Filed Pursuant to Rule 424(b)(3)

Registration No. 333-185676

TRILINC GLOBAL IMPACT FUND, LLC

SUPPLEMENT NO. 15 DATED MARCH 14, 2016

TO THE PROSPECTUS DATED APRIL 27, 2015

This prospectus supplement (“Supplement”) is part of and should be read in conjunction with the prospectus of TriLinc Global Impact Fund, LLC (the “Company”), dated April 27, 2015, as supplemented by Prospectus Supplement No. 1, dated May 12, 2015, Prospectus Supplement No. 2, dated May 15, 2015, Prospectus Supplement No. 3, dated June 5, 2015, Prospectus Supplement No. 4, dated July 10, 2015, Prospectus Supplement No. 5, dated July 30, 2015, Prospectus Supplement No. 6, dated August 12, 2015, Prospectus Supplement No. 7, dated September 9, 2015, Prospectus Supplement No. 8, dated October 14, 2015, Prospectus Supplement No. 9, dated November 17, 2015, Prospectus Supplement No. 10, dated November 23, 2015, Prospectus Supplement No. 11, dated December 9, 2015, Prospectus Supplement No. 12, dated January 22, 2016, Prospectus Supplement No. 13, dated February 9, 2016, and Prospectus Supplement No. 14, dated March 1, 2016 (the “Prospectus”). Unless otherwise defined herein, capitalized terms used in this Supplement shall have the same meanings as in the Prospectus.

The purposes of this Supplement are as follows:

A.To provide information regarding our public offering; and

B.To update the section of the Prospectus titled “Business.”

A. Status of Our Public Offering

As of March 10, 2016, we had raised gross proceeds of approximately $181.0 million from the sale of approximately 18.8 million units of our limited liability company interest, including units issued pursuant to our distribution reinvestment plan.

B. Update to the Section Titled “Business”

On February 29, 2016, the Company, through our Advisor, entered into a sub-advisory agreement with Scipion Capital, Ltd. to become a sub-advisor for the Company’s investments in Sub-Saharan Africa.

On March 3, 2016, the Company, through our Advisor, entered into a sub-advisory agreement with Alsis Funds, S.C. to become a sub-advisor for the Company’s investments in Latin America.

| 1. | a. The fifth paragraph in the “Business—Investment Strategy—Expertise—Investing with Sub-advisors” section of the Prospectus on page 63 of the Prospectus is deleted in its entirety and replaced with the following: |

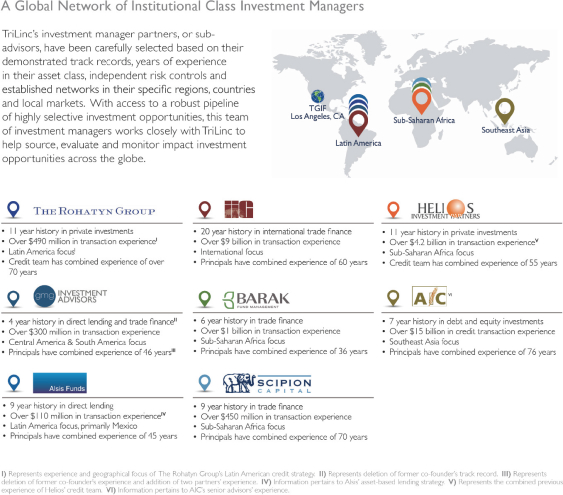

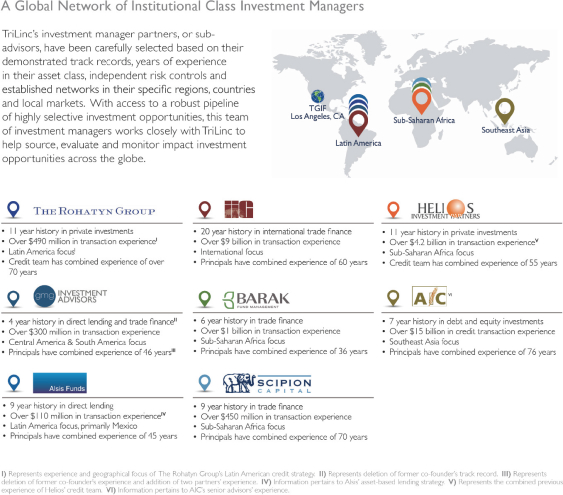

As of March 3, 2016, our Advisor has selected eight institutional-class sub-advisors with access to a robust pipeline of highly selective investment opportunities. Collectively, the sub-advisors have deployed over $30 billion in developing economy debt transactions. The management teams have an average of approximately 23 years of local market experience. The following are the selected managers to act as sub-advisors:

b. The following is inserted as the last two bullet points in the “Business—Investment Strategy—Expertise—Investing with Sub-advisors” section of the Prospectus on page 64 of the Prospectus:

| | • | | Alsis Funds, S.C. (“Alsis”): is a Latin America-focused asset management firm with offices in Mexico City and Miami that has deployed over $250 million, including $114 million asset-based lending, since its inception in 2007. Alsis is managed by a team of locals with significant experience, market knowledge, and extensive in-country networks. While Alsis’ investment activity is primarily in Mexico, the firm has proven to be a critical provider of capital to the growing SME segment and real estate industry across the region, with an attractive track record of deployed capital and realized returns in key growth industries. |

Alsis executes its SME strategy through a direct private lending approach that focuses on transactions that can be collateralized by purchase contracts with strong off-takers and also targets companies

seeking financing backed by financial assets or real estate assets. Alsis’ executive management team possesses over 100 years of combined experience in transaction sourcing, underwriting, credit analysis, and asset management, at firms such as J.P. Morgan Chase, Deutsche Bank, Bear Stearns, and BBVA Bancomer.

Alsis’ SME strategy greatly benefits from the firm’s proprietary relationships throughout Mexico and the greater Latin America region as well as its extensive due diligence and underwriting processes. Additionally, Alsis’ portfolio monitoring, operations, and administration infrastructure supports the firm’s ability to respond to the growing and persistent demand from the region’s SMEs for a timely, efficient, and flexible source of growth financing. Alsis believes that these competitive advantages are further deepened by its top-tier institutional investor base, which is comprised of industry-leading public pension funds, family foundations, and fund of funds in the U.S. and Canada, including the U.S. government’s development finance institution, the Overseas Private Investment Corporation. Alsis serves as a secondary sub-advisor.

| | • | | Scipion Capital, Ltd. (“Scipion”): is a Sub-Saharan Africa-focused investment management firm that has deployed approximately $451 million in trade finance transactions since its inception in 2007. Headquartered in London, with an office in Geneva and investment team member presence in Botswana and South Africa, the firm focuses its investment strategy on managing a diversified portfolio of trade finance assets across multiple industries, geographies, and financing structures. More specifically, Scipion’s emphasis on short duration and self-liquidating transactions is a cornerstone of its investment strategy and has translated into an attractive track record of risk-adjusted returns and a reputation as one of the leading trade finance managers in the region. |

Scipion accomplishes its value proposition through the provision of short-term liquidity, usually with facility tenors of 120 days or less, to SMEs engaged in export and import-related transactions that would otherwise not have time-efficient access to finance from local financial institutions. Furthermore, Scipion’s investments pursue strong collateral coverage profiles consisting of inventory and accounts receivables. Scipion’s senior investment team executes the firm’s strategy through over 125 years of combined experience in banking and emerging markets, including over 50 years of combined experience specifically with trade finance in Africa, at firms such as Credit Suisse, Citicorp Investment Bank, Standard Chartered Bank, Barclays, and Chase.

Scipion’s SME trade finance strategy greatly benefits from the firm’s ability to originate opportunities from its deep professional networks, and to leverage its reputation in the region to develop relationships with new clients. Additionally, Scipion’s extensive credit underwriting processes and procedures, as well as investment administration infrastructure, are competitive advantages that enable the firm to effectively manage both the growing demand for short-term trade finance from the region’s SME segment and the return profile required by its investor base, primarily comprised of leading family offices, pension funds, and financial institutions in Europe. Scipion serves as a secondary sub-advisor.

c. The map in the “Business – Investment Strategy – Expertise – Investing with Sub-advisors” section of the Prospectus on page 64 of the Prospectus is deleted in its entirety and replaced with the following: