Filed Pursuant to Rule 424(b)(3)

Registration No. 333-185676

TRILINC GLOBAL IMPACT FUND, LLC

SUPPLEMENT NO. 1 DATED MAY 11, 2016

TO THE PROSPECTUS DATED APRIL 28, 2016

This prospectus supplement (“Supplement”) is part of and should be read in conjunction with the prospectus of TriLinc Global Impact Fund, LLC (the “Company”), dated April 28, 2016 (the “Prospectus”). Unless otherwise defined herein, capitalized terms used in this Supplement shall have the same meanings as in the Prospectus.

The purposes of this Supplement are as follows:

A.To provide information regarding our public offering;

B.To provide information regarding distributions declared; and

C.To update the section of the Prospectus titled “Business.”

A. Status of Our Public Offering

As of May 9, 2016, we had raised gross proceeds of approximately $203.4 million from the sale of approximately 20.6 million units of our limited liability company interest, including units issued pursuant to our distribution reinvestment plan.

B. Declaration of Distributions

On April 19, 2016, with the authorization of our board of managers, the Company declared distributions for all classes of units for the period from April 1 through April 30, 2016. These distributions were calculated based on unitholders of record for each day in an amount equal to $0.00197268 per unit per day (less the distribution fee with respect to Class C units). On May 2, 2016, $638,949 of these distributions were paid in cash and on April 30, 2016, $506,242 were reinvested in the Company’s units for those investors participating in the Company’s unit Distribution Reinvestment Plan. Some or all of the Company’s distributions have been and may continue to be paid from sources other than cash flow from operations, such as capital contributions from the Sponsor, cash resulting from a waiver or deferral of fees, and/or proceeds from this offering.

C. Update to the Section Titled “Business”

On April 27, 2016, the Company, through our Advisor, entered into a sub-advisory agreement with EuroFin Investments Pte Ltd. and EFA RET Management Pte Ltd., to become a sub-advisor for the Company’s investments in Southeast Asia.

| 1. | a. The first sentence of the fourth paragraph in the “Business—Investment Strategy—Expertise—Investing with Sub-advisors” section of the Prospectus on page 64 of the Prospectus is deleted in its entirety and replaced with the following: |

As of April 30, 2016, TriLinc Advisors has selected nine institutional-class sub-advisors with access to a robust pipeline of highly selective investment opportunities.

b. The following is inserted as the last bullet point in the “Business—Investment Strategy—Expertise—Investing with Sub-advisors” section of the Prospectus on page 67 of the Prospectus:

| | • | | EuroFin Investments Pte Ltd. and EFA RET Management Pte Ltd. (the “EFA Group”):is a Southeast Asia-headquartered asset manager that specializes in term loan and trade finance strategies, respectively, through its affiliated firms. Since inception in 2003, EFA Group has deployed over $5.4 billion in trade finance and term loan transactions globally, including over $107 million in term loan transactions in the Company’s target geographies of Vietnam, Malaysia, Indonesia, and Philippines. Headquartered in Singapore with offices in London, Geneva, Istanbul, and Dubai, EFA Group is a signatory to the United Nations-support Principles for Responsible Investment and is managed by an experienced team of investment professionals with in-depth market knowledge and extensive in-country networks. |

EFA Group’s term loan strategy leverages robust track records, credit histories, and relationships with borrowers from its trade finance portfolio. The synergy between the affiliated firms capitalizes on proprietary information and market intelligence, enabling EFA Group to execute structured senior secured mid-term loans to middle-market enterprises operating along the region’s real economy value chains.

Through its complementary lending strategies, EFA Group structures term loan products with strong collateral packages that include hard assets as well as service contracts, inventory, and share pledges.

The execution of EFA Group’s term loan strategy is led by the firm’s principals who have over 50 years of combined experience in lending strategies throughout the region, including past tenures at Rabobank Singapore, Noble Trade Finance Limited, FINCO Asia, PwC, and Calyon CIB. EFA Group’s investment activities are supported by a global network of more than 50 employees who provide strategic deal origination, credit underwriting, asset management, operations, and financial administration expertise. EFA Group’s experienced team and extensive track record of facilitating timely and flexible financing to growth-stage enterprises in the region is deepened by a diverse investor base, including top-tier pension funds, insurance companies, fund of funds, and family offices.

c. The map in the “Business—Investment Strategy—Expertise—Investing with Sub-advisors” section of the Prospectus on page 68 of the Prospectus is deleted in its entirety and replaced with the following:

| 2. | The following information updates and supplements the “Business—Investments—Overview” section of the Prospectus to provide certain information regarding the Company’s investment portfolio as of April 30, 2016: |

Investments

Since the Company commenced operations and through April 30, 2016, the Company has funded $303 million in aggregate investments, including $23 million in temporary investments. Of the aggregate investment amount, the Company has received $155.8 million in full aggregate transaction repayments from existing and exited trade finance, term loan, and temporary investment facilities. Of the aggregate transaction repayment amount, approximately $68.6 million represents transactions of trade finance, term loan, and temporary investment facilities that are closed and no longer part of the Company’s portfolio.

As of April 30, 2016 the Company had the following investments:

| | | | | | | | | | | | | | | | | | | | | | | | |

| Investment Portfolio |

| Description | | Sector | | Country | | Investment

Type | | Maturity1 | | | Interest

Rate2 | | | Total Loan

Commitment3 | | | Total Amount

Outstanding4 | | | Primary

Impact

Objective |

Agriculture Distributor | | Farm-Product

Raw Materials | | Argentina | | Trade

Finance | | | 9/30/2016 | | | | 9.00 | % | | $ | 15,000,000 | | | $ | 15,000,000 | | | Job Creation |

Agricultural Products Exporter II | | Farm-Product

Raw Materials | | Singapore5 | | Trade

Finance | | | 5/2/2016 | | | | 11.50 | % | | $ | 10,000,000 | | | $ | 10,000,000 | | | N/A6 |

Agricultural Supplies Distributor II | | Miscellaneous

Non-Durable

Goods | | South Africa | | Trade

Finance | | | 5/30/2016 | | | | 10.38 | % | | $ | 10,000,000 | | | $ | 1,827,789 | | | Job Creation |

Beef Exporter | | Meat Products | | Argentina | | Trade

Finance | | | 4/30/2016 | | | | 11.98 | % | | $ | 9,000,000 | | | $ | 9,000,000 | | | Job Creation |

Chia Seed Exporter | | Field Crops,

Except Cash

Grains | | Chile | | Trade

Finance | | | 12/11/2016 | | | | 11.50 | % | | $ | 2,000,000 | | | $ | 1,900,000 | | | Agricultural

Productivity |

Consumer Goods Distributor | | Groceries and

Related Products | | Namibia | | Trade

Finance | | | 3/3/2016 | | | | 12.00 | % | | $ | 2,000,000 | | | $ | 1,000,000 | | | Job Creation |

Dairy Co-Operative7 | | Dairy Products | | Argentina | | Trade

Finance | | | 7/29/2016 | | | | 10.67 | % | | $ | 6,000,000 | | | $ | 6,000,000 | | | Job Creation |

Diaper Manufacturer8 | | Converted Paper

and Paperboard

Products | | Peru | | Term Loan | | | 6/15/2017 | | | | 14.16 | %9 | | $ | 3,700,000 | | | $ | 3,250,000 | | | Job Creation |

Electronics Assembler10 | | Communications

Equipment | | South Africa | | Trade

Finance | | | 8/13/2016 | | | | 13.00 | % | | $ | 11,000,000 | | | $ | 6,588,857 | | | Job Creation |

Farm Supplies Distributor | | Miscellaneous

Non-Durable

Goods | | Zambia | | Trade

Finance | | | 5/3/2016 | | | | 12.43 | % | | $ | 10,000,000 | | | $ | 5,078,526 | | | Job Creation |

Fish Processor & Exporter | | Commercial

Fishing | | Ecuador | | Trade

Finance | | | 6/19/2016 | | | | 9.00 | % | | $ | 2,000,000 | | | $ | 960,472 | | | Job Creation |

Fruit & Nut Distributor | | Groceries and

Related Products | | South Africa | | Trade

Finance | | | 5/22/2015 | 11 | | | 17.50 | % | | $ | 1,250,000 | | | $ | 667,838 | | | Job Creation |

Integrated Steel Producer | | Steel Works,

Blast Furnaces,

and Rolling and

Finishing Mills | | Zambia | | Trade

Finance | | | 8/13/2016 | | | | 13.00 | % | | $ | 6,000,000 | | | $ | 6,000,000 | | | Job Creation |

International Development Logistics Provider12 | | Lumber and

Other

Construction

Materials | | United

Kingdom | | Trade

Finance | | | 10/12/2016 | | | | 8.50 | % | | $ | 5,000,000 | | | $ | 4,100,000 | | | Access to

New

Markets |

IT Service Provider13 | | Computer

Programming

and Data

Processing | | Brazil | | Term Loan | | | 10/31/2019 | | | | 13.50 | % | | $ | 14,000,000 | | | $ | 6,735,548 | | | Job Creation |

Marine Logistics Provider | | Services

Incidental to

Water

Transportation | | Nigeria | | Term Loan | | | 9/16/2020 | | | | 15.59 | %14 | | $ | 16,050,000 | | | $ | 12,956,833 | | | Capacity-

Building |

Metals Trader15 | | Metals and

Minerals, Except

Petroleum | | United

Kingdom | | Trade

Finance | | | 9/27/2016 | | | | 8.41 | % | | $ | 2,000,000 | | | $ | 2,000,000 | | | N/A5 |

Mine Remediation Company | | Metal Mining

Services | | South Africa | | Trade

Finance | | | 8/15/2016 | | | | 17.50 | % | | $ | 2,500,000 | | | $ | 2,500,000 | | | Job Creation |

Oilseed Distributor16 | | Fats and Oils | | Argentina | | Trade

Finance | | | 12/15/2016 | | | | 8.75 | % | | $ | 6,000,000 | | | $ | 6,000,000 | | | Job Creation |

Power Producer17 | | Electric Services | | Ghana | | Trade

Finance | | | 3/10/2017 | | | | 11.50 | % | | $ | 11,500,000 | | | $ | 11,500,000 | | | Access to

Energy |

Rice Importer | | Farm-Product

Raw Materials | | Kenya | | Trade

Finance | | | 5/15/2016 | | | | 11.62 | %18 | | $ | 1,000,000 | | | $ | 24,470 | | | Food

Security |

Sesame Seed Exporter | | Farm-Product

Raw Materials | | Guatemala | | Trade

Finance | | | 3/31/2016 | | | | 12.00 | % | | $ | 2,000,000 | | | $ | 1,000,000 | | | Agricultural

Productivity |

Sugar Producer | | Field Crops,

Except Cash

Grains | | Brazil | | Term Loan | | | 5/15/2017 | | | | 17.43 | %19 | | $ | 3,000,000 | | | $ | 3,000,000 | | | Capacity-

Building |

Textile Distributor | | Apparel, Piece

Goods, and

Notions | | South Africa | | Trade

Finance | | | 5/28/2016 | | | | 15.00 | % | | $ | 2,500,000 | | | $ | 280,181 | | | Job Creation |

Investment Portfolio Total | | | | | | | | | | $ | 153,500,000 | | | $ | 117,370,514 | | | |

| | | | | | | | | | | | | | | | | | | | | | |

Temporary Investments20 |

| Description | | Sector | | Country | | Investment

Type | | Maturity | | Interest

Rate | | | Total Loan

Commitment | | | Total

Amount

Outstanding | | | Primary

Impact

Objective |

Agricultural Products Exporter II | | Farm-Product

Raw Materials | | Singapore | | Bridge Loan | | 5/21/2016 | | | 11.67 | % | | $ | 5,000,000 | | | $ | 5,000,000 | | | N/A |

Financial Services Provider II | | Miscellaneous

Business Credit

Institutions | | Mauritius | | Promissory

Note21 | | 5/21/2016 | | | 12.00 | % | | $ | 15,000,000 | | | $ | 15,000,000 | | | N/A |

Temporary Investments Total | | | | | | | | $ | 20,000,000 | | | $ | 20,000,000 | | | |

Investment Portfolio and Temporary Investments Totals | | | | | | | | $ | 173,500,000 | | | $ | 137,370,514 | | | |

| 1 | The Company’s trade finance borrowers may be granted flexibility with respect to repayment relative to the stated maturity date to accommodate specific contracts and/or business cycle characteristics. This flexibility in each case is agreed upon between the Company and the sub-advisor and between the sub-advisor and the borrower. |

| 2 | Interest rates are as of April 30, 2016 and, where applicable, are weighted averages amongst multiple transactions. Interest rates include contractual rates and accrued fees where applicable. |

| 3 | The total loan commitment represents the maximum amount that can be borrowed under the agreement. The actual amount drawn on the loan by the borrower may change over time. Loan commitments are subject to availability of funds and do not represent a contractual obligation to provide funds to a borrower. |

| 4 | The total amount outstanding represents the actual amount borrowed under the loan as of April 30, 2016. In some instances where there is a $0 balance, the borrower may have paid back the original amount borrowed under a trade finance facility and under an agreement, may borrow again. |

| 5 | The transaction is secured by specific collateral held by the borrower’s subsidiaries in Kenya, Tanzania, and Mozambique. |

| 6 | Impact data is not tracked for this investment. The Company does not track impact data for trade finance transactions that meet standard underwriting guidelines, but generally have the maturity of less than one year and involve borrowers with whom, at the time of funding, the Company does not expect to maintain an ongoing lending relationship or otherwise provide an open loan facility. |

| 7 | Between April 25 and April 27, 2016, the Company funded two separate transactions totaling $6,000,000 to the Dairy Co-Operative as part of an existing $6,000,000 revolving trade finance facility at an interest rate of 10.67%. Secured by purchase contracts and receivables, both transactions are set to mature on July 29, 2016. The borrower anticipates that the Company’s financing will support economic growth through job creation, increased exports, and increased agricultural productivity. |

| 8 | On April 22, 2016, the Company funded $150,000 as part of an existing $3,700,000 senior secured purchase order revolving credit facility to the Diaper Manufacturer. Priced at a variable rate of one month Libor+10.00%, the transaction is set to mature on August 20, 2016. |

