Filed Pursuant to Rule 424(b)(3) and Rule 424(c)

Registration No. 333-198847

Prospectus Supplement No. 21

(To Prospectus filed on July 6, 2015, as supplemented

by Prospectus Supplement No. 1 dated July 14, 2015, Prospectus Supplement No. 2 dated July 28, 2015, Prospectus Supplement No. 3 dated August 4, 2015, Prospectus Supplement No. 4 dated August 12, 2015, Prospectus Supplement No. 5 dated September 17, 2015, Prospectus Supplement No. 6 dated September 18, 2015, Prospectus Supplement No. 7 dated September 24, 2015, Prospectus Supplement No. 8 dated September 25, 2015, Prospectus Supplement No. 9 dated September 30, 2015, Prospectus Supplement No. 10 dated October 2, 2015, Prospectus Supplement No. 11 dated November 3, 2015, Prospectus Supplement No. 12 dated November 10, 2015, Prospectus Supplement No. 13 dated November 18, 2015, Prospectus Supplement No. 14 dated December 1, 2015, Prospectus Supplement No. 15 dated December 8, 2015, Prospectus Supplement No. 16 dated January 8, 2016, Prospectus Supplement No. 17 dated January 11, 2016, Prospectus Supplement No. 18 dated March 11, 2016, Prospectus Supplement No. 19 dated March 30, 2016, and Prospectus Supplement No. 20 dated April 15, 2016)

ENUMERAL BIOMEDICAL HOLDINGS, INC.

This Prospectus Supplement No. 21 supplements the information contained in the Prospectus, dated as of July 6, 2015, as amended by Prospectus Supplement No. 1 dated July 14, 2015, Prospectus Supplement No. 2 dated July 28, 2015, Prospectus Supplement No. 3 dated August 4, 2015, Prospectus Supplement No. 4 dated August 12, 2015, Prospectus Supplement No. 5 dated September 17, 2015, Prospectus Supplement No. 6 dated September 18, 2015, Prospectus Supplement No. 7 dated September 24, 2015, Prospectus Supplement No. 8 dated September 25, 2015, Prospectus Supplement No. 9 dated September 30, 2015, Prospectus Supplement No. 10 dated October 2, 2015, Prospectus Supplement No. 11 dated November 3, 2015, Prospectus Supplement No. 12 dated November 10, 2015, Prospectus Supplement No. 13 dated November 18, 2015, Prospectus Supplement No. 14 dated December 1, 2015, Prospectus Supplement No. 15 dated December 8, 2015, Prospectus Supplement No. 16 dated January 8, 2016, Prospectus Supplement No. 17 dated January 11, 2016, Prospectus Supplement No. 18 dated March 11, 2016, Prospectus Supplement No. 19 dated March 30, 2016, and Prospectus Supplement No. 20 dated April 15, 2016, relating to the resale of up to 52,154,760 shares of our common stock by selling stockholders.

This Prospectus Supplement No. 21 is being filed to include the information set forth in two of our Current Reports on Form 8-K, each of which was filed with the Securities and Exchange Commission on April 18, 2016.

You should read this Prospectus Supplement No. 21 in conjunction with the Prospectus. This Prospectus Supplement No. 21 is qualified by reference to the Prospectus, except to the extent that the information contained in this Prospectus Supplement No. 21 supersedes the information contained in the Prospectus. This Prospectus Supplement No. 21 is not complete without, and may not be utilized except in connection with, the Prospectus.

