UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-22759

The Private Shares Fund

(Exact name of registrant as specified in charter)

88 Pine Street, 31st Floor, Suite 3101

New York, NY 10005

(Address of principal executive offices) (Zip code)

Cogency Global, Inc.

c/o The Private Shares Fund

850 New Burton Rd. Ste. 201

City of Dover, County of Kent, Delaware 19904

(Name and address of agent for service)

Copies to:

Dechert LLP

One Bush Street, Suite 1600

San Francisco, CA 94104-4446

Registrant's telephone number, including area code: (800) 279-7754

Date of fiscal year end: December 31

Date of reporting period: December 31, 2021

Item 1. Reports to Stockholders.

(a) The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended.

THE PRIVATE SHARES FUND

Table of Contents | |

Shareholder Letter | 2 |

Fund Performance | 9 |

Fund Performance & Portfolio Diversification | 10 |

Schedule of Investments | 13 |

Statement of Assets and Liabilities | 20 |

Statement of Operations | 21 |

Statements of Changes in Net Assets | 22 |

Statement of Cash Flows | 23 |

Financial Highlights | 24 |

Notes to the Financial Statements | 27 |

Report of Independent Registered Public Accounting Firm | 37 |

Trustees and Officers | 38 |

Additional Information | 39 |

1

THE PRIVATE SHARES FUND

Shareholder Letter

PORTFOLIO MANAGER 2021 COMMENTARY

The Private Shares Fund (the “Fund”) is pleased to report that for calendar year 2021, the Fund generated a total return of 24.13% as measured by the Fund’s Institutional Class (PIIVX), and was able to achieve those returns with a significantly lower level of volatility than the broader market. The strong results were generated during another unusual year in the financial markets.

The National Venture Capital Association (NVCA) reported approximately 17,054 U.S. Venture Capital (VC)-backed deals closed in 2021, representing total deal value of $329.6 billion, nearly double the previous record of $166.6 billion in 2020. While the number of deals also increased meaningfully compared to 2020, the average deal size continued to trend higher. Despite ongoing headwinds from the COVID-19 pandemic, the U.S. VC Industry remained resilient, posting records for both investments into high-growth private companies and proceeds generated by exits for 2021.

While late-stage investment activity has been rising over the last decade as many companies have continued to stay private for longer, we believe the impacts of COVID-19 made this segment of the market even more attractive. There has been less perceived risk compared to earlier stage companies and investors are looking to allocate more capital to their perceived winners. In parallel, the trend of significant capital inflows from nontraditional investor groups, including sovereign wealth funds, mutual funds, hedge funds and crossover investors has continued through the pandemic. To be more specific, nontraditional investors participated in an estimated 6,483 deals representing $253.5 billion in deal value during 2021.

Late-stage Venture Capital investment in 2021 easily surpassed previous full-year records and has been the largest contributor to overall VC deal value. An estimated 5,055 late-stage deals representing $228.3 billion of deal value was deployed in 2021 (representing 69% of total US VC-backed deal value), compared to the prior full-year record in 2020 of $112.6 billion across 3,444 deals. Mega-deal value (VC late-stage deals over $100 million) also recorded a new high with $190.6 billion deployed across 819 deals, more than doubling the prior record in 2020 of $76.5 billion across 335 deals. These outsized mega-deals represented 83% of all Late-Stage VC deal activity for 2021 and benefited from increased participation of non-traditional investors.

As an aside, it is worth noting that early-stage VC activity in 2021 also set a new annual record, with total value of $84.3 billion across 5,351 deals, which exceeds all prior full-year record totals and eclipsing $80 billion for the first time ever. This is nearly double the prior record when early-stage VC deal value hovered just above $40 billion for the last three consecutive years. This data supports a clear trend of larger investors entering companies at earlier stages in the traditional venture lifecycle, which has also resulted in larger median and average valuations.

In terms of liquidity, VC exit activity for 2021 also set a new annual record with total exit value of $774 billion realized across 1,875 deals, representing a 238% increase from the previous record set in 2020. This also marks the first-year exit deal value surpassed $500 billion. Initial Public Offerings (IPOs) represented most of the exit value with $681.5 billion realized through 296 VC-backed public listings, representing a 114.5% YoY Growth. Special Purpose Acquisition Companies (SPACs) activity set a new annual record with 556 new vehicles and roughly $134.9 billion in capital raised for 2021. That said, sentiment regarding SPACs began to trend negative earlier this year with underperformance and increasing questions on long-term viability. Lastly, Mergers & Acquisitions (M&As) activity remained robust with $79 billion in total exit value realized across 1,007 exits, representing a 15% increase in exit value and a 33% increase in number of exits from the prior annual record set in 2020.

In the ending months of 2021, the CBOE Volatility Index (VIX) began to increase but remained well below peak levels as compared to March 2020. Recent increases in volatility and pressure on major public market indices has been largely driven by a combination of rising inflation, anticipated Fed rate hikes and balance sheet tightening, labor market challenges, ongoing Covid-19 variants, and general concerns around the impacts these measures may have on both the sustainability of corporate growth rates and earnings. We expect to see increased pressure heading into 2022 while these factors persist.

While our portfolio of late-stage VC-backed growth companies is not immune to what may happen if these challenges persist over a longer time period, we have been pleased by the overall performance and resiliency thus far and will continue to monitor developments. In our view, we believe the bigger implication will be that companies planning to raise capital may face greater pressure on valuation and terms, and it may take companies longer to exit.

2

THE PRIVATE SHARES FUND

Shareholder Letter (Continued)

As long-term investors in private market technology innovation and disruption, we believe the Fund could potentially continue to benefit from value creation across sectors including fintech, artificial intelligence, cyber-security, cloud, data storage and analytics, online education, supply chain optimization, e-commerce, digital health, and the space economy. During 2021, the Fund invested approximately $300 million across 33 new positions and 15 add-ons to existing positions. The Fund also benefitted by generating roughly $95.2 million in liquidity proceeds as several portfolio companies went public or were acquired. We believe that many of the companies held by the Fund have differentiated business models, are operated by seasoned management teams, backed by strong VCs, and have healthy balance sheets to help manage through market cycles.

Historically, the Fund’s Net Asset Value (NAV) has been relatively stable during periods of public market stress like those in 2016 and 2018, during which we were able to invest in some very strong names at attractive prices. Similarly, the Fund’s NAV has remained relatively stable in this COVID-19 environment, and we have continued investing throughout this cycle. It is the experience of the Fund’s portfolio managers that periods of increased volatility and uncertainty in the public equity markets and overall macro environment are often good catalysts for increasing the supply of opportunities in the private markets. In other words, these catalysts may improve supply and demand imbalances in favor of buyers and investors as owners of illiquid assets tend to become more risk averse and prefer liquidity. These types of enviroments often result in more attractive risk adjusted entry points. As a result, vintages involving periods of increased public market activity and macro uncertainty have the potential to generate outperformance. So, while this may appear a bit counter intuitive, these environments could create great buying and investing opportunities in the private markets while simultaneously maintaining discipline, relying upon our comprehensive diligence process and leveraging our relationships across the private market ecosystem.

NEW PORTFOLIO ADDITIONS

As mentioned previously, the Fund added 33 new positions during 2021. Below is a brief summary of those companies:

Betterment (Q1)

Provider of an independent online financial adviser designed to help customers manage their financial assets.

Invaio Sciences (Q1)

Operator of multi-platform technology company intended to solve pressing agriculture, nutrition, and environmental challenges.

Crossover Health (Q1)

Operator of a platform intended to identify and provide personalized employee care experiences for a healthy and motivated workforce.

Beta Technologies (Q2)

Developer of aerospace technologies designed to be used in electric vertical takeoff and landing (eVTOL) aircraft and recharging pad systems.

Pavilion Data (Q2)

Provider of data processing solutions for data-driven applications.

Domino Data Labs (Q2)

Provides data science teams with a platform that allows enterprises to manage and scale data.

Collective Health (Q2)

Provides an integrated solution that allows self-funded employers to administer plans, control costs, and offer better options for their people.

3

THE PRIVATE SHARES FUND

Shareholder Letter (Continued)

Tradeshift (Q2)

Developer of a financial platform software intended to help facilitate supply chain innovations for the digitally connected economy.

Kraken (Q2)

Financial platform for cryptocurrency

Lyst (Q3)

Operator of an online fashion retail platform designed to connect shoppers globally with fashion designers and fashion stores.

MasterClass (Q3)

Operator of an online education platform designed to offer video-based online vocational courses taught by celebrities, athletes and business executives.

Cybereason (Q3)

Operator of cloud-based endpoint detection and cyber-security platform intended to protect companies from advanced cyber attacks.

Relativity Space (Q3)

Operator of an aerospace company intended to build an autonomous rocket factory and launch services for satellites.

BlockFi (Q3)

Developer of a wealth management platform designed to seamlessly manage crypto and other digital assets.

Automation Anywhere (Q3)

Provider of robotic process automation designed to work side by side with humans to handle repetitive routines and tasks found within many industries.

Eruditus Learning (Q3)

Provider of executive education programs intended for mid-career professionals.

CiBO (Q3)

Operator of a land information platform intended to facilitate agriculture scaling with unbiased information and direct connections.

Ocrolus (Q3)

Developer of a human-in-the-loop fintech infrastructure platform intended to automate back-office tasks with precision.

GOAT (Q3)

Provider of an online footwear marketplace intended to buy and sell sneakers online.

Stealth Investment Company (Q3)

Developer of space systems designed to simplify interplanetary transportation.

Farmer’s Business Network (Q3)

Farmers Business Network is a provider of a farmer-to-farmer agronomic information network designed to help farmers in the management of their data and gain insights from each other.

4

THE PRIVATE SHARES FUND

Shareholder Letter (Continued)

EquipmentShare (Q4)

Developer of a fleet management platform intended to serve contractors and original equipment manufacturers.

Impossible Foods (Q4)

Producer of plant-based meat substitutes intended to combine natural ingredients into food products.

Verbit (Q4)

Developer of interactive transcription and captioning platform intended to generate detailed speech-to-text files.

CaaStle (Q4)

Operator of a subscription rental platform designed to permit retailers to offer Clothing as a Service (CaaS) to their consumers.

