| | |

| Notes to Financial Statements | | May 31, 2020 |

Actual collateral pledged may be more than reported in order to satisfy broker requirements.

(c) Use of Estimates. The preparation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

(d) Indemnifications. In the normal course of business, the Portfolios enter into contracts that contain a variety of representations which provide general indemnifications. The Portfolios’ maximum exposure under these arrangements cannot be known; however, the Portfolios expect any risk of loss to be remote.

(e) Federal Income Taxes. The Portfolios qualify and intend to continue to qualify as regulated investment companies (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended. If so qualified, the Portfolios will not be subject to federal income tax to the extent they distribute substantially all of their net investment income and capital gains to shareholders. Therefore, no federal income tax provision is required.

(f) Distributions to Shareholders. The Portfolios intend to distribute to their shareholders any net investment income and any net realized long- or short-term capital gains, if any, at least annually. Distributions are recorded on the ex-dividend date. The Portfolios each may periodically make reclassifications among certain of their capital accounts as a result of the characterization of certain income and realized gains determined annually in accordance with federal tax regulations that may differ from GAAP.

(g) Foreign Securities and Currency Transactions. The Portfolios’ books and records are maintained in U.S. dollars. Foreign currency denominated transactions (i.e. market value of investment securities, assets and liabilities, purchases and sales of investment securities, and income and expenses) are translated into U.S. dollars at the current rate of exchange. The Portfolios do not isolate that portion of results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held.

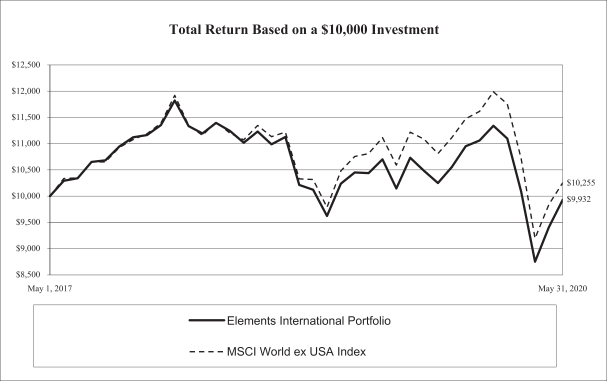

The Elements International Portfolio, the Elements International Small Cap Portfolio and the Elements Emerging Markets Portfolio invest primarily in foreign-issued securities. Investments in foreign (non-U.S.) issuers involve risks not ordinarily associated with exposure to securities and instruments of U.S. issuers, including risks relating to political, social and economic developments affecting issuers located in foreign countries and differences between U.S. and foreign regulatory requirements and market practices, including fluctuations in foreign currency exchange rates and regulations, or foreign withholding taxes. Investing directly or indirectly in foreign securities may result in a Portfolio experiencing more rapid and extreme changes in value than a fund that obtains exposure exclusively in securities of U.S. issuers.

If the Portfolios invest in foreign issuers by purchasing American Depositary Receipts (“ADRs”) (U.S. dollar-denominated depositary receipts issued generally by banks and representing the deposit with the bank of a security of a non-U.S. issuer; ADRs are publicly traded on exchanges or over-the counter in the United States), the Portfolios are exposed to credit risk with respect to the issuer of the ADR, in addition to the risks of the underlying foreign securities.

(h) Other. Investment transactions are recorded on the trade date. Dividend income, less any foreign tax withheld, is recognized on the ex-dividend date and interest income is recognized on an accrual basis, including amortization/accretion of premiums or discounts. Discounts and premiums on securities purchased are amortized over the lives of the respective securities using the constant yield method.

(i) Restricted Securities. The Portfolios may invest a portion of their assets in securities that are restricted, but eligible for purchase and sale by certain qualified institutional buyers, as defined in Rule 144A under the Securities Act of 1933, as amended, as well as other restricted securities. Restricted securities may be resold in transactions that are exempt from registration under Federal securities laws or if the securities are publicly registered. Restricted securities may be deemed illiquid.

(j) REIT Distributions. The character of distributions received from real estate investment trusts (“REITs”) held by the Portfolios is generally made up of net investment income, capital gains, and return of capital. It is the policy of the

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2020 | | |

| | | | |

81