UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22748

YCG Funds

(Exact name of registrant as specified in charter)

3207 Ranch Road 620 South, Suite 200

Austin, TX 78738

(Address of principal executive offices) (Zip code)

William Kruger

YCG Funds

3207 Ranch Road 620 South, Suite 200

Austin, TX 78738

(Name and address of agent for service)

(512) 505-2347

Registrant’s telephone number, including area code

Date of fiscal year end: November 30

Date of reporting period: May 31, 2024

Item 1. Reports to Stockholders.

| | |

| YCG Enhanced Fund | |

| YCGEX |

| Semi-Annual Shareholder Report | May 31, 2024 |

This semi-annual shareholder report contains important information about the YCG Enhanced Fund for the period of December 1, 2023, to May 31, 2024. You can find additional information about the Fund at https://ycgfunds.com/how-to-invest/. You can also request this information by contacting us at 1-855-444-9243.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| YCG Enhanced Fund | $62 | 1.19% |

HOW DID THE FUND PERFORM THE LAST SIX-MONTHS AND WHAT AFFECTED ITS PERFORMANCE?

For the six-month period ending May 31, 2024, the YCG Enhanced Fund (the “Fund”) had a total net return of 6.89%. During the same time period, the S&P 500 Index had a total return of 16.35%, and the S&P Global Broad Market Index had a total return of 14.18%.

WHAT FACTORS INFLUENCED PERFORMANCE

The portfolio’s holdings in the Communication Services Sector had a positive contribution to performance relative to the S&P 500 index.

In aggregate the portfolio’s holdings in the Financials, Industrials, Information Technology and Consumer Discretionary each had a negative contribution to performance relative to the S&P 500 Index.

| |

Top Contributors |

| ↑ | Amazon.com Inc |

| ↑ | Alphabet Inc |

| ↑ | Waste Management Inc |

| ↑ | Microsoft Corp |

| ↑ | Progressive Corp/The |

| |

Top Detractors |

| ↓ | Aon PLC |

| ↓ | Adobe Inc |

| ↓ | Nike Inc |

| ↓ | CoStar Group Inc |

| ↓ | MSCI Inc |

In our Annual and Semi-Annual reports, we include all of the required quantitative information, such as financial statements, detailed footnotes, performance reports and fund holdings. We also produce a Manager Commentary which is a more qualitative perspective on fund performance, discuss our thoughts on individual holdings, and share our investment outlook. You may obtain a copy of the current Manager Commentary either on the Fund’s website at https://ycgfunds.com/how-to-invest/ or by calling 1-855-444-9243.

| YCG Enhanced Fund | PAGE 1 | TSR_SAR_98421P109 |

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

YCG Enhanced Fund | 18.29 | 13.14 | 11.80 |

S&P 500 TR | 28.19 | 15.80 | 12.69 |

S&P Global BMI TR | 23.45 | 11.59 | 8.60 |

Visit https://ycgfunds.com/how-to-invest/ for more recent performance information.

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of May 31, 2024)

| |

Net Assets | $540,715,028 |

Number of Holdings | 48 |

Portfolio Turnover | 2% |

Visit https://ycgfunds.com/how-to-invest/ for more recent performance information.

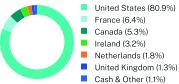

WHAT DID THE FUND INVEST IN? (as of May 31, 2024)*

| |

Top Sectors | (%) |

Financials | 28.8% |

Industrials | 21.4% |

Information Technology | 15.5% |

Consumer Discretionary | 11.9% |

Consumer Staples | 9.7% |

Real Estate | 5.6% |

Communication Services | 4.4% |

Cash & Other | 2.7% |

| |

Top 10 Issuers | (%) |

Microsoft Corp. | 7.4% |

MasterCard, Inc. | 5.7% |

Moody’s Corp. | 5.5% |

Copart, Inc. | 4.7% |

Amazon.com, Inc. | 4.6% |

Alphabet, Inc. | 4.4% |

Waste Management, Inc. | 4.1% |

Verisk Analytics, Inc. | 4.0% |

MSCI, Inc. | 3.8% |

Marsh & McLennan Cos, Inc. | 3.7% |

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

| YCG Enhanced Fund | PAGE 2 | TSR_SAR_98421P109 |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://ycgfunds.com/how-to-invest/.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your YCG, LLC documents not be householded, please contact YCG, LLC at 1-855-444-9243, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by YCG, LLC or your financial intermediary.

| YCG Enhanced Fund | PAGE 3 | TSR_SAR_98421P109 |

10000110331120812943147951645817980256142322125792305101000011181113721335915281158591789525109250342576633028100001058810072119011345613191138111992418386184932282880.96.45.33.21.81.31.1

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable

Item 6. Investments.

| (a) | Schedule of Investments is included within the financial statements filed under Item 7 of this Form. |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

YCG Funds

Core Financial Statements

May 31, 2024 (Unaudited)

TABLE OF CONTENTS

YCG Enhanced Fund

Schedule of Investments

as of May 31, 2024 (Unaudited)

| | | | | | | |

COMMON STOCKS - 97.4%

| | | | | | |

Automobiles - 1.8%

| | | | | | |

Ferrari NV | | | 22,928 | | | $ 9,423,408 |

Beverages - 1.1%

| | | | | | |

PepsiCo., Inc. | | | 35,114 | | | 6,071,211 |

Broadline Retail - 4.6%

| | | | | | |

Amazon.com, Inc.(a) | | | 139,172 | | | 24,555,508 |

Capital Markets - 13.3%

| | | | | | |

CME Group, Inc.(b) | | | 34,460 | | | 6,994,691 |

Moody’s Corp. | | | 74,848 | | | 29,713,908 |

MSCI, Inc.(b) | | | 41,877 | | | 20,736,653 |

S&P Global, Inc. | | | 34,240 | | | 14,637,942 |

| | | | | | 72,083,194 |

Commercial Services & Supplies - 12.1%

| | | | | | |

Copart, Inc.(a) | | | 482,780 | | | 25,616,307 |

Republic Services, Inc. | | | 95,284 | | | 17,645,644 |

Waste Management, Inc. | | | 106,169 | | | 22,372,993 |

| | | | | | 65,634,944 |

Financial Services - 6.7%

| | | | | | |

MasterCard, Inc. - Class A | | | 68,896 | | | 30,801,335 |

Visa, Inc. - Class A | | | 18,925 | | | 5,156,305 |

| | | | | | 35,957,640 |

Ground Transportation - 5.3%

| | | | | | |

Canadian National Railway Co. | | | 117,792 | | | 14,998,455 |

Canadian Pacific Kansas City Ltd.(b) | | | 174,715 | | | 13,865,383 |

| | | | | | 28,863,838 |

Household Products - 2.7%

| | | | | | |

Colgate-Palmolive Co. | | | 82,613 | | | 7,679,704 |

The Procter & Gamble Co.(c) | | | 42,509 | | | 6,994,431 |

| | | | | | 14,674,135 |

Insurance - 8.9%

| | | | | | |

Aon PLC - Class A(c) | | | 61,134 | | | 17,217,780 |

Marsh & McLennan Cos, Inc. | | | 98,033 | | | 20,349,690 |

The Progressive Corp. | | | 50,708 | | | 10,708,515 |

| | | | | | 48,275,985 |

Interactive Media & Services - 4.4%

| | | | | | |

Alphabet, Inc. - Class C(a) | | | 137,067 | | | 23,844,175 |

Personal Care Products - 5.9%

| | | | | | |

L’Oreal SA | | | 2,217 | | | 1,087,548 |

L’Oreal SA - Loyalty Shares | | | 28,805 | | | 14,130,271 |

The Estee Lauder Companies, Inc. - Class A | | | 76,849 | | | 9,480,093 |

Unilever PLC - ADR | | | 127,082 | | | 6,957,739 |

| | | | | | 31,655,651 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

YCG Enhanced Fund

Schedule of Investments

as of May 31, 2024 (Unaudited) (Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Professional Services - 4.0%

| | | | | | |

Verisk Analytics, Inc. | | | 85,668 | | | $21,655,157 |

Real Estate Management & Development - 5.6%

| | | | | | |

CBRE Group, Inc. - Class A(a) | | | 165,570 | | | 14,581,750 |

CoStar Group, Inc.(a) | | | 203,109 | | | 15,877,030 |

| | | | | | 30,458,780 |

Software - 12.6%

| | | | | | |

Adobe, Inc.(a) | | | 15,675 | | | 6,971,613 |

Fair Isaac Corp.(a)(b) | | | 4,480 | | | 5,778,886 |

Intuit, Inc. | | | 26,583 | | | 15,323,505 |

Microsoft Corp. | | | 96,885 | | | 40,219,870 |

| | | | | | 68,293,874 |

Technology Hardware, Storage & Peripherals - 2.9%

| | | | | | |

Apple, Inc.(b) | | | 81,107 | | | 15,592,821 |

Textiles, Apparel & Luxury Goods - 5.5%

| | | | | | |

Hermes International | | | 4,871 | | | 11,500,723 |

LVMH Moet Hennessy Louis Vuitton SE | | | 10,207 | | | 8,139,064 |

NIKE, Inc. - Class B | | | 106,139 | | | 10,088,512 |

| | | | | | 29,728,299 |

TOTAL COMMON STOCKS

(Cost $280,099,522) | | | | | | 526,768,620 |

| | | Par | | | |

SHORT-TERM INVESTMENTS - 1.6%

| | | | | | |

U.S. Treasury Bills - 1.6%

| | | | | | |

5.24%, 10/17/2024(d) | | | 138,000 | | | 135,286 |

5.24%, 10/24/2024(d) | | | 4,915,000 | | | 4,813,649 |

5.24%, 10/31/2024(d) | | | 3,163,000 | | | 3,094,672 |

5.23%, 11/07/2024(d) | | | 16,000 | | | 15,640 |

5.25%, 11/14/2024(d) | | | 362,000 | | | 353,478 |

5.27%, 11/21/2024(d) | | | 15,000 | | | 14,633 |

5.25%, 11/29/2024(d) | | | 16,000 | | | 15,590 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $8,443,225) | | | | | | 8,442,948 |

TOTAL INVESTMENTS - 99.0%

(Cost $288,542,747) | | | | | | $535,211,568 |

Other Assets in Excess of Liabilities - 1.0% | | | | | | 5,503,460 |

TOTAL NET ASSETS - 100.0% | | | | | | $540,715,028 |

| | | | | | | |

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services.

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

YCG Enhanced Fund

Schedule of Investments

as of May 31, 2024 (Unaudited) (Continued)

ADR - American Depositary Receipt

PLC - Public Limited Company

(a)

| Non-income producing security. |

(b)

| Held in connection with written option contracts. See Schedule of Options Written for further information. |

(c)

| A portion of this security is pledged as collateral on options written. As of May 31, 2024, the value of collateral is $12,265,199. |

(d)

| The rate shown is the effective yield as of May 31, 2024. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

YCG Enhanced Fund

Schedule of Written Options

as of May 31, 2024 (Unaudited)

| | | | | | | | | | |

Put Options - (0.1)%

| | | | | | | | | |

Apple, Inc.

| | | | | | | | | |

Expiration: 07/19/2024; Exercise Price: $165.00 | | | $(1,307,300) | | | (68) | | | $(2,244) |

Expiration: 08/16/2024; Exercise Price: $190.00 | | | (672,875) | | | (35) | | | (19,425) |

Canadian Pacific Kansas City Ltd., Expiration: 07/19/2024; Exercise Price: $82.50 | | | (436,480) | | | (55) | | | (22,962) |

CME Group, Inc., Expiration: 06/21/2024; Exercise Price: $210.00 | | | (3,511,554) | | | (173) | | | (149,645) |

Fair Isaac Corp., Expiration: 08/16/2024; Exercise Price: $1,240.00 | | | (2,966,839) | | | (23) | | | (120,175) |

MSCI, Inc., Expiration: 06/21/2024; Exercise Price: $460.00 | | | (5,942,160) | | | (120) | | | (27,600) |

Total Put Options | | | | | | | | | (342,051) |

TOTAL WRITTEN OPTIONS (Premiums received $599,566) | | | | | | | | | (342,051) |

| | | | | | | | | | |

Percentages are stated as a percent of net assets.

(b)

| 100 shares per contract. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

YCG Enhanced Fund

STATEMENT OF ASSETS AND LIABILITIES

May 31, 2024 (Unaudited)

| | | | |

ASSETS:

| | | |

Investments, at value (Cost $288,542,747) | | | $535,211,568 |

Foreign currency, at value (Cost $1,968,971) | | | 1,930,958 |

Cash | | | 4,585 |

Deposits with brokers for options written | | | 3,958,779 |

Receivable for Fund shares sold | | | 154,827 |

Dividends and interest receivable | | | 366,013 |

Prepaid expenses | | | 24,301 |

Total Assets | | | 541,651,031 |

LIABILITIES:

| | | |

Options written, at value (Premiums received $599,566) | | | 342,051 |

Payable for Fund shares redeemed | | | 9,665 |

Payable to investment adviser | | | 469,525 |

Payable to custodian | | | 5,998 |

Other accrued expenses | | | 108,764 |

Total Liabilities | | | 936,003 |

NET ASSETS | | | $540,715,028 |

NET ASSETS CONSIST OF:

| | | |

Paid-in capital | | | $286,902,027 |

Total distributable earnings (accumulated deficit) | | | 253,813,001 |

Total Net Assets | | | $540,715,028 |

Shares outstanding (unlimited shares of no par value authorized) | | | 18,014,630 |

NET ASSET VALUE, OFFERING AND REDEMPTION PRICE PER SHARE(a) | | | $30.02 |

| | | | |

(a)

| A redemption fee of 2.00% is assessed against shares redeemed within 30 days of purchase. See Note 2(i). |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

YCG Enhanced Fund

STATEMENT OF OPERATIONS

For the Six-Months Ended May 31, 2024 (Unaudited)

| | | | |

INVESTMENT INCOME:

| | | |

Dividend income(a) | | | $2,577,924 |

Interest income | | | 136,350 |

Total Investment Income | | | 2,714,274 |

EXPENSES:

| | | |

Investment advisory fees | | | 2,683,173 |

Administration fees | | | 111,832 |

Shareholder service fees | | | 96,201 |

Accounting fees | | | 66,802 |

Transfer agent fees and expenses | | | 44,807 |

Compliance fees (see Note 4) | | | 41,481 |

Legal fees | | | 31,410 |

Custody fees | | | 19,781 |

Federal and state registration fees | | | 17,728 |

Trustees fees and expenses | | | 12,328 |

Audit and tax fees | | | 9,618 |

Insurance fees | | | 6,039 |

Reports to Shareholders | | | 5,422 |

Miscellaneous expenses | | | 549 |

Total expenses before reimbursement/recoupment | | | 3,147,171 |

Expense recoupment by investment adviser (see Note 4) | | | 45,805 |

Net Expenses | | | 3,192,976 |

Net Investment Income (Loss) | | | (478,702) |

REALIZED AND UNREALIZED GAIN (LOSS):

| | | |

Net realized gain (loss) on

| | | |

Investments | | | 7,117,383 |

Options written | | | 324,323 |

Foreign currency transactions | | | (4,179) |

Net change in unrealized appreciation/depreciation on

| | | |

Investments | | | 27,829,804 |

Options written | | | 146,185 |

Foreign currency transactions | | | 19,998 |

Net realized and unrealized gain (loss) on investments | | | 35,433,514 |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | | $34,954,812 |

| | | | |

(a)

| Net of 98,279 in foreign withholding taxes and fees. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

YCG Enhanced Fund

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | |

OPERATIONS:

| | | | | | |

Net investment income (loss) | | | $(478,702) | | | $(1,017,143) |

Net realized gain (loss) on investments, options written, and foreign currency transactions | | | 7,437,527 | | | 14,586,036 |

Net change in unrealized appreciation/depreciation on investments, options written, and foreign currency transactions | | | 27,995,987 | | | 76,943,017 |

Net increase (decrease) in net assets resulting from operations | | | 34,954,812 | | | 90,511,910 |

CAPITAL SHARE TRANSACTIONS:

| | | | | | |

Proceeds from shares sold | | | 10,432,025 | | | 17,703,271 |

Proceeds from reinvestment of distributions | | | 9,212,611 | | | — |

Redemption fees | | | 764 | | | 3,036 |

Payment for shares redeemed | | | (14,855,909) | | | (32,918,382) |

Net increase (decrease) | | | 4,789,491 | | | (15,212,075) |

DISTRIBUTIONS TO SHAREHOLDERS:

| | | | | | |

Distributions to shareholders | | | (10,049,741) | | | — |

TOTAL INCREASE (DECREASE) IN NET ASSETS | | | 29,694,562 | | | 75,299,835 |

NET ASSETS:

| | | | | | |

Beginning of year | | | 511,020,466 | | | 435,720,631 |

End of year | | | $540,715,028 | | | $511,020,466 |

CHANGE IN SHARES OUTSTANDING:

| | | | | | |

Shares sold | | | 354,513 | | | 680,863 |

Issued in reinvestment of distributions | | | 323,023 | | | — |

Shares redeemed | | | (505,047) | | | (1,303,944) |

Net increase (decrease) | | | 172,489 | | | (623,081) |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

YCG Enhanced Fund

FINANCIAL HIGHLIGHTS

For a Fund share outstanding throughout the year or period

| | | | | | | |

NET ASSET VALUE:

| | | | | | | | | | | | | | | | | | |

Beginning of year or period | | | $28.64 | | | $23.60 | | | $30.98 | | | $23.85 | | | $20.95 | | | $16.99 |

OPERATIONS:

| | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.03) (a) | | | (0.06) (a) | | | (0.09) (a) | | | (0.09) (a) | | | (0.03) | | | 0.02 |

Net realized and unrealized gain (loss) on investment securities | | | 1.97 | | | 5.10 | | | (4.53) | | | 7.22 | | | 3.05 | | | 4.48 |

Total from investment operations | | | 1.94 | | | 5.04 | | | (4.62) | | | 7.13 | | | 3.02 | | | 4.50 |

Redemption fee proceeds(b) | | | — | | | — | | | — | | | — | | | — | | | — |

Dividends from net investment income | | | — | | | — | | | — | | | — | | | (0.01) | | | (0.06) |

Dividends from net realized gains | | | (0.56) | | | — | | | (2.76) | | | — | | | (0.11) | | | (0.48) |

Total distributions | | | (0.56) | | | — | | | (2.76) | | | — | | | (0.12) | | | (0.54) |

NET ASSET VALUE:

| | | | | | | | | | | | | | | | | | |

End of year or period | | | $30.02 | | | $28.64 | | | $23.60 | | | $30.98 | | | $23.85 | | | $20.95 |

Total Return(c) | | | 6.89% | | | 21.36% | | | (16.56)% | | | 29.90% | | | 14.49% | | | 27.74% |

SUPPLEMENTAL DATA AND RATIOS:

|

Net assets; end of year or period (000’s) | | | $540,715 | | | $511,020 | | | $435,721 | | | $545,523 | | | $413,553 | | | $317,483 |

Ratio of expenses to average net assets:

|

Expenses including reimbursement/

recoupment(d) | | | 1.19% | | | 1.19% | | | 1.19% | | | 1.19% | | | 1.19% | | | 1.19% |

Expenses excluding reimbursement/

recoupment(d) | | | 1.17% | | | 1.19% | | | 1.19% | | | 1.18% | | | 1.19% | | | 1.20% |

Net investment income (loss) including reimbursement/

recoupment(d) | | | (0.18)% | | | (0.22)% | | | (0.38)% | | | (0.34)% | | | (0.14)% | | | 0.09% |

Net investment income (loss) excluding reimbursement/

recoupment(d) | | | (0.16)% | | | (0.22)% | | | (0.38)% | | | (0.33)% | | | (0.14)% | | | 0.08% |

Portfolio turnover rate(c) | | | 2% | | | 18% | | | 5% | | | 18% | | | 44% | | | 6% |

| | | | | | | | | | | | | | | | | | | |

(a)

| Net investment income (loss) per share has been calculated based on average shares outstanding during the year or period. |

(b)

| Amount represents less than $0.01 per share. |

(c)

| Not annualized for periods less than one year. |

(d)

| Annualized for periods less than one year. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

YCG ENHANCED FUND

NOTES TO FINANCIAL STATEMENTS

May 31, 2024 (Unaudited)

1. ORGANIZATION

YCG Funds (the “Trust”) is a Delaware statutory trust organized under an Agreement and Declaration of Trust dated September 4, 2012. The Trust is an open-end management investment company, as defined in the Investment Company Act of 1940 (the “1940 Act”), as amended. The Trust consists of one series, YCG Enhanced Fund (the “Fund”). The Fund is classified and operates as a non-diversified fund under the 1940 Act. The Fund commenced operations on December 28, 2012. The Fund’s investment adviser is YCG, LLC (the “Adviser”). There are an unlimited number of authorized shares. The investment objective of the Fund is to maximize long-term capital appreciation with reasonable investment risk.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services – Investment Companies.

