technology (0.3%): | |

Seagate Technology PLC (c) | | | 23,171 | | | | 1,440,309 | | |

| | | | 2,507,393 | | |

Italy (1.0%): | |

Energy (0.2%): | |

Snam SpA | | | 161,465 | | | | 911,772 | | |

Financials (0.4%): | |

Assicurazioni Generali SpA | | | 65,280 | | | | 1,142,801 | | |

Poste Italiane SpA (d) | | | 80,209 | | | | 820,334 | | |

| | | | 1,963,135 | | |

Utilities (0.4%): | |

Enel SpA | | | 100,456 | | | | 1,021,982 | | |

Terna Rete Elettrica Nazionale SpA | | | 132,556 | | | | 1,018,454 | | |

| | | | 2,040,436 | | |

| | | | 4,915,343 | | |

Japan (2.6%): | |

Communication Services (0.3%): | |

Softbank Corp. | | | 132,000 | | | | 1,657,104 | | |

See notes to financial statements.

21

Victory Portfolios II

Victory Market Neutral Income Fund | | Schedule of Portfolio Investments — continued

December 31, 2020 | |

(Unaudited)

Security Description | | Shares | | Value | |

Consumer Discretionary (0.4%): | |

Sekisui House Ltd. | | | 54,400 | | | $ | 1,108,387 | | |

Subaru Corp. | | | 40,200 | | | | 804,476 | | |

| | | | 1,912,863 | | |

Consumer Staples (0.3%): | |

Japan Tobacco, Inc. | | | 76,900 | | | | 1,568,001 | | |

Financials (0.5%): | |

Japan Post Holdings Co. Ltd. | | | 150,400 | | | | 1,171,657 | | |

Sumitomo Mitsui Financial Group, Inc. | | | 37,500 | | | | 1,162,600 | | |

| | | | 2,334,257 | | |

Health Care (0.2%): | |

Takeda Pharmaceutical Co. Ltd. | | | 29,800 | | | | 1,078,600 | | |

Industrials (0.7%): | |

Mitsubishi Corp. | | | 56,800 | | | | 1,400,428 | | |

Mitsui & Co. Ltd. | | | 60,400 | | | | 1,107,552 | | |

Sumitomo Corp. | | | 82,800 | | | | 1,097,504 | | |

| | | | 3,605,484 | | |

Information Technology (0.2%): | |

Canon, Inc. (c) | | | 54,400 | | | | 1,054,019 | | |

| | | | 13,210,328 | | |

Korea, Republic Of (0.9%): | |

Consumer Staples (0.3%): | |

KT&G Corp. | | | 16,716 | | | | 1,279,989 | | |

Financials (0.3%): | |

KB Financial Group, Inc. | | | 22,287 | | | | 885,255 | | |

Shinhan Financial Group Co. Ltd. | | | 29,992 | | | | 890,037 | | |

| | | | 1,775,292 | | |

Materials (0.3%): | |

POSCO | | | 5,783 | | | | 1,445,186 | | |

| | | | 4,500,467 | | |

Luxembourg (0.2%): | |

Materials (0.2%): | |

Orion Engineered Carbons SA | | | 57,114 | | | | 978,934 | | |

Macau (0.2%): | |

Consumer Discretionary (0.2%): | |

Sands China Ltd. | | | 190,000 | | | | 829,833 | | |

Malaysia (1.1%): | |

Financials (0.6%): | |

CIMB Group Holdings Bhd | | | 1,093,300 | | | | 1,171,281 | | |

Malayan Banking Bhd (b) | | | 819,800 | | | | 1,726,909 | | |

| | | | 2,898,190 | | |

See notes to financial statements.

22

Victory Portfolios II

Victory Market Neutral Income Fund | | Schedule of Portfolio Investments — continued

December 31, 2020 | |

(Unaudited)

Security Description | | Shares | | Value | |

Utilities (0.5%): | |

Petronas Gas Bhd (b) | | | 292,100 | | | $ | 1,249,286 | | |

Tenaga Nasional Bhd | | | 553,100 | | | | 1,435,668 | | |

| | | | 2,684,954 | | |

| | | | 5,583,144 | | |

Mexico (1.2%): | |

Consumer Staples (0.2%): | |

Kimberly-Clark de Mexico SAB de CV, Class A | | | 562,936 | | | | 961,793 | | |

Financials (0.2%): | |

Grupo Financiero Banorte SAB de CV, Class O (a) | | | 194,155 | | | | 1,072,843 | | |

