Filed Pursuant to Rule 424(b)(3)

Registration No. 333-185676

PROSPECTUS

$1,500,000,000 Maximum Offering

$2,000,000 Minimum Offering

TriLinc Global Impact Fund, LLC, or the Company, is a Delaware limited liability company that makes and will continue to make impact investments in Small and Medium Enterprises, or SMEs, primarily in developing economies that provide the opportunity to achieve both competitive financial returns and positive measurable impact. We intend to use the proceeds of this offering to invest in SMEs through local market sub-advisors in a diversified portfolio of financial assets, including direct loans, loan participations, convertible debt instruments, trade finance, structured credit and preferred and common equity investments. A substantial portion of our assets will consist of collateralized private debt instruments, which we believe offer opportunities for competitive risk-adjusted returns through income generation. Our investment objectives are to generate current income, capital preservation and modest capital appreciation primarily through investments in SMEs. We are externally managed by TriLinc Advisors, LLC, which we refer to as our Advisor.

We are offering on a continuous basis up to $1,500,000,000 in units of our limited liability company interest, consisting of up to $1,250,000,000 of units in our primary offering and up to $250,000,000 of units pursuant to our distribution reinvestment plan. We are publicly offering three classes of units: Class A units, Class C units and Class I units. The unit classes have different sales commissions, dealer manager fees and there is an ongoing distribution fee with respect to Class C units. We are offering to sell any combination of Class A, Class C and Class I units with a dollar value up to the maximum offering amount. The current offering price for the units in the primary offering is $10.000 per Class A unit, $9.576 per Class C unit and $9.186 per Class I unit. We reserve the right to reallocate the units we are offering between this offering and our distribution reinvestment plan. This is a best efforts offering, which means that SC Distributors, LLC, the dealer manager for this offering, will use its best efforts, but is not required, to sell any specific amount of units. The minimum permitted purchase is $2,000 in any class of our units.

We determine our net asset value quarterly. If our net asset value on such valuation date increases above or decreases below our net proceeds per unit as stated in this prospectus, we will adjust the offering price of units, effective five business days later, to ensure that no unit is sold at a price, after deduction of selling commissions, dealer manager fees and organization and offering expenses, that is above or below our net asset value per unit on such valuation date.

We are an “emerging growth company” under the federal securities laws and will be subject to reduced public company reporting requirements. Investing in our units may be considered speculative and involves a high degree of risk, including the risk of a substantial loss of investment. Please see “Risk Factors” on page 31. Among others, these risks include the following:

| | • | | We have limited operating history. We are subject to all of the business risks and uncertainties associated with any new business, including the risk that we will not achieve our investment objectives and that the value of our units could decline substantially. |

| | • | | This is a “blind pool” offering because, other than existing investments, we have not identified what future investments we will make with the net proceeds of this offering. You will not be able to evaluate our future investments prior to purchasing units. We may change our investment policies without unitholder consent, which could result in investments that are different from those described in this prospectus. |

| �� | • | | We may not achieve investment results that will allow us to make distributions on a monthly basis or at a specified level. |

| | • | | We may pay distributions from any source and there are no limits on the amount of proceeds we may use to fund distributions. If we pay distributions from sources other than our cash flow from operations, we will have less funds available for the investments, and your overall return will be reduced. |

| | • | | We are dependent upon our key management personnel and the key management personnel of our Advisor, and on the continued operations of our Advisor, for our future success. |

| | • | | We intend to make non-U.S. investments which involve certain legal, geopolitical, investment, inflationary, repatriation and transparency risks not typically associated with U.S. investments. |

| | • | | There are substantial conflicts among the interests of our investors, our interests and the interests of our Advisor, dealer manager and their respective affiliates regarding compensation, investment opportunities and management resources. |

| | • | | Since this is a “best-efforts” offering, there is no assurance that we will raise significant proceeds. |

| | • | | The units sold in this offering will not be listed on an exchange for the foreseeable future, if ever. Therefore, if you purchase units in this offering, it will be difficult for you to sell your units and, if you are able to sell your units, you will likely sell them at a substantial discount. |

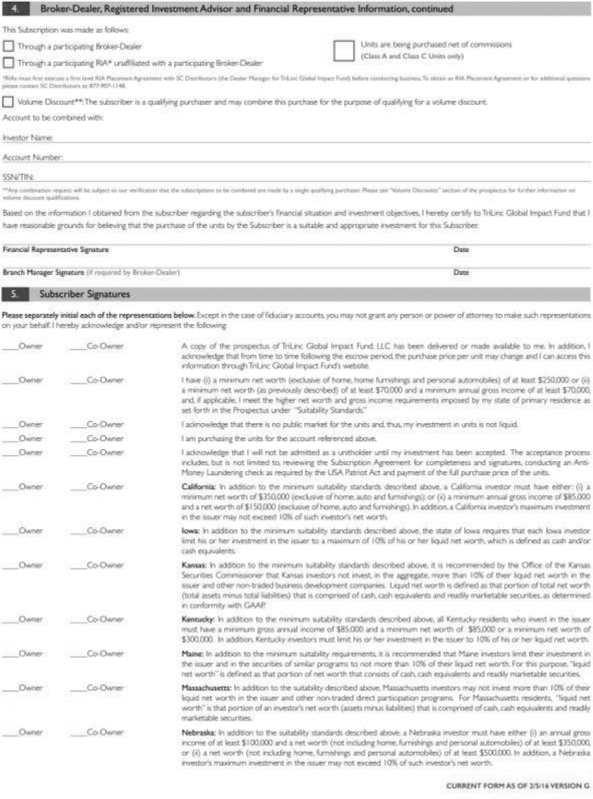

| | | | | | | | | | | | | | | | |

| | | Aggregate Price

to Public (1) | | | Selling

Commissions (2) | | | Dealer Manager

Fee (2) | | | Proceeds Before

Expenses to Us (2)(3) | |

Primary Offering | | | | | | | | | | | | | | | | |

Per Class A Unit | | $ | 10.000 | | | $ | 0.700 | | | $ | 0.275 | | | $ | 9.025 | |

Per Class C Unit | | $ | 9.576 | | | $ | 0.287 | | | $ | 0.263 | | | $ | 9.025 | |

Per Class I Unit | | $ | 9.186 | | | | — | | | $ | 0.161 | | | $ | 9.025 | |

Minimum Offering | | $ | 2,000,000.00 | | | $ | 66,666.67 | | | $ | 48,333.33 | | | $ | 1,885,000 | |

Maximum Offering | | $ | 1,250,000,000.00 | | | $ | 41,666,667.67 | | | $ | 30,208,333.33 | | | $ | 1,178,125,000 | |

Distribution Reinvestment Plan | | | | | | | | | | | | | | | | |

Per Class A Unit | | $ | 9.025 | | | | — | | | | — | | | $ | 9.025 | |

Per Class C Unit | | $ | 9.025 | | | | — | | | | — | | | $ | 9.025 | |

Per Class I Unit | | $ | 9.025 | | | | — | | | | — | | | $ | 9.025 | |

Maximum Offering | | $ | 250,000,000.00 | | | | — | | | | — | | | $ | 250,000,000.00 | |

Total Maximum Offering | | $ | 1,500,000,000.00 | | | $ | 41,666,667.67 | | | $ | 30,208,333.33 | | | $ | 1,428,125,000.00 | |

(Primary and Distribution Reinvestment Plan) | | | | | | | | | | | | | | | | |

| (1) | Assumes we will sell $1,250,000,000 in the primary offering and $250,000,000 in our distribution reinvestment plan. We reserve the right to reallocate units being offered between the primary offering and our distribution reinvestment plan. |

| (2) | The table assumes that 1/3 of primary offering gross proceeds come from sales of Class A units, 1/3 of primary offering gross proceeds come from sales of Class C units and 1/3 of primary offering gross proceeds come from sales of Class I units. We reserve the right to reallocate units being offered between Class A, Class C and Class I units. The table excludes the distribution fees for Class C units, which will be paid over time and will not be paid from offering proceeds. With respect to Class C units, we have paid and will continue to pay our dealer manager a distribution fee that accrues daily equal to 1/365th of 0.80% of the amount of the net asset value for the Class C units for such day on a continuous basis from year to year. We will continue paying distribution fees with respect to all Class C units sold in this offering until the earlier to occur of the following: (i) a listing of the Class C units on a national securities exchange, (ii) following the completion of this offering, total underwriting compensation in this offering equaling 10% of the gross proceeds from our primary offering, or (iii) there are no longer any Class C units outstanding. The figures in the table are calculated based on rounding to three decimal points. |

| (3) | Proceeds are calculated before deducting issuer costs other than selling commissions and the dealer manager fee. These issuer costs consist of, among others, expenses of our organization and offering. |

This prospectus contains important information about us that a prospective investor should know before investing in units of our limited liability company interest. Please read this prospectus before investing and keep it for future reference.

Neither the SEC, the Attorney General of the State of New York, nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense. The use of projections or forecasts in this offering is prohibited. Any representation to the contrary and any predictions, written or oral, as to the amount or certainty of any future benefit or tax consequence that may flow from an investment in units of our limited liability company interest is not permitted.

The date of this prospectus is April 28, 2016

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we have filed with the Securities and Exchange Commission, or the SEC, to register a continuous offering of units of our limited liability company interest, which we refer to as “units.” Periodically, as we make material investments or have other material developments, we will provide a prospectus supplement or amend this prospectus that may add, update or change information contained in this prospectus. We will endeavor to avoid interruptions in the continuous offering of units of our limited liability company interest, but may, to the extent permitted or required under the rules and regulations of the SEC, supplement the prospectus or file an amendment to the registration statement with the SEC if we determine to adjust the prices of our units because our net asset value per unit declines or increases from the amount of the net proceeds per unit as stated in the prospectus. There can be no assurance, however, that our continuous offering will not be suspended while the SEC reviews any such amendment and until it is declared effective.

Any statement that we make in this prospectus may be modified or superseded by us in a subsequent prospectus supplement. The registration statement we have filed with the SEC includes exhibits that provide more detailed descriptions of certain matters discussed in this prospectus. You should read this prospectus and the related exhibits filed with the SEC and any prospectus supplement, together with additional information described in the section entitled “Available Information” in this prospectus. In this prospectus, we use the term “day” to refer to a calendar day, and we use the term “business day” to refer to any day other than Saturday, Sunday, a legal holiday or a day on which banks in New York City are authorized or required to close.

You should rely only on the information contained in this prospectus. Neither we nor the dealer manager has authorized any other person to provide you with different information from that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the dealer manager is not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus is complete and accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or sale of units. If there is a material change in the affairs of our company, we will amend or supplement this prospectus.

For information on the suitability standards that investors must meet in order to purchase units in this offering, see “Suitability Standards.”