You should consider carefully the risks that we have described in “Risk Factors” beginning on page 7 of the Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus Supplement is April 18, 2016

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):April 18, 2016

Enumeral Biomedical Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 000-55415 | 99-0376434 |

| (State or Other Jurisdiction | (Commission File | (I.R.S. Employer |

| of Incorporation) | Number) | Identification Number) |

200 CambridgePark Drive, Suite 2000 Cambridge, Massachusetts (Address of Principal Executive Offices) | | 02140 (Zip Code) |

(617) 945-9146

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01 | Entry into a Material Definitive Agreement. |

On April 18, 2016, Enumeral Biomedical Holdings, Inc. (with its subsidiaries, “Enumeral” or the “Company”) entered into a License and Transfer Agreement (the “Agreement”) with Pieris Pharmaceuticals, Inc. and Pieris Pharmaceuticals GmbH (collectively, “Pieris”). Pursuant to the terms of the Agreement, Enumeral is granting Pieris a non-exclusive, royalty-bearing worldwide license to use specified Enumeral patent rights and know-how to research, develop and market fusion proteins consisting of Enumeral’s 388D4 family of anti-PD-1 antibodies linked to one or more Pieris Anticalin proteins for use in the oncology area. Enumeral has agreed not to practice or assist third parties in practicing in an exclusive field consisting of licensed antibodies fused to Anticalin proteins in the oncology area.

Pursuant to the Agreement, Pieris has agreed to pay Enumeral an upfront initial license fee of $250,000. The Agreement also provides that Pieris has an option to continue the license by paying Enumeral an additional maintenance fee in the amount of $750,000 by May 31, 2016. In the event that Pieris does not pay this maintenance fee by May 31, 2016, the Agreement expires and the license granted thereunder automatically terminates.

If Pieris elects to continue the license and pays Enumeral the maintenance fee, the Agreement provides that Pieris shall also receive an option for twelve months following the date of the Agreement to license from Enumeral one of a specified set of antibodies owned by Enumeral on the same terms and conditions as for Enumeral’s 388D4 family of anti-PD-1 antibodies (the “Subsequent Option”). In the event that Pieris exercises the Subsequent Option, Pieris will pay Enumeral an additional undisclosed license fee.

The terms of the Agreement provide for Pieris to pay Enumeral development milestones of up to an aggregate of $37.8 million upon the achievement of specified events, as well as net sales milestone payments of up to an aggregate of $67.5 million upon the achievement of specified net sales thresholds. Pieris also agrees to pay Enumeral royalties in the low-to-lower middle single digits as a percentage of net sales depending on the amount of net sales in the applicable years. In the event that Pieris is required to pay a license fee or royalty to any third party related to the licensed products, the royalty payment due to Enumeral shall be reduced by the amount of such third party fees or payments, up to 50% of the royalty payment for each calendar year due to Enumeral.

The Agreement also provides that in the event Pieris licenses an additional antibody pursuant to the Subsequent Option, any resulting fusion protein products will be subject to additional royalties and development and sales milestones in the same amounts applicable to the fusion proteins linking PD-1 and Anticalins under the initial license.

Pursuant to the terms of the Agreement, Enumeral will indemnify Pieris Indemnitees (as defined in the Agreement) against certain claims specified therein, including with respect to breaches of representations and warranties, as well as claims by the Massachusetts Institute of Technology and other specified entities who are parties to an agreement with Enumeral. In addition, Pieris will indemnify Enumeral Indemnitees (as defined in the Agreement) against certain claims specified therein, including with respect to breaches of representations and warranties, as well as with respect to the development, commercialization, manufacture or use of any Product before or after Marketing Authorization (as such terms are defined in the Agreement). The Agreement also contains customary representations and warranties for both Enumeral and Pieris.

The term of the Agreement ends upon the expiration of the last to expire patent covered under the license. The Agreement may be terminated by Pieris on 30 days’ notice and by Enumeral upon 60 days’ notice of a material breach by Pieris (or 30 days with respect to a breach of payment obligations by Pieris), provided that Pieris has not cured such breach and that dispute resolution procedures specified in the Agreement have been followed. The Agreement will also automatically terminate if Pieris elects to not make the maintenance fee payment described above.

The foregoing summary of the Agreement does not purport to be complete and is qualified in its entirety by reference to the Agreement, a copy of which will be filed as an exhibit to Enumeral’s Quarterly Report on Form 10-Q for the period ending March 31, 2016. Enumeral intends to seek confidential treatment for certain portions of the Agreement.

