ANNUAL REPORT

F E B R U A R Y 2 8 , 2 0 1 5

| Shareholder Letter | 1 |

| Portfolio Update | 3 |

| Disclosure of Fund Expenses | 5 |

| Portfolio of Investments | 6 |

| Statement of Assets and Liabilities | 10 |

| Statement of Operations | 12 |

| Statements of Changes in Net Assets | 13 |

| Statement of Cash Flows | 15 |

| Financial Highlights | |

| Class A | 16 |

| Class C | 17 |

| Class W | 18 |

| Class I | 19 |

| Class U | 20 |

| Class T | 21 |

| Class D | 22 |

| Notes to Financial Statements | 23 |

| Report of Independent Registered Public Accounting Firm | 30 |

| Additional Information | 31 |

| Trustees & Officers | 32 |

| Renewal of Advisory Agreements | 34 |

| Privacy Notice | 35 |

| Resource Real Estate Diversified Income Fund | Shareholder Letter |

| February 28, 2015 (Unaudited) |

Dear Shareholders:

We are pleased to present you with the Resource Real Estate Diversified Income Fund Annual Report for 2015. The Fund is an alternative real estate investment that seeks to deliver income and low volatility, with a liquidity feature. We are proud to report that the Fund continues to grow, and over the last year of operations we have delivered value to our shareholders by:

| ● | Providing our investors access to a diversified portfolio of both private and public real estate investments across the capital structure. |

| ● | Delivering a growing income yield. Our current annualized dividend represents a nearly 6%1 dividend yield. We have grown our dividend by 11% since our inception. |

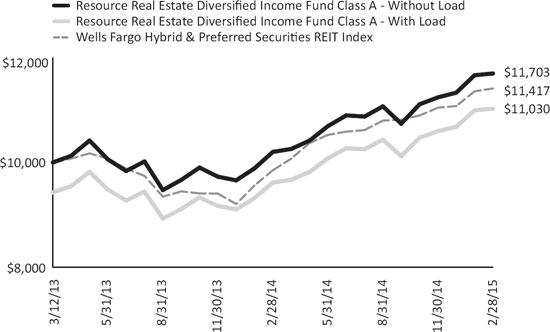

| ● | Providing total return and low volatility. During the fiscal year ended February 28, 2015, the Fund’s Class A share class produced a total return of 14.7% with low volatility of 5.4%. |

Investment Philosophy and Process

As the Fund’s adviser, Resource Real Estate, Inc. (the “Adviser”) has retained a consistent approach to investing our clients’ capital. Our investment focus remains on high quality real estate investments. Our investable universe broadly encompasses three main areas: Traded Equity (US and international REITs), Real Estate Credit (preferred REIT equity and bonds) and Direct Real Estate (including Private Equity and Non-traded REITs). Each investment type offers relative advantages. For instance, publicly traded REITs can offer higher levels of growth, liquidity and access to a more global opportunity set. Direct real estate can offer higher levels of capital stability and attractive income. Debt can offer higher security and income.

As the Adviser, our first decision is to determine the correct balance within the Fund among these three real estate investment types. We base this decision upon where we see the best relative value as well as the context of maintaining the Fund’s strategic objectives.2

Investment Environment and Fund Performance

The Fund benefitted this year from excellent performance from publicly traded REITs, which represented nearly 40% of our assets and globally returned well over 16%. We also saw strong performance from our private real estate investments, which produced over 11% returns. Our real estate credit investments provided steady performance, with nearly 4% return, and helped reduce the overall volatility of the portfolio. The Fund delivered on our key goal of providing an alternative investment return profile with less price volatility when compared to other equity investments including publicly traded REITs. Overall, we believe the Fund’s 14.7% total annual return shows the strength of our diversified investment strategy.

The U.S. economy continues to show that after a prolonged downturn, we are in the midst of a robust recovery, though we continue to observe that this is bifurcated, with major metro areas and coastal markets exhibiting the strongest fundamentals. While the medium-term outlook for real estate fundamentals is very attractive, we do believe the Federal Reserve will increase interest rates this year. In response to this, we are actively positioning the portfolio for the probability of some increase in short-term interest rates.

Investment Positioning

Our investment portfolio seeks to address the key challenges of producing current income today and at the same time being positioned for a changing environment. One of the primary changes we see ahead is the probability of higher short-term interest rates. To address this above, we have implemented the following:

We have reduced our exposure to the public markets, and have sold almost all of our international exposure, at profits, due to the stronger dollar. In addition, the Fund has chosen to focus its investments into real estate companies in sectors that will benefit the most from a rising interest rate environment. These include hotels, residential, international, central business district (“CBD”) office, and industrial. These asset classes tend to have shorter duration leases, thus reducing their sensitivity to interest rates.

As real estate credit investments have the potential to be the most sensitive to interest rates, as investments often have fixed rates, the Fund has made a larger allocation to investments with floating rate debt and shorter durations to decrease its interest rate sensitivity.

In our private real estate holdings, the Fund has reduced its exposure to non-traded REITs, as non-traded REITs tend to have heavy net lease exposure, or long duration leases with little to no rental increase. We have increased our allocation to private equity real estate, as these investments target prime assets in major metro markets, which tend to have a track record of rising rents and capital value growth.

The longer-term prognosis for real estate values is positively impacted by an improvement in economic growth, and we have positioned the Fund to potentially benefit from this growth, even in the event of rising interest rates. Overall, we believe that the macro environment provides attractive opportunities, given improving tenant demand and rental growth and moderate supply coming into the market.

| Annual Report | February 28, 2015 | 1 |

| Resource Real Estate Diversified Income Fund | Shareholder Letter |

| February 28, 2015 (Unaudited) |

Our focus remains on bottom up stock selection, so while macro changes have been have been helpful for the Fund’s investment results, our underlying positions can all be explained by their individual real estate market stories. Our belief is that at this point in the cycle, accessing companies with exposure to strong growth in intrinsic value is the best way to maximize returns. We believe that our approach will allow us to continue to deliver on our key investment objectives over the course of the next year and beyond.

Thank you for being a shareholder of the Resource Real Estate Diversified Income Fund.

Sincerely,

Scott Crowe

Global Portfolio Manager

Resource Real Estate Diversified Income Fund

| 1 | Because certain investments the Fund may make, including preferred and common equity investments, may generate dividends and other distributions to the Fund that are treated for tax purposes as a return of capital, a portion of the Fund’s ordinary cash distributions (and therefore a portion of the Fund’s ordinary cash distributions) may also be deemed to constitute a return of capital for tax purposes to the extent that the Fund may use such dividends or other distribution proceeds as a source of distributions. For the March 31, 2015 distribution, the dividend was comprised of approximately 12% of return of capital. |

| 2 | The Fund seeks to provide: 1) a growing income distribution above 5%; 2) diversification; 3) low volatility and 4) liquidity. |

| Resource Real Estate Diversified Income Fund | Notes to Financial Statements |

| | February 28, 2015 |

Resource Real Estate Diversified Income Fund (the “Trust” or the “Fund”) was organized as a Delaware statutory trust on August 1, 2012 and is registered under the Investment Company Act of 1940, as amended, (the “1940 Act”), as a diversified, closed-end management investment company that operates as an interval fund with a continuous offering of Fund shares. The Fund’s primary investment objective is to produce current income, with a secondary objective to achieve a long-term capital appreciation with moderate volatility and low to moderate correlation to the broader equity markets. The Fund pursues its investment objectives by investing, under normal circumstances, at least 80% of assets (defined in net assets plus the amount of any borrowing for investment purposes) in real estate and real estate related industry securities, primarily in income producing equity and debt securities.

