UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22743

Blackstone Alternative Investment Funds

(Exact Name of Registrant as Specified in Charter)

345 Park Avenue

28th Floor

New York, NY 10154

(Address of Principal Executive Offices)

Registrant’s telephone number, including area code: (212) 583-5000

Peter Koffler, Esq.

c/o Blackstone Alternative Investment Advisors LLC

345 Park Avenue

28th Floor

New York, NY 10154

(Name and Address of Agent for Service)

With a copy to:

James E. Thomas, Esq.

Ropes & Gray LLP

Prudential Tower

800 Boylston Street

Boston, MA 02199-3600

Date of fiscal year end: March 31

Date of reporting period: March 31, 2021

| Item 1. | Reports to Stockholders. |

(a) The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”):

(b) Not applicable.

Blackstone Alternative Multi-Strategy Fund

a series of Blackstone Alternative Investment Funds

|

Annual Report For the Year Ended March 31, 2021 |

TABLE OF CONTENTS

All investors should consider the investment objectives, risks, charges and expenses of the Blackstone Alternative Multi-Strategy Fund (the “Fund”) carefully before investing. The prospectus and the summary prospectus contain this and other information about the Fund. You can obtain a prospectus and a summary prospectus from the Fund’s website (www.bxmix.com). All investors are urged to carefully read the prospectus and the summary prospectus in its entirety before investing. Interests in the Fund are offered through Blackstone Advisory Partners L.P., a member of FINRA and an affiliate of Blackstone Alternative Investment Advisors LLC, the Fund’s investment adviser (“BAIA” or the “Investment Adviser”).

Important Risks: An investment in the Fund should be considered a speculative investment that entails substantial risks; you may lose part or all of your investment or your investment may not perform as well as other investments. The Fund’s investments involve special risks including, but not limited to, loss of all or a significant portion of the investment due to leveraging, short-selling, or other speculative practices, lack of liquidity and volatility of returns. The following is a summary description of certain additional principal risks of investing in the Fund:

Allocation Risk - BAIA’s judgment about the attractiveness, value or market trends affecting a particular asset class, investment style, sub-adviser or security may be incorrect and this may have a negative impact upon performance. Debt Securities Risk - investments in debt securities, such as bonds and certain asset-backed securities involve certain risks which may cause the securities to lose value, including credit risk, liquidity risk, extension risk, interest rate risk, prepayment risk, event risk, inflation risk, and variable and floating rate instrument risk. Derivatives Risk - the use of derivatives involves the risk that their value may not move as expected relative to the value of the relevant underlying assets, rates, or indices. Derivatives can be volatile and illiquid, can subject to counterparty credit risk, and may entail investment exposure greater than their notional amount. Distressed Securities Risk - investments in securities of business enterprises involved in workouts, liquidations, reorganizations, bankruptcies and similar situations involve a high degree of risk of loss since there is typically substantial uncertainty concerning the outcome of such situations. Equity Securities Risk - there is a risk of loss associated with price fluctuations of equity and preferred securities which change based on a company’s financial condition and overall market and economic environment. Event-Driven Trading Risk - involves the risk that the specific event identified may not occur as anticipated and that this may have a negative impact upon the market price of the securities involved. Foreign Investments/Emerging Markets Risk - involves special risks caused by foreign political, social and economic factors, including exposure to currency fluctuations, less liquidity, less developed and less efficient trading markets, political instability and less developed legal and auditing standards. High Portfolio Turnover Risk - active trading of securities can increase transaction costs (thus lowering performance) and taxable distributions. Inflation Risk - Inflation, and investors’ expectation of future inflation, can impact the current value of portfolio investments, resulting in lower asset values and losses to Fund investors. Investment Style Risk - Different investment styles tend to shift in and out of favor depending on market and economic conditions and investor sentiment, and the Fund could underperform other funds that invest in similar asset classes but employ different investment styles. Large Purchase and Redemption Risk - large purchase or redemption activity could result in the Fund

incurring additional costs, selling portfolio securities, investing cash, or holding a relatively large amount of cash at times when it would not otherwise do so, which could have an adverse effect on performance. Leverage Risk - use of leverage can produce volatility and may exaggerate changes in the net asset value of Fund shares and in the return on the Fund’s portfolio, which may increase the risk that the Fund will lose more than it has invested. Liquidity Risk - some securities held by the Fund, including, but not limited to, restricted, distressed, non-exchange traded, and/or privately placed securities, may be difficult to sell, or illiquid, particularly during times of market turmoil. Illiquid securities may be difficult to value and if the Fund is forced to sell an illiquid asset to meet redemption requests or other cash needs, the Fund may be forced to sell at a loss. Market Risk and Selection Risk - one or more markets in which the Fund invests may go down in value, possibly sharply and unpredictably, affecting the values of individual securities held by the Fund. Significant shocks to or disruptions of the financial markets or the real economy could adversely affect the liquidity and volatility of securities held by the Fund. Mortgage- and Asset-Based Securities Risk - these securities are subject to credit, interest rate, valuation, liquidity, prepayment and extension risks. These securities also are subject to risk of default on the underlying mortgage or asset, particularly during periods of economic downturn. Small movements in interest rates may quickly and significantly reduce the value of certain mortgage-backed securities. Model and Technology Risk - involves the risk that model-based strategies, data gathering systems, order execution and trade allocation systems and risk management systems may not be successful on an ongoing basis or could contains errors, omissions, imperfections or malfunctions. Multi-Manager Risk - managers may make investment decisions which conflict with each other and as a result, the Fund could incur transaction costs without accomplishing any net investment result.

BLACKSTONE ALTERNATIVE INVESTMENT FUNDS

Dear Blackstone Investor,

We are pleased to present this annual shareholder report for Blackstone Alternative Investment Funds (“BAIF”) and its series, Blackstone Alternative Multi-Strategy Fund (the “Fund”). This report includes portfolio commentary, a listing of the Fund’s investments and the Fund’s audited financial statements. Audited financial statements for the Fund cover the period from April 1, 2020 to March 31, 2021 (the “Reporting Period”).

The Fund’s investment objective is to seek capital appreciation. The Fund seeks this objective by allocating its assets among a variety of nontraditional, or “alternative,” investment strategies. Blackstone Alternative Investment Advisors LLC (the “Investment Adviser” or “BAIA”) determines the allocations of the Fund’s assets and allocates a majority of the Fund’s assets among a number of affiliated and unaffiliated investment advisory organizations (each, a “Sub-Adviser” and together, the “Sub-Advisers”) with experience managing alternative investment strategies and among investment funds. BAIA also manages a portion of the Fund’s assets directly and, from time to time, may instruct Sub-Advisers with respect to particular investments1. Each Sub-Adviser is responsible for the day-to-day management of the Fund’s assets that the Investment Adviser allocates to it. The Investment Adviser has the ultimate responsibility to oversee each Sub-Adviser, subject to the oversight of the Fund’s Board of Trustees. The Investment Adviser is also responsible for recommending the hiring, termination, and replacement of Sub-Advisers. In pursuing the Fund’s investment objective, BAIA focuses on the mitigation of market risk and seeks to maintain an investment portfolio with, on average, lower volatility relative to the broader equity markets.

Fund Performance2

The Reporting Period was comprised of four consecutive quarters of global equity market appreciation, as accommodative monetary and fiscal policies adopted in response to the COVID-19 pandemic provided support for markets’ rebound following their swift and broad-based drawdown during the first quarter of 2020. The Fund’s collection of alternative strategies and hedge fund vehicles exhibited positive returns over the Reporting Period, outperforming the broader hedge fund universe by more than 2%3. As we look ahead to the next 12 months, we intend to continue leveraging our due diligence, risk management, and investment expertise, accumulated over our 25+ years’ experience in alternative investing, to identify compelling investment strategies and skilled sub-advisers that we believe may advance the Fund in pursuit of its objective. Furthermore, we believe that the market turbulence of the past year has provided opportunities to partner with skilled managers seeking additional capital, and we continue to leverage Blackstone Alternative

Because of the broadly diversified and low beta nature of the portfolio, the Fund is not expected to participate in the full upside of broader equity and fixed income markets. The indices referenced herein are not benchmarks or targets for the Fund.

| 1 | BAIA manages a portion of the Fund’s assets directly, including direct investments into underlying investment funds. During the Reporting Period, such direct investments included allocations to funds managed by EJF Capital LLC, Aeolus Capital Management Ltd., PIMCO Investment Management, Islet Management, L.P. and Saba Capital Management. For the avoidance of doubt, direct investments into these investment funds are not considered “Blackstone Strategies” as defined in the Fund’s prospectus. BAIA allocations are subject to change and BAIA’s fees on directly managed assets are not reduced by a payment to a sub-adviser. |

| 2 | Performance is shown net of the Expense Ratio less waived expenses for Class I shares. Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance data above. There can be no assurance that the Fund will achieve its goals or avoid losses. |

| 3 | As measured by the HFRX Global Hedge Fund Index. |

1

Asset Management’s4 position as the world’s largest allocator to hedge funds to source new talent for the portfolio5. During the Reporting Period, the Fund generated a cumulative return, net of fees and expenses, of 18.34%. Over the same period, the HFRX Global Hedge Fund Index, a measure of hedge fund performance, returned 16.15%; the MSCI World Total Return Index, a measure of global equity market performance, returned 54.76%; and the Bloomberg Barclays Global Aggregate Bond Index, a measure of investment grade bond performance, returned 4.67%6.

Market and Portfolio Commentary

The Reporting Period was characterized by a constructive progression in the business cycle, as most major economies exited brief, but sharp, recessions and generally transitioned from contraction to recovery. While activity remained below 2019 levels in most major economies, rebounds in manufacturing output, employment, and household incomes, in addition to accommodative policies and positive vaccine developments, presented tailwinds for financial markets that pushed stock prices and Treasury yields higher.

In the second quarter of 2020, a marked increase in global risk appetite fueled a rebound in asset prices. Investors came to terms with the economic uncertainty caused by the COVID-19 crisis and seemingly looked past ongoing economic damage, record infections, and societal unrest. Assets supported by fiscal and monetary policy were the first to rebound, and soon investors deployed waves of capital to harvest relative value opportunities in dislocated strategies and assets. We observed approximately $55 billion in private capital raises for dislocation funds, many of which launched in June 2020 and will continue to invest for one to two years7. Notable in this rebound was the participation of retail investors, with online brokerages reporting marked increases in activity. This participation contributed to a fear-of-missing-out (“FOMO”) rally into which many initially skeptical institutional investors were dragged. Outside of equities, retail investors added more than $30 billion of net flows to high yield debt and more than $75 billion to investment-grade bonds8.

The third quarter of 2020 unfolded in three acts. First, in July, asset prices continued to recover thanks to increased risk appetite fueled by improving global outcomes in combating COVID-19. Then, the following month, the S&P 500 Index rallied 8.93%, marking its best August performance since 1986. The continuation of the FOMO rally that began in the second quarter was supported by a momentous change in the Federal Reserve’s (“Fed”) reaction function, which suggested low front-end interest rates for the next several years. In September, however, some of those gains reversed, and we saw a normalization in equity values as investors looked ahead to an uncertain U.S. election season. In fact, the S&P 500 Index dropped 11.3% peak to trough from September 2nd to September 23rd. Stimulative policies enacted by central banks, including, in some cases, negative interest rates (meaning an investor must pay the government for the privilege of lending the government money), continued to support demand for higher-yielding credits. The economic recovery was heterogenous with many segments of the economy rebounding strongly (e.g., technology, new economy, housing), while questions remained about the pace of recovery for others (e.g., retail, hospitality, office). This led to associated differences in the speed of recovery across various segments of the market and set the stage for investors to focus on COVID-19 recovery themes in the fourth quarter.

| 4 | The Investment Adviser shares employees, facilities and processes with Blackstone Alternative Asset Management L.P. (“BAAM”). |

| 5 | Source: InvestHedge Billion Dollar Club (as of June 30, 2020) based on AUM. |

| 6 | The volatility of the indices presented may be materially different from that of the performance of the Fund. In addition, the indices employ different investment guidelines and criteria than the Fund; as a result, the holdings in the Fund may differ significantly from the securities that comprise the indices. The indices have not been selected to represent benchmarks for the Fund, but rather are disclosed to allow for comparison of the Fund’s performance to that of well-known and widely recognized indices. In the case of equity indices, performance of the indices reflects the reinvestment of dividends. |

| 7 | Bloomberg, FundFire, DowJones Factiva, Hedge Fund Alert, Pensions & Investments, Institutional Investor, and BAIA Analysis. As of May 31, 2020. |

| 8 | Source: Credit Suisse Research. As of July 8, 2020. |

2

Global appetite for risk assets increased broadly over the fourth quarter of 2020 as uncertainty surrounding the U.S. Presidential Election, efficacy of a COVID-19 vaccine, and fiscal stimulus resolved. Despite ending the year with over 86 million global cases of the coronavirus, markets looked through a second wave of infections in the fall to price a robust economic recovery in 2021. From its bottom on March 23, 2020, the S&P 500 Index returned 68%, closing at a record high and increasing 16.3% for the year. In Q4, U.S. equity markets experienced a large rotation from beneficiaries of low and falling real yields to beneficiaries of an economic recovery. Large cap and growth leaders gave way to small cap and value. Value stocks, in fact, rose by 16% over the last three months, marking their best quarter since 2009, and small-cap stocks returned 24%, erasing their underperformance for the calendar year9. Further, credit instruments continued their rebound. As central banks took unprecedented action to provide significant monetary and fiscal stimulus throughout the crisis, historically low U.S. treasury yields forced investors to look elsewhere for meaningful sources of income. We observed broad appreciation of credit instruments throughout the quarter, with U.S. High Yield bonds recovering over 90% of their spread widening from March. Residential and commercial mortgage-backed securities and emerging market debt also appreciated meaningfully during the quarter.

The first quarter of 2021 saw the beginning of a return to some semblance of normalcy. Across the world, developed countries saw record COVID-19 vaccinations, with the U.S. exceeding three million doses delivered per day and subsequently loosening lockdown restrictions in many states10. Against this backdrop, robust fiscal stimulus, accommodative monetary policy, and growing strength in consumer balance sheets all provided strong support for economic growth. The White House announced more than $5.3 trillion of fiscal spending, including $1.9 trillion of COVID-19 assistance passed in March11. In sum, this stimulus represented more than 25% of 2020 U.S. GDP and more than 100% of the federal budget for fiscal year 202112. The new administration also stated is plans for even more fiscal stimulus in an effort to keep the economy growing well into 2022 and beyond, including a potential infrastructure package that may approach $3.0 trillion13. Meanwhile, the U.S. Federal Reserve reiterated that its Average Inflation Target of 2% over the long run is consistent with keeping monetary policy loose in the face of incipient inflation pressures as well as an inflation overshoot. Finally, consumer balance sheets continued to expand to record highs with total consumer assets growing by approximately $12 trillion dollars (a 9.5% increase year-over-year), with roughly half coming from appreciation of equity holdings and another 20% coming from appreciation of real estate14. As a result of these supportive conditions, the recovering economy led the median market participant to expect 6.2% of GDP growth for full year 2021, which is a growth rate not seen in the U.S. since 200515. Financial markets continued to price in this robust economic recovery, as interest rates, inflation expectations, and commodity and equity markets all appreciated with positive investor sentiment.

| 9 | Value stocks refers to MSCI World Value Index; Small-cap stocks refers to MSCI World Small Cap Index. |

| 10 | Bloomberg, “U.S. Vaccine Doses Head for 3 Million a Day as Supply Loosens” (March 29, 2021) |

| 11 | Washington Post, “How the 1.9 trillion U.S. stimulus package compares with other countries’ coronavirus spending” (April 5, 2021) |

| 12 | The Balance, “Current US Federal Government Spending” (April 9, 2021) |

| 13 | NYTimes, “Biden Team Prepares $3 Trillion in New Spending for the Economy” (March 22, 2021) |

| 14 | U.S. Federal Reserve, Household Balance Sheet & Changes in Net Worth for Households and Nonprofit Organizations, calculated for data available for 2020 Q1 – Q4. |

| 15 | Bloomberg, Median Market Participant forecast of YoY Real GDP growth as of 4/12/2021. |

3

Over the Reporting Period, the Fund’s Equity strategies contributed positively to performance (+2.50%)16. Equity Long/Short sub-strategies, which successfully captured mispricing opportunities amid heightened levels of market volatility, led gains. The Fund benefited from exposure to Financials, where greater dispersion in the sector provided opportunities for sub-advisers to generate alpha, as well as Healthcare, where newfound winners and losers emerged in the biopharmaceutical and healthcare services sub-sectors, partly in response to pandemic-related catalysts. Exposure to strategies focused on the pan-Asia geographic region offset some of the gains, as losses suffered during a broad-based de-grossing event in January outweighed profits produced throughout the rest of the Reporting Period. The Fund’s exposure to real estate investment trusts (“REITs”), which entered the Reporting Period at significantly depressed price levels on the back of the Global Shutdown, was also accretive to performance, as the increased probability of a post-vaccine world led to considerable price appreciation in COVID-impacted sectors, including travel, entertainment, and retail. Equity Market Neutral sub-strategies were only slight contributors of gains, as headwinds felt by quantitative strategies related to rotations in factors, namely moves away from growth and momentum and towards low volatility and value, led to intermittent losses throughout the Reporting Period.

Credit strategies were a large contributor to performance (+8.86%) during the Reporting Period16. Accommodative policies adopted by global central banks and governments in response to the pandemic provided support for these strategies and facilitated capital formation following the technical selling pressure that characterized the first quarter of 2020. Low and negative interest rate policies offered tailwinds for the performance of Fixed Income – Asset Backed sub-strategies, as capital returned to these arenas and credit spreads tightened. While the recovery was broad-based, greater stabilization was initially observed in residential mortgage markets, which were aided by reports of slowing loan forbearance growth and supportive fundamentals in U.S. housing markets, and less substantial price appreciation in commercial mortgages, where greater uncertainty related to the reopening of the economy weighed on corporate revenues in COVID-affected sectors. Distressed/Restructuring sub-strategies also generated gains, as sub-advisers took advantage of chances to purchase assets at prices they believed to be discounted relative to fundamentals. Sub-advisers also generated risk-adjusted returns in the stressed loan market, as a growing number of companies struggled to service debt and restructured existing financing arrangements, though losses were suffered in more defensive sectors, which lagged in the first quarter of 2021 in response to concerns regarding inflation.

Multi-Asset strategies were the largest contributor to Fund performance (+12.21%) over the Reporting Period16. Discretionary Thematic sub-strategies contributed positively to performance and benefited from exposure to emerging market credit. These exposures generated gains as sovereign and quasi-sovereign bond prices appreciated due, in part, to broader risk appetite bolstered by investor optimism and a search for yield. Easing financial conditions and support from the International Monetary Fund also reduced refinancing risk for sovereign bonds, as interest rates in the U.S. remained near-zero, LIBOR declined and more than $250 billion of financial assistance was provided to 77 countries17. Not to be outdone, aggressive actions from policy makers, including central bank interest rate cuts (e.g., Mexico, Brazil) and government stimulus measures (e.g., Russia), provided further support for prices of emerging market sovereign bonds. The Fund’s exposure to Multi-Strategy sub-strategies also aided performance and was led by profits generated by strategies focused on Special Purpose Acquisition Companies (“SPACs”). Widespread acceptance of SPACs as a vehicle for private companies to pursue an initial public offering (“IPO”) provided a conducive backdrop for these strategies throughout the Reporting Period. In fact, SPACs claimed over 50% of the IPO market in 2020 and proceeded to issue $88 billion of IPOs during the first quarter of 2021 – more than the $83 billion throughout the full year 202018. The Fund’s Reinsurance sub-strategies incurred slight losses, as prices of insurance-linked securities declined following Texas’ winter storm in February 2021.

| 16 | Sub-strategy contribution is shown gross of all fees and expenses. Sub-strategy contribution is estimated and unaudited. |

| 17 | International Monetary Fund (“IMF”). As of July 2, 2020. |

| 18 | SPAC Research. As of April 1, 2021 |

4

Business Update

We are excited to announce an addition to our senior leadership. One of the hallmarks of our business is our ability to identify some of the best investment talent in the industry—not just in the managers with whom we partner, but also in the people that we hire into Blackstone—and we are pleased to announce an important and exciting addition to our firm’s leadership. Joe Dowling, ex-CIO & CEO of the Brown University Investment Office, now serves alongside John McCormick as Global Co-Head of BAAM. Joe will be responsible for all of BAAM’s investment activities, while John will manage the business.

