UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22781

Goldman Sachs Trust II

(Exact name of registrant as specified in charter)

200 West Street

15th Floor

New York, New York 10282

(Address of principal executive offices) (Zip code)

| | |

Copies to: |

Caroline Kraus | | Geoffrey R.T. Kenyon, Esq. |

Goldman Sachs & Co. LLC | | Dechert LLP |

200 West Street | | 100 Oliver Street |

New York, New York 10282 | | 40th Floor |

| | Boston, MA 02110-2605 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (212) 902-1000

Date of fiscal year end: August 31

Date of reporting period: August 31, 2018

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Annual Report to Shareholders is filed herewith. |

Goldman Sachs Funds

| | | | |

| | |

| Annual Report | | | | August 31, 2018 |

| | |

| | | | Target Date Portfolios |

| | | | Target Date 2020 |

| | | | Target Date 2025 |

| | | | Target Date 2030 |

| | | | Target Date 2035 |

| | | | Target Date 2040 |

| | | | Target Date 2045 |

| | | | Target Date 2050 |

| | | | Target Date 2055 |

| | | | Target Date 2060 |

Goldman Sachs Target Date Portfolios

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

MARKET REVIEW

Target Date Portfolios

Market Review

During the 12 months ended August 31, 2018 (the “Reporting Period”), economic growth indicators, shifting expectations about central bank policy, strong corporate earnings and geopolitics drove the performance of the financial markets. U.S. stocks recorded double-digit gains, significantly outperforming non-U.S. developed markets stocks, which nevertheless generated positive returns. In contrast, emerging markets stocks and fixed income declined.

Equity Markets

When the Reporting Period began in September 2017, developed markets stocks gained. In the U.S., economic activity and labor market data showed consistent strength, with the reversal in August of five consecutive downside inflation surprises, the unemployment rate down to 4.2% in September, and the Gross Domestic Product (“GDP”) growing at an annualized rate above 3% during the third calendar quarter. The European Central Bank (“ECB”) kept monetary policy unchanged at its September meeting and revised downward its inflation forecast. Investor sentiment in Japan deteriorated amid North Korean missile launches and escalating geopolitical tensions, while in Europe, the disputed independence referendum in Catalonia, Spain was negative for risk sentiment. Meanwhile, emerging markets equities underperformed developed markets equities in September 2017, as investors generally favored less risky assets. During October 2017, emerging markets stocks advanced despite strength in the U.S. dollar. In Japan, the Prime Minister’s landslide victory reassured investors, signaling a continuation of then-current policies. Progress on U.S. tax reform and strong economic activity data was supportive of U.S. stocks during October and November 2017. In November 2017, a robust earnings season boosted emerging markets stocks, which overcame weakness driven by a global selloff in information technology stocks. In December, the U.S. Federal Reserve (the “Fed”) delivered its third interest rate hike of 2017, having previously raised short-term interest rates in March and June, and maintained its projections for three hikes in 2018. U.S. equities gained additional momentum toward the end of 2017 from the passage of tax reform legislation that reduced the corporate tax rate from 35% to 21%.

Developed markets equities saw a strong start to 2018, driven by positive economic data, the $1.5 trillion U.S. tax reform plan and robust corporate earnings across the U.S., Europe and Japan. Fourth quarter 2017 U.S. GDP came in below the economic growth rates recorded in the second and third calendar quarters but was still at a respectable annualized rate of 2.5%. In January 2018, labor market data highlighted the tightening of slack in the U.S. economy. In Japan, concerns around a strengthening yen increased, driven by the Bank of Japan’s announcement of reduced Japanese government bond purchases, which were interpreted by the markets as a withdrawal from ultra-accommodative monetary policy. Emerging markets equities outperformed developed markets equities during January 2018, bolstered by global economic growth, rising crude oil prices and a softer U.S. dollar. In February 2018, global equities broadly sold off on market speculation about a faster pace of Fed interest rate hikes, which led to a sharp rise in yields and volatility. Robust U.S. labor market data sparked the initial “risk-off” sentiment, or reduced risk appetite. Concerns about Fed monetary policy tightening were further exacerbated by solid U.S. inflation data. New Fed Chair Jerome Powell’s testimony before the U.S. Congress in February 2018, positing a more optimistic economic outlook since the December 2017 Fed policy meeting, surprised the markets with its hawkish tilt. (Jerome Powell assumed the chairmanship of the Fed in February 2018. Hawkish language tends to suggest higher interest rates; opposite of dovish.) Renewed concerns about increasingly hostile exchanges between North Korea and the White House — as well as

1

MARKET REVIEW

heightened European political risk ahead of Italian general elections and a grand coalition referendum in Germany — also fueled volatility. In March 2018, escalating trade tensions and potential tariffs drove further declines in global stocks broadly. Meanwhile, the Fed delivered on a widely expected interest rate increase, with its “dot plot” pointing to a total of three interest rate hikes in the 2018 calendar year and potentially two in 2019. (The “dot plot” shows rate projections of the members of the Fed’s Open Market Committee.) However, Fed policymakers acknowledged that the “economic outlook has strengthened in recent months,” revising their economic growth forecast higher and their unemployment forecast lower. In Europe, an agreement between the U.K. and European Union on a 21-month Brexit transition period reduced political uncertainty. (Brexit refers to the U.K.’s efforts to leave the European Union.)

The U.S. and China continued to generate trade headlines and geopolitical uncertainty about sanctions on Russia surfaced, but the impact of such on developed markets and emerging markets stocks remained relatively muted during April 2018, as investors stayed rather resistant to the risk of a trade war. U.S. equities rallied in May 2018, driven by strong corporate earnings, upside surprises in economic activity and sentiment data, and a new U.S. unemployment low of 3.8%. However, non-U.S. developed markets equities and emerging markets stocks declined amid escalating geopolitical uncertainty stemming from an unexpected political outcome in Italy, ongoing unpredictability around the U.S.-North Korea summit, and escalating trade tensions with many U.S. allies. In June 2018, the Fed raised interest rates again, as widely expected, but the outcome of the Fed meeting was more hawkish than the consensus had anticipated. The Fed retained language indicating an “accommodative” monetary policy stance, but its economic growth and inflation forecasts were upgraded, and its median projection was lifted to four interest rate hikes in 2018 from the three it had indicated in March 2018. Fed Chair Powell was also slightly hawkish in his June press conference. Still-escalating trade tensions between the U.S. and China hurt market sentiment broadly, as the U.S. threatened tariffs on $200 billion worth of Chinese goods and China vowed to retaliate.

Global equities gained during July 2018, though market volatility was high, driven by heightened trade rhetoric between the U.S. and China as well as between the U.S. and key allies and by strong U.S. macroeconomic data relative to other developed and emerging markets countries. The U.S. economy grew 4.2% year over year in the second calendar quarter, its fastest annualized pace since 2004. Re-escalating trade tensions and renewed fears of a Chinese economic slowdown dampened investor risk sentiment, but fiscal stimulus policies announced by the Chinese government and the promising outcome of a trade meeting between the U.S. and European Union lifted developed markets stocks higher in July overall. In August 2018, U.S. equities reached an all-time high, with strong domestic economic data outweighing headwinds posed by moderating global economic growth and escalating trade and diplomatic tensions. However, the same headlines drove declines in non-U.S. developed markets equities and emerging markets stocks. At the start of the month, they fell on signs of an economic slowdown in China, along with escalating U.S.-China trade tensions, as the U.S. considered imposing additional tariffs on Chinese goods. They were also hurt by news about U.S. economic sanctions on Iran and a sharp sell-off in Turkish stocks following its diplomatic disputes with the U.S., which exacerbated existing investor worries about Turkey’s economic imbalances and unorthodox policies. In Europe, political concerns centered around Italy and its upcoming 2019 budget. Although a strong earning season and progress on North American free trade negotiations boosted investor sentiment mid-month, it subsequently deteriorated due

2

MARKET REVIEW

to the U.S. President’s comments about the potential of further additional tariffs on Chinese goods.

Fixed Income Markets

In September 2017, government bond sectors sold off, and spread, or non-government bond, sectors generally advanced. The Fed kept its monetary policy unchanged but unveiled its plans for balance sheet normalization. (Balance sheet normalization refers to the steps the Fed is taking to reverse quantitative easing.) This prompted a modestly hawkish market reaction, with the U.S. dollar strengthening and yields on U.S. government bonds rising, though the move had been largely anticipated given earlier signaling by policymakers. The central banks of other developed countries also set the stage for less accommodative monetary policy. The Bank of England (“BoE”) noted “a majority” of its policymakers were in favor of tightening policy “over the coming months,” while the Bank of Canada (“BoC”) surprised the markets with its second interest rate hike of 2017. The market’s expectations for a BoE rate hike in November 2017, along with a constructive tone for Brexit negotiations, drove the British pound higher versus the U.S. dollar.

During the fourth calendar quarter, spread sector performance was broadly positive, supported by ongoing strength in the global macroeconomic environment and contained market, macro and political volatility. Passage of U.S. tax legislation and solid corporate earnings were particularly supportive of U.S. corporate credit. In October 2017, the ECB announced it would reduce its monthly asset purchases from €60 billion to €30 billion for nine months beginning in January 2018, mainly by purchasing fewer sovereign government bonds. The ECB also said its policy rates would remain low for “an extended period of time, and well past the horizon of the net asset purchases.” During the same month, the BoE reversed an emergency interest rate cut, made in August 2016 following the Brexit referendum, and signaled that future monetary policy tightening would be limited, gradual and dependent on the economic reaction to the U.K.’s eventual departure from the European Union. In December 2017, the Fed delivered its third short-term interest rate hike of 2017. The Fed’s dot plot indicated that three rate increases were on tap for 2018 and potentially two more in 2019. The U.S. dollar weakened versus many major currencies during the fourth quarter of 2017, as strong global economic growth supported non-U.S. currencies and in particular, emerging markets currencies.

In the first quarter of 2018, spread sectors were challenged by a surge in market volatility. Firmer than consensus expected U.S. wage and price inflation data prompted higher market volatility and equity market declines, though the magnitude of the moves was exacerbated by changing market structures, including the increased presence of algorithmic trading strategies. (Algorithmic trading uses complex mathematical models and formulas to make high-speed decisions and transactions in the financial markets.) The Fed raised short-term interest rates at its March policy meeting and reiterated its plan for a total of three rate hikes during 2018. Beyond the U.S., monetary policy action was muted in the developed markets during the first calendar quarter, though policymakers in Europe and Japan sounded mildly dovish and those in Norway appeared more hawkish. Economic activity data moderated in emerging markets and developed markets countries but remained in expansionary territory and therefore was supportive of cyclical asset classes geared toward growth. The U.S. was a notable exception, experiencing continued strength in economic data. During the first quarter of 2018, the U.S. dollar weakened slightly versus many major currencies, due in part to market concerns about the U.S. current account and fiscal deficits.

3

MARKET REVIEW

During the second calendar quarter, spread sectors broadly weakened amid increased U.S.-China trade tensions, political events in emerging markets countries and Italy, higher U.S. interest rates and a stronger U.S. dollar. U.S. high yield corporate bonds, however, generated a small positive return. Rising oil prices were a tailwind for the broader high yield corporate bond sector, as many energy bonds are high yield rated. In June 2018, the Fed delivered the seventh interest rate hike of its current tightening cycle. The Fed’s dot plot pointed to two more rate increases in 2018, implying a total of four rate hikes in the calendar year. U.S. economic growth strengthened, with GDP expanding at an annualized rate of 4.2% in the second calendar quarter. Elsewhere, the ECB announced plans to taper its quantitative easing program beginning September 2018. The U.S. dollar appreciated relative to many major currencies during the second quarter of 2018.

Spread sectors performed well in July 2018 amid “risk-on” market sentiment, or reduced risk aversion, which was motivated by ongoing strength in U.S. economic data, strong second calendar quarter corporate earnings and fewer news reports about protectionist trade policies. The Fed kept interest rates unchanged during the month but issued an upbeat statement. The BoJ said it would continue its existing monetary policy of negative interest rates, quantitative easing and “yield curve control.” (Yield curve control is designed to steepen Japan’s government bond yield curve and alleviate the impact on financial institutions of low longer-term rates. Yield curve indicates a spectrum of maturities.) The BoE raised its interest rates by 25 basis points, citing reduced slack in the U.K. economy and signs of wage growth. (A basis point is 1/100th of a percentage point.) The U.S. dollar strengthened versus many major currencies during July 2018.

In August 2018, spread sectors generally weakened. Emerging markets assets, especially emerging markets currencies, came under pressure due to a number of country-specific events, including U.S. sanctions on Russia, investor concerns about external funding needs in Turkey and Argentina, and doubts surrounding economic reform progress in South Africa. The “risk-off” market sentiment also challenged the performance of U.S. investment grade corporate bonds, which faced additional headwinds from a large amount of new supply. In contrast, U.S. high yield corporate bonds produced a positive return amid muted new issuance and firmer crude oil prices. In August 2018, the U.S. dollar weakened slightly versus many major currencies.

Looking Ahead

At the end of the Reporting Period, we believed the pace of U.S. economic growth had largely peaked relative to the growth of other developed markets countries. In our view, the U.S. economy had benefited from strong fiscal policy support during the second quarter of 2018, and we expected that support to fade over time. Meanwhile, economic growth in Europe appeared to be stabilizing at a lower, but more sustainable, level compared to the growth seen during 2017. The economic recovery in Japan, which has been more muted than we expected, was continuing gradually. In China, policy support has been firm in the face of weaker economic data and risks from trade, and we expected to see a period of positive surprises eventually. Beyond China, most emerging markets countries had healthy economic fundamentals, in our view, and we expected them to benefit from U.S. economic growth. We believed the weakness in emerging markets assets near the end of the Reporting Period reflected country-specific challenges rather than a broad emerging markets crisis. In terms of the bigger picture at the end of the Reporting Period, we expected global economic growth to converge at healthy levels after a period defined by U.S. economic exceptionalism. As for

4

MARKET REVIEW

U.S. interest rates, we expected them to continue climbing over the longer term, but we see few catalysts for a significant move higher in the closing months of 2018. With inflation rising gradually and U.S. economic growth likely to moderate, we believed at the end of the Reporting Period that the Fed would raise short-term interest rates twice more in 2018, which is consistent with market expectations.

5

PORTFOLIO RESULTS

Goldman Sachs Target Date 2020 Portfolio, Goldman Sachs Target Date 2025 Portfolio, Goldman Sachs Target Date 2030 Portfolio, Goldman Sachs Target Date 2035 Portfolio, Goldman Sachs Target Date 2040 Portfolio, Goldman Sachs Target Date 2045 Portfolio, Goldman Sachs Target Date 2050 Portfolio, Goldman Sachs Target Date 2055 Portfolio and Goldman Sachs Target Date 2060 Portfolio

Investment Objective

The Goldman Sachs Target Date 2020 Portfolio, the Goldman Sachs Target Date 2025 Portfolio, the Goldman Sachs Target Date 2030 Portfolio, the Goldman Sachs Target Date 2035 Portfolio, the Goldman Sachs Target Date 2040 Portfolio, the Goldman Sachs Target Date 2045 Portfolio, the Goldman Sachs Target Date 2050 Portfolio, the Goldman Sachs Target Date 2055 Portfolio and the Goldman Sachs Target Date 2060 Portfolio (collectively, the “Portfolios”) seek to provide capital appreciation and current income consistent with each respective Portfolio’s current asset allocation. The Portfolios employ asset allocation strategies designed for investors who plan to retire and to begin gradually withdrawing their investment beginning in or around 2020, 2025, 2030, 2035, 2040, 2045, 2050, 2055 and 2060. The Portfolios generally seek to achieve their investment objective by investing in shares of exchange-traded funds (“ETFs”) and other registered investment companies (collectively, the “Underlying Funds”), according to an asset allocation strategy developed by Madison Asset Management, LLC, the sub-adviser, which is unaffiliated with Goldman Sachs Asset Management, L.P., the investment adviser for the Portfolios.

Portfolio Management Discussion and Analysis

Below, the Madison Asset Management, LLC portfolio management team, the Portfolios’ sub-adviser, discusses the Portfolios’ performance and positioning for the 12-month period ended August 31, 2018 (the “Reporting Period”).

| Q | | How did the Portfolios perform during the Reporting Period? |

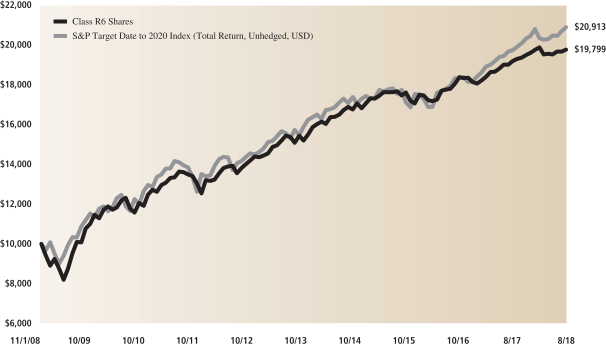

| A | | Goldman Sachs Target Date 2020 Portfolio — During the Reporting Period, the Target Date 2020 Portfolio’s Class A, Institutional, Service, Investor, R and R6 Shares generated average annual total returns of 2.89%, 3.33%, 2.73%, 3.19%, 2.61% and 3.33%, respectively. These returns compare to the 5.82% average annual total return of the Portfolio’s benchmark, the S&P Target Date To 2020 Index (Total Return, Unhedged, USD) during the same period. |

| | Goldman Sachs Target Date 2025 Portfolio — During the Reporting Period, the Target Date 2025 Portfolio’s Class A, Institutional, Service, Investor, R and R6 Shares generated average annual total returns of 5.42%, 5.70%, 5.22%, 5.59%, 4.98% and 5.73%, respectively. These returns compare to the 7.19% average annual total return of the Portfolio’s benchmark, the S&P Target Date To 2025 Index (Total Return, Unhedged, USD) during the same period. |

| | Goldman Sachs Target Date 2030 Portfolio — During the Reporting Period, the Target Date 2030 Portfolio’s Class A, Institutional, Service, Investor, R and R6 Shares generated average annual total returns of 6.93%, 7.29%, 6.71%, 7.06%, 6.59% and 7.30%, respectively. These returns compare to the 8.66% average annual total return of the Portfolio’s benchmark, the S&P Target Date To 2030 Index (Total Return, Unhedged, USD) during the same period. |

| | Goldman Sachs Target Date 2035 Portfolio — During the Reporting Period, the Target Date 2035 Portfolio’s Class A, Institutional, Service, Investor, R and R6 Shares generated average annual total returns of 7.54%, 8.02%, 7.44%, 7.82%, 7.29% and 8.05%, respectively. These returns compare to the 10.01% average annual total return of the Portfolio’s benchmark, the S&P Target Date To 2035 Index (Total Return, Unhedged, USD) during the same period. |

