UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22710

BLUEROCK TOTAL INCOME+ REAL ESTATE FUND

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, 32nd Floor, New York, NY 10105

(Address of principal executive offices) (Zip code)

Bluerock Fund Advisor, LLC

1345 Avenue of the Americas, 32nd Floor,

New York, NY 10105

(Name and address of agent for service)

1-844-819-8287

(Registrant’s telephone number, including area code)

Date of fiscal year end: September 30

Date of reporting period: March 31, 2020

Item 1. Reports to Stockholders.

(a)

Semi-Annual Report

March 31, 2020

Investor Information: 1-844-819-8287

This report and the financial statements contained herein are submitted for the general information of shareholders and are not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. Nothing herein contained is to be considered an offer of sale or solicitation of an offer to buy shares of the Bluerock Total Income+ Real Estate Fund. Such offering is made only by prospectus, which includes details as to offering price and other material information.

Distributed by ALPS Distributors, Inc.

Member FINRA

Shareholder Letter | 1 |

Portfolio Review | 9 |

Portfolio of Investments | 11 |

Statement of Assets and Liabilities | 14 |

Statement of Operations | 15 |

Statements of Changes in Net Assets | 16 |

Statement of Cash Flows | 18 |

Financial Highlights | 19 |

Notes to Financial Statements | 23 |

Renewal of Investment Advisory Agreement and Sub-Advisory Agreements | 31 |

Additional Information | 34 |

Privacy Policy | 35 |

Electronic Report Disclosure Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Fund’s website www.bluerockfunds.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by calling the Fund at (844) 819-8287, or submit a signed letter of instruction requesting paperless reports to PO Box 219445, Kansas City, MO 64121. If you own these shares through a financial intermediary, you may contact your financial intermediary to request your shareholder reports electronically.

You may elect to receive all future reports in paper free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by calling the Fund at (844) 819-8287, or by submitting a signed letter of instruction requesting paper reports to PO Box 219445, Kansas City, MO 64121. If you own these shares through a financial intermediary, contact the financial intermediary to request paper copies. Your election to receive reports in paper will apply to all funds held with the fund complex or your financial intermediary.

| SEMI-ANNUAL REPORT: (4Q 2019-1Q 2020) (UNAUDITED) |

| Letter from the TI+ Portfolio Managers |

To Our Valued Shareholders:

The first half of 2020 has been defined by the COVID-19 pandemic and its far-reaching health, social, and economic impacts. Financial markets, reacting to tremendous near-term uncertainty, have faced significant volatility and drawdowns. Swift and unprecedented fiscal, monetary, and regulatory policy actions have tempered negative sentiment. However, uncertainty clouds the near-term outlook.

Despite these unforeseen challenges leading to the abrupt end of the historic 11-year economic expansion in March of 2020, the Bluerock Total Income+ Real Estate Fund (TI+ or the Fund) has outperformed major equity market indices over the past year and in Q1 of 2020. We believe this outperformance was a result of strategic efforts over the last two years to mitigate portfolio risk and to defensively position the Fund against late-cycle market conditions.

Risk Mitigation Measures

■ | We reduced and repositioned the Fund’s public security portfolio defensively as public REITs reached all-time valuation highs in 2019, limiting the significant downside risk from public securities. This action brought the Fund’s public REIT allocation to less than 3%, reducing its exposure to the MSCI U.S. REIT Index’s -44.03% decline since its peak on February 19, 2020. |

■ | We thoughtfully reduced the Fund’s exposure to traditionally cyclical sectors. As of 3/31/2020, the Fund’s hotel sector exposure was less than 0.1%, while retail and office sector exposures at 8% and 17% were each 56%* lower than the benchmark NCREIF ODCE Index. |

| ■ | We actively increased our exposure to traditionally defensive, cycle-agnostic sectors. The Fund’s multifamily and industrial sector exposures at 29% and 36%, were approximately 39% and 68%* higher, respectively, than the benchmark NCREIF ODCE Index. |

| ■ | We increased our senior real estate debt allocation to approximately 13% in an effort to benefit from structural protections and generate relatively attractive yields. |

*Fund exposures relative to the NCREIF ODCE include sector allocations in the Fund’s debt and private equity securities.

| FUND STRUCTURAL BENEFITS |

| | |

| DIVERSIFICATION. The Fund’s investments hold approximately 3,800 underlying properties diversified across real estate sectors, geographies, strategies and managers, minimizing the potential impact from any one property, market, sector or manager. |

| | |

| CORE INSTITUTIONAL REAL ESTATE. Comprising 91% of the underlying portfolio with a 93% occupancy rate, such real estate has historically generated stable income returns across economic cycles, potentially minimizing the impact of a downturn. |

| | |

| LOW LEVERAGE. The Fund’s underlying investments have a low 27% weighted average loan-to-value ratio, which contributes to the stability of the portfolio. |

| | |

CORPORATE HEADQUARTERS | 1345 AVENUE OF THE AMERICAS | 32ND FLOOR | NEW YORK, NY 10105 | 877.826.BLUE (2583) | BLUEROCKRE.COM

| SEMI-ANNUAL REPORT (4Q 2019- 1Q 2020) |BLUEROCK TOTAL INCOME+ REAL ESTATE FUND | (UNAUDITED) |

Outlook

Government imposed suppression efforts in response to COVID-19 have left some industries less affected, while thrusting others into crisis. As market conditions continues to unfold, we are keeping a close eye on transaction markets, income generation, market liquidity, and other fundamental indicators of long-term value. A wide variation of outcomes has been observed in the public real estate markets and we are already seeing disparate outcomes across private real estate sectors as the evolving situation accelerates some pre-existing trends.

The growth of e-commerce and its impact on in-store sales has been apparent for years, which COVID-19 related restrictions have greatly accelerated. While in-store sales are expected to recover from current conditions to some degree, e-commerce sales and their contribution to the performance of the industrial sector will likely persist. We believe the growth of e-commerce will likely come at the expense of non-grocery anchored retail centers, which may experience additional challenges.

We expect the apartment sector to weather short-term rent collection issues, aided by the CARES Act benefits and mortgage forbearance programs. Long term, we believe the apartment sector remains attractive as Millennials are likely to delay or avoid homeownership even longer in response to the recession’s potential impact on the for-sale housing market.

According to the National Council of Real Estate Investment Fiduciaries (NCREIF) special bulletin, the sector values most affected have been hotels, non-grocery anchored retail, co-working office, and senior housing while the sectors least affected include industrial and apartments.

Based on these trends and industry outlook, we believe the Fund currently has an attractive portfolio mix to help combat near-to-medium term economic turmoil. Further, we plan to strengthen our positions in the industrial and apartment sectors in hopes of positioning our portfolio to continue meeting the Fund’s objectives.

Institutional private real estate, as measured by the NCREIF Property Index, has an extensive track record of generating stable income with minimal drawdowns. Although there can be no guarantees of future performance, institutional real estate has historically generated higher risk-adjusted returns compared to the equity markets and has weathered multiple recessions including the S&L crisis, the “tech/dot.com” bust, the events of 9/11, and the Great Financial Crisis. Given institutional private real estate’s historical performance, we believe an allocation should remain a key component of individual investors’ portfolios.

We thank you for your trust and confidence in the Bluerock Total Income+ Real Estate Fund.

Sincerely,

| |  | |  |

| |  | |  |

| | | | |

| Jordan Ruddy | | Adam Lotterman |

| Co-Chief Investment Officer | | Co-Chief Investment Officer |

| Bluerock Total Income+ Real Estate Fund | | Bluerock Total Income+ Real Estate Fund |

| FUND SUB-ADVISORS |

| |  | About Mercer Investment Management | About Mercer Investment Management

| |

| | Mercer Investment Management, Inc., acts as sub-advisor to the TI+ Fund’s private real estate equity investments. For more than 75 years, Mercer has been one of the world’s leading advisors to endowments, pension funds, sovereign wealth funds and family offices globally, with over 3,700 clients worldwide, and $15.0 trillion in assets under advisement. Mercer works to evaluate over 7,100 investment managers and 35,000 individual investments/strategies and works with Bluerock to select a strategic combination of ‘best-in-class’ institutional real estate managers and investments for the Fund. | |

| | | |

| |

| | About DWS | |

| | DWS (formerly Deutsche Asset Management), through its indirect subsidiary RREEF America, LLC, acts as sub-advisor to the TI+ Fund’s public real estate securities investments and is a registered investment adviser under the Advisers Act. DWS’ real estate business in the U.S. dates back to 1975. Today, DWS has $800+ billion in assets under management and works with 550+ institutional clients. Of that total, approximately $68 billion of AUM is invested in public and private real estate globally, making DWS one of the largest real estate managers in the world. | |

| | | |

| SEMI-ANNUAL REPORT (4Q 2019- 1Q 2020) |BLUEROCK TOTAL INCOME+ REAL ESTATE FUND | (UNAUDITED) |

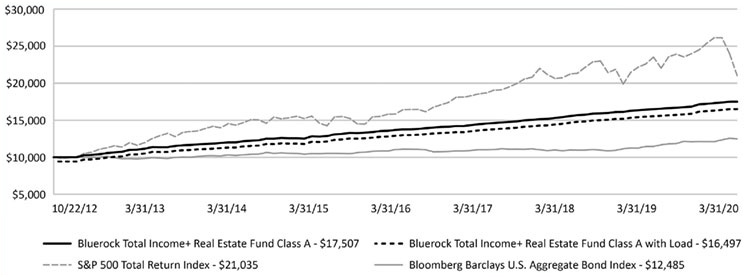

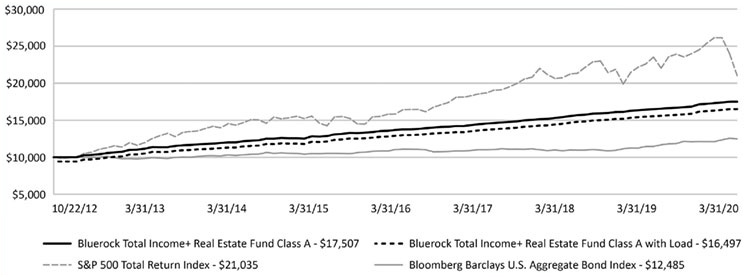

PERFORMANCE

From inception (10.22.2012) through 3.31.2020, TI+ (A Shares) generated a cumulative total return of 75.07%, or 7.82% annualized. The Fund was able to accomplish this primarily through investments in private real estate investments, which own best-in-class real estate, generating both income and capital appreciation. Private investments are supplemented with select public real estate securities. The Fund currently has four share classes outstanding: A, C, I and L Shares. A summary of the performance of each share class is presented below.