Industrials (0.2%): | |

Grupo Aeroportuario del Pacifico SAB de CV, Class B (a) | | | 70,530 | | | | 787,539 | | |

Materials (0.4%): | |

Grupo Mexico SAB de CV, Class B | | | 287,627 | | | | 1,216,187 | | |

Orbia Advance Corp. SAB de CV | | | 385,210 | | | | 905,212 | | |

| | | | 2,121,399 | | |

Utilities (0.2%): | |

Infraestructura Energetica Nova SAB de CV (a) | | | 285,108 | | | | 1,111,666 | | |

| | | | 6,055,240 | | |

Netherlands (1.2%): | |

Communication Services (0.2%): | |

Koninklijke KPN NV | | | 377,400 | | | | 1,146,882 | | |

Consumer Staples (0.2%): | |

X5 Retail Group NV, GDR | | | 18,205 | | | | 657,367 | | |

Financials (0.4%): | |

ABN AMRO Bank NV (a) (d) | | | 59,700 | | | | 584,919 | | |

ING Groep NV (a) | | | 70,503 | | | | 655,442 | | |

NN Group NV | | | 19,648 | | | | 849,279 | | |

| | | | 2,089,640 | | |

Industrials (0.2%): | |

Randstad NV | | | 14,323 | | | | 927,048 | | |

Materials (0.2%): | |

LyondellBasell Industries NV, Class A | | | 10,604 | | | | 971,962 | | |

| | | | 5,792,899 | | |

Norway (0.7%): | |

Communication Services (0.3%): | |

Telenor ASA | | | 79,266 | | | | 1,347,619 | | |

Consumer Staples (0.2%): | |

Mowi ASA (c) | | | 47,602 | | | | 1,064,475 | | |

Financials (0.2%): | |

DNB ASA (a) | | | 49,849 | | | | 978,345 | | |

| | | | 3,390,439 | | |

See notes to financial statements.

23

Victory Portfolios II

Victory Market Neutral Income Fund | | Schedule of Portfolio Investments — continued

December 31, 2020 | |

(Unaudited)

Security Description | | Shares | | Value | |

Philippines (0.5%): | |

Communication Services (0.3%): | |

Globe Telecom, Inc. | | | 20,235 | | | $ | 856,339 | | |

PLDT, Inc. | | | 28,320 | | | | 790,818 | | |

| | | | 1,647,157 | | |

Utilities (0.2%): | |

Manila Electric Co. | | | 131,070 | | | | 797,878 | | |

| | | | 2,445,035 | | |

Poland (0.5%): | |

Financials (0.5%): | |

Bank Polska Kasa Opieki SA (a) | | | 47,866 | | | | 787,528 | | |

Powszechny Zaklad Ubezpieczen SA (a) | | | 122,140 | | | | 1,062,891 | | |

Santander Bank Polska SA (a) | | | 14,162 | | | | 705,572 | | |

| | | | 2,555,991 | | |

Portugal (0.2%): | |

Utilities (0.2%): | |

Energias de Portugal SA (c) | | | 185,627 | | | | 1,164,940 | | |

Russian Federation (2.3%): | |

Communication Services (0.5%): | |

Mobile TeleSystems PJSC | | | 283,760 | | | | 1,277,520 | | |

Rostelecom PJSC (b) | | | 883,700 | | | | 1,163,258 | | |

| | | | 2,440,778 | | |

Consumer Staples (0.2%): | |

Magnit PJSC | | | 14,218 | | | | 1,095,247 | | |

Energy (0.1%): | |

Tatneft PJSC | | | 85,115 | | | | 595,110 | | |

Materials (1.1%): | |

Alrosa PJSC | | | 1,018,070 | | | | 1,364,812 | | |

MMC Norilsk Nickel PJSC | | | 3,132 | | | | 1,007,205 | | |

PhosAgro PJSC, GDR (b) | | | 94,856 | | | | 1,293,589 | | |

Severstal PJSC | | | 104,519 | | | | 1,872,557 | | |

| | | | 5,538,163 | | |

Utilities (0.4%): | |

Federal Grid Co. Unified Energy System PJSC | | | 324,600,000 | | | | 981,539 | | |

RusHydro PJSC | | | 79,317,000 | | | | 846,039 | | |

| | | | 1,827,578 | | |

| | | | 11,496,876 | | |

Singapore (0.3%): | |

Communication Services (0.3%): | |

Singapore Telecommunications Ltd. | | | 771,500 | | | | 1,347,454 | | |

See notes to financial statements.

