UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-22749

(Investment Company Act file number)

Resource Real Estate Diversified Income Fund

(Exact name of registrant as specified in charter)

One Crescent Drive, Suite 203

Philadelphia, PA 19103

(Address of principal executive offices) (Zip code)

Shelle Weisbaum

Resource Real Estate, Inc.

1845 Walnut Street, 18th Floor

Philadelphia, PA 19103

(Name and address of agent for service)

Copy to:

ALPS Fund Services, Inc.

1290 Broadway, Suite 1100

Denver, CO 80203

Registrant's telephone number, including area code: (215) 231-7050

Date of fiscal year end: September 30

Date of reporting period: October 1, 2015 – September 30, 2016

Item 1. Reports to Stockholders.

| Shareholder Letter | 1 |

| Portfolio Update | 3 |

| Portfolio of Investments | 5 |

| Statement of Assets and Liabilities | 11 |

| Statement of Operations | 13 |

| Statements of Changes in Net Assets | 14 |

| Statements of Cash Flows | 17 |

| Financial Highlights | |

| Class A | 18 |

| Class C | 19 |

| Class W | 20 |

| Class I | 21 |

| Class U | 22 |

| Class T | 23 |

| Class D | 24 |

| Notes to Financial Statements | 25 |

| Report of Independent Registered Public Accounting Firm | 35 |

| Additional Information | 36 |

| Trustees & Officers | 38 |

| Privacy Notice | 40 |

| Resource Real Estate Diversified Income Fund | Shareholder Letter |

September 30, 2016 (Unaudited)

Dear Shareholders:

We are pleased to present you with the Resource Real Estate Diversified Income Fund (the “Fund”) Annual Report for the 2016 fiscal year. We are also proud to report that the Fund continued to grow, and over the last six months of operations we have continued to deliver value to shareholders by:

| ● | Providing our investors access to a diversified portfolio of both private and public real estate investments across the capital structure. |

| ● | Delivering a consistent distribution rate. As of the quarter ended September 30, 2016, our annualized distribution rate on the Class A share was 5.87%1. We have paid a consistent distribution for 14 straight quarters. |

| ● | Providing total return and low volatility. The Fund continued to experience significantly lower volatility than publicly traded REIT indices1. |

Investment Philosophy and Process

As the Fund’s Advisor, Resource Real Estate has maintained a consistent approach to investing the Fund’s capital. Our investment focus remains exclusively on high quality real estate investments. Our investable universe broadly encompasses three main strategies: Traded Equity (US and international REITs), Real Estate Credit (preferred REIT equity and bonds) and Direct Real Estate (including Private Equity and Non‐traded REITs). Each investment type offers relative advantages. For instance, publicly traded REITs offer higher levels of growth and liquidity. Direct real estate offers higher levels of capital stability and attractive income. Real estate credit can offer higher security and income.

As the Advisor, our first decision is to determine the appropriate balance within the Fund among these three real estate investment strategies. We base this decision upon where we see the best relative value in the context of achieving the Fund’s strategic objectives.

Investment Environment

The second half of the Fund’s fiscal year was generally characterized by stability in the financial markets as global macro concerns regarding China and the commodities markets faded. Consistent job creation averaging 174,500 per month over the six month period was a key factor in restoring investor faith in a slow growth economic trajectory. During the same time, credit spreads on the Bank of America Merrill Lynch US High Yield Index also tightened by approximately 200 basis points (bps) as another indicator of investor confidence. Our investment thesis assumes a modest rise in interest rates towards the end of 2016 and into 2017 as excess capacity is gradually absorbed.

The US real estate markets also continued to deliver solid results over the second half of the Fund’s fiscal year. While there were exceptions, US REITs mostly reported consistent earnings growth, with net operating income for the industry up nearly 7% year over year as of September 30, 20162. As a result, after rallying by more than 10% in March, the NAREIT index generated an additional total return of over 6% during the second half of the Fund’s fiscal year.

Notwithstanding strong performance overall, some cautionary signs emerged during this time. Especially in gateway markets such as San Francisco, Los Angeles, Boston, New York and Miami, the supply of high end apartment buildings, office buildings and hotels has increased in a manner that could dampen growth in rents. For example, annual office supply growth in the Bay Area is above the national average of 1.5%, while leasing velocity and has slowed compared to 2014 and 2015 and job growth fell below 3% for the first time since 2011. Retail, especially second tier malls, also remain under pressure due to shifting consumer preferences and the shift towards online shopping.

Fund Performance

The Fund was well positioned relative to market conditions over the past six months and continued delivering on its objectives of providing attractive current income and lower volatility than the broader equity markets for its shareholders. Through the end of September 2016, the Fund has paid a consistent distribution for 14 straight quarters1, which corresponded to an annualized rate of 5.87% for the most recent quarter ended September 30, 2016. In addition, for the six months ended September 30, 2016, the Fund’s volatility (as measured by standard deviation) was 6.54% compared to 11.92% for the S&P500 and 14.18% for the NAREIT index.

The Fund had a total return of 9.76% for the second half of the fiscal year as all three of the Fund’s primary investment strategies advanced. Rising values in the Traded Equity strategy was the primary driver of performance. Private Equity funds within the Direct Real Estate Strategy and REIT Preferreds within the Real Estate Credit strategy also made material contributions to the aggregate result.

Investment Positioning

Aside from a few market hiccups driven by external factors such as Brexit4, the US real estate securities markets remained buoyant during the second half of the Fund’s fiscal year. In fact, solid second quarter earnings paired with a benevolent rates outlook drove the NAREIT to a ten year high in August.

| Annual Report | September 30, 2016 | 1 |

| Resource Real Estate Diversified Income Fund | Shareholder Letter |

September 30, 2016 (Unaudited)

The Fund benefitted from this strong market but also took advantage of market conditions to enhance positioning for the future. As valuations rose, we reduced the Fund’s exposure to real estate public and private equity while increasing exposure to real estate credit securities. These credit positions, such as REIT preferred securities, are more senior in the capital structure and should be less exposed to a deceleration of growth in earnings while still providing an attractive yield.

Within the public equity portfolio, we also took advantage of market conditions to exit some larger capitalization and more expensive positions in favor of smaller companies with higher yields and lower multiples to NAV. We especially sought to limit our exposure to those companies with concentrations in high end apartments and offices in gateway markets.

Finally, we remain vigilant regarding interest rates. While inflation in the US remains below 2%, there have been some nascent indications of firming in the global economy and the trend for interest rates is uncertain. We know that a sudden movement can have a dramatic impact on income oriented investments such as real estate and continue to take steps to insulate the Fund’s portfolio. In addition to reducing the portfolio’s weighting to public equities, we employ a number of strategies to hedge our exposure to interest rates such as investing in shorter tenors within our credit portfolio and buying REITs with floating rate exposure.

Our focus remains on providing current income and lower volatility by appropriately balancing our portfolio across private real estate equity, public real estate equity and real estate credit. At the same time, our commitment to thorough fundamental research enhances our security selection within each of those three strategies. In combination, we believe that our approach will allow us to continue to deliver on our key investment objectives over the course of the next year and beyond.

Thank you for being a shareholder of the Resource Real Estate Diversified Income Fund.

Sincerely,

John Snowden

Global Portfolio Manager

Resource Real Estate Diversified Income Fund

1 | Volatility for the Resource Real Estate Diversified Income Fund was 8.19% for the year ending September 30, 2016, as compared to 16.08% for the FTSE NAREIT U.S. Real Estate Index Series. |

2 | NAREIT T-Tracker Q3 2016 report |

3 | The FTSE NAREIT U.S. Real Estate Index Series (FNERTR) is designed to present investors with a comprehensive family of REIT performance indexes that spans the commercial real estate space across the U.S. economy. |

4 | Brexit is an abbreviation for "British exit," which refers to the June 23, 2016, referendum whereby British citizens voted to exit the European Union. |

To calculate the quarterly distribution, the Fund’s management will take the income received from the Fund’s portfolio, subtract expenses and divide the result by the total number of shares the Fund’s investors own. The annualized distribution represents a single distribution from the Fund and does not represent the total returns of the Fund. A portion of our distribution has been comprised of a return of capital because certain Fund investments have included preferred and common equity investments, which may include a return of capital. Distributions are not guaranteed.

Bank of America Merrill Lynch U.S. High Yield Index (H0A0) tracks the performance of U.S. dollar denominated below investment grade corporate debt publicly issued in the U.S. domestic market. One cannot directly invest in an index.

A basis point is a unit of measure that is equal to 1/100th of 1%.

| Resource Real Estate Diversified Income Fund | Portfolio Update |

September 30, 2016 (Unaudited)

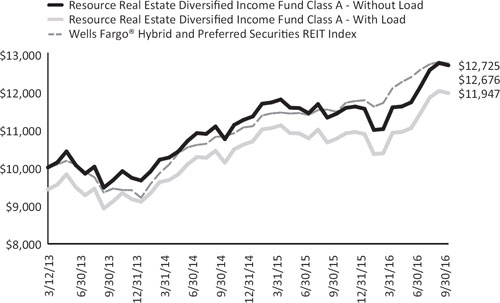

The Fund’s performance figures for the periods ended September 30, 2016*, compared to its benchmark:

| Resource Real Estate Diversified Income Fund | 6 Month** | 1 Year | 3 Year | Since Inception | Inception |

| Class A Shares – Without Load | 9.51% | 11.09% | 9.45% | 6.90% | 3/12/2013 |

| Class A Shares – With Load | 2.40% | 3.89% | 7.32% | 5.13% | 3/12/2013 |

| Class C Shares – Without Load | 9.00% | 10.15% | – | 6.60% | 8/1/2014 |

| Class C Shares – With Load | 7.33% | 8.50% | – | 5.87% | 8/1/2014 |

| Class W Shares | 9.14% | 10.46% | – | 6.57% | 11/21/2014 |

| Class I Shares | 8.67% | 10.12% | – | 6.73% | 8/1/2014 |

Class U Shares – Without Load 1 | 9.51% | 10.98% | – | 4.71% | 2/12/2015 |

| Class U Shares – With Load | 2.40% | 3.79% | – | 0.51% | 2/12/2015 |

Class T Shares – Without Load 2 | 9.01% | 10.05% | – | 3.81% | 2/12/2015 |

| Class T Shares – With Load | 7.34% | 8.39% | – | 2.86% | 2/12/2015 |

Class D Shares3 | 9.14% | 10.35% | – | 4.17% | 2/12/2015 |

Wells Fargo® Hybrid and Preferred Securities REIT Index | 5.38% | 11.06% | 10.44% | 7.02% | 3/12/2013 |

| * | Returns for periods greater than one year are annualized. |

| ** | Returns shown are for the period, April 1, 2016 to September 30, 2016 and include adjustments in accordance with accounting principles generally accepted in the United States of America. |

| 1 | Returns shown prior to 2/12/2015 are based on the returns of RREDX Class A Shares. If Class U Shares had been available during periods prior to 2/12/2015, the performance shown may have been different. |

| 2 | Returns shown prior to 2/12/2015 are based on the returns of CRREX Class C Shares. If Class T Shares had been available during periods prior to 2/12/2015, the performance shown may have been different. |

| 3 | Returns shown prior to 2/12/2015 are based on the returns of WRREX Class W Shares. If Class D Shares had been available during periods prior to 2/12/2015, the performance shown may have been different. |

The Wells Fargo® Hybrid and Preferred Securities REIT (“WHPSR”) Index is designed to track the performance of preferred securities issued in the U.S. market by real estate investment trusts. The WHPSR Index is composed exclusively of preferred shares and depositary shares. Investors cannot invest directly in an index.

Past performance is not predictive of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. Performance figures for periods greater than one year are annualized. The Fund’s total annual operating expense, including underlying funds before fee waivers is 3.30% for Class A, 4.05% for Class C, 3.80% for Class W, 3.05% for Class I, 3.30% for Class U, 4.05% for Class T and 3.80% for Class D shares per the most recent Class specific prospectus filings. After fee waivers, the Fund’s total annual operating expense is 2.24% for Class A, 2.99% for Class C, 2.74% for Class W, 1.99% for Class I, 2.24% for Class U, 2.99% for Class T and 2.74% for Class D shares. Class A and Class U shares are subject to a maximum sales load of 6.50% imposed on purchases. Class T shares are subject to a maximum sales load of 1.50% imposed on purchases. For performance information current to the most recent month-end, please call toll-free 1-855-747-9559.

| Annual Report | September 30, 2016 | 3 |

| Resource Real Estate Diversified Income Fund | Portfolio Update |

September 30, 2016 (Unaudited)

Comparison of the Change in Value of a $10,000 Investment

Portfolio Composition as of September 30, 2016

| Asset Type | Percent of Net Assets |

| Real Estate Investment Trusts - Common Stocks | 82.43% |

| Real Estate Investment Trusts - Preferred Stocks | 25.68% |

| Bonds & Notes | 16.44% |

| Private Investment Funds | 1.49% |

| Common Stock | 1.00% |

| Short Term Investments | 0.61% |

| Purchased Options | 0.53% |

| Total Investments | 128.18% |

| Liabilities in Excess of Other Assets | -28.18% |

| Net Assets | 100.00% |

| Resource Real Estate Diversified Income Fund | Portfolio of Investments |

September 30, 2016

| Principal ($) | | | | Value | |

| | | BONDS & NOTES (16.44%) | | | |

| | | ASSET BACKED SECURITIES (1.57%) | | | |

| | 1,750,000 | | ACA CLO 2007-1, Ltd., 0.000% 06/15/2022(a)(b) | | $ | 384,324 | |

| | 2,000,000 | | Z Capital Credit Partners CLO 2015-1, Ltd., 6.649% 07/16/2027(c) | | | 1,822,556 | |

| | | | | | | 2,206,880 | |

| | | | COMMERCIAL MORTGAGE BACKED SECURITIES (14.87%) | | | | |

| | 200,000 | | Banc of America Commercial Mortgage Trust 2006-4, 5.734% 07/10/2046(c)(d) | | | 187,790 | |

| | 2,160,000 | | Banc of America Commercial Mortgage Trust 2007-3, 5.723% 06/10/2017(c) | | | 2,156,744 | |

| | 320,000 | | CD 2007-CD5 Mortgage Trust, 6.320% 11/15/2017(c) | | | 318,998 | |

| | 32,093 | | Commercial Mortgage Trust 2005-GG5, 5.644% 04/10/2037(c)(d) | | | 32,071 | |

| | 1,000,000 | | Commercial Mortgage Trust 2006-C8, 5.377% 12/10/2016 | | | 977,502 | |

| | 4,100,000 | | Commercial Mortgage Trust 2007-C9, 6.007% 07/10/2017(a)(c) | | | 3,865,131 | |

| | 1,445,817 | | EuroProp EMC SA 2006-4, Class A, 8.000% 04/30/2013(c)(e) | | | 1,843,421 | |

| | 2,973,248 | | EuroProp EMC SA 2006-4, Class B, 8.000% 04/30/2013(c)(e) | | | 334,000 | |

| | 649,218 | | EuroProp EMC SA 2006-6, Class B, 0.000% 04/30/2017(b) | | | 520,537 | |

| | 2,200,000 | | Hypo Real Estate Bank International AG, 0.596% 03/20/2022(c) | | | 270,896 | |

| | 1,000,000 | | JP Morgan Chase Commercial Mortgage Securities Trust 2005-LDP5, 5.735% 12/15/2044(c) | | | 994,032 | |

| | 40,353 | | JP Morgan Chase Commercial Mortgage Securities Trust 2006-LDP6, 5.844% 04/15/2043(c) | | | 40,331 | |

| | 2,000,000 | | JP Morgan Chase Commercial Mortgage Securities Trust 2007-CIBC20, 6.285% 09/12/2017(c) | | | 2,000,915 | |

| | 3,000,000 | | JP Morgan Chase Commercial Mortgage Securities Trust 2007-LD12, 6.207% 08/15/2017(c) | �� | | 2,734,011 | |

| | 300,000 | | LB-UBS Commercial Mortgage Trust 2007-C1, 5.514% 02/15/2040 | | | 299,729 | |

| | 500,000 | | Morgan Stanley Capital I Trust 2006-HQ8, 5.591% 03/12/2044(c) | | | 457,072 | |

| | 1,700,000 | | Morgan Stanley Capital I Trust 2007-HQ11, 5.538% 02/12/2044(c)(d) | | | 1,571,716 | |

| | 2,000,000 | | Wachovia Bank Commercial Mortgage Trust 2006- C25, 6.010% 05/15/2043(c) | | | 1,995,099 | |

| | 250,000 | | Wachovia Bank Commercial Mortgage Trust 2007- C31, 5.660% 04/15/2017(c) | | | 250,404 | |

| | | | | | | 20,850,399 | |

| | | | TOTAL BONDS & NOTES (Cost $25,748,554) | | | 23,057,279 | |

| Shares | | | | | | |

| | | | COMMON STOCKS (1.00%) | | | | |

| | | | BUSINESS DEVELOPMENT COMPANIES (1.00%) | | | | |

| | 59,315 | | Ares Capital Corp.(d) | | | 919,383 | |

| | 34,583 | | New Mountain Finance Corp.(d) | | | 475,862 | |

| | | | | | | 1,395,245 | |

| | | | TOTAL COMMON STOCKS (Cost $1,495,590) | | | 1,395,245 | |

See Notes to Financial Statements.

| Annual Report | September 30, 2016 | 5 |

| Resource Real Estate Diversified Income Fund | Portfolio of Investments |

September 30, 2016

| Shares | | | | Value | |

| | | PREFERRED STOCKS (25.68%) | | | |

| | | REAL ESTATE INVESTMENT TRUSTS (25.68%) | | | |

| | 44,000 | | American Homes 4 Rent, Series E, 6.350%(d) | | $ | 1,142,240 | |

| | 118,328 | | Annaly Capital Management, Inc., Series D, 7.500%(d) | | | 2,987,782 | |

| | 60,000 | | Ares Management LP, Series A, 7.000%(d) | | | 1,560,000 | |

| | 122,984 | | ARMOUR Residential REIT, Inc., Series B, 7.875%(d) | | | 2,858,148 | |

| | 120,000 | | City Office REIT, Inc., Series A, 6.625% | | | 2,978,400 | |

| | 70,953 | | Colony Capital, Inc., Series C, 7.125%(d) | | | 1,758,215 | |

| | 9,820 | | Digital Realty Trust, Inc., Series H, 7.375%(d) | | | 269,952 | |

| | 10,305 | | Digital Realty Trust, Inc., Series F, 6.625%(d) | | | 266,178 | |

| | 132,095 | | Five Oaks Investment Corp., 8.750%(c)(d) | | | 3,135,935 | |

| | 57,000 | | Gladstone Commercial Corp., Series D, 7.000%(d) | | | 1,447,230 | |

| | 100,000 | | Monmouth Real Estate Investment Corp., Series C, 6.125%(d) | | | 2,585,000 | |

| | 55,316 | | New York Mortgage Trust, Inc., Series C, 7.875%(d) | | | 1,301,032 | |

| | 36,497 | | NorthStar Realty Finance Corp., Series D, 8.500%(d) | | | 939,433 | |

| | 121,289 | | NorthStar Realty Finance Corp., Series E, 8.750% | | | 3,092,870 | |

| | 20,700 | | NorthStar Realty Finance Corp., Series C, 8.875%(d) | | | 528,471 | |

| | 17,464 | | Pennsylvania Real Estate Investment Trust, Series B, 7.375%(d) | | | 455,548 | |

| | 10,672 | | PS Business Parks, Inc., Series S, 6.450%(d) | | | 271,602 | |

| | 10,127 | | Retail Properties of America, Inc., Series A, 7.000%(d) | | | 261,783 | |

| | 120,000 | | Sotherly Hotels, Inc., Series B, 8.000%(d) | | | 3,150,000 | |

| | 25,000 | | STAG Industrial, Inc., Series C, 6.875%(d) | | | 673,000 | |

| | 7,391 | | STAG Industrial, Inc., Series A, 9.000%(d) | | | 185,958 | |

| | 34,000 | | UMH Properties, Inc., Series B, 8.000%(d) | | | 940,100 | |

| | 6,173 | | Washington Prime Group, Inc., Series I, 6.875%(d) | | | 161,980 | |

| | 120,000 | | Wheeler Real Estate Investment Trust, Inc., Series D, 8.750% | | | 3,060,000 | |

| | | | | | | 36,010,857 | |

| | | | TOTAL PREFERRED STOCKS (Cost $33,982,521) | | | 36,010,857 | |

| | | | | | | | |

| | | | REAL ESTATE INVESTMENT TRUSTS - COMMON STOCKS (82.43%) | | | | |

| | | | PUBLIC NON-TRADED REAL ESTATE INVESTMENT TRUSTS (9.22%)(f) | | | | |

| | 2,981 | | American Realty Capital Healthcare Trust II(g) | | | 65,075 | |

| | 4,839 | | Cole Credit Property Trust IV, Inc.(g) | | | 44,806 | |

| | 164,930 | | Cole Real Estate Income Strategy (Daily NAV), Inc., Class I | | | 3,029,761 | |

| | 37,823 | | Corporate Property Associates 18 Global, Inc., Class A(g) | | | 295,395 | |

| | 191,111 | | Corporate Property Associates 18 Global, Inc., Class C(g) | | | 1,496,400 | |

| | 30,292 | | Dividend Capital Diversified Property Fund | | | 226,588 | |

| | 446,837 | | Highlands REIT, Inc.(g) | | | 160,861 | |

| | 446,837 | | InvenTrust Properties Corp.(g) | | | 1,523,715 | |

| | 265,355 | | Jones Lang LaSalle Income Property Trust, Inc. | | | 2,985,239 | |

| | 321,623 | | NorthStar Healthcare Income, Inc.(g) | | | 2,630,880 | |

| | 37,429 | | NorthStar Real Estate Income II, Inc.(g) | | | 321,145 | |

| | 14,984 | | Phillips Edison Grocery Center REIT I, Inc.(g) | | | 150,141 | |

| | | | | | | 12,930,006 | |

See Notes to Financial Statements.

| Resource Real Estate Diversified Income Fund | Portfolio of Investments |

September 30, 2016

| Shares | | | | Value | |

| | | PRIVATE REAL ESTATE INVESTMENT TRUSTS (29.70%)(f) | | | |

| | 480,678 | | Charter Hall Direct VA Trust | | $ | 425,535 | |

| | 4,153 | | Clarion Gables Multifamily Trust, LP | | | 4,818,807 | |

| | 3,882 | | Clarion Lion Industrial Trust | | | 5,759,625 | |

| | 11,362 | | Clarion Lion Properties Fund, LP | | | 15,374,139 | |

| | 2,102,757 | | Clarion Ventures | | | 2,046,113 | |

| | 38,601 | | Cornerstone Patriot Fund, LP | | | 4,686,509 | |

| | 67,940 | | Cottonwood Residential, Inc. | | | 1,121,017 | |

| | 3,000,000 | | Guggenheim US Property Private REIT | | | 3,008,801 | |

| | 40,000 | | Reverse Mortgage Investment Trust, Inc.(a)(d)(g) | | | 350,000 | |

| | 169 | | UBS Trumbull LP | | | 2,011,836 | |

| | 191 | | UBS Trumbull Property Fund | | | 2,038,520 | |

| | | | | | | 41,640,902 | |

| | | | TRADED REAL ESTATE INVESTMENT TRUSTS (43.51%) | | | | |

| | 216,260 | | Arlington Asset Investment Corp., Class A(d) | | | 3,198,485 | |

| | 141,746 | | Blackstone Mortgage Trust, Inc., Class A(d) | | | 4,174,420 | |

| | 201,734 | | CBL & Associates Properties, Inc.(d) | | | 2,449,051 | |

| | 187,834 | | City Office REIT, Inc.(d) | | | 2,391,127 | |

| | 55,993 | | Colony Capital, Inc., Class A(d) | | | 1,020,752 | |

| | 163,700 | | Communications Sales & Leasing, Inc.(d) | | | 5,141,817 | |

| | 11,261 | | Digital Realty Trust, Inc.(d) | | | 1,093,668 | |

| | 30,584 | | EPR Properties, Inc.(d) | | | 2,408,184 | |

| | 20,571 | | Extra Space Storage, Inc.(d) | | | 1,633,543 | |

| | 261,760 | | Five Oaks Investment Corp.(d) | | | 1,486,797 | |

| | 350,000 | | Global Medical REIT, Inc.(d) | | | 3,416,000 | |

| | 46,667 | | Great Ajax Corp.(d) | | | 637,005 | |

| | 533,623 | | Independence Realty Trust, Inc.(d) | | | 4,802,607 | |

| | 145,500 | | Lexington Realty Trust(d) | | | 1,498,650 | |

| | 175,000 | | MedEquities Realty Trust, Inc.(a)(f) | | | 2,056,250 | |

| | 120,111 | | Medical Properties Trust, Inc.(d) | | | 1,774,040 | |

| | 26,700 | | National Storage Affiliates Trust(d) | | | 559,098 | |

| | 264,700 | | New Residential Investment Corp.(d) | | | 3,655,507 | |

| | 191,500 | | New Senior Investment Group, Inc.(d) | | | 2,209,910 | |

| | 26,920 | | Omega Healthcare Investors, Inc.(d) | | | 954,314 | |

| | 160,277 | | Orchid Island Capital, Inc.(d) | | | 1,670,086 | |

| | 31,199 | | Pebblebrook Hotel Trust(d) | | | 829,893 | |

| | 57,242 | | RLJ Lodging Trust(d) | | | 1,203,799 | |

| | 103,260 | | STAG Industrial, Inc.(d) | | | 2,530,903 | |

| | 22,376 | | Ventas, Inc.(d) | | | 1,580,417 | |

| | 215,328 | | Whitestone REIT(d) | | | 2,988,753 | |

| | 25,197 | | WP Carey, Inc.(d) | | | 1,625,962 | |

| | 163,715 | | WP Glimcher, Inc. | | | 2,026,792 | |

| | | | | | | 61,017,830 | |

| | | | TOTAL REAL ESTATE INVESTMENT TRUSTS - COMMON STOCKS (Cost $108,487,714) | | | 115,588,738 | |

| | | | | | | | |

| | | | PRIVATE INVESTMENT FUNDS (1.49%) | | | | |

| | 1,967,428 | | Truman REIT(f) | | | 2,083,414 | |

| | | | | | | | |

| | | | TOTAL PRIVATE INVESTMENT FUNDS (Cost $1,872,428) | | | 2,083,414 | |

See Notes to Financial Statements.

| Annual Report | September 30, 2016 | 7 |

| Resource Real Estate Diversified Income Fund | Portfolio of Investments |

September 30, 2016

| Shares | | | | Value | |

| | | PURCHASED OPTIONS (0.53%) | | | |

| | 6,200 | (d) | iShares U.S. Real Estate ETF(d) | | $ | 744,000 | |

| | | | | | | | |

| | | | TOTAL PURCHASED OPTIONS (Cost $1,051,336) | | | 744,000 | |

| | | | | | | | |

| | | | SHORT TERM INVESTMENTS (0.61%) | | | | |

| | 858,902 | | Dreyfus Treasury Cash Management, Institutional Class, 0.21%(h) | | | 858,902 | |

| | | | | | | | |

| | | | TOTAL SHORT TERM INVESTMENTS (Cost $858,902) | | | 858,902 | |

| | | | | | | | |

| | | | TOTAL INVESTMENTS (128.18%) (Cost $173,497,045) | | $ | 179,738,435 | |

| | | | | | | | |

| | | | LIABILITIES IN EXCESS OF OTHER ASSETS (-28.18%) | | | (39,520,293 | )(i) |

| | | | | | | | |

| | | | NET ASSETS (100.00%) | | $ | 140,218,142 | |

(a) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. As of September 30, 2016, the aggregate market value of those securities was $6,655,705, representing 4.75% of net assets. |

(b) | Issued with a zero coupon. Income is recognized through the accretion of discount. |

(c) | Floating or variable rate security. The rate shown is the effective interest rate as of September 30, 2016. |

(d) | All or a portion of each of these securities may be segregated as collateral for written options and the Fund's line of credit. |

(e) | Security in default on interest payments. |

(f) | Illiquid security. See below. |

(g) | Fair Value estimated using Fair Valuation Procedures adopted by the Board of Trustees. Total value of such securities is $7,038,418, representing 5.02% of net assets. |

(h) | Money market fund; interest rate reflects seven-day effective yield on September 30, 2016. |

(i) | Includes cash which is being held as collateral for futures contracts, written options, and the Fund's line of credit. |

See Notes to Financial Statements.

| Resource Real Estate Diversified Income Fund | Portfolio of Investments |

September 30, 2016

Securities determined to be illiquid under the procedures approved by the Fund's Board of Trustees.

Information related to the illiquid securities is as follows:

| Date(s) of Purchase | Security | | Cost | | | Value | | | % of Net Assets | |

| 11/08/13 | American Realty Capital Healthcare Trust II | | $ | 55,886 | | | $ | 65,075 | | | | 0.05 | % |

| 04/15/14 | Charter Hall Direct VA Trust | | | 449,712 | | | | 425,535 | | | | 0.30 | % |

| 07/02/15-07/01/16 | Clarion Gables Multifamily Trust, LP | | | 4,500,000 | | | | 4,818,807 | | | | 3.44 | % |

| 01/01/14-07/01/16 | Clarion Lion Industrial Trust | | | 5,200,000 | | | | 5,759,625 | | | | 4.11 | % |

| 01/01/14-07/01/16 | Clarion Lion Properties Fund, LP | | | 14,050,000 | | | | 15,374,139 | | | | 10.96 | % |

| 07/01/16 | Clarion Ventures | | | 2,102,757 | | | | 2,046,113 | | | | 1.46 | % |

| 05/22/13 | Cole Credit Property Trust IV, Inc. | | | 40,489 | | | | 44,806 | | | | 0.03 | % |

| 04/17/14-08/14/15 | Cole Real Estate Income Strategy (Daily NAV), Inc., Class I | | 2,828,154 | | | | 3,029,761 | | | | 2.16 | % |

| 10/01/15-07/01/16 | Cornerstone Patriot Fund, LP | | | 4,500,000 | | | | 4,686,509 | | | | 3.34 | % |

| 11/05/13-05/30/14 | Corporate Property Associates 18 Global, Inc., Class A | | | 307,648 | | | | 295,395 | | | | 0.21 | % |

| 03/12/15 | Corporate Property Associates 18 Global, Inc., Class C | | | 1,720,000 | | | | 1,496,400 | | | | 1.07 | % |

| 02/24/14-07/21/14 | Cottonwood Residential, Inc. | | | 701,368 | | | | 1,121,017 | | | | 0.80 | % |

| 04/05/13-11/12/14 | Dividend Capital Diversified Property Fund | | | 154,016 | | | | 226,588 | | | | 0.16 | % |

| 09/01/16 | Guggenheim US Property Private REIT | | | 3,000,000 | | | | 3,008,801 | | | | 2.15 | % |

| 02/06/15 | Highlands REIT, Inc. | | | 142,639 | | | | 160,861 | | | | 0.11 | % |

| 02/06/15 | InvenTrust Properties Corp. | | | 1,380,078 | | | | 1,523,715 | | | | 1.09 | % |

| 06/09/15-08/14/15 | Jones Lang LaSalle Income Property Trust, Inc. | | | 2,748,859 | | | | 2,985,239 | | | | 2.13 | % |

| 09/29/16 | MedEquities Realty Trust, Inc. | | | 2,100,000 | | | | 2,056,250 | | | | 1.47 | % |

| 11/27/13-03/12/15 | NorthStar Healthcare Income, Inc. | | | 2,687,879 | | | | 2,630,880 | | | | 1.88 | % |

| 03/11/14-06/30/15 | NorthStar Real Estate Income II, Inc. | | | 297,024 | | | | 321,145 | | | | 0.23 | % |

| 08/07/13-11/25/13 | Phillips Edison Grocery Center REIT I, Inc. | | | 119,650 | | | | 150,141 | | | | 0.11 | % |

| 02/06/14-06/06/14 | Reverse Mortgage Investment Trust, Inc. | | | 576,500 | | | | 350,000 | | | | 0.25 | % |

| 06/24/16 | Truman REIT | | | 1,872,428 | | | | 2,083,414 | | | | 1.49 | % |

| 07/01/16 | UBS Trumbull LP | | | 2,000,000 | | | | 2,011,836 | | | | 1.43 | % |

| 01/04/16-04/01/16 | UBS Trumbull Property Fund | | | 2,000,000 | | | | 2,038,520 | | | | 1.45 | % |

| Total | | $ | 55,535,087 | | | $ | 58,710,572 | | | | 41.88 | % |

Additional information on investments in private real estate investment trusts:

| Value | | Security | | Redemption Frequency | | | Redemption Notice (Days) | | | Unfunded Commitments as of September 30, 2016(a) | |

| $ | 425,535 | | Charter Hall Direct VA Trust | | N/A | | | N/A | | | $ | – | |

| | 4,818,807 | | Clarion Gables Multifamily Trust, LP | | Quarterly | | | 90 | | | | – | |

| | 5,759,625 | | Clarion Lion Industrial Trust | | Quarterly | | | 90 | | | | 4,500,000 | |

| | 15,374,139 | | Clarion Lion Properties Fund, LP | | Quarterly | | | 90 | | | | – | |

| | 2,046,113 | | Clarion Ventures | | N/A | | | N/A | | | | 484,836 | |

| | 4,686,509 | | Cornerstone Patriot Fund, LP | | Quarterly | | | 30 | | | | – | |

| | 1,121,017 | | Cottonwood Residential, Inc. | | Daily | | | 60 | | | | – | |

| | 3,008,801 | | Guggenheim US Property Private REIT | | Quarterly | | | 60 | | | | | |

| | 350,000 | | Reverse Mortgage Investment Trust, Inc.(b) | | N/A | | | IPO(c) | | | | – | |

| | 2,011,836 | | UBS Trumbull LP | | Quarterly | | | 60 | | | | 1,200,000 | |

| | 2,038,520 | | UBS Trumbull Property Fund | | Quarterly | | | 60 | | | | 2,200,000 | |

(a) | Refer to Note 9 for additional information on unfunded commitments. |

(b) | The fair value of this investment has been estimated using the net asset value per share of the investment and adjusted for any changes in market conditions. |

(c) | Redemption eligible after the completion of the Initial Price Offering (IPO). |

See Notes to Financial Statements.

| Annual Report | September 30, 2016 | 9 |

| Resource Real Estate Diversified Income Fund | Portfolio of Investments |

September 30, 2016

FUTURES CONTRACTS

At September 30, 2016, the Fund had the following outstanding futures contracts:

| Description | Position | | Contracts | | Expiration Date | | Notional Value | | | Unrealized Appreciation | |

| Euro Foreign Exchange | | | | | | | | | | | |

| Currency Future | Short | | (29) | | 12/19/16 | | $ | (4,087,913 | ) | | $ | 19,235 | |

| | | | | | | | $ | (4,087,913 | ) | | $ | 19,235 | |

Schedule Of Written Options

At September 30, 2016, the Fund had the following outstanding written options:

| | | Number of Contracts | | | Exercise Price | | Maturity Date | | Value | |

| Call Options | | | | | | | | | | |

| iShares U.S. Real Estate ETF | | (6,200) | | | $ | 86.00 | | 10/21/2016 | | $ | (12,400 | ) |

| | | | | | | | | | | | | |

| Put Options | | | | | | | | | | | | |

| iShares U.S. Real Estate ETF | | (6,200) | | | $ | 76.00 | | 10/21/2016 | | $ | (130,200 | ) |

| | | | | | | | | | | | | |

| Total Written Options (Premiums $1,040,704) | | | | | | | | | | $ | (142,600 | ) |

See Notes to Financial Statements.

| Resource Real Estate Diversified Income Fund | Statement of Assets and Liabilities |

September 30, 2016

| ASSETS | | | |

| Investments, at value (Cost $173,497,045) | | $ | 179,738,435 | |

| Deposit with broker for futures contracts | | | 571,610 | |

| Dividends and interest receivable | | | 1,385,793 | |

| Receivable for securities sold | | | 4,137,883 | |

| Receivable for fund shares sold | | | 820,856 | |

| Prepaid expenses and other assets | | | 41,112 | |

| Total assets | | | 186,695,689 | |

| | | | | |

| LIABILITIES | | | | |

| Line of credit payable | | | 36,821,084 | |

| Written options, at value (Proceeds $1,040,704) | | | 142,600 | |

| Variation margin | | | 9,063 | |

| Payable to custodian | | | 783,296 | |

| Payable for investments purchased | | | 7,454,785 | |

| Payable due to adviser | | | 76,073 | |

| Administration fees payable | | | 15,279 | |

| Custody fees payable | | | 9,821 | |

| Distribution fees payable | | | 21,803 | |

| Distribution due to shareholders | | | 907,583 | |

| Shareholder servicing fees payable | | | 55,942 | |

| Dealer manager fees payable | | | 14,392 | |

| Payable for transfer agency fees | | | 31,338 | |

| Accrued expenses and other liabilities | | | 134,488 | |

| Total liabilities | | | 46,477,547 | |

| NET ASSETS | | $ | 140,218,142 | |

| | | | | |

| NET ASSETS CONSISTS OF | | | | |

| Paid‐in capital | | $ | 132,847,758 | |

| Accumulated net realized gain | | | 211,580 | |

| Net unrealized appreciation | | | 7,158,804 | |

| NET ASSETS | | $ | 140,218,142 | |

Commitments and Contingencies (Note 9)

See Notes to Financial Statements.

| Annual Report | September 30, 2016 | 11 |

| Resource Real Estate Diversified Income Fund | Statement of Assets and Liabilities |

September 30, 2016

| PRICING OF SHARES | | | |

| Class A | | | |

| Net Assets | | $ | 61,469,674 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 5,993,155 | |

Net Asset Value and redemption price per share(a) | | $ | 10.26 | |

| Maximum Offering Price Per Share (Maximum Sales Charge of 6.50%) | | $ | 10.97 | |

| Class C | | | | |

| Net Assets | | $ | 33,114,355 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 3,230,110 | |

Net Asset Value and redemption price per share(a) | | $ | 10.25 | |

| Maximum Offering Price Per Share (Maximum Sales Charge of 1.50%) | | $ | 10.41 | |

| Class W | | | | |

| Net Assets | | $ | 31,075,895 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 2,984,435 | |

| Net Asset Value, offering and redemption price per share | | $ | 10.41 | |

| Class I | | | | |

| Net Assets | | $ | 21 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 2 | |

| Net Asset Value, offering and redemption price per share | | $ | 10.74 | (b) |

| Class U | | | | |

| Net Assets | | $ | 5,766,288 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 561,917 | |

Net Asset Value and redemption price per share(a) | | $ | 10.26 | |

| Maximum Offering Price Per Share (Maximum Sales Charge of 6.50%) | | $ | 10.97 | |

| Class T | | | | |

| Net Assets | | $ | 3,187,195 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 311,412 | |

Net Asset Value and redemption price per share(a) | | $ | 10.23 | |

| Maximum Offering Price Per Share (Maximum Sales Charge of 1.50%) | | $ | 10.39 | |

| Class D | | | | |

| Net Assets | | $ | 5,604,714 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 538,151 | |

| Net Asset Value, offering and redemption price per share | | $ | 10.41 | |

(a) | Redemption price varies based on length of time held (Note 1). |

(b) | Net asset value per share does not recalculate due to fractional shares not presented and rounding. |

See Notes to Financial Statements.

| Resource Real Estate Diversified Income Fund | Statement of Operations |

For the Year Ended September 30, 2016

| INVESTMENT INCOME | | | |

| Dividends | | $ | 4,419,813 | |

| Interest | | | 1,303,912 | |

| Total investment income | | | 5,723,725 | |

| EXPENSES | | | | |

| Investment advisory fees (Note 3) | | | 1,196,758 | |

| Administrative fees (Note 3) | | | 159,816 | |

| Distribution fees (Note 3): | | | | |

| Class C | | | 168,685 | |

| Class T | | | 11,619 | |

| Shareholder servicing fees (Note 3): | | | | |

| Class A | | | 117,140 | |

| Class C | | | 56,229 | |

| Class W | | | 48,126 | |

| Class U | | | 3,958 | |

| Class T | | | 3,873 | |

| Class D | | | 10,026 | |

| Dealer manager fees (Note 3): | | | | |

| Class W | | | 96,245 | |

| Class D | | | 20,051 | |

| Interest expense | | | 384,393 | |

| Transfer agent fees (Note 3) | | | 215,987 | |

| Audit fees | | | 25,000 | |

| Legal fees | | | 47,682 | |

| Printing expense | | | 108,607 | |

| Registration fees | | | 98,661 | |

| Custody fees | | | 41,334 | |

| Trustee fees and expenses (Note 3) | | | 44,969 | |

| Other expenses | | | 101,118 | |

| Total expenses | | | 2,960,277 | |

| Less fees waived/expenses reimbursed by investment adviser (Note 3) | | | (374,046 | ) |

| Total net expenses | | | 2,586,231 | |

| NET INVESTMENT INCOME | | | 3,137,494 | |

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS | | | | |

| Net realized loss on investments | | | (3,069 | ) |

| Net realized loss on futures contracts | | | (29,572 | ) |

| Net realized gain on foreign currency transactions | | | 68,447 | |

| Net change in unrealized appreciation on investments | | | 7,099,652 | |

| Net change in unrealized depreciation on futures contracts | | | (5,649 | ) |

| Net change in unrealized appreciation on written options | | | 898,104 | |

| Net change in unrealized depreciation on translation of assets and liabilities in foreign currencies | | | (181 | ) |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS, FUTURES CONTRACTS AND FOREIGN CURRENCY TRANSACTIONS | | | 8,027,732 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 11,165,226 | |

See Notes to Financial Statements.

| Annual Report | September 30, 2016 | 13 |

| Resource Real Estate Diversified Income Fund | Statements of Changes in Net Assets |

| | | For the Year Ended September 30, 2016 | | | For the Period Ended September 30, 2015(a) | | | For the Year Ended February 28, 2015(b) | |

| OPERATIONS | | | | | | | | | |

| Net investment income | | $ | 3,137,494 | | | $ | 993,903 | | | $ | 528,363 | |

| Net realized gain | | | 35,806 | | | | 224,084 | | | | 112,695 | |

| Net change in unrealized appreciation/(depreciation) | | | 7,991,926 | | | | (2,586,455 | ) | | | 1,663,069 | |

| Net increase/(decrease) in net assets resulting from operations | | $ | 11,165,226 | | | $ | (1,368,468 | ) | | $ | 2,304,127 | |

| | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | |

| From investment income: | | | | | | | | | | | | |

| Class A | | | (1,509,210 | ) | | | (532,818 | ) | | | (681,335 | ) |

| Class C | | | (658,437 | ) | | | (127,483 | ) | | | (34,341 | ) |

| Class W | | | (601,298 | ) | | | (86,896 | ) | | | – | |

| Class I | | | – | | | | (178 | ) | | | – | |

| Class U | | | (70,780 | ) | | | (247 | ) | | | – | |

| Class T | | | (50,499 | ) | | | (1,218 | ) | | | – | |

| Class D | | | (121,430 | ) | | | (8,622 | ) | | | – | |

| From realized gains on investments: | | | | | | | | | | | | |

| Class A | | | – | | | | (116,405 | ) | | | (111,045 | ) |

| Class C | | | – | | | | (41,653 | ) | | | (5,597 | ) |

| Class W | | | – | | | | (34,900 | ) | | | – | |

| Class I | | | – | | | | (145 | ) | | | – | |

| Class U | | | – | | | | (193 | ) | | | – | |

| Class T | | | – | | | | (1,405 | ) | | | – | |

| Class D | | | – | | | | (6,554 | ) | | | – | |

| From return of capital: | | | | | | | | | | | | |

| Class A | | | (1,517,924 | ) | | | (840,103 | ) | | | (106,091 | ) |

| Class C | | | (662,238 | ) | | | (218,427 | ) | | | (5,347 | ) |

| Class W | | | (604,770 | ) | | | (157,913 | ) | | | – | |

| Class I | | | (1 | ) | | | (418 | ) | | | – | |

| Class U | | | (71,188 | ) | | | (568 | ) | | | – | |

| Class T | | | (50,790 | ) | | | (3,394 | ) | | | – | |

| Class D | | | (122,132 | ) | | | (19,567 | ) | | | – | |

| Net decrease in net assets from distributions | | | (6,040,697 | ) | | | (2,199,107 | ) | | | (943,756 | ) |

See Notes to Financial Statements.

| Resource Real Estate Diversified Income Fund | Statements of Changes in Net Assets (continued) |

| | | For the Year Ended September 30, 2016 | | | For the Period Ended September 30, 2015(a) | | | For the Year Ended February 28, 2015(b) | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | | |

| Class A | | | | | | | | | |

| Proceeds from sales of shares | | | 24,246,411 | | | | 11,798,656 | | | | 22,459,088 | |

| Distributions reinvested | | | 1,531,196 | | | | 701,023 | | | | 357,128 | |

| Cost of shares redeemed | | | (4,085,281 | ) | | | (620,522 | ) | | | (1,063,753 | ) |

| Net increase from capital shares transactions | | | 21,692,326 | | | | 11,879,157 | | | | 21,752,463 | |

| | | | | | | | | | | | | |

| Class C | | | | | | | | | | | | |

| Proceeds from sales of shares | | | 19,427,546 | | | | 10,162,184 | | | | 3,857,659 | |

| Distributions reinvested | | | 887,888 | | | | 282,757 | | | | 32,425 | |

| Cost of shares redeemed | | | (1,893,250 | ) | | | (64,440 | ) | | | (261,196 | ) |

| Net increase from capital shares transactions | | | 18,422,184 | | | | 10,380,501 | | | | 3,628,888 | |

| | | | | | | | | | | | | |

| Class W | | | | | | | | | | | | |

| Proceeds from sales of shares | | | 22,518,683 | | | | 10,610,794 | | | | 1,209,498 | |

| Distributions reinvested | | | 552,421 | | | | 111,946 | | | | – | |

| Cost of shares redeemed | | | (4,368,496 | ) | | | (12,187 | ) | | | – | |

| Net increase from capital shares transactions | | | 18,702,608 | | | | 10,710,553 | | | | 1,209,498 | |

| | | | | | | | | | | | | |

| Class I | | | | | | | | | | | | |

| Proceeds from sales of shares | | | – | | | | 50,000 | | | | 20 | |

| Distributions reinvested | | | – | | | | 741 | | | | – | |

| Cost of shares redeemed | | | (49,324 | ) | | | – | | | | – | |

| Net increase/(decrease) from capital shares transactions | | | (49,324 | ) | | | 50,741 | | | | 20 | |

| | | | | | | | | | | | | |

| Class U | | | | | | | | | | | | |

| Proceeds from sales of shares | | | 5,539,265 | | | | 60,795 | | | | 2,500 | |

| Distributions reinvested | | | 54,034 | | | | – | | | | – | |

| Cost of shares redeemed | | | (10,180 | ) | | | – | | | | – | |

| Net increase from capital shares transactions | | | 5,583,119 | | | | 60,795 | | | | 2,500 | |

| | | | | | | | | | | | | |

| Class T | | | | | | | | | | | | |

| Proceeds from sales of shares | | | 2,599,685 | | | | 454,829 | | | | 2,500 | |

| Distributions reinvested | | | 30,599 | | | | 1,389 | | | | – | |

| Net increase from capital shares transactions | | | 2,630,284 | | | | 456,218 | | | | 2,500 | |

| | | | | | | | | | | | | |

| Class D | | | | | | | | | | | | |

| Proceeds from sales of shares | | | 3,072,558 | | | | 2,171,457 | | | | 2,500 | |

| Distributions reinvested | | | 125,740 | | | | 20,583 | | | | – | |

| Cost of shares redeemed | | | (30,003 | ) | | | – | | | | – | |

| Net increase from capital shares transactions | | | 3,168,295 | | | | 2,192,040 | | | | 2,500 | |

| | | | | | | | | | | | | |

| Net increase in net assets | | | 75,274,021 | | | | 32,162,430 | | | | 27,958,740 | |

| | | | | | | | | | | | | |

| NET ASSETS | | | | | | | | | | | | |

| Beginning of period | | | 64,944,121 | | | | 32,781,691 | | | | 4,822,951 | |

| End of period* | | $ | 140,218,142 | | | $ | 64,944,121 | | | $ | 32,781,691 | |

| | | | | | | | | | | | | |

| *Including accumulated net investment income of: | | $ | – | | | $ | – | | | $ | – | |

See Notes to Financial Statements.

| Annual Report | September 30, 2016 | 15 |

| Resource Real Estate Diversified Income Fund | Statements of Changes in Net Assets (continued) |

| | | For the Year Ended September 30, 2016 | | | For the Period Ended September 30, 2015(a) | | | For the Year Ended February 28, 2015(b) | |

| OTHER INFORMATION | | | | | | | | | |

| Capital Shares Transactions | | | | | | | | | |

| Class A | | | | | | | | | |

| Issued | | | 2,442,421 | | | | 1,155,322 | | | | 2,218,819 | |

| Distributions reinvested | | | 154,823 | | | | 70,208 | | | | 35,636 | |

| Redeemed | | | (415,226 | ) | | | (60,300 | ) | | | (103,394 | ) |

| Net increase in capital shares | | | 2,182,018 | | | | 1,165,230 | | | | 2,151,061 | |

| | | | | | | | | | | | | |

| Class C | | | | | | | | | | | | |

| Issued | | | 1,963,693 | | | | 992,068 | | | | 377,181 | |

| Distributions reinvested | | | 89,798 | | | | 28,471 | | | | 3,207 | |

| Redeemed | | | (193,223 | ) | | | (6,233 | ) | | | (24,852 | ) |

| Net increase in capital shares | | | 1,860,268 | | | | 1,014,306 | | | | 355,536 | |

| | | | | | | | | | | | | |

| Class W | | | | | | | | | | | | |

| Issued | | | 2,238,396 | | | | 1,023,118 | | | | 113,580 | |

| Distributions reinvested | | | 54,815 | | | | 11,153 | | | | – | |

| Redeemed | | | (455,467 | ) | | | (1,160 | ) | | | – | |

| Net increase in capital shares | | | 1,837,744 | | | | 1,033,111 | | | | 113,580 | |

| | | | | | | | | | | | | |

| Class I | | | | | | | | | | | | |

| Issued | | | – | | | | 4,677 | | | | 2 | |

| Distributions reinvested | | | – | | | | 72 | | | | – | |

| Redeemed | | | (4,749 | ) | | | – | | | | – | |

| Net increase/(decrease) in capital shares | | | (4,749 | ) | | | 4,749 | | | | 2 | |

| | | | | | | | | | | | | |

| Class U | | | | | | | | | | | | |

| Issued | | | 551,293 | | | | 6,007 | | | | 237 | |

| Distributions reinvested | | | 5,375 | | | | – | | | | – | |

| Redeemed | | | (995 | ) | | | – | | | | – | |

| Net increase in capital shares | | | 555,673 | | | | 6,007 | | | | 237 | |

| | | | | | | | | | | | | |

| Class T | | | | | | | | | | | | |

| Issued | | | 262,716 | | | | 45,253 | | | | 237 | |

| Distributions reinvested | | | 3,063 | | | | 143 | | | | – | |

| Net increase in capital shares | | | 265,779 | | | | 45,396 | | | | 237 | |

| | | | | | | | | | | | | |

| Class D | | | | | | | | | | | | |

| Issued | | | 314,877 | | | | 211,499 | | | | 233 | |

| Distributions reinvested | | | 12,527 | | | | 2,073 | | | | – | |

| Redeemed | | | (3,058 | ) | | | – | | | | – | |

| Net increase in capital shares | | | 324,346 | | | | 213,572 | | | | 233 | |

(a) | With the approval of the Board, effective September 30, 2015, the Fund's fiscal year end was changed from February 28 to September 30 (See Note 1). |

(b) | The Resource Real Estate Diversified Income Fund Class C and Class I commenced operations on August 1, 2014. Class W commenced operations on November 24, 2014. Class D, Class T and Class U commenced operations on February 13, 2015. |

See Notes to Financial Statements.

| Resource Real Estate Diversified Income Fund | Statements of Cash Flows |

| | | For the Year Ended September 30, 2016 | |

| Cash Flow from Operating Activities: | | | |

| Net increase in net assets resulting from operations | | $ | 11,165,226 | |

| Adjustments to reconcile net increase in net assets resulting from operations to net cash provided by / (used in) operating activities: | | | | |

| Purchase of investment securities | | | (114,544,239 | ) |

| Proceeds from sale of investment securities | | | 22,990,470 | |

| Purchase of option contracts | | | (1,051,336 | ) |

| Premiums received from written options transactions | | | 1,040,704 | |

| Net (purchase) proceeds from short‐term investment securities | | | (749,539 | ) |

| Amortization of premium and accretion of discount on investments | | | (224,889 | ) |

| Net realized (gain)/loss on: | | | | |

| Investments | | | 3,069 | |

| Net change in unrealized (appreciation)/depreciation on: | | | | |

| Investments | | | (7,099,652 | ) |

| Written options | | | (898,104 | ) |

| (Increase)/Decrease in assets: | | | | |

| Deposit with broker for futures contracts | | | (40,411 | ) |

| Dividends and interest receivable | | | (665,536 | ) |

| Variation margin receivable | | | 43,013 | |

| Prepaid expenses and other assets | | | 1,779 | |

| Increase/(Decrease) in liabilities: | | | | |

| Payable to custodian | | | 783,296 | |

| Variation margin payable | | | 9,063 | |

| Dealer manager fees payable | | | 9,084 | |

| Shareholder servicing fees payable | | | 28,346 | |

| Distribution fees payable | | | 13,647 | |

| Payable due to advisor | | | 75,845 | |

| Administration fees payable | | | 1,994 | |

| Custody fees payable | | | 7,496 | |

| Payable for trustee fees and expenses | | | (277 | ) |

| Payable for transfer agency fees | | | 21,330 | |

| Accrued expenses and other liabilities | | | 35,771 | |

| Net cash provided by / (used in) operating activities | | | (89,043,850 | ) |

| | | | | |

| Cash Flows from Financing Activities: | | | | |

| Cash provided by loan: | | | 24,448,025 | |

| Proceeds from sale of shares | | | 76,977,787 | |

| Cost of shares redeemed | | | (10,436,534 | ) |

| Cash distributions paid | | | (2,397,841 | ) |

| Net cash provided by /(used in) financing activities | | | 88,591,437 | |

| | | | | |

| Net Change in Cash & Foreign Rates On Cash & Foreign Currency | | | (452,413 | ) |

| Cash & Foreign Currency, Beginning of Period | | | 452,413 | |

| Cash & Foreign Currency, End of Period | | | – | |

| | | | | |

| Non‐cash financing activities not included herein consist of reinvestment of distributions of: | | $ | 3,181,877 | |

| Cash paid for interest on loan during the period was: | | $ | 387,319 | |

See Notes to Financial Statements.

| Annual Report | September 30, 2016 | 17 |

| Resource Real Estate Diversified Income Fund – Class A | Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | Year Ended September 30, 2016 | | | For the Period Ended September 30, 2015(a) | | | Year Ended February 28, 2015 | | | For the Period Ended February 28, 2014(b) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 9.81 | | | $ | 10.52 | | | $ | 9.75 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | |

Net investment income(c)(d) | | | 0.34 | | | | 0.21 | | | | 0.33 | | | | 0.24 | |

| Net realized and unrealized gain/(loss) on investments | | | 0.71 | | | | (0.47 | ) | | | 1.05 | | | | (0.06 | ) |

| Total income/(loss) from investment operations | | | 1.05 | | | | (0.26 | ) | | | 1.38 | | | | 0.18 | |

| | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.32 | ) | | | (0.17 | ) | | | (0.48 | ) | | | (0.39 | ) |

| From net realized gain on investments | | | – | | | | (0.03 | ) | | | (0.05 | ) | | | (0.00 | )(e) |

| From return of capital | | | (0.28 | ) | | | (0.25 | ) | | | (0.08 | ) | | | (0.04 | ) |

| Total distributions | | | (0.60 | ) | | | (0.45 | ) | | | (0.61 | ) | | | (0.43 | ) |

| INCREASE/DECREASE IN NET ASSET VALUE | | | 0.45 | | | | (0.71 | ) | | | 0.77 | | | | (0.25 | ) |

| NET ASSET VALUE, END OF PERIOD | | $ | 10.26 | | | $ | 9.81 | | | $ | 10.52 | | | $ | 9.75 | |

| | | | | | | | | | | | | | | | | |

TOTAL RETURN(f) | | | 11.09 | % | | | (2.50 | )%(g) | | | 14.70 | % | | | 2.03 | % |

| | | | | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 61,470 | | | $ | 37,399 | | | $ | 27,830 | | | $ | 4,823 | |

| | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | | | | | | | | | |

Including interest expense:(h) | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 2.78 | % | | | 3.30 | %(i) | | | 4.81 | % | | | 24.79 | %(i) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.39 | % | | | 2.24 | %(i) | | | 2.29 | % | | | 2.32 | %(i) |

Excluding interest expense:(h) | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 2.38 | % | | | 3.05 | %(i) | | | 4.51 | % | | | 24.46 | %(i) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 1.99 | % | | | 1.99 | %(i) | | | 1.99 | % | | | 1.99 | %(i) |

Net investment income(d) | | | 3.47 | % | | | 3.57 | %(i) | | | 3.21 | % | | | 2.54 | %(i) |

| | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 21 | % | | | 5 | %(j) | | | 91 | % | | | 4 | %(j) |

| (a) | With the approval of the Board, effective September 30, 2015, the Fund's fiscal year end was changed from February 28 to September 30 (See Note 1). |

| (b) | The Fund's Class A commenced operations on March 12, 2013. |

| (c) | Per share numbers have been calculated using the average shares method. |

| (d) | Recognition of net investment income is affected by timing and declaration of dividends by underlying investment companies. |

| (e) | Amount is less than $(0.005). |

| (f) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. Returns shown exclude applicable sales charges. |

| (g) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from net asset values and returns for shareholder transactions. |

| (h) | Ratios do not include expenses of underlying investment companies in which the Fund invests. |

See Notes to Financial Statements.

| Resource Real Estate Diversified Income Fund – Class C | Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | Year Ended September 30, 2016 | | | For the Period Ended September 30, 2015(a) | | | For the Period Ended February 28, 2015(b) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 9.81 | | | $ | 10.50 | | | $ | 10.06 | |

| | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | |

Net investment income(c)(d) | | | 0.28 | | | | 0.18 | | | | 0.14 | |

| Net realized and unrealized gain/(loss) on investments | | | 0.68 | | | | (0.48 | ) | | | 0.58 | |

| Total income/(loss) from investment operations | | | 0.96 | | | | (0.30 | ) | �� | | 0.72 | |

| | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | |

| From net investment income | | | (0.27 | ) | | | (0.14 | ) | | | (0.20 | ) |

| From net realized gain on investments | | | – | | | | (0.03 | ) | | | (0.05 | ) |

| From return of capital | | | (0.25 | ) | | | (0.22 | ) | | | (0.03 | ) |

| Total distributions | | | (0.52 | ) | | | (0.39 | ) | | | (0.28 | ) |

| INCREASE/DECREASE IN NET ASSET VALUE | | | 0.44 | | | | (0.69 | ) | | | 0.44 | |

| NET ASSET VALUE, END OF PERIOD | | $ | 10.25 | | | $ | 9.81 | | | $ | 10.50 | |

| | | | | | | | | | | | | |

TOTAL RETURN(e) | | | 10.15 | % | | | (2.86 | )%(f) | | | 7.33 | % |

| | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 33,114 | | | $ | 13,436 | | | $ | 3,732 | |

| | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | | | | | |

Including interest expense:(g) | | | | | | | | | | | | |

| Expenses, gross | | | 3.53 | % | | | 4.04 | %(h) | | | 6.37 | %(h) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 3.14 | % | | | 2.99 | %(h) | | | 3.04 | %(h) |

Excluding interest expense:(g) | | | | | | | | | | | | |

| Expenses, gross | | | 3.13 | % | | | 3.79 | %(h) | | | 6.07 | %(h) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.74 | % | | | 2.74 | %(h) | | | 2.74 | %(h) |

Net investment income(d) | | | 2.87 | % | | | 2.97 | %(h) | | | 2.34 | %(h) |

| | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 21 | % | | | 5 | %(i) | | | 91 | %(i) |

| (a) | With the approval of the Board, effective September 30, 2015, the Fund's fiscal year end was changed from February 28 to September 30 (See Note 1). |

| (b) | The Fund's Class C commenced operations on August 1, 2014. |

| (c) | Per share numbers have been calculated using the average shares method. |

| (d) | Recognition of net investment income is affected by timing and declaration of dividends by underlying investment companies. |

| (e) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. Returns shown exclude applicable sales charges. |

| (f) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from net asset values and returns for shareholder transactions. |

| (g) | Ratios do not include expenses of underlying investment companies in which the Fund invests. |

See Notes to Financial Statements.

| Annual Report | September 30, 2016 | 19 |

| Resource Real Estate Diversified Income Fund – Class W | Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | Year Ended September 30, 2016 | | | For the Period Ended September 30, 2015(a) | | | For the Period Ended February 28, 2015(b) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 9.96 | | | $ | 10.67 | | | $ | 10.18 | |

| | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | |

Net investment income(c)(d) | | | 0.32 | | | | 0.20 | | | | 0.03 | |

| Net realized and unrealized gain/(loss) on investments | | | 0.69 | | | | (0.49 | ) | | | 0.46 | |

| Total income/(loss) from investment operations | | | 1.01 | | | | (0.29 | ) | | | 0.49 | |

| | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | |

| From net investment income | | | (0.30 | ) | | | (0.15 | ) | | | – | |

| From net realized gain on investments | | | – | | | | (0.03 | ) | | | – | |

| From return of capital | | | (0.26 | ) | | | (0.24 | ) | | | – | |

| Total distributions | | | (0.56 | ) | | | (0.42 | ) | | | – | |

| INCREASE/DECREASE IN NET ASSET VALUE | | | 0.45 | | | | (0.71 | ) | | | 0.49 | |

| NET ASSET VALUE, END OF PERIOD | | $ | 10.41 | | | $ | 9.96 | | | $ | 10.67 | |

| | | | | | | | | | | | | |

TOTAL RETURN(e) | | | 10.46 | % | | | (2.79 | )%(f) | | | 4.81 | %(f) |

| | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 31,076 | | | $ | 11,421 | | | $ | 1,211 | |

| | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | | | | | |

Including interest expense:(g) | | | | | | | | | | | | |

| Expenses, gross | | | 3.30 | % | | | 3.78 | %(h) | | | 11.30 | %(h) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.89 | % | | | 2.74 | %(h) | | | 2.79 | %(h) |

Excluding interest expense:(g) | | | | | | | | | | | | |

| Expenses, gross | | | 2.90 | % | | | 3.53 | %(h) | | | 11.00 | %(h) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.49 | % | | | 2.49 | %(h) | | | 2.49 | %(h) |

Net investment income(d) | | | 3.17 | % | | | 3.28 | %(h) | | | 1.31 | %(h) |

| | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 21 | % | | | 5 | %(i) | | | 91 | %(i) |

| (a) | With the approval of the Board, effective September 30, 2015, the Fund's fiscal year end was changed from February 28 to September 30 (See Note 1). |

| (b) | The Fund's Class W commenced operations on November 24, 2014. |

(c) | Per share numbers have been calculated using the average shares method. |

| (d) | Recognition of net investment income is affected by timing and declaration of dividends by underlying investment companies. |

| (e) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. |

| (f) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from net asset values and returns for shareholder transactions. |

| (g) | Ratios do not include expenses of underlying investment companies in which the Fund invests. |

See Notes to Financial Statements.

| Resource Real Estate Diversified Income Fund – Class I | Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | Year Ended September 30, 2016 | | | For the Period Ended September 30, 2015(a) | | | For the Period Ended February 28, 2015(b) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.36 | | | $ | 10.79 | | | $ | 10.06 | |

| | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | |

Net investment income(c)(d) | | | 0.04 | | | | 0.27 | | | | 0.14 | |

| Net realized and unrealized gain/(loss) on investments | | | 0.97 | | | | (0.54 | ) | | | 0.59 | |

| Total income/(loss) from investment operations | | | 1.01 | | | | (0.27 | ) | | | 0.73 | |

| | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | |

| From net investment income | | | (0.33 | ) | | | (0.04 | ) | | | – | |

| From net realized gain on investments | | | – | | | | (0.03 | ) | | | – | |

| From return of capital | | | (0.30 | ) | | | (0.09 | ) | | | – | |

| Total distributions | | | (0.63 | ) | | | (0.16 | ) | | | – | |

| INCREASE/DECREASE IN NET ASSET VALUE | | | 0.38 | | | | (0.43 | ) | | | 0.73 | |

| NET ASSET VALUE, END OF PERIOD | | $ | 10.74 | | | $ | 10.36 | | | $ | 10.79 | |

| | | | | | | | | | | | | |

TOTAL RETURN(e) | | | 10.12 | % | | | (2.51 | )%(f) | | | 7.26 | % |

| | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 0 | (g) | | $ | 49 | | | $ | 0 | (g) |

| | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | | | | | |

Including interest expense:(h) | | | | | | | | | | | | |

| Expenses, gross | | | 2.49 | % | | | 2.96 | %(i) | | | 3.94 | %(i) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.14 | % | | | 1.99 | %(i) | | | 2.08 | %(i) |

Excluding interest expense:(h) | | | | | | | | | | | | |

| Expenses, gross | | | 2.09 | % | | | 2.71 | %(i) | | | 3.60 | %(i) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 1.74 | % | | | 1.74 | %(i) | | | 1.74 | %(i) |

Net investment income(d) | | | 0.36 | % | | | 4.46 | %(i) | | | 2.36 | %(i) |

| | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 21 | % | | | 5 | %(j) | | | 91 | %(j) |

| (a) | With the approval of the Board, effective September 30, 2015, the Fund's fiscal year end was changed from February 28 to September 30 (See Note 1). |

| (b) | The Fund's Class I commenced operations on August 1, 2014. |

| (c) | Per share numbers have been calculated using the average shares method. |

| (d) | Recognition of net investment income is affected by timing and declaration of dividends by underlying investment companies. |

| (e) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. |

| (f) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from net asset values and returns for shareholder transactions. |

| (g) | Amount less than $500. See Statement of Assets and Liabilities for actual net assets. |

| (h) | Ratios do not include expenses of underlying investment companies in which the Fund invests. |

See Notes to Financial Statements.

| Annual Report | September 30, 2016 | 21 |

| Resource Real Estate Diversified Income Fund – Class U | Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | Year Ended September 30, 2016 | | | For the Period Ended September 30, 2015(a) | | | For the Period Ended February 28, 2015(b) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 9.82 | | | $ | 10.52 | | | $ | 10.57 | |

| | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | |

Net investment income(c)(d) | | | 0.50 | | | | 0.27 | | | | 0.00 | (e) |

| Net realized and unrealized gain/(loss) on investments | | | 0.54 | | | | (0.52 | ) | | | (0.05 | ) |

| Total income/(loss) from investment operations | | | 1.04 | | | | (0.25 | ) | | | (0.05 | ) |

| | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | |

| From net investment income | | | (0.32 | ) | | | (0.17 | ) | | | – | |

| From net realized gain on investments | | | – | | | | (0.03 | ) | | | – | |

| From return of capital | | | (0.28 | ) | | | (0.25 | ) | | | – | |

| Total distributions | | | (0.60 | ) | | | (0.45 | ) | | | – | |

| INCREASE/DECREASE IN NET ASSET VALUE | | | 0.44 | | | | (0.70 | ) | | | (0.05 | ) |

| NET ASSET VALUE, END OF PERIOD | | $ | 10.26 | | | $ | 9.82 | | | $ | 10.52 | |

| | | | | | | | | | | | | |

TOTAL RETURN(f) | | | 10.98 | % | | | (2.40 | )%(g) | | | (0.47 | )% |

| | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 5,766 | | | $ | 61 | | | $ | 2 | |

| | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | | | | | |

Including interest expense:(h) | | | | | | | | | | | | |

| Expenses, gross | | | 2.78 | % | | | 3.42 | %(i) | | | 7.74 | %(i) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.39 | % | | | 2.24 | %(i) | | | 2.28 | %(i) |

Excluding interest expense:(h) | | | | | | | | | | | | |

| Expenses, gross | | | 2.38 | % | | | 3.17 | %(i) | | | 7.45 | %(i) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 1.99 | % | | | 1.99 | %(i) | | | 1.99 | %(i) |

Net investment income(d) | | | 5.00 | % | | | 4.64 | %(i) | | | 0.97 | %(i) |

| | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 21 | % | | | 5 | %(j) | | | 91 | %(j) |

| (a) | With the approval of the Board, effective September 30, 2015, the Fund's fiscal year end was changed from February 28 to September 30 (See Note 1). |

| (b) | The Fund's Class U commenced operations on February 13, 2015. |

| (c) | Per share numbers have been calculated using the average shares method. |

| (d) | Recognition of net investment income is affected by timing and declaration of dividends by underlying investment companies. |

| (e) | Amount is less than $0.005. |

| (f) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. Returns shown exclude applicable sales charges. |

| (g) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from net asset values and returns for shareholder transactions. |

| (h) | Ratios do not include expenses of underlying investment companies in which the Fund invests. |

See Notes to Financial Statements.

| Resource Real Estate Diversified Income Fund – Class T | Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | Year Ended September 30, 2016 | | | For the Period Ended September 30, 2015(a) | | | For the Period Ended February 28, 2015(b) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 9.80 | | | $ | 10.50 | | | $ | 10.55 | |

| | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | |

Net investment income(c)(d) | | | 0.33 | | | | 0.22 | | | | 0.00 | (e) |

| Net realized and unrealized gain/(loss) on investments | | | 0.62 | | | | (0.53 | ) | | | (0.05 | ) |

| Total income/(loss) from investment operations | | | 0.95 | | | | (0.31 | ) | | | (0.05 | ) |

| | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | |

| From net investment income | | | (0.27 | ) | | | (0.14 | ) | | | – | |

| From net realized gain on investments | | | – | | | | (0.03 | ) | | | – | |

| From return of capital | | | (0.25 | ) | | | (0.22 | ) | | | – | |

| Total distributions | | | (0.52 | ) | | | (0.39 | ) | | | – | |

| INCREASE/DECREASE IN NET ASSET VALUE | | | 0.43 | | | | (0.70 | ) | | | (0.05 | ) |

| NET ASSET VALUE, END OF PERIOD | | $ | 10.23 | | | $ | 9.80 | | | $ | 10.50 | |

| | | | | | | | | | | | | |

TOTAL RETURN(f) | | | 10.05 | % | | | (2.96 | )%(g) | | | (0.47 | )% |

| | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 3,187 | | | $ | 447 | | | $ | 2 | |

| | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | | | | | |

Including interest expense:(h) | | | | | | | | | | | | |

| Expenses, gross | | | 3.51 | % | | | 4.10 | %(i) | | | 8.49 | %(i) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 3.14 | % | | | 2.99 | %(i) | | | 3.03 | %(i) |

Excluding interest expense:(h) | | | | | | | | | | | | |

| Expenses, gross | | | 3.11 | % | | | 3.85 | %(i) | | | 8.20 | %(i) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.74 | % | | | 2.74 | %(i) | | | 2.74 | %(i) |

Net investment income(d) | | | 3.31 | % | | | 3.87 | %(i) | | | 0.22 | %(i) |

| | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 21 | % | | | 5 | %(j) | | | 91 | %(j) |

| (a) | With the approval of the Board, effective September 30, 2015, the Fund's fiscal year end was changed from February 28 to September 30 (See Note 1). |

| (b) | The Fund's Class T commenced operations on February 13, 2015. |

| (c) | Per share numbers have been calculated using the average shares method. |

| (d) | Recognition of net investment income is affected by timing and declaration of dividends by underlying investment companies. |

| (e) | Amount is less than $0.005. |

| (f) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. Returns shown exclude applicable sales charges. |

| (g) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from net asset values and returns for shareholder transactions. |

| (h) | Ratios do not include expenses of underlying investment companies in which the Fund invests. |

See Notes to Financial Statements.

| Annual Report | September 30, 2016 | 23 |

| Resource Real Estate Diversified Income Fund – Class D | Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | Year Ended September 30, 2016 | | | For the Period Ended September 30, 2015(a) | | | For the Period Ended February 28, 2015(b) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 9.97 | | | $ | 10.67 | | | $ | 10.72 | |

| | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | |

Net investment income(c)(d) | | | 0.31 | | | | 0.24 | | | | 0.00 | (e) |

| Net realized and unrealized gain/(loss) on investments | | | 0.69 | | | | (0.52 | ) | | | (0.05 | ) |

| Total income/(loss) from investment operations | | | 1.00 | | | | (0.28 | ) | | | (0.05 | ) |

| | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | |

| From net investment income | | | (0.30 | ) | | | (0.15 | ) | | | – | |

| From net realized gain on investments | | | – | | | | (0.03 | ) | | | – | |

| From return of capital | | | (0.26 | ) | | | (0.24 | ) | | | – | |

| Total distributions | | | (0.56 | ) | | | (0.42 | ) | | | – | |

| INCREASE/DECREASE IN NET ASSET VALUE | | | 0.44 | | | | (0.70 | ) | | | (0.05 | ) |

| NET ASSET VALUE, END OF PERIOD | | $ | 10.41 | | | $ | 9.97 | | | $ | 10.67 | |

| | | | | | | | | | | | | |

TOTAL RETURN(f) | | | 10.35 | % | | | (2.69 | )%(g) | | | (0.47 | )% |

| | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 5,605 | | | $ | 2,131 | | | $ | 2 | |

| | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | | | | | |

Including interest expense:(h) | | | | | | | | | | | | |

| Expenses, gross | | | 3.25 | % | | | 3.85 | %(i) | | | 8.19 | %(i) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.89 | % | | | 2.74 | %(i) | | | 2.78 | %(i) |

Excluding interest expense:(h) | | | | | | | | | | | | |

| Expenses, gross | | | 2.85 | % | | | 3.60 | %(i) | | | 7.90 | %(i) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.49 | % | | | 2.49 | %(i) | | | 2.49 | %(i) |

Net investment income(d) | | | 3.12 | % | | | 4.13 | %(i) | | | 0.47 | %(i) |

| | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 21 | % | | | 5 | %(j) | | | 91 | %(j) |