UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22781

Goldman Sachs Trust II

(Exact name of registrant as specified in charter)

200 West Street

15th Floor

New York, New York 10282

(Address of principal executive offices) (Zip code)

| | |

Copies to: |

Caroline Kraus | | Geoffrey R.T. Kenyon, Esq. |

Goldman, Sachs & Co. | | Dechert LLP |

200 West Street | | 100 Oliver Street |

New York, New York 10282 | | 40th Floor |

| | Boston, MA 02110-2605 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (212) 902-1000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2016

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Annual Report to Shareholders is filed herewith. |

Goldman Sachs Funds

| | | | |

| | |

| Annual Report | | | | October 31, 2016 |

| | |

| | | | Active Equity Multi-Manager Funds |

| | | | Multi-Manager International Equity |

| | | | Multi-Manager U.S. Dynamic Equity |

| | | | Multi-Manager U.S. Small Cap Equity |

Active Equity Multi-Manager Funds

| n | | MULTI-MANAGER INTERNATIONAL EQUITY |

| n | | MULTI-MANAGER U.S. DYNAMIC EQUITY |

| n | | MULTI-MANAGER U.S. SMALL CAP EQUITY |

| | | | |

TABLE OF CONTENTS | | | | |

| |

Market Review | | | 1 | |

| |

Portfolio Management Discussions and Performance Summaries | | | 3 | |

| |

Schedules of Investments | | | 20 | |

| |

Financial Statements | | | 32 | |

| |

Financial Highlights | | | 36 | |

| |

Notes to the Financial Statements | | | 42 | |

| |

Report of Independent Registered Public Accounting Firm | | | 54 | |

| |

Other Information | | | 55 | |

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

MARKET REVIEW

Active Equity Multi-Manager Funds

Market Review

The 12 months ended October 31, 2016 (the “Reporting Period”) were marked by spans of uncertainty and volatility, beginning with the Federal Reserve’s (the “Fed”) first interest rate increase in nearly a decade in December 2015. Shortly thereafter, the People’s Bank of China took the step of devaluing its currency, the renminbi, setting off a sharp worldwide sell-off in risk assets, as investors sought what they perceived to be relative safety in the uncertainty surrounding the scale and impact of Chinese monetary policy. This “risk off” sentiment persisted into the middle of February 2016, then subsided until uncertainty around the U.K.’s June 2016 referendum on whether to remain a member of the European Union led to significant price action in U.K. assets. The U.K.’s unexpected decision to leave the European Union, popularly known as “Brexit”, set off another sharp sell-off in equity and currency markets in late June 2016. The British pound dropped precipitously versus the U.S. dollar and the euro, hitting levels not seen since the 1980s.

Equities generally recovered from the Brexit shock over the summer of 2016, as markets turned their attention to the then-upcoming U.S. election. Meanwhile, the Fed expressed an unexpectedly dovish outlook following the volatility of early 2016, reducing the number of potential 2016 interest rate hikes from four to two. (Dovish commentary tends to suggest lower interest rates.) Accommodative monetary policy persisted globally. The European Central Bank left its interest rates unchanged. The Bank of Japan left its interest rates steady while announcing a plan to target its yield curve, or spectrum of maturities, and adjusting its inflation goal to exceed 2%.

Global equity markets ended the Reporting Period broadly positive despite the Reporting Period’s volatility. In the U.S., equities gained strength in the information technology sector and showed strong performance from higher yielding, traditionally defensive sectors, such as utilities, telecommunication services and consumer staples. Quantitative easing on a worldwide scale drove investors to search elsewhere for yield, boosting traditionally defensive equity sectors as well as corporate credit. On the other hand, health care companies underperformed the broader U.S. equity market, as election year rhetoric increased worries about downward pressure on drug pricing and increased regulatory scrutiny. Financials, facing margin pressure from low interest rates and regulatory spending, also underperformed. Low volatility stocks outperformed in the defensive sector rally, and oil prices rebounded from early 2016 lows, boosting the energy sector and certain commodity-linked businesses.

Credit markets ended the Reporting Period in largely positive territory, as accommodative monetary policy drove yield-hungry investors into the corporate credit markets. Credit spreads, or yield differentials to government bonds, tightened from their January 2016 highs, with commodity-exposed and energy-related industries, particularly within the high yield corporate bond sector, leading gains. In the U.S., issuers took advantage of low interest rates and strong foreign demand to drive new offerings. Abroad, emerging market credit, offering comparatively more attractive yields and less sovereign leverage, rallied. Money market reform in the U.S. led to significant outflows from prime money market funds into government money market funds, leading to an increase in the three-month LIBOR rate and implications of the coupon rates of floating rate credit.

Public real estate markets were similarly driven during the Reporting Period by investors’ search for yield within a low interest rate environment. While global real estate markets finished the Reporting Period in positive territory, there was significant dispersion in performance between higher yielding and lower yielding securities, with higher yielding

1

MARKET REVIEW

securities significantly outperforming. The markets experienced notable volatility during the Reporting Period, with a sell-off in U.S. office real estate investment trusts (“REITs”) at the beginning of 2016, a notable rally in Japanese REITs in the first quarter of 2016 despite concerns around quality and valuation following the Bank of Japan’s move to negative interest rates, and a sharp decline and subsequent rebound in U.K. real estate immediately following the European Union referendum vote in June 2016. In the third quarter of 2016 and in October 2016, we saw a rotation in the markets, as pockets that had previously outperformed took a pause, while renewed flows into areas of the market that have previously been stressed, including Hong Kong, stood out to the upside.

By the end of the Reporting Period, the market-implied probability of an interest rate hike by the Fed by December 2016 was 70%. Global central banks, while maintaining policies of quantitative easing, had begun to discuss the limitations of further easing and the broader implications of continued easing in the market. At the end of the Reporting Period, it appeared that political uncertainty in the U.S. surrounding the November 8 election and its aftermath as well as concerns about the effect of a potential “hard Brexit” in March 2017 were likely to be drivers of near-term market volatility. (“Hard Brexit” is one of the ways the U.K. could separate itself from the European Union; opposite of “soft Brexit.” Both terms refer to the closeness or distance of the U.K.’s relationship with the European Union after the separation has been completed.)

2

PORTFOLIO RESULTS

Multi-Manager International Equity Fund

Investment Objective and Principal Strategy

The Fund seeks to provide long-term capital growth.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Alternative Investments & Manager Selection (“AIMS”) Group discusses the Multi-Manager International Equity Fund’s (the “Fund”) performance and positioning for the 12-month period ended October 31, 2016 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Institutional Shares generated an average annual total return of -0.82%. This return compares to the -3.22% average annual total return of the Fund’s benchmark, the MSCI® EAFE® Index (Net, USD, Unhedged) (the “Index”) during the same time period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund’s performance during the Reporting Period can be attributed to the performance of the Fund’s Underlying Managers, who are unaffiliated investment managers that employ an international equity investment strategy. During the Reporting Period, the Fund allocated capital to three Underlying Managers as part of its top-level strategy allocation — Causeway Capital Management LLC (“Causeway”), Massachusetts Financial Services Company doing business as MFS Investment Management (“MFS”) and WCM Investment Management (“WCM”). |

| | Of the three Underlying Managers with allocated capital during the Reporting Period, one generated positive absolute returns and two posted negative absolute returns. Still, the Fund outperformed the Index on a relative basis, driven primarily by the performance of growth-oriented Underlying Manager WCM. |

| Q | | Which international equity strategies most significantly affected Fund performance? |

| A | | The Fund’s relative outperformance was driven by growth-oriented manager WCM, which posted positive absolute returns and outperformed the Index, benefiting from strong stock selection in financials, effective allocation positioning in health care, and both effective allocation positioning and stock selection in information technology. Core-oriented manager MFS posted negative absolute returns but outperformed the Index due to effective allocation positioning and stock selection in information technology and positive stock selection in industrials. MFS’ outperformance was somewhat dampened by weak stock selection in materials, which detracted from performance. Value-oriented manager Causeway also posted negative absolute returns but underperformed the Index during the Reporting Period due to poor stock selection in the financials, industrials and materials sectors. Strong stock selection in consumer discretionary and an overweight to telecommunication services partially mitigated Causeway’s underperformance. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | The Fund used forward foreign currency exchange contracts to take positions in select non-U.S. markets. The use of these derivatives did not have a material impact on the Fund’s results during the Reporting Period. |

| Q | | Were there any notable changes in the Fund’s allocations during the Reporting Period? |

| A | | There were no changes to the Fund’s allocations of assets to Underlying Managers during the Reporting Period. As of October 31, 2016, the Fund’s assets were allocated approximately 44% to Causeway, 19% to MFS and 36% to WCM. The remainder of the Fund’s assets were invested in cash and cash equivalents. |

| Q | | Were there any changes to the Fund’s management team during the Reporting Period? |

| A | | Effective August 19, 2016, Jason Gottlieb was removed as a portfolio manager of the Fund. Kent Clark and Tom Murray were added as portfolio managers of the Fund, joining Betsy Gorton. |

3

PORTFOLIO RESULTS

| Q | | What is the Fund’s tactical view and strategy for the months ahead? |

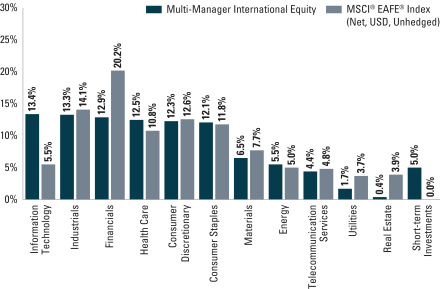

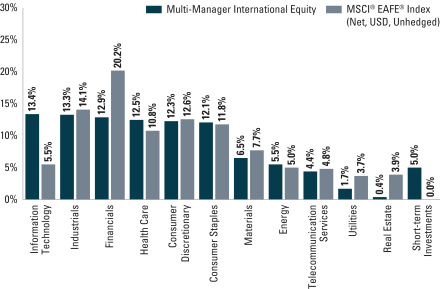

| A | | At the end of the Reporting Period, the Fund was more defensively positioned than the Index. Compared to the Index, the Fund was overweight to information technology and health care, while underweight to financials, real estate, industrials and utilities at the end of the Reporting Period. The Fund held an approximately 5% position in cash at the end of October 2016. On a regional basis, the Fund was slightly underweight relative to the Index in the U.K. and significantly underweight Japan and developed Asia. The Fund also maintained out-of-Index exposure to emerging markets and North America. From a market capitalization perspective, the Fund was overweight at the end of the Reporting Period in mega cap stocks, while maintaining an underweight position relative to the Index in mid-cap companies. |

| | We intend to continue to position the Fund in alignment with our longer-term strategic views within the international equity complex. We further intend to continue to monitor allocations and Underlying Manager performance as we seek to generate long-term capital growth. |

4

FUND BASICS

Multi-Manager International Equity Fund

as of October 31, 2016

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | November 1, 2015–October 31, 2016 | | Fund Total Return

