UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22781

Goldman Sachs Trust II

(Exact name of registrant as specified in charter)

71 South Wacker Drive,

Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| | |

Copies to: |

Caroline Kraus | | Geoffrey R.T. Kenyon, Esq. |

Goldman, Sachs & Co. | | Dechert LLP |

200 West Street | | 100 Oliver Street |

New York, New York 10282 | | 40th Floor |

| | Boston, MA 02110-2605 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: October 31

Date of reporting period: October 31, 2015

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Annual Report to Shareholders is filed herewith. |

Goldman Sachs Funds

| | | | |

| | |

| Annual Report | | | | October 31, 2015 |

| | |

| | | | Strategic Multi-Asset Class Funds |

| | | | Multi-Manager Global Equity |

| | | | Multi-Manager Non-Core Fixed Income |

| | | | Multi-Manager Real Assets Strategy |

Goldman Sachs Strategic

Multi-Asset Class Funds

| n | | MULTI-MANAGER GLOBAL EQUITY |

| n | | MULTI-MANAGER NON-CORE FIXED INCOME |

| n | | MULTI-MANAGER REAL ASSETS STRATEGY |

| | | | |

TABLE OF CONTENTS | | | | |

| |

Principal Investment Strategies and Risks | | | 1 | |

| |

Portfolio Management Discussion and Performance Summaries | | | 3 | |

| |

Schedules of Investments | | | 21 | |

| |

Financial Statements | | | 53 | |

| |

Financial Highlights | | | 56 | |

| |

Notes to Financial Statements | | | 62 | |

| |

Report of Independent Registered Public Accounting Firm | | | 79 | |

| |

Other Information | | | 80 | |

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

GOLDMAN SACHS STRATEGIC MULTI-ASSET CLASS FUNDS

Principal Investment Strategies and Risks

This is not a complete list of risks that may affect the Funds. For additional information concerning the risks applicable to the Funds, please see the Funds’ Prospectus.

The Goldman Sachs Multi-Manager Global Equity Fund invests primarily in equity investments of U.S. and non-U.S. companies. The Fund allocates its assets among multiple investment managers who are unaffiliated with the Investment Adviser. The Fund’s equity investments are subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors or governments and/or general economic conditions. Foreign and emerging markets securities may be more volatile and less liquid than investments in U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments. The securities of mid- and small-capitalization companies involve greater risks than those associated with larger, more established companies and may be subject to more abrupt or erratic price movements. Derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; risk of default by a counterparty; and liquidity risk. The Fund’s use of derivatives may result in leverage, which can make the Fund more volatile. At times, the Fund may be unable to sell certain of its illiquid investments without a substantial drop in price, if at all.

The Goldman Sachs Multi-Manager Non-Core Fixed Income Fund invests primarily in fixed income securities, which may be represented by forwards or other derivatives such as options, futures contracts or swap agreements. The Fund allocates its assets among multiple investment managers who are unaffiliated with the Investment Adviser. Investments in fixed income securities are subject to the risks associated with debt securities generally, including credit, interest rate, liquidity, call and extension risk. The Fund may invest in non-investment grade securities and distressed securities. High yield, lower rated investments involve greater price volatility and present greater risks than higher rated fixed income securities. Foreign and emerging markets investments may be more volatile and less liquid than investments in U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments. Derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; the risk of default by a counterparty; and liquidity risk. At times, the Fund may be unable to sell certain of its illiquid investments without a substantial drop in price, if at all. The Fund’s borrowing and use of derivatives result in leverage, which can make the Fund more volatile. The Fund is “non-diversified” and may invest more of its assets in fewer issuers than “diversified” funds. Accordingly, the Fund may be more susceptible to adverse developments affecting any single issuer held in its portfolio and to greater losses resulting from these developments.

The Goldman Sachs Multi-Manager Real Assets Strategy Fund invests primarily in “real assets”, which includes investments in companies and derivatives (futures, options, swaps and other instruments) that provide exposure to real assets. Real assets are defined broadly by the Fund and include any assets that have physical properties or inflation sensitive characteristics, such as energy, real estate, infrastructure, commodities, and inflation-linked or floating rate fixed income securities. The Fund allocates its assets among multiple investment managers who are unaffiliated with the Investment Adviser. The Fund is subject to market risk, which means that the value of the securities in which it invests may go up or down in response to the prospects of individual companies, particular sectors and/or general economic conditions. Foreign and emerging markets investments may be more volatile and less liquid than investments in U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments. Because the Fund concentrates its investments in the real estate group of industries, the Fund is subject to greater risk of loss as a result of adverse economic, business or other developments affecting industries within those industries than if its

1

GOLDMAN SACHS STRATEGIC MULTI-ASSET CLASS FUNDS

investments were more diversified across different industries. Investments in fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity and interest rate risk.

The Fund primarily gains exposure to the commodities markets by investing in a wholly-owned subsidiary of the Fund organized as a company under the laws of the Cayman Islands (the “Subsidiary”). The Subsidiary primarily obtains its commodity exposure by investing in commodity-linked derivative instruments (which may include total return swaps). The Subsidiary also invests in other instruments, including fixed income securities, either as investments or to serve as margin or collateral for its swap positions. The Fund is subject to the risk that exposure to the commodities markets may subject the Fund to greater volatility than investments in traditional securities. The Fund is subject to tax risk as a result of its investments in the Subsidiary, as the Fund has not received a private letter ruling from the Internal Revenue Service (“IRS”) concluding that income and gains from such investments are “qualifying income.” The IRS has suspended granting such private letter rulings, and the Fund cannot rely on private letter rulings granted to other taxpayers. The tax treatment of investments in the Subsidiary may be adversely affected by future legislation and/or IRS guidance. While the Fund has obtained an opinion of counsel regarding such investments, if the IRS were to successfully assert that the Fund’s income from such investments was not “qualifying income,” in which case the Fund would fail to qualify as a regulated investment company, the Fund would be subject to federal and state income tax on all of its taxable income at regular corporate tax rates with no deduction for any distributions paid to shareholders, which would significantly adversely affect the returns to Fund shareholders.

Derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; the risk of default by a counterparty; and liquidity risk. The Fund’s use of derivatives may result in leverage, which can make the Fund more volatile. At times, the Fund may be unable to sell certain of its illiquid investments without a substantial drop in price, if at all.

2

PORTFOLIO RESULTS

Goldman Sachs Multi-Manager

Global Equity Fund

Investment Objective

The Fund seeks to provide long-term capital growth.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Global Portfolio Solutions (“GPS”) and Alternative Investments & Manager Selection (“AIMS”) Groups discuss the Goldman Sachs Multi-Manager Global Equity Fund’s (the “Fund”) performance and positioning for the period from inception on June 24, 2015 through October 31, 2015 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Institutional Shares generated a cumulative total return of -5.40%. This return compares to the -5.03% cumulative total return of the Fund’s benchmark, the MSCI All Country World Index Investable Market Index (“ACWI IMI”) (Net, USD, 50% Non-U.S. Developed Hedged to USD) (the “Index”) during the same time period. |

| Q | | What economic and market factors most influenced the global equity markets as a whole during the Reporting Period? |

| A | | U.S. economic data continued to recover, albeit sluggishly, during the Reporting Period. Underlying second quarter 2015 Gross Domestic Product (“GDP”) growth was strong at 3.9% year over year, driven largely by an increase in exports as well as by positive numbers in housing and consumer spending. Third quarter 2015 GDP growth decelerated to 1.5% year over year, based on advance estimates, primarily due to an inventory drag. However, economists generally believe the inventory downturn to be temporary, and the majority appear to be encouraged by solid domestic consumer spending. (Inventory is defined as finished product that is ready for sale, but has not been sold yet. Inventory is considered a current asset and shown on the balance sheet, generally at cost. On the scale of the national economy, changes in inventory levels can impact GDP.) |

