UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22781

Goldman Sachs Trust II

(Exact name of registrant as specified in charter)

200 West Street

15th Floor

New York, New York 10282

(Address of principal executive offices) (Zip code)

| | |

Copies to: |

Caroline Kraus | | Geoffrey R.T. Kenyon, Esq. |

Goldman Sachs & Co. LLC | | Dechert LLP |

200 West Street | | 100 Oliver Street |

New York, New York 10282 | | 40th Floor |

| | Boston, MA 02110-2605 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (212) 902-1000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2018

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Annual Report to Shareholders is filed herewith. |

Goldman Sachs Funds

| | | | |

| | |

| Annual Report | | | | October 31, 2018 |

| | |

| | | | Active Equity Multi-Manager Funds |

| | | | Multi-Manager International Equity |

| | | | Multi-Manager U.S. Dynamic Equity |

| | | | Multi-Manager U.S. Small Cap Equity |

Active Equity Multi-Manager Funds

| ∎ | | MULTI-MANAGER INTERNATIONAL EQUITY |

| ∎ | | MULTI-MANAGER U.S. DYNAMIC EQUITY |

| ∎ | | MULTI-MANAGER U.S. SMALL CAP EQUITY |

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

MARKET REVIEW

Active Equity Multi-Manager Funds

Market Review

The capital markets experienced mixed results during the 12 months ended October 31, 2018 (the “Reporting Period”) amidst a resurgence of volatility.

When the Reporting Period began in November 2017, global equity markets marched higher, extending their record highs of the calendar year on the heels of strong corporate earnings growth and positive business sentiment. Bullish market sentiment was further augmented by the passage of a U.S. tax reform bill in December 2017. The U.S. Federal Reserve’s (“Fed”) decision in the same month to raise short-term interest rates by a quarter of a percentage point did little to temper the rally, as the rate hike was largely driven by the Fed’s positive outlook for U.S. economic growth and a strong jobs market. In late January 2018, the U.S. dollar fell to a three-year low versus other developed markets currencies based on concerns about rhetoric from the U.S. Treasury Secretary, who said he favored a weak U.S. dollar, as well as by what investors perceived as the erosion of the U.S. dollar’s yield relative to those of other currencies. During February 2018, volatility returned to the capital markets amid bond market jitters and a significant sell-off in the global equity markets, which was largely influenced by a rise in the 10-year U.S. Treasury yield. The U.S. Administration’s announcement of steel and aluminum tariffs compounded equity investors’ concerns. In March 2018, at Jerome Powell’s first policy meeting as Fed chair, the U.S. central bank raised short-term interest rates by another quarter percentage point. Fed policymakers went on to raise short-term rates by the same amount on two more occasions — in June and September 2018, and the capital markets anticipated a fourth hike before calendar year end. The Fed’s interest rate hikes led to higher U.S. bond yields, which, in addition to strong corporate earnings growth and a relatively stable macroeconomic picture, helped keep global equity markets rather range bound between March and September 2018. Then, in October, global equities sold off significantly, largely erasing earlier gains. The sell-off was triggered by the continued rise in U.S. bond yields and emerging signs of a slowdown in global economic growth, which sparked investors’ rotation out of growth- and momentum-oriented sectors, such as consumer discretionary and information technology, into value-oriented sectors, such as energy, and traditionally defensive sectors, such as utilities. Global equities finished the Reporting Period with modest losses, as positive returns in the U.S. were offset by the negative performance of European and emerging markets stocks. From a sector perspective, gains overall in health care and information technology were offset by declines in financials and industrials. In commodities, energy prices broadly moved higher during the Reporting Period overall on a combination of U.S. sanctions on Russia, trade disputes and continuing tightness in crude oil supplies. However, metals lagged, particularly in the closing months of the Reporting Period, as the outlook for global economic growth became a focal point for investors.

Credit markets generally sold off during the Reporting Period overall, as a more hawkish Fed continued to forecast additional interest rate hikes against the backdrop of strong U.S. economic growth and increasing signs of inflation. (Hawkish tends to suggest higher interest rates; opposite of dovish.) Credit spreads, or yield differentials between corporate bonds and U.S. Treasury securities of comparable maturity, widened slightly, with concerns about U.S.-China trade tensions weighing on investor sentiment for corporate bonds. Floating-rate bank loans were the best performing sector in the U.S. fixed income markets during the Reporting Period, as each increase in LIBOR boosted coupon payments, fueling investor demand. (LIBOR is London interbank offered rates, which are floating interest rates widely used as reference rates in bank, corporate and government lending agreements.) Demand for floating-rate bank loans came at the expense of fixed-rate investment grade bonds and

1

MARKET REVIEW

fixed-rate high yield corporate bonds. That said, high yield corporate bonds recorded a positive return for the Reporting Period overall, as their higher yields generally offset the negative effects of their greater duration and the widening of credit spreads. (Duration measures sensitivity to changes in interest rates.) Outside the U.S., emerging markets credit spreads also widened, as rising U.S. interest rates proved to be a headwind for emerging markets debt. Meanwhile, a strong U.S. dollar dampened the performance of local emerging markets bonds. As a result, U.S. dollar-denominated emerging markets debt and local emerging markets debt were among the worst performing fixed income sectors during the Reporting Period overall.

Public real estate markets were driven primarily by fundamentals during the Reporting Period overall, as investors’ search for yield continued to decrease at the margin. Dispersion among returns across yield quintiles, or market segments, remained modest, with lower yielding, higher quality real estate investment trusts (“REITs”) slightly outperforming. Global real estate markets were up modestly for the Reporting Period as a whole, largely because of a rally in industrial REITs, which benefited from ongoing e-commerce demand and higher barriers to entry for competitive new supply. That said, the performance of the global real estate markets varied during 2018, as a weak first quarter was offset by a rebounding second quarter and a rather muted third quarter. Among market segments, health care REITs struggled on weaker supply/demand dynamics, though more defensive securities performed well during the market volatility in October 2018. Self-storage REITs performed particularly well in the first half of 2018 but had an unusually poor third calendar quarter due to concerns about a potential moderation in 2019 earnings growth. Regionally, North American property stocks experienced a material reversal during the Reporting Period, going from being the worst performing region in the first quarter of 2018 to being the best performing region in the second calendar quarter, with modest additional gains during in the third calendar quarter. Japan and North America generally drove real estate markets during the Reporting Period overall, while Asia (ex-Japan) real estate lagged due in large part to a sell-off in Hong Kong listed companies. Real estate stocks broadly continued to price in further Fed rate hikes as well as elevated investor concerns surrounding U.S. tariffs and trade policy for more economically sensitive property types. In addition, merger and acquisition activity picked up during the Reporting Period.

Looking Ahead

At the end of the Reporting Period, investors appeared to be monitoring political developments in the U.S., with a focus on the midterm elections. A key issue was whether the Democrats would be able to win a majority in the House of Representatives, a result that could create political gridlock in the second half of the President’s term in office, in our view. (On November 6, 2018, after the end of the Reporting Period, the Democratic Party won a majority in the House of Representatives.) Additionally, U.S. trade policy remained a concern at the end of the Reporting Period, as investors monitored whether U.S.-China trade tensions would ease. On the economic front, investors continued to watch for any increase in U.S. inflation, as this could drive the Fed’s schedule for interest rate hikes. Finally, signs of slowing economic growth in China and Europe were drawing significant market attention, with investors looking to discern whether the global economic cycle had plateaued, which could potentially drive strong shifts in market performance.

2

PORTFOLIO RESULTS

Multi-Manager International Equity Fund

Investment Objective and Principal Strategy

The Fund seeks to provide long-term capital growth.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Alternative Investments & Manager Selection (“AIMS”) Group discusses the Multi-Manager International Equity Fund’s (the “Fund”) performance and positioning for the 12-month period ended October 31, 2018 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class P Shares (formerly Institutional Shares) generated an average annual total return of -5.63%. The return compares to the -6.85% average annual total return of the Fund’s benchmark, the MSCI Europe, Australasia and Far East (“EAFE”) Index (Net, USD, Unhedged) (the “Index”) during the same time period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund uses a multi-manager approach and generally seeks to achieve its investment objective by dynamically allocating its assets among unaffiliated investment managers (“Underlying Managers”) that employ an international equity investment strategy. The AIMS Group is responsible for making recommendations with respect to hiring, terminating or replacing the Fund’s Underlying Managers as well as for determining the Fund’s asset allocations. The AIMS Group applies a multifaceted process with respect to manager due diligence, portfolio construction and risk management. |

| | During the Reporting Period, the Fund recorded a negative absolute return but outperformed the Index. The relative outperformance can be attributed to the performance of the Fund’s Underlying Managers. The Fund allocated capital to three Underlying Managers during the Reporting Period as part of its top-level strategy allocation — Causeway Capital Management LLC (“Causeway”), Massachusetts Financial Services Company doing business as MFS Investment Management (“MFS”) and WCM Investment Management (“WCM”). |

| | All three of the Underlying Managers with allocated capital during the Reporting Period generated negative absolute returns. However, on a relative basis, growth-oriented Underlying Manager WCM and core-oriented MFS outperformed the Index. Value-oriented Causeway underperformed the Index. The Index serves as the benchmark index for all three Underlying Managers. |

| Q | | Which international equity strategies most significantly affected Fund performance? |

| A | | The Fund’s results were driven by growth-oriented Underlying Manager WCM, which outperformed the Index during the Reporting Period. WCM benefited from an overweight position and strong stock selection in health care as well as effective stock selection in the information technology and consumer discretionary sectors. |

| | Core-oriented Underlying Manager MFS outperformed the Index as well. Strong stock selection in information technology, plus an underweight and strong stock selection in financials, added to relative returns. In addition, an overweight in the health care sector contributed positively. |

| | Value-oriented Underlying Manager Causeway lagged the Index during the Reporting Period. Causeway was hurt by weak stock selection in consumer staples, information technology and utilities. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | The Fund used forward foreign currency exchange contracts during the Reporting Period to take positions in select non-U.S. markets. The use of these derivatives did not have a material impact on the Fund’s results during the Reporting Period. |

| Q | | Were there any notable changes in the Fund’s allocations during the Reporting Period? |

| A | | At the beginning of the Reporting Period, the Fund’s assets were allocated approximately 44% to Causeway, 25% to MFS and 30% to WCM. The remainder of the Fund’s assets |

3

PORTFOLIO RESULTS

| | were invested in cash and cash equivalents. In August 2018, we decided to reduce the Fund’s exposure to growth stocks and trim its exposure to the emerging markets. As a result, we decreased the Fund’s allocation to WCM and increased its allocation to MFS. At the end of the Reporting Period, the Fund’s assets were allocated approximately 44% to Causeway, 35% to MFS and 20% to WCM. The remainder of the Fund’s assets were invested in cash and cash equivalents. |

| Q | | What is the Fund’s tactical view and strategy for the months ahead? |

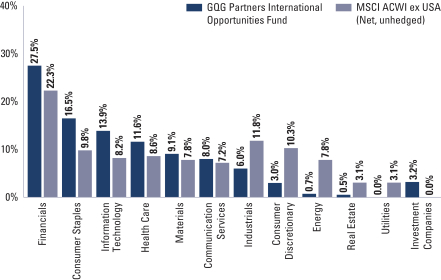

| A | | At the end of the Reporting Period, the Fund was more defensively positioned than the Index. Compared to the Index, the Fund was overweight information technology and health care stocks and was underweight financials and real estate stocks. On a regional basis, the Fund was significantly underweight Japan and developed Asia, while maintaining out-of-benchmark exposure to the emerging markets and North America. From a market capitalization perspective, the Fund was overweight at the end of the Reporting Period in mega-cap stocks and maintained underweights relative to the Index in mid-cap and large-cap companies. |

| | We intend to continue to position the Fund in alignment with our longer-term strategic views within the international equity complex. We further intend to continue to monitor allocations and Underlying Manager performance as we seek to generate long-term capital growth. |