(based on NAV)1 | | | MSCI® EAFE® Index

(Net, USD, Unhedged)2 | |

| | | Institutional | | | -0.82 | % | | | -3.22 | % |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. |

| | 2 | | The MSCI® EAFE® Index is a stock market index that is designed to measure the equity market performance of developed markets in Europe, Australasia and the Far East, excluding the U.S. and Canada. The Index figures do not reflect any deductions for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 9/30/16 | | One Year | | | Since Inception | | | Inception Date |

| | | Institutional | | | 8.03 | % | | | -2.54 | % | | 7/31/15 |

| | 3 | | The Standardized Total Returns are average annual total returns or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. Because Institutional Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | | Institutional | | | 0.57 | % | | | 1.03 | % |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Fund’s waivers and/or expense limitations will remain in place through at least February 28, 2017, and prior to such date the investment adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

5

FUND BASICS

| | | | | | | | |

| | TOP TEN EQUITY HOLDINGS AS OF 10/31/165 |

| | | Holding | | % of Net Assets | | | Line of Business |

| | Taiwan Semiconductor Manufacturing Co. Ltd. ADR | | | 2.2 | % | | Semiconductors & Semiconductor

Equipment |

| | Nestle SA | | | 2.2 | | | Food Products |

| | Reckitt Benckiser Group PLC | | | 2.1 | | | Household Products |

| | Akzo Nobel NV | | | 1.8 | | | Chemicals |

| | Schneider Electric SE | | | 1.7 | | | Electrical Equipment |

| | Volkswagen AG | | | 1.7 | | | Automobiles |

| | Roche Holding AG | | | 1.6 | | | Pharmaceuticals |

| | Compass Group PLC | | | 1.6 | | | Hotels, Restaurants & Leisure |

| | Chubb Ltd. | | | 1.6 | | | Insurance |

| | | Novartis AG | | | 1.6 | | | Pharmaceuticals |

| | 5 | | The top 10 holdings may not be representative of the Fund’s future investments. |

|

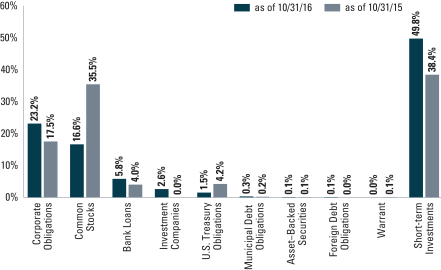

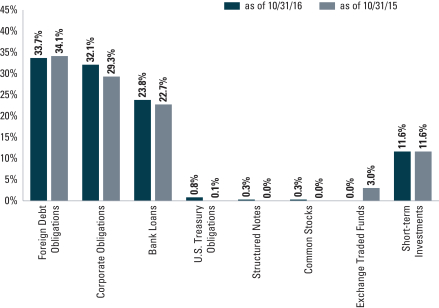

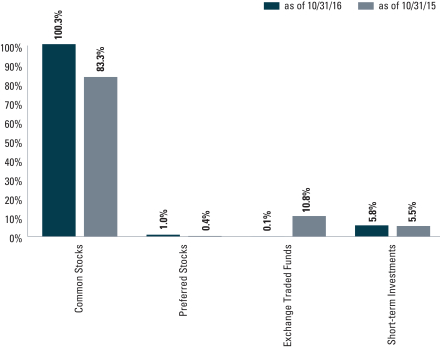

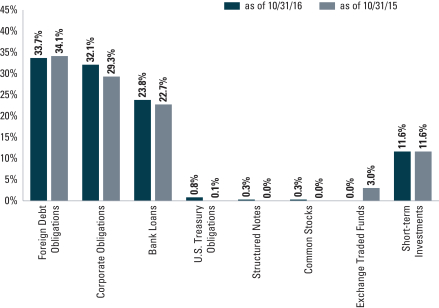

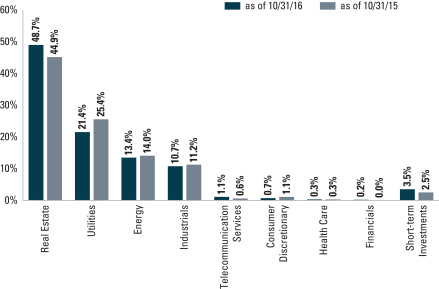

| FUND VS. BENCHMARK SECTOR ALLOCATIONS (%)6 |

| As of October 31, 2016 |

| | 6 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using the Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. Short-term investments represent repurchase agreements. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

6

MULTI-MANAGER INTERNATIONAL EQUITY FUND

Performance Summary

October 31, 2016

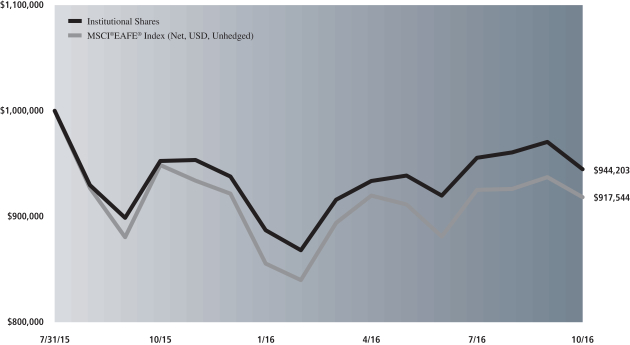

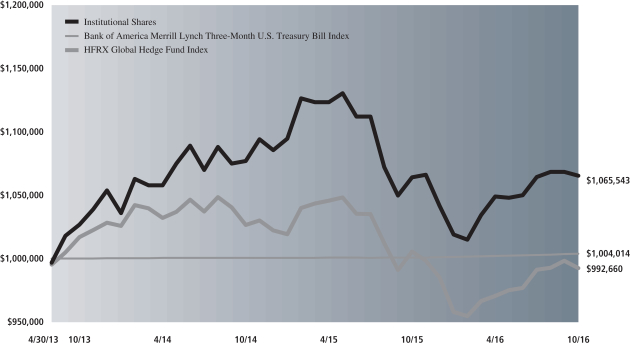

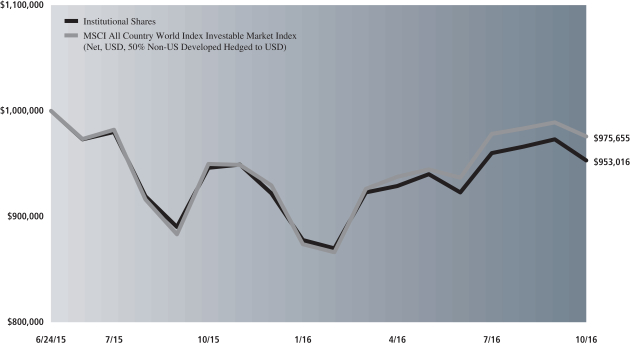

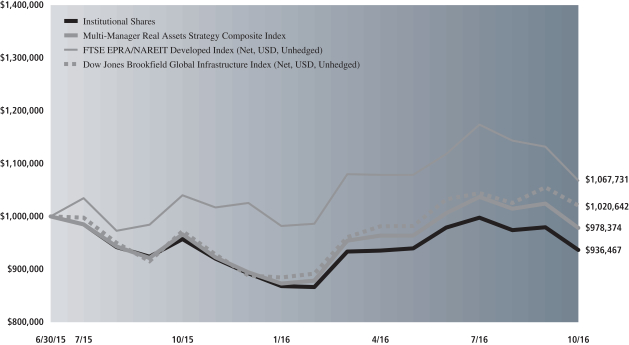

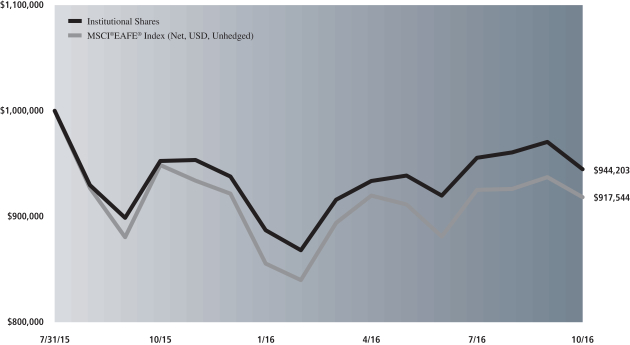

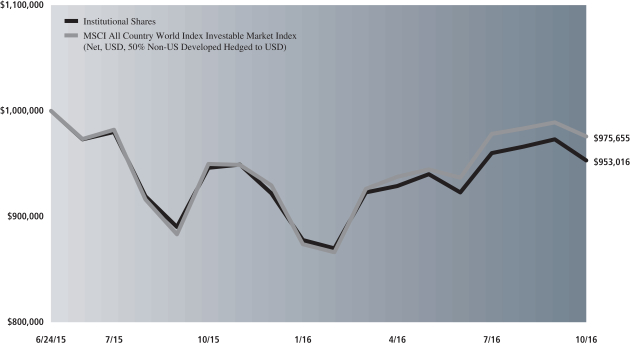

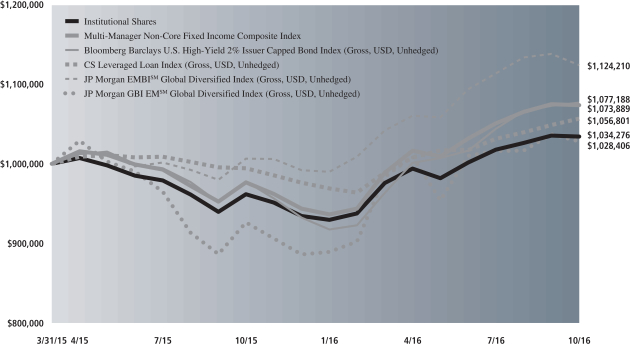

The following graph shows the value, as of October 31, 2016, of a $1,000,000 investment made on July 31, 2015 (commencement of operations) in Institutional Shares at NAV. For comparative purposes, the performance of the Fund’s benchmark, the MSCI® EAFE® Index (Net, USD, Unhedged) is shown. This performance data represents past performance and should not be considered indicative of future performance, which will fluctuate with changes in market conditions. These performance fluctuations may cause an investor’s shares, when redeemed, to be worth more or less than their original cost. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In addition to the Underlying Managers’ decisions regarding issuer/industry investment selection and allocation, other factors may affect Fund performance. These factors include, but are not limited to, Fund operating fees and expenses, portfolio turnover and subscription and redemption cash flows affecting the Fund.

|

| Multi-Manager International Equity Fund’s Lifetime Performance |

Performance of a $1,000,000 Investment, with distributions reinvested, from July 31, 2015 through October 31, 2016.