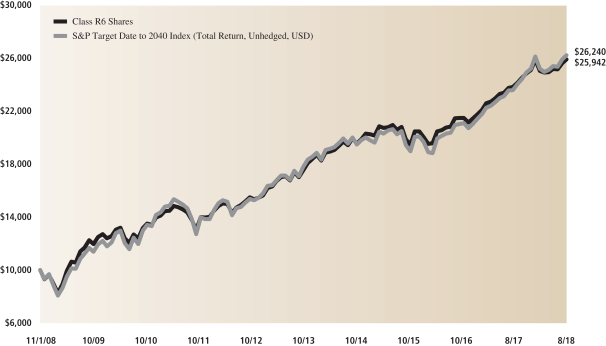

| | Goldman Sachs Target Date 2040 Portfolio — During the Reporting Period, the Target Date 2040 Portfolio’s Class A, |

6

PORTFOLIO RESULTS

| | Institutional, Service, Investor, R and R6 Shares generated average annual total returns of 8.23%, 8.71%, 8.13%, 8.46%, 8.02% and 8.70%, respectively. These returns compare to the 11.10% average annual total return of the Portfolio’s benchmark, the S&P Target Date To 2040 Index (Total Return, Unhedged, USD) during the same period. |

| | Goldman Sachs Target Date 2045 Portfolio — During the Reporting Period, the Target Date 2045 Portfolio’s Class A, Institutional, Service, Investor, R and R6 Shares generated average annual total returns of 9.02%, 9.40%, 8.83%, 9.19%, 8.74% and 9.34%, respectively. These returns compare to the 11.53% average annual total return of the Portfolio’s benchmark, the S&P Target Date To 2045 Index (Total Return, Unhedged, USD) during the same period. |

| | Goldman Sachs Target Date 2050 Portfolio — During the Reporting Period, the Target Date 2050 Portfolio’s Class A, Institutional, Service, Investor, R and R6 Shares generated average annual total returns of 9.66%, 10.10%, 9.53%, 9.98%, 9.38% and 10.11%, respectively. These returns compare to the 11.75% average annual total return of the Portfolio’s benchmark, the S&P Target Date To 2050 Index (Total Return, Unhedged, USD) during the same period. |

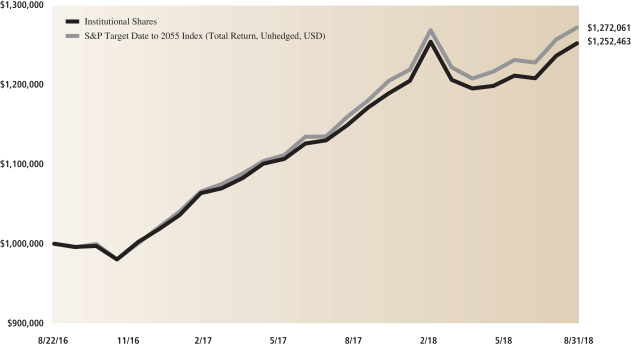

| | Goldman Sachs Target Date 2055 Portfolio — During the Reporting Period, the Target Date 2055 Portfolio’s Class A, Institutional, Service, Investor, R and R6 Shares generated average annual total returns of 10.37%, 10.82%, 10.27%, 10.62%, 10.09% and 10.85%, respectively. These returns compare to the 12.08% average annual total return of the Portfolio’s benchmark, the S&P Target Date To 2055 Index (Total Return, Unhedged, USD) during the same period. |

| | Goldman Sachs Target Date 2060 Portfolio — For the period since their inception on April 30, 2018 through August 31, 2018, the Target Date 2060 Portfolio’s Class A, Institutional, Service, Investor, R and R6 Shares generated cumulative total returns of 4.50%, 4.60%, 4.40%, 4.60%, 4.40% and 4.60%, respectively. These returns compare to the 4.72% cumulative total return of the Portfolio’s benchmark, the S&P Target Date To 2060 Index (Total Return, Unhedged, USD) during the same period. |

| Q | | What key factors affected the Portfolios’ performance during the Reporting Period? |

| A | | All of the Portfolios, including the Goldman Sachs Target Date 2060 Portfolio, were hurt by our asset allocation decisions to favor certain asset classes through the Underlying Funds. Security selection also detracted from each Portfolio’s performance. |

| Q | | How did the Portfolios’ asset allocations affect performance during the Reporting Period? |

| A | | Regarding strategic allocations, we had a slight preference for fixed income over equities in all of the Portfolios, except the Goldman Sachs Target Date 2020 Portfolio and the Goldman Sachs Target Date 2025 Portfolio. This preference had a negative impact on performance, as equities outperformed fixed income during the Reporting Period. In the Goldman Sachs Target Date 2020 Portfolio and the Goldman Sachs Target Date 2025 Portfolio, which have higher exposure to inflation risk compared to the rest of the Portfolios, our slight preference for equities over fixed income bolstered returns. Within equities, all the Portfolios were hampered by our preference for non-U.S. equities over U.S. equities, given that U.S. equities outpaced non-U.S. equities during the Reporting Period. Within fixed income, our focus on investment grade corporate bonds over high yield corporate bonds and the Portfolios’ overweight positions in U.S. Treasury securities also dampened overall performance. |

| | Within the Portfolios’ tactical equity allocations, our decision to overweight U.S. information technology stocks and U.S. growth stocks contributed positively. Tactical positioning in the U.S. energy and materials sectors held back performance. Within non-U.S. equities, the Portfolios benefited from their overweight positions in Japan relative to Europe. In addition, our decision to gain tactical exposure to emerging markets equities through the iShares® Edge MSCI Minimum Volatility Emerging Markets ETF, which tends to have a quality bias and is less cyclically oriented, added to the Portfolios’ results. Select currency hedged positions that sought to gain from the strong U.S. dollar further enhanced returns. Conversely, the Portfolios’ were hurt by their tactical exposure to European equities during the Reporting Period. |

| | Within tactical fixed income allocations, the Portfolios were helped by their positions in Treasury inflation protected securities (“TIPS”), which benefited from higher inflation, and in floating-rate corporate bonds, which have less duration risk. (Duration is a measure of the sensitivity of the price of a fixed income investment to a change in interest rates.) Tactical exposure to short-term corporate bonds also added to performance. On the other hand, the Portfolios’ tactical exposure to U.S. Treasury securities detracted from returns. |

7

PORTFOLIO RESULTS

| Q | | Did the Underlying Funds help or hurt the Portfolios’ performance during the Reporting Period? |

| A | | During the Reporting Period, the Portfolios’ Underlying Funds detracted from performance overall. |

| | | Within the Portfolios’ equity-related Underlying Funds, tactical exposures to the energy and materials sectors through the Energy Select Sector SPDR® ETF and the Vanguard Materials ETF, respectively, hurt results. Both Underlying Funds underperformed their respective benchmark indices during the Reporting Period largely because of the stronger U.S. dollar, slowing economic growth outside the U.S. and broad market concerns about trade. On the positive side, the Portfolios benefited from their tactical exposures to the information technology sector through the Vanguard Information Technology ETF and their tactical exposures to U.S. large-cap growth stocks through the Vanguard Growth ETF. These Underlying Funds performed well due to investors’ preference for growth-oriented stocks during the Reporting Period. Meanwhile, U.S. dollar strength drove positive performance by the Xtrackers MSCI EAFE Hedged Equity ETF. In addition, the Portfolios were helped by their tactical exposures to Japan through the WisdomTree Japan Hedged Equity ETF and the iShares® MSCI Japan ETF, as Japan saw relatively better economic data than Europe. |

| | Among the Portfolios’ fixed income-related Underlying Funds, tactical exposures to U.S. Treasury securities through the Schwab Intermediate-Term U.S. Treasury ETF, the iShares® 7-10 Year Treasury Bond ETF and the iShares® 20+ Year Treasury Bond ETF, detracted from returns as interest rates rose along the U.S. Treasury yield curve, reflecting a higher term premium for U.S. Treasuries and higher inflation expectations by investors. (Yield curve is a spectrum of maturities. Term premium is the amount by which the yield-to-maturity of a long-term bond exceeds that of a short-term bond.) The Portfolios benefited from their tactical exposures to corporate bonds through the Vanguard Short-Term Corporate Bond ETF and the iShares® Floating Rate Bond ETF, as credit spreads narrowed. (Spreads are yield differentials between bonds of comparable maturity.) Corporate bonds broadly outperformed U.S. government bonds during the Reporting Period, as U.S. economic data remained strong. |

| | Of the Portfolios’ commodities-related Underlying Funds, the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF was a drag on performance. Although the Underlying Fund produced a positive return, it trailed the broad U.S. equity market. |

| Q | | How did the Portfolios use derivatives and similar instruments during the Reporting Period? |

| A | | The Portfolios do not directly invest in derivatives. However, some of the Underlying Funds may have used derivatives to allow them to track their respective benchmark indices with more precision. These may have included options, forwards, futures, swaps, structured securities and other derivative instruments. |

| Q | | What changes did you make to the Portfolios’ strategic allocations during the Reporting Period? |

| A | | We slightly reduced the Portfolios’ strategic allocations to non-U.S. stocks and slightly increased their strategic allocations to U.S. stocks, given that U.S. economic prospects looked relatively more attractive than those of other countries, in our view. Within the Portfolios’ U.S. equity allocations, we increased our emphasis on quality. We continued to favor the information technology sector, while maintaining strategic exposures to the cyclically-oriented energy and materials sectors. We increased the Portfolios’ strategic allocations to dividend-paying stocks, which resulted in additional exposure to the consumer staples sector. We also increased their strategic allocations to pharmaceuticals stocks. In addition, during the Reporting Period, we decreased the Portfolios’ broad exposure to non-U.S. equities, while adopting underweight positions in Europe and overweight positions in Japan. We also added select currency hedging positions. |

| Q | | What is the Portfolios’ tactical view and strategy for the months ahead? |

| A | | In the near term, we expect to see low returns from virtually all asset classes. Therefore, we believe managing risk is likely to be of greater importance going forward. We plan to maintain a modestly defensive posture in the Portfolios, with a continued emphasis on seeking to generate strong risk-adjusted returns. |

8

PORTFOLIO RESULTS

|

| |

| Changes to Portfolio Management and Principal Investment Strategy on or about November 30, 2018 |

| |

Effective on or about November 30, 2018, after the close of the Reporting Period, Madison Asset Management, LLC will no longer serve as sub-adviser to the Portfolios, and David Hottmann and Patrick Ryan will no longer serve as portfolio managers of the Portfolios. At the same time, Goldman Sachs Asset Management, L.P. (the “Investment Adviser”) will provide day-to-day advice regarding each of the Portfolios’ investment transactions, and Raymond Chan and Christopher Lvoff will serve as portfolio managers for each of the Portfolios. The Portfolios’ principal investment strategy, including the Portfolios’ glide path, will also change. On or about November 30, 2018, each of the Portfolios will employ an asset allocation strategy designed for investors who plan to retire and withdraw their investment beginning on approximately the date specified in the specific Portfolio’s name (the “Target Date”). Each Portfolio will be managed for an investor planning to retire at the age of 65 on or around the Target Date. The Portfolios will generally seek to achieve their investment objective by investing in shares of exchange-traded funds (“ETFs”) for which the Investment Adviser or an affiliate now or in the future acts as investment adviser or principal underwriter, and may also invest in mutual funds for which the Investment Adviser or an affiliate now or in the future acts as investment adviser or principal underwriter as well as unaffiliated ETFs and mutual funds (collectively, the “Underlying Funds”), without considering or canvassing the universe of unaffiliated funds available. Under normal conditions, each of the Portfolios will invest in Underlying Funds according to the Investment Adviser’s asset allocation strategy such that over time each Portfolio’s asset allocation will generally become more conservative through the reduced allocation to equity funds and increased allocation to fixed income funds in accordance with the glide path’s strategic allocation. |

9

FUND BASICS

Target Date 2020 Portfolio

as of August 31, 2018

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | September 1, 2017–August 31, 2018 | | Portfolio Total Return

(based on NAV)1 | | | S&P Target Date To

2020 (Total Return,

Unhedged, USD)2 | |

| | Class A | | | 2.89 | % | | | 5.82 | % |

| | Institutional | | | 3.33 | | | | 5.82 | |

| | Service | | | 2.73 | | | | 5.82 | |

| | Investor | | | 3.19 | | | | 5.82 | |

| | Class R | | | 2.61 | | | | 5.82 | |

| | | Class R6 | | | 3.33 | | | | 5.82 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Portfolio (ex-dividend) divided by the total number of shares of the class outstanding. The Portfolio’s performance assumes the reinvestment of dividends and other distributions. The Portfolio’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The S&P Target Date Index Series is a component of the S&P Target Allocation Index Family, and is related to the S&P Target Risk Index Series. Both series are broadly representative of the investment opportunity available to investors in target date and target risk funds, respectively. The index series reflects the market consensus for asset allocations for different target date horizons. In particular, each index is representative of the investment opportunity available to investors for the corresponding target date horizon, with asset class exposures driven by a survey of available target date funds for that horizon. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Portfolio’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns.

Performance reflects fee waivers and/or expense limitations in effect. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Returns less than 12 months are cumulative, not annualized.

10

FUND BASICS

| | | | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 6/30/18 | | One Year | | | Five Years | | | Ten Years | | | Since Inception | | Inception Date |

| | Class A | | | -2.64 | % | | | N/A | | | | N/A | | | 0.18% | | 8/22/16 |

| | Institutional | | | 3.46 | | | | N/A | | | | N/A | | | 3.67 | | 8/22/16 |

| | Service | | | 2.87 | | | | N/A | | | | N/A | | | 3.14 | | 8/22/16 |

| | Investor | | | 3.33 | | | | N/A | | | | N/A | | | 3.52 | | 8/22/16 |

| | Class R | | | 2.74 | | | | N/A | | | | N/A | | | 2.99 | | 8/22/16 |

| | | Class R6 | | | 3.46 | | | | 5.45 | % | | | 3.91 | % | | 2.83 | | 10/01/07 |

| | 3 | | The Standardized Total Returns are average annual total returns or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares. Because Institutional, Service, Investor, Class R and Class R6 Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

Effective August 22, 2016, the Madison Target Retirement 2020 Fund (the “Predecessor Fund”) was reorganized into the Portfolio. The Portfolio has assumed the Predecessor Fund’s historical performance. The returns for the Predecessor Fund for periods prior to August 29, 2014 reflect the performance of the Madison Target Retirement 2020 Fund’s Class I Shares, a series of Ultra Series Fund (the “Ultra Predecessor Fund”). As of August 29, 2014, the inception date of the Predecessor Fund, the Ultra Predecessor Fund exchanged in kind substantially all of its portfolio holdings for Class R6 shares of the Predecessor Fund. As a result, the Predecessor Fund assumed the performance of the Ultra Predecessor Fund. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. Past performance does not guarantee future results, which may vary. The value of investments and the income derived from investments will fluctuate and can go down as well as up. A loss of principal may occur.

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Portfolio’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Returns less than 12 months are cumulative, not annualized.

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 0.87 | % | | | 1.52 | % |

| | Institutional | | | 0.48 | | | | 1.13 | |

| | Service | | | 0.98 | | | | 1.63 | |

| | Investor | | | 0.62 | | | | 1.27 | |

| | Class R | | | 1.12 | | | | 1.77 | |

| | | Class R6 | | | 0.47 | | | | 1.12 | |

| | 4 | | The expense ratios of the Portfolio, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Portfolio and will differ from the expense ratios disclosed in the Financial Highlights in this report due to the inclusion of Underlying Fund fees and expenses, which are not included in the operating expenses of the Portfolio reflected in the Financial Highlights. Pursuant to a contractual arrangement, the Portfolio’s waivers and/or expense limitations will remain in place through at least December 29, 2018, and prior to such date, the Investment Adviser may not terminate the arrangements without the approval of the Portfolio’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

11

FUND BASICS

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 8/31/185 |

| | | Holding | | % of Net Assets | | | Line of Business |

| | Schwab Intermediate-Term U.S. Treasury ETF | | | 25.0 | % | | Exchange Traded Funds |

| | Vanguard Short-Term Corporate Bond ETF | | | 21.0 | | | Exchange Traded Funds |

| | Schwab U.S. TIPS ETF | | | 20.0 | | | Exchange Traded Funds |

| | iShares 20+ Year Treasury Bond ETF | | | 5.0 | | | Exchange Traded Funds |

| | iShares Core S&P 500 ETF | | | 4.0 | | | Exchange Traded Funds |

| | Schwab U.S. Dividend Equity ETF | | | 3.5 | | | Exchange Traded Funds |

| | iShares Edge MSCI USA Quality Factor ETF | | | 2.5 | | | Exchange Traded Funds |

| | iShares Edge MSCI Minimum Volatility Emerging Markets ETF | | | 2.0 | | | Exchange Traded Funds |

| | Invesco Optimum Yield Diversified Commodity Strategy No. K-1 ETF | | | 2.0 | | | Exchange Traded Funds |

| | | Vanguard Information Technology ETF | | | 2.0 | | | Exchange Traded Funds |

| | 5 | | The top 10 holdings may not be representative of the Portfolio’s future investments. The top 10 holdings exclude investments in money market funds. |

| | | | | | | | | | |

| | PORTFOLIO COMPOSITION6 | |

| | | Holding | | As of August 31, 2018 | | | As of August 31, 2017 | |

| | Bond Funds | | | 71.0 | % | | | 65.1 | % |

| | Stock Funds | | | 19.0 | | | | 20.3 | |

| | Foreign Stock Funds | | | 5.9 | | | | 7.8 | |

| | Investment Companies | | | 0.5 | | | | 3.2 | |

| | | Alternative Funds | | | 2.0 | | | | 3.0 | |

| | 6 | | The Portfolio is actively managed and, as such, its composition may differ over time. The percentage shown for each fund type reflects the value of that fund type as a percentage of the Portfolio’s net assets. Figures above may not sum to 100% due to rounding and/or exclusion of other assets and liabilities. |

12

GOLDMAN SACHS TARGET DATE 2020 PORTFOLIO

Performance Summary

August 31, 2018

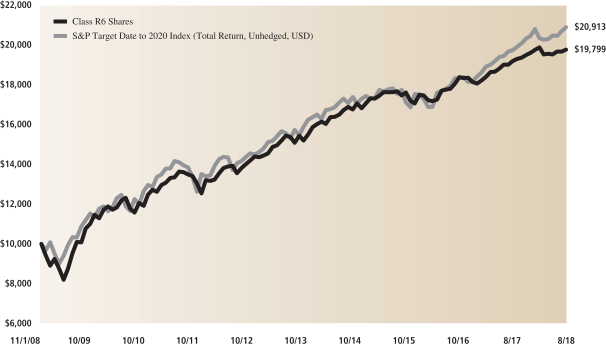

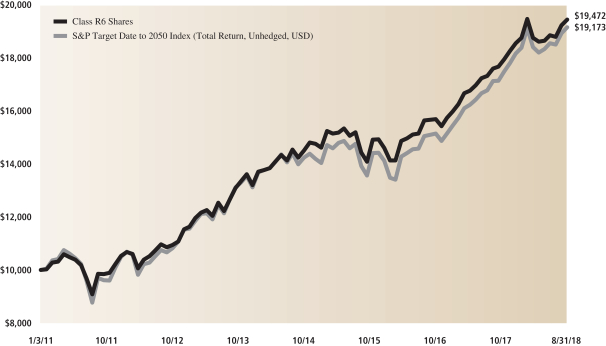

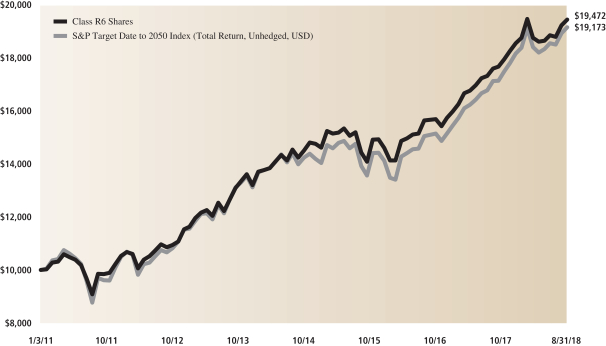

The following graph shows the value, as of August 31, 2018, of a $10,000 investment made on November 1, 2008 in Class R6 Shares. For comparative purposes, the performance of the Portfolio’s benchmark, the S&P Target Date to 2020 Index (Total Return, Unhedged, USD), is shown. This performance data represents past performance and should not be considered indicative of future performance, which will fluctuate with changes in market conditions. These performance fluctuations may cause an investor’s shares, when redeemed, to be worth more or less than their original cost. Performance reflects applicable fee waivers and/or expense limitations currently in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Performance of Class A, Institutional, Service, Investor and Class R Shares will vary from Class R6 Shares due to differences in class specific fees and any applicable sales charges. In addition to the Sub-Adviser’s decisions regarding underlying fund selection and allocations among them, other factors may affect Portfolio performance. These factors include, but are not limited to, portfolio operating fees and expenses, portfolio turnover and subscription and redemption cash flows affecting the Portfolio.

|

| Target Date 2020 Portfolio’s Lifetime Performance |

Performance of a $10,000 investment, with distributions reinvested, from November 1, 2008 through August 31, 2018.

| | | | | | | | | | | | | | | | |

Average Annual Total Return through August 31, 2018 | | | One Year | | | | Five Years | | | | Ten Years | | | | Since Inception | |

Class A (Commenced August 22, 2016) | | | | | | | | | | | | | | | | |

Excluding sales charges | | | 2.89% | | | | N/A | | | | N/A | | | | 3.63% | |

Including sales charges | | | -2.78% | | | | N/A | | | | N/A | | | | 0.80% | |

| |

Institutional (Commenced August 22, 2016) | | | 3.33% | | | | N/A | | | | N/A | | | | 4.07% | |

| |

Service (Commenced August 22, 2016) | | | 2.73% | | | | N/A | | | | N/A | | | | 3.53% | |

| |

Investor (Commenced August 22, 2016) | | | 3.19% | | | | N/A | | | | N/A | | | | 3.93% | |

| |

Class R (Commenced August 22, 2016) | | | 2.61% | | | | N/A | | | | N/A | | | | 3.39% | |

| |

Class R6 (Commenced October 1, 2007) | | | 3.33% | | | | 5.59% | | | | 4.45% | | | | 2.92% | |

| |

13

FUND BASICS

Target Date 2025 Portfolio

as of August 31, 2018

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | September 1, 2017–August 31, 2018 | | Portfolio Total Return

(based on NAV)1 | | | S&P Target Date To

2025 (Total Return,

Unhedged, USD)2 | |

| | Class A | | | 5.42 | % | | | 7.19 | % |

| | Institutional | | | 5.70 | | | | 7.19 | |

| | Service | | | 5.22 | | | | 7.19 | |

| | Investor | | | 5.59 | | | | 7.19 | |

| | Class R | | | 4.98 | | | | 7.19 | |

| | | Class R6 | | | 5.73 | | | | 7.19 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Portfolio (ex-dividend) divided by the total number of shares of the class outstanding. The Portfolio’s performance assumes the reinvestment of dividends and other distributions. The Portfolio’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The S&P Target Date Index Series is a component of the S&P Target Allocation Index Family, and is related to the S&P Target Risk Index Series. Both series are broadly representative of the investment opportunity available to investors in target date and target risk funds, respectively. The index series reflects the market consensus for asset allocations for different target date horizons. In particular, each index is representative of the investment opportunity available to investors for the corresponding target date horizon, with asset class exposures driven by a survey of available target date funds for that horizon. |

| | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 | | | |

| | | For the period ended 6/30/18 | | One Year | | | Since Inception | | | Inception Date |

| | Class A | | | -0.82 | % | | | 2.34 | % | | 8/22/16 |

| | Institutional | | | 5.25 | | | | 5.88 | | | 8/22/16 |

| | Service | | | 4.77 | | | | 5.36 | | | 8/22/16 |

| | Investor | | | 5.14 | | | | 5.74 | | | 8/22/16 |

| | Class R | | | 4.63 | | | | 5.19 | | | 8/22/16 |

| | | Class R6 | | | 5.28 | | | | 5.90 | | | 8/22/16 |

| | 3 | | The Standardized Total Returns are average annual total returns or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares. Because Institutional, Service, Investor, Class R and Class R6 Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Portfolio’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Returns less than 12 months are cumulative, not annualized.

14

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 0.87 | % | | | 3.29 | % |

| | Institutional | | | 0.48 | | | | 2.90 | |

| | Service | | | 0.98 | | | | 3.40 | |

| | Investor | | | 0.62 | | | | 3.04 | |

| | Class R | | | 1.12 | | | | 3.54 | |

| | | Class R6 | | | 0.47 | | | | 2.89 | |

| | 4 | | The expense ratios of the Portfolio, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Portfolio and will differ from the expense ratios disclosed in the Financial Highlights in this report due to the inclusion of Underlying Fund fees and expenses, which are not included in the operating expenses of the Portfolio reflected in the Financial Highlights. Pursuant to a contractual arrangement, the Portfolio’s waivers and/or expense limitations will remain in place through at least December 29, 2018, and prior to such date, the Investment Adviser may not terminate the arrangements without the approval of the Portfolio’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 8/31/185 |

| | | Holding | | % of Net Assets | | | Line of Business |

| | Schwab Intermediate-Term U.S. Treasury ETF | | | 20.0 | % | | Exchange Traded Funds |

| | Vanguard Short-Term Corporate Bond ETF | | | 15.0 | | | Exchange Traded Funds |

| | Schwab U.S. TIPS ETF | | | 15.0 | | | Exchange Traded Funds |

| | iShares Core S&P 500 ETF | | | 11.5 | | | Exchange Traded Funds |

| | Schwab U.S. Dividend Equity ETF | | | 4.5 | | | Exchange Traded Funds |

| | iShares Edge MSCI Minimum Volatility Emerging Markets ETF | | | 3.5 | | | Exchange Traded Funds |

| | iShares 20+ Year Treasury Bond ETF | | | 3.5 | | | Exchange Traded Funds |

| | iShares Core S&P Mid-Cap ETF | | | 3.0 | | | Exchange Traded Funds |

| | iShares Edge MSCI USA Quality Factor ETF | | | 2.5 | | | Exchange Traded Funds |

| | | Invesco Optimum Yield Diversified Commodity Strategy No. K-1 ETF | | | 2.5 | | | Exchange Traded Funds |

| | 5 | | The top 10 holdings may not be representative of the Portfolio’s future investments. The top 10 holdings exclude investments in money market funds. |

| | | | | | | | | | |

| | PORTFOLIO COMPOSITION6 | |

| | | Holding | | As of August 31, 2018 | | | As of August 31, 2017 | |

| | Bond Funds | | | 53.5 | % | | | 48.5 | % |

| | Stock Funds | | | 30.9 | | | | 31.5 | |

| | Foreign Stock Funds | | | 10.9 | | | | 13.1 | |

| | Alternative Funds | | | 2.5 | | | | 3.0 | |

| | | Investment Companies | | | 0.5 | | | | 3.5 | |

| | 6 | | The Portfolio is actively managed and, as such, its composition may differ over time. The percentage shown for each fund type reflects the value of that fund type as a percentage of the Portfolio’s net assets. Figures above may not sum to 100% due to rounding and/or exclusion of other assets and liabilities. |

15

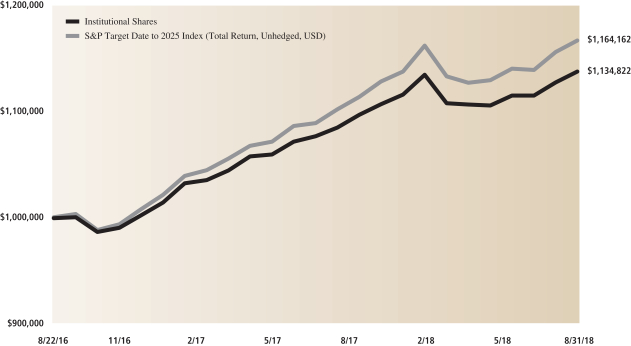

GOLDMAN SACHS TARGET DATE 2025 PORTFOLIO

Performance Summary

August 31, 2018

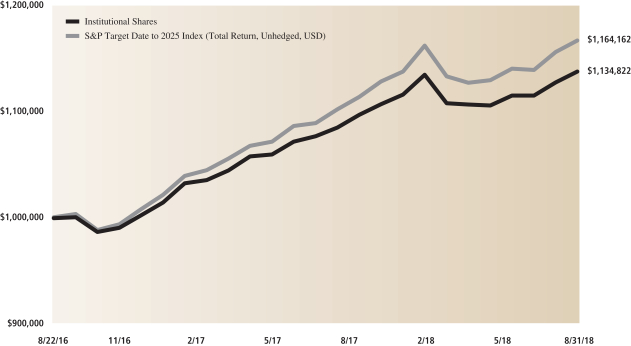

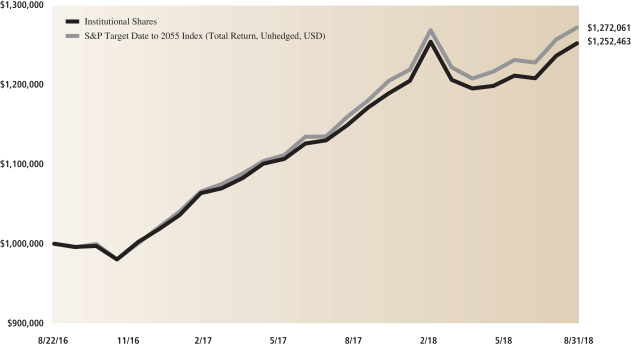

The following graph shows the value, as of August 31, 2018, of a $1,000,000 investment made on August 22, 2016 (commencement of operations) in Institutional Shares. For comparative purposes, the performance of the Portfolio’s benchmark, the S&P Target Date to 2025 Index (Total Return, Unhedged, USD), is shown. This performance data represents past performance and should not be considered indicative of future performance, which will fluctuate with changes in market conditions. These performance fluctuations may cause an investor’s shares, when redeemed, to be worth more or less than their original cost. Performance reflects applicable fee waivers and/or expense limitations currently in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Performance of Class A, Service, Investor, Class R and Class R6 Shares will vary from Institutional Shares due to differences in class specific fees and any applicable sales charges. In addition to the Sub-Adviser’s decisions regarding underlying fund selection and allocations among them, other factors may affect Portfolio performance. These factors include, but are not limited to, portfolio operating fees and expenses, portfolio turnover and subscription and redemption cash flows affecting the Portfolio.

|

| Target Date 2025 Portfolio’s Lifetime Performance |

Performance of a $1,000,000 investment, with distributions reinvested, from August 22, 2016 through August 31, 2018.

| | | | | | | | |

Average Annual Total Return through August 31, 2018 | | | One Year | | | | Since Inception | |

Class A (Commenced August 22, 2016) | | | | | | | | |

Excluding sales charges | | | 5.42% | | | | 6.08% | |

Including sales charges | | | -0.40% | | | | 3.17% | |

| |

Institutional (Commenced August 22, 2016) | | | 5.70% | | | | 6.44% | |

| |

Service (Commenced August 22, 2016) | | | 5.22% | | | | 5.96% | |

| |

Investor (Commenced August 22, 2016) | | | 5.59% | | | | 6.30% | |

| |

Class R (Commenced August 22, 2016) | | | 4.98% | | | | 5.76% | |

| |

Class R6 (Commenced August 22, 2016) | | | 5.73% | | | | 6.45% | |

| |

16

FUND BASICS

Target Date 2030 Portfolio

as of August 31, 2018

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | September 1, 2017–August 31, 2018 | | Portfolio Total Return

(based on NAV)1 | | | S&P Target Date To

2030 (Total Return,

Unhedged, USD)2 | |

| | Class A | | | 6.93 | % | | | 8.66 | % |

| | Institutional | | | 7.29 | | | | 8.66 | |

| | Service | | | 6.71 | | | | 8.66 | |

| | Investor | | | 7.06 | | | | 8.66 | |

| | Class R | | | 6.59 | | | | 8.66 | |

| | | Class R6 | | | 7.30 | | | | 8.66 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Portfolio (ex-dividend) divided by the total number of shares of the class outstanding. The Portfolio’s performance assumes the reinvestment of dividends and other distributions. The Portfolio’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The S&P Target Date Index Series is a component of the S&P Target Allocation Index Family, and is related to the S&P Target Risk Index Series. Both series are broadly representative of the investment opportunity available to investors in target date and target risk funds, respectively. The index series reflects the market consensus for asset allocations for different target date horizons. In particular, each index is representative of the investment opportunity available to investors for the corresponding target date horizon, with asset class exposures driven by a survey of available target date funds for that horizon. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Portfolio’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects fee waivers and/or expense limitations in effect. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Returns less than 12 months are cumulative, not annualized.

17

FUND BASICS

| | | | | | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 6/30/18 | | One Year | | | Five Years | | | Ten Years | | | Since Inception | | | Inception Date |

| | Class A | | | 0.15 | % | | | N/A | | | | N/A | | | | 3.52 | % | | 8/22/16 |

| | Institutional | | | 6.39 | | | | N/A | | | | N/A | | | | 7.20 | | | 8/22/16 |

| | Service | | | 5.82 | | | | N/A | | | | N/A | | | | 6.68 | | | 8/22/16 |

| | Investor | | | 6.16 | | | | N/A | | | | N/A | | | | 6.99 | | | 8/22/16 |

| | Class R | | | 5.70 | | | | N/A | | | | N/A | | | | 6.52 | | | 8/22/16 |

| | | Class R6 | | | 6.40 | | | | 7.50 | % | | | 5.01 | % | | | 3.68 | | | 10/01/07 |

| | 3 | | The Standardized Total Returns are average annual total returns or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares. Because Institutional, Service, Investor, Class R and Class R6 Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

Effective August 22, 2016, the Madison Target Retirement 2030 Fund (the “Predecessor Fund”) was reorganized into the Portfolio. The Portfolio has assumed the Predecessor Fund’s historical performance. The returns for the Predecessor Fund for periods prior to August 29, 2014 reflect the performance of the Madison Target Retirement 2030 Fund’s Class I Shares, a series of Ultra Series Fund (the “Ultra Predecessor Fund”). As of August 29, 2014, the inception date of the Predecessor Fund, the Ultra Predecessor Fund exchanged in kind substantially all of its portfolio holdings for Class R6 shares of the Predecessor Fund. As a result, the Predecessor Fund assumed the performance of the Ultra Predecessor Fund. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. Past performance does not guarantee future results, which may vary. The value of investments and the income derived from investments will fluctuate and can go down as well as up. A loss of principal may occur.

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Portfolio’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Returns less than 12 months are cumulative, not annualized.

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 0.87 | % | | | 1.34 | % |

| | Institutional | | | 0.48 | | | | 0.95 | |

| | Service | | | 0.98 | | | | 1.45 | |

| | Investor | | | 0.62 | | | | 1.09 | |

| | Class R | | | 1.12 | | | | 1.59 | |

| | | Class R6 | | | 0.47 | | | | 0.94 | |

| | 4 | | The expense ratios of the Portfolio, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Portfolio and will differ from the expense ratios disclosed in the Financial Highlights in this report due to the inclusion of Underlying Fund fees and expenses, which are not included in the operating expenses of the Portfolio reflected in the Financial Highlights. Pursuant to a contractual arrangement, the Portfolio’s waivers and/or expense limitations will remain in place through at least December 29, 2018, and prior to such date, the Investment Adviser may not terminate the arrangements without the approval of the Portfolio’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

18

FUND BASICS

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 8/31/185 |

| | | Holding | | % of Net Assets | | | Line of Business |

| | Schwab Intermediate-Term U.S. Treasury ETF | | | 18.0 | % | | Exchange Traded Funds |

| | iShares Core S&P 500 ETF | | | 17.0 | | | Exchange Traded Funds |

| | Vanguard Short-Term Corporate Bond ETF | | | 12.0 | | | Exchange Traded Funds |

| | Schwab U.S. TIPS ETF | | | 10.5 | | | Exchange Traded Funds |

| | Schwab U.S. Dividend Equity ETF | | | 5.0 | | | Exchange Traded Funds |

| | iShares Edge MSCI Minimum Volatility Emerging Markets ETF | | | 4.0 | | | Exchange Traded Funds |

| | iShares Core S&P Mid-Cap ETF | | | 3.5 | | | Exchange Traded Funds |

| | iShares Edge MSCI USA Quality Factor ETF | | | 2.7 | | | Exchange Traded Funds |

| | iShares 20+ Year Treasury Bond ETF | | | 2.5 | | | Exchange Traded Funds |

| | | Invesco DB Optimum Yield Diversified Commodity Strategy No. K-1 ETF | | | 2.5 | | | Exchange Traded Funds |

| | 5 | | The top 10 holdings may not be representative of the Portfolio’s future investments. The top 10 holdings exclude investments in money market funds. |

| | | | | | | | | | |

| | PORTFOLIO COMPOSITION6 | |

| | | Holding | | As of August 31, 2018 | | | As of August 31, 2017 | |

| | Bond Funds | | | 43.1 | % | | | 39.3 | % |

| | Stock Funds | | | 39.9 | | | | 36.3 | |

| | Foreign Stock Funds | | | 12.5 | | | | 16.4 | |

| | Alternative Funds | | | 2.5 | | | | 3.0 | |

| | | Investment Companies | | | 0.5 | | | | 2.0 | |

| | 6 | | The Portfolio is actively managed and, as such, its composition may differ over time. The percentage shown for each fund type reflects the value of that fund type as a percentage of the Portfolio’s net assets. Figures above may not sum to 100% due to rounding and/or exclusion of other assets and liabilities. |

19

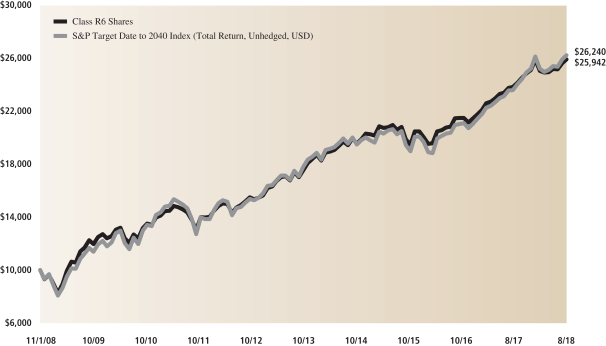

GOLDMAN SACHS TARGET DATE 2030 PORTFOLIO

Performance Summary

August 31, 2018

The following graph shows the value, as of August 31, 2018, of a $10,000 investment made on November 1, 2008 in Class R6 Shares. For comparative purposes, the performance of the Portfolio’s benchmark, the S&P Target Date to 2030 Index (Total Return, Unhedged, USD), is shown. This performance data represents past performance and should not be considered indicative of future performance, which will fluctuate with changes in market conditions. These performance fluctuations may cause an investor’s shares, when redeemed, to be worth more or less than their original cost. Performance reflects applicable fee waivers and/or expense limitations currently in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Performance of Class A, Institutional, Service, Investor and Class R Shares will vary from Class R6 Shares due to differences in class specific fees and any applicable sales charges. In addition to the Sub-Adviser’s decisions regarding underlying fund selection and allocations among them, other factors may affect Portfolio performance. These factors include, but are not limited to, portfolio operating fees and expenses, portfolio turnover and subscription and redemption cash flows affecting the Portfolio.

|

| Target Date 2030 Portfolio’s Lifetime Performance |

Performance of a $10,000 investment, with distributions reinvested, from November 1, 2008 through August 31, 2018.

| | | | | | | | | | | | |

Average Annual Total Return through August 31, 2018 | | | One Year | | | | Five Years | | | Ten Years | | Since Inception |

Class A (Commenced August 22, 2016) | | | | | | | | | | | | |

Excluding sales charges | | | 6.93% | | | | N/A | | | N/A | | 7.53% |

Including sales charges | | | 1.09% | | | | N/A | | | N/A | | 4.56% |

|

Institutional (Commenced August 22, 2016) | | | 7.29% | | | | N/A | | | N/A | | 7.96% |

|

Service (Commenced August 22, 2016) | | | 6.71% | | | | N/A | | | N/A | | 7.43% |

|

Investor (Commenced August 22, 2016) | | | 7.06% | | | | N/A | | | N/A | | 7.77% |

|

Class R (Commenced August 22, 2016) | | | 6.59% | | | | N/A | | | N/A | | 7.28% |

|

Class R6 (Commenced October 1, 2007) | | | 7.30% | | | | 7.82% | | | 5.69% | | 3.87% |

|

20

FUND BASICS

Target Date 2035 Portfolio

as of August 31, 2018

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | September 1, 2017–August 31, 2018 | | Portfolio Total Return

(based on NAV)1 | | | S&P Target Date To

2035 (Total Return,

Unhedged, USD)2 | |

| | Class A | | | 7.54 | % | | | 10.01 | % |

| | Institutional | | | 8.02 | | | | 10.01 | |

| | Service | | | 7.44 | | | | 10.01 | |

| | Investor | | | 7.82 | | | | 10.01 | |

| | Class R | | | 7.29 | | | | 10.01 | |

| | | Class R6 | | | 8.05 | | | | 10.01 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Portfolio (ex-dividend) divided by the total number of shares of the class outstanding. The Portfolio’s performance assumes the reinvestment of dividends and other distributions. The Portfolio’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The S&P Target Date Index Series is a component of the S&P Target Allocation Index Family, and is related to the S&P Target Risk Index Series. Both series are broadly representative of the investment opportunity available to investors in target date and target risk funds, respectively. The index series reflects the market consensus for asset allocations for different target date horizons. In particular, each index is representative of the investment opportunity available to investors for the corresponding target date horizon, with asset class exposures driven by a survey of available target date funds for that horizon. |

| | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 6/30/18 | | One Year | | | Since Inception | | | Inception Date |

| | Class A | | | 0.70 | % | | | 4.25 | % | | 8/22/16 |

| | Institutional | | | 6.94 | | | | 7.86 | | | 8/22/16 |

| | Service | | | 6.37 | | | | 7.33 | | | 8/22/16 |

| | Investor | | | 6.84 | | | | 7.71 | | | 8/22/16 |

| | Class R | | | 6.22 | | | | 7.17 | | | 8/22/16 |

| | | Class R6 | | | 6.97 | | | | 7.87 | | | 8/22/16 |

| | 3 | | The Standardized Total Returns are average annual total returns or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares. Because Institutional, Service, Investor, Class R and Class R6 Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Portfolio’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Returns less than 12 months are cumulative, not annualized.

21

FUND BASICS

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | Class A | | | 0.87 | % | | | 3.26 | % |

| | Institutional | | | 0.48 | | | | 2.87 | |

| | Service | | | 0.98 | | | | 3.37 | |

| | Investor | | | 0.62 | | | | 3.01 | |

| | Class R | | | 1.12 | | | | 3.51 | |

| | | Class R6 | | | 0.47 | | | | 2.86 | |

| | 4 | | The expense ratios of the Portfolio, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Portfolio and will differ from the expense ratios disclosed in the Financial Highlights in this report due to the inclusion of Underlying Fund fees and expenses, which are not included in the operating expenses of the Portfolio reflected in the Financial Highlights. Pursuant to a contractual arrangement, the Portfolio’s waivers and/or expense limitations will remain in place through at least December 29, 2018, and prior to such date, the Investment Adviser may not terminate the arrangements without the approval of the Portfolio’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

| | | | | | | | |

| | TOP TEN HOLDINGS AS OF 8/31/185 |

| | | Holding | | % of Net Assets | | | Line of Business |

| | iShares Core S&P 500 ETF | | | 17.9 | % | | Exchange Traded Funds |

| | Schwab Intermediate-Term U.S. Treasury ETF | | | 16.0 | | | Exchange Traded Funds |

| | Vanguard Short-Term Corporate Bond ETF | | | 10.5 | | | Exchange Traded Funds |

| | Schwab U.S. TIPS ETF | | | 9.0 | | | Exchange Traded Funds |

| | Schwab U.S. Dividend Equity ETF | | | 5.5 | | | Exchange Traded Funds |

| | iShares Edge MSCI Minimum Volatility Emerging Markets ETF | | | 4.5 | | | Exchange Traded Funds |

| | iShares Core S&P Mid-Cap ETF | | | 4.0 | | | Exchange Traded Funds |

| | iShares Edge MSCI USA Quality Factor ETF | | | 3.0 | | | Exchange Traded Funds |

| | Invesco Optimum Yield Diversified Commodity Strategy No. K-1 ETF | | | 3.0 | | | Exchange Traded Funds |

| | | Vanguard FTSE Europe ETF | | | 3.0 | | | Exchange Traded Funds |

| | 5 | | The top 10 holdings may not be representative of the Portfolio’s future investments. The top 10 holdings exclude investments in money market funds. |

| | | | | | | | | | |

| | PORTFOLIO COMPOSITION6 | |

| | | Holding | | As of August 31, 2018 | | | As of August 31, 2017 | |

| | Stock Funds | | | 41.6 | % | | | 39.6 | % |

| | Bond Funds | | | 38.0 | | | | 34.5 | |

| | Foreign Stock Funds | | | 15.2 | | | | 18.5 | |

| | Investment Companies | | | 0.5 | | | | 3.5 | |

| | | Alternative Funds | | | 3.0 | | | | 3.0 | |

| | 6 | | The Portfolio is actively managed and, as such, its composition may differ over time. The percentage shown for each fund type reflects the value of that fund type as a percentage of the Portfolio’s net assets. Figures above may not sum to 100% due to rounding and/or exclusion of other assets and liabilities. |

22

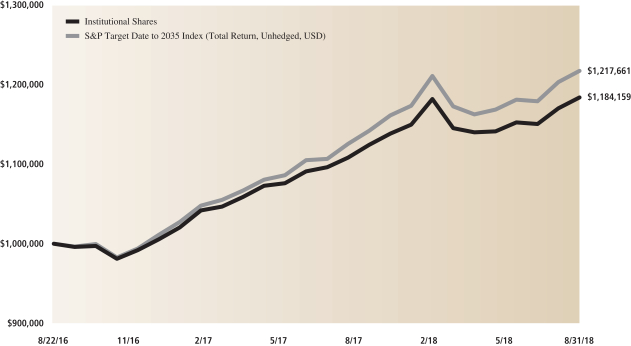

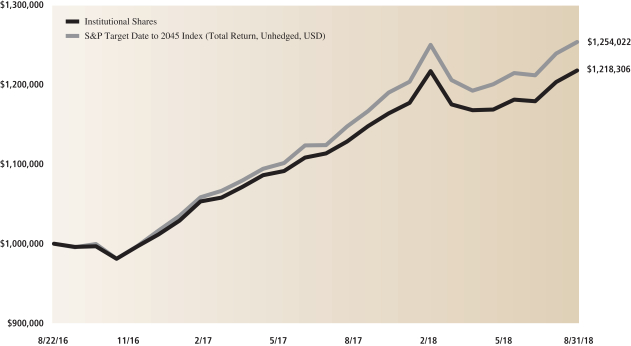

GOLDMAN SACHS TARGET DATE 2035 PORTFOLIO

Performance Summary

August 31, 2018

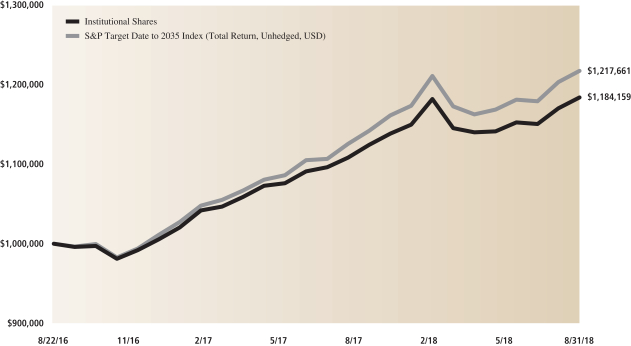

The following graph shows the value, as of August 31, 2018, of a $1,000,000 investment made on August 22, 2016 (commencement of operations) in Institutional Shares. For comparative purposes, the performance of the Portfolio’s benchmark, the S&P Target Date to 2035 Index (Total Return, Unhedged, USD), is shown. This performance data represents past performance and should not be considered indicative of future performance, which will fluctuate with changes in market conditions. These performance fluctuations may cause an investor’s shares, when redeemed, to be worth more or less than their original cost. Performance reflects applicable fee waivers and/or expense limitations currently in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Performance of Class A, Service, Investor, Class R and Class R6 Shares will vary from Institutional Shares due to differences in class specific fees and any applicable sales charges. In addition to the Sub-Adviser’s decisions regarding underlying fund selection and allocations among them, other factors may affect Portfolio performance. These factors include, but are not limited to, portfolio operating fees and expenses, portfolio turnover and subscription and redemption cash flows affecting the Portfolio.

|

| Target Date 2035 Portfolio’s Lifetime Performance |

Performance of a $1,000,000 investment, with distributions reinvested, from August 22, 2016 through August 31, 2018.

| | | | | | |

Average Annual Total Return through August 31, 2018 | | | One Year | | | Since Inception |

Class A (Commenced August 22, 2016) | | | | | | |

Excluding sales charges | | | 7.54% | | | 8.28% |

Including sales charges | | | 1.64% | | | 5.32% |

|

Institutional (Commenced August 22, 2016) | | | 8.02% | | | 8.69% |

|

Service (Commenced August 22, 2016) | | | 7.44% | | | 8.17% |

|

Investor (Commenced August 22, 2016) | | | 7.82% | | | 8.52% |

|

Class R (Commenced August 22, 2016) | | | 7.29% | | | 8.02% |

|

Class R6 (Commenced August 22, 2016) | | | 8.05% | | | 8.71% |

|

23

FUND BASICS

Target Date 2040 Portfolio

as of August 31, 2018

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | September 1, 2017–August 31, 2018 | | Portfolio Total Return

(based on NAV)1 | | | S&P Target Date To

2040 (Total Return,

Unhedged, USD)2 | |

| | Class A | | | 8.23 | % | | | 11.10 | % |

| | Institutional | | | 8.71 | | | | 11.10 | |

| | Service | | | 8.13 | | | | 11.10 | |

| | Investor | | | 8.46 | | | | 11.10 | |

| | Class R | | | 8.02 | | | | 11.10 | |

| | | Class R6 | | | 8.70 | | | | 11.10 | |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Portfolio (ex-dividend) divided by the total number of shares of the class outstanding. The Portfolio’s performance assumes the reinvestment of dividends and other distributions. The Portfolio’s performance does not reflect the deduction of any applicable sales charges. |

| | 2 | | The S&P Target Date Index Series is a component of the S&P Target Allocation Index Family, and is related to the S&P Target Risk Index Series. Both series are broadly representative of the investment opportunity available to investors in target date and target risk funds, respectively. The index series reflects the market consensus for asset allocations for different target date horizons. In particular, each index is representative of the investment opportunity available to investors for the corresponding target date horizon, with asset class exposures driven by a survey of available target date funds for that horizon. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Portfolio’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects fee waivers and/or expense limitations in effect. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Returns less than 12 months are cumulative, not annualized.

24

FUND BASICS

| | | | | | | | | | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 6/30/18 | | One Year | | | Five Years | | | Ten Years | | | Since Inception | | | Inception Date |

| | Class A | | | 1.13 | % | | | N/A | | | | N/A | | | | 4.93 | % | | 8/22/16 |

| | Institutional | | | 7.53 | | | | N/A | | | | N/A | | | | 8.63 | | | 8/22/16 |

| | Service | | | 6.96 | | | | N/A | | | | N/A | | | | 8.11 | | | 8/22/16 |

| | Investor | | | 7.28 | | | | N/A | | | | N/A | | | | 8.47 | | | 8/22/16 |

| | Class R | | | 6.74 | | | | N/A | | | | N/A | | | | 7.90 | | | 8/22/16 |

| | | Class R6 | | | 7.53 | | | | 8.43 | % | | | 5.14 | % | | | 3.70 | | | 10/01/07 |

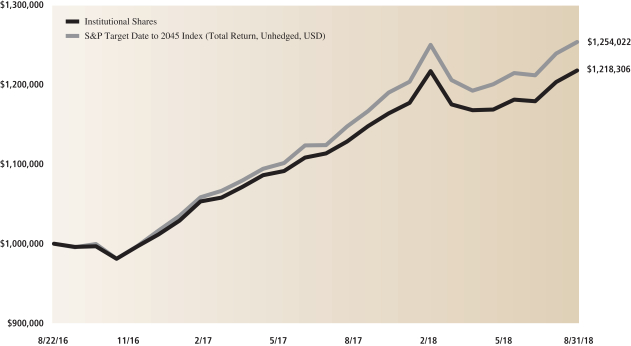

| | 3 | | The Standardized Total Returns are average annual total returns or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. These returns reflect a maximum initial sales charge of 5.5% for Class A Shares. Because Institutional, Service, Investor, Class R and Class R6 Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |