UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22743

Blackstone Alternative Investment Funds

(Exact Name of Registrant as Specified in Charter)

345 Park Avenue

28th Floor

New York, NY 10154

(Address of Principal Executive Offices)

Registrant’s telephone number, including area code: (212) 583-5000

Peter Koffler, Esq.

c/o Blackstone Alternative Investment Advisors LLC

345 Park Avenue

28th Floor

New York, NY 10154

(Name and Address of Agent for Service)

With a copy to:

James E. Thomas, Esq.

Ropes & Gray LLP

Prudential Tower

800 Boylston Street

Boston, MA 02199-3600

Date of fiscal year end: March 31

Date of reporting period: March 31, 2024

Item 1. Reports to Stockholders.

| | (a) | The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”): |

Blackstone Alternative Multi-Strategy Fund

a series of Blackstone Alternative Investment Funds

|

Annual Report For the Year Ended March 31, 2024 |

TABLE OF CONTENTS

All investors should consider the investment objectives, risks, charges and expenses of the Blackstone Alternative Multi-Strategy Fund (the “Fund”) carefully before investing. The prospectus and the summary prospectus contain this and other information about the Fund. You can obtain a prospectus and a summary prospectus from the Fund’s website (www.bxmix.com). All investors are urged to carefully read the prospectus and the summary prospectus in its entirety before investing. Interests in the Fund are offered through Blackstone Securities Partners L.P., a member of FINRA and an affiliate of Blackstone Alternative Investment Advisors LLC, the Fund’s investment adviser (“BAIA” or the “Investment Adviser”).

Important Risks: An investment in the Fund should be considered a speculative investment that entails substantial risks; you may lose part or all of your investment or your investment may not perform as well as other investments. The Fund’s investments involve special risks including, but not limited to, loss of all or a significant portion of the investment due to leveraging, short-selling, or other speculative practices lack of liquidity and volatility of returns. The following is a summary description of certain additional principal risks of investing in the Fund:

Allocation Risk - BAIA’s judgment about the attractiveness, value or market trends affecting a particular asset class, investment style, sub-adviser or security may be incorrect and this may have a negative impact upon performance. Debt Securities Risk - investments in debt securities, such as bonds and certain asset backed securities involve certain risks which may cause the securities to lose value, including credit risk, liquidity risk, extension risk, interest rate risk, prepayment risk, event risk, inflation risk, and variable and floating rate instrument risk. Derivatives Risk - the use of derivatives involves the risk that their value may not move as expected relative to the value of the relevant underlying assets, rates, or indices. Derivatives can be volatile and illiquid, can subject to counterparty credit risk, and may entail investment exposure greater than their notional amount. Distressed Securities Risk - investments in securities of business enterprises involved in workouts, liquidations, reorganizations, bankruptcies and similar situations involve a high degree of risk of loss since there is typically substantial uncertainty concerning the outcome of such situations. Equity Securities Risk - there is a risk of loss associated with price fluctuations of equity and preferred securities which change based on a company’s financial condition and overall market and economic environment. Event-Driven Trading Risk - involves the risk that the specific event identified may not occur as anticipated and that this may have a negative impact upon the market price of the securities involved. Foreign Investments/Emerging Markets Risk - involves special risks caused by foreign political, social and economic factors, including exposure to currency fluctuations, less liquidity, less developed and less efficient trading markets, political instability and less developed legal and auditing standards. High Portfolio Turnover Risk - active trading of securities can increase transaction costs (thus lowering performance) and taxable distributions. Inflation Risk - Inflation, and investors’ expectation of future inflation, can impact the current value of portfolio investments, resulting in lower asset values and losses to Fund investors. Investment Style Risk - Different investment styles tend to shift in and out of favor depending on market and economic conditions and investor sentiment, and the Fund could underperform other funds that invest in similar asset classes but employ different investment styles.

Large Purchase and Redemption Risk - large purchase or redemption activity could result in the Fund incurring additional costs, selling portfolio securities, investing cash, or holding a relatively large amount of cash at times when it would not otherwise do so, which could have an adverse effect on performance. Leverage Risk - use of leverage can produce volatility and may exaggerate changes in the net asset value of Fund shares and in the return on the Fund’s portfolio, which may increase the risk that the Fund will lose more than it has invested. Liquidity Risk - some securities held by the Fund, including, but not limited to, restricted, distressed, non-exchange traded, and/or privately placed securities, may be difficult to sell, or illiquid, particularly during times of market turmoil. Illiquid securities may be difficult to value and if the Fund is forced to sell an illiquid asset to meet redemption requests or other cash needs, the Fund may be forced to sell at a loss. Market Risk and Selection Risk - one or more markets in which the Fund invests may go down in value, possibly sharply and unpredictably, affecting the values of individual securities held by the Fund. Significant shocks to or disruptions of the financial markets or the real economy could adversely affect the liquidity and volatility of securities held by the Fund. Mortgage- and Asset-Based Securities Risk - these securities are subject to credit, interest rate, valuation, liquidity, prepayment and extension risks. These securities also are subject to risk of default on the underlying mortgage or asset, particularly during periods of economic downturn. Small movements in interest rates may quickly and significantly reduce the value of certain mortgage-backed securities. Model and Technology Risk -involves the risk that model-based strategies, data gathering systems, order execution and trade allocation systems and risk management systems may not be successful on an ongoing basis or could contains errors, omissions, imperfections or malfunctions. Multi-Manager Risk - managers may make investment decisions which conflict with each other and as a result, the Fund could incur transaction costs without accomplishing any net investment result.

BLACKSTONE ALTERNATIVE INVESTMENT FUNDS

Dear Blackstone Investor,

We are pleased to present this annual shareholder report for Blackstone Alternative Investment Funds (“BAIF”) and its series, Blackstone Alternative Multi-Strategy Fund (the “Fund”). This report includes portfolio commentary, a listing of the Fund’s investments and the Fund’s audited financial statements. Audited financial statements for the Fund cover the period from April 1, 2023 to March 31, 2024 (the “Reporting Period”).

The Fund’s investment objective is to seek capital appreciation. The Fund seeks to achieve this objective principally by allocating its assets among a variety of non-traditional, or “alternative,” investment strategies. Blackstone Alternative Investment Advisors LLC (the “Investment Adviser” or “BAIA”) determines the allocations of the Fund’s assets and allocates the Fund’s assets among sub-advisers with experience managing non-traditional or alternative investment strategies (each, a “Sub-Adviser” and together, the “Sub-Advisers”) and among investment funds generally employing alternative investment strategies. BAIA also manages a portion of the Fund’s assets directly and, from time to time, may instruct Sub-Advisers with respect to particular investments.1 The Adviser may retain discretionary and non-discretionary Sub-Advisers for the Fund. Each discretionary Sub-Adviser is responsible for the day-to-day management of the Fund’s assets that the Investment Adviser allocates to it. The Investment Adviser has the responsibility to oversee each Sub-Adviser, subject to the ultimate oversight of the Fund’s Board of Trustees. The Investment Adviser is also responsible for recommending the hiring, termination, and replacement of Sub-Advisers. In pursuing the Fund’s investment objective, BAIA seeks to maintain an investment portfolio with, on average, lower volatility relative to the broader equity markets.

Fund Performance2

The Reporting Period was comprised of three quarters of positive global equity market performance (Q2 2023, Q4 2023, and Q1 2024) and one quarter of global equity market decline (Q3 2023). Coming out of a turbulent year for markets in 2022, financial assets rebounded strongly over the course of the Reporting Period, however, there were still moments of instability as evidenced by negative global equity performance in the third quarter of 2023. Investor focus remained fixed upon releases of economic data and subsequent policy decisions from a hawkish Federal Reserve (the “Fed”) facing an ongoing struggle against persistent inflation.

The Fund’s collection of alternative strategies and hedge fund vehicles exhibited positive returns over the Reporting Period, outperforming the broader hedge fund universe by 5.0%pts.3 As we look ahead to the next 12 months, we intend to continue leveraging our due diligence, risk management, and investment expertise, accumulated over our 25+ years of experience in alternative investing, to identify compelling investment strategies and skilled Sub-Advisers that we believe may advance the Fund in pursuit of its objective. During the Reporting Period, the Fund generated a cumulative return, net of fees and expenses, of 10.7%. Over the same period, the HFRX Global Hedge Fund Index, a measure of hedge fund performance, returned 5.7%; the

Because of the historically broadly diversified and low beta nature of the portfolio, the Fund is not expected to participate in the full upside of broader equity and fixed income markets. The indices referenced herein are not benchmarks or targets for the Fund.

| 1 | BAIA’s fees on the assets BAIA manages directly are not reduced by a payment to a Sub-Adviser. Allocations to Sub-Advisers and BAIA vary from time to time. |

| 2 | Performance is shown net of the Expense Ratio less waived expenses for Class I shares. Performance data quoted represents past performance and does not predict future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance data above. There can be no assurance that the Fund will achieve its goals or avoid losses. |

| 3 | As measured against the HFRX Global Hedge Fund Index. |

1

MSCI World Total Return Index, a measure of global equity market performance, returned 28.2%; and the Bloomberg Global Aggregate Bond Index, a measure of investment grade bond performance, returned -2.1%.4

Market and Portfolio Commentary

The start of the Reporting Period was a continuation of positive performance in global markets with the MSCI World Index returning 7.0% in the second quarter of 2023, bringing YTD returns to 15.4%.5 In the face of a positive equity market, questions remained as to the likelihood of a coming recession amidst tighter financial conditions, a slowing economy, and elevated valuations. In contrast to these potentially worrisome economic signals, the labor market has remained resilient and recent earnings reports have beat expectations, leaving an air of optimism present in the market. Markets were broadly calmer entering the second quarter after the spike in volatility introduced by the regional banking crisis in the U.S. in March. Color from U.S. government organizations alluded to an easing of the accommodative posture taken with the initial failure of Silicon Valley Bank and suggested that the banking system had been able to weather the storm for the time being. However, U.S. regional banks continued to be a point of ongoing concern, highlighted by the high-profile failure of First Republic Bank on May 1st, resulting in the speedy acquisition of the financial institution by J.P. Morgan Chase.