At Brown University, Joe and his team delivered consistent outperformance, ranking first in performance among Ivy League universities over the last one, three, five, and seven years. With a strong focus on risk management and diversification, Joe and his team generated the highest Sharpe ratio among 140 U.S. college and university endowments over the last five years. Hedge funds were a prominent allocation in Brown’s endowment. Earlier in his career, Joe also ran his own long / short equity hedge fund, Narragansett, which generated strong performance with good risk control over its lifetime.

Joe is a proven leader with a strong team ethos, a commitment to diversity, low ego, and high energy. We are confident that he will bring fresh thinking, new techniques, and a network of manager relationships that will be accretive to our business.

We also wanted to share that after 19 years of distinguished service, Gideon Berger announced his intention to depart from Blackstone. Accordingly, effective as of March 10, 2021, he no longer serves as a portfolio manager of the Fund. Gideon has been an outstanding partner and has made countless contributions to our clients, people, and platform, which have helped position BAAM as the leading allocator to hedge funds globally. We are grateful to Gideon for his leadership, creativity, and commitment over the last two decades. The Fund’s other existing portfolio managers, Raymond Chan, Min Htoo, Robert Jordan, Ian Morris, Stephen Sullens, and Alberto Santulin, will continue to serve as portfolio managers of the Fund.

In reflecting on the last year, we cannot overstate the importance of your steadfast commitment to the Fund and your continued confidence in our organization. We are focused on generating attractive risk-adjusted returns and remain committed to achieving the Fund’s investment objectives. Thank you for your continued partnership.

Sincerely,

5

Performance Summary

Performance quoted represents past performance, which may be higher or lower than current performance. Past performance is not indicative of future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect taxes that an investor would pay on fund distributions or on the sale of fund shares. To obtain the most recent month-end performance, visit www.bxmix.com.

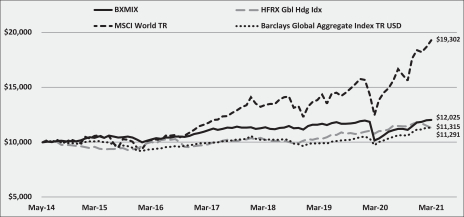

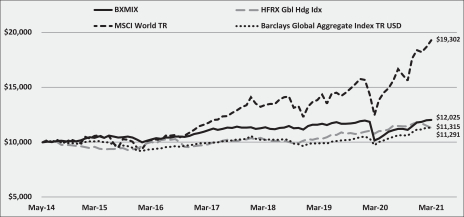

Value of a $10,000 Investment Since Inception at Net Asset Value*

None of the indices presented are benchmarks or targets for the Fund.

| * | The line graph represents historical performance of a hypothetical investment of $10,000 from Inception (June 16, 2014) to March 31, 2021, assuming the reinvestment of distributions. |

Cumulative Total Return

| | | | | | | | | | |

| | | For the

Year Ended

March 31,

2021 | | Since

Inception

(June 16,

2014) |

Class I Shares (“BXMIX”) | | | | 18.34% | | | | | 20.25% | |

HFRX Global Hedge Fund Index | | | | 16.15% | | | | | 13.16% | |

MSCI World Total Return Index | | | | 54.76% | | | | | 93.01% | |

Bloomberg Barclays Global Aggregate Bond Index | | | | 4.67% | | | | | 12.89% | |

6

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Portfolio Information

March 31, 2021

| | | | | |

Geographic Breakdown | | Percentage of

Total Net Assets |

North America | | | | 53.3 | % |

Europe | | | | 1.6 | |

Asia | | | | 0.5 | |

South America | | | | 0.4 | |

Middle East | | | | 0.1 | |

Africa | | | | 0.1 | |

Other 1, 2 | | | | 14.7 | |

Securities Sold Short | | | | (6.8 | ) |

Other Assets and Liabilities 3 | | | | 36.1 | |

| | | | | |

Total | | | | 100.0 | % |

| | | | | |

| 1 | Includes Sovereign Debt, Exchange-Traded Funds, Warrants, Rights, Commodities and Purchased Options. |

| 2 | See the below table for a geographic breakdown of Sovereign Debt. |

| 3 | Assets, other than investments in securities, net of other liabilities. See Consolidated Statement of Assets and Liabilities. A significant portion of the balance represents cash collateral for derivatives. |

| | | | | |

Sovereign Debt Geographic Breakdown | | Percentage of

Total Net Assets |

Africa | | | | 3.3 | % |

Europe | | | | 2.3 | |

Middle East | | | | 2.1 | |

South America | | | | 0.5 | |

North America | | | | 0.4 | |

Asia | | | | 0.2 | |

| | | | | |

Total | | | | 8.8 | % |

| | | | | |

7

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Portfolio Information (Continued)

March 31, 2021

| | | | | |

Portfolio Composition | | Percentage

of Total

Net Assets |

Common Stock | | | | 20.0 | % |

Investments in Investee Funds | | | | 10.4 | |

Sovereign Debt | | | | 8.8 | |

Mortgage-Backed Securities | | | | 8.5 | |

Corporate Bonds & Notes | | | | 6.1 | |

Bank Debt | | | | 6.1 | |

Asset-Backed Securities | | | | 3.9 | |

Municipals | | | | 0.6 | |

U.S. Government Sponsored Agency Securities | | | | 0.2 | |

Exchange-Traded Funds | | | | 0.1 | |

Convertible Bonds | | | | 0.1 | |

Preferred Stock | | | | 0.1 | |

Warrants | | | | 0.1 | |

Rights | | | | 0.0 | 1 |

Other 2 | | | | 5.7 | |

Securities Sold Short | | | | (6.8 | ) |

Other Assets and Liabilities 3 | | | | 36.1 | |

| | | | | |

Total | | | | 100.0 | % |

| | | | | |

| 1 | Represents less than 0.1%. |

| 2 | Includes Commodities and Purchased Options. |

| 3 | Assets, other than investments in securities, net of other liabilities. See Consolidated Statement of Assets and Liabilities. A significant portion of the balance represents cash collateral for derivatives. |

| | | | | |

Credit Quality Allocation1 | | Percentage of

Total

Investments

in Securities |

AAA/Aaa2 | | | | 0.9 | % |

AA/Aa | | | | 0.1 | |

A | | | | 0.2 | |

BBB/Baa | | | | 4.9 | |

BB/Ba | | | | 3.9 | |

B | | | | 20.0 | |

CCC/Caa | | | | 4.3 | |

CC/Ca | | | | 1.1 | |

C | | | | 0.1 | |

D | | | | 0.4 | |

Not Rated | | | | 19.9 | |

Other3 | | | | 44.2 | |

| | | | | |

Total Investments in Securities | | | | 100.0 | % |

| | | | | |

| 1 | Using the higher of Standard & Poor’s (“S&P’s”) or Moody’s Investor Service (“Moody’s”) ratings. |

| 2 | Includes U.S. Government Sponsored Agency Securities that are deemed AAA/Aaa by the Investment Adviser. |

| 3 | Includes Common Stock, Preferred Stock, Exchange-Traded Funds, Investments in Investee Funds and Purchased Options. |

| | | | | |

Industry | | Percentage of

Total Net Assets |

Financial Services | | | | 12.7 | % |

Health Care Facilities & Services | | | | 1.1 | |

Retail - Discretionary | | | | 0.9 | |

Software & Services | | | | 0.9 | |

Health Care | | | | 0.8 | |

Industrial Other | | | | 0.8 | |

Integrated Oils | | | | 0.8 | |

Media | | | | 0.7 | |

Real Estate | | | | 0.7 | |

Banking | | | | 0.6 | |

Consumer Discretionary Services | | | | 0.6 | |

Software & Technology Services | | | | 0.6 | |

Utilities | | | | 0.6 | |

Oil, Gas & Coal | | | | 0.5 | |

8

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Portfolio Information (Continued)

March 31, 2021

| | | | | |

Industry | | Percentage of

Total Net Assets |

Biotechnology & Pharmaceuticals | | | | 0.4 | % |

Entertainment Resources | | | | 0.4 | |

Machinery Manufacturing | | | | 0.4 | |

Manufactured Goods | | | | 0.4 | |

Pipeline | | | | 0.4 | |

Property & Casualty Insurance | | | | 0.4 | |

Software | | | | 0.4 | |

Travel & Lodging | | | | 0.4 | |

Automotive | | | | 0.3 | |

Banks | | | | 0.3 | |

Consumer Finance | | | | 0.3 | |

Industrial Services | | | | 0.3 | |

Pharmaceuticals | | | | 0.3 | |

Restaurants | | | | 0.3 | |

Apparel & Textile Products | | | | 0.2 | |

Asset Management | | | | 0.2 | |

Commercial Finance | | | | 0.2 | |

Consumer Services | | | | 0.2 | |

Consumer Staple Products | | | | 0.2 | |

Containers & Packaging | | | | 0.2 | |

Exploration & Production | | | | 0.2 | |

Hardware | | | | 0.2 | |

Home Improvement | | | | 0.2 | |

Industrial Products | | | | 0.2 | |

Iron & Steel | | | | 0.2 | |

Oil & Gas Services & Equipment | | | | 0.2 | |

Publishing & Broadcasting | | | | 0.2 | |

Refining & Marketing | | | | 0.2 | |

Specialty Finance | | | | 0.2 | |

Tech Hardware & Semiconductors | | | | 0.2 | |

Insurance | | | | 0.1 | |

Aerospace & Defense | | | | 0.1 | |

Airlines | | | | 0.1 | |

Automobiles Manufacturing | | | | 0.1 | |

Cable & Satellite | | | | 0.1 | |

Casinos & Gaming | | | | 0.1 | |

Consumer Discretionary Products | | | | 0.1 | |

Educational Services | | | | 0.1 | |

Entertainment Contents | | | | 0.1 | |

Food & Beverage | | | | 0.1 | |

Internet Media | | | | 0.1 | |

Leisure Products | | | | 0.1 | |

Materials | | | | 0.1 | |

Medical Equipment & Devices | | | | 0.1 | |

Renewable Energy | | | | 0.1 | |

Retail & Wholesale - Staples | | | | 0.1 | |

9

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Portfolio Information (Continued)