As of the date of this filing, Enumeral believes that it has sufficient liquidity to fund operations through June 2016. In the event that Pieris exercises its option to continue the license under the Agreement by paying Enumeral an additional maintenance fee in the amount of $750,000 by May 31, 2016, Enumeral believes that it will have sufficient liquidity to fund operations into the third quarter of 2016. The Company continues to explore a range of potential transactions, which may includepublic or private equity offerings, debt financings, collaborations and licensing arrangements, and/or other strategic alternatives, including a merger, sale of assets or other similar transactions. If the Company is unable to preserve or raise additional capital through one or more of such transactions prior to the end of June 2016, or in the third quarter of 2016 in the event Enumeral receives the additional maintenance fee described above, the Company could face substantial liquidity problems and might be required to implement cost reduction strategies. In addition, the Company may be required to downsize or wind down its operations through liquidation, bankruptcy, or a sale of its assets.

On April 18, 2016, Enumeral issued a press release announcing that Enumeral had entered into the Agreement described in Item 1.01 above. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

| Item 9.01 | Financial Statements and Exhibits. |

Exhibit

Number | | Description |

| | | |

| 99.1 | | Press Release of the Company, dated April 18, 2016 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | ENUMERAL BIOMEDICAL HOLDINGS, INC. |

| | | |

| Dated: April 18, 2016 | By: | /s/ Kevin G. Sarney |

| | | Name: Kevin G. Sarney |

| | | Title: Vice President of Finance, Chief Accounting Officer and Treasurer |

EXHIBIT INDEX

Exhibit

No. | | Description |

| | | |

| 99.1 | | Press Release of the Company, dated April 18, 2016 |

Exhibit 99.1

Enumeral and Pieris Pharmaceuticals Enter into

License and Transfer Agreement

CAMBRIDGE, Mass.—April 18, 2016—Enumeral Biomedical Holdings, Inc. (OTCQB: ENUM) (“Enumeral” or the “Company”), a biotechnology company focused on discovering and developing novel antibody-based immunotherapies to help the immune system fight cancer and other diseases, today announced that it has entered into a License and Transfer Agreement (the “License Agreement”) with Pieris Pharmaceuticals, Inc. and Pieris Pharmaceuticals GmbH (collectively, “Pieris”).

Pursuant to the terms and conditions of the License Agreement, Pieris is licensing from Enumeral specified intellectual property related to Enumeral’s anti-PD-1 antibody program ENUM 388D4 for the potential development and commercialization by Pieris of novel multispecific therapeutic proteins comprising fusion proteins based on Pieris’ Anticalins® class of therapeutic proteins and Enumeral antibodies in the field of oncology.

Under the License Agreement, Pieris has agreed to pay Enumeral a $250,000 initial license fee, and Enumeral is providing Pieris with sequence and related information for Enumeral’s 388D4 family of anti-PD-1 antibodies. The License Agreement provides that Pieris may continue the license by paying Enumeral an additional maintenance fee in the amount of $750,000 by May 31, 2016. In the event that Pieris does not pay this maintenance fee by May 31, 2016, the License Agreement expires and the license granted thereunder automatically terminates.

If Pieris elects to continue the license and pays Enumeral the maintenance fee, the License Agreement provides that Pieris shall also receive a twelve-month option to license Enumeral intellectual property related to an additional antibody program on the same terms and conditions as for the ENUM 388D4 family of anti-PD-1 antibodies (the “Subsequent Option”). The antibody subject to the Subsequent Option will be selected by Pieris from a specified list of antibodies owned by Enumeral. In the event that Pieris exercises the Subsequent Option, Pieris will pay Enumeral an additional undisclosed license fee.

