Filed Pursuant to Rule 424(b)(3)

Registration No. 333-185676

TRILINC GLOBAL IMPACT FUND, LLC

SUPPLEMENT NO. 2 DATED JUNE 9, 2016

TO THE PROSPECTUS DATED APRIL 28, 2016

This prospectus supplement (“Supplement”) is part of and should be read in conjunction with the prospectus of TriLinc Global Impact Fund, LLC (the “Company”), dated April 28, 2016, as supplemented by Prospectus Supplement No. 1, dated May 11, 2016 (the “Prospectus”). Unless otherwise defined herein, capitalized terms used in this Supplement shall have the same meanings as in the Prospectus.

The purposes of this Supplement are as follows:

| A. | To provide information regarding our public offering; |

| B. | To provide information regarding distributions declared; |

| C. | To update the section of the Prospectus titled “Business;” |

| D. | To include our Quarterly Report on Form 10-Q for the quarter ended March 31, 2016; and |

| E. | To update the form of our subscription agreement in Appendix B to the Prospectus. |

| A. | Status of Our Public Offering |

As of June 7, 2016, we had raised gross proceeds of approximately $213.3 million from the sale of approximately 21.6 million units of our limited liability company interest, including units issued pursuant to our distribution reinvestment plan.

| B. | Declaration of Distributions |

On May 6, 2016, with the authorization of our board of managers, the Company declared distributions for all classes of units for the period from May 1 through May 31, 2016. These distributions were calculated based on unitholders of record for each day in an amount equal to $0.00197268 per unit per day (less the distribution fee with respect to Class C units). On June 1, 2016, $696,872 of these distributions were paid in cash and on May 31, 2016, $554,319 were reinvested in the Company’s units for those investors participating in the Company’s unit Distribution Reinvestment Plan. Some or all of the Company’s distributions have been and may continue to be paid from sources other than cash flow from operations, such as capital contributions from the Sponsor, cash resulting from a waiver or deferral of fees, and/or proceeds from this offering.

| C. | Update to the Section Titled “Business” |

| 1. | The following information updates and supplements the “Business—Investments—Overview” section of the Prospectus to provide certain information regarding the Company’s investment portfolio as of May 31, 2016: |

Investments

Since the Company commenced operations and through May 31, 2016, the Company has funded $327.5 million in aggregate investments, including $23 million in temporary investments. Of the aggregate investment amount, the Company has received $161 million in full aggregate transaction repayments from existing and exited trade finance, term loan, and temporary investment facilities. Of the aggregate transaction repayment amount, approximately $79 million represents transactions of trade finance, term loan, and temporary investment facilities that are closed and no longer part of the Company’s portfolio.

As of May 31, 2016 the Company had the following investments:

| | | | | | | | | | | | | | | | | | | | | | |

| Description | | Sector | | Country | | Investment

Type | | Maturity1 | | Interest

Rate2 | | | Total Loan

Commitment3 | | | Total

Amount

Outstanding4 | | | Primary Impact

Objective |

| Agriculture Distributor | | Farm-Product

Raw Materials | | Argentina | | Trade

Finance | | 9/30/2016 | | | 9.00 | % | | $ | 15,000,000 | | | $ | 15,000,000 | | | Job Creation |

| | | | | | | | |

| Agricultural Products Exporter II | | Farm-Product

Raw Materials | | Singapore5 | | Trade

Finance | | 6/1/2016 | | | 11.50 | % | | $ | 10,000,000 | | | $ | 10,000,000 | | | N/A6 |

| | | | | | | | |

| Agricultural Supplies Distributor II | | Miscellaneous

Non-Durable

Goods | | South

Africa | | Trade

Finance | | 5/30/2016 | | | 10.38 | % | | $ | 10,000,000 | | | $ | 316,370 | | | Job Creation |

| | | | | | | | |

| Beef Exporter | | Meat Products | | Argentina | | Trade

Finance | | 4/30/2016 | | | 11.98 | % | | $ | 9,000,000 | | | $ | 9,000,000 | | | Job Creation |

| | | | | | | | |

| Chia Seed Exporter | | Field Crops,

Except Cash

Grains | | Chile | | Trade

Finance | | 12/11/2016 | | | 11.50 | % | | $ | 2,000,000 | | | $ | 1,900,000 | | | Agricultural

Productivity |

| | | | | | | | |

| Consumer Goods Distributor | | Groceries and

Related Products | | Namibia | | Trade

Finance | | 3/3/2016 | | | 12.00 | % | | $ | 2,000,000 | | | $ | 1,000,000 | | | Job Creation |

| | | | | | | | |

| Dairy Co-Operative | | Dairy Products | | Argentina | | Trade

Finance | | 7/29/2016 | | | 10.67 | % | | $ | 6,000,000 | | | $ | 6,000,000 | | | Job Creation |

| | | | | | | | |

| Diaper Manufacturer | | Converted Paper

and Paperboard

Products | | Peru | | Term Loan | | 6/15/2017 | | | 14.16 | %7 | | $ | 3,700,000 | | | $ | 3,250,000 | | | Job Creation |

| | | | | | | | |

| Electronics Assembler8 | | Communications

Equipment | | South

Africa | | Trade

Finance | | 8/23/2016 | | | 13.00 | % | | $ | 11,000,000 | | | $ | 5,784,581 | | | Job Creation |

| | | | | | | | |

| Farm Supplies Distributor | | Miscellaneous

Non-Durable

Goods | | Zambia | | Trade

Finance | | 5/3/2016 | | | 12.43 | % | | $ | 10,000,000 | | | $ | 5,078,526 | | | Job Creation |

| | | | | | | | |

| Fish Processor & Exporter | | Commercial

Fishing | | Ecuador | | Trade

Finance | | 6/19/2016 | | | 9.00 | % | | $ | 2,000,000 | | | $ | 896,328 | | | Job Creation |

| | | | | | | | |

| Fruit & Nut Distributor | | Groceries and

Related Products | | South

Africa | | Trade

Finance | | 5/22/20159 | | | 17.50 | % | | $ | 1,250,000 | | | $ | 656,960 | | | Job Creation |

| | | | | | | | |

| Hospitality Service Provider10 | | Hotels and

Motels | | Cape

Verde | | Term Loan | | 8/21/2021 | | | 13.50 | % | | $ | 17,000,000 | | | $ | 17,000,000 | | | Job Creation |

| | | | | | | | |

| Integrated Steel Producer | | Steel Works,

Blast Furnaces,

and Rolling and

Finishing Mills | | Zambia | | Trade

Finance | | 8/13/2016 | | | 13.00 | % | | $ | 6,000,000 | | | $ | 6,000,000 | | | Job Creation |

| | | | | | | | |

| International Development Logistics Provider11 | | Lumber and

Other

Construction

Materials | | Italy | | Trade

Finance | | 10/12/2016 | | | 8.50 | % | | $ | 5,000,000 | | | $ | 4,284,308 | | | Access to New

Markets |

| | | | | | | | |

| IT Service Provider | | Computer

Programming

and Data

Processing | | Brazil | | Term Loan | | 10/31/2019 | | | 13.50 | % | | $ | 14,000,000 | | | $ | 6,641,897 | | | Job Creation |

| | | | | | | | |

| Marine Logistics Provider | | Services

Incidental to

Water

Transportation | | Nigeria | | Term Loan | | 9/16/2020 | | | 15.59 | %12 | | $ | 16,050,000 | | | $ | 12,719,299 | | | Capacity-

Building |

| | | | | | | | |

| Meat Processor II13 | | Meat Products | | South

Africa | | Trade

Finance | | 3/17/2017 | | | 14.50 | % | | $ | 2,800,000 | | | $ | 1,250,000 | | | Job Creation |

| | | | | | | | |

| Metals Trader | | Metals and

Minerals, Except

Petroleum | | United

Kingdom | | Trade

Finance | | 9/27/2016 | | | 9.45 | % | | $ | 2,000,000 | | | $ | 2,000,000 | | | N/A6 |

| | | | | | | | |

| Mine Remediation Company | | Metal Mining

Services | | South

Africa | | Trade

Finance | | 8/15/2016 | | | 17.50 | % | | $ | 2,500,000 | | | $ | 2,500,000 | | | Job Creation |

| | | | | | | | |

| Oilseed Distributor | | Fats and Oils | | Argentina | | Trade

Finance | | 12/15/2016 | | | 8.75 | % | | $ | 6,000,000 | | | $ | 6,000,000 | | | Job Creation |

| | | | | | | | |

| Power Producer | | Electric Services | | Ghana | | Trade

Finance | | 3/10/2017 | | | 11.50 | % | | $ | 11,500,000 | | | $ | 11,500,000 | | | Access to

Energy |

| | | | | | | | | | | | | | | | | | | | |

| Description | | Sector | | Country | | Investment

Type | | Maturity1 | | Interest

Rate2 | | Total Loan

Commitment3 | | | Total

Amount

Outstanding4 | | | Primary

Impact

Objective |

| Railway Equipment Provider14 | | Rental of

Railroad Cars | | South

Africa | | Term Loan | | 1/31/2020 | | 12.00% | | $ | 5,000,000 | | | $ | 4,570,619 | | | Productivity and