| | | Despite these numbers, uncertainty surrounding the Federal Reserve’s (the “Fed”) rate hike timing, combined with fears of a slowdown in China and other emerging markets, resulted in a dramatic sell-off in equity markets globally in August and September 2015. In the U.S., the most weakness was observed in the health care sector, particularly in the biotechnology industry, which declined approximately 8% as measured by the S&P 500 Index and approximately 23% in the Russell 2000 Index during the Reporting Period. Energy names declined approximately 10% in the S&P 500 Index and approximately 28% in the Russell 2000 Index. While U.S. equities rallied in October 2015, driven largely by rebounds in information technology, consumer discretionary, health care and energy, the S&P 500 Index ended the Reporting Period down approximately 1%, while the Russell 2000 Index was down approximately 9%. |

| | | Internationally, we saw the most weakness in the energy and materials sectors. The energy sector declined approximately 12% in the MSCI Europe, Australasia and Far East (“EAFE”) Index and approximately 19% in the MSCI Emerging Markets Index during the Reporting Period. The materials sector was down approximately 16% in both the MSCI EAFE Index and the MSCI Emerging Markets Index during the Reporting Period. Weak Chinese economic data weighed heavily on emerging markets, and Chinese equities fell approximately 19% in the MSCI Emerging Markets Index during the Reporting Period. Brazil was also an area of focus, as the country’s debt was downgraded by independent ratings agency Standard & Poor’s Ratings Services to non-investment grade in September 2015. Brazilian equities were down approximately 31% in the MSCI Emerging Markets Index during the Reporting Period. Australian equities, which declined approximately 14% in the MSCI EAFE Index during the Reporting Period, significantly underperformed given weakness in commodity markets. Japanese equities, down approximately 4% in the MSCI EAFE Index during the Reporting Period, succumbed to the global equity sell-off in September 2015, yet still managed to lead other regions, as the country benefited from positive market reception to governmental reforms and pension inflows into its equity market during the first half of 2015. A strong U.S. dollar weighed on corporate earnings, particularly for companies with significant international exposure. |

3

PORTFOLIO RESULTS

| | | International equities enjoyed a strong month in October 2015, largely driven by information technology, energy and materials, as the price of oil modestly increased. Despite the global equity market rebound, major international indices largely trended downward for the Reporting Period overall. The MSCI EAFE Index was down approximately 7%, while the MSCI Emerging Markets Index was down approximately 13% during the Reporting Period as a whole. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund’s performance during the Reporting Period can be attributed to the performance of the Fund’s Underlying Managers, who are unaffiliated investment managers that employ a global equity investment strategy. During the Reporting Period, the Fund allocated capital to eight Underlying Managers — Causeway Capital Management LLC (“Causeway”), Epoch Investment Partners, Inc. (“Epoch”), Fisher Asset Management, LLC (“Fisher”), GW&K Investment Management, LLC (“GW&K”), Robeco Investment Management, Inc. doing business as Boston Partners (“Boston Partners”), Scharf Investments, LLC (“Scharf”); Vulcan Value Partners, LLC (“Vulcan”) and WCM Investment Management (“WCM”). These eight Underlying Managers represented five asset classes across global equity as part of the Fund’s top-level strategy allocation — U.S. large cap (Scharf and Vulcan), EAFE large cap (Causeway and WCM), U.S. small cap (GW&K and Boston Partners), EAFE small cap (Epoch) and emerging markets (Fisher). Of the eight Underlying Managers with allocated capital during the Reporting Period, all eight generated negative absolute returns amidst the sell-off in global equity markets. |

| | | Parametric Portfolio Associates LLC (“Parametric”) was approved by the Fund’s Board but did not have assets allocated to it during the Reporting Period. |

| | | The Fund additionally uses Russell Implementation Services Inc. (“Russell”) for a currency overlay program given the hedged nature of the Fund’s benchmark. The Fund also had exposure to two exchange-traded funds during the Reporting Period. |

| | | Of the five global equity asset classes to which the Fund had exposure via Underlying Manager strategies during the Reporting Period, all five generated negative absolute returns amidst persistent market pressure. Performance relative to the Index was mainly driven by strategic asset allocation, which reflects a longer-term perspective to diversify and invest across global equity markets, and manager selection. We would note that while the Fund posted muted performance since inception, we do not consider the brief Reporting Period to be a strong indicator of Fund performance in light of the impact of short-term market dynamics. |

| | | That said, strategic asset allocation performance relative to the Index had a positive effect on the Fund’s results, as an overweight to EAFE small cap relative to U.S. large cap bolstered performance. |

| | | Manager selection detracted from the Fund’s performance relative to the Index during the Reporting Period. The weakest relative performance came from U.S. equity Underlying Manager Vulcan, who significantly underperformed the S&P 500 Index, the primary index to which we compare this Underlying Manager. This was partially offset by international growth-oriented Underlying Manager WCM, who outperformed the Morgan Stanley Capital International All Country World Index ex-U.S. (“MSCI ACWI ex-U.S.”), the index to which we compare this Underlying Manager. |

| Q | | Which global equity asset classes most significantly affected Fund performance? |

| A | | From an absolute return perspective, EAFE large cap had the most significant effect on the Fund’s negative performance during the Reporting Period, followed by emerging markets. As mentioned earlier, uncertainty around the timing of interest rate hikes, combined with fears of an economic slowdown in China and other emerging markets, resulted in volatility across most global equity markets during the Reporting Period. |

| | | Also relative to the Index, EAFE large cap detracted most. This was due to significant underperformance by value- oriented Underlying Manager Causeway, whose results were only partially offset by stronger relative performance by growth-oriented Underlying Manager WCM. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | Russell manages a currency overlay allocation that seeks to minimize unintended currency exposures that either reduce performance or increase risk of the Fund’s portfolio. Russell uses currency forwards as part of this strategy. Outside of Russell, the Fund did not use derivatives during the Reporting Period. |

4

PORTFOLIO RESULTS

| Q | | Were there any notable changes in the Fund’s allocations during the Reporting Period? |

| A | | Given the Fund’s launch on June 24, 2015, it was not a matter of making changes but of building the Fund’s portfolio via allocating assets to Underlying Managers. |

| | | Throughout the Reporting Period, the Fund’s assets were allocated 33% to U.S. large cap, 28% to EAFE large cap, 9% to U.S. small cap, 17% to EAFE small cap and 11% to emerging markets. The remainder of the Fund’s assets were invested in cash and cash equivalents. |

| Q | | What is the Fund’s tactical view and strategy for the months ahead? |

| A | | At the end of the Reporting Period, we maintained our belief that the current environment is supportive of risk assets, which should be underpinned by economic improvement in developed markets, quiescent inflation and supportive policy. We remained more constructive on equities over credit and credit over rates. We anticipate equities will have a positive, albeit low, Sharpe ratio into year-end, led by Europe, with strong data supporting conviction in the European recovery. (The Sharpe ratio is a measure for calculating risk-adjusted return, and this ratio has become the industry standard for such calculations. The Sharpe ratio is the average return earned in excess of the risk-free rate per unit of volatility or total risk. Generally, the greater the value of the Sharpe ratio, the more attractive the risk-adjusted return.) We maintain confidence in the U.S. expansion, as the consumer continues to play a key role and as signs appear to indicate that the labor market is continuing its healing process. We expect there to be a continued focus on China. Looking forward, we have rising confidence in the view that the near term data momentum in China is bottoming out and thus, too, its potential impact on Asia. |

| | | Overall, we intend to continue to position the Fund in alignment with our longer-term strategic views within the equity complex as a complement to additional strategic market exposures. We further intend to continue to monitor allocations and Underlying Manager performance as we seek to generate long-term capital growth. |

