As filed with the Securities and Exchange Commission on 8/6/2019

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-22761

Stone Ridge Trust

(Exact name of registrant as specified in charter)

510 Madison Avenue, 21st Floor

New York, NY 10022

(Address of principal executive offices) (Zip code)

Stone Ridge Asset Management LLC

510 Madison Avenue, 21st Floor

New York, NY 10022

(Name and address of agent for service)

(855)609-3680

Registrant’s telephone number, including area code

Date of fiscal year end: May 31, 2019

Date of reporting period: May 31, 2019

Item 1. Reports to Stockholders.

Annual Report

May 31, 2019

Elements U.S. Portfolio

Elements U.S. Small Cap Portfolio

Elements International Portfolio

Elements International Small Cap Portfolio

Elements Emerging Markets Portfolio

Beginning on January 1, 2021, as permitted by regulations adopted by the Commission, paper copies of the Portfolios’ shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from your financial intermediary or, if you invest directly through the Portfolios’ transfer agent, U.S. Bancorp Fund Services, LLC (the “Transfer Agent”), from the Transfer Agent. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications electronically by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge by contacting your financial intermediary or, if you invest directly through the Transfer Agent, by contacting the Transfer Agent at (855) 609-3680. Your election to receive reports in paper will apply to all funds held in your account if you invest through a financial intermediary or all funds within the fund complex if you invest directly through the Transfer Agent.

Shareholder Letter

The shareholder letter below is reprinted from the Annual Report of the Stone Ridge Funds for the year ended October 31, 2018. The letter is dated December 2018 and speaks only as of its date. No updates have been made to, and no undertaking has been made to update, any data or other information contained in the letter.

“The high volatility of stock returns is common knowledge, but many professional investors seem unaware of its implications.”

- Eugene Fama (2018),Volatility Lessons

“It’s not supposed to be this easy to make so much money, especially with such remarkable consistency.”

- Foreword toReducing the Risk of Black Swans(December 2017), referring to the S&P 500

“It’s possible to go forward with no 60/40 at all. In fact, it may even be necessary.”

- Stone Ridge 2017 Shareholder Letter

“Don’t tell me what you ‘think,’ just tell me what’s in your portfolio.”

- Nassim Taleb (2018),Skin in the Game

December 2018

Dear Fellow Shareholder:

We just passed the 10th anniversary of the discovery that Bernie Madoff was running a Ponzi scheme,1 a sobering reminder of how easy it is for any of us to believe things we want to be true. I was given an opportunity to invest in Madoff in 1998. At the time, I was running a fund with lots of excess cash and Madoff was pitched to me as a cash management tool, given its (lack of) volatility and positive mean. After seeing the cumulative return chart, I passed – due solely, and thankfully, to my training in the finance department at the University of Chicago. We just don’t get 45 degree lines in finance. In trigonometry maybe, but not in finance.

All along, there was one Madoff “game over” diligence question, hiding in plain sight. Madoff was supposedly too big for the listed options markets, which was the given reason why his trades never showed up on the tape.

So if Madoff did all of his “trading”over-the-counter (OTC), the only necessary diligence question would have been“Who are the OTC counterparties?”Just one name would have sufficed. And we wouldn’t even have needed to ask the OTC counterpartywhatMadoff trades orhowhe trades, justthathe trades.

Of course, there would have been no name because there were no trades, OTC or listed, ever. Tragically, no one asked this simple question. We should never underestimate the power of believing things we want to be true.

| 1 | For a riveting podcast on the Madoff scandal, check out The Alpha Exchange, with host Dean Curnutt interviewing Harry Markopolos, to whom I attribute the content of this section. |

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2019 | | |

| | | | |

1

Shareholder Letter

Is the Equity Risk Premium Positive?

“The disease is spread by contagion. For example, consider the introduction of scurvy into French military hospitals by veterans returning from war, or the rapid spread of scurvy from one sailor to another in naval vessels.”

-Dr. Jean-Antoine Villemin, member of the prestigious Paris Academy of Medicine, and the first to demonstrate that tuberculosis was an infectious disease, speaking in 1874 and echoing the near universal view of scurvy at the time and since themid-1500s

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

- maybe Mark Twain

From themid-1500s until about 1900, scurvy plagued the shipping industry. Generations of medical researchers frantically searched for a cure. Back then, most of the world was as convinced about how scurvy “spread” as we are today about the theory of gravity: scurvy was a communicable,germ-spread disease passed sailor to sailor over long journeys in close quarters. Unfortunately, this was also the era ofhero-making scientific breakthroughs ingerm-detection processes, which blinded thegerm-focused researchers to the truth for centuries.

Thegerm-spread theory turned out to be false. We know today that scurvy is a disease caused solely by lack of vitamin C in the diet. Germs have nothing to do with it. Tragically, even in the beginning of the last century, after thediet-based “cure” for scurvy became widely accepted, many prominent infectious disease researchers kept bacteria hunting. They so strongly believed what they wanted to be true.

The story of scurvy is only one of innumerable examples throughout history in which the world was utterly convinced of something important that turned out to be false (e.g., the earth is flat, the sun revolves around the earth, smoking is not bad for you).

Today, the world is convinced that the stock market has a positive risk premium – because for 90+ years it has. The world is equally convinced that every time the stock market goes down, no matter how far or for how long, it always comes back – because for 90 years it has.

Let’s be careful with what we know for sure, that maybe just ain’t so.

First, let’s dimension uncertainty about the mean

In recent work, Nobel Prize winner Eugene Fama rigorously quantifiesthe substantial role luck will play in the future realized equity risk premium.2 Despite utilizing the heftyhistorical equity risk premium to anchor his analysis, Fama shows that negativefuturerealized equity premiums should still occur in 1 in 4five-year periods, 1 in 9twenty-year periods, and 1 in 12thirty-year periods. 1 in 12 is not low.

While Fama’s conclusion about the important role chance plays in markets is nothing new, he warns us “many professional investors seem unaware of its implications.” Let’s try the following thought experiment: how much of our future quality of life is riding on the performance of our stock portfolios over the next 30 years? What would have to change if it’s cumulatively negative?

| 2 | Eugene Fama (2018), Volatility lessons, working paper, University of Chicago Booth School of Business. |

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2019 | | |

| | | | |

2

Shareholder Letter

It’s a fiduciary’s responsibility to wonder if the equity risk premium, like all risk premiums, will be the same going forward as it’s been in the past.

Price-insensitive buying

Consider the buying behavior of just one market participant, Vanguard. Over the last five years, Vanguard – with a ~50% market share of the index fund market – averaged about $300 million of net buying of U.S. stocks per day, every day, from just their two largest mutual funds and two largest ETFs.3 This doesn’t include the role of State Street, iShares, and others who, together, represent the other ~50% of the index fund market. Let’s conservatively assume that there’s been at least $500 million of net buying of U.S. stocks per day during this period from index players. Now consider the implications of theprice-insensitive nature of index fund behavior. In what other industry do the largest customers say to their merchants, “I’m going to buy at least $500 million of your product per day, every day ok? You’re asking if I want a great deal for giving you that kind of volume. Well, I appreciate you asking, but no, actually, I don’t. I’m going to show up to buy from you at your offer price, every day, no matter what your offer price is.”

While there are many factors that drive stock returns, years of unprecedented index fund net buying of the same names unquestionably helped. The market largely went straight up with bursts of “epic quiet” volatility, fueled by index funds mechanically buying every dip. Index funds provided “Corporate QE” (QE = quantitative easing), with an impact on stocks likely on par with what global Central Bank QE provided for bonds. Systemic risk lurks when theprice-insensitive net buying becomesprice-insensitive net selling.4

The combined effect of global Central Bank money printing, zero percent interest rates, and price-insensitive net buying from equity index funds makes it difficult to support the view that the future equity risk premium will be higher than it’s been in the past. Perhaps it’s the same, but common sense suggests it will be lower. Using a more conservative, but still positive, estimate for the future equity risk premium – that is, just shifting Fama’s starting point for the equity risk premium in his analysis from the historical level to something smaller – Fama’s methodology could easily show there is really a 1 in 5 chance, not 1 in 12, that the equity risk premium will be negative for futurethirty-year periods. It’s prudent tore-underwrite whether we would take that kind of risk with so much of our life savings.

Unfortunately, the news for stocks gets worse.

What has really caused wealth creation in the stock market?

Since 1926, when the CRSP5database began, there have been approximately 26,000 U.S. public companies that, collectively, have delivered about $35 trillion of wealth creation for their shareholders. So it might seem absurd to question whether the equity risk premium is positive. But let’s be precise in our use of “is” versus “was” and be extra careful about believing things we want to be true.