SUITABILITY STANDARDS

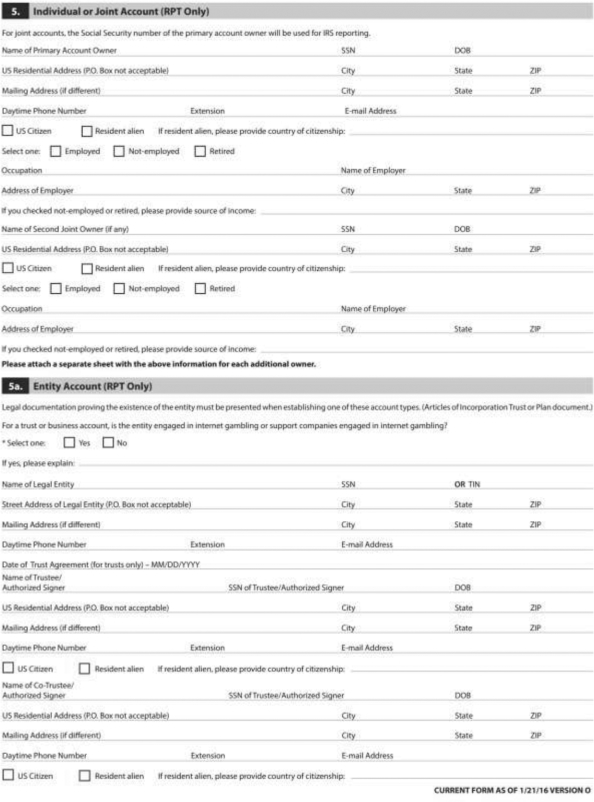

The following are our suitability standards for investors that are required by the Omnibus Guidelines published by the North American Securities Administrators Association in connection with our continuous offering of our units under this registration statement.

Pursuant to applicable state securities laws, units offered through this prospectus are suitable only as a long-term investment for persons of adequate financial means who have no need for liquidity in this investment. There is not expected to be any public market for the units, which means that it may be difficult for unitholders to sell units. As a result, we have established suitability standards which require investors to have either (i) a net worth (not including home, furnishings, and personal automobiles) of at least $70,000 and an annual gross income of at least $70,000, or (ii) a net worth (not including home, home furnishings, and personal automobiles) of at least $250,000. Our suitability standards also require that a potential investor (1) can reasonably benefit from an investment in us based on such investor’s overall investment objectives and portfolio structuring; (2) is able to bear the economic risk of the investment based on the prospective unitholder’s overall financial situation; and (3) has apparent understanding of (a) the fundamental risks of the investment, (b) the risk that such investor may lose his or her entire investment, (c) the lack of liquidity and restrictions on transferability of the units and (d) the tax consequences of the investment. Persons who meet these standards are most likely to benefit from an investment in our company.

The minimum purchase amount is $2,000 in units. To satisfy the minimum purchase requirements for retirement plans, unless otherwise prohibited by state law, a husband and wife may jointly contribute funds from their separate individual retirement accounts, or IRAs, provided that each such contribution should be not less than $500. You should note that an investment in our units will not, in itself, create a retirement plan and that, in order to create a retirement plan, you must comply with all applicable provisions of the Internal Revenue Code of 1986 as amended, or the Code and the U.S. Treasury Regulations promulgated thereunder, or the Regulations.

If you have satisfied the applicable minimum purchase requirement, any additional purchase must be in amounts of at least $500. The investment minimum for subsequent purchases does not apply to units purchased pursuant to our distribution reinvestment plan.

In the case of sales to fiduciary accounts, these suitability standards must be met by the person who directly or indirectly supplied the funds for the purchase of units or by the beneficiary of the account.

These suitability standards are intended to help ensure that, given the long-term nature of an investment in units, our investment objectives and the relative illiquidity of units, units are an appropriate investment for those of you who become unitholders. Our sponsor and those selling units on our behalf must make every reasonable effort to determine that the purchase of units is a suitable and appropriate investment for each unitholder based on information provided by the unitholder in the subscription agreement. Each participating broker-dealer is required to maintain for six years records of the information used to determine that an investment in units is suitable and appropriate for a unitholder.

Certain states have established suitability requirements different from those described above. Units will be sold to investors in these states only if they meet the special suitability standards set forth below:

California: In addition to the minimum suitability standards described above, a California investor must have either: (i) a minimum net worth of $350,000 (exclusive of home, auto and furnishings); or (ii) a minimum annual gross income of $85,000 and a net worth of $150,000 (exclusive of home, auto and furnishings). In addition, a California investor’s maximum investment in us may not exceed 10% of such investor’s net worth.

Iowa: In addition to the minimum suitability standards described above, the state of Iowa requires that each Iowa investor limit his or her investment in us to a maximum of 10% of his or her liquid net worth, which is defined as cash and/or cash equivalents.

1

Kansas: In addition to the minimum suitability standards described above, it is recommended by the Office of the Kansas Securities Commissioner that Kansas investors not invest, in the aggregate, more than 10% of their liquid net worth in us and other non-traded business development companies. Liquid net worth is defined as that portion of total net worth (total assets minus total liabilities) that is comprised of cash, cash equivalents and readily marketable securities, as determined in conformity with GAAP.

Kentucky: In addition to the minimum suitability standards described above, all Kentucky residents who invest in us must have a minimum gross annual income of $85,000 and a minimum net worth of $85,000 or a minimum net worth of $300,000. In addition, Kentucky investors must limit his or her investment in us to 10% of his or her liquid net worth.

Maine: In addition to our suitability requirements, it is recommended that Maine investors limit their investment in us and in the securities of similar programs to not more than 10% of their liquid net worth. For this purpose, “liquid net worth” is defined as that portion of net worth that consists of cash, cash equivalents and readily marketable securities.

Massachusetts:Massachusetts investors may not invest more than 10% of their liquid net worth in us and other non-traded direct participation programs. For Massachusetts residents, “liquid net worth” is that portion of an investor’s net worth (assets minus liabilities) that is comprised of cash, cash equivalents and readily marketable securities.

Nebraska: In addition to the suitability standards described above, a Nebraska investor must have either (i) an annual gross income of at least $100,000 and a net worth (not including home, furnishings and personal automobiles) of at least $350,000, or (ii) a net worth (not including home, furnishings and personal automobiles) of at least $500,000. In addition, a Nebraska investor’s maximum investment in us may not exceed 10% of such investor’s net worth.

New Jersey: New Jersey investors must limit their investment in us, our affiliates, and in other non-traded business development companies to not more than 10% of their liquid net worth. Liquid net worth is defined as that portion of total net worth (total assets minus total liabilities) that is comprised of cash, cash equivalents and readily marketable securities.

New Mexico: In addition to our suitability standards, a New Mexico investor’s maximum investment in us may not exceed 10% of such investor’s liquid net worth.

North Dakota:In addition to the minimum suitability standards described above, North Dakota investors must represent that they have a net worth of at least ten times their investment in us.

Ohio: In addition to the minimum suitability standards described above, an Ohio investor must have a liquid net worth of at least ten times such Ohio resident’s investment in us, our affiliates, and in other non-traded business development companies. Liquid net worth is defined as that portion of net worth (total assets exclusive of home, home furnishings, and automobiles minus total liabilities) that is comprised of cash, cash equivalents, and readily marketable securities.

Oklahoma: In addition to the minimum suitability standards described above, Oklahoma residents’ investments in us must not exceed ten percent (10%) of their liquid net worth.

Oregon: In addition to the minimum suitability standards described above, Oregon investors must have a net worth of at least ten times their investment in us.

Tennessee: In addition to the suitability standards above, Tennessee residents must have a minimum annual gross income of $100,000 and a minimum net worth of $100,000, or a minimum net worth of $500,000 exclusive of home, home furnishings and automobile. In addition, Tennessee residents’ investment must not exceed ten percent (10%) of their liquid net worth.

2

Texas:Texas residents purchasing units (i) must have either (a) an annual gross income of at least $100,000 and a net worth of at least $100,000, or (b) a net worth of at least $250,000; and (ii) may not invest more than 10% of their net worth in us, our affiliates or other non-traded business development companies. For Texas residents, “net worth” does not include the value of one’s home, home furnishings or automobiles.

No subscription for Class C units will be accepted from the residents of the state of Kentucky.

The exemptions for secondary trading available under California Corporations Code §25104(h) will be withheld, but there may be other exemptions to cover private sales by the bona fide owner for his own account without advertising and without being effected by or through a broker dealer in a public offering.

In purchasing units, custodians or trustees of employee pension benefit plans or IRAs may be subject to the fiduciary duties imposed by the Employee Retirement Income Security Act of 1974, or ERISA, or other applicable laws and to the prohibited transaction rules prescribed by ERISA and related provisions of the Code. In addition, prior to purchasing units, the trustee or custodian of an employee pension benefit plan or an IRA should determine that such an investment would be permissible under the governing instruments of such plan or account and applicable law. Please note that the purchase of units may not be suitable for tax exempt investors because they may receive unrelated business taxable income from the investments that we make.

3

QUESTIONS AND ANSWERS

Q: What is a best efforts securities offering?

A: When units are offered to the public on a “best efforts” basis, the broker-dealers participating in the offering are only required to use their best efforts to sell such units. Broker-dealers are not underwriters, and they do not have a firm commitment or obligation to purchase any of the units.

Q: When will you accept and close on subscriptions?

A: We close on subscriptions received and accepted by us on a daily basis.

Q: Who can buy units in this offering?

A: In general, you may buy units pursuant to this prospectus if you have either (1) net worth of at least $70,000 and an annual gross income of at least $70,000, or (2) a net worth of at least $250,000. For this purpose, net worth does not include your home, home furnishings and personal automobiles. Our suitability standards also require that a potential investor (1) can reasonably benefit from an investment in us based on such investor’s overall investment objectives and portfolio structuring; (2) is able to bear the economic risk of the investment based on the prospective unitholder’s overall financial situation; and (3) has apparent understanding of (a) the fundamental risks of the investment, (b) the risk that such investor may lose his or her entire investment, (c) the lack of liquidity and restrictions on transferability of the units and (d) the tax consequences of the investment.

Generally, you must purchase at least $2,000 of units, except for certain investors. See “Suitability Standards.” Certain volume discounts may be available for large purchases. See “Plan of Distribution.” If you have previously acquired units, additional purchases must be not less than $500, except for purchases made pursuant to our distribution reinvestment plan. These minimum net worth and investment levels may be higher in certain states, so you should carefully read the more detailed description under “Suitability Standards.”

Our affiliates may also purchase units. The selling commission that is payable by other investors in this offering will be reduced or waived for certain purchasers, including our affiliates.

Q: What is the difference between the Class A, Class C and Class I units being offered?