Competitiveness

Improvement |

| | | | | | | | |

| Sesame Seed Exporter15 | | Farm-Product

Raw Materials | | Guatemala | | Trade

Finance | | 3/31/2016 | | 12.00% | | $ | 2,000,000 | | | $ | 1,000,000 | | | Agricultural

Productivity |

| | | | | | | | |

| Sugar Producer16 | | Field Crops,

Except Cash

Grains | | Brazil | | Term Loan | | 5/15/2017 | | 17.43% | | $ | 3,000,000 | | | $ | 3,000,000 | | | Capacity-

Building |

Investment Portfolio Total | | | | | | | | | $174,800,000 | | | | $137,348,888 | | | |

| | | | | | |

Temporary Investments17 | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Description | | Sector | | Country | | Investment

Type | | Maturity | | | Interest

Rate | | | Total Loan

Commitment | | | Total

Amount

Outstanding | | | Primary

Impact

Objective |

| Agricultural Products Exporter II | | Farm-Product

Raw Materials | | Singapore | | Bridge

Loan | | | 5/21/2016 | | | | 11.67 | % | | $ | 5,000,000 | | | $ | 5,000,000 | | | N/A |

| | | | | | | | |

| Financial Services Provider II | | Miscellaneous

Business Credit

Institutions | | Mauritius | | Promissory

Note18 | | | 5/21/2016 | | | | 12.00 | % | | $ | 15,000,000 | | | $ | 15,000,000 | | | N/A |

Temporary Investments Total | | | | | | | | | | | | $ | 20,000,000 | | | $ | 20,000,000 | | | |

Investment Portfolio and

Temporary Investments Totals | | | | | | | | | | | | $ | 194,800,000 | | | $ | 157,348,888 | | | |

| 1 | The Company’s trade finance borrowers may be granted flexibility with respect to repayment relative to the stated maturity date to accommodate specific contracts and/or business cycle characteristics. This flexibility in each case is agreed upon between the Company and the sub-advisor and between the sub-advisor and the borrower. |

| 2 | Interest rates are as of May 31, 2016 and, where applicable, are weighted averages amongst multiple transactions. Interest rates include contractual rates and accrued fees where applicable. |

| 3 | The total loan commitment represents the maximum amount that can be borrowed under the agreement. The actual amount drawn on the loan by the borrower may change over time. Loan commitments are subject to availability of funds and do not represent a contractual obligation to provide funds to a borrower. |

| 4 | The total amount outstanding represents the actual amount borrowed under the loan as of May 31, 2016. In some instances where there is a $0 balance, the borrower may have paid back the original amount borrowed under a trade finance facility and under an agreement, may borrow again. |

| 5 | The transaction is secured by specific collateral held by the borrower’s subsidiaries in Kenya, Tanzania, and Mozambique. |

| 6 | Impact data is not tracked for this investment. The Company does not track impact data for trade finance transactions that meet standard underwriting guidelines, but generally have the maturity of less than one year and involve borrowers with whom, at the time of funding, the Company does not expect to maintain an ongoing lending relationship or otherwise provide an open loan facility. |

| 7 | The interest rate includes 2.50% of deferred interest. |

| 8 | On May 25, 2016, the Company funded $1,500,000 as part of an existing $11,000,000 revolving senior secured trade finance facility with a South African electronics company that assembles affordable cellular phones and televisions. With a fixed interest rate of 13.00%, the transaction is set to mature on August 23, 2016 and is secured by the specific inventory. The borrower anticipates that the Company’s financing will support its continued growth efforts and create more jobs, particularly among the country’s female population, while increasing the supply of affordable devices in the region. |

| 9 | The Company, together with its sub-advisor, have agreed to further extend the principal maturity date to facilitate the strategic sale of the Fruit & Nut Distributor, which is expected to close on or before June 30, 2016. |

| 10 | On May 27, 2016, the Company funded $17,000,000 as part of a new senior secured term loan to a hospitality service provider operating in Cape Verde. With an interest rate of 10.00% plus 3.50% in deferred interest and a maturity date of August 21, 2021, the Company’s financing will enable the borrower to execute its growth plan and develop two new hotel resort properties located throughout Cape Verde’s archipelago. Secured through a combination of first and second lien pledges over key assets and contracts, the transaction also includes the option to exercise certain warrants (1.50% of the common shares of the borrower) at loan maturity. The borrower anticipates that the Company’s timely financing will support both temporary and permanent job creation as well as the transfer of knowledge and skills in hospitality best practices to the local labor force. |

| 11 | On May 10, 2016, the Company funded $184,308 as part of an existing $5,000,000 senior secured pre-export trade finance facility to an Italian international development logistics provider contracted by the United Nations to consolidate and ship prefabricated housing units and materials for UN mission personnel throughout Africa. With an interest rate of 8.50% plus six month Euribor (if positive) and secured by UN purchase orders, the Company’s financing will allow the borrower access to new markets and continue supporting the UN’s operations across Sub-Saharan Africa. This transaction is set to mature on October 12, 2016. For companies located in developed markets, the Company provides trade financing transactions involving exports/imports for enterprises located in developing economies. The borrower’s operating entity is an Italian-headquartered company engaged in the provision of international development logistics services. The United Kingdom was originally disclosed as the borrower’s country location given that a United Kingdom-domiciled holding company was purposely created to provide structural enhancements to the transaction. |

| 12 | The interest rate is a variable rate of one month Libor +10.5% plus 4.68% in deferred fixed interest. |

| 13 | Between May 20 and May 24, 2016, the Company funded two separate transactions totaling $1,250,000 as part of an existing $2,800,000 revolving senior secured trade finance facility to a vertically-integrated South African meat processing company. With a fixed interest rate of 14.50% and maturity date of March 17, 2017, both transactions are secured by livestock feed inventory. The Company’s financing is expected to continue supporting the borrower’s growth objectives, including expansion of its employee base, distribution network, and community engagement initiatives. |

| 14 | On May 25, 2016, the Company funded $4,570,619 as part of a new $5,000,000 senior secured four year term loan to a South African locomotive and railway equipment leasing company. With an interest rate of 12.00%, the transaction is set to mature on January 31, 2020 and is secured by first security interest over leased machinery and cash flows derived from the underlying lease contracts. The Company’s financing will be used by the borrower to purchase refurbished locomotives to fulfill pending lease contracts with various clients operating in Africa. The borrower anticipates that the Company’s financing will facilitate improvements in regional trade, market access, and productivity and competitiveness across the continent’s growth industries and geographies. |

| 15 | The Sesame Seed Exporter has a collateral coverage ratio of³1.05x. |

| 16 | On August 27, 2015, the Company was informed that the borrower had filed for judicial recuperation with the local court in Brazil. On March 31, 2016, the Company placed the Sugar Producer on non-accrual status effective August 27, 2015. Negotiations regarding an alternative repayment plan are ongoing and in line with the judicial process, which calls for the convening of an assembly of creditors on June 15, 2016. |

| 17 | Temporary investments are defined as short-term investments that are not trade finance or term loan transactions that generally expire within one year, are intended to generate a higher yield than would be realized on cash and may be unsecured positions. The temporary investments that are unsecured positions may present a higher level of risk. |

| 18 | The promissory note from the Financial Services Provider is an unsecured position and therefore may present a higher risk profile. |

As of May 31, 2016 the Company had exited the following investments:

| | | | | | | | | | | | | | | | | | | | | | | | |

| Investment Portfolio | | | | | | | | | | | | | | | | | | | | |

| Description | | Sector | | Country | | Investment

Type | | Transaction

Date | | | Transaction

Amount | | | Payoff Date | | | Internal

Rate of

Return

(“IRR”)1 | | | Primary

Impact

Objective |

| Agricultural Products Exporter I | | Farm-Product Raw Materials | | Singapore | | Trade

Finance | | | 4/23/2015 | | | $ | 10,000,000 | | | | 2/29/2016 | | | | 11.85 | % | | N/A2 |

| | | | | | | | |

| Agricultural Supplies Distributor I | | Miscellaneous Non-Durable Goods | | South

Africa | | Trade

Finance | | | 10/15/2014 | | | $ | 15,202,091 | | | | 8/14/2015 | | | | 13.11 | % | | Job Creation |

| | | | | | | | |

| Candle Distributor | | Miscellaneous Manufacturing Industries | | South

Africa | | Trade

Finance | | | 9/2/2014 | | | $ | 1,400,000 | | | | 9/16/2015 | | | | 14.27 | % | | Job Creation |

| | | | | | | | |

| Cement Distributor | | Cement, Hydraulic | | Kenya | | Trade

Finance | | | 9/23/2014 | | | $ | 12,000,000 | | | | 10/15/2015 | | | | 15.29 | % | | Job Creation |

| | | | | | | | |

| Construction Materials Distributor | | Hardware, Plumbing, and Heating Equipment | | South

Africa | | Trade

Finance | | | 10/9/2014 | | | $ | 838,118 | | | | 4/1/2016 | | | | 13.00 | % | | Job Creation |

| | | | | | | | |

| Electronics Retailer | | Radio, Television, Consumer Electronics, and Music Stores | | Indonesia | | Term

Loan | | | 7/26/2013 | | | $ | 5,000,000 | | | | 6/17/2014 | | | | 19.59 | % | | Access to