4

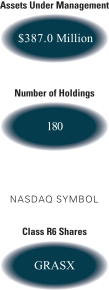

FUND BASICS

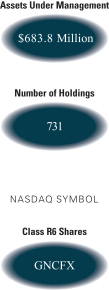

Multi-Manager International Equity Fund

as of October 31, 2018

| | | | | | | | | | |

| | PERFORMANCE REVIEW | | | | | | | | |

| | | November 1, 2017–October 31, 2018 | | Fund Total Return

(based on NAV)1 | | | MSCI® EAFE® Index

(Net, USD, Unhedged)2 | |

| | | Class P Shares | | | -5.63 | % | | | -6.85 | % |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. |

| | 2 | | The MSCI® EAFE® Index is a stock market index that is designed to measure the equity market performance of developed markets in Europe, Australasia and the Far East, excluding the U.S. and Canada. The Index figures do not reflect any deductions for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 9/30/18 | | One Year | | | Since Inception | | | Inception Date |

| | | Class P Shares | | | 5.01 | % | | | 6.42 | % | | 7/31/15 |

| | 3 | | The Standardized Total Returns are average annual total returns or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. Because Class P Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | | Class P Shares | | | 0.57 | % | | | 0.82 | % |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to contractual arrangements, the Fund’s waivers and/or expense limitations will remain in place through at least February 28, 2019, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

5

FUND BASICS

| | | | | | | | |

| TOP TEN EQUITY HOLDINGS AS OF 10/31/185 |

| | | Holding | | % of Net Assets | | | Line of Business |

| | Nestle SA | | | 2.2 | % | | Food Products |

| | Volkswagen AG | | | 1.9 | | | Automobiles |

| | Linde PLC | | | 1.9 | | | Chemicals |

| | Roche Holding AG | | | 1.8 | | | Pharmaceuticals |

| | Novartis AG | | | 1.8 | | | Pharmaceuticals |

| | Akzo Nobel NV | | | 1.8 | | | Chemicals |

| | AIA Group Ltd. | | | 1.6 | | | Insurance |

| | LVMH Moet Hennessy Louis Vuitton SE | | | 1.6 | | | Textiles, Apparel & Luxury Goods |

| | Prudential PLC | | | 1.6 | | | Insurance |

| | | Experian PLC | | | 1.5 | | | Professional Services |

| | 5 | | The top 10 holdings may not be representative of the Fund’s future investments. |

| | | | | | |

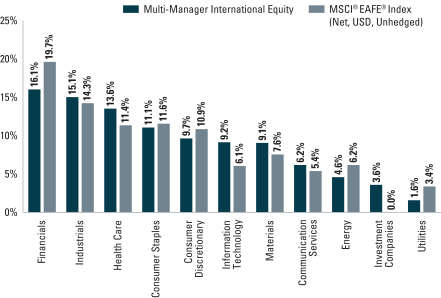

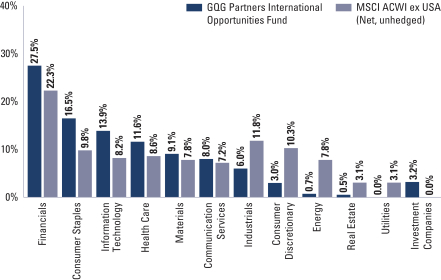

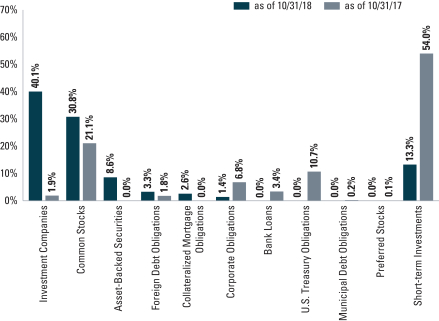

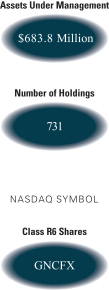

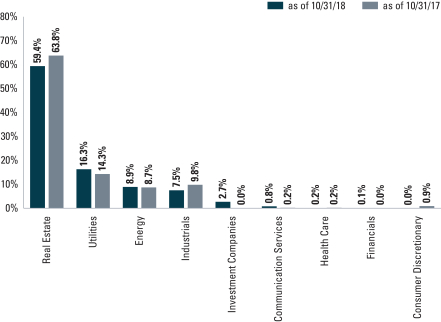

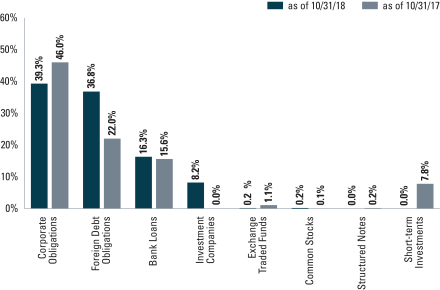

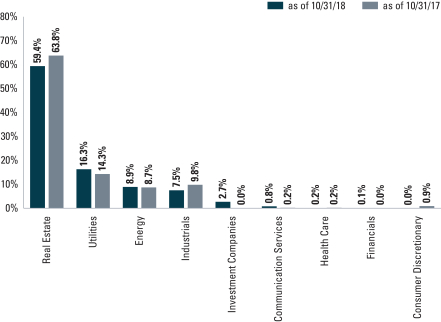

| | FUND VS. BENCHMARK SECTOR ALLOCATIONS (%)6 |

| | | As of October 31, 2018 | | | | |

| | 6 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. Figures in the graph may not sum to 100% due to rounding and/or the exclusion of other assets and liabilities. The graph categorizes investments using the Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