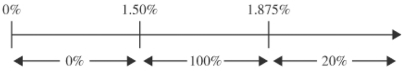

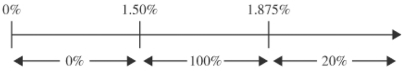

A: We are offering three classes of units, Class A units, Class C units and Class I units at a current offering price of $10.00 per Class A unit, $9.576 per Class C unit and $9.186 per Class I unit. The unit classes have different sales commissions and dealer manager fees, and there is an ongoing distribution fee with respect to Class C units. Specifically, we pay to our dealer manager a sales commission of up to 7.00% of gross proceeds from the sale of Class A units sold in the primary offering. For Class C units sold in the primary offering, we pay a sales commission of up to 3.00% of gross proceeds. In addition, for Class C units, we pay the dealer manager a distribution fee that accrues daily equal to 1/365th of 0.80% of the amount of the net asset value for the Class C units for such day on a continuous basis from year to year. We will continue paying the distribution fees with respect to Class C units sold in this offering until the earlier to occur of the following: (i) a listing of the Class C units on a national securities exchange, (ii) upon the completion of this offering, total underwriting compensation in this offering equaling 10% of the gross proceeds from the primary offering, or (iii) such Class C units no longer being outstanding. We do not pay any selling commission with respect to Class I units. We pay our dealer manager a dealer manager fee of up to 2.75% of gross proceeds from the primary offering of class A and Class C units and up to 1.75% of gross proceeds from the primary offering of Class I units. See “Description of Units and Our Operating Agreement” and “Plan of Distribution” for a discussion of the differences between our classes of units.

Our Class A units, Class C units and Class I units are available for different categories of investors and/or different distribution channels. Class I units are available for purchase to institutional clients. Class A and C units

4

each are available for purchase by the general public through different distribution channels (See “Plan of Distribution”). Only Class A units are available for purchase in this offering by our executive officers and board of managers and their immediate family members, as well as officers and employees of our Advisor and other affiliates of our Advisor and their immediate family members and, if approved by our management, joint venture partners, consultants and other service providers. When deciding which class of units to buy, you should consider, among other things, whether you are eligible to purchase one or more classes of units, the amount of your investment, the length of time you intend to hold the units (assuming you are able to dispose of them), the selling commission and fees attributable to each class of units and whether you qualify for any selling commission discounts described below. Before making your investment decision, please consult with your financial advisor regarding your account type and the classes of units you may be eligible to purchase.

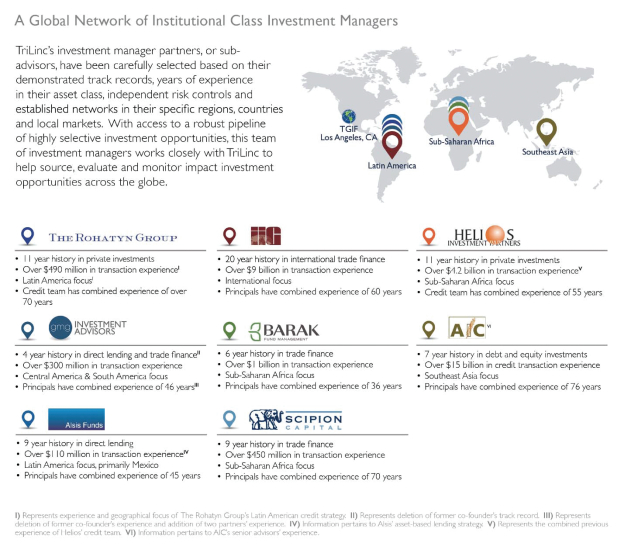

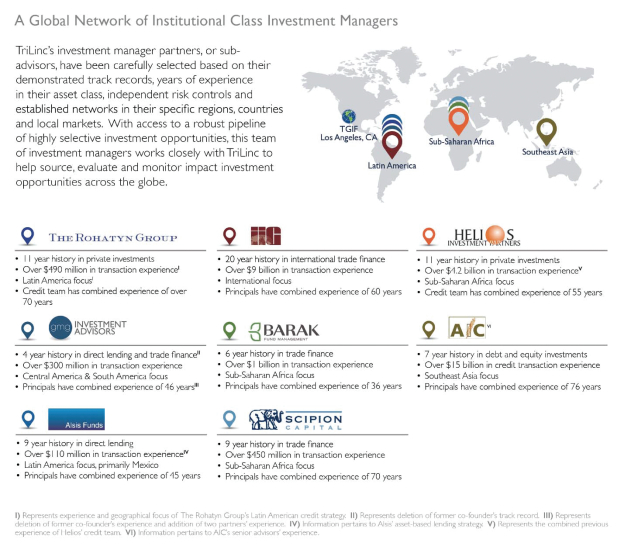

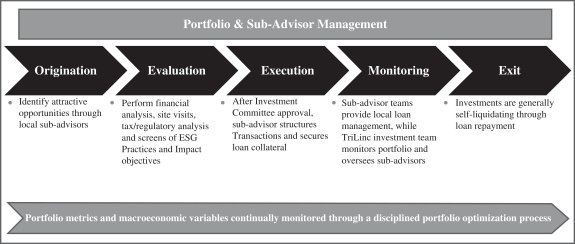

Q: How will investments be made?

A: We have implemented our investment strategy through partnering with multiple sub-advisors in our target regions. Our Advisor retains the services of sub-advisors to, subject to our Advisor’s oversight, identify, evaluate, and negotiate our investments, and to provide asset management services. Our Advisor has engaged in an extensive search for leading providers of SME finance to serve as our sub-advisors, and has chosen those with solid track records, deep experience in target geographies and asset classes, and a commitment to sustainable business principles. Sub-advisors make individual investment decisions based on the underwriting guidelines and other criteria provided by our Advisor as approved by our board of managers. As an element of oversight and quality control, a member of our Advisor’s investment team may participate as an observer in each sub-advisor’s investment committee. TriLinc maintains observer rights on all relevant sub-advisor investment committees. Individual sub-advisor policy and practice can vary widely and TriLinc may elect to adopt more stringent processes than sub-advisor investment committee observance. In addition, although our Advisor engages sub-advisors, our Advisor retains ultimate responsibility for the performance of all of the services under the Amended and Restated Advisory Agreement, also referred to as the Advisory Agreement. Our Advisor pays to sub-advisors a portion of certain fees payable to our Advisor under the Advisory Agreement for the performance of these services. Our board of managers annually reviews the compensation we pay to TriLinc Advisors to determine that the compensation is reasonable and that the provisions of the Advisory Agreement are carried out.

Q: What is the experience of TriLinc Advisors?

A: TriLinc Advisors is a private investment advisory firm focusing on impact investments in SMEs around the world. TriLinc Advisors’ management team has a long track record and broad experience in the management of regulated, multi-billion dollar fund complexes and global macro portfolio management. TriLinc Advisors and our sub-advisors have an extensive network of relationships with emerging market private equity and debt managers, bilateral and multilateral Development Finance Institutions (“DFIs”), and international consultancies and service providers that we believe will benefit our portfolio of investments. We benefit from both the top-down, global macro investing approach of TriLinc Advisors and its affiliates and the bottom-up deal sourcing and structuring of our sub-advisors. See “Management of the Company” for more information on the experience of the members of the senior management team.

Q: What is impact investing?

A: Simply stated, impact investing is defined as investing with the specific objective of achieving both a competitive financial return and positive, measurable economic, social and/or environmental impact. More broadly, impact investing is an emerging asset class that has captured the attention of some of the most sophisticated money managers in the world, who understand the power of mobilizing private capital to help solve some of the world’s biggest social and economic challenges. JP Morgan Global Research reports that impact investing is expected to constitute 5% to 10% of investor portfolios within 10 years. Further, according to the U.S. State Department, this emerging class of investors is generating business opportunities that analysts estimate could reach between $500 billion and several trillion dollars over the next decade.

5

Q: How long will this offering last?

A: This is a continuous offering of units as permitted by the federal securities laws. The offering commenced on February 25, 2013. We file post-effective amendments to the registration statement of which this prospectus is a part, that are subject to SEC review, to allow us to continue this offering. We have decided to extend this offering until December 31, 2016; however, we may terminate the offering earlier. This offering has been registered in every state in which we offer or sell units, provided that we may not offer or sell any Class C units in the state of Kentucky. Generally, such registrations are for a period of one year. Thus, we may have to stop selling units in any state in which our registration is not annually renewed or otherwise extended. Your ability to submit units for repurchase will not be affected by the expiration of this offering and the commencement of a new one.

Q: Can I invest through my IRA, SEP or after-tax deferred account?

A: Yes, subject to the suitability standards. A custodian, trustee or other authorized person must process and forward to us subscriptions made through individual retirement accounts, or IRAs, simplified employee pension plans, or SEPs, or after-tax deferred accounts. In the case of investments through IRAs, SEPs or after-tax deferred accounts, we send the confirmation and notice of our acceptance to such custodian, trustee or other authorized person. Please be aware that in purchasing units, custodians or trustees of employee pension benefit plans or IRAs may be subject to the fiduciary duties imposed by ERISA or other applicable laws and to the prohibited transaction rules prescribed by ERISA and related provisions of the United States Code. In addition, depending on the structure used to make investments, it is possible that the purchase of units by tax-exempt investors such as IRAs and employee pension benefit plans could result in unrelated business taxable income. Furthermore, prior to purchasing units, the trustee or custodian of an employee pension benefit plan or an IRA should determine that such an investment would be permissible under the governing instruments of such plan or account and applicable law. See “Suitability Standards” for more information.

Q: Who is the transfer agent?

A: The name and address of our transfer agent is as follows:

DST Systems, Inc.

P.O. Box 219312

Kansas City, MO 64121-9312

To ensure that any account changes are made promptly and accurately, all changes (including your address, ownership type and distribution mailing address) should be directed to the transfer agent.

Q: What kinds of fees will I be paying?

A: There are upfront and other types of fees that you will incur. First, there are unitholder transaction expenses that are a one-time up-front fee. They are calculated as a percentage of the public offering price and made up of selling commissions and dealer manager fees. There are also other offering expenses, and, with respect to Class C units, a distribution fee. In addition, as an externally managed fund, we will also incur various recurring expenses, including asset management fees and incentive fees that are payable under our Advisory Agreement. See “Our Expenses,” “Compensation of the Dealer Manager and Our Advisor,” and “Advisory and Sub-Advisory Agreements” for more information.

Q: How will the payment of fees and expenses affect my invested capital?

A: The payment of fees and expenses reduces: (1) the funds available to us for investments, (2) the net income generated by us, (3) funds available for distribution to our unitholders and (4) the net asset value of your units.

6

Q: Are there any restrictions on the transfer of units?

A: The operating agreement places substantial limitations upon your ability to transfer units. Any transferee must be a person that would have been qualified to purchase units in this offering. No unit may be transferred if, in the judgment of the managers, and/or their counsel, a transfer would jeopardize our status as a “partnership” for federal income tax purposes. In addition, you will not be permitted to make any transfer or assignment of your units if we determine such transfer or assignment would result in the Company being classified as a “publicly traded partnership” within the meaning of Section 7704(b) of the Code. Furthermore, our operating agreement requires the consent of our board of managers for a transferee to be substituted as a member of the Company, which consent shall not be unreasonably withheld. We do not intend to list units on any securities exchange, and we do not expect there to be a public market for units in the foreseeable future. As a result, your ability to sell your units will be limited. We do not charge for transfers of units except for necessary and reasonable costs actually incurred by us. See “Risk Factors — Risks Relating to Investing in the Offering.”

Q: Will I be able to sell the units in a secondary market?

A: We do not intend to list units on a securities exchange during the offer period, and do not expect a public market to develop for units in the foreseeable future. Because of the lack of a trading market for units, unitholders may not be able to sell their units promptly or at a desired price. If you are able to sell your units you may have to sell them at a discount to the purchase price of your units.

Q: Will I otherwise be able to liquidate my investment?

A: In the future, our board of managers may consider various forms of liquidity, each of which is referred to as a liquidity event, including, but not limited to: (1) dissolution and winding up distribution of our assets; (2) merger or sale of all or substantially all of our assets; or (3) the listing of units on a national securities exchange. If we do not consummate a liquidity event within five years from August 25, 2016, we will be required to commence an orderly liquidation of the assets unless a majority of our board, including a majority of the independent managers, determines that liquidation is not in the best interests of our unitholders. Under such circumstances the commencement of an orderly liquidation will be postponed for one year. Further postponement of the liquidity event would only be permitted if a majority of our board, including a majority of independent managers, again determined that liquidation would not be in the best interest of our unitholders and our board must make a determination in this manner during each successive year until a liquidity event has occurred. If we at any time choose to seek but then fail to obtain unitholder approval of our liquidation, our operating agreement would not require us to consummate a liquidity event or liquidate and would not require our board to revisit the issue of liquidation, and we could continue to operate as before. There can be no assurance that we will complete a liquidity event. Prior to the completion of a liquidity event, our unit repurchase program may provide a limited opportunity for you to have your units repurchased, subject to certain restrictions and limitations, at a price which may reflect a discount from the purchase price you paid for the units being repurchased. See “Unit Repurchase Program” for a detailed description of our unit repurchase program.

Q: Will the distributions I receive be taxable?

A: As discussed below, we are characterized as a partnership for federal income tax purposes. As a partnership, our unitholders are allocated their respective share of the Company items of income gain, loss, deduction and credit that may not be directly related to the actual cash distributions made by the Company. Accordingly, while the Company is operating, a unitholder generally will not recognize gain on the receipt of a distribution of money from the Company (including any constructive distribution of money resulting from a reduction in the unitholder’s share of our liabilities), except to the extent such a distribution exceeds the unitholder’s adjusted tax basis in our units. A unitholder’s tax basis in its units initially is the amount paid for such units, plus the unitholder’s allocable share (as determined for federal income tax purposes) of any liabilities of the Company, and will thereafter be adjusted as required under the Code to give effect on an ongoing basis to the unitholder’s allocable share of our tax items, distributions and liabilities. Liquidating distributions, however, generally will

7

result in the recognition of taxable gain by the unitholder. Such gain will be recognized to the extent that the amount of money received (including any constructive distribution of money resulting from a reduction in the unitholder’s share of our liabilities) exceeds the unitholder’s adjusted tax basis in its units.

The rules governing the taxation of partnerships and individual partners are quite complex, and unitholders should consult their tax advisors concerning the tax consequences of an investment in the units in light of the investor’s particular circumstances.

Q: When will I get my detailed tax information?

A: We send to each of our U.S. unitholders, within 75 days after the end of each calendar year, a Form K-1 detailing each unitholder’s allocable share of the Company’s items of income, gain, loss, deduction and credit.

Q: Who can help answer my questions?

A: If you have more questions about the offering or if you would like additional copies of this prospectus, you should contact your registered representative or the dealer manager at:

SC Distributors, LLC

695 Town Center Drive

Suite 600

Costa Mesa, CA 92626

657-383-9640

8

FORWARD LOOKING STATEMENTS

Some of the statements in this prospectus constitute forward-looking statements, which relate to future events or our future performance or financial condition. The forward-looking statements contained in this prospectus involve risks and uncertainties, including statements as to:

| | • | | our future operating results; |

| | • | | our ability to raise capital in this offering; |

| | • | | our ability to purchase or make investments; |

| | • | | our business prospects and the prospects of our borrowers; |

| | • | | the economic, social and/or environmental impact of the investments that we expect to make; |

| | • | | our contractual arrangements and relationships with third parties; |

| | • | | our ability to make distributions to our unitholders; |

| | • | | the dependence of our future success on the general economy and its impact on the companies in which we invest; |

| | • | | the availability of cash flow from operating activities for distributions and payment of operating expenses; |

| | • | | the performance of our Advisor, our sub-advisors and our Sponsor; |

| | • | | our dependence on the resources and personnel of our Advisor and the financial resources of our Sponsor; |

| | • | | the ability of our borrowers to make required payments; |

| | • | | our Advisor’s ability to attract and retain sufficient personnel to support our growth and operations; |

| | • | | the lack of a public trading market for our units; |

| | • | | our limited operating history; |

| | • | | any failure in our Advisor’s or sub-advisors’ due diligence to identify all relevant facts in our underwriting process or otherwise; |

| | • | | the ability of our sub-advisors and borrowers to achieve their objectives; |

| | • | | our ability to obtain financing; |

| | • | | performance of our investments relative to our expectations and the impact on our actual return on invested equity, as well as the cash provided by these investments; |

| | • | | the effectiveness of our portfolio management techniques and strategies; |

| | • | | the adequacy of our cash resources and working capital; |

| | • | | failure to maintain effective internal controls; and |

| | • | | the loss of our exemption from the definition of an “investment company” under the Investment Company Act of 1940, as amended. |

We use words such as “anticipates,” “believes,” “expects,” “intends” and similar expressions to identify forward-looking statements. Our actual results could differ materially from those projected in the forward-looking statements for any reason, including the factors set forth in “Risk Factors” and elsewhere in this prospectus.

9

We have based the forward-looking statements included in this prospectus on information available to us on the date of this prospectus, and we assume no obligation to update any such forward-looking statements. Although we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise, you are advised to consult any additional disclosures that we may make directly to you or through reports that we in the future may file with the SEC.

10

PROSPECTUS SUMMARY

This summary highlights some of the information in this prospectus. It may not contain all of the information that you may want to consider. To understand this offering fully, you should read the entire prospectus carefully, including the section entitled “Risk Factors,” before making a decision to invest in the units of our limited liability company interest.

TriLinc Global Impact Fund, LLC is a Delaware limited liability company formed on April 30, 2012. Unless otherwise noted, the terms “we,” “us,” “our,” “the Company” and “our company” refer to TriLinc Global Impact Fund, LLC; the term our “Advisor” and “TriLinc Advisors” refers to TriLinc Advisors, LLC, our external advisor; the term “SC Distributors” and our “dealer manager” refers to SC Distributors, LLC, our dealer manager; and the term our “Sponsor” refers to TriLinc Global, LLC, our sponsor.

TriLinc Global Impact Fund

TriLinc Global Impact Fund, LLC is a Delaware limited liability company that makes impact investments in Small and Medium Enterprises, or SMEs, which we define as those businesses having less than 500 employees, primarily in developing economies that provide the opportunity to achieve both competitive financial returns and positive measurable impact. We have used and intend to continue to use the proceeds of this offering to invest in SMEs through local market sub-advisors in a diversified portfolio of financial assets, including trade finance, direct loans, convertible debt instruments, structured credit and preferred and common equity investments. The majority of our assets consist of collateralized private debt instruments, which we believe offer opportunities for competitive risk-adjusted returns through income generation. We are externally managed and advised by TriLinc Advisors.

Market Opportunity

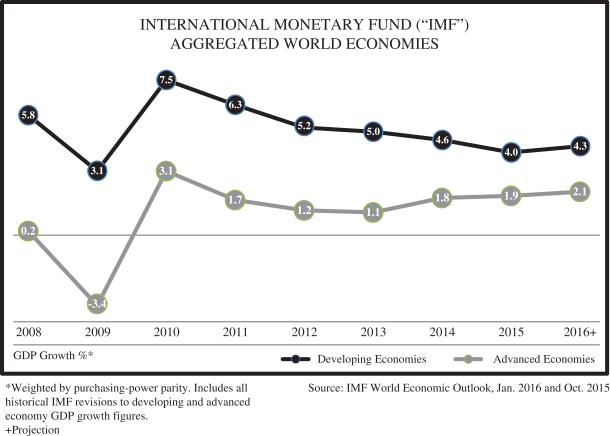

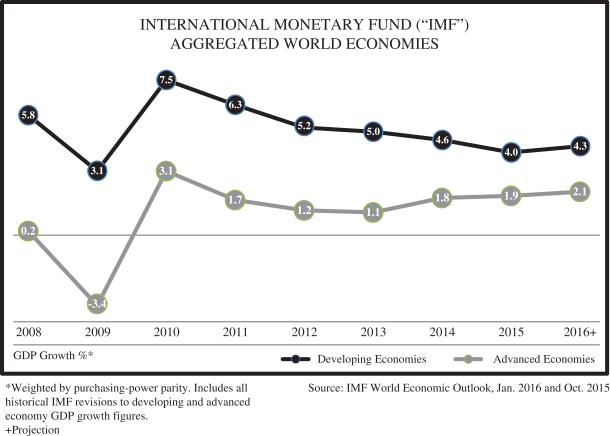

We are centered on a single idea: providing access to finance for SMEs, particularly in developing economies, is both a profitable investment proposition and an effective driver of sustainable economic development. We believe significant opportunity exists in small and growing businesses, which through expansion have the ability to hire more employees, produce more goods for local consumption, provide training to locally-based employees and pay more taxes through increased revenues. By increasing the local production of quality goods and services, these businesses can support the growing middle class in those markets.