The Fund currently offers Class A, Class C, Class W, Class I, Class U, Class T and Class D shares. Class A shares commenced operations on March 12, 2013, Class C and Class I shares commenced operations on August 1, 2014, Class W shares commenced operations on November 24, 2014 and Class U, Class T and Class D shares commenced operations on February 13, 2015. Class W, Class I and Class D shares are offered at net asset value. Class A and Class U shares are offered at net asset value plus a maximum sales charge of 6.50% and may also be subject to a 0.50% early withdrawal charge, which will be deducted from repurchase proceeds, for Shareholders tendering shares fewer than 365 days after the original purchase date, if (i) the original purchase was for amounts of $1 million or more and (ii) the selling broker received the reallowance of the dealer-manager fee. Class C and Class T shares are offered at net asset value plus a maximum sales charge of 1.50% and may also be subject to a 1.00% early withdrawal charge, which will be deducted from repurchase proceeds, for Shareholders tendering shares fewer than 365 days after the original purchase date. Each class represents an interest in the same assets of the Fund and classes are identical except for differences in their sales charge structures and ongoing service and distribution charges. All classes of shares have equal voting privileges except that each class has exclusive voting rights with respect to its service and/or distribution plans. The Fund’s income, expenses (other than class specific distribution fees) and realized and unrealized gains and losses are allocated proportionately each day based upon the relative net assets of each class.

| 2. SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Fund is considered an investment company for financial reporting purposes under GAAP. The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates.

Security Valuation – Securities listed on an exchange are valued at the last reported sale price at the close of the regular trading session of the exchange on the business day the value is being determined, or in the case of securities listed on NASDAQ at the NASDAQ Official Closing Price (“NOCP”). In the absence of a sale such securities shall be valued at the last bid price. Short-term investments that mature in 60 days or less may be valued at amortized cost, provided such valuations represent fair value.

When price quotations for certain securities are not readily available, or if the available quotations are not believed to be reflective of market value by Resource Real Estate, Inc. (the “Adviser”), those securities will be valued at “fair value” as determined in good faith by the Valuation Committee using procedures adopted by and under the supervision of the Fund’s Board of Trustees (the “Board”). There can be no assurance that the Fund could purchase or sell a portfolio security at the price used to calculate the Fund’s net asset value (NAV).

Fair valuation procedures may be used to value a substantial portion of the assets of the Fund. The Fund may use the fair value of a security to calculate its NAV when, for example, (1) a portfolio security is not traded in a public market or the principal market in which the security trades is closed, (2) trading in a portfolio security is suspended and not resumed prior to the normal market close, (3) a portfolio security is not traded in significant volume for a substantial period, or (4) the Adviser determines that the quotation or price for a portfolio security provided by a broker-dealer or independent pricing service is inaccurate.

The “fair value” of securities may be difficult to determine and thus judgment plays a greater role in the valuation process. The fair valuation methodology may include or consider the following guidelines, as appropriate: (1) evaluation of all relevant factors, including but not limited to, pricing history, current market level, supply and demand of the respective security; (2) comparison to the values and current pricing of securities that have comparable characteristics; (3) knowledge of historical market information with respect to the security; (4) other factors relevant to the security which would include, but not be limited to, duration, yield, fundamental analytical data, the Treasury yield curve, and credit quality.

| Annual Report | February 28, 2015 | 23 |

| Resource Real Estate Diversified Income Fund | Notes to Financial Statements |

| | February 28, 2015 |

Valuation of Private REITS – The Fund invests a significant portion of its assets in Private Real Estate Investment Trusts (“Private REITs”). The Private REITs measure their investment assets at fair value, and report a NAV per share on a calendar quarter basis. In accordance with Accounting Standards Codification (“ASC”) 820, the Fund has elected to apply the practical expedient and to value its investments in Private REITs at their respective NAVs at each quarter. For non-calendar quarter days, the Valuation Committee estimates the fair value of each Private REIT by adjusting the most recent NAV for each REIT, as necessary, by the change in a relevant benchmark that the Valuation Committee has deemed to be representative of the entire Private REIT market.

Valuation of Public Non-Traded REITS – The Fund invests a significant portion of its assets in Public Non-Traded Real Estate Investment Trusts (“Public Non-Traded REITs”). The Public Non-Traded REITs do not timely report periodic NAVs and therefore cannot be valued using the practical expedient. The Valuation Committee determines the fair value of Public Non-Traded REITs by considering various factors such as the most recent published NAV, the transaction price, secondary market trades, shareholder redemption and dividend reinvestment programs, discounted cash flows and potentially illiquidity discounts.

Fair Value Measurements – A three-tier hierarchy has been established to classify fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available. In accordance with the authoritative guidance on fair value measurements and disclosure under GAAP, the Fund discloses fair value of it’s investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value.

Various inputs are used in determining the value of the Fund’s investments as of the reporting period end. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 – | Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| Level 2 – | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability at the measurement date; and |

| Level 3 – | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

An investment level within the fair value hierarchy is based on the lowest level input, individually or in the aggregate, that is significant to fair value measurement. The valuation techniques used by the Fund to measure fair value during the year ended February 28, 2015 maximized the use of observable inputs and minimized the use of unobservable inputs.

| Resource Real Estate Diversified Income Fund | Notes to Financial Statements |

| | February 28, 2015 |

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk or liquidity associated with investing in those securities. The following is a summary of the inputs used in valuing the Fund’s investments as of February 28, 2015:

| Investments in Securities at Value | | Level 1 | | Level 2 | | Level 3 | | Total | |

| Bonds & Notes | | | | | | | | | |

| Asset Backed Securities | | $ | — | | $ | — | | $ | 3,019,775 | | $ | 3,019,775 | |

| Commercial Mortgage Backed Securities | | | — | | | 4,256,512 | | | — | | | 4,256,512 | |

Common Stocks(a) | | | 1,937,973 | | | — | | | — | | | 1,937,973 | |

| Preferred Stocks | | | 3,669,891 | | | — | | | — | | | 3,669,891 | |

| Real Estate Investment Trusts ‐ Common Stocks | | | | | | | | | | | | | |

| Public Non‐Traded Real Estate Investment Trusts | | | — | | | — | | | 4,361,669 | | | 4,361,669 | |

| Private Real Estate Investment Trusts | | | — | | | — | | | 6,036,072 | | | 6,036,072 | |

| Traded Real Estate Investment Trusts | | | 12,355,975 | | | — | | | — | | | 12,355,975 | |

| Short Term Investments | | | 1,436,169 | | | — | | | — | | | 1,436,169 | |

| TOTAL | | $ | 19,400,008 | | $ | 4,256,512 | | $ | 13,417,516 | | $ | 37,074,036 | |

(a) | For detailed descriptions, see the accompanying Portfolio of Investments. |

There were no transfers between Levels 1, 2 and 3 during the year ended February 28, 2015. It is the Fund’s policy to recognize transfers between levels at the end of the reporting period.

The following is a reconciliation of assets in which Level 3 inputs were used in determining value:

| Investments in Securities | | Balance

as of February 28, 2014 | | Accrued discount/

premium | | Realized

Gain/

(Loss) | | | Change in Unrealized

Appreciation | | Purchases | | Sales Proceeds | | | Transfer

into

Level 3 | | Transfer

out of

Level 3 | | Balance

as of February 28, 2015 | | Net change in unrealized appreciation/(depreciation) included

in the Statements

of Operations attributable to Level 3 investments

held at

February 28, 2015 | |

| Resource Real Estate Diversified Income Fund | | | | | | | | | | | | | | �� | | | | | | | | | |

| Bonds & Notes | | $ | — | | $ | 9,485 | | $ | (287 | ) | | $ | 73,195 | | $ | 2,937,659 | | $ | (277 | ) | | $ | — | | $ | — | | $ | 3,019,775 | | $ | 73,196 | |

Real Estate Investment

Trusts - Common

Stock | | | 1,451,820 | | | — | | | 2,880 | | | | 540,185 | | | 11,276,709 | | | (2,873,853 | ) | | | — | | | — | | | 10,397,741 | | | 540,620 | |

| Total | | $ | 1,451,820 | | $ | 9,485 | | $ | 2,593 | | | $ | 613,380 | | $ | 14,214,368 | | $ | (2,874,130 | ) | | $ | — | | $ | — | | $ | 13,417,516 | | $ | 613,816 | |

Significant unobservable valuation inputs for material Level 3 investments as of February 28, 2015, are as follows:

| | | Fair Value at 2/28/2015 | | Valuation Technique | Unobservable Input | Range (Weighted Average) |

| Asset Backed Securities | | $ | 3,019,775 | | Transaction Data | N/A | N/A |

| Private Real Estate | | | | | | | |

| Investment Trusts | | $ | 6,036,072 | | Net Asset Value adjusted as necessary for any changes in market conditions | N/A | N/A |

| Non-Traded Real Estate | | | | | | | |

| Investment Trusts | | $ | 4,361,669 | | Transaction Data | Secondary Market Prices | $5.00 - $10.10 |

| | | | | | Discounted Cash Flows | Weighting of Transaction Prices

by Volume(a) | 20% |

| | | | | | | Discounted Rate | 3% - 14% |

(a) | Represents amounts used when the reporting entity has determined that market participant would use such multiples when pricing the investments. |

| Annual Report | February 28, 2015 | 25 |

| Resource Real Estate Diversified Income Fund | Notes to Financial Statements |

| | February 28, 2015 |

A change to the unobservable input may result in a significant change to the value of the investment as follows:

| Unobservable Input | Impact to Value if Input Increases | Impact to Value if Input Decreases |

| Secondary Market Prices | Increase | Decrease |

| Weighting Transaction Prices by Volume | Increase | Decrease |

| Discounted Rate | Decrease | Increase |

Security Transactions and Investment Income – Investment security transactions are accounted for on a trade date basis. Cost is determined and gains and losses are based upon the specific identification method for both financial statement and federal income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on the accrual basis. Purchase discounts and premiums on securities are accreted and amortized over the life of the respective securities.

Federal and Other Taxes – No provision for income taxes is included in the accompanying financial statements, as the Fund intends to distribute to shareholders all taxable investment income and realized gains and otherwise comply with Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies.

The Fund evaluates tax positions taken (or expected to be taken) in the course of preparing the Fund’s tax provisions to determine whether these positions meet a “more-likely-than-not” standard that, based on the technical merits, have a more than fifty percent likelihood of being sustained by a taxing authority upon examination. A tax position that meets the “more-likely-than-not” recognition threshold is measured to determine the amount of benefit to recognize in the financial statements.

For the open tax year ended 2014, and as of and during the year ended February 28, 2015, the Fund did not have a liability for any unrecognized tax benefits. The Fund files U.S. federal, state, and local tax returns as required. The Fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations which is generally three years after the filing of the tax return for federal purposes and four years for most state returns. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

Foreign Currency – The accounting records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency, and income receipts and expense payments are translated into U.S. dollars using the prevailing exchange rate at the London market close. Purchases and sales of securities are translated into U.S. dollars at the contractual currency rates established at the approximate time of the trade. Net realized gains and losses on foreign currency transactions represent net gains and losses from currency realized between the trade and settlement dates on securities transactions and the difference between income accrued versus income received. The effects of changes in foreign currency exchange rates on investments in securities are included with the net realized and unrealized gain or loss on investment securities.

Distributions to Shareholders – Distributions from investment income are declared and paid quarterly. Distributions from net realized capital gains, if any, are declared and paid annually and are recorded on the ex-dividend date. The character of income and gains to be distributed is determined in accordance with income tax regulations, which may differ from GAAP.

Indemnification – The Trust indemnifies its officers and Trustees for certain liabilities that may arise from the performance of their duties to the Trust. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on industry experience, the Trust expects the risk of loss due to these warranties and indemnities to be remote.

| 3. ADVISORY FEES AND OTHER RELATED PARTY TRANSACTIONS |

Advisory Fees – Pursuant to an investment advisory agreement (the “Advisory Agreement”), investment advisory services are provided to the Fund by the Adviser. Under the terms of the Advisory Agreement, the Adviser receives monthly fees calculated at an annual rate of 1.25% of the average daily net assets of the Fund.

| Resource Real Estate Diversified Income Fund | Notes to Financial Statements |

| | February 28, 2015 |

The Adviser has contractually agreed to waive all or part of its management fees and/or make payments to limit Fund expenses, (including all organization and offering expenses, but excluding interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) at least until February 28, 2016, so that the total annual operating expenses of the Fund do not exceed 1.99% per annum of Class A average daily net assets, 2.74% per annum of Class C average daily net assets, 2.49% per annum of Class W average daily net assets, 1.74% per annum of Class I average daily net assets, 1.99% per annum of Class U and average daily net assets, 2.74% per annum of Class T average daily net assets and 2.49% per annum of Class D average daily net assets. Fee waivers and expense payments may be recouped by the Adviser from the Fund, to the extent that overall expenses fall below the expense limitation, within three years of when the amounts were waived or reimbursed. During the year ended February 28, 2015, the Adviser waived fees and reimbursed expenses of $431,960, all of which are available to be recouped by the Adviser until February 28, 2018. During the period ended February 28, 2014, the Adviser waived fees and reimbursed expenses of $343,290, all of which are available to be recouped by the Adviser until February 28, 2017. The Adviser waived fees and reimbursed expenses of $28,487 from the seed audit which are available to be recouped by the Adviser until March 8, 2016.

Fund Accounting Fees and Expenses – Effective November 4, 2014 ALPS Fund Services, Inc. (“ALPS”) serves as the Fund’s Administrator and Accounting Agent (the “Administrator”). The Administrator receives the following fees: for administrative, fund accounting, legal and tax administration services: 0.08% for up to $250 million in annual net assets, 0.06% for $250 million to $500 million in annual net assets, and 0.03% for $500 million or more in annual net assets, provided that the Administrator shall receive a first year minimum annual fee of $125,000 and a second year and thereafter minimum fee of $145,000. The Administrator is also reimbursed by the Fund for certain out of pocket expenses.

Prior to November 4, 2014 the Fund paid Gemini Fund Services, LLC (“GFS”), customary fees for providing administration and fund accounting services to the Fund. In addition, certain affiliates of GFS provided ancillary services to the Fund as follows:

Gemcom, LLC (“Gemcom”) - Gemcom, an affiliate of GFS, provided EDGAR conversion and filing services as well as print management services for the Fund on an ad-hoc basis. For the provision of these services, Gemcom received customary fees from the Fund.

Transfer Agent – Effective October 6, 2014, DST Systems Inc., an affiliate of ALPS, serves as transfer, dividend paying and shareholder servicing agent for the Fund (“Transfer Agent”).

Prior to October 6, 2014 the Fund paid GFS customary fees for providing transfer agent services to the Fund.

Distributor – Effective November 4, 2014, the Fund entered into a Distribution Agreement with ALPS Distributors, Inc. (the “Distributor”) to provide distribution services to the Fund. There are no fees paid to the Distributor pursuant to the Distribution Agreement. The Board has adopted, on behalf of the Fund, a Shareholder Services Plan under which the Fund may compensate financial industry professionals for providing ongoing services in respect of clients with whom they have distributed shares of the Fund. Under the Shareholder Services Plan, the Fund’s Class A, Class C, Class W, Class U, Class T and Class D shares are subject to a shareholder servicing fee at an annual rate of 0.25% of the average daily net assets attributable to that share class. For the year ended February 28, 2015, the Fund incurred shareholder servicing fees of $41,857. The Class C and Class T shares also pay to the Distributor a distribution fee that accrues at an annual rate equal to 0.75% of the Fund’s average daily net assets attributable to Class C and Class T shares and is payable on a quarterly basis. In addition Class W and Class D shares pay to Resource Securities, Inc. (the “Dealer Manager”), an affiliate of the Adviser, a dealer manager fee that accrues at an annual rate equal to 0.50% of the Fund’s average daily net assets attributable to Class W and Class D shares and is payable on a quarterly basis. Class A, Class I, and Class U shares are not currently subject to a distribution fee. For the year ended February 28, 2015, the Fund accrued $7,422 in distribution fees and $132 in dealer manager fees.

The Distributor acts as the Fund’s principal underwriter in a continuous public offering of the Fund’s shares. The Distributor is an affiliate of ALPS. During the year ended February 28, 2015, no fees were retained by the Distributor.

Prior to November 4, 2014, the distributor of the Fund was Northern Lights Distributors, LLC. The Board of Trustees had adopted, on behalf of the Fund, a Shareholder Services Plan under which the Fund compensated financial industry professionals for providing ongoing services in respect of clients with whom they had distributed shares of the Fund.

Trustees – Effective November 21, 2014, each Trustee who is not affiliated with the Trust or Adviser will receive an annual fee of $10,000, plus $2,000 for attending the annual in‐person meeting of the Board of Trustees, plus $500 for attending each of the remaining telephonic meetings, as well as reimbursement for any reasonable expenses incurred attending the meetings. None of the executive officers receive compensation from the Trust. Prior to November 21, 2014, each Trustee who was not affiliated with the Trust or Adviser received an annual fee of $5,000, as well as reimbursement for any reasonable expenses incurred attending the meetings.

| 4. INVESTMENT TRANSACTIONS |

The cost of purchases and proceeds from the sale of securities, other than short-term securities, for the year ended February 28, 2015 amounted to $46,888,365 and $17,790,807, respectively.

| Annual Report | February 28, 2015 | 27 |

| Resource Real Estate Diversified Income Fund | Notes to Financial Statements |

| | February 28, 2015 |

For the year ended February 28, 2015, the following reclassifications, which had no impact on results of operations or net assets, were recorded to reflect tax character.

| | | | Paid-in Capital | | | Accumulated Net Investment Income | | | Accumulated Net Realized Loss on Investments | |

| Resource Real Estate Diversified Income Fund | | | $ | – | | | $ | 203,875 | | | $ | (203,875 | ) |

The tax character of distributions paid for the periods ended February 28, 2015 and February 28, 2014 were as follows:

| 2015 | | Ordinary Income | | | | | | Return of Capital | |

| Resource Real Estate Diversified Income Fund | | $ | 817,261 | | | $ | 15,057 | | | $ | 111,438 | |

| 2014 | | Ordinary Income | | | | | | Return of Capital | |

| Resource Real Estate Diversified Income Fund | | $ | 55,211 | | | $ | 4,407 | | | $ | 7,984 | |

As of February 28, 2015, the components of accumulated earnings/ (deficit) on a tax basis were as follows:

| Undistributed ordinary income | | $ | – | |

| Accumulated capital losses | | | (81,647 | ) |

| Net unrealized appreciation on investments | | | 1,625,609 | |

| Total distributable earnings | | $ | 1,543,962 | |

The Fund elects to defer to the period ending February 28, 2016, capital losses recognized during the period November 1, 2014 to February 28, 2015 in the amount of:

| Fund | | Capital Losses Recognized | |

| Resource Real Estate Diversified Income Fund | | $ | 81,647 | |

The following information is computed on a tax basis for each item as of February 28, 2015:

| | | | Gross

Appreciation (excess of value over tax cost) | | Gross

Depreciation (excess of tax cost over value) | | | Net Depreciation of Foreign Currency | | | Net Unrealized Appreciation | | | Cost of

Investments for Income Tax Purposes | |

| Resource Real Estate Diversified Income Fund | | | $ | 1,862,952 | | | $ | (235,180 | ) | | $ | (2,163 | ) | | $ | 1,625,609 | | | $ | 35,446,264 | |

The difference between book basis and tax basis distributable earnings and unrealized appreciation/(depreciation) is primarily attributable to the tax deferral of losses on wash sales, mark-to-market on passive foreign investment companies and certain other investments.

Pursuant to Rule 23c-3 under the Investment Company Act of 1940, as amended (the “1940 Act”), the Fund offers shareholders on a quarterly basis the option of redeeming shares, at net asset value, of up to 5% of its issued and outstanding shares as of the close of regular business hours on the New York Stock Exchange on the Repurchase Pricing Date (defined below). If shareholders tender for repurchase more than 5% of the outstanding shares of the Fund, the Fund may, but is not required to, repurchase up to an additional 2%. If the Fund determines not to repurchase an additional 2%, or if more than 7% of the shares are tendered, then the Fund will repurchase shares on a pro rata basis based upon the number of shares tendered by each shareholder. There can be no assurance that the Fund will be able to repurchase all shares that each shareholder has tendered, even if all the shares in a shareholder's account are tendered. In the event of an oversubscribed offer, you may not be able to tender all shares that you wish to tender and may have to wait until the next quarterly repurchase offer to tender the remaining shares. Subsequent repurchase requests will not be given priority over other shareholder requests.

| Resource Real Estate Diversified Income Fund | Notes to Financial Statements |

| | February 28, 2015 |

During the year ended February 28, 2015, the Fund completed four quarterly repurchase offers. In these offers, the Fund offered to repurchase up to 5% of the number of its outstanding shares as of the Repurchase Pricing Dates. The result of those repurchase offers were as follows:

| | | Repurchase Offer #1 | | Repurchase Offer #2 | | Repurchase Offer #3 | | Repurchase Offer #4 |

| Commencement Date | | March 14, 2014 | | June 17, 2014 | | September 17, 2014 | | December 17, 2014 |

| Repurchase Request Deadline | | April 16, 2014 | | July 17, 2014 | | October 17, 2014 | | January 16, 2015 |

| Repurchase Pricing Date | | April 16, 2014 | | July 17, 2014 | | October 17, 2014 | | January 16, 2015 |

| Amount Repurchased | | $60,253 | | $38,058 | | $289,907 | | $936,731 |

| Shares Repurchased | | 6,205 | | 3,750 | | 29,224 | | 89,067 |

The Fund has a secured $25,000,000 bank line of credit through BNP Paribas Prime Brokerage International, Ltd. (“the Bank”) for purpose of investment purchases subject to the limitations of the 1940 Act for borrowings.

The Fund has until June 1, 2015 to pay back the line of credit. Borrowings under this arrangement bear interest at the Bank’s 3 month LIBOR plus 95 basis points at the time of borrowing. During the year ended February 28, 2015, the Fund incurred $49,840 of interest expense related to the borrowings. Average borrowings and the average interest rate during the year ended February 28, 2015 were $4,038,784 and 1.19%, respectively. The largest outstanding borrowing during the year ended February 28, 2015 was $6,900,655. As of February 28, 2015, the Fund had $5,187,850 of outstanding borrowings.

As collateral security for the Bank line of credit, the Fund grants the Bank a first position security interest in and lien on all securities of any kind or description held by the Fund in the pledge account. As of February 28, 2015, the Fund had $16,127,603 in securities pledged as collateral for the line of credit.

Subsequent events after the date of the Statement of Assets and Liabilities have been evaluated through the date the financial statements were issued.

Distributions: The Funds’ Board of Trustees declared the following distributions:

| Fund | Dividend Per Share | Record Date | Payable Date |

| Resource Real Estate Diversified Income Fund – Class A | 0.15000 | March 27, 2015 | March 30, 2015 |

| Resource Real Estate Diversified Income Fund – Class C | 0.13125 | March 27, 2015 | March 30, 2015 |

| Resource Real Estate Diversified Income Fund – Class W | 0.13750 | March 27, 2015 | March 30, 2015 |

| Resource Real Estate Diversified Income Fund – Class U | 0.15000 | March 27, 2015 | March 30, 2015 |

| Resource Real Estate Diversified Income Fund – Class T | 0.13125 | March 27, 2015 | March 30, 2015 |

| Resource Real Estate Diversified Income Fund – Class D | 0.13750 | March 27, 2015 | March 30, 2015 |

The Fund completed a quarterly repurchase offer on April 15, 2015 which resulted in 34,908 of Fund shares being repurchased for $361,760.

Management has determined that there were no other subsequent events to report through the issuance of these financial statements.

| Annual Report | February 28, 2015 | 29 |