| | | | |

| Average Annual Total Return through October 31, 2016 | | One Year | | Since Inception |

|

Institutional (Commenced July 31, 2015) | | -0.82% | | -4.46% |

|

7

PORTFOLIO RESULTS

Multi-Manager U.S. Dynamic Equity Fund

Investment Objective and Principal Strategy

The Fund seeks to provide long-term capital growth.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Alternative Investments & Manager Selection (“AIMS”) Group discusses the Multi-Manager U.S. Dynamic Equity Fund’s (the “Fund”) performance and positioning for the 12-month period ended October 31, 2016 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Institutional Shares generated an average annual total return of -3.54%. This return compares to the 4.50% average annual total return of the Fund’s benchmark, the S&P 500® Total Return Index (the “Index”) during the same time period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund’s performance during the Reporting Period can be attributed to the performance of the Fund’s Underlying Managers, who are unaffiliated investment managers that employ a dynamic equity investment strategy. During the Reporting Period, the Fund allocated capital to four Underlying Managers as part of its top-level strategy allocation — Sirios Capital Management, L.P. (“Sirios”), Smead Capital Management, Inc. (“Smead”), Weitz Investment Management, Inc. (“Weitz”) and Lazard Asset Management LLC (“Lazard”). Lazard was added as an Underlying Manager and funded in September 2016. |

| | Of the four Underlying Managers with allocated capital during the Reporting Period, all four generated negative absolute returns. While all four Underlying Managers also underperformed the Index on a relative basis, Sirios and Smead experienced the most notable underperformance. |

| Q | | Which dynamic equity strategies most significantly affected Fund performance? |

| A | | The Fund’s relative underperformance was driven most by core-oriented manager Smead and growth-oriented manager Sirios. Smead lagged the Index due primarily to stock selection within and an overweight to consumer discretionary, partially offset by its underweight to energy, which contributed positively. Stock selection in health care and financials detracted most from Sirios’ relative results, only partially offset by effective positioning in information technology and consumer staples. Stock selection in consumer discretionary and health care negatively impacted performance for Weitz, partially mitigated by favorable stock selection in energy and industrials. Lazard marginally contributed to the Fund’s underperformance since funding in September 2016 due to weak stock selection in information technology and consumer discretionary. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | The Fund used forward foreign currency exchange contracts to take positions in select non-U.S. markets. The use of these derivatives did not have a material impact on the Fund’s results during the Reporting Period. |

| Q | | Were there any notable changes in the Fund’s allocations during the Reporting Period? |

| A | | Allocations to Weitz were halted in November 2015 and thereafter cash flows into the Fund were allocated to Sirios and Smead and Weitz’s allocation was reduced. In April 2016, we revised the target Underlying Manager allocations from 33% each to 35.5% to Sirios, 35.5% to Smead and 28% to Weitz with the remainder of the Fund’s assets invested in cash and cash equivalents. Weitz’s allocation was further reduced to 18% in September 2016 in order to fund Lazard at 10%. |

| | As of October 31, 2016, the Fund’s assets were allocated approximately 35.5% to Sirios, 35.5% to Smead, 18% to Weitz and 10% to Lazard. |

8

PORTFOLIO RESULTS

| Q | | Were there any changes to the Fund’s management team during the Reporting Period? |

| A | | Effective August 19, 2016, Jason Gottlieb was removed as a portfolio manager of the Fund. Kent Clark and Yvonne Woo were added as portfolio managers of the Fund, joining Betsy Gorton. |

| Q | | What is the Fund’s tactical view and strategy for the months ahead? |

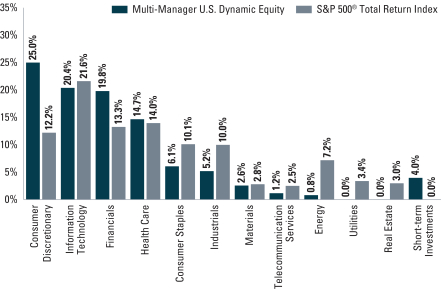

| A | | The addition of Lazard as an Underlying Manager in September 2016 moderately reduced the Fund’s overweight to consumer discretionary and, within financials, to banks, and added more exposure to the information technology and consumer staples sectors in the Fund. That said, compared to the Index, the Fund was still overweight to consumer discretionary at the end of the Reporting Period, primarily concentrated in media. The Fund was underweight to information technology, consumer staples and industrials at the end of the Reporting Period and had no exposure to utilities, which had been a drag on relative results year-to-date through October 31, 2016. The Fund held an approximately 4% position in cash at the end of October 2016. In terms of market capitalization, the Fund maintained a significant underweight to mega caps and an overweight relative to the Index in small/mid cap stocks. Regionally, the Fund was primarily invested in North American equities, but also had modest exposure to companies domiciled in Europe and the U.K. |

| | We intend to continue to position the Fund in alignment with our longer-term strategic views within the U.S. equity complex. We further intend to continue to monitor allocations and Underlying Manager performance as we seek to generate long-term capital growth. |

9

FUND BASICS

Multi-Manager U.S. Dynamic Equity Fund

as of October 31, 2016

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | November 1, 2015–October 31, 2016 | | Fund Total Return

(based on NAV)1 | | | S&P 500®

Total Return Index2 | |

| | | Institutional | | | -3.54 | % | | | 4.50 | % |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. |

| | 2 | | The S&P 500® Total Return Index is the Standard & Poor’s 500 Composite Index of 500 stocks, an unmanaged index of common stock prices. The Index figures do not reflect any deductions for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 | |

| | | For the period ended 9/30/16 | | One Year | | | Since Inception | | | Inception Date | |

| | | Institutional | | | 4.69 | % | | | -4.94 | % | | | 7/31/15 | |

| | 3 | | The Standardized Total Returns are average annual total returns or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. Because Institutional Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | | Institutional | | | 0.79 | % | | | 1.44 | % |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Fund’s waivers and/or expense limitations will remain in place through at least February 28, 2017, and prior to such date the investment adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

10

FUND BASICS

| | | | | | | | |

| | TOP TEN EQUITY HOLDINGS AS OF 10/31/165 |

| | | Holding | | % of Net Assets | | | Line of Business |

| | Berkshire Hathaway, Inc. Class B | | | 3.5 | % | | Diversified Financial Services |

| | Allergan PLC | | | 3.4 | | | Pharmaceuticals |

| | Bank of America Corp. | | | 3.3 | | | Banks |

| | eBay, Inc. | | | 2.3 | | | Internet Software & Services |

| | NVR, Inc. | | | 2.1 | | | Household Durables |

| | Time Warner, Inc. | | | 2.1 | | | Media |

| | Wells Fargo & Co. | | | 2.1 | | | Banks |

| | Constellation Brands, Inc. Class A | | | 2.1 | | | Beverages |

| | Amgen, Inc. | | | 2.0 | | | Biotechnology |

| | | Aflac, Inc. | | | 1.8 | | | Insurance |

| | 5 | | The top 10 holdings may not be representative of the Fund’s future investments. |

|

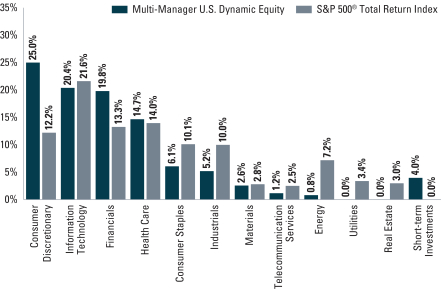

| FUND VS. BENCHMARK SECTOR ALLOCATIONS (%)6 |

| As of October 31, 2016 |

| | 6 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using the Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. Short-term investments represent repurchase agreements. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

11

MULTI-MANAGER U.S. DYNAMIC EQUITY FUND

Performance Summary

October 31, 2016

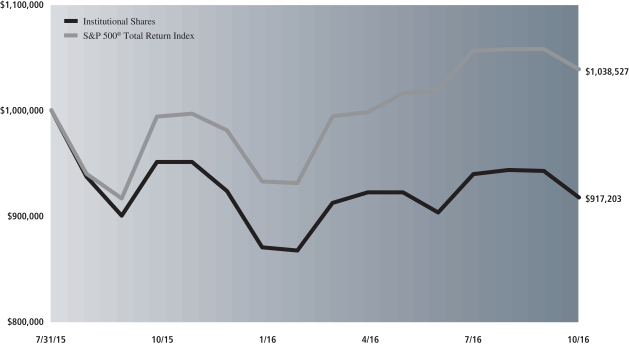

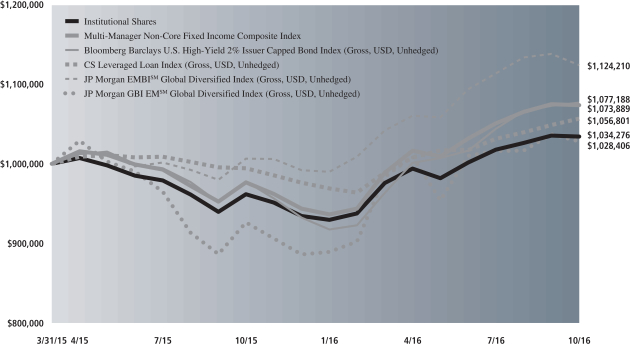

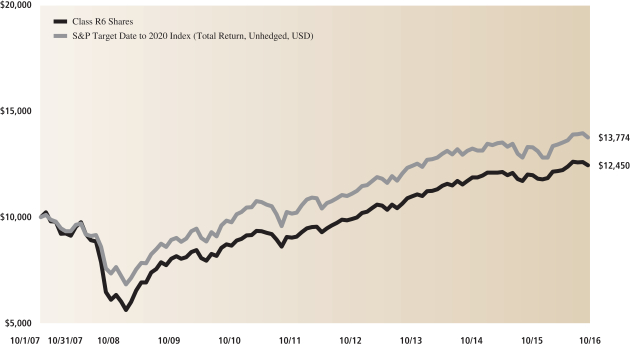

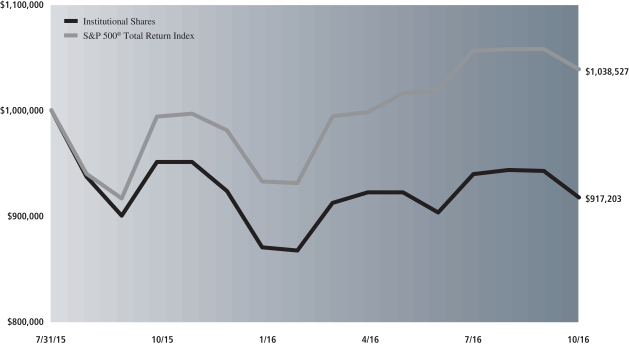

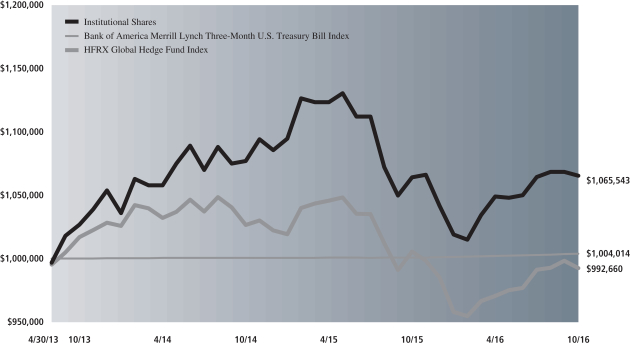

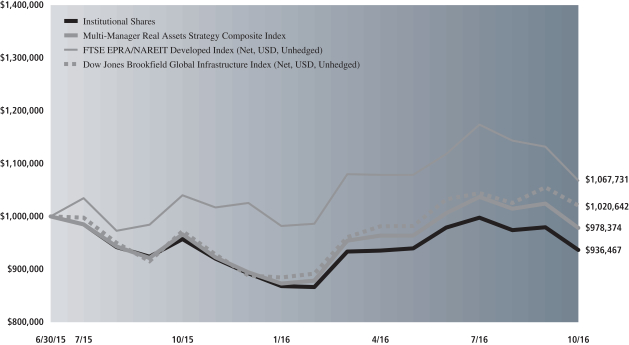

The following graph shows the value, as of October 31, 2016, of a $1,000,000 investment made on July 31, 2015 (commencement of operations) in Institutional Shares at NAV. For comparative purposes, the performance of the Fund’s benchmark, the S&P 500® Total Return Index is shown. This performance data represents past performance and should not be considered indicative of future performance, which will fluctuate with changes in market conditions. These performance fluctuations may cause an investor’s shares, when redeemed, to be worth more or less than their original cost. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In addition to the Underlying Managers’ decisions regarding issuer/industry investment selection and allocation, other factors may affect Fund performance. These factors include, but are not limited to, Fund operating fees and expenses, portfolio turnover and subscription and redemption cash flows affecting the Fund.