A

| Subsequent Events Evaluation. In preparing these financial statements, the Fund has evaluated events and transactions for potential recognition or disclosure resulting from subsequent events through the date the financial statements were issued. This evaluation did not result in any subsequent events that necessitated disclosures and/or adjustments. |

B

| Foreign Currency. Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments and currency gains or losses realized between the trade and settlement dates on securities transactions from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments. Reported net realized foreign exchange gains or losses that arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on foreign currency transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the values of assets and liabilities, other than investments in securities at fiscal period end, resulting from changes in exchange rates. |

C

| Investment Valuation. The Fund’s investments are valued at fair value. Fair value as used for determining the Fund’s net asset value is in contrast to the use of the term “fair value” for making valuation measurements in connection with preparing the Fund’s financial statements, as discussed below under “Valuation Measurements.” FASB Accounting Standard Codification Topic 820, Fair Value Measurement uses the term “fair value” to refer generally to the value of an asset or liability, regardless of whether that value is based on readily available market quotations or on other inputs. |

Securities which are traded on a national stock exchange are valued at the last sale price on the securities exchange on which such securities are primarily traded. Securities that are traded on The Nasdaq OMX Group, Inc., referred to as Nasdaq, are valued at the Nasdaq Official Closing Price. Exchange-traded securities for which there were no transactions are valued at the current bid prices. Securities traded on only over-the-counter markets are valued on the basis of closing over-the-counter bid prices. Short-term debt instruments maturing within 60 days are valued by the amortized cost method, which approximates fair value. Amortized cost is not used if its use would be inappropriate due to credit or other impairments of the issuer, in which case the security’s fair value would be determined, as described below. Debt securities (other than short-term instruments) are valued at the mean price furnished by a national pricing service, subject to review by the Fund’s investment adviser, which acts as the “Valuation Designee” under Rule 2a-5 of the 1940 Act, and determination of the appropriate price whenever a furnished price is significantly different from the previous day’s furnished price. Options written or purchased by the Fund are valued at the last sales price. If

TABLE OF CONTENTS

YCG ENHANCED FUND

NOTES TO FINANCIAL STATEMENTS

May 31, 2024 (Unaudited) (Continued)

there are no trades for an option on a given day, options are valued at the mean between the current bid and asked prices. The value of a foreign security or other asset shall be determined as of the normal close of trading on the foreign exchange or other market on which it is traded or as of the Value Time, if that is earlier, in its national foreign currency or the Euro, as applicable, and shall then be converted into its U.S. dollar equivalent at the prevailing foreign currency exchange rate as of the close of the New York Stock Exchange, generally 4:00 p.m. Eastern Standard Time, on the Value Date. If market quotations are not readily available for a security or if a security’s value has been materially affected by events occurring after the close of the exchange or market on which the security is principally traded, then that security may be valued by another method that the Valuation Designee believes accurately reflects fair value. A security’s valuation may differ depending on the method used for determining fair value. Fair value in this context is the value of securities for which no readily available market quotations exist, as determined in good faith by the Adviser pursuant to fair value methodologies established by the Adviser as the Valuation Designee under the supervision of the Board.

Valuation Measurements

The Fund has adopted authoritative fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion of changes in valuation techniques and related inputs, if any, during the period. In addition, these standards require expanded disclosure for each major category of assets. These inputs are summarized in the three broad levels listed below:

Level 1 – Quoted prices in active markets for identical securities.

Level 2 – Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 – Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities. The following is a summary of the inputs used to value the Fund’s investments as of May 31, 2024:

| | | | | | | | | | | | | |

Assets:

|

Investments:

| |

Common Stocks | | | $512,638,349 | | | $14,130,271 | | | $ — | | | $526,768,620 |

U.S. Treasury Bills | | | — | | | 8,442,948 | | | — | | | 8,442,948 |

Total Investments | | | $512,638,349 | | | $22,573,219 | | | $— | | | $535,211,568 |

Liabilities:

|

Investments:

|

Written Options | | | $(198,914) | | | $(143,137) | | | $— | | | $(342,051) |

Total Investments | | | $(198,914) | | | $(143,137) | | | $— | | | $(342,051) |

| | | | | | | | | | | | | |

Refer to the Schedule of Investments for industry classifications.

The Fund did not invest in any Level 3 investments during the period.

D

| Option Writing. The Fund may write covered call options and put options on a substantial portion of the Fund’s long equity portfolio as a means to generate additional income and to tax-efficiently enter and exit positions. The Fund will not use this strategy as a means of generating implicit leverage. In other words, if all put options were to be exercised, the Fund will generally have enough cash on hand to purchase the assigned shares. When the Fund writes an option, an amount equal to the premium received by the Fund is recorded as |

TABLE OF CONTENTS

YCG ENHANCED FUND

NOTES TO FINANCIAL STATEMENTS

May 31, 2024 (Unaudited) (Continued)

a liability and is subsequently adjusted to the current fair value of the option written. Premiums received from writing options that expire unexercised are treated by the Fund on the expiration date as realized gains from options written. The difference between the premium and the amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain, or, if the premium is less than the amount paid for the closing purchase transaction, as a realized loss. If a call option is exercised, the premium is added to the proceeds from the sale of the underlying security in determining whether the Fund has realized a gain or loss. If a put option is exercised, the premium reduces the cost basis of the securities purchased by the Fund. The Fund, as a writer of an option, bears the market risk of an unfavorable change in the price of the security underlying the written option. Upon writing an option, the Fund is required to pledge an amount of cash or securities, as determined by the broker, as collateral. As of May 31, 2024, the Fund held securities with a value of $12,265,199 and cash of $3,958,779 as collateral for options written. During the period, the Fund used written put options in a manner consistent with the strategy described above.