5

FUND BASICS

Multi-Manager Global Equity Fund

as of October 31, 2015

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | June 24, 2015–

October 31, 2015 | | Fund Total Return

(based on NAV)1 | | | MSCI ACWI IMI (Net, USD, 50% Non-U.S. Developed Hedged to USD)2 | |

| | | Institutional | | | -5.40 | % | | | -5.03 | % |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The MSCI ACWI IMI (Net, USD, 50% Non-US Developed Hedged to USD) captures large, mid and small cap representation across 23 developed markets and 23 emerging markets. With 8,575 constituents, the MSCI ACWI IMI is comprehensive, covering approximately 99% of the global equity investment opportunity set. As of February 28, 2015, the 23 developed markets in the MSCI ACWI IMI include Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the U.K. and the U.S. The 23 emerging markets include Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, South Korea, Malaysia, Mexico, Peru, Philippines, Poland, Russia, Qatar, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates. |

| | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 9/30/15 | | Since Inception | | | Inception Date |

| | | Institutional | | | -11.00 | % | | 6/24/2015 |

| | 3 | | The Standardized Total Returns are cumulative total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. Because Institutional Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | | Institutional | | | 0.85 | % | | | 1.50 | % |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Fund’s waivers and/or expense limitations will remain in place through at least May 20, 2016, and prior to such date the investment adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

6

FUND BASICS

|

| FUND COMPOSITION (%)5 |

| As of October 31, 2015 |

| | 5 | | The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Short-term investments represent repurchase agreements. Figures in the graph may not sum to 100% due to the exclusion of other assets and liabilities. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

7

PORTFOLIO RESULTS

Goldman Sachs Multi-Manager Non-Core Fixed Income Fund

Investment Objective

The Fund seeks a total return consisting of income and capital appreciation.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Global Portfolio Solutions (“GPS”) and Alternative Investments & Manager Selection (“AIMS”) Groups discuss the Goldman Sachs Multi-Manager Non-Core Fixed Income Fund’s (the “Fund”) performance and positioning for the period from inception on March 31, 2015 through October 31, 2015 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Institutional Shares generated a cumulative total return of -3.84%. This return compares to the -2.35% cumulative total return of the Fund’s benchmark, the Multi-Manager Non-Core Fixed Income Composite Index (the “Index”) during the same time period. |

| | | The Index is composed 40% of the Barclays U.S. High-Yield 2% Issuer Capped Bond Index (Gross, USD, Unhedged); 20% of the Credit Suisse Leveraged Loan Index (Gross, USD, Unhedged); 20% of the J.P. Morgan Emerging Market Bond Index (EMBISM) Global Diversified Index (Gross, USD, Unhedged); and 20% of the J.P. Morgan Government Bond Index — Emerging Markets (GBI-EMSM) Global Diversified Index (Gross, USD, Unhedged), which returned -2.22%, -0.58%, 0.64% and -7.39%, respectively, during the Reporting Period. |

| Q | | What economic and market factors most influenced the non-core fixed income markets as a whole during the Reporting Period? |

| A | | U.S. economic data continued to recover, albeit sluggishly, during the Reporting Period. Underlying second quarter 2015 Gross Domestic Product (“GDP”) growth was strong at 3.9% year over year, driven largely by an increase in exports as well as by positive numbers in housing and consumer spending. Third quarter 2015 GDP growth decelerated to 1.5% year over year, based on advance estimates, primarily due to an inventory drag. However, economists generally believe the inventory downturn to be temporary, and the majority appear to be encouraged by solid domestic consumer spending. (Inventory is defined as finished product that is ready for sale, but has not been sold yet. Inventory is considered a current asset and shown on the balance sheet, generally at cost. On the scale of the national economy, changes in inventory levels can impact GDP.) |

| | | Three macro drivers have affected the non-core fixed income markets most during the Reporting Period. The first was volatility around oil prices. Risk assets generally traded inline with oil — i.e. a sharp rally in the second quarter of 2015 with West Texas Intermediate crude oil prices climbing to more than $60 per barrel followed by a steep sell-off in the third quarter of 2015 as crude oil prices fell back to less than $40 per barrel. This volatility affected virtually all segments of the non-core fixed income markets, particularly energy-related bonds and emerging market currencies. |

| | | The second was slowing economic growth in China and its government’s policy making. This macro driver mostly impacted the emerging market debt sector. China’s GDP growth fell below 7% for the first time during the Reporting Period in conjunction with the correction in its stock market and its government surprisingly devaluing its currency. All of this brought into question by market participants the ability of Chinese policy makers to navigate a soft landing. Latin American and Asian markets were most impacted by these events. |

| | | The third macro driver that affected the non-core fixed income markets during the Reporting Period was uncertainty around the hiking of interest rates by the Federal Reserve (the “Fed”). Market consensus appeared to be surprised as the lift-off, or first interest rate hike, continued to be pushed out. While such a delay ostensibly would benefit U.S. duration-sensitive sectors, such as U.S. dollar-denominated emerging market debt and high yield corporate bonds, recent postponements seemed to be perceived by the market as negative events. |

8

PORTFOLIO RESULTS

| | | Against this backdrop, emerging market debt was the worst performing sector in the non-core fixed income market during the Reporting Period. In particular, local currency bonds declined 7.4% in U.S. dollar terms during the Reporting Period, primarily due to the sharp weakening of emerging market currencies. For example, the Brazilian real depreciated 17.1% during the Reporting Period. External emerging market debt outperformed local currency markets but still posted negative returns, as spreads, or yield differentials, widened to 393 basis points during the Reporting Period. (A basis point is 1/100th of a percentage point.) U.S. high yield also posted negative performance during the Reporting Period, with the Barclays U.S. High- Yield 2% Issuer Capped Index down 2.22%, driven largely by high yield bonds in the energy sector, which makes up approximately 13% of this index. Energy-related bonds particularly suffered from persistent volatility and a large decline in oil prices during the summer months of 2015. Finally, loans experienced some spread widening, particularly during the third quarter of 2015. The Credit Suisse Leveraged Loan Index was down 0.58% for the Reporting Period as a whole but was down 1.3% in the third quarter of 2015. This was the first time the loan market had posted three consecutive months of negative performance since 2008. Still, loans outperformed high yield bonds primarily, in our view, because they are higher in the capital structure and because less of the loan market has exposure to commodity prices. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund’s performance during the Reporting Period can be attributed to the performance of the Fund’s Underlying Managers, who are unaffiliated investment managers that employ a non-core fixed income investment strategy. During the Reporting Period, the Fund allocated capital to four Underlying Managers — Ares Capital Management II LLC (“Ares”), BlueBay Asset Management LLP (“BlueBay”), Lazard Asset Management LLC (“Lazard”) and Symphony Asset Management LLC (“Symphony”). These four Underlying Managers represented four sectors across non- core fixed income as part of the Fund’s top-level strategy allocation — high yield (Ares), bank loans (Symphony), external emerging market debt (BlueBay and Lazard) and local emerging market debt (BlueBay and Lazard). Of the four Underlying Managers with allocated capital during the Reporting Period, three generated negative absolute returns and one posted positive absolute returns. |

| | | Of the four sectors of the non-core fixed income market to which the Fund had exposure via Underlying Manager strategies during the Reporting Period, three generated negative absolute returns amidst persistent market pressure and one posted positive absolute returns. |

| | | Performance relative to the Index was mainly driven by strategic asset allocation, which reflects a longer-term perspective to diversify and invest in non-core fixed income sectors, and manager selection. We would note that while the Fund posted muted performance since inception, we do not consider the brief Reporting Period to be a strong indicator of Fund performance, particularly in light of the impact of short-term market dynamics. |

| | | That said, strategic asset allocation performance relative to the Index was most significantly impacted by the performance of local emerging market debt, to which the Fund was overweight relative to the Index. Fears about emerging market economic weakness and strength in the U.S. dollar during the Reporting Period put pressure on local emerging market currencies, which performed poorly. |

| | | From a manager selection perspective, underperformance relative to the Index primarily came from BlueBay, one of the emerging market debt Underlying Managers. This was partially offset by modestly positive relative returns from Ares, the high yield Underlying Manager. |

| Q | | Which non-core fixed income sectors most significantly affected Fund performance? |

| A | | On an absolute return basis and from a contribution to return perspective, emerging market debt posted the most negative returns during the Reporting Period amidst persistent volatility in the emerging markets. The Fund currently has two managers — BlueBay and Lazard — within the emerging market debt strategy. BlueBay posted negative absolute returns, while Lazard posted significant positive absolute returns. That said, from an absolute return perspective, the divergence in returns was primarily due to the different funding dates. BlueBay was funded on March 31, 2015, i.e. for the full Reporting Period, while Lazard was allocated capital for a much shorter time frame, beginning September 30, 2015, which was the start of a rally in the sector. |

| | | Bank loans, as a sector, posted the least negative returns during the Reporting Period, as spreads widened less given the seniority of loans in the capital structure. |

9

PORTFOLIO RESULTS

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | The Fund’s Underlying Managers used currency forwards, bond futures, credit default swaps and interest rate swaps during the Reporting Period to implement their strategies for the Fund. |

| Q | | Were there any notable changes in the Fund’s allocations during the Reporting Period? |

| A | | Given the Fund’s launch on March 31, 2015, it was not a matter of making changes but of building the Fund’s portfolio via allocating assets to Underlying Managers. |

| | | Throughout the Reporting Period, the Fund’s assets were allocated 25% to local emerging market debt, 14% to external emerging market debt, 21% to bank loans and 40% to high yield. Within the emerging market debt sectors, we did reduce BlueBay’s allocation as we funded Lazard on September 30, 2015. |

| Q | | What is the Fund’s tactical view and strategy for the months ahead? |

| A | | At the end of the Reporting Period, we remained neutral on non-investment grade credit, including U.S. high yield and bank loans. In this environment, we anticipate carry- generative strategies may outperform. (The carry of an asset is the return obtained from holding it, if positive, or the cost of holding it, if negative.) Low real rates and a benign U.S. default outlook imply, in our view, that spreads provide sufficient compensation for credit risk. However, given tightening toward the end of the Reporting Period, we do not expect material capital appreciation in the near term and generally find the rates exposure of cash bonds unattractive relative to other risk assets. We believe credit fundamentals largely remain in line with an expansionary phase of the business cycle. At the same time, we are cognizant that the credit cycle is exhibiting a number of late-cycle behaviors that suggest to us that the cycle is maturing. Strategically, we believe emerging market debt is still a valuable portfolio allocation. Still, we are moderately bearish on a tactical basis given its longer duration and weaker domestic fundamentals. Further, the higher sensitivity to U.S. rates to these emerging market debt assets is a key point of concern for us. |

| | | Overall, we intend to continue to position the Fund in alignment with our longer-term strategic views on the non-core fixed income market as a complement to additional strategic market exposures. We further intend to continue to monitor allocations and Underlying Manager performance as we seek to generate income and capital appreciation. |

10

FUND BASICS

Non-Core Fixed Income Fund

as of October 31, 2015

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | March 31, 2015– October 31, 2015 | | Fund Total Return (based on NAV)1 | | | Multi- Manager Non-Core Fixed Income Composite Index2 | | | Barclays U.S. High-Yield 2% Issuer Capped Bond Index (Gross, USD, Unhedged) | | | Credit Suisse Leveraged Loan Index (Gross, USD, Unhedged) | | | JP Morgan EMBISM Global Diversified Index (Gross, USD, Unhedged) | | | JP Morgan GBI-EMSM Global Diversified Index (Gross, USD, Unhedged) | |

| | | Institutional | | | -3.84 | % | | | -2.35 | % | | | -2.22 | % | | | -0.58 | % | | | 0.64 | % | | | -7.39 | % |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The Multi-Manager Non-Core Fixed Income Composite Index is comprised of the Barclays U.S. High-Yield 2% Issuer Capped Bond (Gross, USD, Unhedged) Index (40%), the Credit Suisse Leveraged Loan (Gross, USD, Unhedged) Index (20%), the J.P. Morgan EMBISM Global Diversified (Gross, USD, Unhedged) Index (20%), and the J.P. Morgan GBI-EMSM Global Diversified (Gross, USD, Unhedged) Index (20%). |

| | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 9/30/15 | | Since Inception | | | Inception Date |

| | | Institutional | | | -6.06 | % | | 3/31/2015 |

| | 3 | | The Standardized Total Returns are cumulative total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. Because Institutional Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | | Institutional | | | 0.70 | % | | | 1.13 | % |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Fund’s waivers and/or expense limitations will remain in place through at least January 31, 2016, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

11

FUND BASICS

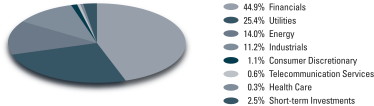

|

| FUND COMPOSITION (%)5 |

| As of October 31, 2015 |

| | 5 | | The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Short-term investments represent repurchase agreements. Figures in the graph may not sum to 100% due to the exclusion of other assets and liabilities. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

12

GOLDMAN SACHS MULTI-MANAGER NON-CORE FIXED INCOME FUND

Performance Summary

October 31, 2015

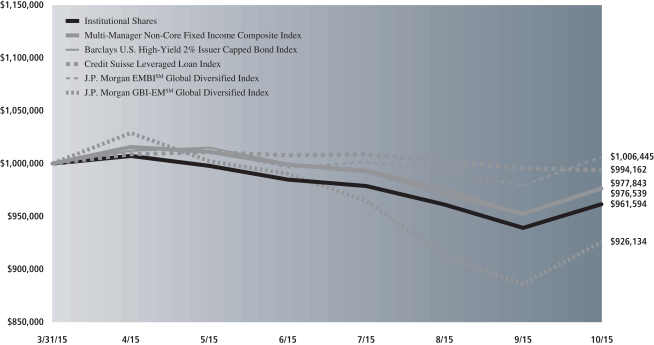

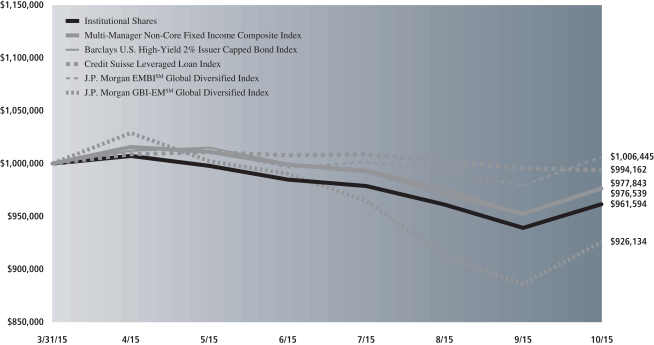

The following graph shows the value, as of October 31, 2015, of a $1,000,000 investment made on March 31, 2015 (commencement of operations) in Institutional Shares at NAV. For comparative purposes, the performance of the Fund’s benchmark, the Multi- Manager Non-Core Fixed Income Composite Index which is composed of the Barclays U.S. High-Yield 2% Issuer Capped Bond Index (Gross, USD, Unhedged) (40%), the Credit Suisse Leveraged Loan Index (Gross, USD, Unhedged) (20%), the J.P. Morgan Emerging Market Bond Index (EMBISM) Global Diversified Index (Gross, USD, Unhedged) (20%) and the J.P. Morgan Government Bond Index — Emerging Markets (GBI-EMSM) Global Diversified Index (Gross, USD, Unhedged) (20%), is shown. This performance data represents past performance and should not be considered indicative of future performance, which will fluctuate with changes in market conditions. These performance fluctuations will cause an investor’s shares, when redeemed, to be worth more or less than their original cost. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In addition to the Underlying Managers’ decisions regarding issuer/industry investment selection and allocation, other factors may affect Fund performance. These factors include, but are not limited to, Fund operating fees and expenses, portfolio turnover and subscription and redemption cash flows affecting the Fund.

|

| Multi-Manager Non-Core Fixed Income Fund’s Lifetime Performance |

Performance of a $1,000,000 Investment, with distributions reinvested, from March 31, 2015 through October 31, 2015.

| | |

| Average Annual Total Return through October 31, 2015 | | Since Inception |

Institutional (Commenced March 31, 2015) | | -3.84%* |

| | |

| * | | Total return for periods of less than one year represents cumulative total return. |

13

PORTFOLIO RESULTS

Goldman Sachs Multi-Manager

Real Assets Strategy Fund

Investment Objective

The Fund seeks to provide long-term capital growth through investments related to real assets.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Global Portfolio Solutions (“GPS”) and Alternative Investments & Manager Selection (“AIMS”) Groups discuss the Goldman Sachs Multi-Manager Real Assets Strategy Fund’s (the “Fund”) performance and positioning for the period from inception on June 30, 2015 through October 31, 2015 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Institutional Shares generated a cumulative total return of -4.30%. This return compares to the -3.40% cumulative total return of the Fund’s benchmark, the Multi-Manager Real Assets Strategy Composite Index (the “Index”) during the same time period. |

| | | The Index is composed 20% of the S&P GSCI® Commodity Index (Net, USD, Unhedged); 40% of the FTSE EPRA/NAREIT Developed Index (Net, USD, Unhedged); and 40% of the Dow Jones Brookfield Global Infrastructure Index (Net, USD, Unhedged), which returned -19.11%, 4.02% and -2.78%, respectively, during the Reporting Period. |

| Q | | What economic and market factors most influenced the real assets-oriented markets as a whole during the Reporting Period? |

| A | | Global equity markets were volatile during the Reporting Period, selling off through the third quarter of 2015 and then rebounding sharply in October 2015. For the Reporting Period overall, the S&P 500 Index returned approximately 1%; the MSCI® EAFE® Index returned approximately -3%; and the MSCI Emerging Markets Index returned approximately -12%. |

| | | The sell-off in the third calendar quarter was led by Asia and driven mainly around concerns about Chinese economic growth and about the impact of the surprise devaluation of its renminbi in August 2015. Equity markets sold off in August and September 2015, after achieving positive results in July 2015, to end the third calendar quarter sharply lower. Markets then rebounded in October 2015, although uncertainty remained given the Federal Reserve’s (the “Fed”) decision to leave rates unchanged in the wake of global market volatility and mixed U.S. economic data. In Europe, trend growth remained positive, though political uncertainty remained around the fiscal stability of Greece. Also, broader concerns around low inflation throughout the European Union led the European Central Bank to keep interest rates at historic lows. The U.S. dollar strengthened given the relative growth profile of the U.S. economy and expected divergent monetary policy versus other major trading partners. A strengthening U.S. dollar put pressure on U.S. companies conducting business abroad and on U.S. dollar returns of foreign assets. |

| | | Commodity markets sold off during the Reporting Period on the back of downward pressure within the energy and materials sectors. The supply/demand structure within oil depressed prices. The U.S. shale revolution pumped extra supply into the market, while global demand remained tepid given mixed growth prospects, especially within emerging markets where economic growth was below potential and missed expectations. Within materials, a slowing of growth |

14

PORTFOLIO RESULTS

| | in demand from China coupled with an abundance of supply from mines recently brought online put pressure on prices. |

| | | Global infrastructure securities posted negative returns and underperformed global equities during the Reporting Period. The Dow Jones Brookfield Global Infrastructure Index (Net, USD, Unhedged) returned approximately -4% during the Reporting Period compared to an approximately -1% return for the MSCI World Index. Infrastructure stocks exhibited a return path similar to that of global equities, posting strongly negative returns in the third quarter of 2015 before rebounding in October 2015. Most of the losses in infrastructure were concentrated within energy midstream1 names given the heightened volatility in energy prices. For example, the oil & gas storage & transportation industry returned approximately -13% during the Reporting Period. Conversely, global regulated utilities outperformed during the Reporting Period given the more defensive nature of the industry and its higher dividend yield characteristics as rates remained at record low levels. North American energy names experienced a reversal in performance in October 2015 and led global infrastructure stocks higher. However, global infrastructure lagged broader equities for the month of October, as stable cash flow businesses, such as regulated utilities and toll roads did not keep up with the broader equity markets, where high growth stocks continued to outperform. |

| | | Global real estate securities held up well amidst market volatility. As evidence, the global real estate benchmark, the FTSE EPRA/NAREIT Developed Index (Net, USD, Unhedged) returned approximately 4% during the Reporting Period. Real estate investment trust (“REITs”) found some support due to their yield orientation. Additionally, accommodative interest rate policy out of the Fed and |

| | 1 | | The downstream component of the energy industry is usually defined as the oil and gas operations that take place after the production phase, through to the point of sale. Downstream operations can include refining crude oil and distributing the by-products down to the retail level. By-products can include gasoline, natural gas liquids, diesel and a variety of other energy sources. The upstream component of the energy industry is usually defined as those operations stages in the oil and gas industry that involve exploration and production. Upstream operations deal primarily with the exploration stages of the oil and gas industry, with upstream firms taking the first steps to first locate, test and drill for oil and gas. Later, once reserves are proven, upstream firms will extract any oil and gas from the reserve. The midstream component of the energy industry is usually defined as those companies providing products or services that help link the supply side, i.e. energy producers, and the demand side, i.e. energy end-users, for any type of energy commodity. Such midstream business can include, but are not limited to, those that process, store, market and transport various energy commodities. |

| | positive supply/demand characteristics in the U.S. and Europe provided tailwinds to global real estate securities’ performance. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund’s performance during the Reporting Period can be attributed to the performance of the Fund’s Underlying Managers, who are unaffiliated investment managers that employ a real assets investment strategy. Real assets are defined broadly by the Fund and include any assets that have physical properties or inflation sensitive characteristics, such as energy, real estate, infrastructure, commodities and inflation linked or floating rate fixed income securities. Inflation is a sustained increase in prices that erodes the purchasing power of money. Assets with inflation sensitive characteristics are assets that benefit from rising real cash flows in times of rising inflation. |

| | | During the Reporting Period, the Fund allocated capital to three Underlying Managers — Prudential Real Estate Investors, a business unit of Prudential Investment Management Inc. (“Prudential”); RREEF America L.L.C. (“RREEF”) and Gresham Investment Management LLC (“Gresham”). These three Underlying Managers represented three asset classes across real assets as part of the Fund’s top-level strategy allocation — commodities (Gresham), global infrastructure (RREEF) and global real estate (Prudential). Of the three Underlying Managers with allocated capital during the Reporting Period, two generated negative absolute returns and one posted positive absolute returns. |

| | | Of the three asset classes of the real assets universe to which the Fund had exposure via Underlying Manager strategies during the Reporting Period, two generated negative absolute returns amidst persistent market pressure, while one, i.e. real estate, posted positive absolute returns. |

| | | Performance relative to the Index was mainly driven by strategic asset allocation, which reflects a longer-term perspective to diversify and invest across real assets, and manager selection. We would note that while the Fund posted muted performance since inception, we do not consider the brief Reporting Period to be a strong indicator of performance in light of the impact of short-term market dynamics. |

