J. Garrett Stevens

Item 1. Reports to Stockholders.

(a)(1) The Registrant’s Board of Trustees has determined that Mr. Timothy J. Jacoby is the audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Timothy J. Jacoby is independent for purposes of this Item.

Item 4. Principal Accountant Fees and Services.

(a) Audit Fees. The aggregate fees billed for each of the last two fiscal years for professional services rendered by the registrant's principal accountant for the audit of the registrant's annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years are as follows:

(b) Audit-Related Fees. There were no fees billed in each of the last two fiscal years for assurances and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item.

(c) Tax Fees. The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance are as follows:

Preparation of Federal & State income tax returns, assistance with calculation of required income, capital gain and excise distributions and preparation of Federal excise tax returns.

(d) All Other Fees. The aggregate fees billed in each of the last two fiscal years for products and services provided by the registrant’s principal accountant, other than the services reported in paragraphs (a) through (c) of this item were $0 and $0 for the fiscal years ended November 30, 2024 and 2023, respectively.

(e)(1) The audit committee does not have pre-approval policies and procedures. Instead, the audit committee or audit committee chairman approves on a case-by-case basis each audit or non-audit service before the principal accountant is engaged by the registrant.

(e)(2) There were no services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Not applicable.

(g) All non-audit fees billed by the registrant's principal accountant for services rendered to the registrant for the fiscal years ended November 30, 2024 and 2023 respectively are disclosed in (b)-(d) above. There were no audit or non-audit services performed by the registrant's principal accountant for the registrant's adviser.

(h) Not applicable.

(i) Not applicable.

(j) Not applicable.

The Registrant is a listed issuer as defined in Rule 10A-3 under the Exchange Act and has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The Registrant's audit committee members are Timothy J. Jacoby (chairman), Linda Petrone and Stuart Strauss.

(a) The Schedule of Investments is included as part of the Financial Statements and Other Information filed under Item 7 of this form.

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

EXCHANGE LISTED FUNDS TRUST

Saba Closed-End Funds ETF (CEFS)

Annual Financials and Other Information

November 30, 2024

Exchange Listed Funds Trust TABLE OF CONTENTS | | November 30, 2024 |

Financial Statements (Form N-CSR, Item 7)

For additional information about the Fund; including its prospectus, financial information, holdings, and proxy voting information, call or visit: • 888-615-4310 • https://www.sabaetf.com/investor-materials |

i

Saba Closed-End Funds ETF SCHEDULE OF INVESTMENTS | | November 30, 2024 |

| | Shares | | Fair Value |

CLOSED-END FUNDS — 112.7% | | | |

Alternative — 15.7% | | | | | |

BlackRock ESG Capital Allocation Term Trust(b) | | 2,048,168 | | $ | 35,761,013 |

Destra Multi-Alternative Fund(a) | | 267,238 | | | 2,391,780 |

| | | | | | 38,152,793 |

| | | | | | |

Equity — 55.1% | | | | | |

abrdn Emerging Markets Equity Income Fund, Inc. | | 5,932 | | | 31,084 |

abrdn Global Dynamic Dividend Fund | | 14,418 | | | 147,785 |

abrdn Global Infrastructure Income Fund(b) | | 287,543 | | | 5,710,604 |

abrdn Healthcare Investors(b) | | 152,297 | | | 2,654,537 |

abrdn Total Dynamic Dividend Fund | | 162,650 | | | 1,431,320 |

Adams Diversified Equity Fund, Inc.(b) | | 367,980 | | | 7,569,349 |

Adams Natural Resources Fund, Inc. | | 14,078 | | | 333,367 |

ASA Gold and Precious Metals Ltd. | | 575,128 | | | 11,726,860 |

BlackRock Energy and Resources Trust | | 34,770 | | | 475,306 |

BlackRock Enhanced Global Dividend Trust(b) | | 309,558 | | | 3,516,579 |

BlackRock Enhanced International Dividend Trust | | 336,243 | | | 1,872,874 |

BlackRock Health Sciences Term Trust | | 191,058 | | | 2,991,968 |

BlackRock Innovation and Growth Term Trust(b) | | 3,266,052 | | | 26,095,754 |

BlackRock Resources & Commodities Strategy Trust | | 138,113 | | | 1,307,930 |

BlackRock Science and Technology Term Trust(b) | | 226,699 | | | 4,830,956 |

ClearBridge Energy Midstream Opportunity Fund, | | 35,995 | | | 1,817,388 |

Clough Global Equity Fund | | 76,592 | | | 525,038 |

First Trust Specialty Finance and Financial Opportunity Fund | | 29,821 | | | 127,634 |

Gabelli Dividend & Income Trust (The)(b) | | 584,150 | | | 14,948,398 |

Gabelli Healthcare & WellnessRx Trust (The) | | 254,000 | | | 2,646,680 |

GAMCO Natural Resources Gold & Income Trust | | 42,849 | | | 252,809 |

| | Shares | | Fair Value |

CLOSED-END FUNDS (Continued) | | | |

Equity (Continued) | | | | | |

General American Investors Company, Inc.(b) | | 193,877 | | $ | 9,967,217 |

Japan Smaller Capitalization Fund, Inc. | | 126,970 | | | 996,715 |

John Hancock Hedged Equity & Income Fund | | 4,044 | | | 44,929 |

Kayne Anderson Energy Infrastructure Fund | | 2,021 | | | 27,647 |

Lazard Global Total Return and Income Fund, Inc. | | 118,007 | | | 1,971,897 |

Mexico Equity and Income Fund, Inc. (The) | | 1,943 | | | 16,376 |

Morgan Stanley India Investment Fund, Inc. | | 65,828 | | | 1,857,008 |

Neuberger Berman Energy Infrastructure and Income Fund Inc. | | 7,560 | | | 71,366 |

Neuberger Berman Next Generation Connectivity Fund Inc.(b) | | 740,485 | | | 9,759,592 |

New Germany Fund, Inc. (The) | | 140,410 | | | 1,141,533 |

Nuveen Dow 30sm Dynamic Overwrite Fund | | 2,017 | | | 31,768 |

Nuveen NASDAQ 100 Dynamic Overwrite Fund | | 20,893 | | | 551,157 |

NYLI CBRE Global Infrastructure Megatrends Term(b) | | 510,491 | | | 7,019,251 |

Principal Real Estate Income Fund | | 84,193 | | | 909,284 |

Royce Micro-Cap Trust, Inc. | | 276 | | | 2,848 |

Swiss Helvetia Fund, Inc. (The) | | 19,294 | | | 152,037 |

Taiwan Fund Inc (The) | | 7,184 | | | 306,254 |

Tekla Life Sciences Investors | | 268,088 | | | 3,822,935 |

Tortoise Energy Independence Fund, Inc. | | 12,440 | | | 548,604 |

Tortoise Energy Infrastructure Corporation | | 2,344 | | | 107,824 |

Tortoise Midstream Energy Fund, Inc. | | 33,037 | | | 1,935,638 |

Tortoise Pipeline & Energy Fund, Inc. | | 4,994 | | | 261,364 |

Voya Emerging Markets High Dividend Equity Fund | | 176,295 | | | 911,445 |

Wells Fargo Global Dividend Opportunity Fund | | 72,555 | | | 361,324 |

| | | | | | 133,790,233 |

1

Saba Closed-End Funds ETF SCHEDULE OF INVESTMENTS (Continued) | | November 30, 2024

|

| | Shares | | Fair Value |

CLOSED-END FUNDS (Continued) | | | |

Fixed Income — 30.3% | | | | | |

AllianceBernstein National Municipal Income Fund, | | 217,913 | | $ | 2,503,820 |