24

Victory Portfolios II

Victory Market Neutral Income Fund | | Schedule of Portfolio Investments — continued

December 31, 2020 | |

(Unaudited)

Security Description | | Shares | | Value | |

South Africa (1.7%): | |

Communication Services (0.3%): | |

MTN Group Ltd. | | | 120,054 | | | $ | 495,737 | | |

Vodacom Group Ltd. | | | 132,116 | | | | 1,116,429 | | |

| | | | 1,612,166 | | |

Consumer Staples (0.3%): | |

The SPAR Group Ltd. | | | 105,195 | | | | 1,355,264 | | |

Energy (0.2%): | |

Exxaro Resources Ltd. | | | 88,127 | | | | 836,608 | | |

Financials (0.5%): | |

Absa Group Ltd. | | | 116,154 | | | | 950,060 | | |

FirstRand Ltd. | | | 281,897 | | | | 982,747 | | |

Standard Bank Group Ltd. | | | 95,242 | | | | 825,308 | | |

| | | | 2,758,115 | | |

Industrials (0.2%): | |

The Bidvest Group Ltd. | | | 93,918 | | | | 1,006,125 | | |

Materials (0.2%): | |

African Rainbow Minerals Ltd. | | | 44,888 | | | | 800,324 | | |

| | | | 8,368,602 | | |

Spain (0.8%): | |

Industrials (0.1%): | |

Aena SME SA (a) (d) | | | 4,260 | | | | 740,503 | | |

Utilities (0.7%): | |

Endesa SA | | | 36,568 | | | | 1,002,892 | | |

Naturgy Energy Group SA | | | 47,453 | | | | 1,103,336 | | |

Red Electrica Corp. SA | | | 59,574 | | | | 1,222,962 | | |

| | | | 3,329,190 | | |

| | | | 4,069,693 | | |

Sweden (0.4%): | |

Communication Services (0.2%): | |

Telia Co. AB | | | 296,299 | | | | 1,224,237 | | |

Consumer Staples (0.2%): | |

ICA Gruppen AB | | | 20,567 | | | | 1,029,251 | | |

| | | | 2,253,488 | | |

Switzerland (0.8%): | |

Communication Services (0.2%): | |

Swisscom AG, Registered Shares | | | 2,334 | | | | 1,257,372 | | |

Financials (0.2%): | |

Zurich Insurance Group AG | | | 2,293 | | | | 966,647 | | |

Industrials (0.2%): | |

Adecco Group AG | | | 14,722 | | | | 980,867 | | |

Materials (0.2%): | |

LafargeHolcim Ltd. | | | 18,675 | | | | 1,025,377 | | |

| | | | 4,230,263 | | |

See notes to financial statements.

25

Victory Portfolios II

Victory Market Neutral Income Fund | | Schedule of Portfolio Investments — continued

December 31, 2020 | |

(Unaudited)

