J. Garrett Stevens

Item 1. Reports to Stockholders.

(a)(1) The Registrant’s Board of Trustees has determined that Mr. Timothy J. Jacoby is the audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Timothy J. Jacoby is independent for purposes of this Item.

Item 4. Principal Accountant Fees and Services.

(a) Audit Fees. The aggregate fees billed for each of the last two fiscal years for professional services rendered by the registrant's principal accountant for the audit of the registrant's annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years are as follows:

(b) Audit-Related Fees. There were no fees billed in each of the last two fiscal years for assurances and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item.

(c) Tax Fees. The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance are as follows:

Preparation of Federal & State income tax returns, assistance with calculation of required income, capital gain and excise distributions and preparation of Federal excise tax returns.

(d) All Other Fees. The aggregate fees billed in each of the last two fiscal years for products and services provided by the registrant’s principal accountant, other than the services reported in paragraphs (a) through (c) of this item were $0 and $0 for the fiscal years ended November 30, 2024 and 2023, respectively.

(e)(1) The audit committee does not have pre-approval policies and procedures. Instead, the audit committee or audit committee chairman approves on a case-by-case basis each audit or non-audit service before the principal accountant is engaged by the registrant.

(e)(2) There were no services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Not applicable.

(g) All non-audit fees billed by the registrant's principal accountant for services rendered to the registrant for the fiscal years ended November 30, 2024 and 2023 respectively are disclosed in (b)-(d) above. There were no audit or non-audit services performed by the registrant's principal accountant for the registrant's adviser.

(h) Not applicable.

(i) Not applicable.

(j) Not applicable.

The Registrant is a listed issuer as defined in Rule 10A-3 under the Exchange Act and has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The Registrant's audit committee members are Timothy J. Jacoby (chairman), Linda Petrone and Stuart Strauss.

(a) The Schedule of Investments is included as part of the Financial Statements and Other Information filed under Item 7 of this form.

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

EXCHANGE LISTED FUNDS TRUST

BANCREEK INTERNATIONAL LARGE CAP ETF (BCIL)

BANCREEK U.S. LARGE CAP ETF (BCUS)

Annual Financials and Other Information

November 30, 2024

BANCREEK ETFs TABLE OF CONTENTS | | November 30, 2024 |

Financial Statements (Form N-CSR, Item 7)

For additional information about the Funds; including each Fund’s prospectus, financial information, holdings, and proxy voting information, call or visit: • 833-442-3223 • https://bancreeketfs.com/investor-materials |

i

BANCREEK INTERNATIONAL LARGE CAP ETF SCHEDULE OF INVESTMENTS | | November 30, 2024 |

| | Shares | | Fair Value |

Common Stocks — 99.9% | | | | | |

Australia — 5.9% | | | | | |

Consumer Discretionary — 2.1% | | | | | |

JB Hi-Fi Ltd. | | 10,133 | | $ | 599,779 |

| | | | | | |

Financials — 3.8% | | | | | |

Computershare Ltd. | | 51,408 | | | 1,067,986 |

Total Australia | | | | | 1,667,765 |

Canada — 27.7% | | | | | |

Consumer Staples — 9.4% | | | | | |

Alimentation Couche-Tard, Inc. | | 8,669 | | | 507,144 |

Dollarama, Inc. | | 10,178 | | | 1,060,143 |

Loblaw Companies Ltd. | | 8,307 | | | 1,078,014 |

| | | | | | 2,645,301 |

Industrials — 11.5% | | | | | |

Stantec, Inc. | | 12,335 | | | 1,068,361 |

TFI International, Inc. | | 7,133 | | | 1,085,985 |

WSP Global, Inc. | | 6,029 | | | 1,072,057 |

| | | | | | 3,226,403 |

Technology — 6.8% | | | | | |

CGI, Inc. | | 7,211 | | | 816,198 |

Constellation Software, Inc. | | 323 | | | 1,092,122 |

| | | | | | 1,908,320 |

Total Canada | | | | | 7,780,024 |

Denmark — 3.8% | | | | | |

Health Care — 3.8% | | | | | |

Novo Nordisk A/S | | 10,101 | | | 1,083,343 |

Total Denmark | | | | | 1,083,343 |

France — 14.7% | | | | | |

Consumer Discretionary — 3.9% | | | | | |

LVMH Moet Hennessy Louis Vuitton S.E. | | 1,744 | | | 1,091,393 |

| | | | | | |

Consumer Staples — 3.6% | | | | | |

L’Oreal S.A. | | 2,967 | | | 1,029,906 |

| | | | | | |

Health Care — 3.5% | | | | | |

EssilorLuxottica S.A. | | 4,063 | | | 986,150 |

| | | | | | |

Materials — 3.7% | | | | | |

Air Liquide S.A. | | 6,347 | | | 1,054,359 |

Total France | | | | | 4,161,808 |

| | Shares | | Fair Value |

Common Stocks (Continued) | | | |

Germany — 7.8% | | | | | |

Communications — 7.8% | | | | | |

Deutsche Telekom A.G. | | 34,650 | | $ | 1,108,168 |

Freenet A.G. | | 35,361 | | | 1,092,811 |

| | | | | | 2,200,979 |

Total Germany | | | | | 2,200,979 |

Japan — 1.9% | | | | | |

Consumer Staples — 1.9% | | | | | |

Japan Tobacco, Inc. | | 19,400 | | | 544,985 |

Total Japan | | | | | 544,985 |

Netherlands — 7.7% | | | | | |

Communications — 3.9% | | | | | |

Koninklijke KPN N.V. | | 280,934 | | | 1,089,269 |

Technology — 3.8% | | | | | |

Wolters Kluwer N.V. | | 6,439 | | | 1,074,198 |

Total Netherlands | | | | | 2,163,467 |

Switzerland — 11.4% | | | | | |

Health Care — 1.9% | | | | | |

Novartis AG | | 5,053 | | | 534,953 |

Industrials — 7.5% | | | | | |

ABB Ltd. | | 18,497 | | | 1,055,652 |

Kuehne + Nagel International A.G. | | 4,519 | | | 1,080,251 |

| | | | | | 2,135,903 |

Materials — 2.0% | | | | | |

Sika A.G. | | 2,128 | | | 550,961 |

Total Switzerland | | | | | 3,221,817 |

United Kingdom — 19.0% | | | | | |

Consumer Staples — 3.9% | | | | | |

Imperial Brands plc | | 33,398 | | | 1,090,556 |

| | | | | | |

Financials — 3.9% | | | | | |

3i Group plc | | 23,694 | | | 1,117,013 |

| | | | | | |

Health Care — 1.9% | | | | | |

AstraZeneca PLC | | 4,037 | | | 544,527 |

| | | | | | |

Industrials — 2.7% | | | | | |

BAE Systems plc | | 48,196 | | | 751,655 |

1

BANCREEK INTERNATIONAL LARGE CAP ETF SCHEDULE OF INVESTMENTS (Continued) | | November 30, 2024 |

| | Shares | | Fair Value |

Common Stocks (Continued) | | | |

United Kingdom (continued) | | | | | |

Technology — 6.6% | | | | | |

RELX PLC | | 17,263 | | $ | 812,957 |

Sage Group plc (The) | | 63,128 | | | 1,052,735 |

| | | | | | 1,865,692 |

Total United Kingdom | | | | | 5,369,443 |

| | | | | | |

TOTAL COMMON STOCKS

(Cost $27,788,151) | | | | | 28,193,631 |

| | | | | | |

Total Investments — 99.9%

(Cost $27,788,151) | | | | | 28,193,631 |

| | | | | | |

Other Assets in Excess of Liabilities — 0.1% | | | | | 30,000 |

TOTAL NET ASSETS — 100.0% | | | | $ | 28,223,631 |

A.G. — Aktiengesellschaft

A/S — Anonim Sirketi

N.V. — Naamioze Vennootschap

PLC — Public Limited Company

S.A. — Société Anonyme

S.E. — Societas Europaea

2

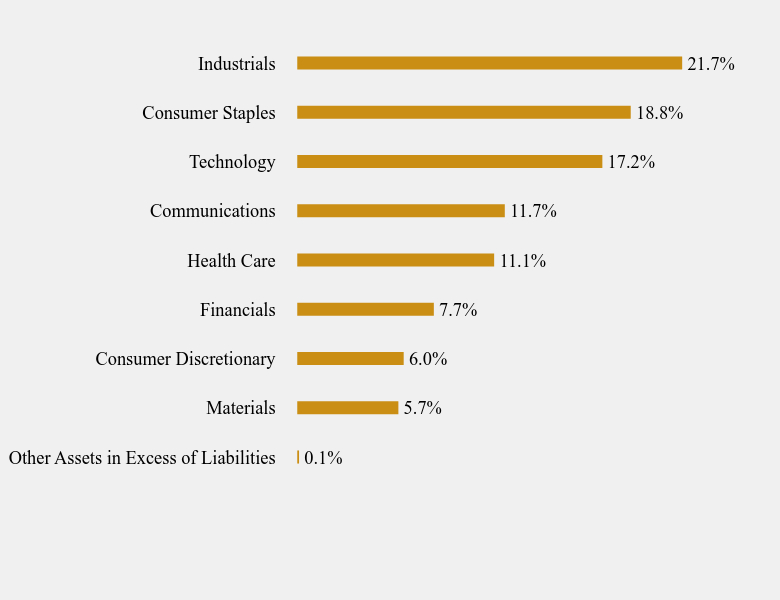

BANCREEK INTERNATIONAL LARGE CAP ETF SUMMARY OF INVESTMENTS | | November 30, 2024 |

Security Type/Sector | | Percent of

Total Net

Assets |

Common Stocks | | | |

Communications | | 11.7 | % |

Consumer Discretionary | | 6.0 | % |

Consumer Staples | | 18.8 | % |

Financials | | 7.7 | % |

Health Care | | 11.1 | % |

Industrials | | 21.7 | % |

Materials | | 5.7 | % |

Technology | | 17.2 | % |

Total Common Stocks | | 99.9 | % |

Total Investments | | 99.9 | % |

Other Assets in Excess of Liabilities | | 0.1 | % |

Total Net Assets | | 100.0 | % |

Diversification of Assets | | Percent of

Total Net

Assets |

Country | | | |

Australia | | 5.9 | % |

Canada | | 27.7 | % |

Denmark | | 3.8 | % |

France | | 14.7 | % |

Germany | | 7.8 | % |

Japan | | 1.9 | % |

Netherlands | | 7.7 | % |

Switzerland | | 11.4 | % |

United Kingdom | | 19.0 | % |

Total Investments | | 99.9 | % |

Other Assets in Excess of Liabilities | | 0.1 | % |

Total Net Assets | | 100.0 | % |

3

BANCREEK U.S. LARGE CAP ETF SCHEDULE OF INVESTMENTS | | November 30, 2024 |

| | Shares | | Fair Value |

COMMON STOCKS — 99.7% | | | | | |

Consumer Discretionary — 5.0% | | | | | |

AutoZone, Inc.(a) | | 501 | | $ | 1,587,940 |

O’Reilly Automotive, Inc.(a) | | 1,897 | | | 2,358,388 |

| | | | | | 3,946,328 |

Consumer Staples — 2.0% | | | | | |

Hershey Company (The) | | 8,878 | | | 1,563,682 |

| | | | | | |

Financials — 11.1% | | | | | |

Brown & Brown, Inc. | | 28,274 | | | 3,197,789 |

Houlihan Lokey, Inc. | | 12,334 | | | 2,332,236 |

Marsh & McLennan Companies, Inc. | | 14,191 | | | 3,309,767 |

| | | | | | 8,839,792 |

Health Care — 11.7% | | | | | |

AbbVie, Inc. | | 16,811 | | | 3,075,236 |

Danaher Corporation | | 8,224 | | | 1,971,211 |

Eli Lilly & Company | | 2,853 | | | 2,269,134 |

UnitedHealth Group, Inc. | | 3,282 | | | 2,002,676 |

| | | | | | 9,318,257 |

Industrials — 36.0% | | | | | |

Amphenol Corporation, Class A | | 43,519 | | | 3,161,655 |

CBIZ, Inc.(a) | | 36,015 | | | 2,974,119 |

Cintas Corporation | | 14,579 | | | 3,291,792 |

Eaton Corporation PLC | | 8,394 | | | 3,151,275 |

Hubbell, Inc. | | 6,875 | | | 3,163,120 |

Lincoln Electric Holdings, Inc. | | 11,808 | | | 2,579,812 |

Republic Services, Inc. | | 14,913 | | | 3,255,508 |

Trane Technologies PLC | | 5,111 | | | 2,127,300 |

Watsco, Inc. | | 2,913 | | | 1,606,811 |

WW Grainger, Inc. | | 2,679 | | | 3,229,106 |

| | | | | | 28,540,498 |

Materials — 7.5% | | | | | |

Linde plc | | 7,109 | | | 3,277,178 |

Reliance, Inc. | | 8,304 | | | 2,667,577 |

| | | | | | 5,944,755 |

Technology — 26.4% | | | | | |

Apple, Inc. | | 14,065 | | | 3,338,046 |

Broadcom, Inc. | | 19,686 | | | 3,190,707 |

Crane NXT Company | | 27,967 | | | 1,752,972 |

FactSet Research Systems, Inc. | | 3,314 | | | 1,626,080 |

Microsoft Corporation | | 7,133 | | | 3,020,540 |

Motorola Solutions, Inc. | | 6,454 | | | 3,225,064 |

Oracle Corporation | | 8,405 | | | 1,553,580 |

Synopsys, Inc.(a) | | 5,722 | | | 3,195,680 |

| | | | | | 20,902,669 |

| | | | Fair Value |

COMMON STOCKS (Continued) | | | | | |

Total Common Stocks (Cost $73,739,270) | | | | $ | 79,055,981 |

| | | | | | |

Total Investments — 99.7%

(Cost $73,739,270) | | | | | 79,055,981 |

| | | | | | |

Other Assets in Excess of Liabilities — 0.3% | | | | | 228,686 |

| | | | | | |

TOTAL NET ASSETS — 100.0% | | | | $ | 79,284,667 |

PLC — Public Limited Company

4

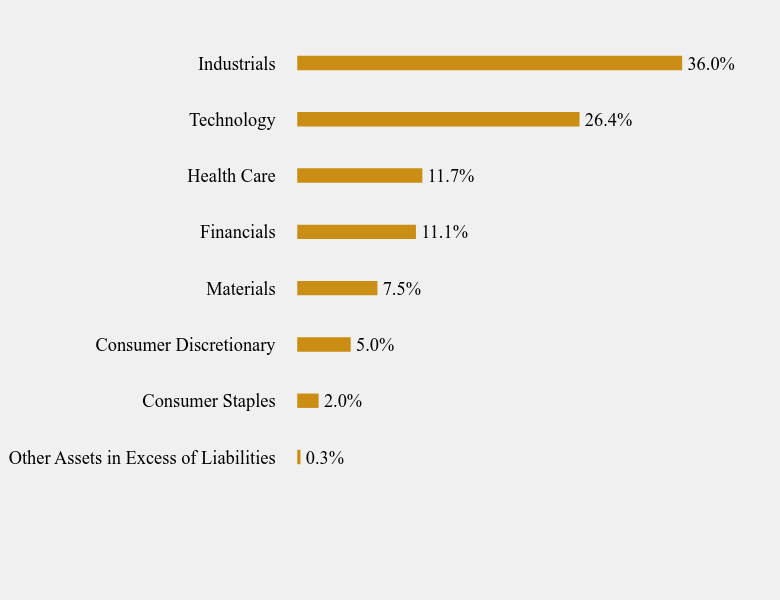

BANCREEK U.S. LARGE CAP ETF SUMMARY OF INVESTMENTS | | November 30, 2024 |

Security Type/Sector | | Percent of

Total Net

Assets |

Common Stocks | | | |

Consumer Discretionary | | 5.0 | % |

Consumer Staples | | 2.0 | % |

Financials | | 11.1 | % |

Health Care | | 11.7 | % |

Industrials | | 36.0 | % |

Materials | | 7.5 | % |

Technology | | 26.4 | % |

Total Common Stocks | | 99.7 | % |

Total Investments | | 99.7 | % |

Other Assets in Excess of Liabilities | | 0.3 | % |

Total Net Assets | | 100.0 | % |

5

EXCHANGE LISTED FUNDS TRUST STATEMENTS OF ASSETS AND LIABILITIES | | November 30, 2024 |

| | Bancreek

International

Large Cap

ETF | | Bancreek U.S.

Large Cap

ETF |

Assets | | | | | | |

Investments, at value | | $ | 28,193,631 | | $ | 79,055,981 |

Cash | | | — | | | 208,084 |

Investment securities sold receivable | | | 523,632 | | | — |

Dividends and interest receivable | | | 34,832 | | | 65,560 |

Foreign tax reclaim receivable | | | 930 | | | — |

Total Assets | | | 28,753,025 | | | 79,329,625 |

| | | | | | | |

Liabilities | | | | | | |

Advisory fee payable | | | 6,611 | | | 44,958 |

Due to custodian | | | 140 | | | — |

Due to custodian – Foreign cash (Cost – $522,686 and $0, respectively) | | | 522,643 | | | — |

Total Liabilities | | | 529,394 | | | 44,958 |

| | | | | | | |

Net Assets | | $ | 28,223,631 | | $ | 79,284,667 |

| | | | | | | |

Net Assets consist of: | | | | | | |

Paid-in capital | | | 28,197,112 | | | 76,328,562 |

Accumulated earnings | | | 26,519 | | | 2,956,105 |

Net Assets | | $ | 28,223,631 | | $ | 79,284,667 |

| | | | | | | |

Shares of Beneficial Interest Outstanding

(unlimited number of shares authorized, no par value) | | | 1,070,000 | | | 2,440,000 |

Net Asset Value, Offering and Redemption Price Per Share | | | 26.38 | | | 32.49 |

Investments, at cost | | $ | 27,788,151 | | $ | 73,739,270 |

6

EXCHANGE LISTED FUNDS TRUST Statements of Operations | | For the Period Ended November 30, 2024 |

| | Bancreek

International

Large Cap

ETF(a) | | Bancreek U.S.

Large Cap

ETF(b) |

Investment Income | | | | | | | | |

Dividend income | | $ | 61,373 | | | $ | 363,362 | |

Less foreign taxes withheld | | | (3,259 | ) | | | — | |

Interest income | | | 702 | | | | 2,893 | |

Total investment income | | | 58,816 | | | | 366,255 | |

| | | | | | | | | |

Expenses | | | | | | | | |

Advisory fees | | | 25,072 | | | | 303,136 | |

Total expenses | | | 25,072 | | | | 303,136 | |

Waiver | | | (2,786 | ) | | | (37,892 | ) |

Net Expenses | | | 22,286 | | | | 265,244 | |

Net Investment Income (Loss) | | | 36,530 | | | | 101,011 | |

| | | | | | | | | |

Net Realized and Unrealized Gain (Loss) on Investments | | | | | | | | |

Net Realized Gain (Loss) on: | | | | | | | | |

Investments | | | (380,955 | ) | | | (2,492,498 | ) |

In-kind redemptions | | | 198,431 | | | | 8,211,153 | |

Foreign currency transactions | | | (21,994 | ) | | | — | |

| | | | (204,518 | ) | | | 5,718,655 | |

Net Change in Unrealized Gain (Loss) on: | | | | | | | | |

Investments | | | 405,480 | | | | 5,316,711 | |

Foreign currency translations | | | 43 | | | | — | |

| | | | 405,523 | | | | 5,316,711 | |

Net Realized and Unrealized Gain (Loss) on Investments | | | 201,005 | | | | 11,035,366 | |

| | | | | | | | | |

Net Increase (Decrease) in Net Assets Resulting From Operations | | $ | 237,535 | | | $ | 11,136,377 | |

7

EXCHANGE LISTED FUNDS TRUST Statements of Changes in Net Assets | | |

| | Bancreek

International

Large Cap

ETF | | Bancreek U.S.

Large Cap

ETF |

| | Period Ended

November 30,

2024(a) | | Period Ended

November 30,

2024(b) |

Operations | | | | | | | | |

Net investment income (loss) | | $ | 36,530 | | | $ | 101,011 | |

Net realized gain (loss) | | | (204,518 | ) | | | 5,718,655 | |

Net change in unrealized gain (loss) | | | 405,523 | | | | 5,316,711 | |

Net Increase (Decrease) in Net Assets Resulting From Operations | | | 237,535 | | | | 11,136,377 | |

| | | | | | | | | |

Distribution to Shareholders | | | (13,653 | ) | | | (88,549 | ) |

| | | | | | | | | |

Capital Share Transactions | | | | | | | | |

Proceeds from shares sold | | | 30,665,024 | | | | 138,221,152 | |

Cost of shares redeemed | | | (2,665,275 | ) | | | (69,984,313 | ) |

Net Increase (Decrease) in Net Assets Resulting from Capital Share Transactions | | | 27,999,749 | | | | 68,236,839 | |

| | | | | | | | | |

Net Increase (Decrease) in Net Assets | | | 28,223,631 | | | | 79,284,667 | |

| | | | | | | | | |

Net Assets | | | | | | | | |

Beginning of period | | | — | | | | — | |

End of period | | $ | 28,223,631 | | | $ | 79,284,667 | |

| | | | | | | | | |

Change in Share Transactions | | | | | | | | |

Shares sold | | | 1,170,000 | | | | 4,730,000 | |

Shares redeemed | | | (100,000 | ) | | | (2,290,000 | ) |

Net Increase (Decrease) in Shares Outstanding | | $ | 1,070,000 | | | $ | 2,440,000 | |

8

Bancreek International Large Cap ETF Financial Highlights | | |

(For a Share Outstanding Throughout the Period Presented) | | Period Ended

November 30,

2024(a) |

Net asset value, beginning of period | | $ | 25.03 | |

| | | | | |

Investment operations: | | | | |

Net investment income(b) | | | 0.24 | |

Net realized and unrealized gain on investments | | | 1.27 | |

Total from investment operations | | | 1.51 | |

| | | | | |

Distributions to shareholders from: | | | | |

Net investment income | | | (0.16 | ) |

Total distributions | | | (0.16 | ) |

| | | | | |

Net asset value, end of period | | $ | 26.38 | |

Net Asset Value, Total Return | | | 6.05 | %(c) |

| | | | | |

Ratios and Supplemental Data: | | | | |

Net assets, end of period (000 omitted) | | $ | 28,224 | |

| | | | | |

Ratio of expenses to: | | | | |

Expenses before fee waiver | | | 0.90 | %(d) |

Expenses after fee waiver | | | 0.80 | %(d) |

Net investment income | | | 1.31 | %(d) |

Portfolio turnover rate(e) | | | 326 | %(c) |

9

Bancreek U.S. Large Cap ETF Financial Highlights | | |

(For a Share Outstanding Throughout the Period Presented) | | Period Ended

November 30,

2024(a) |

Net asset value, beginning of period | | $ | 24.72 | |

| | | | | |

Investment operations: | | | | |

Net investment income(b) | | | 0.07 | |

Net realized and unrealized gain on investments | | | 7.76 | |

Total from investment operations | | | 7.83 | |

| | | | | |

Distributions to shareholders from: | | | | |

Net investment income | | | (0.06 | ) |

Total distributions | | | (0.06 | ) |

| | | | | |

Net asset value, end of period | | $ | 32.49 | |

Net Asset Value, Total Return | | | 31.69 | %(c) |

| | | | | |

Ratios and Supplemental Data: | | | | |

Net assets, end of period (000 omitted) | | $ | 79,285 | |

| | | | | |

Ratio of expenses to: | | | | |

Expenses before fee waiver | | | 0.80 | %(d) |

Expenses after fee waiver | | | 0.70 | %(d) |

Net investment income | | | 0.27 | %(d) |

Portfolio turnover rate(e) | | | 207 | %(c) |

10

EXCHANGE LISTED FUNDS TRUST NOTES TO FINANCIAL STATEMENTS | | November 30, 2024 |

Note 1 – Organization

Exchange Listed Funds Trust (the “Trust”) was organized on April 4, 2012 as a Delaware statutory trust and is registered with the Securities and Exchange Commission (“SEC”) under the Investment Company Act of 1940, as amended (the “1940 Act”) as an open-end management investment company. The Agreement and Declaration of Trust permits the Trust to issue an unlimited number of shares of beneficial interest (“Shares”) in one or more series representing interests in separate portfolios of securities. The Trust has registered its Shares in multiple separate series. The assets of each series in the Trust are segregated and a shareholder’s interest is limited to the series in which Shares are held. The financial statements presented herein relate to the funds listed below and are individually referred to as a “Fund” or collectively as the “Funds”:

Bancreek International Large Cap ETF

Bancreek U.S. Large Cap ETF

The Bancreek International Large Cap ETF and the Bancreek U.S. Large Cap ETF are each classified as a diversified investment company under the 1940 Act.

Each Fund is an actively managed exchange-traded fund (“ETF”). Unlike index ETFs, actively managed ETFs do not seek to track the performance of a specified index. Instead, each Fund uses an active investment strategy in seeking to meet its investment objective.

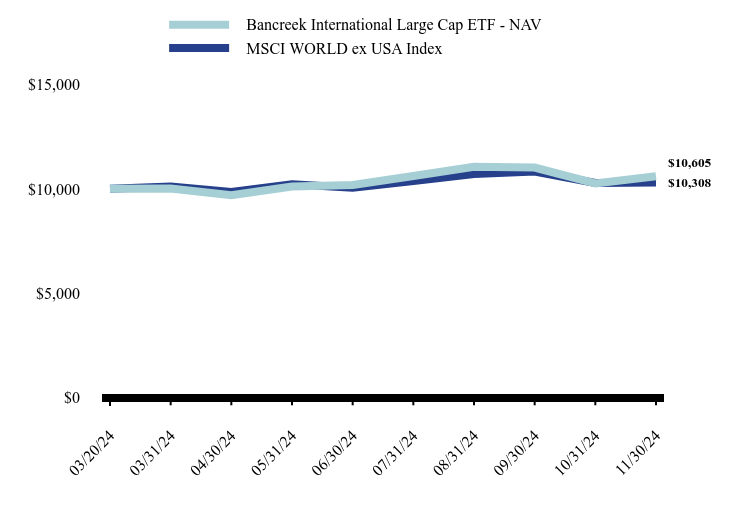

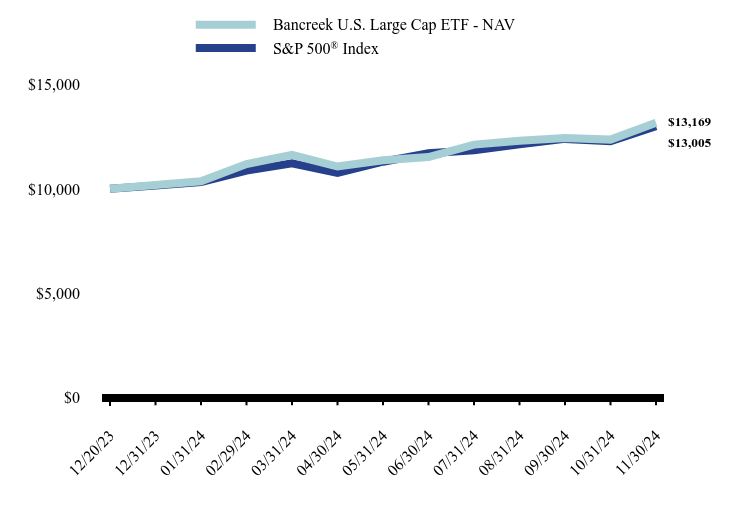

The Bancreek International Large Cap ETF’s investment objective is to seek long-term capital appreciation. The Bancreek U.S. Large Cap ETF’s investment objective is to seek long-term capital appreciation. The Bancreek International Large Cap ETF commenced operations on March 20, 2024 and the Bancreek U.S. Large Cap ETF commenced operations on December 20, 2023.

Under the Trust’s organizational documents, its officers and Board of Trustees (the “Board”) are indemnified against certain liabilities arising out of the performance of their duties to the Trust. In addition, in the normal course of business, the Trust may enter into contracts with vendors and others that provide for general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust.

Note 2 – Basis of Presentation and Significant Accounting Policies

The following is a summary of the significant accounting policies followed by the Trust in the preparation of the financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”). The Trust is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”.

(a) Use of Estimates

The preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and income and expenses during the reporting period. Management believes the estimates and security valuations are appropriate; however, actual results may differ from those estimates, and the security valuations reflected in the financial statements may differ from the value each Fund ultimately realizes upon sale of the securities.

(b) Valuation of Investments

Each Fund records investments at fair value using procedures approved by the Board and are generally valued using market valuations (Market Approach). A market valuation generally means a valuation (i) obtained from an exchange, a pricing service, or a major market maker (or dealer) or (ii) based on a price quotation or other equivalent indication of value supplied by an exchange, a pricing service, or a major market maker (or dealer). A price obtained from a pricing service based on such pricing service’s valuation matrix may be considered a market valuation. Any assets or liabilities denominated in currencies other than the U.S. dollar are converted into U.S. dollars at the current market rates on the date of valuation as quoted by one or more sources.

11

EXCHANGE LISTED FUNDS TRUST NOTES TO FINANCIAL STATEMENTS (Continued) | | November 30, 2024 |

In December 2020, the SEC adopted Rule 2a-5 under the 1940 Act, establishing requirements to determine fair value in good faith for purposes of the 1940 Act. The rule permits fund boards to designate a fund’s investment adviser to perform fair-value determinations, subject to board oversight and certain other conditions. The rule also defines when market quotations are “readily available” for purposes of the 1940 Act and requires a fund to fair value a portfolio investment when a market quotation is not readily available. The SEC also adopted new Rule 31a-4 under the 1940 Act, which sets forth recordkeeping requirements associated with fair-value determinations.

Pursuant to the requirements of Rule 2a-5, the Board (i) has designated the Adviser as the Board’s valuation designee to perform fair-value determinations for the Funds through the Adviser’s Valuation Committee and (ii) has approved the Adviser’s Valuation Procedures.

In the event that current market valuations are not readily available or such valuations do not reflect current fair market value, the Trust’s procedures require the Valuation Committee, in accordance with the Trust’s Board-approved Valuation Procedures, to determine a security’s fair value. In determining such value, the Valuation Committee may consider, among other things, (i) price comparisons among multiple sources, (ii) a review of corporate actions and news events, and (iii) a review of relevant financial indicators (e.g., movement in interest rates or market indices). Fair value pricing involves subjective judgments and it is possible that the fair value determination for a security is materially different than the value that could be realized upon the sale of the security. With respect to securities that are primarily listed on foreign exchanges, the value of each Fund’s portfolio securities may change on days when the investors will not be able to purchase or sell their Shares.

Each Fund discloses the fair value of its investments in a hierarchy that distinguishes between: (1) market participant assumptions developed based on market data obtained from sources independent of each Fund (observable inputs) and (2) each Fund’s own assumptions about market participant assumptions developed based on the best information available under the circumstances (unobservable inputs). The three levels defined by the hierarchy are as follows:

• | | Level 1 – Quoted prices in active markets for identical assets. |

• | | Level 2 – Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). |

• | | Level 3 – Significant unobservable inputs (including each Fund’s own assumptions in determining the fair value of investments). |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Pursuant to the Valuation Procedures noted previously, equities and short-term investments are generally categorized as Level 1 in the fair value hierarchy (unless there is a fair valuation event, in which case affected securities are generally categorized as Level 2 or Level 3).

The following is a summary of the valuations as of November 30, 2024, for each Fund based upon the three levels defined above:

Bancreek International Large Cap ETF

Assets | | Level 1 | | Level 2 | | Level 3 | | Total |

Common Stocks* | | $ | 28,193,631 | | $ | — | | $ | — | | $ | 28,193,631 |

Total | | $ | 28,193,631 | | $ | — | | $ | — | | $ | 28,193,631 |

Bancreek U.S. Large Cap ETF

Assets | | Level 1 | | Level 2 | | Level 3 | | Total |

Common Stocks* | | $ | 79,055,981 | | $ | — | | $ | — | | $ | 79,055,981 |

Total | | $ | 79,055,981 | | $ | — | | $ | — | | $ | 79,055,981 |

12

EXCHANGE LISTED FUNDS TRUST NOTES TO FINANCIAL STATEMENTS (Continued) | | November 30, 2024 |

(c) Investment Transactions and Related Income

For financial reporting purposes, investment transactions are reported on the trade date. However, for daily Net Asset Value (“NAV”) determination, portfolio securities transactions are reflected no later than in the first calculation on the first business day following the trade date. Dividend income is recorded on the ex-dividend date. Interest income is recognized on an accrual basis and includes, where applicable, the amortization of premium or accretion of discount, using the effective yield method. Gains or losses realized on sales of securities are determined using the specific identification method by comparing the identified cost of the security lot sold with the net sales proceeds. Dividend Income on the Statements of Operations is shown net of any foreign taxes withheld on income from foreign securities, which are provided for in accordance with each Fund’s understanding of the applicable tax rules and regulations, if any.

(d) Foreign Currency Transactions

The accounting records of each Fund are maintained in U.S. dollars. Financial instruments and other assets and liabilities of each Fund denominated in a foreign currency, if any, are translated into U.S. dollars at current exchange rates. Purchases and sales of financial instruments, income receipts and expense payments are translated into U.S. dollars at the exchange rate on the date of the transaction. Each Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates from those resulting from changes in values to financial instruments. Such fluctuations are included with the net realized and unrealized gains or losses from investments. Realized foreign exchange gains or losses arise from transactions in financial instruments and foreign currencies, currency exchange fluctuations between the trade and settlement date of such transactions, and the difference between the amount of assets and liabilities recorded and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities, including financial instruments, resulting from changes in currency exchange rates. Each Fund may be subject to foreign taxes related to foreign income received, capital gains on the sale of securities and certain foreign currency transactions (a portion of which may be reclaimable). All foreign taxes are recorded in accordance with the applicable regulations and rates that exist in the foreign jurisdictions in which each Fund invests.

(e) Federal Income Tax

Internal Revenue Code of 1986 (the “Code”) and to distribute substantially all of its net investment income and capital gains, if any, to its shareholders. Therefore, no federal income tax provision is required as long as each Fund qualifies as a regulated investment company.

Management of each Fund has evaluated tax positions taken or expected to be taken in the course of preparing each Fund’s tax returns to determine whether it is more-likely-than-not (i.e., greater than 50%) that each tax position will be sustained upon examination by a taxing authority based on the technical merits of the position. A tax position that meets the more-likely-than-not recognition threshold is measured to determine the amount of benefit to recognize in the financial statements. Differences between tax positions taken in a tax return and amounts recognized in the financial statements will generally result in an increase in a liability for taxes payable (or a reduction of a tax refund receivable), including the recognition of any related interest and penalties as an operating expense. In general, tax positions taken in previous tax years remain subject to examination by tax authorities (generally three years for federal income tax purposes). The determination has been made that there are not any uncertain tax positions that would require each Fund to record a tax liability and, therefore, there is no impact to the Fund’s financial statements. Each Fund’s policy is to classify interest and penalties associated with underpayment of federal and state income taxes, if any, as income tax expense on its Statements of Operations. As of November 30, 2024, the Funds did not have any interest or penalties associated with the underpayment of any income taxes.

(f) Distributions to Shareholders

The Bancreek International Large Cap ETF and the Bancreek U.S. Large Cap ETF each pay out dividends from their net investment income at least quarterly and distribute their net capital gains, if any, at least annually. Each Fund may make distributions on a more frequent basis to comply with the distributions requirement of the Code, in all events in a manner consistent with the provisions of the 1940 Act.

13

EXCHANGE LISTED FUNDS TRUST NOTES TO FINANCIAL STATEMENTS (Continued) | | November 30, 2024 |

The amount of distributions from net investment income and net realized gains are determined in accordance with federal income tax regulations, which may differ from GAAP. These “book/tax” differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature (e.g., return of capital and distribution reclassifications), such amounts are reclassified within the composition of net assets based on their federal tax basis treatment; temporary differences (e.g., wash sales and straddles) do not require a reclassification.

Note 3 – Transactions with Affiliates and Other Servicing Agreements

(a) Investment Advisory Agreement and Administrative Services

Exchange Traded Concepts, LLC (the “Adviser”) serves as the investment adviser to each Fund pursuant to an investment advisory agreement with the Trust (the “Advisory Agreement”). Under the Advisory Agreement, the Adviser provides investment advisory services to each Fund and is responsible for, among other things, overseeing the Sub-Adviser (as defined below), including regular review of the Sub-Adviser’s performance, trading portfolio securities on behalf of each Fund, and selecting broker-dealers to execute purchase and sale transactions, subject to the oversight of the Board. For the services it provides, each Fund pays the Adviser a fee calculated daily and paid monthly at an annual rate of 0.90% for Bancreek International Large Cap ETF and 0.80% for Bancreek U.S. Large Cap ETF of each Fund’s average daily net assets.

The Adviser has contractually agreed to waive its fees and reimburse expenses to the extent necessary to keep total annual operating expenses of the Funds (excluding amounts payable pursuant to any plan adopted in accordance with Rule 12b-1, interest expense, taxes, acquired fund fees and expenses, brokerage commissions, other expenditures which are capitalized in accordance with generally accepted accounting principles, and extraordinary expenses) from exceeding 0.80% of the Fund’s average daily net assets through at least April 1, 2025 for Bancreek International Large Cap ETF, and 0.70% of the Fund’s average daily net assets through at least April 1, 2025 for Bancreek U.S. Large Cap ETF, unless earlier terminated by the Board for any reason at any time. Waived fees are not recoupable in future periods.

ETC Platform Services, LLC (“ETC Platform Services”), a direct wholly owned subsidiary of the Adviser, administers each Fund’s business affairs and provides office facilities and equipment, certain clerical, bookkeeping and administrative services, paying agent services under each Fund’s unitary fee arrangement (as described below), and its officers and employees to serve as officers or Trustees of the Trust. ETC Platform Services also arranges for transfer agency, custody, fund administration and accounting, and other non-distribution related services necessary for each Fund to operate. For the services it provides to each Fund, ETC Platform Services is paid a fee calculated daily and paid monthly based on a percentage of each Fund’s average daily net assets.

Under the Advisory Agreement, the Adviser has agreed to pay all expenses of each Fund (including the fee charged by ETC Platform Services) except for the advisory fee, interest, taxes, brokerage commissions and other expenses incurred in placing orders for the purchase and sale of securities and other investment instruments, acquired fund fees and expenses, accrued deferred tax liability, extraordinary expenses, and distribution fees and expenses paid by the Trust under any distribution plan adopted pursuant to Rule 12b-1 under the 1940 Act (collectively, “Excluded Expenses”). As part of an arrangement between the Sub-Adviser and the Adviser, the Sub-Adviser has agreed to assume the Adviser’s obligation to pay all expenses of each Fund (except Excluded Expenses) and, to the extent applicable, pay the Adviser a minimum fee.

An interested Trustee and certain officers of the Trust are affiliated with the Adviser and receive no compensation from the Trust for serving as officers and/or Trustee.

(b) Investment Sub-Advisory Agreement

The Adviser has entered into an investment sub-advisory agreement (the “Sub-Advisory Agreement”) with respect to the Funds with Bancreek Capital Advisors, LLC (the “Sub-Adviser”). Under the Sub-Advisory Agreement, the Sub-Adviser continuously reviews and administers the investment program of the Funds, subject to the supervision of the Adviser and the oversight of the Board. The Adviser pays a fee to the Sub-Adviser out of the Fee the Adviser receives from each Fund, which is calculated daily and paid monthly.

14

EXCHANGE LISTED FUNDS TRUST NOTES TO FINANCIAL STATEMENTS (Continued) | | November 30, 2024 |

(c) Distribution Arrangement

Foreside Fund Services, LLC (the “Distributor”), a Delaware limited liability company, is the principal underwriter and distributor of each Fund’s Shares. The Distributor does not maintain any secondary market in any Fund’s Shares.

The Trust has adopted a Rule 12b-1 Distribution and Service Plan (the “Distribution and Service Plan”) pursuant to which payments of up to a maximum of 0.25% of a Fund’s average daily net assets may be made to compensate or reimburse financial intermediaries for activities principally intended to result in the sale of each Fund’s Shares. In accordance with the Distribution and Service Plan, the Distributor may enter into agreements with financial intermediaries and dealers relating to distribution and/or marketing services with respect to the Trust.

Currently, no payments are made under the Distribution and Service Plan. Such payments may only be made after approval by the Board. The Adviser and its affiliates may, out of their own resources, pay amounts to third parties for distribution or marketing services on behalf of the Trust.

(d) Other Servicing Agreements

Ultimus Fund Services, LLC provides administration and fund accounting services to the Trust pursuant to separate servicing agreements. Brown Brothers Harriman & Co. serves as each fund’s custodian and transfer agent pursuant to a custodian agreement and transfer agency services agreement. The Adviser pays these fees.

Note 4 – Investment Transactions

Purchases and sales of investments, excluding in-kind transactions and short-term investments, for the period ended November 30, 2024, were as follows:

Fund | | Purchases | | Sales |

Bancreek International Large Cap ETF | | $ | 20,275,327 | | $ | 20,319,951 |

Bancreek U.S. Large Cap ETF | | | 86,031,263 | | | 87,625,486 |

Purchases and sales of in-kind transactions for the period ended November 30, 2024, were as follows:

Fund | | Purchases | | Sales |

Bancreek International Large Cap ETF | | $ | 30,348,486 | | $ | 2,333,137 |

Bancreek U.S. Large Cap ETF | | | 137,935,829 | | | 68,320,990 |

Note 5 – Capital Share Transactions

Fund Shares are listed and traded on the NYSE Arca, Inc. ( the “Exchange”) each day that the Exchange is open for business (“Business Day”). Each Fund’s Shares may only be purchased and sold on the Exchange through a broker-dealer. Because each Fund’s Shares trade at market prices rather than at their NAV, Shares may trade at a price equal to NAV, greater than NAV (premium) or less than NAV (discount).

Each Fund offers and redeems Shares on a continuous basis at NAV only in large blocks of shares (each a “Creation Unit”). Except when aggregated in Creation Units, Shares are not redeemable securities of a Fund. Fund Shares may only be purchased from or redeemed directly from each Fund by certain financial institutions (“Authorized Participants”). An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of the National Securities Clearing Corporation or (ii) a Depository Trust Company (“DTC”) participant and, in each case, must have executed a Participant Agreement with the Distributor. Creation Units are available for purchase and redemption on each Business Day and are offered and redeemed on an in-kind basis, together with the specified cash amount, or for an all cash amount.

15

EXCHANGE LISTED FUNDS TRUST NOTES TO FINANCIAL STATEMENTS (Continued) | | November 30, 2024 |

To the extent contemplated by a Participant Agreement, in the event an Authorized Participant has submitted a redemption request in proper form but is unable to transfer all or part of the shares comprising a Creation Unit to be redeemed by the Distributor, on behalf of each Fund, by the time as set forth in a Participant Agreement, the Distributor may nonetheless accept the redemption request in reliance on the undertaking by the Authorized Participant to deliver the missing shares as soon as possible, which undertaking shall be secured by the Authorized Participant’s delivery and maintenance of collateral equal to a percentage of the market value as set forth in the Participant Agreement. A Participant Agreement may permit each Fund to use such collateral to purchase the missing shares, and could subject an Authorized Participant to liability for any shortfall between the cost of each Fund acquiring such shares and the value of the collateral.

Most retail investors will not qualify as Authorized Participants or have the resources to buy and sell whole Creation Units. Therefore, they will be unable to purchase or redeem the Shares directly from each Fund. Rather, most retail investors will purchase Shares in the secondary market with the assistance of a broker, which will be subject to customary brokerage commissions or fees.

A purchase (i.e., creation) transaction fee may be imposed for the transfer and other transaction costs associated with the purchase of Creation Units, and investors will be required to pay a creation transaction fee regardless of the number of Creation Units created in the transaction. Each Fund may adjust the creation transaction fee from time to time based upon actual experience. In addition, a variable fee may be imposed for cash purchases, non-standard orders, or partial cash purchases of Creation Units. The variable fee is primarily designed to cover non-standard charges, e.g., brokerage, taxes, foreign exchange, execution, market impact, and other costs and expenses, related to the execution of trades resulting from such transaction. Each Fund may adjust the non-standard charge from time to time based upon actual experience. Investors who use the services of an Authorized Participant, broker or other such intermediary may be charged a fee for such services which may include an amount for the creation transaction fee and non-standard charges. Investors are responsible for the costs of transferring the securities constituting the deposit securities to the account of the Trust. The Adviser may retain all or a portion of the transaction fee to the extent the Adviser bears the expenses that otherwise would be borne by the Trust in connection with the issuance of a Creation Unit, which the transaction fee is designed to cover.

A redemption transaction fee may be imposed for the transfer and other transaction costs associated with the redemption of Creation Units, and Authorized Participants will be required to pay a redemption transaction fee regardless of the number of Creation Units created in the transaction. The redemption transaction fee is the same no matter how many Creation Units are being redeemed pursuant to any one redemption request. Each Fund may adjust the redemption transaction fee from time to time based upon actual experience. In addition, a variable fee, payable to each Fund, may be imposed for cash redemptions, non-standard orders, or partial cash redemptions for each Fund. The variable fee is primarily designed to cover non-standard charges, e.g., brokerage, taxes, foreign exchange, execution, market impact, and other costs and expenses, related to the execution of trades resulting from such transaction. Investors who use the services of an Authorized Participant, broker or other such intermediary may be charged a fee for such services which may include an amount for the redemption transaction fees and non-standard charges. Investors are responsible for the costs of transferring the securities constituting each Fund’s securities to the account of the Trust. The non-standard charges are payable to each Fund as it incurs costs in connection with the redemption of Creation Units, the receipt of each Fund’s securities and the cash redemption amount and other transaction costs.

Note 6 – Principal Risks

As with any investment, an investor could lose all or part of their investment in each Fund and each Fund’s performance could trail that of other investments. Each Fund is subject to the principal risks noted below, any of which may adversely affect a Fund’s NAV, trading price, yield, total return and ability to meet its investment objective. Additional principal risks are disclosed in the Funds’ prospectus. Please refer to the relevant Fund’s prospectus for a complete description of the principal risks of investing in that Fund.

Market Risk: Overall market risk may affect the value of individual instruments in which a Fund invests. A Fund is subject to the risk that the securities markets will move down, sometimes rapidly and unpredictably, based on overall economic conditions and other factors, which may negatively affect a Fund’s performance. Factors such as domestic and foreign (non-U.S.) economic growth and market conditions, real or perceived adverse economic or political conditions, military conflict, acts of terrorism, social unrest, natural disasters, recessions, inflation, changes in interest rate levels, supply chain disruptions, sanctions, the spread of infectious illness or other public health threats, lack of liquidity in the bond or other markets, volatility in the securities markets, adverse

16

EXCHANGE LISTED FUNDS TRUST NOTES TO FINANCIAL STATEMENTS (Continued) | | November 30, 2024 |

investor sentiment and political events affect the securities markets. U.S. and foreign stock markets have experienced periods of substantial price volatility in the past and may do so again in the future. Securities markets also may experience long periods of decline in value. A change in financial condition or other event affecting a single issuer or market may adversely impact securities markets as a whole. Rates of inflation have recently risen. The value of assets or income from an investment may be worth less in the future as inflation decreases the value of money.

Trading Risk: Shares of each Fund may trade on the Exchange above (premium) or below (discount) their NAV. The NAV of shares of each Fund will fluctuate with changes in the market value of that Fund’s holdings. The market prices of each Fund’s shares will fluctuate continuously throughout trading hours based on market supply and demand and may deviate significantly from the value of such Fund’s holdings, particularly in times of market stress, with the result that investors may pay more or receive less than the underlying value of the Fund shares bought or sold. When buying or selling shares in the secondary market, you may incur costs attributable to the difference between the highest price a buyer is willing to pay to purchase shares of a Fund (bid) and the lowest price a seller is willing to accept for shares of a Fund (ask), which is known as the bid-ask spread. In addition, although each Fund’s shares are currently listed on the Exchange, there can be no assurance that an active trading market for shares will develop or be maintained. Trading in Fund shares may be halted due to market conditions or for reasons that, in the view of the Exchange, make trading in shares of a Fund inadvisable. In stressed market conditions, the market for a Fund’s shares may become less liquid in response to deteriorating liquidity in the markets for the Fund’s underlying portfolio holdings. In such a circumstance, a Fund’s shares could trade at a premium or discount to their NAV.

Foreign Securities Risk (Bancreek Internal Large Cap ETF only): Investments in non-U.S. securities involve certain risks that may not be present with investments in U.S. securities. For example, investments in non-U.S. securities may be subject to risk of loss due to foreign currency fluctuations or to expropriation, nationalization or adverse political or economic developments. Foreign securities may have relatively low market liquidity and decreased publicly available information about issuers. Investments in non-U.S. securities also may be subject to withholding or other taxes and may be subject to additional trading, settlement, custodial, and operational risks. Non-U.S. issuers may also be subject to inconsistent and potentially less stringent accounting, auditing, financial reporting and investor protection standards than U.S. issuers. These and other factors can make investments in the Fund more volatile and potentially less liquid than other types of investments. In addition, where all or a portion of the Fund’s portfolio holdings trade in markets that are closed when the Fund’s market is open, there may be valuation differences that could lead to differences between the Fund’s market price and the value of the Fund’s portfolio holdings.

Exposure to country, region, industry or sector — Subject to each Fund’s investment limitations, a Fund may have significant exposure to a particular country, region, industry or sector. Such exposure may cause the Fund to be more impacted by risks relating to and developments affecting the country, region, industry or sector, and thus its net asset value may be more volatile, than a fund without such levels of exposure. For example, if a Fund has significant exposure in a particular country, then social, economic, regulatory or other issues that negatively affect that country may have a greater impact on the Fund than on a fund that is more geographically diversified.

Sector Focus Risk: Each Fund’s sector exposure is expected to vary over time, a Fund may have a significant portion of its assets in one or more sectors from time to time. When a Fund has significant exposure to a particular sector, it will be more susceptible to the risks affecting that sector.

Industrials Sector Risk: Stock prices for industrials companies are affected by supply and demand both for their specific product or service and for industrials sector products in general. Government regulation, world events, exchange rates and economic conditions, technological developments and liabilities for environmental damage and general civil liabilities will likewise affect the performance of these companies.

Technology Sector Risk. Each Fund is subject to the risk that market or economic factors impacting technology companies and companies that rely heavily on technology advances could have a major effect on the value of a Fund’s investments. The value of stocks of technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles, rapid product obsolescence, government regulation and competition, both domestically and internationally, including competition from foreign competitors with lower production costs.

17

EXCHANGE LISTED FUNDS TRUST NOTES TO FINANCIAL STATEMENTS (Continued) | | November 30, 2024 |

Note 7 – Federal Income Taxes

GAAP requires certain components of net assets to be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or NAV per share. For the period ended November 30, 2024, the following amounts, resulting primarily from the differing book and tax treatment relating to the reversal of gains and losses emanating from redemption-in-kind transactions have been reclassified:

Fund | | Paid-in Capital | | Total

Distributable

Earnings (Loss) |

Bancreek International Large Cap ETF | | $ | 197,363 | | $ | (197,363 | ) |

Bancreek U.S. Large Cap ETF | | | 8,091,723 | | | (8,091,723 | ) |

The tax character of the distributions paid during the tax period ended November 30, 2024, was as follows:

| | Period Ended November 30, 2024 |

Fund | | Ordinary

Income | | Net Long-Term

Capital

Gains | | Return of

Capital | | Total

Distributions |

Bancreek International Large Cap ETF | | $ | 13,653 | | $ | — | | $ | — | | $ | 13,653 |

Bancreek U.S. Large Cap ETF | | | 88,549 | | | — | | | — | | | 88,549 |

As of the tax period ended November 30, 2024, the components of distributable earnings (loss) on a tax basis were as follows:

Fund | | Undistributed

Ordinary

Income | | Undistributed

Capital Gains

(Losses)* | | Unrealized

Appreciation

(Depreciation)

on Investments | | Distributable

Earnings

(Loss) |

Bancreek International Large Cap ETF | | $ | 64,954 | | $ | (188,724) | | $ | 150,289 | | $ | 26,519 |

Bancreek U.S. Large Cap ETF | | | 12,491 | | | (2,101,479) | | | 5,045,093 | | | 2,956,105 |

At November 30, 2024, the aggregate cost for federal tax purposes, which differs from fair value by net unrealized appreciation (depreciation) of securities, are as follows:

Fund | | Tax Cost of

Investments | | Unrealized

Appreciation

on Investments | | Unrealized

Depreciation

on Investments | | Net Unrealized

Appreciation

Depreciation

on Investments |

Bancreek International Large Cap ETF | | $ | 28,043,385 | | $ | 280,544 | | $ | (130,298) | | $ | 150,246 |

Bancreek U.S. Large Cap ETF | | | 74,010,888 | | | 5,145,751 | | | (100,658) | | | 5,045,093 |

The difference between cost amounts for financial statement and federal income tax purposes is due primarily to timing differences in recognizing certain gains and losses in security transactions. The difference in Unrealized Appreciation (Depreciation), if any, in the table above is due to the foreign cash holdings.

As of the tax period ended November 30, 2024, each Fund has non-expiring accumulated capital loss carryforwards as follows:

Fund | | Short-Term | | Long-Term | | Total Amount |

Bancreek International Large Cap ETF | | $ | 188,724 | | $ | — | | $ | 188,724 |

Bancreek U.S. Large Cap ETF | | | 2,101,479 | | | — | | | 2,101,479 |

18

EXCHANGE LISTED FUNDS TRUST NOTES TO FINANCIAL STATEMENTS (Continued) | | November 30, 2024 |

Note 8 – Recent Market Events

Local, regional, or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues, recessions, or other events could have a significant impact on the market generally and on specific securities. Periods of market volatility may occur in response to such events and other economic, political, and global macro factors.

Governments and central banks, including the Federal Reserve in the United States, took extraordinary and unprecedented actions to support local and global economies and the financial markets in response to the COVID-19 pandemic, including by keeping interest rates at historically low levels for an extended period. The Federal Reserve concluded its market support activities in 2022 and began to raise interest rates in an effort to fight inflation. However, the Federal Reserve had recently lowered interest rates and may continue to do so. This and other government intervention into the economy and financial markets to address the pandemic, inflation, or other significant events in the future may not work as intended, particularly if the efforts are perceived by investors as being unlikely to achieve the desired results.

Note 9 – Events Subsequent to Fiscal Period End

In preparing these financial statements, management has evaluated events and transactions for potential recognition or disclosure through the date the financial statements were issued. Management has determined there are no subsequent events that would require disclosure in a Fund’s financial statements.

19

EXCHANGE LISTED FUNDS TRUST Report of Independent Registered

Public Accounting Firm | | November 30, 2024 |

To the Shareholders of Bancreek International Large Cap ETF and Bancreek U.S. Large Cap ETF and Board of Trustees of Exchange Listed Funds Trust

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of the funds listed below (the “Funds”), each a series of Exchange Listed Funds Trust, as of November 30, 2024, the related statements of operations and changes in net assets, and the financial highlights for each of the periods indicated below, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of each of the Funds as of November 30, 2024, the results of their operations, the changes in net assets, and the financial highlights for each of the periods indicated below in conformity with accounting principles generally accepted in the United States of America.

Fund Name | Statements of

Operations | Statements of

Changes in

Net Assets |

Financial Highlights

|

Bancreek International Large Cap ETF | For the period from March 20, 2024 (commencement of operations) to November 30, 2024 |

Bancreek U.S. Large Cap ETF | For the period from December 20, 2023 (commencement of operations) to November 30, 2024 |

Basis for Opinion

These financial statements are the responsibility of the Funds’ management. Our responsibility is to express an opinion on the Funds’ financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of November 30, 2024, by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more investment companies advised by Exchange Traded Concepts, LLC since 2012.

COHEN & COMPANY, LTD.

Cleveland, Ohio

January 28, 2025

20

EXCHANGE LISTED FUNDS TRUST Other Information | | November 30, 2024 |

Tax Information

For the year ended November 30, 2024, the Fund listed below had a percentage of the dividends paid from net investment income, including short-term capital gains (if any) designated as qualified dividend income.

Fund | | Qualified

Dividend Income |

Bancreek International Large Cap ETF | | 49.49 | % |

Bancreek U.S. Large Cap ETF | | 100.00 | % |

For the year ended November 30, 2024, the Fund listed below had a percentage of the dividends paid from net investment income, including short-term capital gains (if any), qualify for the dividends received deduction available to corporate shareholders.

Fund | | Corporate Dividend

Received Deduction |

Bancreek International Large Cap ETF | | 49.71 | % |

Bancreek U.S. Large Cap ETF | | 100.00 | % |

Premium/Discount information

Information regarding how often the shares of the Fund traded on the Exchange at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund for various time periods can be found on the Fund’s website at https://bancreeketfs.com/investor-materials.

21

10900 Hefner Pointe Drive, Suite 400

Oklahoma City, OK 73120

Investment Adviser:

Exchange Traded Concepts, LLC

10900 Hefner Pointe Drive, Suite 400

Oklahoma City, OK 73120

Investment Sub-Adviser:

Bancreek Capital Advisors, LLC

401 Wilshire Boulevard, Suite 1200

Santa Monica, California 90401

Distributor:

Foreside Fund Services, LLC

Three Canal Plaza, Suite 100

Portland, ME 04101

Legal Counsel:

Chapman and Cutler LLP

320 South Canal Street

Chicago, IL 60606

This information must be preceded or accompanied by a current prospectus for the Funds.

For additional information about the Funds; including each Fund’s prospectus, financial information, holdings, and proxy voting information, call or visit: • 833-442-3223 • https://bancreeketfs.com/investor-materials |

Item 8. Changes in and Disagreements with Accountants for Open-End Investment Companies.

There were no changes in or disagreements with accountants during the period covered by this report.

Item 9. Proxy Disclosures for Open-End Management Investment Companies.

Remuneration was paid by the company during the period covered by the report to Trustees on the company’s Board of Trustees. The Board of Trustees expensed $19,323 to each Fund in the Trust for the period covered by the report.

The disclosure regarding the Approval of Advisory Agreement, if applicable, is included as part of the financial statements included above in Item 7.

Item 12. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Not applicable.

Not applicable.

There have been no changes to the procedures by which shareholders may recommend nominees to the Registrant’s Board of Trustees during the period covered by this report.

(a) The Registrant’s principal executive and principal financial officers, or persons performing similar functions, have concluded that the Registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Act are effective based on the evaluation of these controls and procedures required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934 as of a date within 90 days of the filing date of this report.

(b) There were no changes in the Registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the Registrant's internal control over financial reporting.

Item 17. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable.

Item 19. Exhibits.

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.