The terms of the License Agreement provide for Pieris to pay Enumeral development milestones of up to an aggregate of $37.8 million upon the achievement of specified events, as well as net sales milestone payments of up to an aggregate of $67.5 million upon the achievement of specified net sales thresholds. Under the License Agreement, Pieris also agrees to pay Enumeral royalties in the low-to-lower middle single digits as a percentage of net sales depending on the amount of net sales in the applicable years. In the event that Pieris licenses an additional antibody pursuant to the Subsequent Option, any resulting fusion protein products will be subject to additional royalties and development and sales milestones in the same amounts applicable to the fusion proteins linking PD-1 and Anticalins under the initial license.

“We are excited that Pieris has decided to work with our antibody sequences, and we are encouraged that these sequences could become part of a novel class of therapeutic based on Pieris’ Anticalin platform,” said Cokey Nguyen, Ph.D., Enumeral’s Vice President of Research and Development. “Enumeral has been able to generate antibodies using our proprietary platform technology in a very efficient manner, and this transaction is further validation of the Enumeral approach. We look forward to working with Pieris as we pursue our mutual interests under the License Agreement.”

“Gaining access to Enumeral’s valuable PD-1 antibody IP not only enables Pieris to leverage its antibody-Anticalin multispecifics capabilities with a cornerstone immune checkpoint inhibitor, but also brings a high level of intra-pipeline synergy, including with Pieris’ lead CD137 bispecific immune costimulator candidate PRS-343,” commented Pieris President and CEO, Stephen S. Yoder. “This license gives Pieris an opportunity to independently develop anti-PD-1 antibody-Anticalin multispecific immune checkpoint inhibitors as next generation cancer immunotherapeutics.”

About Enumeral

Enumeral is a biopharmaceutical company discovering and developing novel antibody immunotherapies that help the immune system fight cancer and other diseases. The Company is building a pipeline focused on next-generation checkpoint modulators, with initial targets including PD-1, TIM-3, LAG-3, OX40, and VISTA. In developing these agents, Enumeral’s researchers apply a proprietary immune profiling technology platform that measures functioning of the human immune system at the level of individual cells, providing key insights for candidate selection and validation. For more information on Enumeral, please visit www.enumeral.com.

About Pieris

Pieris Pharmaceuticals is a clinical-stage biotechnology company that discovers and develops Anticalin-based drugs to target validated disease pathways in a unique and transformative way. Pieris’ pipeline includes immuno-oncology multi-specifics tailored for the tumor micro-environment, an inhaled Anticalin to treat uncontrolled asthma and a half-life-optimized Anticalin to treat anemia. Proprietary to Pieris, Anticalins are a novel class of protein therapeutics validated in the clinic and by partnerships with leading pharmaceutical companies. Anticalin®, Anticalins® are registered trademarks of Pieris. For more information, visit www.pieris.com.

Forward Looking Statements Disclosure

This press release contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Such statements reflect current beliefs of Enumeral Biomedical Holdings, Inc. (“Enumeral”) with respect to future events and involve known and unknown risks, uncertainties, and other factors affecting operations, market growth, Enumeral’s stock price, services, products and licenses. No assurances can be given regarding the achievement of future results, and although Enumeral believes that the expectations reflected in these forward-looking statements are based on reasonable assumptions, actual results may differ from the assumptions underlying the statements that have been made regarding anticipated events. Factors that may cause actual results, performance or achievements, or industry results to differ materially from those contemplated by such forward-looking statements include, among others, the risks that (a) Enumeral’s expectations regarding market acceptance of the Company’s business in general and the Company’s ability to penetrate the antibody discovery and development fields in particular, as well as the timing of such acceptance, (b) Enumeral’s ability to attract and retain management with experience in biotechnology and antibody discovery and similar emerging technologies, (c) the scope, validity and enforceability of Enumeral’s and third party intellectual property rights, (d) Enumeral’s ability to raise capital when needed and on acceptable terms and conditions, (e) Enumeral’s ability to comply with governmental regulation, (f) the intensity of competition, (g) changes in the political and regulatory environment and in business and fiscal conditions in the United States and overseas and (h) general economic conditions.

More detailed information about Enumeral and risk factors that may affect the realization of forward-looking statements, including forward-looking statements in this press release, is set forth in Enumeral’s filings with the Securities and Exchange Commission. Enumeral urges investors and security holders to read those documents free of charge at the Commission’s website at http://www.sec.gov. Forward-looking statements speak only as to the date they are made, and except for any obligation under the U.S. federal securities laws, Enumeral undertakes no obligation to publicly update any forward-looking statement as a result of new information, future events or otherwise.

Contact

Enumeral Biomedical Holdings, Inc.

Kevin Sarney, (617) 945-9146

kevin@enumeral.com

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):April 18, 2016

Enumeral Biomedical Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 000-55415 | 99-0376434 |

| (State or Other Jurisdiction | (Commission File | (I.R.S. Employer |

| of Incorporation) | Number) | Identification Number) |

| 200 CambridgePark Drive, Suite 2000 | |

| Cambridge, Massachusetts | 02140 |

| (Address of Principal Executive Offices) | (Zip Code) |

(617) 945-9146

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

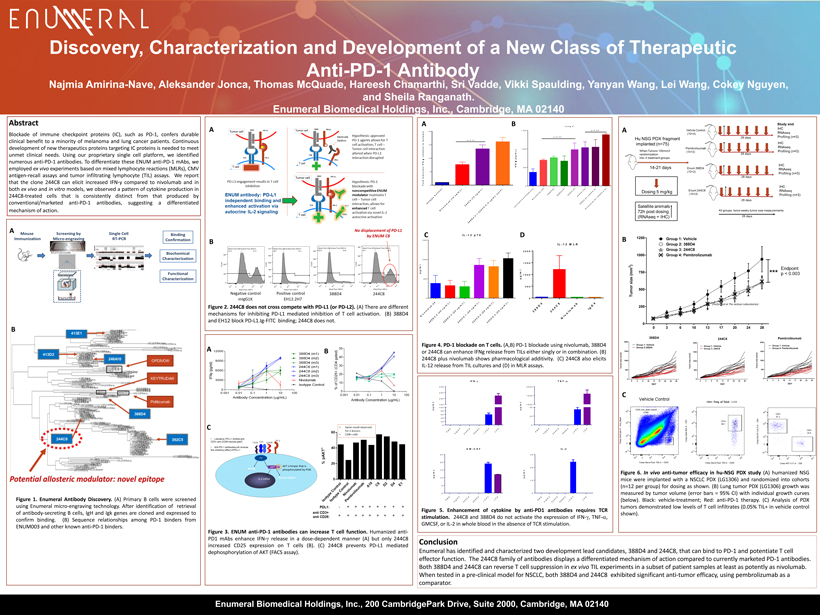

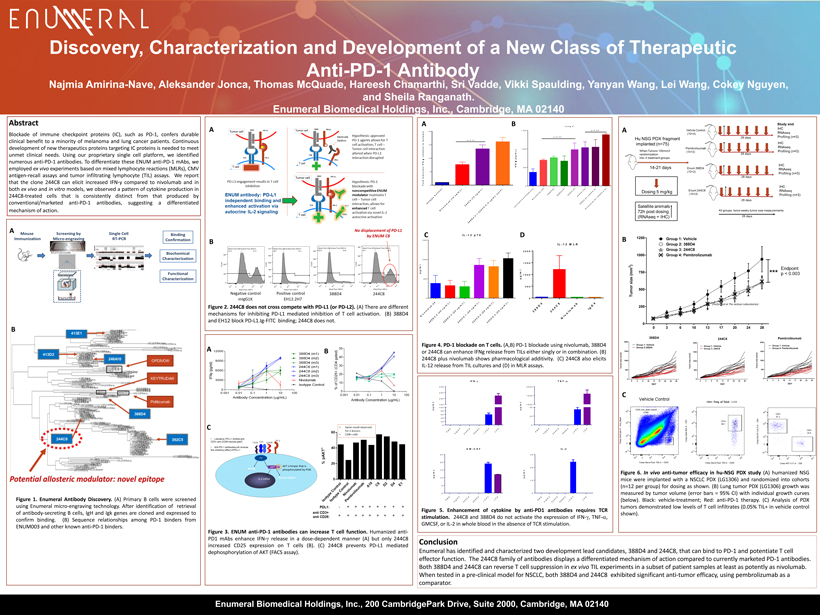

Item 7.01 Regulation FD Disclosure.