The evidence that stock returns exceed therisk-free return in the long term is based on broadly diversified portfolios. That is, “the market.” And, on this topic the science is, indeed, settled, if only historically. The stock market as a whole has soundly beaten Treasury bills(T-bills) since 1926. However, if instead we focus on individual stock returns, the story is more nuanced, and what the data tells us is remarkable.

| 4 | To highlight the fragility just below the surface, consider that this month the most liquid tool for hedging market risk, S&P 500E-mini futures, has volume available on the best bid and offer between 2/5th and 1/20th of what was available 12 months ago. |

| 5 | Center for Research in Security Prices at the University of Chicago. |

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2019 | | |

| | | | |

3

Shareholder Letter

In groundbreaking new work, Hendrik Bessembinder shows us that, even during the golden age of public equities these last ~90 years, the majority of individual stocks have returned less thanT-bills. And this holds at every time horizon: monthly, quarterly, annually, and all the way out to cumulative lifetime returns.6 Taken together with the substantially positive historical equity risk premium, we’re forced to conclude that the entire premium itself has been driven by relatively few stocks.

How few?Bessembinder shows that, astonishingly, only 4% of stocks explain all stock market-driven wealth creation since 1926. The other 96% are a push. Further, the majority of stocks have negative lifetime returns. And the single most common return for a public company?-100%. Let’s pause,re-read this paragraph, and begin to consider its implications.

Perhaps there are no implications, and the results should be met with a shrug. Who really cares if all the gains are concentrated in a few stocks as long as one holds the entire market?i

What do we want to be true about the sign of the equity risk premium?

“The singular goal is to invest in those very few mega deals that deliver crushing returns. Anything less simply won’t move the needle.”

- Joe Dwyer, Founder Equity blog (2014), on the importance of the right tail in venture capital investing

If wedouble-click on Bessembinder’s 4% and look even more narrowly at only the top 25 wealth generating stocks since 1926, including names like Amazon and Microsoft, we see that those 25 – less than 1 in 1000 stocks ever to exist – account for ~30% of all stockmarket-driven wealth creation. We also see that theinflation-adjusted current market cap of those stocks is, on average, about 400 times larger now compared to when each first appeared in CRSP. Amazon’s and Microsoft’s ratios are about 1000x and 400x, respectively. These firms clearly achieved venturecapital-style returns via public markets and those returns were available to public market investors because those companies went public with relatively modest first day market caps of $696 million and $1.9 billion, respectively.

Now, let’s examine twowell-known private companies considering 2019 IPOs: Peloton and Uber. Capital markets professionals believe that the initial public market IPO valuation of each company could be $10 billion and $120 billion, respectively. Applying the 400x standard above would imply that someday Peloton would have to be a $4 trillion company and someday Uber would have to be a $48 trillion company. Both numbers are preposterous. I don’t know anyone at Uber, but I do at Peloton as I’m a shareholder, and I think Peloton is one of the best run companies in the world today. However, with all due respect to Peloton’s phenomenal executives, there is no way it’s going to be a $4 trillion company.

If we look under the hood of each firm, wewill find investors whodid earn more than 400x on their investments. They were the early stage investors, either via venture funds or via direct stock purchases.

So400x returns remain available, but they have moved to the private markets. Onerous regulations, primarilySarbanes-Oxley, but also many others, disproportionately hit small stocks, and may have contributed to the trend of the best companies, like Peloton, staying private longer – and, critically for public market investors, until they are no longer small.

An IPO is just a method of financing, period. Nothing fundamental changes overnight,post-IPO, about the quality of a firm’s products or about its relationship with its customers.

| 6 | Hendrik Bessembinder (2018), Do stocks outperform treasury bills? Forthcoming in the Journal of Financial Economics. |

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2019 | | |

| | | | |

4

Shareholder Letter

So who would go public? Only companies that have to, where “have to” is defined as a) needing the money, or b) needing to create liquidity for their early investors and/or employees who own shares.

The growth in private markets has created adverse selection in the quality of companies that go public small. Essentially, what the private markets – with a far higher bar for return on invested capital – have told small IPO companies is: “We won’t fund your growth any more, and we certainly won’t fund your early investors and/or employees cashing out. If you don’t want to go away, go public where the questions are easier and the bar for funding is much lower.”

Taken together, in my view, Bessembinder’s work, combined with the explosion in private markets and the resulting elimination of the “right tail” (i.e., 400x) for individual stock public market returns –the entire source of the historical equity risk premium – drives a stake through the heart of public equities as an asset class.

Too good to be true?

While the empirical analysis is compelling, it’s unnecessary. We can combine the parable of “The Emperor’s New Clothes” with the lessons from Madoff and briefly review certain aspects of the public equity market:

We get to make on average4-6% annualized excess return in a tradeeveryone knows about, with limitless capacity andtax-free compounding, and we get the exposure permanently for free with a single mouse click? And we can invest without fear because if our positions go down, regardless of how much, all we have to do is be patient and they willalways come back?

Perhaps what’s above should start with “Once upon a time…”? It sounds like a magic money tree more fitting a Hans Christian Andersen story than as the prime driver of folks’ future ability to retire and stay retired with dignity. Public equities are the most crowded trade in capital markets today, with an unrelenting gusher of price-insensitive money rushing in (for now). Is there another asset class whose owners feel a stronger sense of entitlement to positive,long-term returns?

Public equities no longer pass the smell test because a free and limitlessreturn-generating mechanism that delivers a4-6% annual risk premium means that it’s too easy to make too much money with no work. Nothing in life that good is that easy.When the4-6%7equity risk premium was available, it wasn’t clear that was the size of the premium. Realized risk premiums are only obvious in hindsight.

Let’s see what happens in the coming decades. For investors with substantial public equity allocations, it’s appropriate tore-assess the retirement lifestyle impact if what they currently believe about the public equity risk premium turns out not to be true.

I interpret Bessembinder’s work to suggest that the likely sign of the equity risk premium is not statistically positive going forward and, at best, the equity risk premium is much smaller now than it has been historically. As a practical matter, in light of the substantial uncertainty around the estimate of the true mean excess return of the overall market, a 50% public equities allocation – common in the wealth

| 7 | Equity risk premium estimate from Damodaran, A., “Equity Risk Premiums (ERP): Determinants, Estimation and Implications – The 2018 Edition,” Stern School of Business, working paper. |

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2019 | | |

| | | | |

5

Shareholder Letter

management industry – is too high.8Prudent risk management requires that the more uncertain we are about future expected excess return of any asset class, the more conservative (i.e., truly diversified) of an allocation we should have. Simply put, let’s not keep 50% of our eggs in one basket, if our future depends on those eggs.

In light of the unmeasurable model uncertainty inherent in all areas of the capital markets, my personal investing rule is that nothing – literally nothing no matter what – deserves more than a 10% allocation. For my own life savings I find anything more concentrated too risky.

Skin in the Game at Stone Ridge

The profound, and unavoidable, implications of model uncertainty surface an important motivational element of what caused me to start Stone Ridge in the first place: to help our investors and our employees (including me) truly diversify and thereforede-risk the path to and through retirement. We take the “buy the market” philosophy of a firm like Vanguard, marry it with the patient “m choose n” execution innovation of a firm like Dimensional Fund Advisors (DFA), and apply it to what we believe to be valuable and diversifying asset classes where it hasn’t been applied before.

However,our core original innovation is to create funds that systematically tap into the business profits and losses, not capital market returns, of globally important risk transfer services.

At the firm’s inception, we contrasted the equity risk premium with the reinsurance risk premium as proxied by the Swiss Re Index (SRI) of catastrophe (“cat”) bonds. Back in 2012, fund returns data suggested to us that it would be very easy to replicate the S&P 500 and very hard, but potentially extremely valuable, if we could replicate the SRI. In practice, to match the SRI one would have to obtain and maintain the benchmark exposures to each bond, each with extremely limited capacity, especially in the primary issuance market, which is when the index “buys” its bonds. And building a cat bond portfolio is only possible bond by bond, not with a click.

Fast forward to the July2013-November 2018 period, the fully invested timeframe of our first fund – the Stone Ridge High Yield Reinsurance Risk Premium Fund (ticker: SHRIX) – designed to track the SRI net of its fees. During this 5+ year period, theno-fee,no-transaction cost,non-investable Swiss Re index was valuable indeed, “returning” 29.3% with no correlation to anything (note: this compares to the Barclays Agg’s return of 11.5%). Of the eight Eurekahedge ILS index reinsurance funds with “cat bond” in their name, the median cumulative net return has been 15.5%, and the 75th percentile fund returned 19.4%. During this same period, SHRIX returned 29.9% net. The reinsurance risk premium, and particularly the Stone Ridge approach, which uniquely accesses the limited market in catastrophe bonds via maniacal focus on primary issuance – sharply limiting its capacity – passes the smell test.9

Since we launched that first Stone Ridge fund, we’ve tirelessly sought innovation, though the vast majority of our collective work just isn’t good enough and ends up on the cutting room floor. Having said that, additional alternative franchises – a whopping two in the subsequent five years – have met our standards

| 8 | “Don’t tell me what you think, tell me what’s in your portfolio”: I have zero net market exposure to public equities. Having said that, based on our best available shareholder information, I am by far the largest end investor of the Elements funds, which I beta hedge to zero net market exposure. In the realm of public equities, I only wantlong-term exposure to the “Elements” (i.e., the factors). For those who do want net long public equities exposure, I believe systematically tilting towards the riskier names and paying zero management fees should benon-negotiables. |

| 9 | Relatedly, in proprietary research available on request, a mimicking portfolio of quota shares returned ~1.5%/year over cat bonds due to higher levels of diversification which facilitate higher levels of structural leverage inherent in a reinsurer’s business model, and therefore a quota share. In addition, quota shares, especially with the globally leading reinsurers (i.e., the best underwriters with the lowest loss ratios) are far harder to source, structure, evaluate, and risk manage than cat bonds. |

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2019 | | |

| | | | |

6

Shareholder Letter

asanti-fad, possessing what we believe to be a materially positive risk premium, truly diversifying to each other and, critically, to stocks and bonds. We are honored to now be responsible for $14 billion of our investors’ and our employees’ life savings.

Inspired by Taleb’s “Don’t tell me what you ‘think,’ just tell me what’s in your portfolio” morality, the team at Stone Ridge has skin in the game. In 2018, I personally shouldered the largest losses in SRRIX and AVRPX of any Stone Ridge fund investor (and the largest gains in LENDX). In my view, if you give an opinion and someone follows it, you must be exposed to its consequences. And it has to be real exposure, not window dressing.

At Stone Ridge, our code is symmetry with our investors, having a share of the harm, and paying a material financial penalty if something goes wrong, regardless of the cause (the opposite of Wall Street executives during the credit crisis). And although nothing “went wrong” in 2018 in the intellectual sense that successful risk premium investingrequires occasional rough years –which must be unpredictable else there would be no risk premium in the first place– something certainly “went wrong” in the actual sense, the only sense that matters: we lost money.

I lead from the front and share the pain as a matter of justice and honor. Alongside me, with locked arms,every Stone Ridge employee invests in every strategy at full fees. Skin in the game keeps hubris in check.

The Law of Practice

While nothing in investing is easy or obvious, when you source priced risks, returns are reliably positive on average, but unpredictable over any particular interval.Some years are great, others can hurt – it is simply a function of when the intentional risk bearing pays off. Yet many investors try to time the market, an expensive and dangerous pursuit.

Why is succumbing to market timing prevalent among so many (but certainly far from all) investors? Perhaps because it’s in our nature to think we’re exceptional. It’s hard wired in our brains as a component of evolutionary survival. 90% of us think we’re above average drivers and 25% of us think we’re in the top 1%. And we especially don’t like to think of ourselves as passive or static when something is not going as we hoped. Instead, we want to “do something!” Unfortunately,in investing, confusing strategy with outcome is hazardous to our wealth.

Getting the sign and magnitude of the risk premium right and thenstaying in the trade – patiently and at times uncomfortably – is, in our view, the right thing forlong-term wealth creation andthe only way to earn the average.

We don’t generally associate inactivity with practice, but maintaining a target asset allocation each year is active and itdoesrequire practice. Every decision is an active decision, including a decision not to change. Practice is such a powerful thing that it doesn’t have the ability to discriminate between what is good for you and what is not. If you practice negative habits that are not conducive to your growth, you will become really good at those negative habits. If you practice positive habits that are conducive to your growth you will become really good at those positive habits.

Whatever it is you practice is that which you become good at. That’s the immutable Law of Practice.

However, just because something is simple doesn’t mean it’s easy. Staying in the trade and seeking to earn the average requires patience, discipline, and an ability to mentally manage substantial uncertainty –

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2019 | | |

| | | | |

7

Shareholder Letter

for an uncertain period of time. While not everyone can do that, the motivation to develop this practice is clear, as the ability to handle uncertainty is directly proportional to the quality of thelong-term outcome that can be generated (i.e., the quality of your life). There are no shortcuts or magic pills.

People and societies that can delay gratification – and manage the associated uncertainty along the way – end up controlling the vast majority of capital accumulation and enjoying the vast majority of health and prosperity. It’s the most powerful source of life inequality.

The Stone Ridge Network

We have enoughhumility at Stone Ridge to avoid the need for complexity in product development and enoughfocus to say no to almost 100% of the opportunities that come our way. Ourkindness has attracted the Stone Ridge Network who, like us, prefer the path of simple things properly done.

Comprised of 100+ of the leading RIAs in the U.S. who each invest across multiple Stone Ridge products, the RIAs in the Stone Ridge Network create value for each other... he most recent example: Flourish Cash.iiFlourish Cash currently offers a 2.3% annual percentage yield (APY)iiion cash held at its program banks, with that cash eligible for up to $6 million of FDIC insurance pertwo-person household.ivSince launch earlier this month, it’s averaged 40% growth,per day, an utterly unsustainable pace, but one I believe will stay brisk.

What made Flourish Cash possible was an observation about the “CAC” (customer acquisition cost) of retail deposits at banks: it costs a bank$1500-$2000 to acquire a retail depositor and far more to acquire a high net worth retail depositor.10

In contrast, the Flourish Cash team, powered by the Stone Ridge Network,can provide a single source of thousands of high net worth retail depositors for each of the Flourish Cash program banks,CAC-free. TheseCAC-free deposits from Flourish Cash customers are so valuable that the banks offer those customers a higher yield. These banks are notnon-profits. It’s all about their CAC, and not paying it, which is all about the Stone Ridge Network.

I’m old enough to remember when cash was an asset class, as it is again today. RIAs who win the future will be as forward thinking about their cash management practices as they are today about their alternative asset management practices. Basically anything that’s not stocks and bonds will be needed as a critical enhancement to the RIA arsenal. Cash is now just another uncorrelated alternative.

Business is a Listening Contest

Some things need to be believed to be seen – Flourish Cash was one of those things. At Stone Ridge, we think from the future, close our eyes and imagine our vision is realized. Then, together, we relentlessly iterate so that what we believe will ultimately be seen. Working quietly out of view, we ignore the impulses of others to seek recognition. And we don’t believe that those out there in the limelight are getting the better end of the deal. We’re too busy loving our work to do anything else.

New opportunities arrive ceaselessly, as long as we’re each willing to learn.Business is a learning contest, and our ability to innovate as an organization depends on each of us entering every conversation as if we have something to learn. Because we do. True listening requires a setting aside of oneself. When done expertly, the person across the table senses this. They open up their inner recesses, and share their

| 10 | https://tearsheet.co/data/why-customer-acquisition-is-so-difficult-for-financial-startups/ |

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2019 | | |

| | | | |

8

Shareholder Letter

deepest creativity. Conversations are not promotional opportunities. In a real conversation, you’re in it together.And because business is a learning contest, it’s actually a listening contest.

The most sustainable fountainhead of innovation at Stone Ridge will flow from each of us developing and maintaining world class listening skills. Not excellent. World class. The average person can talk at about 200 words per minute, but can listen at about 500 words per minute. The problem is that when we only hear 200 words per minute in a conversation, it’s easy to fill in the gaps with distracting thoughts. It takes real energy and focus to appropriately pay attention to someone, but if you can’t do that, you’re not in a conversation and you’re not learning. Check yourself on this. Do you listen with the intent to understand, or do you listen with the intent to reply?

Folks who talk too much feel in control and the center of attention. Talking means they don’t have to hear anything they’re not interested in, including new ideas that might tweak their perspective or expand their world. In contrast, consider Randy Cohen, my brilliant and blind old friend andco-author, with Josh Zwick, in the Illuminating the Path Forward series. Randy didn’t used to be blind, but now he is so instead of reading, he listens to books and emails. Through deliberate practice over many years, he can listen up to 750 words per minute. 750 words! No wonder he’s one of the most creative and interesting people I’ve ever met.

My Mom

As some of you know, my mother passed earlier this year. This is my first New Year’s without her. It stinks. A parent passing is something we each process differently and my father passing over six years ago was the animating spark that caused me to start Stone Ridge. However, when my mom passed this year there was no such spark. For me, a second parent passing was another thing altogether and I unfortunately learned that a second parent passing for an only child comes with its own set of trials. While I now feel mostly back to myself, I still really miss my mom.