6

MULTI-MANAGER INTERNATIONAL EQUITY FUND

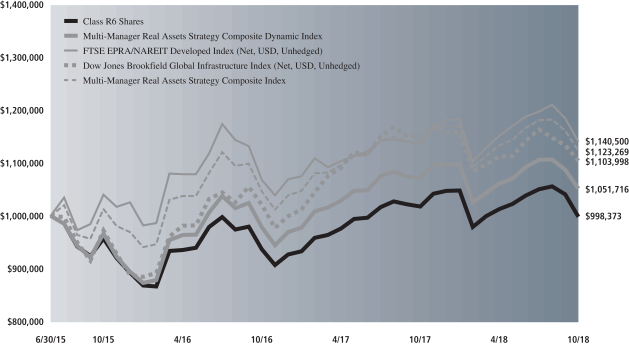

Performance Summary

October 31, 2018

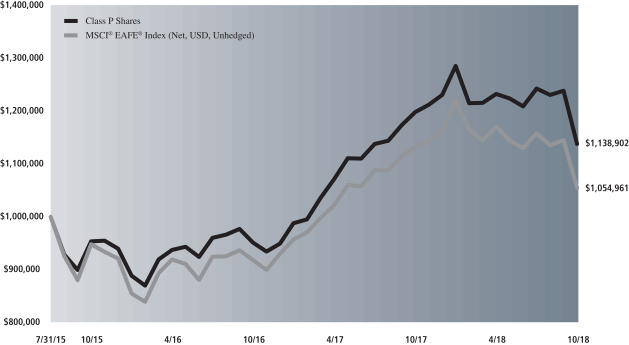

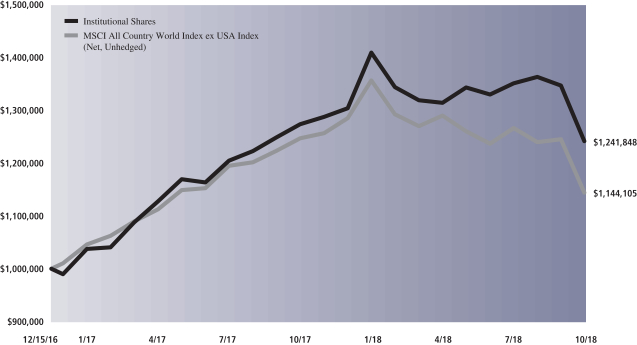

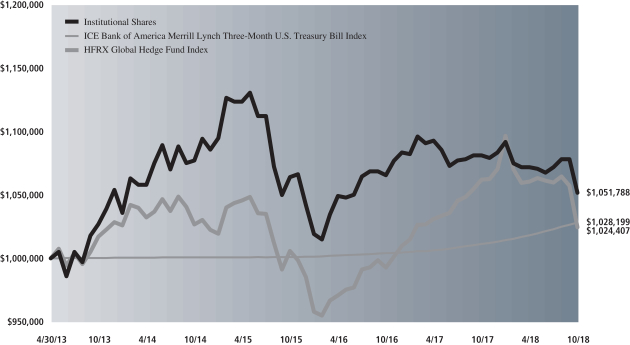

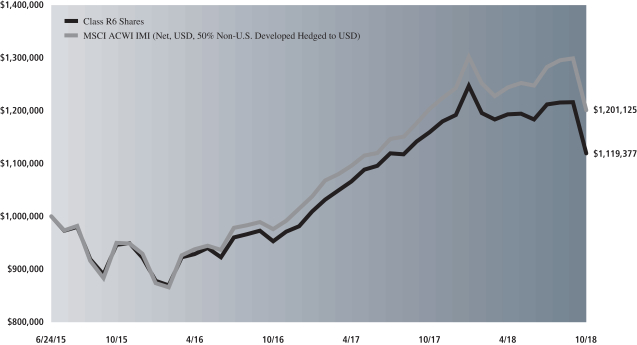

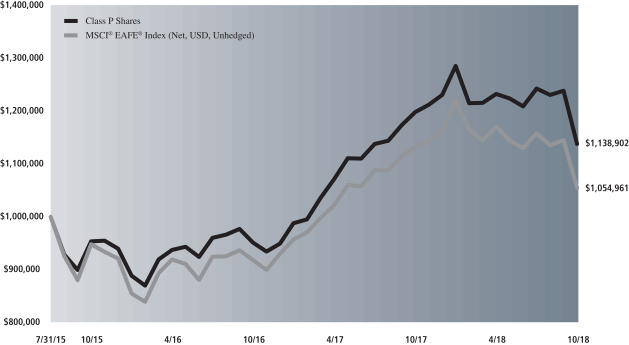

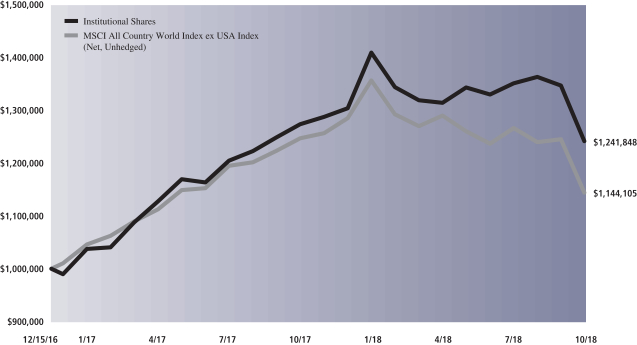

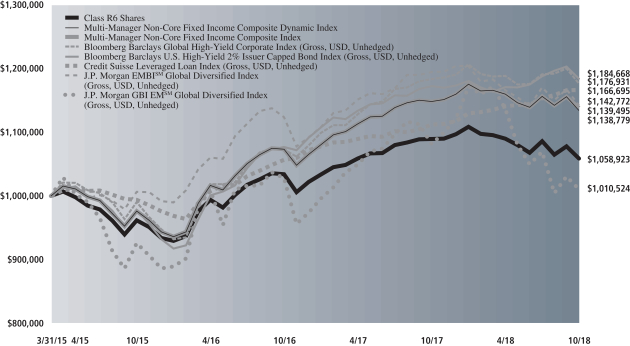

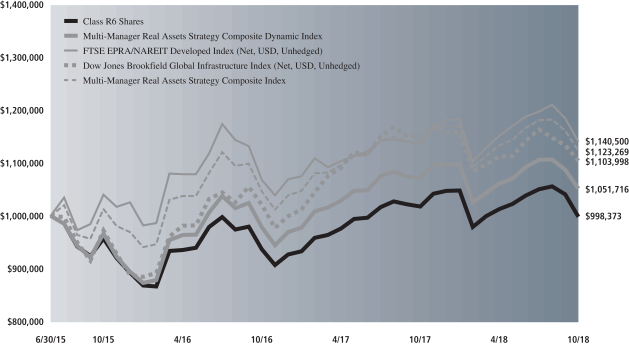

The following graph shows the value, as of October 31, 2018, of a $1,000,000 investment made on July 31, 2015 (commencement of operations) in Class P Shares at NAV. For comparative purposes, the performance of the Fund’s benchmark, the MSCI® EAFE® Index (Net, USD, Unhedged) is shown. This performance data represents past performance and should not be considered indicative of future performance, which will fluctuate with changes in market conditions. These performance fluctuations may cause an investor’s shares, when redeemed, to be worth more or less than their original cost. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In addition to the Underlying Managers’ decisions regarding issuer/industry investment selection and allocation, other factors may affect Fund performance. These factors include, but are not limited to, Fund operating fees and expenses, portfolio turnover and subscription and redemption cash flows affecting the Fund.

|

| Multi-Manager International Equity Fund’s Lifetime Performance |

Performance of a $1,000,000 Investment, with distributions reinvested, from July 31, 2015 through October 31, 2018.

| | | | |

| Average Annual Total Return through October 31, 2018 | | One Year | | Since Inception |

|

Class P (Commenced July 31, 2015)* | | (5.63)% | | 3.47% |

|

| * | | Effective April 16, 2018, Institutional Shares were redesignated as Class P Shares. |

7

PORTFOLIO RESULTS

Multi-Manager U.S. Dynamic Equity Fund

Investment Objective and Principal Strategy

The Fund seeks to provide long-term capital growth.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Alternative Investments & Manager Selection (“AIMS”) Group discusses the Multi-Manager U.S. Dynamic Equity Fund’s (the “Fund”) performance and positioning for the 12-month period ended October 31, 2018 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class P Shares (formerly Institutional Shares) generated an average annual total return of 6.51%. This return compares to the 7.35% average annual total return of the Fund’s benchmark, the S&P 500® Total Return Index (the “Index”) during the same time period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund uses a multi-manager approach and generally seeks to achieve its investment objective by dynamically allocating its assets among unaffiliated investment managers (“Underlying Managers”) that employ dynamic equity investment strategies. (Dynamic equity investment strategies generally involve investing in equity instruments, often with a long term view. They are long-biased strategies and may have low excess return correlations to traditional long-only equity strategies.) The AIMS Group is responsible for making recommendations with respect to hiring, terminating or replacing the Fund’s Underlying Managers as well as for determining the Fund’s asset allocations. The AIMS Group applies a multifaceted process with respect to manager due diligence, portfolio construction and risk management. |

| | During the Reporting Period, the Fund recorded a positive absolute return but underperformed the Index. The relative underperformance can be attributed to the performance of the Fund’s Underlying Managers. The Fund allocated capital to three Underlying Managers during the Reporting Period as part of its top-level strategy allocation — Lazard Asset Management LLC (“Lazard”), Sirios Capital Management, L.P. (“Sirios”) and Smead Capital Management, Inc. (“Smead”). |

| | All three of the Underlying Managers with allocated capital during the Reporting Period posted positive absolute returns. On a relative basis, Sirios and Lazard underperformed the Index during the Reporting Period, while Smead outperformed the Index. The Index serves as the benchmark index for all three Underlying Managers. |

| Q | | Which dynamic equity strategies most significantly affected Fund performance? |

| A | | The Fund’s relative underperformance was driven by growth-oriented Underlying Manager Sirios, which lagged the Index during the Reporting Period because of weak stock selection in the consumer discretionary and telecommunication services sectors. An overweight and poor stock selection in the financials sector also detracted from results. |

| | Lazard, which uses an all cap, concentrated investment strategy, also underperformed the Index. An overweight in materials, along with a significant overweight and poor stock selection in consumer staples, detracted from relative performance. Weak stock selection in information technology further diminished returns. |

| | Core-oriented Underlying Manager Smead outpaced the Index during the Reporting Period through an underweight position and strong stock selection in consumer staples. Effective stock selection in health care and a significant overweight in the consumer discretionary sector also aided relative performance. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | The Fund used forward foreign currency exchange contracts during the Reporting Period to take positions in select non-U.S. markets. The use of these derivatives had a positive impact on the Fund’s results during the Reporting Period. |

8

PORTFOLIO RESULTS

| Q | | Were there any notable changes in the Fund’s allocations during the Reporting Period? |

| A | | There were no changes in the Fund’s allocations during the Reporting Period. At the beginning and end of the Reporting Period, the Fund’s assets were allocated approximately 40.5% to Smead, 40.5% to Sirios and 18% to Lazard. The remainder of the Fund’s assets were invested in cash and cash equivalents. |

| | | Near the end of the Reporting Period, Vaughan Nelson Investment Management, L.P. (“Vaughan Nelson”) was added as an Underlying Manager of the Fund but was not allocated capital. Vaughan Nelson invests in companies that are earning above their cost of capital, with stable to improving returns and where it considers the valuation to be attractive (undervalued growth); companies valued at a significant discount to a specific asset value, with an identifiable catalyst to close the gap (undervalued assets); and companies with an attractive dividend yield and minimum basis risk (undervalued dividends). We added Vaughan Nelson as an Underlying Manager to balance the Fund more effectively from a sector perspective while more evenly dispersing risk across the Fund’s Underlying Managers. |

| Q | | What is the Fund’s tactical view and strategy for the months ahead? |

| A | | At the end of the Reporting Period, the Fund remained overweight relative to the Index in the consumer discretionary sector, primarily concentrated in the media and household durables industries. It also maintained an overweight in financials, with bank exposure held by Smead and Sirios. Lazard has not historically invested in banks. In addition, the Fund was overweight in the consumer staples sector compared to the Index. The Fund was most underweight in information technology, energy and communication services relative to the Index at the end of the Reporting Period and had no exposure to utilities or real estate. (Near the end of September 2018, the telecommunications services sector was renamed the communication services sector and was broadened to include certain companies from the information technology and consumer discretionary sectors that facilitate communication and offer related content and information through various media.) In terms of market capitalization, the Fund maintained a significant underweight in mega caps and an overweight relative to the Index in small/mid cap stocks. Regionally, the Fund was primarily invested in North American equities but also had modest exposure to companies domiciled in Europe and the U.K. |

| | We intend to continue to position the Fund in alignment with our longer-term strategic views within the U.S. equity complex. We further intend to continue to monitor allocations and Underlying Manager performance as we seek to generate long-term capital growth. |

9

FUND BASICS

Multi-Manager U.S. Dynamic Equity Fund

as of October 31, 2018

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | November 1, 2017–October 31, 2018 | | Fund Total Return

(based on NAV)1 | | | S&P 500®

Total Return Index2 | |

| | | Class P Shares | | | 6.51 | % | | | 7.35 | % |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. |

| | 2 | | The S&P 500® Total Return Index is the Standard & Poor’s 500 Composite Index of 500 stocks, an unmanaged index of common stock prices. The Index figures do not reflect any deductions for fees, expenses or taxes. It is not possible to invest directly in an index. |

| | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 9/30/18 | | One Year | | | Since Inception | | | Inception Date |

| | | Class P Shares | | | 14.69 | % | | | 8.43 | % | | 7/31/15 |

| | 3 | | The Standardized Total Returns are average annual total returns or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. Because Class P Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | | Class P Shares | | | 0.79 | % | | | 1.23 | % |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to contractual arrangements, the Fund’s waivers and/or expense limitations will remain in place through at least February 28, 2019, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

10

FUND BASICS

| | | | | | | | |

| | TOP TEN EQUITY HOLDINGS AS OF 10/31/185 |

| | | Holding | | % of Net Assets | | | Line of Business |

| | Berkshire Hathaway, Inc. Class B | | | 4.7 | % | | Diversified Financial Services |

| | JPMorgan Chase & Co. | | | 3.9 | | | Banks |

| | The Coca-Cola Co. | | | 3.5 | | | Beverages |

| | Bank of America Corp. | | | 3.1 | | | Banks |

| | Discovery, Inc. Class A | | | 3.1 | | | Media |

| | Amgen, Inc. | | | 2.6 | | | Biotechnology |

| | Airbus SE | | | 2.5 | | | Aerospace & Defense |

| | Walgreens Boots Alliance, Inc. | | | 2.4 | | | Food & Staples Retailing |

| | Target Corp. | | | 2.4 | | | Multiline Retail |

| | | American Express Co. | | | 2.3 | | | Consumer Finance |

| | 5 | | The top 10 holdings may not be representative of the Fund’s future investments. |

|

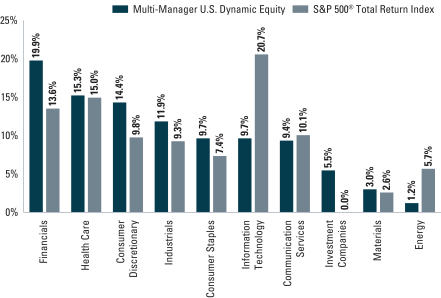

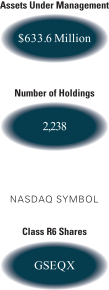

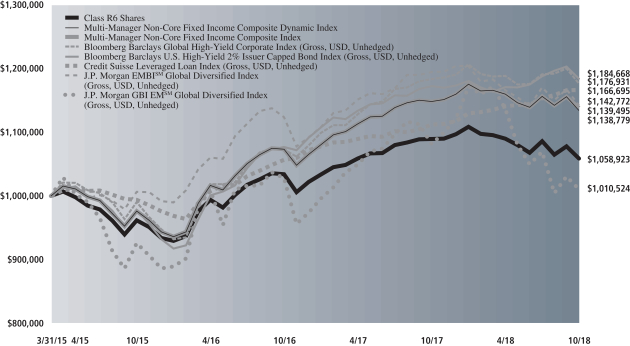

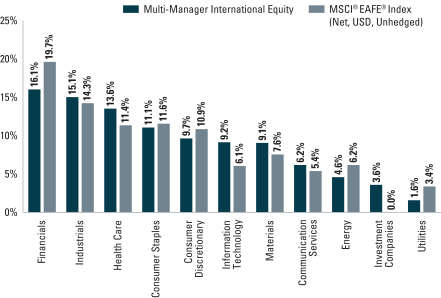

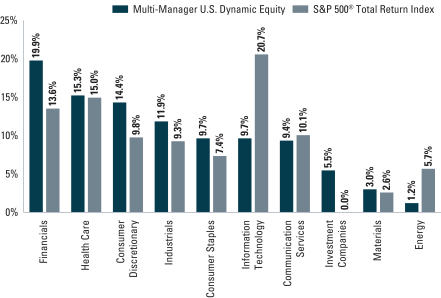

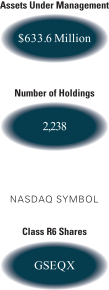

| FUND VS. BENCHMARK SECTOR ALLOCATIONS (%)6 |

| As of October 31, 2018 |

| | 6 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. Figures in the graph may not sum to 100% due to rounding and/or the exclusion of other assets and liabilities. The graph categorizes investments using the Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