15

PORTFOLIO RESULTS

| | | That said, strategic asset allocation performance relative to the Index was most significantly impacted by an overweight allocation to global infrastructure and, to a lesser degree, commodities as well as by an underweight allocation to real estate. As discussed above, commodities and global infrastructure sold off relative to global real estate, which generated positive returns during the Reporting Period. |

| | | From a manager selection perspective, Gresham outperformed the commodities benchmark. However, this was largely offset by Prudential, the global real estate Underlying Manager, who underperformed the global real estate benchmark. |

| Q | | Which real assets asset classes most significantly affected Fund performance? |

| A | | On an absolute return basis, commodities posted the most negative returns during the Reporting Period amidst persistent market pressure. Indeed, Gresham posted dramatically negative absolute performance given the sell-off in commodities, but it protected better than its strategy specific benchmark — the S&P GSCI® (Net, USD, Unhedged). |

| | | Conversely, global real estate posted positive absolute returns during the Reporting Period. Prudential also generated positive absolute returns but underperformed its strategy specific benchmark — the FTSE EPRA/NAREIT Developed Index (Net, USD, Unhedged). |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | An Underlying Manager that focused on commodities used commodity futures to implement its strategy. |

| Q | | Were there any notable changes in the Fund’s allocations during the Reporting Period? |

| A | | Given the Fund’s launch on June 30, 2015, it was not a matter of making changes but of building the Fund’s portfolio via allocating assets to Underlying Managers. |

| | | Throughout the Reporting Period, the Fund’s assets were allocated 23% to commodities, 30% to global real estate and 46% to global infrastructure. The remainder of the Fund’s assets were invested in cash and cash equivalents |

| Q | | What is the Fund’s tactical view and strategy for the months ahead? |

| A | | At the end of the Reporting Period, we remained neutral on global infrastructure and global real estate but recognized the likelihood of near-term volatility, as sensitivity to energy prices and interest rates, respectively, may well, in our view, continue to drive returns in the months ahead. With respect to global infrastructure, we expect its greater correlations with crude oil prices of late to likely continue in the near term. Therefore, the market could experience choppiness should crude oil markets continue to experience heightened volatility. Critically, we are less constructive on commodities as a strategic allocation in the Fund, driven by what we believe are diminished hedging properties, modest sources of returns and higher correlations to equities all minimizing any potential diversification benefits of the allocation. |

| | | Overall, we intend to continue to position the Fund in alignment with our longer-term strategic views on the real assets complex as a complement to additional strategic market exposures, potentially adjusting the Fund’s commodities exposure materially downward in the near term. We further intend to continue to monitor allocations and Underlying Manager performance as we seek to generate long-term capital growth. |

16

FUND BASICS

Multi-Manager Real Assets Strategy Fund

as of October 31, 2015

| | | | | | | | | | | | | | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | June 30, 2015– October 31, 2015 | | Fund Total Return (based on NAV)1 | | | Multi-Manager Real Assets Strategy Composite Index2 | | | S&P GSCI® Commodity Index (Net, USD,

Unhedged) | | | FTSE EPRA/ NAREIT Developed Index (Net, USD,

Unhedged) | | | Dow Jones Brookfield Global Infrastructure Index (Net, USD,

Unhedged) | |

| | | Institutional | | | -4.30 | % | | | -3.40 | % | | | -19.11 | % | | | 4.02 | % | | | -2.78 | % |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The Fund’s benchmark index is the Multi-Manager Real Assets Strategy Composite Index, which is composed of the S&P GSCI® Commodity Index (20%) (Net, USD, Unhedged), the FTSE EPRA/ NAREIT Developed Index (40%) (Net, USD, Unhedged) and the Dow Jones Brookfield Global Infrastructure Index (40%) (Net, USD, Unhedged). |

| | | | The S&P GSCI® is an unmanaged composite index of commodity sector returns, representing an unleveraged, long-only investment in commodity futures that is broadly diversified across the spectrum of commodities. Individual components qualify for inclusion in the S&P GSCI® on the basis of liquidity and are weighted by their respective world production quantities. |

| | | | The FTSE EPRA/NAREIT Developed Index is designed to measure the stock performance of companies engaged in specific real estate activities of the North American, European and Asian real estate markets. Relevant real estate activities are defined as the ownership, trading and development of income-producing real estate. |

| | | | Dow Jones Brookfield Global Infrastructure Index includes companies domiciled globally that qualify as “pure-play” infrastructure companies — companies whose primary business is the ownership and operation of infrastructure assets, activities that generally generate long-term stable cash flows. Index components are required to have more than 70% of cash flows derived from infrastructure lines of business. The index intends to measure all sectors of the infrastructure market. |

| | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 9/30/15 | | Since Inception | | | Inception Date |

| | | Institutional | | | -7.60 | % | | 6/30/2015 |

| | 3 | | The Standardized Total Returns are cumulative total returns as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. Because Institutional Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

17

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | | Institutional | | | 0.90 | % | | | 1.36 | % |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to a contractual arrangement, the Fund’s waivers and/or expense limitations will remain in place through at least May 20, 2016, and prior to such date the investment adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

| | | | | | | | |

| | TOP TEN EQUITY HOLDINGS AS OF 10/31/155 |

| | | Holding | | % of Net Assets | | | Line of Business |

| | National Grid PLC | | | 3.4 | % | | Multi-Utilities |

| | American Tower Corp. | | | 2.9 | | | Real Estate Investment Trusts |

| | Sempra Energy | | | 2.8 | | | Multi-Utilities |

| | Crown Castle International Corp. | | | 2.3 | | | Real Estate Investment Trusts |

| | PG&E Corp. | | | 2.2 | | | Multi-Utilities |

| | Enbridge, Inc. | | | 1.8 | | | Oil, Gas & Consumable Fuels |

| | Spectra Energy Corp. | | | 1.6 | | | Oil, Gas & Consumable Fuels |

| | TransCanada Corp. | | | 1.6 | | | Oil, Gas & Consumable Fuels |

| | Ferrovial SA | | | 1.6 | | | Construction & Engineering |

| | | Eversource Energy | | | 1.4 | | | Electric Utilities |

| | 5 | | The top 10 holdings may not be representative of the Fund’s future investments. |

18

FUND BASICS

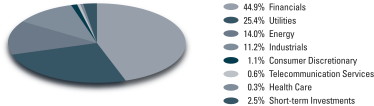

|

| FUND COMPOSITION (%)6 |

| As of October 31, 2015 |

| | 6 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using the Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. Short-term investments represent repurchase agreements. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

19

PORTFOLIO RESULTS

Index Definitions:

The Barclays U.S. High-Yield 2% Issuer Capped Bond Index (Gross, USD, Unhedged) is an issuer-constrained version of the U.S. Corporate High-Yield Index that measures the market of USD-denominated, non-investment grade, fixed-rate, taxable corporate bonds. The index follows the same rules as the uncapped index but limits the exposure of each issuer to 2% of the total market value and redistributes any excess market value index-wide on a pro-rata basis.

The Credit Suisse Leveraged Loan Index (Gross, USD, Unhedged) is designed to mirror the investable universe of the U.S. dollar-denominated leveraged loan market.

The J.P. Morgan EMBISM Global Diversified Index (Gross, USD, Unhedged) tracks total returns for U.S. dollar-denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities.

The J.P. Morgan GBI-EMSM Global Diversified Index (Gross, USD, Unhedged) is a comprehensive local emerging markets index, consisting of regularly traded, fixed-rate, local currency government bonds.

The S&P 500® Total Return Index is an American stock market index based on the market capitalizations of 500 large companies listed on the NYSE or NASDAQ.

The Russell 2000® Index is an unmanaged index of common stock prices that measures the performance of the 2000 smallest companies in the Russell 3000® Index. The Index is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set.

The MSCI® EAFE® Index is a stock market index that is designed to measure the equity market performance of developed markets in Europe, Australasia and the Far East, excluding the U.S. and Canada.

The MSCI Emerging Markets Index (Net, USD, Unhedged) is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. As of January 1, 2015, the MSCI Emerging Markets Index (Net, USD, Unhedged) consisted of the following 21 emerging market country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand and Turkey.

The MSCI World Index captures large and mid cap representation across 23 Developed Markets (DM) countries. DM countries include: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the UK and the US. With 1,642 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The MSCI World Growth Index captures large and mid-cap securities exhibiting overall growth style characteristics across 23 Developed Markets countries. Developed Markets countries include: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the UK and the US. The growth investment style characteristics for index construction are defined using five variables: long-term forward EPS growth rate, short-term forward EPS growth rate, current internal growth rate and long-term historical EPS growth trend and long-term historical sales per share growth trend.