Finance |

| | | | | | | | |

| Farm Supplies Wholesaler | | Miscellaneous Non-Durable Goods | | South

Africa | | Trade

Finance | | | 5/28/2015 | | | $ | 2,250,000 | | | | 1/19/2016 | | | | 13.14 | % | | Agricultural

Productivity |

| | | | | | | | |

| Fertilizer Distributor | | Agricultural Chemicals | | Zambia | | Trade

Finance | | | 7/17/2014 | | | $ | 3,000,000 | | | | 11/4/2014 | | | | 12.65 | % | | Job Creation |

| | | | | | | | |

| Food Processor | | Groceries and Related Products | | Peru | | Term

Loan | | | 3/25/2014 | | | $ | 576,000 | | | | 11/28/2014 | | | | 14.01 | % | | Job Creation |

| | | | | | | | |

| Frozen Seafood Exporter | | Groceries and Related Products | | Ecuador | | Trade

Finance | | | 6/17/2013 | | | $ | 240,484 | | | | 5/14/2014 | | | | 13.49 | % | | Job Creation |

| | | | | | | | |

| Industrial Materials Distributor | | Mineral and Ores | | South

Africa | | Trade

Finance | | | 11/20/2014 | | | $ | 4,030,000 | | | | 12/15/2015 | | | | 13.64 | % | | Job Creation |

| | | | | | | | |

| Insulated Wire Manufacturer | | Rolling, Drawing, and Extruding of Nonferrous Metals | | Peru | | Trade

Finance | | | 5/2/2014 | | | $ | 1,991,000 | | | | 12/2/2014 | | | | 8.43 | % | | Job Creation |

| | | | | | | | |

| International Tuna Exporter | | Groceries and Related Products | | Ecuador | | Trade

Finance | | | 7/17/2013 | | | $ | 1,000,000 | | | | 10/9/2013 | | | | 13.58 | % | | Job Creation |

| | | | | | | | |

| Meat Processor I | | Meat Products | | South

Africa | | Trade

Finance | | | 7/7/2014 | | | $ | 2,950,000 | | | | 4/1/2016 | | | | 14.08 | % | | Job Creation |

| Meat Producer | | Meat Products | | South

Africa | | Trade

Finance | | | 11/27/2015 | | | $ | 1,500,000 | | | | 2/3/2016 | | | | 14.83 | % | | N/A2 |

| | | | | | | | |

| Rice & Bean Importer | | Groceries and Related Products | | South

Africa | | Trade

Finance | | | 7/7/2014 | | | $ | 1,000,000 | | | | 8/5/2015 | | | | 12.97 | % | | Job Creation |

| | | | | | | | |

| Rice Importer | | Farm-Product Raw Materials | | Kenya | | Trade

Finance | | | 11/6/2015 | | | $ | 399,653 | | | | 5/19/2016 | | | | 11.50 | % | | Food

Security |

| | | | | | | | |

| Rice Producer | | Cash Grains | | Tanzania | | Trade

Finance | | | 1/22/2015 | | | $ | 3,900,000 | | | | 4/1/2016 | | | | 12.04 | % | | Job Creation |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Investment Portfolio |

| Description | | Sector | | Country | | Investment

Type | | Transaction

Date | | | Transaction

Amount | | | Payoff Date | | | Internal

Rate of

Return

(“IRR”)1 | | | Primary

Impact

Objective |

| Seafood Processing Company | | Miscellaneous Food Preparations and Kindred Products | | Ecuador | | Trade

Finance | | | 6/19/2013 | | | $ | 496,841 | | | | 7/1/2013 | | | | 13.44 | % | | Job Creation |

| | | | | | | | |

| Textile Distributor | | Apparel, Piece Goods, and Notions | | South

Africa | | Trade

Finance | | | 7/25/2014 | | | $ | 7,026,515 | | | | 5/30/2016 | | | | 15.81 | % | | Job Creation |

| | | | | | | | |

| Timber Exporter | | Sawmills and Planing Mills | | Chile | | Trade

Finance | | | 7/3/2013 | | | $ | 915,000 | | | | 6/12/2014 | | | | 10.25 | % | | Job Creation |

| | | | | | | | |

| Waste Management Equipment Distributor | | Machinery, Equipment, and Supplies | | South

Africa | | Trade

Finance | | | 2/13/2015 | | | $ | 310,752 | | | | 5/15/2015 | | | | 20.19 | % | | Equality &

Empowerment |

| | | | | | | |

| Investment Portfolio Total | | | | | | | | | | $ | 76,026,454 | | | | | | | | | | | |

| | | | | | |

| Investment Portfolio—Weighted Average IRR | | | | | | | | | | | | | | | | | 13.89 | % | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Temporary Investments3 | | | | | | | | | | | | | | | | | | | | | | | | |

| Description | | Sector | | Country | | Investment

Type | | Transaction

Date | | | Transaction

Amount | | | Payoff

Date | | | Internal

Rate of

Return

(“IRR”)1 | | | Primary

Impact

Objective |

| Financial Services Provider I | | Miscellaneous Business Credit Institutions | | Mauritius | | Promissory

Note | | | 9/23/2014 | | | $ | 3,000,000 | | | | 11/17/2014 | | | | 15.94 | % | | N/A |

| | | | | | | |

| Temporary Investments Total | | | | | | | | | | $ | 3,000,000 | | | | | | | | | | | |

| | | | | | |

| Temporary Investments – Weighted Average IRR | | | | | | | | | | | | | | | | | 15.94 | % | | |

| | | | | | |

| Investment Portfolio and Temporary Investments Total | | | | | | | | $ | 79,026,454 | | | | | | | | | | | |

| | | | |

| Investment Portfolio and Temporary Investments – Weighted Average IRR | | | | | | | | | | | | 13.97 | % | | |

| 1 | Given that the loan has been paid off, this investment is no longer part of the Company’s portfolio. The internal rate of return is defined as the gross average annual return earned through the life of an investment. The internal rate of return was calculated by our Advisor (unaudited) as the investment (loan advance) was made and cash was received (principal, interest and fees). |

| 2 | Impact data is not tracked for this investment. The Company does not track impact data for trade finance transactions that meet standard underwriting guidelines, but generally have the maturity of less than one year and involve borrowers with whom, at the time of funding, the Company does not expect to maintain an ongoing lending relationship or otherwise provide an open loan facility. |

| 3 | Temporary investments are defined as short-term investments that are not trade finance or term loan transactions that generally expire within one year, are intended to generate a higher yield than would be realized on cash and may be unsecured positions. The temporary investments that are unsecured positions may present a higher level of risk. |

Certain Portfolio Characteristics1

| | | | |

Total Assets (est.) | | $ | 184,000,000 | |

Current Loan Commitments | | $ | 174,800,000 | |

Leverage | | | 0 | % |

Weighted Average Portfolio Loan Size | | $ | 6,301,108 | |

Weighted Average Portfolio Duration | | | 1.25 years | |

Weighted Average Position Yield | | | 12.21 | % |

Average Collateral Coverage Ratio | | | 1.54x | |

USD Denominated | | | 100 | % |

Senior Secured First-Lien | | | 100 | % |

Countries | | | 15 | |

Sectors | | | 19 | |

Top Five Investments by Percentage2

| | | | | | |

| Company Description | | Country | | % of Total Assets | |

Hospitality Service Provider | | Cape Verde | | | 9.2 | % |

Agriculture Distributor | | Argentina | | | 8.2 | % |

Marine Logistics Provider | | Nigeria | | | 6.9 | % |

Power Producer | | Ghana | | | 6.3 | % |

Agricultural Products Exporter II | | Singapore | | | 5.4 | % |

| | | | |

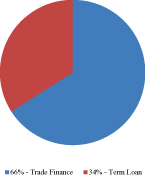

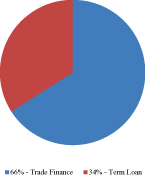

| Investment Type3 | | Developing Economies3 | | Sector Diversification3 |

| |

| |

|

| 1 | All information provided in this section, with the exception of the Total Asset (est.) figure, does not include the Company’s temporary investment commitments such as the promissory note from the Mauritian Financial Services Provider and the bridge loan from the Singaporean Agricultural Products Exporter comprising 9.5% and 3.2%, respectively, of all the investments currently held by the Company. The promissory note from the Mauritian Financial Services Provider is an unsecured position. |

| 2 | This represents all countries/sectors where the Company currently has a loan commitment other than through a temporary investment. Due to the revolving debt nature of trade finance facilities and the timing of funding, it is possible that certain commitments currently have a zero outstanding balance and would therefore not be represented in the country/sector allocation charts, which represents invested capital. |

| 3 | The above charts represent investment type, developing economy, and sector diversification as a percentage of the total amount outstanding of the Company’s investments other than the Company’s temporary investments. The Company’s temporary investments include the promissory note from the Mauritian Financial Services Provider and the bridge loan from the Singaporean Agricultural Products Exporter comprising 9.5% and 3.2%, of all the investments currently held by the Company. |

| D. | Quarterly Report on Form 10-Q for the Quarter Ended March 31, 2016 |

On May 13, 2016, we filed our Quarterly Report on Form 10-Q for the quarter ended March 31, 2016 with the SEC. The report (without exhibits) is attached to this Supplement.

| E. | Updates to the Form of Subscription Agreement in Appendix B of the Prospectus |

The subscription agreement is beginning on page B-1 of the Prospectus is hereby deleted in its entirety and replaced with the following:

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended March 31, 2016

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 000-55432

TriLinc Global Impact Fund, LLC

(Exact name of registrant as specified in its charter)

| |

Delaware | 36-4732802 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

1230 Rosecrans Avenue, Suite 605,

Manhattan Beach, CA 90266

(Address of principal executive offices)

(310) 997-0580

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | |

Large accelerated filer | ¨ | Accelerated filer | ¨ |

| | | |

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Table of Contents

Part I. Financial Information

Item 1. Consolidated Financial Statements.

