UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22715

Guggenheim Credit Allocation Fund

(Exact name of registrant as specified in charter)

227 West Monroe Street, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Amy J. Lee

227 West Monroe Street, Chicago, IL 60606

(Name and address of agent for service)

Registrant's telephone number, including area code: (312) 827-0100

Date of fiscal year end: May 31

Date of reporting period: June 1, 2016 – May 31, 2017

Item 1. Reports to Stockholders.

The registrant's annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the "Investment Company Act"), is as follows:

GUGGENHEIMINVESTMENTS.COM/GGM

... YOUR LINK TO THE LATEST, MOST UP-TO-DATE INFORMATION ABOUT GUGGENHEIM CREDIT ALLOCATION FUND

The shareholder report you are reading right now is just the beginning of the story.

Online at guggenheiminvestments.com/ggm, you will find:

| · | Daily, weekly and monthly data on share prices, distributions and more |

| · | Portfolio overviews and performance analyses |

| · | Announcements, press releases and special notices |

| · | Fund and adviser contact information |

Guggenheim Partners Investment Management, LLC and Guggenheim Funds Investment Advisors, LLC are constantly updating and expanding shareholder information services on the Fund’s website in an ongoing effort to provide you with the most current information about how your Fund’s assets are managed and the results of our efforts. It is just one more small way we are working to keep you better informed about your investment in the Fund.

DEAR SHAREHOLDER

We thank you for your investment in the Guggenheim Credit Allocation Fund (the “Fund”). This report covers the Fund’s performance for the 12-month period ended May 31, 2017.

The Fund’s investment objective is to seek total return through a combination of current income and capital appreciation.

Under normal market conditions, the Fund invests at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in fixed income securities, debt securities, loans and investments with economic characteristics similar to fixed-income securities, debt securities and loans (collectively, “credit securities”). The Fund seeks to achieve its investment objective by investing in a portfolio of credit securities selected from a variety of sectors and credit qualities. The Fund may invest in credit securities of any duration or maturity. Credit securities in which the Fund may invest may pay fixed or variable rates of interest. The Fund may invest without limitation in securities of non-U.S. issuers, including issuers in emerging markets.

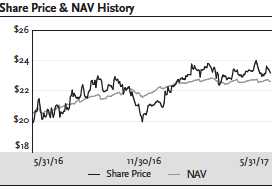

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. For the 12-month period ended May 31, 2017, the Fund provided a total return based on market price of 28.83% and a total return based on NAV of 21.55%. NAV return includes the deduction of management fees, operating expenses, and all other Fund expenses.

As of May 31, 2017, the Fund’s market price of $23.18 represented a premium of 2.48% to its NAV of $22.62. The market value of the Fund’s shares fluctuates from time to time and may be higher or lower than the Fund’s NAV. Past performance is not a guarantee of future results.

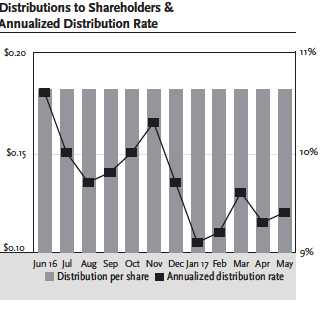

From June 2016 through May 2017, the Fund paid a monthly distribution of $0.1813. The May distribution represents an annualized distribution rate of 9.39% based on the Fund’s closing market price of $23.18 on May 31, 2017. The Fund’s distribution rate is not constant, and the amount of distributions, when declared by the Fund’s Board of Trustees, is subject to change based on the performance of the Fund. Please see Note 2(e) on page 38 for more information on distributions for the period.

Guggenheim Funds Investment Advisors, LLC (the “Adviser”) serves as the investment adviser to the Fund. Guggenheim Partners Investment Management, LLC (“GPIM” or the “Sub-Adviser”) serves as the Fund’s investment sub-adviser and is responsible for the management of the Fund’s portfolio of investments. Each of the Adviser and the Sub-Adviser is an affiliate of Guggenheim Partners, LLC (“Guggenheim”), a global diversified financial services firm.

We encourage shareholders to consider the opportunity to reinvest their distributions from the Fund through the Dividend Reinvestment Plan (“DRIP”), which is described in detail on page 64 of this report. When shares trade at a discount to NAV, the DRIP takes advantage of the discount by reinvesting the monthly distribution in common shares of the Fund purchased in the market at a price less than NAV. Conversely, when the market price of the Fund’s common shares is at a premium above NAV, the DRIP reinvests participants’ distributions in newly-issued common shares at the greater of NAV per share or

GGM l GUGGENHEIM CREDIT ALLOCATION FUND ANNUAL REPORT l 3| | |

DEAR SHAREHOLDER (Unaudited) continued | May 31, 2017 |

95% of the market price per share. The DRIP provides a cost-effective means to accumulate additional shares and enjoy the benefits of compounding returns over time. Since the Fund endeavors to maintain a stable monthly distribution, the DRIP effectively provides an income averaging technique, which causes shareholders to accumulate a larger number of Fund shares when the market price is depressed than when the price is higher.

To learn more about the Fund’s performance and investment strategy, we encourage you to read the Questions & Answers section of this report, which begins on page 5. You’ll find information on GPIM’s investment philosophy, views on the economy and market environment, and detailed information about the factors that impacted the Fund’s performance.

We appreciate your investment and look forward to serving your investment needs in the future. For the most up-to-date information on your investment, please visit the Fund’s website at guggenheiminvestments.com/ggm.

Sincerely,

Donald C. Cacciapaglia

President and Chief Executive Officer

Guggenheim Credit Allocation Fund

June 30, 2017

4 l GGM l GUGGENHEIM CREDIT ALLOCATION FUND ANNUAL REPORT| | |

QUESTIONS & ANSWERS (Unaudited) | May 31, 2017 |

Guggenheim Credit Allocation Fund (the “Fund”) is managed by a team of seasoned professionals at Guggenheim Partners Investment Management, LLC (“GPIM”). This team includes B. Scott Minerd, Chairman of Guggenheim Investments and Global Chief Investment Officer; Anne B. Walsh, CFA, JD, Senior Managing Director and Assistant Chief Investment Officer; Kevin H. Gundersen, Senior Managing Director and Portfolio Manager; James W. Michal, Senior Managing Director and Portfolio Manager; Thomas J. Hauser, Senior Managing Director and Portfolio Manager; and Richard de Wet, Director and Portfolio Manager. In the following interview, the investment team discusses the market environment and the Fund’s performance for the 12-month period ended May 31, 2017.

What is the Fund’s investment objective and how is it pursued?

The Fund’s investment objective is to seek total return through a combination of current income and capital appreciation.

Under normal market conditions, the Fund invests at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in fixed income securities, debt securities, loans and investments with economic characteristics similar to fixed-income securities (collectively, “credit securities”). Credit securities in which the Fund may invest consist of corporate bonds, loans and loan participations, asset-backed securities (all or a portion of which may consist of collateralized loan obligations), mortgage-backed securities (both residential mortgage-backed securities and commercial mortgage-backed securities), U.S. Government and agency securities, mezzanine and preferred securities, convertible securities, commercial paper, municipal securities and sovereign government and supranational debt securities. The Fund will seek to achieve its investment objective by investing in a portfolio of credit securities selected from a variety of sectors and credit qualities. The Fund may invest in credit securities that are rated below investment grade, or, if unrated, determined to be of comparable quality (also known as “high yield securities” or “junk bonds”). The Fund may invest in credit securities of any duration or maturity. Credit securities in which the Fund may invest may pay fixed or variable rates of interest. The Fund may invest without limitation in securities of non-U.S. issuers, including issuers in emerging markets.

The Fund may, but is not required to, use various derivatives transactions for hedging and risk management purposes, to facilitate portfolio management and to earn income or enhance total return. The Fund may use such transactions as a means to synthetically implement the Fund’s investment strategies. In addition, as an alternative to holding investments directly, the Fund may also obtain investment exposure by investing in other investment companies. To the extent that the Fund invests in synthetic investments with economic characteristics similar to credit securities, the value of such investments will be counted as credit securities for purposes of the Fund’s policy of investing at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in credit securities (the “80% Policy”).

GGM l GUGGENHEIM CREDIT ALLOCATION FUND ANNUAL REPORT l 5| | |

QUESTIONS & ANSWERS (Unaudited) continued | May 31, 2017 |

The Fund may invest in open-end funds, closed-end funds and exchange-traded funds. For purposes of the Fund’s 80% Policy, the Fund will include its investments in other investment companies that have a policy of investing at least 80% of their net assets, plus the amount of any borrowings for investment purposes, in one or more types of credit securities.

The Fund uses financial leverage (borrowing and reverse repurchase agreements) to finance the purchase of additional securities. Although financial leverage may create an opportunity for increased return for shareholders, it also results in additional risks and can magnify the effect of any losses. There is no assurance that the strategy will be successful. If income and gains on securities purchased with the financial leverage proceeds are greater than the cost of the financial leverage, common shareholders’ return will be greater than if financial leverage had not been used. Conversely, if the income or gains from the securities purchased with the proceeds of financial leverage are less than the cost of financial leverage, common shareholders’ return will be less than if financial leverage had not been used.

What were the significant events affecting the economy and market environment over the past 12 months?

Much of the 12 months ended May 31, 2017, was marked by significant events in the political sphere, both in the U.S. and globally. Last June Britain voted to leave the European Union and this was later followed by the U.S. presidential election in November. These results led to higher market volatility initially, which later subsided. Optimism surrounding future growth has helped equity markets in the U.S. reach record highs in 2017. Fixed Income markets have seen strength for the same reasons, combined with improvement in corporate performance.

The global macroeconomic backdrop for the foreseeable future is positive. Chinese growth has stabilized in the last few months, Europe is gradually improving, U.S. corporate earnings are rising, and confidence measures remain strong. Despite strong gains in consumer and business sentiment following the U.S. election, tracking estimates for first-quarter real Gross Domestic Product (“GDP”) growth slowly fell throughout the first quarter of 2017. In late June, after the period ended, the final reading of first quarter GDP came in at 1.4%. A large portion of the apparent weakness can be attributed to seasonal factors that have depressed as-reported first-quarter GDP growth over the past few years. More importantly, the prospects for quarterly U.S. GDP growth are better going forward, and GPIM expects a strong bounce back in the second quarter.