Bancroft Fund Ltd. | | 25,375 | | | 468,676 |

BlackRock California Municipal Income Trust(b) | | 585,715 | | | 6,835,294 |

BlackRock Municipal 2030 Target Term Trust | | 628 | | | 13,458 |

BlackRock MuniHoldings California Quality Fund, Inc. | | 596 | | | 6,765 |

BlackRock MuniHoldings New Jersey Quality Fund, Inc. | | 7 | | | 84 |

BlackRock MuniHoldings New York Quality Fund, Inc. | | 496 | | | 5,436 |

BlackRock MuniYield Michigan Quality Fund, Inc. | | 124 | | | 1,489 |

BlackRock MuniYield New York Quality Fund, Inc. | | 780 | | | 8,315 |

BlackRock MuniYield Pennsylvania Quality Fund | | 12,755 | | | 158,034 |

BlackRock New York Municipal Income Trust | | 167 | | | 1,799 |

BlackRock Virginia Municipal Bond Trust | | 11 | | | 125 |

BNY Mellon Municipal Bond Infrastructure Fund, | | 37,573 | | | 414,430 |

BNY Mellon Strategic Municipal Bond Fund, Inc. | | 120,563 | | | 740,257 |

BNY Mellon Strategic Municipals, Inc. | | 219,949 | | | 1,416,472 |

Brookfield Real Assets Income Fund, Inc. | | 18,266 | | | 247,687 |

Delaware Investments National Municipal Income | | 156 | | | 1,700 |

Eaton Vance California Municipal Bond Fund(b) | | 555,181 | | | 5,252,012 |

Eaton Vance California Municipal Income Trust | | 56,366 | | | 600,298 |

Eaton Vance New York Municipal Bond Fund(b) | | 535,515 | | | 5,296,243 |

Ellsworth Growth and Income Fund Ltd. | | 186,638 | | | 1,859,848 |

Federated Hermes Premier Municipal Income Fund | | 32,801 | | | 371,635 |

Invesco Municipal Opportunity Trust | | 23,660 | | | 240,149 |

Invesco Pennsylvania Value Municipal Income Trust | | 157,131 | | | 1,777,152 |

| | Shares | | Fair Value |

CLOSED-END FUNDS (Continued) | | | |

Fixed Income (Continued) | | | | | |

Invesco Trust for Investment Grade New York Municipals | | 103,599 | | $ | 1,195,532 |

MFS High Income Municipal Trust | | 137,736 | | | 534,416 |

MFS Municipal Income Trust | | 2,354 | | | 13,418 |

Morgan Stanley Emerging Markets Domestic Debt Fund, Inc. | | 246,854 | | | 1,150,340 |

Neuberger Berman Municipal Fund, Inc. | | 94,851 | | | 1,033,876 |

New America High Income Fund, Inc. (The) | | 79,120 | | | 656,696 |

Nuveen California Quality Municipal Income Fund | | 19 | | | 221 |

Nuveen Core Plus Impact Fund(b) | | 478,485 | | | 5,435,590 |

Nuveen New Jersey Quality Municipal Income Fund(b) | | 326,256 | | | 4,117,351 |

Nuveen Pennsylvania Quality Municipal Income Fund(b) | | 347,696 | | | 4,175,829 |

PIMCO California Municipal Income Fund II | | 52,944 | | | 317,135 |

PIMCO Dynamic Income Strategy Fund(b) | | 577,594 | | | 15,595,037 |

PIMCO New York Municipal Income Fund II | | 3,261 | | | 24,458 |

Pioneer Municipal High Income Advantage Fund, Inc.(b) | | 316,814 | | | 2,810,140 |

Pioneer Municipal High Income Fund, Inc.(b) | | 395,418 | | | 3,803,921 |

Pioneer Municipal High Income Opportunities Fund, | | 137,809 | | | 1,696,429 |

Saba Capital Income & Opportunities Fund II(b) | | 302,398 | | | 2,694,366 |

| | | | | | 73,475,933 |

| | | | | | |

Mixed Allocation — 11.6% | | | | | |

Allspring Utilities and High Income Fund | | 11,254 | | | 126,495 |

Bexil Investment Trust | | 17,190 | | | 229,315 |

BlackRock Capital Allocation Term Trust(b) | | 432,706 | | | 7,057,435 |

Calamos Long/Short Equity & Dynamic Income Trust | | 20,509 | | | 321,991 |

Clough Global Dividend and Income Fund | | 6,986 | | | 40,170 |

Clough Global Opportunities Fund | | 12,285 | | | 65,049 |

2

Saba Closed-End Funds ETF SCHEDULE OF INVESTMENTS (Continued) | | November 30, 2024

|

| | Shares | | Fair Value |

CLOSED-END FUNDS (Continued) | | | | |

Mixed Allocation (Continued) | | | | | | |

Nuveen Multi-Asset Income Fund | | 682,990 | | $ | 8,742,272 | |

Thornburg Income Builder Opportunities Trust | | 14,524 | | | 243,713 | |

Tortoise Sustainable and Social Impact Term Fund(b) | | 181,675 | | | 2,300,006 | |

Virtus Dividend Interest & Premium Strategy Fund(b) | | 683,779 | | | 9,046,395 | |

| | | | | | 28,172,841 | |

Total Closed End Funds

(Cost $231,790,737) | | | | | 273,591,800 | |

Total Investments — 112.7%

(Cost $231,790,737) | | | | | 273,591,800 | |

Liabilities in Excess of Other Assets — (12.7)% | | | | | (30,932,148 | ) |

TOTAL NET ASSETS — 100.0% | | | | $ | 242,659,652 | |

3

Saba Closed-End Funds ETF SCHEDULE OF INVESTMENTS (Concluded) | | November 30, 2024

|

Short Futures Contracts | | Number of

Contracts | | Expiration

Date | | Notional

Amount | | Value | | Unrealized

Appreciation

(Depreciation) |

FUTURES | | | | | | | | | | | | | | | | |

CBOT 10 Year US Treasury Note | | (249) | | March 2025 | | $ | (27,522,281 | ) | | $ | (27,685,688 | ) | | $ | (163,407 | ) |

CBOT 5 Year US Treasury Note | | (378) | | April 2025 | | | (40,508,016 | ) | | | (40,673,390 | ) | | | (165,374 | ) |

CME E-Mini Russell 2000 Index Futures | | (45) | | December 2024 | | | (4,964,063 | ) | | | (5,500,350 | ) | | | (536,287 | ) |

CME E-Mini Standard & Poor’s 500 Index Future | | (50) | | December 2024 | | | (14,396,063 | ) | | | (15,128,750 | ) | | | (732,687 | ) |

Total Futures Contracts | | | | | | $ | (87,390,423 | ) | | $ | (88,988,178 | ) | | $ | (1,597,755 | ) |

Other Affiliated Investments

Fiscal period to date transactions with investments which are or were affiliates are as follows:

Affiliate | | Value at

beginning

of the

period | | Purchases

Cost | | Sales

Proceeds | | Net

Realized

Gain/(Loss) | | Net Change

in Unrealized

Appreciation

(Depreciation) | | Value at

the end of

the period | | Number of

Shares at

the end of

the period | | Dividend

Income | | Capital Gain

Distributions |

Saba Capital Income & Opportunities Fund II(a) | | $ | 3,612,515 | | $ | — | | $ | (2,824,332) | | | $ | 1,373,213 | | $ | 532,970 | | $ | 2,694,366 | | 302,398 | | $ | 125,520 | | $ | — |

Total | | $ | 3,612,515 | | $ | — | | $ | (2,824,332 | ) | | $ | 1,373,213 | | $ | 532,970 | | $ | 2,694,366 | | 302,398 | | $ | 125,520 | | $ | — |

