As filed with the Securities and Exchange Commission on 21 March 2016

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 20-F

(Mark One)

☐REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

or

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended 31 December 2015

or

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

or

☐SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report

For the transition period from to

Commission file number: 001-35785

Sibanye Gold Limited

(Exact name of registrant as specified in its charter)

Republic of South Africa

(Jurisdiction of incorporation or organization)

Libanon Business Park

1 Hospital Street (off Cedar Avenue)

Libanon, Westonaria, 1780

South Africa.

011-27-11-278-9600

(Address of principal executive offices)

With copies to:

Charl Keyter

Chief Financial Officer

Sibanye Gold Limited

Tel: 011-27-11-278-9700

Fax: 011-27-11-278-9863

Libanon Business Park

1 Hospital Street (off Cedar Avenue)

Libanon, Westonaria, 1780

South Africa

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

and

Thomas B. Shropshire, Jr.

Linklaters LLP

Tel: 011-44-20-7456-3223

Fax: 011-44-20-7456-2222

One Silk Street

London EC2Y 8HQ

United Kingdom

Securities registered or to be registered pursuant to Section 12(b) of the Act

| | |

Title of Each Class

Ordinary shares of no par value each

American Depositary Shares, each representing four ordinary shares | Name of Each Exchange on Which Registered

New York Stock Exchange*

New York Stock Exchange |

*Not for trading, but only in connection with the registration of the American Depositary Shares pursuant to the requirements of the Securities and Exchange Commission. Securities registered or to be registered pursuant to Section 12(g) of the Act None (Title of Class) Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act None (Title of Class) Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock

as of the close of the period covered by the Annual Report 916,140,552 ordinary shares of no par value each |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act: Yes ☒ No If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes No ☒ Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections. Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes No Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files)*. Yes No Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one): Large accelerated filer ☒Accelerated filer Non-accelerated filer Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing: |

US GAAP | International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ | Other |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: Item 17 Item 18 If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No ☒ (APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS) Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes No |

* This requirement does not apply to the registrant

FORM 20-F CROSS REFERENCE GUIDE

| | | | | | |

Item | | Form 20-F Caption | | Location in this document | | Page |

1 | | Identity of directors, senior management and advisers | | NA | | NA |

2 | | Offer statistics and expected timetable | | NA | | NA |

3 | | Key information | | | | |

| | (a) Selected Financial Data | | Annual Financial Report—Overview——Five year financial performance | | 76-77 |

| | (b) Capitalisation and indebtedness | | NA | | NA |

| | (c) Reasons for the offer | | NA | | NA |

| | (d) Risk factors | | Further Information—Risk Factors | | 183-195 |

4 | | Information on the Company | | | | |

| | (a) History and Development of the Company | | Annual Financial Report—Administrative Details—Administration and corporate information | | 182 |

| | | | Integrated Annual Report—About Sibanye’s reports | | 12 |

| | | | Integrated Annual Report—Group profile | | 13-14 |

| | | | Integrated Annual Report—Perspective from the Chair | | 18-19 |

| | | | Integrated Annual Report—Chief Executive’s review | | 20-23 |

| | | | Annual Financial Report—Accountability—Directors’ report | | 111-115 |

| | | | Annual Financial Report—Overview——Five year financial performance | | 76-77 |

| | | | Integrated Annual Report—Capitals overview and business model | | 24-25 |

| | | | Integrated Annual Report—Grow—Acquisitions and funding model | | 72 |

| | | | Annual Financial Report— Overview—Management’s discussion and analysis of the financial statements—Acquisitions | | 80-82 |

| | | | Annual Financial Report—Annual Financial Statements—Notes to the consolidated financial statements—Note 12: Acquisitions | | 151-153 |

| | | | Further Information—Acquisition Assets | | 202-207 |

| | (b) Business Overview | | Integrated Annual Report—Group profile | | 13-14 |

| | | | Integrated Annual Report—Capitals overview and business model | | 24-25 |