In honor of my mom this holiday season, I’d like to share something she told me just a few weeks before she passed. She said,“Whenever you talk to someone, be prepared to be amazed.I am, and I’m never disappointed. You can do the same thing. Whether it’s a teammate, a client, a child, a parent or a spouse: listen and be prepared to be amazed.”

Is it any wonder I’m endlessly grateful for my mom?

So over this holiday season, please put down that piece of plastic and glass you are addicted to stroking.Technology is a wonderful thing, but only ifyouare in charge ofit.Give your family your undivided attention. In conversation today, do not think about what you are going to say next. Just listen. Listening equals love. And be prepared to be amazed.

On behalf of Stone Ridge, I offer my deepest gratitude to you for sharing responsibility for your wealth with us this year. We look forward to serving you again in 2019.

Warmly,

Ross L. Stevens

Founder, CEO

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2019 | | |

| | | | |

9

Shareholder Letter

ENDNOTES

iBessembinder’s work also has profound implications for active management of equities. The 4% result means that a bet on any particular active manager reduces to a bet that manager can identify enough of the 4%wealth-creating stocks in advance, because the market portfolio, by definition, contains them. The bar, then, is not “beat the market,” rather it’s “don’t miss too many of the 4%.” How important are the 4%? Consider that a) missing only the top 25 wealth generating stocks out of the ~26,000 U.S. stocks to ever exist (so less than 1 in 1000), and b) not holding those 25 since their inception in CRSP (an impossible task without time travel), would have incurred an opportunity cost of almost a third of the cumulative wealth generated by owning the entire U.S. stock market the last 90 years.

How likely is it that an active manager will own enough of the 4%? Or the 25? Consider the fact that the typical active mutual fund manager holds 65 stocks and decide (Kacperczyk, M., Sialm C., Zheng L., (2006).On the industry concentration of actively managed equity mutual funds.Journal of Finance 60 1983–2011).

Some market observers suggest that individual stock return dispersion is needed for active managers to outperform, and that some market environments are “better” for active management than others. Bessembinder shows this is nonsense. The pool active managers need to fish in, the 4% or the 25, is vanishingly small, likely impossible to identify in advance, and almost certainly institutionally impossible to stick with through the inevitable drawdowns along the way.

But the news gets worse for active management, because the percentage of stocks beatingT-bills has been dropping. Precipitously. In the first five decades of the last ~90 years, the average decade saw 70% of public equities beatingT-bills, while in the average decade of the last 40 years 38% of stocks beatT-bills – andin none of the last four decades did the typical stock beatT-bills.

However, the final stake through the heart of active management is not a comparison of stocks toT-bills. It’s a comparison of stocks to the overall market.In each of the last four decades, only a quarter of stocks beat the market on average, ranging from a low per decade of 21% to a high of 33%.Bessembinder shows us that the active management fishing pool is way too tiny. It’s unrealistic to think that any manager,especially one identifiable in advance,is skilled enough to own enough of the 25% market beating stocks over a decade vs. the losing 75%. No wonder active management underperforms: it’s hopeless. The data supports what we know intuitively: alpha and luck are synonyms.

Disclosures relating to Flourish Cash

IiFlourish Cash is a service offered by Stone Ridge Securities LLC, a registeredbroker-dealer and FINRA member firm. Flourish Cash is currently available via invitation only and is currently available only in certain states, and this letter is not an invitation or solicitation to open an account. Stone Ridge Securities LLC is an affiliate of Stone Ridge Asset Management LLC. Stone Ridge Asset Management LLC does not provide any services, including investment advisory services, in connection with Flourish Cash and does not provide any guarantees or financial support to Flourish Cash accounts. The cash balance in a Flourish Cash account is swept from a brokerage account at Stone Ridge Securities LLC to deposit account(s) at one or morethird-party banks that have agreed to accept deposits from customers of Stone Ridge Securities LLC (“program banks”). The accounts at program banks pay a variable rate of interest.

Iii the Annual Percentage Yield (APY) displayed here is effective as of 12/27/2018. This APY is variable and may change at any time. The current APY for Flourish Cash is available at www.flourish.com.

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2019 | | |

| | | | |

10

Shareholder Letter

ivThe cash balance in a Flourish Cash account that is swept to one or more Program Banks is eligible for Federal Deposit Insurance Corporation (“FDIC”) insurance, subject to FDIC rules, including FDIC aggregate insurance coverage limits. FDIC insurance will not be provided until the funds arrive at the program bank. There are currently 6 program banks available to accept deposits, making customers eligible for up to $1,500,000 of FDIC insurance for individual accounts ($250,000 for each of the 6 program banks) and up to $3,000,000 of FDIC insurance for joint accounts with two owners ($500,000 for each of the 6 program banks). The total FDIC coverage for atwo-person household is calculated assuming that each household member has an individual account and that both household members share a joint account. Although Flourish Cash is offered through a brokerage account and cash held in brokerage accounts often has the benefit of SIPC protection, until such time as Stone Ridge Securities LLC offers securities products, customers likely will not have the benefit of SIPC protection for cash held in their Flourish Cash account. Further, SIPC protection is not available for any cash held at the program banks. The investment Funds described in this letter are separate from Flourish Cash, and such Funds are (i) not insured by the FDIC; (ii) not deposits or other obligations of anyFDIC-insured financial institution and are not guaranteed by anyFDIC-insured financial institution and are not guaranteed by anyFDIC-insured financial institution; and (iii) subject to investment risks, including possible loss of the principal invested.

RISK DISCLOSURES

The Stone Ridge High Yield Reinsurance Risk Premium Fund (the “High Yield Reinsurance Fund”), the Stone Ridge Reinsurance Risk Premium Interval Fund (“SRRIX” and, together with the High Yield Reinsurance Fund, the “Reinsurance Funds”), the Stone Ridge U.S. Large Cap Variance Risk Premium Fund (the “U.S. Large Cap VRP Fund”), the Stone Ridge U.S. Small Cap Variance Risk Premium Fund (the “U.S. Small Cap VRP Fund”), the Stone Ridge U.S. Variance Risk Premium Master Fund (the “U.S. VRP Master Fund” and, together with the U.S. Large Cap VRP Fund and the U.S. Small Cap VRP Fund, the “U.S. VRP Funds”), the Stone Ridge International Developed Markets Variance Risk Premium Fund (the “Developed Markets VRP Fund”), the Stone Ridge Global Equity Variance Risk Premium Master Fund (the “Global VRP Master Fund” and, together with the Developed Markets VRP Fund, the “International VRP Funds”), the Stone Ridge All Asset Variance Risk Premium Fund (“AVRPX” and, together with the U.S. VRP Funds and the International VRP Funds, the “VRP Funds”) and the Stone Ridge Alternative Lending Risk Premium Fund (“LENDX” and, together with the Reinsurance Funds and the VRP Funds, the “Funds”), and the Elements U.S. Portfolio (“ELUSX”), Elements U.S. Small Cap Portfolio (“ELSMX”), Elements International Portfolio (“ELINX”), Elements International Small Cap Portfolio (“ELISX”), and Elements Emerging Markets Portfolio (“ELMMX”) (collectively, the “Portfolios,” and each a “Portfolio” are generally sold to (i) institutional investors, including registered investment advisers (“RIAs”), that meet certain qualifications and have completed an educational program provided by Stone Ridge Asset Management LLC (the “Adviser”); (ii) clients of such institutional investors; and (iii) certain other eligible investors (as described in the relevant prospectus). Investors should carefully consider the Funds’ and the Portfolios’ risks and investment objectives, as an investment in the Funds and/or the Portfolios may not be appropriate for all investors and the Funds and the Portfolios are not designed to be a complete investment program. There can be no assurance that the Funds and/or the Portfolios will achieve their investment objectives. An investment in the Funds and/or the Portfolios involves a high degree of risk. It is possible that investing in a Fund and/or a Portfolio may result in a loss of some or all of the amount invested. Before making an investment/allocation decision, investors should (i) consider the suitability of this investment with respect to an investor’s or a client’s investment objectives and individual situation and (ii) consider factors such as an investor’s or a client’s net worth, income, age and risk tolerance. Investment should be avoided where an investor/client has a short-term investing horizon and/or cannot bear the loss of some or all of the investment. Before investing in a Fund and/or a Portfolio, an investor should read the discussion of the risks of investing in the Fund and/or a Portfolio in the relevant prospectus.

As of 7/22/2019, ELUSX holds positions in Amazon and Microsoft, which represent 1.92% and 0.22%, respectively, of ELUSX’s total assets. Holdings and sector allocations are subject to change and are not a recommendation to buy or sell any security.