4

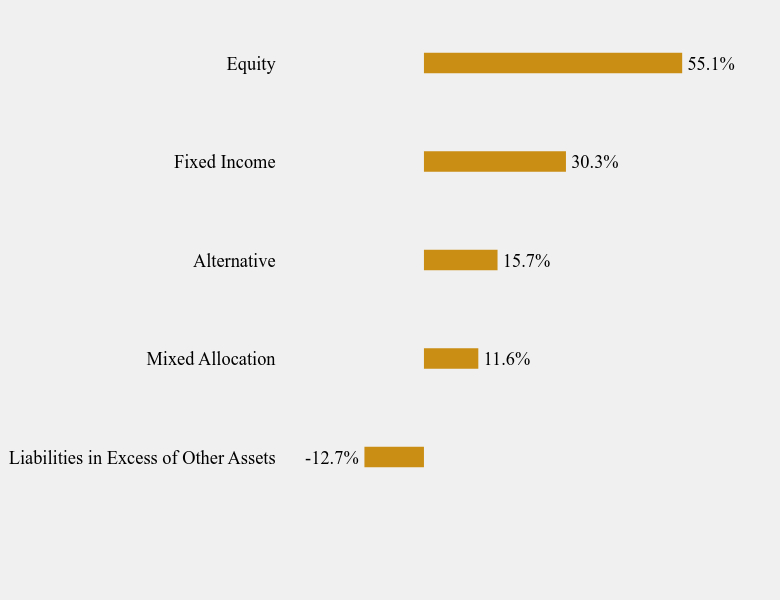

Saba Closed-End Funds ETF SUMMARY OF INVESTMENTS | | November 30, 2024

|

Security Type/Sector | | Percent of

Total Net

Assets |

Closed-End Funds | | | |

Alternative | | 15.7 | % |

Equity | | 55.1 | % |

Fixed Income | | 30.3 | % |

Mixed Allocation | | 11.6 | % |

Total Closed-End Funds | | 112.7 | % |

Total Investments | | 112.7 | % |

Liabilities in Excess of Other Assets | | (12.7 | )% |

Total Net Assets | | 100.0 | % |

5

EXCHANGE LISTED FUNDS TRUST STATEMENT OF ASSETS AND LIABILITIES | | November 30, 2024 |

| | Saba Closed-End

Funds ETF |

Assets | | | |

Unaffiliated investments, at value | | $ | 270,897,434 |

Affiliated investments, at value | | | 2,694,366 |

Cash | | | 2,570,907 |

Deposit at broker for futures contracts | | | 2,218,840 |

Receivable for fund shares sold | | | 1,121,110 |

Receivable for investments sold | | | 20,117 |

Dividends and interest receivable | | | 1,742,548 |

Total Assets | | | 281,265,322 |

| | | | |

Liabilities | | | |

Variation margin on future contracts | | | 237,613 |

Advisory fee payable | | | 211,850 |

Credit Facility payable | | | 38,061,178 |

Payable for investments purchased | | | 866 |

Interest payable – Line of Credit | | | 94,163 |

Total Liabilities | | | 38,605,670 |

| | | | |

Net Assets | | $ | 242,659,652 |

| | | | |

Net Assets consist of: | | | |

Paid-in capital | | | 200,298,186 |

Accumulated earnings | | | 42,361,466 |

Net Assets | | $ | 242,659,652 |

| | | | |

Shares of Beneficial Interest Outstanding

(unlimited number of shares authorized, no par value) | | | 10,850,001 |

Net Asset Value, Offering and Redemption Price Per Share | | $ | 22.36 |

Unaffiliated investments, at cost | | $ | 229,428,728 |

Affiliated investments, at cost | | $ | 2,362,009 |

6

EXCHANGE LISTED FUNDS TRUST STATEMENT OF OPERATIONS | |

|

| | Saba Closed-End

Funds ETF |

| | For the Year

Ended

November 30,

2024 |

Investment Income | | | | |

Unaffiliated dividend income | | $ | 8,731,559 | |

Affiliated dividend income | | | 125,520 | |

Interest income | | | 58,619 | |

Total investment income | | | 8,915,698 | |

| | | | | |

Expenses | | | | |

Advisory fees | | | 2,175,250 | |

Interest expense: | | | | |

Line of credit | | | 1,632,704 | |

Total expenses | | | 3,807,954 | |

Affiliated Waiver (See Note 3) | | | (20,009 | ) |

Net Expenses | | | 3,787,945 | |

Net Investment Income (Loss) | | | 5,127,753 | |

| | | | | |

Net Realized and Unrealized Gain (Loss) on Investments | | | | |

Net Realized Gain (Loss) on: | | | | |

Unaffiliated investments | | | 11,040,510 | |

Affiliated investments | | | 1,373,213 | |

Futures contracts | | | 388,942 | |

Capital gain distributions from underlying funds | | | 1,094,783 | |

| | | | 13,897,448 | |

Net Change in Unrealized Gain (Loss) on: | | | | |

Unaffiliated investments | | | 34,890,361 | |

Affiliated investments | | | 532,970 | |

Futures contracts | | | (1,228,127 | ) |

| | | | 34,195,204 | |

Net Realized and Unrealized Gain (Loss) on Investments | | | 48,092,652 | |

Net Increase (Decrease) in Net Assets Resulting From Operations | | $ | 53,220,405 | |

7

EXCHANGE LISTED FUNDS TRUST STATEMENTS OF CHANGES IN NET ASSETS | | |

| | Saba Closed-End Funds ETF |

| | Year Ended

November 30,

2024 | | Year Ended

November 30,

2023 |

Operations | | | | | | | | |

Net investment income (loss) | | $ | 5,127,753 | | | $ | 2,926,845 | |

Net realized gain (loss) from investment transactions | | | 13,897,448 | | | | 1,303,502 | |

Net change in unrealized gain (loss) of investment transactions | | | 34,195,204 | | | | 10,155,349 | |

Net Increase (Decrease) in Net Assets Resulting From Operations | | | 53,220,405 | | | | 14,385,696 | |

| | | | | | | | | |

Distributions to Shareholders | | | | | | | | |

Distributions | | | (16,725,037 | ) | | | (4,325,763 | ) |

Return of Capital | | | — | | | | (7,391,723 | ) |

Total Distributions to Shareholders | | | (16,725,037 | ) | | | (11,717,486 | ) |

| | | | | | | | | |

Capital Share Transactions | | | | | | | | |

Proceeds from shares sold | | | 68,452,959 | | | | 49,483,528 | |

Cost of shares redeemed | | | (7,579,423 | ) | | | — | |

Net Increase (Decrease) in Net Assets Resulting from Capital Share Transactions | | | 60,873,536 | | | | 49,483,528 | |

Net Increase (Decrease) in Net Assets | | | 97,368,904 | | | | 52,151,738 | |

| | | | | | | | | |

Net Assets | | | | | | | | |

Beginning of year | | | 145,290,748 | | | | 93,139,010 | |

End of year | | $ | 242,659,652 | | | $ | 145,290,748 | |

| | | | | | | | | |

Change in Share Transactions | | | | | | | | |

Shares sold | | | 3,350,000 | | | | 2,750,000 | |

Shares redeemed | | | (350,000 | ) | | | — | |

Net Increase (Decrease) in Shares Outstanding | | | 3,000,000 | | | | 2,750,000 | |

8

EXCHANGE LISTED FUNDS TRUST STATEMENT OF CASH FLOWS | |

|

| | Saba Closed-End

Funds ETF |

| | For the

Year Ended

November 30,

2024 |

Cash Flows from Operating Activities: | | | | |

Net increase (decrease) in net assets from operations | | $ | 53,220,405 | |

| | | | | |

Adjustments to reconcile net increase (decrease) in net assets resulting from operations to net cash provided by (used for) operating activities: | | | | |

Purchase of long-term portfolio investments | | | (133,897,115 | ) |

Proceeds from sales of long-term investments | | | 77,270,773 | |

Realized gain (loss) from security transactions | | | (12,413,723 | ) |

Proceeds from capital gains received from investments | | | (1,094,783 | ) |

Change in unrealized appreciation/(depreciation) on investments | | | (35,423,331 | ) |

Decrease in investments sold | | | 468,328 | |

Increase in dividends and interest receivable | | | (1,241,946 | ) |

Increase for fund shares sold | | | (1,121,110 | ) |

Decrease in investments purchased | | | (2,074,252 | ) |

Increase in advisory fee payable | | | 90,060 | |

Decrease in variation margin on futures contracts | | | 405,847 | |

Increase in interest payable – line of credit | | | 94,163 | |

Net cash provided by (used for) operating activities | | | (55,716,684 | ) |

| | | | | |

Cash Flows from Financing Activities: | | | | |

Net repayments on line of credit | | | 15,655,731 | |

Dividend distributions paid | | | (16,725,037 | ) |

Payments for shares issued | | | 68,452,959 | |

Proceeds for shares sold | | | (7,579,423 | ) |

Net cash provided by (used for) financing activities | | | 59,804,230 | |

Net increase (decrease) in Cash | | | 4,087,546 | |

Cash and Deposits at Broker – Beginning of year | | | 702,201 | |

Cash and Deposits at Broker – End of year | | $ | 4,789,747 | |

| | | | | |

Supplemental Disclosure of cash flow information: | | | | |

| | | | | |

Reconciliation of restricted and unrestricted cash at the beginning of the year to the Statement of Assets and Liabilities: | | | | |

Cash | | $ | 1,996 | |

Deposit with broker | | | | |

Futures contracts | | $ | 700,205 | |

| | | | | |

Reconciliation of restricted and unrestricted cash at the end of the year to the Statement of Assets and Liabilities: | | | | |

Cash | | $ | 2,570,907 | |

Deposit with broker | | | | |

Futures contracts | | $ | 2,218,840 | |

| | | | | |

Supplemental Disclosure for Non-Cash Financing Activities | | | | |

Cash paid for line of credit interest expense | | $ | 1,632,704 | |

9

EXCHANGE LISTED FUNDS TRUST FINANCIAL HIGHLIGHTS | |

|

(For Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout the Year Presented)

| | Year Ended

November 30,

2024 | | Year Ended

November 30,

2023 | | Year Ended

November 30,

2022 | | Year Ended

November 30,

2021 | | Year Ended

November 30,

2020 |

Net asset value, beginning of year | | $ | 18.51 | | | $ | 18.26 | | | $ | 20.91 | | | $ | 19.37 | | | $ | 20.05 | |

| | | | | | | | | | | | | | | | | | | | | |

Investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income(a) | | | 0.54 | | | | 0.48 | | | | 0.67 | | | | 0.53 | | | | 1.05 | |