| | | | Integrated Annual Report—Optimise | | 39-50 |

| | | | Integrated Annual Report—Sustain—Manage environmental impact | | 60-64 |

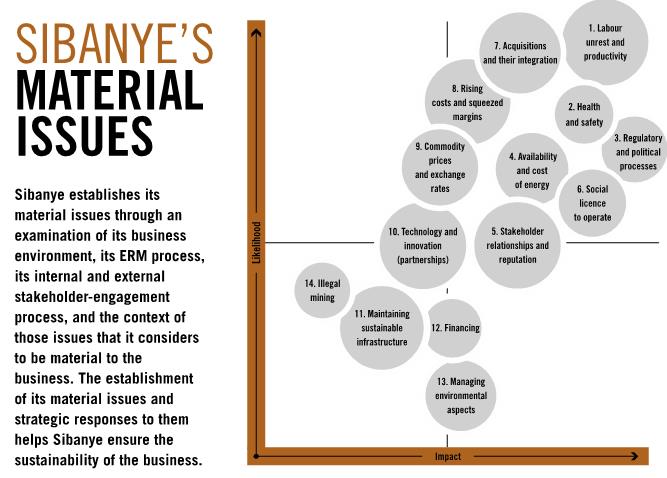

| | | | Integrated Annual Report—Material issues | | 26-38 |

| | | | Annual Financial Report—Overview——Five year financial performance | | 76-77 |