GPIM’s medium-term growth outlook has dimmed marginally as a result of the lack of progress on U.S. fiscal policy initiatives. The ongoing struggle to create a healthcare bill has taken away early legislative momentum, and tax reform shows that work still needs to be done to put the agenda into effect in a timely manner. Nevertheless, financial conditions since the election remain positive despite U.S. Federal Reserve (the “Fed”) rate hikes, and we continue to expect the economy to grow modestly. This should push the unemployment rate to under 4.1% by the end of 2018, well below its natural rate of 4.7%, and support a continued gradual rise in underlying inflation, which is nearing the Fed’s 2% goal.

Coming off the lows in early 2016, the Fed is set to continue raising interest rates and at a faster pace than the market is pricing in. In addition to another rate hike this year, the Fed may raise rates three to four more times in 2018 according to GPIM estimates. The Fed’s strategy to begin reducing its balance

6 l GGM l GUGGENHEIM CREDIT ALLOCATION FUND ANNUAL REPORT| | |

QUESTIONS & ANSWERS (Unaudited) continued | May 31, 2017 |

sheet later this year could pressure yields higher in the short end of the curve. In sum, solid but unspectacular economic growth, a cautious Fed, and improving fundamentals underpin our positive outlook for the U.S. economy, which should continue to support a historically low default environment for credit.

How did the Fund perform for the 12 months ended May 31, 2017?

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. For the 12-month period ended May 31, 2017, the Fund provided a total return based on market price of 28.83% and a total return based on NAV of 21.55%. NAV return includes the deduction of management fees, operating expenses, and all other Fund expenses.

As of May 31, 2017, the Fund’s market price of $23.18 represented a premium of 2.48% to its NAV of $22.62. As of May 31, 2016, the Fund’s market price of $19.86 represented a discount of 3.26% to its NAV of $20.53. The market value of the Fund’s shares fluctuates from time to time and may be higher or lower than the Fund’s NAV. Past performance is not a guarantee of future results.

What were the distributions over the period?

From June 2016 through May 2017, the Fund paid a monthly distribution of $0.1813. The May distribution represents an annualized distribution rate of 9.39% based on the Fund’s closing market price of $23.18 on May 31, 2017. The Fund’s distribution rate is not constant, and the amount of distributions, when declared by the Fund’s Board of Trustees, is subject to change based on the performance of the Fund. Please see Note 2(e) on page 38 for more information on distributions for the period.

Why did the Fund accrue excise tax during the period?

As a registered investment company, the Fund is subject to a 4% excise tax that is imposed if the Fund does not distribute by the end of any calendar year at least the sum of (i) 98% of its ordinary income (not taking into account any capital gain or loss) for the calendar year and (ii) 98.2% of its capital gain in excess of its capital loss (adjusted for certain ordinary losses) for a one-year period generally ending on October 31 of the calendar year (unless an election is made to use the fund’s fiscal year). The Fund generally intends to distribute income and capital gains in the manner necessary to minimize (but not necessarily eliminate) the imposition of such excise tax. While the Fund’s income and capital gains can vary significantly from year to year, the Fund seeks to maintain more stable monthly distributions over time. The Fund may retain income or capital gains and pay excise tax when it is determined that doing so is in the best interest of shareholders. Management, in consultation with the Board of Trustees, evaluates the costs of the excise tax relative to the benefits of retaining income and capital gains, including that such undistributed amounts (net of the excise tax paid) remain available for investment by the Fund and are available to supplement future distributions, which may facilitate the payment of more stable monthly distributions year over year.

What influenced the Fund’s performance?

During the period, the Fund saw positive performance primarily attributable to the tightening of credit spreads, particularly among the portfolio’s investments in high yield corporate bonds and senior bank loans, which together comprise most of the Fund. The mix varies according to the relative valuation of

GGM l GUGGENHEIM CREDIT ALLOCATION FUND ANNUAL REPORT l 7| | |

QUESTIONS & ANSWERS (Unaudited) continued | May 31, 2017 |

the two asset classes and availability of attractively priced assets. As proxies for the two markets, the Bloomberg Barclays U.S. Corporate High Yield Index returned 13.58% for the 12-month period, while the Credit Suisse Leveraged Loan Index returned 7.56%. In the high yield market, the biggest gains in the period came from lower quality, with CCC bonds (+23.13%) outperforming BB bonds (+10.08%) and B bonds (+13.48%) by a sizeable margin, continuing a trend from last year. Similarly, CCC loans (+24.16%) outperformed BB loans (+4.55%) and B loans (+7.22%).

An important driver of positive performance over the period was the rebound in commodity markets. The high yield market rallied, marked by the bottoming of oil prices and the beginning of a slew of downgrades by the credit ratings agencies, primarily of commodity-related issuers. The market was pricing in a high level of defaults just prior to this period in early 2016; but with the easing of concerns over global growth, especially in China, and the beginning of a recovery in oil and metals pricing, the market rapidly snapped back. The Fund took advantage of market weakness to find attractive entry points in high yield energy bonds as well as other assets that had sold off in tandem with commodities for no fundamental reason. Outperformance was also driven by portfolio exposure to asset-backed securities (ABS) and the technology sector.

The high-yield default rate reached a recent high in mid-2016, as a result of defaults in commodity-sensitive sectors. But with the recovery in the price of oil over the past year, the default rate has fallen below the long-term average default rate, reflecting the sound financial situation for most issuers, driven by improving fundamentals and a solid macroeconomic backdrop. Moody’s expects the default rate to drop to 3.1% by the end of 2017 and, excluding commodity sectors, the default rate for high yield bonds is near post-crisis lows. This is evident in the yield to worst on the Bloomberg Barclays U.S. Corporate High Yield Index which started the period at 7.31% and ended at 5.48%.

How is the Fund positioned for the coming months?

The Fund is positioned well across its three primary asset class exposures, with the heaviest allocation to high yield bonds, followed by bank loans and ABS. GPIM has incrementally added ABS that have shown strong yield and potential for price appreciation.

Spreads on high yield corporate bonds and bank loans were driven to near-2014 lows during the period. GPIM remains vigilant to ensure that we are being adequately compensated for the level of risk taken. The Fund continues to avoid highly levered industries and companies with heavy capital expenditure needs that can impair cash flow generation. Companies with strong cash flows, recurring revenue streams, and high-quality margins should remain the focus in the later stages of the credit cycle.

GPIM’s conscious that the securities in the Fund will need to survive another downturn. Therefore, despite seeing strong tailwinds that we expect will drive positive returns over the next two years, we maintain a more conservative outlook and continue to focus on more defensive credits with consistent cash flow and sustainable debt profiles. The Fund is overweight in technology issuers and has favored B-rated bonds, which offer attractive risk-adjusted returns relative to other rating tranches.

8 l GGM l GUGGENHEIM CREDIT ALLOCATION FUND ANNUAL REPORT| | |

QUESTIONS & ANSWERS (Unaudited) continued | May 31, 2017 |

Any other comments about the Fund?

GPIM expects the economy to remain on solid footing driven by growing consumer sentiment coupled with improving corporate fundamentals and low default rates. However, it appears the majority of this has already been priced into spreads. As a result, GPIM believes this will likely be a year of clipping coupons in high-yield, with moderate price upside coming primarily from single B-rated and a few highly selective CCC-rated credits. Amid this positive backdrop for risk assets, GPIM remains focused on credit selection.

With a sizeable portion of the Fund exposed to floating rate assets in the form of bank loans and ABS, the prospect of higher interest rates makes this basket of assets more attractive. Specifically, bank loans stand to benefit from higher interest rates, as their coupons reset at a higher rate.

What is the Fund’s duration?

The Fund has consistently been positioned conservatively in terms of duration, with higher exposure to short-dated bonds and overweight to floating rate securities (bank loans), the Fund is positioned for volatility with diversified sources of return from different assets classes in various parts of the capital structure.

The effective duration for the Fund as of May 31, 2017, was below three years. GPIM’s view is that we are unlikely to see rates move in a sudden and aggressive upward trajectory, as the Fed is providing ample guidance about the future path of interest rates. The Fund may invest in credit securities of any duration or maturity and is not required to maintain any particular maturity or duration for its portfolio as a whole. It typically maintains a leverage-adjusted average portfolio duration of one to four years. However, average portfolio duration is adjusted based on market conditions.

Discuss the Fund’s use of leverage.

The Fund utilizes leverage as part of its investment strategy, to finance the purchase of additional securities that provide increased income and potentially greater appreciation potential to common shareholders than could be achieved from a portfolio that is not leveraged.

With the low cost of borrowing and stability in the fundamentals of American companies, the amount of leverage used by the Fund is highly accretive to income generation.

The Fund currently employs leverage through borrowing and reverse repurchase agreements, under which the Fund temporarily transfers possession of portfolio securities and receives cash that can be used for additional investments.

As of May 31, 2017, the amount of leverage was approximately 29% of managed assets (including the proceeds of leverage). While leverage increases the income of the Fund in yield terms, it also amplifies the effects of changing market prices in the portfolio and can cause the Fund’s NAV to change to a greater degree than the market as a whole. This can create volatility in Fund pricing but should not affect the Fund’s ability to pay dividends under normal circumstances.

GGM l GUGGENHEIM CREDIT ALLOCATION FUND ANNUAL REPORT l 9

| | |

QUESTIONS & ANSWERS (Unaudited) continued | May 31, 2017 |

Index Definitions

Indices are unmanaged and reflect no expenses. It is not possible to invest directly in an index.

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including U.S. Treasuries, government-related and corporate securities, mortgage-backed securities or “MBS” (agency fixed-rate and hybrid adjustable-rate mortgage, or “ARM”, pass-throughs), asset-backed securities (“ABS”), and commercial mortgage-backed securities (“CMBS”) (agency and non-agency).

The Bloomberg Barclays U.S. Corporate High Yield Index measures the U.S. dollar-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB +/BB + or below.