Investing in funds involves risks. Principal loss is possible.

The VRP Funds may invest in a variety of derivatives, including put and call options, futures contracts, options on futures contracts, swaps, swaptions, and other exchange-traded andover-the-counter derivatives contracts. The VRP Funds may invest in derivatives to generate income from premiums, for investment purposes, and for hedging and risk management purposes. A VRP Fund’s use of derivatives as part of its principal investment strategy to sell protection against the volatility of various underlying references involves the risk that, if the volatility of the underlying references is greater than expected, the VRP Fund will bear losses to the extent of its obligations under the relevant derivative contracts, which may not be outweighed by the amount of any premiums received for the sale of such derivative instruments. The use of derivatives involves risks that are in addition to, and potentially greater than, the risks of investing directly in securities and other more traditional assets. Derivatives also present other risks, including market risk, illiquidity risk, currency risk, and credit risk.

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2019 | | |

| | | | |

11

Shareholder Letter

The equity securities of smaller, less seasoned companies are generally subject to greater price fluctuations, limited liquidity, higher transaction costs and higher investment risk. The equity securities of large-capitalization companies can perform differently from other segments of the equity market or the equity market as a whole and they may be less flexible in evolving markets or unable to implement changes as quickly as their smaller counterparts. Direct or indirect investments in securities of foreign issuers involve risks not ordinarily associated with exposure to securities and instruments of U.S. issuers, including differences in accounting, auditing and financial standards; less government supervision and regulation; currency risk; risks of expropriation, confiscatory taxation, political or social instability or diplomatic developments; less publicly available information; less volume in foreign markets; and increased costs of transacting in foreign markets. These risks are heightened in emerging markets.

The reinsurance industry relies on risk modeling to analyze potential risks in a single transaction and in a portfolio of transactions. The models are based on probabilistic simulations that generate thousands or millions of potential events based on historical data, scientific and meteorological principles and extensive data on current insured properties. Sponsors of reinsurance-related securities typically provide risk analytics and statistics at the time of issuance that typically include model results.

Event-linked bonds, catastrophe bonds and other reinsurance-related securities carry large uncertainties and major risk exposures to adverse conditions. If a trigger event, as defined within the terms of the bond, involves losses or other metrics exceeding a specific magnitude in the geographic region and time period specified therein, a Fund may lose a portion or all of its investment in such security. Such losses may be substantial. The reinsurance-related securities in which the Funds invest are considered “high yield” or “junk bonds.”

SHRIX and SRRIX may invest in reinsurance-related securities issued by foreign sovereigns and foreign entities that are corporations, partnerships, trusts or other types of business entities. Because the majority of reinsurance-related security issuers are domiciled outside the United States, each of SHRIX and SRRIX will normally invest significant amounts of its assets innon-U.S. entities. Accordingly, each of them may invest without limitation in securities issued bynon-U.S. entities, including those in emerging market countries. Foreign issuers could be affected by factors not present in the U.S., including expropriation, confiscatory taxation, lack of uniform accounting and auditing standards, less publicly available financial and other information, potential difficulties in enforcing contractual obligations, and increased costs to enforce applicable contractual obligations outside the U.S. These risks are greater in emerging markets.

The value of LENDX’s investments in whole loans and other alternative lending-related securities, such as shares, certificates, notes or other securities representing an interest in and the right to receive principal and interest payments due on whole loans or fractions of whole loans, is entirely dependent on the borrowers’ continued and timely payments. If a borrower is unable or fails to make payments on a loan for any reason, LENDX may be greatly limited in its ability to recover any outstanding principal or interest due, as (among other reasons) LENDX may not have direct recourse against the borrower or may otherwise be limited in its ability to directly enforce its rights under the loan, whether through the borrower or the platform through which such loan was originated, the loan may be unsecured or under-collateralized and/or it may be impracticable to commence a legal proceeding against the defaulting borrower. LENDX generally will need to rely on the efforts of the platforms, servicers or their designated collection agencies to collect on defaulted loans and there is no guarantee that such parties will be successful in their efforts to collect on loans. Even if a loan in which LENDX has investment exposure is secured, there can be no assurance that the collateral will, when recovered and liquidated, generate sufficient (or any) funds to offset any losses associated with the defaulting loan. Although LENDX conducts diligence on the platforms, LENDX generally does not have the ability to independently verify, and will not independently diligence or confirm the truthfulness of, the information provided by the platforms, other than payment information regarding loans and other alternative lending-related securities owned by LENDX, which LENDX will observe directly as payments are received. The default history for alternative lending borrowing arrangements is limited and future defaults may be higher than historical defaults.

In general, the value of a debt security is likely to fall as interest rates rise. LENDX may invest in below-investment grade securities, which are often referred to as “junk,” or in securities that are unrated but that have similar characteristics to junk bonds. Such instruments have predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. They may also be difficult to value and illiquid. LENDX’s investments in securitization vehicles or other special purpose entities that hold alternative lending-related securities (asset-backed securities) may involve risks that differ from or are greater than risks associated with other types of investments. The risks and returns for investors like LENDX in asset-backed securities depend on the tranche in which the investor holds an interest, and the value of an investment in LENDX may be more volatile and other risks tend to be compounded if and to the extent that LENDX is exposed to asset-backed securities directly or indirectly.

LENDX may invest directly or indirectly in the alternative lending-related securities of foreign issuers. Such investments may involve risks not ordinarily associated with exposure to alternative lending-related securities of U.S. issuers. The foreign alternative lending industry may be subject to less governmental supervision and regulation than exists in the U.S.; conversely, foreign regulatory regimes applicable to the alternative lending industry may be more complex and more restrictive than those in the U.S., resulting in higher costs associated with such investments, and such regulatory regimes may be subject to interpretation or change without prior notice to investors, such as LENDX. Foreign platforms may not be subject to accounting, auditing, and financial reporting standards and practices comparable to those in the U.S. Due to difference in legal systems, there may be difficulty in obtaining or enforcing a court judgment outside the U.S.

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2019 | | |

| | | | |

12

Shareholder Letter

A Fund (or its subsidiaries) may obtain financing to make investments and may obtain leverage through derivative instruments that afford the Fund economic leverage. Therefore, the Funds are subject to leverage risk. Leverage magnifies a Fund’s exposure to declines in the value of one or more underlying reference instruments or creates investment risk with respect to a larger pool of assets than the Fund would otherwise have and may be considered a speculative technique. The value of an investment in a Fund will be more volatile and other risks tend to be compounded if and to the extent the Fund borrows or uses derivatives or other investments that have embedded leverage. This risk is enhanced for SHRIX and SRRIX because they invest substantially all their assets in reinsurance-related securities. Reinsurance-related securities can quickly lose all or much of their value if a triggering event occurs. Thus, to the extent assets subject to a triggering event are leveraged, the losses could substantially outweigh SHRIX’s or SRRIX’s investment and result in significant losses to the relevant Fund.

Economic, political, and issuer-specific events will cause the value of securities, and the Portfolio that owns them, to rise or fall. Because the value of your investment in a Portfolio will fluctuate, you may lose money, even over the long term. Securities of smaller companies are often less liquid than those of larger companies, and smaller companies are generally more vulnerable to adverse business or economic developments and may have more limited resources. Foreign securities prices may decline or fluctuate because of economic or political actions of foreign governments and/or less regulated or liquid securities markets and may give rise to foreign currency risk. Securities of companies that exhibit other factors such as value, momentum or quality may be riskier than securities of companies that do not exhibit those factors, and may perform differently from the market as a whole. If a Portfolio uses derivatives, such Portfolio will be directly exposed to the risks of that derivative, including the risk that the counterparty is unable or unwilling to perform its obligations. Derivatives are subject to a number of additional risks, including risks associated with liquidity, interest rates, market movements and valuation. Securities lending and similar transactions involve the risk that the counterparty may fail to return the securities in a timely manner or at all and that the value of collateral securing a securities loan or similar transaction falls.

The Funds and the Portfolios may invest in illiquid or restricted securities, which may be difficult or impossible to sell at a time that a Fund or a Portfolio would like, at the price that a Fund or a Portfolio believes the security is currently worth, or without significantly changing the market value of the security.

Each Fund and each Portfolio intends to qualify for treatment as a regulated investment company (“RIC”) under the Internal Revenue Code. A Fund’s and a Portfolio’s investment strategy will potentially be limited by its intention to qualify for treatment as a RIC. The tax treatment of certain of the Funds’ and certain of the Portfolios’ investments under one or more of the qualification or distribution tests applicable to RICs is not certain. An adverse determination or future guidance by the IRS might affect a Fund’s and a Portfolio’s ability to qualify for such treatment.