|

| Multi-Manager U.S. Dynamic Equity Fund’s Lifetime Performance |

Performance of a $1,000,000 Investment, with distributions reinvested, from July 31, 2015 through October 31, 2016.

| | | | |

| Average Annual Total Return through October 31, 2016 | | One Year | | Since Inception |

|

Institutional (Commenced July 31, 2015) | | -3.54% | | -6.64% |

|

12

PORTFOLIO RESULTS

Multi-Manager U.S. Small Cap Equity Fund

Investment Objective and Principal Strategy

The Fund seeks to provide long-term capital growth.

Portfolio Management Discussion and Analysis

The Multi-Manager U.S. Small Cap Equity Fund (the “Fund”) commenced operations on April 29, 2016. Below, the Goldman Sachs Alternative Investments & Manager Selection (“AIMS”) Group discusses the Fund’s performance and positioning for the period from its inception on April 29, 2016 through October 31, 2016 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Institutional Shares generated a cumulative total return of 5.20%. This return compares to the 6.13% cumulative total return of the Fund’s benchmark, the Russell 2000® Total Return Index (the “Index”) during the same time period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | While the Fund posted solid positive absolute returns, it underperformed the Index during the Reporting Period. The Fund’s performance during the Reporting Period can be attributed to the performance of the Fund’s Underlying Managers, who are unaffiliated investment managers that employ a small-cap equity investment strategy. During the Reporting Period, the Fund allocated capital to three Underlying Managers as part of its top-level strategy allocation — Brown Advisory LLC (“Brown Advisory”), PNC Capital Advisors, LLC (“PNC”) and Robeco Investment Management, Inc., doing business as Boston Partners (“Boston Partners”). |

| | Of the three Underlying Managers with allocated capital during the Reporting Period, all three generated positive absolute returns. However, on a relative basis, two of the Underlying Managers outperformed their respective benchmark index, while one underperformed its benchmark index during the Reporting Period. |

| Q | | Which dynamic equity strategies most significantly affected Fund performance? |

| A | | The Fund’s relative underperformance was driven most by core-oriented manager PNC and value-oriented manager Boston Partners. PNC underperformed the Index due to weak stock selection in financials and information technology, partially offset by stock selection in materials, which contributed positively. Boston Partners underperformed the Russell 2000® Value Index due to positioning in materials, health care and information technology. Boston Partners’ underperformance was somewhat mitigated by favorable positioning in consumer discretionary. Growth-oriented manager Brown Advisory outperformed the Russell 2000® Growth Index due to effective stock selection and allocation positioning within consumer discretionary, strong stock selection in information technology, and a favorable underweight to and stock selection in health care. Brown Advisory’s relative results were dampened somewhat by positioning in consumer staples and energy, which detracted from performance. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | The Fund did not use derivatives or similar instruments during the Reporting Period. |

| Q | | Were there any notable changes in the Fund’s allocations during the Reporting Period? |

| A | | As the Fund was launched on April 29, 2016, it was not a matter of making changes during the Reporting Period but of building the Fund’s portfolios. As of October 31, 2016, the Fund’s assets were allocated approximately 44% to Boston Partners, 30% to Brown Advisory and 25% to PNC. |

| Q | | Were there any changes to the Fund’s management team during the Reporting Period? |

| A | | Effective August 19, 2016, Jason Gottlieb was removed as a portfolio manager of the Fund. Kent Clark and Yvonne Woo |

13

PORTFOLIO RESULTS

| | were added as portfolio managers of the Fund, joining Betsy Gorton. |

| Q | | What is the Fund’s tactical view and strategy for the months ahead? |

| A | | Compared to the Index, the Fund did not have significantly overweighted or underweighted sector allocations at the end of the Reporting Period but was moderately overweight to industrials and financials and modestly underweight to real estate, utilities and health care. The Fund held an approximately 5% position in cash at the end of October 2016. In terms of market capitalization, the Fund maintained a slight small-mid cap bias, driven predominantly by Underlying Manager Brown Advisory. |

| | We intend to continue to position the Fund in alignment with our longer-term strategic views within the U.S. small-cap equity complex. We further intend to continue to monitor allocations and Underlying Manager performance as we seek to generate long-term capital growth. |

14

FUND BASICS

Multi-Manager U.S. Small Cap Equity Fund

as of October 31, 2016

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | April 29, 2016–October 31, 2016 | | Fund Total Return

(based on NAV)1 | | | Russell 2000®

Total Return Index2 | |

| | | Institutional | | | 5.20 | % | | | 6.13 | % |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. |

| | 2 | | The Russell 2000® Total Return Index is an unmanaged index of common stock prices that measures the performance of the 2000 smallest companies in the Russell 3000® Index. The Index is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set. |

| | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 | |

| | | For the period ended 9/30/16 | | Since Inception | | | Inception Date | |

| | | Institutional | | | 9.90 | % | | | 4/29/16 | |

| | 3 | | The Standardized Total Returns are average annual total returns or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. Because Institutional Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | | Institutional | | | 0.80 | % | | | 2.19 | % |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Fund’s waivers and/or expense limitations will remain in place through at least March 31, 2017, and prior to such date the investment adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

15

FUND BASICS

| | | | | | | | |

| | TOP TEN EQUITY HOLDINGS AS OF 10/31/165 |

| | | Holding | | % of Net Assets | | | Line of Business |

| | Drew Industries, Inc. | | | 1.7 | % | | Auto Components |

| | EnerSys | | | 1.5 | | | Electrical Equipment |

| | HEICO Corp. | | | 1.3 | | | Aerospace & Defense |

| | World Fuel Services Corp. | | | 1.3 | | | Oil, Gas & Consumable Fuels |

| | Waste Connections, Inc. | | | 1.2 | | | Commercial Services & Supplies |

| | Lithia Motors, Inc. Class A | | | 1.2 | | | Specialty Retail |

| | PAREXEL International Corp. | | | 1.2 | | | Life Sciences Tools & Services |

| | Cogent Communications Holdings, Inc. | | | 1.0 | | | Diversified Telecommunication

Services |

| | Air Lease Corp. | | | 1.0 | | | Trading Companies & Distributors |

| | | PRA Group, Inc. | | | 1.0 | | | Consumer Finance |

| | 5 | | The top 10 holdings may not be representative of the Fund’s future investments. |

16

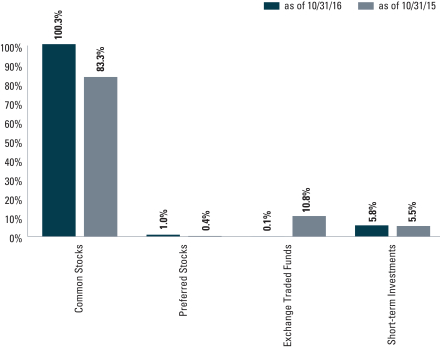

FUND BASICS

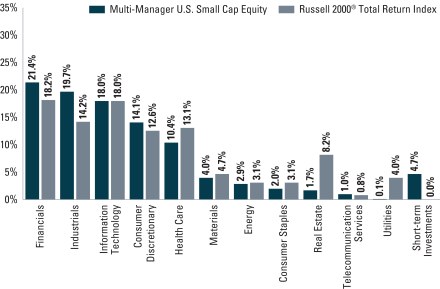

|

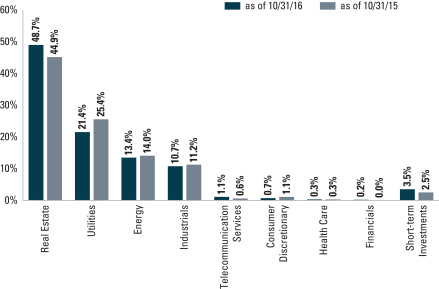

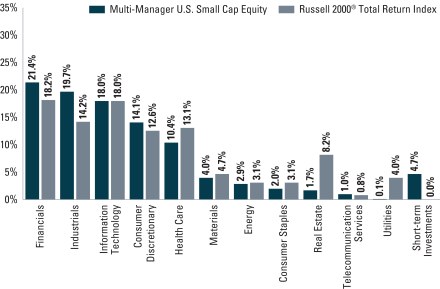

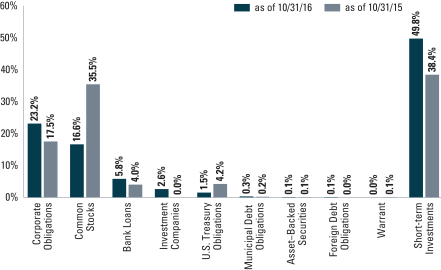

| FUND VS. BENCHMARK SECTOR ALLOCATIONS (%)6 |

| As of October 31, 2016 |

| | 6 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using the Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. Short-term investments represent repurchase agreements. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