| | | | | | |

Item | | Form 20-F Caption | | Location in this document | | Page |

| | | | Further Information—Environmental and Regulatory Matters | | 208-212 |

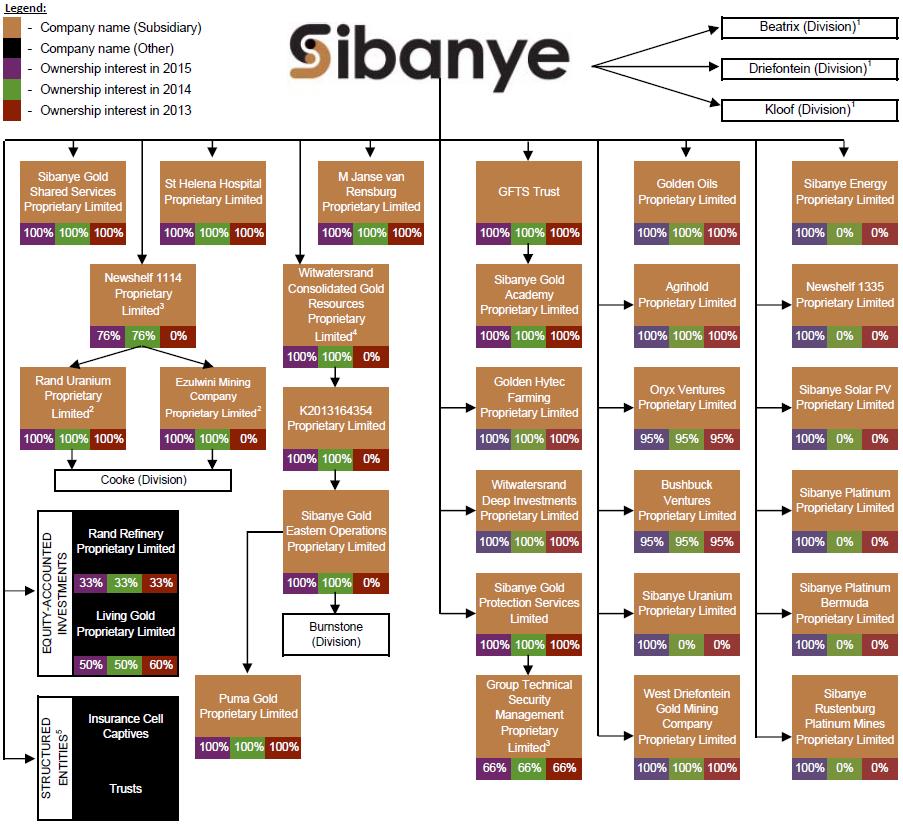

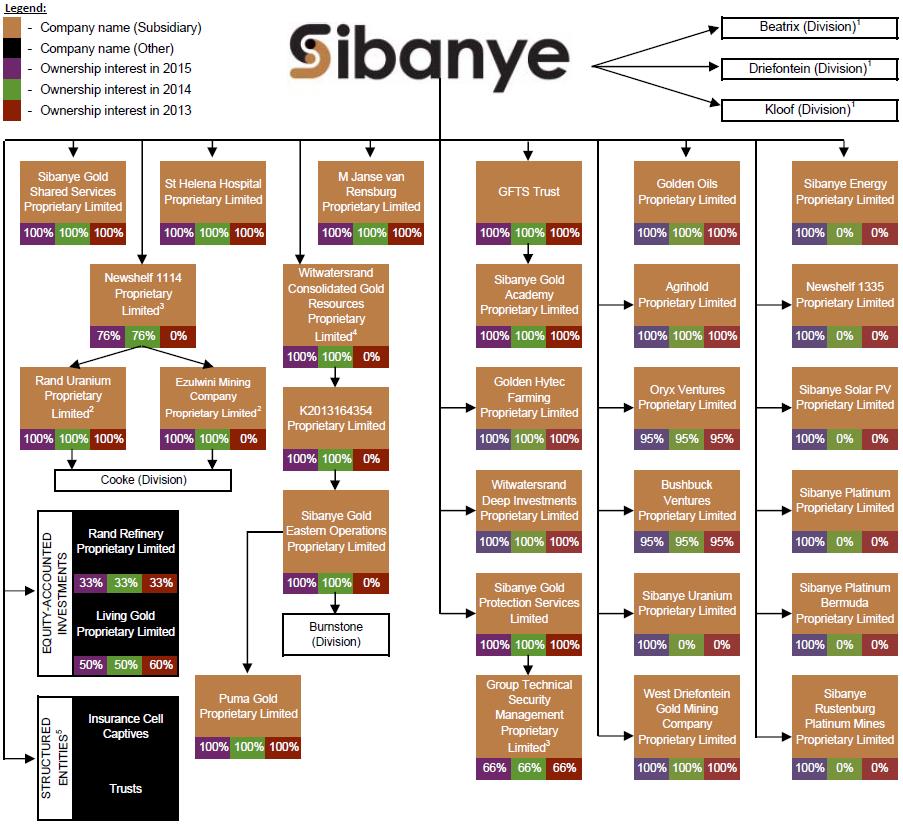

| | (c) Organisational structure | | Integrated Annual Report—Group profile | | 13-14 |

| | | | Annual Financial Report—Annual Financial Statements—Notes to the consolidated financial statements—Note 1.3: Consolidation | | 133-134 |

| | (d) Property, plant and equipment | | Integrated Annual Report—Optimise—Optimise and integrate operations | | 39-45 |

| | | | Further Information—Reserves of Sibanye as of 31 December 2015 | | 196-201 |

| | | | Further Information—Acquisition Assets | | 202-207 |

| | | | Further Information—Environmental and Regulatory Matters | | 208-212 |

| | | | Annual Financial Report—Annual Financial Statements—Notes to the consolidated financial statements—Note 11: Property, plant and equipment | | 146-150 |

4A | | Unresolved staff comments | | NA | | NA |

5 | | Operating and financial review and prospects | | | | |

| | (a) Operating results | | Annual Financial Report—Overview—Management’s discussion and analysis of the financial statements | | 78-95 |

| | | | Annual Financial Report—Annual Financial Statements—Consolidated income statement | | 127 |

| | | | Annual Financial Report—Annual Financial Statements—Consolidated statement of financial position | | 128 |

| | | | Annual Financial Report—Annual Financial Statements—Consolidated statement of cash flows | | 130 |

| | (b) Liquidity and capital resources | | Annual Financial Report—Overview—Management’s discussion and analysis of the financial statements—Liquidity and capital resources | | 91-94 |

| | (c) Research and development, patents and licences, etc. | | NA | | NA |

| | (d) Trend information | | Annual Financial Report—Overview—Management’s discussion and analysis of the financial statements | | 78-95 |

| | (e) Off-balance sheet arrangements | | Annual Financial Report—Overview—Management’s discussion and analysis of the financial statements—Off balance sheet arrangements and contractual commitments | | 94 |

| | (f) Tabular disclosure of contractual obligations | | Annual Financial Report—Overview—Management’s discussion and analysis of the financial statements—Off balance sheet arrangements and contractual commitments | | 94 |

| | (g) Safe harbour | | Forward-looking statements | | 9 |

| | | | | | |

Item | | Form 20-F Caption | | Location in this document | | Page |

6 | | Directors, senior management and employees | | | | |

| | (a) Directors and senior management | | Annual Financial Report—Accountability—Board of directors and management | | 98-102 |

| | (b) Compensation | | Annual Financial Report—Accountability—Remuneration report | | 118-125 |

| | (c) Board practices | | Annual Financial Report—Accountability—Corporate governance report | | 103-108 |

| | (d) Employees | | Integrated Annual Report—Optimise—Develop productive, skilled and engaged workforce | | 46-50 |

| | (e) Share ownership | | Annual Financial Report—Accountability—Remuneration report | | 118-125 |

| | | | Annual Financial Report—Overview—Management’s discussion and analysis of the financial statements—Share-based payments | | 89 |

| | | | Annual Financial Report—Annual Financial Statements—Notes to the consolidated financial statements—Note 6: Share-based payments | | 139-142 |