Mynd (Q4)

Operator of a property management platform intended to ease property rental management services.

Fathom Digital Manufacturing Corporation (Q4)

Fathom is a leading on-demand digital manufacturing platform in North America, providing comprehensive product development and on-demand manufacturing services to many of the largest and most innovative companies in the world.

Omada Health (Q4)

Operator of a digital care platform intended to empower people to achieve their health goals through sustainable lifestyle change.

Arctic Wolf (Q4)

Arctic Wolf helps companies end cyber risk by providing security operations as a concierge service.

TMGcore (Q4)

TMGcore is an award-winning U.S. based provider of High-Performance Computing solutions.

Invenia Technical Computing (Q4)

Developer of a cloud-based machine learning software designed to use data and algorithms in order to add efficiency in electricity transmission.

PORTFOLIO COMPANY LIQUIDITY ACTIVITY

HIMS (Q1)

On January 21, 2021, Hims & Hers Health (HIMS) began trading on the NYSE via a de-SPAC with Oaktree Acquisition Corp. HIMS started trading at $17.08 and closed at $15.06. The Fund fully exited its position in HIMS in Q4 2021.

ChargePoint (Q1)

On March 1, 2021, ChargePoint (CHPT) began trading on the NYSE via a de-SPAC with Switchback Energy Acquisition Corp. CHPT started trading at $32.30 and closed at $30.11. The Fund fully exited its position in CHPT in Q2 2021.

DigitalOcean (Q1)

On March 24, 2021, DigitalOcean (DOCN) began trading on the NYSE. DOCN initially priced its shares at $47.00, started trading at $41.50, and closed at $42.50 (valuing the company at roughly $4.5 billion). The Fund fully exited its position in DOCN in Q4 2021.

5

THE PRIVATE SHARES FUND

Shareholder Letter (Continued)

Sprinklr (Q2)

On April 4, 2021, the fund completed a secondary sale of its stake in Sprinklr.

Darktrace (Q2)

On April 30, 2021, Darktrace (DARK) began trading on the London Stock Exchange. DARK initially priced its shares at £250, started trading at £350, and closed at £330 (valuing the company at roughly £3 billion). The Fund fully exited its position in DARK in Q3 2021.

SoFi (Q2)

On June 1, 2021, SoFI (SOFI) began trading on the Nasdaq via a de-SPAC with Social Capital Hedosophia Corp V. SOFI started trading at $21.97 and closed at $22.65. The Fund fully exited its position in SOFI in Q3 2021.

Marqeta (Q2)

On June 9, 2021, Marqeta (MQ) began trading on the Nasdaq. MQ initially priced its shares at $27.00, started trading at $32.50, and closed at $30.52 (valuing the company at roughly $16 billion).

23andMe (Q2)

On June 17, 2021, 23andMe (ME) began trading on the Nasdaq via a de-SPAC with VG Acquisition Corp. ME started trading at $11.13 and closed at $13.32.

Blend Labs (Q3)

On July 16, 2021, Blend Labs (BLND) began trading on the NYSE. BLND initially priced its shares at $18.00, started trading at $20.00, and closed at $20.90 (valuing the company at roughly $4 billion).

Robinhood (Q3)

On July 29, 2021, Robinhood (HOOD) began trading on the Nasdaq. HOOD initially priced its shares at $38.00, started trading at $38.00, and closed at $34.82 (valuing the company at roughly $29 billion).

XANT (Q3)

On August 2, 2021, Aurea Software announced that it had acquired XANT, Inc. The Fund fully wrote off its position in Q3 2021.

Chartboost (Q3)

On August 4, 2021, Zynga announced that it had acquired Chartboost for approximately $250 million. The Fund fully exited its position in Q3 2021.

Udemy (Q4)

On October 29, 2021, Udemy (UDMY) began trading on the Nasdaq. UDMY initially priced its shares at $29.00, started trading at $27.00, and closed at $27.50 (valuing the company at roughly $3.7 billion).

Nextdoor (Q4)

On November 8, 2021, Nextdoor (KIND) began trading on the NYSE via a de-SPAC with Khosla Ventures Acquisition Co. II. KIND started trading at $11.74 and closed at $13.01.

6

THE PRIVATE SHARES FUND

Shareholder Letter (Continued)

Planet Labs (Q4)

On December 8, 2021, Planet Labs (PL) began trading on the NYSE via a de-SPAC with dMY Technology Group IV. PL started trading at $11.25 and closed at $11.35.

Fathom (Q4)

On December 23, 2021, Fathom (FATH) began trading on the NYSE via a de-SPAC with Altimar Acquisition Corp. II. FATH started trading at $9.50 and closed at $10.53.

CBOE Volatility Index measures the stock market’s expectation of volatility based on S&P 500 index options. One cannot invest in an index.

A SPAC is a publicly traded company with no commercial operations that raises investment capital via an initial public offering (IPO) for the purpose of identifying and acquiring one or more operating businesses or assets.

IMPORTANT DISCLOSURE

Investment in the Fund involves substantial risk. The Fund is not suitable for investors who cannot bear the risk of loss of all or part of their investment. The Fund is appropriate only for investors who can tolerate a high degree of risk and do not require a liquid investment. All investing involves risk including the possible loss of principal. Shares in the Fund are highly illiquid, and can be sold by shareholders only in the quarterly repurchase program of the Fund which allows for up to 5% of the Fund’s outstanding shares at NAV to be redeemed each quarter. As a result, you may not be able to sell your shares when, or in the amount that, you desire. The Fund intends to primarily invest in securities of private, late-stage, venture-backed growth companies. There are significant potential risks relating to investing in such securities. Because most of the securities in which the Fund invests are not publicly traded, the Fund’s investments will be valued by Liberty Street Advisors, Inc. (the “Investment Adviser”) pursuant to fair valuation procedures and methodologies adopted by the Board of Trustees, as set forth in the prospectus. As a consequence, the value determined for a security may differ materially from the value that could be realized upon the sale of the security. There are significant potential risks associated with investing in venture capital and private equity-backed companies with complex capital structures. The Fund focuses its investments in a limited number of securities, which could subject it to greater risk than that of a larger, more varied portfolio. There is a greater focus in technology securities that could adversely affect the Fund’s performance. The Fund is a non-diversified investment company, and as such, the Fund may invest a greater percentage of its assets in the securities of a smaller number of issuers than a diversified fund. The Fund’s quarterly repurchase policy may require the Fund to liquidate portfolio holdings earlier than the Investment Adviser would otherwise do so and may also result in an increase in the Fund’s expense ratio. Portfolio holdings of private companies that become publicly traded likely will be subject to more volatile market fluctuations than when private, and the Fund may not be able to sell shares at favorable prices. Such companies frequently impose lock-ups that would prohibit the Fund from selling shares for a period of time after an initial public offering (IPO). Market prices of public securities held by the Fund may decline substantially before the Investment Adviser is able to sell the securities. The Fund may invest in private securities utilizing special purpose vehicles (“SPVs”), private investments in public equity (“PIPE”) transactions where the issuer is a special purpose acquisition company (“SPAC”), and profit sharing agreements. The Fund will bear its pro rata portion of expenses on investments in SPVs or similar investment structures and will have no direct claim against underlying portfolio companies. PIPE transactions involve price risk, market risk, expense risk, and the Fund may not be able to sell the securities due to lock-ups or restrictions. Profit sharing agreements may expose the Fund to certain risks, including that the agreements could reduce the gain the Fund otherwise would have achieved on its investment, may be difficult to value and may result in contractual disputes. Certain conflicts of interest involving the Fund and its affiliates could impact the Fund’s investment returns and limit the flexibility of its investment policies. This is not a complete enumeration of the Fund’s risks. Please read the Fund prospectus for other risk factors related to the Fund.

7

THE PRIVATE SHARES FUND

Shareholder Letter (Continued)

All investing involves risk including the possible loss of principal. Shares in the Fund are highly illiquid, and you may not be able to sell your shares when, or in the amount that, you desire. The Fund intends to primarily invest in securities of private, late-stage, venture-backed growth companies. There are significant potential risks relating to investing in such securities. Because most of the securities in which the Fund invests are not publicly traded, the Fund’s investments will be valued by the Investment Adviser pursuant to fair valuation procedures and methodologies adopted by the Board of Trustees.

There are significant potential risks associated with investing in venture capital and private equity-backed companies with complex capital structures. The Fund focuses its investments on a limited number of securities, which could subject it to greater risk than that of a larger, more varied portfolio. There is a greater focus in technology securities which could adversely affect the Fund’s performance. The inclusion of various indices is for comparison purposes only. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

The Fund’s quarterly repurchase policy may require the Fund to liquidate portfolio holdings earlier than the Investment Adviser would otherwise do so, and may also result in an increase in the Fund’s expense ratio. This is not a complete enumeration of the Fund’s risks. Please read the Fund prospectus for other risk factors related to the Fund, its investment strategy and your investment in the Fund, and other additional details.

8

THE PRIVATE SHARES FUND

Fund Performance

December 31, 2021 (Unaudited)

As of December 31, 2021, the Fund’s performance is as follows:

Total Return Information (Unaudited) |

The Private Shares Fund

– Class A

(Inception Date: 03/25/2014) | Five

Years | Three

Years | One Year | Annualized

Since Inception | Cumulative

Since Inception |

Returns based on Purchase Without Any Sales Charge (NAV) | 11.33% | 17.30% | 23.85% | 11.28% | 129.48% |

Returns based on Purchase With Maximum Sales Charge of 5.75% (POP) | 10.02% | 15.00% | 16.71% | 10.44% | 116.28% |

Fund Benchmark | | | | | |

Russell 2000® Index | 12.02% | 20.02% | 14.82% | 10.11% | 111.38% |

The Private Shares Fund – Class I

(Inception Date: 11/17/2017) | Three

Years | One Year | Annualized

Since Inception | Cumulative

Since Inception |

Returns based on Purchase Without Any Sales Charge (NAV) | 17.58% | 24.13% | 14.67% | 75.76% |

Fund Benchmark | | | | |

Russell 2000® Index | 20.02% | 14.82% | 11.84% | 58.57% |

The Private Shares Fund – Class L

(Inception Date: 05/11/2018) | Three

Years | One Year | Annualized

Since Inception | Cumulative

Since Inception |

Returns based on Purchase Without Any Sales Charge (NAV) | 16.99% | 23.52% | 13.82% | 60.21% |

Returns based on Purchase With Maximum Sales Charge of 4.25% (POP) | 15.30% | 18.27% | 12.47% | 53.40% |

Fund Benchmark | | | | |

Russell 2000® Index | 20.02% | 14.82% | 11.05% | 46.44% |

Performance data quoted represents past performance and is no guarantee of future results. POP performance assumes a maximum sales load of 5.75% (Class A) and 4.25% (Class L) on all sales. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Current performance may be lower or higher than the performance data quoted. For performance as of the most recent month-end, please call 1-855-551-5510. Some of the Fund’s fees were waived or expenses reimbursed; otherwise, returns would have been lower. The Fund’s total annual expenses per the currently stated prospectus are 2.56% (Class A), 2.38% (Class I), and 2.75% (Class L). The Adviser has contractually agreed to waive fees and/or reimburse expenses such that the total expenses do not exceed 2.50% (Class A), 2.25% (Class I), and 2.75% (Class L) through December 9, 2022.

9

THE PRIVATE SHARES FUND

Fund Performance & Portfolio Diversification

December 31, 2021 (Unaudited)

Growth of $10,000 Investment

This graph illustrates the hypothetical investment of $10,000 in the Class A from March 25, 2014 (Class inception) to December 31, 2021. The Total Return Information table and Growth of $10,000 Investment graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Public Offering Price (“POP”) assumes an initial investment of $9,425 ($10,000 less the maximum sales load of 5.75%). The Net Asset Value (“NAV”) assumes no sales load.

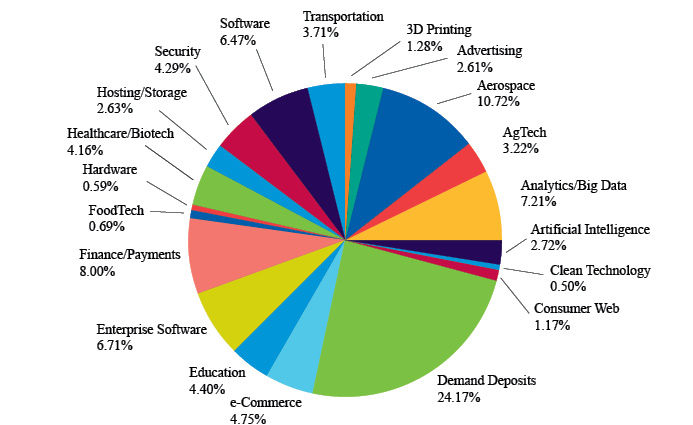

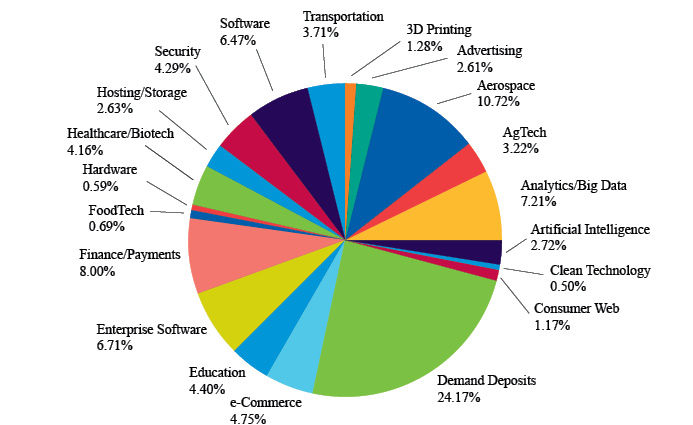

Fund Sector Diversification

The following chart provides a visual breakdown of the Fund by the industry sectors that underlying securities represent as a percentage of the total investments.

10

THE PRIVATE SHARES FUND

Portfolio Composition

December 31, 2021 (Unaudited)

Fund Holdings

11

THE PRIVATE SHARES FUND

Portfolio Composition (Continued)

December 31, 2021 (Unaudited)

Fund Holdings (Continued)

12

THE PRIVATE SHARES FUND

Schedule of Investments

December 31, 2021

| | Acquisition

Date | | Shares | | | Cost | | | Fair Value | |

COMMON STOCK IN PUBLIC COMPANIES — 5.1% | | | | | | | | | | | | |

3D PRINTING — 0.7% | | | | | | | | | | | | | |

Fathom Digital Manufacturing, Corp.(a)(b)(c) | Dec 2021 | | | 500,000 | | | $ | 5,000,000 | | | $ | 5,000,000 | |

| | | | | | | | | | | | | | |

ANALYTICS/BIG DATA — 0.1% | | | | | | | | | | | | | |

Planet Labs, Inc.(a) | Mar 2018 | | | 141,479 | | | | 540,302 | | | | 870,096 | |

| | | | | | | | | | | | | | |

CONSUMER WEB — 1.0% | | | | | | | | | | | | | |

Nextdoor(a)(c) | Nov 2018 | | | 925,479 | | | | 5,037,326 | | | | 7,042,895 | |

| | | | | | | | | | | | | | |

EDUCATION — 1.1% | | | | | | | | | | | | | |

Udemy, Inc.(a)(c) | Aug 2019 | | | 424,326 | | | | 6,024,987 | | | | 8,087,653 | |

| | | | | | | | | | | | | | |

ENTERPRISE SOFTWARE — 0.2% | | | | | | | | | | | | | |

Blend Labs, Inc.(a) | Aug 2018 | | | 200,216 | | | | 645,279 | | | | 1,469,585 | |

| | | | | | | | | | | | | | |

FINANCE/PAYMENTS — 1.2% | | | | | | | | | | | | | |

Marqeta, Inc.(a) | Jul 2018 | | | 452,133 | | | | 528,996 | | | | 7,763,124 | |

Robinhood Markets, Inc.(a) | Jul 2019 | | | 65,500 | | | | 870,298 | | | | 1,163,280 | |

| | | | | | | | | 1,399,294 | | | | 8,926,404 | |

HEALTHCARE/BIOTECH — 0.8% | | | | | | | | | | | | | |

23andMe, Inc.(a) | Oct 2017 | | | 874,260 | | | | 5,575,973 | | | | 5,822,571 | |

TOTAL COMMON STOCK IN PUBLIC COMPANIES | | | | | | | | 24,223,161 | | | | 37,219,204 | |

| | | | | | | | | | | | | | |

COMMON STOCK IN PRIVATE COMPANIES(c) — 30.6% | | | | | | | | | | | | |

3D PRINTING — 0.6% | | | | | | | | | | | | | |

Carbon, Inc.(a) | Jun 2019 | | | 158,853 | | | | 2,125,214 | | | | 4,271,557 | |

| | | | | | | | | | | | | | |

ADVERTISING — 2.6% | | | | | | | | | | | | | |

GroundTruth (f.k.a. xAd, Inc.)(a) | Oct 2016 | | | 1,659,427 | | | | 446,424 | | | | 497,828 | |

NextRoll (f.k.a. AdRoll)(a) | Mar 2017 | | | 1,073,155 | | | | 6,079,050 | | | | 13,178,344 | |

OpenX(a) | Jun 2015 | | | 2,899,297 | | | | 2,615,386 | | | | 3,566,135 | |

WideOrbit, Inc. (a) | Oct 2015 | | | 400,000 | | | | 1,100,000 | | | | 1,556,000 | |

| | | | | | | | | 10,240,860 | | | | 18,798,307 | |

AEROSPACE — 5.9% | | | | | | | | | | | | | |

Axiom Space, Inc.(a) | Mar 2021 | | | 29,543 | | | | 5,099,983 | | | | 5,505,633 | |

Relativity Space(a) | Oct 2021 | | | 437,922 | | | | 9,999,993 | | | | 9,999,993 | |

SpaceX(a) | May 2019 | | | 49,020 | | | | 10,049,100 | | | | 27,451,200 | |

| | | | | | | | | 25,149,076 | | | | 42,956,826 | |

AGTECH — 0.7% | | | | | | | | | | | | | |

Farmers Business Network(a) | Sep 2021 | | | 87,500 | | | | 5,042,625 | | | | 5,438,808 | |

See accompanying Notes to the Financial Statements

13

THE PRIVATE SHARES FUND

Schedule of Investments (Continued)

December 31, 2021

| | | Acquisition

Date | | | Shares | | | Cost | | | Fair Value | |

COMMON STOCK IN PRIVATE COMPANIES(c) — 30.6% (Continued) | | | | | | | | | | | | |

ANALYTICS/BIG DATA — 4.1% | | | | | | | | | | | | | | | | |

Baktus, Inc(a) | | | Apr 2015 | | | | 9,740 | | | $ | 1,500,951 | | | $ | 20,406 | |

Dataminr, Inc.(a) | | | Sep 2015 | | | | 189,583 | | | | 1,559,716 | | | | 8,191,882 | |

Domino Data Labs, Inc.(a) | | | Apr 2021 | | | | 330,000 | | | | 4,118,400 | | | | 5,355,900 | |

INRIX, Inc.(a) | | | May 2014 | | | | 133,238 | | | | 3,026,249 | | | | 7,545,268 | |

SingleStore (f.k.a. MemSQL)(a) | | | May 2020 | | | | 308,000 | | | | 616,000 | | | | 1,629,320 | |

Tealium(a) | | | Sep 2020 | | | | 200,000 | | | | 1,300,000 | | | | 2,664,000 | |

ThoughtSpot, Inc.(a) | | | Oct 2018 | | | | 162,087 | | | | 1,745,758 | | | | 4,186,707 | |

| | | | | | | | | | | | 13,867,074 | | | | 29,593,483 | |

ARTIFICIAL INTELLIGENCE — 0.4% | | | | | | | | | | | | | | | | |

Brain Corp.(a) | | | Dec 2020 | | | | 500,000 | | | | 2,040,000 | | | | 2,760,000 | |

| | | | | | | | | | | | | | | | | |

CLEAN TECHNOLOGY — 0.1% | | | | | | | | | | | | | | | | |

WiTricity(a)(f) | | | Mar 2021 | | | | 166,667 | | | | 1,667 | | | | 521,668 | |

| | | | | | | | | | | | | | | | | |

CONSUMER WEB — 0.2% | | | | | | | | | | | | | | | | |

Wag Labs, Inc.(a) | | | Oct 2018 | | | | 438,828 | | | | 2,314,001 | | | | 1,364,755 | |

| | | | | | | | | | | | | | | | | |

E-COMMERCE — 0.1% | | | | | | | | | | | | | | | | |

GOAT(a)(f) | | | Sep 2021 | | | | 128,148 | | | | 760,724 | | | | 753,510 | |

| | | | | | | | | | | | | | | | | |

EDUCATION — 2.4% | | | | | | | | | | | | | | | | |

Course Hero(a) | | | Jun 2020 | | | | 270,000 | | | | 3,429,200 | | | | 9,795,600 | |

Eruditus Learning(a)(f) | | | Aug 2021 | | | | 36,265 | | | | 5,065,228 | | | | 5,015,450 | |

Udacity, Inc.(a) | | | Nov 2018 | | | | 448,075 | | | | 2,884,586 | | | | 2,939,372 | |

| | | | | | | | | | | | 11,379,014 | | | | 17,750,422 | |

ENTERPRISE SOFTWARE — 4.0% | | | | | | | | | | | | | | | | |

Algolia(a) | | | Jan 2020 | | | | 45,000 | | | | 420,000 | | | | 1,307,250 | |

Automation Anywhere(a) | | | Jul 2021 | | | | 50,000 | | | | 1,545,000 | | | | 1,375,500 | |

D2iQ (f.k.a. Mesosphere, Inc.)(a) | | | Feb 2019 | | | | 165,000 | | | | 1,605,450 | | | | 869,550 | |

EquipmentShare(a) | | | Oct 2021 | | | | 86,850 | | | | 9,985,874 | | | | 9,887,004 | |

KeepTruckin(a) | | | May 2019 | | | | 788,562 | | | | 3,420,734 | | | | 5,685,532 | |

Tebra (a) | | | Nov 2020 | | | | 190,009 | | | | 1,235,126 | | | | 1,723,391 | |

Trax Ltd. (a) | | | Mar 2020 | | | | 149,970 | | | | 5,100,000 | | | | 8,585,782 | |

| | | | | | | | | | | | 23,312,184 | | | | 29,434,009 | |

See accompanying Notes to the Financial Statements

14

THE PRIVATE SHARES FUND

Schedule of Investments (Continued)

December 31, 2021

| | | Acquisition

Date | | | Shares | | | Cost | | | Fair Value | |

COMMON STOCK IN PRIVATE COMPANIES(c) — 30.6% (Continued) | | | | | | | | | | | | |

FINANCE/PAYMENTS — 2.8% | | | | | | | | | | | | | | | | |

Betterment(a) | | | Mar 2021 | | | | 588,235 | | | $ | 4,999,998 | | | $ | 7,390,349 | |

Circle Internet Financial, Inc.(a) | | | Apr 2018 | | | | 290,200 | | | | 2,604,825 | | | | 7,580,024 | |

Kraken(a) | | | Jun 2021 | | | | 105,218 | | | | 5,079,228 | | | | 5,463,971 | |

Prosper Marketplace, Inc.(a) | | | Jan 2016 | | | | 244,130 | | | | 1,307,998 | | | | 183,097 | |

| | | | | | | | | | | | 13,992,049 | | | | 20,617,441 | |

HARDWARE — 0.6% | | | | | | | | | | | | | | | | |

Tempo Automation, Inc.(a) | | | Aug 2019 | | | | 550,000 | | | | 1,868,000 | | | | 4,301,000 | |

| | | | | | | | | | | | | | | | | |

HEALTHCARE/BIOTECH — 0.6% | | | | | | | | | | | | | | | | |

Click Therapeutics, Inc. (a) | | | Nov 2020 | | | | 1,000,000 | | | | 3,500,000 | | | | 3,470,000 | |

ZocDoc, Inc.(a) | | | Feb 2015 | | | | 61,016 | | | | 1,321,708 | | | | 1,177,609 | |

| | | | | | | | | | | | 4,821,708 | | | | 4,647,609 | |

HOSTING/STORAGE — 1.8% | | | | | | | | | | | | | | | | |

Rubrik(a) | | | Sep 2019 | | | | 126,281 | | | | 3,220,166 | | | | 3,083,782 | |

TMGcore, Inc.(a) | | | Dec 2021 | | | | 1,596 | | | | 10,000,000 | | | | 9,998,940 | |

| | | | | | | | | | | | 13,220,166 | | | | 13,082,722 | |

SECURITY — 2.7% | | | | | | | | | | | | | | | | |

Arctic Wolf(a) | | | Dec 2021 | | | | 900,901 | | | | 10,000,000 | | | | 9,351,352 | |

Code 42 Software, Inc.(a) | | | May 2016 | | | | 330,000 | | | | 754,500 | | | | 1,277,100 | |

Exabeam, Inc.(a) | | | Jul 2021 | | | | 54,500 | | | | 1,590,855 | | | | 1,570,145 | |

Tanium(a) | | | Apr 2019 | | | | 640,000 | | | | 4,787,200 | | | | 7,379,200 | |

| | | | | | | | | | | | 17,132,555 | | | | 19,577,797 | |

SOFTWARE — 1.0% | | | | | | | | | | | | | | | | |

Docker, Inc.(a) | | | May 2017 | | | | 2,500 | | | | 531,250 | | | | 15,850 | |

Malwarebytes(a) | | | Dec 2019 | | | | 188,173 | | | | 1,129,038 | | | | 4,181,204 | |

Mynd Management(a) | | | Dec 2021 | | | | 166,390 | | | | 3,060,012 | | | | 3,161,410 | |

| | | | | | | | | | | | 4,720,300 | | | | 7,358,464 | |

TOTAL COMMON STOCK IN PRIVATE COMPANIES | | | | | | | | | | | 151,987,217 | | | | 223,228,378 | |

| | | | | | | | | | | | | | | | | |

PREFERRED STOCK IN PRIVATE COMPANIES(c) — 30.4% | | | | | | | | | | | | |

ADVERTISING — 0.0% | | | | | | | | | | | | | | | | |

GroundTruth (f.k.a. xAd, Inc.), Preferred Series B-1(a) | | | Jan 2017 | | | | 600,000 | | | | 149,200 | | | | 180,000 | |

| | | | | | | | | | | | | | | | | |

AEROSPACE — 2.8% | | | | | | | | | | | | | | | | |

Axiom Space, Inc., Preferred Series B(a) | | | Dec 2020 | | | | 32,221 | | | | 2,019,958 | | | | 6,004,706 | |

Beta Technologies, Preferred Series A(a) | | | Apr 2021 | | | | 40,944 | | | | 2,999,967 | | | | 3,003,242 | |

Stealth Company Investment, Preferred Series Seed 2(a) | | | Sep 2021 | | | | 303,668 | | | | 999,999 | | | | 1,000,009 | |

Relativity Space, Preferred Series E(a) | | | Jul 2021 | | | | 437,922 | | | | 10,299,992 | | | | 9,999,993 | |

| | | | | | | | | | | | 16,319,916 | | | | 20,007,950 | |

See accompanying Notes to the Financial Statements

15

THE PRIVATE SHARES FUND

Schedule of Investments (Continued)

December 31, 2021

| | | Acquisition

Date | | | Shares | | | Cost | | | Fair Value | |

PREFERRED STOCK IN PRIVATE COMPANIES(c) — 30.4% (Continued) | | | | | | | | | | | | |

AGTECH — 2.5% | | | | | | | | | | | | | | | | |

Cibo, Preferred Series C(a)(f) | | | Aug 2021 | | | | 600,000 | | | $ | 3,090,000 | | | $ | 3,000,000 | |

Farmers Business Network, Preferred Series G(a) | | | Sep 2021 | | | | 160,880 | | | | 10,199,946 | | | | 9,999,947 | |

Invaio Sciences, Inc., Preferred Series C(a)(f) | | | Mar 2021 | | | | 1,061,390 | | | | 5,150,000 | | | | 4,967,305 | |

| | | | | | | | | | | | 18,439,946 | | | | 17,967,252 | |

ANALYTICS/BIG DATA — 2.3% | | | | | | | | | | | | | | | | |

Dataminr, Inc., Preferred Series A(a) | | | Apr 2019 | | | | 20,000 | | | | 198,000 | | | | 864,200 | |

Dataminr, Inc., Preferred Series B(a) | | | Apr 2019 | | | | 87,496 | | | | 866,211 | | | | 3,780,702 | |

Heap, Preferred Series C(a) | | | May 2019 | | | | 1,361,503 | | | | 4,999,997 | | | | 11,520,494 | |

Heap, Preferred Series D(a) | | | Nov 2021 | | | | 84,047 | | | | 711,170 | | | | 711,172 | |

| | | | | | | | | | | | 6,775,378 | | | | 16,876,568 | |

ARTIFICIAL INTELLIGENCE — 2.3% | | | | | | | | | | | | | | | | |

Invenia, Preferred Series B-2(a)(f) | | | Dec 2021 | | | | 117,119 | | | | 10,000,000 | | | | 10,000,000 | |

Verbit, Preferred Series A(a) | | | Nov 2021 | | | | 2,382 | | | | 693,256 | | | | 693,329 | |

Verbit, Preferred Series B(a) | | | Nov 2021 | | | | 14,409 | | | | 4,194,173 | | | | 4,194,028 | |

Verbit, Preferred Series E-1(a) | | | Nov 2021 | | | | 4,008 | | | | 1,166,667 | | | | 1,166,608 | |

Verbit, Preferred Series Seed 2(a) | | | Nov 2021 | | | | 3,250 | | | | 945,904 | | | | 945,977 | |

| | | | | | | | | | | | 17,000,000 | | | | 16,999,942 | |

CLEAN TECHNOLOGY — 0.4% | | | | | | | | | | | | | | | | |

WiTricity, Preferred Series A(a) | | | Oct 2020 | | | | 1,000,000 | | | | 1,020,000 | | | | 3,130,000 | |

| | | | | | | | | | | | | | | | | |

CONSUMER WEB — 0.0% | | | | | | | | | | | | | | | | |

Musely, Preferred Series B(a) | | | Oct 2014 | | | | 7,961 | | | | 100,012 | | | | 88,367 | |

| | | | | | | | | | | | | | | | | |

E-COMMERCE — 4.6% | | | | | | | | | | | | | | | | |

Caastle, Preferred Series A-12(a) | | | Dec 2021 | | | | 806,460 | | | | 5,000,052 | | | | 5,000,052 | |

GOAT, Preferred Series A-1(a)(f) | | | Sep 2021 | | | | 112,563 | | | | 668,206 | | | | 661,870 | |

GOAT, Preferred Series A-5(a)(f) | | | Sep 2021 | | | | 2,394 | | | | 14,211 | | | | 14,077 | |

GOAT, Preferred Series A-7(a)(f) | | | Sep 2021 | | | | 146,495 | | | | 869,637 | | | | 861,391 | |

GOAT, Preferred Series B(a)(f) | | | Sep 2021 | | | | 231,687 | | | | 1,375,362 | | | | 1,362,320 | |

GOAT, Preferred Series C(a)(f) | | | Sep 2021 | | | | 237,913 | | | | 1,412,322 | | | | 1,398,928 | |

GrubMarket, Preferred Series D(a) | | | Oct 2020 | | | | 440,742 | | | | 1,999,999 | | | | 4,347,030 | |

GrubMarket, Preferred Series E(a) | | | Jun 2021 | | | | 1,520,838 | | | | 14,999,995 | | | | 14,999,995 | |

Lyst, Preferred Series E(a) | | | Jul 2021 | | | | 401,929 | | | | 5,172,500 | | | | 5,120,575 | |

| | | | | | | | | | | | 31,512,284 | | | | 33,766,238 | |

EDUCATION — 0.9% | | | | | | | | | | | | | | | | |

MasterClass, Preferred Series 1(a) | | | Jul 2021 | | | | 193,100 | | | | 6,146,189 | | | | 6,121,270 | |

See accompanying Notes to the Financial Statements

16

THE PRIVATE SHARES FUND

Schedule of Investments (Continued)

December 31, 2021

| | | Acquisition

Date | | | Shares | | | Cost | | | Fair Value | |

PREFERRED STOCK IN PRIVATE COMPANIES(c) — 30.4% (Continued) | | | | | | | | | | | | |

ENTERPRISE SOFTWARE — 2.5% | | | | | | | | | | | | |

Checkr, Inc., Preferred Series A-1(a) | | | Mar 2020 | | | | 50,000 | | | $ | 1,405,000 | | | $ | 2,683,500 | |

Cohere Technologies, Preferred Series D-2(a) | | | Dec 2020 | | | | 386,038 | | | | 2,071,233 | | | | 2,071,233 | |

KeepTruckin, Preferred Series E(a) | | | May 2021 | | | | 638,843 | | | | 4,599,996 | | | | 4,606,058 | |

Ocrolus, Inc., Preferred Series C(a)(f) | | | Sep 2021 | | | | 438,327 | | | | 3,030,000 | | | | 2,998,157 | |

Tebra, Preferred Series Seed 2(a) | | | Nov 2020 | | | | 123,819 | | | | 804,870 | | | | 1,123,047 | |

Trax Ltd., Pre IPO(a) | | | Mar 2021 | | | | 76,722 | | | | 3,999,978 | | | | 4,392,335 | |

| | | | | | | | | | | | 15,911,077 | | | | 17,874,330 | |

FINANCE/PAYMENTS — 3.8% | | | | | | | | | | | | | | | | |

Betterment, Preferred Series F(a) | | | Sep 2021 | | | | 318,380 | | | | 3,999,999 | | | | 3,999,999 | |

BlockFi, Preferred Series E(a)(f) | | | Jul 2021 | | | | 40,201 | | | | 3,045,000 | | | | 2,987,738 | |

Fundbox, Preferred Series C(a) | | | Jun 2019 | | | | 439,552 | | | | 4,999,992 | | | | 6,197,683 | |

Fundbox, Preferred Series D(a) | | | Sep 2021 | | | | 531,914 | | | | 7,499,988 | | | | 7,499,988 | |

Kraken, Preferred Series A(a) | | | Nov 2021 | | | | 100,000 | | | | 5,310,000 | | | | 5,193,000 | |

Prosper Marketplace, Inc., Preferred Series A(a) | | | Jan 2016 | | | | 55,395 | | | | 305,781 | | | | 41,546 | |

Prosper Marketplace, Inc., Preferred Series A-1(a) | | | Jan 2016 | | | | 58,165 | | | | 116 | | | | 87,248 | |

Ripple, Preferred Series A(a) | | | Dec 2018 | | | | 42,000 | | | | 504,000 | | | | 1,566,600 | |

| | | | | | | | | | | | 25,664,876 | | | | 27,573,802 | |

FOODTECH — 0.7% | | | | | | | | | | | | | | | | |

Impossible Foods, Inc., Preferred Series H-1(a)(f) | | | Nov 2021 | | | | 153,494 | | | | 3,746,778 | | | | 3,708,660 | |

Impossible Foods, Inc., Preferred Series H-2(a)(f) | | | Nov 2021 | | | | 53,389 | | | | 1,303,222 | | | | 1,289,964 | |

| | | | | | | | | | | | 5,050,000 | | | | 4,998,624 | |

HEALTHCARE/BIOTECH — 2.7% | | | | | | | | | | | | | | | | |

Click Therapeutics, Inc., Preferred Series A(a) | | | Nov 2020 | | | | 60,087 | | | | 210,305 | | | | 208,502 | |

Collective Health, Inc., Preferred Series F(a) | | | May 2021 | | | | 3,989,361 | | | | 3,120,000 | | | | 2,792,552 | |

Crossover Health, Inc., Preferred Series D(a) | | | Mar 2021 | | | | 224,976 | | | | 7,999,966 | | | | 8,119,384 | |

Omada Health, Preferred Series E(a) | | | Dec 2021 | | | | 1,334,400 | | | | 7,999,995 | | | | 7,999,995 | |

ZocDoc, Inc., Preferred Series A(a) | | | Feb 2015 | | | | 35,000 | | | | 875,000 | | | | 675,500 | |

| | | | | | | | | | | | 20,205,266 | | | | 19,795,933 | |

HOSTING/STORAGE — 0.8% | | | | | | | | | | | | | | | | |

Pavilion Data Systems, Inc., Preferred Series C-1(a) | | | Apr 2021 | | | | 2,038,687 | | | | 6,059,997 | | | | 6,059,997 | |

| | | | | | | | | | | | | | | | | |

SECURITY — 1.6% | | | | | | | | | | | | | | | | |

Cybereason, Preferred Series F(a)(f) | | | Jul 2021 | | | | 1,510,600 | | | | 7,631,457 | | | | 7,099,820 | |

Exabeam, Preferred Series A(a) | | | Nov 2020 | | | | 80,000 | | | | 1,020,000 | | | | 2,304,800 | |

Lookout, Inc., Preferred Series A(a) | | | Feb 2015 | | | | 204,000 | | | | 1,927,800 | | | | 2,172,600 | |

| | | | | | | | | | | | 10,579,257 | | | | 11,577,220 | |

SOFTWARE — 0.9% | | | | | | | | | | | | | | | | |

SoundHound, Inc., Preferred Series D(a) | | | Sep 2016 | | | | 107,484 | | | | 2,200,767 | | | | 5,552,623 | |

SoundHound, Inc., Preferred Series D-3(a) | | | Nov 2020 | | | | 25,000 | | | | 1,000,000 | | | | 1,291,500 | |

| | | | | | | | | | | | 3,200,767 | | | | 6,844,123 | |

See accompanying Notes to the Financial Statements

17

THE PRIVATE SHARES FUND

Schedule of Investments (Continued)

December 31, 2021

| | | Acquisition

Date | | | Shares/

Principal/ Units | | | Cost | | | Fair Value | |

PREFERRED STOCK IN PRIVATE COMPANIES(c) — 30.4% (Continued) | | | | | | | | | | | | |

TRANSPORTATION — 1.6% | | | | | | | | | | | | | | | | |

Lime (Neutron Holdings, Inc.), Preferred Series 1-D(a) | | | Mar 2019 | | | | 20,618,556 | | | $ | 5,000,000 | | | $ | 2,268,041 | |

Turo, Preferred Series D-1(a) | | | Jun 2018 | | | | 642,535 | | | | 2,999,996 | | | | 9,252,504 | |

Virgin Hyperloop One, Preferred Series B-1(a) | | | Jun 2017 | | | | 4,144 | | | | 999,999 | | | | 136,876 | |

Virgin Hyperloop One, Preferred Series C(a) | | | May 2019 | | | | 12,992 | | | | 37,938 | | | | 37,938 | |

| | | | | | | | | | | | 9,037,933 | | | | 11,695,359 | |

TOTAL PREFERRED STOCK IN PRIVATE COMPANIES | | | | | | | | | | | 193,172,098 | | | | 221,556,975 | |

| | | | | | | | | | | | | | | | | |

CONVERTIBLE NOTES OF PRIVATE COMPANIES(c) — 6.2% | | | | | | | | |

AEROSPACE — 2.1% | | | | | | | | | | | | | | | | |

Axiom Space, Inc., 3.00% 8/11/2023 | | | Aug 2021 | | | $ | 15,000,000 | | | | 15,000,000 | | | | 15,000,000 | |

| | | | | | | | | | | | | | | | | |

SOFTWARE — 2.0% | | | | | | | | | | | | | | | | |

Tradeshift, 3.00% 6/16/2023 | | | Jun 2021 | | | $ | 10,000,000 | | | | 10,072,740 | | | | 10,000,000 | |

Tradeshift, 5.00% 11/22/2023(d) | | | Nov 2021 | | | $ | 5,000,000 | | | | 5,000,000 | | | | 5,000,000 | |

| | | | | | | | | | | | 15,072,740 | | | | 15,000,000 | |

TRANSPORTATION — 2.1% | | | | | | | | | | | | | | | | |

Lime (Neutron Holdings, Inc.), 4.00% 10/29/2025 | | | Oct 2021 | | | $ | 15,000,000 | | | | 15,000,000 | | | | 15,000,000 | |

Lime (Neutron Holdings, Inc.), 4.00% 6/1/2027 | | | Jun 2020 | | | $ | 253,169 | | | | 253,169 | | | | 253,169 | |

| | | | | | | | | | | | 15,253,169 | | | | 15,253,169 | |

TOTAL CONVERTIBLE NOTES OF PRIVATE COMPANIES | | | | | | | 45,325,909 | | | | 45,253,169 | |

| | | | | | | | | | | | | | | | | |

WARRANTS OF PRIVATE COMPANIES(c) — 1.9% | | | | | | | | | | | | | | | | |

FINANCE/PAYMENTS — 0.1% | | | | | | | | | | | | | | | | |

BlockFi, Exercise Price $75.74, Exercise Date 8/15/2028(a)(f) | | | Jul 2021 | | | | 20,100 | | | | 0 | | | | 1,014,580 | |

| | | | | | | | | | | | | | | | | |

SOFTWARE — 1.8% | | | | | | | | | | | | | | | | |

Tradeshift, Exercise Price $0.001, Exercise Date 11/20/2031(a) | | | Nov 2021 | | | | 213,797 | | | | 0 | | | | 4,229,418 | |

Tradeshift, Exercise Price $0.001, Exercise Date 9/8/2031(a) | | | Dec 2021 | | | | 427,594 | | | | 0 | | | | 8,458,835 | |

| | | | | | | | | | | | 0 | | | | 12,688,253 | |

TRANSPORTATION — 0.0% | | | | | | | | | | | | | | | | |

Lime (Neutron Holdings, Inc.), Exercise Price $0.01, Exercise Date 6/2/2027(a) | | | Jun 2020 | | | | 1,016,483 | | | | 0 | | | | 2,656 | |

TOTAL WARRANTS OF PRIVATE COMPANIES | | | | | | | | | | | 0 | | | | 13,705,489 | |

| | | | | | | | | | | | | | | | | |

SPECIAL PURPOSE VEHICLES(c) — 1.4% | | | | | | | | | | | | | | | | |

ANALYTICS/BIG DATA — 0.7% | | | | | | | | | | | | | | | | |

KVC Select, LLC(a)(g) | | | Aug 2021 | | | | 5,050,000 | | | | 5,050,000 | | | | 5,050,000 | |

| | | | | | | | | | | | | | | | | |

SOFTWARE — 0.7% | | | | | | | | | | | | | | | | |

Artist Edge Partners IV LP(a)(g) | | | Dec 2021 | | | | 5,125,792 | | | | 5,125,792 | | | | 5,125,792 | |

TOTAL SPECIAL PURPOSE VEHICLES | | | | | | | | | | | 10,175,792 | | | | 10,175,792 | |

See accompanying Notes to the Financial Statements

18

THE PRIVATE SHARES FUND

Schedule of Investments (Continued)

December 31, 2021

| | | Acquisition

Date | | | Shares | | | Cost | | | Fair Value | |

SHORT-TERM INVESTMENTS — 24.2% | | | | | | | | | | | | | | | | |

MUTUAL FUND — 24.2% | | | | | | | | | | | | | | | | |

Goldman Sachs Government Fund, 0.03%(e) | | | | | | | | | | $ | 175,918,136 | | | $ | 175,918,136 | |

TOTAL SHORT-TERM INVESTMENTS | | | | | | | | | | | 175,918,136 | | | | 175,918,136 | |

| | | | | | | | | | | | | | | | | |

TOTAL INVESTMENTS — 99.8% | | | | | | | | | | | 600,802,313 | | | | 727,057,143 | |

Other assets less liabilities— 0.2 % | | | | | | | | | | | | | | | 1,427,367 | |

| | | | | | | | | | | | | | | | | |

NET ASSETS — 100.0% | | | | | | | | | | | | | | $ | 728,484,510 | |

(b) | Fathom Digital is classified as common stock in public companies in the Schedule of Investments. However, the Fathom Digital securities held by the Fund are unregistered securities that were purchased through a PIPE (private investment in public equity) offering. |

(c) | Investments in private companies, and in some cases public companies, may be subject to restrictions on disposition imposed by the issuer. As of December 31, 2021, restricted securities represented 73.31% of the net assets of the Fund. |

(d) | Denotes a variable rate security. The rate shown is the current interest rate as of December 31, 2021. |

(e) | Represents the 7-day effective yield as of December 31, 2021. |

(f) | These securities have been purchased through Special Purpose Vehicles in which the Fund has a direct investment of ownership units of the Vehicles. The shares, cost basis and fair value stated are determined based on the underlying securities purchased by the Vehicle and the Fund’s ownership percentage of the Vehicle. |

(g) | These investments in Special Purpose Vehicles are expected to be invested into Portfolio Companies’ common and preferred shares. |

All issuers are based in the United States, except for Lyst, Ltd. and OpenX, which are based in the UK, and Trax Ltd., Eruditus Learning, Invenia and Fundbox, which are based in the Cayman Islands, Singapore, Canada and Israel, respectively.

See accompanying Notes to the Financial Statements

19

THE PRIVATE SHARES FUND

Statement of Assets and Liabilities

December 31, 2021

Assets: | | | | |

Investments, at fair value (Note 3) | | $ | 727,057,143 | |

Receivable for investments sold | | | 916,944 | |

Receivable for fund shares sold | | | 1,566,296 | |

Interest receivable | | | 460,799 | |

Prepaid expenses and other assets | | | 335,857 | |

Total assets | | | 730,337,039 | |

| | | | |

Liabilities: | | | | |

Advisory fees | | | 1,057,621 | |

Payable for shareholder servicing fees - Class L | | | 805 | |

Payable for shareholder servicing fees - Class A | | | 33,539 | |

Payable for audit and tax fees | | | 330,000 | |

Payable for transfer agent fees | | | 203,994 | |

Payable for 12b-1 fees - Class L | | | 805 | |

Other accrued liabilities | | | 225,765 | |

Total liabilities | | | 1,852,529 | |

Commitments and contingencies (Note 9) | | | | |

Net assets | | $ | 728,484,510 | |

| | | | |

Net assets consist of: | | | | |

Capital stock (unlimited shares authorized, 25,000,000 shares registered, no par value) | | $ | 590,710,271 | |

Total distributable earnings | | | 137,774,239 | |

Net assets | | $ | 728,484,510 | |

| | | | |

Net assets: | | | | |

Class A | | $ | 158,432,551 | |

Class I | | | 566,271,709 | |

Class L | | | 3,780,250 | |

Total net assets | | $ | 728,484,510 | |

| | | | |

Shares outstanding: | | | | |

Class A | | | 3,793,389 | |

Class I | | | 13,411,310 | |

Class L | | | 91,469 | |

Total shares outstanding | | | 17,296,168 | |

| | | | |

Net asset value, public offering price, and redemption proceeds per share: | | | | |

Class A - Net asset value and redemption proceeds per share | | $ | 41.77 | |

Class I - Net asset value and redemption proceeds per share | | $ | 42.22 | |

Class L - Net asset value and redemption proceeds per share | | $ | 41.33 | |

Class A - Public offering price per share(a) | | $ | 44.32 | |

Class L - Public offering price per share(b) | | $ | 43.16 | |

| | | | |

Cost of investments | | $ | 600,802,313 | |

(a) | Computation of public offering price per share 100/94.25 of net asset value. (See Note 10). |

(b) | Computation of public offering price per share 100/95.75 of net asset value. (See Note 10). |

See accompanying Notes to the Financial Statements

20

THE PRIVATE SHARES FUND

Statement of Operations

For the year ended December 31, 2021

Investment Income: | | | | |

Interest | | $ | 543,634 | |

Total investment income | | | 543,634 | |

| | | | |

Expenses: | | | | |

Investment advisory fees (Note 5) | | | 9,974,853 | |

Transfer agent fees | | | 731,309 | |

Legal fees1 | | | 716,416 | |

Audit and tax fees | | | 408,325 | |

Fund accounting & administration fees | | | 343,431 | |

Printing & postage | | | 296,725 | |

Shareholder servicing fees - Class A | | | 193,604 | |

Insurance fees | | | 165,877 | |

Trustee fees | | | 157,200 | |

Registration fees | | | 122,002 | |

Chief compliance officer fees | | | 93,500 | |

Miscellaneous expenses | | | 57,060 | |

Custodian fees | | | 42,290 | |

Distribution fees - Class L | | | 7,096 | |

Shareholder servicing fees - Class L | | | 2,580 | |

Total expenses | | | 13,312,268 | |

Less: Contractual waiver of fees and reimbursement of expenses (Note 4) | | | (1,073,207 | ) |

Net expenses | | | 12,239,061 | |

Net investment loss | | $ | (11,695,427 | ) |

| | | | |

Net realized gain on investments | | | 65,538,431 | |

Net change in unrealized gain on investments | | | 40,658,916 | |

Net realized & change in unrealized gain on investments | | | 106,197,347 | |

Net change in net assets from operations | | $ | 94,501,920 | |

1 | Includes extraordinary expenses incurred during the fiscal year. Extraordinary expenses related to Legal expenses incurred in the amount of $66,717 were excluded from the contractual waiver of fees due to their nature. Please see Note 4 in the Notes to the Financial Statements for additional information. |

See accompanying Notes to the Financial Statements

21

THE PRIVATE SHARES FUND

Statements of Changes in Net Assets

| | | Year ended

December 31,2021 | | | Year ended

December 31,2020 | |

Operations: | | | | | | | | |

Net investment loss | | $ | (11,695,427 | ) | | $ | (5,159,407 | ) |

Net realized gain on investments | | | 65,538,431 | | | | 6,126,301 | |

Net change in unrealized gain on investments | | | 40,658,916 | | | | 51,184,979 | |

Net change in net assets resulting from operations | | | 94,501,920 | | | | 52,151,873 | |

| | | | | | | | |

Distributions to Shareholders: | | | | | | | | |

Distributions from return of capital | | | — | | | | (546,574 | ) |

Distributions from long term capital gain | | | (51,227,704 | ) | | | (5,071,155 | ) |

Net change in net assets from distributions | | | (51,227,704 | ) | | | (5,617,729 | ) |

| | | | | | | | |

Fund share transactions: | | | | | | | | |

Proceeds from shares issued - Class A | | | 62,603,597 | | | | 31,989,710 | |

Proceeds from shares issued - Class I | | | 351,778,917 | | | | 95,838,436 | |

Proceeds from shares issued - Class L | | | 2,173,960 | | | | 763,686 | |

Reinvested distributions - Class A | | | 5,041,316 | | | | 956,585 | |

Reinvested distributions - Class I | | | 21,362,256 | | | | 1,933,478 | |

Reinvested distributions - Class L | | | 204,652 | | | | 17,901 | |

Cost of shares redeemed - Class A | | | (28,951,952 | ) | | | (56,972,217 | ) |

Cost of shares redeemed - Class I | | | (32,099,168 | ) | | | (9,208,975 | ) |

Cost of shares redeemed - Class L | | | (346,778 | ) | | | (278,561 | ) |

Net change in net assets from fund share transactions | | | 381,766,800 | | | | 65,040,043 | |

Net change in net assets | | $ | 425,041,016 | | | $ | 111,574,187 | |

| | | | | | | | |

Net assets: | | | | | | | | |

Beginning of year | | $ | 303,443,494 | | | $ | 191,869,307 | |

End of year | | $ | 728,484,510 | | | $ | 303,443,494 | |

| | | | | | | | |

Transactions in shares: | | | | | | | | |

Issuance of shares - Class A | | | 1,500,815 | | | | 990,071 | |

Issuance of shares - Class I | | | 8,243,895 | | | | 2,878,957 | |

Issuance of shares - Class L | | | 52,196 | | | | 23,983 | |

Reinvested distributions - Class A | | | 120,808 | | | | 27,183 | |

Reinvested distributions - Class I | | | 506,455 | | | | 54,541 | |

Reinvested distributions - Class L | | | 4,955 | | | | 512 | |

Redemption of shares - Class A | | | (690,399 | ) | | | (1,761,574 | ) |

Redemption of shares - Class I | | | (745,246 | ) | | | (283,050 | ) |

Redemption of shares - Class L | | | (8,342 | ) | | | (8,989 | ) |

Net change in shares | | | 8,985,137 | | | | 1,921,634 | |

See accompanying Notes to the Financial Statements

22

THE PRIVATE SHARES FUND

Statement of Cash Flows

For the year ended December 31, 2021

Cash flows from operating activities: | | | | |

Net change in net assets from operations | | $ | 94,501,920 | |

Adjustments to reconcile net change in net assets from operations to net cash used in operating activities: | | | | |

Purchases of investments | | | (302,783,586 | ) |

Net purchases of short-term investments | | | (109,500,075 | ) |

Proceeds from sales of investments | | | 93,613,878 | |

Net change in unrealized gain on investments | | | (40,658,916 | ) |

Net realized gain on investments | | | (65,538,431 | ) |

Change in operating assets and liabilities: | | | | |

Increase in interest receivable | | | (453,685 | ) |

Increase in prepaid expenses and other assets | | | (221,266 | ) |

Increase in net payable to adviser | | | 707,632 | |

Increase in other accrued liabilities | | | 476,459 | |

Net cash used in operating activities | | | (329,856,070 | ) |

| | | | |

Cash flows from financing activities: | | | | |

Proceeds from shares issued, net of change in receivable for fund shares sold | | | 398,278,115 | |

Cost of shares redeemed | | | (43,802,565 | ) |

Cash distributions paid | | | (24,619,480 | ) |

Net cash provided by financing activities | | | 329,856,070 | |

| | | | |

Net change in cash | | | — | |

| | | | |

Cash at beginning of year | | | — | |

Cash at end of year | | $ | — | |

| | | | |

Supplemental disclosure of noncash financing activities | | | | |

Transfer in and out between share classes | | $ | 17,595,333 | |

Purchases of shares through reinvested distributions | | | 26,608,224 | |

See accompanying Notes to the Financial Statements

23

THE PRIVATE SHARES FUND

Financial Highlights – Class A

For a capital share outstanding throughout each period

| | | Year ended

December 31,

2021 | | | Year ended

December 31,

2020 | | | Year ended

December 31,

2019 | | | Year ended

December 31,

2018 | | | Year ended

December 31,

2017 | |

Per share operating performance | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 36.33 | | | $ | 29.96 | | | $ | 28.44 | | | $ | 26.85 | | | $ | 26.83 | |

| | | | | | | | | | | | | | | | | | | | |

Change in net assets from operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.88 | ) | | | (0.90 | ) | | | (0.88 | ) | | | (0.71 | ) | | | (0.63 | ) |

Net realized and unrealized gain on investments | | | 9.54 | | | | 7.98 | | | | 2.40 | | | | 2.30 | | | | 0.65 | |

Total change in net assets from operations | | | 8.66 | | | | 7.08 | | | | 1.52 | | | | 1.59 | | | | 0.02 | |

| | | | | | | | | | | | | | | | | | | | |

Distributions: | | | | | | | | | | | | | | | | | | | | |

From net return of capital | | | — | | | | (0.07 | ) | | | — | | | | — | | | | — | |

From net realized gain on investments | | | (3.22 | ) | | | (0.64 | ) | | | — | | | | — | | | | — | |

Total distributions | | | (3.22 | ) | | | (0.71 | ) | | | — | | | | — | | | | — | |

Net increase in net asset value | | | 5.44 | | | | 6.37 | | | | 1.52 | | | | 1.59 | | | | 0.02 | |

Net asset value, end of year | | $ | 41.77 | | | $ | 36.33 | | | $ | 29.96 | | | $ | 28.44 | | | $ | 26.85 | |

| | | | | | | | | | | | | | | | | | | | |

Total return(a) | | | 23.85 | % | | | 23.69 | % | | | 5.34 | % | | | 5.92 | % | | | 0.07 | % |

| | | | | | | | | | | | | | | | | | | | |

Ratios and supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (in thousands) | | $ | 158,433 | | | $ | 103,984 | | | $ | 108,068 | | | $ | 109,902 | | | $ | 101,248 | |

Ratio of net expenses to average net assets | | | 2.51 | %(b)(c) | | | 2.50 | %(b) | | | 2.79 | %(b)(d) | | | 2.50 | %(b) | | | 2.50 | %(b) |

Ratio of gross expenses before reimbursement to average net assets | | | 2.64 | % | | | 2.97 | % | | | 3.56 | % | | | 3.29 | % | | | 3.69 | % |

Ratio of net investment loss to average net assets | | | (2.42 | )% | | | (2.48 | )% | | | (2.71 | )% | | | (2.44 | )% | | | (2.52 | )% |

Portfolio turnover | | | 26.20 | % | | | 6.97 | % | | | 14.76 | % | | | 24.75 | % | | | 8.78 | % |

(a) | The Fund’s total investment returns do not include a sales load. |

(b) | The ratio of net expenses are the result of $171,876, $492,357, $916,804, $887,579, and $1,120,912, respectively, in contractual waivers and expense reimbursement representing (0.12)%, (0.47)%, (0.78)%, (0.79)%, and (1.19)%, respectively. Please see Note 4 in the Notes to the Financial Statements for additional information. |

(c) | During the calendar year ended December 31, 2021, there were legal expenses incurred by the Fund that were distinguishable in their characterization as being unusual in nature as well as not expected to be recurring in future periods. The exclusion of these extraordinary expenses from the Fund’s expense limitation agreement caused the expense ratio to exceed the contractual expense limit by $17,584 or 0.01%. |

(d) | During the calendar year ended December 31, 2019, there were certain expenses incurred by the Fund that were distinguishable in their characterization as being unusual in nature as well as not expected to be recurring in future periods. The exclusion of these extraordinary expenses from the Fund’s expense limitation agreement caused the expense ratio to exceed the contractual expense limit by $336,193 or 0.29%. |

See accompanying Notes to the Financial Statements

24

THE PRIVATE SHARES FUND

Financial Highlights – Class I

For a capital share outstanding throughout each period

| | | Year ended

December 31,

2021 | | | Year ended

December 31,

2020 | | | Year ended

December 31,

2019 | | | Year ended

December 31,

2018 | | | Period ended

December 31,

2017* | |

Per share operating performance | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 36.61 | | | $ | 30.12 | | | $ | 28.51 | | | $ | 26.85 | | | $ | 26.37 | |

| | | | | | | | | | | | | | | | | | | | |

Change in net assets from operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.62 | ) | | | (0.47 | ) | | | (0.59 | ) | | | (0.20 | ) | | | (0.01 | ) |

Net realized and unrealized gain on investments | | | 9.45 | | | | 7.67 | | | | 2.20 | | | | 1.86 | | | | 0.49 | |

Total change in net assets from operations | | | 8.83 | | | | 7.20 | | | | 1.61 | | | | 1.66 | | | | 0.48 | |

| | | | | | | | | | | | | | | | | | | | |

Distributions: | | | | | | | | | | | | | | | | | | | | |

From net return of capital | | | — | | | | (0.07 | ) | | | — | | | | — | | | | — | |

From net realized gain on investments | | | (3.22 | ) | | | (0.64 | ) | | | — | | | | — | | | | — | |

Total distributions | | | (3.22 | ) | | | (0.71 | ) | | | — | | | | — | | | | — | |

Net increase in net asset value | | | 5.61 | | | | 6.49 | | | | 1.61 | | | | 1.66 | | | | 0.48 | |

Net asset value, end of period | | $ | 42.22 | | | $ | 36.61 | | | $ | 30.12 | | | $ | 28.51 | | | $ | 26.85 | |

| | | | | | | | | | | | | | | | | | | | |

Total return | | | 24.13 | % | | | 23.97 | % | | | 5.65 | % | | | 6.18 | % | | | 1.82 | %(a) |

| | | | | | | | | | | | | | | | | | | | |

Ratios and supplemental data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 566,272 | | | $ | 197,921 | | | $ | 82,992 | | | $ | 33,945 | | | $ | 1,115 | |

Ratio of net expenses to average net assets | | | 2.26 | %(b)(c) | | | 2.25 | %(b) | | | 2.54 | %(b)(d) | | | 2.25 | %(b) | | | 2.25 | %(b)(e) |

Ratio of gross expenses before reimbursement to average net assets | | | 2.50 | % | | | 2.75 | % | | | 3.36 | % | | | 3.10 | % | | | 3.50 | %(e) |

Ratio of net investment loss to average net assets | | | (2.15 | )% | | | (2.24 | )% | | | (2.46 | )% | | | (2.17 | )% | | | (2.25 | )%(e) |

Portfolio turnover | | | 26.20 | % | | | 6.97 | % | | | 14.76 | % | | | 24.75 | % | | | 8.78 | %(a) |

* | Reflects operations for the period from November 17, 2017 (inception date) to December 31, 2017. |

(a) | Not annualized for periods less than one year. |

(b) | The ratio of net expenses are the result of $899,197, $567,388, $546,174, $94,654, and $109, respectively, in contractual waivers and expense reimbursement representing (0.23)%, (0.50)%, (0.82)%, (0.85)%, and (1.25)%, respectively. Please see Note 4 in the Notes to the Financial Statements for additional information. |

(c) | During the calendar year ended December 31, 2021, there were legal expenses incurred by the Fund that were distinguishable in their characterization as being unusual in nature as well as not expected to be recurring in future periods. The exclusion of these extraordinary expenses from the Fund’s expense limitation agreement caused the expense ratio to exceed the contractual expense limit by $48,772 or 0.01%. |

(d) | During the calendar year ended December 31, 2019, there were certain expenses incurred by the Fund that were distinguishable in their characterization as being unusual in nature as well as not expected to be recurring in future periods. The exclusion of these extraordinary expenses from the Fund’s expense limitation agreement caused the expense ratio to exceed the contractual expense limit by $189,435 or 0.29%. |

(e) | Annualized for period less than one year. |

See accompanying Notes to the Financial Statements

25

THE PRIVATE SHARES FUND

Financial Highlights – Class L

For a capital share outstanding throughout each period

| | | Year ended

December 31,

2021 | | | Year ended

December 31,

2020 | | | Year ended

December 31,

2019 | | | Period ended

December 31,

2018* | |

Per share operating performance | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 36.07 | | | $ | 29.83 | | | $ | 28.39 | | | $ | 28.37 | |

| | | | | | | | | | | | | | | | |

Change in net assets from operations: | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.82 | ) | | | (0.67 | ) | | | (0.58 | ) | | | (0.49 | ) |

Net realized and unrealized gain on investments | | | 9.30 | | | | 7.62 | | | | 2.02 | | | | 0.51 | |

Total change in net assets from operations | | | 8.48 | | | | 6.95 | | | | 1.44 | | | | 0.02 | |

| | | | | | | | | | | | | | | | |

Distributions: | | | | | | | | | | | | | | | | |

From net return of capital | | | — | | | | (0.07 | ) | | | — | | | | — | |

From net realized gain on investments | | | (3.22 | ) | | | (0.64 | ) | | | — | | | | — | |

Total distributions | | | (3.22 | ) | | | (0.71 | ) | | | — | | | | — | |

Net increase in net asset value | | | 5.26 | | | | 6.24 | | | | 1.44 | | | | 0.02 | |

Net asset value, end of period | | $ | 41.33 | | | $ | 36.07 | | | $ | 29.83 | | | $ | 28.39 | |

| | | | | | | | | | | | | | | | |

Total return(a) | | | 23.52 | % | | | 23.36 | % | | | 5.07 | % | | | 0.07 | %(b) |

| | | | | | | | | | | | | | | | |

Ratios and supplemental data | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 3,780 | | | $ | 1,539 | | | $ | 810 | | | $ | 1 | |

Ratio of net expenses to average net assets | | | 2.76 | %(c)(d) | | | 2.75 | %(c) | | | 3.04 | %(c)(e) | | | 2.75 | %(c)(f) |

Ratio of gross expenses before reimbursement to average net assets | | | 2.84 | % | | | 3.18 | % | | | 3.86 | % | | | 3.60 | %(f) |

Ratio of net investment loss to average net assets | | | (2.66 | )% | | | (2.74 | )% | | | (2.97 | )% | | | (2.68 | )%(f) |

Portfolio turnover | | | 26.20 | % | | | 6.97 | % | | | 14.76 | % | | | 24.75 | %(b) |

* | Reflects operations for the period from May 11, 2018 (inception date) to December 31, 2018. |

(a) | The Fund’s total investment returns do not include a sales load. |

(b) | Not annualized for periods less than one year. |

(c) | The ratio of net expenses are the result of $2,134, $4,514, $4,364, and $6, respectively, in contractual waivers and expense reimbursement representing (0.08)%, (0.43)%, (0.82)%, and (0.85)%, respectively. Please see Note 4 in the Notes to the Financial Statements for additional information. |

(d) | During the calendar year ended December 31, 2021, there were legal expenses incurred by the Fund that were distinguishable in their characterization as being unusual in nature as well as not expected to be recurring in future periods. The exclusion of these extraordinary expenses from the Fund’s expense limitation agreement caused the expense ratio to exceed the contractual expense limit by $361 or 0.01%. |

(e) | During the calendar year ended December 31, 2019, there were certain expenses incurred by the Fund that were distinguishable in their characterization as being unusual in nature as well as not expected to be recurring in future periods. The exclusion of these extraordinary expenses from the Fund’s expense limitation agreement caused the expense ratio to exceed the contractual expense limit by $1,514 or 0.29%. |

(f) | Annualized for period less than one year. |

See accompanying Notes to the Financial Statements

26

THE PRIVATE SHARES FUND

Notes to the Financial Statements

December 31, 2021

1. Organization

The Private Shares Fund (the “Fund”) was established as a limited liability company under the laws of the State of Delaware on August 20, 2012 and converted into a Delaware statutory trust on March 22, 2013. The Fund is registered with the Securities and Exchange Commission (the “SEC”) as a non-diversified, closed-end management investment company that operates as an “interval fund” under the Investment Company Act of 1940, as amended (the “1940 Act”). The shares of beneficial interest of the Fund (the “Shares”) will be continuously offered under Rule 415 of the Securities Act of 1933, as amended (the “Securities Act”). As an interval fund, the Fund makes quarterly repurchase offers for 5% of the Fund’s outstanding Shares at net asset value (“NAV”), with no repurchase fee incurred. The Fund’s inception date was March 25, 2014. Prior to March 25, 2014, the Fund had been inactive except for matters relating to the Fund’s establishment, designation and planned registration of the Fund’s Shares under the Securities Act and the sale of 5,000 Shares (“Initial Shares”) for $100,000 to the Fund’s then-current investment adviser, which occurred on July 30, 2013. On December 1, 2020, the Fund’s shareholders approved a new investment advisory agreement appointing Liberty Street Advisors, Inc. (“Liberty”) as the investment adviser to the Fund. Accordingly, Liberty (the “Investment Adviser”) has replaced SP Investments Management, LLC as the investment adviser, effective December 9, 2020.

The investment objective of the Fund is to provide investors capital appreciation, which it seeks by primarily investing, under normal market conditions, at least 80% of (i) the value of its net assets, plus (ii) the amount of any borrowings for investment purposes, in the equity securities (e.g., common and/or preferred stock, or equity-linked securities convertible into such equity securities) of private, operating growth companies (each, a “Portfolio Company”). The Investment Adviser’s primary strategy is to invest in Portfolio Companies and to hold such securities until a liquidity event with respect to such Portfolio Company occurs, such as an initial public offering, or a merger or acquisition transaction. The Fund currently offers three different classes of shares: Class A, Class I, and Class L shares. The separate classes of shares differ principally in the applicable sales charges (if any) and shareholder servicing fees. Generally, shareholders of each class also bear certain expenses that pertain to that particular class. All shareholders bear the common expenses of the Fund and earn income and realized gains/ losses pro rata based on the daily ending net assets of each class, without discrimination between share classes. Expenses that are specific to a class are charged directly to that class. Dividends are determined separately for each class based on income and expenses allocated to each class. Realized gain distributions are allocated to each class pro rata based on the shares outstanding of each class on the date of distribution. Differences in per share dividend rates generally result from the differences in separate class expenses, including distribution and shareholder servicing fees.

2. Significant accounting policies

The Fund is an investment company and follows the accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services – Investment Companies. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements.

Investment transactions and income recognition — Investment transactions are accounted for on a trade date basis. Net realized gains and losses on securities are computed on a specific identification basis. Dividend income is recorded on the ex-dividend date or as soon as known if after the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at fair market value. Interest income and estimated expenses are accrued daily.

Use of estimates — The preparation of the financial statements in accordance with US generally accepted accounting principles (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates.

Investment valuation — The Fund’s NAV is based in large part on the value of its securities which are carried at fair value in accordance with the provisions of FASB ASC Topic 820, Fair Value Measurements and Disclosures. Where reliable market prices are available for those securities, the Investment Adviser will rely on those prices. However, because the securities in which the Fund invests are often illiquid, market prices may not be readily available or, where available, may be unreliable. At any point in

27

THE PRIVATE SHARES FUND

Notes to the Financial Statements (Continued)

December 31, 2021

2. Significant accounting policies — (continued)

time, there may be few recent purchase or sale transactions or offers on which to base the value of a given Portfolio Company’s security. In addition, the prices reflected in recent transactions or offers may be extremely sensitive to changes in supply or demand, including changes fueled by investor perceptions or other conditions.

When reliable market values are not available, the Fund’s investments will be valued by the Investment Adviser, under the supervision of the Board of Trustees, pursuant to fair valuation procedures and methodologies adopted by the Board of Trustees. While the Fund and the Investment Adviser will use good faith efforts to determine the fair value of the Fund’s securities, fair value will be dependent on the judgment of the Investment Adviser. The Investment Adviser may also rely to some extent on information provided by the Portfolio Companies.

From time to time, the Fund may determine that it should modify its estimates or assumptions, as new information becomes available. As a consequence, the value of the securities, and therefore the Fund’s NAV, may vary. This may adversely affect Shareholders. Because of the uncertainty and judgment involved in the valuation of the Portfolio Company securities, which do not have a readily available market, the estimated fair value of such securities may be different from values that would have been used had a readily available market existed for such securities. In addition, in the event that the Fund desires to sell Portfolio Company shares, the Fund may also not be able to sell these securities at the prices at which they are carried on the Fund’s books or may have to delay their sale in order to do so. This may adversely affect the Fund’s NAV.