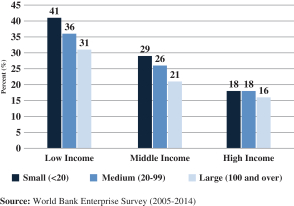

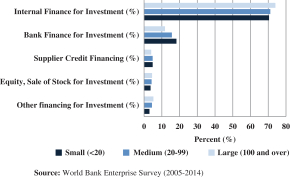

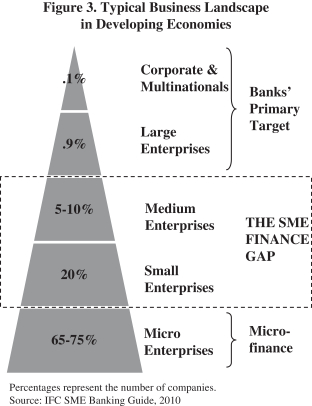

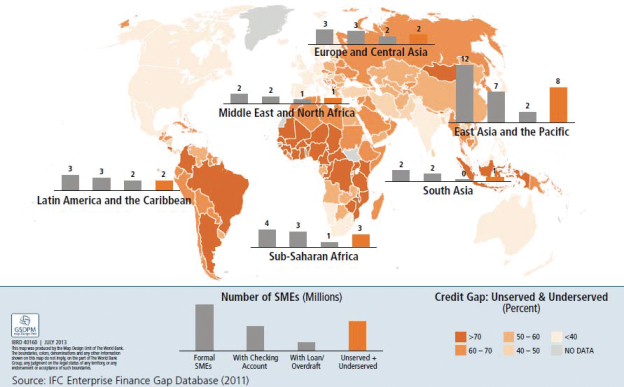

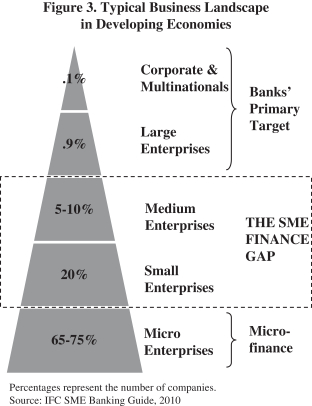

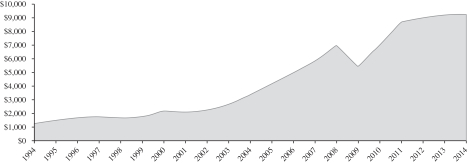

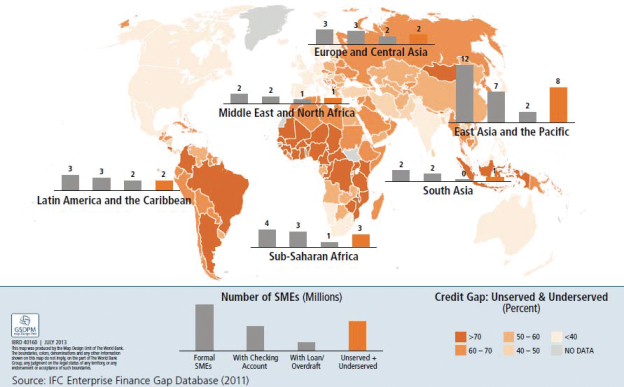

Consistently across countries in the developed and developing world, SMEs account for a significant portion of economic growth and job creation. According to the private sector arm of the World Bank, the International Finance Corporation (“IFC”) in its most recent SME Banking Guide, SMEs account for over half of GDP and over two-thirds of the new jobs in high-income countries. In developing economies, defined as those classified as upper-middle income and below by the World Bank, IFC studies have estimated that there are 25-30 million formal SMEs in operation, representing up to 33% of GDP and up to 45% of formal employment. Despite the economic and social importance of small businesses, there are many obstacles to their growth globally.

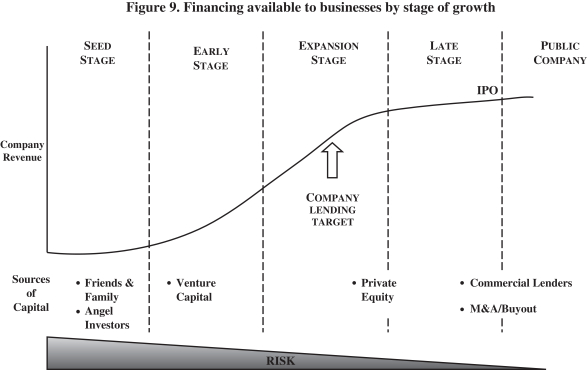

We believe that the underserved nature of such a large segment of the global economy, coupled with a strong demand for capital from the SMEs themselves, has created significant opportunity for investment. Because of the current investing environment, we believe that SMEs are likely to offer attractive investment terms in the form of current cash yield, deferred interest and equity warrants, and more attractive security features such as stricter loan covenants and quality collateral. Additionally, as compared to larger companies, SMEs often have simpler capital structures and carry less debt, thus aiding the structuring and negotiation process and allowing for greater flexibility in structuring favorable transactions.

11

Potential Competitive Strengths

We believe that the following key strengths and potential competitive advantages will enable us to capitalize on the significant opportunities in SME finance around the world.

| | • | | Significant Experience of Management of our Advisor and Sub-Advisors |

The senior management team of our Advisor has a long track record and broad experience in managing and operating regulated, multi-billion dollar fund complexes. Among this experience, members of TriLinc Advisors’ senior management team have held senior executive positions at large global banks, institutional money managers and independent investment advisors. Furthermore, the senior management team has significant experience in global macro portfolio management, including executing multi-manager global macro investment strategies across asset classes, geographies and industries. This experience emphasizes maximizing risk-adjusted returns, utilizing alternative asset classes and hedging portfolio risk exposures, as well as the importance of a rigorous and disciplined approach to manager due diligence. This macro experience is complemented by the experience of our sub-advisors, who have deep local networks, a firm understanding of the local culture and regulatory environment, and a reputation for being high-quality investment partners. The principals of our sub-advisors have collectively deployed more than $42 billion in developing economy debt transactions. These qualities have enabled them to realize solid track records, and afford them access to high quality deal flow to the benefit of the Company.

| | • | | Attractive Return Profile of Asset Classes |

We believe that investments in SME direct loans and SME trade finance globally present the opportunity to generate competitive and stable cash flows and deliver attractive financial returns. Although SMEs are underserved by traditional capital providers like local commercial banks, global financial institutions believe SMEs to be a “key source of profits,” according to the World Economic Forum (“WEF”). Surveys reported in the WEF 2012 Report have indicated that banks globally perceive SME banking as a “large” and “attractive” market that can be more “profitable than serving large companies.” We also provide trade financing to SMEs, an asset class, according to the International Chamber of Commerce (ICC), that has enjoyed stable performance and low default rates in recent years. We believe that SME finance will continue to present an attractive financial opportunity in the coming years, and that we will be well-positioned to identify high-quality borrowers in our target regions.

| | • | | Strategic Relationships and Access to Deal Flow |

Our senior executives have extensive backgrounds in the asset management and investment industry, and along with our sub-advisors, have developed an expansive network of relationships with developing economy private equity and debt managers, bilateral and multilateral DFIs, and international consultancies and service providers that we believe will benefit our portfolio of investments. TriLinc Advisors’ local market sub-advisors are the conduit to country and region-specific deal flow. To be considered for participation, sub-advisors must demonstrate their presence and track record in their geographies, both of which are dependent on their ability to tap their local market networks to source lending opportunities from local SMEs. Since our sub-advisors typically have decades of experience in these markets, they are able to maintain a robust pipeline of potential investments and maintain a high degree of selectivity when evaluating multiple opportunities.

| | • | | Unique Focus, Structure, and Early Mover Advantage |

We have created a unique fund structure that we believe gives U.S. non-accredited investors their first-ever opportunity to invest in a fund dedicated to financing developing economy SMEs. As a public company with access to capital, we believe that we will be uniquely positioned to address the capital shortage problem in global

12

SME finance. In making these investments, we measure and report the economic, social and/or environmental impacts at the borrower and portfolio level. We believe that we are the first retail product that provides this level of transparency and impact reporting to non-accredited investors.

We have taken multiple steps to structure our relationship with TriLinc Advisors so that our interests and those of TriLinc Advisors are closely aligned. TriLinc Advisors will not offer any units it owns for repurchase as long as TriLinc Advisors remains our Advisor. We believe TriLinc Advisors’ incentive compensation structure will align our interests with those of TriLinc Advisors, which will create the conditions to optimize returns and risk tolerance for our unitholders. In addition, by providing primarily debt to SMEs instead of equity, we leave ownership in the hands of the current owners, which encourages responsible growth to protect the value of their equity. Furthermore, we have voluntarily structured the Company with a board of managers, a majority of who are independent, in order to monitor our policies and conflicts.

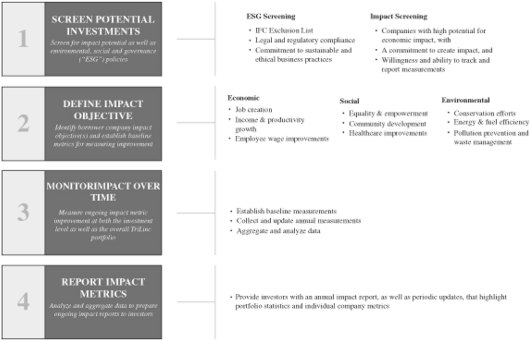

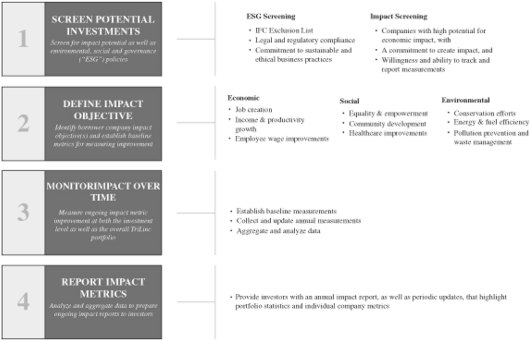

Our Business Strategy and Policies

Our business strategy is to generate competitive financial returns and positive economic, social and/or environmental impact by providing financing to SMEs, primarily in developing economies. Our style of investment is referred to as impact investing, which J.P. Morgan Global Research and Rockefeller Foundation in a 2010 report called “an emerging alternative asset class” and defined as investing with the intent to create positive impact beyond financial return. We believe it is possible to generate competitive financial returns while creating positive, measurable impact. We measure the economic, social and environmental impact of our investments using industry-standard metrics, and intend to report using the Impact Reporting and Investment Standards, or IRIS. Through our investments in SMEs, we believe we are enabling job creation and stimulating economic growth.

