UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-22781

Goldman Sachs Trust II

(Exact name of registrant as specified in charter)

200 West Street

15th Floor

New York, New York 10282

(Address of principal executive offices) (Zip code)

| | |

Copies to: |

Caroline Kraus | | Geoffrey R.T. Kenyon, Esq. |

Goldman Sachs & Co. LLC | | Dechert LLP |

200 West Street | | 100 Oliver Street |

New York, New York 10282 | | 40th Floor |

| | Boston, MA 02110-2605 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (212) 902-1000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2019

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| | The Annual Report to Shareholders is filed herewith. |

Goldman Sachs Funds

| | | | |

| | |

| Annual Report | | | | October 31, 2019 |

| | |

| | | | Active Equity Multi-Manager Funds |

| | | | Multi-Manager International Equity |

| | | | Multi-Manager U.S. Dynamic Equity |

| | | | Multi-Manager U.S. Small Cap Equity |

It is our intention that beginning on January 1, 2021, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from a Fund or from your financial intermediary. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. At any time, you may elect to receive reports and certain communications from a Fund electronically by calling the applicable toll-free number below or by contacting your financial intermediary.

You may elect to receive all future shareholder reports in paper free of charge. If you hold shares of a Fund directly with the Fund’s transfer agent, you can inform the transfer agent that you wish to receive paper copies of reports by callingtoll-free 800-621-2550 for Class P shareholders. If you hold shares of a Fund through a financial intermediary, please contact your financial intermediary to make this election. Your election to receive reports in paper will apply to all Goldman Sachs Funds held in your account if you invest through your financial intermediary or all Goldman Sachs Funds held with the Funds’ transfer agent if you invest directly with the transfer agent.

Active Equity Multi-Manager Funds

| ∎ | | MULTI-MANAGER INTERNATIONAL EQUITY |

| ∎ | | MULTI-MANAGER U.S. DYNAMIC EQUITY |

| ∎ | | MULTI-MANAGER U.S. SMALL CAP EQUITY |

| | | | |

| | | |

| NOT FDIC-INSURED | | May Lose Value | | No Bank Guarantee |

MARKET REVIEW

Active Equity Multi-Manager Funds

Market Review

The capital markets experienced mixed results during the 12 months ended October 31, 2019 (the “Reporting Period”), as global economic growth concerns and trade war uncertainty led to sustained market volatility.

The first half of the Reporting Period was characterized by a challenging 2018 year-end followed by a remarkably strong rally during the first four months of 2019. Global equities fell significantly in November and December 2018, as investors’ hopes for a trade reconciliation between the U.S. and China were dashed. Risk-off market sentiment, or reduced risk appetite, increased, and U.S. Treasury yields began a downward slide that endured for most of the Reporting Period. In January 2019, global equities rebounded from their losses, jumpstarted by a more accommodative tone from U.S. Federal Reserve (“Fed”) Chair Jerome Powell, who cited the need for a patient approach toward future interest rate changes given the continued economic slowdown in China and softening U.S. economic data. In March 2019, amid ongoing U.S.-China trade tensions and in response to the stock market volatility at 2018 year-end, the Fed announced its intention to hold interest rates steady through the conclusion of the 2019 calendar year. Meanwhile, monetary policy easing by central banks in Europe and China further supported global equities, which experienced their strongest first calendar quarter rally in more than two decades. However, despite the global equity rally, the weakening global economy, which was exacerbated by unpredictable trade rhetoric between the U.S. and China, stayed top of mind for investors. In March 2019, these concerns drove yields on German and Japanese 10-year government bonds into negative territory.

During the second half of the Reporting Period, global equity markets generally traded sideways and remained heavily influenced by trade disputes and global central bank policies. (When a market trades sideways, it generally moves within a fairly stable range without forming any distinct trends over a period of time.) Global equities began May 2019 near all-time highs before sharply declining during the month, as a breakdown in U.S. and China trade negotiations led to fresh U.S. tariffs on Chinese imports. For much of the spring and summer, investor sentiment whipsawed as the U.S. and China swapped tariff threats and company-specific blacklists. Meanwhile, the Fed shifted its monetary policy stance, deciding to cut short-term interest rates by 25 basis points in July 2019—its first interest rate cut in more than a decade. (A basis point is 1/100th of a percentage point.) Further 25 basis point reductions followed in September and October 2019. The Fed’s concern about declining economic growth and its accommodative monetary policy stance was reiterated by European Central Bank President Mario Draghi, who unveiled a new quantitative easing plan for the European Union just as his term ended on October 31st. In October 2019, the European Union remained front and center, as it approved another delay in Brexit (or the U.K.’s departure from the European Union) beyond the originally scheduled October 31st deadline. For the Reporting Period overall, global equities (as represented by the MSCI All Country World Index Investable Market Index) were up more than 12%, driven by positive performance across all major regions. From a sector perspective, cyclical stocks and information technology stocks were notable performers. Energy was the only sector that posted a negative absolute return for the Reporting Period.

Credit markets broadly sold off during the first two months of the Reporting Period. The sell-off was driven by risk-off investor sentiment and a flight to quality through November and December 2018 as well as by significant market volatility due in part to the partial U.S. federal government shutdown, investor uncertainty around the Fed’s monetary policy, tumultuous U.S.-China trade relations and uncertain global economic growth. At the beginning of 2019, however, investor sentiment improved in light of seemingly positive developments in U.S.-China trade talks as well as data indicative of ongoing solid U.S. economic growth and a more dovish Fed. (Dovish tends to suggest lower interest rates; opposite of hawkish.) Investment grade corporate bonds outperformed nearly all other major fixed income sectors during the first 10 months of 2019, surpassing high yield corporate bonds midway through the calendar year as the longer duration profile of investment grade corporate bonds benefited from a significant rally in interest rates and tightening credit spreads (or yield differentials between corporate bonds and U.S. Treasury securities of comparable maturity). Emerging markets debt also rallied, as investor optimism around U.S.-China trade negotiations persisted, with U.S. dollar-denominated emerging markets debt outpacing local currency emerging markets debt.

1

MARKET REVIEW

Looking Ahead

At the end of the Reporting Period, investors remained focused on a potential resolution to the U.S.-China trade war. Suggestions from both countries that an agreement might be reached by the end of 2019 were met with cautious optimism. Investors also adopted a wait-and-see approach toward Brexit given a second delay in its implementation and a new deadline of January 31, 2020. An early general election in the U.K., scheduled for December 2019, added further to Brexit-related uncertainty. Going forward, we expect investors to remain watchful for signs the accommodative efforts of the world’s central banks are effective in staving off a further slowdown in the global economy. We also expect investors to continue monitoring the progress of U.S.-China trade talks.

2

PORTFOLIO RESULTS

Multi-Manager International Equity Fund

Investment Objective

The Fund seeks to provide long-term capital growth.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Alternative Investments & Manager Selection (“AIMS”) Group discusses the Multi-Manager International Equity Fund’s (the “Fund”) performance and positioning for the 12-month period ended October 31, 2019 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class P Shares generated an average annual total return of 12.78%. This return compares to the 11.04% average annual total return of the Fund’s benchmark, the MSCI Europe, Australasia and Far East (“EAFE”) Index (Net, USD, Unhedged) (the “Index”) during the same time period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund uses a multi-manager approach and generally seeks to achieve its investment objective by dynamically allocating its assets among unaffiliated investment managers (“Underlying Managers”) that employ an international equity investment strategy. The AIMS Group is responsible for making recommendations with respect to hiring, terminating or replacing the Fund’s Underlying Managers as well as for determining the Fund’s asset allocations. The AIMS Group applies a multifaceted process with respect to manager due diligence, portfolio construction and risk management. |

| | During the Reporting Period, the Fund recorded a positive absolute return and outperformed the Index. The relative outperformance can be attributed to the performance of the Fund’s Underlying Managers overall. The Fund allocated capital to three Underlying Managers during the Reporting Period as part of its top-level strategy allocation—Causeway Capital Management LLC (“Causeway”), Massachusetts Financial Services Company doing business as MFS Investment Management (“MFS”) and WCM Investment Management (“WCM”). |

| | All three of the Underlying Managers with allocated capital during the Reporting Period generated positive absolute returns. On a relative basis, growth-oriented Underlying Manager WCM and core-oriented MFS outperformed the Index. Value-oriented Causeway underperformed the Index. The Index serves as the benchmark index for all three Underlying Managers. |

| Q | | Which international equity strategies most significantly affected Fund performance? |

| A | | Growth-oriented Underlying Manager WCM outperformed the Index during the Reporting Period. WCM’s positive results were driven by overweight positions and effective stock selection in the information technology and financials sectors. |

| | Core-oriented Underlying Manager MFS also outperformed the Index, primarily because of an overweight position and stock selection within the health care sector. |

| | Value-oriented Underlying Manager Causeway underperformed the Index. An underweight position and poor stock selection in the communication services sector detracted from returns as did an overweight position and weak stock selection in the energy sector. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | The Fund used forward foreign currency exchange contracts during the Reporting Period to take positions in select non-U.S. markets. Rights were employed to give the Fund the opportunity, but not the obligation, to buy additional shares of specific stocks at a discount. Overall, the use of these instruments had a rather neutral impact on the Fund’s performance during the Reporting Period. |

| Q | | Were there any notable changes in the Fund’s allocations during the Reporting Period? |

| A | | There were no changes in the Fund’s allocations during the Reporting Period. At the beginning and end of the Reporting Period, the Fund’s assets were allocated approximately 44% |

3

PORTFOLIO RESULTS

| | to Causeway, 35% to MFS and 20% to WCM. The remainder of the Fund’s assets were invested in cash and cash equivalents. |

| Q | | Were there any changes to the Fund’s portfolio management team during the Reporting Period? |

| A | | Effective January 25, 2019, Tom Murray no longer served as a portfolio manager of the Fund. By design, all investment decisions for the Fund are performed within a co-lead or team structure, with multiple subject matter experts. This strategic decision making has been the cornerstone of our approach and ensures continuity in the Fund. At the end of the Reporting Period, the portfolio managers for the Fund were Kent Clark and Betsy Gorton. |

| Q | | What is the Fund’s tactical view and strategy for the months ahead? |

| A | | At the end of the Reporting Period, compared to the Index, the Fund was overweight information technology and health care stocks and was underweight financials and consumer discretionary stocks. It had no exposure to real estate stocks. On a regional basis, the Fund was significantly underweight Japan and developed Asia, while maintaining out-of-benchmark exposure to the emerging markets and North America. From a market capitalization perspective, the Fund was overweight at the end of the Reporting Period in mega-cap stocks and maintained underweights relative to the Index in mid-cap and large-cap companies. |

| | We intend to continue to position the Fund in alignment with our longer-term strategic views within the international equity complex. We further intend to continue to monitor allocations and Underlying Manager performance as we seek to generate long-term capital growth. |

4

FUND BASICS

Multi-Manager International Equity Fund

as of October 31, 2019

| | | | | | | | |

| | TOP TEN EQUITY HOLDINGS AS OF 10/31/191 |

| | | |

| | | Holding | | % of Net Assets | | | Line of Business |

| | | |

| | Nestle SA | | | 2.2 | % | | Food Products |

| | | |

| | SAP SE | | | 1.9 | | | Software |

| | | |

| | Volkswagen AG | | | 1.9 | | | Automobiles |

| | | |

| | Roche Holding AG | | | 1.7 | | | Pharmaceuticals |

| | | |

| | BASF SE | | | 1.7 | | | Chemicals |

| | | |

| | AIA Group Ltd. | | | 1.7 | | | Insurance |

| | | |

| | Takeda Pharmaceutical Co. Ltd. | | | 1.6 | | | Pharmaceuticals |

| | | |

| | UniCredit SpA | | | 1.6 | | | Banks |

| | | |

| | LVMH Moet Hennessy Louis Vuitton SE | | | 1.5 | | | Textiles, Apparel & Luxury Goods |

| | | |

| | | Experian PLC | | | 1.5 | | | Professional Services |

| 1 | | The top 10 holdings may not be representative of the Fund’s future investments. |

|

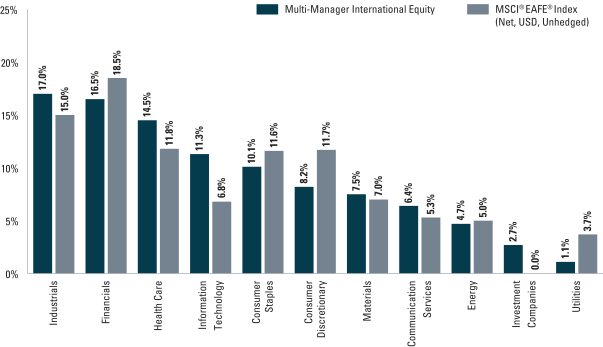

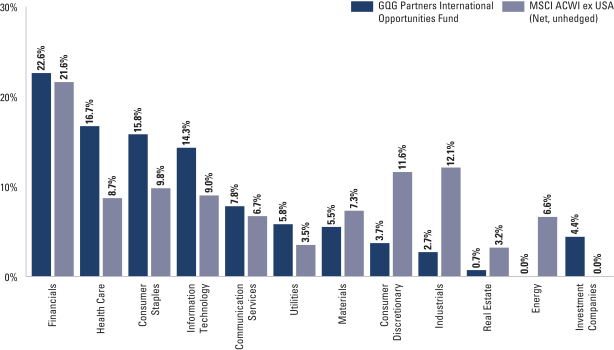

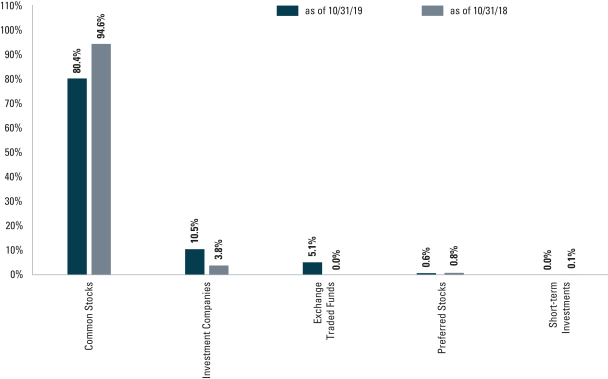

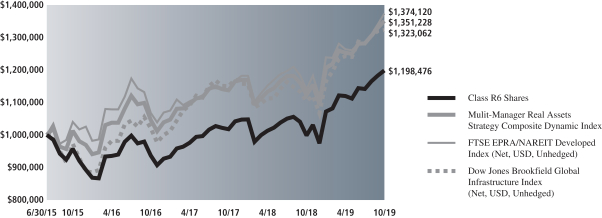

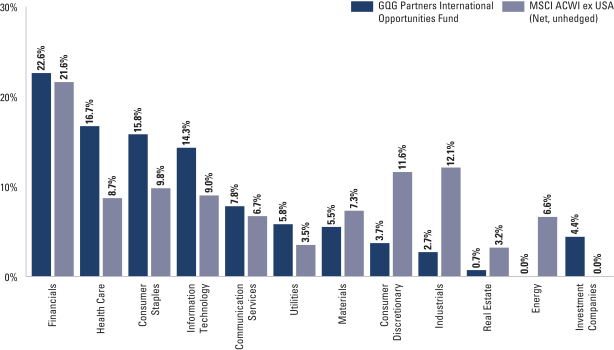

| FUND VS. BENCHMARK SECTOR ALLOCATIONS (%)2 |

|

| As of October 31, 2019 |

| 2 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. Figures in the graph may not sum to 100% due to rounding and/or the exclusion of other assets and liabilities. The graph categorizes investments using the Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

For more information about your Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about your Fund’s investment strategies, holdings, and performance.

5

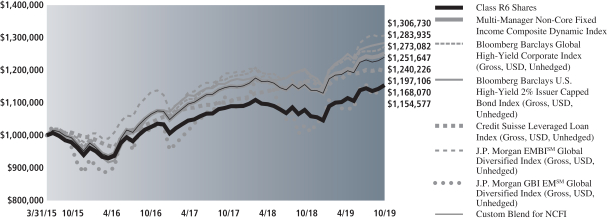

MULTI-MANAGER INTERNATIONAL EQUITY FUND

Performance Summary

October 31, 2019

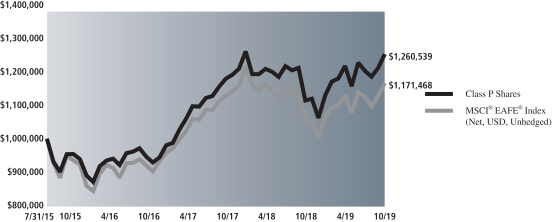

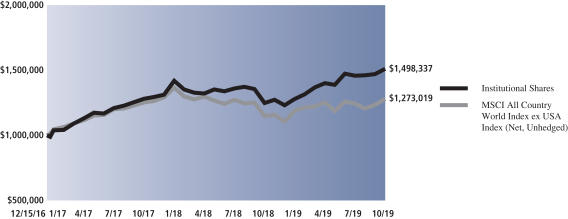

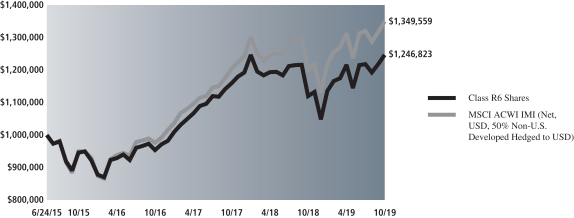

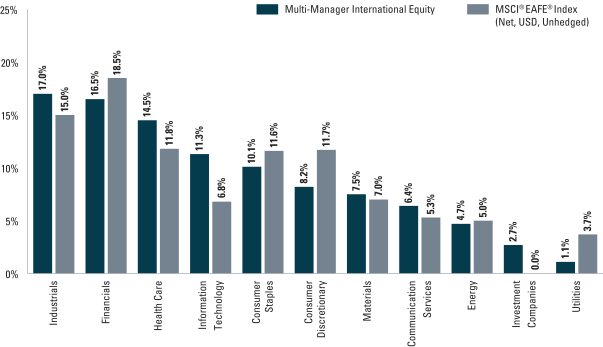

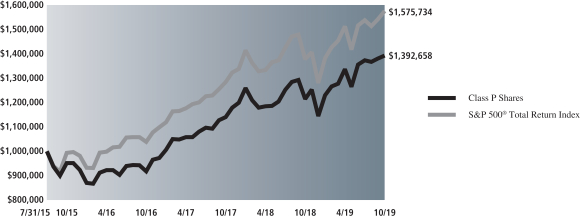

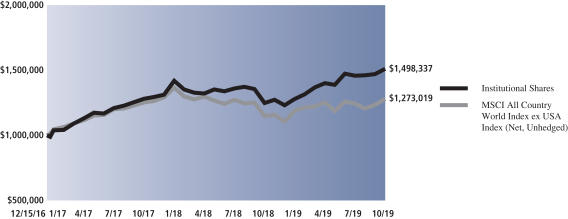

The following graph shows the value, as of October 31, 2019, of a $1,000,000 investment made on July 31, 2015 (commencement of operations) in Class P Shares at NAV. For comparative purposes, the performance of the Fund’s benchmark, the MSCI® EAFE® Index (Net, USD, Unhedged) is shown. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns set forth below represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns.

|

| Multi-Manager International Equity Fund’s Lifetime Performance |

Performance of a $1,000,000 investment, with distributions reinvested, from July 31, 2015 through October 31, 2019.

| | | | |

| Average Annual Total Return through October 31, 2019 | | One Year | | Since Inception |

|

Class P (Commenced July 31, 2015)* | | 12.78% | | 5.59% |

|

| * | | Effective April 16, 2018, Institutional Shares were redesignated as Class P Shares. |

6

PORTFOLIO RESULTS

Multi-Manager U.S. Dynamic Equity Fund

Investment Objective

The Fund seeks to provide long-term capital growth.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Alternative Investments & Manager Selection (“AIMS”) Group discusses the Multi-Manager U.S. Dynamic Equity Fund’s (the “Fund”) performance and positioning for the12-month period ended October 31, 2019 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class P Shares generated an average annual total return of 14.66%. This return compares to the 14.33% average annual total return of the Fund’s benchmark, the S&P 500® Total Return Index (the “Index”) during the same time period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund uses a multi-manager approach and generally seeks to achieve its investment objective by dynamically allocating its assets among unaffiliated investment managers (“Underlying Managers”) that employ dynamic equity investment strategies. (Dynamic equity investment strategies generally involve investing in equity instruments, often with a long term view. They are long-biased strategies and may have low excess return correlations to traditional long-only equity strategies.) The AIMS Group is responsible for making recommendations with respect to hiring, terminating or replacing the Fund’s Underlying Managers as well as for determining the Fund’s asset allocations. The AIMS Group applies a multifaceted process with respect to manager due diligence, portfolio construction and risk management. |

| | | During the Reporting Period, the Fund recorded a positive absolute return and outperformed the Index. The relative outperformance can be attributed to the performance of the Fund’s Underlying Managers overall. |

| | | At various points during the Reporting Period, the Fund had capital allocated to four Underlying Managers as part of itstop-level strategy allocation — Lazard Asset Management LLC (“Lazard”), Sirios Capital Management, L.P. (“Sirios”), Smead Capital Management, Inc. (“Smead”) and Vaughan Nelson Investment Management, L.P. (“Vaughan Nelson”). |

| | | Of the three Underlying Managers with allocated capital for the entire Reporting Period, all three posted positive absolute returns. Vaughan Nelson recorded a positive absolute return between December 20, 2018, when it was allocated capital as an Underlying Manager of the Fund, and the end of the Reporting Period. On a relative basis, Sirios and Lazard outperformed the Index during the Reporting Period, while Smead underperformed the Index. Vaughan Nelson outperformed the Index between December 20, 2018 and the end of the Reporting Period. The Index serves as the benchmark index for all four Underlying Managers. |

| Q | | Which dynamic equity strategies most significantly affected Fund performance? |

| A | | Growth-oriented Underlying Manager Sirios outperformed the Index during the Reporting Period, benefiting from an overweight position and positive stock selection in the industrials sector. |

| | | Lazard, which uses an all cap, concentrated investment strategy, also outperformed the Index. Strong stock selection in the financials sector added to returns as did a lack of exposure to the energy sector. |

| | | Core-oriented Vaughan Nelson outperformed the Index between December 20, 2018, when it was allocated capital, and the end of the Reporting Period. Strong stock selection in the materials sector drove these positive results. |

| | | Smead, the other core-oriented Underlying Manager, underperformed the Index during the Reporting Period overall. Smead was hurt by its underweight in the consumer staples sector. |

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | The Fund used rights and forward foreign currency exchange contracts during the Reporting Period to take positions in |

7

PORTFOLIO RESULTS

| | selectnon-U.S. markets. The use of these derivatives had a rather neutral impact on the Fund’s results during the Reporting Period. |

| Q | | Were there any notable changes in the Fund’s allocations during the Reporting Period? |

| A | | At the beginning of the Reporting Period, the Fund’s assets were allocated approximately 40.5% to Smead, 40.5% to Sirios and 18% to Lazard. The remainder of the Fund’s assets were invested in cash and cash equivalents. During December 2018, Vaughan Nelson was allocated capital as an Underlying Manager of the Fund. At the end of the Reporting Period, the Fund’s assets were allocated approximately 33% to Smead, 33% to Sirios, 18% to Lazard and 15% to Vaughan Nelson. The remainder of the Fund’s assets were invested in cash and cash equivalents. |

| Q | | Were there any changes to the Fund’s portfolio management team during the Reporting Period? |

| A | | There were no changes to the Fund’s portfolio management team during the Reporting Period. |

| Q | | What is the Fund’s tactical view and strategy for the months ahead? |

| A | | At the end of the Reporting Period, the Fund maintained an overweight relative to the Index in financials, with bank exposure held by Smead and Sirios. Lazard has not historically invested in banks. In addition, the Fund was overweight the health care and consumer discretionary sectors compared to the Index. The Fund was most underweight in information technology, energy and real estate relative to the Index at the end of the Reporting Period and had no exposure to utilities. In terms of market capitalization, the Fund maintained a significant underweight in mega caps and an overweight relative to the Index insmall/mid-cap stocks. Regionally, the Fund was primarily invested in North American equities but also had modest exposure to companies domiciled in Europe. |

| | | We intend to continue to position the Fund in alignment with our longer-term strategic views within the U.S. equity complex. We further intend to continue to monitor allocations and Underlying Manager performance as we seek to generate long-term capital growth. |

8

FUND BASICS

Multi-Manager U.S. Dynamic Equity Fund

as of October 31, 2019

| | | | | | | | |

| | TOP TEN EQUITY HOLDINGS AS OF 10/31/191 |

| | | |

| | | Holding | | % of Net Assets | | | Line of Business |

| | | |

| | Berkshire Hathaway, Inc. Class B | | | 5.1 | % | | Diversified Financial Services |

| | JPMorgan Chase & Co. | | | 3.2 | | | Banks |

| | Elanco Animal Health, Inc. | | | 2.7 | | | Pharmaceuticals |

| | The Home Depot, Inc. | | | 2.4 | | | Specialty Retail |

| | NVR, Inc. | | | 2.3 | | | Household Durables |

| | Medtronic PLC | | | 2.2 | | | Health Care Equipment & Supplies |

| | Target Corp. | | | 2.2 | | | Multiline Retail |

| | Amgen, Inc. | | | 2.1 | | | Biotechnology |

| | Raytheon Co. | | | 2.1 | | | Aerospace & Defense |

| | | The Walt Disney Co. | | | 2.0 | | | Entertainment |

| 1 | | The top 10 holdings may not be representative of the Fund’s future investments. |

|

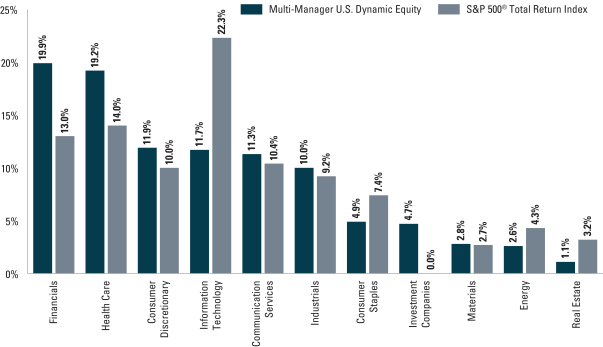

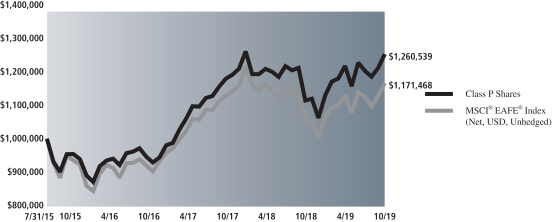

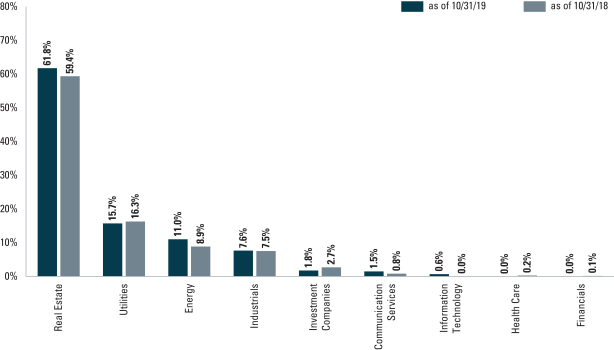

| FUND VS. BENCHMARK SECTOR ALLOCATIONS (%)2 |

|

| As of October 31, 2019 |

| 2 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. Figures in the graph may not sum to 100% due to rounding and/or the exclusion of other assets and liabilities. The graph categorizes investments using the Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

For more information about your Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about your Fund’s investment strategies, holdings, and performance.

9

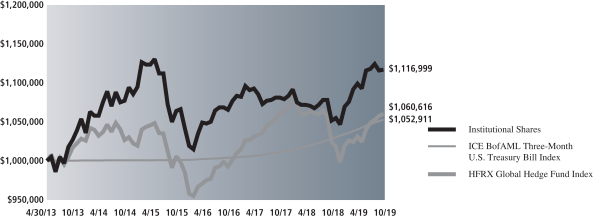

MULTI-MANAGER U.S. DYNAMIC EQUITY FUND

Performance Summary

October 31, 2019

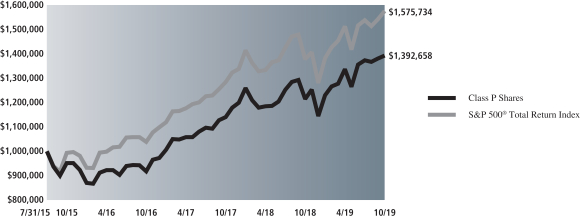

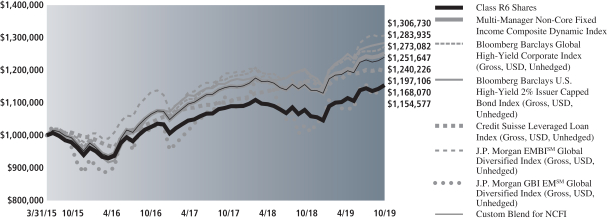

The following graph shows the value, as of October 31, 2019, of a $1,000,000 investment made on July 31, 2015 (commencement of operations) in Class P Shares at NAV. For comparative purposes, the performance of the Fund’s benchmark, the S&P 500® Total Return Index is shown. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns set forth below represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns.

|

| Multi-Manager U.S. Dynamic Equity Fund’s Lifetime Performance |

Performance of a $1,000,000 investment, with distributions reinvested, from July 31, 2015 through October 31, 2019.

| | | | |

| Average Annual Total Return through October 31, 2019 | | One Year | | Since Inception |

|

Class P (Commenced July 31, 2015)* | | 14.66% | | 8.09% |

|

| * | | Effective April 16, 2018, Institutional Shares were redesignated as Class P Shares. |

10

PORTFOLIO RESULTS

Multi-Manager U.S. Small Cap Equity Fund

Investment Objective

The Fund seeks to provide long-term capital growth.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Alternative Investments & Manager Selection (“AIMS”) Group discusses the Multi-Manager U.S. Small Cap Equity Fund’s (the “Fund”) performance and positioning for the12-month period ended October 31, 2019 (the “Reporting Period”).

| Q | | How did the Fund perform during the Reporting Period? |

| A | | During the Reporting Period, the Fund’s Class P Shares generated an average annual total return of 10.56%. This return compares to the 4.90% average annual total return of the Fund’s benchmark, the Russell 2000® Total Return Index (the “Index”) during the same time period. |

| Q | | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | | The Fund uses a multi-manager approach and generally seeks to achieve its investment objective by dynamically allocating its assets among unaffiliated investment managers (“Underlying Managers”) that employ asmall-cap equity investment strategy. The AIMS Group is responsible for making recommendations with respect to hiring, terminating or replacing the Fund’s Underlying Managers as well as for determining the Fund’s asset allocations. The AIMS Group applies a multifaceted process with respect to manager due diligence, portfolio construction and risk management. |

| | During the Reporting Period, the Fund recorded a positive absolute return and outperformed the Index. The relative outperformance can be attributed to the performance of the Fund’s Underlying Managers overall. At various points during the Reporting Period, the Fund allocated capital to four Underlying Managers as part of itstop-level strategy allocation—Boston Partners Global Investors (“Boston Partners”), Brown Advisory, LLC (“Brown Advisory”), QMA LLC (“QMA”) and PNC Capital Advisors, LLC (“PNC”). |

| | Of the two Underlying Managers with allocated capital for the entire Reporting Period, both generated positive absolute returns. PNC generated a positive absolute return from the beginning of the Reporting Period to May 22, 2019, when we redeemed it as an Underlying Manager of the Fund. QMA generated a positive absolute return from May 14, 2019, when it was allocated capital as an Underlying Manager of the Fund, to the end of the Reporting Period. On a relative basis, two Underlying Managers outperformed their respective benchmark indices. PNC outperformed its benchmark index between the start of the Reporting Period and May 22, 2019. QMA underperformed its benchmark index between May 14, 2019 and the end of the Reporting Period. |

| Q | | Whichsmall-cap equity strategies most significantly affected Fund performance? |

| A | | Growth-oriented Underlying Manager Brown Advisory outperformed its benchmark index, the Russell 2000® Growth Index, during the Reporting Period. An underweight position and effective stock selection in the health care sector contributed positively. Stock selection in communication services also added to relative returns. |

| | Value-oriented Underlying Manager Boston Partners outpaced its benchmark index, the Russell 2000® Value Index, benefiting from robust stock selection in the consumer discretionary and energy sectors. |

| | Core-oriented Underlying Manager PNC outperformed its benchmark index, the Russell 2000® Index, between the beginning of the Reporting Period and May 22, 2019, when it was redeemed. Strong stock selection in the consumer discretionary sector added to returns. An underweight position and effective stock selection in the health care sector were also advantageous. |

| | QMA, another core-oriented Underlying Manager, underperformed the Russell 2000® Index between May 14, 2019, when it was allocated capital, and the end of the Reporting Period. These negative results were primarily due to exposure to value factors, which resulted in weak stock selection in the real estate sector. |

11

PORTFOLIO RESULTS

| Q | | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | | The Fund used equity futures to manage its market exposure. These derivatives had a slightly positive impact on performance during the Reporting Period. |

| Q | | Were there any notable changes in the Fund’s allocations during the Reporting Period? |

| A | | In April 2019, QMA was added as an Underlying Manager of the Fund and was allocated capital in May 2019. QMA uses a systematic investment approach, based on fundamental insights, that ranks stocks across nearly 300 fundamental, market and forecast data metrics (i.e., earnings, sales and cash flow estimate revisions, price-volume behaviors, target price movement). |

| | In May 2019, PNC was redeemed and no longer served as an Underlying Manager of the Fund. We reallocated the capital to QMA. |

| | At the beginning of the Reporting Period, the Fund’s assets were allocated approximately 44% to Boston Partners, 30% to Brown Advisory and 25% to PNC, with the remainder invested in cash and cash equivalents. At the end of the Reporting Period, the Fund’s assets were allocated approximately 39% to QMA, 35% to Boston Partners and 25% to Brown Advisory, with the remainder invested in cash and cash equivalents. |

| Q | | Were there any changes to the Fund’s portfolio management team during the Reporting Period? |

| A | | There were no changes to the Fund’s portfolio management team during the Reporting Period. |

| Q | | What is the Fund’s tactical view and strategy for the months ahead? |

| A | | At the end of the Reporting Period, the Fund was most overweight compared to the Index in financials, industrials and information technology. It was underweight health care, utilities and real estate. In terms of market capitalization, the Fund maintained a slightsmall/mid-cap bias relative to the Index, driven predominantly by Underlying Manager Brown Advisory. |

| | We intend to continue to position the Fund in alignment with our longer-term strategic views within the U.S.small-cap equity complex. We further intend to continue to monitor allocations and Underlying Manager performance as we seek to generate long-term capital growth. |

12

FUND BASICS

Multi-Manager U.S. Small Cap Equity Fund

as of October 31, 2019

| | | | | | | | |

| | TOP TEN EQUITY HOLDINGS AS OF 10/31/191 |

| | | |

| | | Holding | | % of Net Assets | | | Line of Business |

| | | |

| | Lithia Motors, Inc. Class A | | | 1.2 | % | | Specialty Retail |

| | Waste Connections, Inc. | | | 1.1 | | | Commercial Services & Supplies |

| | World Fuel Services Corp. | | | 1.0 | | | Oil, Gas & Consumable Fuels |

| | Walker & Dunlop, Inc. | | | 1.0 | | | Thrifts & Mortgage Finance |

| | Graphic Packaging Holding Co. | | | 1.0 | | | Containers & Packaging |

| | Bright Horizons Family Solutions, Inc. | | | 0.9 | | | Diversified Consumer Services |

| | Genpact Ltd. | | | 0.9 | | | IT Services |

| | Essent Group Ltd. | | | 0.9 | | | Thrifts & Mortgage Finance |

| | Two Harbors Investment Corp. | | | 0.8 | | | Mortgage Real Estate Investment Trusts (REITs) |

| | | Air Lease Corp. | | | 0.8 | | | Trading Companies & Distributors |

| 1 | | The top 10 holdings may not be representative of the Fund’s future investments. |

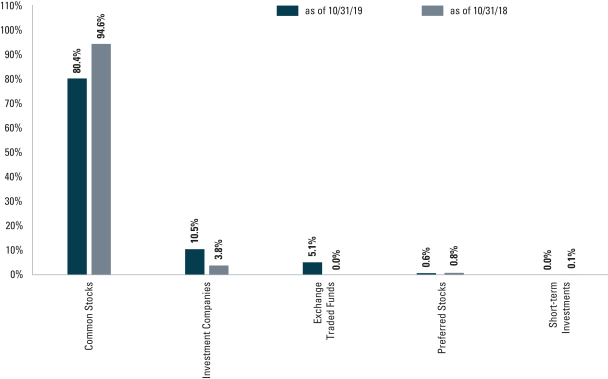

|

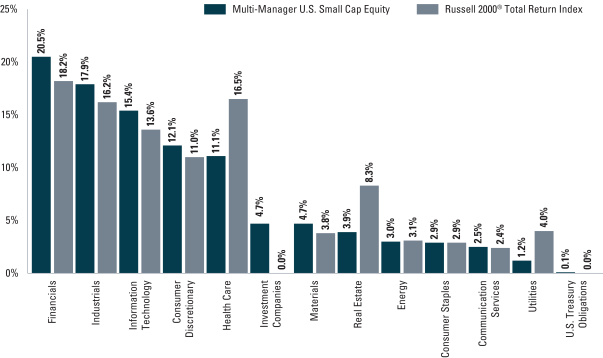

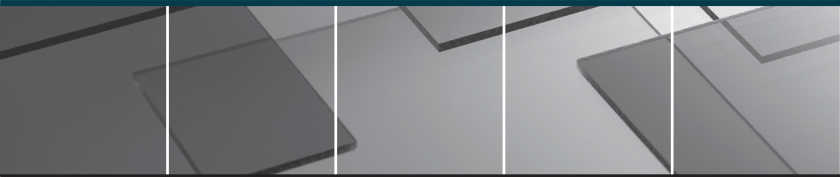

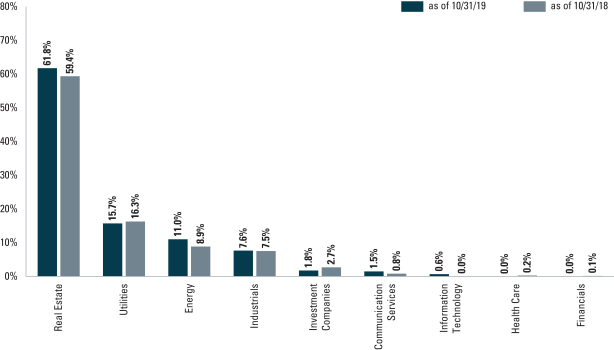

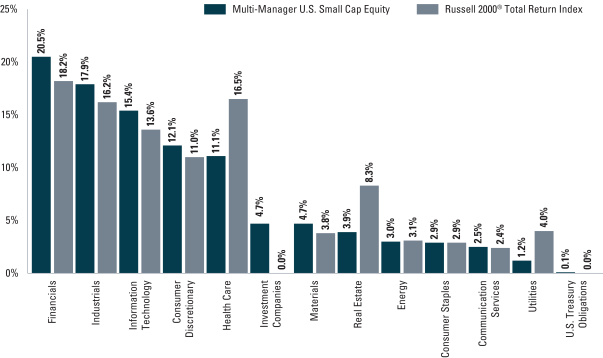

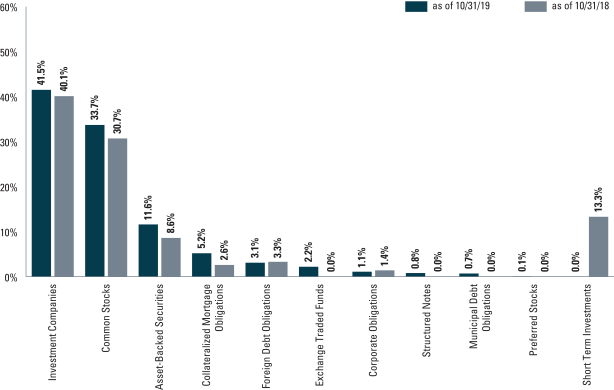

| FUND VS. BENCHMARK SECTOR ALLOCATIONS(%)2 |

|

As of October 31, 2019 |

| 2 | | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. Figures in the graph may not sum to 100% due to rounding and/or the exclusion of other assets and liabilities. The graph categorizes investments using the Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

For more information about your Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about your Fund’s investment strategies, holdings, and performance.

13

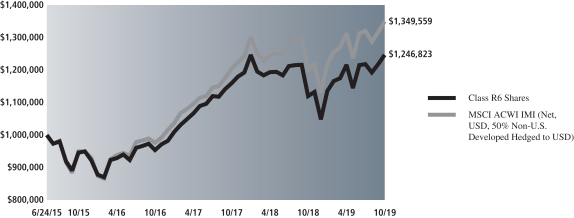

MULTI-MANAGER U.S. SMALL CAP EQUITY

Performance Summary

October 31, 2019

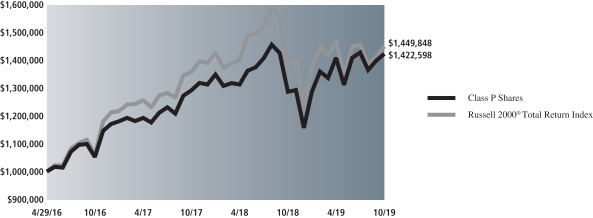

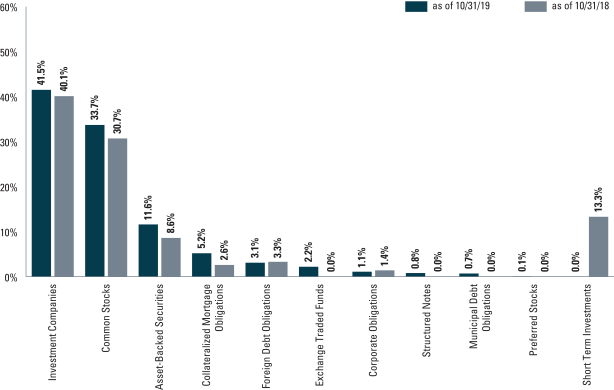

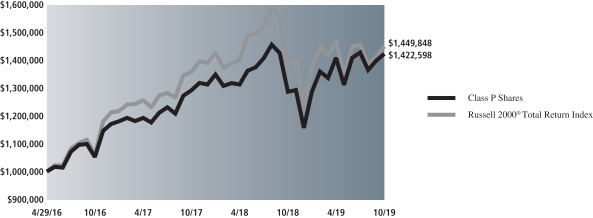

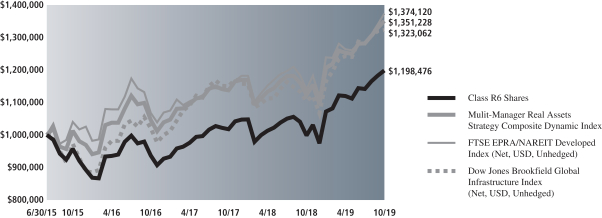

The following graph shows the value, as of October 31, 2019, of a $1,000,000 investment made on April 29, 2016 (commencement of operations) in Class P Shares at NAV. For comparative purposes, the performance of the Fund’s benchmark, the Russell 2000® Total Return Index is shown. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns set forth below represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns.

|

| Multi-Manager U.S. Small Cap Equity Fund’s Lifetime Performance |

Performance of a $1,000,000 investment, with distributions reinvested, from April 29, 2016 through October 31, 2019.

| | | | |

| Average Annual Total Return through October 31, 2019 | | One Year | | Since Inception |

|

Class P (Commenced April 29, 2016)* | | 10.56% | | 10.57% |

|

| * | | Effective April 16, 2018, Institutional Shares were redesignated as Class P Shares. |

14

FUND BASICS

Index Definitions

MSCI All Country World Index Investable Market Index captures large- and mid-cap representation across 23 developed markets and 24 emerging markets countries.

Russell 2000® Index is an unmanaged index of common stock prices that measures the performance of the 2000 smallest companies in the Russell 3000® Index. The Index is constructed to provide a comprehensive and unbiasedsmall-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the truesmall-cap opportunity set.

Russell 2000® Growth Index measures the performance of thesmall-cap growth stocks of the U.S. equity universe.

Russell 2000® Value Index measures the performance of thesmall-cap value stocks of the U.S. equity universe.

It is not possible to invest directly in an unmanaged index.

15

MULTI-MANAGER INTERNATIONAL EQUITY FUND

Schedule of Investments

October 31, 2019

| | | | | | | | |

Shares | | | Description | | Value | |

| | | | | | | | |

|

| Common Stocks – 95.1% | |

| Australia – 1.0% | |

| | 44,341 | | | CSL Ltd. (Biotechnology) | | $ | 7,819,813 | |

| | |

| Belgium – 0.6% | |

| | 64,453 | | | KBC Group NV (Banks) | | | 4,531,966 | |

| | |

| Brazil – 0.2% | |

| | 359,210 | | | Ambev SA ADR (Beverages) | | | 1,548,195 | |

| | |

| Canada – 4.6% | |

| | 31,560 | | | Canadian Imperial Bank of Commerce (Banks) | | | 2,691,142 | |

| | 64,604 | | | Canadian National Railway Co. (Road & Rail) | | | 5,773,660 | |

| | 28,517 | | | Canadian Pacific Railway Ltd. (Road & Rail) | | | 6,482,199 | |

| | 67,438 | | | Dollarama, Inc. (Multiline Retail) | | | 2,268,756 | |

| | 1,147,615 | | | Encana Corp. (Oil, Gas & Consumable Fuels) | | | 4,496,009 | |

| | 86,559 | | | Gildan Activewear, Inc. (Textiles, Apparel & Luxury Goods) | | | 2,211,457 | |

| | 195,281 | | | Manulife Financial Corp. (Insurance) | | | 3,636,962 | |

| | 20,560 | | | Shopify, Inc. Class A* (IT Services) | | | 6,446,999 | |

| | 128,437 | | | Suncor Energy, Inc. (Oil, Gas & Consumable Fuels) | | | 3,818,687 | |

| | | | | | | | |

| | | | | | | 37,825,871 | |

| | |

| China – 1.7% | |

| | 76,171 | | | Baidu, Inc. ADR* (Interactive Media & Services) | | | 7,758,016 | |

| | 431,109 | | | Sinopharm Group Co. Ltd. Class H (Health Care Providers & Services) | | | 1,543,908 | |

| | 123,240 | | | Tencent Holdings Ltd. (Interactive Media & Services) | | | 4,998,974 | |

| | | | | | | | |

| | | | | | | 14,300,898 | |

| | |

| Denmark – 1.7% | |

| | 16,395 | | | Carlsberg A/S Class B (Beverages) | | | 2,308,812 | |

| | 33,043 | | | Chr Hansen Holding A/S (Chemicals) | | | 2,536,899 | |

| | 35,235 | | | DSV PANALPINA A/S (Air Freight & Logistics) | | | 3,424,458 | |

| | 96,479 | | | Novo Nordisk A/S Class B (Pharmaceuticals) | | | 5,305,254 | |

| | | | | | | | |

| | | | | | | 13,575,423 | |

| | |

| France – 11.1% | |

| | 85,102 | | | Air France-KLM* (Airlines) | | | 1,014,456 | |

| | 58,866 | | | Air Liquide SA (Chemicals) | | | 7,826,884 | |

| | 154,746 | | | BNP Paribas SA (Banks) | | | 8,086,955 | |

| | 230,736 | | | Carrefour SA (Food & Staples Retailing) | | | 3,928,407 | |

| | 70,814 | | | Danone SA (Food Products) | | | 5,866,318 | |

| | 9,563 | | | Dassault Systemes SE (Software) | | | 1,452,397 | |

| | 198,491 | | | Engie SA (Multi-Utilities) | | | 3,323,687 | |

| | 66,953 | | | EssilorLuxottica SA (Textiles, Apparel & Luxury Goods) | | | 10,223,341 | |

| | 878 | | | Hermes International (Textiles, Apparel & Luxury Goods) | | | 632,469 | |

| | |

| | | | | | | | |

|

| Common Stocks – (continued) | |

| France – (continued) | |

| | 13,958 | | | Ingenico Group SA (Electronic Equipment, Instruments & Components) | | | 1,492,544 | |

| | 11,686 | | | L’Oreal SA (Personal Products) | | | 3,413,032 | |

| | 35,107 | | | Legrand SA (Electrical Equipment) | | | 2,742,699 | |

| | 29,714 | | | LVMH Moet Hennessy Louis Vuitton SE (Textiles, Apparel & Luxury Goods) | | | 12,689,530 | |

| | 55,116 | | | Pernod Ricard SA (Beverages) | | | 10,181,749 | |

| | 86,137 | | | Schneider Electric SE (Electrical Equipment) | | | 8,005,604 | |

| | 159,430 | | | TOTAL SA (Oil, Gas & Consumable Fuels) | | | 8,428,776 | |

| | 41,155 | | | Ubisoft Entertainment SA* (Entertainment) | | | 2,432,229 | |

| | | | | | | | |

| | | | | | | 91,741,077 | |

| | |

| Germany – 9.9% | |

| | 19,905 | | | adidas AG (Textiles, Apparel & Luxury Goods) | | | 6,146,081 | |

| | 184,440 | | | BASF SE (Chemicals) | | | 14,020,982 | |

| | 153,180 | | | Bayer AG (Pharmaceuticals) | | | 11,883,117 | |

| | 49,635 | | | Beiersdorf AG (Personal Products) | | | 5,876,241 | |

| | 18,806 | | | Deutsche Boerse AG (Capital Markets) | | | 2,912,290 | |

| | 199,238 | | | Deutsche Post AG (Air Freight & Logistics) | | | 7,058,013 | |

| | 87,782 | | | Infineon Technologies AG (Semiconductors & Semiconductor Equipment) | | | 1,700,229 | |

| | 28,460 | | | Merck KGaA (Pharmaceuticals) | | | 3,394,323 | |

| | 7,031 | | | MTU Aero Engines AG (Aerospace & Defense) | | | 1,880,307 | |

| | 74,308 | | | ProSiebenSat.1 Media SE (Media) | | | 1,097,274 | |

| | 119,803 | | | SAP SE (Software) | | | 15,874,071 | |

| | 82,547 | | | Siemens AG (Industrial Conglomerates) | | | 9,525,923 | |

| | | | | | | | |

| | | | | | | 81,368,851 | |

| | |

| Hong Kong – 3.1% | |

| | 1,385,200 | | | AIA Group Ltd. (Insurance) | | | 13,794,123 | |

| | 911,514 | | | China Merchants Port Holdings Co. Ltd. (Transportation Infrastructure) | | | 1,425,179 | |

| | 1,267,524 | | | China Mobile Ltd. (Wireless Telecommunication Services) | | | 10,300,781 | |

| | | | | | | | |

| | | | | | | 25,520,083 | |

| | |

| India – 1.6% | |

| | 95,618 | | | HDFC Bank Ltd. ADR (Banks) | | | 5,841,304 | |

| | 93,879 | | | Housing Development Finance Corp. Ltd. (Thrifts & Mortgage Finance) | | | 2,817,501 | |

| | 137,928 | | | Tata Consultancy Services Ltd. (IT Services) | | | 4,413,560 | |

| | | | | | | | |

| | | | | | | 13,072,365 | |

| | |

| | |

| 16 | | The accompanying notes are an integral part of these financial statements. |

MULTI-MANAGER INTERNATIONAL EQUITY FUND

| | | | | | | | |

Shares | | | Description | | Value | |

| | | | | | | | |

|

| Common Stocks – (continued) | |

| Ireland – 2.1% | |

| | 35,714 | | | Accenture PLC Class A (IT Services) | | $ | 6,622,090 | |

| | 18,322 | | | ICON PLC* (Life Sciences Tools & Services) | | | 2,691,502 | |

| | 106,264 | | | Ryanair Holdings PLC ADR* (Airlines) | | | 7,931,545 | |

| | | | | | | | |

| | | | | | | 17,245,137 | |

| | |

| Israel* – 0.4% | |

| | 29,537 | | | Check Point Software Technologies Ltd. (Software) | | | 3,320,254 | |

| | |

| Italy – 2.3% | |

| | 164,915 | | | Eni SpA (Oil, Gas & Consumable Fuels) | | | 2,501,923 | |

| | 1,309,810 | | | Intesa Sanpaolo SpA (Banks) | | | 3,282,153 | |

| | 1,058,689 | | | UniCredit SpA (Banks) | | | 13,431,621 | |

| | | | | | | | |

| | | | | | | 19,215,697 | |

| | |

| Japan – 11.9% | |

| | 46,800 | | | Coca-Cola Bottlers Japan Holdings, Inc. (Beverages) | | | 1,062,550 | |

| | 36,100 | | | Daikin Industries Ltd. (Building Products) | | | 5,052,541 | |

| | 31,600 | | | Denso Corp. (Auto Components) | | | 1,467,185 | |

| | 68,800 | | | East Japan Railway Co. (Road & Rail) | | | 6,245,732 | |

| | 62,600 | | | FANUC Corp. (Machinery) | | | 12,347,804 | |

| | 91,800 | | | Hitachi Ltd. (Electronic Equipment, Instruments & Components) | | | 3,426,200 | |

| | 84,200 | | | Hoya Corp. (Health Care Equipment & Supplies) | | | 7,441,361 | |

| | 133,600 | | | Japan Tobacco, Inc. (Tobacco) | | | 3,019,721 | |

| | 317,300 | | | KDDI Corp. (Wireless Telecommunication Services) | | | 8,780,053 | |

| | 7,500 | | | Keyence Corp. (Electronic Equipment, Instruments & Components) | | | 4,742,223 | |

| | 234,200 | | | Kubota Corp. (Machinery) | | | 3,719,858 | |

| | 63,300 | | | Kyocera Corp. (Electronic Equipment, Instruments & Components) | | | 4,152,915 | |

| | 36,700 | | | Murata Manufacturing Co. Ltd. (Electronic Equipment, Instruments & Components) | | | 1,998,247 | |

| | 396,600 | | | Olympus Corp. (Health Care Equipment & Supplies) | | | 5,396,290 | |

| | 13,400 | | | Shin-Etsu Chemical Co. Ltd. (Chemicals) | | | 1,494,116 | |

| | 112,200 | | | Sompo Holdings, Inc. (Insurance) | | | 4,410,142 | |

| | 122,100 | | | Sumitomo Mitsui Financial Group, Inc. (Banks) | | | 4,334,937 | |

| | 373,200 | | | Takeda Pharmaceutical Co. Ltd. (Pharmaceuticals) | | | 13,484,856 | |

| | 167,000 | | | Terumo Corp. (Health Care Equipment & Supplies) | | | 5,450,333 | |

| | | | | | | | |

| | | | | | | 98,027,064 | |

| | |

| Mexico – 0.5% | |

| | 1,331,065 | | | Wal-Mart de Mexico SAB de CV (Food & Staples Retailing) | | | 3,994,613 | |

| | |

| | | | | | | | |

|

| Common Stocks – (continued) | |

| Netherlands – 3.2% | |

| | 107,202 | | | Akzo Nobel NV (Chemicals) | | | 9,883,315 | |

| | 15,425 | | | ASML Holding NV (Semiconductors & Semiconductor Equipment) | | | 4,040,887 | |

| | 699,482 | | | ING Groep NV (Banks) | | | 7,920,575 | |

| | 52,947 | | | QIAGEN NV* (Life Sciences Tools & Services) | | | 1,592,595 | |

| | 51,030 | | | Randstad NV (Professional Services) | | | 2,832,004 | |

| | | | | | | | |

| | | | | | | 26,269,376 | |

| | |

| Portugal – 0.2% | |

| | 91,688 | | | Galp Energia SGPS SA (Oil, Gas & Consumable Fuels) | | | 1,466,529 | |

| | |

| Singapore – 0.4% | |

| | 178,800 | | | DBS Group Holdings Ltd. (Banks) | | | 3,408,083 | |

| | |

| South Korea – 2.2% | |

| | 8,366 | | | Samsung Electronics Co. Ltd. GDR (Technology Hardware, Storage & Peripherals) | | | 8,943,153 | |

| | 9,638 | | | SK Innovation Co. Ltd. (Oil, Gas & Consumable Fuels) | | | 1,318,821 | |

| | 342,411 | | | SK Telecom Co. Ltd. ADR (Wireless Telecommunication Services) | | | 7,892,573 | |

| | | | | | | | |

| | | | | | | 18,154,547 | |

| | |

| Spain – 1.7% | |

| | 137,768 | | | Amadeus IT Group SA (IT Services) | | | 10,191,836 | |

| | 1,447,249 | | | CaixaBank SA (Banks) | | | 4,150,127 | |

| | | | | | | | |

| | | | | | | 14,341,963 | |

| | |

| Sweden – 0.7% | |

| | 95,866 | | | Atlas Copco AB Class A (Machinery) | | | 3,383,734 | |

| | 81,883 | | | Essity AB Class B (Household Products) | | | 2,558,084 | |

| | | | | | | | |

| | | | | | | 5,941,818 | |

| | |

| Switzerland – 10.9% | |

| | 463,552 | | | ABB Ltd. (Electrical Equipment) | | | 9,734,584 | |

| | 94,321 | | | Alcon, Inc.* (Health Care Equipment & Supplies) | | | 5,577,967 | |

| | 805,679 | | | Aryzta AG* (Food Products) | | | 636,429 | |

| | 36,316 | | | Chubb Ltd. (Insurance) | | | 5,535,285 | |

| | 40,603 | | | Cie Financiere Richemont SA (Textiles, Apparel & Luxury Goods) | | | 3,190,630 | |

| | 7,080 | | | Geberit AG (Building Products) | | | 3,597,277 | |

| | 44,788 | | | Julius Baer Group Ltd.* (Capital Markets) | | | 1,983,374 | |

| | 166,960 | | | Nestle SA (Food Products) | | | 17,861,600 | |

| | 137,450 | | | Novartis AG (Pharmaceuticals) | | | 12,009,721 | |

| | 47,759 | | | Roche Holding AG (Pharmaceuticals) | | | 14,373,348 | |

| | 36,028 | | | Sika AG (Chemicals) | | | 6,193,447 | |

| | 371,101 | | | UBS Group AG* (Capital Markets) | | | 4,392,040 | |

| | 11,159 | | | Zurich Insurance Group AG (Insurance) | | | 4,370,981 | |

| | | | | | | | |

| | | | | | | 89,456,683 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 17 |

MULTI-MANAGER INTERNATIONAL EQUITY FUND

Schedule of Investments(continued)

October 31, 2019

| | | | | | | | |

Shares | | | Description | | Value | |

| | | | | | | | |

|

| Common Stocks – (continued) | |

| Taiwan – 1.3% | |

| | 214,131 | | | Taiwan Semiconductor Manufacturing Co. Ltd. ADR (Semiconductors & Semiconductor Equipment) | | $ | 11,055,584 | |

| | |

| United Kingdom – 20.3% | |

| | 115,017 | | | Amcor PLC (Containers & Packaging) | | | 1,101,332 | |

| | 72,114 | | | AstraZeneca PLC (Pharmaceuticals) | | | 7,032,357 | |

| | 1,022,361 | | | Aviva PLC (Insurance) | | | 5,510,572 | |

| | 1,063,051 | | | Balfour Beatty PLC (Construction & Engineering) | | | 3,097,754 | |

| | 5,408,571 | | | Barclays PLC (Banks) | | | 11,731,578 | |

| | 1,321,744 | | | BP PLC (Oil, Gas & Consumable Fuels) | | | 8,381,656 | |

| | 270,679 | | | British American Tobacco PLC (Tobacco) | | | 9,467,231 | |

| | 892,515 | | | Cobham PLC (Aerospace & Defense) | | | 1,825,622 | |

| | 398,555 | | | Compass Group PLC (Hotels, Restaurants & Leisure) | | | 10,611,164 | |

| | 128,614 | | | Diageo PLC (Beverages) | | | 5,264,297 | |

| | 394,600 | | | Experian PLC (Professional Services) | | | 12,438,305 | |

| | 98,616 | | | Johnson Matthey PLC (Chemicals) | | | 3,917,707 | |

| | 60,655 | | | Linde PLC (Chemicals) | | | 11,973,035 | |

| | 5,739,712 | | | Lloyds Banking Group PLC (Banks) | | | 4,222,167 | |

| | 645,270 | | | M&G PLC* (Diversified Financial Services) | | | 1,787,049 | |

| | 233,271 | | | Micro Focus International PLC (Software) | | | 3,201,692 | |

| | 604,207 | | | Prudential PLC (Insurance) | | | 10,553,585 | |

| | 46,132 | | | Reckitt Benckiser Group PLC (Household Products) | | | 3,569,769 | |

| | 284,679 | | | RELX PLC (Professional Services) | | | 6,851,948 | |

| | 48,325 | | | Rio Tinto PLC (Metals & Mining) | | | 2,515,887 | |

| | 54,985,151 | | | Rolls-Royce Holdings PLC* (Aerospace & Defense) | | | 11,024,760 | |

| | 296,908 | | | Royal Dutch Shell PLC Class B (Oil, Gas & Consumable Fuels) | | | 8,550,880 | |

| | 177,298 | | | Smith & Nephew PLC (Health Care Equipment & Supplies) | | | 3,805,952 | |

| | 90,809 | | | Smiths Group PLC (Industrial Conglomerates) | | | 1,898,238 | |

| | 337,094 | | | SSE PLC (Electric Utilities) | | | 5,607,911 | |

| | 723,645 | | | Tesco PLC (Food & Staples Retailing) | | | 2,208,964 | |

| | 3,417,556 | | | Vodafone Group PLC (Wireless Telecommunication Services) | | | 6,974,273 | |

| | 150,771 | | | WPP PLC (Media) | | | 1,881,555 | |

| | | | | | | | |

| | | | | | | 167,007,240 | |

| | |

| | | | | | | | |

|

| Common Stocks – (continued) | |

| United States – 1.5% | |

| | 5,405 | | | Mettler-Toledo International, Inc.* (Life Sciences Tools & Services) | | | 3,810,201 | |

| | 40,649 | | | ResMed, Inc. (Health Care Equipment & Supplies) | | | 6,012,800 | |

| | 66,056 | | | Yum China Holdings, Inc. (Hotels, Restaurants & Leisure) | | | 2,807,380 | |

| | | | | | | | |

| | | | | | | 12,630,381 | |

| | |

| | TOTAL COMMON STOCKS | |

| | (Cost $701,369,954) | | $ | 782,839,511 | |

| | |

| | |

| Shares | | | Dividend Rate | | Value | |

|

| Preferred Stocks – 1.9% | |

| Germany – 1.9% | |

|

| | Volkswagen AG (Automobiles) | |

| | 80,539 | | | 2.790% | | $ | 15,310,885 | |

| | (Cost $11,989,712) | |

| | |

| | | | | | | | |

|

| Investment Company(a) – 2.7% | |

| Goldman Sachs Financial Square Government Fund –

Institutional Shares |

|

| | 22,489,043 | | | 1.701% | | $ | 22,489,043 | |

| | (Cost $22,489,043) | |

| | |

| | TOTAL INVESTMENTS – 99.7% | |

| | (Cost $735,848,709) | | $ | 820,639,439 | |

| | |

| OTHER ASSETS IN EXCESS OF

LIABILITIES – 0.3% | | | 2,564,532 | |

| | |

| | NET ASSETS – 100.0% | | $ | 823,203,971 | |

| | |

| | |

|

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

| |

* | | Non-income producing security. |

| |

(a) | | Represents an affiliated issuer. |

| | |

|

Currency Abbreviations: |

JPY | | —Japanese Yen |

USD | | —U.S. Dollar |

|

Investment Abbreviations: |

ADR | | —American Depositary Receipt |

GDR | | —Global Depository Receipt |

PLC | | —Public Limited Company |

|

| | |

| 18 | | The accompanying notes are an integral part of these financial statements. |

MULTI-MANAGER INTERNATIONAL EQUITY FUND

|

| ADDITIONAL INVESTMENT INFORMATION |

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS — At October 31, 2019, the Fund had the following forward foreign currency exchange contracts:

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS WITH UNREALIZED GAIN

| | | | | | | | | | | | | | | | | | | | |

| Counterparty | | Currency Purchased | | | Currency Sold | | | Settlement

Date | | | Unrealized

Gain | |

| | | | | | |

State Street Bank and Trust | | JPY | | | 1,676,016 | | | USD | | | 15,501 | | | | 11/05/19 | | | $ | 24 | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 19 |

MULTI-MANAGER U.S. DYNAMIC EQUITY FUND

Schedule of Investments

October 31, 2019

| | | | | | | | |

Shares | | | Description | | Value | |

| | | | | | | | |

|

| Common Stocks – 95.4% | |

| Aerospace & Defense – 5.2% | |

| | 16,082 | | | Airbus SE | | $ | 2,307,096 | |

| | 9,179 | | | General Dynamics Corp. | | | 1,622,847 | |

| | 16,742 | | | Raytheon Co. | | | 3,552,820 | |

| | 8,947 | | | Safran SA | | | 1,417,114 | |

| | | | | | | | |

| | | | | | | 8,899,877 | |

| | |

| Auto Components – 0.4% | |

| | 6,765 | | | Aptiv PLC | | | 605,806 | |

| | |

| Banks – 7.6% | |

| | 86,305 | | | Bank of America Corp. | | | 2,698,757 | |

| | 7,925 | | | Citigroup, Inc. | | | 569,491 | |

| | 43,706 | | | JPMorgan Chase & Co. | | | 5,459,754 | |

| | 34,922 | | | SunTrust Banks, Inc. | | | 2,386,569 | |

| | 37,538 | | | Wells Fargo & Co. | | | 1,938,087 | |

| | | | | | | | |

| | | | | | | 13,052,658 | |

| | |

| Beverages – 1.7% | |

| | 2,150 | | | Constellation Brands, Inc. Class A | | | 409,210 | |

| | 47,115 | | | TheCoca-Cola Co. | | | 2,564,469 | |

| | | | | | | | |

| | | | | | | 2,973,679 | |

| | |

| Biotechnology – 2.8% | |

| | 14,750 | | | AbbVie, Inc. | | | 1,173,363 | |

| | 16,849 | | | Amgen, Inc. | | | 3,593,049 | |

| | | | | | | | |

| | | | | | | 4,766,412 | |

| | |

| Building Products – 0.8% | |

| | 14,493 | | | Armstrong World Industries, Inc. | | | 1,355,530 | |

| | |

| Capital Markets – 4.0% | |

| | 41,650 | | | Ares Capital Corp. | | | 762,195 | |

| | 14,395 | | | Intercontinental Exchange, Inc. | | | 1,357,736 | |

| | 6,246 | | | London Stock Exchange Group PLC | | | 562,882 | |

| | 2,113 | | | Moody’s Corp. | | | 466,318 | |

| | 5,598 | | | S&P Global, Inc. | | | 1,444,228 | |

| | 26,725 | | | The Charles Schwab Corp. | | | 1,087,975 | |

| | 13,561 | | | Tradeweb Markets, Inc. Class A | | | 566,172 | |

| | 34,775 | | | Virtu Financial, Inc. Class A | | | 589,784 | |

| | | | | | | | |

| | | | | | | 6,837,290 | |

| | |

| Chemicals – 1.5% | |

| | 3,066 | | | International Flavors & Fragrances, Inc. | | | 374,083 | |

| | 3,809 | | | The Sherwin-Williams Co. | | | 2,179,967 | |

| | | | | | | | |

| | | | | | | 2,554,050 | |

| | |

| Commercial Services & Supplies* – 1.0% | |

| | 43,819 | | | IAA, Inc. | | | 1,671,695 | |

| | |

| Communications Equipment – 2.1% | |

| | 55,615 | | | Cisco Systems, Inc. | | | 2,642,268 | |

| | 6,290 | | | Motorola Solutions, Inc. | | | 1,046,153 | |

| | | | | | | | |

| | | | | | | 3,688,421 | |

| | |

| Construction Materials – 1.0% | |

| | 11,604 | | | Vulcan Materials Co. | | | 1,657,863 | |

| | |

| | | | | | | | |

|

| Common Stocks – (continued) | |

| Consumer Finance – 1.9% | |

| | 28,506 | | | American Express Co. | | | 3,343,184 | |

| | |

| Diversified Financial Services* – 5.1% | |

| | 41,198 | | | Berkshire Hathaway, Inc. Class B | | | 8,757,871 | |

| | |

| Diversified Telecommunication Services – 2.0% | |

| | 23,650 | | | AT&T, Inc. | | | 910,289 | |

| | 59,060 | | | Cellnex Telecom SA*(a) | | | 2,548,370 | |

| | | | | | | | |

| | | | | | | 3,458,659 | |

| | |

| Electronic Equipment, Instruments & Components* – 1.4% | |

| | 24,532 | | | Keysight Technologies, Inc. | | | 2,475,524 | |

| | |

| Entertainment – 4.7% | |

| | 34,213 | | | Electronic Arts, Inc.* | | | 3,298,133 | |

| | 26,075 | | | The Walt Disney Co. | | | 3,387,664 | |

| | 26,024 | | | World Wrestling Entertainment, Inc. Class A | | | 1,458,385 | |

| | | | | | | | |

| | | | | | | 8,144,182 | |

| | |

| Equity Real Estate Investment Trusts (REITs) – 0.8% | |

| | 52,864 | | | The Macerich Co. | | | 1,453,760 | |

| | |

| Food & Staples Retailing – 2.9% | |

| | 105,104 | | | BJ’s Wholesale Club Holdings, Inc.* | | | 2,806,277 | |

| | 38,112 | | | Walgreens Boots Alliance, Inc. | | | 2,087,775 | |

| | | | | | | | |

| | | | | | | 4,894,052 | |

| | |

| Food Products – 0.3% | |

| | 9,330 | | | General Mills, Inc. | | | 474,524 | |

| | |

| Health Care Equipment & Supplies – 8.6% | |

| | 32,233 | | | Abbott Laboratories | | | 2,695,001 | |

| | 36,957 | | | Alcon, Inc.* | | | 2,190,441 | |

| | 26,100 | | | Baxter International, Inc. | | | 2,001,870 | |

| | 6,314 | | | Becton Dickinson & Co. | | | 1,616,384 | |

| | 31,238 | | | Boston Scientific Corp.* | | | 1,302,625 | |

| | 9,189 | | | Danaher Corp. | | | 1,266,428 | |

| | 34,510 | | | Medtronic PLC | | | 3,758,139 | |

| | | | | | | | |

| | | | | | | 14,830,888 | |

| | |

| Health Care Providers & Services – 1.9% | |

| | 3,680 | | | UnitedHealth Group, Inc. | | | 929,936 | |

| | 17,468 | | | Universal Health Services, Inc. Class B | | | 2,401,151 | |

| | | | | | | | |

| | | | | | | 3,331,087 | |

| | |

| Hotels, Restaurants & Leisure – 0.4% | |

| | 7,874 | | | Starbucks Corp. | | | 665,825 | |

| | |

| Household Durables – 3.7% | |

| | 38,984 | | | Lennar Corp. Class A | | | 2,323,447 | |

| | 1,097 | | | NVR, Inc.* | | | 3,989,339 | |

| | | | | | | | |

| | | | | | | 6,312,786 | |

| | |

| Industrial Conglomerates – 0.3% | |

| | 1,385 | | | Roper Technologies, Inc. | | | 466,690 | |

| | |

| Insurance – 1.3% | |

| | 41,841 | | | Aflac, Inc. | | | 2,224,268 | |

| | |

| | |

| 20 | | The accompanying notes are an integral part of these financial statements. |

MULTI-MANAGER U.S. DYNAMIC EQUITY FUND

| | | | | | | | |

Shares | | | Description | | Value | |

| | | | | | | | |

|

| Common Stocks – (continued) | |

| Interactive Media & Services* – 1.6% | |

| | 1,583 | | | Alphabet, Inc. Class A | | $ | 1,992,680 | |

| | 4,200 | | | Facebook, Inc. Class A | | | 804,930 | |

| | | | | | | | |

| | | | | | | 2,797,610 | |

| | |

| Internet & Direct Marketing Retail – 1.2% | |

| | 301 | | | Booking Holdings, Inc.* | | | 616,680 | |

| | 39,841 | | | eBay, Inc. | | | 1,404,395 | |

| | | | | | | | |

| | | | | | | 2,021,075 | |

| | |

| IT Services – 2.9% | |

| | 8,707 | | | Accenture PLC Class A | | | 1,614,452 | |

| | 8,805 | | | Fiserv, Inc.* | | | 934,563 | |

| | 2,840 | | | Mastercard, Inc. Class A | | | 786,140 | |

| | 6,139 | | | PayPal Holdings, Inc.* | | | 639,070 | |

| | 19,826 | | | Perspecta, Inc. | | | 526,182 | |

| | 20,305 | | | Sabre Corp. | | | 476,761 | |

| | | | | | | | |

| | | | | | | 4,977,168 | |

| | |

| Leisure Products – 0.3% | |

| | 9,250 | | | Brunswick Corp. | | | 538,720 | |

| | |

| Life Sciences Tools & Services – 0.7% | |

| | 3,314 | | | PRA Health Sciences, Inc.* | | | 323,811 | |

| | 2,935 | | | Thermo Fisher Scientific, Inc. | | | 886,311 | |

| | | | | | | | |

| | | | | | | 1,210,122 | |

| | |

| Machinery – 0.4% | |

| | 3,548 | | | Cummins, Inc. | | | 611,959 | |

| | |

| Media – 3.0% | |

| | 42,028 | | | Comcast Corp. Class A | | | 1,883,695 | |

| | 118,279 | | | Discovery, Inc. Class A* | | | 3,188,210 | |

| | | | | | | | |

| | | | | | | 5,071,905 | |

| | |

| Metals & Mining – 0.3% | |

| | 18,775 | | | Wheaton Precious Metals Corp. | | | 527,014 | |

| | |

| Multiline Retail – 2.9% | |

| | 11,900 | | | Dollar Tree, Inc.* | | | 1,313,760 | |

| | 34,749 | | | Target Corp. | | | 3,715,016 | |

| | | | | | | | |

| | | | | | | 5,028,776 | |

| | |

| Oil, Gas & Consumable Fuels – 2.6% | |

| | 57,050 | | | Cameco Corp. | | | 509,457 | |

| | 175,700 | | | Kosmos Energy Ltd. | | | 1,089,340 | |

| | 58,721 | | | Occidental Petroleum Corp. | | | 2,378,200 | |

| | 4,075 | | | Pioneer Natural Resources Co. | | | 501,307 | |

| | | | | | | | |

| | | | | | | 4,478,304 | |

| | |

| Pharmaceuticals – 5.1% | |

| | 171,875 | | | Elanco Animal Health, Inc.* | | | 4,644,062 | |

| | 4,025 | | | Johnson & Johnson | | | 531,461 | |

| | 24,306 | | | Merck & Co., Inc. | | | 2,106,358 | |

| | 40,396 | | | Pfizer, Inc. | | | 1,549,995 | |

| | | | | | | | |

| | | | | | | 8,831,876 | |

| | |

| | | | | | | | |

|

| Common Stocks – (continued) | |

| Professional Services – 0.7% | |

| | 6,073 | | | Equifax, Inc. | | | 830,240 | |

| | 3,175 | | | Insperity, Inc. | | | 335,375 | |

| | | | | | | | |

| | | | | | | 1,165,615 | |

| | |

| Real Estate Management & Development – 0.3% | |

| | 3,341 | | | Jones Lang LaSalle, Inc. | | | 489,523 | |

| | |

| Road & Rail – 1.7% | |

| | 2,287 | | | Kansas City Southern | | | 321,964 | |

| | 21,600 | | | Knight-Swift Transportation Holdings, Inc. | | | 787,536 | |

| | 862 | | | Old Dominion Freight Line, Inc. | | | 156,953 | |

| | 9,956 | | | Union Pacific Corp. | | | 1,647,320 | |

| | | | | | | | |

| | | | | | | 2,913,773 | |

| | |

| Semiconductors & Semiconductor Equipment – 3.4% | |

| | 12,935 | | | Analog Devices, Inc. | | | 1,379,259 | |

| | 26,861 | | | QUALCOMM, Inc. | | | 2,160,699 | |

| | 16,296 | | | Skyworks Solutions, Inc. | | | 1,483,914 | |

| | 6,475 | | | Texas Instruments, Inc. | | | 763,985 | |

| | | | | | | | |

| | | | | | | 5,787,857 | |

| | |

| Software – 1.6% | |

| | 8,442 | | | Check Point Software Technologies Ltd.* | | | 948,965 | |

| | 8,400 | | | Microsoft Corp. | | | 1,204,308 | |

| | 7,313 | | | Varonis Systems, Inc.* | | | 523,245 | |

| | | | | | | | |

| | | | | | | 2,676,518 | |

| | |

| Specialty Retail – 3.0% | |

| | 10,091 | | | Lowe’s Cos., Inc. | | | 1,126,256 | |

| | 17,434 | | | The Home Depot, Inc. | | | 4,089,668 | |

| | | | | | | | |

| | | | | | | 5,215,924 | |

| | |

| Technology Hardware, Storage & Peripherals* – 0.3% | |

| | 23,541 | | | Pure Storage, Inc. Class A | | | 458,108 | |

| | |

| | TOTAL COMMON STOCKS | |

| | (Cost $128,382,522) | | $ | 163,698,428 | |

| | |

| | |

| Shares | | | Dividend Rate | | Value | |

|

| Investment Company(b) – 4.7% | |

| Goldman Sachs Financial Square Government Fund –

Institutional Shares |

|

| | 8,028,001 | | | 1.701% | | $ | 8,028,001 | |

| | (Cost $8,028,001) | |

| | |

| | TOTAL INVESTMENTS – 100.1% | |

| | (Cost $136,410,523) | | $ | 171,726,429 | |

| | |

| LIABILITIES IN EXCESS OF

OTHER ASSETS – (0.1)% | | | (149,914 | ) |

| | |

| | NET ASSETS – 100.0% | | $ | 171,576,515 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 21 |

MULTI-MANAGER U.S. DYNAMIC EQUITY FUND

Schedule of Investments(continued)

October 31, 2019

| | |

|

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

| |

* | | Non-income producing security. |

| |

(a) | | Exempt from registration under Rule 144A of the Securities Act of 1933. |

| |

(b) | | Represents an affiliated issuer. |

| | |

|

Currency Abbreviations: |

EUR | | —Euro |

GBP | | —British Pound |

USD | | —U.S. Dollar |

|

Investment Abbreviations: |

PLC | | —Public Limited Company |

|

|

| ADDITIONAL INVESTMENT INFORMATION |

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS — At October 31, 2019, the Fund had the following forward foreign currency exchange contracts:

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS WITH UNREALIZED GAIN

| | | | | | | | | | | | | | | | | | | | |

| Counterparty | | Currency Purchased | | | Currency Sold | | | Settlement

Date | | | Unrealized

Gain | |

MS & Co. Int. PLC | | EUR | | | 542,000 | | | USD | | | 598,853 | | | | 12/18/19 | | | $ | 7,764 | |

| | | GBP | | | 375,000 | | | USD | | | 482,884 | | | | 12/18/19 | | | | 3,706 | |

| | | | | | |

| TOTAL | | | | | | | | | | | | | | | | | | $ | 11,470 | |

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS WITH UNREALIZED LOSS

| | | | | | | | | | | | | | | | | | | | |

| Counterparty | | Currency Purchased | | | Currency Sold | | | Settlement

Date | | | Unrealized

Loss | |

MS & Co. Int. PLC | | USD | | | 6,829,823 | | | EUR | | | 6,160,000 | | | | 12/18/19 | | | $ | (64,583 | ) |

| | | USD | | | 1,017,829 | | | GBP | | | 816,000 | | | | 12/18/19 | | | | (40,991 | ) |

| | | | | | |

| TOTAL | | | | | | | | | | | | | | | | | | $ | (105,574 | ) |

| | |

|

Abbreviations: |

MS & Co. Int. PLC | | —Morgan Stanley & Co. International PLC |

|

| | |

| 22 | | The accompanying notes are an integral part of these financial statements. |

MULTI-MANAGER U.S. SMALL CAP EQUITY FUND

Schedule of Investments

October 31, 2019

| | | | | | | | |

Shares | | | Description | | Value | |

| | | | | | | | |

|

| Common Stocks – 94.4% | |

| Aerospace & Defense – 1.8% | |

| | 4,800 | | | AAR Corp. | | $ | 200,400 | |

| | 13,100 | | | Aerojet Rocketdyne Holdings, Inc.* | | | 566,313 | |

| | 30,362 | | | BWX Technologies, Inc. | | | 1,764,032 | |

| | 4,813 | | | Curtiss-Wright Corp. | | | 650,958 | |

| | 8,515 | | | HEICO Corp. | | | 1,050,240 | |

| | 20,570 | | | Hexcel Corp. | | | 1,534,934 | |

| | 6,461 | | | Mercury Systems, Inc.* | | | 475,917 | |

| | 3,300 | | | Moog, Inc. Class A | | | 276,243 | |

| | 2,700 | | | Vectrus, Inc.* | | | 123,417 | |

| | | | | | | | |

| | | | | | | 6,642,454 | |

| | |

| Air Freight & Logistics* – 0.2% | |

| | 12,800 | | | Hub Group, Inc. Class A | | | 586,240 | |

| | 44,500 | | | Radiant Logistics, Inc. | | | 239,855 | |

| | | | | | | | |

| | | | | | | 826,095 | |

| | |

| Airlines* – 0.2% | |

| | 13,100 | | | Mesa Air Group, Inc. | | | 99,822 | |

| | 13,076 | | | Spirit Airlines, Inc. | | | 491,135 | |

| | | | | | | | |

| | | | | | | 590,957 | |

| | |

| Auto Components – 0.7% | |

| | 13,100 | | | Dana, Inc. | | | 212,613 | |

| | 18,198 | | | LCI Industries | | | 1,767,390 | |

| | 18,800 | | | Modine Manufacturing Co.* | | | 214,884 | |

| | 10,299 | | | Standard Motor Products, Inc. | | | 539,255 | |

| | | | | | | | |

| | | | | | | 2,734,142 | |

| | |

| Banks – 7.1% | |

| | 1,100 | | | ACNB Corp. | | | 38,929 | |

| | 6,000 | | | Amalgamated Bank Class A | | | 109,260 | |

| | 6,500 | | | Ameris Bancorp | | | 278,525 | |

| | 42,250 | | | BankUnited, Inc. | | | 1,449,175 | |

| | 10,100 | | | Berkshire Hills Bancorp, Inc. | | | 313,403 | |

| | 52,324 | | | Boston Private Financial Holdings, Inc. | | | 588,645 | |

| | 3,200 | | | Bridge Bancorp, Inc. | | | 103,680 | |

| | 79,129 | | | Cadence BanCorp. | | | 1,217,004 | |

| | 12,900 | | | Cathay General Bancorp | | | 458,853 | |

| | 21,070 | | | CenterState Bank Corp. | | | 534,335 | |

| | 1,200 | | | Century Bancorp, Inc. Class A | | | 104,412 | |

| | 22,250 | | | Columbia Banking System, Inc. | | | 874,425 | |

| | 13,900 | | | ConnectOne Bancorp, Inc. | | | 337,492 | |

| | 5,000 | | | Customers Bancorp, Inc.* | | | 117,900 | |

| | 2,500 | | | FB Financial Corp. | | | 94,175 | |

| | 10,200 | | | Financial Institutions, Inc. | | | 320,586 | |

| | 18,100 | | | First Bancorp (Banks) | | | 296,609 | |

| | 1,444 | | | First Citizens BancShares, Inc. Class A | | | 710,333 | |

| | 24,600 | | | First Commonwealth Financial Corp. | | | 346,614 | |

| | 68,434 | | | First Hawaiian, Inc. | | | 1,870,301 | |

| | 22,580 | | | First Merchants Corp. | | | 893,039 | |

| | 27,536 | | | First Midwest Bancorp, Inc. | | | 565,589 | |

| | 900 | | | Great Southern Bancorp, Inc. | | | 54,378 | |

| | 25,900 | | | Hancock Whitney Corp. | | | 1,010,100 | |

| | 53,802 | | | Hanmi Financial Corp. | | | 1,035,689 | |

| | 2,500 | | | Heartland Financial USA, Inc. | | | 116,950 | |

| | 29,800 | | | Hilltop Holdings, Inc. | | | 696,128 | |

| | 13,900 | | | IBERIABANK Corp. | | | 1,020,121 | |

| | |

| | | | | | | | |

|

| Common Stocks – (continued) | |

| Banks – (continued) | |

| | 13,600 | | | International Bancshares Corp. | | | 557,056 | |

| | 13,900 | | | Live Oak Bancshares, Inc. | | | 252,285 | |

| | 6,100 | | | MidWestOne Financial Group, Inc. | | | 198,830 | |

| | 36,100 | | | OFG Bancorp | | | 733,191 | |

| | 5,100 | | | Old Second Bancorp, Inc. | | | 61,557 | |

| | 13,786 | | | Peapack Gladstone Financial Corp. | | | 402,551 | |

| | 8,824 | | | Preferred Bank | | | 470,407 | |

| | 21,541 | | | Prosperity Bancshares, Inc. | | | 1,486,760 | |

| | 9,100 | | | QCR Holdings, Inc. | | | 369,278 | |

| | 15,900 | | | Sandy Spring Bancorp, Inc. | | | 548,550 | |

| | 5,500 | | | SB One Bancorp | | | 121,440 | |

| | 4,000 | | | Sierra Bancorp | | | 108,960 | |

| | 36,400 | | | Simmons First National Corp. Class A | | | 870,688 | |

| | 8,000 | | | Southern National Bancorp of Virginia, Inc. | | | 126,720 | |

| | 35,065 | | | Synovus Financial Corp. | | | 1,187,652 | |

| | 42,100 | | | The Bancorp, Inc.* | | | 458,890 | |

| | 28,000 | | | The Bank of NT Butterfield & Son Ltd. | | | 922,600 | |

| | 2,100 | | | TriState Capital Holdings, Inc.* | | | 48,552 | |

| | 2,900 | | | Triumph Bancorp, Inc.* | | | 94,105 | |

| | 34,915 | | | Umpqua Holdings Corp. | | | 552,355 | |

| | 12,100 | | | Univest Financial Corp. | | | 311,575 | |

| | 27,052 | | | Webster Financial Corp. | | | 1,192,993 | |

| | | | | | | | |

| | | | | | | 26,633,645 | |

| | |

| Biotechnology* – 3.6% | |

| | 29,800 | | | ACADIA Pharmaceuticals, Inc. | | | 1,263,818 | |

| | 7,999 | | | Acceleron Pharma, Inc. | | | 358,915 | |

| | 45,100 | | | AMAG Pharmaceuticals, Inc. | | | 437,696 | |

| | 4,800 | | | Anika Therapeutics, Inc. | | | 337,872 | |

| | 10,200 | | | Athenex, Inc. | | | 112,608 | |

| | 20,822 | | | Biohaven Pharmaceutical Holding Co. Ltd. | | | 956,146 | |

| | 4,600 | | | BioSpecifics Technologies Corp. | | | 222,778 | |

| | 7,731 | | | Blueprint Medicines Corp. | | | 532,202 | |

| | 77,000 | | | Catalyst Pharmaceuticals, Inc. | | | 364,210 | |

| | 17,616 | | | Coherus Biosciences, Inc. | | | 305,990 | |

| | 20,100 | | | Concert Pharmaceuticals, Inc. | | | 125,223 | |

| | 56,700 | | | CytomX Therapeutics, Inc. | | | 347,571 | |

| | 1,100 | | | Eagle Pharmaceuticals, Inc. | | | 68,970 | |

| | 16,500 | | | Emergent BioSolutions, Inc. | | | 943,140 | |

| | 23,200 | | | FibroGen, Inc. | | | 908,280 | |

| | 10,330 | | | Global Blood Therapeutics, Inc. | | | 495,323 | |

| | 15,336 | | | Iovance Biotherapeutics, Inc. | | | 324,050 | |

| | 14,095 | | | Kura Oncology, Inc. | | | 211,143 | |

| | 11,463 | | | Neurocrine Biosciences, Inc. | | | 1,140,454 | |

| | 11,400 | | | Prothena Corp. PLC | | | 103,740 | |

| | 19,100 | | | PTC Therapeutics, Inc. | | | 780,999 | |

| | 25,600 | | | Recro Pharma, Inc. | | | 403,712 | |

| | 10,900 | | | Repligen Corp. | | | 866,441 | |

| | 27,800 | | | Retrophin, Inc. | | | 333,600 | |

| | 12,100 | | | Spectrum Pharmaceuticals, Inc. | | | 93,896 | |

| | 10,300 | | | Syndax Pharmaceuticals, Inc. | | | 69,216 | |

| | 600 | | | United Therapeutics Corp. | | | 53,904 | |

| | 56,900 | | | Vanda Pharmaceuticals, Inc. | | | 768,719 | |

| | 30,800 | | | Veracyte, Inc. | | | 706,244 | |

| | | | | | | | |

| | | | | | | 13,636,860 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 23 |

MULTI-MANAGER U.S. SMALL CAP EQUITY FUND

Schedule of Investments(continued)

October 31, 2019

| | | | | | | | |

Shares | | | Description | | Value | |

| | | | | | | | |

|

| Common Stocks – (continued) | |

| Building Products – 0.9% | |

| | 15,200 | | | Advanced Drainage Systems, Inc. | | $ | 562,704 | |

| | 6,200 | | | American Woodmark Corp.* | | | 614,792 | |

| | 12,500 | | | Builders FirstSource, Inc.* | | | 282,625 | |

| | 800 | | | CSW Industrials, Inc. | | | 55,376 | |

| | 36,200 | | | JELD-WEN Holding, Inc.* | | | 618,658 | |

| | 12,700 | | | Quanex Building Products Corp. | | | 244,983 | |

| | 21,900 | | | Universal Forest Products, Inc. | | | 1,102,884 | |

| | | | | | | | |

| | | | | | | 3,482,022 | |

| | |

| Capital Markets – 1.4% | |

| | 42,079 | | | Ares Management Corp. Class A | | | 1,244,276 | |

| | 180 | | | Ashford, Inc.* | | | 4,300 | |

| | 64,700 | | | Brightsphere Investment Group, Inc.* | | | 635,354 | |

| | 27,800 | | | Donnelley Financial Solutions, Inc.* | | | 314,140 | |

| | 11,541 | | | Evercore, Inc. Class A | | | 849,879 | |

| | 13,881 | | | Hamilton Lane, Inc. Class A | | | 827,585 | |

| | 7,000 | | | Oppenheimer Holdings, Inc. Class A | | | 190,400 | |

| | 17,900 | | | Stifel Financial Corp. | | | 1,002,042 | |

| | 1,900 | | | Virtus Investment Partners, Inc. | | | 206,112 | |