Net realized and unrealized gain (loss) on investments | | | 5.06 | | | | 1.72 | | | | (1.10 | ) | | | 2.69 | | | | (0.05 | )(b) |

Total from investment operations | | | 5.60 | | | | 2.20 | | | | (0.43 | ) | | | 3.22 | | | | 1.00 | |

| | | | | | | | | | | | | | | | | | | | | |

Distributions to Shareholders: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.83 | ) | | | (0.62 | ) | | | (1.45 | ) | | | (1.59 | ) | | | (1.21 | ) |

Net realized gains | | | (0.92 | ) | | | (0.12 | ) | | | (0.64 | ) | | | (0.09 | ) | | | — | |

Return of capital | | | — | | | | (1.21 | ) | | | (0.13 | ) | | | — | | | | (0.47 | ) |

Total distributions | | | (1.75 | ) | | | (1.95 | ) | | | (2.22 | ) | | | (1.68 | ) | | | (1.68 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 22.36 | | | $ | 18.51 | | | $ | 18.26 | | | $ | 20.91 | | | $ | 19.37 | |

| | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, Total Return | | | 31.56 | % | | | 13.13 | % | | | (1.76 | )% | | | 17.09 | % | | | 6.07 | % |

| | | | | | | | | | | | | | | | | | | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000 omitted) | | $ | 242,660 | | | $ | 145,291 | | | $ | 93,139 | | | $ | 85,739 | | | $ | 55,214 | |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

Expenses(c) | | | 1.92 | %(e) | | | 2.49 | % | | | 1.30 | % | | | 1.18 | % | | | 1.25 | % |

Interest Expense | | | 0.83 | % | | | 1.39 | % | | | 0.20 | % | | | 0.08 | % | | | 0.15 | % |

Expenses excluding interest expense(c) | | | 1.09 | %(e) | | | 1.10 | % | | | 1.10 | % | | | 1.10 | % | | | 1.10 | % |

Ratio of net investment income to average net assets | | | 2.59 | % | | | 2.68 | % | | | 3.58 | % | | | 2.54 | % | | | 5.71 | % |

Portfolio turnover rate(d) | | | 29 | % | | | 44 | % | | | 71 | % | | | 85 | % | | | 76 | % |

10

EXCHANGE LISTED FUNDS TRUST NOTES TO FINANCIAL STATEMENTS | | November 30, 2024 |

Note 1 – Organization

Exchange Listed Funds Trust (the “Trust”) was organized on April 4, 2012 as a Delaware statutory trust and is registered with the Securities and Exchange Commission (“SEC”) under the Investment Company Act of 1940, (the “1940 Act”) as an open-end management investment company. The Agreement and Declaration of Trust permits the Trust to issue an unlimited number of shares of beneficial interest (“Shares”) in one or more series representing interests in separate portfolios of securities. The Trust has registered its Shares in multiple separate series. The assets of each series in the Trust are segregated and a shareholder’s interest is limited to the series in which Shares are held. The financial statements presented herein are for the Saba Closed-End Funds ETF (the “Fund”).

The Fund is classified as a diversified investment company under the 1940 Act. The Fund is an actively managed exchange-traded fund (“ETF”). Unlike index ETFs, actively managed ETFs do not seek to track the performance of a specified index. Instead, the Fund uses an active investment strategy in seeking to meet its investment objective.

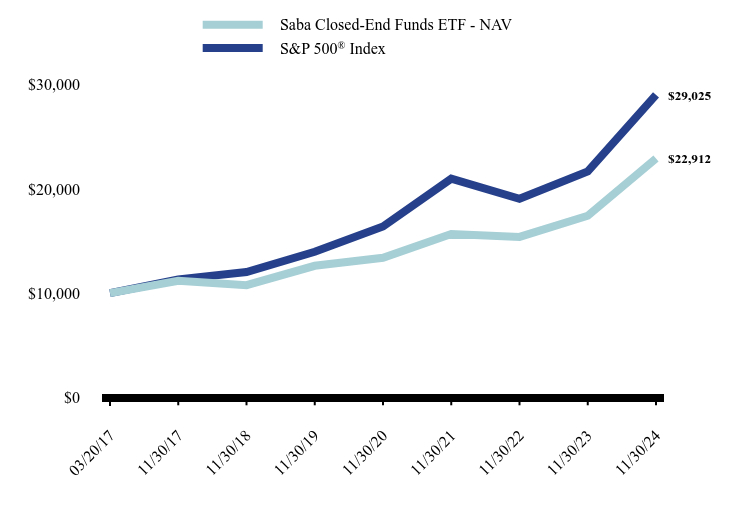

The Fund’s investment objective is to seek to provide capital appreciation and dividend income. The Fund commenced operations on March 20, 2017.

Under the Trust’s organizational documents, its officers and Board of Trustees (the “Board”) are indemnified against certain liabilities arising out of the performance of their duties to the Trust. In addition, in the normal course of business, the Trust may enter into contracts with vendors and others that provide for general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust.

Note 2 – Basis of Presentation and Significant Accounting Policies

The following is a summary of the significant accounting policies followed by the Trust in the preparation of the financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”). The Trust is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies.”

(a) Use of Estimates

The preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and income and expenses during the reporting period. Management believes the estimates and security valuations are appropriate; however, actual results may differ from those estimates, and the security valuations reflected in the financial statements may differ from the value the Fund ultimately realizes upon sale of the securities.

(b) Valuation of Investments

The Fund records investments at fair value using procedures approved by the Board and are generally valued using market valuations (Market Approach). A market valuation generally means a valuation (i) obtained from an exchange, a pricing service, or a major market maker (or dealer) or (ii) based on a price quotation or other equivalent indication of value supplied by an exchange, a pricing service, or a major market maker (or dealer). A price obtained from a pricing service based on such pricing service’s valuation matrix may be considered a market valuation. Any assets or liabilities denominated in currencies other than the U.S. dollar are converted into U.S. dollars at the current market rates on the date of valuation as quoted by one or more sources.

In December 2020, the SEC adopted Rule 2a-5 under the 1940 Act, establishing requirements to determine fair value in good faith for purposes of the 1940 Act. The rule permits fund boards to designate a fund’s investment adviser to perform fair-value determinations, subject to board oversight and certain other conditions. The rule also defines when market quotations are “readily available” for purposes of the 1940 Act and requires a fund to fair value a portfolio investment when a market quotation is not readily available. The SEC also adopted new Rule 31a-4 under the 1940 Act, which sets forth recordkeeping requirements associated with fair-value determinations.

11

EXCHANGE LISTED FUNDS TRUST NOTES TO FINANCIAL STATEMENTS (Continued) | | November 30, 2024 |

Pursuant to the requirements of Rule 2a-5, the Board (i) has designated the Adviser as the Board’s valuation designee to perform fair-value determinations for the Fund through the Adviser’s Valuation Committee and (ii) has approved the Adviser’s Valuation Procedures.

In the event that current market valuations are not readily available or such valuations do not reflect current fair market value, the Trust’s procedures require the Valuation Committee, in accordance with the Trust’s Board-approved Valuation Procedures, to determine a security’s fair value. In determining such value, the Valuation Committee may consider, among other things, (i) price comparisons among multiple sources, (ii) a review of corporate actions and news events, and (iii) a review of relevant financial indicators (e.g., movement in interest rates or market indices). Fair value pricing involves subjective judgments and it is possible that the fair value determination for a security is materially different than the value that could be realized upon the sale of the security. With respect to securities that are primarily listed on foreign exchanges, the value of the Fund’s portfolio securities may change on days when the investors will not be able to purchase or sell their Shares.

The Fund discloses the fair value of its investments in a hierarchy that distinguishes between: (1) market participant assumptions developed based on market data obtained from sources independent of the Fund (observable inputs) and (2) the Fund’s own assumptions about market participant assumptions developed based on the best information available under the circumstances (unobservable inputs). The three levels defined by the hierarchy are as follows:

• | | Level 1 – Quoted prices in active markets for identical assets. |

• | | Level 2 – Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). |

• | | Level 3 – Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Pursuant to the Valuation Procedures noted previously, closed-ed funds, ETFs and exchange traded futures contracts and short-term investments are generally categorized as Level 1 in the fair value hierarchy (unless there is a fair valuation event, in which case affected securities are generally categorized as Level 2 or Level 3).

The following is a summary of the valuations as of November 30, 2024, for the Fund based upon the three levels defined above:

Saba Closed-End Funds ETF | | Level 1 | | Level 2 | | Level 3 | | Total |

Assets | | | | | | | | | | | | |

Closed End Funds* | | $ | 273,591,800 | | $ | — | | $ | — | | $ | 273,591,800 |

Total | | | 273,591,800 | | | — | | | — | | | 273,591,800 |

Liabilities | | | | | | | | | | | | |

Futures Contracts(a) | | | 1,597,755 | | | — | | | — | | | 1,597,755 |

Total | | $ | 271,994,045 | | $ | — | | $ | — | | $ | 271,994,045 |

(c) Investment Transactions and Related Income

For financial reporting purposes, investment transactions are reported on the trade date. However, for daily Net Asset Value (“NAV”) determination, portfolio securities transactions are reflected no later than in the first calculation on the first business day following the trade date. Dividend income is recorded on the ex-dividend date. Interest income is recognized on an accrual basis

12

EXCHANGE LISTED FUNDS TRUST NOTES TO FINANCIAL STATEMENTS (Continued) | | November 30, 2024 |

and includes, where applicable, the amortization of premium or accretion of discount, using the effective yield method. Gains or losses realized on sales of securities are determined using the specific identification method by comparing the identified cost of the security lot sold with the net sales proceeds. Dividend Income on the Statement of Operations is shown net of any foreign taxes withheld on income from foreign securities, which are provided for in accordance with the Fund’s understanding of the applicable tax rules and regulations, if any.

(d) Foreign Currency Transactions

The accounting records of the Fund are maintained in U.S. dollars. Financial instruments and other assets and liabilities of the Fund denominated in a foreign currency, if any, are translated into U.S. dollars at current exchange rates. Purchases and sales of financial instruments, income receipts and expense payments are translated into U.S. dollars at the exchange rate on the date of the transaction. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates from those resulting from changes in values to financial instruments. Such fluctuations are included with the net realized and unrealized gains or losses from investments. Realized foreign exchange gains or losses arise from transactions in financial instruments and foreign currencies, currency exchange fluctuations between the trade and settlement date of such transactions, and the difference between the amount of assets and liabilities recorded and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities, including financial instruments, resulting from changes in currency exchange rates. The Fund may be subject to foreign taxes related to foreign income received, capital gains on the sale of securities and certain foreign currency transactions (a portion of which may be reclaimable). All foreign taxes are recorded in accordance with the applicable regulations and rates that exist in the foreign jurisdictions in which the Fund invests.

(e) Federal Income Tax

It is the policy of the Fund to continue to qualify each year as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986 (the “Code”) and to distribute substantially all of its net investment income and capital gains, if any, to its shareholders. Therefore, no federal income tax provision is required as long as the Fund qualifies as a regulated investment company.

Management of the Fund has evaluated tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether it is more-likely-than-not (i.e., greater than 50%) that each tax position will be sustained upon examination by a taxing authority based on the technical merits of the position. A tax position that meets the more-likely-than-not recognition threshold is measured to determine the amount of benefit to recognize in the financial statements. Differences between tax positions taken in a tax return and amounts recognized in the financial statements will generally result in an increase in a liability for taxes payable (or a reduction of a tax refund receivable), including the recognition of any related interest and penalties as an operating expense. In general, tax positions taken in previous tax years remain subject to examination by tax authorities (generally three years for federal income tax purposes). The determination has been made that there are not any uncertain tax positions that would require the Fund to record a tax liability and, therefore, there is no impact to the Fund’s financial statements. The Fund’s policy is to classify interest and penalties associated with underpayment of federal and state income taxes, if any, as income tax expense on its Statement of Operations. As of November 30, 2024, the Funds did not have any interest or penalties associated with the underpayment of any income taxes.

(f) Short Sales

Short sales are transactions under which the Fund, or an underlying closed-end fund in which the Fund invests (an “Underlying Fund”), sells a security it does not own in anticipation of a decline in the value of that security and/or hedge against a raise in interest rates. To complete such a transaction, the Fund or an Underlying Fund must borrow the security to make delivery to the buyer. The Fund or Underlying Fund then is obligated to replace the security borrowed by purchasing the security at market price at the time of replacement. The price at such time may be more or less than the price at which the security was sold by the Fund or Underlying Fund. When a security is sold short a decrease in the value of the security will be recognized as a gain and an increase in the value of the security will be recognized as a loss, which is potentially limitless. Until the security is replaced, the Fund or Underlying Fund is required to pay the lender amounts equal to dividend or interest that accrue during the period of the loan which is recorded as interest expense for securities sold short. To borrow the security, the Fund or Underlying Fund also may

13

EXCHANGE LISTED FUNDS TRUST NOTES TO FINANCIAL STATEMENTS (Continued) | | November 30, 2024 |

be required to pay a premium or an interest fee, which is also recorded as interest expense for securities sold short. Cash and/or securities are segregated for the broker to meet the necessary margin requirements. The Fund or an Underlying Fund is subject to the risk that it may not always be able to close out a short position at a particular time or at an acceptable price. During the year ended November 30, 2024, the Fund did not hold any short positions.

(g) Futures Contracts

The Fund, directly or through an Underlying Fund, may utilize futures contracts to hedge against a rise in interest rates. Futures contracts generally provide for the future sale by one party and purchase by another party of a specified commodity or security at a specified future time and at a specified price. Index futures contracts are settled daily with a payment by one party to the other of a cash amount based on the difference between the level of the index specified in the contract from one day to the next. Futures contracts are standardized as to maturity date and underlying instrument and are traded on futures exchanges.

The Fund is required to make a good faith margin deposit in cash or U.S. government securities with a broker or custodian to initiate and maintain open positions in futures contracts. A margin deposit is intended to assure completion of the contract (delivery or acceptance of the underlying commodity or payment of the cash settlement amount) if it is not terminated prior to the specified delivery date. Brokers may establish deposit requirements which are higher than the exchange minimums. Futures contracts are customarily purchased and sold on margin deposits which may range upward of approximately 5% of the value of the contract being traded.

After a futures contract position is opened, the value of the contract is marked to market daily. If the futures contract price changes to the extent that the margin on deposit does not satisfy margin requirements, payment of additional “variation margin” will be required. Conversely, change in the contract value may reduce the required margin, resulting in a repayment of excess margin to the contract holder. Variation margin payments are made to and from the futures broker for as long as the contract remains open. In such case, the Fund would expect to earn interest income on its margin deposits. Closing out an open futures position is done by taking an opposite position (“buying” a contract which has previously been “sold” or “selling” a contract previously “purchased”) in an identical contract to terminate the position. Brokerage commissions are incurred when a futures contract position is opened or closed. As of November 30, 2024, the Fund held futures contracts.

A margin deposit held at one counterparty for the futures contracts is included in “Deposit at broker for futures contracts” on the Statement of Assets and Liabilities.

(h) Distributions to Shareholders

The Fund pays out dividends from its net investment income, if any, monthly and distributes its net capital gains, if any, to investors at least annually. In so doing, the Fund seeks to make cash distributions once per month throughout a calendar year based on a rate determined at the beginning of the year. This rate is based on the Sub-Adviser’s (as defined below) annual projection of income and forecast of interest rates for the upcoming year. Thus, the rate will vary from year to year. Further, the rate may be adjusted at any time during a given year. The Sub-Adviser monitors the Fund’s distributions, the expected cash flow from investments and other metrics in determining whether to adjust the distribution rate during the course of a year. A portion of the distributions made by the Fund may be treated as return of capital for tax purposes (as discussed further below). One or more additional distributions may be made generally in December or after the Fund’s fiscal year-end to comply with applicable law.

The amount of distributions from net investment income and net realized gains are determined in accordance with federal income tax regulations, which may differ from GAAP. These “book/tax” differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature (e.g., return of capital and distribution reclassifications), such amounts are reclassified within the composition of net assets based on their federal tax basis treatment; temporary differences (e.g., wash sales and straddles) do not require a reclassification.

If the Fund’s distributions exceed its earnings and profits, all or a portion of the distributions made in the taxable year may be treated as a return of capital to shareholders. A return of capital distribution generally will not be taxable but will reduce a shareholder’s cost basis and result in a higher capital gain and lower capital loss when the Shares on which the distribution was received are sold. A return of capital distribution does not necessarily reflect the Fund’s investment performance and should not be confused with “yield” or “income.”

14

EXCHANGE LISTED FUNDS TRUST NOTES TO FINANCIAL STATEMENTS (Continued) | | November 30, 2024 |

The estimated characterization of the monthly distributions paid are expected to be either an ordinary income or return of capital distribution. This estimate is based on the Fund’s operating results during the period and the most recent industry information available from the Underlying Funds. The actual characterization of the distributions made during the period may not be determined until after the end of the fiscal year and any differences may be adjusted in the subsequent year. The Fund will inform shareholders of the final tax character of the distributions on IRS Form 1099-DIV in February of the following year. The Fund holds certain investments which pay dividends to their shareholders based upon available funds from operations. It is possible for these dividends to exceed the underlying investments’ taxable earnings and profits resulting in the excess portion of such dividends being designated as a return of capital. Distributions received from investments in securities that represent a return of capital or capital gains are recorded as a reduction of the cost of investments or as a realized gain, respectively.

Note 3 – Transactions with Affiliates and Other Servicing Agreements

(a) Investment Advisory and Administrative Services

Exchange Traded Concepts, LLC (the “Adviser”) serves as the investment adviser to the Fund pursuant to an investment advisory agreement with the Trust (the “Advisory Agreement”). Under the Advisory Agreement, the Adviser provides investment advisory services to the Fund and is responsible for, among other things, overseeing the Sub-Adviser (as defined below), including regular review of the Sub-Adviser’s performance, trading portfolio securities on behalf of the Fund, and selecting broker-dealers to execute purchase and sale transactions, subject to the oversight of the Board. For the services it provides to the Fund, the Adviser receives a fee, which is calculated daily and paid monthly, at an annual rate of 1.10% of average daily net assets of the Fund.

ETC Platform Services, LLC (“ETC Platform Services”), a direct wholly owned subsidiary of the Adviser, administers the Fund’s business affairs and provides office facilities and equipment, certain clerical, bookkeeping and administrative services, paying agent services under the Fund’s unitary fee arrangement (as described below), and its officers and employees to serve as officers or Trustees of the Trust. ETC Platform Services also arranges for transfer agency, custody, fund administration and accounting, and other non-distribution related services necessary for the Fund to operate. For the services it provides to the Fund, ETC Platform Services is paid a fee calculated daily and paid monthly based on a percentage of the Fund’s average daily net assets.

Under the Advisory Agreement, the Adviser has agreed to pay all expenses of the Fund (including the fee charged by ETC Platform Services) except for the advisory fee, interest, taxes, brokerage commissions and other expenses incurred in placing orders for the purchase and sale of securities and other investment instruments, acquired fund fees and expenses, accrued deferred tax liability, extraordinary expenses, and distribution fees and expenses paid by the Trust under any distribution plan adopted pursuant to Rule 12b-1 under the 1940 Act (collectively, “Excluded Expenses”). As part of an arrangement between the Sub-Adviser and the Adviser, the Sub-Adviser has agreed to assume the Adviser’s obligation to pay all the expenses of the Fund (except Excluded Expenses) and to the extent applicable, pay the Adviser a minimum fee.

During the year ended November 30, 2024, the Adviser voluntarily waived the advisory fees of the underlying affiliated fund in the amount of $20,009. Waived fees are not recoupable in future periods.

An interested Trustee and certain officers of the Trust are affiliated with the Adviser and receive no compensation from the Trust for serving as officers and/or Trustee.

(b) Sub-Advisory Agreement

The Adviser has entered into investment sub-advisory agreement (the “Sub-Advisory Agreement”) with respect to the Fund with Saba Capital Management, L.P. (the “Sub-Adviser”). Under the Sub-Advisory Agreement, the Sub-Adviser makes investment decisions for the Fund and continuously reviews and administers the investment program of the Fund, subject to the supervision of the Adviser and the oversight of the Board.

15

EXCHANGE LISTED FUNDS TRUST NOTES TO FINANCIAL STATEMENTS (Continued) | | November 30, 2024 |

(c) Distribution Arrangement

Foreside Fund Services, LLC (the “Distributor”), a Delaware limited liability company, is the principal underwriter and distributor of the Fund’s Shares. The Distributor does not maintain any secondary market in any Fund’s Shares.

The Trust has adopted a Rule 12b-1 Distribution and Service Plan (the “Distribution and Service Plan”) pursuant to which payments of up to a maximum of 0.25% of a Fund’s average daily net assets may be made to compensate or reimburse financial intermediaries for activities principally intended to result in the sale of the Fund’s Shares. In accordance with the Distribution and Service Plan, the Distributor may enter into agreements with financial intermediaries and dealers relating to distribution and/or marketing services with respect to the Trust.

Currently, no payments are made under the Distribution and Service Plan. Such payments may only be made after approval by the Board. The Adviser and its affiliates may, out of their own resources, pay amounts to third parties for distribution or marketing services on behalf of the Trust.

(d) Other Servicing Agreements

Effective September 28, 2024, Ultimus Fund Services, LLC (“Ultimus”) became the service provider for the Fund. Ultimus provides administration and fund accounting services to the Trust pursuant to separate servicing agreements. Brown Brothers Harriman & Co. serves as the Fund’s custodian and transfer agent pursuant to a custodian agreement and transfer agency services agreement. The Adviser pays these fees.

Note 4 – Investments Transactions

Purchases and sales of investments, excluding in-kind transactions and short-term investments, for the year ended November 30, 2024, were as follows:

Fund | | Purchases | | Sales |

Saba Closed-End Funds ETF | | $ | 133,897,115 | | $ | 64,758,287 |

Purchases and sales of in-kind transactions for the year ended November 30, 2024, were as follows:

Fund | | Purchases | | Sales |

Saba Closed-End Funds ETF | | $ | — | | $ | — |

Note 5 – Capital Share Transactions

Fund Shares are listed and traded on the Exchange each day that the Cboe BZX Exchange, Inc. ( the “Exchange”) is open for business (“Business Day”). The Fund’s Shares may only be purchased and sold on the Exchange through a broker-dealer. Because the Fund’s Shares trade at market prices rather than at their NAV, Shares may trade at a price equal to NAV, greater than NAV (premium) or less than NAV (discount).

The Fund offers and redeems Shares on a continuous basis at NAV only in large blocks of shares (each a “Creation Unit”). Except when aggregated in Creation Units, Shares are not redeemable securities of the Fund. Fund Shares may only be purchased from or redeemed directly from the Fund by certain financial institutions (“Authorized Participants”). An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of the National Securities Clearing Corporation or (ii) a Depository Trust Company (“DTC”) participant and, in each case, must have executed a Participant Agreement with the Distributor. Creation Units are available for purchase and redemption on each Business Day and are offered and redeemed on an in-kind basis, together with the specified cash amount, or for an all cash amount.

To the extent contemplated by a Participant Agreement, in the event an Authorized Participant has submitted a redemption request in proper form but is unable to transfer all or part of the shares comprising a Creation Unit to be redeemed by the Distributor, on behalf of the Fund, by the time as set forth in a Participant Agreement, the Distributor may nonetheless accept the redemption request in reliance on the undertaking by the Authorized Participant to deliver the missing shares as soon as possible,

16

EXCHANGE LISTED FUNDS TRUST NOTES TO FINANCIAL STATEMENTS (Continued) | | November 30, 2024 |

which undertaking shall be secured by the Authorized Participant’s delivery and maintenance of collateral equal to a percentage of the market value as set forth in the Participant Agreement. A Participant Agreement may permit the Fund to use such collateral to purchase the missing shares, and could subject an Authorized Participant to liability for any shortfall between the cost of the Fund acquiring such shares and the value of the collateral.

Most retail investors will not qualify as Authorized Participants or have the resources to buy and sell whole Creation Units. Therefore, they will be unable to purchase or redeem the Shares directly from the Fund. Rather, most retail investors will purchase Shares in the secondary market with the assistance of a broker, which will be subject to customary brokerage commissions or fees.

A purchase (i.e., creation) transaction fee may be imposed for the transfer and other transaction costs associated with the purchase of Creation Units, and investors will be required to pay a creation transaction fee regardless of the number of Creation Units created in the transaction. The Fund may adjust the creation transaction fee from time to time based upon actual experience. In addition, a variable fee may be imposed for cash purchases, non-standard orders, or partial cash purchases of Creation Units. The variable fee is primarily designed to cover non-standard charges, e.g., brokerage, taxes, foreign exchange, execution, market impact, and other costs and expenses, related to the execution of trades resulting from such transaction. The Fund may adjust the non-standard charge from time to time based upon actual experience. Investors who use the services of an Authorized Participant, broker or other such intermediary may be charged a fee for such services which may include an amount for the creation transaction fee and non-standard charges. Investors are responsible for the costs of transferring the securities constituting the deposit securities to the account of the Trust. The Adviser may retain all or a portion of the transaction fee to the extent the Adviser bears the expenses that otherwise would be borne by the Trust in connection with the issuance of a Creation Unit, which the transaction fee is designed to cover.