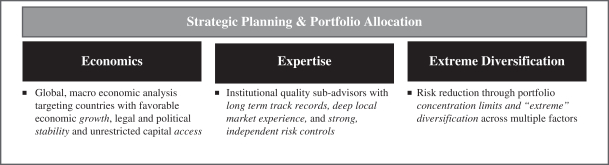

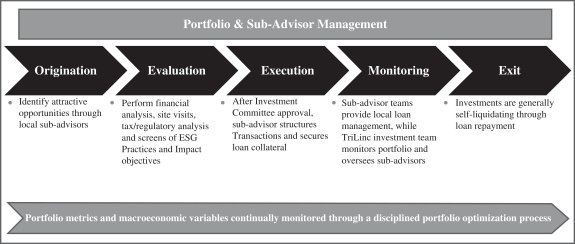

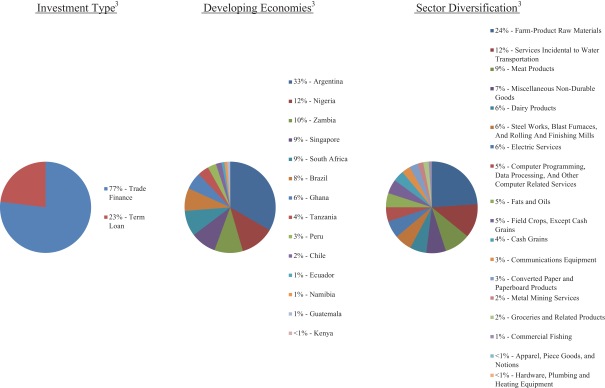

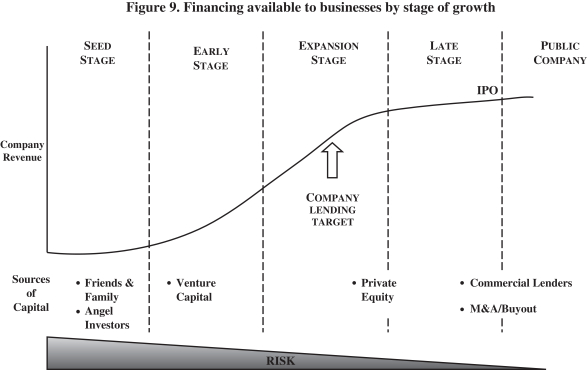

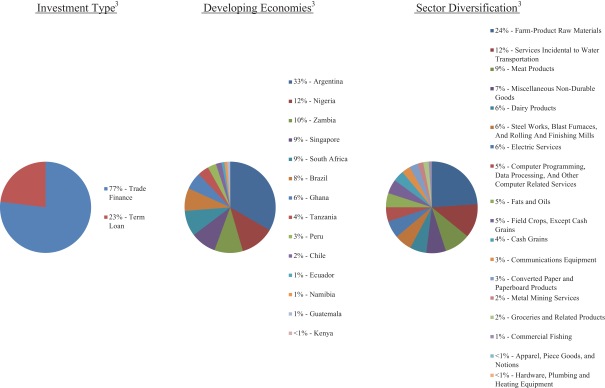

Our investment objectives are to provide our unitholders current income, capital preservation and modest capital appreciation. This is achieved primarily through SME trade finance and term loan financing, while employing rigorous risk-mitigation and due diligence practices, and transparently measuring and reporting the economic, social and/or environmental impacts of our investments. The majority of our investments are, and we expect will continue to be, senior secured trade finance, senior secured loans and other collateralized loans or loan participations to SMEs with established, profitable businesses in developing economies. With our sub-advisors, we expect to provide growth capital financing generally ranging in size from $5-15 million per transaction for direct SME loans and $500,000 to $5 million for trade finance transactions. We seek to protect and grow investor capital by: (1) targeting countries with favorable economic growth and investor protections; (2) partnering with sub-advisors with significant experience in local markets; (3) focusing on creditworthy lending targets which have at least 3-year operating histories and demonstrated cash flows enabling loan repayment; (4) making primarily debt investments, backed by collateral and borrower guarantees; (5) employing best practices in our due diligence and risk mitigation processes; and (6) monitoring our portfolio on an ongoing basis.

Our goal is to create a diversified portfolio of primarily private debt instruments, including trade finance and term loans, whose counterparties are small and medium-size businesses in developing economies. Private debt facilities generate current income and, in some cases, offer the potential for modest capital appreciation, while maintaining a higher place in a company’s capital structure than the equity held by the owners and other investors. It is expected that, as small and growing businesses, our borrowers will use capital to expand operations, improve the financial standing of their operations, or finance the trade of their goods with other markets. According to the most recent IFC SME Banking Guide, SMEs have been shown to improve job creation and GDP growth throughout the world, and, based on our underwriting criteria, we expect the portfolio of our

13

investments to have a positive, measurable impact in their communities, in addition to offering a competitive financial return to the investor.

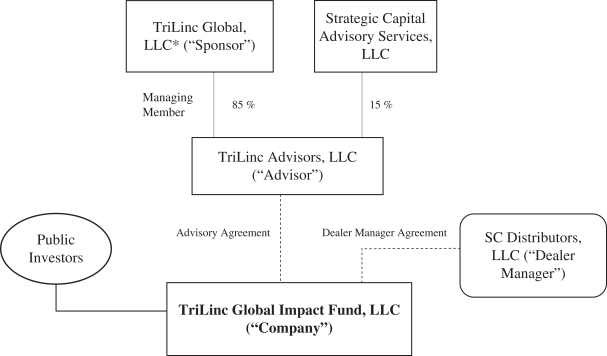

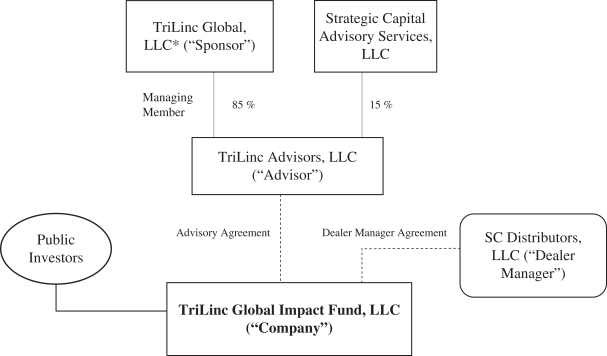

Our Corporate Structure

Our anticipated organizational structure is as follows:

| * | Gloria S. Nelund owns 33.97% of the equity interest in the Sponsor. |

Risk Factors

An investment in our units involves a high degree of risk and may be considered speculative. You should carefully consider the information found in “Risk Factors” before deciding to invest in our units. The following are some of the risks you will take in investing in our units:

| | • | | This is a “blind pool” offering because, other than the investments we have made, we have not identified what future investments we will make with the net proceeds of this offering. You will not be able to evaluate our future investments prior to purchasing units. We may change our investment policies without unitholder consent, which could result in investments that are different from those described in this prospectus. |

| | • | | We may not achieve investment results that will allow us to make distributions on a monthly basis or at a specified level of cash distributions. |

| | • | | We may pay distributions from any source and there are no limits on the amount of proceeds we may use to fund distributions. Until the proceeds from this offering are fully invested and from time to time during our operational stage, we may not generate sufficient cash flow from operations to fund distributions. If we pay distributions from sources other than our cash flow from operations, we will have less funds available for the investments, and your overall return may be reduced. |

14

| | • | | We are dependent upon our key management personnel and the key management personnel of our Advisor, and on the continued operations of our Advisor, for our future success. |

| | • | | We have made and intend to continue to make non-U.S. investments which involve certain legal, geopolitical, investment, repatriation, and transparency risks not typically associated with U.S. investments. |

| | • | | There are substantial conflicts among the interests of our investors, our interests and the interests of our Advisor, dealer manager and their respective affiliates regarding compensation, investment opportunities and management resources. The fees we pay to affiliates were not determined on an arms-length basis. |

| | • | | Since this is a “best-efforts” offering, there is neither any requirement, nor any assurance, that a certain offering amounts will be raised. |

| | • | | The units sold in this offering will not be listed on an exchange for the foreseeable future, if ever. Therefore, if you purchase units in this offering, it will be difficult for you to sell your units and, if you are able to sell your units, you will likely sell them at a substantial discount. |

| | • | | We established the current offering price for our units on an arbitrary basis and the offering price may not accurately reflect the value of our assets. |

| | • | | We have limited operating history. We are subject to all of the business risks and uncertainties associated with any new business, including the risk that we will not achieve our investment objectives and that the value of units could decline substantially. |

| | • | | Our investment objectives provide for substantial investment diversification amongst countries, regions and individual borrowers. There is no assurance that we will be able to achieve our stated targets for portfolio diversification. |

| | • | | Our ability to achieve our investment objectives depends on our Advisor’s ability to manage and support our investment process and to choose appropriate sub-advisors. If our Advisor were to lose any members of its senior management team, our ability to achieve our investment objectives could be significantly harmed. |

| | • | | We will be subject to risks incident to making loans to small and medium sized enterprises in developing countries. |

| | • | | You will experience substantial dilution in the net tangible book value of your units equal to the offering costs associated with your units. |

Our Advisor

TriLinc Advisors, a Delaware limited liability company, manages our investments. TriLinc Advisors is a private investment advisory firm focusing on impact investments in SMEs around the world. TriLinc Advisors is a registered investment adviser under the Investment Advisors Act of 1940, as amended. Led by its Chief Executive Officer, President and Chief Compliance Officer Gloria Nelund, Brent VanNorman, its Chief Operating Officer and Chief Financial Officer, and Paul Sanford, its Chief Investment Officer, TriLinc Advisors’ management team has a long track record and broad experience in the management of regulated, multi-billion dollar fund complexes and global macro portfolio management. TriLinc Advisors and our sub-advisors have an extensive network of relationships with emerging market private equity and debt managers, bilateral and multilateral DFIs, and international consultancies and service providers that we believe will benefit our portfolio of investments. We benefit from both the top-down, global macro investing approach of TriLinc Advisors and its affiliates and the bottom-up deal sourcing and structuring of our sub-advisors. TriLinc Advisors receives certain management and incentive fees and expense reimbursements for services relating to this offering and the investment and management of our assets. See “— Compensation of the Dealer Manager and Our Advisor” below.

15

TriLinc Advisors is a joint venture between TriLinc Global, LLC, or TriLinc Global, and Strategic Capital Advisory Services, LLC, or Strategic Capital. The purpose of the joint venture is to permit our Advisor to capitalize upon the expertise of the TriLinc management team as well as the experience of the executives of Strategic Capital in providing advisory services in connection with the formation, organization, registration and operation of entities similar to the Company. Strategic Capital provides certain services to, and on behalf of, our Advisor, including but not limited to formation and advisory services related to our formation and the structure of this offering, financial and strategic planning advice and analysis, overseeing the development of marketing materials, selecting and negotiating with third party vendors and other administrative and operational services. Pursuant to the joint venture agreement and its ownership in TriLinc Advisors, Strategic Capital is entitled to receive distributions equal to 15% of the gross cash proceeds received by TriLinc Advisors from the management and incentive fees payable by us to TriLinc Advisors under the Advisory Agreement. These distributions are for bona fide services performed by Strategic Capital for TriLinc Advisors in accordance with its ownership percentage and is not underwriting compensation.

On May 15, 2012, TriLinc Advisors purchased 22,161 Class A units for aggregate gross proceeds of $200,000. In addition, our Sponsor had purchased through June 13, 2013, an additional 321,329.639 Class A units for aggregate gross proceeds of $2,900,000 to further align its interests with the interests of the investors. Certain investors in the Sponsor, including, Baldwin Brothers, Inc. and Chilton Capital Management LLC, provided funds for this investment.

Our Sponsor

TriLinc Global serves as our Sponsor and is the managing member of our Advisor with the right to control the activities of our Advisor, except with respect to certain major decisions. TriLinc Global is a private asset management company that invests capital in small and mid-sized businesses in developing economies globally through a series of impact-focused investment funds. TriLinc Global’s primary goal across its business platforms is to provide access to impact investments with potential for both competitive financial returns and positive, measurable global impact through the alternative investment products it creates. TriLinc Global believes it is differentiated from other impact investors in both its focus on generating investor returns in line with broader commercial markets and its ability to deliver quantitative reporting on the impact generated through its investments.