TriLinc Global Impact Fund, LLC

Consolidated Statements of Assets and Liabilities

| | As of | |

| | March 31, | | | December 31, | |

| | 2016 | | | 2015 | |

| | (Unaudited) | | | | | |

ASSETS | | | | | | | | |

Investments owned, at fair value (amortized cost of $126,254,063 and $101,346,528, respectively) | | $ | 125,876,561 | | | $ | 101,028,104 | |

Cash | | | 36,879,526 | | | | 33,246,769 | |

Interest receivable | | | 3,779,476 | | | | 3,580,530 | |

Due from affiliates (see Note 5) | | | 2,144,985 | | | | 1,874,932 | |

Prepaid expenses | | | 45,895 | | | | 53,181 | |

Total assets | | | 168,726,443 | | | | 139,783,516 | |

| | | | | | | | |

LIABILITIES | | | | | | | | |

Due to unitholders | | | 662,106 | | | | 548,700 | |

Management fee payable | | | 225,975 | | | | 135,863 | |

Unit repurchases payable | | | 4,502,964 | | | | — | |

Due to affiliates (see Note 5) | | | 146,710 | | | | 472,057 | |

Other payables | | | 13,533 | | | | 6,289 | |

Total liabilities | | | 5,551,288 | | | | 1,162,909 | |

Commitments and Contingencies (see Note 5) | | | | | | | | |

NET ASSETS | | $ | 163,175,155 | | | $ | 138,620,607 | |

| | | | | | | | |

ANALYSIS OF NET ASSETS: | | | | | | | | |

Net capital paid in on Class A units | | $ | 96,397,340 | | | $ | 87,625,105 | |

Net capital paid in on Class C units | | | 22,492,133 | | | | 9,689,230 | |

Net capital paid in on Class I units | | | 53,753,546 | | | | 49,128,638 | |

Offering costs | | | (9,467,864 | ) | | | (7,822,366 | ) |

Net assets (equivalent to $8.530 and $8.543, respectively per unit based on total units outstanding of 19,129,421 and 16,226,368, respectively) | | $ | 163,175,155 | | | $ | 138,620,607 | |

Net assets, Class A (units outstanding of 10,681,146 and 9,709,153, respectively) | | $ | 91,110,844 | | | $ | 82,944,542 | |

Net assets, Class C (units outstanding of 2,492,203 and 1,073,599, respectively) | | | 21,258,648 | | | | 9,171,672 | |

Net assets, Class I (units outstanding of 5,956,072 and 5,443,616, respectively) | | | 50,805,663 | | | | 46,504,393 | |

NET ASSETS | | $ | 163,175,155 | | | $ | 138,620,607 | |

See accompanying notes to the consolidated financial statements.

1

TriLinc Global Impact Fund, LLC

Consolidated Statements of Operations

(Unaudited)

| | | |

| | March 31, | | | March 31, | |

| | 2016 | | | 2015 | |

INVESTMENT INCOME | | | | | | | | |

Interest income | | $ | 3,249,585 | | | $ | 1,768,866 | |

Interest from cash | | | 92,269 | | | | 17,616 | |

Total investment income | | | 3,341,854 | | | | 1,786,482 | |

EXPENSES | | | | | | | | |

Management fees | | | 816,326 | | | | 361,748 | |

Incentive fees | | | 650,348 | | | | 277,180 | |

Professional fees | | | 289,031 | | | | 289,988 | |

General and administrative expenses | | | 201,876 | | | | 144,057 | |

Board of managers fees | | | 46,875 | | | | 46,875 | |

Total expenses | | | 2,004,456 | | | | 1,119,848 | |

Expense support payment from Sponsor | | | (1,914,344 | ) | | | (719,265 | ) |

Net expenses | | | 90,112 | | | | 400,583 | |

NET INVESTMENT INCOME | | | 3,251,742 | | | | 1,385,899 | |

Net change in unrealized depreciation on investments | | | (59,077 | ) | | | — | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 3,192,665 | | | $ | 1,385,899 | |

| | | | | | | | |

NET INVESTMENT INCOME PER UNITS - BASIC AND DILUTED | | $ | 0.18 | | | $ | 0.18 | |

EARNINGS PER UNITS - BASIC AND DILUTED | | $ | 0.18 | | | $ | 0.18 | |

WEIGHTED AVERAGE UNITS OUTSTANDING - BASIC AND DILUTED | | | 17,816,842 | | | | 7,804,588 | |

See accompanying notes to the consolidated financial statements.

2

TriLinc Global Impact Fund, LLC

Consolidated Statements of Changes in Net Assets

(Unaudited)

| | | |

| | March 31, | | | March 31, | |

| | 2016 | | | 2015 | |

INCREASE FROM OPERATIONS | | | | | | | | |

Net investment income | | $ | 3,251,742 | | | $ | 1,385,899 | |

Net change in unrealized depreciation on investments | | | (59,077 | ) | | | — | |

Net increase from operations | | | 3,192,665 | | | | 1,385,899 | |

DECREASE FROM DISTRIBUTIONS | | | | | | | | |

Distributions to Class A unitholders | | | (1,872,086 | ) | | | (597,038 | ) |

Distributions to Class C unitholders | | | (300,798 | ) | | | (84,759 | ) |

Distributions to Class I unitholders | | | (1,016,190 | ) | | | (704,363 | ) |

Net decrease from distributions | | | (3,189,074 | ) | | | (1,386,160 | ) |

INCREASE FROM CAPITAL TRANSACTIONS | | | | | | | | |

Issuance of Class A units | | | 13,383,247 | | | | 6,308,401 | |

Issuance of Class C units | | | 12,803,403 | | | | 1,165,174 | |

Issuance of Class I units | | | 4,621,436 | | | | 2,774,805 | |

Repurchase of units | | | (4,611,631 | ) | | | — | |

Offering costs | | | (1,645,498 | ) | | | (550,229 | ) |

Net increase from capital transactions | | | 24,550,957 | | | | 9,698,151 | |

NET INCREASE IN NET ASSETS | | | 24,554,548 | | | | 9,697,890 | |

Net assets at beginning of period | | | 138,620,607 | | | | 62,289,992 | |

Net assets at end of period | | $ | 163,175,155 | | | $ | 71,987,882 | |

See accompanying notes to the consolidated financial statements.

3

TriLinc Global Impact Fund, LLC

Consolidated Statements of Cash Flows

(Unaudited)

| | | |

| | March 31, | | | March 31, | |

| | 2016 | | | 2015 | |

Cash flows from operating activities | | | | | | | | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 3,192,665 | | | $ | 1,385,899 | |

ADJUSTMENT TO RECONCILE NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS TO NET CASH USED IN OPERATING ACTIVITIES | | | | | | | | |

Purchase of investments | | | (49,897,194 | ) | | | (31,259,529 | ) |

Maturity of investments | | | 24,994,660 | | | | 23,282,033 | |

Net change in unrealized depreciation on investments | | | 59,077 | | | | — | |

Accretion of discounts on investments | | | (5,000 | ) | | | — | |

Increase in interest receivable | | | (198,946 | ) | | | (269,141 | ) |

Increase in due from affiliates | | | (270,053 | ) | | | (329,548 | ) |

Decrease in prepaid expenses | | | 7,286 | | | | 6,089 | |

Increase in due to unitholders | | | 113,406 | | | | 43,751 | |

Increase in management fee payable | | | 90,112 | | | | 48,263 | |

Increase in other payable | | | 7,244 | | | | 819 | |

NET CASH USED IN OPERATING ACTIVITIES | | | (21,906,743 | ) | | | (7,091,364 | ) |

Cash flows from financing activities | | | | | | | | |

Net proceeds from issuance of units | | | 29,476,761 | | | | 9,807,070 | |

Distributions paid to unitholders | | | (1,857,749 | ) | | | (944,850 | ) |

Payments of offering costs | | | (1,970,845 | ) | | | (567,906 | ) |

Repurchase of units | | | (108,667 | ) | | | — | |

NET CASH PROVIDED BY FINANCING ACTIVITIES | | | 25,539,500 | | | | 8,294,314 | |

TOTAL INCREASE IN CASH | | | 3,632,757 | | | | 1,202,950 | |

Cash at beginning of period | | | 33,246,769 | | | | 7,875,917 | |

Cash at end of period | | $ | 36,879,526 | | | $ | 9,078,867 | |

Supplemental non-cash information | | | | | | | | |

Issuance of units in connection with distribution reinvestment plan | | $ | 1,331,325 | | | $ | 441,310 | |

See accompanying notes to the consolidated financial statements.

4

TriLinc Global Impact Fund, LLC

Consolidated Schedule of Investments

As of March 31, 2016

(Unaudited)

Investment Type / Country | | Portfolio Company | | Sector | | Description | | Interest | | | Fees (2) | | | Maturity | | Principal Amount | | | Participation % (4) | | | Amortized Cost | | | Fair Value | | | % of Net Assets | |

Senior Secured Term Loan (1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Brazil | | Other Investments (14) | | Programing and Data Processing | | IT Service Provider | | | 13.50% | | | | 2.0 | % | | 10/31/2019 | | $ | 5,296,274 | | | N/A | | | $ | 5,296,274 | | | $ | 5,296,274 | | | | 3.2 | % |

Total Senior Secured Term Loan (1) | | | | | | | | | | | | | | | | | | | | | | | | | 5,296,274 | | | | 5,296,274 | | | | 3.2 | % |

Senior Secured Term Loan Participations (1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Brazil | | Usivale Industria E Commercio (6) | | Agricultural Products | | Sugar Producer | | | 17.43% | | | | 0.0 | % | | 12/15/2016 - 5/15/2017 | | | 3,000,000 | | | | 100% | | | | 3,000,000 | | | | 2,681,576 | | | | 1.6 | % |

Nigeria | | Helios Maritime I Ltd. (8) | | Water Transportation | | Marine Logistics Provider | | | 15.61% | | | | 0.8 | % | | 9/16/2020 | | | 12,956,833 | | | | 100% | | | | 12,867,666 | | | | 12,867,666 | | | | 7.9 | % |

Peru | | Corporacion Prodesa S.R.L. (5) | | Consumer Products | | Diaper Manufacturer | | 15.50%-15.60% | | | | 0.0 | % | | 12/22/2016 - 6/15/2017 | | | 3,500,000 | | | | 100% | | | | 3,500,000 | | | | 3,500,000 | | | | 2.1 | % |

Total Senior Secured Term Loan Participations | | | | | | | | | | | | | | | | | | | | | | | | | 19,367,666 | | | | 19,049,242 | | | | 11.7 | % |

Senior Secured Trade Finance Participations (1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Argentina | | Compania Argentina De Granos (15) | | Agricultural Products | | Agriculture Distributor | | | 9.00% | | | | 0.0 | % | | 9/3/2016 - 9/30/2016 | | | 15,000,000 | | | | 52% | | | | 15,000,000 | | | | 15,000,000 | | | | 9.2 | % |

Argentina | | Other Investments (16) | | Consumer Products | | Dairy Co-Operative | | | 10.90% | | | | 0.0 | % | | 2/25/2016 - 3/31/2016 (12) | | | 6,000,000 | | | | 16% | | | | 6,000,000 | | | | 6,000,000 | | | | 3.7 | % |

Argentina | | Frigorifico Regional Industrias Alimenticias S.A. (16) | | Meat, Poultry & Fish | | Beef Exporter | | | 11.98% | | | | 0.0 | % | | 4/30/2016 | | | 9,000,000 | | | | 32% | | | | 9,000,000 | | | | 9,000,000 | | | | 5.5 | % |

Argentina | | Other Investments (16) | | Fats and Oils | | Oilseed Distributor | | | 8.89% | | | | 0.0 | % | | 2/3/2016-3/1/2016 (12) | | | 5,100,000 | | | | 85% | | | | 5,100,000 | | | | 5,100,000 | | | | 3.1 | % |

Chile | | Other Investments (15) | | Farm Products | | Chia Seed Exporter | | | 11.50% | | | | 0.0 | % | | 12/11/2016 | | | 1,900,000 | | | | 100% | | | | 1,900,000 | | | | 1,900,000 | | | | 1.2 | % |

Ecuador | | Other Investments (15) | | Commercial Fishing | | Fish Processor & Exporter | | | 9.00% | | | | 0.0 | % | | 6/19/2016 | | | 1,462,700 | | | | 100% | | | | 1,462,700 | | | | 1,462,700 | | | | 0.9 | % |

Ghana | | Other Investments (17) | | Electric Services | | Power Producer | | | 11.50% | | | | 0.0 | % | | 3/10/2017 | | | 6,000,000 | | | | 35% | | | | 6,000,000 | | | | 6,000,000 | | | | 3.7 | % |

Guatemala | | Other Investments (15) | | Farm Products | | Sesame Seed Exporter | | | 12.00% | | | | 0.0 | % | | 3/31/2016 | | | 1,000,000 | | | | 25% | | | | 1,000,000 | | | | 1,000,000 | | | | 0.6 | % |

Kenya | | Other Investments (17) | | Cash Grains | | Rice Importer | | | 11.33% | | | | 0.0 | % | | 5/15/2016 | | | 24,470 | | | | 48% | | | | 24,470 | | | | 24,470 | | | | 0.0 | % |

Namibia | | Other Investments (16) | | Packaged Foods & Meats | | Consumer Goods Distributor | | | 12.00% | | | | 0.0 | % | | 3/3/2016 (3) | | | 1,000,000 | | | | 43% | | | | 1,000,000 | | | | 1,000,000 | | | | 0.6 | % |

Singapore | | Export Trading Group Pte. Ltd. (7) (17) | | Agricultural Products | | Agricultural Products Exporter | | | 11.50% | | | | 0.0 | % | | 4/1/2016 | | | 10,000,000 | | | | 16% | | | | 10,000,000 | | | | 10,000,000 | | | | 6.1 | % |

South Africa | | Other Investments (17) | | Communications equipment | | Electronics Assembler | | | 13.00% | | | | 0.0 | % | | 1/29/2016 - 4/15/2016 (3) | | | 3,728,340 | | | | 25% | | | | 3,728,340 | | | | 3,728,340 | | | | 2.3 | % |

South Africa | | Other Investments (17) | | Meat, Poultry & Fish | | Meat Processor | | | 14.50% | | | | 0.0 | % | | 12/15/2015 (12) | | | 600,000 | | | | 18% | | | | 600,000 | | | | 600,000 | | | | 0.4 | % |

South Africa | | Other Investments (17) | | Food Products | | Fruit & Nut Distributor | | | 17.50% | | | | 0.0 | % | | 5/22/2015 (9) | | | 761,684 | | | | 19% | | | | 820,761 | | | | 761,684 | | | | 0.5 | % |

South Africa | | Other Investments (17) | | Textiles, Apparel & Luxury Goods | | Textile Distributor | | | 15.00% | | | | 0.0 | % | | 5/17/2016 - 5/28/2016 | | | 280,181 | | | | 18% | | | | 280,181 | | | | 280,181 | | | | 0.2 | % |

South Africa | | Other Investments (17) | | Construction Materials | | Construction Materials Distributor | | | 12.75% | | | | 0.0 | % | | 7/1/2015 (12) | | | 167,355 | | | | 14% | | | | 167,355 | | | | 167,355 | | | | 0.1 | % |

South Africa | | Other Investments (16) | | Metals & Mining | | Mine Remediation Company | | | 17.50% | | | | 0.0 | % | | 6/15/2016 - 8/15/2016 | | | 2,500,000 | | | | 27% | | | | 2,500,000 | | | | 2,500,000 | | | | 1.5 | % |

South Africa | | Other Investments (17) | | Agricultural Products | | Agricultural Supplies Distributor | | | 10.38% | | | | 0.0 | % | | 4/24/2016 - 5/30/2016 | | | 2,027,789 | | | | 44% | | | | 2,027,789 | | | | 2,027,789 | | | | 1.2 | % |

Tanzania | | Other Investments (17) | | Cash Grains | | Rice Producer | | | 11.50% | | | | 0.0 | % | | 10/26/2015 (12) | | | 3,900,000 | | | | 74% | | | | 3,900,000 | | | | 3,900,000 | | | | 2.4 | % |

Zambia | | Other Investments (17) | | Fertilizer & Agricultural Chemicals | | Farm Supplies Distributor | | 12.08%-12.50% | | | | 0.0 | % | | 10/25/15 - 5/3/2016 (13) | | | 5,078,526 | | | | 19% | | | | 5,078,526 | | | | 5,078,526 | | | | 3.1 | % |

Zambia | | Other Investments (15) | | Primary Metal Industries | | Integrated Steel Producer | | | 13.00% | | | | 0.0 | % | | 8/13/2016 | | | 6,000,000 | | | | 86% | | | | 6,000,000 | | | | 6,000,000 | | | | 3.7 | % |

Total Senior Secured Trade Finance Participations | | | | | | | | | | | | | | | | | | | | | | | | | 81,590,122 | | | | 81,531,045 | | | | 50.0 | % |

Short Term Notes and Bridge Loan (1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Mauritius | | Barak Fund Management Ltd.(10), (17) | | Financial Services | | Investment Manager | | | 12.00% | | | | 0.8 | % | | 5/22/2016 | | | 15,000,000 | | | N/A | | | | 15,000,000 | | | | 15,000,000 | | | | 9.2 | % |

Singapore | | Export Trading Group Pte. Ltd. (11), (17) | | Agricultural Products | | Agricultural Products Exporter | | | 12.00% | | | | 0.8 | % | | 6/20/2016 | | | 5,000,000 | | | | 8% | | | | 5,000,000 | | | | 5,000,000 | | | | 3.1 | % |

Total Short Term Notes and Bridge Loan | | | | | | | | | | | | | | | | | | | | | | | | | 20,000,000 | | | | 20,000,000 | | | | 12.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Investments | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 126,254,063 | | | $ | 125,876,561 | | | | | |

See accompanying notes to the consolidated financial statements.