March 31, 2021

| | | | | |

Industry | | Percentage of

Total Net Assets |

Retail - Consumer Discretionary | | | | 0.1 | % |

Telecommunications | | | | 0.1 | |

Transportation & Logistics | | | | 0.1 | |

Auto Parts Manufacturing | | | | 0.0 | 1 |

Chemicals | | | | 0.0 | 1 |

Commercial Services | | | | 0.0 | 1 |

Communications Equipment | | | | 0.0 | 1 |

Construction Materials | | | | 0.0 | 1 |

Construction Materials Manufacturing | | | | 0.0 | 1 |

Consumer Products | | | | 0.0 | 1 |

Distributors - Discretionary | | | | 0.0 | 1 |

Electrical Equipment | | | | 0.0 | 1 |

Engineering & Construction Services | | | | 0.0 | 1 |

Forest & Paper Products | | | | 0.0 | 1 |

Gaming, Lodging & Restaurants | | | | 0.0 | 1 |

Home & Office Products | | | | 0.0 | 1 |

Institutional Financial Services | | | | 0.0 | 1 |

Leisure Products Manufacturing | | | | 0.0 | 1 |

Machinery | | | | 0.0 | 1 |

Medical Equipment & Devices Manufacturing | | | | 0.0 | 1 |

Metals & Mining | | | | 0.0 | 1 |

Power Generation | | | | 0.0 | 1 |

Private Equity | | | | 0.0 | 1 |

Recreation Facilities & Services | | | | 0.0 | 1 |

Semiconductors | | | | 0.0 | 1 |

Supranationals | | | | 0.0 | 1 |

Technology Services | | | | 0.0 | 1 |

Waste & Environmental Services & Equipment | | | | 0.0 | 1 |

Wireless Telecommunications Services | | | | 0.0 | 1 |

Other 2 | | | | 38.3 | |

Securities Sold Short | | | | (6.8 | ) |

Other Assets and Liabilities3 | | | | 36.1 | |

| | | | | |

Total Investments | | | | 100.0 | % |

| | | | | |

| 1 | Represents less than 0.1%. |

| 2 | Includes Asset-Backed Securities, Sovereign Debt, Mortgage-Backed Securities, U.S. Government Sponsored Agency Securities, Municipals, Exchange-Traded Funds, Warrants, Rights, Investments in Investee Funds, Commodities and Purchased Options. |

| 3 | Assets, other than investments in securities, net of other liabilities. See Consolidated Statement of Assets and Liabilities. A significant portion of the balance represents cash collateral for derivatives. |

10

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Consolidated Schedule of Investments

March 31, 2021

| | | | | | | | | | | | |

Security Description | | Shares | | | | | | Value | |

| | | |

INVESTMENTS IN SECURITIES — 70.7% | | | | | | | | | | | | |

COMMON STOCK — 20.0% | | | | | | | | | | | | |

Asia — 0.4% | | | | | | | | | | | | |

Asset Management — 0.0% | | | | | | | | | | | | |

Noah Holdings Ltd., ADR (a) | | | 2,900 | | | | | | | $ | 128,760 | |

| | | | | | | | | | | | |

Automotive — 0.1% | | | | | | | | | | | | |

NIO, Inc., ADR (a),(c) | | | 76,500 | | | | | | | | 2,981,970 | |

Niu Technologies, ADR (a) | | | 200 | | | | | | | | 7,330 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,989,300 | |

| | | | | | | | | | | | |

Biotechnology & Pharmaceuticals — 0.0% | | | | | | | | | | | | |

Sinovac Biotech Ltd. (a) | | | 200 | | | | | | | | 1,294 | |

| | | | | | | | | | | | |

Financial Services — 0.3% | | | | | | | | | | | | |

360 Finance, Inc., ADR (a) | | | 10,400 | | | | | | | | 270,504 | |

Futu Holdings Ltd., ADR (a) | | | 7,200 | | | | | | | | 1,143,504 | |

Ivanhoe Capital Acquisition Corp. (a),(b),(c) | | | 489,387 | | | | | | | | 5,079,739 | |

L Catterton Asia Acquisition Corp. (a),(b),(c) | | | 310,000 | | | | | | | | 3,084,500 | |

LexinFintech Holdings Ltd., ADR (a) | | | 1,400 | | | | | | | | 14,084 | |

Qudian, Inc., ADR (a) | | | 14,600 | | | | | | | | 33,288 | |

Silver Crest Acquisition Corp. (a),(b),(c) | | | 468,988 | | | | | | | | 4,657,051 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 14,282,670 | |

| | | | | | | | | | | | |

Industrial Services — 0.0% | | | | | | | | | | | | |

Textainer Group Holdings Ltd. (a) | | | 1,400 | | | | | | | | 40,110 | |

| | | | | | | | | | | | |

Machinery — 0.0% | | | | | | | | | | | | |

China Yuchai International Ltd. (a) | | | 745 | | | | | | | | 11,532 | |

Hollysys Automation Technologies Ltd. (a) | | | 3,200 | | | | | | | | 40,064 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 51,596 | |

| | | | | | | | | | | | |

Materials — 0.0% | | | | | | | | | | | | |

Tantech Holdings Ltd. (a) | | | 200 | | | | | | | | 290 | |

| | | | | | | | | | | | |

Media — 0.0% | | | | | | | | | | | | |

Bilibili, Inc., ADR (a) | | | 10,100 | | | | | | | | 1,081,306 | |

iClick Interactive Asia Group Ltd., ADR (a) | | | 2,900 | | | | | | | | 34,133 | |

So-Young International, Inc., ADR (a) | | | 300 | | | | | | | | 2,961 | |

Sogou, Inc., ADR (a) | | | 5,500 | | | | | | | | 41,525 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,159,925 | |

| | | | | | | | | | | | |

Real Estate — 0.0% | | | | | | | | | | | | |

Xinyuan Real Estate Co. Ltd., ADR | | | 500 | | | | | | | | 1,405 | |

| | | | | | | | | | | | |

Semiconductors — 0.0% | | | | | | | | | | | | |

Himax Technologies, Inc., ADR (a) | | | 15,800 | | | | | | | | 215,670 | |

See Notes to Consolidated Financial Statements.

11

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Consolidated Schedule of Investments (Continued)

March 31, 2021

| | | | | | | | | | | | |

Security Description | | Shares | | | | | | Value | |

MagnaChip Semiconductor Corp. (a) | | | 8,500 | | | | | | | $ | 211,650 | |

Silicon Motion Technology Corp., ADR | | | 6,800 | | | | | | | | 403,852 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 831,172 | |

| | | | | | | | | | | | |

Software — 0.0% | | | | | | | | | | | | |

HUYA, Inc., ADR (a) | | | 9,100 | | | | | | | | 177,268 | |

OneConnect Financial Technology Co. Ltd., ADR (a) | | | 1,100 | | | | | | | | 16,258 | |

Sea Ltd., ADR (a) | | | 3,100 | | | | | | | | 692,013 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 885,539 | |

| | | | | | | | | | | | |

Software & Technology Services — 0.0% | | | | | | | | | | | | |

Aurora Mobile Ltd., ADR (a) | | | 1,100 | | | | | | | | 4,653 | |

| | | | | | | | | | | | |

Specialty Finance — 0.0% | | | | | | | | | | | | |

FinVolution Group, ADR (a) | | | 2,900 | | | | | | | | 20,329 | |

| | | | | | | | | | | | |

Tech Hardware & Semiconductors — 0.0% | | | | | | | | | | | | |

Kulicke & Soffa Industries, Inc. | | | 6,400 | | | | | | | | 314,304 | |

UTStarcom Holdings Corp. (a) | | | 200 | | | | | | | | 282 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 314,586 | |

| | | | | | | | | | | | |

Technology Services — 0.0% | | | | | | | | | | | | |

WNS Holdings Ltd., ADR (a) | | | 1,800 | | | | | | | | 130,392 | |

| | | | | | | | | | | | |

Telecommunications — 0.0% | | | | | | | | | | | | |

VEON Ltd., ADR (a) | | | 12,800 | | | | | | | | 22,656 | |

| | | | | | | | | | | | |

Total Asia | | | | | | | | | | | 20,864,677 | |

| | | | | | | | | | | | |

Europe — 0.3% | | | | | | | | | | | | |

Biotechnology & Pharmaceuticals — 0.0% | | | | | | | | | | | | |

Affimed NV (a) | | | 12,700 | | | | | | | | 100,457 | |

CRISPR Therapeutics AG (a),(c) | | | 16,500 | | | | | | | | 2,010,525 | |

Prothena Corp. plc (a) | | | 7,100 | | | | | | | | 178,352 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,289,334 | |

| | | | | | | | | | | | |

Chemicals — 0.0% | | | | | | | | | | | | |

Orion Engineered Carbons SA (a) | | | 6,700 | | | | | | | | 132,124 | |

| | | | | | | | | | | | |

Consumer Products — 0.0% | | | | | | | | | | | | |

Nomad Foods Ltd. (a) | | | 3,800 | | | | | | | | 104,348 | |

| | | | | | | | | | | | |

Financial Services — 0.2% | | | | | | | | | | | | |

ScION Tech Growth I (a),(b),(c) | | | 465,000 | | | | | | | | 4,682,550 | |

ScION Tech Growth II (a),(b),(c) | | | 300,000 | | | | | | | | 2,988,000 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 7,670,550 | |

| | | | | | | | | | | | |

See Notes to Consolidated Financial Statements.

12

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Consolidated Schedule of Investments (Continued)

March 31, 2021

| | | | | | | | | | |

Security Description | | Shares | | | | | Value | |

Health Care — 0.0% | | | | | | | | | | |

Aprea Therapeutics, Inc. (a) | | | 4,600 | | | | | $ | 23,460 | |

Contra Aduro Biotech I (a) | | | 1,040 | | | | | | 0 | |

Genfit, ADR (a) | | | 100 | | | | | | 462 | |

ICON PLC (a) | | | 2,600 | | | | | | 510,562 | |

Merus NV (a) | | | 3,000 | | | | | | 62,670 | |

NuCana plc, ADR (a) | | | 600 | | | | | | 2,994 | |

Orchard Therapeutics plc, ADR (a) | | | 100 | | | | | | 726 | |

uniQure NV (a) | | | 600 | | | | | | 20,214 | |

| | | | | | | | | | |

| | | | | | | | | 621,088 | |

| | | | | | | | | | |

Industrial Products — 0.0% | | | | | | | | | | |

Luxfer Holdings plc (a) | | | 100 | | | | | | 2,128 | |

| | | | | | | | | | |

Industrial Services — 0.0% | | | | | | | | | | |

Costamare, Inc. (a) | | | 3,500 | | | | | | 33,670 | |

GasLog Partners LP (a) | | | 300 | | | | | | 801 | |

Performance Shipping, Inc. (a) | | | 1,100 | | | | | | 6,127 | |

Tsakos Energy Navigation Ltd. (a) | | | 40 | | | | | | 379 | |

| | | | | | | | | | |

| | | | | | | | | 40,977 | |

| | | | | | | | | | |

Iron & Steel — 0.0% | | | | | | | | | | |

ArcelorMittal (a) | | | 2,500 | | | | | | 72,925 | |

| | | | | | | | | | |

Media — 0.0% | | | | | | | | | | |

Jumia Technologies AG, ADR (a) | | | 1,700 | | | | | | 60,282 | |

Liberty Global PLC, Class A (a) | | | 100 | | | | | | 2,566 | |

Trivago NV, ADR (a) | | | 500 | | | | | | 2,150 | |

| | | | | | | | | | |

| | | | | | | | | 64,998 | |

| | | | | | | | | | |

Oil, Gas & Coal — 0.1% | | | | | | | | | | |

BP plc (b) | | | 166,700 | | | | | | 677,143 | |

BP plc, ADR | | | 7,400 | | | | | | 180,190 | |

Eni SpA (b) | | | 45,500 | | | | | | 559,937 | |

Equinor ASA (b) | | | 6,650 | | | | | | 130,074 | |

Royal Dutch Shell plc, Class A (b),(a) | | | 42,800 | | | | | | 843,218 | |

TechnipFMC plc (a) | | | 84,000 | | | | | | 648,480 | |

TOTAL SA (b),(a) | | | 29,900 | | | | | | 1,394,660 | |

| | | | | | | | | | |

| | | | | | | | | 4,433,702 | |

| | | | | | | | | | |

Retail—Discretionary — 0.0% | | | | | | | | | | |

Farfetch Ltd., Class A (a) | | | 17,400 | | | | | | 922,548 | |

| | | | | | | | | | |

Software & Technology Services — 0.0% | | | | | | | | | | |

Endava plc, ADR (a) | | | 300 | | | | | | 25,407 | |

Materialise NV, ADR (a) | | | 800 | | | | | | 28,760 | |

Micro Focus International plc, ADR | | | 13,800 | | | | | | 105,984 | |

| | | | | | | | | | |

| | | | | | | | | 160,151 | |

| | | | | | | | | | |

See Notes to Consolidated Financial Statements.

13

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Consolidated Schedule of Investments (Continued)

March 31, 2021

| | | | | | | | | | | | |

Security Description | | Shares | | | | | | Value | |

Specialty Finance — 0.0% | | | | | | | | | | | | |

AerCap Holdings NV (a) | | | 800 | | | | | | | $ | 46,992 | |

| | | | | | | | | | | | |

Transportation & Logistics — 0.0% | | | | | | | | | | | | |

Diana Shipping, Inc. (a) | | | 3,047 | | | | | | | | 9,110 | |

Golden Ocean Group Ltd. (a) | | | 2,720 | | | | | | | | 18,238 | |

Safe Bulkers, Inc. (a) | | | 7,400 | | | | | | | | 18,130 | |

Star Bulk Carriers Corp. (a) | | | 2,400 | | | | | | | | 35,232 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 80,710 | |

| | | | | | | | | | | | |

Total Europe | | | | | | | | | | | 16,642,575 | |

| | | | | | | | | | | | |

Middle East — 0.1% | | | | | | | | | | | | |

Aerospace & Defense — 0.0% | | | | | | | | | | | | |

Ituran Location and Control Ltd. (a) | | | 300 | | | | | | | | 6,369 | |

| | | | | | | | | | | | |

Biotechnology & Pharmaceuticals — 0.0% | | | | | | | | | | | | |

Compugen Ltd. (a) | | | 1,400 | | | | | | | | 12,026 | |

| | | | | | | | | | | | |

Electrical Equipment — 0.0% | | | | | | | | | | | | |

Camtek Ltd. (a) | | | 900 | | | | | | | | 26,910 | |

| | | | | | | | | | | | |

Financial Services — 0.1% | | | | | | | | | | | | |

ION Acquisition Corp. 2 Ltd. (a),(b),(c) | | | 348,254 | | | | | | | | 3,538,261 | |

| | | | | | | | | | | | |

Hardware — 0.0% | | | | | | | | | | | | |

Kornit Digital Ltd. (a) | | | 300 | | | | | | | | 29,736 | |

| | | | | | | | | | | | |

Health Care — 0.0% | | | | | | | | | | | | |

Galmed Pharmaceuticals Ltd. (a) | | | 100 | | | | | | | | 343 | |

InspireMD, Inc. (a) | | | 23,200 | | | | | | | | 15,597 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 15,940 | |

| | | | | | | | | | | | |

Industrial Products — 0.0% | | | | | | | | | | | | |

RADA Electronic Industries Ltd. (a) | | | 2,200 | | | | | | | | 26,422 | |

| | | | | | | | | | | | |

Media — 0.0% | | | | | | | | | | | | |

Wix.com Ltd. (a) | | | 2,500 | | | | | | | | 698,050 | |

| | | | | | | | | | | | |

Software & Technology Services — 0.0% | | | | | | | | | | | | |

Check Point Software Technologies Ltd. (a) | | | 2,300 | | | | | | | | 257,531 | |

Perion Network Ltd. (a) | | | 500 | | | | | | | | 8,950 | |

Sapiens International Corp. NV (a) | | | 100 | | | | | | | | 3,179 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 269,660 | |

| | | | | | | | | | | | |

Tech Hardware & Semiconductors — 0.0% | | | | | | | | | | | | |

Radware Ltd. (a) | | | 500 | | | | | | | | 13,040 | |

| | | | | | | | | | | | |

Total Middle East | | | | | | | | | | | 4,636,414 | |

| | | | | | | | | | | | |

See Notes to Consolidated Financial Statements.

14

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Consolidated Schedule of Investments (Continued)

March 31, 2021

| | | | | | | | | | | | |

Security Description | | Shares | | | | | | Value | |

North America — 19.2% | | | | | | | | | | | | |

Apparel & Textile Products — 0.0% | | | | | | | | | | | | |

Levi Strauss & Co., Class A | | | 2,300 | | | | | | | $ | 54,993 | |

| | | | | | | | | | | | |

Asset Management — 0.2% | | | | | | | | | | | | |

Amplitude Healthcare Acquisition Corp., Class A (a),(b),(c) | | | 300,000 | | | | | | | | 2,982,000 | |

Apollo Investment Corp. | | | 6,900 | | | | | | | | 94,668 | |

Ares Capital Corp. (c) | | | 8,000 | | | | | | | | 149,680 | |

CHP Merger Corp., Class A (a),(b) | | | 465,000 | | | | | | | | 4,608,150 | |

Horizon Technology Finance Corp. (a) | | | 2,300 | | | | | | | | 33,074 | |

Main Street Capital Corp. (a) | | | 4,194 | | | | | | | | 164,195 | |

Manning & Napier, Inc. (a) | | | 1,200 | | | | | | | | 7,764 | |

Oaktree Specialty Lending Corp. | | | 7,500 | | | | | | | | 46,500 | |

Oxford Square Capital Corp. (a) | | | 5,300 | | | | | | | | 24,592 | |

PennantPark Floating Rate Capital Ltd. | | | 4,600 | | | | | | | | 54,648 | |

Portman Ridge Finance Corp. | | | 5,233 | | | | | | | | 11,303 | |

Sixth Street Specialty Lending, Inc. | | | 1,500 | | | | | | | | 31,545 | |

Solar Capital Ltd. | | | 200 | | | | | | | | 3,552 | |

Solar Senior Capital Ltd. | | | 1,300 | | | | | | | | 19,110 | |

TriplePoint Venture Growth BDC Corp. | | | 3,700 | | | | | | | | 53,465 | |

WhiteHorse Finance, Inc. | | | 1,800 | | | | | | | | 27,306 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 8,311,552 | |

| | | | | | | | | | | | |

Automotive — 0.2% | | | | | | | | | | | | |

Cooper-Standard Holding, Inc. (a) | | | 2,400 | | | | | | | | 87,168 | |

Tesla, Inc. (a),(c) | | | 12,103 | | | | | | | | 8,083,957 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 8,171,125 | |

| | | | | | | | | | | | |

Banking — 0.6% | | | | | | | | | | | | |

Arrow Financial Corp. | | | 291 | | | | | | | | 9,693 | |

Atlantic Capital Bancshares, Inc. (a) | | | 1,000 | | | | | | | | 24,100 | |

Bancorp, Inc. (a) | | | 4,800 | | | | | | | | 99,456 | |

Bank of Marin Bancorp | | | 300 | | | | | | | | 11,748 | |

Bank of NT Butterfield & Son Ltd. (a) | | | 1,300 | | | | | | | | 49,686 | |

BankFinancial Corp. | | | 455 | | | | | | | | 4,696 | |

Bridgewater Bancshares, Inc. (a) | | | 300 | | | | | | | | 4,845 | |

Broadway Financial Corp. (a) | | | 100 | | | | | | | | 249 | |

Cadence BanCorp | | | 19,640 | | | | | | | | 407,137 | |

Carver Bancorp, Inc. (a) | | | 300 | | | | | | | | 2,724 | |

Central Pacific Financial Corp. | | | 1,200 | | | | | | | | 32,016 | |

CIT Group, Inc. | | | 900 | | | | | | | | 46,359 | |

Citigroup, Inc. | | | 22,800 | | | | | | | | 1,658,700 | |

Citizens Financial Group, Inc. | | | 3,600 | | | | | | | | 158,940 | |

Comerica, Inc. | | | 4,400 | | | | | | | | 315,656 | |

Farmers National Banc Corp. | | | 800 | | | | | | | | 13,360 | |

See Notes to Consolidated Financial Statements.

15

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Consolidated Schedule of Investments (Continued)

March 31, 2021

| | | | | | | | | | |

Security Description | | Shares | | | | | Value | |

Financial Institutions, Inc. | | | 800 | | | | | $ | 24,232 | |

First BanCorp | | | 23,600 | | | | | | 265,736 | |

First Community Bankshares, Inc. | | | 400 | | | | | | 11,996 | |

First Financial Corp. | | | 300 | | | | | | 13,503 | |

First Financial Northwest, Inc. | | | 100 | | | | | | 1,425 | |

First Foundation, Inc. | | | 100 | | | | | | 2,346 | |

First of Long Island Corp. (The) | | | 100 | | | | | | 2,125 | |

Flushing Financial Corp. | | | 500 | | | | | | 10,615 | |

FS Bancorp, Inc. | | | 100 | | | | | | 6,720 | |

Great Southern Bancorp, Inc. | | | 100 | | | | | | 5,667 | |

HBT Financial, Inc. | | | 800 | | | | | | 13,696 | |

Heritage Commerce Corp. | | | 3,100 | | | | | | 37,882 | |

HomeTrust Bancshares, Inc. | | | 700 | | | | | | 17,045 | |

Horizon Bancorp, Inc. | | | 800 | | | | | | 14,864 | |

Independent Bank Corp. | | | 1,200 | | | | | | 28,368 | |

KeyCorp | | | 800 | | | | | | 15,984 | |

Macatawa Bank Corp. | | | 1,200 | | | | | | 11,940 | |

Mercantile Bank Corp. | | | 400 | | | | | | 12,988 | |

Metrocity Bankshares, Inc. | | | 100 | | | | | | 1,538 | |

MidWestOne Financial Group, Inc. | | | 400 | | | | | | 12,388 | |

National Bankshares, Inc. | | | 100 | | | | | | 3,551 | |

Northrim BanCorp, Inc. | | | 400 | | | | | | 17,004 | |

OceanFirst Financial Corp. (b),(c) | | | 990,721 | | | | | | 23,717,861 | |

PCB Bancorp | | | 200 | | | | | | 3,000 | |

PCSB Financial Corp. | | | 700 | | | | | | 11,627 | |

Peapack Gladstone Financial Corp. | | | 900 | | | | | | 27,792 | |

Peoples Bancorp, Inc. | | | 200 | | | | | | 6,634 | |

Popular, Inc. (c) | | | 2,390 | | | | | | 168,065 | |

PRIMIS FINANCIAL Corp. (a) | | | 800 | | | | | | 11,632 | |

Provident Bancorp, Inc. | | | 500 | | | | | | 7,200 | |

QCR Holdings, Inc. | | | 100 | | | | | | 4,722 | |

Republic First Bancorp, Inc. (a) | | | 700 | | | | | | 2,639 | |

Sierra Bancorp | | | 400 | | | | | | 10,720 | |

SmartFinancial, Inc. | | | 100 | | | | | | 2,165 | |

Spirit of Texas Bancshares, Inc. | | | 500 | | | | | | 11,155 | |

Stock Yards Bancorp, Inc. | | | 700 | | | | | | 35,742 | |

Territorial Bancorp, Inc. | | | 200 | | | | | | 5,292 | |

TriState Capital Holdings, Inc. (a) | | | 1,400 | | | | | | 32,284 | |

TrustCo Bank Corp. | | | 3,600 | | | | | | 26,532 | |

Washington Trust Bancorp, Inc. | | | 800 | | | | | | 41,304 | |

| | | | | | | | | | |

| | | | | | | | | 27,497,344 | |

| | | | | | | | | | |

Biotechnology & Pharmaceuticals — 0.4% | | | | |

AbbVie, Inc. (a),(c) | | | 70,760 | | | | | | 7,657,647 | |

Adamas Pharmaceuticals, Inc. (a) | | | 8,200 | | | | | | 39,360 | |

Agenus, Inc. (a) | | | 9,900 | | | | | | 26,928 | |

See Notes to Consolidated Financial Statements.

16

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Consolidated Schedule of Investments (Continued)

March 31, 2021

| | | | | | | | | | |

Security Description | | Shares | | | | | Value | |

Agile Therapeutics, Inc. (a) | | | 5,000 | | | | | $ | 10,400 | |

Akebia Therapeutics, Inc. (a) | | | 9,695 | | | | | | 32,818 | |

Aldeyra Therapeutics, Inc. (a) | | | 10,300 | | | | | | 122,364 | |

Alpine Immune Sciences, Inc. (a) | | | 1,800 | | | | | | 19,080 | |

Amicus Therapeutics, Inc. (a) | | | 25,000 | | | | | | 247,000 | |

Apellis Pharmaceuticals, Inc. (a),(c) | | | 10,500 | | | | | | 450,555 | |

Applied Genetic Technologies Corp. (a) | | | 3,600 | | | | | | 18,252 | |

Aptinyx, Inc. (a) | | | 11,700 | | | | | | 35,100 | |

Aravive, Inc. (a) | | | 4,300 | | | | | | 28,337 | |

Arbutus Biopharma Corp. (a) | | | 7,800 | | | | | | 25,974 | |

Arcturus Therapeutics Holdings Co. (a) | | | 4,900 | | | | | | 202,370 | |

Arcus Biosciences, Inc. (a) | | | 8,400 | | | | | | 235,872 | |

Arrowhead Pharmaceuticals, Inc. (a) | | | 700 | | | | | | 46,417 | |

Arvinas Holding Co. LLC (a) | | | 6,000 | | | | | | 396,600 | |

Athenex, Inc. (a) | | | 12,700 | | | | | | 54,610 | |

Avid Bioservices, Inc. (a) | | | 1,400 | | | | | | 25,522 | |

BioCryst Pharmaceuticals, Inc. (a) | | | 3,900 | | | | | | 39,663 | |

BioDelivery Sciences International, Inc. (a) | | | 9,900 | | | | | | 38,709 | |

Biohaven Pharmaceutical Holding Co. Ltd. (a) | | | 300 | | | | | | 20,505 | |

Bluebird Bio, Inc. (a) | | | 900 | | | | | | 27,135 | |

Bridgebio Pharma, Inc. (a) | | | 4,900 | | | | | | 301,840 | |

Calithera Biosciences, Inc. (a) | | | 2,800 | | | | | | 6,776 | |

Catalyst Biosciences, Inc. (a) | | | 4,300 | | | | | | 21,672 | |

Catalyst Pharmaceuticals, Inc. (a) | | | 15,900 | | | | | | 73,299 | |

Celldex Therapeutics, Inc. (a) | | | 5,934 | | | | | | 122,240 | |

Cerecor, Inc. (a) | | | 6,000 | | | | | | 18,120 | |

Chimerix, Inc. (a) | | | 11,100 | | | | | | 107,004 | |

Collegium Pharmaceutical, Inc. (a) | | | 600 | | | | | | 14,220 | |

CTI BioPharma Corp. (a) | | | 13,500 | | | | | | 39,285 | |

Cue Biopharma, Inc. (a) | | | 5,300 | | | | | | 64,660 | |

Cymabay Therapeutics, Inc. (a) | | | 15,100 | | | | | | 68,554 | |

Cytokinetics, Inc. (a) | | | 15,600 | | | | | | 362,856 | |

CytomX Therapeutics, Inc. (a) | | | 9,400 | | | | | | 72,662 | |

Editas Medicine, Inc. (a) | | | 10,500 | | | | | | 441,000 | |

Eiger BioPharmaceuticals, Inc. (a) | | | 5,800 | | | | | | 51,330 | |

Enanta Pharmaceuticals, Inc. (a) | | | 2,200 | | | | | | 108,504 | |

Endo International PLC (a) | | | 4,100 | | | | | | 30,381 | |

Exelixis, Inc. (a) | | | 4,700 | | | | | | 106,173 | |

Exicure, Inc. (a) | | | 1,300 | | | | | | 2,834 | |

Fate Therapeutics, Inc. (a) | | | 13,500 | | | | | | 1,113,075 | |

Five Prime Therapeutics, Inc. (a) | | | 9,100 | | | | | | 342,797 | |

Flexion Therapeutics, Inc. (a) | | | 10,900 | | | | | | 97,555 | |

G1 Therapeutics, Inc. (a) | | | 9,200 | | | | | | 221,352 | |

GlycoMimetics, Inc. (a) | | | 11,300 | | | | | | 34,013 | |

Gossamer Bio, Inc. (a) | | | 8,200 | | | | | | 75,850 | |

Harpoon Therapeutics, Inc. (a) | | | 800 | | | | | | 16,736 | |

See Notes to Consolidated Financial Statements.

17

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Consolidated Schedule of Investments (Continued)

March 31, 2021

| | | | | | | | | | |

Security Description | | Shares | | | | | Value | |

Idera Pharmaceuticals, Inc. (a) | | | 1,300 | | | | | $ | 1,690 | |

Immunic, Inc. (a) | | | 3,000 | | | | | | 47,820 | |

ImmunoGen, Inc. (a) | | | 43,900 | | | | | | 355,590 | |

Infinity Pharmaceuticals, Inc. (a) | | | 12,300 | | | | | | 39,729 | |

Intellia Therapeutics, Inc. (a) | | | 12,700 | | | | | | 1,019,238 | |

Intercept Pharmaceuticals, Inc. (a),(c) | | | 4,800 | | | | | | 110,784 | |

Intersect ENT, Inc. (a) | | | 3,800 | | | | | | 79,344 | |

Ironwood Pharmaceuticals, Inc. (a) | | | 600 | | | | | | 6,708 | |

Kadmon Holdings, Inc. (a) | | | 21,800 | | | | | | 84,802 | |

Karyopharm Therapeutics, Inc. (a) | | | 12,700 | | | | | | 133,604 | |

Kezar Life Sciences, Inc. (a) | | | 3,500 | | | | | | 20,860 | |

Kura Oncology, Inc. (a) | | | 11,700 | | | | | | 330,759 | |

Leap Therapeutics, Inc. (a) | | | 12,200 | | | | | | 23,180 | |

Lineage Cell Therapeutics, Inc. (a) | | | 31,900 | | | | | | 74,965 | |

MannKind Corp. (a) | | | 41,271 | | | | | | 161,782 | |

MEI Pharma, Inc. (a) | | | 15,800 | | | | | | 54,194 | |

MeiraGTx Holdings plc (a) | | | 100 | | | | | | 1,443 | |

Merck & Co., Inc. (c) | | | 18,200 | | | | | | 1,403,038 | |

Mersana Therapeutics, Inc. (a) | | | 11,100 | | | | | | 179,598 | |

Millendo Therapeutics, Inc. (a) | | | 4,000 | | | | | | 4,800 | |

Mustang Bio, Inc. (a) | | | 8,000 | | | | | | 26,560 | |

Myovant Sciences Ltd. (a) | | | 400 | | | | | | 8,232 | |

Navidea Biopharmaceuticals, Inc. (a) | | | 1,500 | | | | | | 3,030 | |

Omthera Pharmaceutical, Inc. (a) | | | 700 | | | | | | 0 | |

OncoSec Medical, Inc. (a) | | | 2,100 | | | | | | 10,017 | |

Organogenesis Holdings, Inc . (a) | | | 5,000 | | | | | | 91,100 | |

Otonomy, Inc. (a) | | | 7,800 | | | | | | 19,890 | |

Precigen, Inc. (a) | | | 9,800 | | | | | | 67,522 | |

Provention Bio, Inc. (a) | | | 13,900 | | | | | | 145,881 | |

Recro Pharma, Inc. (a) | | | 2,000 | | | | | | 5,580 | |

Sage Therapeutics, Inc. (a),(c) | | | 5,400 | | | | | | 404,190 | |

Seres Therapeutics, Inc. (a) | | | 1,500 | | | | | | 30,885 | |

Spectrum Pharmaceuticals, Inc. (a) | | | 26,900 | | | | | | 87,694 | |

Stoke Therapeutics, Inc. (a) | | | 100 | | | | | | 3,884 | |

Strongbridge Biopharma plc (a) | | | 8,500 | | | | | | 23,460 | |

Surface Oncology, Inc. (a) | | | 2,700 | | | | | | 21,060 | |

Syndax Pharmaceuticals, Inc. (a) | | | 9,900 | | | | | | 221,364 | |

Synlogic, Inc. (a) | | | 8,600 | | | | | | 30,788 | |

Syros Pharmaceuticals, Inc. (a) | | | 6,300 | | | | | | 47,124 | |

United Therapeutics Corp. (a) | | | 1 | | | | | | 167 | |

USANA Health Sciences, Inc. (a) | | | 1,200 | | | | | | 117,120 | |

VBI Vaccines, Inc. (a) | | | 1,200 | | | | | | 3,732 | |

Viking Therapeutics, Inc. (a) | | | 16,300 | | | | | | 103,098 | |

VistaGen Therapeutics, Inc. (a) | | | 10,900 | | | | | | 23,217 | |

Xencor, Inc. (a) | | | 100 | | | | | | 4,306 | |

Xenon Pharmaceuticals, Inc. (a) | | | 700 | | | | | | 12,530 | |

ZIOPHARM Oncology, Inc. (a) | | | 13,500 | | | | | | 48,600 | |

See Notes to Consolidated Financial Statements.

18

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Consolidated Schedule of Investments (Continued)

March 31, 2021

| | | | | | | | | | |

Security Description | | Shares | | | | | Value | |

Zymeworks, Inc. (a) | | | 5,300 | | | | | $ | 167,374 | |

| | | | | | | | | | |

| | | | | | | | | 19,578,339 | |

| | | | | | | | | | |

Chemicals — 0.0% | | | | |

AdvanSix, Inc. (a) | | | 2,200 | | | | | | 59,004 | |

Axalta Coating Systems Ltd. (a) | | | 11,400 | | | | | | 337,212 | |

Ingevity Corp. (a) | | | 3,000 | | | | | | 226,590 | |

Mosaic Co. | | | 12,100 | | | | | | 382,481 | |

Rayonier Advanced Materials, Inc. (a) | | | 11,300 | | | | | | 102,491 | |

Venator Materials plc (a) | | | 10,000 | | | | | | 46,300 | |

| | | | | | | | | | |

| | | | | | | | | 1,154,078 | |

| | | | | | | | | | |

Commercial Services — 0.0% | | | | |

ARC Document Solutions, Inc. (a) | | | 2,500 | | | | | | 5,275 | |

Avalara, Inc. (a) | | | 800 | | | | | | 106,744 | |

BrightView Holdings, Inc. (a) | | | 400 | | | | | | 6,748 | |

CRA International, Inc. | | | 400 | | | | | | 29,856 | |

Emerald Holding, Inc. (a) | | | 2,000 | | | | | | 11,040 | |

Insperity, Inc. | | | 1,400 | | | | | | 117,236 | |

ShotSpotter, Inc. (a) | | | 600 | | | | | | 21,042 | |

SP Plus Corp. (a) | | | 1,900 | | | | | | 62,301 | |

Viad Corp. (a) | | | 1,900 | | | | | | 79,325 | |

| | | | | | | | | | |

| | | | | | | | | 439,567 | |

| | | | | | | | | | |

Construction Materials — 0.0% | | | | |

Forterra, Inc. (a) | | | 8,700 | | | | | | 202,275 | |

| | | | | | | | | | |

Consumer Discretionary Products — 0.1% | | | | |

American Axle & Manufacturing Holdings, Inc. (a) | | | 4,100 | | | | | | 39,606 | |

American Outdoor Brands, Inc. (a) | | | 300 | | | | | | 7,560 | |

Caesarstone Ltd. (a) | | | 1,400 | | | | | | 19,222 | |

Callaway Golf Co. (a) | | | 10,600 | | | | | | 283,550 | |

Camping World Holdings, Inc., Class A | | | 2,400 | | | | | | 87,312 | |

Canada Goose Holdings, Inc. (a) | | | 400 | | | | | | 15,700 | |

Casper Sleep, Inc. (a) | | | 2,500 | | | | | | 18,100 | |

Charles & Colvard Ltd. (a) | | | 1,500 | | | | | | 4,440 | |

Cornerstone Building Brands, Inc. (a) | | | 1,500 | | | | | | 21,045 | |

Crocs, Inc. (a) | | | 7,400 | | | | | | 595,330 | |

Culp, Inc. | | | 700 | | | | | | 10,773 | |

Flexsteel Industries, Inc. | | | 700 | | | | | | 24,395 | |

Ford Motor Co. (a) | | | 146,800 | | | | | | 1,798,300 | |

Funko, Inc., Class A (a) | | | 7,900 | | | | | | 155,472 | |

Goodyear Tire & Rubber Co. (a) | | | 12,900 | | | | | | 226,653 | |

Green Brick Partners, Inc. (a) | | | 900 | | | | | | 20,412 | |

Griffon Corp. | | | 1,100 | | | | | | 29,887 | |

Herman Miller, Inc. | | | 4,600 | | | | | | 189,290 | |

See Notes to Consolidated Financial Statements.

19

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Consolidated Schedule of Investments (Continued)

March 31, 2021

| | | | | | | | | | |

Security Description | | Shares | | | | | Value | |

iRobot Corp. (a) | | | 1,400 | | | | | $ | 171,052 | |

JAKKS Pacific, Inc. (a) | | | 100 | | | | | | 713 | |

JELD-WEN Holding, Inc. (a) | | | 600 | | | | | | 16,614 | |

Kimball International, Inc., Class B | | | 1,400 | | | | | | 19,600 | |

Masco Corp. | | | 2,000 | | | | | | 119,800 | |

Meritage Homes Corp. (a) | | | 600 | | | | | | 55,152 | |

Modine Manufacturing Co. (a) | | | 5,000 | | | | | | 73,850 | |

Mohawk Group Holdings, Inc. (a) | | | 400 | | | | | | 11,800 | |

Movado Group, Inc. | | | 1,200 | | | | | | 34,140 | |

New Home Co., Inc. (a) | | | 300 | | | | | | 1,572 | |

OneWater Marine, Inc., Class A (a) | | | 200 | | | | | | 7,992 | |

Polaris, Inc. | | | 6,200 | | | | | | 827,700 | |

Superior Industries International, Inc. (a) | | | 5,600 | | | | | | 31,808 | |

Tapestry, Inc. (a),(c) | | | 4,000 | | | | | | 164,840 | |

Tenneco, Inc., Class A (a) | | | 14,600 | | | | | | 156,512 | |

Toll Brothers, Inc. (a) | | | 500 | | | | | | 28,365 | |

TRI Pointe Group, Inc. (a) | | | 1,900 | | | | | | 38,684 | |

Under Armour, Inc., Class A (a) | | | 18,000 | | | | | | 398,880 | |

Unifi, Inc. (a) | | | 1,700 | | | | | | 46,852 | |

VF Corp. | | | 401 | | | | | | 32,048 | |

Wolverine World Wide, Inc. | | | 100 | | | | | | 3,832 | |

YETI Holdings, Inc. (a) | | | 900 | | | | | | 64,989 | |

| | | | | | | | | | |

| | | | | | | | | 5,853,842 | |

| | | | | | | | | | |

Consumer Discretionary Services — 0.2% | | | | |

Aaron’s Co., Inc. (The) | | | 1,000 | | | | | | 25,680 | |

AZEK Co., Inc. (The) (a) | | | 1,100 | | | | | | 46,255 | |

Bloomin’ Brands, Inc. (a) | | | 200 | | | | | | 5,410 | |

Bluegreen Vacations Holding Corp. (a) | | | 400 | | | | | | 7,416 | |

Boyd Gaming Corp. (a) | | | 2,000 | | | | | | 117,920 | |

Carriage Services, Inc. | | | 1,400 | | | | | | 49,266 | |

Carrols Restaurant Group, Inc. (a) | | | 300 | | | | | | 1,795 | |

Century Casinos, Inc. (a) | | | 2,100 | | | | | | 21,567 | |

Chegg, Inc. (a) | | | 2,700 | | | | | | 231,282 | |

Del Taco Restaurants, Inc. | | | 4,200 | | | | | | 40,236 | |

DineEquity, Inc. (a) | | | 100 | | | | | | 9,003 | |

Drive Shack, Inc. (a) | | | 14,033 | | | | | | 45,046 | |

Golden Entertainment, Inc. (a) | | | 1,600 | | | | | | 40,416 | |

Hilton Grand Vacations, Inc. (a) | | | 100 | | | | | | 3,749 | |

Jack in the Box, Inc. | | | 5,000 | | | | | | 548,900 | |

Lindblad Expeditions Holdings, Inc. (a) | | | 1,900 | | | | | | 35,910 | |

Marcus Corp. (a) | | | 2,300 | | | | | | 45,977 | |

McDonald’s Corp. (c) | | | 29,100 | | | | | | 6,522,474 | |

Medifast, Inc. | | | 1,900 | | | | | | 402,458 | |

Monarch Casino & Resort, Inc. (a) | | | 1,100 | | | | | | 66,682 | |

Papa John’s International, Inc. (c) | | | 5,700 | | | | | | 505,248 | |

See Notes to Consolidated Financial Statements.

20

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Consolidated Schedule of Investments (Continued)

March 31, 2021

| | | | | | | | | | |

Security Description | | Shares | | | | | Value | |

Penn National Gaming, Inc. (a) | | | 10,000 | | | | | $ | 1,048,400 | |

Ruth’s Hospitality Group, Inc. (a) | | | 400 | | | | | | 9,932 | |

SeaWorld Entertainment, Inc. (a) | | | 10,900 | | | | | | 541,403 | |

Select Interior Concepts, Inc., Class A (a) | | | 2,400 | | | | | | 17,280 | |

Service Corp. International/US | | | 7,600 | | | | | | 387,980 | |

Shake Shack, Inc., Class A (a) | | | 500 | | | | | | 56,385 | |

Six Flags Entertainment Corp. (a) | | | 1,500 | | | | | | 69,705 | |

Stride, Inc. (a) | | | 7,100 | | | | | | 213,781 | |

Vail Resorts, Inc. (a) | | | 1,500 | | | | | | 437,490 | |

Waitr Holdings, Inc. (a) | | | 13,200 | | | | | | 38,676 | |

Wingstop, Inc. (c) | | | 6,500 | | | | | | 826,605 | |

| | | | | | | | | | |

| | | | | | | | | 12,420,327 | |

| | | | | | | | | | |

Consumer Products — 0.0% | | | | |

Contra Restorbio, Inc. (a) | | | 1,142 | | | | | | 0 | |

elf Beauty, Inc. (a) | | | 400 | | | | | | 10,732 | |

Nu Skin Enterprises, Inc., Class A | | | 800 | | | | | | 42,312 | |

| | | | | | | | | | |

| | | | | | | | | 53,044 | |

| | | | | | | | | | |

Consumer Services — 0.0% | | | | | | | | | | |

2U, Inc. (a) | | | 15,200 | | | | | | 581,096 | |

American Public Education, Inc. (a) | | | 400 | | | | | | 14,252 | |

Perdoceo Education Corp (a) | | | 7,000 | | | | | | 83,720 | |

WW International, Inc. (a) | | | 1,600 | | | | | | 50,048 | |

| | | | | | | | | | |

| | | | | | | | | 729,116 | |

| | | | | | | | | | |

Consumer Staple Products — 0.2% | | | | | | | | | | |

Aphria, Inc. (a) | | | 5,100 | | | | | | 93,687 | |

AquaBounty Technologies, Inc. (a) | | | 15,600 | | | | | | 104,520 | |

BellRing Brands, Inc., Class A (a) | | | 400 | | | | | | 9,444 | |

Canopy Growth Corp. (a) | | | 14,300 | | | | | | 458,029 | |

Church & Dwight Co., Inc. | | | 1,900 | | | | | | 165,965 | |

Coca-Cola Co. | | | 16,500 | | | | | | 869,715 | |

Farmer Brothers Co. (a) | | | 1,400 | | | | | | 14,616 | |

General Mills, Inc. (c) | | | 24,600 | | | | | | 1,508,472 | |

HEXO Corp. (a) | | | 1,700 | | | | | | 11,016 | |

Hormel Foods Corp. | | | 26,300 | | | | | | 1,256,614 | |

Hostess Brands, Inc. (a) | | | 8,000 | | | | | | 114,720 | |

JM Smucker Co. | | | 4,500 | | | | | | 569,385 | |

Kimberly-Clark Corp. (c) | | | 14,800 | | | | | | 2,057,940 | |

McCormick & Co., Inc. | | | 4,600 | | | | | | 410,136 | |

Molson Coors Brewing Co., Class B (a) | | | 1,700 | | | | | | 86,955 | |

Mondelez International, Inc., Class A | | | 26,500 | | | | | | 1,551,045 | |

PepsiCo, Inc. | | | 300 | | | | | | 42,435 | |

SunOpta, Inc. (a) | | | 500 | | | | | | 7,385 | |

Tyson Foods, Inc., Class A (a) | | | 18,900 | | | | | | 1,404,270 | |

See Notes to Consolidated Financial Statements.

21

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Consolidated Schedule of Investments (Continued)

March 31, 2021

| | | | | | | | | | |

Security Description | | Shares | | | | | Value | |

Vital Farms, Inc. (a) | | | 100 | | | | | $ | 2,184 | |

| | | | | | | | | | |

| | | | | | | | | 10,738,533 | |

| | | | | | | | | | |

Containers & Packaging — 0.0% | | | | | | | | | | |

O-I Glass, Inc. (a) | | | 500 | | | | | | 7,370 | |

| | | | | | | | | | |

Distributors—Discretionary — 0.0% | | | | | | | | | | |

KAR Auction Services, Inc. (a) | | | 4,100 | | | | | | 61,500 | |

| | | | | | | | | | |

Electrical Equipment — 0.0% | | | | | | | | | | |

Babcock & Wilcox Enterprises, Inc. (a) | | | 7,700 | | | | | | 72,919 | |

Capstone Turbine Corp. (a) | | | 1,052 | | | | | | 9,615 | |

Carrier Global Corp. | | | 500 | | | | | | 21,110 | |

LSI Industries, Inc. | | | 1,200 | | | | | | 10,236 | |

SMART Global Holdings, Inc. (a) | | | 3,400 | | | | | | 156,468 | |

| | | | | | | | | | |

| | | | | | | | | 270,348 | |

| | | | | | | | | | |

Engineering & Construction Services — 0.0% | | | | | | | | | | |

frontdoor, Inc. (a) | | | 300 | | | | | | 16,125 | |

Iteris, Inc. (a) | | | 2,300 | | | | | | 14,191 | |

Mistras Group, Inc. (a) | | | 1,900 | | | | | | 21,679 | |

Orion Group Holdings, Inc. (a) | | | 2,900 | | | | | | 17,603 | |

| | | | | | | | | | |

| | | | | | | | | 69,598 | |

| | | | | | | | | | |

Financial Services — 11.5% | | | | | | | | | | |

26 Capital Acquisition Corp. (a),(b),(c) | | | 527,701 | | | | | | 5,298,118 | |

7GC & Co. Holdings, Inc. (a),(b),(c) | | | 436,939 | | | | | | 4,439,300 | |

890 5th Avenue Partners, Inc. (a),(b),(c) | | | 127,300 | | | | | | 1,273,000 | |

ABG Acquisition Corp. I (a),(b),(c) | | | 300,000 | | | | | | 2,967,000 | |

Accelerate Acquisition Corp. (a),(b) | | | 310,000 | | | | | | 3,078,300 | |

ACRES Commercial Realty Corp. (a) | | | 2,033 | | | | | | 29,662 | |

Adit EdTech Acquisition Corp. (a),(b),(c) | | | 214,900 | | | | | | 2,118,054 | |

AG Mortgage Investment Trust, Inc. | | | 3,600 | | | | | | 14,508 | |

Alliance Data Systems Corp. | | | 929 | | | | | | 104,132 | |

Alpha Capital Acquisition Co. (a),(b),(c) | | | 417,953 | | | | | | 4,158,632 | |

Apollo Strategic Growth Capital (a),(b),(c) | | | 439,000 | | | | | | 4,521,700 | |

Apollo Strategic Growth Capital II (a),(b),(c) | | | 450,000 | | | | | | 4,491,000 | |

Arbor Realty Trust, Inc. | | | 200 | | | | | | 3,180 | |

ArcLight Clean Transition Corp. II (a),(b) | | | 310,000 | | | | | | 3,100,000 | |

Ares Acquisition Corp. (a),(b),(c) | | | 425,500 | | | | | | 4,255,000 | |

Arlington Asset Investment Corp., Class A (a) | | | 800 | | | | | | 3,232 | |

ARMOUR Residential REIT, Inc. | | | 700 | | | | | | 8,540 | |

Athena Technology Acquisition Corp. (a),(b),(c) | | | 81,000 | | | | | | 801,090 | |

Athlon Acquisition Corp. (a),(b),(c) | | | 465,000 | | | | | | 4,598,850 | |

Atlas Crest Investment Corp. II (a),(b),(c) | | | 421,140 | | | | | | 4,213,506 | |

Austerlitz Acquisition Corp. I (a),(b),(c) | | | 242,900 | | | | | | 2,438,716 | |

Austerlitz Acquisition Corp. II (a),(b),(c) | | | 465,000 | | | | | | 4,663,950 | |

See Notes to Consolidated Financial Statements.

22

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Consolidated Schedule of Investments (Continued)

March 31, 2021

| | | | | | | | | | |

Security Description | | Shares | | | | | Value | |

Authentic Equity Acquisition Corp. (a),(b),(c) | | | 550,000 | | | | | $ | 5,439,500 | |

Biotech Acquisition Co. (a),(b),(c) | | | 465,000 | | | | | | 4,598,850 | |

BlackRock Capital Investment Corp. | | | 9,081 | | | | | | 30,421 | |

BlackRock TCP Capital Corp. | | | 7,200 | | | | | | 99,576 | |

Blucora, Inc. (a) | | | 1,300 | | | | | | 21,632 | |

BlueRiver Acquisition Corp. (a),(b),(c) | | | 142,900 | | | | | | 1,424,713 | |

Boston Private Financial Holdings, Inc. | | | 100 | | | | | | 1,332 | |

Broadmark Realty Capital, Inc. | | | 900 | | | | | | 9,414 | |

Broadscale Acquisition Corp. (a),(b) | | | 465,000 | | | | | | 4,608,150 | |

Cannae Holdings, Inc. (a) | | | 100 | | | | | | 3,962 | |

Capital Southwest Corp. | | | 400 | | | | | | 8,864 | |

Capitala Finance Corp. (a) | | | 483 | | | | | | 7,458 | |

Capstar Special Purpose Acquisition Corp., Class A (a),(b),(c) | | | 537,300 | | | | | | 5,244,048 | |

Cartesian Growth Corp. (a),(b),(c) | | | 394,700 | | | | | | 3,927,265 | |

CC Neuberger Principal Holdings II, Class A (a),(b),(c) | | | 465,000 | | | | | | 4,584,900 | |

CC Neuberger Principal Holdings III (a),(b),(c) | | | 405,677 | | | | | | 4,052,713 | |

CF Acquisition Corp. IV (a),(b),(c) | | | 465,000 | | | | | | 4,663,950 | |

CF Acquisition Corp. V (a),(b),(c) | | | 465,000 | | | | | | 4,640,700 | |

CF Acquisition Corp. VI (a),(b),(c) | | | 450,000 | | | | | | 4,455,000 | |

CF Acquisition Corp. VIII (a),(b),(c) | | | 310,000 | | | | | | 3,075,200 | |

Cherry Hill Mortgage Investment Corp. | | | 3,700 | | | | | | 34,558 | |

Churchill Capital Corp. V (a),(b),(c) | | | 367,801 | | | | | | 3,751,570 | |

Churchill Capital Corp. VI (a),(b),(c) | | | 300,000 | | | | | | 3,018,000 | |

Churchill Capital Corp. VII (a),(b),(c) | | | 164,831 | | | | | | 1,643,365 | |

Climate Real Impact Solutions II Acquisition Corp. (a),(b),(c) | | | 407,004 | | | | | | 4,070,040 | |