| 9 | The interest rate includes 2.50% of deferred interest. |

| 10 | Between April 12 and April 15, 2016, the Company funded three separate transactions totaling $3,445,883 as part of an existing $11,000,000 revolving senior secured trade finance facility with the Electronics Assembler. With a fixed interest rate of 13.00%, all transactions are set to mature between July 30 and August 13, 2016 and are secured by receivables as well as specific inventory being imported into South Africa from Asia. The borrower anticipates that the Company’s financing will support job creation and increase the volume of affordable devices in the region. |

| 11 | The Company, together with its sub-advisor, have agreed to further extend the principal maturity date to facilitate the strategic sale of the Fruit & Nut Distributor, which is expected to close on or before May 31, 2016. |

| 12 | On April 13, 2016, the Company funded $4,100,000 as part of a new $5,000,000 pre-export trade finance facility to the International Development Logistics Provider contracted by the United Nations to consolidate and ship prefabricated housing units and materials for UN mission personnel throughout Africa. With an interest rate of 8.50% plus six month EURIBOR, if positive, and maturity date of October 12, 2016, this transaction is secured by cash, inventory, and receivables. It is anticipated that the Company’s financing will provide critical support in accessing markets in Africa that are new to the borrower and its international development operations. |

| 13 | On April 15, 2016, the Company funded $1,500,000 as part of an existing $14,000,000 senior secured five-year term loan commitment to an IT Service Provider. With a fixed rate of 13.50%, the transaction is set to mature on October 31, 2019 and is secured by service contracts and receivables. |

| 14 | The interest rate is a variable rate of one month Libor +10.5% plus 4.68% in deferred fixed interest. |

| 15 | On April 25, 2016, the Company funded $2,000,000 as part of a new $2,000,000 revolving receivables trade finance facility to the Metals Trader. With an interest rate of 8.41% the transaction is set to mature on September 27, 2016 and is secured by a bill of exchange and sales contracts. The Company’s financing will facilitate the trade of South African-produced nickel cathodes, a critical input to iron and steel production, to a developed market off-taker for further value added processing. |

| 16 | Between April 20 and April 29, 2016, the Company funded three separate transactions totaling $6,000,000 as part of an existing $6,000,000 revolving trade finance facility to the Oilseed Distributor at an interest rate of 8.75%. Secured by specific purchase contracts and receivables, all three transactions are set to mature between October 15 and December 15, 2016. The borrower anticipates that the Company’s financing will support economic growth through job creation, increased exports, and increased agricultural productivity. |

| 17 | On April 12 and April 13, 2016, the Company funded $3,634,695 and $1,865,305, respectively, as part of a $7,000,000 senior secured equipment purchase facility with the Power Producer. With an interest rate of 11.50%, both transactions have a maturity date of March 10, 2017 and are secured by a letter of credit as well as the underlying equipment being financed by the power producer. The borrower anticipates that the Company’s financing will support increased access to energy for end-users in Ghana and will contribute to reducing the demand pressures and blackout frequency that currently burdens the country’s electric grid. |

| 18 | The interest rate is a variable rate of three month Libor + 11.00%. |

| 19 | The interest rate includes 5.00% of penalty interest because the Sugar Producer has missed making required interest payments. On August 27, 2015, the Company was informed that the borrower had filed for judicial recuperation with the local court in Brazil. An initial repayment plan was presented and published on January 19, 2016 and has been reviewed and rejected by the Company. Negotiations regarding an alternative plan are ongoing and in line with the judicial process, which calls for the convening of an assembly of the Sugar Producer’s creditors on June 15, 2016. |

| 20 | Temporary investments are defined as short-term investments that are not trade finance or term loan transactions that generally expire within one year, are intended to generate a higher yield than would be realized on cash and may be unsecured positions. The temporary investments that are unsecured positions may present a higher level of risk. |

| 21 | The promissory note from the Financial Services Provider is an unsecured position and therefore may present a higher risk profile. |

As of April 30, 2016 the Company had exited the following investments:

| | | | | | | | | | | | | | | | | | | | | | | | |

| Investment Portfolio |

| Description | | Sector | | Country | | Investment

Type | | Transaction

Date | | | Transaction

Amount | | | Payoff

Date | | | Internal

Rate of

Return

(“IRR”)1 | | | Primary

Impact

Objective |

Agricultural Products Exporter I | | Farm-Product

Raw Materials | | Singapore | | Trade Finance | | | 4/23/2015 | | | $ | 10,000,000 | | | | 2/29/2016 | | | | 11.85 | % | | N/A2 |

Agricultural Supplies Distributor I | | Miscellaneous

Non-Durable

Goods | | South Africa | | Trade Finance | | | 10/15/2014 | | | $ | 15,202,091 | | | | 8/14/2015 | | | | 13.11 | % | | Job Creation |

Candle Distributor | | Miscellaneous

Manufacturing

Industries | | South Africa | | Trade Finance | | | 9/2/2014 | | | $ | 1,400,000 | | | | 9/16/2015 | | | | 14.27 | % | | Job Creation |

Cement Distributor | | Cement,

Hydraulic | | Kenya | | Trade Finance | | | 9/23/2014 | | | $ | 12,000,000 | | | | 10/15/2015 | | | | 15.29 | % | | Job Creation |

Construction Materials Distributor | | Hardware,

Plumbing, and

Heating

Equipment | | South Africa | | Trade Finance | | | 10/9/2014 | | | $ | 838,118 | | | | 4/1/2016 | | | | 13.00 | % | | Job Creation |

Electronics Retailer | | Radio,

Television,

Consumer

Electronics,

and Music

Stores | | Indonesia | | Term Loan | | | 7/26/2013 | | | $ | 5,000,000 | | | | 6/17/2014 | | | | 19.59 | % | | Access to

Finance |

Farm Supplies Wholesaler | | Miscellaneous

Non-Durable

Goods | | South Africa | | Trade Finance | | | 5/28/2015 | | | $ | 2,250,000 | | | | 1/19/2016 | | | | 13.14 | % | | Agricultural

Productivity |

Fertilizer Distributor | | Agricultural

Chemicals | | Zambia | | Trade Finance | | | 7/17/2014 | | | $ | 3,000,000 | | | | 11/4/2014 | | | | 12.65 | % | | Job Creation |

Food Processor | | Groceries and

Related

Products | | Peru | | Term Loan | | | 3/25/2014 | | | $ | 576,000 | | | | 11/28/2014 | | | | 14.01 | % | | Job Creation |

Frozen Seafood Exporter | | Groceries and

Related

Products | | Ecuador | | Trade Finance | | | 6/17/2013 | | | $ | 240,484 | | | | 5/14/2014 | | | | 13.49 | % | | Job Creation |

Industrial Materials Distributor | | Mineral and

Ores | | South Africa | | Trade Finance | | | 11/20/2014 | | | $ | 4,030,000 | | | | 12/15/2015 | | | | 13.64 | % | | Job Creation |

Insulated Wire Manufacturer | | Rolling,

Drawing, and

Extruding of

Nonferrous

Metals | | Peru | | Trade Finance | | | 5/2/2014 | | | $ | 1,991,000 | | | | 12/2/2014 | | | | 8.43 | % | | Job Creation |

International Tuna Exporter | | Groceries and

Related

Products | | Ecuador | | Trade Finance | | | 7/17/2013 | | | $ | 1,000,000 | | | | 10/9/2013 | | | | 13.58 | % | | Job Creation |

Meat Processor | | Meat Products | | South Africa | | Trade Finance | | | 7/7/2014 | | | $ | 2,950,000 | | | | 4/1/2016 | | | | 14.08 | % | | Job Creation |

Meat Producer | | Meat Products | | South Africa | | Trade Finance | | | 11/27/2015 | | | $ | 1,500,000 | | | | 2/3/2016 | | | | 14.83 | % | | N/A2 |

Rice & Bean Importer | | Groceries and

Related

Products | | South Africa | | Trade Finance | | | 7/7/2014 | | | $ | 1,000,000 | | | | 8/5/2015 | | | | 12.97 | % | | Job Creation |

Rice Producer | | Cash Grains | | Tanzania | | Trade Finance | | | 1/22/2015 | | | $ | 3,900,000 | | | | 4/1/2016 | | | | 12.04 | % | | Job Creation |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Seafood Processing Company | | Miscellaneous

Food

Preparations

and Kindred

Products | | | Ecuador | | | Trade Finance | | | 6/19/2013 | | | $ | 496,841 | | | | 7/1/2013 | | | | 13.44 | % | | | Job Creation | |

Timber Exporter | | Sawmills and

Planing Mills | | | Chile | | | Trade Finance | | | 7/3/2013 | | | $ | 915,000 | | | | 6/12/2014 | | | | 10.25 | % | | | Job Creation | |

Waste Management Equipment Distributor | | Machinery,

Equipment,

and Supplies | | | South Africa | | | Trade Finance | | | 2/13/2015 | | | $ | 310,752 | | | | 5/15/2015 | | | | 20.19 | % | |

| Equality &

Empowerment |

|

Investment Portfolio Total | | | | | | | | | | | | $ | 68,600,286 | | | | | | | | | | | | | |

Investment Portfolio—Weighted Average IRR | | | | | | | | | | | | | | | | | | 13.71 | % | | | | |

| | | | | | |

Temporary Investments3 | | | | | | | | | | | | | | | | | | | | | | | |

| Description | | Sector | | Country | | | Investment

Type | | Transaction

Date | | | Transaction

Amount | | | Payoff

Date | | | Internal

Rate of

Return

(“IRR”)1 | | | Primary

Impact

Objective | |

Financial Services Provider I | | Miscellaneous

Business

Credit

Institutions | | | Mauritius | | | Promissory

Note | | | 9/23/2014 | | | $ | 3,000,000 | | | | 11/17/2014 | | | | 15.94 | % | | | N/A | |

Temporary Investments Total | | | | | | | | | | | | $ | 3,000,000 | | | | | | | | | | | | | |

| | | | | |

Temporary Investments—Weighted Average IRR | | | | | | | | | | | | | | | 15.94 | % | | | | |

| | | | | |

Investment Portfolio and Temporary Investments Total | | | | | | $ | 71,600,286 | | | | | | | | | | | | | |

| | | | |

Investment Portfolio and Temporary Investments—Weighted Average IRR | | | | | | | | | | | | 13.80 | % | | | | |

| 1 | Given that the loan has been paid off, this investment is no longer part of the Company’s portfolio. The internal rate of return is defined as the gross average annual return earned through the life of an investment. The internal rate of return was calculated by our Advisor (unaudited) as the investment (loan advance) was made and cash was received (principal, interest and fees). |

| 2 | Impact data is not tracked for this investment. The Company does not track impact data for trade finance transactions that meet standard underwriting guidelines, but generally have the maturity of less than one year and involve borrowers with whom, at the time of funding, the Company does not expect to maintain an ongoing lending relationship or otherwise provide an open loan facility. |

| 3 | Temporary investments are defined as short-term investments that are not trade finance or term loan transactions that generally expire within one year, are intended to generate a higher yield than would be realized on cash and may be unsecured positions. The temporary investments that are unsecured positions may present a higher level of risk. |

Certain Portfolio Characteristics1

| | | | |

Total Assets (est.) | | $ | 174,400,000 | |

Current Loan Commitments | | $ | 153,500,000 | |

Leverage | | | 0 | % |

Weighted Average Portfolio Loan Size | | $ | 4,747,604 | |

Weighted Average Portfolio Duration | | | 0.72 years | |

Weighted Average Position Yield | | | 12.01 | % |

Average Collateral Coverage Ratio | | | 1.45x | |

USD Denominated | | | 100 | % |

Senior Secured First-Lien | | | 100 | % |

Countries | | | 14 | |

Sectors | | | 18 | |

Top Five Investments by Percentage2

| | | | | | |

| Company Description | | Country | | % of Total Assets | |

Agriculture Distributor | | Argentina | | | 8.6 | % |

Marine Logistics Provider | | Nigeria | | | 7.4 | % |

Power Producer | | Ghana | | | 6.6 | % |

Agricultural Products Exporter II | | Singapore | | | 5.7 | % |

Beef Exporter | | Argentina | | | 5.2 | % |

| 1 | All information provided in this section, with the exception of the Total Asset (est.) figure, does not include the Company’s temporary investment commitments such as the promissory note from the Mauritian Financial Services Provider and the bridge loan from the Singaporean Agricultural Products Exporter comprising 10.9% and 3.6%, respectively, of all the investments currently held by the Company. The promissory note from the Mauritian Financial Services Provider is an unsecured position. |

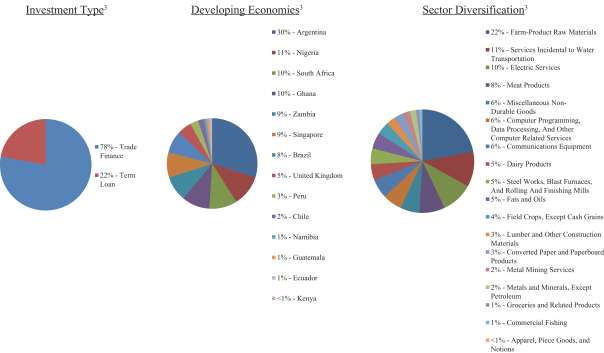

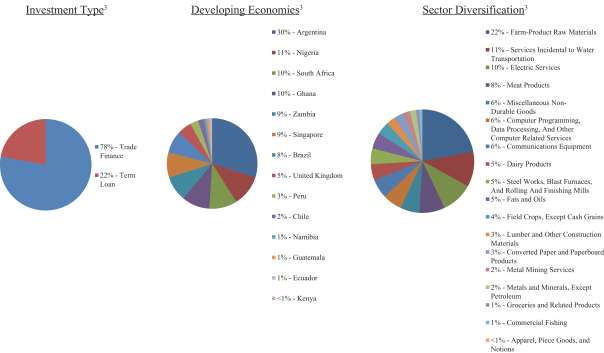

| 2 | This represents all countries/sectors where the Company currently has a loan commitment other than through a temporary investment. Due to the revolving debt nature of trade finance facilities and the timing of funding, it is possible that certain commitments currently have a zero outstanding balance and would therefore not be represented in the country/sector allocation charts, which represents invested capital. |

| 3 | The above charts represent investment type, developing economy, and sector diversification as a percentage of the total amount outstanding of the Company’s investments other than the Company’s temporary investments. The Company’s temporary investments include the promissory note from the Mauritian Financial Services Provider and the bridge loan from the Singaporean Agricultural Products Exporter comprising 10.9% and 3.6%, respectively, of all the investments currently held by the Company. |

| 3. | The following disclosures are inserted in the section titled “Business—Investments—Investment Spotlights” on page 76 of the Prospectus: |

Chia Seed Exporter

Investment Overview1

| | |

Investment Type | | Senior Secured Trade Finance |

Structure | | Revolving Facility |

Facility Amount2 | | $2,000,000 |

Approximate Repayment Period3 | | < 1 year |

Interest Rate | | 11.50% |

Sector | | Field Crops, Except Cash Grains |

Collateral Coverage Ratio4 | | ³1.53x |

Environmental, Social, and Governance Screens | | Compliant |

Primary Impact Objective | | Agricultural Productivity |

| 1 | The Investment Overview section reflects the terms of the facility as of April 30, 2016. |

| 2 | The facility amount represents the current amount that is available to the borrower under the agreement. This amount may change over time. |

| 3 | Represents approximate repayment period of transactions drawn under the facility. Due to the revolving nature of trade finance facilities and the timing of their underlying transactions, the length of each transaction repayment period may vary, but generally will not exceed one year. |

| 4 | The collateral coverage ratio is the amount of collateral the borrower must maintain in relation to the total amount outstanding on the facility. |

Borrower Background

The Company has provided financing to a chia seed exporter located in Santiago, Chile. Established in 2005 by Belgian and Chilean entrepreneurs who incorporated a small group of Argentine and Bolivian farmers, the borrower’s market share has steadily grown to comprise up to 15% of global chia seed exports in 2014 and the borrower expects to double its sales volume by 2020. Growing in popularity in international markets, chia seeds are the richest non-marine whole food source of Omega-3 fatty acids and contain protein, dietary fiber, and antioxidants, in addition to numerous vitamins and minerals. The borrower sources chia seeds from multiple growers in Argentina, Brazil, Bolivia, and Paraguay and processes them in a new state of the art plant in the Arica free trade zone of Chile. The Company’s financing provides the borrower with timely and flexible short-term export financing for shipments of packaged chia seeds, chia oil (bulk and capsules), and baked good snacks to health food stores, pharmacies, supermarkets, and food service companies located in the Americas, Europe, and Asia. Additionally, the borrower:

| | • | | Seeks to ensure the highest levels of product quality and nutritional value through the attainment and maintenance of relevant product certifications, including Good Agricultural Practices (GAP), Good Manufacturing Practices (GMP), Hazard Analysis Critical Control Point (HACCP), ISO 9001—Product Quality Management System, and FSSC 22000- Food Safety Management System. |

| | • | | Is committed to conserving resources by implementing water usage and waste management reduction policies as part of its production practices. |

Fish Processor and Exporter

Investment Overview1

| | |

Investment Type | | Senior Secured Trade Finance |

Structure | | Revolving Facility |

Facility Amount2 | | $2,000,000 |

Approximate Repayment Period3 | | < 1 year |

Interest Rate | | 9.00% |

Sector | | Commercial Fishing |

Collateral Coverage Ratio4 | | ³ 1.25x |

Environmental, Social, and Governance Screens | | Compliant |

Primary Impact Objective | | Job Creation |

| 1 | The Investment Overview section reflects the terms of the facility as of April 30, 2016. |

| 2 | The facility amount represents the current amount that is available to the borrower under the agreement. This amount may change over time. |

| 3 | Represents approximate repayment period of transactions drawn under the facility. Due to the revolving nature of trade finance facilities and the timing of their underlying transactions, the length of each transaction repayment period may vary, but generally will not exceed one year. |

| 4 | The collateral coverage ratio is the amount of collateral the borrower must maintain in relation to the total amount outstanding on the facility. |

Borrower Background

The Company has provided financing to a vertically-integrated fish processor and exporter in Ecuador. Established in 1973, the company is engaged in the processing and sale of dolphin-safe tuna and sardine products for domestic and international consumption, primarily in the U.S, Europe, and Japan. As a locally-owned family business with over 40 years of industry experience, the borrower is a recognized leader in the Ecuadorian tuna industry. The Company’s financing provides the borrower with timely and flexible short-term capital to meet its production and sales projections while supporting further efforts to create jobs and increase employee wages. Additionally, the borrower:

| | • | | Incorporates state-of-the-art industrial ozone water treatment equipment to disinfect and oxygenate wastewater generated during production and manufacturing processes at its fish processing facility. Through efficient wastewater treatment methods, the company reduces its overall energy consumption and dependence on the national electricity grid. |

| | • | | Has planted approximately 2,500 trees on eight hectares around its processing and manufacturing facility as part of a broader reforestation project and uses the treated wastewater for watering, care, and maintenance. |

| | • | | Provides financial support to two nearby rural schools and implements a company-wide recycling program that benefits a foundation for the elderly. |

| | • | | Implements fish catching and processing best practices to ensure consistent product quality while minimizing impacts on the environment. These practices are compliant with recognized Hazard Analysis Critical Control Points (HACCP) norms, local and international regulations, and Dolphin Safe standards. |