Our Dealer Manager

SC Distributors, LLC, or SC Distributors, a Delaware limited liability company formed in March 2009, serves as our dealer manager for this offering. Strategic Capital is an affiliate of our dealer manager and has an equity interest in our Advisor. Our dealer manager is a member firm of the Financial Industry Regulatory Authority, or FINRA, and is located at 695 Town Center Drive, Suite 600, Costa Mesa, California 92626. Our dealer manager receives dealer manager fees, selling commissions, distribution fees with respect to Class C units, and certain reimbursements for services relating to this offering. See “— Compensation of the Dealer Manager and Our Advisor” below.

Classes of Units

Class A Units

Each Class A unit issued in the primary offering is subject to a sales commission of up to 7.00% per unit and a dealer manager fee of up to 2.75% per unit. We do not pay sales commissions or dealer manager fees on Class A units sold pursuant to our distribution reinvestment plan. Class A units are available for purchase by the general public through different distribution channels. In addition, our executive officers and board of managers and their immediate family members, as well as officers and employees of our Advisor and other affiliates of our

16

Advisor and their immediate family members and, if approved by our board of managers, joint venture partners, consultants and other service providers may only purchase Class A units.

Class C Units

Each Class C unit issued in the primary offering is subject to a sales commission of up to 3.00% per unit and a dealer manager fee of up to 2.75% per unit. In addition, for Class C units, we pay our dealer manager on a monthly basis a distribution fee that accrues daily equal to 1/365th of 0.80% of the amount of the net asset value for the Class C units for such day on a continuous basis from year to year. The payment of distribution fees with respect to Class C units out of cash otherwise distributable to Class C unitholders results in a lower amount of distributions being paid with respect to Class C units. We do not pay sales commissions or dealer manager fees on Class C units sold pursuant to our distribution reinvestment plan. Class C units are available for purchase by the general public through different distribution channels.

Class I Unit

No selling commission is paid for sales of any Class I units, and we do not pay our dealer manager a distribution fee with respect to the Class I units. Each Class I unit is subject to a dealer manager fee of up to 1.75% per unit. Class I units are available for purchase to certain institutional clients.

Other than the differing fees with respect to each class described above and the payment of a distribution fee out of cash otherwise distributable to Class C unitholders, Class A units, Class C units, and Class I units have identical rights and privileges, such as identical voting rights. The net proceeds from the sale of all three classes of units are commingled for investment purposes and all earnings from all of the investments proportionally accrue to each unit regardless of the class.

In addition, the net asset value per unit is calculated in the same manner for each unit of any class and the net asset value per unit of any class is the same. In the event of any voluntary or involuntary liquidation, dissolution or winding up of the Company, or any liquidating distribution of our assets, such assets, or the proceeds thereof, will be distributed among all the unitholders in proportion to the number of units held by such holder. See “Description of Units and Our Operating Agreement” for more details regarding our classes of units.

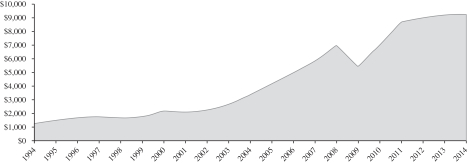

The Offering

We are offering up to $1,500,000,000 in our units, $1,250,000,000 of which are being offered to the public at a price based on the most recent valuation, plus related selling commissions, dealer manager fees and organization and offering expenses and $250,000,000 of which are being offered pursuant to our distribution reinvestment plan at a price equal to our then current offering price per each class of units, less the sales fees associated with that class of units in the primary offering. Until the price of units changes pursuant to such a valuation, we will sell units on a continuous basis at a price of $10.00 per Class A unit, $9.576 per Class C unit and $9.186 per Class I unit. In May, 2012, our Advisor purchased 22,160.665 Class A units for aggregate gross proceeds of $200,000. On June 11, 2013, our Sponsor purchased $2.4 million in Class A units and on June 13, 2013, our Sponsor purchased an additional $500,000 in Class A units. Certain investors in the Sponsor, including Baldwin Brothers, Inc. and Chilton Capital Management LLC, provided funds for this investment. Therefore, as of June 11, 2013, we had raised sufficient offering proceeds to satisfy the minimum offering requirements for our initial public offering with respect to all states other than the state of Pennsylvania and we commenced operations. As of March 31, 2016, we had raised gross proceeds of approximately $189.4 million from the sale of approximately 19.7 million units of our limited liability company interest, including units issued pursuant to our distribution reinvestment plan. As of March 31, 2016, $1.31 billion in units remained available for sales pursuant to this offering, including approximately $245.0 million in units available pursuant to our distribution reinvestment plan.

17

We are publicly offering three classes of units: Class A units, Class C units and Class I units. The unit classes have different selling commissions and dealer manager fees and there is an ongoing distribution fee with respect to Class C units. We are offering to sell any combination of Class A, Class C and Class I units with a dollar value up to the maximum offering amount. We reserve the right to reallocate the units between Class A, Class C and Class I and between the primary offering and our distribution reinvestment plan.

On November 20, 2015, we filed a registration statement on Form S-1 with the SEC in connection with the proposed offering of up to $1.15 billion in units of our limited liability company interest, including $150.0 million in units to be issued pursuant to our distribution reinvestment plan (the “Follow-On Offering”). As of the date of this prospectus, the registration statement for the Follow-On Offering has not been declared effective by the SEC. The Follow-On Offering will only commence after the termination of this offering.

The offering commenced on February 25, 2013. We may sell the units in this offering until December 31, 2016; however, we may decide to extend this offering,, or we may terminate the offering earlier. In some states, we will need to renew our registration annually in order to continue offering units.

Valuations

Our board of managers has established procedures for the valuation of our investment portfolio, which commenced the third quarter of 2013. Our net asset value is determined by our board of managers based on the input of our Advisor, our audit committee, an opinion of Duff & Phelps, LLC as to the reasonableness of our internal estimates of fair value of selected loans, and, if engaged by our board of managers, one or more independent valuation firms. We may value our investments using different valuation approaches. For more information regarding our valuation process and approaches, see “Business — Valuations.” If our net asset value increases above or decreases below our net proceeds per unit as stated in this prospectus, we will adjust the offering prices of units to ensure that after the effective date of the new offering prices no unit is sold at a price, after deduction of selling commissions, dealer manager fees and organization and offering expenses, that is above or below our net asset value per unit as of the most recent valuation date. See “Plan of Distribution.” We will supplement the prospectus or file an amendment to the registration statement with the SEC, as appropriate, if we adjust the prices of our units because our net asset value per unit increases or decreases from the amount of the net proceeds per unit as stated in the prospectus. We will include in any such prospectus supplement or amendment the new offering price as well as how each class of assets in our investment portfolio was valued. New offering prices will be effective five business days after the board of managers determines to set new prices and we publicly disclose such prices.

Based on our net asset value of $138,620,607 as of December 31, 2015, our board of managers has determined that no change to the offering price of our units is required and we are continuing to sell our units at their original price of $10.00 per Class A unit, $9.576 per Class C unit and $9.186 per Class I unit. Our estimated net asset value was determined in accordance with the procedures set forth above. Our net asset value and the offering prices would have decreased if the Sponsor had not made a capital contribution in the amount of $51,034 in the quarter ended December 31, 2013 and $31,750 in the quarter ended March 31, 2014, or had not absorbed and deferred reimbursement for a substantial portion of our operating expenses since we began our operations. As of December 31, 2015, our Sponsor has agreed to pay a cumulative total of approximately $7.5 million of operating expenses.

Estimated Use of Proceeds

Assuming that 1/3 of the primary offering gross proceeds come from sales of Class A units, 1/3 of primary offering gross proceeds come from sales of Class C units and 1/3 of primary offering gross proceeds come from sales of Class I units and all of the units available for the distribution reinvestment plan are sold if we sell the maximum offering, our management team expects to invest approximately 89.25%, if only the minimum offering

18

is sold, to 93.96%, if the maximum offering is sold, of the gross offering proceeds to make investments in accordance with our investment objectives and by following the strategies described in this prospectus. If all of our gross offering proceeds come from sales of Class A units, we expect to invest approximately 85.25%, if only the minimum offering is sold, to 90.63%, if the maximum offering is sold, of the gross offering proceeds. If gross proceeds are split evenly among the three classes of units (Classes A, C and I) and we only raise $750 million in this offering, we expect to invest approximately 92.58% and if we only raise $200 million in this offering, we expect to invest approximately 89.25%. If all of our gross offering proceeds come from sales of Class A units and we only raise $750 million in the offering, we expect to invest approximately 88.58%, and if we only raise $200 million in this offering, we expect to invest approximately 85.25%. The actual percentage of offering proceeds used to make investments will depend on the number of primary units sold and the number of units sold pursuant to our distribution reinvestment plan as well as whether we sell more or less than we have assumed of Class A units, Class C units or Class I units and actual organization and offering expenses incurred. See “Estimated Use of Proceeds.”

Suitability Standards

Pursuant to applicable state securities laws, units offered through this prospectus are suitable only as a long-term investment for persons of adequate financial means who have no need for liquidity in this investment. There is not expected to be any public market for the units, which means that investors will likely have limited ability to sell their units. As a result, we have established suitability standards which require investors to have either (i) a net worth (not including home, furnishings, and personal automobiles) of at least $70,000 and an annual gross income of at least $70,000, or (ii) a net worth (not including home, furnishings, and personal automobiles) of at least $250,000. These minimum net worth and investment levels may be higher in certain states, so you should carefully read the more detailed description under “Suitability Standards” above.