While fears of larger bank failures may have been abated following positive regulator stress test results in June, recently shaken confidence in the Fed’s oversight ability may have tempered hopes that the crisis had passed.6 Enhanced scrutiny and tighter lending conditions coming out of the bank failures heightened investor focus on liquidity conditions with many looking to how the Fed would respond. Despite acknowledgment of the potential impacts on liquidity, the Fed reaffirmed its commitment to bringing inflation down to its target rate. While inflation readings in the quarter appeared favorable from a headline perspective for both March CPI (5.0% vs. 5.2% expected)7 and April CPI (4.9% vs. 5.0% expected)8, readings for Core CPI were in line for both months (5.6% for March and 5.5% for April)7,8, indicating core inflation may be more persistent than the Fed anticipated. The Fed continued its hiking cycle at its May 3rd meeting, raising interest rates by 25bps. U.S. and global rates sold off materially in May amidst this policy decision and rhetoric from the Fed discouraging hopes for rate cuts before the end of 2023.9 On June 3rd, the Fed paused raising rates for the first time in their most aggressive rate-hiking cycle in decades, leaving target rates at 5-5.25%.10 An easing of monetary policy aggression had the potential to be short-lived, however, as Federal Open Market Committee (“FOMC”) sentiment remains hawkish, with a majority of the Fed board seeing the case for around two more rate hikes in the current cycle.11

| 4 | The volatility of the indices presented may be materially different from that of the performance of the Fund. In addition, the indices employ different investment guidelines and criteria than the Fund; as a result, the holdings in the Fund may differ significantly from the securities that comprise the indices. The indices have not been selected to represent benchmarks for the Fund, but rather are disclosed to allow for comparison of the Fund’s performance to that of well-known and widely recognized indices. In the case of equity indices, performance of the indices reflects the reinvestment of dividends. |

| 5 | Source: Bloomberg as of June 30, 2023. |

| 6 | Source: Federal Reserve as of June 28, 2023. |

| 7 | Source: United States Bureau of Labor Statistics: Consumer Price Index as of April 12, 2023. |

| 8 | Source: United States Bureau of Labor Statistics: Consumer Price Index as of May 10, 2023. |

| 9 | Source: Federal Open Market Committee as of May 3, 2023. |

| 10 | Source: Federal Open Market Committee as of June 3, 2023. |

| 11 | Source: Federal Open Market Committee as of February 1, 2023. |

2

Global markets reversed a streak of four consecutive quarters of positive performance in the third quarter of 2023, with the MSCI World Index returning -3.4%, bringing YTD returns to 11.6%.12 Early positive performance from equity markets in July was quickly traded for a return to elevated volatility in the last two months of Q3 as rising yields placed pressure on valuations. The third quarter began with a continuation of 2023’s rally in equity markets, coming off the back of a relatively solid Q2 earnings season and favorable readings of economic data. While the U.S. equity indices continued to rally into July, the Fed appeared to be nearing the end of its rate hiking campaign as June CPI released July 12th was softer for both headline (3.0% vs. 3.1% expected) and core (4.8% vs. 5.0% expected).13 Core CPI decelerated, increasing at its lowest month-over-month rate (+15bps) since February of 2021.6 Even as inflation seemed to be decelerating, the Fed hiked interest rates an additional +25bps—the highest level in 22 years—during the July 26th FOMC meeting.14

Commentary coming out of the meeting recognized the early evidence of decelerating inflation, but also alluded to the possibility of an additional rate increase before the end of this year. Still, equity markets finished the month positively with the MSCI World Index up +3.4% in July.15 In August, positive momentum in the market faced headwinds when Fitch Ratings announced its downgrading of U.S. sovereign debt, citing long-term risks of the current U.S. fiscal trajectory.16 This downgrade likely put downward pressure on U.S. Treasuries to begin the month. This action coincided with resurfacing inflation worries coming out of the late July FOMC meeting and elevated Treasury sales due to the stalled debt-ceiling negotiations in June. The confluence of these factors likely resulted in the sharp uptick in yields, with the 10-year Treasury yield rising from 4.05% on August 1st to a high of 4.34% on August 21st, the highest level since mid-2007.17 Rising yields weighed on stock prices during the month as the MSCI World Index posted its first negative monthly return since May, finishing August down -2.4%.18

Volatility eased in early September amidst positive economic data and a pause in rising Treasury yields. However, this calm in the markets was short lived, as soon after the Federal Reserve reaffirmed its “hawkish” stance at the September FOMC meeting. Most Fed members indicated that there was an expectation of an additional rate hike by the end of the year and decreased the forecast for rate cuts in 2024 from four to two. With the Fed again committing to its fight against inflation, the market began to ingest the likelihood of higher rates for longer, with the MSCI World Index declining another -4.3% in September.19

Global markets returned to positive performance in the fourth quarter of 2023, with the MSCI World Index returning 11.5%, bringing YTD returns to 24.4%.20 A continuation of the previous quarter’s negative performance in equity markets transitioned to a broad market rally in the last two months of the year, likely on the back of positive economic data and commentary from the Fed. At the start of the fourth quarter the MSCI World dropped 2.9% in October and entered into correction territory.21 Long-dated Treasury yields continued to move higher coinciding with fresh geopolitical risks and a slightly higher than expected reading for both headline (3.7% vs. 3.6% expected) and core inflation (4.1% vs. 4.1% expected).22 Further

| 12 | Source: Bloomberg as of September 30, 2023. |

| 13 | Source: United States Bureau of Labor Statistics: Consumer Price Index as of July 12, 2023. |

| 14 | Federal Open Market Committee as of July 26, 2023. |

| 15 | Source: Bloomberg as of July 31, 2023. |

| 16 | Source: Fitch Ratings as of August 1, 2023. |

| 17 | Source: Bloomberg as of August 21, 2023. |

| 18 | Source: Bloomberg as of August 31, 2023. |

| 19 | Source: Bloomberg as of September 30, 2023. |

| 20 | Source: Bloomberg as of December 31, 2023. |

| 21 | Source: Bloomberg as of October 31, 2023. |

| 22 | Source: United States Bureau of Labor Statistics: Consumer Price Index as of October 12, 2023. |

3

data released in October pointed to a U.S. economic growth rate of 4.8%, exceeding expectations for Q3 (4.3% expected)23 and bolstering the narrative for “higher-for-longer” rates, as the Fed continued its battle against persistent inflation and a strong labor market.

However, the drawdown in markets was met with a reversal to the upside off the back of favorable economic data prints in November in conjunction with the largest monthly shift downward in long-dated treasury yields since December of 2008.24 A cooler than expected inflation reading released in the same month showed CPI fall to 3.2% year-over-year from the 3.7% reading in October.25 Perhaps being influenced by a cool inflation print, market participants wagered that the Fed was not just finished with the current rate hiking cycle, but that it would be implementing as many as six rates cuts in 2024.26

Positive sentiment held strong through the last month of the year with the broader risk-asset rally gaining steam. The last Federal Open Market Committee (“FOMC”) meeting of 2023 seemingly confirmed investor sentiment of a dovish Fed pivot following the decision to hold rates steady for the third meeting in a row.27 The policy statement released on the same day indicated the Fed board members projected 75bps of rate cuts in 2024, an increase from the previous projection of 50bps.28 The perceived trend towards dovishness may have bolstered risk assets into the end of the year, with the MSCI World finishing the month up 4.9%.29

The first quarter of 2024 showed a continuation of positive market sentiment with the MSCI World returning 9.0%.30 Markets appeared to have been responding to the continued resilience of the U.S. economy and its labor market, while putting aside concerns of elevated inflation and high-interest rates. Part of this optimism may have been due to the investor expectation for the Fed to begin cutting interest rates in 2024, despite the FOMC indicating that they are proceeding with caution as more economic data is released throughout the year.

The rally in Q4 of 2023 came in coordination with a sharp shift lower in the yield curve, likely resulting from investors anticipating a more dovish Fed in the near term. However, markets continued to rally in Q1 2024 even as hawkishness crept back into monetary policy sentiment—expectations of seven rate cuts in 2024 reduced to just three over the course of the quarter.31 During both FOMC meetings during the quarter, the Fed chose to hold rates steady while continuing the current pace of quantitative tightening (reducing its Treasury securities and agency debt and agency mortgage-backed securities) in alignment with previous FOMC meetings.

A neutral inflation print in January followed by two higher than expected readings in both February and March likely further tampered expectations for Fed rate cuts coming in the more immediate FOMC meetings.32 However, equities continued to show momentum with the MSCI World returning 1.2%, 4.3%, and 3.3% in each month of the quarter.33 The economic situation remained strong as tight labor conditions remained through the duration of the quarter and GDP readings showed an accelerating economy.34 Positive economic data likely contributed to the ongoing momentum in the stock market as sentiment for a possible ‘soft-landing’ gained favor in the market.

| 23 | Source: United States Bureau of Economic Analysis as of October 26, 2023. |

| 24 | Source: Bloomberg as of November 30, 2023. |

| 25 | Source: United States Bureau of Labor Statistics: Consumer Price Index as of November 14, 2023. |

| 26 | Source: Bloomberg as of November 14, 2023. |

| 27 | Federal Open Market Committee as of December 13, 2023. |

| 28 | Federal Open Market Committee as of December 13, 2023. |

| 29 | Source: Bloomberg as of December 31, 2023. |

| 30 | Source: Bloomberg as of March 31, 2024. |

| 31 | Source: Bloomberg as of March 31, 2024. |

| 32 | Source: United States Bureau of Labor Statistics: Consumer Price Index as of January 19, 2024; February 14, 2024; and March 12, 2024. |

| 33 | Source: Bloomberg as of March 31, 2024. |

| 34 | Source: United States Bureau of Labor Statistics as of March 31, 2024. |

4

Over the Reporting Period, the Fund’s Macro strategies were accretive to performance (+4.2%). A sub-strategy focused on Carbon Credit Allowances (“CCAs”) contributed to Fund performance over the period, likely benefiting from demand for inflation exposure, as CCAs provide direct exposure to the Consumer Price Index. Some of the Fund’s defensive positions in this portion of the book detracted from performance because financing and holding costs were higher than returns throughout the reporting period.

Quant strategies contributed positively to Fund performance (+4.6%) during the Reporting Period. The Fund’s exposure to commodities and rates positions added positively to the Fund during the Reporting Period. An Asian equities focused strategy took on losses from mark-to-market beta hedge positions during the reporting period.

Credit strategies contributed positively to performance (+3.9%). Corporate credit strategies benefited from the tightening of high yield spreads during the reporting period and the positive carry being generated in the portfolio. In this portion of the book, agency mortgage securities detracted at points during the reporting period when the mortgage basis spread widened.

Equities strategies contributed positively to performance (+2.2%). Financials-focused strategies benefited both from the broader rally in equities during the reporting period as well as nimble trading success around pockets of volatility. Certain exposures to small-cap equity strategies performed negatively during equity market contractions during the period.