17

MULTI-MANAGER U.S. SMALL CAP EQUITY

Performance Summary

October 31, 2016

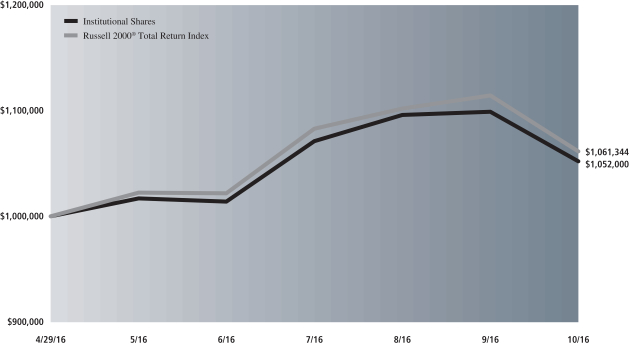

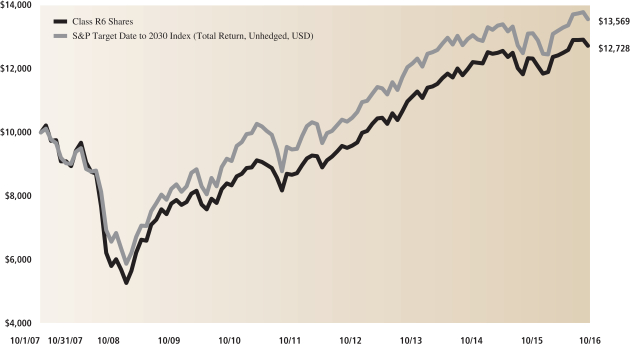

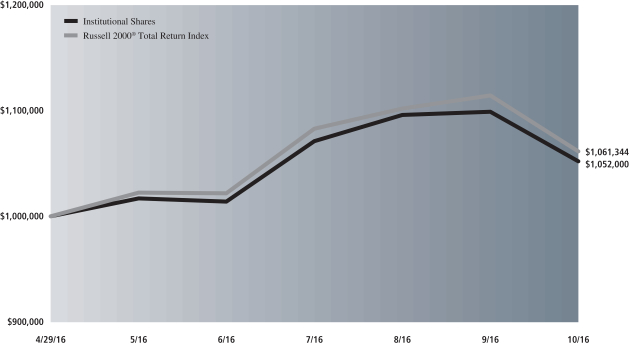

The following graph shows the value, as of October 31, 2016, of a $1,000,000 investment made on April 29, 2016 (commencement of operations) in Institutional Shares at NAV. For comparative purposes, the performance of the Fund’s benchmark, the Russell 2000® Total Return Index is shown. This performance data represents past performance and should not be considered indicative of future performance, which will fluctuate with changes in market conditions. These performance fluctuations may cause an investor’s shares, when redeemed, to be worth more or less than their original cost. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In addition to the Underlying Managers’ decisions regarding issuer/industry investment selection and allocation, other factors may affect Fund performance. These factors include, but are not limited to, Fund operating fees and expenses, portfolio turnover and subscription and redemption cash flows affecting the Fund.

|

| Multi-Manager U.S. Small Cap Equity Fund’s Lifetime Performance |

Performance of a $1,000,000 Investment, with distributions reinvested, from April 29, 2016 through October 31, 2016.

| | |

| Average Annual Total Return through October 31, 2016 | | Since Inception |

|

Institutional (Commenced April 29, 2016) | | 5.20%* |

|

| * | | Total return for periods of less than one year represents cumulative total return. |

18

PORTFOLIO RESULTS

Index Definitions

The Russell 2000® Growth Index measures the performance of the small-cap growth stocks of the U.S. equity universe.

The Russell 2000® Value Index measures the performance of the small-cap value stocks of the U.S. equity universe.

19

MULTI-MANAGER INTERNATIONAL EQUITY FUND

Schedule of Investments

October 31, 2016

| | | | | | | | |

Shares | | | Description | | Value | |

| | Common Stocks – 93.2% | |

| | Australia – 2.0% | |

| | 56,135 | | | CSL Ltd. (Biotechnology) | | $ | 4,283,412 | |

| | 24,868 | | | Orica Ltd. (Chemicals) | | | 307,229 | |

| | 187,307 | | | Westfield Corp. (Equity Real Estate Investment Trusts (REITs)) | | | 1,265,797 | |

| | | | | | | | |

| | | | | | | 5,856,438 | |

| | |

| | Belgium* – 0.2% | |

| | 9,662 | | | KBC Group NV (Banks) | | | 589,006 | |

| | |

| | Brazil – 0.9% | |

| | 439,723 | | | Ambev SA ADR (Beverages) | | | 2,594,366 | |

| | |

| | Canada – 3.7% | |

| | 14,231 | | | Canadian National Railway Co. (Road & Rail) | | | 894,703 | |

| | 29,042 | | | Canadian Pacific Railway Ltd. (Road & Rail) | | | 4,151,844 | |

| | 6,455 | | | Constellation Software, Inc. (Software) | | | 3,023,931 | |

| | 4,664 | | | ECN Capital Corp.* (Diversified Financial Services) | | | 10,188 | |

| | 37,861 | | | Element Fleet Management Corp. (Diversified Financial Services) | | | 368,928 | |

| | 104,600 | | | Encana Corp. (Oil, Gas & Consumable Fuels) | | | 997,416 | |

| | 3,444 | | | Loblaw Cos. Ltd. (Food & Staples Retailing) | | | 169,928 | |

| | 24,300 | | | Manulife Financial Corp. (Insurance) | | | 352,009 | |

| | 29,361 | | | Suncor Energy, Inc. (Oil, Gas & Consumable Fuels) | | | 881,071 | |

| | | | | | | | |

| | | | | | | 10,850,018 | |

| | |

| | China – 4.3% | |

| | 4,803 | | | Alibaba Group Holding Ltd. ADR* (Internet Software & Services) | | | 488,417 | |

| | 13,100 | | | Baidu, Inc. ADR* (Internet Software & Services) | | | 2,316,866 | |

| | 2,095,000 | | | CNOOC Ltd. (Oil, Gas & Consumable Fuels) | | | 2,636,084 | |

| | 72,890 | | | Ctrip.com International Ltd. ADR* (Internet & Direct Marketing Retail) | | | 3,218,094 | |

| | 153,840 | | | Tencent Holdings Ltd. (Internet Software & Services) | | | 4,077,117 | |

| | | | | | | | |

| | | | | | | 12,736,578 | |

| | |

| | Denmark – 3.9% | |

| | 4,264 | | | Carlsberg A/S Class B (Beverages) | | | 384,162 | |

| | 44,065 | | | Chr Hansen Holding A/S (Chemicals) | | | 2,638,959 | |

| | 43,697 | | | Coloplast A/S Class B (Health Care Equipment & Supplies) | | | 3,044,050 | |

| | 78,577 | | | Novo Nordisk A/S ADR (Pharmaceuticals) | | | 2,792,627 | |

| | 67,659 | | | Novozymes A/S (Chemicals) | | | 2,509,932 | |

| | | | | | | | |

| | | | | | | 11,369,730 | |

| | |

| | Common Stocks – (continued) | |

| | France – 11.1% | |

| | 12,735 | | | Air Liquide SA (Chemicals) | | $ | 1,294,037 | |

| | 33,913 | | | BNP Paribas SA (Banks) | | | 1,966,386 | |

| | 15,681 | | | Bureau Veritas SA (Professional Services) | | | 296,169 | |

| | 18,376 | | | Danone SA (Food Products) | | | 1,274,529 | |

| | 5,529 | | | Dassault Systemes (Software) | | | 437,635 | |

| | 223,632 | | | Engie SA (Multi-Utilities) | | | 3,225,157 | |

| | 23,671 | | | Essilor International SA (Health Care Equipment & Supplies) | | | 2,659,992 | |

| | 6,019 | | | Hermes International (Textiles, Apparel & Luxury Goods) | | | 2,438,330 | |

| | 3,166 | | | L’Oreal SA (Personal Products) | | | 567,218 | |

| | 29,810 | | | Legrand SA (Electrical Equipment) | | | 1,684,170 | |

| | 22,549 | | | LVMH Moet Hennessy Louis Vuitton SE (Textiles, Apparel & Luxury Goods) | | | 4,105,296 | |

| | 11,267 | | | Pernod Ricard SA (Beverages) | | | 1,339,909 | |

| | 30,393 | | | Sanofi (Pharmaceuticals) | | | 2,365,146 | |

| | 74,901 | | | Schneider Electric SE (Electrical Equipment) | | | 5,037,098 | |

| | 80,921 | | | TOTAL SA (Oil, Gas & Consumable Fuels) | | | 3,876,512 | |

| | | | | | | | |

| | | | | | | 32,567,584 | |

| | |

| | Germany – 5.0% | |

| | 14,285 | | | adidas AG (Textiles, Apparel & Luxury Goods) | | | 2,346,940 | |

| | 22,997 | | | BASF SE (Chemicals) | | | 2,030,128 | |

| | 17,752 | | | Bayer AG (Pharmaceuticals) | | | 1,762,589 | |

| | 12,198 | | | Beiersdorf AG (Personal Products) | | | 1,075,372 | |

| | 13,543 | | | Linde AG (Chemicals) | | | 2,236,851 | |

| | 6,692 | | | Merck KGaA (Pharmaceuticals) | | | 688,808 | |

| | 2,916 | | | MTU Aero Engines AG (Aerospace & Defense) | | | 304,500 | |

| | 10,254 | | | ProSiebenSat.1 Media SE (Media) | | | 441,929 | |

| | 42,162 | | | SAP SE (Software) | | | 3,714,448 | |

| | | | | | | | |

| | | | | | | 14,601,565 | |

| | |

| | Hong Kong – 2.1% | |

| | 235,600 | | | AIA Group Ltd. (Insurance) | | | 1,482,160 | |

| | 339,563 | | | China Merchants Holdings International Co. Ltd. (Transportation Infrastructure) | | | 877,914 | |

| | 322,000 | | | China Mobile Ltd. (Wireless Telecommunication Services) | | | 3,688,958 | |

| | 1,038,000 | | | Global Brands Group Holding Ltd.* (Textiles, Apparel & Luxury Goods) | | | 117,570 | |

| | 274,000 | | | Li & Fung Ltd. (Textiles, Apparel & Luxury Goods) | | | 134,692 | |

| | | | | | | | |

| | | | | | | 6,301,294 | |

| | |

| | India – 1.6% | |

| | 48,686 | | | HDFC Bank Ltd. ADR (Banks) | | | 3,445,995 | |

| | 33,412 | | | Housing Development Finance Corp. Ltd. (Thrifts & Mortgage Finance) | | | 690,022 | |

| | |

| | |

| 20 | | The accompanying notes are an integral part of these financial statements. |