Security Description | | Shares | | Value | |

Taiwan (3.9%): | |

Industrials (0.2%): | |

Far Eastern New Century Corp. | | | 1,215,000 | | | $ | 1,254,030 | | |

Information Technology (3.1%): | |

Asustek Computer, Inc. | | | 141,000 | | | | 1,259,275 | | |

Catcher Technology Co. Ltd. | | | 138,000 | | | | 1,014,751 | | |

Compal Electronics, Inc. (b) | | | 2,464,000 | | | | 1,818,416 | | |

Foxconn Technology Co. Ltd. | | | 668,000 | | | | 1,272,573 | | |

Inventec Corp. | | | 1,626,000 | | | | 1,390,919 | | |

Lite-On Technology Corp. | | | 741,000 | | | | 1,314,752 | | |

Novatek Microelectronics Corp. | | | 98,000 | | | | 1,289,559 | | |

Pegatron Corp. | | | 450,000 | | | | 1,080,390 | | |

Quanta Computer, Inc. (b) | | | 424,000 | | | | 1,223,462 | | |

Synnex Technology International Corp. | | | 946,000 | | | | 1,585,076 | | |

Wistron Corp. | | | 751,000 | | | | 830,977 | | |

WPG Holdings Ltd. (b) | | | 971,000 | | | | 1,484,609 | | |

| | | | 15,564,759 | | |

Materials (0.6%): | |

Asia Cement Corp. | | | 858,000 | | | | 1,321,509 | | |

Formosa Plastics Corp. | | | 464,000 | | | | 1,593,772 | | |

| | | | 2,915,281 | | |

| | | | 19,734,070 | | |

Thailand (1.1%): | |

Communication Services (0.3%): | |

Intouch Holdings PCL | | | 598,500 | | | | 1,123,216 | | |

Total Access Communication PCL | | | 593,200 | | | | 657,918 | | |

| | | | 1,781,134 | | |

Energy (0.3%): | |

PTT Exploration & Production PCL | | | 176,900 | | | | 580,219 | | |

PTT PCL | | | 544,900 | | | | 773,717 | | |

| | | | 1,353,936 | | |

Financials (0.4%): | |

Krung Thai Bank PCL | | | 2,586,800 | | | | 957,788 | | |

The Siam Commercial Bank PCL | | | 296,400 | | | | 865,102 | | |

| | | | 1,822,890 | | |

Utilities (0.1%): | |

Ratch Group PCL | | | 458,300 | | | | 809,507 | | |

| | | | 5,767,467 | | |

Turkey (0.4%): | |

Consumer Discretionary (0.2%): | |

Ford Otomotiv Sanayi A/S | | | 68,014 | | | | 1,155,597 | | |

Industrials (0.2%): | |

Enka Insaat ve Sanayi A/S | | | 972,829 | | | | 966,962 | | |

| | | | 2,122,559 | | |

See notes to financial statements.

26

Victory Portfolios II

Victory Market Neutral Income Fund | | Schedule of Portfolio Investments — continued

December 31, 2020 | |

(Unaudited)

Security Description | | Shares | | Value | |

United Kingdom (2.6%): | |

Communication Services (0.2%): | |

BT Group PLC (a) | | | 534,449 | | | $ | 963,180 | | |

Consumer Staples (0.7%): | |

British American Tobacco PLC | | | 30,376 | | | | 1,127,902 | | |

Imperial Brands PLC | | | 57,887 | | | | 1,213,975 | | |

Tesco PLC | | | 452,735 | | | | 1,428,514 | | |

| | | | 3,770,391 | | |

Financials (0.5%): | |

Legal & General Group PLC | | | 180,111 | | | | 656,302 | | |

Natwest Group PLC | | | 431,223 | | | | 985,623 | | |

Phoenix Group Holdings PLC | | | 80,595 | | | | 772,227 | | |

| | | | 2,414,152 | | |

Health Care (0.2%): | |

GlaxoSmithKline PLC (b) | | | 62,683 | | | | 1,146,801 | | |

Industrials (0.2%): | |

BAE Systems PLC | | | 134,181 | | | | 894,690 | | |

Materials (0.4%): | |

BHP Group PLC | | | 30,391 | | | | 802,336 | | |

Rio Tinto PLC | | | 13,155 | | | | 990,070 | | |

| | | | 1,792,406 | | |

Utilities (0.4%): | |

National Grid PLC | | | 89,931 | | | | 1,062,595 | | |

SSE PLC | | | 45,317 | | | | 928,099 | | |

| | | | 1,990,694 | | |

| | | | 12,972,314 | | |

United States (42.5%): | |

Communication Services (1.9%): | |

AT&T, Inc. | | | 44,700 | | | | 1,285,572 | | |

CenturyLink, Inc. | | | 84,083 | | | | 819,809 | | |

National CineMedia, Inc. | | | 136,519 | | | | 507,851 | | |

Omnicom Group, Inc. | | | 19,429 | | | | 1,211,787 | | |

Sinclair Broadcast Group, Inc., Class A (c) | | | 33,180 | | | | 1,056,783 | | |

Telephone & Data Systems, Inc. | | | 41,550 | | | | 771,583 | | |

The Interpublic Group of Cos., Inc. | | | 47,780 | | | | 1,123,786 | | |

Verizon Communications, Inc. | | | 31,846 | | | | 1,870,952 | | |

ViacomCBS, Inc., Class B | | | 23,164 | | | | 863,091 | | |

| | | | 9,511,214 | | |

Consumer Discretionary (3.4%): | |

Big Lots, Inc. (c) | | | 11,618 | | | | 498,761 | | |

Brinker International, Inc. | | | 9,817 | | | | 555,348 | | |

Dana, Inc. | | | 42,585 | | | | 831,259 | | |

Dave & Buster's Entertainment, Inc. | | | 20,154 | | | | 605,023 | | |

Franchise Group, Inc. (c) | | | 19,106 | | | | 581,778 | | |

General Motors Co. | | | 26,689 | | | | 1,111,330 | | |

See notes to financial statements.

27

Victory Portfolios II

Victory Market Neutral Income Fund | | Schedule of Portfolio Investments — continued

December 31, 2020 | |

(Unaudited)

Security Description | | Shares | | Value | |

Genuine Parts Co. | | | 9,714 | | | $ | 975,577 | | |

H&R Block, Inc. | | | 60,459 | | | | 958,880 | | |

Hasbro, Inc. | | | 11,030 | | | | 1,031,746 | | |

Kontoor Brands, Inc. | | | 31,819 | | | | 1,290,579 | | |

Las Vegas Sands Corp. (b) | | | 16,257 | | | | 968,917 | | |

MDC Holdings, Inc. | | | 16,246 | | | | 789,555 | | |

PetMed Express, Inc. (b) (c) | | | 24,351 | | | | 780,693 | | |

Rent-A-Center, Inc. | | | 27,638 | | | | 1,058,259 | | |

Steven Madden Ltd. | | | 35,861 | | | | 1,266,610 | | |

The Buckle, Inc. (c) | | | 46,214 | | | | 1,349,449 | | |

Vail Resorts, Inc. | | | 4,422 | | | | 1,233,561 | | |

VF Corp. | | | 12,682 | | | | 1,083,170 | | |

| | | | 16,970,495 | | |

Consumer Staples (4.1%): | |

Archer-Daniels-Midland Co. | | | 26,921 | | | | 1,357,088 | | |

B&G Foods, Inc. (c) | | | 27,334 | | | | 757,972 | | |

General Mills, Inc. | | | 24,457 | | | | 1,438,071 | | |

Inter Parfums, Inc. | | | 17,551 | | | | 1,061,660 | | |

Kellogg Co. | | | 21,290 | | | | 1,324,877 | | |

Medifast, Inc. | | | 5,852 | | | | 1,148,982 | | |

Nu Skin Enterprises, Inc., Class A | | | 12,401 | | | | 677,467 | | |

PepsiCo, Inc. | | | 9,070 | | | | 1,345,081 | | |

Philip Morris International, Inc. | | | 15,125 | | | | 1,252,199 | | |

SpartanNash Co. | | | 39,458 | | | | 686,964 | | |

Sysco Corp. | | | 11,632 | | | | 863,792 | | |

The Coca-Cola Co. | | | 28,162 | | | | 1,544,404 | | |

The J.M. Smucker Co. | | | 12,173 | | | | 1,407,199 | | |

Universal Corp. | | | 33,440 | | | | 1,625,518 | | |

Vector Group Ltd. | | | 115,359 | | | | 1,343,932 | | |

Walgreens Boots Alliance, Inc. | | | 27,840 | | | | 1,110,259 | | |

Weis Markets, Inc. (b) (c) | | | 29,808 | | | | 1,425,120 | | |

| | | | 20,370,585 | | |

Energy (1.6%): | |

Arch Resources, Inc. | | | 18,716 | | | | 819,199 | | |

Brigham Minerals, Inc. | | | 56,704 | | | | 623,177 | | |

ConocoPhillips | | | 18,131 | | | | 725,059 | | |

CVR Energy, Inc. | | | 37,307 | | | | 555,874 | | |

EOG Resources, Inc. | | | 15,106 | | | | 753,336 | | |

Exxon Mobil Corp. | | | 24,194 | | | | 997,277 | | |

Kinder Morgan, Inc. | | | 61,681 | | | | 843,179 | | |

Murphy Oil Corp. | | | 38,959 | | | | 471,404 | | |

ONEOK, Inc. | | | 18,444 | | | | 707,881 | | |

The Williams Cos., Inc. | | | 35,122 | | | | 704,196 | | |

Valero Energy Corp. | | | 12,661 | | | | 716,233 | | |

| | | | 7,916,815 | | |

Financials (11.0%): | |

Aflac, Inc. | | | 22,539 | | | | 1,002,309 | | |

Ally Financial, Inc. | | | 27,073 | | | | 965,423 | | |

See notes to financial statements.

28

Victory Portfolios II

Victory Market Neutral Income Fund | | Schedule of Portfolio Investments — continued

December 31, 2020 | |

(Unaudited)

Security Description | | Shares | | Value | |

Ares Management Corp., Class A | | | 22,138 | | | $ | 1,041,593 | | |

Associated Bancorp | | | 65,323 | | | | 1,113,757 | | |

B. Riley Financial, Inc. | | | 34,545 | | | | 1,527,580 | | |

BGC Partners, Inc., Class A | | | 290,843 | | | | 1,163,372 | | |

Cathay General Bancorp | | | 34,799 | | | | 1,120,180 | | |

Cincinnati Financial Corp. | | | 10,561 | | | | 922,715 | | |

Citigroup, Inc. | | | 13,814 | | | | 851,771 | | |

Citizens Financial Group, Inc. | | | 24,801 | | | | 886,884 | | |

Discover Financial Services | | | 10,599 | | | | 959,527 | | |

FBL Financial Group, Inc., Class A | | | 20,498 | | | | 1,076,350 | | |

Fidelity National Financial, Inc. | | | 26,468 | | | | 1,034,634 | | |

Fifth Third Bancorp | | | 31,454 | | | | 867,187 | | |

First Commonwealth Financial Corp. | | | 112,873 | | | | 1,234,831 | | |

First Financial Bancorp | | | 55,943 | | | | 980,681 | | |

First Hawaiian, Inc. | | | 57,856 | | | | 1,364,244 | | |

FNB Corp. | | | 95,943 | | | | 911,459 | | |

Franklin Resources, Inc. (c) | | | 43,953 | | | | 1,098,385 | | |

Fulton Financial Corp. | | | 89,984 | | | | 1,144,597 | | |

Hope Bancorp, Inc. | | | 108,488 | | | | 1,183,604 | | |

Huntington Bancshares, Inc. | | | 81,754 | | | | 1,032,553 | | |

Investors Bancorp, Inc. | | | 114,623 | | | | 1,210,419 | | |

JPMorgan Chase & Co. | | | 8,874 | | | | 1,127,619 | | |

KeyCorp | | | 52,343 | | | | 858,949 | | |

Lincoln National Corp. | | | 14,139 | | | | 711,333 | | |

M&T Bank Corp. | | | 8,060 | | | | 1,026,038 | | |

Mercury General Corp. | | | 27,174 | | | | 1,418,755 | | |

MetLife, Inc. | | | 20,813 | | | | 977,170 | | |

Navient Corp. | | | 75,334 | | | | 739,780 | | |

Northern Trust Corp. | | | 11,295 | | | | 1,052,016 | | |

Northwest Bancshares, Inc. (b) | | | 113,018 | | | | 1,439,849 | | |

Principal Financial Group, Inc. | | | 17,490 | | | | 867,679 | | |

Provident Financial Services, Inc. | | | 59,792 | | | | 1,073,864 | | |

Regions Financial Corp. | | | 60,342 | | | | 972,713 | | |

S&T Bancorp, Inc. | | | 47,585 | | | | 1,182,011 | | |

Safety Insurance Group, Inc. (b) | | | 17,595 | | | | 1,370,651 | | |

Sandy Spring Bancorp, Inc. | | | 36,783 | | | | 1,184,045 | | |

State Street Corp. | | | 12,181 | | | | 886,533 | | |

Synchrony Financial | | | 25,430 | | | | 882,675 | | |

The Bank of New York Mellon Corp. | | | 27,351 | | | | 1,160,776 | | |

The Blackstone Group, Inc., Class A | | | 16,771 | | | | 1,086,929 | | |

The Hartford Financial Services Group, Inc. | | | 18,168 | | | | 889,869 | | |

The PNC Financial Services Group, Inc. | | | 7,513 | | | | 1,119,437 | | |

The Travelers Cos., Inc. | | | 8,473 | | | | 1,189,355 | | |

Truist Financial Corp. | | | 18,618 | | | | 892,361 | | |

U.S. Bancorp | | | 22,803 | | | | 1,062,392 | | |

Waddell & Reed Financial, Inc., Class A | | | 75,869 | | | | 1,932,383 | | |

Webster Financial Corp. | | | 26,208 | | | | 1,104,667 | | |

Wells Fargo & Co. | | | 32,789 | | | | 989,572 | | |

WesBanco, Inc. | | | 42,497 | | | | 1,273,210 | | |

| | | | 55,166,686 | | |

See notes to financial statements.