Business Update

Effective June 30, 2023 and September 30, 2023, respectively, Ian Morris and Alberto Santulin no longer serve as portfolio managers of the Fund. The other existing portfolio managers continue to serve as portfolio managers of the Fund.

In reflecting on the last year, we cannot overstate the importance of your steadfast commitment to the Fund and your continued confidence in our organization. We are focused on generating attractive risk-adjusted returns and remain committed to achieving the Fund’s investment objectives. Thank you for your continued partnership.

Sincerely,

5

Performance Summary

Performance quoted represents past performance, which may be higher or lower than current performance. Past performance is not indicative of future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect taxes that an investor would pay on fund distributions or on the sale of fund shares. To obtain the most recent month-end performance, visit www.bxmix.com.

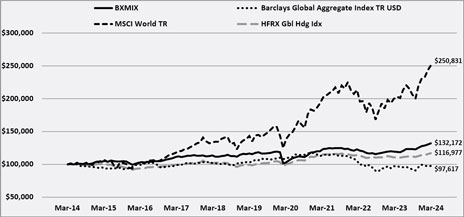

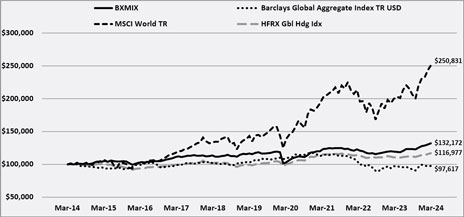

Value of a $100,000 Investment Since Inception at Net Asset Value*

None of the indices presented are benchmarks or targets for the Fund.

| * | The line graph represents historical performance of a hypothetical investment of $100,000 from Inception (June 16, 2014) to March 31, 2024, assuming the reinvestment of distributions. |

Average Annual Returns

| | | | | | | | | | | | | | | |

| | | For the

Year Ended

March 31,

2024 | | Five Year

(March 31,

2019 -

March 31,

2024) | | Since

Inception

(June 16,

2014) |

Class I Shares (“BXMIX”) | | | | 10.73% | | | | | 2.66% | | | | | 2.89% | |

HFRX Global Hedge Fund Index | | | | 5.70% | | | | | 3.44% | | | | | 1.57% | |

MSCI World Total Return Index | | | | 25.72% | | | | | 12.62% | | | | | 9.76% | |

Bloomberg Global Aggregate Bond Index | | | | 0.49% | | | | | (1.16)% | | | | | (0.23)% | |

6

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Portfolio Information

March 31, 2024

| | | | | |

Geographic Breakdown | | Percentage of

Total Net Assets |

North America | | | | 66.0 | % |

Europe | | | | 3.0 | |

South America | | | | 2.0 | |

Asia | | | | 1.2 | |

Middle East | | | | 1.1 | |

Africa | | | | 0.3 | |

Oceania | | | | 0.1 | |

Other1,2 | | | | 19.9 | |

Securities Sold Short | | | | (30.9 | ) |

Other Assets and Liabilities3 | | | | 37.3 | |

| | | | | |

Total | | | | 100.0 | % |

| | | | | |

| 1 | Includes Sovereign Debt, Exchange-Traded Funds, Warrants, Rights, Undertakings For Collective Investment in Transferable Securities, Commodities, Repurchase Agreements and Purchased Options. |

| 2 | See the below table for a geographic breakdown of Sovereign Debt. |

| 3 | Assets, other than investments in securities, less liabilities. See Consolidated Statement of Assets and Liabilities. A significant portion of this balance represents cash collateral for derivatives. |

| | | | | |

Sovereign Debt Geographic Breakdown | | Percentage of

Total Net Assets |

North America | | | | 1.8 | % |

Middle East | | | | 1.5 | |

South America | | | | 1.0 | |

Europe | | | | 0.9 | |

Asia | | | | 0.6 | |

Africa | | | | 0.5 | |

| | | | | |

Total | | | | 6.3 | % |

| | | | | |

See Notes to Consolidated Financial Statements.

7

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Portfolio Information (Continued)

March 31, 2024

| | | | | |

Portfolio Composition | | Percentage of

Total Net Assets |

Common Stock | | | | 22.2 | % |

Mortgage-Backed Securities1 | | | | 16.6 | |

Corporate Bonds & Notes | | | | 10.9 | |

Investments in Investee Funds | | | | 10.9 | |

Sovereign Debt | | | | 6.3 | |

Asset-Backed Securities | | | | 5.6 | |

Bank Debt | | | | 3.9 | |

Undertakings For Collective Investment in Transferable Security | | | | 3.8 | |

U.S. Treasury Notes | | | | 3.3 | |

Exchange-Traded Funds | | | | 0.6 | |

Preferred Stock | | | | 0.1 | |

Warrants | | | | 0.1 | |

Rights2 | | | | 0.0 | |

Other3 | | | | 6.3 | |

Securities Sold Short | | | | (30.9 | ) |

Repurchase Agreements | | | | 3.0 | |

Other Assets and Liabilities4 | | | | 37.3 | |

| | | | | |

Total | | | | 100.0 | % |

| | | | | |

| 1 | Includes Agency-Guaranteed TBA securities held long, that are guaranteed by the Federal National Mortgage Association or the Government National Mortgage Association, which represents 8.4% of Total Net Assets. |

| 2 | Represents less than 0.1%. |

| 3 | Includes Commodities and Purchased Options. |

| 4 | Assets, other than investments in securities, net of other liabilities. See Consolidated Statement of Assets and Liabilities. A significant portion of the balance represents cash collateral for derivatives. |

| | | | | |

Credit Quality Allocation1 | | Percentage of

Total

Net Assets |

Not Rated but Agency-Guaranteed2 | | | | 8.4 | % |

AAA/Aaa | | | | 0.2 | |

AA/Aa | | | | 0.3 | |

A | | | | 1.1 | |

BBB/Baa | | | | 5.0 | |

BB/Ba | | | | 5.4 | |

B | | | | 6.0 | |

CCC/Caa | | | | 3.6 | |

CC/Ca | | | | 0.7 | |

D | | | | 0.3 | |

Not Rated | | | | 15.6 | |

Other3 | | | | 53.4 | |

| | | | | |

Total | | | | 100.0 | % |

| | | | | |

| 1 | Using the higher of Standard & Poor’s (“S&P’s”) or Moody’s Investor Service (“Moody’s”) ratings. |

| 2 | Not Rated but Agency-Guaranteed represents TBA securities which are affiliated with the Federal National Mortgage Association or the Government National Mortgage Association. |

| 3 | Includes Assets, other than investments in securities, net of other liabilities, all Non-Fixed Income securities and Fixed Income securities held short. |

| | | | | |

Industry | | Percentage of

Total Net Assets |

Software & Services | | | | 3.5 | % |

Banks | | | | 2.8 | |

Capital Goods | | | | 2.6 | |

Oil & Gas | | | | 1.9 | |

Diversified Financials | | | | 1.4 | |

Technology Hardware & Equipment | | | | 1.4 | |

Media & Entertainment | | | | 1.4 | |

Semiconductors & Semiconductor Equipment | | | | 1.3 | |

Insurance | | | | 1.1 | |

See Notes to Consolidated Financial Statements.

8

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Portfolio Information (Continued)

March 31, 2024

| | | | | |

Industry | | Percentage of

Total Net Assets |

Investment Company Security | | | | 1.1 | % |

Pharmaceuticals, Biotechnology & Life Sciences | | | | 1.1 | |

Healthcare-Services | | | | 0.8 | |

Retail | | | | 0.7 | |

Consumer Services | | | | 0.7 | |

Software | | | | 0.8 | |

Energy | | | | 0.7 | |

Retailing | | | | 0.7 | |

Electric | | | | 0.7 | |

Pipelines | | | | 0.6 | |

Health Care Equipment & Services | | | | 0.5 | |

Machinery-Diversified | | | | 0.6 | |

Iron/Steel | | | | 0.5 | |

Utilities | | | | 0.5 | |

Food | | | | 0.5 | |

Telecommunications | | | | 0.5 | |

Materials | | | | 0.4 | |

Food Service | | | | 0.5 | |

Media | | | | 0.5 | |

Food, Beverage & Tobacco | | | | 0.5 | |

Transportation | | | | 0.4 | |

Diversified Financial Services | | | | 0.4 | |

Airlines | | | | 0.4 | |

Commercial & Professional Services | | | | 0.3 | |

Real Estate | | | | 0.4 | |

Chemicals | | | | 0.3 | |

Commercial Banks | | | | 0.3 | |

Internet | | | | 0.2 | |

Engineering & Construction | | | | 0.2 | |

Cosmetics/Personal Care | | | | 0.2 | |

Packaging & Containers | | | | 0.2 | |

Leisure Time | | | | 0.2 | |

Housewares | | | | 0.3 | |

Household & Personal Products | | | | 0.2 | |

Energy-Alternate Sources | | | | 0.2 | |

Entertainment | | | | 0.2 | |

Food & Staples Retailing | | | | 0.2 | |

Consumer Durables & Apparel | | | | 0.2 | |

Hand/Machine Tools | | | | 0.2 | |

Household Products/Wares | | | | 0.2 | |

Automobiles & Components | | | | 0.2 | |

Auto Manufacturers | | | | 0.2 | |

Lodging | | | | 0.2 | |

Telecommunication Services | | | | 0.2 | |

Agriculture | | | | 0.1 | |

See Notes to Consolidated Financial Statements.

9

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Portfolio Information (Continued)

March 31, 2024

| | | | | |

Industry | | Percentage of

Total Net Assets |

Mining | | | | 0.1 | % |

Advertising | | | | 0.1 | |

Consumer Discretionary Distribution & Retail | | | | 0.1 | |

Healthcare-Products | | | | 0.1 | |

Pharmaceuticals | | | | 0.1 | |

Trucking & Leasing | | | | 0.1 | |

Environmental Control | | | | 0.1 | |

Home Furnishings | | | | 0.1 | |

Distribution/Wholesale | | | | 0.1 | |

Commercial Services | | | | 0.1 | |

Auto Parts & Equipment | | | | 0.0 | 1 |

Computers | | | | 0.0 | 1 |

Office/Business Equip | | | | 0.0 | 1 |

Beverages | | | | 0.0 | 1 |

Other2 | | | | 56.2 | |

Securities Sold Short | | | | (30.9 | ) |

Other Assets and Liabilities3 | | | | 37.3 | |

| | | | | |

Total Investments | | | | 100 | % |

| | | | | |

| 1 | Represents less than 0.1%. |

| 2 | Includes Asset-Backed Securities, Sovereign Debt, Mortgage-Backed Securities, U.S. Government Sponsored Agency Securities, Exchange-Traded Funds, Warrants, Rights, Investments in Investee Funds, Undertakings For Collective Investment in Transferable Securities, Commodities, Repurchase Agreements and Purchased Options. |

| 3 | Assets, other than investments in securities, net of other liabilities. See Consolidated Statement of Assets and Liabilities. A significant portion of the balance represents cash collateral for derivatives. |

See Notes to Consolidated Financial Statements.

10

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Consolidated Schedule of Investments ^

March 31, 2024

| | | | | | | | | | | | |

Security Description | | Shares | | | | | | Value | |

|

INVESTMENT IN SECURITIES — 84.3% | |

COMMON STOCK — 22.2% | |

Africa — 0.0% | | | | | | | | | |

Energy — 0.0% | | | | | | | | | | | | |

Golar LNG Ltd., | | | 3,600 | | | | | | | $ | 86,616 | |

| | | | | | | | | | | | |

Materials — 0.0% | | | | | | | | | | | | |

IAMGOLD Corp. (a) | | | 63,600 | | | | | | | | 211,788 | |

Sasol Ltd., ADR | | | 300 | | | | | | | | 2,343 | |

Sibanye Stillwater Ltd., ADR | | | 5,500 | | | | | | | | 25,905 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 240,036 | |

| | | | | | | | | | | | |

Total Africa | | | | | | | | | | | 326,652 | |

| | | | | | | | | | | | |

Asia — 0.2% | | | | | | | | | | | | |

Automobiles & Components — 0.1% | | | | | | | | | | | | |

Kandi Technologies Group, Inc. (a) | | | 100 | | | | | | | | 212 | |

Li Auto, Inc., ADR (a) | | | 73,100 | | | | | | | | 2,213,468 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,213,680 | |

| | | | | | | | | | | | |

Capital Goods — 0.0% | | | | | | | | | | | | |

BAIYU Holdings, Inc. (a) | | | 12 | | | | | | | | 17 | |

China Yuchai International Ltd. | | | 245 | | | | | | | | 2,090 | |

Euro Tech Holdings Co. Ltd. (a) | | | 150 | | | | | | | | 213 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,320 | |

| | | | | | | | | | | | |

Consumer Services — 0.0% | | | | | | | | | | | | |

E-Home Household Service Holdings Ltd. (a) | | | 2 | | | | | | | | 3 | |

Yum China Holdings, Inc. | | | 16,400 | | | | | | | | 652,556 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 652,559 | |

| | | | | | | | | | | | |

Diversified Financials — 0.0% | | | | | | | | | | | | |

FinVolution Group, ADR | | | 8,200 | | | | | | | | 41,328 | |

LexinFintech Holdings Ltd., ADR | | | 14,200 | | | | | | | | 25,560 | |

Lufax Holding Ltd., ADR | | | 38,500 | | | | | | | | 162,470 | |

Noah Holdings Ltd., ADR | | | 1,100 | | | | | | | | 12,573 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 241,931 | |

| | | | | | | | | | | | |

Food & Staples Retailing — 0.0% | | | | | | | | | | | | |

Dada Nexus Ltd., ADR (a) | | | 100 | | | | | | | | 205 | |

| | | | | | | | | | | | |

Materials — 0.0% | | | | | | | | | | | | |

Tantech Holdings Ltd., (a) | | | 38 | | | | | | | | 25 | |

| | | | | | | | | | | | |

See Notes to Consolidated Financial Statements.

11

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Consolidated Schedule of Investments ^ (Continued)

March 31, 2024

| | | | | | | | | | | | |

Security Description | | Shares | | | | | | Value | |

Media & Entertainment — 0.0% | | | | | | | | | | | | |

Autohome, Inc., ADR | | | 500 | | | | | | | $ | 13,110 | |

Bilibili, Inc., ADR (a) | | | 59,511 | | | | | | | | 666,524 | |

GigaMedia Ltd. (a) | | | 100 | | | | | | | | 127 | |

Hello Group, Inc., ADR | | | 16,100 | | | | | | | | 99,981 | |

Kanzhun Ltd., ADR | | | 2,100 | | | | | | | | 36,813 | |

Pop Culture Group Co. Ltd., Class A (a) | | | 40 | | | | | | | | 93 | |

Weibo Corp., ADR | | | 8,800 | | | | | | | | 79,992 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 896,640 | |

| | | | | | | | | | | | |

Pharmaceuticals, Biotechnology & Life Sciences — 0.0% | | | | | | | | | |

I-Mab, ADR (a) | | | 9,700 | | | | | | | | 18,042 | |

Sinovac Biotech Ltd. (a),(b) | | | 200 | | | | | | | | 1,294 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 19,336 | |

| | | | | | | | | | | | |

Retailing — 0.1% | | | | | | | | | | | | |

ATRenew, Inc., ADR (a) | | | 100 | | | | | | | | 176 | |

Baozun, Inc., ADR (a) | | | 12,800 | | | | | | | | 29,440 | |

JD.com, Inc., ADR | | | 90,900 | | | | | | | | 2,489,751 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,519,367 | |

| | | | | | | | | | | | |

Semiconductors & Semiconductor Equipment — 0.0% | | | | | | | | | | | | |

Allegro MicroSystems, Inc. (a) | | | 1,600 | | | | | | | | 43,136 | |

ChipMOS Technologies, Inc., ADR | | | 200 | | | | | | | | 6,290 | |

Himax Technologies, Inc., ADR | | | 9,300 | | | | | | | | 49,755 | |

Magnachip Semiconductor Corp. (a) | | | 7,200 | | | | | | | | 40,176 | |

Silicon Motion Technology Corp., ADR | | | 1,000 | | | | | | | | 76,940 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 216,297 | |

| | | | | | | | | | | | |

Software & Services — 0.0% | | | | | | | | | | | | |

Agora, Inc., ADR (a) | | | 5,900 | | | | | | | | 14,809 | |

Cellebrite DI Ltd. (a) | | | 16,200 | | | | | | | | 179,496 | |

Infobird Co. Ltd. (a) | | | 0 | | | | | | | | 3 | |

TaskUS, Inc., Class A (a) | | | 3,300 | | | | | | | | 38,445 | |

TDCX, Inc., ADR (a) | | | 2,000 | | | | | | | | 14,340 | |

WNS Holdings Ltd. (a) | | | 2,900 | | | | | | | | 146,537 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 393,630 | |

| | | | | | | | | | | | |

Technology Hardware & Equipment — 0.0% | | | | | | | | | | | | |

Zepp Health Corp., ADR (a) | | | 100 | | | | | | | | 102 | |

| | | | | | | | | | | | |

Transportation — 0.0% | | | | | | | | | | | | |

MingZhu Logistics Holdings Ltd., (a) | | | 21 | | | | | | | | 8 | |

| | | | | | | | | | | | |

Total Asia | | | | | | | | | | | 7,156,100 | |

| | | | | | | | | | | | |

See Notes to Consolidated Financial Statements.

12

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Consolidated Schedule of Investments ^ (Continued)

March 31, 2024

| | | | | | | | | | | | |

Security Description | | Shares | | | | | | Value | |

Europe — 0.4% | | | | | | | | | | | | |

Capital Goods — 0.1% | | | | | | | | | | | | |

AerCap Holdings NV (a) | | | 4,300 | | | | | | | $ | 373,713 | |

Airbus SE (c) | | | 11,613 | | | | | | | | 2,139,096 | |

Freyr Battery, Inc. (a) | | | 5,200 | | | | | | | | 8,736 | |

Luxfer Holdings PLC, ADR | | | 2,700 | | | | | | | | 27,999 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,549,544 | |

| | | | | | | | | | | | |

Consumer Durables & Apparel — 0.0% | | | | | | | | | | | | |

Amer Sports, Inc. (a) | | | 59,501 | | | | | | | | 969,866 | |

Ermenegildo Zegna NV | | | 7,000 | | | | | | | | 102,550 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,072,416 | |

| | | | | | | | | | | | |

Energy — 0.1% | | | | | | | | | | | | |

Ardmore Shipping Corp. | | | 500 | | | | | | | | 8,210 | |

BP PLC (c) | | | 8,665 | | | | | | | | 54,225 | |

Eni SpA (c) | | | 13,488 | | | | | | | | 213,171 | |

Euronav NV | | | 2,000 | | | | | | | | 33,260 | |

Frontline PLC | | | 33,900 | | | | | | | | 792,582 | |

KNOT Offshore Partners LP | | | 1,500 | | | | | | | | 7,740 | |

Seadrill Ltd. (a) | | | 4,100 | | | | | | | | 206,230 | |

Shell PLC (c) | | | 45,721 | | | | | | | | 1,527,031 | |

StealthGas, Inc. (a) | | | 1,400 | | | | | | | | 8,316 | |

TechnipFMC PLC | | | 100 | | | | | | | | 2,511 | |

TORM PLC, Class A | | | 10,000 | | | | | | | | 349,500 | |

TotalEnergies SE (c) | | | 9,434 | | | | | | | | 646,049 | |

Tsakos Energy Navigation Ltd. | | | 5,400 | | | | | | | | 137,106 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,985,931 | |

| | | | | | | | | | | | |

Food, Beverage & Tobacco — 0.1% | | | | | | | | | | | | |

Anheuser-Busch InBev SA, ADR | | | 37,152 | | | | | | | | 2,258,099 | |

Nomad Foods Ltd. | | | 6,300 | | | | | | | | 123,228 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,381,327 | |

| | | | | | | | | | | | |

Materials — 0.0% | | | | | | | | | | | | |

ArcelorMittal SA | | | 30,000 | | | | | | | | 827,400 | |

Orion SA | | | 1,000 | | | | | | | | 23,520 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 850,920 | |

| | | | | | | | | | | | |

Media & Entertainment — 0.0% | | | | | | | | | | | | |

Criteo SA, ADR (a) | | | 4,400 | | | | | | | | 154,308 | |

Gambling.com Group Ltd. (a) | | | 2,000 | | | | | | | | 18,260 | |

Trivago NV, ADR | | | 1,700 | | | | | | | | 4,692 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 177,260 | |

| | | | | | | | | | | | |

See Notes to Consolidated Financial Statements.

13

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Consolidated Schedule of Investments ^ (Continued)

March 31, 2024

| | | | | | | | | | | | |

Security Description | | Shares | | | | | | Value | |

Pharmaceuticals, Biotechnology & Life Sciences — 0.1% | | | | | | | | | |

Achilles Therapeutics PLC, ADR (a) | | | 100 | | | | | | | $ | 125 | |

Affimed NV (a) | | | 740 | | | | | | | | 3,922 | |

Amarin Corp. PLC, ADR (a) | | | 46,200 | | | | | | | | 41,155 | |

Ascendis Pharma AS, ADR (a) | | | 1,500 | | | | | | | | 226,755 | |

AstraZeneca PLC, ADR | | | 4,100 | | | | | | | | 277,775 | |

ATAI Life Sciences NV (a) | | | 3,100 | | | | | | | | 6,107 | |

Bicycle Therapeutics PLC, ADR (a) | | | 2,600 | | | | | | | | 64,740 | |

Compass Pathways PLC, ADR (a) | | | 100 | | | | | | | | 832 | |

Immatics NV (a) | | | 1,200 | | | | | | | | 12,612 | |

Immunocore Holdings PLC, ADR (a) | | | 400 | | | | | | | | 26,000 | |

InflaRx NV (a) | | | 200 | | | | | | | | 308 | |

Merus NV (a) | | | 10,300 | | | | | | | | 463,809 | |

MorphoSys AG, ADR (a) | | | 1,200 | | | | | | | | 21,768 | |

ProQR Therapeutics NV (a) | | | 4,200 | | | | | | | | 9,534 | |

Silence Therapeutics PLC, ADR (a) | | | 900 | | | | | | | | 19,440 | |

Stevanato Group SpA | | | 35,180 | | | | | | | | 1,129,278 | |

uniQure NV (a) | | | 2,400 | | | | | | | | 12,480 | |

Verona Pharma PLC, ADR (a) | | | 1,100 | | | | | | | | 17,699 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,334,339 | |

| | | | | | | | | | | | |

Semiconductors & Semiconductor Equipment — 0.0% | | | | | | | | | | | | |

ASML Holding NV (c) | | | 1,097 | | | | | | | | 1,064,605 | |

ASML Holding NV (c) | | | 356 | | | | | | | | 342,700 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,407,305 | |

| | | | | | | | | | | | |

Software & Services — 0.0% | | | | | | | | | | | | |

Materialise NV, ADR (a) | | | 500 | | | | | | | | 2,640 | |

Opera Ltd., ADR | | | 2,100 | | | | | | | | 33,201 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 35,841 | |

| | | | | | | | | | | | |

Transportation — 0.0% | | | | | | | | | | | | |

Aduro Biotech, Inc. (a),(b) | | | 1,040 | | | | | | | | — | |

Global Ship Lease, Inc., Class A | | | 400 | | | | | | | | 8,120 | |

Golden Ocean Group Ltd. | | | 3,500 | | | | | | | | 45,360 | |

Star Bulk Carriers Corp. | | | 2,000 | | | | | | | | 47,740 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 101,220 | |

| | | | | | | | | | | | |

Total Europe | | | | | | | | | | | 14,896,103 | |

| | | | | | | | | | | | |

Middle East — 0.1% | | | | | | | | | | | | |

Capital Goods — 0.0% | | | | | | | | | | | | |

Kornit Digital Ltd., (a) | | | 3,200 | | | | | | | | 57,984 | |

| | | | | | | | | | | | |

Household & Personal Products — 0.1% | | | | | | | | | | | | |

Oddity Tech Ltd., Class A (a) | | | 59,501 | | | | | | | | 2,585,319 | |

| | | | | | | | | | | | |

See Notes to Consolidated Financial Statements.

14

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Consolidated Schedule of Investments ^ (Continued)

March 31, 2024

| | | | | | | | | | | | |

Security Description | | Shares | | | | | | Value | |

Materials — 0.0% | | | | | | | | | | | | |

Eldorado Gold Corp., (a) | | | 14,800 | | | | | | | $ | 208,236 | |

| | | | | | | | | | | | |

Pharmaceuticals, Biotechnology & Life Sciences — 0.0% | | | | | | | | | |

Chemomab Therapeutics Ltd., ADR (a) | | | 200 | | | | | | | | 156 | |

Compugen Ltd. (a) | | | 4,700 | | | | | | | | 12,126 | |

Galmed Pharmaceuticals Ltd (a) | | | 401 | | | | | | | | 131 | |

Oramed Pharmaceuticals, Inc. (a) | | | 4,400 | | | | | | | | 12,848 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 25,261 | |

| | | | | | | | | | | | |

Retailing — 0.0% | | | | | | | | | | | | |

D-MARKET Elektronik Hizmetler ve Ticaret AS, ADR (a) | | | 2,700 | | | | | | | | 4,050 | |

| | | | | | | | | | | | |

Semiconductors & Semiconductor Equipment — 0.0% | | | | | | | | | | | | |

Camtek Ltd. (a) | | | 1,300 | | | | | | | | 108,901 | |

Valens Semiconductor Ltd. (a) | | | 1,100 | | | | | | | | 2,585 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 111,486 | |

| | | | | | | | | | | | |

Software & Services — 0.0% | | | | | | | | | | | | |

JFrog Ltd. (a) | | | 10,300 | | | | | | | | 455,466 | |

Radware Ltd. (a) | | | 1,600 | | | | | | | | 29,952 | |

Sapiens International Corp. NV | | | 1,000 | | | | | | | | 32,160 | |

SimilarWeb Ltd. (a) | | | 400 | | | | | | | | 3,600 | |

Wix.com Ltd. (a) | | | 4,200 | | | | | | | | 577,416 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,098,594 | |

| | | | | | | | | | | | |

Technology Hardware & Equipment — 0.0% | | | | | | | | | | | | |

AudioCodes Ltd. | | | 1,100 | | | | | | | | 14,344 | |

Ituran Location & Control Ltd. | | | 500 | | | | | | | | 13,980 | |

Silicom Ltd. (a) | | | 300 | | | | | | | | 4,455 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 32,779 | |

| | | | | | | | | | | | |

Total Middle East | | | | | | | | | | | 4,123,709 | |

| | | | | | | | | | | | |

North America — 21.4% | | | | | | | | | | | | |

Automobiles & Components — 0.1% | | | | | | | | | | | | |

Adient PLC (a) | | | 5,000 | | | | | | | | 164,600 | |

American Axle & Manufacturing Holdings, Inc. (a) | | | 500 | | | | | | | | 3,680 | |

Canoo, Inc. (a) | | | 23 | | | | | | | | 82 | |

Cooper-Standard Holdings, Inc. (a) | | | 2,600 | | | | | | | | 43,056 | |

Dana, Inc. | | | 200 | | | | | | | | 2,540 | |

Ford Motor Co. | | | 38,900 | | | | | | | | 516,592 | |

General Motors Co. | | | 61,200 | | | | | | | | 2,775,420 | |

Gentherm, Inc. (a) | | | 1,700 | | | | | | | | 97,886 | |

See Notes to Consolidated Financial Statements.

15

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Consolidated Schedule of Investments ^ (Continued)

March 31, 2024

| | | | | | | | | | |

Security Description | | Shares | | | | | Value | |

Holley, Inc. (a) | | | 800 | | | | | $ | 3,568 | |

Motorcar Parts of America, Inc. (a) | | | 500 | | | | | | 4,020 | |

Mullen Automotive, Inc. (a) | | | 1 | | | | | | 5 | |

Standard Motor Products, Inc. | | | 800 | | | | | | 26,840 | |

Stoneridge, Inc. (a) | | | 1,200 | | | | | | 22,128 | |

Superior Industries International, Inc. (a) | | | 1,100 | | | | | | 3,190 | |

| | | | | | | | | | |

| | | | | | | | | 3,663,607 | |

| | | | | | | | | | |

Banks — 2.7% | | | | | | | | | | |

1st Source Corp. | | | 300 | | | | | | 15,726 | |

Amerant Bancorp, Inc. | | | 2,904 | | | | | | 67,634 | |

Ameris Bancorp | | | 177,062 | | | | | | 8,566,260 | |

Ames National Corp. | | | 100 | | | | | | 2,018 | |

Arrow Financial Corp. | | | 522 | | | | | | 13,060 | |

Bank of Hawaii Corp. | | | 28,656 | | | | | | 1,787,848 | |

Bank of Marin Bancorp | | | 11,932 | | | | | | 200,100 | |

BankFinancial Corp. | | | 55 | | | | | | 578 | |

Banner Corp. | | | 800 | | | | | | 38,400 | |

Bar Harbor Bankshares | | | 200 | | | | | | 5,296 | |

BayCom Corp. | | | 200 | | | | | | 4,122 | |

Blue Ridge Bankshares, Inc. | | | 100 | | | | | | 269 | |

Bridgewater Bancshares, Inc. (a) | | | 500 | | | | | | 5,820 | |

Brookline Bancorp, Inc. | | | 297 | | | | | | 2,958 | |

Business First Bancshares, Inc. | | | 600 | | | | | | 13,368 | |

Byline Bancorp, Inc. | | | 1,000 | | | | | | 21,720 | |

Camden National Corp. | | | 400 | | | | | | 13,408 | |

Capital Bancorp, Inc. | | | 100 | | | | | | 2,083 | |

Capital City Bank Group, Inc. | | | 200 | | | | | | 5,540 | |

Carter Bankshares, Inc. (a) | | | 700 | | | | | | 8,848 | |

Central Pacific Financial Corp. | | | 4,285 | | | | | | 84,629 | |

Civista Bancshares, Inc. | | | 200 | | | | | | 3,076 | |

CNB Financial Corp. | | | 500 | | | | | | 10,195 | |

Coastal Financial Corp. (a) | | | 400 | | | | | | 15,548 | |

Codorus Valley Bancorp, Inc. | | | 100 | | | | | | 2,276 | |

Colony Bankcorp, Inc. | | | 500 | | | | | | 5,750 | |

Columbia Banking System, Inc. | | | 32,711 | | | | | | 632,958 | |

Comerica, Inc. | | | 144,594 | | | | | | 7,951,224 | |

Commerce Bancshares, Inc. | | | 26,674 | | | | | | 1,419,057 | |

Community Trust Bancorp, Inc. | | | 400 | | | | | | 17,060 | |

Community West Bancshares | | | 100 | | | | | | 1,989 | |

ConnectOne Bancorp, Inc. | | | 1,400 | | | | | | 27,300 | |

CrossFirst Bankshares, Inc. (a) | | | 1,000 | | | | | | 13,840 | |

Eagle Bancorp, Inc. | | | 2,700 | | | | | | 63,423 | |

ECB Bancorp, Inc. (a) | | | 100 | | | | | | 1,298 | |

Enact Holdings, Inc. | | | 4,300 | | | | | | 134,074 | |

Equity Bancshares, Inc., Class A | | | 200 | | | | | | 6,874 | |

See Notes to Consolidated Financial Statements.

16

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Consolidated Schedule of Investments ^ (Continued)

March 31, 2024

| | | | | | | | | | |

Security Description | | Shares | | | | | Value | |

Esquire Financial Holdings, Inc. | | | 100 | | | | | $ | 4,747 | |

Farmers National Banc Corp. | | | 800 | | | | | | 10,688 | |

Financial Institutions, Inc. | | | 500 | | | | | | 9,410 | |

First Bancorp | | | 800 | | | | | | 28,896 | |

First Bancshares, Inc. (The) | | | 80,175 | | | | | | 2,080,541 | |

First Busey Corp. | | | 1,100 | | | | | | 26,455 | |

First Community Bankshares, Inc. | | | 200 | | | | | | 6,926 | |

First Community Corp. | | | 100 | | | | | | 1,743 | |

First Financial Bankshares, Inc. | | | 5,100 | | | | | | 167,331 | |

First Financial Corp. | | | 300 | | | | | | 11,499 | |

First Foundation, Inc. | | | 4,900 | | | | | | 36,995 | |

First Horizon Corp. | | | 795,122 | | | | | | 12,244,879 | |

First Internet Bancorp | | | 200 | | | | | | 6,948 | |

First of Long Island Corp. (The) | | | 2,600 | | | | | | 28,834 | |

First Western Financial, Inc. (a) | | | 30,623 | | | | | | 446,483 | |

Five Star Bancorp | | | 11,850 | | | | | | 266,625 | |

Flushing Financial Corp. | | | 5,014 | | | | | | 63,227 | |

Frost Bankers, Inc. | | | 760 | | | | | | 85,553 | |

FS Bancorp, Inc. | | | 100 | | | | | | 3,471 | |

FVCBankcorp, Inc. (a) | | | 175 | | | | | | 2,132 | |

German American Bancorp, Inc. | | | 700 | | | | | | 24,248 | |

Great Southern Bancorp, Inc. | | | 100 | | | | | | 5,482 | |

Guaranty Bancshares, Inc. | | | 100 | | | | | | 3,036 | |

Hanmi Financial Corp. | | | 2,900 | | | | | | 46,168 | |

Heartland Financial USA, Inc. | | | 1,500 | | | | | | 52,725 | |

Heritage Commerce Corp. | | | 5,500 | | | | | | 47,190 | |

Heritage Financial Corp. | | | 2,000 | | | | | | 38,780 | |

Hilltop Holdings, Inc. | | | 70,383 | | | | | | 2,204,396 | |

Hingham Institution For Savings The | | | 18,752 | | | | | | 3,271,474 | |

HomeTrust Bancshares, Inc. | | | 300 | | | | | | 8,202 | |

Hope Bancorp, Inc. | | | 2,400 | | | | | | 27,624 | |

Horizon Bancorp, Inc. | | | 1,600 | | | | | | 20,528 | |

Independent Bank Corp. | | | 500 | | | | | | 12,675 | |

Independent Bank Group, Inc. | | | 800 | | | | | | 36,520 | |

International Bancshares Corp. | | | 108,021 | | | | | | 6,064,299 | |

Investar Holding Corp. | | | 100 | | | | | | 1,636 | |

Kearny Financial Corp. | | | 800 | | | | | | 5,152 | |

Lakeland Bancorp, Inc. | | | 2,035 | | | | | | 24,623 | |

LCNB Corp. | | | 200 | | | | | | 3,188 | |

Live Oak Bancshares, Inc. | | | 2,200 | | | | | | 91,322 | |

Macatawa Bank Corp. | | | 700 | | | | | | 6,853 | |

Mercantile Bank Corp. | | | 300 | | | | | | 11,547 | |

Merchants Bancorp | | | 450 | | | | | | 19,431 | |

Meridian Corp. | | | 100 | | | | | | 992 | |

Metrocity Bankshares, Inc. | | | 100 | | | | | | 2,496 | |

Metropolitan Bank Holding Corp. (a) | | | 1,000 | | | | | | 38,500 | |

Mid Penn Bancorp, Inc. | | | 200 | | | | | | 4,002 | |

See Notes to Consolidated Financial Statements.

17

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Consolidated Schedule of Investments ^ (Continued)

March 31, 2024

| | | | | | | | | | |

Security Description | | Shares | | | | | Value | |

Midland States Bancorp, Inc. | | | 600 | | | | | $ | 15,078 | |

MidWestOne Financial Group, Inc. | | | 200 | | | | | | 4,688 | |

Northeast Bank | | | 100 | | | | | | 5,534 | |

Northfield Bancorp, Inc. | | | 200 | | | | | | 1,944 | |

OceanFirst Financial Corp. | | | 2,600 | | | | | | 42,666 | |

Ocwen Financial Corp. (a) | | | 94 | | | | | | 2,539 | |

OFG Bancorp | | | 2,100 | | | | | | 77,301 | |

Old Second Bancorp, Inc. | | | 1,900 | | | | | | 26,296 | |

OP Bancorp | | | 200 | | | | | | 1,996 | |

PCB Bancorp | | | 200 | | | | | | 3,266 | |

Peapack-Gladstone Financial Corp. | | | 30,974 | | | | | | 753,597 | |

Penns Woods Bancorp, Inc. | | | 200 | | | | | | 3,882 | |

Peoples Bancorp, Inc. | | | 900 | | | | | | 26,649 | |

Pinnacle Financial Partners, Inc. | | | 125,158 | | | | | | 10,748,569 | |

PNC Financial Services Group, Inc. (The) (c) | | | 1,959 | | | | | | 316,574 | |

Preferred Bank | | | 400 | | | | | | 30,708 | |

Premier Financial Corp. | | | 100 | | | | | | 2,030 | |

Primis Financial Corp. | | | 600 | | | | | | 7,302 | |

Provident Bancorp, Inc. (a) | | | 500 | | | | | | 4,550 | |

QCR Holdings, Inc. | | | 200 | | | | | | 12,148 | |

RBB Bancorp | | | 400 | | | | | | 7,204 | |

Riverview Bancorp, Inc. | | | 200 | | | | | | 944 | |

S&T Bancorp, Inc. | | | 400 | | | | | | 12,832 | |

Sandy Spring Bancorp, Inc. | | | 118,329 | | | | | | 2,742,866 | |

Seacoast Banking Corp. of Florida | | | 315,100 | | | | | | 8,000,389 | |

Shore Bancshares, Inc. | | | 600 | | | | | | 6,900 | |

Sierra Bancorp | | | 200 | | | | | | 4,040 | |

SmartFinancial, Inc. | | | 200 | | | | | | 4,214 | |

South Plains Financial, Inc. | | | 200 | | | | | | 5,352 | |

Southern First Bancshares, Inc. (a) | | | 100 | | | | | | 3,176 | |

Southern Missouri Bancorp, Inc. | | | 100 | | | | | | 4,371 | |

Southside Bancshares, Inc. | | | 700 | | | | | | 20,461 | |

Stock Yards Bancorp, Inc. | | | 400 | | | | | | 19,564 | |

Synovus Financial Corp. | | | 205,401 | | | | | | 8,228,364 | |

Territorial Bancorp, Inc. | | | 100 | | | | | | 806 | |

Texas Capital Bancshares, Inc. (a) | | | 170,400 | | | | | | 10,488,120 | |

Third Coast Bancshares, Inc. (a) | | | 100 | | | | | | 2,002 | |

Tompkins Financial Corp. | | | 100 | | | | | | 5,029 | |

TriCo Bancshares | | | 700 | | | | | | 25,746 | |

Truist Financial Corp. | | | 126,147 | | | | | | 4,917,210 | |

TrustCo Bank Corp. | | | 520 | | | | | | 14,643 | |

Trustmark Corp. | | | 800 | | | | | | 22,488 | |

Univest Financial Corp. | | | 1,000 | | | | | | 20,820 | |

US Bancorp | | | 7,607 | | | | | | 340,033 | |

USCB Financial Holdings, Inc. | | | 100 | | | | | | 1,140 | |

UWM Holdings Corp. | | | 400 | | | | | | 2,904 | |

Veritex Holdings, Inc. | | | 15,230 | | | | | | 312,063 | |

Washington Trust Bancorp, Inc. | | | 500 | | | | | | 13,440 | |

See Notes to Consolidated Financial Statements.

18

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Consolidated Schedule of Investments ^ (Continued)

March 31, 2024

| | | | | | | | | | |

Security Description | | Shares | | | | | Value | |

Waterstone Financial, Inc. | | | 200 | | | | | $ | 2,434 | |

Wells Fargo & Co. | | | 174,964 | | | | | | 10,140,913 | |

WesBanco, Inc. | | | 100 | | | | | | 2,981 | |

West BanCorp, Inc. | | | 200 | | | | | | 3,566 | |

Westamerica BanCorp | | | 800 | | | | | | 39,104 | |

Western New England Bancorp, Inc. | | | 300 | | | | | | 2,301 | |

Zions Bancorp NA | | | 15,800 | | | | | | 685,720 | |

| | | | | | | | | | |

| | | | | | | | | 106,963,556 | |

| | | | | | | | | | |

Capital Goods — 2.5% | | | | | | | | | | |

3M Co. | | | 2,000 | | | | | | 212,140 | |

A O Smith Corp. | | | 1,200 | | | | | | 107,352 | |

AECOM | | | 3,000 | | | | | | 294,240 | |

Albany International Corp., Class A | | | 600 | | | | | | 56,106 | |

Allient, Inc. | | | 500 | | | | | | 17,840 | |

Allison Transmission Holdings, Inc. | | | 700 | | | | | | 56,812 | |

Alta Equipment Group, Inc. | | | 1,100 | | | | | | 14,245 | |

AMETEK, Inc. | | | 67,800 | | | | | | 12,400,620 | |

Apogee Enterprises, Inc. | | | 1,200 | | | | | | 71,040 | |

Argan, Inc. | | | 600 | | | | | | 30,324 | |

Art’s-Way Manufacturing Co., Inc. (a) | | | 100 | | | | | | 204 | |

Astronics Corp. (a) | | | 1,200 | | | | | | 22,848 | |

Atmus Filtration Technologies, Inc. (a) | | | 2,730 | | | | | | 88,042 | |

Barnes Group, Inc. | | | 100 | | | | | | 3,715 | |

Beacon Roofing Supply, Inc. (a) | | | 5,300 | | | | | | 519,506 | |

Bloom Energy Corp., Class A (a) | | | 30,938 | | | | | | 347,743 | |

Blue Bird Corp. (a) | | | 3,700 | | | | | | 141,858 | |

BlueLinx Holdings, Inc. (a) | | | 700 | | | | | | 91,168 | |

Bowman Consulting Group Ltd. (a) | | | 9,155 | | | | | | 318,502 | |

Broadwind, Inc. (a) | | | 700 | | | | | | 1,666 | |

Caesarstone Ltd. (a) | | | 800 | | | | | | 3,272 | |

Columbus McKinnon Corp. | | | 900 | | | | | | 40,167 | |

Commercial Vehicle Group, Inc. (a) | | | 2,300 | | | | | | 14,789 | |

Concrete Pumping Holdings, Inc. (a) | | | 1,100 | | | | | | 8,690 | |

Construction Partners, Inc., Class A (a) | | | 400 | | | | | | 22,460 | |

Core & Main, Inc., Class A (a) | | | 166,956 | | | | | | 9,558,231 | |

CSW Industrials, Inc. | | | 100 | | | | | | 23,460 | |

Cummins, Inc. | | | 3,431 | | | | | | 1,010,944 | |

Curtiss-Wright Corp. | | | 100 | | | | | | 25,594 | |

Custom Truck One Source, Inc. (a) | | | 4,600 | | | | | | 26,772 | |

DNOW, Inc. (a) | | | 8,000 | | | | | | 121,600 | |

Donaldson Co., Inc. | | | 1,700 | | | | | | 126,956 | |

Douglas Dynamics, Inc. | | | 1,600 | | | | | | 38,592 | |

Dover Corp. | | | 200 | | | | | | 35,438 | |

Ducommun, Inc. (a) | | | 200 | | | | | | 10,260 | |

DXP Enterprises, Inc. (a) | | | 600 | | | | | | 32,238 | |

See Notes to Consolidated Financial Statements.

19

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Consolidated Schedule of Investments ^ (Continued)

March 31, 2024

| | | | | | | | | | |

Security Description | | Shares | | | | | Value | |

Energy Recovery, Inc. (a) | | | 3,700 | | | | | $ | 58,423 | |

Enovix Corp. (a) | | | 30,500 | | | | | | 244,305 | |

Enpro, Inc. | | | 400 | | | | | | 67,508 | |

Esab Corp. | | | 1,500 | | | | | | 165,855 | |

EVI Industries, Inc. | | | 100 | | | | | | 2,490 | |

Federal Signal Corp. | | | 2,200 | | | | | | 186,714 | |

Fluor Corp. (a) | | | 5,400 | | | | | | 228,312 | |

Fortune Brands Innovations, Inc. | | | 600 | | | | | | 50,802 | |

FTAI Aviation Ltd. | | | 8,700 | | | | | | 585,510 | |

Gates Industrial Corp. PLC (a) | | | 33,800 | | | | | | 598,598 | |

GATX Corp. | | | 1,000 | | | | | | 134,030 | |

Gibraltar Industries, Inc. (a) | | | 900 | | | | | | 72,477 | |

Global Industrial Co. | | | 500 | | | | | | 22,390 | |

GMS, Inc. (a) | | | 400 | | | | | | 38,936 | |

Gorman-Rupp Co. (The) | | | 400 | | | | | | 15,820 | |

Graco, Inc. | | | 70,000 | | | | | | 6,542,200 | |

GrafTech International Ltd. | | | 600 | | | | | | 828 | |

Great Lakes Dredge & Dock Corp. (a) | | | 4,300 | | | | | | 37,625 | |

Griffon Corp. | | | 5,100 | | | | | | 374,034 | |

H&E Equipment Services, Inc. | | | 2,400 | | | | | | 154,032 | |

Hayward Holdings, Inc. (a) | | | 3,100 | | | | | | 47,461 | |

HEICO Corp. | | | 3,800 | | | | | | 725,800 | |

HEICO Corp., Class A | | | 67,800 | | | | | | 10,437,132 | |

Helios Technologies, Inc. | | | 400 | | | | | | 17,876 | |

Hexcel Corp. | | | 700 | | | | | | 50,995 | |

Hudson Technologies, Inc. (a) | | | 2,400 | | | | | | 26,424 | |

Hurco Cos., Inc. | | | 100 | | | | | | 2,016 | |

Hydrofarm Holdings Group, Inc. (a) | | | 3,400 | | | | | | 3,672 | |

IDEX Corp. | | | 41,500 | | | | | | 10,126,830 | |

Ingersoll Rand, Inc. | | | 48 | | | | | | 4,558 | |

Insteel Industries, Inc. | | | 400 | | | | | | 15,288 | |

Janus International Group, Inc. (a) | | | 21,800 | | | | | | 329,834 | |

Johnson Controls International PLC | | | 16,300 | | | | | | 1,064,716 | |

Kaman Corp. | | | 1,100 | | | | | | 50,457 | |

Karat Packaging, Inc. | | | 100 | | | | | | 2,861 | |

Kennametal, Inc. | | | 4,200 | | | | | | 104,748 | |

L B Foster Co., Class A (a) | | | 100 | | | | | | 2,731 | |

Lockheed Martin Corp. | | | 9,400 | | | | | | 4,275,778 | |

LSI Industries, Inc. | | | 1,500 | | | | | | 22,680 | |

Manitowoc Co., Inc. (The) (a) | | | 3,700 | | | | | | 52,318 | |

Masonite International Corp. (a) | | | 4,800 | | | | | | 630,960 | |

MasTec, Inc. (a) | | | 1,200 | | | | | | 111,900 | |

Masterbrand, Inc. (a) | | | 11,300 | | | | | | 211,762 | |

Matrix Service Co. (a) | | | 1,200 | | | | | | 15,636 | |

Mayville Engineering Co., Inc. (a) | | | 700 | | | | | | 10,031 | |

McGrath RentCorp | | | 300 | | | | | | 37,011 | |

See Notes to Consolidated Financial Statements.

20

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Consolidated Schedule of Investments ^ (Continued)

March 31, 2024

| | | | | | | | | | |

Security Description | | Shares | | | | | Value | |

MDU Resources Group, Inc. | | | 700 | | | | | $ | 17,640 | |

Mercury Systems, Inc. (a) | | | 1,800 | | | | | | 53,100 | |

Miller Industries, Inc. | | | 300 | | | | | | 15,030 | |

Momentus, Inc. (a) | | | 34 | | | | | | 15 | |

MRC Global, Inc. (a) | | | 8,900 | | | | | | 111,873 | |

Mueller Water Products, Inc., Class A | | | 2,000 | | | | | | 32,180 | |

MYR Group, Inc. (a) | | | 200 | | | | | | 35,350 | |

NEXTracker, Inc., Class A (a) | | | 181,310 | | | | | | 10,202,314 | |

NN, Inc. (a) | | | 1,200 | | | | | | 5,688 | |

Northrop Grumman Corp. | | | 1,000 | | | | | | 478,660 | |

Northwest Pipe Co. (a) | | | 300 | | | | | | 10,404 | |

Nuvve Holding Corp. (a) | | | 12 | | | | | | 13 | |

Orion Group Holdings, Inc. (a) | | | 500 | | | | | | 4,100 | |

Oshkosh Corp. | | | 3,000 | | | | | | 374,130 | |

Park Aerospace Corp. | | | 500 | | | | | | 8,315 | |

Proto Labs, Inc. (a) | | | 1,900 | | | | | | 67,925 | |

Quanex Building Products Corp. | | | 500 | | | | | | 19,215 | |

RBC Bearings, Inc. (a) | | | 42,088 | | | | | | 11,378,491 | |

Redwire Corp. (a) | | | 100 | | | | | | 439 | |

REV Group, Inc. | | | 60,940 | | | | | | 1,346,164 | |

Rockwell Automation, Inc. | | | 600 | | | | | | 174,798 | |

Rush Enterprises, Inc., Class A | | | 1,100 | | | | | | 58,872 | |

Shyft Group, Inc. (The) | | | 4,400 | | | | | | 54,648 | |

Simpson Manufacturing Co., Inc. | | | 16,171 | | | | | | 3,317,966 | |

SPX Technologies, Inc. (a) | | | 1,400 | | | | | | 172,382 | |

Standex International Corp. | | | 100 | | | | | | 18,222 | |

Stanley Black & Decker, Inc. | | | 1,000 | | | | | | 97,930 | |

Sterling Infrastructure, Inc. (a) | | | 4,800 | | | | | | 529,488 | |

Sunrun, Inc. (a),(c) | | | 10,662 | | | | | | 140,525 | |

Tecnoglass, Inc. | | | 3,100 | | | | | | 161,293 | |

Tennant Co. | | | 300 | | | | | | 36,483 | |

Thermon Group Holdings, Inc. (a) | | | 2,200 | | | | | | 71,984 | |

Timken Co. (The) | | | 900 | | | | | | 78,687 | |

Titan International, Inc. (a) | | | 4,400 | | | | | | 54,824 | |

Titan Machinery, Inc. (a) | | | 2,400 | | | | | | 59,544 | |

Transcat, Inc. (a) | | | 300 | | | | | | 33,429 | |

Trex Co., Inc. (a) | | | 1,300 | | | | | | 129,675 | |

Triumph Group, Inc. (a) | | | 900 | | | | | | 13,536 | |

Tutor Perini Corp. (a) | | | 3,400 | | | | | | 49,164 | |

Ultralife Corp. (a) | | | 1,000 | | | | | | 8,810 | |

Vertiv Holdings Co., Class A | | | 48,500 | | | | | | 3,960,995 | |

Vicor Corp. (a) | | | 3,000 | | | | | | 114,720 | |

View, Inc. (a) | | | 4 | | | | | | 5 | |

Wabash National Corp. | | | 3,900 | | | | | | 116,766 | |

Westinghouse Air Brake Technologies Corp. | | | 7,600 | | | | | | 1,107,168 | |

Westport Fuel Systems, Inc. (a) | | | 900 | | | | | | 6,066 | |

Woodward, Inc. | | | 3,700 | | | | | | 570,244 | |

| | | | | | | | | | |

| | | | | | | | | 99,157,068 | |

| | | | | | | | | | |

See Notes to Consolidated Financial Statements.

21

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Consolidated Schedule of Investments ^ (Continued)

March 31, 2024

| | | | | | | | | | |

Security Description | | Shares | | | | | Value | |

Commercial & Professional Services — 0.3% | | | | | | | | | | |

ACCO Brands Corp. | | | 10,600 | | | | | $ | 59,466 | |

Asure Software, Inc. (a) | | | 3,000 | | | | | | 23,340 | |

Avalon Holdings Corp., Class A (a) | | | 200 | | | | | | 446 | |

Barrett Business Services, Inc. | | | 200 | | | | | | 25,344 | |

BGSF, Inc. | | | 200 | | | | | | 2,082 | |

Brady Corp., Class A | | | 1,100 | | | | | | 65,208 | |

BrightView Holdings, Inc. (a) | | | 7,200 | | | | | | 85,680 | |

CACI International, Inc., Class A (a) | | | 700 | | | | | | 265,181 | |

CBIZ, Inc. (a) | | | 1,200 | | | | | | 94,200 | |

CECO Environmental Corp. (a) | | | 2,600 | | | | | | 59,852 | |

Civeo Corp. | | | 1,325 | | | | | | 35,576 | |

Copart, Inc. (a) | | | 100,000 | | | | | | 5,792,000 | |

CRA International, Inc. | | | 100 | | | | | | 14,958 | |

Dun & Bradstreet Holdings, Inc. | | | 74,305 | | | | | | 746,022 | |

Ennis, Inc. | | | 1,100 | | | | | | 22,561 | |

Enviri Corp. (a) | | | 6,400 | | | | | | 58,560 | |

Forrester Research, Inc. (a) | | | 500 | | | | | | 10,780 | |

Franklin Covey Co. (a) | | | 600 | | | | | | 23,556 | |

GFL Environmental, Inc. | | | 59,388 | | | | | | 2,048,886 | |

Healthcare Services Group, Inc. (a) | | | 7,700 | | | | | | 96,096 | |

Heidrick & Struggles International, Inc. | | | 700 | | | | | | 23,562 | |

HNI Corp. | | | 334 | | | | | | 15,073 | |

Huron Consulting Group, Inc. (a) | | | 1,100 | | | | | | 106,282 | |

ICF International, Inc. | | | 400 | | | | | | 60,252 | |

Insperity, Inc. | | | 400 | | | | | | 43,844 | |

Interface, Inc. | | | 3,000 | | | | | | 50,460 | |

Kelly Services, Inc., Class A | | | 1,300 | | | | | | 32,552 | |

Liquidity Services, Inc. (a) | | | 1,000 | | | | | | 18,600 | |

Matthews International Corp., Class A | | | 1,200 | | | | | | 37,296 | |

Millennium Corp. (a),(b),(c) | | | 60,879 | | | | | | 1,552,415 | |

Mistras Group, Inc. (a) | | | 900 | | | | | | 8,604 | |

Parsons Corp. (a) | | | 3,600 | | | | | | 298,620 | |

Paycom Software, Inc. | | | 3,300 | | | | | | 656,733 | |

Pitney Bowes, Inc. | | | 2,800 | | | | | | 12,124 | |

Quad/Graphics, Inc. | | | 100 | | | | | | 531 | |

Resources Connection, Inc. | | | 1,800 | | | | | | 23,688 | |

TrueBlue, Inc. (a) | | | 1,900 | | | | | | 23,788 | |

Upwork, Inc. (a) | | | 31,100 | | | | | | 381,286 | |

Veralto Corp. | | | 1 | | | | | | 89 | |

Verisk Analytics, Inc., Class A | | | 700 | | | | | | 165,011 | |

Vestis Corp. | | | 9,400 | | | | | | 181,138 | |

Viad Corp. (a) | | | 100 | | | | | | 3,949 | |

Wilhelmina International, Inc. (a) | | | 100 | | | | | | 487 | |

| | | | | | | | | | |

| | | | | | | | | 13,226,178 | |

| | | | | | | | | | |

See Notes to Consolidated Financial Statements.

22

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Consolidated Schedule of Investments ^ (Continued)

March 31, 2024

| | | | | | | | | | |

Security Description | | Shares | | | | | Value | |

Consumer Discretionary Distribution & Retail — 0.0% | | | | | | | |

Destination XL Group, Inc., (a) | | | 6,800 | | | | | $ | 24,480 | |

| | | | | | | | | | |

Consumer Durables & Apparel — 0.2% | | | | | | | | | | |

Acushnet Holdings Corp. | | | 3,200 | | | | | | 211,040 | |

Allbirds, Inc., Class A (a) | | | 13,400 | | | | | | 9,301 | |

American Outdoor Brands, Inc. (a) | | | 500 | | | | | | 4,400 | |

Bassett Furniture Industries, Inc. | | | 200 | | | | | | 2,952 | |

Beazer Homes USA, Inc. (a) | | | 3,300 | | | | | | 108,240 | |

Charles & Colvard Ltd. (a) | | | 1,000 | | | | | | 341 | |

Cricut, Inc., Class A | | | 100 | | | | | | 476 | |

Culp, Inc. (a) | | | 200 | | | | | | 960 | |

Delta Apparel, Inc. (a) | | | 300 | | | | | | 897 | |

Escalade, Inc. | | | 200 | | | | | | 2,750 | |

Ethan Allen Interiors, Inc. | | | 1,200 | | | | | | 41,484 | |

Fossil Group, Inc. (a) | | | 11,800 | | | | | | 12,036 | |

Funko, Inc., Class A (a) | | | 100 | | | | | | 624 | |

G-III Apparel Group Ltd. (a) | | | 2,500 | | | | | | 72,525 | |

Gildan Activewear, Inc. | | | 600 | | | | | | 22,278 | |

GoPro, Inc., Class A (a) | | | 17,900 | | | | | | 39,917 | |

Green Brick Partners, Inc. (a) | | | 800 | | | | | | 48,184 | |

Hooker Furnishings Corp. | | | 200 | | | | | | 4,802 | |

Installed Building Products, Inc. | | | 100 | | | | | | 25,873 | |

JAKKS Pacific, Inc. (a) | | | 1,000 | | | | | | 24,700 | |

Johnson Outdoors, Inc., Class A | | | 300 | | | | | | 13,833 | |

Lakeland Industries, Inc. | | | 200 | | | | | | 3,660 | |

Landsea Homes Corp. (a) | | | 1,800 | | | | | | 26,154 | |

La-Z-Boy, Inc. | | | 400 | | | | | | 15,048 | |

Legacy Housing Corp. (a) | | | 500 | | | | | | 10,760 | |

MasterCraft Boat Holdings, Inc. (a) | | | 1,700 | | | | | | 40,324 | |

Movado Group, Inc. | | | 100 | | | | | | 2,793 | |

NIKE, Inc., Class B | | | 27,400 | | | | | | 2,575,052 | |

Peloton Interactive, Inc., Class A (a) | | | 70,100 | | | | | | 300,379 | |

PVH Corp. | | | 2,700 | | | | | | 379,647 | |

SharkNinja, Inc. | | | 22,412 | | | | | | 1,396,043 | |

Singing Machine Co., Inc. (The) (a) | | | 800 | | | | | | 730 | |

Smith Douglas Homes Corp. (a) | | | 29,752 | | | | | | 883,634 | |

Sturm Ruger & Co., Inc. | | | 200 | | | | | | 9,230 | |

Superior Group of Cos., Inc. | | | 200 | | | | | | 3,304 | |

Tempur Sealy International, Inc. | | | 1,000 | | | | | | 56,820 | |

Tri Pointe Homes, Inc. (a) | | | 700 | | | | | | 27,062 | |

Twin Vee PowerCats Co. (a) | | | 200 | | | | | | 172 | |

Unifi, Inc. (a) | | | 1,900 | | | | | | 11,381 | |

Universal Electronics, Inc. (a) | | | 900 | | | | | | 9,009 | |

Vera Bradley, Inc. (a) | | | 3,600 | | | | | | 24,480 | |

| | | | | | | | | | |

| | | | | | | | | 6,423,295 | |

| | | | | | | | | | |

See Notes to Consolidated Financial Statements.

23

Blackstone Alternative Multi-Strategy Fund and Subsidiaries

Consolidated Schedule of Investments ^ (Continued)

March 31, 2024

| | | | | | | | | | |

Security Description | | Shares | | | | | Value | |

Consumer Services — 0.7% | | | | | | | | | | |

2U, Inc. (a) | | | 19,200 | | | | | $ | 7,482 | |

Accel Entertainment, Inc. (a) | | | 200 | | | | | | 2,358 | |

Allied Gaming & Entertainment, Inc. (a) | | | 800 | | | | | | 808 | |

American Public Education, Inc. (a) | | | 800 | | | | | | 11,360 | |

BJ’s Restaurants, Inc. (a) | | | 2,600 | | | | | | 94,068 | |

Booking Holdings, Inc. | | | 1,000 | | | | | | 3,627,880 | |

Carnival Corp. (a) | | | 21,300 | | | | | | 348,042 | |

Carnival PLC, ADR (a) | | | 3,700 | | | | | | 54,501 | |

Carriage Services, Inc. | | | 1,000 | | | | | | 27,040 | |

Carrols Restaurant Group, Inc. | | | 12,100 | | | | | | 115,071 | |

Cava Group, Inc. (a) | | | 79,678 | | | | | | 5,581,444 | |

Chegg, Inc. (a) | | | 23,600 | | | | | | 178,652 | |

Choice Hotels International, Inc. | | | 6,600 | | | | | | 833,910 | |

Chuy’s Holdings, Inc. (a) | | | 1,000 | | | | | | 33,730 | |

Denny’s Corp. (a) | | | 3,600 | | | | | | 32,256 | |

Dine Brands Global, Inc. | | | 1,800 | | | | | | 83,664 | |

Domino’s Pizza, Inc. | | | 600 | | | | | | 298,128 | |

DoorDash, Inc., Class A (a) | | | 43,800 | | | | | | 6,032,136 | |

DraftKings, Inc., Class A (a) | | | 48,870 | | | | | | 2,219,187 | |

Duolingo, Inc. (a) | | | 8,100 | | | | | | 1,786,698 | |

Dutch Bros, Inc., Class A (a) | | | 92,003 | | | | | | 3,036,099 | |

El Pollo Loco Holdings, Inc. (a) | | | 3,500 | | | | | | 34,090 | |