The Credit Suisse Leveraged Loan Index is an index designed to mirror the investable universe of the $US-denominated leveraged loan market.

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks. The index is designed to measure the performance of the economy, representing all major industries and is considered a representation of U.S. stock market.

Risks and Other Considerations

Investing involves risk, including the possible loss of principal and fluctuation of value.

The views expressed in this report reflect those of the portfolio managers only through the report period as stated on the cover. These views are expressed for informational purposes only and are subject to change at any time, based on market and other conditions, and may not come to pass. These views may differ from views of other investment professionals at Guggenheim and should not be construed as research, investment advice or a recommendation of any kind regarding the fund or any issuer or security, do not constitute a solicitation to buy or sell any security and should not be considered specific legal, investment or tax advice. The information provided does not take into account the specific objectives, financial situation or particular needs of any specific investor.

The views expressed in this report may also include forward looking statements that involve risk and uncertainty, and there is no guarantee that any predictions will come to pass. Actual results or events may differ materially from those projected, estimated, assumed or anticipated in any such forward looking statements. Important factors that could result in such differences, in addition to the other factors noted with such forward-looking statements, include general economic conditions such as inflation, recession and interest rates.

There can be no assurance that the Fund will achieve its investment objectives or that any investment strategies or techniques discussed herein will be effective. The value of the Fund will fluctuate with the value of the underlying securities. Historically, closed-end funds often trade at a discount to their net asset value.

10 l GGM l GUGGENHEIM CREDIT ALLOCATION FUND ANNUAL REPORT| | |

QUESTIONS & ANSWERS (Unaudited) continued | May 31, 2017 |

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown.

Please see guggenheiminvestments.com/ggm for a detailed discussion of the Fund’s risks and considerations.

This material is not intended as a recommendation or as investment advice of any kind, including in connection with rollovers, transfers, and distributions. Such material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. All content has been provided for informational or educational purposes only and is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional regarding your specific situation.

GGM l GUGGENHEIM CREDIT ALLOCATION FUND ANNUAL REPORT l 11

| | |

FUND SUMMARY (Unaudited) | May 31, 2017 |

| | |

Fund Statistics | |

| Share Price | $23.18 |

| Net Asset Value | $22.62 |

| Premium to NAV | 2.48% |

| Net Assets ($000) | $158,663 |

| | | | |

AVERAGE ANNUAL TOTAL RETURNS | | | |

FOR THE PERIOD ENDED MAY 31, 2017 | | | |

| | | | Since |

| | One | Three | Inception |

| | Year | Year | (06/26/13) |

| Guggenheim Credit Allocation Fund | | | |

| NAV | 21.55% | 7.09% | 7.99% |

| Market | 28.83% | 8.24% | 7.58% |

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. All NAV returns include the deduction of management fees, operating expenses and all other Fund expenses. The deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares is not reflected in the total returns. For the most recent month-end performance figures, please visit guggenheiminvestments.com/ggm. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

| | |

Portfolio Breakdown | % of Net Assets |

| Corporate Bonds | 78.3% |

| Senior Floating Rate Interests | 44.2% |

| Asset Backed Securities | 11.9% |

| Preferred Stocks | 2.9% |

| Exchange-Traded Funds | 2.8% |

| Common Stocks | 1.9% |

| Short Term Investments | 0.5% |

| Warrants | 0.0%* |

Total Investments | 142.5% |

Other Assets & Liabilities, net | -42.5% |

Net Assets | 100.0% |

| * Less than 0.1% | |

12 l GGM l GUGGENHEIM CREDIT ALLOCATION FUND ANNUAL REPORT| | |

FUND SUMMARY (Unaudited) continued | May 31, 2017 |

GGM l GUGGENHEIM CREDIT ALLOCATION FUND ANNUAL REPORT l 13| | |

FUND SUMMARY (Unaudited) continued | May 31, 2017 |

| | |

Ten Largest Holdings | |

(% of Total Net Assets) | |

| American Midstream Partners Limited Partnership / | |

| American Midstream Finance Corp., 8.50%, 12/15/21 | 2.6% |

| Terraform Global Operating LLC, 9.75%, 08/15/22 | 2.5% |

| MDC Partners, Inc., 6.50%, 05/01/24 | 2.4% |

| Reddy Ice Holdings, Inc., 10.75%, 10/01/19 | 2.4% |

| HRG Group, Inc., 7.88%, 07/15/19 | 1.9% |

| Vector Group Ltd., 6.13%, 02/01/25 | 1.9% |

| Epicor Software, 9.40%, 06/21/23 | 1.8% |

| CTI Foods Holding Co. LLC, 8.40%, 06/28/21 | 1.8% |

| Moss Creek Resources LLC, 9.50%, 04/07/22 | 1.8% |

| SFR Group S.A., 7.38%, 05/01/26 | 1.8% |

| Top Ten Total | 20.9% |

“Ten Largest Holdings” excludes any temporary cash or derivative investments.

Portfolio breakdown and holdings are subject to change daily. For more information, please visit guggenheiminvestments.com/ggm. The above summaries are provided for informational purposes only and should not be viewed as recommendations. Past performance does not guarantee future results.

| | |

Portfolio Composition by Quality Rating* | |

| |

| | % of Total |

Rating | Investments |

| |

Fixed Income Instruments | |

| A | 1.4% |

| BBB | 3.3% |

| BB | 24.8% |

| B | 41.0% |

| CCC | 16.5% |

| CC | 0.5% |

| NR** | 9.5% |

Other Instruments | |

| Short Term Investments | 2.9% |

| Common Stocks | 0.1% |

| Total Investments | 100.0% |

| * | Source: BlackRock Solutions. Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). All securities except for “NR”, or not rated, have been rated by Moody’s, Standard & Poor’s (“S&P”), or Fitch, which are all a Nationally Recognized Statistical Rating Organization (“NRSRO”). For purposes of this presentation, when ratings are available from more than one agency, the highest rating is used. Guggenheim Investments has converted Moody’s and Fitch ratings to the equivalent S&P rating. Security ratings are determined at the time of purchase and may change thereafter. |

| ** | NR securities do not necessarily indicate low credit quality. |

14 l GGM l GUGGENHEIM CREDIT ALLOCATION FUND ANNUAL REPORT| | |

SCHEDULE OF INVESTMENTS | May 31, 2017 |

| | | |

| | Shares | Value |

| |

COMMON STOCKS† – 1.9% | | |

Energy – 1.0% | | |

SandRidge Energy, Inc.*,1 | 58,927 | $ 1,166,165 |

| Titan Energy LLC* | 27,133 | 256,407 |

| Approach Resources, Inc.* | 95,220 | 241,860 |

Total Energy | | 1,664,432 |

| |

Technology – 0.6% | | |

Aspect Software Parent, Inc.*,†††,2,12 | 57,610 | 862,445 |

Qlik Technologies, Inc. A*,†††,2 | 56 | 55,839 |

Qlik Technologies, Inc. B*,†††,2 | 13,812 | 564 |

Qlik Technologies, Inc.*,†† | 3,600 | – |

Total Technology | | 918,848 |

| |

Industrial – 0.3% | | |

Sparta Holdings Corp., Class A*,†††,1,2 | 228 | 289,922 |

Sparta Holdings Corp., Class B*,†††,1,2 | 94,522 | 127,843 |

Ursa Insulation B.V.*,†††,2 | 5,282 | – |

Total Industrial | | 417,765 |

| |

Consumer, Non-cyclical – 0.0%** | | |

Targus Group International Equity, Inc.*,†††,2,12 | 33,098 | 49,647 |

| |

Basic Materials – 0.0%** | | |

Mirabela Nickel Ltd.*,†††,2 | 4,839,202 | 360 |

Total Common Stocks | | |

| (Cost $7,073,426) | | 3,051,052 |

| |

PREFERRED STOCKS† – 2.9% | | |

Financial – 2.2% | | |

Bank of America Corp., Series X 6.25%*,3,4 | 1,150,000 | 1,235,100 |

Citigroup, Inc., Series M 6.30%*,1,3,4 | 1,100,000 | 1,159,125 |

PNC Financial Services Group, Inc. 5.00%*,3,4 | 550,000 | 561,000 |

M&T Bank Corp. 5.13%*,3,4 | 450,000 | 461,250 |

Total Financial | | 3,416,475 |

| |

Industrial – 0.7% | | |

| Seaspan Corp. | | |

6.38%1,4 | 46,990 | 1,179,449 |

Total Preferred Stocks | | |

| (Cost $4,407,049) | | 4,595,924 |

| |

WARRANTS†† – 0.0%** | | |

| Comstock Resources, Inc. | | |

| 09/06/18 | 6,119 | 40,079 |

Total Warrants | | |

| (Cost $49,782) | | 40,079 |

See notes to financial statements.

GGM l GUGGENHEIM CREDIT ALLOCATION FUND ANNUAL REPORT l 15| | |

SCHEDULE OF INVESTMENTS continued | May 31, 2017 |

| | | |

| | Shares | Value |

| |

EXCHANGE-TRADED FUNDS† – 2.8% | | |

| SPDR Bloomberg Barclays High Yield Bond ETF | 65,000 | $ 2,430,350 |

| iShares iBoxx $ High Yield Corporate Bond ETF | 22,750 | 2,016,788 |

Total Exchange-Traded Funds | | |

| (Cost $4,348,877) | | 4,447,138 |

| |

SHORT TERM INVESTMENTS† – 0.5% | | |

| Dreyfus Treasury Prime Cash Management Institutional Shares | | |

0.65%5 | 747,391 | 747,391 |

Total Short Term Investments | | |

| (Cost $747,391) | | 747,391 |

| | Face | |

| | Amount~ | Value |

| |

CORPORATE BONDS†† – 78.3% | | |

Communications – 14.9% | | |

| MDC Partners, Inc. | | |

6.50% due 05/01/241,6 | 3,750,000 | $ 3,778,125 |

| DISH DBS Corp. | | |

5.88% due 11/15/241 | 2,300,000 | 2,449,499 |

7.75% due 07/01/261 | 850,000 | 998,750 |

| SFR Group S.A. | | |

7.38% due 05/01/261,6 | 2,600,000 | 2,812,861 |

| Sprint Communications, Inc. | | |

9.00% due 11/15/181,6 | 2,200,000 | 2,414,500 |

| EIG Investors Corp. | | |

10.88% due 02/01/241 | 2,000,000 | 2,180,000 |

| Cengage Learning, Inc. | | |

9.50% due 06/15/241,6 | 2,475,000 | 2,140,875 |

| McGraw-Hill Global Education Holdings LLC / McGraw-Hill Global Education Finance | | |

7.88% due 05/15/241,6 | 1,890,000 | 1,842,750 |

| CSC Holdings LLC | | |

5.25% due 06/01/241 | 1,350,000 | 1,378,688 |

| 6.75% due 11/15/21 | 400,000 | 442,500 |

| Virgin Media Secured Finance plc | | |

| 5.00% due 04/15/27 | 1,000,000 GBP | 1,351,948 |

| CCO Holdings LLC / CCO Holdings Capital Corp. | | |

5.13% due 05/01/271,6 | 900,000 | 921,938 |

| Comcast Corp. | | |

3.20% due 07/15/361 | 700,000 | 646,960 |

| EW Scripps Co. | | |

5.13% due 05/15/256 | 275,000 | 281,531 |

Total Communications | | 23,640,925 |

See notes to financial statements.