If, in any year, a Fund or a Portfolio were to fail to qualify for treatment as a RIC under the Internal Revenue Code for any reason, and were unable to cure such failure, the Fund or the Portfolio would be subject to tax on its taxable income at corporate rates, and all distributions from earnings and profits, including any distributions of nettax-exempt income and net long-term capital gains, would be taxable to shareholders as ordinary income.

For additional risks, please refer to the relevant prospectus and statement of additional information.

Each of SHRIX and LENDX, and each of the Portfolios, is classified asnon-diversified under the 1940 Act. Accordingly, each such Fund and Portfolio may invest a greater portion of its assets in the securities of a single issuer than if it were a diversified fund, which may subject such Fund or Portfolio to a higher degree of risk associated with and developments affecting that issuer than a fund that invests more widely.

Each of the High Yield Reinsurance Fund, the U.S. VRP Funds, the International VRP Funds and the Portfolios is anopen-end management investment company. Each of SRRIX, AVRPX and LENDX is aclosed-end management investment company.

Diversification does not assure a profit or protect against a loss in a declining market.

Each of AVRPX, SRRIX and LENDX has an interval fund structure pursuant to which each Fund, subject to applicable law, conducts quarterly repurchase offers of the Fund’s outstanding shares at net asset value (“NAV”), subject to approval of the Board of Trustees. In all cases, such repurchases will be for at least 5% and not more than 25% of the relevant Fund’s outstanding shares. Repurchase offers are currently expected to be 5% for SRRIX and LENDX and 25% for AVRPX. In connection with any given repurchase offer, it is possible that a Fund may offer to repurchase only the minimum amount of 5% of its outstanding shares. It is possible that a repurchase offer may be oversubscribed, with the result that shareholders may only be able to have a portion of their shares repurchased. There is no assurance that you will be able to tender your Shares when or in the amount that you desire. The Funds’ shares are not listed, and the Funds do not currently intend to list their shares for trading on any national securities exchange; the shares are, therefore, not marketable, and you should consider the shares to be illiquid.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of a Fund or Portfolio may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling855-609-3680.

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2019 | | |

| | | | |

13

Shareholder Letter

Standardized returns as of most recentquarter-end (6/30/19): VRLIX 1Yr=4.87%, 5Yr=5.10%, since inception (5/1/2013)=6.57%; for VRSIX 1Yr=0.80%, 5Yr=4.15%, since inception (5/1/2013)=5.40%; for VRFIX 1Yr=2.00%, 5Yr=2.56%, since inception (2/11/14)=2.95%; for VRGIX 1Yr=2.42%, since inception (11/14/2014)=3.37%; for VRPIX 1Yr=3.17%, 5Yr=4.63%, since inception (5/22/2013)=5.83%; for SHRIX 1Yr=0.81%, 5Yr=3.63%, since inception (2/1/2013)=4.36%; for SRRIX1Yr=-8.16%, 5Yr=0.39%, since inception (12/9/2013)=0.88%; for AVRPX1Yr=-3.74%, since inception (4/2/2015)=2.61%; for LENDX 1Yr=4.51%, since inception (6/1/2016)=7.26%; for ELUSX 1Yr=8.17%, since inception (3/31/17)=10.94%; for ELSMX1Yr=-5.33%, since inception (3/31/17)=4.72%; for ELINX1Yr=-2.62%, since inception (4/28/17)=3.29%; for ELISX1Yr=-8.66%, since inception (4/28/17)=1.68%; for ELMMX 1Yr=1.50%, since inception (5/31/17)=4.42%. As of 6/30/19,30-day SEC yield: SHRIX 4.90% (net), 4.61% (gross of subsidized expenses); SRRIX 0.00% (net), 0.00% (gross of subsidized expenses); LENDX 10.93% (net), 11.05% (gross of subsidized expenses). Results for the Funds and the Portfolios are annualized; all Fund and Portfolio returns reflect the reinvestment of dividends and other earnings and are net of fees and expenses. As a result of economic incentives received from platforms that may not be repeated, early LENDX performance was unusually strong and should not be extrapolated to future periods. Results for the Elements Portfolios reflect waivers of all of the Portfolios’ investment management fees and partial reimbursement of expenses by the Adviser. The Adviser has contractually agreed to waive its management fee entirely through September 30, 2021 and to pay or otherwise bear operating expenses as necessary to limit total annualized expenses, other than certain excluded expenses, of the Portfolios to 0.15% (for ELUSX and ELSMX) or 0.20% (for ELINX, ELISX and ELMMX) for the period from September 28, 2018 through September 30, 2019. Fee waiver and expense reimbursement may be discontinued in whole or in part after such dates. In the absence of fee waivers and reimbursements, returns for the Portfolios would have been lower.

Total Annual Fund Operating Expenses as disclosed in the most recent prospectus: for SRRIX, 2.45%; for VRPIX, 3.78%; for ELUSX, 0.52%; for ELSMX, 0.77%; for ELINX, 0.78%; for ELISX, 1.13%; for ELMMX, 1.03%. Total Annual Fund Operating Expenses before fee waiver and/or expense reimbursement/(recoupment) as disclosed in the most recent prospectus: for SHRIX, 1.72%; for VRLIX, 2.03%; for VRSIX, 2.71%; for VRFIX, 4.76%; for VRGIX, 3.46%; for AVRPX, 2.62%; for LENDX, 4.89%. Total Annual Fund Operating Expenses after fee waiver and/or expense reimbursement/(recoupment) as disclosed in the most recent prospectus: for SHRIX, 1.67%; for VRLIX, 1.75%; for VRSIX, 1.75%; for VRFIX, 2.87%; for VRGIX, 3.09%; for AVRPX, 2.62%; for LENDX, 4.97%. Please see the financial highlights section of each Fund’s and each Portfolio’s shareholder report for more recent Fund Operating Expenses.

Information furnished by others, upon which all or portions of the information contained herein is based, is from sources believed to be reliable. Stone Ridge makes no representation as to the accuracy, adequacy or completeness of such information and it has accepted the information without further verification.

The information provided herein should not be construed in any way as tax, capital, accounting, legal or regulatory advice. Investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision. Opinions expressed are subject to change at any time and are not guaranteed and should not be considered investment advice.

The Funds’ and Portfolios’ investment objectives, risks, charges and expenses must be considered carefully before investing. The relevant prospectus contains this and other important information about the investment company. You can obtain an additional copy of the Funds’ and the Portfolios’ most recent periodic reports and certain other regulatory filings by calling855-609-3680 or visiting www.stoneridgefunds.com for the Funds and www.elementsfunds.com for the Portfolios. The Funds’ and the Portfolios’ prospectuses, which include a statement of additional information, can be found by visiting:

Stone Ridge High Yield Reinsurance Risk Premium Fund1: Prospectus and SAI

Stone Ridge Reinsurance Risk Premium Interval Fund2: Prospectus and SAI

Stone Ridge Post-Event Reinsurance Fund2: Prospectus and SAI

Stone Ridge U.S. Large Cap Variance Risk Premium Fund, Stone Ridge U.S. Small Cap Variance Risk Premium Fund, Stone Ridge U.S. Variance Risk Premium Master Fund, Stone Ridge International Developed Markets Variance Risk Premium Fund, and Stone Ridge Global Equity Variance Risk Premium Master Fund1: Prospectus and SAI

Stone Ridge All Asset Variance Risk Premium Fund2: Prospectus and SAI

Stone Ridge Alternative Lending Risk Premium Fund2: Prospectus and SAI

Elements Portfolios1: Prospectus and SAI

1Open-end fund,2Closed-end interval fund

The prospectuses should be read carefully before investing.

Past performance is no guarantee of future results.