11

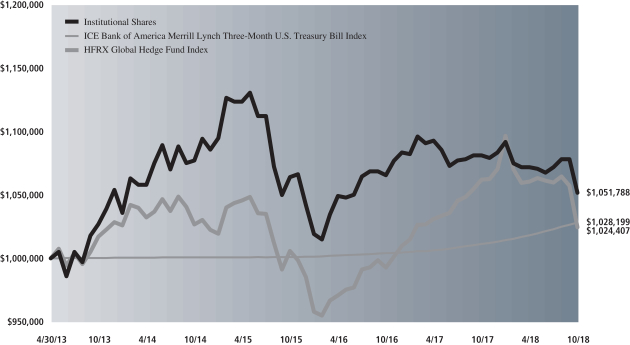

MULTI-MANAGER U.S. DYNAMIC EQUITY FUND

Performance Summary

October 31, 2018

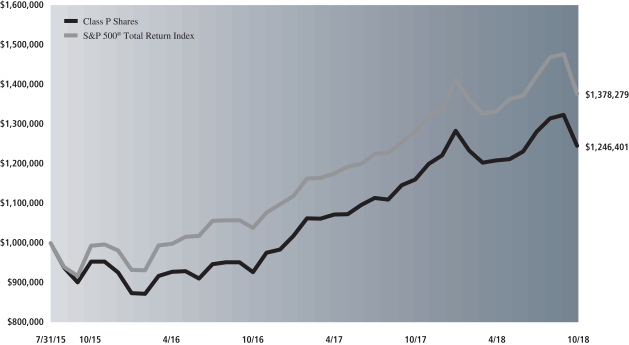

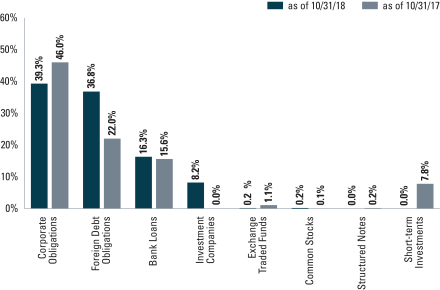

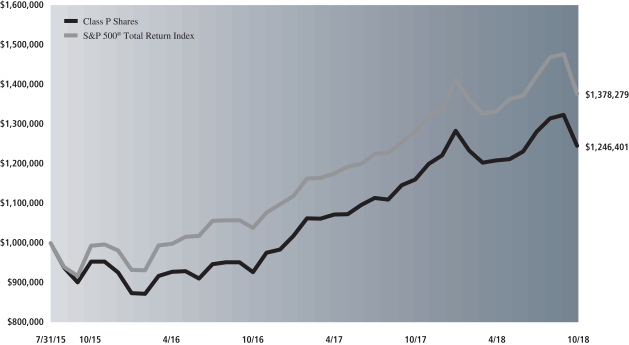

The following graph shows the value, as of October 31, 2018, of a $1,000,000 investment made on July 31, 2015 (commencement of operations) in Class P Shares at NAV. For comparative purposes, the performance of the Fund’s benchmark, the S&P 500® Total Return Index is shown. This performance data represents past performance and should not be considered indicative of future performance, which will fluctuate with changes in market conditions. These performance fluctuations may cause an investor’s shares, when redeemed, to be worth more or less than their original cost. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In addition to the Underlying Managers’ decisions regarding issuer/industry investment selection and allocation, other factors may affect Fund performance. These factors include, but are not limited to, Fund operating fees and expenses, portfolio turnover and subscription and redemption cash flows affecting the Fund.

|

| Multi-Manager U.S. Dynamic Equity Fund’s Lifetime Performance |

Performance of a $1,000,000 Investment, with distributions reinvested, from July 31, 2015 through October 31, 2018.

| | | | |

| Average Annual Total Return through October 31, 2018 | | One Year | | Since Inception |

|

Class P (Commenced July 31, 2015)* | | 6.51% | | 6.15% |

|

| * | | Effective April 16, 2018, Institutional Shares were redesignated as Class P Shares. |

12

PORTFOLIO RESULTS

Multi-Manager U.S. Small Cap Equity Fund

Investment Objective and Principal Strategy

The Fund seeks to provide long-term capital growth.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Alternative Investments & Manager Selection (“AIMS”) Group discusses the Multi-Manager U.S. Small Cap Equity Fund’s (the “Fund”) performance and positioning for the 12-month period ended October 31, 2018 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class P Shares (formerly Institutional Shares) generated an average annual total return of -0.40%. This return compares to the 1.85% average annual total return of the Fund’s benchmark, the Russell 2000® Total Return Index (the “Index”) during the same time period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund uses a multi-manager approach and generally seeks to achieve its investment objective by dynamically allocating its assets among unaffiliated investment managers (“Underlying Managers”) that employ a small-cap equity investment strategy. The AIMS Group is responsible for making recommendations with respect to hiring, terminating or replacing the Fund’s Underlying Managers as well as for determining the Fund’s asset allocations. The AIMS Group applies a multifaceted process with respect to manager due diligence, portfolio construction and risk management. |

| | | During the Reporting Period, the Fund recorded a slightly negative absolute return and underperformed the Index. The relative underperformance can be attributed to the performance of the Fund’s Underlying Managers. The Fund allocated capital to three Underlying Managers during the Reporting Period as part of its top-level strategy allocation — Brown Advisory, LLC (“Brown Advisory”), PNC Capital Advisors, LLC (“PNC”) and Boston Partners Global Investors Inc. (“Boston Partners”). |

| | | All three of the Underlying Managers with allocated capital during the Reporting Period generated negative absolute returns. On a relative basis, value-oriented Boston Partners and core-oriented manager PNC underperformed their benchmark indices. Growth-oriented manager Brown Advisory slightly outperformed its benchmark index during the Reporting Period. |

| Q | | Which small-cap equity strategies most significantly affected Fund performance? |

| A | | The Fund’s relative underperformance was led by value-oriented Underlying Manager Boston Partners, which lagged its benchmark index, the Russell 2000® Value Index, during the Reporting Period. An overweight position and poor stock selection within materials detracted from relative returns. Weak stock selection and an overweight in the consumer discretionary sector further diminished results. |

| | | Core-oriented Underlying Manager PNC also underperformed its benchmark index, the Russell 2000® Total Return Index. Its negative results were due to poor stock selection in the consumer discretionary sector as well as an underweight position and weak stock selection in the health care sector. |

| | | Growth-oriented Underlying Manager Brown Advisory slightly outperformed its benchmark index, the Russell 2000® Growth Index, during the Reporting Period, driven by a significant overweight in the information technology sector and a lack of exposure to the materials sector. Additionally, strong stock selection in industrials aided results. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | The Fund did not use derivatives or similar instruments during the Reporting Period. |

| Q | | Were there any notable changes in the Fund’s allocations during the Reporting Period? |

| A | | There were no changes in the Fund’s allocations during the Reporting Period. At the beginning and end of the Reporting Period, the Fund’s assets were allocated approximately 44% |

13

PORTFOLIO RESULTS

| | to Boston Partners, 30% to Brown Advisory and 25% to PNC. The remainder of the Fund’s assets were invested in cash and cash equivalents. |

| Q | | What is the Fund’s tactical view and strategy for the months ahead? |

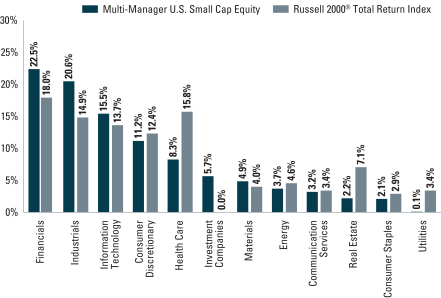

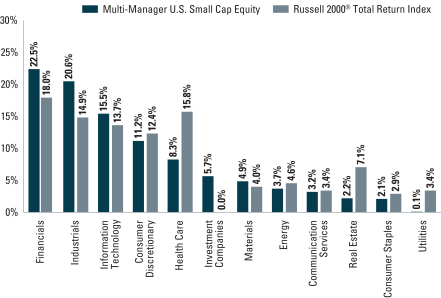

| A | | At the end of the Reporting Period, the Fund was moderately overweight compared to the Index in financials, industrials and information technology, while it was underweight health care, real estate and utilities. In terms of market capitalization, the Fund maintained a slight small/mid cap bias relative to the Index, driven predominantly by Underlying Manager Brown Advisory. |

| | | We intend to continue to position the Fund in alignment with our longer-term strategic views within the U.S. small-cap equity complex. We further intend to continue to monitor allocations and Underlying Manager performance as we seek to generate long-term capital growth. |

14

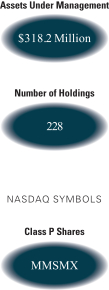

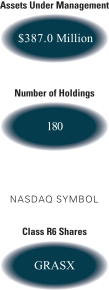

FUND BASICS

Multi-Manager U.S. Small Cap Equity Fund

as of October 31, 2018

| | | | | | | | | | |

| | PERFORMANCE REVIEW | |

| | | November 1, 2017–October 31, 2018 | | Fund Total Return

(based on NAV)1 | | | Russell 2000®

Total Return Index2 | |

| | | Class P Shares | | | -0.40 | % | | | 1.85 | % |

| | 1 | | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. |

| | 2 | | The Russell 2000® Total Return Index is an unmanaged index of common stock prices that measures the performance of the 2000 smallest companies in the Russell 3000® Index. The Index is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set. |

| | | | | | | | | | | | |

| | STANDARDIZED TOTAL RETURNS3 |

| | | For the period ended 9/30/18 | | One Year | | | Since Inception | | | Inception Date |

| | | Class P Shares | | | 12.03 | % | | | 15.75 | % | | 4/29/16 |

| | 3 | | The Standardized Total Returns are average annual total returns or cumulative total returns (only if the performance period is one year or less) as of the most recent calendar quarter-end. They assume reinvestment of all distributions at NAV. Because Class P Shares do not involve a sales charge, such a charge is not applied to their Standardized Total Returns. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | | | | |

| | EXPENSE RATIOS4 | |

| | | | | Net Expense Ratio (Current) | | | Gross Expense Ratio (Before Waivers) | |

| | | Class P Shares | | | 0.80 | % | | | 1.13 | % |

| | 4 | | The expense ratios of the Fund, both current (net of applicable fee waivers and/or expense limitations) and before waivers (gross of applicable fee waivers and/or expense limitations) are as set forth above according to the most recent publicly available Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights in this report. Pursuant to contractual arrangements, the Fund’s waivers and/or expense limitations will remain in place through at least February 28, 2019, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Fund’s Board of Trustees. If these arrangements are discontinued in the future, the expense ratios may change without shareholder approval. |

15

FUND BASICS

| | | | | | | | |

| | TOP TEN EQUITY HOLDINGS AS OF 10/31/185 |

| | | Holding | | % of Net Assets | | | Line of Business |

| | EnerSys | | | 1.4 | % | | Electrical Equipment |

| | HEICO Corp. | | | 1.4 | | | Aerospace & Defense |

| | Waste Connections, Inc. | | | 1.2 | | | Commercial Services & Supplies |

| | Lithia Motors, Inc. Class A | | | 1.2 | | | Specialty Retail |

| | ASGN, Inc. | | | 1.1 | | | Professional Services |

| | Bright Horizons Family Solutions, Inc. | | | 1.1 | | | Diversified Consumer Services |

| | National General Holdings Corp. | | | 1.0 | | | Insurance |

| | Two Harbors Investment Corp. | | | 1.0 | | | Mortgage Real Estate

Investment Trusts (REITs) |

| | PRA Group, Inc. | | | 1.0 | | | Consumer Finance |

| | | SLM Corp. | | | 1.0 | | | Consumer Finance |

| | 5 | | The top 10 holdings may not be representative of the Fund’s future investments. |

|

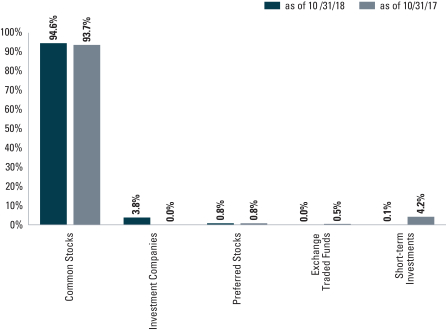

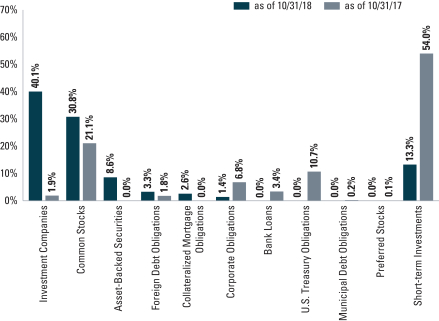

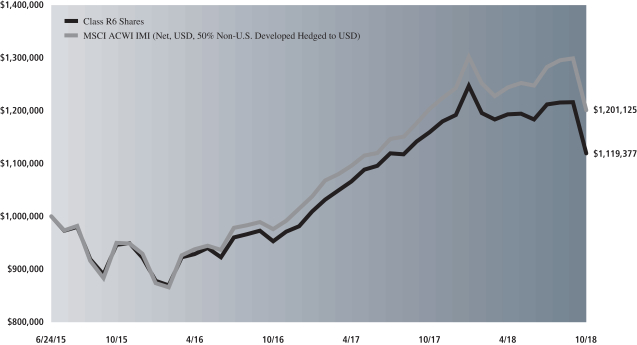

| FUND VS. BENCHMARK SECTOR ALLOCATIONS(%)6 |

| As of October 31, 2018 |

| | 6 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. Figures in the graph may not sum to 100% due to rounding and/or the exclusion of other assets and liabilities. The graph categorizes investments using the Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. Short-term investments represent repurchase agreements. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

16

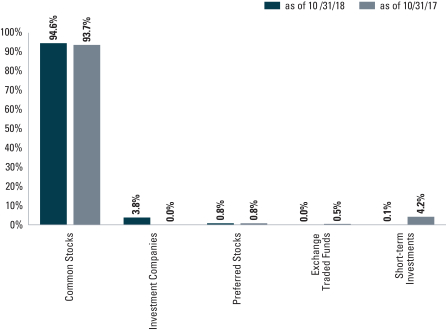

MULTI-MANAGER U.S. SMALL CAP EQUITY

Performance Summary

October 31, 2018

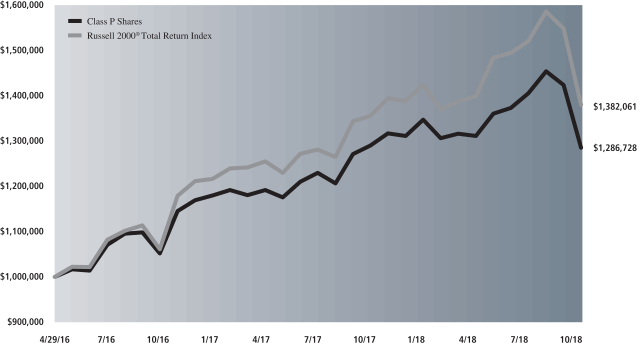

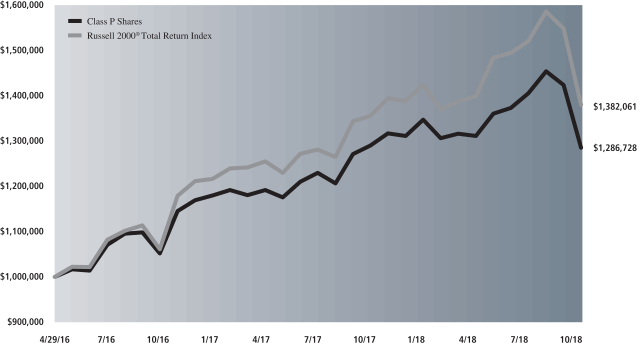

The following graph shows the value, as of October 31, 2018, of a $1,000,000 investment made on April 29, 2016 (commencement of operations) in Class P Shares at NAV. For comparative purposes, the performance of the Fund’s benchmark, the Russell 2000® Total Return Index is shown. This performance data represents past performance and should not be considered indicative of future performance, which will fluctuate with changes in market conditions. These performance fluctuations may cause an investor’s shares, when redeemed, to be worth more or less than their original cost. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In addition to the Underlying Managers’ decisions regarding issuer/industry investment selection and allocation, other factors may affect Fund performance. These factors include, but are not limited to, Fund operating fees and expenses, portfolio turnover and subscription and redemption cash flows affecting the Fund.

|

| Multi-Manager U.S. Small Cap Equity Fund’s Lifetime Performance |

Performance of a $1,000,000 Investment, with distributions reinvested, from April 29, 2016 through October 31, 2018.

| | | | |

| Average Annual Total Return through October 31, 2018 | | One Year | | Since Inception |

|

Class P (Commenced April 29, 2016)* | | (0.40)% | | 10.57% |

|

| * | | Effective April 16, 2018, Institutional Shares were redesignated as Class P Shares. |

17

FUND BASICS

Index Definitions

The Russell 2000® Growth Index measures the performance of the small-cap growth stocks of the U.S. equity universe. It is not possible to invest in an unmanaged index.

The Russell 2000® Value Index measures the performance of the small-cap value stocks of the U.S. equity universe. It is not possible to invest in an unmanaged index.

18

MULTI-MANAGER INTERNATIONAL EQUITY FUND

Schedule of Investments

October 31, 2018

| | | | | | | | |

Shares | | | Description | | Value | |

| Common Stocks – 94.3% | |

| Australia – 1.3% | | | |

| | 96,002 | | | Amcor Ltd. (Containers & Packaging) | | $ | 905,895 | |

| | 48,846 | | | CSL Ltd. (Biotechnology) | | | 6,520,801 | |

| | 41,839 | | | Orica Ltd. (Chemicals) | | | 509,760 | |

| | | | | | | | |

| | | | | | | 7,936,456 | |

| | |

| Belgium – 0.5% | |

| | 42,519 | | | KBC Group NV (Banks) | | | 2,930,241 | |

| | |

| Brazil – 0.6% | |

| | 305,338 | | | Ambev SA ADR (Beverages) | | | 1,322,114 | |

| | 125,800 | | | Raia Drogasil SA (Food & Staples Retailing) | | | 2,123,540 | |

| | | | | | | | |

| | | | | | | 3,445,654 | |

| | |

| Canada – 6.6% | |

| | 7,835 | | | Canadian Imperial Bank of Commerce (Banks) | | | 676,579 | |

| | 47,029 | | | Canadian National Railway Co. (Road & Rail) | | | 4,020,039 | |

| | 48,594 | | | Canadian Pacific Railway Ltd. (Road & Rail) | | | 9,963,046 | |

| | 74,283 | | | Dollarama, Inc. (Multiline Retail) | | | 2,054,498 | |

| | 491,954 | | | Encana Corp. (Oil, Gas & Consumable Fuels) | | | 5,022,494 | |

| | 134,243 | | | Gildan Activewear, Inc. (Textiles, Apparel & Luxury Goods) | | | 4,012,657 | |

| | 436,838 | | | Manulife Financial Corp. (Insurance) | | | 6,878,842 | |

| | 35,840 | | | Shopify, Inc. Class A* (IT Services) | | | 4,951,296 | |

| | 113,937 | | | Suncor Energy, Inc. (Oil, Gas & Consumable Fuels) | | | 3,821,989 | |

| | | | | | | | |

| | | | | | | 41,401,440 | |

| | |

| Cayman Islands – 1.8% | |

| | 42,334 | | | Baidu, Inc. ADR* (Interactive Media & Services) | | | 8,046,000 | |

| | 95,840 | | | Tencent Holdings Ltd. (Interactive Media & Services) | | | 3,283,407 | |

| | | | | | | | |

| | | | | | | 11,329,407 | |

| | |

| Denmark – 1.6% | |

| | 264 | | | AP Moller – Maersk A/S Class B (Marine) | | | 333,223 | |

| | 14,792 | | | Carlsberg A/S Class B (Beverages) | | | 1,631,803 | |

| | 47,663 | | | Chr Hansen Holding A/S (Chemicals) | | | 4,811,201 | |

| | 80,980 | | | Novo Nordisk A/S Class B (Pharmaceuticals) | | | 3,497,247 | |

| | | | | | | | |

| | | | | | | 10,273,474 | |

| | |

| France – 8.6% | |

| | 48,595 | | | Air Liquide SA (Chemicals) | | | 5,874,467 | |

| | 97,092 | | | BNP Paribas SA (Banks) | | | 5,059,857 | |

| | 40,728 | | | Danone SA (Food Products) | | | 2,884,086 | |

| | 10,733 | | | Dassault Systemes SE (Software) | | | 1,343,606 | |

| | 324,918 | | | Engie SA (Multi-Utilities) | | | 4,317,249 | |

| | 38,538 | | | EssilorLuxottica SA (Health Care Equipment & Supplies) | | | 5,263,463 | |