Fund Performance thru 3.31.2020†

| One Year | Three Year | Five Year | Since Inception2 |

TI+ Fund - Class A | 6.55% | 7.20% | 6.79% | 7.82% |

TI+ Fund - Class A

with Max Sales Charge1 | 0.43% | 5.10% | 5.53% | 6.96% |

TI+ Fund - Class C | 5.79% | 6.40% | 6.00% | 7.03% |

TI+ Fund - Class C

with Load 3 | 4.79% | 6.40% | 6.00% | 7.03% |

TI+ Fund - Class I | 6.85% | 7.47% | 7.06% | 8.07% |

TI+ Fund - Class L | 6.31% | 6.94% | 6.53% | 7.55% |

TI+ Fund - Class L

with Max Sales Charge1 | 1.78% | 5.40% | 5.61% | 6.93% |

1 | The maximum sales charge for the A Shares is 5.75% and for L Shares is 4.25%. Investors may be eligible for a reduction in sales charges. |

2 | Since Inception returns as of October 22, 2012. Actual Inception date of the A Shares is October 22, 2012. Actual Inception date of the Fund’s C and I Shares is April 1, 2014. Actual Inception date for the L Shares is June 1, 2017 |

3 | Adjusted for early withdrawal charge of 1.00%. |

† Returns for Class C, Class I and Class L Shares prior to their inception dates are based on the performance of Class A Shares. For Class C and Class L Shares, prior performance has been adjusted to reflect differences in expenses between the respective classes and Class A. The actual returns of Class I would have been different than those shown because Class I has lower expenses than Class A.

The total annual fund operating expense ratio, gross of any fee waivers or expense reimbursements, is 2.21% for Class A, 2.96% for Class C, 1.95% for Class I and 2.46% for Class L per the February 1, 2020 prospectuses.

The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Past performance is not a guarantee of future results. The Fund’s investment advisor has contractually agreed to reduce its fees and/or absorb expenses of the Fund, at least until January 31, 2021, for Class A, C, I and L shares to ensure that the net annual fund operating expenses will not exceed 1.95% for Class A, 2.70% for Class C and 1.70% for Class I, and 2.20% for Class L, subject to possible recoupment from the Fund in future years. Please review the Fund’s Prospectuses for more detail on the expense waiver. Results shown reflect the full fee waiver, without which the results could have been lower. A Fund’s performance, especially for very short periods of time, should not be the sole factor in making your investment decisions. For performance information current to the most recent month end, please call toll-free 1-844-819-8287.

Total returns are calculated using SEC Form N-2 instructions and reflect all fees and charges.

The Fund’s Class M Shares commenced operations on February 1, 2020, however as of March 31, 2020 no such shares have been issued and therefore are not included in the Fund’s performance information.

| SEMI-ANNUAL REPORT (4Q 2019- 1Q 2020) |BLUEROCK TOTAL INCOME+ REAL ESTATE FUND | (UNAUDITED) |

LONG-TERM CAPITAL APPRECIATION

The Fund’s A Shares 7.82% annualized total net return has provided capital appreciation in addition to current income. TI+ generated this appreciation with a positive or neutral return 89% of all days from inception through 3.31.2020.

Past performance is not a guarantee of future results.

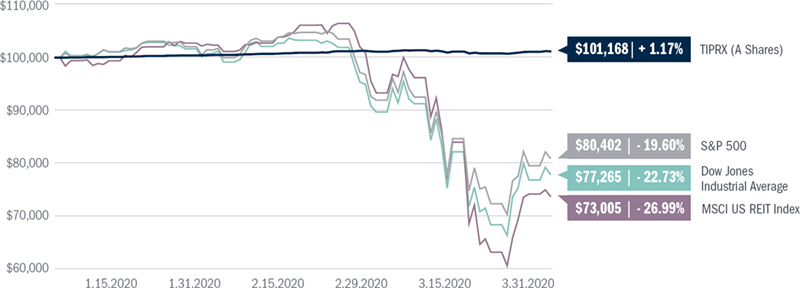

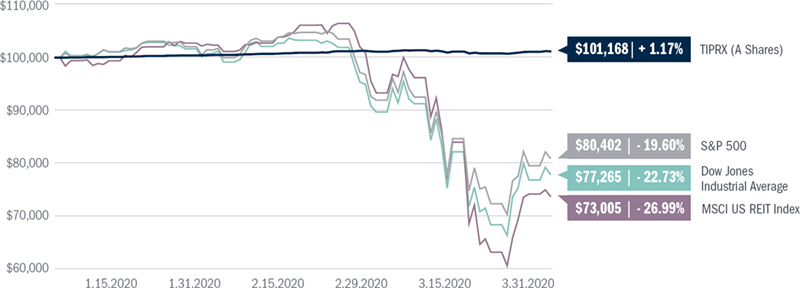

TI+: OUTPERFORMANCE OF EQUITY INDEXES IN A VOLATILE Q1 2020

TIPRX generated a positive return in Q1 while major equity indexes dropped 20%+ due to the COVID-19 bear market.

Hypothetical Growth of $100,000

1.1.2020 - 3.31.2020

Page Sources: Morningstar Direct

TI+ Fund: A-Shares, no load | Stocks: S&P 500 Total Return, Dow Jones Industrial Average | REITs: MSCI U.S. REIT Index

| ** | Please refer to the full descriptions and risks of select asset classes on pages 7-8. |

Past performance is not a guarantee of future results. Risk and liquidity factors vary significantly between asset classes.

| SEMI-ANNUAL REPORT (4Q 2019- 1Q 2020) |BLUEROCK TOTAL INCOME+ REAL ESTATE FUND | (UNAUDITED) |

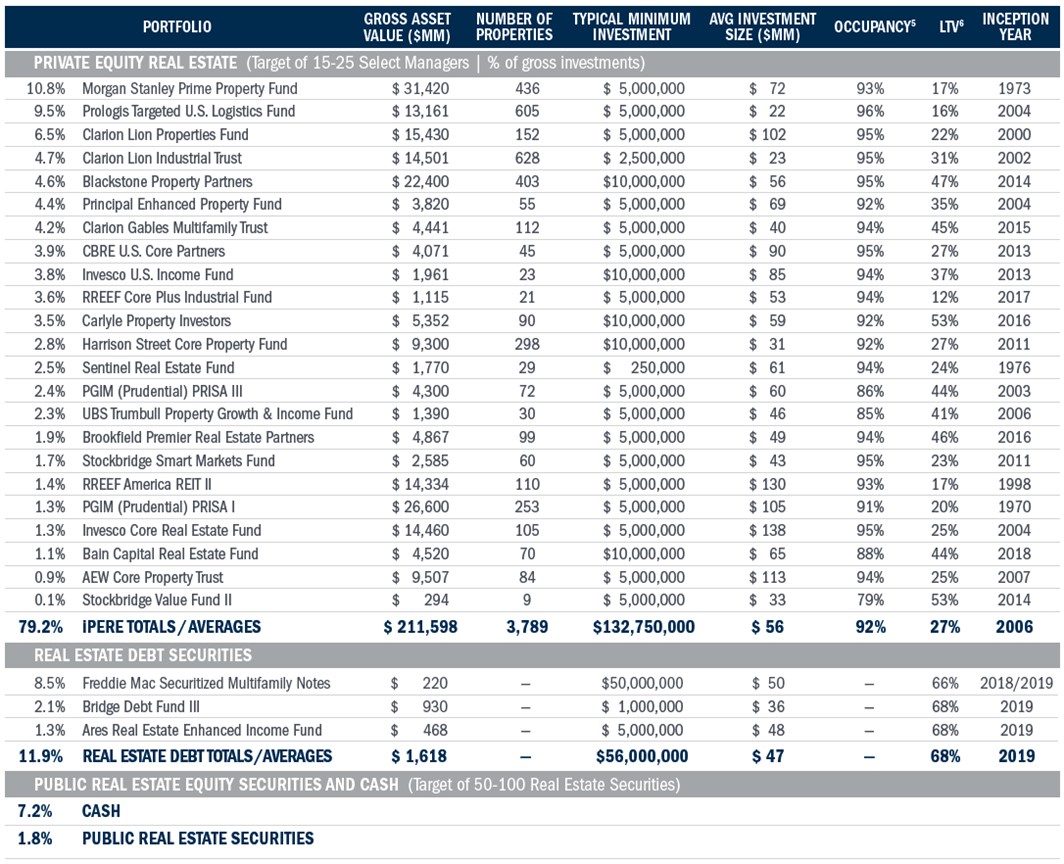

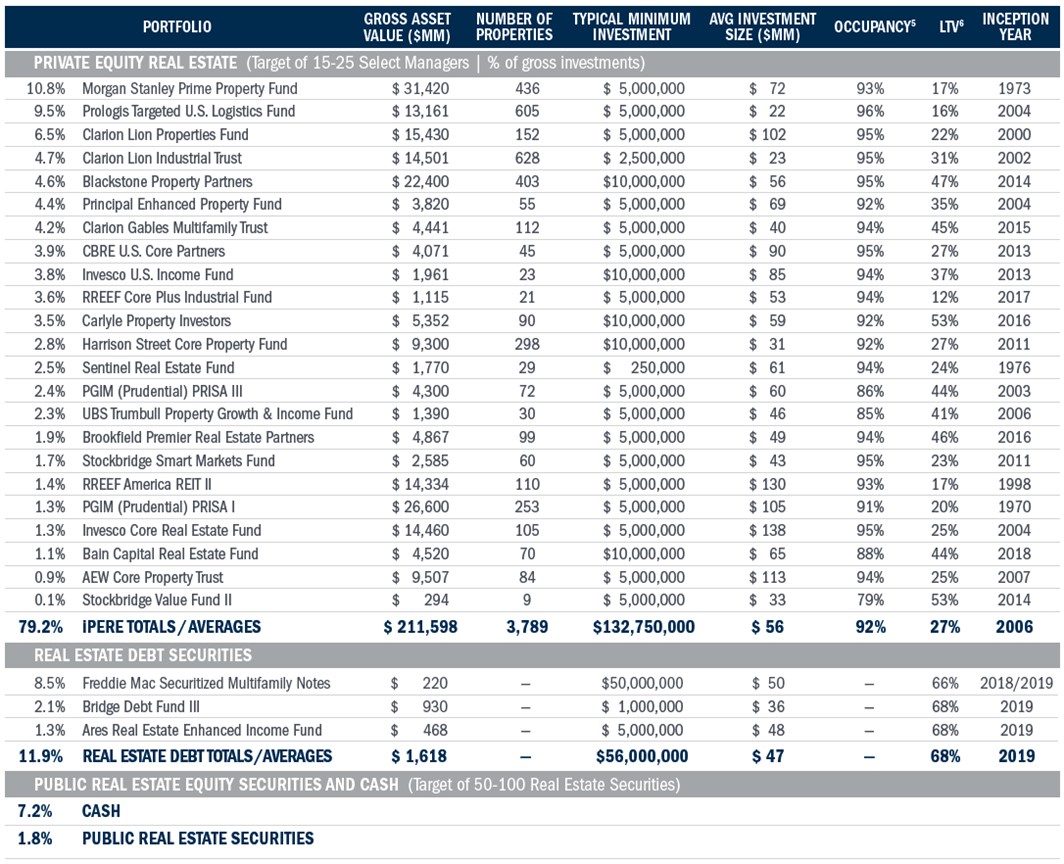

FUND HOLDINGS

As of 3.31.2020, the Gross Asset Value of the underlying real estate in the institutional private equity real estate funds in which TI+ is invested is approximately $212 billion, comprising nearly 3,800 properties across the United States.4