A redemption transaction fee may be imposed for the transfer and other transaction costs associated with the redemption of Creation Units, and Authorized Participants will be required to pay a redemption transaction fee regardless of the number of Creation Units created in the transaction. The redemption transaction fee is the same no matter how many Creation Units are being redeemed pursuant to any one redemption request. The Fund may adjust the redemption transaction fee from time to time based upon actual experience. In addition, a variable fee, payable to the Fund, may be imposed for cash redemptions, non-standard orders, or partial cash redemptions for the Fund. The variable fee is primarily designed to cover non-standard charges, e.g., brokerage, taxes, foreign exchange, execution, market impact, and other costs and expenses, related to the execution of trades resulting from such transaction. Investors who use the services of an Authorized Participant, broker or other such intermediary may be charged a fee for such services which may include an amount for the redemption transaction fees and non-standard charges. Investors are responsible for the costs of transferring the securities constituting the Fund’s securities to the account of the Trust. The non-standard charges are payable to the Fund as it incurs costs in connection with the redemption of Creation Units, the receipt of the Fund’s securities and the cash redemption amount and other transactions costs.

Note 6 – Principal Risks

As with any investment, an investor could lose all or part of their investment in the Fund and the Fund’s performance could trail that of other investments. The Fund is subject to the principal risks noted below, any of which may adversely affect the Fund’s NAV, trading price, yield, total return and ability to meet its investment objective. Additional principal risks are disclosed in the Fund’s prospectus. Please refer to the Fund’s prospectus for a complete description of the principal risks of investing in the Fund.

Derivatives Risk. A derivative instrument often has risks similar to its underlying instrument and may have additional risks, including imperfect correlation between the value of the derivative and the underlying instrument, risks of default by the counterparty to certain derivative transactions, magnification of losses incurred due to changes in the market value of the securities, instruments, indices or interest rates to which the derivative relates, and risks that the derivative instruments may not be liquid. The use of derivatives presents risks different from, and possibly greater than, the risks associated with investing directly in traditional securities. Changes in the value of a derivative may not correlate perfectly with the underlying asset, rate or index. Gains or losses in a derivative may be magnified and may be much greater than the derivative’s original cost.

Fund of Funds Risk. Because the Fund is a “fund of funds,” its investment performance largely depends on the investment performance of the Underlying Funds in which it invests. An investment in the Fund is subject to the risks associated with the Underlying Funds. The Fund will pay indirectly a proportional share of the fees and expenses of the Underlying Funds in which it

17

EXCHANGE LISTED FUNDS TRUST NOTES TO FINANCIAL STATEMENTS (Continued) | | November 30, 2024 |

invests (referred to herein as “acquired fund fees and expenses”), including their investment advisory and administration fees, in addition to its own fees and expenses. In addition, at times, certain segments of the market represented by constituent Underlying Funds may be out of favor and underperform other segments.

Market Risk. Overall market risk may affect the value of individual instruments in which a Fund invests. A Fund is subject to the risk that the securities markets will move down, sometimes rapidly and unpredictably, based on overall economic conditions and other factors, which may negatively affect a Fund’s performance. Factors such as domestic and foreign (non-U.S.) economic growth and market conditions, real or perceived adverse economic or political conditions, military conflict, acts of terrorism, social unrest, natural disasters, recessions, inflation, changes in interest rate levels, supply chain disruptions, sanctions, the spread of infectious illness or other public health threats, lack of liquidity in the bond or other markets, volatility in the securities markets, adverse investor sentiment and political events affect the securities markets. U.S. and foreign stock markets have experienced periods of substantial price volatility in the past and may do so again in the future. Securities markets also may experience long periods of decline in value. A change in financial condition or other event affecting a single issuer or market may adversely impact securities markets as a whole. Rates of inflation have recently risen. The value of assets or income from an investment may be worth less in the future as inflation decreases the value of money.

Trading Risk. Shares of the Fund may trade on the Exchange above (premium) or below (discount) their NAV. The NAV of shares of the Fund will fluctuate with changes in the market value of the Fund’s holdings. The market prices of the Fund’s shares will fluctuate continuously throughout trading hours based on market supply and demand and may deviate significantly from the value of the Fund’s holdings, particularly in times of market stress, with the result that investors may pay more or receive less than the underlying value of the Fund shares bought or sold. When buying or selling shares in the secondary market, you may incur costs attributable to the difference between the highest price a buyer is willing to pay to purchase shares of the Fund (bid) and the lowest price a seller is willing to accept for shares of the Fund (ask), which is known as the bid-ask spread. In addition, although the Fund’s shares are currently listed on the Exchange, there can be no assurance that an active trading market for shares will develop or be maintained. Trading in Fund shares may be halted due to market conditions or for reasons that, in the view of the Exchange, make trading in shares of the Fund inadvisable. In stressed market conditions, the market for the Fund’s shares may become less liquid in response to deteriorating liquidity in the markets for the Fund’s underlying portfolio holdings. In such a circumstance, the Fund’s shares could trade at a premium or discount to their NAV.

Note 7 – Federal Income Taxes

The tax character of the distributions paid during the tax year ended November 30, 2024, and November 30, 2023, were as follows:

| | Year Ended November 30, 2024 |

Fund | | Ordinary

Income | | Net Long-Term

Capital Gains | | Return of

Capital | | Total

Distributions |

Saba Closed-End Funds ETF | | $ | 7,714,619 | | $ | 9,010,418 | | $ | — | | $ | 16,725,037 |

| | Year Ended November 30, 2023 |

Fund | | Ordinary

Income | | Net Long-Term

Capital Gains | |

Return of

Capital

| | Total

Distributions |

Saba Closed-End Funds ETF | | $ | 3,259,607 | | $ | 1,066,156 | | $ | 7,391,723 | | $ | 11,717,486 |

As of the tax year ended November 30, 2024, the components of distributable earnings (loss) on a tax basis were as follows:

Fund | | Undistributed

Ordinary

Income | | Undistributed

Capital Gains

(Losses) | | Unrealized

Appreciation

(Depreciation)

on Investments | | Distributable

Earnings

(Loss) |

Saba Closed-End Funds ETF | | $ | 986,871 | | $ | — | | $ | 41,374,595 | | $ | 42,361,466 |

18

EXCHANGE LISTED FUNDS TRUST NOTES TO FINANCIAL STATEMENTS (Continued) | | November 30, 2024 |

At November 30, 2024, gross unrealized appreciation and depreciation of investments owned by the Fund, based on cost for federal income tax purposes were as follows:

Fund | | Tax Cost of

Investments | | Unrealized

Appreciation

on Investments | | Unrealized

Depreciation

on Investments | | Net

Unrealized

Appreciation

(Depreciation)

on Investments |

Saba Closed-End Funds ETF | | $ | 232,217,205 | | $ | 42,685,419 | | $ | (1,310,824 | ) | | $ | 41,374,595 |

The difference between cost amounts for financial statement and federal income tax purposes is due primarily to timing differences in recognizing certain gains and losses in security transactions.

Note 8 – Credit Facility

Effective March 14, 2017, the Fund entered into a committed line of credit facility (the “LOC”) with BNP Paribas used for cash management purposes, such as providing liquidity for investments and redemptions of Creation Units, and leverage. Under the current terms of the LOC, the Fund is allowed to borrow an amount set daily by BNP Paribas that floats depending on the mix of securities held as collateral and of the cash pledged. As of November 30, 2024, the market value of securities and cash pledged as collateral was $105,683,716 and $0, respectively. These securities are noted in the Schedule of Investments and the value of cash pledged as collateral is reflected as Due from broker and any outstanding borrowing is reflected as Credit Facility Receivable/Payable on the Statement of Assets and Liabilities. The interest rate charged on borrowings on the LOC is the Overnight Bank Funding Rate plus a spread of 125 basis points (1.25%). The interest rate at November 30, 2024 was 5.83%. The average interest rate, the average daily loan balance, and the amount recorded as interest expense for line of credit for the 366 days the Fund had outstanding borrowings under the LOC were 5.21%, $26,914,985, and $1,632,704, respectively, for the year ended November 30, 2024. The maximum amount borrowed during the year ended November 30, 2024, was $46,799,087. As of November 30, 2024, the Fund had $38,061,178 in outstanding borrowings.