The MSCI World Value Index captures large and mid-cap securities exhibiting overall value style characteristics across 23 Developed Markets countries. The index includes all Developed Market countries: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the UK and the USA. The value investment style characteristics for index construction are defined using three variables: book value to price, 12-month forward earnings to price and dividend yield. With 850 constituents, the index targets 50% coverage of the free float-adjusted market capitalization of the MSCI World Index.

20

GOLDMAN SACHS MULTI-MANAGER GLOBAL EQUITY FUND

Schedule of Investments

October 31, 2015

| | | | | | | | |

Shares | | | Description | | Value | |

| | Common Stocks – 83.3% | |

| | Australia – 0.7% | |

| | 84,100 | | | Ainsworth Game Technology Ltd. (Hotels, Restaurants & Leisure) | | $ | 189,351 | |

| | 52,100 | | | Aristocrat Leisure Ltd. (Hotels, Restaurants & Leisure) | | | 343,908 | |

| | 124,000 | | | Asaleo Care Ltd. (Personal Products) | | | 154,741 | |

| | 25,545 | | | CSL Ltd. (Biotechnology) | | | 1,697,982 | |

| | 2,300 | | | Flight Centre Travel Group Ltd. (Hotels, Restaurants & Leisure) | | | 61,878 | |

| | 48,800 | | | Pact Group Holdings Ltd. (Containers & Packaging) | | | 177,077 | |

| | 124,900 | | | Spotless Group Holdings Ltd. (Commercial Services & Supplies) | | | 190,731 | |

| | 63,264 | | | Westfield Corp. (Real Estate Investment Trusts) | | | 458,988 | |

| | | | | | | | |

| | | | | | | 3,274,656 | |

| | |

| | Belgium – 0.1% | |

| | 6,177 | | | KBC Groep NV (Commercial Banks) | | | 375,572 | |

| | 6,000 | | | Ontex Group NV (Personal Products) | | | 184,310 | |

| | | | | | | | |

| | | | | | | 559,882 | |

| | |

| | Bermuda – 0.7% | |

| | 2,834 | | | Assured Guaranty Ltd. (Insurance) | | | 77,765 | |

| | 42,886 | | | Axis Capital Holdings Ltd. (Insurance) | | | 2,315,844 | |

| | 3,951 | | | Essent Group Ltd.* (Thrifts & Mortgage Finance) | | | 95,219 | |

| | 4,639 | | | Everest Re Group Ltd. (Insurance) | | | 825,603 | |

| | | | | | | | |

| | | | | | | 3,314,431 | |

| | |

| | Brazil – 0.4% | |

| | 92,851 | | | Ambev SA ADR (Beverages) | | | 452,184 | |

| | 61,700 | | | Cielo SA (IT Services) | | | 585,697 | |

| | 12,315 | | | Embraer SA ADR (Aerospace & Defense) | | | 361,692 | |

| | 17,700 | | | JSL SA (Road & Rail) | | | 43,037 | |

| | 25,092 | | | Petroleo Brasileiro SA ADR (Oil, Gas & Consumable Fuels) | | | 122,449 | |

| | 18,500 | | | Ultrapar Participacoes SA (Oil, Gas & Consumable Fuels) | | | 321,200 | |

| | | | | | | | |

| | | | | | | 1,886,259 | |

| | |

| | Cambodia – 0.0% | |

| | 228,000 | | | NagaCorp Ltd. (Hotels, Restaurants & Leisure) | | | 161,242 | |

| | |

| | Canada – 2.2% | |

| | 44,200 | | | Algonquin Power & Utilities Corp. (Independent Power Producers & Energy Traders) | | | 341,066 | |

| | 18,100 | | | ATS Automation Tooling Systems, Inc.* (Machinery) | | | 190,606 | |

| | 36,200 | | | Baytex Energy Corp. (Oil, Gas & Consumable Fuels) | | | 147,281 | |

| | 32,639 | | | Canadian Pacific Railway Ltd. (Road & Rail) | | | 4,585,780 | |

| | 99,400 | | | Capstone Mining Corp.* (Metals & Mining) | | | 50,932 | |

| | |

| | Common Stocks – (continued) | |

| | Canada – (continued) | |

| | 3,600 | | | CCL Industries, Inc. Class B (Containers & Packaging) | | $ | 510,018 | |

| | 3,800 | | | Constellation Software, Inc. (Software) | | | 1,641,939 | |

| | 26,535 | | | Element Financial Corp.* (Diversified Financial Services) | | | 343,153 | |

| | 24,900 | | | Imperial Oil Ltd. (Oil, Gas & Consumable Fuels) | | | 828,540 | |

| | 13,455 | | | Ritchie Bros. Auctioneers, Inc. (Commercial Services & Supplies) | | | 349,426 | |

| | 122,000 | | | Surge Energy, Inc. (Oil, Gas & Consumable Fuels) | | | 274,304 | |

| | 42,600 | | | Whitecap Resources, Inc. (Oil, Gas & Consumable Fuels) | | | 378,240 | |

| | | | | | | | |

| | | | | | | 9,641,285 | |

| | |

| | China – 3.2% | |

| | 5,738 | | | Alibaba Group Holding Ltd. ADR* (Internet Software & Services) | | | 481,016 | |

| | 18,778 | | | Baidu, Inc. ADR* (Internet Software & Services) | | | 3,520,312 | |

| | 434,000 | | | Brilliance China Automotive Holdings Ltd. (Automobiles) | | | 601,803 | |

| | 524,000 | | | China Construction Bank Corp. Class H (Commercial Banks) | | | 379,772 | |

| | 133,600 | | | China Pacific Insurance Group Co. Ltd. Class H (Insurance) | | | 532,182 | |

| | 311,500 | | | CITIC Securities Co. Ltd. Class H (Capital Markets) | | | 671,227 | |

| | 16,624 | | | Ctrip.com International Ltd. ADR* (Internet & Catalog Retail) | | | 1,545,533 | |

| | 39,000 | | | Hengan International Group Co. Ltd. (Personal Products) | | | 421,139 | |

| | 610,000 | | | Industrial and Commercial Bank of China Ltd. Class H (Commercial Banks) | | | 386,926 | |

| | 185,000 | | | Ping An Insurance Group Co. of China Ltd. Class H (Insurance) | | | 1,038,451 | |

| | 164,400 | | | Sands China Ltd. (Hotels, Restaurants & Leisure) | | | 591,997 | |

| | 197,000 | | | Tencent Holdings Ltd. (Internet Software & Services) | | | 3,713,326 | |

| | | | | | | | |

| | | | | | | 13,883,684 | |

| | |

| | Denmark – 2.1% | |

| | 2,500 | | | ALK-Abello A/S (Pharmaceuticals) | | | 271,929 | |

| | 44,845 | | | Chr Hansen Holding A/S (Chemicals) | | | 2,694,419 | |

| | 25,935 | | | Coloplast A/S Class B (Health Care Equipment & Supplies) | | | 1,860,168 | |

| | 46,645 | | | Novo Nordisk A/S ADR (Pharmaceuticals) | | | 2,480,581 | |

| | 40,160 | | | Novozymes A/S (Chemicals) | | | 1,861,701 | |

| | | | | | | | |

| | | | | | | 9,168,798 | |

| | |

| | Finland – 0.1% | |

| | 16,400 | | | Cramo OYJ (Trading Companies & Distributors) | | | 301,156 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 21 |

GOLDMAN SACHS MULTI-MANAGER GLOBAL EQUITY FUND

Schedule of Investments (continued)