7 | | Major Shareholders and Related Party Transactions | | | | |

| | (a) Major shareholders | | Annual Financial Report—Administrative Details—Shareholder ownership | | 180-181 |

| | | | Integrated Annual Report—Group profile | | 13-14 |

| | | | Further Information—The Offer and Listing | | 214-215 |

| | (b) Related party transactions | | Annual Financial Report—Accountability—Directors’ report | | 111-115 |

| | | | Annual Financial Report—Annual Financial Statements—Notes to the consolidated financial statements—Note 34: Related-party transactions | | 177-178 |

| | (c) Interests of experts and counsel | | NA | | NA |

8 | | Financial information | | | | |

| | (a) Consolidated statements and other financial information | | Annual Financial Report—Overview—Management’s discussion and analysis of the financial statements | | 78-95 |

| | | | Annual Financial Report—Annual Financial Statements—Consolidated income statement | | 127 |

| | | | Annual Financial Report—Annual Financial Statements—Consolidated statement of financial position | | 128 |

| | | | Annual Financial Report—Annual Financial Statements—Consolidated statement of cash flows | | 130 |

| | | | Annual Financial Report—Accountability—Directors’ report—Financial affairs—Dividend policy | | 112 |

| | | | | | |

Item | | Form 20-F Caption | | Location in this document | | Page |

| | | | Further information—Financial information—Dividend policy and dividend distributions | | 213 |

| | (b) Significant Changes | | NA | | NA |

9 | | The Offer and Listing | | | | |

| | (a) Offer and listing details | | Further Information—The Offer and Listing | | 214-215 |

| | (b) Plan of distribution | | NA | | NA |

| | (c) Markets | | Further Information—The Offer and Listing | | 214-215 |

| | (d) Selling shareholders | | NA | | NA |

| | (e) Dilution | | NA | | NA |

| | (f) Expenses of the issue | | NA | | NA |

10 | | Additional information | | | | |

| | (a) Share capital | | NA | | NA |

| | (b) Memorandum and articles of association | | Further Information—Additional Information—Memorandum of Incorporation | | 216 |

| | (c) Material contracts | | Further Information—Additional Information—Material Contracts | | 216-218 |

| | (d) Exchange controls | | Further Information—Additional Information—South African Exchange Control Limitations Affecting Security Holders | | 223 |

| | | | Further Information—Environmental and Regulatory Matters—Exchange Controls | | 212 |

| | (e) Taxation | | Further Information—Additional Information—Taxation | | 223-226 |

| | (f) Dividends and paying agents | | NA | | NA |

| | (g) Statement by experts | | NA | | NA |

| | (h) Documents on display | | Further Information—Additional Information—Documents on display | | 226-227 |

| | (i) Subsidiary information | | NA | | NA |

11 | | Quantitative and qualitative disclosures about market risk | | Annual Financial Report—Annual Financial Statements—Notes to the Consolidated Financial Statements—Note 33: Risk Management Activities | | 173-177 |

12 | | Description of securities other than equity securities | | | | |

| | (a) Debt securities | | NA | | NA |

| | (b) Warrants and rights | | NA | | NA |

| | (c) Other securities | | NA | | NA |

| | (d) American depositary shares | | Further Information—Additional Information—American Depositary Shares | | 218-223 |

13 | | Defaults, dividend arrearages and delinquencies | | NA | | NA |

14 | | Material modifications to the rights of security holders and use of proceeds | | NA | | NA |

| | | | | | |

Item | | Form 20-F Caption | | Location in this document | | Page |

15 | | Controls and procedures | | Further Information—Controls and Procedures | | 228 |

16A | | Audit Committee Financial Expert | | Annual Financial Report—Accountability—Corporate governance report—Board committees—The Audit Committee | | 105-106 |