The Stone Ridge Funds and the Elements Portfolios are distributed by ALPS Distributors, Inc. SRG000902. Exp

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2019 | | |

| | | | |

14

|

|

| PERFORMANCE DATA (Unaudited) |

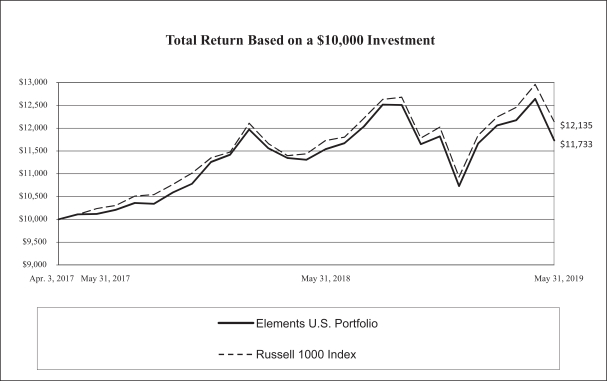

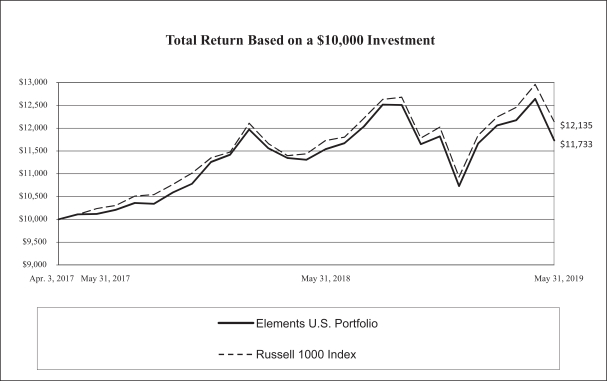

This chart assumes an initial gross investment of $10,000 made on April 3, 2017 (commencement of operations). Returns shown reflect the reinvestment of all dividends, and are net of fees and expenses, and reflect waivers of all of the Portfolio’s investment management fee and partial reimbursement of the Portfolio’s expenses by Stone Ridge Asset Management LLC (“Stone Ridge”). Stone Ridge has contractually agreed to waive its management fee entirely through September 30, 2021 and to pay or otherwise bear expenses as necessary to limit total annualized expenses, other than certain excluded expenses, of the applicable share class of the Portfolio, for the period from September 28, 2018 through September 30, 2019, to 0.15% for Class M shares and 0.05% for Class Y shares, in each case of the average daily net assets attributable to such class. Fee waivers and expense reimbursement may be discontinued after that date. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, returns for the Portfolio would have been lower. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

TheRussell 1000 Index is an unmanaged index that measures the performance of the stocks of the large-capitalization segment of the U.S. equity universe. Index figures do not reflect any deduction of fees, taxes or expenses, and are not available for investment. Returns shown for the index include reinvestment of all dividends.

| | | | | | | | |

|

| AVERAGE ANNUAL TOTAL RETURNS (FOR PERIODS ENDED MAY 31, 2019) | |

| | | 1-year

period

ended

5/31/19 | | | Since

Commencement of

Operations | |

| | |

Elements U.S. Portfolio — Class M (commencement of operations 4/3/17) | | | 1.68% | | | | 7.67% | |

| | |

Elements U.S. Portfolio — Class Y (commencement of operations 4/1/19) | | | N/A | | | | -4.82% | |

| | |

Russell 1000 Index | | | 3.47% | | | | 9.37% | |

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2019 | | |

| | | | |

15

| | | | |

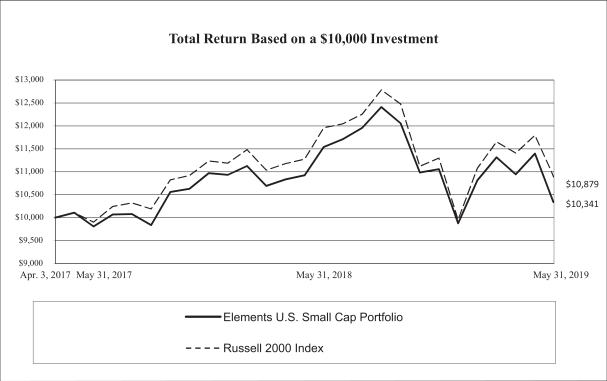

| ELEMENTS U.S. SMALL CAP PORTFOLIO | | | | |

|

|

| PERFORMANCE DATA (Unaudited) |

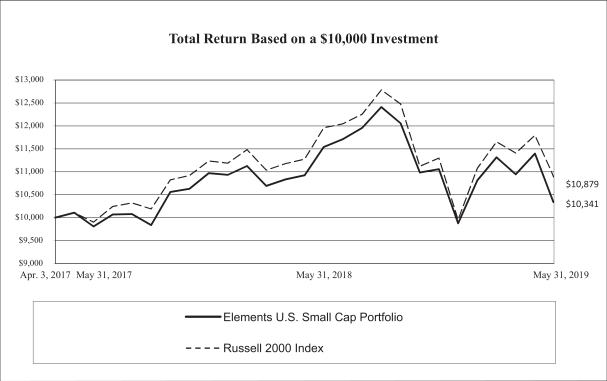

This chart assumes an initial gross investment of $10,000 made on April 3, 2017 (commencement of operations). Returns shown reflect the reinvestment of all dividends, and are net of fees and expenses, and reflect waivers of all of the Portfolio’s investment management fee and partial reimbursement of the Portfolio’s expenses by Stone Ridge. Stone Ridge has contractually agreed to waive its management fee entirely through September 30, 2021 and to pay or otherwise bear expenses as necessary to limit total annualized expenses, other than certain excluded expenses, of the applicable share class of the Portfolio, for the period from September 28, 2018 through September 30, 2019, to 0.15% for Class M shares and 0.05% for Class Y shares, in each case of the average daily net assets attributable to such class. Fee waivers and expense reimbursement may be discontinued after that date. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, returns for the Portfolio would have been lower. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

TheRussell 2000 Index is an unmanaged index that measures the performance of the small-capitalization segment of the U.S. equity universe. Index figures do not reflect any deduction of fees, taxes or expenses, and are not available for investment. Returns shown for the index include reinvestment of all dividends.

| | | | | | | | |

|

| AVERAGE ANNUAL TOTAL RETURNS (FOR PERIODS ENDED MAY 31, 2019) | |

| | | 1-year

period

ended

5/31/19 | | | Since

Commencement of

Operations | |

| | |

Elements U.S. Small Cap Portfolio — Class M

(commencement of operations 4/3/17) | | | -10.41% | | | | 1.56% | |

| | |

Elements U.S. Small Cap Portfolio — Class Y

(commencement of operations 4/1/19) | | | N/A | | | | -6.58% | |

| | |

Russell 2000 Index | | | -9.04% | | | | 3.97% | |

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2019 | | |

| | | | |

16

| | | | |

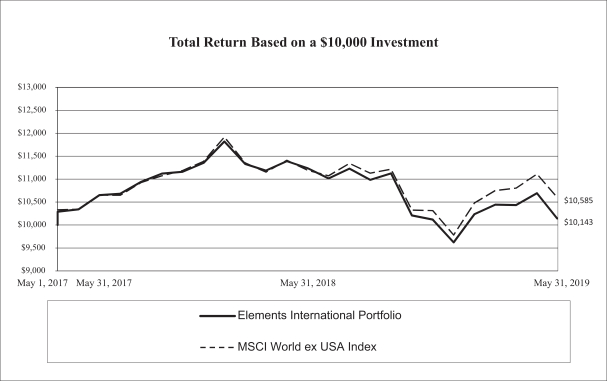

| ELEMENTS INTERNATIONAL PORTFOLIO | | | | |

|

|

| PERFORMANCE DATA (Unaudited) |

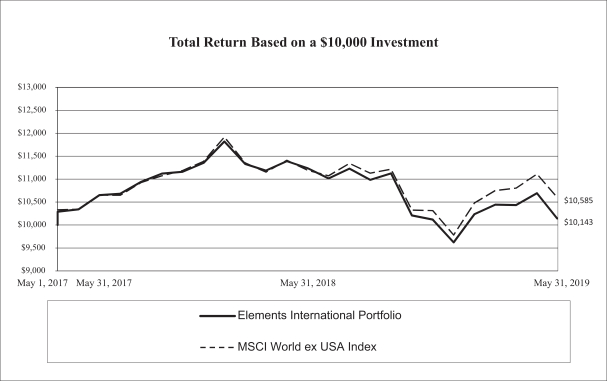

This chart assumes an initial gross investment of $10,000 made on May 1, 2017 (commencement of operations). Returns shown reflect the reinvestment of all dividends, and are net of fees and expenses, and reflect waivers of all of the Portfolio’s investment management fee and partial reimbursement of the Portfolio’s expenses by Stone Ridge. Stone Ridge has contractually agreed to waive its management fee entirely through September 30, 2021 and to pay or otherwise bear expenses as necessary to limit total annualized expenses, other than certain excluded expenses, of the applicable share class of the Portfolio, for the period from September 28, 2018 through September 30, 2019, to 0.20% for Class M shares and 0.10% for Class Y shares, in each case of the average daily net assets attributable to such class. Fee waivers and expense reimbursement may be discontinued after that date. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, returns for the Portfolio would have been lower. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

TheMSCI World ex USA Index is a free-float adjusted index which captures large- andmid-cap representation across 22 of 23 developed market countries, as determined by MSCI, excluding the United States. Index figures do not reflect any deduction of fees, taxes or expenses, and are not available for investment. Returns shown for the index include reinvestment of all dividends net of withholding tax.