The value of Derivative Instruments on the Statement of Assets and Liabilities as of May 31, 2024, are as follows:

| | | | |

Equity Contracts - Options | | | Options written, at value | | | $(342,051) |

| | | | | | | |

The effect of Derivative Instruments on the Statement of Operations for the period ended May 31, 2024, are as follows:

| | | | |

Equity Contracts | | | $324,323 | | | Equity Contracts | | | $146,185 |

| | | | | | | | | | |

The average monthly value of options written during the period ended May 31, 2024, was $184,434.

Derivative Risks

The risks of using the various types of derivatives in which the Fund may engage include the risk that movements in the value of the derivative may not fully offset or complement instruments currently held in the Fund in the manner intended by the Adviser, the risk that the counterparty to a derivative contract may fail to comply with its obligations to the Fund, the risk that there may not be a liquid secondary market for the derivative at a time when the Fund would look to disengage the position, the risk that additional capital from the Fund may be called upon to fulfill the conditions of the derivative contract, the risk that the use of derivatives may induce leverage in the Fund, and the risk that the cost of the derivative may reduce the overall returns experienced by the Fund.

In October 2020, the SEC adopted new regulations governing the use of derivatives by registered investment companies (“Rule 18f-4”). The Fund has adopted policies and procedures to comply with Rule 18f-4.

Offsetting Assets and Liabilities

The Fund is subject to various Master Netting Arrangements, which govern the terms of certain transactions with select counterparties. The Master Netting Arrangements allow the Fund to close out and net its total exposure to a counterparty in the event of a default with respect to all the transactions governed under a single agreement with a counterparty. The Master Netting Arrangements also specify collateral posting arrangements at pre-arranged exposure levels. Under the Master Netting Arrangements, collateral is routinely

TABLE OF CONTENTS

YCG ENHANCED FUND

NOTES TO FINANCIAL STATEMENTS

May 31, 2024 (Unaudited) (Continued)

transferred if the total net exposure to certain transactions (net of existing collateral already in place) governed under the relevant Master Netting Arrangement with a counterparty in a given account exceeds a specified threshold depending on the counterparty and the type of Master Netting Arrangement.

The following is a summary of the Assets and Liabilities subject to offsetting in the Fund as of May 31, 2024:

| | | | | | | | | | | | | | | | |

Options Written

|

Interactive Brokers | | | $(342,051) | | | $ — | | | $(342,051) | | | $ — | | | $(342,051) | | | $ — |

| | | | | | | | | | | | | | | | | | | |

In some instances, the collateral amounts disclosed in the tables were adjusted due to the requirement to limit the collateral amounts to avoid the effect of overcollateralization. Actual collateral received/pledged may be more than the amounts disclosed herein.

E

| Federal Income Taxes. The Fund intends to qualify as a “regulated investment company” under Subchapter M of the Internal Revenue Code of 1986, as amended. If so qualified, the Fund will not be subject to federal income tax to the extent it distributes substantially all of its net investment income and capital gains to shareholders. Therefore, no federal income tax provision is required. |

The Fund has adopted financial reporting rules regarding recognition and measurement of tax positions taken or expected to be taken on a tax return. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. As of and during the year ended November 30, 2023, the Fund did not incur any interest or penalties and did not have any liabilities for unrecognized tax benefits.

The Fund is generally not subject to examination by U.S. tax authorities for tax years prior to the year ended November 30, 2020.

F

| Distributions to Shareholders. The Fund will declare and distribute any net investment income and any net realized long or short-term capital gains annually. Distributions to shareholders are recorded on the ex-dividend date. The character of distributions made during the year from net investment income or net realized gains may differ from the characterization for federal income tax purposes due to differences in the recognition of income, expense and gain items for financial statement and tax purposes. Where appropriate, reclassifications between capital accounts are made for such differences that are permanent in nature. |

G

| Use of Estimates. The preparation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. |

H

| Guarantees and Indemnifications. Under the Fund’s organizational documents, its officers and trustees are indemnified by the Fund against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims against the Fund that have not yet occurred. Currently, the Fund expects the risk of loss to be remote. |

TABLE OF CONTENTS

YCG ENHANCED FUND

NOTES TO FINANCIAL STATEMENTS

May 31, 2024 (Unaudited) (Continued)

I

| Redemption Fee. Those who buy and sell the Fund within 30 calendar days will incur a 2% redemption fee, retained for the benefit of long-term shareholders, recorded as additional capital in the Statement of Changes in Net Assets. |

J

| Beneficial Ownership. The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of the Fund creates a presumption of control of the Fund, under Section 2(a)(9) of the 1940 Act. At May 31, 2024, no shareholder held more than 25% of the outstanding shares of the YCG Enhanced Fund. |

K

| Other. Investment transactions and shareholder transactions are accounted for on the trade date. Net realized gains and losses on securities are computed on the basis of specific identification. Dividend income is recognized on the ex-dividend date and interest income is recognized on an accrual basis. Discounts and premiums on securities purchased are accreted and amortized over the lives of the respective securities. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and regulations. |

3. INVESTMENT TRANSACTIONS

For the period ended May 31, 2024, the aggregate purchases and sales of securities, excluding short-term securities, were $10,929,180 and $22,201,811 respectively for the Fund. For the period ended May 31, 2024, there were no long-term purchases or sales of U.S. Government securities for the Fund.

4. FEES AND OTHER RELATED PARTY TRANSACTIONS

The Adviser acts as the investment adviser to the Fund pursuant to an investment advisory agreement (the “Advisory Agreement”) which has been approved by the Fund’s Board of Trustees (including a majority of the Trustees who are not parties to the Advisory Agreement, or interested persons of any such party). Under the terms of the Advisory Agreement between the Fund and the Adviser, the Adviser conducts investment research and management for the Fund and is responsible for the purchase and sale of securities for the Fund’s investment portfolio. The Adviser provides the Fund with investment advice, supervises the management and investment programs and provides investment advisory facilities and executive and supervisory personnel for managing the investments and effectuating portfolio transactions. The Adviser also furnishes, at its own expense, all necessary administrative services, office space, equipment and clerical personnel for servicing the investments of the Fund. With the exception of the Chief Compliance Officer, who is an employee of the Adviser, such officers receive no compensation from the Fund for serving in their respective roles. The Fund makes reimbursement payments to the Adviser for the salary and benefits associated with the office of the Chief Compliance Officer. During the period ended May 31, 2024, those fees were $35,862 and are included in the Statement of Operations. Under the Advisory Agreement, the monthly compensation paid to the Adviser is accrued daily at an annual rate of 1.00% on the average daily net assets of the Fund.

In the interest of limiting the expenses of the Fund, the Adviser has entered into a contractual expense limitation agreement with the Fund. Pursuant to the Expense Limitation Agreement, the Adviser (for the lifetime of the Fund) has agreed to waive or limit its fees and assume other expenses of the Fund (excluding interest, taxes, brokerage commissions and dividend expenses on securities sold short and extraordinary expenses not incurred in the ordinary course of business) so that the Fund’s ratio of total annual operating expenses is limited to 1.39%. In addition to the lifetime limit, the Adviser has agreed to reimburse the Fund to the extent necessary to ensure that total annual fund operating expenses to do not exceed 1.19% at least through April 1, 2025. The Adviser is entitled to the reimbursement of fees waived or reimbursed by the Adviser to the Fund subject to the limitations that (1) the reimbursement is made only for fees and expenses incurred not more than thirty-six months following the month in which the reimbursement occurred, and (2) the reimbursement may not be made if it would cause the Fund’s annual expense limitation to be exceeded. The reimbursement amount may not include any additional charges or fees, such as interest accruable on the

TABLE OF CONTENTS

YCG ENHANCED FUND

NOTES TO FINANCIAL STATEMENTS

May 31, 2024 (Unaudited) (Continued)

reimbursement account. During the period ended May 31, 2024, the Fund reimbursed $45,805 of previously waived expenses, and did not waive any expenses or let any fees subject to recoupment expire. As of May 31, 2024, the following expenses are subject to recoupment by the Adviser:

Certain officers, trustees and shareholders of the Fund are also owners or employees of the Adviser.

5. CERTAIN RISKS

Non-Diversification Risk: The Fund is non-diversified. A non-diversified fund may invest more of its assets in fewer companies than if it were a diversified fund. The Fund may be more exposed to the risks of loss and volatility than a fund that invests more broadly.

Recent Market Conditions: General economic, political and public health conditions may have a significant adverse effect on the Fund’s investment operations and profitability. A rise in protectionist trade policies, slowing global economic growth, the risk of trade disputes, and the possibility of changes to some international trade agreements, tensions or open conflict between and among nations, such as between Russia and Ukraine, and Israel and Hamas in the Middle East, could affect the economies of many nations, including the United States, in ways that cannot necessarily be foreseen at the present time, and may negatively impact the markets in which the Fund invests. Additionally, securities in the Fund’s portfolio may underperform due to volatility in the banking sector, including bank failures, inflation (or expectations for inflation), increasing interest rates, global demand for particular products or resources, natural disasters, pandemics, epidemics, terrorism, regulatory events and governmental or quasi-governmental actions. The occurrence of such events may result in market volatility and may have long-term negative effects on both the U.S. and global financial markets.

The above are only a few of the principal risks of the Fund. The other principal risks are discussed in the Fund’s most recent Prospectus.

6. FEDERAL TAX INFORMATION

A.

| Tax Basis of Distributions to Shareholders: The tax character of the distributions paid by the Fund were as follows: |

| | | | |

Ordinary Income | | | $ — | | | $ 10,010,993 |

Long-Term Capital Gains | | | — | | | 38,622,162 |

Total | | | $ — | | | $48,633,155 |

| | | | | | | |

Reclassifications: The tax components of distributable earnings are determined in accordance with income tax regulations which may differ from the compositions of net assets reported under GAAP. Accordingly, for the year ended November 30, 2023, certain differences were reclassified. The reclassifications were as follows:

| | | | |

Paid-in capital | | | $(2,240,335) |

Distributable earnings (accumulated deficit) | | | $2,240,335 |

| | | | |

These differences are primarily due to net operating loss lost.

TABLE OF CONTENTS

YCG ENHANCED FUND

NOTES TO FINANCIAL STATEMENTS

May 31, 2024 (Unaudited) (Continued)

B.

| Tax Basis of Investments: As of November 30, 2023, the components of the tax basis cost of investments and net unrealized appreciation (depreciation) were as follows: |

| | | | | | | | | | |

Tax cost of investments | | | $287,788,948 | | | $(291,195) | | | $1,972,549 |

Gross unrealized appreciation | | | 227,018,904 | | | 111,330 | | | — |

Gross unrealized depreciation | | | (8,213,685) | | | — | | | (56,764) |

Net tax unrealized appreciation (depreciation) | | | 218,805,219 | | | 111,330 | | | (56,764) |

Undistributed ordinary income | | | — | | | — | | | — |

Undistributed long-term capital gain (loss) | | | 10,049,632 | | | — | | | — |

Accumulated gain (loss) | | | 10,049,632 | | | — | | | — |

Other accumulated gain (loss) | | | (425) | | | — | | | (1,062) |

Distributable earnings (accumulated deficit) | | | $228,854,426 | | | $111,330 | | | $(57,826) |

| | | | | | | | | | |

The tax basis of investments for tax and financial reporting purposes differs, principally due to deferral of losses on wash sales.

At November 30, 2023, the Fund had the following capital loss carryforwards:

Net capital losses incurred after October 31, and within the taxable year are deemed to arise on the first business day of the Fund’s next taxable year. Qualified late-year ordinary losses are the excess of the sum of the specified loss attributable to the portion of the taxable year after October 31, and the late-year losses attributable to the portion of the taxable year after December 31, over the sum of the specified gains attributable to the portion of the taxable year after October 31, and other ordinary income attributable to the portion of the taxable year after December 31. For the fiscal year ended November 30, 2023, there were no late year deferred losses.

TABLE OF CONTENTS

YCG ENHANCED FUND

ADDITIONAL INFORMATION (Unaudited)

1. SHAREHOLDER NOTIFICATION OF FEDERAL TAX STATUS

For the year ended November 30, 2023, 0.00% of the dividends paid from net investment income, including short-term capital gains, for the Fund qualify for the dividends received deduction available to corporate shareholders.

For the year ended November 30, 2023, 0.00% of the dividends paid from net investment income, including short-term capital gains, for the Fund are designated as qualified dividend income.

2. COMPENSATION OF TRUSTEES

Each Trustee who is not an “interested person” of the Trust (i.e. an “Independent Trustee”) receives an annual retainer of $4,000, paid quarterly, as well as $1,000 per meeting attended. In addition, Independent Trustees are eligible for reimbursement of out-of-pocket expenses incurred in connection with attendance at such meetings. The Fund’s Statement of Additional Information includes additional information about the Trustees and is available upon request by calling toll free 1-855-444-9243 or by accessing the Fund’s website at www.ycgfunds.com. (Note for clarification: The information on our website is not incorporated by reference into this report.)

3. PROXY VOTING POLICIES AND PROCEDURES

For a description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, please call 1-855-444-9243 and request a Statement of Additional Information. One will be mailed to you free of charge. The Statement of Additional Information is also available on the Fund’s website at www.ycgfunds.com or on the website of the Securities and Exchange Commission at http://www.sec.gov. Information on how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available without charge, upon request, by calling 1-855-444-9243 or by accessing the website of the Securities and Exchange Commission at http://www.sec.gov. The Fund Proxy Voting Policy is also available on the Fund website at https://ycgfunds.com/how-to-invest/.

4. DISCLOSURE OF PORTFOLIO HOLDINGS

The Fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the website of the Securities and Exchange Commission at http://www.sec.gov or on request by calling 1-800-SEC-0330.

| (b) | Financial Highlights are included within the financial statements filed under Item 7 of this Form. |

Item 8. Changes in and Disagreements with Accountants for Open-End Investment Companies.

There were no changes in or disagreements with accountants during the period covered by this report.

Item 9. Proxy Disclosure for Open-End Investment Companies.

There were no matters submitted to a vote of shareholders during the period covered by this report.

Item 10. Remuneration Paid to Directors, Officers, and Others of Open-End Investment Companies.

The compensation paid to the registrant’s trustees for the period covered by this report is reported in the Statement of Operations included as part of Item 7(a) of this report. The compensation paid to the registrant’s officers for the period covered by this report is reported in the Statement of Operations and Note 4 to the Notes to the Financial Statements included as part of Item 7(a) of this report.

Item 11. Statement Regarding Basis for Approval of Investment Advisory Contract.

Not applicable.

Item 12. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 13. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 14. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end investment companies.

Item 15. Submission of Matters to a Vote of Security Holders.

Not Applicable.

Item 16. Controls and Procedures.

| (a) | The Registrant’s Principal Executive Officer and Principal Financial Officer have reviewed the Registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the Registrant and by the Registrant’s service provider. |

| (b) | There were no changes in the Registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the Registrant’s internal control over financial reporting. |

Item 17. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies

Not applicable to open-end investment companies.

Item 18. Recovery of Erroneously Awarded Compensation.

Not applicable

Item 19. Exhibits.

| (a) | (1) Any code of ethics or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an exhibit. Not Applicable. |

(2) A separate certification for each principal executive officer and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | By (Signature and Title)* | /s/ Brian A. Yacktman | |

| | | Brian A. Yacktman, Principal Executive Officer | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | By (Signature and Title)* | /s/ Brian A. Yacktman | |

| | | Brian A. Yacktman, Principal Executive Officer | |

| | By (Signature and Title)* | /s/ William D. Kruger | |

| | | William D. Kruger, Principal Financial Officer | |

* Print the name and title of each signing officer under his or her signature.