UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-22749

(Investment Company Act file number)

Resource Real Estate Diversified Income Fund

(Exact name of registrant as specified in charter)

1845 Walnut Street, 18th Floor

Philadelphia, PA 19103

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

Corporation Trust Center, 1209 Orange Street

Wilmington, DE 19801

(Name and address of agent for service)

Copy to:

JoAnn M. Strasser Thompson Hine LLP 41 South High Street, 17th Floor Columbus, OH 43215 (614) 469-3265 | Darshan Patel Resource Real Estate Diversified Income Fund 712 Fifth Avenue, 12th Floor New York, NY 10019 (212) 506-3899 |

Registrant's telephone number, including area code: (215) 231-7050

Date of fiscal year end: September 30

Date of reporting period: October 1, 2016 - March 31, 2017

Item 1. Reports to Stockholders.

TABLE OF CONTENTS

| Shareholder Letter | 1 |

| Portfolio Update | 3 |

| Portfolio of Investments | 5 |

| Statement of Assets and Liabilities | 11 |

| Statement of Operations | 13 |

| Statements of Changes in Net Assets | 14 |

| Statements of Cash Flows | 17 |

| Financial Highlights | |

| Class A | 18 |

| Class C | 19 |

| Class W | 20 |

| Class I | 21 |

| Class U | 22 |

| Class T | 23 |

| Class D | 24 |

| Notes to Financial Statements | 25 |

| Additional Information | 34 |

| Resource Real Estate Diversified Income Fund | Shareholder Letter |

March 31, 2017 (Unaudited)

Dear Shareholders:

We are pleased to present you with the Resource Real Estate Diversified Income Fund Semi Annual Report for the first half of the 2017 fiscal year. As the Fund’s Advisor, Resource Real Estate has maintained a consistent approach to investing our clients’ capital and has continued to deliver on its key investment objectives of current income and low to moderate volatility.

Our investable universe broadly encompasses three main strategies: Traded Equity (US and international REITs), Real Estate Credit (preferred REIT equity and bonds) and Direct Real Estate (including Private Equity and Non‐traded REITs). Each investment type offers relative advantages. For instance, Traded Equity is a more liquid asset class. Direct Real Estate offers higher levels of capital stability and Real Estate Credit can offer higher security and income.

Our first decision is to determine the appropriate balance within the Fund among these three investment strategies. We base this decision upon where we see the best relative value in the context of achieving the Fund’s strategic objectives.

Investment Environment

We believe that US real estate markets remain solid with manageable supply dynamics, steady economic growth, leverage in line with historical norms, and financing rates still below historical averages. That said, guidance from both REIT CEOs and Real Estate Private Equity managers suggest that the rate of earnings growth is likely to slow from approximately 6‐7%1 on average in 2016 to a range of 2‐4% in 2017. We are not surprised to find some deceleration of growth given the strong performance over the past three years.

With real estate sector growth expectations moderating, the six months ended March 31, 2017 was a period of underperformance for the US NAREIT Index relative to the broader equity markets. The S&P500 realized total returns of 10.12% during the period, reflecting investor optimism regarding strengthening in the global economy and the potential for stimulative economic policies from the new Administration. By contrast, the US NAREIT Index declined by 0.81% as investors absorbed guidance towards lower sector growth and also reacted to the potential for higher interest rates.

The small movement in the US NAREIT Index during the six month period masked interim periods of higher volatility tied to interest rate concerns as well as divergent performance in certain subsectors. Regional mall REITs were down over 15%2 based on concerns regarding competition from online retailers and poor performance from conventional mall anchors such as Macy’s and Sears. Healthcare REITs recovered somewhat as prospects for the repeal of the Affordable Care Act receded but still ended up down by more than 4%3 for the period. In stark contrast to those two sectors, the Hotel REIT sector returned over 18%4 as rising business and consumer confidence improved prospects for the travel industry.

Fund Performance

The Fund continued to deliver on its objectives of providing attractive current income and lower volatility than the broader equity markets for its shareholders. Through March 31, 2017, the Fund has paid a consistent distribution for 16 straight quarters, which corresponded to an annualized rate of 5.88%5 for the most recent quarter ended March 31, 2017. In addition, for that same period, the Fund’s volatility (as measured by standard deviation) was 4.80% compared to 7.70% for the S&P500, 5.87% for the Wells Fargo Hybrid and Preferred Securities REIT Index, and 13.82% for the US NAREIT Index.

Given our defensive positioning, we were pleased that the Fund had a total return of 3.02% for the first half of the fiscal year as compared to a return of 0.95% for the Wells Fargo Hybrid and Preferred Securities REIT Index and a decline of 0.81% for the US NAREIT Index. All three of the Fund’s primary investment strategies advanced. Within the Traded Equity strategy, rising valuations for Mortgage REITs helped offset a small decline in Equity REITs.

Investment Positioning

We target an approximately equal weighting in each of our main strategies but diverge from that balanced approach when we believe we can capture incremental returns by doing so. Thus, we begin the second half of the 2017 fiscal year with slight overweight in the Public Equity Strategy and a slight underweight in the Private Equity strategy as we took advantage of volatility in early 2017 to acquire REIT stocks at what we believe to be attractive valuations. As relative value between these strategies shifts through the second half of the fiscal year, we will rebalance as appropriate.

We seek broad diversification6 not only at an asset class level but also across real estate sectors Such diversification may protect the portfolio as real estate markets continue to adjust to policy changes by the new Administration. Furthermore, our commitment to thorough fundamental research is intended to enhance our security selection within each of those sectors.

| Semi-Annual Report | March 31, 2017 | 1 |

| Resource Real Estate Diversified Income Fund | Shareholder Letter |

March 31, 2017 (Unaudited)

We also continue to be vigilant regarding interest rates. In fact, the sharp spike in Treasury rates after the Presidential election illustrated the importance of our allocations to investments that perform well in a rising rate environment such as Mortgage REITs as well as floating rate and short term credit instruments. Our Direct Real Estate strategy also seeks to provide a source of stability as market sentiment on interest rates shifts.

We are proud of our track record over the past four years and believe that our approach to asset allocation, security selection and diversification will enable us to continue to deliver on our key investment objectives over the course of the next year and beyond. Thank you for being a shareholder of the Resource Real Estate Diversified Income Fund.

Sincerely,

John Snowden

Global Portfolio Manager

Resource Real Estate Diversified Income Fund

| 1 | Annual Net Operating Income growth rate per US NAREIT T-Tracker Q4 2016 report. |

| 2 | Bloomberg Mall REIT Index (BBREMALL). Data as of 3/31/2017. |

| 3 | Bloomberg Healthcare REIT Index (BBREHLTH). Data as of 3/31/2017. |

| 4 | Bloomberg Hotel REIT Index (BBREHOTL). Data as of 3/31/2017. |

| 5 | To calculate the quarterly distribution, the Fund’s management takes the income received from the Fund’s portfolio, subtracts expenses and divides the result by the total number of shares the Fund’s investors own. The annualized distribution represents a single distribution from the Fund and does not represent the total returns of the Fund. A portion of our distribution has been comprised of a return of capital because certain Fund investments have included preferred and common equity investments, which may include a return of capital. Distributions are not guaranteed. |

| 6 | Diversification does not eliminate the risk of experiencing investment losses. |

| Resource Real Estate Diversified Income Fund | Portfolio Update |

March 31, 2017 (Unaudited)

The Fund’s performance figures for the periods ended March 31, 2017*, compared to its benchmark:

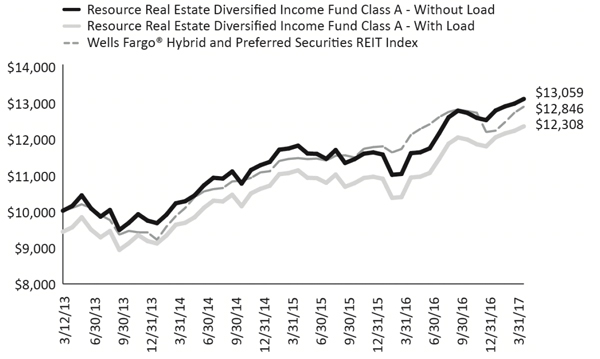

| Resource Real Estate Diversified Income Fund | 6 Month** | 1 Year | 3 Year | Since Inception | Inception |

| Class A Shares – Without Load | 3.02% | 12.82% | 8.37% | 6.81% | 3/12/2013 |

| Class A Shares – With Load | ‐3.65% | 5.50% | 6.25% | 5.26% | 3/12/2013 |

| Class C Shares | 2.63% | 11.87% | – | 6.37% | 8/1/2014 |

| Class W Shares | 2.89% | 12.30% | – | 6.43% | 11/21/2014 |

| Class I Shares | 2.57% | 11.47% | – | 6.45% | 8/1/2014 |

Class U Shares – Without Load1 | 3.12% | 12.93% | 8.41% | 6.83% | 2/12/2015 |

| Class U Shares – With Load | ‐3.55% | 5.60% | 6.01% | 5.06% | 2/12/2015 |

Class T Shares – Without Load2 | 2.73% | 11.99% | – | 6.33% | 2/12/2015 |

| Class T Shares – With Load | 1.15% | 10.27% | – | 5.74% | 2/12/2015 |

Class D Shares3 | 2.86% | 12.26% | – | 6.41% | 2/12/2015 |

Wells Fargo® Hybrid and Preferred Securities REIT Index | 0.95% | 6.38% | 8.44% | 6.38% | 3/12/2013 |

| * | Returns for periods greater than one year are annualized. |

| ** | Returns shown are for the period, October 1, 2016 to March 31, 2017 and include adjustments in accordance with accounting principles generally accepted in the United States of America. |

| 1 | Returns shown prior to 2/12/2015 are based on the returns of RREDX Class A Shares. If Class U Shares had been available during periods prior to 2/12/2015, the performance shown may have been different. |

| 2 | Returns shown prior to 2/12/2015 are based on the returns of CRREX Class C Shares. If Class T Shares had been available during periods prior to 2/12/2015, the performance shown may have been different. |

| 3 | Returns shown prior to 2/12/2015 are based on the returns of WRREX Class W Shares. If Class D Shares had been available during periods prior to 2/12/2015, the performance shown may have been different. |

The Wells Fargo® Hybrid and Preferred Securities REIT (“WHPSR”) Index is designed to track the performance of preferred securities issued in the U.S. market by real estate investment trusts. The WHPSR Index is composed exclusively of preferred shares and depositary shares. Investors cannot invest directly in an index.

Past performance is not predictive of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. Performance figures for periods greater than one year are annualized. The Fund’s total annual operating expense, including underlying funds before fee waivers is 2.93% for Class A, 3.68% for Class C, 2.93% for Class W, 2.68% for Class I, 2.93% for Class U, 3.68% for Class T and 3.43% for Class D shares per the most recent Class specific prospectus filings. After fee waivers, the Fund’s total annual operating expense is 2.54% for Class A, 3.29% for Class C, 2.54% for Class W, 2.29% for Class I, 2.54% for Class U, 3.29% for Class T and 3.04% for Class D shares. Class A are subject to a maximum sales load of 5.75% imposed on purchases Class U shares are subject to a maximum sales load of 6.50% imposed on purchases. Class T shares are subject to a maximum sales load of 1.50% imposed on purchases. For performance information current to the most recent month-end, please call toll-free 1-855-747-9559.

| Semi-Annual Report | March 31, 2017 | 3 |

| Resource Real Estate Diversified Income Fund | Portfolio Update |

March 31, 2017 (Unaudited)

Comparison of the Change in Value of a $10,000 Investment

Portfolio Composition as of March 31, 2017

| Asset Type | Percent of Net Assets |

| Real Estate Investment Trusts ‐ Common Stocks | 87.27% |

| Real Estate Investment Trusts ‐ Preferred Stocks | 23.47% |

| Bonds & Notes | 13.31% |

| Private Investment Funds | 1.15% |

| Purchased Options | 0.52% |

| Bank Loan | ‐25.41% |

| Total Investments | 100.31% |

| Liabilities in Excess of Other Assets | ‐0.31% |

| Net Assets | 100.00% |

| Resource Real Estate Diversified Income Fund | Portfolio of Investments |

March 31, 2017 (Unaudited)

| Principal ($) | | | | Value |

| | | | BONDS & NOTES (13.31%) | | | | |

| | | | ASSET BACKED SECURITIES (0.99%) | | | | |

| | 1,750,000 | | ACA CLO 2007‐1, Ltd., 0.000%, 06/15/2022(a)(b) | | $ | 175 | |

| | 2,000,000 | | Z Capital Credit Partners CLO 2015‐1, Ltd., 6.993%, 07/16/2027(c) | | | 1,941,474 | |

| | | | | | | 1,941,649 | |

| | | | COMMERCIAL MORTGAGE BACKED SECURITIES (12.32%) | | | | |

| | 200,000 | | Banc of America Commercial Mortgage Trust 2006‐4, 5.734%, 07/10/2046(c)(d) | | | 186,850 | |

| | 500,000 | | Banc of America Commercial Mortgage Trust 2007‐3 AJ, 5.761%, 06/10/2017(c) | | | 502,395 | |

| | 1,660,000 | | Banc of America Commercial Mortgage Trust 2007‐3 B, 5.761%, 06/10/2017(c) | | | 1,664,202 | |

| | 320,000 | | CD 2007‐CD5 Mortgage Trust, 6.159%, 11/15/2017(c) | | | 324,948 | |

| | 758,958 | | Commercial Mortgage Trust 2006‐C8, 5.377%, 12/10/2046 | | | 762,374 | |

| | 5,100,000 | | Commercial Mortgage Trust 2007‐C9, 5.808%, 07/10/2017(a)(c) | | | 5,057,755 | |

| | 1,319,709 | | EuroProp EMC SA 2006‐4, Class A, 8.000%, 04/30/2013(c)(e) | | | 1,185,583 | |

| | 2,973,248 | | EuroProp EMC SA 2006‐4, Class B, 8.000%, 04/30/2013(c)(e) | | | 63,437 | |

| | 649,218 | | EuroProp EMC SA 2006‐6, Class B, 0.000%, 04/30/2017(b) | | | 529,828 | |

| | 2,200,000 | | Hypo Real Estate Bank International AG, 0.562%, 03/20/2022(c)(f) | | | 799,349 | |

| | 986,876 | | JP Morgan Chase Commercial Mortgage Securities Trust 2005‐LDP5, 5.699%, 12/15/2044(c) | | | 984,420 | |

| | 2,000,000 | | JP Morgan Chase Commercial Mortgage Securities Trust 2007‐CIBC20, 6.178%, 09/12/2017(c) | | | 2,048,750 | |

| | 3,000,000 | | JP Morgan Chase Commercial Mortgage Securities Trust 2007‐LD12, 6.066%, 08/15/2017(c) | | | 2,859,486 | |

| | 3,495,000 | | Merrill Lynch CFC Commercial Mortgage Trust 2007‐8, 6.156%, 08/12/2049(c) | | | 3,478,198 | |

| | 500,000 | | Morgan Stanley Capital I Trust 2006‐HQ8, 5.399%, 03/12/2044(c) | | | 486,856 | |

| | 1,700,000 | | Morgan Stanley Capital I Trust 2007‐HQ11, 5.538%, 02/12/2044(c)(d) | | | 1,595,940 | |

| | 1,320,825 | | Wachovia Bank Commercial Mortgage Trust 2006‐C25, 5.880%, 05/15/2043(c) | | | 1,318,582 | |

| | 250,000 | | Wachovia Bank Commercial Mortgage Trust 2007‐C31, 5.660%, 04/15/2017(c) | | | 251,146 | |

| | | | | | | 24,100,099 | |

| | | | TOTAL BONDS & NOTES (Cost $28,519,937) | | | 26,041,748 | |

See Notes to Financial Statements.

| Semi-Annual Report | March 31, 2017 | 5 |

| Resource Real Estate Diversified Income Fund | Portfolio of Investments |

March 31, 2017 (Unaudited)

| Shares | | | | Value |

| | | | PREFERRED STOCKS (23.47%) | | | | |

| | | | REAL ESTATE INVESTMENT TRUSTS (23.47%) | | | | |

| | 44,000 | | American Homes 4 Rent, Series E, 6.350%(d) | | $ | 1,126,400 | |

| | 118,328 | | Annaly Capital Management, Inc., Series D, 7.500%(d) | | | 2,958,200 | |

| | 60,000 | | Ares Management LP, Series A, 7.000%(d) | | | 1,575,600 | |

| | 161,972 | | ARMOUR Residential REIT, Inc., Series B, 7.875%(d) | | | 3,822,539 | |

| | 36,800 | | Chimera Investment Corp., Series B, 8.000%(c) | | | 934,352 | |

| | 120,000 | | City Office REIT, Inc., Series A, 6.625%(d) | | | 3,012,000 | |

| | 70,953 | | Colony NorthStar, Inc., Series H, 7.125%(d) | | | 1,771,696 | |

| | 121,289 | | Colony NorthStar, Inc., Series E, 8.750%(d) | | | 3,191,114 | |

| | 36,497 | | Colony NorthStar, Inc., Series D, 8.500%(d) | | | 944,907 | |

| | 20,700 | | Colony NorthStar, Inc., Series C, 8.875%(d) | | | 531,369 | |

| | 6,123 | | CYS Investments, Inc., Series B, 7.500% | | | 143,891 | |

| | 9,820 | | Digital Realty Trust, Inc., Series H, 7.375%(d) | | | 270,050 | |

| | 10,305 | | Digital Realty Trust, Inc., Series F, 6.625%(d) | | | 259,995 | |

| | 135,006 | | Five Oaks Investment Corp., Series A, 8.750%(c)(d) | | | 3,327,898 | |

| | 57,000 | | Gladstone Commercial Corp., Series D, 7.000%(d) | | | 1,434,690 | |

| | 100,000 | | Monmouth Real Estate Investment Corp., Series C, 6.125%(d) | | | 2,489,000 | |

| | 59,376 | | New York Mortgage Trust, Inc., Series C, 7.875%(d) | | | 1,412,555 | |

| | 129,600 | | Pennsylvania Real Estate Investment Trust, Series C, 7.200% | | | 3,461,616 | |

| | 17,464 | | Pennsylvania Real Estate Investment Trust, Series B, 7.375%(d) | | | 439,744 | |

| | 10,127 | | Retail Properties of America, Inc., Series A, 7.000%(d) | | | 258,745 | |

| | 120,000 | | Sotherly Hotels, Inc., Series B, 8.000%(d) | | | 3,087,000 | |

| | 25,000 | | STAG Industrial, Inc., Series C, 6.875%(d) | | | 650,500 | |

| | 120,000 | | Two Harbors Investment Corp., Series A, 8.125%(c) | | | 3,136,800 | |

| | 34,000 | | UMH Properties, Inc., Series B, 8.000%(d) | | | 915,110 | |

| | 6,173 | | Washington Prime Group, Inc., Series I, 6.875%(d) | | | 154,016 | |

| | 176,700 | | Wheeler Real Estate Investment Trust, Inc., Series D, 8.750%(d) | | | 4,595,967 | |