IT Service Provider

Investment Overview1

| | |

Investment Type | | Senior Secured Term Loan |

Structure | | Term Loan due on October 31, 2019 |

Facility Amount2 | | $14,000,000 |

Interest Rate | | 13.50% |

Sector | | Computer Programming, Data Processing, and Other Computer Related Services |

Collateral Coverage Ratio4 | | ³ 1.20x |

Environmental, Social, and Governance Screens | | Compliant |

Primary Impact Objective | | Job Creation |

| 1 | The Investment Overview section reflects the terms of the facility as of April 30, 2016. |

| 2 | The facility amount represents the current amount that is available to the borrower under the agreement. This amount may change over time. |

| 3 | Represents approximate repayment period of transactions drawn under the facility. Due to the revolving nature of trade finance facilities and the timing of their underlying transactions, the length of each transaction repayment period may vary, but generally will not exceed one year. |

| 4 | The collateral coverage ratio is the amount of collateral the borrower must maintain in relation to the total amount outstanding on the facility. |

Borrower Background

The Company has provided financing to an IT service provider in Brazil. Founded in 1988 in São Paulo, the borrower is an established information technology system integrator in Brazil. The borrower specializes in data center solutions and services, including virtualization, backup site, service desk, and cloud computing solutions. The borrower has offices throughout Brazil and partners with large multinational IT companies to deliver unique and tailored solutions to its core client base of mid-size Brazilian enterprises, as well as local and regional government entities. The Company’s term loan financing provides the borrower with a source of medium term liquidity to purchase equipment needed to service newly-attained contracts and existing supplier accounts. The borrower anticipates that the Company’s financing will also support its efforts to increase its employee base in line with its revenue and growth projections. Additionally, the borrower:

| | • | | Contributes to its clients’ ability to generate higher earnings and employment through its provision of technology solutions. On average, Brazilian SMEs with higher technology access grow their revenues by 16 percent more than SMEs with lower access, and generate 11 percent more jobs. |

| | • | | Seeks to optimize energy usage and reduce waste by using low-power light bulbs throughout its facilities, committing to using air conditioning only in extreme weather conditions, using recycled paper for printing, and eliminating unnecessary printer use. |

| | • | | Offers human resource policies that include premium health insurance coverage, maternity leave, and fair hiring/recruiting, compensation, and career advancement practices. The borrower also encourages its employees to participate in community service by providing them with flexible working schedules to pursue volunteer activities. |

Sesame Seed Exporter

Investment Overview1

| | |

Investment Type | | Senior Secured Trade Finance |

Structure | | Revolving Facility |

Facility Amount2 | | $2,000,000 |

Approximate Repayment Period3 | | < 1 year |

Interest Rate | | 12.00% |

Sector | | Farm-Product Raw Materials |

Collateral Coverage Ratio4 | | ³ 1.33x |

Environmental, Social, and Governance Screens | | Compliant |

Primary Impact Objective | | Agricultural Productivity |

| 1 | The Investment Overview section reflects the terms of the facility as of April 30, 2016. |

| 2 | The facility amount represents the current amount that is available to the borrower under the agreement. This amount may change over time. |

| 3 | Represents approximate repayment period of transactions drawn under the facility. Due to the revolving nature of trade finance facilities and the timing of their underlying transactions, the length of each transaction repayment period may vary, but generally will not exceed one year. |

| 4 | The collateral coverage ratio is the amount of collateral the borrower must maintain in relation to the total amount outstanding on the facility. |

Borrower Background

The Company has provided financing to a sesame seed exporter in Guatemala. In operation for over 40 years, the family-owned company is engaged in the purchase, processing, and export of sesame seeds and honey sourced from producers throughout Latin America and India. With a production capacity of over 3.5 million pounds of sesame seeds per year, the borrower sells its product to bakeries around the world that supply leading global fast food chains, including McDonalds. The Company’s financing provides the borrower with a source of short-term funding to purchase inventory and fulfill customer orders in a timely fashion. Additionally, it is

anticipated that the Company’s financing will indirectly improve agricultural productivity of the borrower’s supplier base as well as support the borrower’s employee capacity-building initiatives. Additionally, the borrower:

| | • | | Is conscious of its environmental footprint through optimizing energy usage by utilizing solar panels and replacing its bunker boilers (used for heating water for material processing) with natural gas, a cleaner and more cost efficient energy source. In addition, the borrower recycles and filters wastewater throughout all of its manufacturing processes. |

| | • | | Is committed to improving employee welfare by implementing human resource policies that include health and dental insurance, disability coverage, parental leave, fair hiring/recruiting and compensation practices, and job-related training opportunities. |