GEOGRAPHIC DIVERSIFICATION The regions and allocations presented represent the Funds’ institutional fund investments as of the date herein, but is subject to change at any time.

| | | SECTOR DIVERSIFICATION The sector diversification presented represents examples of how the Fund’s institutional fund investments are allocated as of the date herein, but is subject to change at any time.

|

4 | Portfolio holdings are subject to change at any time and should not be considered investment advice. Underlying iPERE data as of 3.31.2020. Diversification does not ensure profit. The organizations referenced above are not invested in Bluerock or the Total Income+ Real Estate Fund, and they may not be invested in the funds in which the Bluerock Total Income+ Real Estate Fund invests. |

| SEMI-ANNUAL REPORT (4Q 2019- 1Q 2020) |BLUEROCK TOTAL INCOME+ REAL ESTATE FUND | (UNAUDITED) |

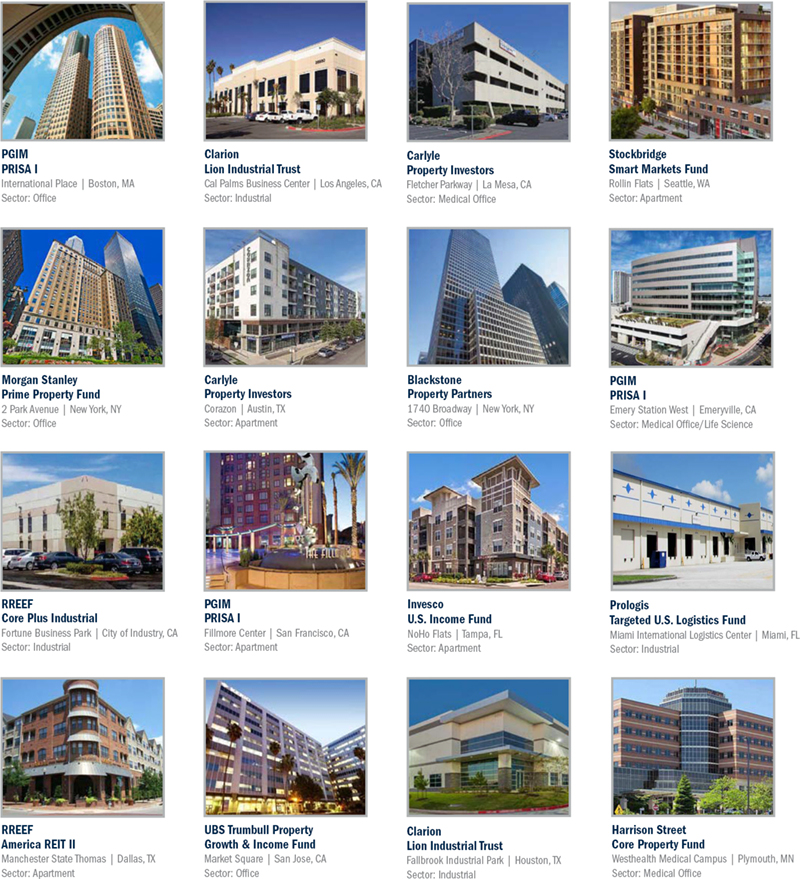

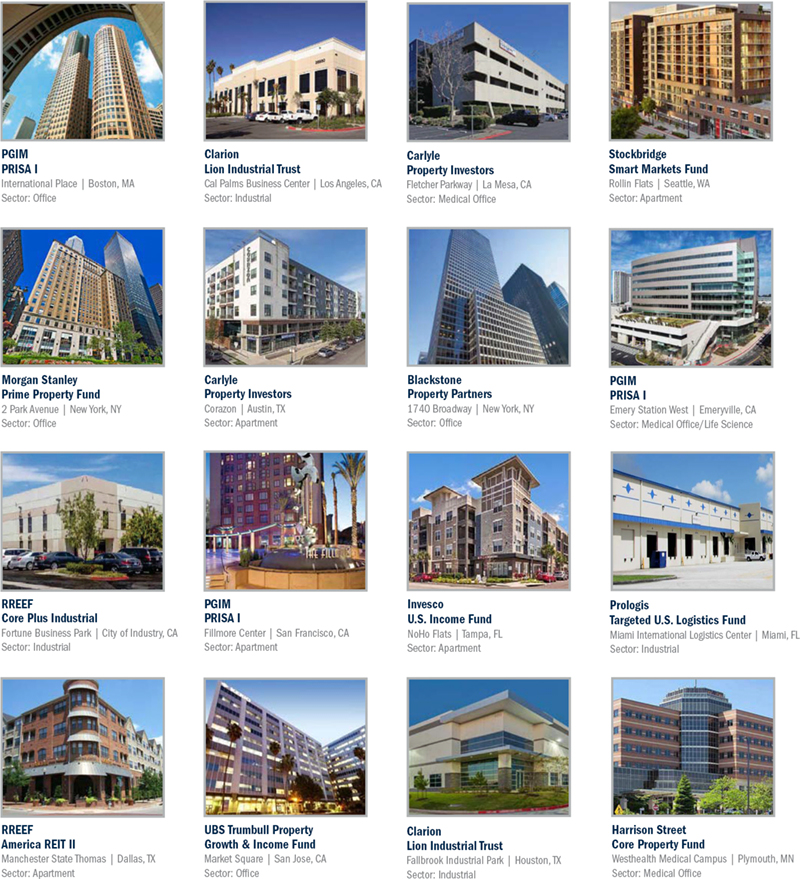

HIGHLIGHTED ASSETS

The properties pictured below are currently owned by the underlying third-party institutional private equity real estate funds described herein.

Active Portfolio; subject to change.

| SEMI-ANNUAL REPORT (4Q 2019- 1Q 2020) |BLUEROCK TOTAL INCOME+ REAL ESTATE FUND | (UNAUDITED) |

DEFINITIONS

Bloomberg Barclays U.S. Aggregate Bond Index: The BloombergBarclaysU.S. Aggregate Bond Index measures the performance of the U.S. investment grade bond market. The index invests in a wide spectrum of public, investment-grade, taxable, fixed income securities in the United States - including government, corporate, and international dollar-denominated bonds, as well as mortgage-backed and asset-backed securities, all with maturities of more than 1 year. Risks include rising interest rates, credit quality of the issuers and general economic conditions.

Correlation:The degree to which two securities move in relation to each other. Correlation is measured as a correlation coefficient, with a value falling between -1 and 1.0 = No Correlation | 1 = Perfectly Positively Correlated | -1 = Perfectly Negatively Correlated

MSCI U.S. REIT Index:A free float-adjusted market capitalization weighted index that is comprised of equity REITs that are included in the MSCI US Investable Market 2500 Index, with the exception of specialty equity REITs that do not generate a majority of their revenue and income from real estate rental and leasing operations. The index represents approximately 85% of the US REIT universe. (www.msci.com).

NCREIF ODCE Index: a capitalization-weighted, gross of fees, time-weighted return index with an inception date of January 1, 1978. Published reports may also contain equal-weighted and net of fees information. Open-end Funds are generally defined as infinite-life vehicles consisting of multiple investors who have the ability to enter or exit the fund on a periodic basis, subject to contribution and/or redemption requests, thereby providing a degree of potential investment liquidity. The term Diversified Core Equity style typically reflects lower risk investment strategies utilizing low leverage and generally represented by equity own-ership positions in stable US operating properties.

Sharpe Ratio: Measurement of the risk-adjusted performance. The annualized Sharpe Ratio is calculated by subtracting the annualized risk-free rate - (3-month Treasury Bill) - from the annualized rate of return for a portfolio and dividing the result by the standard deviation of the portfolio returns.

Standard Deviation: The measure of the daily percentage change in an investment. Standard deviation shows how much variation from the average exists with a larger number indicating the data points are more spread out over a larger range of values.

S&P 500: An index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P 500 is designed to be a leading indi-cator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe. (Investopedia).

You cannot invest directly in an index. Benchmark performance should not be considered reflective of Fund performance.

| ** | Please note that the indices are for informational purposes only and are not reflective of any investment. As it is not possible to invest in the indices, the data shown does not reflect or compare features of an actual investment, such as its objectives, costs and expenses, liquidity, safety, guarantees or insurance, fluctuation of principal or return, or tax features. There are limitations when comparing the Bluerock Total Income Fund to Stock, Bond, and Public Real Estate indices. Many open-end funds which track these indices offer daily liquidity, while closed-end interval funds offer liquidity only on a periodic basis. Deteriorating general market conditions will reduce the value of stock securities. When interest rates rise, the value of bond securities tends to fall. Real estate securities may decline because of adverse developments affecting the real estate industry and real property values. |

RISK DISCLOSURES

Not FDIC Insured | No Bank Guarantee | May Lose Value

This material has been distributed for informational purposes only. The views and information discussed in this commentary are as of the date of publication, are subject to change without notification of any kind, and may not reflect the writer's current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the fund(s) or any securities or any sectors mentioned herein. The subject matter contained herein has been derived from several sources believed to be reliable and accurate, but not guaranteed, at the time of compilation.

This shareholder letter may contain certain forward-looking statements. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” or other similar words. Because such statements include risks, uncertainties and contingencies, actual results may differ materially from the expectations, intentions, beliefs, plans or predictions of the future expressed or implied by such forward-looking statements. These risks, uncertainties and contingencies include, but are not limited to: uncertainties relating to changes in general economic and real estate conditions; uncertainties relating to the implementation of our investment strategy; and other risk factors as outlined in the Fund's prospectuses and statement of additional information filed with the U.S. Securities and Exchange Commission.

Investing in the Fund's shares involves substantial risks, including the risk that you may receive little or no return on your investment or that you may lose part or all of your investment.

| SEMI-ANNUAL REPORT (4Q 2019- 1Q 2020) |BLUEROCK TOTAL INCOME+ REAL ESTATE FUND | (UNAUDITED) |

RISK DISCLOSURES CONT.