Assets permitted as investment collateral include any cash, securities, and other investments. The LOC agreement can be terminated by the Fund or lender upon delivery of written notice to the other party.

Note 9 – Derivatives and Hedging Disclosures

ASB’s ASC Topic 815 Derivatives and Hedging requires enhanced disclosures about the Fund’s derivative and hedging activities, including how such activities are accounted for and their effects on the Fund’s financial position, performance and cash flows. The Fund invested in futures contracts during the year ended November 30, 2024.

The effects of these derivative instruments on the Fund’s financial position and financial performance as reflected in the Statement of Assets and Liabilities and Statement of Operations are presented in the tables below. The fair values of derivative instruments held as of November 30, 2024 by risk category are as follows:

| | Asset Derivatives | | Liability Derivatives |

Risk Exposure | | Statement of Asset and

Liabilities Location | | Value* | | Statement of Asset and

Liabilities Location | | Value* |

Interest rate contracts | | Unrealized

appreciation on open futures contracts | | $ | — | | Unrealized

depreciation on open futures contracts | | $ | 1,597,755 |

19

EXCHANGE LISTED FUNDS TRUST NOTES TO FINANCIAL STATEMENTS (Continued) | | November 30, 2024 |

The effects of the Fund’s derivative instruments on the Statement of Operations for the year ended November 30, 2024 are as follows:

Amount of Realized Gain or (Loss) on Derivatives

Risk Exposure | | Futures Contracts |

Interest rate contracts | | $ | 388,942 |

Change in Unrealized Appreciation/(Depreciation) on Derivatives

Risk Exposure | | Futures Contracts |

Interest rate contracts | | $ | (1,228,127 | ) |

The quarterly average volume of derivative instruments for the year ended November 30, 2024 are as follows:

Risk Exposure | | Derivative | | Number of Contracts |

Interest rate contracts | | Short futures contracts | | 702 |

Note 10 – Disclosures about Offsetting Assets and Liabilities

ASC 815 Disclosures about Offsetting Assets and Liabilities requires an entity to disclose information about offsetting and related arrangements to enable users of its financial statements to understand the effect of those arrangements on its financial position. The guidance requires retrospective application for all comparative periods presented.

The Fund has standard contracts governing most derivative transactions between the Fund and each of its counterparties and intends to mitigate credit risk with respect to over the counter derivatives. These agreements allow the Fund and each counterparty to offset certain derivative financial instruments’ payables and/or receivables against each other and/or with collateral, which is generally held by the Fund’s custodian. The amount of collateral moved to/from applicable counterparties is based upon minimum transfer amounts specified in the agreement. To the extent amounts due to the Fund from its counterparties are not fully collateralized contractually or otherwise, the Fund bears the risk of loss from counterparty non-performance.

During the year ended November 30, 2024, the Fund’s only derivative activity was the use of exchange-traded futures. Under a Futures Agreement the Futures Commission Merchant (“FCM”) generally has the right, in the event that the fund defaults, to liquidate the fund’s open positions and to use those proceeds and any related collateral posted by the fund to satisfy the fund’s obligations to the FCM. Such setoff provisions are considered “one-sided” or “asymmetrical” in that, although the FCM has the right to setoff against the fund in the event of a fund default, the fund does not have a corresponding right to offset its assets and liabilities with the FCM in the event of a default by the FCM. A Futures Agreement with “one-sided” setoff provisions does not meet the definition of an enforceable master netting (or similar) agreement in that the reporting entity has no right of set off. As such, futures would not be considered in-scope for purposes of ASU 2011-11’s balance sheet offsetting disclosures.

Note 11 – Recent Market Events

Local, regional, or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues, recessions, or other events could have a significant impact on the market generally and on specific securities. Periods of market volatility may occur in response to such events and other economic, political, and global macro factors.

Governments and central banks, including the Federal Reserve in the United States, took extraordinary and unprecedented actions to support local and global economies and the financial markets in response to the COVID-19 pandemic, including by keeping interest rates at historically low levels for an extended period. The Federal Reserve concluded its market support activities in 2022 and began to raise interest rates in an effort to fight inflation. However, the Federal Reserve had recently lowered interest rates and may continue to do so. This and other government intervention into the economy and financial markets to address the pandemic, inflation, or other significant events in the future may not work as intended, particularly if the efforts are perceived by investors as being unlikely to achieve the desired results.

20

EXCHANGE LISTED FUNDS TRUST NOTES TO FINANCIAL STATEMENTS (Concluded) | | November 30, 2024 |

Note 12 – Events Subsequent to Fiscal Period End

In preparing these financial statements, management has evaluated events and transactions for potential recognition or disclosure through the date the financial statements were issued. Management has determined there are no subsequent events that would require disclosure in a Fund’s financial statements.

21

EXCHANGE LISTED FUNDS TRUST Report of Independent Registered Public Accounting Firm | | November 30, 2024 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders of Saba Closed‐End Funds ETF and

Board of Trustees of Exchange Listed Funds Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Saba Closed‐End Funds ETF (the “Fund”), a series of Exchange Listed Funds Trust, as of November 30, 2024, the related statements of operations and cash flows for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of November 30, 2024, the results of its operations and its cash flows for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of November 30, 2024, by correspondence with the custodian and brokers. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more investment companies advised by Exchange Traded Concepts, LLC since 2012.

COHEN & COMPANY, LTD.

Cleveland, Ohio

January 28, 2025

22

EXCHANGE LISTED FUNDS TRUST Approval of Continuance of Investment Advisory and Sub-Advisory Agreements (Form n-csr, ITEM 11) | | November 30, 2024 |

At a meeting held on September 17, 2024 (the “Meeting”), the Board of Trustees (the “Board”) of Exchange Listed Funds Trust (the “Trust”) considered and approved the continuance of the following agreements (the “Agreements”) with respect to the Saba Closed-End Funds ETF (the “Fund”):

• the investment advisory agreement between the Trust, on behalf of the Fund, and Exchange Traded Concepts, LLC (“ETC”) pursuant to which ETC provides advisory services to the Fund; and

• the sub-advisory agreement between ETC and Saba Capital Management, L.P. (“Saba”) pursuant to which Saba provides sub-advisory services to the Fund.

Pursuant to Section 15 of the Investment Company Act of 1940 (the “1940 Act”), the Agreements must be approved by a vote of (i) the Trustees or the shareholders of the Fund and (ii) a majority of the Trustees who are not parties to the Agreements or “interested persons” of any party thereto, as defined in the 1940 Act (the “Independent Trustees”), cast in person at a meeting called for the purpose of voting on such approval. In connection with its consideration of such approval, the Board must request and evaluate, and ETC and Saba are required to furnish, such information as may be reasonably necessary to evaluate the terms of the Agreements. In addition, rules under the 1940 Act require the Fund to disclose in its shareholder reports the material factors and the conclusions with respect thereto that formed the basis for the Board’s approval of the Agreements.

Consistent with these responsibilities, prior to the Meeting, the Board reviewed materials from ETC and Saba and, at the Meeting, representatives from ETC presented additional information to help the Board evaluate the Agreements. Among other things, the Board was provided an overview of ETC’s and Saba’s advisory business, including investment personnel and investment processes. During the Meeting, the Board discussed the materials it received, including a memorandum from legal counsel to the Independent Trustees on the responsibilities of Trustees in considering the approval of investment advisory agreements under the 1940 Act, considered ETC’s oral presentations, and deliberated on the approval of the Agreements in light of this information. Throughout the process, the Trustees were afforded the opportunity to ask questions of and request additional materials from ETC and Saba. The Independent Trustees were assisted in their review by independent legal counsel and met with counsel separately and without management present.

In considering whether to approve the continuance of the Agreements, the Board took into account the materials provided for the Meeting, the extensive discussion before and during the Meeting, including the discussion the Independent Trustees had during their executive session with independent legal counsel. In particular, the Board took into consideration (i) the nature, extent, and quality of the services provided by ETC and Saba to the Fund; (ii) the Fund’s performance; (iii) ETC’s and Saba’s costs of and profits realized from providing advisory and sub-advisory services to the Fund, including any fall-out benefits to ETC and Saba or their respective affiliates; (iv) comparative fee and expense data; (v) the extent to which the advisory fee for the Fund reflects economies of scale shared with Fund shareholders; and (vi) other factors the Board deemed to be relevant.