5

1 | Refer to Notes 3 and 4 of the consolidated financial statements for additional information on the Company’s investments. |

2 | Fees may include upfront, origination, commitment, facility and/or other fees that the borrower must contractually pay to the Company. Fees, if any, are typically received in connection with term loan transactions and are rarely applicable to trade finance transactions. |

3 | Trade finance borrowers may be granted flexibility with respect to repayment relative to the stated maturity date to accommodate specific contracts and/or business cycle characteristics. This flexibility in each case is agreed upon between the Company and the sub-advisor and between the sub-advisor and the borrower. The Company typically does not consider trade finance investments to be past due until they are over 90 days past the maturity date. |

4 | Percentage of the Company’s participation in total borrowings outstanding under sub-advisor provided financing facility. |

5 | Interest accruing includes 2.5% of deferred interest due at maturity. See discussion about Prodesa in Note 3. |

6 | Interest includes 5.0% of penalty interest due to the borrower missing 11 interest payments. This investment was on non-accrual status as of March 31, 2016. See Note 3. |

7 | The transaction is secured by specific collateral held by the borrower’s subsidiaries in Kenya, Tanzania, and Zambia. |

8 | Interest accrues at a variable rate of one-month Libor + 10.5%, which is paid monthly, and also includes 4.68% of deferred interest due at maturity. Monthly principal payments starting in May 2016 |

9 | The Company, together with its Sub-Advisor, have agreed to extend the principal maturity date to facilitate the strategic sale of this borrower. The borrower has been experiencing some cash flow difficulties, but has made some partial payments of principal. The amortized cost includes $152,923 of interest which has been capitalized as of March 31, 2016. This investment was on non-accrual status as of March 31, 2016. See Note 3. |

10 | Barak Fund Management Ltd. is a sub-advisor to the Company. This unsecured short term note was provided to support a strategic temporary investment. |

11 | Senior secured bridge loan secured by shares in the borrower. |

12 | This investment was repaid in full during April 2016. |

13 | $4.1 million of this investment has a maturity date of 10/25/15. The Zambian government, as the purchaser of fertilizer, is responsible for the repayment of this trade finance transaction. The Company has access to insurance should the Zambian government not pay. In addition, the Company ultimately has recourse to the borrower for repayment. |

14 | Principal and interest paid monthly. |

15 | Monthly interest only payment. Principal due at maturity. |

16 | Quarterly interest only payment. Principal due at maturity. |

17 | Principal and interest paid at maturity. |

6

TriLinc Global Impact Fund, LLC

Consolidated Schedule of Investments

December 31, 2015

Investment Type / Country | | Portfolio Company | | Sector | | Description | | Interest | | | Fees (2) | | | Maturity (3) | | Principal Amount | | | Current Commitment (4) | | | Amortized Cost | | | Fair Value | | | % of Net Assets | |

Senior Secured Term Loan (1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Brazil | | Other Investments | | Programing and Data Processing | | IT Service Provider | | | 13.50% | | | | 0.0 | % | | 10/31/2019 | | $ | 5,474,534 | | | $ | 14,000,000 | | | $ | 5,474,534 | | | $ | 5,474,534 | | | | 3.9 | % |

Total Senior Secured Term Loan (1) | | | | | | | | | | | | | | | | | | | | | | | | | 5,474,534 | | | | 5,474,534 | | | | 3.9 | % |

Senior Secured Term Loan Participations (1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Brazil | | Usivale Industria E Commercio (6) | | Agricultural Products | | Sugar Producer | | | 17.43% | | | | 0.0 | % | | 12/15/2016-5/15/2017 | | | 3,000,000 | | | | 3,000,000 | | | | 3,000,000 | | | | 2,681,576 | | | | 1.9 | % |

Nigeria | | Helios Maritime I Ltd. (8) | | Water Transportation | | Marine Logistics Provider | | | 15.42% | | | | 0.8 | % | | 9/16/2020 | | | 12,956,833 | | | | 16,050,000 | | | | 12,862,666 | | | | 12,862,666 | | | | 9.3 | % |

Peru | | Corporacion Prodesa S.R.L. (5) | | Consumer Products | | Diaper Manufacturer | | 15.50%-15.60% | | | | 0.0 | % | | 12/22/2016-6/15/2017 | | | 2,940,000 | | | | 3,250,000 | | | | 2,940,000 | | | | 2,940,000 | | | | 2.1 | % |

Total Senior Secured Term Loan Participations | | | | | | | | | | | | | | | | | | | | | | | | | 18,802,666 | | | | 18,484,242 | | | | 13.3 | % |

Senior Secured Trade Finance Participations (1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Argentina | | Compania Argentina De Granos | | Agricultural Products | | Agriculture Distributor | | | 9.00% | | | | 0.0 | % | | 12/15/2015 - 9/23/16 | | | 9,700,000 | | | | 13,000,000 | | | | 9,700,000 | | | | 9,700,000 | | | | 7.0 | % |

Argentina | | Other Investments | | Consumer Products | | Dairy Co-Operative | | | 10.90% | | | | 0.0 | % | | 2/25/16 - 3/31/16 | | | 6,000,000 | | | | 6,000,000 | | | | 6,000,000 | | | | 6,000,000 | | | | 4.3 | % |

Argentina | | Frigorifico Regional Industrias Alimenticias S.A. | | Meat, Poultry & Fish | | Beef Exporter | | | 11.98% | | | | 0.0 | % | | 4/30/2016 | | | 9,000,000 | | | | 9,000,000 | | | | 9,000,000 | | | | 9,000,000 | | | | 6.5 | % |

Argentina | | Other Investments | | Fats and Oils | | Oilseed Distributor | | | 8.89% | | | | 0.0 | % | | 2/3/2016 | | | 3,100,000 | | | | 3,100,000 | | | | 3,100,000 | | | | 3,100,000 | | | | 2.2 | % |

Chile | | Other Investments | | Farm Products | | Chia Seed Exporter | | | 11.50% | | | | 0.0 | % | | 12/11/2016 | | | 1,900,000 | | | | 2,000,000 | | | | 1,900,000 | | | | 1,900,000 | | | | 1.4 | % |

Ecuador | | Other Investments | | Commercial Fishing | | Fish Processor & Exporter | | | 9.00% | | | | 0.0 | % | | 6/19/2016 | | | 1,756,243 | | | | 2,000,000 | | | | 1,756,243 | | | | 1,756,243 | | | | 1.3 | % |

Guatemala | | Other Investments | | Farm Products | | Sesame Seed Exporter | | | 12.00% | | | | 0.0 | % | | 3/31/2016 | | | 1,000,000 | | | | 2,000,000 | | | | 1,000,000 | | | | 1,000,000 | | | | 0.7 | % |

Kenya | | Other Investments | | Cash Grains | | Rice Importer | | | 11.33% | | | | 0.0 | % | | 2/18/2016 | | | 375,182 | | | | 1,000,000 | | | | 375,182 | | | | 375,182 | | | | 0.3 | % |

Namibia | | Other Investments | | Packaged Foods & Meats | | Consumer Goods Distributor | | | 12.00% | | | | 0.0 | % | | 3/03/16 | | | 1,000,000 | | | | 2,000,000 | | | | 1,000,000 | | | | 1,000,000 | | | | 0.7 | % |

Singapore | | Export Trading Group Pte. Ltd. (7) | | Agricultural Products | | Agricultural Products Exporter | | | 11.50% | | | | 0.0 | % | | 2/7/2016 | | | 10,000,000 | | | | 10,000,000 | | | | 10,000,000 | | | | 10,000,000 | | | | 7.2 | % |

South Africa | | Other Investments | | Communications equipment | | Electronics Assembler | | | 13.00% | | | | 0.0 | % | | 1/29/16 - 4/15/16 | | | 5,918,086 | | | | 11,000,000 | | | | 5,918,086 | | | | 5,918,086 | | | | 4.3 | % |

South Africa | | Other Investments | | Meat, Poultry & Fish | | Meat Processor | | | 14.50% | | | | 0.0 | % | | 12/22/15 - 1/31/16 | | | 2,524,816 | | | | 4,300,000 | | | | 2,524,816 | | | | 2,524,816 | | | | 1.8 | % |

South Africa | | Other Investments (9) | | Food Products | | Fruit & Nut Distributor | | | 17.50% | | | | 0.0 | % | | 5/22/2015 | | | 667,838 | | | | 1,250,000 | | | | 667,838 | | | | 667,838 | | | | 0.5 | % |

South Africa | | Other Investments | | Textiles, Apparel & Luxury Goods | | Textile Distributor | | | 15.00% | | | | 0.0 | % | | 1/13/16 - 2/11/16 | | | 724,219 | | | | 2,500,000 | | | | 724,219 | | | | 724,219 | | | | 0.5 | % |