MULTI-MANAGER INTERNATIONAL EQUITY FUND

| | | | | | | | |

Shares | | | Description | | Value | |

| | Common Stocks – (continued) | |

| | India – (continued) | |

| | 18,219 | | | Tata Consultancy Services Ltd. (IT Services) | | $ | 652,426 | |

| | | | | | | | |

| | | | | | | 4,788,443 | |

| | |

| | Ireland – 1.9% | |

| | 27,364 | | | Accenture PLC Class A (IT Services) | | | 3,180,791 | |

| | 29,325 | | | ICON PLC* (Life Sciences Tools & Services) | | | 2,354,211 | |

| | | | | | | | |

| | | | | | | 5,535,002 | |

| | |

| | Israel* – 0.2% | |

| | 7,352 | | | Check Point Software Technologies Ltd. (Software) | | | 621,685 | |

| | |

| | Italy – 0.3% | |

| | 32,019 | | | Eni SpA (Oil, Gas & Consumable Fuels) | | | 464,668 | |

| | 7,033 | | | Luxottica Group SpA (Textiles, Apparel & Luxury Goods) | | | 350,190 | |

| | | | | | | | |

| | | | | | | 814,858 | |

| | |

| | Japan – 11.7% | |

| | 25,500 | | | Asahi Group Holdings Ltd. (Beverages) | | | 909,609 | |

| | 5,500 | | | Daikin Industries Ltd. (Building Products) | | | 527,063 | |

| | 24,000 | | | Denso Corp. (Auto Components) | | | 1,044,360 | |

| | 42,900 | | | East Japan Railway Co. (Road & Rail) | | | 3,776,420 | |

| | 2,800 | | | FANUC Corp. (Machinery) | | | 512,645 | |

| | 674,000 | | | Hitachi Ltd. (Electronic Equipment, Instruments & Components) | | | 3,593,021 | |

| | 38,300 | | | Hoya Corp. (Health Care Equipment & Supplies) | | | 1,598,029 | |

| | 1,100 | | | Inpex Corp. (Oil, Gas & Consumable Fuels) | | | 10,262 | |

| | 88,800 | | | Japan Airlines Co. Ltd. (Airlines) | | | 2,620,647 | |

| | 23,200 | | | Japan Tobacco, Inc. (Tobacco) | | | 882,067 | |

| | 131,300 | | | KDDI Corp. (Wireless Telecommunication Services) | | | 3,990,621 | |

| | 5,150 | | | Keyence Corp. (Electronic Equipment, Instruments & Components) | | | 3,775,421 | |

| | 102,100 | | | Komatsu Ltd. (Machinery) | | | 2,272,654 | |

| | 32,500 | | | Kubota Corp. (Machinery) | | | 523,846 | |

| | 14,300 | | | Kyocera Corp. (Electronic Equipment, Instruments & Components) | | | 694,822 | |

| | 69,500 | | | Nikon Corp. (Household Durables) | | | 1,050,347 | |

| | 5,000 | | | Shin-Etsu Chemical Co. Ltd. (Chemicals) | | | 379,107 | |

| | 73,700 | | | Sumitomo Mitsui Financial Group, Inc. (Banks) | | | 2,555,301 | |

| | 37,495 | | | Sysmex Corp. (Health Care Equipment & Supplies) | | | 2,598,481 | |

| | 30,700 | | | TERUMO Corp. (Health Care Equipment & Supplies) | | | 1,187,223 | |

| | | | | | | | |

| | | | | | | 34,501,946 | |

| | |

| | Common Stocks – (continued) | |

| | Luxembourg* – 0.3% | |

| | 141,928 | | | ArcelorMittal (Metals & Mining) | | $ | 959,001 | |

| | |

| | Mexico – 0.5% | |

| | 742,665 | | | Wal-Mart de Mexico SAB de CV (Food & Staples Retailing) | | | 1,571,302 | |

| | |

| | Netherlands – 5.4% | |

| | 83,942 | | | Akzo Nobel NV (Chemicals) | | | 5,423,580 | |

| | 29,598 | | | Core Laboratories NV (Energy Equipment & Services) | | | 2,870,118 | |

| | 902 | | | Heineken NV (Beverages) | | | 74,296 | |

| | 153,468 | | | ING Groep NV (Banks) | | | 2,014,576 | |

| | 212,842 | | | PostNL NV* (Air Freight & Logistics) | | | 1,002,414 | |

| | 20,252 | | | Randstad Holding NV (Professional Services) | | | 1,041,618 | |

| | 76,346 | | | RELX NV (Professional Services) | | | 1,287,387 | |

| | 113,362 | | | Yandex NV Class A* (Internet Software & Services) | | | 2,232,098 | |

| | | | | | | | |

| | | | | | | 15,946,087 | |

| | |

| | Singapore – 0.4% | |

| | 75,400 | | | DBS Group Holdings Ltd. (Banks) | | | 812,714 | |

| | 105,100 | | | Singapore Telecommunications Ltd. (Diversified Telecommunication Services) | | | 292,906 | |

| | | | | | | | |

| | | | | | | 1,105,620 | |

| | |

| | South Africa – 1.0% | |

| | 190,748 | | | Shoprite Holdings Ltd. (Food & Staples Retailing) | | | 2,814,950 | |

| | |

| | South Korea – 2.3% | |

| | 8,606 | | | KT&G Corp. (Tobacco) | | | 848,811 | |

| | 4,392 | | | Samsung Electronics Co. Ltd. GDR (Technology Hardware, Storage & Peripherals) | | | 3,098,556 | |

| | 131,100 | | | SK Telecom Co. Ltd. ADR (Wireless Telecommunication Services) | | | 2,864,535 | |

| | | | | | | | |

| | | | | | | 6,811,902 | |

| | |

| | Spain – 1.4% | |

| | 13,490 | | | Amadeus IT Group SA (IT Services) | | | 634,891 | |

| | 592,202 | | | CaixaBank SA (Banks) | | | 1,786,903 | |

| | 46,384 | | | Industria de Diseno Textil SA (Specialty Retail) | | | 1,618,450 | |

| | | | | | | | |

| | | | | | | 4,040,244 | |

| | |

| | Sweden – 0.6% | |

| | 62,865 | | | Alfa Laval AB (Machinery) | | | 901,903 | |

| | 26,408 | | | Hennes & Mauritz AB (Specialty Retail) | | | 742,663 | |

| | | | | | | | |

| | | | | | | 1,644,566 | |

| | |

| | Switzerland – 12.5% | |

| | 91,476 | | | ABB Ltd.* (Electrical Equipment) | | | 1,887,188 | |

| | 47,382 | | | Aryzta AG* (Food Products) | | | 2,082,034 | |

| | 36,985 | | | Chubb Ltd. (Insurance) | | | 4,697,095 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 21 |

MULTI-MANAGER INTERNATIONAL EQUITY FUND

Schedule of Investments (continued)

October 31, 2016

| | | | | | | | |

Shares | | | Description | | Value | |

| | Common Stocks – (continued) | |

| | Switzerland – (continued) | |

| | 37,059 | | | Cie Financiere Richemont SA (Textiles, Apparel & Luxury Goods) | | $ | 2,382,518 | |

| | 37,638 | | | Clariant AG* (Chemicals) | | | 623,265 | |

| | 1,986 | | | Kuehne & Nagel International AG (Marine) | | | 269,187 | |

| | 87,172 | | | Nestle SA (Food Products) | | | 6,321,179 | |

| | 65,690 | | | Novartis AG (Pharmaceuticals) | | | 4,661,860 | |

| | 20,647 | | | Roche Holding AG (Pharmaceuticals) | | | 4,742,235 | |

| | 1,434 | | | SGS SA (Professional Services) | | | 2,902,549 | |

| | 1,953 | | | Sonova Holding AG (Health Care Equipment & Supplies) | | | 261,922 | |

| | 152,805 | | | UBS Group AG (Capital Markets) | | | 2,160,305 | |

| | 13,914 | | | Zurich Insurance Group AG* (Insurance) | | | 3,642,080 | |

| | | | | | | | |

| | | | | | | 36,633,417 | |

| | |

| | Taiwan – 2.3% | |

| | 29,466 | | | Hon Hai Precision Industry Co. Ltd. GDR (Electronic Equipment, Instruments & Components) | | | 159,409 | |

| | 212,275 | | | Taiwan Semiconductor Manufacturing Co. Ltd. ADR (Semiconductors & Semiconductor Equipment) | | | 6,601,752 | |

| | | | | | | | |

| | | | | | | 6,761,161 | |

| | |

| | United Kingdom – 17.3% | |

| | 587,220 | | | Aviva PLC (Insurance) | | | 3,182,013 | |

| | 411,169 | | | Balfour Beatty PLC (Construction & Engineering) | | | 1,363,233 | |

| | 1,336,548 | | | Barclays PLC (Banks) | | | 3,096,524 | |

| | 61,751 | | | British American Tobacco PLC (Tobacco) | | | 3,539,131 | |

| | 57,724 | | | Carnival PLC (Hotels, Restaurants & Leisure) | | | 2,784,195 | |

| | 402,472 | | | Cobham PLC (Aerospace & Defense) | | | 702,212 | |

| | 260,234 | | | Compass Group PLC (Hotels, Restaurants & Leisure) | | | 4,708,746 | |

| | 4,571 | | | Delphi Automotive PLC (Auto Components) | | | 297,435 | |

| | 107,251 | | | Diageo PLC (Beverages) | | | 2,854,650 | |

| | 175,576 | | | Experian PLC (Professional Services) | | | 3,375,367 | |

| | 89,732 | | | GlaxoSmithKline PLC (Pharmaceuticals) | | | 1,772,595 | |

| | 3,076,011 | | | Lloyds Banking Group PLC (Banks) | | | 2,148,049 | |

| | 172,092 | | | Prudential PLC (Insurance) | | | 2,808,347 | |

| | 68,579 | | | Reckitt Benckiser Group PLC (Household Products) | | | 6,135,112 | |

| | 15,403 | | | Rio Tinto PLC (Metals & Mining) | | | 535,644 | |

| | 2,142,685 | | | Rolls-Royce Holdings PLC* (Aerospace & Defense) | | | 414,610 | |

| | 168,209 | | | Royal Dutch Shell PLC Class B (Oil, Gas & Consumable Fuels) | | | 4,338,531 | |

| | 63,604 | | | Sky PLC (Media) | | | 635,865 | |

| | 21,233 | | | Smiths Group PLC (Industrial Conglomerates) | | | 367,929 | |

| | 98,659 | | | SSE PLC (Electric Utilities) | | | 1,918,231 | |

| | |

| | Common Stocks – (continued) | |

| | United Kingdom – (continued) | |

| | 721,580 | | | Vodafone Group PLC (Wireless Telecommunication Services) | | $ | 1,981,693 | |

| | 80,261 | | | WPP PLC (Media) | | | 1,742,711 | |

| | | | | | | | |

| | | | | | | 50,702,823 | |

| | |

| | United States – 0.3% | |

| | 11,297 | | | Yum! Brands, Inc. (Hotels, Restaurants & Leisure) | | | 974,705 | |

| | |

| | TOTAL COMMON STOCKS | | | | |

| | (Cost $273,338,702) | | $ | 273,694,291 | |

| | |

| | | | | | | | |

| | Preferred Stock – 1.7% | |

| | Germany – 1.7% | |

| | 36,368 | | | Volkswagen AG (Automobiles) | | | | |

| | (Cost $5,195,168) | | $ | 5,014,257 | |

| | |

| | | | | | | | | | | | | | |

Principal Amount | | | Interest

Rate | | | Maturity

Date | | | Value | |

| | Short-term Investment(a) – 5.0% | |

| | Repurchase Agreements – 5.0% | |

| Joint Repurchase Agreement Account II | |

| $ | 14,600,000 | | | | 0.338 | % | | | 11/01/16 | | | $ | 14,600,000 | |

| | (Cost $14,600,000) | | | | | |

| | |

| | TOTAL INVESTMENTS – 99.9% | |

| | (Cost $293,133,870) | | | $ | 293,308,548 | |

| | |

| OTHER ASSETS IN EXCESS OF

LIABILITIES – 0.1% |

| | | 311,627 | |

| | |

| | NET ASSETS – 100.0% | | | $ | 293,620,175 | |

| | |

| | |

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

* | | Non-income producing security. |

(a) | | Joint repurchase agreement was entered into on October 31, 2016. Additional information appears on page 31. |

| | |

|

Investment Abbreviations: |

ADR | | —American Depositary Receipt |

GDR | | —Global Depository Receipt |

PLC | | —Public Limited Company |

|

| | |

| 22 | | The accompanying notes are an integral part of these financial statements. |

MULTI-MANAGER U.S. DYNAMIC EQUITY FUND

Schedule of Investments

October 31, 2016

| | | | | | | | |

Shares | | | Description | | Value | |

| | Common Stocks – 94.2% | |

| | Aerospace & Defense – 1.1% | |

| | 12,214 | | | Airbus Group SE | | $ | 725,266 | |

| | 2,590 | | | TransDigm Group, Inc. | | | 705,671 | |

| | | | | | | | |

| | | | | | | 1,430,937 | |

| | |

| | Air Freight & Logistics – 1.8% | |

| | 14,054 | | | FedEx Corp. | | | 2,449,893 | |

| | |

| | Airlines – 0.6% | |

| | 11,814 | | | Alaska Air Group, Inc. | | | 853,207 | |

| | |

| | Auto Components – 0.2% | |

| | 4,215 | | | Delphi Automotive PLC | | | 274,270 | |

| | |

| | Banks – 8.5% | |

| | 272,057 | | | Bank of America Corp. | | | 4,488,940 | |

| | 32,800 | | | Bank of the Ozarks, Inc. | | | 1,212,288 | |

| | 35,057 | | | JPMorgan Chase & Co. | | | 2,428,048 | |

| | 61,991 | | | Wells Fargo & Co. | | | 2,852,206 | |

| | 17,110 | | | Western Alliance Bancorp* | | | 639,230 | |

| | | | | | | | |

| | | | | | | 11,620,712 | |

| | |

| | Beverages – 2.6% | |

| | 16,716 | | | Constellation Brands, Inc. Class A | | | 2,793,578 | |

| | 6,835 | | | Molson Coors Brewing Co. Class B | | | 709,541 | |

| | | | | | | | |

| | | | | | | 3,503,119 | |

| | |

| | Biotechnology – 2.0% | |

| | 19,452 | | | Amgen, Inc. | | | 2,745,844 | |

| | |

| | Capital Markets – 2.6% | |

| | 17,276 | | | Affiliated Managers Group, Inc.* | | | 2,291,834 | |

| | 2,493 | | | Intercontinental Exchange, Inc. | | | 674,082 | |

| | 43,639 | | | OM Asset Management PLC | | | 614,001 | |

| | | | | | | | |

| | | | | | | 3,579,917 | |

| | |

| | Chemicals – 2.0% | |

| | 9,869 | | | The Sherwin-Williams Co. | | | 2,416,523 | |

| | 14,901 | | | Valvoline, Inc.* | | | 303,981 | |

| | | | | | | | |

| | | | | | | 2,720,504 | |

| | |

| | Commercial Services & Supplies* – 0.5% | |

| | 12,925 | | | Copart, Inc. | | | 678,175 | |

| | |

| | Communications Equipment – 2.1% | |

| | 34,900 | | | Cisco Systems, Inc. | | | 1,070,732 | |

| | 18,953 | | | Juniper Networks, Inc. | | | 499,222 | |

| | 11,025 | | | Motorola Solutions, Inc. | | | 800,195 | |

| | 30,891 | | | Radware Ltd.* | | | 417,337 | |

| | | | | | | | |

| | | | | | | 2,787,486 | |

| | |

| | Consumer Finance – 1.8% | |

| | 36,142 | | | American Express Co. | | | 2,400,552 | |

| | |

| | Containers & Packaging* – 0.6% | |

| | 14,040 | | | Crown Holdings, Inc. | | | 761,670 | |

| | |

| | Diversified Financial Services* – 3.5% | |

| | 33,063 | | | Berkshire Hathaway, Inc. Class B | | | 4,770,991 | |

| | |

| | Common Stocks – (continued) | |

| | Diversified Telecommunication Services(a) – 0.9% | |

| | 34,642 | | | Cellnex Telecom SAU | | $ | 568,094 | |

| | 10,455 | | | Sunrise Communications Group AG* | | | 714,341 | |

| | | | | | | | |

| | | | | | | 1,282,435 | |

| | |

| | Electronic Equipment, Instruments & Components – 0.4% | |

| | 17,135 | | | FLIR Systems, Inc. | | | 564,084 | |

| | |

| | Food & Staples Retailing – 1.7% | |

| | 27,180 | | | Walgreens Boots Alliance, Inc. | | | 2,248,601 | |

| | |

| | Food Products – 1.0% | |

| | 18,414 | | | Nestle SA | | | 1,335,270 | |

| | |

| | Health Care Equipment & Supplies – 0.9% | |

| | 7,426 | | | Becton Dickinson & Co. | | | 1,246,900 | |

| | |

| | Health Care Providers & Services – 3.4% | |

| | 8,037 | | | Acadia Healthcare Co., Inc.* | | | 289,010 | |

| | 28,702 | | | Express Scripts Holding Co.* | | | 1,934,515 | |

| | 7,655 | | | HCA Holdings, Inc.* | | | 585,837 | |

| | 8,700 | | | Laboratory Corp. of America Holdings* | | | 1,090,458 | |

| | 5,963 | | | Universal Health Services, Inc. Class B | | | 719,794 | |

| | | | | | | | |

| | | | | | | 4,619,614 | |

| | |

| | Hotels, Restaurants & Leisure – 2.1% | |

| | 42,205 | | | ILG, Inc. | | | 691,318 | |

| | 14,842 | | | McDonald’s Corp. | | | 1,670,764 | |

| | 10,036 | | | Starbucks Corp. | | | 532,610 | |

| | | | | | | | |

| | | | | | | 2,894,692 | |

| | |

| | Household Durables – 2.8% | |

| | 22,555 | | | Lennar Corp. Class A | | | 940,318 | |

| | 1,892 | | | NVR, Inc.* | | | 2,881,516 | |

| | | | | | | | |

| | | | | | | 3,821,834 | |

| | |

| | Household Products – 0.5% | |

| | 8,360 | | | The Procter & Gamble Co. | | | 725,648 | |

| | |

| | Insurance – 2.4% | |

| | 35,686 | | | Aflac, Inc. | | | 2,457,695 | |

| | 4,500 | | | Aon PLC | | | 498,735 | |

| | 2,645 | | | Willis Towers Watson PLC | | | 333,005 | |

| | | | | | | | |

| | | | | | | 3,289,435 | |

| | |

| | Internet & Direct Marketing Retail* – 0.7% | |

| | 53,300 | | | Liberty Interactive Corp. QVC Group Class A | | | 985,517 | |

| | |

| | Internet Software & Services* – 4.0% | |

| | 1,570 | | | Alphabet, Inc. Class A | | | 1,271,543 | |

| | 1,290 | | | Alphabet, Inc. Class C | | | 1,012,057 | |

| | 111,107 | | | eBay, Inc. | | | 3,167,660 | |

| | | | | | | | |

| | | | | | | 5,451,260 | |

| | |

| | IT Services – 3.9% | |

| | 12,894 | | | Accenture PLC Class A | | | 1,498,799 | |

| | 21,258 | | | CSRA, Inc. | | | 533,363 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 23 |

MULTI-MANAGER U.S. DYNAMIC EQUITY FUND

Schedule of Investments (continued)

October 31, 2016

| | | | | | | | |

Shares | | | Description | | Value | |

| | Common Stocks – (continued) | |

| | IT Services – (continued) | |

| | 10,375 | | | MasterCard, Inc. Class A | | $ | 1,110,332 | |

| | 53,415 | | | PayPal Holdings, Inc.* | | | 2,225,269 | |

| | | | | | | | |

| | | | | | | 5,367,763 | |

| | |

| | Machinery – 1.2% | |

| | 19,455 | | | Allison Transmission Holdings, Inc. | | | 569,837 | |

| | 31,385 | | | Colfax Corp.* | | | 997,729 | |

| | | | | | | | |

| | | | | | | 1,567,566 | |

| | |

| | Media – 14.8% | |

| | 25,069 | | | Comcast Corp. Class A | | | 1,549,766 | |

| | 30,067 | | | Discovery Communications, Inc. Class A* | | | 785,049 | |

| | 14,000 | | | Discovery Communications, Inc. Class C* | | | 351,540 | |

| | 34,866 | | | DISH Network Corp. Class A* | | | 2,041,753 | |

| | 96,726 | | | Gannett Co., Inc. | | | 751,561 | |

| | 29,303 | | | JCDecaux SA | | | 896,146 | |

| | 25,000 | | | Liberty Broadband Corp. Class C* | | | 1,666,250 | |

| | 10,200 | | | Liberty Global PLC LiLAC Class C* | | | 281,928 | |

| | 46,000 | | | Liberty Global PLC Series C* | | | 1,462,800 | |

| | 29,600 | | | Liberty Media Corp.-Liberty SiriusXM Class C* | | | 982,424 | |

| | 37,584 | | | News Corp. Class A | | | 455,518 | |

| | 8,039 | | | Scripps Networks Interactive, Inc. Class A | | | 517,390 | |

| | 110,538 | | | TEGNA, Inc. | | | 2,168,755 | |

| | 2,520 | | | The Madison Square Garden Co. Class A* | | | 417,035 | |

| | 18,759 | | | The Walt Disney Co. | | | 1,738,772 | |

| | 32,236 | | | Time Warner, Inc. | | | 2,868,682 | |

| | 46,000 | | | Twenty-First Century Fox, Inc. Class A | | | 1,208,420 | |

| | | | | | | | |

| | | | | | | 20,143,789 | |

| | |

| | Mortgage Real Estate Investment Trusts (REITs) – 0.6% | |

| | 54,500 | | | Redwood Trust, Inc. | | | 766,270 | |

| | |

| | Multiline Retail – 0.9% | |

| | 8,000 | | | J.C. Penney Co., Inc.* | | | 68,720 | |

| | 21,013 | | | Nordstrom, Inc. | | | 1,092,676 | |

| | | | | | | | |

| | | | | | | 1,161,396 | |

| | |

| | Oil, Gas & Consumable Fuels – 0.8% | |

| | 2,600 | | | Pioneer Natural Resources Co. | | | 465,452 | |

| | 18,000 | | | Range Resources Corp. | | | 608,220 | |

| | | | | | | | |

| | | | | | | 1,073,672 | |

| | |

| | Personal Products – 0.3% | |

| | 54,310 | | | Avon Products, Inc. | | | 355,731 | |

| | |

| | Pharmaceuticals – 8.1% | |

| | 22,197 | | | Allergan PLC* | | | 4,637,841 | |

| | 6,691 | | | Bristol-Myers Squibb Co. | | | 340,639 | |

| | 8,594 | | | Johnson & Johnson | | | 996,818 | |

| | 1,125 | | | Mallinckrodt PLC* | | | 66,668 | |

| | 30,659 | | | Merck & Co., Inc. | | | 1,800,296 | |

| | |

| | Common Stocks – (continued) | |

| | Pharmaceuticals – (continued) | |

| | 74,266 | | | Pfizer, Inc. | | $ | 2,354,975 | |

| | 16,375 | | | Zoetis, Inc. | | | 782,725 | |

| | | | | | | | |

| | | | | | | 10,979,962 | |

| | |

| | Semiconductors & Semiconductor Equipment – 1.4% | |

| | 8,573 | | | Mellanox Technologies Ltd.* | | | 372,068 | |

| | 8,820 | | | Skyworks Solutions, Inc. | | | 678,611 | |

| | 2,881 | | | Synaptics, Inc.* | | | 150,158 | |

| | 9,500 | | | Texas Instruments, Inc. | | | 673,075 | |

| | | | | | | | |

| | | | | | | 1,873,912 | |

| | |

| | Software – 4.8% | |

| | 442 | | | CommVault Systems, Inc.* | | | 23,647 | |

| | 62,348 | | | Oracle Corp. | | | 2,395,410 | |

| | 36,220 | | | PTC, Inc.* | | | 1,718,277 | |

| | 30,227 | | | Verint System, Inc.* | | | 1,088,172 | |

| | 17,379 | | | VMware, Inc. Class A* | | | 1,365,989 | |

| | | | | | | | |

| | | | | | | 6,591,495 | |

| | |

| | Specialty Retail – 2.5% | |

| | 4,235 | | | Advance Auto Parts, Inc. | | | 593,239 | |

| | 19,587 | | | Cabela’s, Inc.* | | | 1,206,755 | |

| | 13,569 | | | The Home Depot, Inc. | | | 1,655,554 | |

| | | | | | | | |

| | | | | | | 3,455,548 | |

| | |

| | Technology Hardware, Storage & Peripherals – 3.4% | |

| | 70,651 | | | NetApp, Inc. | | | 2,397,895 | |

| | 37,692 | | | Western Digital Corp. | | | 2,202,721 | |

| | | | | | | | |

| | | | | | | 4,600,616 | |

| | |

| | Textiles, Apparel & Luxury Goods* – 0.5% | |

| | 4,475 | | | Deckers Outdoor Corp. | | | 233,550 | |

| | 16,870 | | | Fossil Group, Inc. | | | 460,045 | |

| | | | | | | | |

| | | | | | | 693,595 | |

| | |

| | Wireless Telecommunication Services – 0.3% | |

| | 113,760 | | | VimpelCom Ltd. ADR | | | 379,958 | |

| | |

| | TOTAL COMMON STOCKS | | | | |

| | (Cost $122,797,496) | | $ | 128,053,840 | |

| | |

| | | | | | | | | | | | | | |

Principal Amount | | | Interest

Rate | | | Maturity

Date | | | Value | |

| | Short-term Investment(b) – 4.0% | |

| | Repurchase Agreements – 4.0% | |

| Joint Repurchase Agreement Account II | |

| $ | 5,500,000 | | | | 0.338 | % | | | 11/01/16 | | | $ | 5,500,000 | |

| | (Cost $5,500,000) | | | | | |

| | |

| | TOTAL INVESTMENTS – 98.2% | | | | | |

| | (Cost $128,297,496) | | | $ | 133,553,840 | |

| | |

| OTHER ASSETS IN EXCESS OF

LIABILITIES – 1.8% |

| | | 2,441,794 | |

| | |

| | NET ASSETS – 100.0% | | | $ | 135,995,634 | |

| | |

| | |

| 24 | | The accompanying notes are an integral part of these financial statements. |

MULTI-MANAGER U.S. DYNAMIC EQUITY FUND

| | |

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

* | | Non-income producing security. |

(a) | | Exempt from registration under Rule 144A of the Securities Act of 1933. Such securities have been deemed liquid by an Underlying Manager and may be resold, normally to qualified institutional buyers in transactions exempt from registration. Total market value of Rule 144A securities amounts to $1,282,435, which represents approximately 0.9% of net assets as of October 31, 2016. |

(b) | | Joint repurchase agreement was entered into on October 31, 2016. Additional information appears on page 31. |

| | |

|

Currency Abbreviations: |

CHF | | —Swiss Franc |

EUR | | —Euro |

USD | | —U.S. Dollar |

| | |

Investment Abbreviations: |

ADR | | —American Depositary Receipt |

PLC | | —Public Limited Company |

|

| | |

| The accompanying notes are an integral part of these financial statements. | | 25 |

MULTI-MANAGER U.S. DYNAMIC EQUITY FUND

Schedule of Investments (continued)

October 31, 2016

|

| ADDITIONAL INVESTMENT INFORMATION |

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS — At October 31, 2016, the Fund had the following forward foreign currency exchange contracts:

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS WITH UNREALIZED GAIN

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Counterparty | | Currency

Purchased | | | Currency

Sold | | | Current

Value | | | Settlement

Date | | | Unrealized

Gain | |

Morgan Stanley & Co. | | USD | | | 857,064 | | | | CHF | | | | 840,000 | | | $ | 849,591 | | | | 11/17/16 | | | $ | 7,473 | |

| | | USD | | | 3,137,656 | | | | EUR | | | | 2,819,000 | | | | 3,096,653 | | | | 11/17/16 | | | | 41,002 | |

| TOTAL | | | | | | | $ | 48,475 | |

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS WITH UNREALIZED LOSS

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Counterparty | | Currency

Purchased | | | Currency

Sold | | | Current

Value | | | Settlement

Date | | | Unrealized

Loss | |

Morgan Stanley & Co. | | CHF | | | 135,000 | | | | USD | | | | 138,703 | | | $ | 136,541 | | | | 11/17/16 | | | | (2,162 | ) |

| | EUR | | | 1,362,000 | | | | USD | | | | 1,518,633 | | | | 1,496,150 | | | | 11/17/16 | | | | (22,484 | ) |

| | | USD | | | 588,942 | | | | EUR | | | | 538,000 | | | | 590,990 | | | | 11/17/16 | | | | (2,047 | ) |

| TOTAL | | | | | | | $ | (26,693 | ) |

| | |

| 26 | | The accompanying notes are an integral part of these financial statements. |

MULTI-MANAGER U.S. SMALL CAP EQUITY FUND

Schedule of Investments

October 31, 2016

| | | | | | | | |

Shares | | | Description | | Value | |

| | Common Stocks – 94.9% | |

| | Aerospace & Defense – 4.4% | |

| | 20,491 | | | Astronics Corp.* | | $ | 758,577 | |

| | 3,049 | | | Astronics Corp. Class B* | | | 112,798 | |

| | 7,068 | | | BE Aerospace, Inc. | | | 420,687 | |

| | 6,096 | | | Cubic Corp. | | | 260,299 | |

| | 3,386 | | | Curtiss-Wright Corp. | | | 303,453 | |

| | 12,732 | | | DigitalGlobe, Inc.* | | | 319,573 | |

| | 24,280 | | | HEICO Corp. | | | 1,640,357 | |

| | 19,846 | | | Hexcel Corp. | | | 902,795 | |

| | 10,551 | | | KLX, Inc.* | | | 363,166 | |

| | 2,414 | | | The KEYW Holding Corp.* | | | 25,323 | |

| | 48,264 | | | Wesco Aircraft Holdings, Inc.* | | | 620,192 | |

| | | | | | | | |

| | | | | | | 5,727,220 | |

| | |

| | Auto Components – 2.8% | |

| | 23,654 | | | American Axle & Manufacturing Holdings, Inc.* | | | 423,880 | |

| | 15,458 | | | Dorman Products, Inc.* | | | 993,022 | |

| | 23,899 | | | Drew Industries, Inc. | | | 2,140,155 | |

| | | | | | | | |

| | | | | | | 3,557,057 | |

| | |

| | Automobiles – 0.2% | |

| | 3,739 | | | Thor Industries, Inc. | | | 296,540 | |

| | |

| | Banks – 5.3% | |

| | 24,761 | | | Banc of California, Inc. | | | 329,321 | |

| | 29,730 | | | Bank of the Ozarks, Inc. | | | 1,098,821 | |

| | 14,189 | | | Columbia Banking System, Inc. | | | 468,521 | |

| | 21,878 | | | ConnectOne Bancorp, Inc. | | | 401,461 | |

| | 23,374 | | | Eagle Bancorp, Inc.* | | | 1,148,832 | |

| | 10,592 | | | FCB Financial Holdings, Inc. Class A* | | | 395,082 | |

| | 1,937 | | | First Citizens BancShares, Inc. Class A | | | 563,667 | |

| | 11,229 | | | Hanmi Financial Corp. | | | 280,725 | |

| | 31,769 | | | Home BancShares, Inc. | | | 683,351 | |

| | 27,963 | | | LegacyTexas Financial Group, Inc. | | | 956,614 | |

| | 8,613 | | | Prosperity Bancshares, Inc. | | | 477,763 | |

| | | | | | | | |

| | | | | | | 6,804,158 | |

| | |

| | Beverages* – 0.2% | |

| | 1,237 | | | The Boston Beer Co., Inc. Class A | | | 192,044 | |

| | |

| | Biotechnology* – 1.4% | |

| | 8,031 | | | Acceleron Pharma, Inc. | | | 225,109 | |

| | 10,503 | | | Alder Biopharmaceuticals, Inc. | | | 254,698 | |

| | 7,246 | | | BeiGene Ltd. ADR | | | 240,857 | |

| | 10,217 | | | Coherus Biosciences, Inc. | | | 279,435 | |

| | 7,673 | | | Neurocrine Biosciences, Inc. | | | 335,847 | |

| | 7,421 | | | Ultragenyx Pharmaceutical, Inc. | | | 437,765 | |

| | | | | | | | |

| | | | | | | 1,773,711 | |

| | |

| | Building Products* – 0.5% | |

| | 13,971 | | | Builders FirstSource, Inc. | | | 135,100 | |

| | 9,358 | | | Patrick Industries, Inc. | | | 536,681 | |

| | | | | | | | |

| | | | | | | 671,781 | |

| | |

| | Common Stocks – (continued) | |

| | Capital Markets – 0.8% | |

| | 1,688 | | | Diamond Hill Investment Group, Inc. | | $ | 307,233 | |

| | 19,283 | | | Stifel Financial Corp.* | | | 754,736 | |

| | | | | | | | |

| | | | | | | 1,061,969 | |

| | |

| | Chemicals – 1.5% | |

| | 9,843 | | | Balchem Corp. | | | 747,084 | |

| | 3,341 | | | Cabot Corp. | | | 174,200 | |

| | 11,204 | | | Ferro Corp.* | | | 145,204 | |

| | 7,703 | | | Minerals Technologies, Inc. | | | 517,641 | |

| | 15,304 | | | Olin Corp. | | | 335,617 | |

| | | | | | | | |

| | | | | | | 1,919,746 | |

| | |

| | Commercial Services & Supplies – 3.5% | |

| | 15,835 | | | ABM Industries, Inc. | | | 618,832 | |

| | 5,220 | | | G&K Services, Inc. Class A | | | 494,334 | |

| | 18,172 | | | Healthcare Services Group, Inc. | | | 671,819 | |