Enumeral Biomedical Holdings, Inc. (the “Company”) may use a poster presentation, in whole or in part, from time to time in presentations to potential partners, investors, analysts and others. A copy of the poster presentation is furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference herein. A copy of this poster presentation is also available on the Company’s website atwww.enumeral.com.

The information in this Item 7.01 of this Current Report on Form 8-K and in the accompanying Exhibit 99.1 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this Item 7.01 of this Current Report on Form 8-K and in the accompanying Exhibit 99.1 shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit

Number | | Description |

| 99.1 | | Enumeral Biomedical Holdings, Inc. April 2016 Poster Presentation Entitled “Discovery, Characterization and Development of a New Class of Therapeutic Anti-PD-1 Antibody” |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | ENUMERAL BIOMEDICAL HOLDINGS, INC. |

| | |

| Dated: April 18, 2016 | By: | /s/ Kevin G. Sarney |

| | | Name: Kevin G. Sarney |

| | | Title: Vice President of Finance, Chief Accounting Officer and Treasurer |

EXHIBIT INDEX

Exhibit

No. | | Description |

| | | |

| 99.1 | | Enumeral Biomedical Holdings, Inc. April 2016 Poster Presentation Entitled “Discovery, Characterization and Development of a New Class of Therapeutic Anti-PD-1 Antibody” |