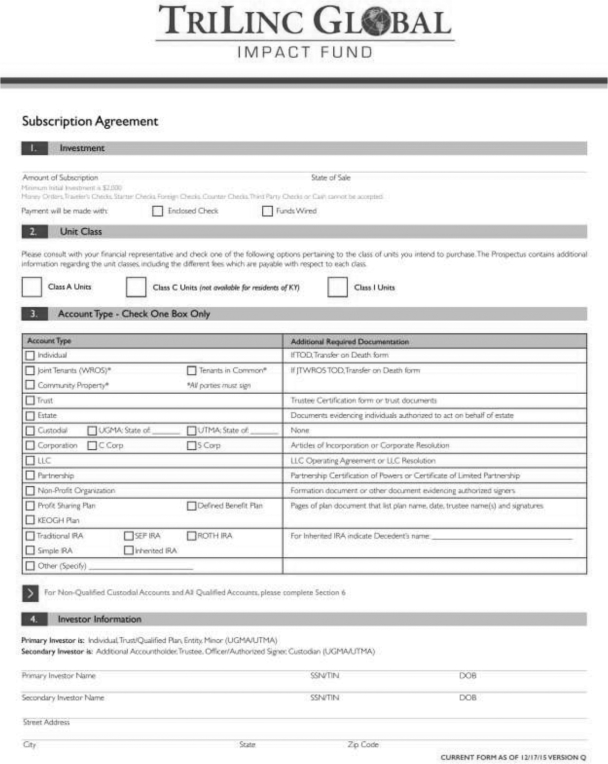

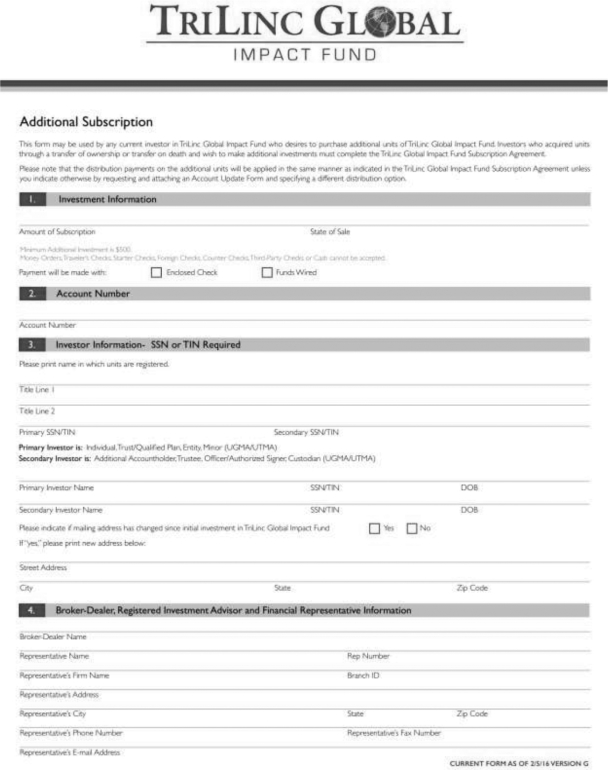

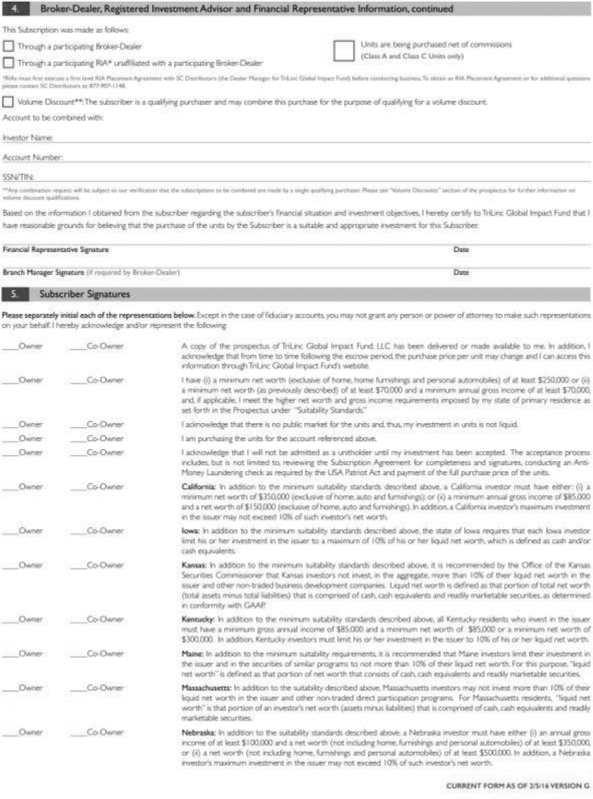

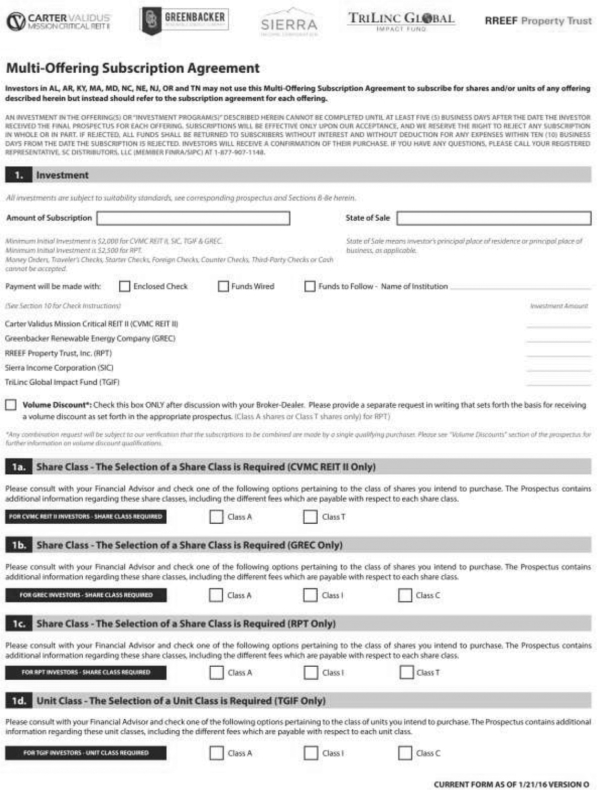

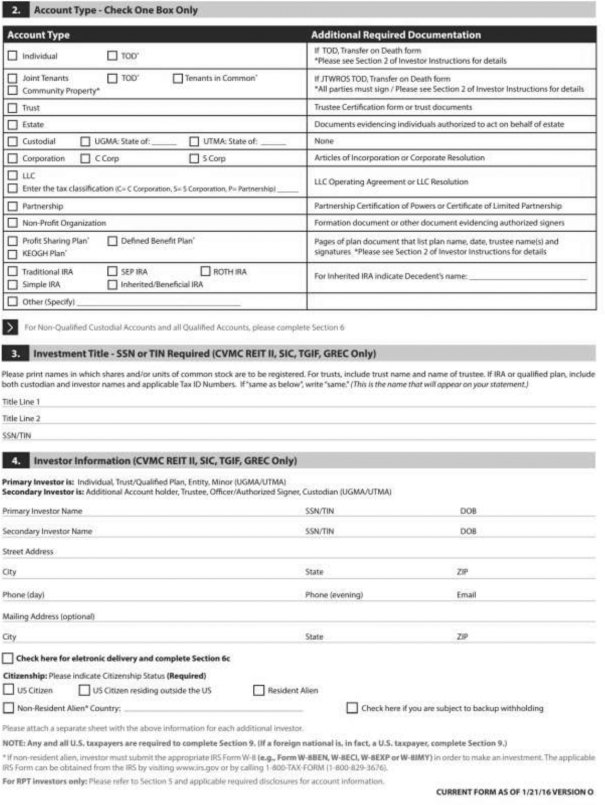

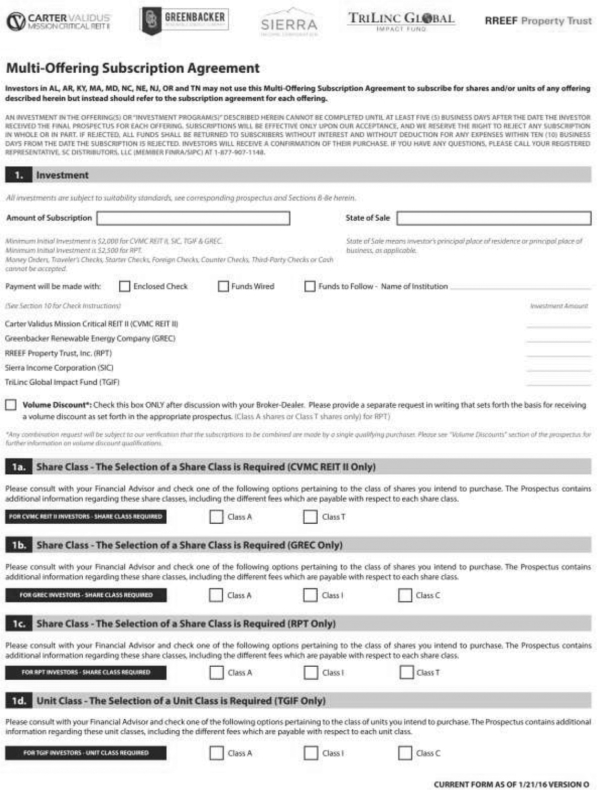

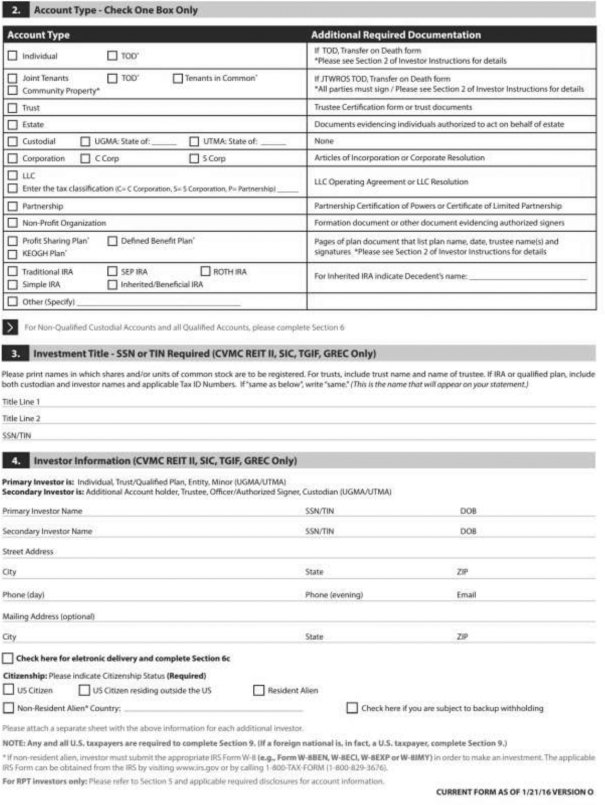

How to Subscribe

Investors who meet the suitability standards described herein may purchase our units. Investors seeking to purchase our units should proceed as follows:

| | • | | Read this entire prospectus and all appendices and supplements accompanying this prospectus. |

| | • | | Complete the execution copy of the subscription agreement. A specimen copy of the subscription agreement, including instructions for completing it, is included in this prospectus as Appendix B. |

| | • | | Deliver a check for the full purchase price of the units being subscribed for along with the completed subscription agreement to the participating broker-dealer. You should make your check payable to “TriLinc Global Impact Fund, LLC.” After you have satisfied the applicable minimum purchase requirement, additional purchases must be for the minimum of $500, except for purchases made pursuant to our distribution reinvestment plan. |

| | • | | By executing the subscription agreement and paying the total purchase price for the units subscribed for, each investor attests that he or she meets the suitability standards as stated in the subscription agreement and agrees to be bound by all of the terms of our operating agreement. |

Subscriptions are effective only upon our acceptance, and we reserve the right to reject any subscription in whole or in part. Subscriptions are accepted or rejected within 10 business days of receipt of each completed subscription agreement by us and, if rejected, all funds shall be returned to subscribers without interest and without deduction for any expenses within 10 business days from the date the subscription is rejected. We are not permitted to accept a subscription for the units until at least five business days after the date you receive the final prospectus. If we accept your subscription, our transfer agent will mail you a confirmation of acceptance.

19