| | | | | | | | |

| | | | TOTAL PREFERRED STOCKS (Cost $43,792,736) | | | 45,905,754 | |

| | | | | | | | |

| | | | REAL ESTATE INVESTMENT TRUSTS ‐COMMON STOCKS (87.27%) | | | | |

| | | | PUBLIC NON‐TRADED REAL ESTATE INVESTMENT TRUSTS (8.12%)(g) | | | | |

| | 4,839 | | Cole Credit Property Trust IV, Inc.(f) | | | 48,097 | |

| | 274,251 | | Cole Real Estate Income Strategy (Daily NAV), Inc., Class I(f) | | | 4,996,848 | |

| | 37,823 | | Corporate Property Associates 18 Global, Inc., Class A(f) | | | 293,504 | |

| | 191,111 | | Corporate Property Associates 18 Global, Inc., Class C(f) | | | 1,484,933 | |

| | 30,292 | | Dividend Capital Diversified Property Fund(f) | | | 227,800 | |

| | 132,979 | | Dividend Capital Diversified Property Fund, Class I | | | 1,000,000 | |

| | 2,981 | | Healthcare Trust, Inc.(f) | | | 60,216 | |

| | 446,837 | | Highlands REIT, Inc.(f) | | | 156,393 | |

| | 446,837 | | InvenTrust Properties Corp.(f) | | | 1,353,917 | |

| | 265,355 | | Jones Lang LaSalle Income Property Trust, Inc.(f) | | | 3,011,774 | |

| | 321,623 | | NorthStar Healthcare Income, Inc.(f) | | | 2,772,394 | |

| | 37,429 | | NorthStar Real Estate Income II, Inc.(f) | | | 332,748 | |

| | 14,984 | | Phillips Edison Grocery Center REIT I, Inc.(f) | | | 144,446 | |

| | | | | | | 15,883,070 | |

See Notes to Financial Statements.

| Resource Real Estate Diversified Income Fund | Portfolio of Investments |

March 31, 2017 (Unaudited)

| Shares | | | | Value |

| | | | PRIVATE REAL ESTATE INVESTMENT TRUSTS (34.39%)(g) | | | | |

| | 38,601 | | Barings Core Property Fund, LP(f) | | $ | 4,761,008 | |

| | 103,239 | | Broadstone Net Lease(f) | | | 8,155,844 | |

| | 480,678 | | Charter Hall Direct VA Trust(f) | | | 453,833 | |

| | 991,074 | | Clarion Debt Fund(f) | | | 981,163 | |

| | 4,153 | | Clarion Gables Multifamily Trust, LP(f) | | | 4,824,709 | |

| | 5,761 | | Clarion Lion Industrial Trust(f) | | | 8,988,605 | |

| | 11,362 | | Clarion Lion Properties Fund, LP(f) | | | 15,694,510 | |

| | 1,407,155 | | Clarion Ventures(f) | | | 1,533,800 | |

| | 67,940 | | Cottonwood Residential, Inc.(f) | | | 1,146,156 | |

| | 8,966,398 | | Guggenheim US Property Private REIT(f) | | | 9,091,750 | |

| | 40,000 | | Reverse Mortgage Investment Trust, Inc.(a)(d)(f) | | | 190,000 | |

| | 1,588,902 | | Talmage Private Credit Fund(f) | | | 1,541,235 | |

| | 386 | | UBS Trumbull LP(f) | | | 4,641,505 | |

| | 490 | | UBS Trumbull Property Fund(f) | | | 5,261,273 | |

| | | | | | | 67,265,391 | |

| | | | TRADED REAL ESTATE INVESTMENT TRUSTS (44.76%) | | | | |

| | 431,004 | | Arlington Asset Investment Corp., Class A(d) | | | 6,090,087 | |

| | 141,746 | | Blackstone Mortgage Trust, Inc., Class A(d) | | | 4,388,456 | |

| | 411,734 | | CBL & Associates Properties, Inc.(d) | | | 3,927,942 | |

| | 347,834 | | City Office REIT, Inc.(d) | | | 4,226,183 | |

| | 82,102 | | Colony NorthStar, Inc.(d) | | | 1,059,937 | |

| | 302,500 | | Condor Hospitality Trust, Inc. | | | 3,206,500 | |

| | 11,261 | | Digital Realty Trust, Inc.(d) | | | 1,198,058 | |

| | 30,584 | | EPR Properties, Inc.(d) | | | 2,251,900 | |

| | 20,571 | | Extra Space Storage, Inc.(d) | | | 1,530,277 | |

| | 368,716 | | Five Oaks Investment Corp.(d) | | | 1,891,513 | |

| | 665,949 | | Global Medical REIT, Inc.(d) | | | 6,046,817 | |

| | 46,667 | | Great Ajax Corp.(d) | | | 609,004 | |

| | 533,623 | | Independence Realty Trust, Inc.(d) | | | 5,000,048 | |

| | 226,431 | | Innovative Industrial Properties, Inc.(d) | | | 3,862,913 | |

| | 145,500 | | Lexington Realty Trust(d) | | | 1,452,090 | |

| | 215,000 | | MedEquities Realty Trust, Inc.(a)(d) | | | 2,410,150 | |

| | 120,111 | | Medical Properties Trust, Inc.(d) | | | 1,548,231 | |

| | 26,700 | | National Storage Affiliates Trust(d) | | | 638,130 | |

| | 299,700 | | New Residential Investment Corp.(d) | | | 5,088,906 | |

| | 231,500 | | New Senior Investment Group, Inc.(d) | | | 2,361,300 | |

| | 26,920 | | Omega Healthcare Investors, Inc.(d) | | | 888,091 | |

| | 422,162 | | Orchid Island Capital, Inc.(d) | | | 4,217,398 | |

| | 78,554 | | Park Hotels & Resorts, Inc. | | | 2,016,481 | |

| | 600,000 | | Sachem Capital Corp. | | | 3,084,000 | |

| | 211,600 | | Spirit Realty Capital, Inc.(d) | | | 2,143,508 | |

| | 103,260 | | STAG Industrial, Inc.(d) | | | 2,583,565 | |

| | 177,800 | | Uniti Group, Inc.(d) | | | 4,596,130 | |

| | 22,376 | | Ventas, Inc.(d) | | | 1,455,335 | |

| | 369,515 | | Washington Prime Group, Inc.(d) | | | 3,211,085 | |

| | 215,328 | | Whitestone REIT(d) | | | 2,980,140 | |

| | 25,197 | | WP Carey, Inc.(d) | | | 1,567,757 | |

| | | | | | | 87,531,932 | |

| | | | TOTAL REAL ESTATE INVESTMENT TRUSTS ‐ COMMON STOCKS (Cost $163,908,621) | | | 170,680,393 | |

See Notes to Financial Statements.

| Semi-Annual Report | March 31, 2017 | 7 |

| Resource Real Estate Diversified Income Fund | Portfolio of Investments |

March 31, 2017 (Unaudited)

| Shares | | | | Value |

| | | | PRIVATE INVESTMENT FUNDS (1.15%) | | | | |

| | | | REITS (1.15%) | | | | |

| | 2,039,791 | | Truman REIT(f)(g) | | $ | 2,250,369 | |

| | | | | | | | |

| | | | TOTAL PRIVATE INVESTMENT FUNDS (Cost $1,952,428) | | | 2,250,369 | |

| | | | | | | | |

| Number of Contracts | | | | | | |

| | | | PURCHASED OPTIONS (0.52%) | | | | |

| | 10,000(d) | | iShares U.S. Real Estate ETF, Put, Exercise Price $76, (expiring 06/16/17)(d) | | | 1,020,000 | |

| | | | | | | | |

| | | | TOTAL PURCHASED OPTIONS (Cost $1,695,731) | | | 1,020,000 | |

| | | | | | | | |

| | | | TOTAL INVESTMENTS (125.72%) (Cost $239,869,453) | | $ | 245,898,264 | |

| | | | | | | | |

| | | | LINE OF CREDIT (‐25.41%) | | | (49,702,248 | ) |

| | | | | | | | |

| | | | LIABILITIES IN EXCESS OF OTHER ASSETS (‐0.31%) | | | (611,107 | )(h) |

| | | | | | | | |

| | | | NET ASSETS (100.00%) | | $ | 195,584,909 | |

(a) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. As of March 31, 2017, the aggregate market value of those securities was $7,658,080, representing 3.92% of net assets. |

(b) | Issued with a zero coupon. Income is recognized through the accretion of discount. |

(c) | Floating or variable rate security. The rate shown is the effective interest rate as of March 31, 2017. |

(d) | All or a portion of each of these securities may be segregated as collateral for written options and the Fund's line of credit. |

(e) | Security in default on interest payments. |

(f) | Fair Value estimated using Fair Valuation Procedures adopted by the Board of Trustees. Total value of such securities is $85,248,178, representing 43.59% of net assets. |

(g) | Illiquid security. See below. |

(h) | Includes cash which is being held as collateral for written options. |

See Notes to Financial Statements.

| Resource Real Estate Diversified Income Fund | Portfolio of Investments |

March 31, 2017 (Unaudited)

Securities determined to be illiquid under the procedures approved by the Fund's Board of Trustees.

Information related to the illiquid securities is as follows:

| Date(s) of Purchase | Security | | Cost | | | Value | | | % of Net Assets | |

10/01/15-07/01/16 | Barings Core Property Fund, LP | | $ | 4,500,000 | | | $ | 4,761,008 | | | | 2.43 | % |

10/31/16-03/31/17 | Broadstone Net Lease | | | 8,000,000 | | | | 8,155,844 | | | | 4.17 | % |

| 04/15/14 | Charter Hall Direct VA Trust | | | 449,712 | | | | 453,833 | | | | 0.23 | % |

| 02/14/17 | Clarion Debt Fund | | | 991,074 | | | | 981,163 | | | | 0.50 | % |

07/02/15-07/01/16 | Clarion Gables Multifamily Trust, LP | | | 4,500,000 | | | | 4,824,709 | | | | 2.47 | % |

01/01/14-01/03/17 | Clarion Lion Industrial Trust | | | 8,050,000 | | | | 8,988,605 | | | | 4.60 | % |

01/01/14-07/01/16 | Clarion Lion Properties Fund, LP | | | 14,050,000 | | | | 15,694,510 | | | | 8.02 | % |

07/01/16-11/09/16 | Clarion Ventures | | | 1,406,152 | | | | 1,533,800 | | | | 0.78 | % |

| 05/22/13 | Cole Credit Property Trust IV, Inc. | | | 40,489 | | | | 48,097 | | | | 0.02 | % |

04/17/14-03/31/17 | Cole Real Estate Income Strategy (Daily NAV), Inc., Class I | | | 4,828,154 | | | | 4,996,848 | | | | 2.55 | % |

11/05/13-05/30/14 | Corporate Property Associates 18 Global, Inc., Class A | | | 307,648 | | | | 293,504 | | | | 0.15 | % |

| 03/12/15 | Corporate Property Associates 18 Global, Inc., Class C | | | 1,720,000 | | | | 1,484,933 | | | | 0.76 | % |

02/24/14-07/21/14 | Cottonwood Residential, Inc. | | | 701,368 | | | | 1,146,156 | | | | 0.59 | % |

04/05/13-11/12/14 | Dividend Capital Diversified Property Fund | | | 154,016 | | | | 227,800 | | | | 0.12 | % |

| 03/31/17 | Dividend Capital Diversified Property Fund, Class I | | | 1,000,000 | | | | 1,000,000 | | | | 0.51 | % |

09/01/16-01/03/17 | Guggenheim US Property Private REIT | | | 9,000,000 | | | | 9,091,750 | | | | 4.65 | % |

| 11/08/13 | Healthcare Trust, Inc. | | | 55,886 | | | | 60,216 | | | | 0.03 | % |

| 02/06/15 | Highlands REIT, Inc. | | | 142,639 | | | | 156,393 | | | | 0.08 | % |

| 02/06/15 | InvenTrust Properties Corp. | | | 1,380,078 | | | | 1,353,917 | | | | 0.69 | % |

06/09/15-08/14/15 | Jones Lang LaSalle Income Property Trust, Inc. | | | 2,748,859 | | | | 3,011,774 | | | | 1.54 | % |

11/27/13-03/12/15 | NorthStar Healthcare Income, Inc. | | | 2,687,879 | | | | 2,772,394 | | | | 1.42 | % |

03/11/14-06/30/15 | NorthStar Real Estate Income II, Inc. | | | 297,024 | | | | 332,748 | | | | 0.17 | % |

08/07/13-11/25/13 | Phillips Edison Grocery Center REIT I, Inc. | | | 119,650 | | | | 144,446 | | | | 0.07 | % |

02/06/14-06/06/14 | Reverse Mortgage Investment Trust, Inc. | | | 576,500 | | | | 190,000 | | | | 0.10 | % |

| 01/03/17 | Talmage Private Credit Fund | | | 1,588,902 | | | | 1,541,235 | | | | 0.79 | % |

06/24/16-12/15/16 | Truman REIT | | | 1,952,428 | | | | 2,250,369 | | | | 1.15 | % |

07/01/16-01/03/17 | UBS Trumbull LP | | | 4,600,000 | | | | 4,641,505 | | | | 2.37 | % |

01/04/16-01/03/17 | UBS Trumbull Property Fund | | | 5,200,000 | | | | 5,261,273 | | | | 2.69 | % |

| | Total | | $ | 81,048,458 | | | $ | 85,398,830 | | | | 43.66 | % |

See Notes to Financial Statements.

| Semi-Annual Report | March 31, 2017 | 9 |

| Resource Real Estate Diversified Income Fund | Portfolio of Investments |

March 31, 2017 (Unaudited)

Additional information on investments in private real estate investment trusts:

| Value | | Security | | Redemption Frequency | | Redemption Notice (Days) | | Unfunded Commitments as of March 31, 2017(a) | |

| $ | 4,761,008 | | Barings Core Property Fund, LP | | Quarterly | | 30 | | $ | – | |

| | 8,155,844 | | Broadstone Net Lease | | N/A | | N/A | | | – | |

| | 453,833 | | Charter Hall Direct VA Trust | | N/A | | N/A | | | – | |

| | 981,163 | | Clarion Debt Fund | | N/A | | N/A | | | 1,037,294 | |

| | 4,824,709 | | Clarion Gables Multifamily Trust, LP | | Quarterly | | 90 | | | – | |

| | 8,988,605 | | Clarion Lion Industrial Trust | | Quarterly | | 90 | | | 2,250,000 | |

| | 15,694,510 | | Clarion Lion Properties Fund, LP | | Quarterly | | 90 | | | – | |

| | 1,533,800 | | Clarion Ventures | | N/A | | N/A | | | 1,178,553 | |

| | 1,146,156 | | Cottonwood Residential, Inc. | | Daily | | 60 | | | – | |

| | 9,091,750 | | Guggenheim US Property Private REIT | | Quarterly | | 60 | | | – | |

| | 190,000 | | Reverse Mortgage Investment Trust, Inc.(b) | | N/A | | IPO(c) | | | – | |

| | 1,541,235 | | Talmage Private Credit Fund | | N/A | | N/A | | | 6,424,871 | |

| | 4,641,505 | | UBS Trumbull LP | | Quarterly | | 60 | | | 600,000 | |

| | 5,261,273 | | UBS Trumbull Property Fund | | Quarterly | | 60 | | | – | |

(a) | Refer to Note 9 for additional information on unfunded commitments. |

(b) | The fair value of this investment has been estimated using the net asset value per share of the investment and adjusted for any changes in market conditions. |

(c) | Redemption eligible after the completion of the Initial Price Offering (IPO). |

Schedule Of Written Options

At March 31, 2017, the Fund had the following outstanding written options:

| | | Number of Contracts | | | Exercise Price | | Maturity Date | | Value | |

| Call Options | | | | | | | | | | |

| iShares U.S. Real Estate ETF | | | (10,000 | ) | | $ | 81.00 | | 6/16/2017 | | $ | (790,000 | ) |

| | | | | | | | | | | | | | |

| Put Options | | | | | | | | | | | | | |

| iShares U.S. Real Estate ETF | | | (10,000 | ) | | $ | 72.00 | | 6/16/2017 | | $ | (360,000 | ) |

| | | | | | | | | | | | | | |

| Total Written Options (Premiums $1,508,505) | | | | | | | | | | | $ | (1,150,000 | ) |

See Notes to Financial Statements.

| Resource Real Estate Diversified Income Fund | Statement of Assets and Liabilities |

March 31, 2017 (Unaudited)

| ASSETS | | | |

| Investments, at value (Cost $239,869,453) | | $ | 245,898,264 | |

| Due from broker | | | 110,104 | |

| Deposit with broker for written options | | | 150,000 | |

| Dividends and interest receivable | | | 2,100,050 | |

| Receivable for fund shares sold | | | 1,844,551 | |

| Prepaid expenses and other assets | | | 75,678 | |

| Total assets | | | 250,178,647 | |

| | | | | |

| LIABILITIES | | | | |

| Line of credit payable | | | 49,702,248 | |

| Interest on line of credit payable | | | 6,953 | |

| Written options, at value (Proceeds 1,508,505) | | | 1,150,000 | |

| Payable to custodian | | | 1,246,880 | |

| Payable for investments purchased | | | 1,981,593 | |

| Payable due to adviser | | | 178,903 | |

| Administration fees payable | | | 38,548 | |

| Custody fees payable | | | 7,066 | |

| Distribution fees payable | | | 30,021 | |

| Distribution due to shareholders | | | 162 | |

| Shareholder servicing fees payable | | | 52,473 | |

| Dealer manager fees payable | | | 2,797 | |

| Payable for transfer agency fees | | | 61,420 | |

| Accrued expenses and other liabilities | | | 134,674 | |

| Total liabilities | | | 54,593,738 | |

| NET ASSETS | | $ | 195,584,909 | |

| | | | | |

| NET ASSETS CONSISTS OF | | | | |

Paid-in capital | | $ | 188,254,635 | |

| Accumulated net investment income | | | 159,682 | |

| Accumulated net realized gain | | | 783,272 | |

| Net unrealized appreciation | | | 6,387,320 | |

| NET ASSETS | | $ | 195,584,909 | |

Commitments and Contingencies (Note 9)

See Notes to Financial Statements.

| Semi-Annual Report | March 31, 2017 | 11 |

| Resource Real Estate Diversified Income Fund | Statement of Assets and Liabilities |

March 31, 2017 (Unaudited)

| PRICING OF SHARES | | | |

| Class A | | | |

| Net Assets | | $ | 78,219,490 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 7,647,661 | |

Net Asset Value and redemption price per share(a) | | $ | 10.23 | |

| Maximum Offering Price Per Share (Maximum Sales Charge of 5.75%) | | $ | 10.85 | |

| Class C | | | | |

| Net Assets | | $ | 45,180,282 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 4,419,362 | |

| Net Asset Value and redemption price per share | | $ | 10.22 | |

| Class W | | | | |

| Net Assets | | $ | 48,821,352 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 4,701,771 | |

| Net Asset Value, offering and redemption price per share | | $ | 10.38 | |

| Class I | | | | |

| Net Assets | | $ | 100,820 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 9,465 | |

| Net Asset Value, offering and redemption price per share | | $ | 10.65 | |

| Class U | | | | |

| Net Assets | | $ | 11,047,037 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 1,079,288 | |

Net Asset Value and redemption price per share(a) | | $ | 10.24 | |

| Maximum Offering Price Per Share (Maximum Sales Charge of 6.50%) | | $ | 10.95 | |

| Class T | | | | |

| Net Assets | | $ | 4,986,235 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 488,537 | |

Net Asset Value and redemption price per share(a) | | $ | 10.21 | |

| Maximum Offering Price Per Share (Maximum Sales Charge of 1.50%) | | $ | 10.37 | |

| Class D | | | | |

| Net Assets | | $ | 7,229,693 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 696,012 | |

| Net Asset Value, offering and redemption price per share | | $ | 10.39 | |

(a) | Redemption price varies based on length of time held (Note 1). |

See Notes to Financial Statements.

| Resource Real Estate Diversified Income Fund | Statement of Operations |

For the Six Months Ended March 31, 2017 (Unaudited)

| INVESTMENT INCOME | | | |

| Dividends | | $ | 6,426,900 | |

| Interest | | | 1,005,143 | |

| Total investment income | | | 7,432,043 | |

| EXPENSES | | | | |

| Investment advisory fees (Note 3) | | | 1,007,182 | |

| Administrative fees (Note 3) | | | 83,781 | |

| Distribution fees (Note 3): | | | | |

| Class C | | | 137,841 | |

| Class T | | | 14,166 | |

| Shareholder servicing fees (Note 3): | | | | |

| Class A | | | 85,392 | |

| Class C | | | 45,947 | |

| Class W | | | 48,058 | |

| Class U | | | 10,308 | |

| Class T | | | 4,722 | |

| Class D | | | 6,986 | |

| Dealer manager fees (Note3): | | | | |

Class W(a) | | | 46,720 | |

| Class D | | | 13,971 | |

| Interest expense | | | 531,391 | |

| Transfer agent fees (Note 3) | | | 123,073 | |

| Audit fees | | | 12,533 | |

| Legal fees | | | 38,713 | |

| Printing expense | | | 55,046 | |

| Registration fees | | | 41,868 | |

| Custody fees | | | 22,765 | |

| Trustee fees and expenses (Note 3) | | | 21,921 | |

| Other expenses | | | 62,312 | |

| Total expenses | | | 2,414,696 | |

| Less fees waived/expenses reimbursed by investment adviser (Note 3) | | | (67,140 | ) |

| Total net expenses | | | 2,347,556 | |

| NET INVESTMENT INCOME | | | 5,084,487 | |

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS | | | | |

| Net realized loss on investments | | | (2,681,508 | ) |

| Net realized gain on futures contracts | | | 322,214 | |

| Net realized gain on written options | | | 3,435,268 | |

| Net realized loss on foreign currency transactions | | | (1,170 | ) |

| Total net realized gain | | | 1,074,804 | |

| Net change in unrealized depreciation on investments | | | (212,580 | ) |

| Net change in unrealized depreciation on futures contracts | | | (19,235 | ) |

| Net change in unrealized depreciation on written options | | | (539,599 | ) |

| Net change in unrealized depreciation on translation of assets and liabilities in foreign currencies | | | (70 | ) |

| Total net change in unrealized depreciation | | | (771,484 | ) |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS AND FOREIGN CURRENCY TRANSACTIONS | | | 303,320 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 5,387,807 | |

(a) | Effective January 6, 2017, Class W shares are no longer subject to a dealer manager fee. |

See Notes to Financial Statements.

| Semi-Annual Report | March 31, 2017 | 13 |

| Resource Real Estate Diversified Income Fund | Statements of Changes in Net Assets |

| | | For the Six Months Ended March 31, 2017 (Unaudited) | | | For the Year Ended September 30, 2016 | |

| OPERATIONS | | | | | | |

| Net investment income | | $ | 5,084,487 | | | $ | 3,137,494 | |

| Net realized gain | | | 1,074,804 | | | | 35,806 | |

| Net change in unrealized appreciation | | | (771,484 | ) | | | 7,991,926 | |

| Net increase in net assets resulting from operations | | $ | 5,387,807 | | | $ | 11,165,226 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From investment income: | | | | | | | | |

| Class A | | | (2,143,466 | ) | | | (1,509,210 | ) |

| Class C | | | (1,028,642 | ) | | | (658,437 | ) |

| Class W | | | (1,201,802 | ) | | | (601,298 | ) |

| Class I | | | (1,542 | ) | | | – | |

| Class U | | | (271,069 | ) | | | (70,780 | ) |

| Class T | | | (109,048 | ) | | | (50,499 | ) |

| Class D | | | (169,236 | ) | | | (121,430 | ) |

| From realized gains on investments: | | | | | | | | |

| Class A | | | (215,368 | ) | | | – | |

| Class C | | | (113,360 | ) | | | – | |

| Class W | | | (118,447 | ) | | | – | |

| Class U | | | (26,415 | ) | | | – | |

| Class T | | | (11,690 | ) | | | – | |

| Class D | | | (17,832 | ) | | | – | |

| From return of capital: | | | | | | | | |

| Class A | | | – | | | | (1,517,924 | ) |

| Class C | | | – | | | | (662,238 | ) |

| Class W | | | – | | | | (604,770 | ) |

| Class I | | | – | | | | (1 | ) |

| Class U | | | – | | | | (71,188 | ) |

| Class T | | | – | | | | (50,790 | ) |

| Class D | | | – | | | | (122,132 | ) |

| Net decrease in net assets from distributions | | | (5,427,917 | ) | | | (6,040,697 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Class A | | | | | | | | |

| Proceeds from sales of shares | | | 17,931,616 | | | | 24,246,411 | |

| Distributions reinvested | | | 1,161,258 | | | | 1,531,196 | |

| Cost of shares redeemed | | | (2,270,111 | ) | | | (4,085,281 | ) |

| Net increase from capital shares transactions | | | 16,822,763 | | | | 21,692,326 | |

| | | | | | | | | |

| Class C | | | | | | | | |

| Proceeds from sales of shares | | | 13,371,813 | | | | 19,427,546 | |

| Distributions reinvested | | | 737,985 | | | | 887,888 | |

| Cost of shares redeemed | | | (2,037,346 | ) | | | (1,893,250 | ) |

| Net increase from capital shares transactions | | | 12,072,452 | | | | 18,422,184 | |

| | | | | | | | | |

| Class W | | | | | | | | |

| Proceeds from sales of shares | | | 19,212,485 | | | | 22,518,683 | |

| Distributions reinvested | | | 635,692 | | | | 552,421 | |

| Cost of shares redeemed | | | (2,127,093 | ) | | | (4,368,496 | ) |

| Net increase from capital shares transactions | | | 17,721,084 | | | | 18,702,608 | |

| | | | | | | | | |

| Class I | | | | | | | | |

| Proceeds from sales of shares | | | 101,507 | | | | – | |

| Distributions reinvested | | | 23 | | | | – | |

| Cost of shares redeemed | | | – | | | | (49,324 | ) |

| Net increase/(decrease) from capital shares transactions | | | 101,530 | | | | (49,324 | ) |

See Notes to Financial Statements.

| Resource Real Estate Diversified Income Fund | Statements of Changes in Net Assets (continued) |

| | | For the Six Months Ended March 31, 2017 (Unaudited) | | | For the Year Ended September 30, 2016 | |

| Class U | | | | | | |

| Proceeds from sales of shares | | | 5,220,435 | | | | 5,539,265 | |

| Distributions reinvested | | | 122,243 | | | | 54,034 | |

| Cost of shares redeemed | | | (71,887 | ) | | | (10,180 | ) |

| Net increase from capital shares transactions | | | 5,270,791 | | | | 5,583,119 | |

| | | | | | | | | |

| Class T | | | | | | | | |

| Proceeds from sales of shares | | | 1,747,866 | | | | 2,599,685 | |

| Distributions reinvested | | | 47,438 | | | | 30,599 | |

| Net increase from capital shares transactions | | | 1,795,304 | | | | 2,630,284 | |

| | | | | | | | | |

| Class D | | | | | | | | |

| Proceeds from sales of shares | | | 1,679,563 | | | | 3,072,558 | |

| Distributions reinvested | | | 98,340 | | | | 125,740 | |

| Cost of shares redeemed | | | (154,950 | ) | | | (30,003 | ) |

| Net increase from capital shares transactions | | | 1,622,953 | | | | 3,168,295 | |

| | | | | | | | | |

| Net increase in net assets | | | 55,366,767 | | | | 75,274,021 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 140,218,142 | | | | 64,944,121 | |

| End of period* | | $ | 195,584,909 | | | $ | 140,218,142 | |

| | | | | | | | | |

| *Including accumulated net investment income of: | | $ | 159,682 | | | $ | – | |

See Notes to Financial Statements.

| Semi-Annual Report | March 31, 2017 | 15 |

| Resource Real Estate Diversified Income Fund | Statements of Changes in Net Assets (continued) |

| | | For the Six Months Ended March 31, 2017 (Unaudited) | | | For the Year Ended September 30, 2016 | |

| OTHER INFORMATION | | | | | | |

| Capital Shares Transactions | | | | | | |

| Class A | | | | | | |

| Issued | | | 1,761,043 | | | | 2,442,421 | |

| Distributions reinvested | | | 115,283 | | | | 154,823 | |

| Redeemed | | | (221,820 | ) | | | (415,226 | ) |

| Net increase in capital shares | | | 1,654,506 | | | | 2,182,018 | |

| | | | | | | | | |

| Class C | | | | | | | | |

| Issued | | | 1,315,000 | | | | 1,963,693 | |

| Distributions reinvested | | | 73,303 | | | | 89,798 | |

| Redeemed | | | (199,051 | ) | | | (193,223 | ) |

| Net increase in capital shares | | | 1,189,252 | | | | 1,860,268 | |

| | | | | | | | | |

| Class W | | | | | | | | |

| Issued | | | 1,860,089 | | | | 2,238,396 | |

| Distributions reinvested | | | 62,166 | | | | 54,815 | |

| Redeemed | | | (204,919 | ) | | | (455,467 | ) |

| Net increase in capital shares | | | 1,717,336 | | | | 1,837,744 | |

| | | | | | | | | |

| Class I | | | | | | | | |

| Issued | | | 9,461 | | | | – | |

| Distributions reinvested | | | 2 | | | | – | |

| Redeemed | | | – | | | | (4,749 | ) |

| Net increase/(decrease) in capital shares | | | 9,463 | | | | (4,749 | ) |

| | | | | | | | | |

| Class U | | | | | | | | |

| Issued | | | 512,292 | | | | 551,293 | |

| Distributions reinvested | | | 12,129 | | | | 5,375 | |

| Redeemed | | | (7,050 | ) | | | (995 | ) |

| Net increase in capital shares | | | 517,371 | | | | 555,673 | |

| | | | | | | | | |

| Class T | | | | | | | | |

| Issued | | | 172,403 | | | | 262,716 | |

| Distributions reinvested | | | 4,722 | | | | 3,063 | |

| Net increase in capital shares | | | 177,125 | | | | 265,779 | |

| | | | | | | | | |

| Class D | | | | | | | | |

| Issued | | | 163,244 | | | | 314,877 | |

| Distributions reinvested | | | 9,617 | | | | 12,527 | |

| Redeemed | | | (15,000 | ) | | | (3,058 | ) |

| Net increase in capital shares | | | 157,861 | | | | 324,346 | |

See Notes to Financial Statements.

| Resource Real Estate Diversified Income Fund | Statements of Cash Flows |

| | | For the Six Months Ended March 31, 2017 (Unaudited) | |

| Cash Flow from Operating Activities: | | | |

| Net increase in net assets resulting from operations | | $ | 5,387,807 | |

| Adjustments to reconcile net increase in net assets resulting from operations to net cash provided by / (used in) operating activities: | | | | |

| Purchase of investment securities | | | (79,566,075 | ) |

| Proceeds from sale of investment securities | | | 10,460,984 | |

| Purchase of option contracts | | | (4,355,764 | ) |

| Proceeds from sale of option contracts | | | 1,850,407 | |

| Premiums received from written options transactions | | | 3,903,068 | |

Net (purchase) proceeds from short-term investment securities | | | 858,901 | |

| Amortization of premium and accretion of discount on investments | | | 343,087 | |

| Net realized (gain)/loss on: | | | | |

| Investments | | | 2,681,508 | |

| Written options | | | (3,435,268 | ) |

| Net change in unrealized (appreciation)/depreciation on: | | | | |

| Investments | | | 212,580 | |

| Written options | | | 539,599 | |

| Futures Contracts | | | 19,235 | |

| (Increase)/Decrease in assets: | | | | |

| Deposit with broker for futures contracts / collateral | | | 571,610 | |

| Deposit with broker for written option contracts | | | (150,000 | ) |

| Interest on line of credit | | | | |

| Dividends receivable | | | (714,257 | ) |

| Prepaid expenses & other assets | | | (144,670 | ) |

| Increase/(Decrease) in liabilities: | | | 6,953 | |

| Payable to custodian/overdrafts | | | 463,584 | |

| Variation margin payable on futures contracts | | | (9,063 | ) |

| Payable for dealer manager fees | | | (11,595 | ) |

| Payable for shareholder servicing fees | | | (3,469 | ) |

| Payable for distribution fees | | | 8,218 | |

| Payable to advisor / investment advisor | | | 102,830 | |

| Payable for administration fees | | | 23,269 | |

| Payable for custody fees | | | (2,755 | ) |

| Payable for transfer agency fees | | | 30,082 | |

| Accrued expenses and other liabilities | | | 186 | |

| Net cash provided by / (used in) operating activities | | | (60,929,008 | ) |

| | | | | |

| Cash Flows from Financing Activities: | | | | |

| Cash provided by loan: | | | 12,881,164 | |

| Proceeds from sale of shares | | | 58,241,590 | |

| Cost of shares redeemed | | | (6,661,387 | ) |

| Cash distributions paid | | | (3,532,359 | ) |

| Net cash provided by /(used in) financing activities | | | 60,929,008 | |

| | | | | |

| Net Change in Cash & Foreign Rates On Cash & Foreign Currency | | | - | |

| Cash & Foreign Currency, Beginning of Period | | | - | |

| Cash & Foreign Currency, End of Period | | | - | |

| | | | | |

Non-cash financing activities not included herein consist of reinvestment of distributions of: | | $ | 2,802,979 | |

| Cash paid for interest on loan during the period was: | | $ | 524,438 | |

See Notes to Financial Statements.

| Semi-Annual Report | March 31, 2017 | 17 |

| Resource Real Estate Diversified Income Fund – Class A | Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | For the Six Months Ended March 31, 2017 (Unaudited) | | | Year Ended September 30, 2016 | | | For the Period Ended September 30, 2015(a) | | | Year Ended February 28, 2015 | | | For the Period Ended February 28, 2014(b) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.26 | | | $ | 9.81 | | | $ | 10.52 | | | $ | 9.75 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | | | | | |

Net investment income(c)(d) | | | 0.33 | | | | 0.34 | | | | 0.21 | | | | 0.33 | | | | 0.24 | |

| Net realized and unrealized gain/(loss) on investments | | | (0.03 | ) | | | 0.71 | | | | (0.47 | ) | | | 1.05 | | | | (0.06 | ) |

| Total income/(loss) from investment operations | | | 0.30 | | | | 1.05 | | | | (0.26 | ) | | | 1.38 | | | | 0.18 | |

| | | | | | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.30 | ) | | | (0.32 | ) | | | (0.17 | ) | | | (0.48 | ) | | | (0.39 | ) |

| From net realized gain on investments | | | (0.03 | ) | | | – | | | | (0.03 | ) | | | (0.05 | ) | | | (0.00 | )(e) |

| From return of capital | | | – | | | | (0.28 | ) | | | (0.25 | ) | | | (0.08 | ) | | | (0.04 | ) |

| Total distributions | | | (0.33 | ) | | | (0.60 | ) | | | (0.45 | ) | | | (0.61 | ) | | | (0.43 | ) |

| INCREASE/DECREASE IN NET ASSET VALUE | | | (0.03 | ) | | | 0.45 | | | | (0.71 | ) | | | 0.77 | | | | (0.25 | ) |

| NET ASSET VALUE, END OF PERIOD | | $ | 10.23 | | | $ | 10.26 | | | $ | 9.81 | | | $ | 10.52 | | | $ | 9.75 | |

| | | | | | | | | | | | | | | | | | | | | |

TOTAL RETURN(f) | | | 3.02 | % | | | 11.09 | % | | | (2.50 | )%(g) | | | 14.70 | % | | | 2.03 | % |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 78,219 | | | $ | 61,470 | | | $ | 37,399 | | | $ | 27,830 | | | $ | 4,823 | |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | | | | | | | | | | | | | |

Including interest expense:(h) | | | | | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 2.73 | %(i) | | | 2.78 | % | | | 3.30 | %(i) | | | 4.81 | % | | | 24.79 | %(i) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.65 | %(i) | | | 2.39 | % | | | 2.24 | %(i) | | | 2.29 | % | | | 2.32 | %(i) |

Excluding interest expense:(h) | | | | | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 2.07 | %(i) | | | 2.38 | % | | | 3.05 | %(i) | | | 4.51 | % | | | 24.46 | %(i) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 1.99 | %(i) | | | 1.99 | % | | | 1.99 | %(i) | | | 1.99 | % | | | 1.99 | %(i) |

Net investment income(d) | | | 6.50 | %(i) | | | 3.47 | % | | | 3.57 | %(i) | | | 3.21 | % | | | 2.54 | %(i) |

| | | | | | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 3 | %(j) | | | 21 | % | | | 5 | %(j) | | | 91 | % | | | 4 | %(j) |

| (a) | With the approval of the Board, effective September 30, 2015, the Fund's fiscal year end was changed from February 28 to September 30 (See Note 1). |

| (b) | The Fund's Class A commenced operations on March 12, 2013. |

| (c) | Per share numbers have been calculated using the average shares method. |

(d) | Recognition of net investment income is affected by timing and declaration of dividends by underlying investment companies. |

| (e) | Amount is less than $(0.005). |

| (f) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. Returns shown exclude applicable sales charges. |

| (g) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from net asset values and returns for shareholder transactions. |

| (h) | Ratios do not include expenses of underlying investment companies in which the Fund invests. |

See Notes to Financial Statements.

| Resource Real Estate Diversified Income Fund – Class C | Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | For the Six Months Ended March 31, 2017 (Unaudited) | | | Year Ended September 30, 2016 | | | For the Period Ended September 30, 2015(a) | | | For the Period Ended February 28, 2015(b) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.25 | | | $ | 9.81 | | | $ | 10.50 | | | $ | 10.06 | |

| | | | | | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | |

Net investment income(c)(d) | | | 0.29 | | | | 0.28 | | | | 0.18 | | | | 0.14 | |

| Net realized and unrealized gain/(loss) on investments | | | (0.03 | ) | | | 0.68 | | | | (0.48 | ) | | | 0.58 | |

| Total income/(loss) from investment operations | | | 0.26 | | | | 0.96 | | | | (0.30 | ) | | | 0.72 | |

| | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.26 | ) | | | (0.27 | ) | | | (0.14 | ) | | | (0.20 | ) |

| From net realized gain on investments | | | (0.03 | ) | | | – | | | | (0.03 | ) | | | (0.05 | ) |

| From return of capital | | | – | | | | (0.25 | ) | | | (0.22 | ) | | | (0.03 | ) |

| Total distributions | | | (0.29 | ) | | | (0.52 | ) | | | (0.39 | ) | | | (0.28 | ) |

| INCREASE/DECREASE IN NET ASSET VALUE | | | (0.03 | ) | | | 0.44 | | | | (0.69 | ) | | | 0.44 | |

| NET ASSET VALUE, END OF PERIOD | | $ | 10.22 | | | $ | 10.25 | | | $ | 9.81 | | | $ | 10.50 | |

| | | | | | | | | | | | | | | | | |

TOTAL RETURN(e) | | | 2.63 | % | | | 10.15 | % | | | (2.86 | )%(f) | | | 7.33 | % |

| | | | | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 45,180 | | | $ | 33,114 | | | $ | 13,436 | | | $ | 3,732 | |

| | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | | | | | | | | | |

Including interest expense:(g) | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 3.48 | %(h) | | | 3.53 | % | | | 4.04 | %(h) | | | 6.37 | %(h) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 3.40 | %(h) | | | 3.14 | % | | | 2.99 | %(h) | | | 3.04 | %(h) |

Excluding interest expense:(g) | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 2.82 | %(h) | | | 3.13 | % | | | 3.79 | %(h) | | | 6.07 | %(h) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.74 | %(h) | | | 2.74 | % | | | 2.74 | %(h) | | | 2.74 | %(h) |

Net investment income(d) | | | 5.82 | %(h) | | | 2.87 | % | | | 2.97 | %(h) | | | 2.34 | %(h) |

| | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 3 | %(i) | | | 21 | % | | | 5 | %(i) | | | 91 | %(i) |

(a) | With the approval of the Board, effective September 30, 2015, the Fund's fiscal year end was changed from February 28 to September 30 (See Note 1). |

(b) | The Fund's Class C commenced operations on August 1, 2014. |

(c) | Per share numbers have been calculated using the average shares method. |

(d) | Recognition of net investment income is affected by timing and declaration of dividends by underlying investment companies. |

(e) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. Returns shown exclude applicable sales charges. |

(f) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from net asset values and returns for shareholder transactions. |

(g) | Ratios do not include expenses of underlying investment companies in which the Fund invests. |

See Notes to Financial Statements.

| Semi-Annual Report | March 31, 2017 | 19 |

| Resource Real Estate Diversified Income Fund – Class W | Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | For the Six Months Ended March 31, 2017 (Unaudited) | | | Year Ended September 30, 2016 | | | For the Period Ended September 30, 2015(a) | | | For the Period Ended February 28, 2015(b) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.41 | | | $ | 9.96 | | | $ | 10.67 | | | $ | 10.18 | |

| | | | | | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | |

Net investment income(c)(d) | | | 0.33 | | | | 0.32 | | | | 0.20 | | | | 0.03 | |

| Net realized and unrealized gain/(loss) on investments | | | (0.04 | ) | | | 0.69 | | | | (0.49 | ) | | | 0.46 | |

| Total income/(loss) from investment operations | | | 0.29 | | | | 1.01 | | | | (0.29 | ) | | | 0.49 | |

| | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.29 | ) | | | (0.30 | ) | | | (0.15 | ) | | | – | |

| From net realized gain on investments | | | (0.03 | ) | | | – | | | | (0.03 | ) | | | – | |

| From return of capital | | | – | | | | (0.26 | ) | | | (0.24 | ) | | | – | |

| Total distributions | | | (0.32 | ) | | | (0.56 | ) | | | (0.42 | ) | | | – | |

| INCREASE/DECREASE IN NET ASSET VALUE | | | (0.03 | ) | | | 0.45 | | | | (0.71 | ) | | | 0.49 | |

| NET ASSET VALUE, END OF PERIOD | | $ | 10.38 | | | $ | 10.41 | | | $ | 9.96 | | | $ | 10.67 | |

| | | | | | | | | | | | | | | | | |

TOTAL RETURN(e) | | | 2.89 | % | | | 10.46 | % | | | (2.79 | )%(f) | | | 4.81 | %(f) |

| | | | | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 48,821 | | | $ | 31,076 | | | $ | 11,421 | | | $ | 1,211 | |

| | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | | | | | | | | | |

Including interest expense:(g) | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 2.99 | %(h) | | | 3.30 | % | | | 3.78 | %(h) | | | 11.30 | %(h) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.89 | %(h)(i) | | | 2.89 | % | | | 2.74 | %(h) | | | 2.79 | %(h) |

Excluding interest expense:(g) | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 2.33 | %(h) | | | 2.90 | % | | | 3.53 | %(h) | | | 11.00 | %(h) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.23 | %(h)(i) | | | 2.49 | % | | | 2.49 | %(h) | | | 2.49 | %(h) |

Net investment income(d) | | | 6.41 | %(h) | | | 3.17 | % | | | 3.28 | %(h) | | | 1.31 | %(h) |

| | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 3 | %(j) | | | 21 | % | | | 5 | %(j) | | | 91 | %(j) |

| (a) | With the approval of the Board, effective September 30, 2015, the Fund's fiscal year end was changed from February 28 to September 30 (See Note 1). |

| (b) | The Fund's Class W commenced operations on November 24, 2014. |

| (c) | Per share numbers have been calculated using the average shares method. |

(d) | Recognition of net investment income is affected by timing and declaration of dividends by underlying investment companies. |

| (e) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. |

| (f) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from net asset values and returns for shareholder transactions. |

| (g) | Ratios do not include expenses of underlying investment companies in which the Fund invests. |

| (i) | Effective January 5, 2017, the annual expense limitation changed from 3.09% to 2.59%. |

See Notes to Financial Statements.

| Resource Real Estate Diversified Income Fund – Class I | Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | For the Six Months Ended March 31, 2017 (Unaudited) | | | Year Ended September 30, 2016 | | | For the Period Ended September 30, 2015(a) | | | For the Period Ended February 28, 2015(b) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.74 | | | $ | 10.36 | | | $ | 10.79 | | | $ | 10.06 | |

| | | | | | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | |

Net investment income(c)(d) | | | 0.57 | | | | 0.04 | | | | 0.27 | | | | 0.14 | |

| Net realized and unrealized gain/(loss) on investments | | | (0.30 | ) | | | 0.97 | | | | (0.54 | ) | | | 0.59 | |

| Total income/(loss) from investment operations | | | 0.27 | | | | 1.01 | | | | (0.27 | ) | | | 0.73 | |

| | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.33 | ) | | | (0.33 | ) | | | (0.04 | ) | | | – | |

| From net realized gain on investments | | | (0.03 | ) | | | – | | | | (0.03 | ) | | | – | |

| From return of capital | | | – | | | | (0.30 | ) | | | (0.09 | ) | | | – | |

| Total distributions | | | (0.36 | ) | | | (0.63 | ) | | | (0.16 | ) | | | – | |

| INCREASE/DECREASE IN NET ASSET VALUE | | | (0.09 | ) | | | 0.38 | | | | (0.43 | ) | | | 0.73 | |

| NET ASSET VALUE, END OF PERIOD | | $ | 10.65 | | | $ | 10.74 | | | $ | 10.36 | | | $ | 10.79 | |

| | | | | | | | | | | | | | | | | |

TOTAL RETURN(e) | | | 2.57 | % | | | 10.12 | % | | | (2.51 | )%(f) | | | 7.26 | % |

| | | | | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 101 | | | $ | 0 | (g) | | $ | 49 | | | $ | 0 | (g) |

| | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | | | | | | | | | |

Including interest expense:(h) | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 2.53 | %(i) | | | 2.49 | % | | | 2.96 | %(i) | | | 3.94 | %(i) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.40 | %(i) | | | 2.14 | % | | | 1.99 | %(i) | | | 2.08 | %(i) |

Excluding interest expense:(h) | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 1.87 | %(i) | | | 2.09 | % | | | 2.71 | %(i) | | | 3.60 | %(i) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 1.74 | %(i) | | | 1.74 | % | | | 1.74 | %(i) | | | 1.74 | %(i) |

Net investment income(d) | | | 11.10 | %(i) | | | 0.36 | % | | | 4.46 | %(i) | | | 2.36 | %(i) |

| | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 3 | %(j) | | | 21 | % | | | 5 | %(j) | | | 91 | %(j) |

| (a) | With the approval of the Board, effective September 30, 2015, the Fund's fiscal year end was changed from February 28 to September 30 (See Note 1). |

| (b) | The Fund's Class I commenced operations on August 1, 2014. |

| (c) | Per share numbers have been calculated using the average shares method. |

| (d) | Recognition of net investment income is affected by timing and declaration of dividends by underlying investment companies. |

| (e) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. |

| (f) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from net asset values and returns for shareholder transactions. |

| (g) | Amount less than $500. See Statement of Assets and Liabilities for actual net assets. |

| (h) | Ratios do not include expenses of underlying investment companies in which the Fund invests. |

See Notes to Financial Statements.