Exhibit 99.1

N i v o l u m a b - 2 0 3 8 8 D 4 - 2 ( 2 0 u g / m L ) 3 8 8 D 4 - 3 ( 2 0 u g / m L ) 2 4 4 C 8 - 1 ( 2 0 u g / m L ) 2 4 4 C 8 - 2 ( 2 0 u g / m L ) 2 4 4 C 8 - 3 ( 2 0 u g / m L ) 0 500 1000 1500 IL-12 p70 p g / m l Discovery, C haracterization and Development of a New C lass of T herapeutic A nti - PD - 1 A ntibody Abstract Blockade of immune checkpoint proteins (IC), such as PD - 1 , confers durable clinical benefit to a minority of melanoma and lung cancer patients . Continuous development of new therapeutics proteins targeting IC proteins is needed to meet unmet clinical needs . Using our proprietary single cell platform , we identified numerous anti - PD - 1 antibodies . To differentiate these ENUM anti - PD - 1 mAbs , we employed ex vivo experiments based on mixed lymphocyte reactions ( MLRs), CMV antigen - recall assays and tumor infiltrating lymphocyte ( TIL) assays . We report that the clone 244 C 8 can elicit increased IFN - y compared to nivolumab and in both ex vivo and in vitro models, we observed a pattern of cytokine production in 244 C 8 - treated cells that is consistently distinct from that produced by conventional/marketed anti - PD - 1 antibodies, suggesting a differentiated mechanism of action . Figure 1 . Enumeral Antibody Discovery . (A) Primary B cells were screened using Enumeral micro - engraving technology . After identification of retrieval of antibody - secreting B cells, IgH and Igk genes are cloned and expressed to confirm binding . (B) Sequence relationships among PD - 1 binders from ENUM 003 and other known anti - PD - 1 binders . Conclusion Enumeral has identified and characterized two development lead candidates, 388D4 and 244C8, that can bind to PD - 1 and potentiate T cell effector function. The 244C8 family of antibodies displays a differentiated mechanism of action compared to currently marketed PD - 1 antibodies. Both 388D4 and 244C8 can reverse T cell suppression in ex vivo TIL experiments in a subset of patient samples at least as potently as nivolumab . When tested in a pre - clinical model for NSCLC, both 388D4 and 244C8 exhibited significant anti - tumor efficacy, using pembrolizumab as a comparator. Figure 3 . ENUM anti - PD - 1 a ntibodies can increase T cell function . Humanized anti - PD 1 mAbs enhance IFN - g release in a dose - dependent manner (A ) but only 244 C 8 increased CD 25 expression on T cells (B) . (C) 244 C 8 prevents PD - L 1 mediated dephosphorylation of AKT (FACS assay) . A B A A B Najmia Amirina - Nave, Aleksander Jonca, Thomas McQuade, Hareesh Chamarthi, Sri Vadde, Vikki Spaulding, Yanyan Wang, Lei Wang, Cok ey Nguyen, and Sheila Ranganath. Enumeral Biomedical Holdings, Inc., Cambridge, MA 02140 Figure 6 . In vivo anti - tumor efficacy in hu - NSG PDX study (A) humanized NSG mice were implanted with a NSCLC PDX (LG 1306 ) and randomized into cohorts (n= 12 per group) for dosing as shown . (B) Lung tumor PDX (LG 1306 ) growth was measured by tumor volume (error bars = 95 % CI) with individual growth curves (below) . Black : vehicle - treatment ; Red : anti - PD - 1 therapy . (C) Analysis of PDX tumors demonstrated low levels of T cell infiltrates ( 0 . 05 % TIL+ in vehicle control shown) . Figure 2 . 244 C 8 does not cross compete with PD - L 1 (or PD - L 2 ) . (A) There are different mechanisms for inhibiting PD - L 1 mediated inhibition of T cell activation . (B) 388 D 4 and EH 12 block PD - L 1 . Ig - FITC binding ; 244 C 8 does not . Figure 4 . PD - 1 blockade on T cells . (A,B) PD - 1 blockade using nivolumab , 388 D 4 or 244 C 8 can enhance IFNg release from TILs either singly or in combination . (B) 244 C 8 plus nivolumab shows pharmacological additivity . (C) 244 C 8 also elicits IL - 12 release from TIL cultures and (D) in MLR assays . Figure 5 . Enhancement of cytokine by anti - PD 1 antibodies requires TCR stimulation . 244 C 8 and 388 D 4 do not activate the expression of IFN - g , TNF - a , GMCSF, or IL - 2 in whole blood in the absence of TCR stimulation . A B C B C A B I s o t y p e C o n t r o l N i v o l u m a b ( 1 0 u g / m L ) 2 4 4 C 8 ( 1 0 u g / m L ) 3 8 8 D 4 - 2 + 2 4 4 C 8 - 2 ( 5 u g / m L e a c h ) 0 5 10 15 20 F o l d I n d u c t i o n I F N - ( r e l a t i v e t o I s o t y p e ) p<0.01 C (Performed at The Jackson Laboratories) Enumeral Biomedical Holdings, Inc., 200 CambridgePark Drive, Suite 2000, Cambridge, MA 02140 3 8 8 D 4 2 4 4 C 8 N i v o l u m a b I g G 4 0 500 1000 1500 2000 IL-12 MLR p g / m l a n t i - C D 3 + a n t i - C D 2 8 o n l y N i v o l u m a b ( 1 0 ) 3 8 8 D 4 ( 5 ) 3 8 8 D 4 ( 1 0 ) 2 4 4 C 8 ( 5 ) 2 4 4 C 8 ( 1 0 ) 3 8 8 D 4 ( 5 ) + 2 4 4 C 8 ( 5 ) N i v o l u m a b ( 5 ) + 2 4 4 C 8 - 2 ( 5 ) 0 500 1,000 1,500 Lung 4 I F N - ( p g / m L ) p<0.05 p<0.05 D