16 l GGM l GUGGENHEIM CREDIT ALLOCATION FUND ANNUAL REPORT| | |

SCHEDULE OF INVESTMENTS continued | May 31, 2017 |

| | | |

| | Face | |

| | Amount~ | Value |

| |

CORPORATE BONDS†† – 78.3% (continued) | | |

Energy – 14.1% | | |

| American Midstream Partners Limited Partnership / American Midstream Finance Corp. | | |

8.50% due 12/15/211,6 | 4,000,000 | $ 4,079,999 |

| CONSOL Energy, Inc. | | |

8.00% due 04/01/231 | 2,500,000 | 2,634,375 |

| Comstock Resources, Inc. | | |

10.00% due 03/15/201,7 | 2,225,000 | 2,258,374 |

| Unit Corp. | | |

| 6.63% due 05/15/21 | 2,300,000 | 2,254,000 |

| Exterran Energy Solutions Limited Partnership / EES Finance Corp. | | |

8.13% due 05/01/251,6 | 1,500,000 | 1,556,250 |

| EP Energy LLC / Everest Acquisition Finance, Inc. | | |

8.00% due 02/15/251,6 | 1,200,000 | 1,026,000 |

6.38% due 06/15/231 | 400,000 | 286,500 |

| 9.38% due 05/01/20 | 120,000 | 109,800 |

| Alta Mesa Holdings, LP / Alta Mesa Finance Services Corp. | | |

7.88% due 12/15/246 | 1,175,000 | 1,230,813 |

| Gibson Energy, Inc. | | |

5.25% due 07/15/246 | 1,200,000 CAD | 890,636 |

6.75% due 07/15/216 | 215,000 | 223,063 |

| FTS International, Inc. | | |

8.63% due 06/15/201,3,6 | 950,000 | 966,625 |

| Covey Park Energy LLC / Covey Park Finance Corp. | | |

7.50% due 05/15/256 | 750,000 | 768,750 |

| QEP Resources, Inc. | | |

6.88% due 03/01/211 | 700,000 | 735,000 |

| BreitBurn Energy Partners Limited Partnership / BreitBurn Finance Corp. | | |

7.88% due 04/15/221,8 | 2,200,000 | 621,500 |

| Legacy Reserves Limited Partnership / Legacy Reserves Finance Corp. | | |

6.63% due 12/01/211 | 750,000 | 562,500 |

| Whiting Petroleum Corp. | | |

5.75% due 03/15/211 | 550,000 | 539,550 |

| Pattern Energy Group, Inc. | | |

5.88% due 02/01/241,6 | 500,000 | 522,500 |

| Crestwood Midstream Partners Limited Partnership / Crestwood Midstream Finance Corp. | |

5.75% due 04/01/256 | 400,000 | 409,000 |

6.25% due 04/01/231 | 50,000 | 51,844 |

| TerraForm Power Operating LLC | | |

6.63% due 06/15/251,6,9 | 250,000 | 263,750 |

| Trinidad Drilling Ltd. | | |

6.63% due 02/15/256 | 200,000 | 199,000 |

| Schahin II Finance Co. SPV Ltd. | | |

5.88% due 09/25/221,8,11 | 825,233 | 107,280 |

Total Energy | | 22,297,109 |

See notes to financial statements.

GGM l GUGGENHEIM CREDIT ALLOCATION FUND ANNUAL REPORT l 17| | |

SCHEDULE OF INVESTMENTS continued | May 31, 2017 |

| | | |

| | Face | |

| | Amount~ | Value |

| |

CORPORATE BONDS†† – 78.3% (continued) | | |

Consumer, Non-cyclical – 11.6% | | |

| Vector Group Ltd. | | |

6.13% due 02/01/251,6 | 2,850,000 | $ 2,963,999 |

| Midas Intermediate Holdco II LLC / Midas Intermediate Holdco II Finance, Inc. | | |

7.88% due 10/01/221,6 | 2,651,000 | 2,730,530 |

| Great Lakes Dredge & Dock Corp. | | |

8.00% due 05/15/226 | 2,500,000 | 2,537,500 |

| Valeant Pharmaceuticals International, Inc. | | |

7.00% due 03/15/241,6 | 1,325,000 | 1,401,201 |

6.50% due 03/15/221,6 | 650,000 | 682,370 |

| Bumble Bee Holdings, Inc. | | |

9.00% due 12/15/171,6 | 1,950,000 | 1,950,000 |

| KeHE Distributors LLC / KeHE Finance Corp. | | |

7.63% due 08/15/216 | 1,400,000 | 1,407,000 |

| Bumble Bee Holdco SCA | | |

9.63% due 03/15/186,7 | 1,105,000 | 1,082,900 |

| Halyard Health, Inc. | | |

6.25% due 10/15/221 | 925,000 | 959,688 |

| Post Holdings, Inc. | | |

5.75% due 03/01/276 | 900,000 | 941,895 |

| Tenet Healthcare Corp. | | |

7.50% due 01/01/221,6 | 600,000 | 653,175 |

| Nielsen Company Luxembourg SARL | | |

5.00% due 02/01/251,6 | 575,000 | 586,500 |

| Albertsons Cos. LLC / Safeway Inc. / New Albertson’s Inc. / Albertson’s LLC | | |

6.63% due 06/15/246 | 500,000 | 517,500 |

Total Consumer, Non-cyclical | | 18,414,258 |

| |

Financial – 11.5% | | |

| Jefferies Finance LLC / JFIN Company-Issuer Corp. | | |

7.50% due 04/15/211,6 | 1,500,000 | 1,560,000 |

6.88% due 04/15/226 | 650,000 | 653,250 |

| Lincoln Finance Ltd. | | |

| 6.88% due 04/15/21 | 1,750,000 EUR | 2,116,779 |

| NFP Corp. | | |

9.00% due 07/15/211,6 | 2,000,000 | 2,100,000 |

| Jefferies Finance LLC / JFIN Co.-Issuer Corp. | | |

7.38% due 04/01/201,6 | 1,900,000 | 1,964,125 |

| FBM Finance, Inc. | | |

8.25% due 08/15/211,6 | 1,600,000 | 1,720,000 |

| Garfunkelux Holding Co. 3 S.A. | | |

| 8.50% due 11/01/22 | 1,200,000 GBP | 1,677,334 |

See notes to financial statements.

18 l GGM l GUGGENHEIM CREDIT ALLOCATION FUND ANNUAL REPORT| | |

SCHEDULE OF INVESTMENTS continued | May 31, 2017 |

| | | |

| | Face | |

| | Amount~ | Value |

| |

CORPORATE BONDS†† – 78.3% (continued) | | |

Financial – 11.5% (continued) | | |

| Majid AL Futtaim Holding | | |

7.13%4 | 1,500,000 | $ 1,577,418 |

| GEO Group, Inc. | | |

| 6.00% due 04/15/26 | 775,000 | 802,125 |

| 5.88% due 10/15/24 | 350,000 | 360,500 |

| 5.88% due 01/15/22 | 250,000 | 260,000 |

| NewStar Financial, Inc. | | |

7.25% due 05/01/201 | 1,125,000 | 1,153,125 |

| Prosight Global Inc. | | |

7.50% due 11/26/20†††,1 | 650,000 | 684,957 |

| Cabot Financial Luxembourg S.A. | | |

| 7.50% due 10/01/23 | 350,000 GBP | 494,129 |

| Greystar Real Estate Partners LLC | | |

8.25% due 12/01/221,6 | 450,000 | 484,875 |

| USIS Merger Sub, Inc. | | |

6.88% due 05/01/256 | 400,000 | 405,000 |

| Fidelity & Guaranty Life Holdings, Inc. | | |

6.38% due 04/01/216 | 200,000 | 205,500 |

| Lock AS | | |

| 7.00% due 08/15/21 | 50,000 EUR | 58,736 |

Total Financial | | 18,277,853 |

| |

Consumer, Cyclical – 7.3% | | |

| Ferrellgas Limited Partnership / Ferrellgas Finance Corp. | | |

6.50% due 05/01/211 | 1,750,000 | 1,697,499 |

6.75% due 06/15/231 | 950,000 | 916,750 |

| Nathan’s Famous, Inc. | | |

10.00% due 03/15/206 | 1,800,000 | 1,921,500 |

| WMG Acquisition Corp. | | |

6.75% due 04/15/221,6 | 1,550,000 | 1,632,538 |

| Ferrellgas, LP / Ferrellgas Finance Corp. | | |

| 6.75% due 01/15/22 | 1,365,000 | 1,317,225 |

| L Brands, Inc. | | |

6.75% due 07/01/361 | 650,000 | 625,755 |

| 7.60% due 07/15/37 | 250,000 | 250,625 |

6.88% due 11/01/351 | 175,000 | 170,188 |

| AMC Entertainment Holdings, Inc. | | |

6.13% due 05/15/276 | 750,000 | 775,313 |

| Suburban Propane Partners Limited Partnership/Suburban Energy Finance Corp. | | |

| 5.88% due 03/01/27 | 650,000 | 645,125 |

| TVL Finance PLC | | |

| 8.50% due 05/15/23 | 450,000 GBP | 640,028 |

| PetSmart, Inc. | | |

5.88% due 06/01/256 | 575,000 | 577,156 |

See notes to financial statements.