October 31, 2015

| | | | | | | | |

Shares | | | Description | | Value | |

| | Common Stocks – (continued) | |

| | France – 3.3% | |

| | 5,900 | | | Alten SA (IT Services) | | $ | 305,844 | |

| | 69,500 | | | Altran Technologies SA (IT Services) | | | 866,413 | |

| | 13,116 | | | AXA SA (Insurance) | | | 350,041 | |

| | 20,701 | | | BNP Paribas SA (Commercial Banks) | | | 1,254,423 | |

| | 19,800 | | | Elior(a) (Commercial Services & Supplies) | | | 375,398 | |

| | 93,341 | | | Engie SA (Multi-Utilities) | | | 1,633,542 | |

| | 700 | | | Eurofins Scientific SE (Life Sciences Tools & Services) | | | 253,217 | |

| | 17,500 | | | Havas SA (Media) | | | 151,564 | |

| | 4,800 | | | IPSOS (Media) | | | 97,370 | |

| | 23,680 | | | Legrand SA (Electrical Equipment) | | | 1,297,759 | |

| | 9,610 | | | LVMH Moet Hennessy Louis Vuitton SE (Textiles, Apparel & Luxury Goods) | | | 1,789,089 | |

| | 7,200 | | | Nexity SA (Real Estate Management & Development) | | | 318,602 | |

| | 3,000 | | | Saft Groupe SA (Electrical Equipment) | | | 77,326 | |

| | 13,441 | | | Sanofi (Pharmaceuticals) | | | 1,355,872 | |

| | 22,311 | | | Schneider Electric SE (Electrical Equipment) | | | 1,345,691 | |

| | 5,600 | | | Sopra Steria Group (IT Services) | | | 637,024 | |

| | 18,868 | | | Technip SA (Energy Equipment & Services) | | | 983,207 | |

| | 31,590 | | | TOTAL SA (Oil, Gas & Consumable Fuels) | | | 1,527,655 | |

| | | | | | | | |

| | | | | | | 14,620,037 | |

| | |

| | Germany – 1.9% | |

| | 8,348 | | | Bayer AG (Pharmaceuticals) | | | 1,113,084 | |

| | 1,300 | | | Duerr AG (Machinery) | | | 108,242 | |

| | 5,300 | | | Gerresheimer AG (Life Sciences Tools & Services) | | | 413,267 | |

| | 10,000 | | | KION Group AG* (Machinery) | | | 450,619 | |

| | 8,156 | | | Linde AG (Chemicals) | | | 1,414,702 | |

| | 3,300 | | | MorphoSys AG* (Life Sciences Tools & Services) | | | 204,171 | |

| | 7,700 | | | ProSiebenSat.1 Media SE (Media) | | | 416,074 | |

| | 13,398 | | | SAP SE (Software) | | | 1,056,232 | |

| | 40,673 | | | SAP SE ADR (Software) | | | 3,201,372 | |

| | 3,200 | | | Stroeer SE (Media) | | | 201,905 | |

| | | | | | | | |

| | | | | | | 8,579,668 | |

| | |

| | Hong Kong – 1.8% | |

| | 168,000 | | | China Merchants Holdings International Co. Ltd. (Transportation Infrastructure) | | | 557,927 | |

| | 202,000 | | | China Mobile Ltd. (Wireless Telecommunication Services) | | | 2,421,957 | |

| | 41,638 | | | China Mobile Ltd. ADR (Wireless Telecommunication Services) | | | 2,511,188 | |

| | 986,000 | | | CNOOC Ltd. (Oil, Gas & Consumable Fuels) | | | 1,113,698 | |

| | 312,000 | | | Dawnrays Pharmaceutical Holdings Ltd. (Pharmaceuticals) | | | 258,820 | |

| | |

| | Common Stocks – (continued) | |

| | Hong Kong – (continued) | |

| | 1,030,000 | | | Emperor Watch & Jewellery Ltd. (Specialty Retail) | | $ | 27,298 | |

| | 394,000 | | | Hutchison Telecommunications Hong Kong Holdings Ltd. (Diversified Telecommunication Services) | | | 145,376 | |

| | 784,000 | | | Lenovo Group Ltd. (Computers & Peripherals) | | | 728,443 | |

| | | | | | | | |

| | | | | | | 7,764,707 | |

| | |

| | India – 1.5% | |

| | 65,541 | | | Cipla Ltd. GDR (Pharmaceuticals) | | | 689,287 | |

| | 18,674 | | | Dr. Reddy’s Laboratories Ltd. ADR (Pharmaceuticals) | | | 1,209,888 | |

| | 40,702 | | | HDFC Bank Ltd. ADR (Commercial Banks) | | | 2,488,520 | |

| | 19,830 | | | ICICI Bank Ltd. ADR (Commercial Banks) | | | 170,935 | |

| | 75,141 | | | Infosys Ltd. ADR (IT Services) | | | 1,364,561 | |

| | 120,572 | | | Tata Global Beverages Ltd. GDR (Food Products) | | | 217,030 | |

| | 21,795 | | | Tata Motors Ltd. ADR (Automobiles) | | | 644,478 | |

| | | | | | | | |

| | | | | | | 6,784,699 | |

| | |

| | Indonesia – 0.4% | |

| | 737,100 | | | Bank Mandiri Persero Tbk PT (Commercial Banks) | | | 466,488 | |

| | 283,700 | | | Bank Negara Indonesia Persero Tbk PT (Commercial Banks) | | | 98,073 | |

| | 797,200 | | | Bank Rakyat Indonesia Persero Tbk PT (Commercial Banks) | | | 610,142 | |

| | 135,200 | | | Semen Indonesia Persero Tbk PT (Construction Materials) | | | 96,153 | |

| | 1,894,900 | | | Telekomunikasi Indonesia Persero Tbk PT (Diversified Telecommunication Services) | | | 371,756 | |

| | | | | | | | |

| | | | | | | 1,642,612 | |

| | |

| | Ireland – 0.8% | |

| | 2,373 | | | Global Indemnity PLC* (Insurance) | | | 67,417 | |

| | 28,053 | | | ICON PLC* (Life Sciences Tools & Services) | | | 1,791,745 | |

| | 6,500 | | | Kingspan Group PLC (Building Products) | | | 157,229 | |

| | 6,960 | | | Perrigo Co. PLC (Pharmaceuticals) | | | 1,097,870 | |

| | 4,777 | | | Ryanair Holdings PLC ADR (Airlines) | | | 373,514 | |

| | 8,300 | | | Smurfit Kappa Group PLC (Containers & Packaging) | | | 236,210 | |

| | | | | | | | |

| | | | | | | 3,723,985 | |

| | |

| | Israel* – 0.1% | |

| | 6,610 | | | Check Point Software Technologies Ltd. (Software) | | | 561,453 | |

| | |

| | Italy – 0.9% | |

| | 18,200 | | | Astaldi SpA (Construction & Engineering) | | | 146,603 | |

| | |

| | |

| 22 | | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS MULTI-MANAGER GLOBAL EQUITY FUND

| | | | | | | | |

Shares | | | Description | | Value | |

| | Common Stocks – (continued) | |

| | Italy – (continued) | |

| | 25,100 | | | Azimut Holding SpA (Capital Markets) | | $ | 603,730 | |

| | 5,700 | | | Banca Generali SpA (Capital Markets) | | | 175,558 | |

| | 52,100 | | | Banca Popolare dell’Emilia Romagna SC (Commercial Banks) | | | 420,451 | |

| | 21,200 | | | Banco Popolare SC* (Commercial Banks) | | | 316,796 | |

| | 12,900 | | | Buzzi Unicem SpA (Construction Materials) | | | 218,269 | |

| | 349,800 | | | Credito Valtellinese SC* (Commercial Banks) | | | 440,345 | |

| | 160,200 | | | Hera SpA (Multi-Utilities) | | | 420,399 | |

| | 3,100 | | | Industria Macchine Automatiche SpA (Machinery) | | | 160,059 | |