The ability of the Fund to achieve its investment objective depends, in part, on the ability of the Advisor to allocate effectively the Fund's assets across the various asset classes in which it invests and to select investments in each such asset class. There can be no assurance that the actual allocations will be effective in achieving the Fund's investment objective or delivering positive returns.

Limited liquidity is provided to shareholders only through the Fund's quarterly repurchase offers for no less than 5% of the Fund's shares outstanding at net asset value. There is no guarantee that shareholders will be able to sell all of the shares they desire in a quarterly repurchase offer. Quarterly repurchases by the Fund of its shares typically will be funded from available cash or sales of portfolio securities. The sale of securities to fund repurchases could reduce the market price of those securities, which in turn would reduce the Fund's net asset value.

An investment in shares represents an indirect investment in the securities owned by the Fund. The value of these securities, like other market investments, may move up or down, sometimes rapidly and unpredictably. The Fund is "non-diversified" under the Investment Company Act of 1940 and therefore may invest more than 5% of its total assets in the securities of one or more issuers. As such, changes in the financial condition or market value of a single issuer may cause a greater fluctuation in the Fund's net asset value than in a "diversified" fund. The Fund is not intended to be a complete investment program.

The Fund is subject to the risk that geopolitical and other similar events will disrupt the economy on a national or global level. For instance, war, terrorism, market manipulation, government defaults, government shutdowns, political changes or diplomatic developments, public health emergencies (such as the spread of infectious diseases, pandemics and epidemics) and natural/environmental disasters can all negatively impact the securities markets.

The current novel coronavirus (COVID-19) global pandemic and the aggressive responses taken by many governments, including closing borders, restricting international and domestic travel, and the imposition of prolonged quarantines or similar restrictions, as well as the forced or voluntary closure of, or operational changes to, many retail and other businesses, have had negative impacts, and in many cases severe negative impacts, on markets worldwide. Potential impacts on the real estate market may include lower occupancy rates, decreased lease payments, defaults and foreclosures, among other consequences. It is not known how long such impacts, or any future impacts of other significant events described above, will or would last, but there could be a prolonged period of global economic slowdown.

The Fund will concentrate its investments in real estate industry securities. The value of the Fund's shares will be affected by factors affecting the value of real estate and the earnings of companies engaged in the real estate industry. These factors include, among others: (i) changes in general economic and market conditions; (ii) changes in the value of real estate properties; (iii) risks related to local economic conditions, overbuilding and increased competition; (iv) increases in property taxes and operating expenses; (v) changes in zoning laws; (vi) casualty and condemnation losses; (vii) variations in rental income, neighborhood values or the appeal of property to tenants; (viii) the availability of financing and (ix) changes in interest rates. Many real estate companies utilize leverage, which increases investment risk and could adversely affect a company's operations and market value in periods of rising interest rates. The value of securities of companies in the real estate industry may go through cycles of relative under-performance and over-performance in comparison to equity securities markets in general.

A significant portion of the Fund's underlying investments are in private real estate investment funds managed by institutional investment managers ("Institutional Investment Funds"). Investments in Institutional Investment Funds pose specific risks, including: such investments require the Fund to bear a pro rata share of the vehicles' expenses, including management and performance fees; the Advisor and Sub-Advisor will have no control over investment decisions may by such vehicle; such vehicle may utilize financial leverage; such investments have limited liquidity; the valuation of such investment as of a specific date may vary from the actual sale price that may be obtained if such investment were sold to a third party.

Additional risks related to an investment in the Fund are set forth in the "Risk Factors" section of the prospectus, which include, but are not limited to the following: convertible securities risk; correlation risk; credit risk; fixed income risk; leverage risk; risk of competition between underlying funds; and preferred securities risk.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Bluerock Total Income+ Real Estate Fund. This and other important information about the Fund is contained in the prospectus, which can be obtained by calling toll free 844-819-8287, or online at bluerockfunds.com. The prospectus should be read carefully before investing. The Bluerock Total Income+ Real Estate Fund is distributed by ALPS Distributors, Inc (ALPS). Bluerock Fund Advisor, LLC is not affiliated with ALPS, Mercer Investment Management, or DWS. Neither Mercer Investment Management nor DWS are affiliated with ALPS.

| BLU000581 |

| Bluerock Total Income+ Real Estate Fund | Portfolio Review |

March 31, 2020 (Unaudited)

Comparison of the Change in Value of a $10,000 Investment

The Fund’s performance figures for certain periods ended March 31, 2020, compared to its benchmarks:

| Bluerock Total Income+ Real Estate Fund: | | Six Month | | One Year | | Three Year | | Five Year | | Since Inception Class A* | | Since Inception Class C and Class I* | | Since Inception Class L* | |

| Class A | | | | | | | | | | | | | | | |

| Without Load | | 3.95 | % | 6.55 | % | 7.20 | % | 6.79 | % | 7.82 | % | – | | – | |

| With Load(a) | | -2.03 | % | 0.43 | % | 5.10 | % | 5.53 | % | 6.96 | % | – | | – | |

| Class C | | | | | | | | | | | | | | | |

| Without Load | | 3.57 | % | 5.79 | % | 6.40 | % | 6.00 | % | – | | 6.24 | % | – | |

| With Load(b) | | 2.57 | % | 4.79 | % | 6.40 | % | 6.00 | % | – | | 6.24 | % | – | |

| Class I | | 4.10 | % | 6.85 | % | 7.47 | % | 7.06 | % | – | | 7.33 | % | – | |

| Class L | | | | | | | | | | | | | | | |

| Without Load | | 3.85 | % | 6.31 | % | – | | – | | – | | – | | 6.68 | % |

| With Load(c) | | -0.55 | % | 1.78 | % | – | | – | | – | | – | | 5.05 | % |

| S&P 500 Total Return Index | | -12.31 | % | -6.98 | % | 5.10 | % | 6.73 | % | 10.51 | % | 7.58 | % | 4.24 | % |

| Bloomberg Barclays U.S. Aggregate Bond Index | | 3.33 | % | 8.93 | % | 4.82 | % | 3.36 | % | 3.03 | % | 3.77 | % | 4.59 | % |

| * | Class A commenced operations October 22, 2012, Class C and Class I commenced operations April 1, 2014, and Class L commenced operations June 1, 2017. |

| (a) | Adjusted for initial maximum sales charge of 5.75%. |

| (b) | Adjusted for early withdrawal charge of 1.00%. |

| (c) | Adjusted for initial maximum sales charge of 4.25%. |

The S&P 500 Total Return Index is an unmanaged market capitalization-weighted index which is comprised of 500 of the largest U.S. domiciled companies and includes the reinvestment of all dividends. Investors cannot invest directly in an index or benchmark.

The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index which represents the U.S. investment-grade fixed-rate bond market (including government and corporate securities, mortgage pass-through securities and asset-backed securities). Investors cannot invest directly in an index or benchmark.

The performance data quoted is historical. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. Total returns are calculated using closing Net Asset Value as of March 31, 2020. Total returns are calculated assuming reinvestment of all dividends and distributions. Total returns

| Semi-Annual Report | March 31, 2020 | 9 |

| Bluerock Total Income+ Real Estate Fund | Portfolio Review |

March 31, 2020 (Unaudited)

would have been lower had the Advisor not waived a portion of its fees. Returns greater than one year are annualized. The Advisor and the Fund have entered into an expense limitation agreement under which the Advisor has contractually agreed to reduce its fees and/or absorb expenses for Class A, Class C, Class I and Class L at least until January 31, 2021 to ensure that the net annual fund operating expenses (exclusive of any taxes, interest, brokerage commissions, acquired fund fees and expenses, and extraordinary expenses, such as litigation or reorganization costs, but inclusive of organizational costs and offering costs) will not exceed 1.95%, 2.70%, 1.70%, and 2.20% of the Fund’s average daily net assets attributable to the Class A, Class C, Class I and Class L shares, respectively. The Fund has agreed to repay the Advisor in the amount of any fees the Advisor previously waived and or Fund expenses reimbursed, pursuant to the expense limitation agreement, subject to the limitations therein that: (1) the reimbursement will be made if payable not more than three fiscal years from the fiscal year in which they were incurred; (2) the reimbursement may not be made if it would cause the Expense Limitation then in effect or in effect at time of waiver to be exceeded; and (3) the reimbursement is approved by the Fund’s Board of Trustees.

The Fund’s total gross annual operating expenses, including the expenses of underlying funds and before any fee waiver, are 2.43%, 3.18%, 2.22% and 2.74% for Class A, Class C, Class I and Class L, respectively, per the February 1, 2020 prospectus. Class A shares are subject to a maximum sales charge imposed on purchases of 5.75%. Class A shareholders who tender for repurchase Class A shares that were purchased in amounts of $1,000,000 or more that have been held less than one year (365 days) from the purchase date will be subject to an early withdrawal charge of 1.00% of the original purchase price. Class C shares are subject to an early withdrawal charge of 1.00% if redeemed less than 365 days after the purchase. Class L shares are subject to a maximum sales charge imposed on purchases of 4.25%. The Fund's Class M shares commenced operations on February 1, 2020, however as of March 31, 2020 no such shares have been issued and therefore are not included in the Fund's performance information. The above performance figures do not reflect the deduction of taxes that a shareholder would have to pay on Fund distributions or the redemption of the Fund shares. For performance information current to the most recent month-end, please call 1-844-819-8287.