South Africa | | Other Investments | | Construction Materials | | Construction Materials Distributor | | | 12.75% | | | | 0.0 | % | | 7/1/2015 | | | 181,943 | | | | 750,000 | | | | 181,943 | | | | 181,943 | | | | 0.1 | % |

South Africa | | Other Investments | | Metals & Mining | | Mine Remediation Company | | | 17.50% | | | | 0.0 | % | | 6/15/16 - 8/15/16 | | | 2,500,000 | | | | 2,500,000 | | | | 2,500,000 | | | | 2,500,000 | | | | 1.8 | % |

South Africa | | Other Investments | | Agricultural Products | | Agricultural Supplies Distributor | | | 10.38% | | | | 0.0 | % | | 1/14/2016 | | | 5,071,000 | | | | 10,000,000 | | | | 5,071,000 | | | | 5,071,000 | | | | 3.7 | % |

South Africa | | Other Investments | | Fertilizer & Agricultural Chemicals | | Farm Supplies Wholesaler | | | 12.50% | | | | 0.0 | % | | 10/17/15 - 12/03/15 | | | 1,250,000 | | | | 1,500,000 | | | | 1,250,000 | | | | 1,250,000 | | | | 0.9 | % |

Tanzania | | Other Investments | | Cash Grains | | Rice Producer | | | 11.50% | | | | 0.0 | % | | 10/26/2015 | | | 3,900,000 | | | | 3,900,000 | | | | 3,900,000 | | | | 3,900,000 | | | | 2.8 | % |

Zambia | | Other Investments | | Fertilizer & Agricultural Chemicals | | Farm Supplies Distributor | | 12.08%-12.50% | | | | 0.0 | % | | 10/25/2015 | | | 4,500,000 | | | | 10,000,000 | | | | 4,500,000 | | | | 4,500,000 | | | | 3.2 | % |

Zambia | | Other Investments | | Primary Metal Industries | | Integrated Steel Producer | | | 13.00% | | | | 0.0 | % | | 2/14/2016 | | | 6,000,000 | | | | 6,000,000 | | | | 6,000,000 | | | | 6,000,000 | | | | 4.3 | % |

Total Senior Secured Trade Finance Participations | | | | | | | | | | | | | | | | | | | | | | | | | 77,069,328 | | | | 77,069,328 | | | | 55.6 | % |

Total Investments | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 101,346,528 | | | $ | 101,028,104 | | | | | |

See accompanying notes to the consolidated financial statements.

1 | Refer to Notes 3 and 4 of the consolidated financial statements for additional information on the Company’s investments. |

2 | Fees may include upfront, origination, commitment, facility and/or other fees that the borrower must contractually pay to the Company. Fees, if any, are typically received in connection with term loan transactions and are rarely applicable to trade finance transactions. |

3 | Trade finance borrowers may be granted flexibility with respect to repayment relative to the stated maturity date to accommodate specific contracts and/or business cycle characteristics. This flexibility in each case is agreed upon between the Company and the sub-advisor and between the sub-advisor and the borrower. |

7

4 | Loan commitments are subject to the availability of funds and do not represent a contractual obligation to provide funding to the borrower. |

5 | Interest accruing includes 2.5% of deferred interest due at maturity. |

6 | Interest includes 5.0% of penalty interest due to the borrower missing 11 interest payments. This investment was on non-accrual status as of March 31, 2016. See Note 3. |

7 | The transaction is secured by specific collateral held by the borrower’s subsidiaries in Kenya, Tanzania, and Zambia. |

8 | Interest accrues at a variable rate of one-month Libor + 10.5%, which is paid currently, and also includes 4.68% of deferred interest due at maturity. |

9 | The Company, together with its Sub-Advisor, have agreed to extend the principal maturity date to facilitate the strategic sale of this borrower. The borrower has been experiencing some cash flow difficulties but has made some partial payments of principal. |

8

TRILINC GLOBAL IMPACT FUND, LLC

Notes to Consolidated Financial Statements

March 31, 2016

(Unaudited)

Note 1. Organization and Operations of the Company

TriLinc Global Impact Fund, LLC (the “Company”) was organized as a Delaware limited liability company on April 30, 2012 and formally commenced operations on June 11, 2013. The Company makes impact investments in Small and Medium Enterprises, known as SMEs, primarily in developing economies that provide the opportunity to achieve both competitive financial returns and positive measurable impact. The Company uses the proceeds raised from the issuance of units to invest in SMEs through local market sub-advisors in a diversified portfolio of financial assets, including direct loans, convertible debt instruments, trade finance, structured credit and preferred and common equity investments. The Company’s investment objectives are to generate current income, capital preservation and modest capital appreciation primarily through investments in SMEs. The Company is externally managed by TriLinc Advisors, LLC (the “Advisor”). The Advisor is an investment advisor registered with the SEC.

TriLinc Global, LLC (the “Sponsor”) owns 85% of the units of the Advisor, and is the sponsor of the Company. Strategic Capital Advisory Services, LLC (“SCAS”) owns 15% of the Advisor, and is considered an affiliate of the Company. The Sponsor employs staff who operate both the Advisor and the Company. The Sponsor, the Advisor and SCAS are Delaware limited liability companies.

In May 2012, the Advisor purchased 22,161 Class A units for aggregate gross proceeds of $200,000. The Company commenced its initial public offering of up to $1.5 billion in units of limited liability company interest (the “Offering”) on February 25, 2013. On June 11, 2013, the Company satisfied its minimum offering requirement of $2,000,000 when the Sponsor purchased 321,330 Class A units for aggregate gross proceeds of $2,900,000 and the Company commenced operations. In February 2015, the Company elected to extend its current offering period for up to an additional one year period, expiring on February 25, 2016. On November 18, 2015, the Company elected to extend its current offering for up to an additional six month period, expiring August 25, 2016. On February 19, 2016, the Company elected to further extend its current offering to December 31, 2016. Our board has the right to further extend or terminate the Offering at any time.

Although the Company was organized and intends to conduct its business in a manner so that it is not required to register as an investment company under the Investment Company Act of 1940, as amended, the consolidated financial statements are prepared using the specialized accounting principles of the Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, Financial Services — Investment Companies. Overall, the Company’s management believes the use of investment company accounting makes the Company’s financial statements more useful to investors and other financial statement users since it allows a more appropriate basis of comparison to other entities with similar objectives.

To assist the Company in achieving its investment objective, the Company makes investments via wholly owned subsidiaries, all of which are Cayman Islands exempted companies. As of March 31, 2016, the Company’s subsidiaries are as follows:

| · | TriLinc Global Impact Fund – Asia, Ltd. |

| · | TriLinc Global Impact Fund – Latin America, Ltd. |

| · | TriLinc Global Impact Fund – Trade Finance, Ltd. |

| · | TriLinc Global Impact Fund – African Trade Finance, Ltd. |

| · | TriLinc Global Impact Fund – Africa, Ltd. |

| · | TriLinc Global Impact Fund – Latin America II, Ltd. |

| · | TriLinc Global Impact Fund – African Trade Finance II, Ltd. |

| · | TriLinc Global Impact Fund – Latin America III, Ltd. |

Through March 31, 2016, the Company has made, through its subsidiaries, loans in several countries located in South America, Asia and Africa.

Note 2. Significant Accounting Policies

Basis of Presentation

The Company’s financial information is prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”). The Company follows the accounting and reporting guidance in the Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946 — Financial Services, Investment Companies (“ASC 946”). The preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the

9

reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. These financial statements are presented in United States dollars, which is the functional and reporting currency of the Company and all its subsidiaries.

The interim consolidated financial statements and notes are presented as permitted by the requirements for Quarterly Reports on Form 10-Q. Certain financial information that is normally included in annual financial statements, including certain financial statement footnotes, prepared in accordance with GAAP is not required for interim reporting purposes and has been omitted herein. These consolidated financial statements should be read in conjunction with the Company’s consolidated financial statements and notes related thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2015, which was filed with the Securities and Exchange Commission (“SEC”) on March 30, 2016.

The results of operations for the three months ended March 31, 2016 are not necessarily indicative of the results that ultimately may be achieved for the full year ending December 31, 2016.

The accompanying consolidated financial statements include the accounts of the Company and its subsidiaries, which were established to hold certain investments of the Company. The Company owns 100% of each subsidiary and, as such, the subsidiaries are consolidated into the Company’s consolidated financial statements. Transactions between subsidiaries, to the extent they occur, are eliminated in consolidation. The consolidated financial statements reflect all adjustments, consisting solely of normal recurring accruals, that, in the opinion of management, are necessary for the fair presentation of the results of the operations and financial condition as of and for the periods presented.

Certain prior year amounts have been reclassified to conform to the current year presentation.

Cash

Cash consists of demand deposits at a financial institution. Such deposits may be in excess of the Federal Deposit Insurance Corporation insurance limits. The Company considers the credit risk of this financial institution to be remote and has not experienced and does not expect to experience any losses in any such accounts.

Prepaid expenses

Prepaid expenses represent prepaid insurance paid by the Company during 2015. Prepaid insurance is being amortized over the term of the insurance policy which is one year. The amortization of prepaid expenses for the three months ended March 31, 2016 and 2015 is reimbursable to the Company by the Sponsor under the Amended and Restated Operating Expense Responsibility Agreement.

Revenue Recognition

The Company records interest income on an accrual basis to the extent that the Company expects to collect such amounts. The Company does not accrue as a receivable interest on loans for accounting purposes if there is reason to doubt the ability to collect such interest. Structuring, upfront and similar fees are recorded as a discount on investments purchased and are accreted into interest income, on a straight line basis, which the Company has determined not to be materially different from the effective yield method.

The Company records prepayment fees for loans and debt securities paid back to the Company prior to the maturity date as income upon receipt.

The Company generally places loans on non-accrual status when principal and interest are past due 90 days or more or when there is a reasonable doubt that principal or interest will be collected. If, however, management believes the principal and interest will be collected, a loan may be left on accrual status during the period the Company is pursuing repayment of the loan, Accrued interest is generally reversed when a loan is placed on non-accrual. Interest payments received on non-accrual loans may be recognized as income or applied to principal depending upon management’s judgment of the financial condition of the borrower. Non-accrual loans are generally restored to accrual status when past due principal and interest is paid and, in the Company’s management’s judgment, is likely to remain current over the remainder of the term. At March 31, 2016, two portfolio companies were on non-accrual status with an aggregate fair value of $3,443,260 or 2.1% of the fair value of the Company’s total investments.

Valuation of Investments

The Company applies fair value accounting to all of its investments in accordance with ASC Topic 820, Fair Value Measurement (“ASC 820”). ASC 820 requires enhanced disclosures about assets and liabilities that are measured and reported at fair

10

value. As defined in ASC 820, fair value is the price that would be received when selling an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. In accordance with ASC 820, the Company has categorized its investments into a three-level fair value hierarchy as discussed in Note 4.

ASC 820 establishes a hierarchal disclosure framework that prioritizes and ranks the level of market price observability of inputs used in measuring investments at fair value. Market price observability is affected by a number of factors, including the type of investment and the characteristics specific to the investment. Investments with readily available active quoted prices or for which fair value can be measured from actively quoted prices generally will have a higher degree of market price observability and a lesser degree of judgment used in measuring fair value.

Based on the observability of the inputs used in the valuation techniques, the Company is required to provide disclosures on fair value measurements according to the fair value hierarchy. The fair value hierarchy ranks the observability of the inputs used to determine fair values. Investments carried at fair value are classified and disclosed in one of the following three categories:

| · | Level 1 — Valuations based on unadjusted quoted prices in active markets for identical assets or liabilities that the Company has the ability to access at the measurement date. |

| · | Level 2 — Valuations based on inputs other than quoted prices included in Level 1, which are either directly or indirectly observable. |

| · | Level 3 — Valuations based on inputs that are unobservable and where there is little, if any, market activity at the measurement date. The inputs for the determination of fair value may require significant management judgment or estimation and is based upon management’s assessment of the assumptions that market participants would use in pricing the assets or liabilities. These investments include debt and equity investments in private companies or assets valued using the market or income approach and may involve pricing models whose inputs require significant judgment or estimation because of the absence of any meaningful current market data for identical or similar investments. The inputs in these valuations may include, but are not limited to, capitalization and discount rates and earnings before interest, taxes, depreciation and amortization (“EBITDA”) multiples. The information may also include pricing information or broker quotes which include a disclaimer that the broker would not be held to such a price in an actual transaction. Certain investments may be valued based upon estimated value of underlying collateral and include adjustments deemed necessary for estimates of costs to obtain control and liquidate available collateral. The non-binding nature of consensus pricing and/or quotes accompanied by disclaimer would result in classification as Level 3 information, assuming no additional corroborating evidence. |

The inputs used in the determination of fair value may require significant judgment or estimation.

Investments for which market quotations are readily available are valued at those quotations. Most of the Company’s investments are loans to private companies, which are not actively traded in any market and for which quotations are not available. For those investments for which market quotations are not readily available, or when such market quotations are deemed by the Advisor not to represent fair value, the Company’s board of managers has approved a multi-step valuation process to be followed each fiscal quarter, as described below:

| 1. | Each investment is valued by the Advisor in collaboration with the relevant sub-advisor; |

| 2. | For all investments with a maturity of greater than 12 months, the Company has engaged Duff & Phelps, LLC (“Duff & Phelps”) to conduct a review on the reasonableness of the Company’s internal estimates of fair value on each asset on a quarterly rotating basis, with each of such investments being reviewed at least annually, and provide an opinion that the Advisor’s estimate of fair value for each investment is reasonable; |

| 3. | The audit committee of the Company’s board of managers reviews and discusses the preliminary valuation prepared by the Advisor and any opinion rendered by Duff & Phelps; and |

| 4. | The board of managers discusses the valuations and determines the fair value of each investment in the Company’s portfolio in good faith based on the input of the Advisor, Duff & Phelps and the audit committee. The board of managers is ultimately responsible for the determination, in good faith, of the fair value of each investment. |

Below is a description of factors that the Company’s board of managers may consider when valuing the Company’s investments.

Fixed income investments are typically valued utilizing a market approach, an income approach, or both approaches, as appropriate. The market approach uses prices and other relevant information generated by market transactions involving identical or comparable assets or liabilities (including the sale of a business). The income approach uses valuation techniques to convert future amounts (for example, interest and principal payments) to a single present value amount (discounted) calculated based on an appropriate discount rate. The measurement is based on the net present value indicated by current market expectations about those

11

future amounts. In following these approaches, the types of factors that the Company may take into account in valuing the Company’s investments include, as applicable: available current market data, including relevant and applicable market trading and transaction comparables, applicable market yields and multiples, security covenants, call protection provisions, information rights, the nature and realizable value of any collateral, the borrower’s ability to make payments, its earnings and discounted cash flows, the markets in which the company does business, comparisons of financial ratios of peer companies that are public, the principal market for the borrower’s securities and an estimate of the borrower’s enterprise value, among other factors.

The Company may also look to private merger and acquisition statistics, public trading multiples discounted for illiquidity and other factors, valuations implied by third-party investments in the portfolio companies or industry practices in determining fair value. The Company may also consider the size and scope of a portfolio company and its specific strengths and weaknesses, as well as any other factors the Company deems relevant in measuring the fair values of the Company’s investments.

Net Realized Gains or Losses and Net Change in Unrealized Appreciation or Depreciation on Investments

The Company measures net realized gains or losses by the difference between the net proceeds from the repayment or sale on investments and the amortized cost basis of the investment including unamortized upfront fees and prepayment penalties. Realized gains or losses on the disposition of an investment are calculated using the first in first out (FIFO) method, utilizing the amortized cost basis of the investment, without regard to unrealized appreciation or depreciation previously recognized, but considering unamortized upfront fees and prepayment penalties. Net change in unrealized appreciation or depreciation reflects the change in portfolio investment values during the reporting period, including any reversal of previously recorded unrealized appreciation or depreciation, when gains or losses are realized.

Payment-in-Kind Interest

The Company may have investments that contain a payment-in-kind, or PIK, interest provision. For loans with contractual PIK interest, any interest will be added to the principal balance of such investments and be recorded as income, if the valuation indicates that such interest is collectible.

Income Taxes

The Company, as a limited liability company, allocates all income or loss to its unitholders according to their respective percentage of ownership. Therefore, no provision for federal or state income taxes has been included in these financial statements.

The Company may be subject to withholding taxes on income and capital gains imposed by certain countries in which the Company invests. The withholding tax on income is netted against the income accrued or received. Any reclaimable taxes are recorded as income. The withholding tax on realized or unrealized gain is recorded as a liability.

The Company follows the guidance for uncertainty in income taxes included in the ASC 740, Income Taxes. This guidance requires the Company to determine whether a tax position of the Company is more likely than not to be sustained upon examination by the applicable taxing authority, including the resolution of any related appeals or litigation processes, based on the technical merits of the position.

As of March 31, 2016, no tax liability for uncertain tax provision had been recognized in the accompanying financial statements nor did the Company recognize any interest and penalties related to unrecognized tax benefits. The earliest year that the Company’s income tax returns are subject to examination is the period ending December 31, 2012.

Unitholders are individually responsible for reporting income or loss, to the extent required by the federal and state income tax laws and regulations, based upon their respective share of the Company’s income and expense as reported for income tax purposes.

Calculation of Net Asset Value

The Company’s net asset value is calculated on a quarterly basis and commenced with respect to the first full quarter after the Company commenced operations. The Company calculates its net asset value per unit by subtracting total liabilities from the total value of the Company’s assets on the date of valuation and dividing the result by the total number of outstanding units on the date of valuation. The net asset value per Class A, Class C and Class I units are calculated on a pro-rata basis based on units outstanding.

12

Net Income (Loss) per Unit

Basic net income (loss) per unit is computed by dividing net income (loss) by the weighted average number of members’ units outstanding during the period. Diluted net income or loss per unit is computed by dividing net income (loss) by the weighted average number of members’ units and members’ unit equivalents outstanding during the period. The Company did not have any potentially dilutive units outstanding at March 31, 2016 and 2015.

Organization and Offering Costs