GGM l GUGGENHEIM CREDIT ALLOCATION FUND ANNUAL REPORT l 19| | |

SCHEDULE OF INVESTMENTS continued | May 31, 2017 |

| | | |

| | Face | |

| | Amount~ | Value |

| |

CORPORATE BONDS†† – 78.3% (continued) | | |

Consumer, Cyclical – 7.3% (continued) | | |

| Carrols Restaurant Group, Inc. | | |

8.00% due 05/01/221 | 400,000 | $ 427,500 |

Total Consumer, Cyclical | | 11,597,202 |

| |

Industrial – 5.4% | | |

| LMI Aerospace, Inc. | | |

7.38% due 07/15/191 | 2,628,000 | 2,733,120 |

| StandardAero Aviation Holdings, Inc. | | |

10.00% due 07/15/231,6 | 1,885,000 | 2,078,213 |

| Summit Materials LLC / Summit Materials Finance Corp. | | |

8.50% due 04/15/221 | 1,000,000 | 1,122,500 |

| Grinding Media Inc. / MC Grinding Media Canada Inc. | | |

7.38% due 12/15/236 | 850,000 | 916,938 |

| Ardagh Packaging Finance PLC | | |

| 6.75% due 05/15/24 | 600,000 EUR | 753,193 |

| Princess Juliana International Airport Operating Company N.V. | | |

5.50% due 12/20/27†††,1,2,6 | 397,045 | 392,699 |

| Tutor Perini Corp. | | |

6.88% due 05/01/251,6 | 350,000 | 366,188 |

| Ardagh Packaging Finance plc / Ardagh Holdings USA, Inc. | | |

7.25% due 05/15/241,6 | 225,000 | 245,531 |

Total Industrial | | 8,608,382 |

| |

Technology – 4.6% | | |

| Epicor Software | | |

9.40% due 06/21/23†††,1,2 | 3,000,000 | 2,931,000 |

| Micron Technology, Inc. | | |

7.50% due 09/15/231 | 1,375,000 | 1,536,012 |

5.25% due 08/01/231,6 | 925,000 | 950,438 |

| Infor US, Inc. | | |

6.50% due 05/15/221 | 1,800,000 | 1,874,250 |

Total Technology | | 7,291,700 |

| |

Utilities – 3.8% | | |

| Terraform Global Operating LLC | | |

9.75% due 08/15/226 | 3,545,000 | 3,952,675 |

| LBC Tank Terminals Holding Netherlands BV | | |

6.88% due 05/15/231,6 | 1,300,000 | 1,358,500 |

| AmeriGas Partners, LP / AmeriGas Finance Corp. | | |

5.75% due 05/20/271 | 750,000 | 757,500 |

Total Utilities | | 6,068,675 |

See notes to financial statements.

20 l GGM l GUGGENHEIM CREDIT ALLOCATION FUND ANNUAL REPORT| | |

SCHEDULE OF INVESTMENTS continued | May 31, 2017 |

| | | |

| | Face | |

| | Amount~ | Value |

| |

CORPORATE BONDS†† – 78.3% (continued) | | |

Basic Materials – 3.1% | | |

| Eldorado Gold Corp. | | |

6.13% due 12/15/201,6 | 1,900,000 | $ 1,947,500 |

| Alcoa Nederland Holding B.V. | | |

7.00% due 09/30/261,6 | 1,000,000 | 1,095,000 |

| GCP Applied Technologies, Inc. | | |

9.50% due 02/01/236 | 875,000 | 997,500 |

| Constellium N.V. | | |

7.88% due 04/01/216 | 750,000 | 807,188 |

| Mirabela Nickel Ltd. | | |

9.50% due 06/24/197,8 | 1,279,819 | 89,587 |

1.00% due 09/10/44†††,1,2,8 | 25,570 | – |

| New Day Aluminum | | |

10.00% due 10/28/20†††,2,7 | 5,403 | 4,976 |

Total Basic Materials | | 4,941,751 |

| |

Diversified – 2.0% | | |

| HRG Group, Inc. | | |

7.88% due 07/15/191 | 3,000,000 | 3,097,500 |

Total Corporate Bonds | | |

| (Cost $122,004,758) | | 124,235,355 |

| |

SENIOR FLOATING RATE INTERESTS††,3 – 44.2% | | |

Technology – 8.7% | | |

| Advanced Computer Software | | |

| 10.67% due 01/31/23 | 2,250,000 | 2,053,125 |

| 6.56% due 03/18/22 | 879,750 | 855,557 |

| TIBCO Software, Inc. | | |

| 5.55% due 12/04/20 | 2,639,368 | 2,664,125 |

| Planview, Inc. (PHNTM Holdings, Inc.) | | |

10.79% due 07/27/23†††,2 | 2,000,000 | 1,971,676 |

| Sparta Holding Corp. | | |

6.65% due 07/28/20†††,2 | 1,719,102 | 1,710,052 |

| Aspect Software, Inc. | | |

11.02% due 05/25/2012 | 1,287,955 | 1,284,735 |

4.84% due 05/25/18†††,2,12 | 385,000 | 385,000 |

| Qlik Technologies, Inc. | | |

| 4.67% due 04/26/24 | 1,000,000 | 995,420 |

| Cologix Holdings, Inc. | | |

| 8.01% due 03/20/25 | 750,000 | 751,875 |

| Seattle Spnco | | |

| 2.75% due 04/19/24 | 696,817 | 696,385 |

| MA Financeco | | |

| 3.67% due 11/19/21 | 300,000 | 299,688 |

| 2.75% due 04/19/24 | 103,183 | 103,119 |

Total Technology | | 13,770,757 |

See notes to financial statements.

GGM l GUGGENHEIM CREDIT ALLOCATION FUND ANNUAL REPORT l 21| | | |

SCHEDULE OF INVESTMENTS continued | | May 31, 2017 |

| |

| |

| |

| | Face | |

| | Amount~ | Value |

| |

SENIOR FLOATING RATE INTERESTS††,3 – 44.2% (continued) | | |

Industrial – 7.9% | | |

| Ursa Insulation B.V. | | |

25.00% due 04/26/21†††,2,7 | 1,231,327 EUR | $ 1,659,270 |

7.75% due 04/26/20†††,2 | 1,511,071 EUR | 1,697,452 |

| Doncasters Group Ltd. | | |

| 9.50% due 10/09/20 | 1,351,724 | 1,299,912 |

| Advanced Integration Technology LP | | |

| 6.54% due 04/03/23 | 1,106,750 | 1,117,818 |

| Diversitech Holdings, Inc. | | |

| 8.50% due 05/18/25 | 1,000,000 | 1,011,250 |

| Bioplan USA, Inc. | | |

| 5.75% due 09/23/21 | 894,903 | 878,499 |

| HBC Hardware Holdings | | |

7.65% due 03/30/20††† | 862,500 | 845,250 |

| Resource Label Group LLC | | |

| 11.50% due 11/26/23 | 850,000 | 837,250 |

| SRS Distribution, Inc. | | |

| 9.75% due 02/24/23 | 810,000 | 832,275 |

| National Technical | | |

7.25% due 06/12/21†††,2 | 732,407 | 714,097 |

| Ranpak | | |

| 8.25% due 10/03/22 | 560,000 | 557,200 |

| NaNa Development Corp. | | |

| 8.00% due 03/15/18 | 443,510 | 434,640 |

| ProAmpac PG Borrower LLC | | |

| 9.67% due 11/18/24 | 250,000 | 253,750 |

| Pro Mach Group, Inc. | | |

1.38% due 10/22/19†††,2 | 216,667 | 204,174 |

| Omnitracs, Inc. | | |

| 8.75% due 05/25/21 | 150,000 | 150,470 |

| Wencor Group | | |

0.89% due 06/19/19†††,2 | 76,923 | 73,228 |

Total Industrial | | 12,566,535 |

| |

Consumer, Cyclical – 7.2% | | |

| Accuride Corp. | | |

| 8.15% due 11/17/23 | 2,615,000 | 2,634,613 |

| ABRA Auto Body | | |

| 8.33% due 09/19/22 | 1,600,000 | 1,600,000 |

| 8.25% due 09/02/22 | 750,000 | 750,000 |

| Sky Bet Cyan Blue HoldCo | | |

| 4.59% due 02/25/22 | 1,500,000 GBP | 1,952,999 |

| BC Equity Ventures LLC | | |

| 7.50% due 08/31/22 | 1,939,270 | 1,919,878 |

| Sears Holdings Corp. | | |

| 5.54% due 06/30/18 | 1,468,129 | 1,439,500 |

See notes to financial statements.