Portfolio Composition as of March 31, 2020 (Unaudited)

| | | Percent of Net Assets | |

| Private Real Estate Securities | | | 86.33 | % |

| Real Estate Debt Securities | | | 8.94 | % |

| Short-Term Investments | | | 7.72 | % |

| Public Equity Real Estate Securities | | | 1.39 | % |

| Preferred Stocks | | | 0.49 | % |

| Total Investments | | | 104.87 | % |

| Liabilities in Excess of Other Assets | | | -4.87 | % |

| Total Net Assets | | | 100.00 | % |

See the Portfolio of Investments in this annual report for a more detailed account of the Fund’s holdings.

| Bluerock Total Income+ Real Estate Fund | Portfolio of Investments |

March 31, 2020 (Unaudited)

| Security | | Principal | | | Value | |

| REAL ESTATE DEBT SECURITIES (8.94%)(a) | | | | | | | | |

| FREMF 2018-K82 Mortgage Trust, Class X2A, IO, 0.100%, 9/25/2028 | | $ | 1,073,973,435 | | | $ | 7,258,986 | |

| FREMF 2018-K82 Mortgage Trust, Class X2B, IO, 0.100%, 10/25/2028 | | | 262,694,906 | | | | 1,838,339 | |

| FREMF 2018-K82 Mortgage Trust, Class D, PO, 0.000%, 10/25/2028 | | | 100,392,906 | | | | 48,769,067 | |

| FREMF 2019-K101 Mortgage Trust, Class X2A, IO, 0.100%, 10/25/2052 | | | 1,189,011,379 | | | | 8,849,812 | |

| FREMF 2019-K101 Mortgage Trust, Class X2B, IO, 0.100%, 10/25/2052 | | | 270,043,635 | | | | 2,097,159 | |

| FREMF 2019-K101 Mortgage Trust, Class D, PO, 0.000%, 1/25/2030 | | | 109,477,635 | | | | 48,239,349 | |

| FREMF 2019-K91 Mortgage Trust, Class X2A, IO, 0.100%, 3/25/2029 | | | 1,136,167,864 | | | | 8,047,477 | |

| FREMF 2019-K91 Mortgage Trust, Class X2B, IO, 0.100%, 10/25/2029 | | | 247,526,565 | | | | 1,849,271 | |

| FREMF 2019-K91 Mortgage Trust, Class D, PO, 0.000%, 10/25/2029 | | | 103,857,565 | | | | 45,685,489 | |

| FREMF 2019-KC03 Mortgage Trust, Class C, 4.365%, 1/25/2026 | | | 58,088,000 | | | | 46,880,211 | |

| TOTAL REAL ESTATE DEBT SECURITIES (Cost $217,761,544) | | | | | | | 219,515,160 | |

| Security | | Shares | | | Value | |

| PRIVATE REAL ESTATE SECURITIES (86.33%)(b) | | | | | | | | |

| Apartments (7.07%) | | | | | | | | |

| Clarion Gables Multifamily Trust | | | 82,268 | | | | 108,547,756 | |

| Sentinel Real Estate Fund | | | 718 | | | | 65,088,663 | |

| | | | | | | | 173,636,419 | |

| Diversified (60.43%) | | | | | | | | |

| AEW Core Property Trust | | | 22,139 | | | | 22,543,294 | |

| Ares Real Estate Enhanced Income Fund | | | 34,365 | | | | 34,250,682 | |

| Bain Capital Real Estate Fund I | | | N/A | | | | 27,552,091 | |

| Blackstone Property Partners | | | 82,577 | | | | 114,583,089 | |

| Bridge Debt Strategies Fund III, LP | | | N/A | | | | 43,370,086 | |

| Brookfield Premier Real Estate Partners | | | 36,085 | | | | 50,122,087 | |

| Carlyle Property Investors | | | 67,957 | | | | 89,358,247 | |

| CBRE U.S. Core Partners, LP | | | 69,799,656 | | | | 102,227,218 | |

| Clarion Lion Properties Fund | | | 108,240 | | | | 168,528,537 | |

| Harrison Street Core Property Fund | | | 50,957 | | | | 72,067,909 | |

| Invesco Core Real Estate Fund | | | 174 | | | | 33,720,974 | |

| Invesco U.S. Income Fund LP | | | 69,420 | | | | 98,064,146 | |

| Morgan Stanley Prime Property Fund LLC | | | 14,470 | | | | 277,458,579 | |

| PGIM PRISA I | | | 19,009 | | | | 33,676,729 | |

| PGIM PRISA III | | | 30,536 | | | | 61,943,206 | |

| Principal Enhanced Property Fund LP | | | 8,735,240 | | | | 113,639,953 | |

| RREEF America REIT II, Inc. | | | 281,886 | | | | 35,950,488 | |

| Stockbridge Smart Markets Fund | | | 26,836 | | | | 42,608,296 | |

| Stockbridge Value Fund II | | | N/A | | | | 2,611,120 | |

| UBS Trumbull Property G&I Fund | | | 2,259 | | | | 58,816,499 | |

| | | | | | | | 1,483,093,230 | |

| Industrial (18.83%) |

| Clarion Lion Industrial Trust | | | 56,887 | | | | 122,605,825 | |

| Prologis Targeted U.S. Logistics(c) | | | 130,640 | | | | 244,927,623 | |

| RREEF Core Plus Industrial Fund LP | | | 703,549 | | | | 94,670,137 | |

| | | | | | | | 462,203,585 | |

| TOTAL PRIVATE REAL ESTATE SECURITIES (Cost $1,940,338,326) | | | | | | | 2,118,933,234 | |

| | | | | | | | | |

PUBLIC EQUITY REAL ESTATE SECURITIES (1.39%) | | | | | | | | |

| Public Non-Traded Real Estate Investment Trusts (0.02%) | | | | | | | | |

| Diversified (0.02%) | | | | | | | | |

| Highlands REIT, Inc.(d)(e) | | | 140,161 | | | | 47,655 | |

| Inventrust Properties Corp.(e) | | | 140,161 | | | | 420,229 | |

| Total Public Non-Traded Real Estate Investment Trusts (Cost $445,781) | | | | | | | 467,884 | |

The accompanying notes are an integral part of these financial statements.

| Semi-Annual Report | March 31, 2020 | 11 |

| Bluerock Total Income+ Real Estate Fund | Portfolio of Investments (Continued) |

March 31, 2020 (Unaudited)

| Security | | Shares | | | Value | |

| Publicly Traded Real Estate Investment Trusts (1.37%) | | | | | | | | |

| Apartments (0.18%) | | | | | | | | |

| AvalonBay Communities, Inc. | | | 2,865 | | | $ | 421,642 | |

| Equity Residential | | | 8,563 | | | | 528,423 | |

| Essex Property Trust, Inc. | | | 2,140 | | | | 471,314 | |

| Independence Realty Trust, Inc. | | | 85,254 | | | | 762,170 | |

| Mid-America Apartment Communities, Inc. | | | 9,194 | | | | 947,257 | |

| NexPoint Residential Trust, Inc. | | | 27,332 | | | | 689,040 | |

| UDR, Inc. | | | 16,331 | | | | 596,735 | |

| | | | | | | | 4,416,581 | |

| Communications (0.18%) | | | | | | | | |

| American Tower Corp. | | | 6,534 | | | | 1,422,779 | |

| Crown Castle International Corp. | | | 8,505 | | | | 1,228,122 | |

| SBA Communications Corp. | | | 6,337 | | | | 1,710,799 | |

| | | | | | | | 4,361,700 | |

| Data Centers (0.22%) | | | | | | | | |

| Digital Realty Trust, Inc. | | | 18,423 | | | | 2,559,140 | |

| Equinix, Inc. | | | 2,291 | | | | 1,430,890 | |

| QTS Realty Trust, Inc. | | | 24,962 | | | | 1,448,046 | |

| | | | | | | | 5,438,076 | |

| Diversified (0.08%) | | | | | | | | |

| Safehold, Inc. | | | 30,526 | | | | 1,930,159 | |

| | | | | | | | 1,930,159 | |

| Healthcare (0.06%) | | | | | | | | |

| Healthcare Realty Trust, Inc. | | | 20,118 | | | | 561,896 | |

| Healthcare Trust of America, Inc. | | | 22,386 | | | | 543,532 | |

| Physicians Realty Trust | | | 28,248 | | | | 393,777 | |

| | | | | | | | 1,499,205 | |

| Industrial (0.23%) | | | | | | | | |

| EastGroup Properties, Inc. | | | 7,930 | | | | 828,526 | |

| First Industrial Realty Trust, Inc. | | | 19,176 | | | | 637,218 | |

| Hannon Armstrong Sustainable Infrastructure Capital, Inc. | | | 41,550 | | | | 848,036 | |

| Prologis, Inc. | | | 11,787 | | | | 947,321 | |

| Rexford Industrial Realty, Inc. | | | 28,974 | | | | 1,188,224 | |

| Terreno Realty Corp. | | | 24,211 | | | | 1,252,920 | |

| | | | | | | | 5,702,245 | |

| Manufactured Homes (0.09%) | | | | | | | | |

| Equity LifeStyle Properties, Inc. | | | 19,710 | | | | 1,132,931 | |

| Sun Communities, Inc. | | | 8,313 | | | | 1,037,878 | |

| | | | | | | | 2,170,809 | |

| Office (0.11%) | | | | | | | | |

| Alexandria Real Estate Equities, Inc. | | | 7,069 | | | | 968,877 | |

| Easterly Government Properties, Inc. | | | 73,016 | | | | 1,799,114 | |

| | | | | | | | 2,767,991 | |

| Self-Storage (0.14%) | | | | | | | | |

| CubeSmart | | | 17,049 | | | | 456,743 | |

| Extra Space Storage, Inc. | | | 7,687 | | | | 736,107 | |

| Life Storage, Inc. | | | 10,266 | | | | 970,650 | |

| National Storage Affiliates Trust | | | 40,332 | | | | 1,193,827 | |

| | | | | | | | 3,357,327 | |

| Single Tenant (0.03%) | | | | | | | | |

| Agree Realty Corp. | | | 12,009 | | | | 743,357 | |

| | | | | | | | 743,357 | |

The accompanying notes are an integral part of these financial statements.

12

| Bluerock Total Income+ Real Estate Fund | Portfolio of Investments (Continued) |

March 31, 2020 (Unaudited)

| Security | | Shares | | | Value | |

| Single-Family Rental (0.05%) | | | | | | | | |

| American Homes 4 Rent | | | 33,906 | | | $ | 786,619 | |

| Invitation Homes, Inc. | | | 25,073 | | | | 535,810 | |

| | | | | | | | 1,322,429 | |

| Total Publicly Traded Real Estate Investment Trusts (Cost $32,007,424) | | | | | | | 33,709,879 | |

| | | | | | | | | |

| TOTAL PUBLIC EQUITY REAL ESTATE SECURITIES (Cost $32,453,205) | | | | | | | 34,177,763 | |

| | | | | | | | | |

| PREFERRED STOCKS (0.49%) | | | | | | | | |

| American Homes 4 Rent, 6.350%, Series E | | | 39,579 | | | | 949,896 | |

| American Homes 4 Rent, 5.875%, Series G | | | 39,750 | | | | 916,238 | |

| Digital Realty Trust, Inc., 5.250%, Series J | | | 40,477 | | | | 962,542 | |

| EPR Properties, 5.750%, Series G | | | 45,052 | | | | 700,559 | |

| Kimco Realty Corp., 5.125%, Series L | | | 40,450 | | | | 877,765 | |

| National Storage Affiliates Trust, 6.000%, Series A | | | 38,812 | | | | 891,512 | |

| PS Business Parks, Inc., 5.250%, Series X | | | 40,125 | | | | 922,474 | |

| PS Business Parks, Inc., 5.200%, Series W | | | 40,150 | | | | 921,844 | |

| Public Storage, 5.050%, Series G | | | 39,248 | | | | 952,156 | |

| Public Storage, 5.375%, Series V | | | 40,547 | | | | 977,993 | |

| Rexford Industrial Realty, Inc., 5.875%, Series A | | | 20,708 | | | | 480,426 | |