| Semi-Annual Report | March 31, 2017 | 21 |

| Resource Real Estate Diversified Income Fund – Class U | Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | For the Six Months Ended March 31, 2017 (Unaudited) | | | Year Ended September 30, 2016 | | | For the Period Ended September 30, 2015(a) | | | For the Period Ended February 28, 2015(b) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.26 | | | $ | 9.82 | | | $ | 10.52 | | | $ | 10.57 | |

| | | | | | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | |

Net investment income(c)(d) | | | 0.34 | | | | 0.50 | | | | 0.27 | | | | 0.00 | (e) |

| Net realized and unrealized gain/(loss) on investments | | | (0.03 | ) | | | 0.54 | | | | (0.52 | ) | | | (0.05 | ) |

| Total income/(loss) from investment operations | | | 0.31 | | | | 1.04 | | | | (0.25 | ) | | | (0.05 | ) |

| | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.30 | ) | | | (0.32 | ) | | | (0.17 | ) | | | – | |

| From net realized gain on investments | | | (0.03 | ) | | | – | | | | (0.03 | ) | | | – | |

| From return of capital | | | – | | | | (0.28 | ) | | | (0.25 | ) | | | – | |

| Total distributions | | | (0.33 | ) | | | (0.60 | ) | | | (0.45 | ) | | | – | |

| INCREASE/DECREASE IN NET ASSET VALUE | | | (0.02 | ) | | | 0.44 | | | | (0.70 | ) | | | (0.05 | ) |

| NET ASSET VALUE, END OF PERIOD | | $ | 10.24 | | | $ | 10.26 | | | $ | 9.82 | | | $ | 10.52 | |

| | | | | | | | | | | | | | | | | |

TOTAL RETURN(f) | | | 3.12 | % | | | 10.98 | % | | | (2.40 | )%(g) | | | (0.47 | )% |

| | | | | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 11,047 | | | $ | 5,766 | | | $ | 61 | | | $ | 2 | |

| | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | | | | | | | | | |

Including interest expense:(h) | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 2.71 | %(i) | | | 2.78 | % | | | 3.42 | %(i) | | | 7.74 | %(i) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.65 | %(i) | | | 2.39 | % | | | 2.24 | %(i) | | | 2.28 | %(i) |

Excluding interest expense:(h) | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 2.05 | %(i) | | | 2.38 | % | | | 3.17 | %(i) | | | 7.45 | %(i) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 1.99 | %(i) | | | 1.99 | % | | | 1.99 | %(i) | | | 1.99 | %(i) |

Net investment income(d) | | | 6.67 | %(i) | | | 5.00 | % | | | 4.64 | %(i) | | | 0.97 | %(i) |

| | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 3 | %(j) | | | 21 | % | | | 5 | %(j) | | | 91 | %(j) |

| (a) | With the approval of the Board, effective September 30, 2015, the Fund's fiscal year end was changed from February 28 to September 30 (See Note 1). |

| (b) | The Fund's Class U commenced operations on February 13, 2015. |

| (c) | Per share numbers have been calculated using the average shares method. |

| (d) | Recognition of net investment income is affected by timing and declaration of dividends by underlying investment companies. |

(e) | Amount is less than $0.005. |

| (f) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. Returns shown exclude applicable sales charges. |

| (g) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from net asset values and returns for shareholder transactions. |

| (h) | Ratios do not include expenses of underlying investment companies in which the Fund invests. |

See Notes to Financial Statements.

| Resource Real Estate Diversified Income Fund – Class T | Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | For the Six Months Ended March 31, 2017 (Unaudited) | | | Year Ended September 30, 2016 | | | For the Period Ended September 30, 2015(a) | | | For the Period Ended February 28, 2015(b) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.23 | | | $ | 9.80 | | | $ | 10.50 | | | $ | 10.55 | |

| | | | | | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | |

Net investment income(c)(d) | | | 0.30 | | | | 0.33 | | | | 0.22 | | | | 0.00 | (e) |

| Net realized and unrealized gain/(loss) on investments | | | (0.03 | ) | | | 0.62 | | | | (0.53 | ) | | | (0.05 | ) |

| Total income/(loss) from investment operations | | | 0.27 | | | | 0.95 | | | | (0.31 | ) | | | (0.05 | ) |

| | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.26 | ) | | | (0.27 | ) | | | (0.14 | ) | | | – | |

| From net realized gain on investments | | | (0.03 | ) | | | – | | | | (0.03 | ) | | | – | |

| From return of capital | | | – | | | | (0.25 | ) | | | (0.22 | ) | | | – | |

| Total distributions | | | (0.29 | ) | | | (0.52 | ) | | | (0.39 | ) | | | – | |

| INCREASE/DECREASE IN NET ASSET VALUE | | | (0.02 | ) | | | 0.43 | | | | (0.70 | ) | | | (0.05 | ) |

| NET ASSET VALUE, END OF PERIOD | | $ | 10.21 | | | $ | 10.23 | | | $ | 9.80 | | | $ | 10.50 | |

| | | | | | | | | | | | | | | | | |

TOTAL RETURN(f) | | | 2.73 | % | | | 10.05 | % | | | (2.96 | )%(g) | | | (0.47 | )% |

| | | | | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 4,986 | | | $ | 3,187 | | | $ | 447 | | | $ | 2 | |

| | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | | | | | | | | | |

Including interest expense:(h) | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 3.46 | %(i) | | | 3.51 | % | | | 4.10 | %(i) | | | 8.49 | %(i) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 3.40 | %(i) | | | 3.14 | % | | | 2.99 | %(i) | | | 3.03 | %(i) |

Excluding interest expense:(h) | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 2.80 | %(i) | | | 3.11 | % | | | 3.85 | %(i) | | | 8.20 | %(i) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.74 | %(i) | | | 2.74 | % | | | 2.74 | %(i) | | | 2.74 | %(i) |

Net investment income(d) | | | 5.90 | %(i) | | | 3.31 | % | | | 3.87 | %(i) | | | 0.22 | %(i) |

| | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 3 | %(j) | | | 21 | % | | | 5 | %(j) | | | 91 | %(j) |

| (a) | With the approval of the Board, effective September 30, 2015, the Fund's fiscal year end was changed from February 28 to September 30 (See Note 1). |

| (b) | The Fund's Class T commenced operations on February 13, 2015. |

| (c) | Per share numbers have been calculated using the average shares method. |

| (d) | Recognition of net investment income is affected by timing and declaration of dividends by underlying investment companies. |

| (e) | Amount is less than $0.005. |

| (f) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distribution, if any. Had the Adviser not absorbed a portion of Fund expenses, total returns would have been lower. Total returns for periods less than one year are not annualized. Returns shown exclude applicable sales charges. |

| (g) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from net asset values and returns for shareholder transactions. |

| (h) | Ratios do not include expenses of underlying investment companies in which the Fund invests. |

See Notes to Financial Statements.

| Semi-Annual Report | March 31, 2017 | 23 |

| Resource Real Estate Diversified Income Fund – Class D | Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | For the Six Months Ended March 31, 2017 (Unaudited) | | | Year Ended September 30, 2016 | | | For the Period Ended September 30, 2015(a) | | | For the Period Ended February 28, 2015(b) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.41 | | | $ | 9.97 | | | $ | 10.67 | | | $ | 10.72 | |

| | | | | | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | |

Net investment income(c)(d) | | | 0.32 | | | | 0.31 | | | | 0.24 | | | | 0.00 | (e) |

| Net realized and unrealized gain/(loss) on investments | | | (0.03 | ) | | | 0.69 | | | | (0.52 | ) | | | (0.05 | ) |

| Total income/(loss) from investment operations | | | 0.29 | | | | 1.00 | | | | (0.28 | ) | | | (0.05 | ) |

| | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.28 | ) | | | (0.30 | ) | | | (0.15 | ) | | | – | |

| From net realized gain on investments | | | (0.03 | ) | | | – | | | | (0.03 | ) | | | – | |

| From return of capital | | | – | | | | (0.26 | ) | | | (0.24 | ) | | | – | |

| Total distributions | | | (0.31 | ) | | | (0.56 | ) | | | (0.42 | ) | | | – | |

| INCREASE/DECREASE IN NET ASSET VALUE | | | (0.02 | ) | | | 0.44 | | | | (0.70 | ) | | | (0.05 | ) |

| NET ASSET VALUE, END OF PERIOD | | $ | 10.39 | | | $ | 10.41 | | | $ | 9.97 | | | $ | 10.67 | |

| | | | | | | | | | | | | | | | | |

TOTAL RETURN(f) | | | 2.86 | % | | | 10.35 | % | | | (2.69 | )%(g) | | | (0.47 | )% |

| | | | | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 7,230 | | | $ | 5,605 | | | $ | 2,131 | | | $ | 2 | |

| | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | | | | | | | | | |

Including interest expense:(h) | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 3.21 | %(i) | | | 3.25 | % | | | 3.85 | %(i) | | | 8.19 | %(i) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 3.15 | %(i) | | | 2.89 | % | | | 2.74 | %(i) | | | 2.78 | %(i) |

Excluding interest expense:(h) | | | | | | | | | | | | | | | | |

| Expenses, gross | | | 2.55 | %(i) | | | 2.85 | % | | | 3.60 | %(i) | | | 7.90 | %(i) |

| Expenses, net of fees waived/expenses reimbursed by investment adviser | | | 2.49 | %(i) | | | 2.49 | % | | | 2.49 | %(i) | | | 2.49 | %(i) |

Net investment income(d) | | | 6.17 | %(i) | | | 3.12 | % | | | 4.13 | %(i) | | | 0.47 | %(i) |

| | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 3 | %(j) | | | 21 | % | | | 5 | %(j) | | | 91 | %(j) |

| (a) | With the approval of the Board, effective September 30, 2015, the Fund's fiscal year end was changed from February 28 to September 30 (See Note 1). |

| (b) | The Fund's Class D commenced operations on February 13, 2015. |

| (c) | Per share numbers have been calculated using the average shares method. |