22 l GGM l GUGGENHEIM CREDIT ALLOCATION FUND ANNUAL REPORT| | | |

SCHEDULE OF INVESTMENTS continued | | May 31, 2017 |

| |

| |

| |

| | Face | |

| | Amount~ | Value |

| |

SENIOR FLOATING RATE INTERESTS††,3 – 44.2% (continued) | | |

Consumer, Cyclical – 7.2% (continued) | | |

| Acosta, Inc. | | |

3.65% due 09/26/19†††,2 | 577,778 | $ 542,075 |

| Blue Nile, Inc. | | |

| 7.66% due 02/17/23 | 475,000 | 470,250 |

| CH Holding Corp. | | |

| 8.29% due 02/03/25 | 200,000 | 204,750 |

Total Consumer, Cyclical | | 11,514,065 |

| |

Consumer, Non-cyclical – 5.8% | | |

| Reddy Ice Holdings, Inc. | | |

| 10.75% due 10/01/19 | 4,000,000 | 3,760,000 |

| 6.76% due 05/01/19 | 298,446 | 294,157 |

| CTI Foods Holding Co. LLC | | |

| 8.40% due 06/28/21 | 3,430,000 | 2,881,200 |

| IHC Holding Corp. | | |

7.02% due 04/30/21†††,2 | 1,228,125 | 1,216,102 |

| Hanger, Inc. | | |

| 11.50% due 08/01/19 | 925,000 | 938,875 |

| Targus Group International, Inc. | | |

15.00% due 12/31/19†††,2,7,12 | 158,467 | 158,467 |

| Targus Group International, Inc. | | |

14.00% due 06/07/16†††,2,7,8,12 | 383,461 | – |

| American Seafoods Group LLC / American Seafoods Finance, Inc. | | |

0.88% due 08/19/21†††,2 | 22,500 | 20,143 |

Total Consumer, Non-cyclical | | 9,268,944 |

| |

Energy – 4.6% | | |

| Invenergy Thermal | | |

| 6.50% due 10/19/22 | 2,409,937 | 2,313,540 |

| Cactus Wellhead | | |

| 7.15% due 07/31/20 | 1,722,019 | 1,635,918 |

| Gavilan Resources LLC | | |

| 7.08% due 03/01/24 | 1,500,000 | 1,483,125 |

| MRP Generation Holding | | |

| 8.15% due 10/18/22 | 746,250 | 731,325 |

| Exgen Texas Power LLC | | |

5.90% due 09/18/217 | 1,044,603 | 592,812 |

| Summit Midstream Partners, LP | | |

| 7.02% due 05/13/22 | 500,000 | 508,750 |

Total Energy | | 7,265,470 |

| |

Communications – 4.0% | | |

| Anaren, Inc. | | |

| 9.40% due 08/18/21 | 2,200,000 | 2,166,999 |

| Cengage Learning Acquisitions, Inc. | | |

| 5.25% due 06/07/23 | 2,288,078 | 2,153,379 |

| |

| | |

See notes to financial statements.

GGM l GUGGENHEIM CREDIT ALLOCATION FUND ANNUAL REPORT l 23| | | |

SCHEDULE OF INVESTMENTS continued | | May 31, 2017 |

| |

| |

| |

| | Face | |

| | Amount~ | Value |

| |

SENIOR FLOATING RATE INTERESTS††,3 – 44.2% (continued) | | |

Communications – 4.0% (continued) | | |

| CSC Holdings, LLC | | |

| 3.25% due 07/17/25 | 1,350,000 | $ 1,346,963 |

| Proquest LLC | | |

| 10.01% due 12/15/22 | 656,200 | 635,694 |

Total Communications | | 6,303,035 |

| |

Utilities – 3.7% | | |

| Moss Creek Resources LLC | | |

9.50% due 04/07/22†††,2 | 2,916,667 | 2,851,042 |

| Panda Temple II Power | | |

| 7.25% due 04/03/19 | 2,962,500 | 2,592,187 |

| Stonewall | | |

| 6.65% due 11/15/21 | 450,000 | 409,500 |

Total Utilities | | 5,852,729 |

| |

Financial – 1.8% | | |

| Misys Ltd. | | |

| 4.50% due 04/26/24 | 1,600,000 | 1,603,072 |

| 4.25% due 04/26/24 | 650,000 EUR | 739,694 |

| Integro Parent, Inc. | | |

| 6.75% due 10/28/22 | 543,282 | 543,282 |

Total Financial | | 2,886,048 |

| |

Electric – 0.3% | | |

| Viva Alamo LLC | | |

| 5.30% due 02/22/21 | 496,159 | 416,773 |

| |

Transportation – 0.2% | | |

| Ceva Group PLC (UK) | | |

| 3.15% due 03/19/19 | 310,000 EUR | 313,792 |

Total Senior Floating Rate Interests | | |

| (Cost $72,214,378) | | 70,158,148 |

| |

ASSET BACKED SECURITIES†† – 11.9% | | |

Collateralized Loan Obligations – 9.4% | | |

| CIFC Funding Ltd. | | |

2014-1A, 5.66% due 04/18/253,6 | 1,340,000 | 1,273,728 |

| Anchorage Credit Funding 1 Ltd | | |

2015-1A, 6.30% due 07/28/306 | 1,000,000 | 1,001,023 |

| Monroe Capital CLO 2014-1 Ltd. | | |

2014-1A, 5.88% due 10/22/261,3,6 | 1,000,000 | 975,878 |

| Eaton Vance CLO Ltd. | | |

2014-1A, 6.19% due 07/15/263,6 | 1,000,000 | 933,562 |

| Denali Capital CLO X Ltd. | | |

2013-1A, 6.92% due 04/28/251,3,6 | 1,000,000 | 931,540 |

See notes to financial statements.

24 l GGM l GUGGENHEIM CREDIT ALLOCATION FUND ANNUAL REPORT| | | |

SCHEDULE OF INVESTMENTS continued | | May 31, 2017 |

| |

| |

| |

| | Face | |

| | Amount~ | Value |

| |

ASSET BACKED SECURITIES†† – 11.9% (continued) | | |

Collateralized Loan Obligations – 9.4% (continued) | | |

| OZLM XI Ltd. | | |

2015-11A, 7.32% due 01/30/273,6 | 1,000,000 | $ 894,121 |

| Ares Enhanced Loan Investment Strategy IR Ltd. | | |

2013-IRAR, 6.15% due 07/23/251,3,6 | 830,000 | 813,889 |

| NewStar Arlington Senior Loan Program LLC | | |

2014-1A, 5.41% due 07/25/251,3,6 | 750,000 | 718,670 |

| Saranac CLO III Ltd. | | |

2014-3A, 6.31% due 06/22/253,6 | 750,000 | 693,750 |

| Babson CLO Ltd. | | |

2012-2A, 0.00% due 05/15/231,6,10 | 1,000,000 | 582,935 |

| Fortress Credit Opportunities V CLO Ltd. | | |

2017-5A, 5.70% due 10/15/263,6 | 500,000 | 501,388 |

| FDF I Ltd. | | |

2015-1A, 6.88% due 11/12/301,6 | 500,000 | 500,435 |

| Cerberus Onshore II CLO-2 LLC | | |

2014-1A, 5.17% due 10/15/231,3,6 | 500,000 | 495,909 |

| Fortress Credit Opportunities VI CLO Ltd. | | |

2015-6A, 6.11% due 10/10/261,3,6 | 500,000 | 493,337 |

| Jamestown CLO VI Ltd. | | |

2015-6A, 5.92% due 02/20/273,6 | 500,000 | 474,225 |

| Saranac CLO II Ltd. | | |

2014-2A, 6.32% due 02/20/253,6 | 500,000 | 469,083 |

| MP CLO V Ltd. | | |

2014-1A, 7.06% due 07/18/263,6 | 500,000 | 465,861 |

| WhiteHorse VII Ltd. | | |

2013-1A, 5.99% due 11/24/253,6 | 500,000 | 464,588 |

| Adams Mill CLO Ltd. | | |

2014-1A, 6.16% due 07/15/263,6 | 500,000 | 462,586 |

| Treman Park CLO Ltd. | | |

2015-1A, 0.00% due 04/20/271,6,10 | 500,000 | 440,433 |

| Dryden 41 Senior Loan Fund | | |

2015-41A, 0.00% due 01/15/281,6,10 | 600,000 | 434,503 |

| KVK CLO Ltd. | | |

2014-2A, 5.91% due 07/15/263,6 | 500,000 | 434,189 |

| Shackleton CLO | | |

2014-6A, 6.91% due 07/17/263,6 | 250,000 | 230,954 |

| Voya CLO Ltd. | | |

2015-3A, 7.66% due 10/20/273,6 | 250,000 | 230,000 |

Total Collateralized Loan Obligations | | 14,916,587 |

| |

Transportation – 2.2% | | |

| Apollo Aviation Securitization Equity Trust | | |

2014-1, 7.38% due 12/15/293 | 722,680 | 722,680 |

| 2016-2, 7.87% due 11/15/41 | 450,000 | 450,546 |

2016-1A, 9.20% due 03/17/361,6,7 | 383,350 | 385,267 |

See notes to financial statements.

GGM l GUGGENHEIM CREDIT ALLOCATION FUND ANNUAL REPORT l 25| | | |

SCHEDULE OF INVESTMENTS continued | | May 31, 2017 |

| |

| |

| | Face | |

| | Amount~ | Value |

| |

ASSET BACKED SECURITIES†† – 11.9% (continued) | | |

Transportation – 2.2% (continued) | | |

| Turbine Engines Securitization Ltd. | | |

2013-1A, 6.38% due 12/13/481,11 | 286,776 | $ 266,701 |

| Emerald Aviation Finance Ltd. | | |

2013-1, 6.35% due 10/15/381,6,7 | 1,091,719 | 1,124,179 |

| Rise Ltd. | | |

2014-1AB, 6.50% due 02/12/39††† | 353,296 | 354,048 |

| AASET | | |

| 2014-1 C, 10.00% due 12/15/29 | 138,934 | 138,935 |

Total Transportation | | 3,442,356 |

| |

Financial – 0.3% | | |

| NCBJ 2015-1 A | | |

5.88% due 07/08/22†††,1,2 | 500,000 | 500,964 |

Total Asset Backed Securities | | |

| (Cost $17,659,968) | | 18,859,907 |

Total Investments – 142.5% | | |

| (Cost $228,505,629) | | $ 226,134,994 |

Other Assets & Liabilities, net – (42.5)% | | (67,472,431) |

Total Net Assets – 100.0% | | $ 158,662,563 |

~ | The face amount is denominated in U.S. Dollars, unless otherwise noted. |

* | Non-income producing security. |

** | Less than 0.1% |

† | Value determined based on Level 1 inputs, unless otherwise noted — See Note 4. |

†† | Value determined based on Level 2 inputs, unless otherwise noted — See Note 4. |

††† | Value determined based on Level 3 inputs — See Note 4. |

1 | All or a portion of these securities have been physically segregated in connection with borrowings, reverse repurchase agreements and unfunded loan commitments. As of May 31, 2017, the total value of securities segregated was $102,798,953. |

2 | Security was fair valued by the Valuation Committee at May 31, 2017. The total market value of fair valued securities amounts to $18,419,037, (cost $21,125,279) or 11.6% of total net assets. |

3 | Variable rate security. Rate indicated is rate effective at May 31, 2017. |

4 | Perpetual maturity. |

5 | Rate indicated is the 7-day yield as of May 31, 2017. |

6 | Security is a 144A or Section 4(a)(2) security. These securities have been determined to be liquid under guidelines established by the Board of Trustees. The total market value of 144A or Section 4(a)(2) liquid securities is $89,317,196 (cost ($85,179,925), or 56.3% of total net assets. |

7 | Payment-in-kind security. |

| 8 | Security is in default of interest and/or principal obligations. |

| 9 | Security is a step up/step down bond. The coupon increases or decreases at regular intervals until the bond reaches full maturity. |

See notes to financial statements.

26 l GGM l GUGGENHEIM CREDIT ALLOCATION FUND ANNUAL REPORT| | |

SCHEDULE OF INVESTMENTS continued | May 31, 2017 |

| 10 | Security has no stated coupon. However, it is expected to receive residual cash flow payments on defined deal dates. |

| 11 | Security is a 144A or Section 4(a)(2) security. These securities are considered illiquid and restricted under guidelines established by the Board of Trustees. The total market value of 144A or Section 4(a)(2) securities is $373,981 (cost $1,066,121), or 0.2% of total net assets — See Note 12. |

| 12 | Investment in an affiliated issuer. See Note 13. |

| | |

| B.V. | Limited Liability Company |

| CLO | Collateralized Loan Obligation |

| EUR | Euro |

| GBP | Great Britain Pound |

| LLC | Limited Liability Company |

| N.V. | Publicly Traded Company |

| plc | Public Limited Company |

| S.A. | Corporation |

See Sector Classification in Supplemental Information section.

The following table summarizes the inputs used to value the Fund’s investments at May 31, 2017 (see Note 4 in the Notes to Financial Statements):

| | | | | | | | | | | | | |

| | | | | | Level 2 | | | Level 3 | | | | |

| | | | | | Significant | | | Significant | | | | |

| | | Level 1 | | | Observable | | | Unobservable | | | | |

Description | | Quoted Prices | | | Inputs | | | Inputs | | | Total | |

Assets: | | | | | | | | | | | | |

| Common Stocks | | $ | 1,664,432 | | | $ | – | | | $ | 1,386,620 | | | $ | 3,051,052 | |

| Preferred Stocks | | | 4,595,924 | | | | – | | | | – | | | | 4,595,924 | |

| Warrants | | | – | | | | 40,079 | | | | | | | | 40,079 | |

| Exchange-Traded Funds | | | 4,447,138 | | | | – | | | | – | | | | 4,447,138 | |

| Short Term Investments | | | 747,391 | | | | – | | | | – | | | | 747,391 | |

| Corporate Bonds | | | – | | | | 120,221,723 | | | | 4,013,632 | | | | 124,235,355 | |

| Senior Floating Rate Interests | | | – | | | | 56,110,120 | | | | 14,048,028 | | | | 70,158,148 | |

| Asset Backed Securities | | | – | | | | 18,004,895 | | | | 855,012 | | | | 18,859,907 | |

| Forward Foreign Currency Exchange Contracts* | | | – | | | | 29,864 | | | | – | | | | 29,864 | |

| Total Assets | | $ | 11,454,885 | | | $ | 194,406,681 | | | $ | 20,303,292 | | | $ | 226,164,858 | |

| | |

Liabilities: | | | | | | | | | | | | | | | | |

| Forward Foreign Currency Exchange Contracts* | | $ | – | | | $ | 198,613 | | | $ | – | | | $ | 198,613 | |

| Unfunded Loan Commitments | | | – | | | | – | | | | 671,334 | | | | 671,334 | |

| Total Liabilities | | $ | – | | | $ | 198,613 | | | $ | 671,334 | | | $ | 869,947 | |

* Represents the unrealized gain/loss at the end of the period.

Please refer to the Schedule of Investments for a breakdown of investment type by industry category.

See notes to financial statements.

GGM l GUGGENHEIM CREDIT ALLOCATION FUND ANNUAL REPORT l 27| | |

SCHEDULE OF INVESTMENTS continued | May 31, 2017 |

The following is a summary of the significant unobservable input used in the fair valuation of assets and liabilities categorized within the Level 3 of the fair value hierarchy:

| | | | | |

| | Ending Balance | Valuation | Unobservable | Input |

Category | at 5/31/2017 | Technique | Inputs | Range |

Assets: | | | | |

| Asset Backed Securities | $ 354,048 | Option adjusted spread | Indicative Quote | – |

| | | off the month end broker | | |

| | | quote over the | | |

| | | 3 month LIBOR | | |

| Asset Backed Securities | 500,964 | Option adjusted spread | Indicative Quote | – |

| | | | for Comparable Security | |

| Corporate Bonds | 684,957 | Option adjusted spread | Indicative Quote | – |

| | | off the month end broker | | |

| | | quote over the | | |

| | | 3 month LIBOR | | |

| Corporate Bonds | 3,328,675 | Model Price | Market Comparable Yields | 5.7% - 10.4% |

| Common Stocks | 1,386,260 | Enterprise Value | Valuation Multiple | 6.3x -13.0x |

| Common Stocks | 360 | Model Price | Liquidation Value | – |

| Senior Floating Rate Interests | 845,250 | Option adjusted spread | Indicative Quote | – |

| | | off the month end broker | | |

| | | quote over the | | |

| | | 3 month LIBOR | | |

| Senior Floating Rate Interests | 5,451,774 | Enterprise Value | Valuation Multiple | 6.7x - 13.0x |

| Senior Floating Rate Interests | 5,662,338 | Model Price | Purchase Price | – |

| Senior Floating Rate Interests | 1,930,199 | Model Price | Market Comparable Yields | 5.3% - 5.7% |

| Senior Floating Rate Interests | 158,467 | Model Price | Liquidation Value | – |

Total Assets | $20,303,292 | | | |

Liabilities: | | | | |

| Unfunded Loan Commitments | $671,334 | Model Price | Purchase Price | – |

Significant changes in indicative quote or valuation multiple would generally result in significant changes in the fair value of the security.

Transfers between investment levels may occur as the markets fluctuate and/or the availability of data used in an investment’s valuation changes. Transfers between valuation levels, if any, are in comparison to the valuation levels at the end of the previous fiscal year, and are effective using the fair value as of the end of the current period.

As of May 31, 2017, the Fund had a security with a total value of $73,228 transfer from Level 2 to Level 3 due to lack of availability of market price information at the year end. The Fund had a security with a total value of $228,522 transfer from Level 3 to Level 2 due to availability of market price information at year end.

See notes to financial statements.

28 l GGM l GUGGENHEIM CREDIT ALLOCATION FUND ANNUAL REPORT| | |

SCHEDULE OF INVESTMENTS continued | May 31, 2017 |

Summary of Fair Value of Level 3 Activity

Following is a reconciliation of Level 3 assets and liabilities for which significant unobservable inputs were used to determine fair value for the year ended May 31, 2017:

| | | | | | | | | | | | | | | | | | | |

| | | | | | Assets | | | | | | | | | Liabilities | |

| | | Senior | | | | | | | | | | | | | | | Unfunded | |

| | | Floating | | | Asset-Backed | | | Corporate | | | Common | | | Total | | | Loan | |

Rate Interests | | | Securities | | | Bonds | | | Stocks | | | Assets | | | Commitments | |

| Beginning Balance | | $ | 11,180,172 | | | $ | 1,351,858 | | | $ | 5,956,415 | | | $ | 1,484,363 | | | $ | 19,972,808 | | | $ | (1,024,204 | ) |

| Purchases/(Receipts) | | | 8,440,258 | | | | – | | | | – | | | | 86,291 | | | | 8,526,549 | | | | (978,408 | ) |

| Corporate Actions | | | – | | | | – | | | | (380,626 | ) | | | 380,626 | | | | – | | | | – | |

| Paydowns Received | | | (1,969,759 | ) | | | (367,022 | ) | | | (1,566,417 | ) | | | – | | | | (3,903,198 | ) | | | – | |

| Payment-in-kind Distributions | | | | | | | | | | | | | | | | | | | | | | | | |

| Received | | | 44,862 | | | | – | | | | 16,290 | | | | – | | | | 61,152 | | | | – | |

| Realized Gain/(Loss) | | | (651,565 | ) | | | – | | | | – | | | | (26 | ) | | | (651,591 | ) | | | 503,838 | |

| Total change in unrealized gains | | | | | | | | | | | | | | | | | | | | | | | | |

| or (losses) included in earnings | | | 874,032 | | | | 9,901 | | | | 29,967 | | | | (564,634 | ) | | | 349,266 | | | | 23,146 | |

| Accrued discounts/(premiums) | | | (23,307 | ) | | | (790 | ) | | | 47,590 | | | | – | | | | 23,493 | | | | – | |

| (Sales)/Fundings | | | (3,919,893 | ) | | | – | | | | – | | | | – | | | | (3,919,893 | ) | | | 804,294 | |

| Transfers into Level 3 | | | 73,228 | | | | – | | | | – | | | | – | | | | 73,228 | | | | – | |

| Transfers out of Level 3 | | | – | | | | (138,935 | ) | | | (89,587 | ) | | | – | | | | (228,522 | ) | | | – | |

| Ending Balance | | $ | 14,048,028 | | | $ | 855,012 | | | $ | 4,013,632 | | | $ | 1,386,620 | | | $ | 20,303,292 | | | $ | (671,334 | ) |

| Net change in unrealized | | | | | | | | | | | | | | | | | | | | | | | | |

| appreciation (depreciation) | | | | | | | | | | | | | | | | | | | | | | | | |

| for investments in securities | | | | | | | | | | | | | | | | | | | | | | | | |

| still held at May 31, 2017 | | $ | 249,964 | | | $ | 7,529 | | | $ | 69,369 | | | $ | (564,634 | ) | | $ | (237,772 | ) | | $ | 254,621 | |

GGM l GUGGENHEIM CREDIT ALLOCATION FUND ANNUAL REPORT l 29| | | | |

STATEMENTS OF ASSETS AND LIABILITIES | | May 31, 2017 | |

| | |

| | |

ASSETS: | | | |

| Investments in unaffiliated issuers, at value (cost $224,770,288) | | $ | 223,394,700 | |

| Investments in affiliated issuers, at value (cost $3,735,341) | | | 2,740,294 | |

| Foreign currency, at value (cost $269,603) | | | 269,603 | |

| Cash | | | 247,100 | |

| Unrealized appreciation on forward foreign currency exchange contracts | | | 29,864 | |

| Receivables: | | | | |

| Interest | | | 2,866,397 | |

| Investments sold | | | 1,756,931 | |

| Fund shares sold | | | 269,847 | |

| Tax reclaims | | | 10,414 | |

| Other assets | | | 4,357 | |

Total assets | | | 231,589,507 | |

LIABILITIES: | | | | |

| Reverse repurchase agreements | | | 61,258,540 | |

| Borrowings | | | 4,500,000 | |

| Unfunded loan commitments, at value (Note 10) (commitment fees | | | | |

| received $1,349,303) | | | 671,334 | |

| Segregated Cash from broker | | | 524,000 | |

| Interest payable on borrowings | | | 77,462 | |

| Unrealized depreciation on forward foreign currency exchange contracts | | | 198,613 | |

| Payable for: | | | | |

| Investments purchased | | | 5,339,493 | |

| Investment advisory fees | | | 193,594 | |

| Offering costs | | | 27,752 | |

| Trustee’s fees and expenses* | | | 6,284 | |

| Accrued expenses and other liabilities | | | 129,872 | |

Total liabilities | | | 72,926,944 | |

NET ASSETS | | $ | 158,662,563 | |

NET ASSETS CONSIST OF: | | | | |

| Common stock, $.01 par value per share; unlimited number of shares authorized, | | | | |

| 7,013,806 shares issued and outstanding | | $ | 70,138 | |

| Additional paid-in capital | | | 166,182,709 | |

| Undistributed net investment income | | | 1,247,091 | |

| Accumulated net realized loss on investments | | | (6,962,393 | ) |

| Net unrealized depreciation on investments | | | (1,874,982 | ) |

NET ASSETS | | $ | 158,662,563 | |

| Net Asset Value | | $ | 22.62 | |

* Relates to Trustees not deemed “interested persons” within the meaning of Section 2(a)(19) of the 1940 Act.

See notes to financial statements.

30 l GGM l GUGGENHEIM CREDIT ALLOCATION FUND ANNUAL REPORT| | | | |

STATEMENTS OF OPERATIONS | | May 31, 2017 | |

| For the Year Ended May 31, 2017 | | | |

| | | | |

INVESTMENT INCOME | | | |

| Interest from securities of unaffiliated issuers | | $ | 16,011,650 | |

| Interest from securities of affiliated issuers | | | 262,974 | |

| Dividends | | | 274,176 | |

| Total investment income | | | 16,548,800 | |

EXPENSES | | | | |

| Investment advisory fees | | | 2,122,221 | |

| Interest expense | | | 945,212 | |

| Professional fees | | | 210,050 | |

| Excise tax expense | | | 122,457 | |

| Trustees’ fees and expenses* | | | 81,270 | |

| Fund accounting fees | | | 73,729 | |

| Administration fees | | | 57,403 | |

| Printing fees | | | 36,756 | |

| Custodian fees | | | 28,994 | |

| Registration and filings | | | 24,725 | |

| Transfer agent fees | | | 20,269 | |

| Insurance | | | 7,975 | |

| Other Expenses | | | 1,900 | |

| Total expenses | | | 3,732,961 | |

| Net investment income | | | 12,815,839 | |

NET REALIZED AND UNREALIZED GAIN (LOSS) | | | | |

| Net realized gain (loss) on: | | | | |

| Investments in unaffiliated issuers | | | (2,622,919 | ) |

| Foreign currency transactions | | | 1,187,610 | |

| Net realized (loss) | | | (1,435,309 | ) |

| Net change in unrealized appreciation (depreciation) on: | | | | |

| Investments in unaffiliated issuers | | | 18,158,128 | |

| Investments in affiliated issuers | | | (672,364 | ) |

| Foreign currency translations | | | (419,665 | ) |

| Net change in unrealized appreciation (depreciation) on: | | | 17,066,099 | |

| Net realized and unrealized gain | | | 15,630,790 | |

Net increase in net assets resulting from operations | | $ | 28,446,629 | |

* Relates to Trustees not deemed “interested persons” within the meaning of Section 2(a)(19) of the 1940 Act.

See notes to financial statements.

GGM l GUGGENHEIM CREDIT ALLOCATION FUND ANNUAL REPORT l 31| | | | | | | |

STATEMENTS OF CHANGES IN NET ASSETS | | | | | May 31, 2017 | |

| | |

| | | Year Ended | | | Year Ended | |

| | | May 31, 2017 | | | May 31, 2016 | |

INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS: | | | | | | |

| Net investment income | | $ | 12,815,839 | | | $ | 13,366,634 | |

| Net realized (loss) on investments | | | (1,435,309 | ) | | | (3,042,312 | ) |

| Net change in unrealized appreciation (depreciation) on investments | | | 17,066,099 | | | | (14,515,990 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 28,446,629 | | | | (4,191,668 | ) |

DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| From net investment income | | | (14,635,933 | ) | | | (14,423,713 | ) |

SHAREHOLDER TRANSACTIONS | | | | | | | | |

| Net proceeds from shares issued through at-the-market offering | | | 8,558,824 | | | | – | |

| Reinvestments | | | 202,920 | | | | 4,542 | |

| Common share offering costs charged to paid-in capital | | | (51,978 | ) | | | – | |

| Net increase from capital share transactions | | | 8,709,766 | | | | 4,542 | |

| Total increase (decrease) in net assets | | | 22,520,462 | | | | (18,610,839 | ) |

NET ASSETS: | | | | | | | | |

| Beginning of year | | | 136,142,101 | | | | 154,752,940 | |

| End of year | | $ | 158,662,563 | | | $ | 136,142,101 | |

| Undistributed net investment income at end of year | | $ | 1,247,091 | | | $ | 2,415,765 | |

See notes to financial statements.

32 l GGM l GUGGENHEIM CREDIT ALLOCATION FUND ANNUAL REPORT| | | | |

STATEMENT OF CASH FLOWS | | May 31, 2017 | |

| For the Year Ended May 31, 2017 | | | |

| | |

Cash Flows from Operating Activities: | | | |

| Net Increase in net assets resulting from operations | | $ | 28,446,629 | |

| | | | | |

Adjustments to Reconcile Net Increase in Net Assets Resulting from Operations to | | | | |

Net Cash Used In Operating and Investing Activities: | | | | |

| Net change in unrealized (appreciation) depreciation on investments | | | (17,485,764 | ) |

| Net change in unrealized (appreciation) depreciation on forward foreign | | | | |

| currency exchange contracts | | | 419,665 | |

| Net realized loss on investments | | | 2,622,919 | |

| Net accretion of discount and amortization of premium | | | (1,001,901 | ) |

| Purchase of long-term investments | | | (143,933,610 | ) |

| Paydowns received on mortgage and asset backed securities | | | 30,817,760 | |

| Proceeds from sales of long-term investments | | | 98,147,377 | |

| Net purchases of short-term investments | | | (500,070 | ) |

| Other payments | | | 253,608 | |

| Commitment fees received and repayments of unfunded commitments | | | 978,408 | |

| Loan commitment fundings | | | (804,294 | ) |

| Increase in segregated cash from broker | | | 274,000 | |

| Decrease in interest receivable | | | 54,376 | |

| Decrease in investments sold receivable | | | 298,689 | |

| Decrease in tax reclaims receivables | | | 11,527 | |

| Decrease in other assets | | | 9,912 | |

| Increase in payable for investments purchased | | | 987,570 | |

| Increase in investment advisory fees payable | | | 30,661 | |

| Increase in interest payable on borrowings | | | 17,750 | |

| Increase in trustees fees and expenses payable | | | 2,847 | |

| Decrease in accrued expenses and other liabilities | | | (12,678 | ) |

| Net Cash Used in Operating and Investing Activities | | | (364,619 | ) |

Cash Flows From Financing Activities: | | | | |

| Net proceeds from the issuance of common shares | | | 8,288,977 | |

| Distributions to common shareholders | | | (14,433,013 | ) |

| Proceeds from reverse repurchase agreements | | | 667,812,408 | |

| Payments made on reverse repurchase agreements | | | (666,221,002 | ) |

| Proceeds from borrowings | | | 9,000,000 | |

| Payments made on borrowings | | | (4,500,000 | ) |

| Offering costs in connection with the issuance of common shares | | | (24,226 | ) |

| Net Cash Used in Financing Activities | | | (76,856 | ) |

| Net decrease in cash | | | (441,475 | ) |

Cash at Beginning of Year (including foreign currency) | | | 958,178 | |

Cash at End of Year (including foreign currency) | | $ | 516,703 | |

Supplemental Disclosure of Cash Flow Information: Cash paid during | | | | |

the year for interest | | $ | 927,462 | |

Supplemental Disclosure of Non Cash Financing Activity: Dividend reinvestment | | $ | 202,920 | |

Supplemental Disclosure of Non Cash Financing Activity: Additional principal | | | | |

received on payment-in-kind bonds | | $ | 71,605 | |

See notes to financial statements.

GGM l GUGGENHEIM CREDIT ALLOCATION FUND ANNUAL REPORT l 33| | | | | | | | | | | | | |

FINANCIAL HIGHLIGHTS | | | | | | | | | | | May 31, 2017 | |

| | |

| | |

| | | For the | | | For the | | | For the | | | | |

| | | year ended | | | year ended | | | year ended | | | Period Ended | |

| | | May 31, 2017 | | | May 31, 2016 | | | May 31, 2015 | | | May 31, 2014(a) | |

Per Share Data: | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 20.53 | | | $ | 23.34 | | | $ | 24.71 | | | $ | 23.82 | |

| Income from investment operations: | | | | | | | | | | | | | | | | |

Net investment income(b) | | | 1.91 | | | | 2.02 | | | | 1.95 | | | | 1.64 | |