| Rexford Industrial Realty, Inc., 5.875%, Series B | | | 20,376 | | | | 445,623 | |

| Spirit Realty Capital, Inc., 6.000%, Series A | | | 40,631 | | | | 864,221 | |

| VEREIT, Inc., 6.700%, Series F | | | 40,607 | | | | 897,415 | |

| Vornado Realty Trust, 5.250%, Series M | | | 13,026 | | | | 254,789 | |

| TOTAL PREFERRED STOCKS (Cost $12,859,151) | | | | | | | 12,015,453 | |

| | | | | | | | | |

| SHORT TERM INVESTMENTS (7.72%) | | | | | | | | |

| Fidelity Investments Money Market Funds - Government Portfolio - Class I, 0.30%(Cost $189,489,388) | | | 189,489,388 | | | | 189,489,388 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (104.87%) (Cost $2,392,901,614) | | | | | | $ | 2,574,130,998 | |

| LIABILITIES IN EXCESS OF OTHER ASSETS (-4.87%) | | | | | | | (119,493,709 | ) |

| NET ASSETS (100.00%) | | | | | | $ | 2,454,637,289 | |

Common Abbreviations

IO - Interest Only Security

PO - Principal Only Security

| (a) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. As of March 31, 2020, the aggregate market value of those securities was $219,515,160, representing 8.94% of net assets. |

| (b) | All or a portion of these securities are segregated as collateral for the Line of Credit as of March 31, 2020. |

| (c) | Holding is comprised of two share classes of the same underlying investment. |

| (d) | Non-income producing security. |

| (e) | Fair value estimated using fair valuation procedures adopted by the Board of Trustees. Total value of such securities is $467,884, representing 0.02% of net assets. |

The accompanying notes are an integral part of these financial statements.

| Semi-Annual Report | March 31, 2020 | 13 |

Bluerock Total Income+ Real Estate Fund | Statement of Assets and Liabilities |

March 31, 2020 (Unaudited)

ASSETS | | | | |

Investments, at value (Cost $2,392,901,614) | | $ | 2,574,130,998 | |

Cash | | | 12,571,197 | |

Receivable for shares sold | | | 7,468,566 | |

Dividends and interest receivable | | | 18,423,898 | |

Prepaid expenses and other assets | | | 122,261 | |

Total Assets | | | 2,612,716,920 | |

LIABILITIES | | | | |

Line of credit payable | | | 154,000,000 | |

Line of credit interest payable | | | 228,333 | |

Investment advisory fees payable | | | 3,091,661 | |

Shareholder servicing fees payable | | | 230,334 | |

Administration fees payable | | | 94,732 | |

Transfer agency fees payable | | | 58,975 | |

Distribution fees payable | | | 302,823 | |

Due to custodian | | | 7,044 | |

Accrued expenses and other liabilities | | | 65,729 | |

Total Liabilities(a) | | | 158,079,631 | |

NET ASSETS | | $ | 2,454,637,289 | |

NET ASSETS CONSIST OF | | | | |

Paid-in capital | | $ | 2,227,137,179 | |

Total distributable earnings | | | 227,500,110 | |

NET ASSETS | | $ | 2,454,637,289 | |

PRICING OF SHARES | | | | |

Class A: | | | | |

Net asset value and redemption price | | $ | 30.11 | |

Net assets | | $ | 565,325,193 | |

Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 18,778,352 | |

Maximum offering price per share ((NAV/0.9425), based on maximum sales charge of 5.75% of the offering price) | | $ | 31.95 | |

Class C: | | | | |

Net asset value, offering and redemption price | | $ | 28.80 | |

Net assets | | $ | 453,428,170 | |

Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 15,744,202 | |

Class I: | | | | |

Net asset value, offering and redemption price | | $ | 30.62 | |

Net assets | | $ | 1,362,059,585 | |

Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 44,476,781 | |

Class L: | | | | |

Net asset value and redemption price | | $ | 29.89 | |

Net assets | | $ | 73,824,341 | |

Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 2,469,693 | |

Maximum offering price per share ((NAV/0.9575), based on maximum sales charge of 4.25% of the offering price) | | $ | 31.22 | |

(a) | Separately, see Note 8 Commitment and Contingencies for detail on unfunded commitments. |

The accompanying notes are an integral part of these financial statements.

14

Bluerock Total Income+ Real Estate Fund | Statement of Operations |

For the Six Months Ended March 31, 2020 (Unaudited)

INVESTMENT INCOME | | | | |

Dividend income | | $ | 30,491,465 | |

Interest | | | 7,730,851 | |

Total Investment Income | | | 38,222,316 | |

| | | | | |

EXPENSES | | | | |

Investment advisory fees | | | 16,912,616 | |

Administrative fees | | | 460,482 | |

Transfer Agency fees | | | 562,170 | |

Shareholder servicing fees: | | | | |

Class A | | | 681,636 | |

Class C | | | 534,487 | |

Class L | | | 100,367 | |

Distribution fees: | | | | |

Class C | | | 1,603,462 | |

Class L | | | 100,367 | |

Legal fees | | | 44,620 | |

Audit and tax fees | | | 11,750 | |

Reports to shareholders and printing fees | | | 328,590 | |

Custody fees | | | 54,571 | |

Chief compliance officer fees | | | 30,129 | |

Interest expense | | | 2,007,409 | |

Trustees' fees | | | 47,917 | �� |

Other expenses | | | 214,291 | |

Total Expenses | | | 23,694,864 | |

Recoupment of previously waived fees (See Note 3) | | | 219,042 | |

Net Expenses | | | 23,913,906 | |

Net Investment Income | | | 14,308,410 | |

Net realized gain/(loss) on investments | | | 46,529,246 | |

Net change in unrealized appreciation/(depreciation) on investments | | | (27,326,629 | ) |

NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | 19,202,617 | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 33,511,027 | |

The accompanying notes are an integral part of these financial statements.

Semi-Annual Report | March 31, 2020 | 15 |

Bluerock Total Income+ Real Estate Fund | Statements of Changes in Net Assets |

| | For the Six Months Ended March 31, 2020 (Unaudited) | | For the Year Ended September 30, 2019 | |

OPERATIONS: | | | | | | | |

Net investment income | | $ | 14,308,410 | | $ | 16,746,223 | |

Net realized gain on investments | | | 46,529,246 | | | 6,996,972 | |

Net change in unrealized appreciation/(depreciation) on investments | | | (27,326,629 | ) | | 88,969,563 | |

Net Increase in Net Assets Resulting from Operations | | | 33,511,027 | | | 112,712,758 | |

DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | |

Class A | | | | | | | |

From distributable earnings | | | (10,703,459 | ) | | (4,322,594 | ) |

From return of capital | | | (3,751,639 | ) | | (20,268,110 | ) |

Class C | | | | | | | |

From distributable earnings | | | (8,530,851 | ) | | (3,365,580 | ) |

From return of capital | | | (2,990,125 | ) | | (14,930,780 | ) |

Class I | | | | | | | |

From distributable earnings | | | (24,853,275 | ) | | (5,759,735 | ) |

From return of capital | | | (8,711,251 | ) | | (35,088,851 | ) |

Class L | | | | | | | |

From distributable earnings | | | (1,357,585 | ) | | (534,202 | ) |

From return of capital | | | (475,843 | ) | | (3,034,353 | ) |

Total Distributions to Shareholders | | | (61,374,028 | ) | | (87,304,205 | ) |

BENEFICIAL INTEREST TRANSACTIONS: | | | | | | | |

Class A | | | | | | | |

Shares sold | | | 102,603,154 | | | 229,930,652 | |

Distributions reinvested | | | 7,440,989 | | | 13,638,889 | |

Shares redeemed | | | (40,729,516 | ) | | (45,478,111 | ) |

Shares transferred out | | | (34,693,645 | ) | | (41,853,107 | ) |

Class C | | | | | | | |

Shares sold | | | 71,494,532 | | | 129,145,908 | |

Distributions reinvested | | | 7,458,424 | | | 11,933,103 | |

Shares redeemed | | | (16,825,908 | ) | | (31,505,469 | ) |

Shares transferred out | | | (3,554,964 | ) | | (1,425,778 | ) |

Class I | | | | | | | |

Shares sold | | | 316,949,070 | | | 555,137,710 | |

Distributions reinvested | | | 17,233,970 | | | 22,702,402 | |

Shares redeemed | | | (69,435,555 | ) | | (67,085,843 | ) |

Shares transferred in | | | 71,676,748 | | | 43,654,088 | |

Class L | | | | | | | |

Shares sold | | | 18,993,276 | | | 45,320,799 | |

Distributions reinvested | | | 1,308,784 | | | 2,371,314 | |

Shares redeemed | | | (1,033,847 | ) | | (2,605,496 | ) |

Shares transferred out | | | (33,428,139 | ) | | (375,203 | ) |

Net Increase in Net Assets Derived from Beneficial Interest Transactions | | | 415,457,373 | | | 863,505,858 | |

Net increase in net assets | | | 387,594,372 | | | 888,914,411 | |

NET ASSETS: | | | | | | | |

Beginning of year | | | 2,067,042,917 | | | 1,178,128,506 | |

End of year | | $ | 2,454,637,289 | | $ | 2,067,042,917 | |

The accompanying notes are an integral part of these financial statements.

16

Bluerock Total Income+ Real Estate Fund | Statements of Changes in Net Assets |

| | For the Six

Months Ended

March 31, 2020

(Unaudited) | | For the

Year Ended

September 30, 2019 | |

Other Information | | | | | | | |

Share Transactions: | | | | | | | |

Class A | | | | | | | |

Beginning shares | | | 17,641,782 | | | 12,451,402 | |

Shares sold | | | 3,359,306 | | | 7,633,796 | |

Distributions reinvested | | | 245,679 | | | 455,793 | |

Shares redeemed | | | (1,332,088 | ) | | (1,509,363 | ) |

Shares transferred out | | | (1,136,327 | ) | | (1,389,846 | ) |

Net increase in shares outstanding | | | 1,136,570 | | | 5,190,380 | |

Ending shares | | | 18,778,352 | | | 17,641,782 | |

Class C | | | | | | | |

Beginning shares | | | 13,738,958 | | | 10,012,148 | |

Shares sold | | | 2,443,871 | | | 4,446,961 | |

Distributions reinvested | | | 257,107 | | | 414,114 | |

Shares redeemed | | | (574,159 | ) | | (1,085,210 | ) |

Shares transferred out | | | (121,575 | ) | | (49,055 | ) |

Net increase in shares outstanding | | | 2,005,244 | | | 3,726,810 | |

Ending shares | | | 15,744,202 | | | 13,738,958 | |

Class I | | | | | | | |

Beginning shares | | | 33,636,423 | | | 15,498,144 | |

Shares sold | | | 10,210,698 | | | 18,156,358 | |

Distributions reinvested | | | 559,569 | | | 747,430 | |

Shares redeemed | | | (2,233,645 | ) | | (2,194,162 | ) |

Shares transferred in | | | 2,303,736 | | | 1,428,653 | |

Net increase in shares outstanding | | | 10,840,358 | | | 18,138,279 | |

Ending shares | | | 44,476,781 | | | 33,636,423 | |

Class L | | | | | | | |

Beginning shares | | | 2,928,639 | | | 1,437,606 | |

Shares sold | | | 627,371 | | | 1,510,841 | |

Distributions reinvested | | | 43,506 | | | 79,640 | |

Shares redeemed | | | (34,039 | ) | | (86,907 | ) |

Shares transferred out | | | (1,095,784 | ) | | (12,541 | ) |

Net increase/(decrease) in shares outstanding | | | (458,946 | ) | | 1,491,033 | |

Ending shares | | | 2,469,693 | | | 2,928,639 | |

The accompanying notes are an integral part of these financial statements.

Semi-Annual Report | March 31, 2020 | 17 |

Bluerock Total Income+ Real Estate Fund | Statement of Cash Flows |

| | For the Six Months Ended

March 31, 2020

(Unaudited) | |

Cash Flows from Operating Activities: | | | | |

Net increase in net assets resulting from operations | | $ | 33,511,027 | |

Adjustments to reconcile net increase in net assets from operations to net cash used in operating activities: | | | | |

Purchase of investments securities | | | (644,816,618 | ) |

Proceeds from disposition of investment securities | | | 355,366,347 | |

Net purchases of short-term investment securities | | | (60,094,289 | ) |

Net realized gain on investments | | | (46,529,246 | ) |

Net change in unrealized depreciation on investments | | | 27,326,629 | |

Discount and premiums amortized | | | (4,588,834 | ) |

(Increase)/Decrease in Assets: | | | | |

Dividends and interest receivable | | | (6,896,987 | ) |

Prepaid expenses and other assets | | | (53,970 | ) |

Increase/(Decrease) in Liabilities: | | | | |

Shareholder servicing fees payable | | | 25,896 | |

Investment advisory fees payable | | | 642,439 | |

Administrative fees payable | | | 27,527 | |

Transfer agency fees payable | | | (18,811 | ) |

Distribution fees payable | | | 45,861 | |

Interest due on loan payable | | | 83,184 | |

Accrued expenses and other liabilities | | | (84,278 | ) |

Net Cash Used in Operating Activities | | | (346,054,123 | ) |

| | | | | |

Cash Flows from Financing Activities: | | | | |

Increase in Line of Credit Borrowing | | | 5,900,000 | |

Proceeds from shares sold | | | 508,674,963 | |

Payment on shares redeemed | | | (128,024,826 | ) |

Cash distributions paid | | | (27,931,861 | ) |

Due to custodian | | | 7,044 | |

Net Cash Provided by Financing Activities | | | 358,625,320 | |

| | | | | |

Net Change in Cash | | | 12,571,197 | |

| | | | | |

Cash Beginning of Period | | $ | – | |

| | | | | |

Cash End of Period | | $ | 12,571,197 | |

| | | | | |

Non-cash financing Activities not included herein consist of reinvestment of distributions of: | | $ | 33,442,167 | |

Cash paid for interest on lines of credit during the year was: | | | 1,924,225 | |

The accompanying notes are an integral part of these financial statements.

18

Bluerock Total Income+ Real Estate Fund - Class A | Financial Highlights |

The table below sets forth financial data for one share of beneficial interest outstanding throughout each period presented.

| | For the Six Months Ended March 31, 2020 (Unaudited) | | For the Year Ended September 30, 2019 | | For the Year Ended September 30, 2018 | | For the Year Ended September 30, 2017 | | For the Year Ended September 30, 2016 | | For the Year Ended September 30, 2015 | |

Net asset value, beginning of year | | $ | 30.43 | | $ | 30.00 | | $ | 29.37 | | $ | 29.13 | | $ | 28.68 | | $ | 27.98 | |

INCOME FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | |

Net investment income(a) | | | 0.19 | | | 0.33 | | | 0.21 | | | 0.23 | | | 0.23 | | | 0.39 | |

Net realized and unrealized gain | | | 0.30 | | | 1.69 | | | 2.00 | | | 1.56 | | | 1.75 | | | 1.81 | |

Total from investment operations | | | 0.49 | | | 2.02 | | | 2.21 | | | 1.79 | | | 1.98 | | | 2.20 | |

DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | |

From net investment income | | | – | | | – | | | – | | | – | | | – | | | (0.09 | ) |

From net realized gain on investments | | | (0.60 | ) | | (0.32 | ) | | (0.54 | ) | | (0.37 | ) | | (0.16 | ) | | (0.29 | ) |

Return of capital | | | (0.21 | ) | | (1.27 | ) | | (1.04 | ) | | (1.18 | ) | | (1.37 | ) | | (1.12 | ) |

Total distributions | | | (0.81 | ) | | (1.59 | ) | | (1.58 | ) | | (1.55 | ) | | (1.53 | ) | | (1.50 | ) |

Net asset value, end of period | | $ | 30.11 | | $ | 30.43 | | $ | 30.00 | | $ | 29.37 | | $ | 29.13 | | $ | 28.68 | |

TOTAL RETURN(b)(c) | | | 1.60 | % | | 6.94 | % | | 7.69 | % | | 6.29 | % | | 7.08 | % | | 8.06 | % |

RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000s) | | $ | 565,325 | | $ | 536,913 | | $ | 373,488 | | $ | 291,772 | | $ | 226,712 | | $ | 129,287 | |

Ratios to Average Net Assets (including interest expense) | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets excluding fee waivers and reimbursements(d)(e) | | | 2.08 | %(f) | | 2.20 | % | | 2.43 | % | | 2.37 | % | | 2.19 | % | | 2.25 | % |

Ratio of expenses to average net assets including fee waivers and reimbursements(e) | | | 2.11 | %(f) | | 2.21 | % | | 2.37 | % | | 2.21 | % | | 1.82 | % | | 1.79 | % |

Ratio of net investment income to average net assets(e) | | | 1.26 | %(f) | | 1.10 | % | | 0.71 | % | | 0.80 | % | | 0.79 | % | | 1.36 | % |

Ratios to Average Net Assets (excluding interest expense) | | | | | | �� | | | | | | | | | | | | | |

Ratio of expenses to average net assets excluding fee waivers and reimbursements(d)(e) | | | 1.90 | %(f) | | 1.94 | % | | 1.99 | % | | 2.04 | % | | 2.19 | % | | 2.24 | % |

Ratio of expenses to average net assets including fee waivers and reimbursements(e) | | | 1.93 | %(f) | | 1.95 | % | | 1.93 | % | | 1.89 | % | | 1.82 | % | | 1.78 | % |

Portfolio turnover rate | | | 14 | %(g) | | 8 | % | | 13 | % | | 16 | % | | 18 | % | | 35 | % |

(a) | Per share amounts are calculated using the average shares method. |

(b) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any, and does not reflect the impact of sales charges. Had the Advisor not absorbed a portion of the Fund expenses, total returns would have been lower. |

(c) | Includes adjustments in accordance with accounting principles generally accepted in the United States and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

(d) | Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursement by the Advisor. |

(e) | The ratios of expenses to average net assets and net investment income to average net assets do not directly reflect the expenses of the underlying institutional private real estate investments in which the Fund invests. The Fund invests in each underlying institutional private real estate investment based upon its net asset value, inclusive of management fees, which typically range from 0.50% to 1.30% on an annualized basis. The Fund’s Total Return is reported net of all fees and expenses. |

(f) | Annualized. |

(g) | Not annualized. |

The accompanying notes are an integral part of these financial statements.

Semi-Annual Report | March 31, 2020 | 19 |

Bluerock Total Income+ Real Estate Fund - Class C | Financial Highlights |

The table below sets forth financial data for one share of beneficial interest outstanding throughout each period presented.

| | For the Six Months Ended March 31, 2020 (Unaudited) | | For the Year Ended September 30, 2019 | | For the Year Ended September 30, 2018 | | For the Year Ended September 30, 2017 | | For the Year Ended September 30, 2016 | | For the Year Ended September 30, 2015 | |

Net asset value, beginning of year | | $ | 29.22 | | $ | 29.02 | | $ | 28.63 | | $ | 28.61 | | $ | 28.38 | | $ | 27.89 | |

INCOME FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | |

Net investment income/(loss)(a) | | | 0.08 | | | 0.10 | | | (0.01 | ) | | 0.01 | | | (0.01 | ) | | 0.16 | |

Net realized and unrealized gain | | | 0.27 | | | 1.63 | | | 1.93 | | | 1.52 | | | 1.75 | | | 1.82 | |

Total from investment operations | | | 0.35 | | | 1.73 | | | 1.92 | | | 1.53 | | | 1.74 | | | 1.98 | |

DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | |

From net investment income | | | – | | | – | | | – | | | – | | | – | | | (0.09 | ) |

From net realized gain on investments | | | (0.57 | ) | | (0.32 | ) | | (0.52 | ) | | (0.37 | ) | | (0.16 | ) | | (0.29 | ) |

Return of capital | | | (0.20 | ) | | (1.21 | ) | | (1.01 | ) | | (1.14 | ) | | (1.35 | ) | | (1.11 | ) |

Total distributions | | | (0.77 | ) | | (1.53 | ) | | (1.53 | ) | | (1.51 | ) | | (1.51 | ) | | (1.49 | ) |

Net asset value, end of period | | $ | 28.80 | | $ | 29.22 | | $ | 29.02 | | $ | 28.63 | | $ | 28.61 | | $ | 28.38 | |

TOTAL RETURN(b)(c) | | | 1.21 | % | | 6.15 | % | | 6.86 | % | | 5.50 | % | | 6.28 | % | | 7.28 | % |

RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000s) | | $ | 453,428 | | $ | 401,507 | | $ | 290,549 | | $ | 232,200 | | $ | 153,859 | | $ | 37,920 | |

Ratios to Average Net Assets (including interest expense) | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets excluding fee waivers and reimbursements(d)(e) | | | 2.83 | %(f) | | 2.95 | % | | 3.18 | % | | 3.13 | % | | 2.95 | % | | 3.04 | % |

Ratio of expenses to average net assets including fee waivers and reimbursements(e) | | | 2.86 | %(f) | | 2.96 | % | | 3.12 | % | | 2.97 | % | | 2.56 | % | | 2.55 | % |

Ratio of net investment income/(loss) to average net assets(e) | | | 0.52 | %(f) | | 0.35 | % | | (0.04 | )% | | 0.05 | % | | (0.04 | )% | | 0.55 | % |

Ratios to Average Net Assets (excluding interest expense) | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets excluding fee waivers and reimbursements(d)(e) | | | 2.65 | %(f) | | 2.69 | % | | 2.74 | % | | 2.79 | % | | 2.95 | % | | 3.02 | % |

Ratio of expenses to average net assets including fee waivers and reimbursements(e) | | | 2.68 | %(f) | | 2.70 | % | | 2.68 | % | | 2.63 | % | | 2.56 | % | | 2.54 | % |

Portfolio turnover rate | | | 14 | %(g) | | 8 | % | | 13 | % | | 16 | % | | 18 | % | | 35 | % |

(a) | Per share amounts are calculated using the average shares method. |

(b) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any. Had the Advisor not absorbed a portion of the Fund expenses, total returns would have been lower. |

(c) | Includes adjustments in accordance with accounting principles generally accepted in the United States and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

(d) | Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursement by the Advisor. |

(e) | The ratios of expenses to average net assets and net investment income (loss) to average net assets do not directly reflect the expenses of the underlying institutional private real estate investments in which the Fund invests. The Fund invests in each underlying institutional private real estate investment based upon its net asset value, inclusive of management fees, which typically range from 0.50% to 1.30% on an annualized basis. The Fund’s Total Return is reported net of all fees and expenses. |

(f) | Annualized. |

(g) | Not annualized. |

The accompanying notes are an integral part of these financial statements.

20

Bluerock Total Income+ Real Estate Fund - Class I | Financial Highlights |

The table below sets forth financial data for one share of beneficial interest outstanding throughout each period presented.

| | For the Six Months Ended March 31, 2020 (Unaudited) | | For the Year Ended September 30, 2019 | | For the Year Ended September 30, 2018 | | For the Year Ended September 30, 2017 | | For the Year Ended September 30, 2016 | | For the Year Ended September 30, 2015 | |

Net asset value, beginning of year | | $ | 30.92 | | $ | 30.40 | | $ | 29.70 | | $ | 29.38 | | $ | 28.85 | | $ | 28.03 | |

INCOME FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | |

Net investment income(a) | | | 0.24 | | | 0.42 | | | 0.29 | | | 0.31 | | | 0.28 | | | 0.45 | |

Net realized and unrealized gain | | | 0.28 | | | 1.72 | | | 2.01 | | | 1.57 | | | 1.79 | | | 1.88 | |

Total from investment operations | | | 0.52 | | | 2.14 | | | 2.30 | | | 1.88 | | | 2.07 | | | 2.33 | |

DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | |

From net investment income | | | – | | | – | | | – | | | – | | | – | | | (0.10 | ) |

From net realized gain on investments | | | (0.61 | ) | | (0.32 | ) | | (0.54 | ) | | (0.37 | ) | | (0.16 | ) | | (0.29 | ) |

Return of capital | | | (0.21 | ) | | (1.30 | ) | | (1.06 | ) | | (1.19 | ) | | (1.38 | ) | | (1.12 | ) |

Total distributions | | | (0.82 | ) | | (1.62 | ) | | (1.60 | ) | | (1.56 | ) | | (1.54 | ) | | (1.51 | ) |

Net asset value, end of period | | $ | 30.62 | | $ | 30.92 | | $ | 30.40 | | $ | 29.70 | | $ | 29.38 | | $ | 28.85 | |

TOTAL RETURN(b)(c) | | | 1.69 | % | | 7.23 | % | | 7.91 | % | | 6.58 | % | | 7.36 | % | | 8.51 | % |

RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000s) | | $ | 1,362,060 | | $ | 1,040,017 | | $ | 471,116 | | $ | 257,366 | | $ | 110,845 | | $ | 25,274 | |

Ratios to Average Net Assets (including interest expense) | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets excluding fee waivers and reimbursements(d)(e) | | | 1.83 | %(f) | | 1.94 | % | | 2.22 | % | | 2.15 | % | | 1.96 | % | | 2.03 | % |

Ratio of expenses to average net assets including fee waivers and reimbursements(e) | | | 1.85 | %(f) | | 1.95 | % | | 2.15 | % | | 1.99 | % | | 1.56 | % | | 1.54 | % |

Ratio of net investment income to average net assets(e) | | | 1.56 | %(f) | | 1.38 | % | | 0.95 | % | | 1.06 | % | | 0.96 | % | | 1.59 | % |

Ratios to Average Net Assets (excluding interest expense) | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets excluding fee waivers and reimbursements(d)(e) | | | 1.65 | %(f) | | 1.69 | % | | 1.75 | % | | 1.80 | % | | 1.96 | % | | 2.02 | % |

Ratio of expenses to average net assets including fee waivers and reimbursements(e) | | | 1.67 | %(f) | | 1.70 | % | | 1.68 | % | | 1.64 | % | | 1.56 | % | | 1.53 | % |

Portfolio turnover rate | | | 14 | %(g) | | 8 | % | | 13 | % | | 16 | % | | 18 | % | | 35 | % |

(a) | Per share amounts are calculated using the average shares method. |

(b) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any. Had the Advisor not absorbed a portion of the Fund expenses, total returns would have been lower. |

(c) | Includes adjustments in accordance with accounting principles generally accepted in the United States and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

(d) | Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursement by the Advisor. |

(e) | The ratios of expenses to average net assets and net investment income (loss) to average net assets do not directly reflect the expenses of the underlying institutional private real estate investments in which the Fund invests. The Fund invests in each underlying institutional private real estate investment based upon its net asset value, inclusive of management fees, which typically range from 0.50% to 1.30% on an annualized basis. The Fund’s Total Return is reported net of all fees and expenses. |

(f) | Annualized. |

(g) | Not annualized. |

The accompanying notes are an integral part of these financial statements.

Semi-Annual Report | March 31, 2020 | 21 |

Bluerock Total Income+ Real Estate Fund - Class L | Financial Highlights |

The table below sets forth financial data for one share of beneficial interest outstanding throughout each period presented.

| | For the Six Months Ended March 31, 2020 (Unaudited) | | For the Year Ended September 30, 2019 | | For the Year Ended September 30, 2018 | | For the Period Ended September 30, 2017(a) | |

Net asset value, beginning of period | | $ | 30.25 | | $ | 29.89 | | $ | 29.34 | | $ | 29.42 | |

INCOME FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | |

Net investment income/(loss)(b) | | | 0.15 | | | 0.26 | | | 0.13 | | | (0.06 | ) |

Net realized and unrealized gain | | | 0.29 | | | 1.68 | | | 1.99 | | | 0.76 | |

Total from investment operations | | | 0.44 | | | 1.94 | | | 2.12 | | | 0.70 | |

| | | | | | | | | | | | | | |

DISTRIBUTIONS: | | | | | | | | | | | | | |

From net realized gain on investments | | | (0.59 | ) | | (0.32 | ) | | (0.53 | ) | | – | |

Return of capital | | | (0.21 | ) | | (1.26 | ) | | (1.04 | ) | | (0.78 | ) |

Total distributions | | | (0.80 | ) | | (1.58 | ) | | (1.57 | ) | | (0.78 | ) |

| | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 29.89 | | $ | 30.25 | | $ | 29.89 | | $ | 29.34 | |

TOTAL RETURN(c)(d) | | | 1.46 | % | | 6.70 | % | | 7.40 | % | | 2.40 | %(e) |

| | | | | | | | | | | | | | |

RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | |

Net assets, end of period (000s) | | $ | 73,824 | | $ | 88,605 | | $ | 42,975 | | $ | 5,059 | |

Ratios to Average Net Assets (including interest expense) | | | | | | | | | | | | | |

Ratio of expenses to average net assets excluding fee waivers and reimbursements(f)(g) | | | 2.32 | %(h) | | 2.44 | % | | 2.84 | % | | 2.83 | %(h) |

Ratio of expenses to average net assets including fee waivers and reimbursements(f) | | | 2.35 | %(h) | | 2.46 | % | | 2.74 | % | | 2.63 | %(h) |

| | | | | | | | | | | | | | |

Ratio of net investment income/(loss) to average net assets(f) | | | 0.96 | %(h) | | 0.87 | % | | 0.44 | % | | (0.64 | )%(h) |

Ratios to Average Net Assets (excluding interest expense) | | | | | | | | | | | | | |

Ratio of expenses to average net assets excluding fee waivers and reimbursements(f)(g) | | | 2.15 | %(h) | | 2.18 | % | | 2.27 | % | | 2.35 | %(h) |

Ratio of expenses to average net assets including fee waivers and reimbursements(f) | | | 2.18 | %(h) | | 2.20 | % | | 2.17 | % | | 2.14 | %(h) |

Portfolio turnover rate | | | 14 | %(i) | | 8 | % | | 13 | % | | 16 | %(i) |

(a) | Class L commenced operations June 1, 2017. |

(b) | Per share amounts are calculated using the average shares method. |

(c) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any. Had the Advisor not absorbed a portion of the Fund expenses, total returns would have been lower. |

(d) | Includes adjustments in accordance with accounting principles generally accepted in the United States and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

(e) | Not Annualized. |

(f) | The ratios of expenses to average net assets and net investment income (loss) to average net assets do not directly reflect the expenses of the underlying institutional private real estate investments in which the Fund invests. The Fund invests in each underlying institutional private real estate investment based upon its net asset value, inclusive of management fees, which typically range from 0.50% to 1.30% on an annualized basis. The Fund’s Total Return is reported net of all fees and expenses. |

(g) | Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursement by the Advisor. |

(h) | Annualized. |

(i) | Not annualized. |

The accompanying notes are an integral part of these financial statements.

22

Bluerock Total Income+ Real Estate Fund | Notes to Financial Statements |

March 31, 2020 (Unaudited)

1. ORGANIZATION

Bluerock Total Income+ Real Estate Fund, formerly known as Total Income+ Real Estate Fund, (the “Fund” or the “Trust”) was organized as a Delaware statutory trust on May 25, 2012 and is registered under the Investment Company Act of 1940, as amended, (the “1940 Act”), as a non-diversified, closed-end management investment company that operates as an interval fund with a continuous offering of Fund shares. The Fund’s investment advisor is Bluerock Fund Advisor, LLC (the “Advisor”). The Fund’s primary investment objective is to generate current income while secondarily seeking long-term capital appreciation, with low to moderate volatility and low correlation to the broader markets. The Fund pursues its investment objectives by investing, under normal circumstances, at least 80% of assets plus the amount of any borrowings for investment purposes, in real estate industry securities, primarily in income producing equity and debt securities.