| | | | | | | | |

|

| AVERAGE ANNUAL TOTAL RETURNS (FOR PERIODS ENDED MAY 31, 2019) | |

| | | 1-year

period

ended

5/31/19 | | | Since

Commencement of

Operations | |

| | |

Elements International Portfolio — Class M

(commencement of operations 5/1/17) | | | -9.75% | | | | 0.68% | |

| | |

Elements International Portfolio — Class Y

(commencement of operations 4/1/19) | | | N/A | | | | -3.85% | |

| | |

MSCI World ex USA Index | | | -5.44% | | | | 2.76% | |

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2019 | | |

| | | | |

17

| | | | |

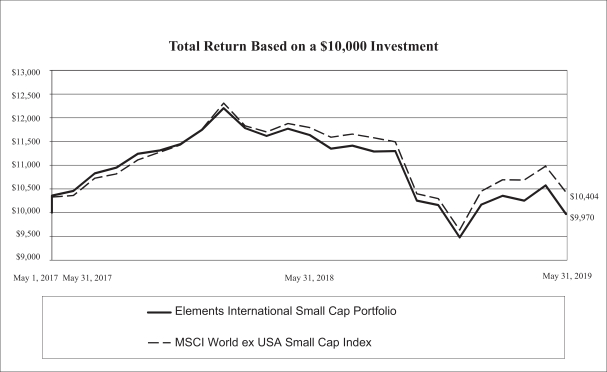

| ELEMENTS INTERNATIONAL SMALL CAP PORTFOLIO | | | | |

|

|

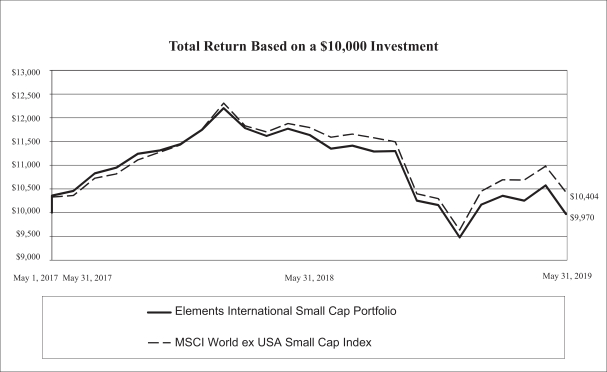

| PERFORMANCE DATA (Unaudited) |

This chart assumes an initial gross investment of $10,000 made on May 1, 2017 (commencement of operations). Returns shown reflect the reinvestment of all dividends, and are net of fees and expenses, and reflect waivers of all of the Portfolio’s investment management fee and partial reimbursement of the Portfolio’s expenses by Stone Ridge. Stone Ridge has contractually agreed to waive its management fee entirely through September 30, 2021 and to pay or otherwise bear expenses as necessary to limit total annualized expenses, other than certain excluded expenses, of the applicable share class of the Portfolio, for the period from September 28, 2018 through September 30, 2019, to 0.20% for Class M shares and 0.10% for Class Y shares, in each case of the average daily net assets attributable to such class. Fee waivers and expense reimbursement may be discontinued after that date. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, returns for the Portfolio would have been lower. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

TheMSCI World ex USA Small Cap Index is a free-float adjusted index which capturessmall-cap representation across 22 or 23 developed market countries, as determined by MSCI, excluding the United States. Index figures do not reflect any deduction of fees, taxes or expenses, and are not available for investment. Returns shown for the index include reinvestment of all dividends net of withholding tax.

| | | | | | | | |

|

| AVERAGE ANNUAL TOTAL RETURNS (FOR PERIODS ENDED MAY 31, 2019) | |

| | | 1-year

period

ended

5/31/19 | | | Since

Commencement of

Operations | |

| | |

Elements International Small Cap Portfolio — Class M

(commencement of operations 5/1/17) | | | -14.33% | | | | -0.14% | |

| | |

Elements International Small Cap Portfolio — Class Y

(commencement of operations 4/1/19) | | | N/A | | | | -4.12% | |

| | |

MSCI World ex USA Small Cap Index | | | -11.80% | | | | 1.92% | |

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2019 | | |

| | | | |

18

| | | | |

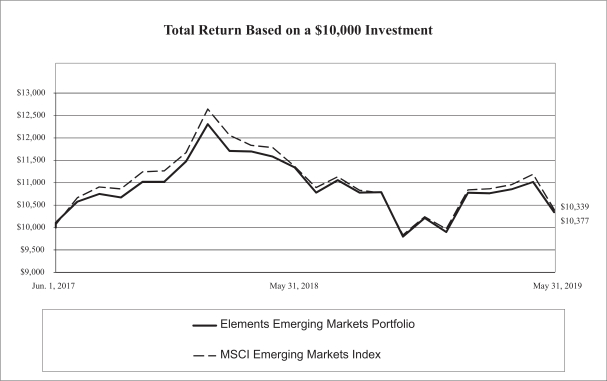

| ELEMENTS EMERGING MARKETS PORTFOLIO | | | | |

|

|

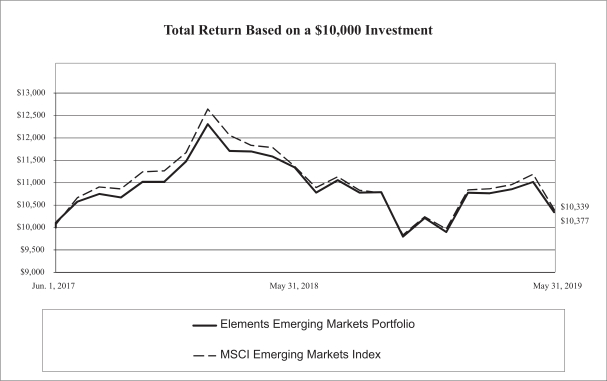

| PERFORMANCE DATA (Unaudited) |

This chart assumes an initial gross investment of $10,000 made on June 1, 2017 (commencement of operations). Returns shown reflect the reinvestment of all dividends, and are net of fees and expenses, and reflect waivers of all of the Portfolio’s investment management fee and partial reimbursement of the Portfolio’s expenses by Stone Ridge. Stone Ridge has contractually agreed to waive its management fee entirely through September 30, 2021 and to pay or otherwise bear expenses as necessary to limit total annualized expenses, other than certain excluded expenses, of the applicable share class of the Portfolio, for the period from September 28, 2018 through September 30, 2019, to 0.20% for Class M shares and 0.10% for Class Y shares, in each case of the average daily net assets attributable to such class. Fee waivers and expense reimbursement may be discontinued after that date. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, returns for the Portfolio would have been lower. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

TheMSCI Emerging Markets Index is a free-float weighted equity index which captures large andmid-cap representation across Emerging Markets countries, as determined by MSCI. The Index covers approximately 85% of the free float-adjusted market capitalization in each country. Index figures do not reflect any deduction of fees, taxes or expenses, and are not available for investment. Returns shown for the index include reinvestment of all dividends net of withholding tax.

| | | | | | | | |

|

| TOTAL RETURNS (FOR PERIOD ENDED MAY 31, 2019) | |

| | | 1-year

period

ended

5/31/19 | | | Since

Commencement of

Operations | |

| | |

Elements Emerging Markets Portfolio — Class M

(commencement of operations 6/1/17) | | | -8.87% | | | | 1.69% | |

| | |

Elements Emerging Markets Portfolio — Class Y

(commencement of operations 4/1/19) | | | N/A | | | | -6.06% | |

| | |

MSCI Emerging Markets Index | | | -8.70% | | | | 1.87% | |

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2019 | | |

| | | | |

19

| | |

| Management’s Discussion of Fund Performance | | |

The Elements U.S. Portfolio seeks to capture the equity risk premium by investing in a broad and diverse group of securities or derivatives on U.S. companies, with a focus on intuitive risk factors such as size, value, momentum, and quality that the Adviser believes may contribute to a positive equity risk premium.1 For the 12 months ended May 31, 2019, total returns were 1.68% for the Portfolio and 3.47% for the Russell 1000 Index.2 Periods of positive performance for the Portfolio, such as the most recently completed fiscal year, correspond to periods when the equity risk premium or factors emphasized are positive for U.S. companies. The performance of the Portfolio was primarily driven by the broad trend of the market for U.S. companies as illustrated by the Russell 1000 Index. Differences in Portfolio performance relative to the index were primarily driven by the factors, which contributed negatively in this period. There can be no assurance that the equity risk premium will be positive for the Portfolio’s investments at any time or on average and over time.