29

Victory Portfolios II

Victory Market Neutral Income Fund | | Schedule of Portfolio Investments — continued

December 31, 2020 | |

(Unaudited)

Security Description | | Shares | | Value | |

Health Care (1.4%): | |

AbbVie, Inc. | | | 15,003 | | | $ | 1,607,571 | | |

CVS Health Corp. | | | 20,458 | | | | 1,397,281 | | |

Merck & Co., Inc. | | | 17,559 | | | | 1,436,326 | | |

National Healthcare Corp. (b) | | | 19,450 | | | | 1,291,675 | | |

Pfizer, Inc. | | | 39,500 | | | | 1,453,995 | | |

| | | | 7,186,848 | | |

Industrials (5.2%): | |

3M Co. | | | 7,752 | | | | 1,354,972 | | |

ACCO Brands Corp. | | | 132,342 | | | | 1,118,290 | | |

Apogee Enterprises, Inc. | | | 31,085 | | | | 984,773 | | |

Caterpillar, Inc. | | | 7,715 | | | | 1,404,284 | | |

Emerson Electric Co. | | | 12,777 | | | | 1,026,887 | | |

Ennis, Inc. (b) | | | 67,381 | | | | 1,202,751 | | |

GATX Corp. (c) | | | 14,978 | | | | 1,245,870 | | |

General Dynamics Corp. | | | 7,991 | | | | 1,189,221 | | |

GrafTech International Ltd. | | | 109,118 | | | | 1,163,198 | | |

H&E Equipment Services, Inc. | | | 35,773 | | | | 1,066,393 | | |

Healthcare Services Group (c) | | | 41,768 | | | | 1,173,681 | | |

HNI Corp. | | | 25,883 | | | | 891,928 | | |

Hyster-Yale Materials Handling, Inc. | | | 20,774 | | | | 1,237,092 | | |

KAR Auction Services, Inc. | | | 45,412 | | | | 845,117 | | |

Knoll, Inc. | | | 59,299 | | | | 870,509 | | |

Macquarie Infrastructure Corp. | | | 22,296 | | | | 837,215 | | |

McGrath RentCorp | | | 14,743 | | | | 989,255 | | |

National Presto Industries, Inc. | | | 14,502 | | | | 1,282,412 | | |

Snap-on, Inc. | | | 6,687 | | | | 1,144,413 | | |

Steelcase, Inc., Class A | | | 71,258 | | | | 965,546 | | |

Systemax, Inc. | | | 50,220 | | | | 1,802,396 | | |

The Greenbrier Cos., Inc. | | | 27,084 | | | | 985,316 | | |

Trinity Industries, Inc. (c) | | | 52,590 | | | | 1,387,850 | | |

| | | | 26,169,369 | | |

Information Technology (2.9%): | |

Benchmark Electronics, Inc. | | | 41,657 | | | | 1,125,156 | | |

Broadcom, Inc. | | | 2,647 | | | | 1,158,989 | | |

Cass Information Systems, Inc. | | | 26,789 | | | | 1,042,360 | | |

Cisco Systems, Inc. | | | 26,668 | | | | 1,193,393 | | |

HP, Inc. | | | 43,786 | | | | 1,076,698 | | |

International Business Machines Corp. | | | 9,655 | | | | 1,215,371 | | |

Juniper Networks, Inc. | | | 54,604 | | | | 1,229,136 | | |

MTS Systems Corp. | | | 25,872 | | | | 1,504,715 | | |

NetApp, Inc. | | | 19,922 | | | | 1,319,633 | | |

Paychex, Inc. | | | 12,642 | | | | 1,177,982 | | |

The Western Union Co. | | | 47,528 | | | | 1,042,764 | | |

Vishay Intertechnology, Inc. | | | 59,636 | | | | 1,235,062 | | |

| | | | 14,321,259 | | |

See notes to financial statements.

30

Victory Portfolios II

Victory Market Neutral Income Fund | | Schedule of Portfolio Investments — continued

December 31, 2020 | |

(Unaudited)

Security Description | | Shares | | Value | |

Materials (4.8%): | |