| | |

| Common Stocks – (continued) | |

| France – (continued) | |

| | 232 | | | Hermes International (Textiles, Apparel & Luxury Goods) | | | 132,449 | |

| | 10,994 | | | L’Oreal SA (Personal Products) | | | 2,477,017 | |

| | 31,919 | | | Legrand SA (Electrical Equipment) | | | 2,084,340 | |

| | 33,053 | | | LVMH Moet Hennessy Louis Vuitton SE (Textiles, Apparel & Luxury Goods) | | | 10,028,460 | |

| | 57,983 | | | Pernod Ricard SA (Beverages) | | | 8,841,630 | |

| | 74,821 | | | Schneider Electric SE (Electrical Equipment) | | | 5,410,388 | |

| | | | | | | | |

| | | | | | | 53,717,012 | |

| | |

| Germany – 5.4% | |

| | 21,925 | | | adidas AG (Textiles, Apparel & Luxury Goods) | | | 5,155,969 | |

| | 107,586 | | | BASF SE (Chemicals) | | | 8,255,989 | |

| | 14,982 | | | Bayer AG (Pharmaceuticals) | | | 1,148,407 | |

| | 43,618 | | | Beiersdorf AG (Personal Products) | | | 4,509,984 | |

| | 124,661 | | | Deutsche Post AG (Air Freight & Logistics) | | | 3,936,204 | |

| | 25,630 | | | Merck KGaA (Pharmaceuticals) | | | 2,742,493 | |

| | 6,533 | | | MTU Aero Engines AG (Aerospace & Defense) | | | 1,387,165 | |

| | 41,861 | | | ProSiebenSat.1 Media SE (Media) | | | 966,633 | |

| | 53,045 | | | SAP SE (Software) | | | 5,679,711 | |

| | | | | �� | | | |

| | | | | | | 33,782,555 | |

| | |

| Hong Kong – 3.1% | |

| | 1,352,000 | | | AIA Group Ltd. (Insurance) | | | 10,284,722 | |

| | 759,514 | | | China Merchants Port Holdings Co. Ltd. (Transportation Infrastructure) | | | 1,293,702 | |

| | 847,000 | | | China Mobile Ltd. (Wireless Telecommunication Services) | | | 7,934,593 | |

| | | | | | | | |

| | | | | | | 19,513,017 | |

| | |

| India – 1.6% | |

| | 52,664 | | | HDFC Bank Ltd. ADR (Banks) | | | 4,682,356 | |

| | 81,901 | | | Housing Development Finance Corp. Ltd. (Thrifts & Mortgage Finance) | | | 1,959,361 | |

| | 135,496 | | | Tata Consultancy Services Ltd. (IT Services) | | | 3,552,088 | |

| | | | | | | | |

| | | | | | | 10,193,805 | |

| | |

| Ireland – 3.9% | |

| | 39,339 | | | Accenture PLC Class A (IT Services) | | | 6,200,613 | |

| | 31,722 | | | ICON PLC* (Life Sciences Tools & Services) | | | 4,380,174 | |

| | 71,599 | | | Linde PLC* (Chemicals) | | | 11,746,778 | |

| | 26,773 | | | Ryanair Holdings PLC ADR* (Airlines) | | | 2,216,805 | |

| | | | | | | | |

| | | | | | | 24,544,370 | |

| | |

| Israel* – 0.4% | |

| | 23,167 | | | Check Point Software Technologies Ltd. (Software) | | | 2,571,537 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 19 |

MULTI-MANAGER INTERNATIONAL EQUITY FUND

Schedule of Investments (continued)

October 31, 2018

| | | | | | | | |

Shares | | | Description | | Value | |

| Common Stocks – (continued) | |

| Italy – 2.5% | |

| | 141,286 | | | Eni SpA (Oil, Gas & Consumable Fuels) | | $ | 2,509,204 | |

| | 830,029 | | | Intesa Sanpaolo SpA (Banks) | | | 1,838,576 | |

| | 48,259 | | | Luxottica Group SpA (Textiles, Apparel & Luxury Goods) | | | 3,030,822 | |

| | 664,853 | | | UniCredit SpA (Banks) | | | 8,500,250 | |

| | | | | | | | |

| | | | | | | 15,878,852 | |

| | |

| Japan – 12.2% | |

| | 24,400 | | | Daikin Industries Ltd. (Building Products) | | | 2,828,250 | |

| | 62,400 | | | Denso Corp. (Auto Components) | | | 2,783,398 | |

| | 62,100 | | | East Japan Railway Co. (Road & Rail) | | | 5,423,669 | |

| | 47,300 | | | FANUC Corp. (Machinery) | | | 8,228,635 | |

| | 102,300 | | | Hoya Corp. (Health Care Equipment & Supplies) | | | 5,787,700 | |

| | 124,200 | | | Japan Airlines Co. Ltd. (Airlines) | | | 4,408,001 | |

| | 118,100 | | | Japan Tobacco, Inc. (Tobacco) | | | 3,034,615 | |

| | 6,800 | | | Kao Corp. (Personal Products) | | | 452,351 | |

| | 262,600 | | | KDDI Corp. (Wireless Telecommunication Services) | | | 6,354,877 | |

| | 11,100 | | | Keyence Corp. (Electronic Equipment, Instruments & Components) | | | 5,422,567 | |

| | 170,700 | | | Kubota Corp. (Machinery) | | | 2,694,804 | |

| | 58,200 | | | Kyocera Corp. (Electronic Equipment, Instruments & Components) | | | 3,149,951 | |

| | 73,300 | | | Olympus Corp. (Health Care Equipment & Supplies) | | | 2,443,221 | |

| | 9,100 | | | Shin-Etsu Chemical Co. Ltd. (Chemicals) | | | 760,400 | |

| | 102,600 | | | Sompo Holdings, Inc. (Insurance) | | | 4,231,789 | |

| | 93,100 | | | Sumitomo Mitsui Financial Group, Inc. (Banks) | | | 3,624,857 | |

| | 40,495 | | | Sysmex Corp. (Health Care Equipment & Supplies) | | | 2,840,299 | |

| | 191,400 | | | Takeda Pharmaceutical Co. Ltd. (Pharmaceuticals) | | | 7,935,352 | |

| | 80,100 | | | Terumo Corp. (Health Care Equipment & Supplies) | | | 4,323,950 | |

| | | | | | | | |

| | | | | | | 76,728,686 | |

| | |

| Mexico – 0.6% | |

| | 1,466,265 | | | Wal-Mart de Mexico SAB de CV (Food & Staples Retailing) | | | 3,744,838 | |

| | |

| Netherlands – 3.7% | |

| | 130,767 | | | Akzo Nobel NV (Chemicals) | | | 10,979,851 | |

| | 32,016 | | | Core Laboratories NV (Energy Equipment & Services) | | | 2,729,044 | |

| | 440,645 | | | ING Groep NV (Banks) | | | 5,213,267 | |

| | 46,522 | | | QIAGEN NV* (Life Sciences Tools & Services) | | | 1,688,688 | |

| | 53,377 | | | Randstad NV (Professional Services) | | | 2,685,538 | |

| | | | | | | | |

| | | | | | | 23,296,388 | |

| | |

| Common Stocks – (continued) | |

| Singapore – 0.3% | |

| | 92,500 | | | DBS Group Holdings Ltd. (Banks) | | | 1,569,486 | |

| | |

| South Korea – 1.6% | |

| | 3,083 | | | Samsung Electronics Co. Ltd. GDR (Technology Hardware, Storage & Peripherals) | | | 2,876,439 | |

| | |

| | 4,343 | | | SK Innovation Co. Ltd. (Oil, Gas & Consumable Fuels) | | | 815,051 | |

| | 236,623 | | | SK Telecom Co. Ltd. ADR (Wireless Telecommunication Services) | | | 6,130,902 | |

| | | | | | | | |

| | | | | | | 9,822,392 | |

| | |

| Spain – 1.8% | |

| | 90,559 | | | Amadeus IT Group SA (IT Services) | | | 7,292,225 | |

| | 687,534 | | | CaixaBank SA (Banks) | | | 2,782,252 | |

| | 50,172 | | | Industria de Diseno Textil SA (Specialty Retail) | | | 1,414,083 | |

| | | | | | | | |

| | | | | | | 11,488,560 | |

| | |

| Sweden – 1.3% | |

| | 105,601 | | | Atlas Copco AB Class A (Machinery) | | | 2,610,642 | |

| | 68,390 | | | Essity AB Class B (Household Products) | | | 1,560,759 | |

| | 81,610 | | | Hexagon AB Class B (Electronic Equipment, Instruments & Components) | | | 3,994,288 | |

| | | | | | | | |

| | | | | | | 8,165,689 | |

| | |

| Switzerland – 11.1% | |

| | 391,429 | | | ABB Ltd. (Electrical Equipment) | | | 7,876,154 | |

| | 74,280 | | | Aryzta AG* (Food Products) | | | 692,804 | |

| | 40,006 | | | Chubb Ltd. (Insurance) | | | 4,997,150 | |

| | 68,196 | | | Cie Financiere Richemont SA (Textiles, Apparel & Luxury Goods) | | | 4,984,485 | |

| | 1,357 | | | Givaudan SA (Chemicals) | | | 3,289,256 | |

| | 6,881 | | | Kuehne & Nagel International AG (Marine) | | | 956,353 | |

| | 162,008 | | | Nestle SA (Food Products) | | | 13,677,215 | |

| | 128,062 | | | Novartis AG (Pharmaceuticals) | | | 11,214,683 | |

| | 46,573 | | | Roche Holding AG (Pharmaceuticals) | | | 11,334,118 | |

| | 23,790 | | | Sika AG (Chemicals) | | | 3,050,413 | |

| | 332,778 | | | UBS Group AG* (Capital Markets) | | | 4,651,276 | |

| | 8,758 | | | Zurich Insurance Group AG (Insurance) | | | 2,719,194 | |

| | | | | | | | |

| | | | | | | 69,443,101 | |

| | |

| Taiwan – 1.3% | |

| | 215,018 | | | Taiwan Semiconductor Manufacturing Co. Ltd. ADR (Semiconductors & Semiconductor Equipment) | | | 8,192,186 | |

| | |

| Turkey – 0.1% | |

| | 674,881 | | | Akbank T.A.S. (Banks) | | | 798,104 | |

| | |

| | |

| 20 | | The accompanying notes are an integral part of these financial statements. |

MULTI-MANAGER INTERNATIONAL EQUITY FUND

| | | | | | | | |

Shares | | | Description | | Value | |

| Common Stocks – (continued) | |

| United Kingdom – 21.2% | |

| | 82,015 | | | AstraZeneca PLC (Pharmaceuticals) | | $ | 6,273,296 | |

| | 910,595 | | | Aviva PLC (Insurance) | | | 4,976,297 | |

| | 556,479 | | | Balfour Beatty PLC (Construction & Engineering) | | | 1,869,491 | |

| | 4,255,421 | | | Barclays PLC (Banks) | | | 9,375,992 | |

| | 101,667 | | | BHP Billiton PLC (Metals & Mining) | | | 2,028,124 | |

| | 927,982 | | | BP PLC (Oil, Gas & Consumable Fuels) | | | 6,703,481 | |

| | 218,538 | | | British American Tobacco PLC (Tobacco) | | | 9,473,680 | |

| | 72,148 | | | Carnival PLC (Hotels, Restaurants & Leisure) | | | 3,932,461 | |

| | 2,541,577 | | | Cobham PLC* (Aerospace & Defense) | | | 3,488,697 | |

| | 378,433 | | | Compass Group PLC (Hotels, Restaurants & Leisure) | | | 7,443,320 | |

| | 213,348 | | | Diageo PLC (Beverages) | | | 7,375,764 | |

| | 416,063 | | | Experian PLC (Professional Services) | | | 9,569,114 | |

| | 172,848 | | | GlaxoSmithKline PLC (Pharmaceuticals) | | | 3,347,678 | |

| | 48,089 | | | Johnson Matthey PLC (Chemicals) | | | 1,823,233 | |

| | 121,287 | | | Just Eat PLC* (Internet & Direct Marketing Retail) | | | 940,881 | |

| | 4,375,425 | | | Lloyds Banking Group PLC (Banks) | | | 3,192,917 | |

| | 161,695 | | | Micro Focus International PLC (Software) | | | 2,506,630 | |

| | 492,525 | | | Prudential PLC (Insurance) | | | 9,862,138 | |

| | 53,937 | | | Reckitt Benckiser Group PLC (Household Products) | | | 4,361,566 | |

| | 123,789 | | | RELX PLC* (Professional Services) | | | 2,449,463 | |

| | 55,529 | | | RELX PLC (Professional Services) | | | 1,098,178 | |

| | 53,431 | | | Rio Tinto PLC (Metals & Mining) | | | 2,594,116 | |

| | 29,495,967 | | | Rolls-Royce Holdings PLC* (Aerospace & Defense) | | | 7,098,962 | |

| | 221,453 | | | Royal Dutch Shell PLC Class B (Oil, Gas & Consumable Fuels) | | | 7,222,230 | |

| | 43,617 | | | Smiths Group PLC (Industrial Conglomerates) | | | 777,495 | |

| | 394,061 | | | SSE PLC (Electric Utilities) | | | 5,743,606 | |

| | 528,419 | | | Tesco PLC (Food & Staples Retailing) | | | 1,439,108 | |

| | 2,106,507 | | | Vodafone Group PLC (Wireless Telecommunication Services) | | | 3,961,367 | |

| | 200,030 | | | WPP PLC (Media) | | | 2,263,486 | |

| | | | | | | | |

| | | | | | | 133,192,771 | |

| | |

| United States – 1.2% | |

| | 8,450 | | | Mettler-Toledo International, Inc.* (Life Sciences Tools & Services) | | | 4,620,629 | |

| | 82,492 | | | Yum China Holdings, Inc. (Hotels, Restaurants & Leisure) | | | 2,976,311 | |

| | | | | | | | |

| | | | | | | 7,596,940 | |

| | |

| | TOTAL COMMON STOCKS

| |

| (Cost $583,251,407) | | $591,556,961 | |

| | |

| Preferred Stock – 1.9% | |

| Germany – 1.9% | |

Volkswagen AG (Automobiles) | |

| 70,351 | | 2.700% | | $ | 11,819,173 | |

| (Cost $10,582,188) | | | | |

| |

| | | | | | |

| Investment Company(a) – 3.6% | |

Goldman Sachs Financial Square Government Fund – Institutional Shares | |

| 22,326,171 | | 2.102% | | $ | 22,326,171 | |

| (Cost $22,326,171) | | | | |

| |

| TOTAL INVESTMENTS – 99.8% | |

| (Cost $616,159,766) | | $ | 625,702,305 | |

| |

OTHER ASSETS IN EXCESS OF LIABILITIES – 0.2% | | | 1,268,944 | |

| |

| NET ASSETS – 100.0% | | $ | 626,971,249 | |

| |

| | | | |

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

* | | Non-income producing security. |

(a) | | Represents an affiliated issuer. |

| | |

|

Investment Abbreviations: |

ADR | | —American Depositary Receipt |

GDR | | —Global Depository Receipt |

PLC | | —Public Limited Company |

|

| | |

| The accompanying notes are an integral part of these financial statements. | | 21 |

MULTI-MANAGER INTERNATIONAL EQUITY FUND

Schedule of Investments (continued)

October 31, 2018

|

| ADDITIONAL INVESTMENT INFORMATION |

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS — At October 31, 2018, the Fund had the following forward foreign currency exchange contracts:

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS WITH UNREALIZED GAIN

| | | | | | | | | | | | | | |

| Counterparty | | Currency

Purchased | | | Currency

Sold | | Settlement

Date | | | Unrealized

Gain | |

State Street Bank and Trust | | | JPY 13,235,371 | | | USD 117,049 | | | 11/05/18 | | | $ | 290 | |

| | | | USD 82,269 | | | JPY 9,252,099 | | | 11/01/18 | | | | 267 | |

| Total | | | | | | | | | | | | $ | 557 | |

| | |

| 22 | | The accompanying notes are an integral part of these financial statements. |

MULTI-MANAGER U.S. DYNAMIC EQUITY FUND

Schedule of Investments

October 31, 2018

| | | | | | | | |

Shares | | | Description | | Value | |

| Common Stocks – 92.5% | |

| Aerospace & Defense – 4.6% | | | |

| | 35,785 | | | Airbus SE | | $ | 3,954,751 | |

| | 15,769 | | | General Dynamics Corp. | | | 2,721,414 | |

| | 5,037 | | | Safran SA | | | 650,921 | |

| | | | | | | | |

| | | | | | | 7,327,086 | |

| | |

| Air Freight & Logistics – 0.7% | |

| | 5,174 | | | FedEx Corp. | | | 1,140,039 | |

| | |

| Auto Components – 0.5% | |

| | 9,970 | | | Aptiv PLC | | | 765,696 | |

| | |

| Automobiles*(a) – 0.1% | |

| | 9,162 | | | Aston Martin Lagonda Global Holdings PLC | | | 178,614 | |

| | |

| Banks – 8.8% | |

| | 184,704 | | | Bank of America Corp. | | | 5,079,360 | |

| | 56,902 | | | JPMorgan Chase & Co. | | | 6,203,456 | |

| | 37,651 | | | Regions Financial Corp. | | | 638,938 | |

| | 40,017 | | | Wells Fargo & Co. | | | 2,130,105 | |

| | 2,455 | | | Western Alliance Bancorp* | | | 118,429 | |

| | | | | | | | |

| | | | | | | 14,170,288 | |

| | |

| Beverages – 4.5% | |

| | 2,910 | | | Constellation Brands, Inc. Class A | | | 579,759 | |

| | 14,880 | | | Molson Coors Brewing Co. Class B | | | 952,320 | |

| | 118,336 | | | The Coca-Cola Co. | | | 5,665,928 | |

| | | | | | | | |

| | | | | | | 7,198,007 | |

| | |

| Biotechnology – 2.6% | |

| | 21,272 | | | Amgen, Inc. | | | 4,101,029 | |

| | |

| Building Products* – 0.8% | |

| | 20,970 | | | Armstrong World Industries, Inc. | | | 1,294,897 | |

| | 1 | | | Resideo Technologies, Inc. | | | 18 | |

| | | | | | | | |

| | | | | | | 1,294,915 | |

| | |

| Capital Markets – 1.8% | |

| | 18,049 | | | Affiliated Managers Group, Inc. | | | 2,051,449 | |

| | 4,205 | | | S&P Global, Inc. | | | 766,656 | |

| | | | | | | | |

| | | | | | | 2,818,105 | |

| | |

| Chemicals – 1.8% | |

| | 7,188 | | | The Sherwin-Williams Co. | | | 2,828,262 | |

| | |

| Communications Equipment – 2.6% | |

| | 59,780 | | | Cisco Systems, Inc. | | | 2,734,935 | |

| | 11,725 | | | Motorola Solutions, Inc. | | | 1,437,016 | |

| | | | | | | | |

| | | | | | | 4,171,951 | |

| | |

| Construction Materials – 0.9% | |

| | 14,211 | | | Vulcan Materials Co. | | | 1,437,301 | |

| | |

| Consumer Finance – 2.3% | |

| | 35,847 | | | American Express Co. | | | 3,682,562 | |

| | |

| Diversified Financial Services* – 4.7% | |

| | 36,431 | | | Berkshire Hathaway, Inc. Class B | | | 7,478,556 | |

| | |

| Common Stocks – (continued) | |

| Electrical Equipment – 0.5% | |

| | 5,125 | | | Rockwell Automation, Inc. | | | 844,241 | |

| | |

| Energy Equipment & Services – 0.2% | |

| | 5,683 | | | Schlumberger Ltd. | | | 291,595 | |

| | |

| Entertainment – 2.7% | |

| | 8,500 | | | Electronic Arts, Inc.* | | | 773,330 | |

| | 21,818 | | | The Walt Disney Co. | | | 2,505,361 | |

| | 14,147 | | | World Wrestling Entertainment, Inc. Class A | | | 1,026,931 | |

| | | | | | | | |

| | | | | | | 4,305,622 | |

| | |

| Food & Staples Retailing – 4.9% | |

| | 85,849 | | | BJ’s Wholesale Club Holdings, Inc.* | | | 1,901,555 | |

| | 67,147 | | | The Kroger Co. | | | 1,998,295 | |

| | 48,827 | | | Walgreens Boots Alliance, Inc. | | | 3,894,930 | |

| | | | | | | | |

| | | | | | | 7,794,780 | |

| | |

| Health Care Equipment & Supplies – 7.3% | |

| | 48,183 | | | Abbott Laboratories | | | 3,321,736 | |

| | 13,470 | | | Becton Dickinson & Co. | | | 3,104,835 | |

| | 76,843 | | | Boston Scientific Corp.* | | | 2,777,106 | |

| | 28,230 | | | Medtronic PLC | | | 2,535,619 | |

| | | | | | | | |

| | | | | | | 11,739,296 | |

| | |

| Health Care Providers & Services – 1.6% | |

| | 12,810 | | | AmerisourceBergen Corp. | | | 1,127,280 | |

| | 11,225 | | | Universal Health Services, Inc. Class B | | | 1,364,511 | |

| | | | | | | | |

| | | | | | | 2,491,791 | |

| | |

| Hotels, Restaurants & Leisure – 1.9% | |

| | 13,615 | | | McDonald’s Corp. | | | 2,408,493 | |

| | 10,070 | | | Starbucks Corp. | | | 586,779 | |

| | | | | | | | |

| | | | | | | 2,995,272 | |

| | |

| Household Durables – 3.8% | |

| | 18,509 | | | D.R. Horton, Inc. | | | 665,583 | |

| | 49,952 | | | Lennar Corp. Class A | | | 2,146,937 | |

| | 1,498 | | | NVR, Inc.* | | | 3,354,067 | |

| | | | | | | | |

| | | | | | | 6,166,587 | |

| | |

| Industrial Conglomerates – 0.9% | |

| | 9,841 | | | Honeywell International, Inc. | | | 1,425,174 | |

| | |

| Insurance – 1.9% | |

| | 71,206 | | | Aflac, Inc. | | | 3,066,842 | |

| | |

| Interactive Media & Services* – 1.1% | |

| | 1,620 | | | Alphabet, Inc. Class A | | | 1,766,740 | |

| | |

| Internet & Direct Marketing Retail* – 1.6% | |

| | 90,923 | | | eBay, Inc. | | | 2,639,495 | |

| | |

| IT Services – 2.9% | |

| | 12,913 | | | Accenture PLC Class A | | | 2,035,347 | |

| | 6,550 | | | DXC Technology Co. | | | 477,036 | |

| | 6,195 | | | International Business Machines Corp. | | | 715,089 | |

| | 10,747 | | | PayPal Holdings, Inc.* | | | 904,790 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 23 |

MULTI-MANAGER U.S. DYNAMIC EQUITY FUND

Schedule of Investments (continued)

October 31, 2018

| | | | | | | | |

Shares | | | Description | | Value | |

| Common Stocks – (continued) | |

| IT Services – (continued) | |

| | 22,997 | | | Perspecta, Inc. | | $ | 563,197 | |

| | | | | | | | |

| | | | | | | 4,695,459 | |

| | |

| Machinery – 0.8% | |

| | 17,135 | | | Kennametal, Inc. | | | 607,436 | |

| | 8,330 | | | Wabtec Corp. | | | 683,226 | |

| | | | | | | | |

| | | | | | | 1,290,662 | |

| | |

| Media – 5.2% | |

| | 53,414 | | | Comcast Corp. Class A | | | 2,037,210 | |

| | 152,955 | | | Discovery, Inc. Class A* | | | 4,954,212 | |

| | 124,412 | | | TEGNA, Inc. | | | 1,435,715 | |

| | | | | | | | |

| | | | | | | 8,427,137 | |

| | |

| Metals & Mining – 0.3% | |

| | 12,955 | | | Steel Dynamics, Inc. | | | 513,018 | |

| | |

| Multiline Retail – 3.4% | |

| | 25,182 | | | Nordstrom, Inc. | | | 1,656,220 | |

| | 45,018 | | | Target Corp. | | | 3,764,855 | |

| | | | | | | | |

| | | | | | | 5,421,075 | |

| | |

| Oil, Gas & Consumable Fuels – 1.0% | |

| | 1,353 | | | Marathon Petroleum Corp. | | | 95,319 | |

| | 13,641 | | | PBF Energy, Inc. Class A | | | 570,876 | |

| | 5,253 | | | Pioneer Natural Resources Co. | | | 773,609 | |

| | 2,705 | | | Royal Dutch Shell PLC ADR Class A | | | 170,929 | |

| | | | | | | | |

| | | | | | | 1,610,733 | |

| | |

| Personal Products – 0.2% | |

| | 2,403 | | | Beiersdorf AG | | | 248,464 | |

| | |

| Pharmaceuticals – 3.5% | |

| | 8,562 | | | Johnson & Johnson | | | 1,198,594 | |

| | 30,690 | | | Merck & Co., Inc. | | | 2,259,091 | |

| | 51,908 | | | Pfizer, Inc. | | | 2,235,159 | |

| | | | | | | | |

| | | | | | | 5,692,844 | |

| | |

| Road & Rail – 3.3% | |

| | 18,189 | | | CSX Corp. | | | 1,252,494 | |

| | 23,869 | | | Kansas City Southern | | | 2,433,683 | |

| | 12,711 | | | Old Dominion Freight Line, Inc. | | | 1,657,769 | |

| | | | | | | | |

| | | | | | | 5,343,946 | |

| | |

| Semiconductors & Semiconductor Equipment – 3.5% | |

| | 34,250 | | | Analog Devices, Inc. | | | 2,867,067 | |

| | 13,414 | | | Intel Corp. | | | 628,848 | |

| | 13,155 | | | Skyworks Solutions, Inc. | | | 1,141,328 | |

| | 10,796 | | | Texas Instruments, Inc. | | | 1,002,193 | |

| | | | | | | | |

| | | | | | | 5,639,436 | |

| | |

| Software* – 0.4% | |

| | 1,705 | | | Check Point Software Technologies Ltd. | | | 189,255 | |

| | 9,629 | | | Imperva, Inc. | | | 532,965 | |

| | | | | | | | |

| | | | | | | 722,220 | |

| | |

| Common Stocks – (continued) | |

| Specialty Retail – 2.8% | |

| | 14,629 | | | CarMax, Inc.* | | | 993,455 | |

| | 10,925 | | | Lowe’s Cos., Inc. | | | 1,040,278 | |

| | 14,237 | | | The Home Depot, Inc. | | | 2,504,004 | |

| | | | | | | | |

| | | | | | | 4,537,737 | |

| | |

| Wireless Telecommunication Services – 0.1% | |

| | 85,734 | | | VEON Ltd. ADR | | | 240,913 | |

| | |

| | TOTAL COMMON STOCKS

| |

| | (Cost $126,406,324) | | $ | 148,503,490 | |

| | |

| | |

| Shares | | | Dividend

Rate | | Value | |

| Investment Company(b) – 5.4% | |

| Goldman Sachs Financial Square Government Fund –

Institutional Shares |

|

| | 8,575,215 | | | 2.102% | | $ | 8,575,215 | |

| | (Cost $8,575,215) | | | | |

| | |

| | TOTAL INVESTMENTS – 97.9%

| |

| | (Cost $134,981,539) | | $ | 157,078,705 | |

| | |

| OTHER ASSETS IN EXCESS OF

LIABILITIES – 2.1% | | | 3,447,951 | |

| | |

| | NET ASSETS – 100.0% | | $ | 160,526,656 | |

| | |

| | |

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

* | | Non-income producing security. |

(a) | | Exempt from registration under Rule 144A of the Securities Act of 1933. Under procedures approved by the Board of Trustees, such securities may be deemed liquid by the investment Adviser and may be resold, normally to qualified institutional buyers in transactions exempt from registration. Total market value of Rule 144A securities amounts to $178,614, which represents approximately 0.1% of the Fund’s net assets as of October 31, 2018. The liquidity determination is unaudited. |

(b) | | Represents an affiliated issuer. |

| | |

|

| Currency Abbreviations: |

| | EUR —Euro |

| | GBP —British Pound |

| | USD —U.S. Dollar |

| | |

| | Investment Abbreviations: |

| | ADR —American Depositary Receipt |

| | PLC —Public Limited Company |

|

| | |

| 24 | | The accompanying notes are an integral part of these financial statements. |

MULTI-MANAGER U.S. DYNAMIC EQUITY FUND

|

| ADDITIONAL INVESTMENT INFORMATION |

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS — At October 31, 2018, the Fund had the following forward foreign currency exchange contracts:

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS WITH UNREALIZED GAIN

| | | | | | | | | | | | | | | | | | | | |

| Counterparty | | Currency

Purchased | | | Currency

Sold | | | Settlement

Date | | | Unrealized

Gain | |

MS & Co. Int. PLC | | USD | | | 6,045,524 | | | EUR | | | 5,159,000 | | | | 12/19/18 | | | $ | 175,506 | |

| | | USD | | | 198,758 | | | GBP | | | 152,000 | | | | 12/19/18 | | | | 3,964 | |

| TOTAL | | | | | | | $ | 179,470 | |

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS WITH UNREALIZED LOSS

| | | | | | | | | | | | | | | | | | | | |

| Counterparty | | Currency

Purchased | | | Currency

Sold | | | Settlement

Date | | | Unrealized

Loss | |

MS & Co. Int. PLC | | EUR | | | 966,000 | | | USD | | | 1,122,778 | | | | 12/19/18 | | | $ | (23,644 | ) |

| | | USD | | | 106,643 | | | EUR | | | 94,000 | | | | 12/19/18 | | | | (312 | ) |

| TOTAL | | | | | | | $ | (23,956 | ) |

| | |

|

| Abbreviations: |

| | MS & Co. Int. PLC—Morgan Stanley & Co. International PLC |

|

| | |

| The accompanying notes are an integral part of these financial statements. | | 25 |

MULTI-MANAGER U.S. SMALL CAP EQUITY FUND

Schedule of Investments

October 31, 2018

| | | | | | | | |

Shares | | | Description | | Value | |

| Common Stocks – 92.5% | |

| Aerospace & Defense – 2.8% | | | |

| | 34,547 | | | BWX Technologies, Inc. | | $ | 2,019,618 | |

| | 16,975 | | | Engility Holdings, Inc.* | | | 526,734 | |

| | 52,479 | | | HEICO Corp. | | | 4,399,314 | |

| | 22,490 | | | Hexcel Corp. | | | 1,316,115 | |

| | 12,421 | | | Mercury Systems, Inc.* | | | 582,048 | |

| | | | | | | | |

| | | | | | | 8,843,829 | |

| | |

| Auto Components – 2.6% | |

| | 31,715 | | | Cooper Tire & Rubber Co. | | | 979,676 | |

| | 22,703 | | | Dorman Products, Inc.* | | | 1,793,764 | |

| | 41,946 | | | Fox Factory Holding Corp.* | | | 2,253,759 | |

| | 39,630 | | | LCI Industries | | | 2,748,341 | |

| | 9,231 | | | Standard Motor Products, Inc. | | | 499,489 | |

| | | | | | | | |

| | | | | | | 8,275,029 | |

| | |

| Banks – 6.1% | |

| | 12,169 | | | Allegiance Bancshares, Inc.* | | | 471,062 | |

| | 59,320 | | | Bank OZK | | | 1,622,995 | |

| | 71,590 | | | BankUnited, Inc. | | | 2,369,629 | |

| | 38,167 | | | Cadence BanCorp | | | 841,964 | |

| | 21,386 | | | CenterState Bank Corp. | | | 525,668 | |

| | 22,584 | | | Columbia Banking System, Inc. | | | 837,641 | |

| | 25,693 | | | ConnectOne Bancorp, Inc. | | | 532,616 | |

| | 24,517 | | | FCB Financial Holdings, Inc. Class A* | | | 959,350 | |

| | 3,858 | | | First Citizens BancShares, Inc. Class A | | | 1,645,939 | |

| | 22,918 | | | First Merchants Corp. | | | 953,618 | |

| | 27,952 | | | First Midwest Bancorp, Inc. | | | 641,778 | |

| | 33,187 | | | Hanmi Financial Corp. | | | 696,263 | |

| | 63,331 | | | Home BancShares, Inc. | | | 1,205,822 | |

| | 39,738 | | | LegacyTexas Financial Group, Inc. | | | 1,531,105 | |

| | 18,531 | | | Pacific Premier Bancorp, Inc.* | | | 541,661 | |

| | 14,041 | | | Peapack Gladstone Financial Corp. | | | 378,967 | |