16B | | Code of ethics | | Annual Financial Report—Accountability—Corporate governance report—Key Standards and Principles | | 103 |

16C | | Principal accountant fees and services | | Annual Financial Report—Accountability—Report of the Audit Committee | | 109-110 |

16D | | Exemptions from the listing standards for audit committees | | NA | | NA |

16E | | Purchase of equity securities by the issuer and affiliated purchasers | | None | | |

16F | | Change in registrant’s certifying accountant | | NA | | NA |

16G | | Corporate governance | | Annual Financial Report—Accountability—Corporate governance report—Corporate Governance | | 108 |

16H | | Mine safety disclosure | | NA | | NA |

17 | | Financial statements | | NA | | NA |

18 | | Financial statements | | Annual Financial Report—Accountability—Report of Independent Registered Public Accounting Firm | | 117 |

| | | | Annual Financial Report—Annual Financial Statements—Consolidated income statement | | 127 |

| | | | Annual Financial Report—Annual Financial Statements—Consolidated statement of financial position | | 128 |

| | | | Annual Financial Report—Annual Financial Statements—Consolidated Statement of Changes in Equity | | 129 |

| | | | Annual Financial Report—Annual Financial Statements—Consolidated statement of cash flows | | 130 |

| | | | Annual Financial Report—Annual Financial Statements—Notes to the consolidated financial statements | | 131-178 |

19 | | Exhibits | | Exhibits | | 229-230 |

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

Historical Consolidated Financial Statements

Sibanye Gold Limited (Sibanye) is a South African company and all of our existing operations are located in South Africa. Accordingly, our books of account are maintained in South African Rand and our annual financial statements are prepared in accordance with International Financial Reporting Standards (IFRS), as issued by the International Accounting Standards Board, as prescribed by law. These financial statements are distributed to shareholders and are submitted to the Johannesburg Stock Exchange (JSE) and the New York Stock Exchange (NYSE).

In previous years, the IFRS financial statements were furnished to the Securities and Exchange Commission (SEC) on Form 6-K. Until 31 December 2013, Sibanye also prepared annual financial statements in accordance with United States Generally Accepted Accounting Principles (US GAAP) for inclusion in the annual report on Form 20-F, which were translated into US dollars. Sibanye has prepared the annual financial statements contained in this annual report on Form 20-F for the fiscal years ended 31 December 2015, 2014 and 2013 and as at 31 December 2015, 2014 and 2013 in accordance with IFRS. Sibanye changed to reporting in accordance with IFRS in our Form 20-F to remove duplication, improve efficiencies as we report in accordance with IFRS in South Africa, our home country, and align with the majority of our peers.

The audited consolidated financial statements of Sibanye as at and for the fiscal years ended 31 December 2015, 2014 and 2013 (the Consolidated Financial Statements) have been prepared using the historical results of operations, assets and liabilities attributable to Sibanye and all of its subsidiaries (the Sibanye Group). In addition, the Consolidated Financial Statements include historical charges from Gold Fields Limited (Gold Fields). The Consolidated Financial Statements have been prepared under the historical cost convention, except for financial assets and financial liabilities (including derivative financial instruments), which are measured at fair value through profit or loss or through the fair value adjustment reserve in equity.

Non-IFRS Measures

The financial information in this annual report includes certain measures that are not defined by IFRS, including “operating costs”, “operating margin,”, “earnings before interest, tax, depreciation and amortisation” (EBITDA), “total cash cost”, “All-in sustaining cost”, “All-in cost”, “All-in cost margin”, “headline earnings per share”, “free cash flow” and “net debt” (each as defined below or in “Annual Financial Report—Overview—Five year financial performance”). These measures are not measures of financial performance or cash flows under IFRS and may not be comparable to similarly titled measures of other companies. These measures have been included for the reasons described below or in “Annual Financial Report—Overview—Five year financial performance” and should not be considered by investors as alternatives to costs of sales, net operating profit, profit before taxation, cash from operating activities or any other measure of financial performance presented in accordance with IFRS.

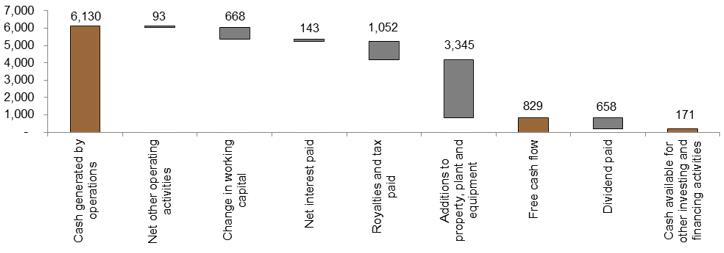

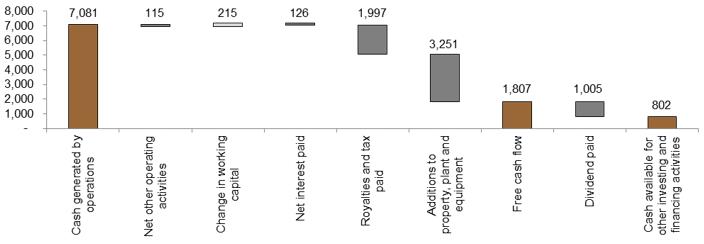

Operating costs is defined as cost of sales excluding amortisation and depreciation. Operating margin is defined as revenue minus operating costs, divided by revenue. Free cash flow is defined as cash flows from operating activities before dividends paid, less additions to property, plant and equipment. Management considers free cash flow to be an indicator of cash available for repaying debt, funding exploration and paying dividends.

See “Annual Financial Report—Overview—Five year financial performance—Footnote 1” and “Annual Financial Report—Overview—Five year financial performance—Footnote 2” for more information.

Conversion Rates

Certain information in this annual report presented in Rand has been translated into US dollars. Unless otherwise stated, the conversion rate for these translations is R15.54/US$1.00 which was the closing rate on 31 December 2015. By including the US dollar equivalents, Sibanye is not representing that the Rand amounts actually represent the US dollar amounts shown or that these amounts could be converted into US dollars at the rates indicated.

The Acquisitions of the Rustenburg Operations and Aquarius

On 9 September 2015, Sibanye announced that it entered into an agreement with Rustenburg Platinum Mines Limited (RPM), a wholly owned subsidiary of Anglo American Platinum Limited (Anglo American Platinum) to acquire the Bathopele, Siphumelele (including Khomanani), and Thembelani (including Khuseleka) mining operations, two concentrating plants, an on-site chrome recovery plant, the Western Limb Tailings Retreatment Plant, associated surface infrastructure and related assets and liabilities on a going concern basis (the Rustenburg Operations) (the Rustenburg Transaction).

On 6 October 2015, Sibanye announced a cash offer of US$0.195 per share for the entire issued share capital of Aquarius (the Aquarius Transaction and, together with the Rustenburg Transaction, the Acquisitions). Aquarius owns stakes in the Kroondal mine and Platinum Mile retreatment facilities near Rustenburg in South Africa and the Mimosa joint venture with Impala Platinum in Zimbabwe. Both Acquisitions remain subject to conditions precedent.

This annual report contains operational and financial information regarding the Rustenburg Operations and the operations of Aquarius which have been extracted without material adjustment from the publicly available information regarding these operations published by Anglo American Platinum and Aquarius, respectively. Sibanye has not independently verified the completeness or accuracy of this information and such information was not prepared for the purpose of this annual report.

The ore reserve statements of the Rustenburg Operations and Aquarius have not been included in this annual report because they have not been prepared in accordance with Industry Guide 7. Management believes that the Acquisitions will add a substantial amount of platinum group metals (PGMs) (4E) to Sibanye’s ore reserves.

Investors should note that the Acquisitions remain subject to conditions precedent, including obtaining clearances from the DMR with regard to the Rustenburg Operations.

Market Information

This annual report includes industry data about Sibanye’s markets obtained from industry surveys, industry publications, market research and other publicly available third-party information. Industry surveys and industry publications generally state that the information they contain has been obtained from sources believed to be reliable but that the accuracy and completeness of such information is not guaranteed. Sibanye and its advisers have not independently verified this data.

In addition, in many cases statements in this annual report regarding the gold mining industry and Sibanye’s position in that industry have been made based on internal surveys, industry forecasts, market research, as well as Sibanye’s own experiences. While these statements are believed by Sibanye to be reliable, they have not been independently verified.

DEFINED TERMS AND CONVENTIONS

In this annual report, all references to “we”, “us” and “our” refer to Sibanye and the Sibanye Group, as applicable. On 18 February 2013, the board of directors of Gold Fields completed the separation of its wholly-owned subsidiary, Sibanye (formerly known as GFI Mining South Africa Proprietary Limited (GFIMSA)), into an independent, publicly traded company (the Spin-off). The Spin-off was achieved by way of Gold Fields making a distribution on a pro rata basis of one Sibanye share for every one Gold Fields share (whether held in the form of shares, American Depositary Receipts (ADRs) or international depositary receipts) to Gold Fields shareholders, registered as such in Gold Fields’ register at close of business on 15 February 2013, in terms of section 46 of the South African Companies Act, 2008 (Act No 71 of 2008) (the Companies Act), section 46 of the Income Tax Act and the JSE Listing Requirements. The board of directors of Gold Fields passed the resolution necessary to implement the Spin-off on 12 December 2012, and Sibanye shares were listed on the JSE as well as on the NYSE on 11 February 2013. As of the Spin-off date, Gold Fields and Sibanye were independent, publicly traded companies and with separate public ownership, boards of directors and management. Results of operations for the periods prior to the Spin-off date are for GFIMSA when it was operated as a wholly-owned subsidiary of Gold Fields.

In this annual report, all references to “fiscal 2016” and “2016” are to the fiscal year ending 31 December 2016, all references to “fiscal 2015” and “2015” are to the audited fiscal year ended 31 December 2015, all references to “fiscal 2014” and “2014” are to the audited fiscal year ended 31 December 2014 and all references to “fiscal 2013” and “2013” are to the audited fiscal year ended 31 December 2013.

In this annual report, all references to “South Africa” are to the Republic of South Africa, all references to the “United States” and “US” are to the United States of America, its territories and possessions and any state of the United States and the District of Columbia, all references to the “United Kingdom” and “UK” are to the United Kingdom of Great Britain and Northern Ireland and all references to “Zimbabwe” are to the Republic of Zimbabwe.

In this annual report, all references to the “DMR” are references to the South African Department of Mineral Resources, the government body responsible for regulating the mining industry in South Africa.

This annual report contains descriptions of gold mining and the gold mining industry, including descriptions of geological formations and mining proceeds. In order to facilitate a better understanding of these descriptions, this annual report contains a glossary defining a number of technical and geological terms.

In this annual report, gold production figures are provided in kilograms, which are referred to as “kg”, or in troy ounces, which are referred as “ounces” or “oz”. Ore grades are provided in grams per metric ton, which are referred to as “grams per ton” or “g/t.” All references to “tons”, “tonnes” or “t” in this annual report are to metric tons.

In this annual report, “R”, “Rand” and “rand” refer to the South African Rand and “Rand cents” and “SA cents” refers to subunits of the South African Rand, “$”, “US$”, “US dollars” and “dollars” refer to United States dollars and “US cents” refers to subunits of the US dollar, “£”, “GBP” and “pounds sterling” refer to British pounds and “pence” refers to the subunits of the British pound.

FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the US Securities Exchange Act of 1934, as amended (the Exchange Act) with respect to our financial condition, results of operations, business strategies, operating efficiencies, competitive position, growth opportunities for existing services, plans and objectives of management, markets for stock and other matters.

These forward-looking statements, including, among others, those relating to our future business prospects, revenues and income, wherever they may occur in this annual report and the exhibits to this annual report, are necessarily estimates reflecting the best judgment of our senior management and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. As a consequence, these forward-looking statements should be considered in light of various important factors, including those set forth in this annual report. Important factors that could cause actual results to differ materially from estimates or projections contained in the forward-looking statements include, without limitation:

| · | | the occurrence of labour disruptions and industrial actions; |

| · | | the outcome and consequence of any potential or pending litigation or regulatory proceedings or other environmental, health or safety issues; |

| · | | the occurrence of temporary stoppages of mines for safety incidents and unplanned maintenance; |

| · | | the occurrence of hazards associated with underground and surface gold and uranium mining; |

| · | | changes in relevant government regulations, particularly environmental, tax, health and safety regulations and new legislation affecting water, mining, mineral rights and business ownership, including any interpretation thereof which may be subject to dispute; |

| · | | economic, business, political and social conditions in South Africa and elsewhere; |

| · | | power disruption, constraints and cost increases; |

| · | | the ability of Sibanye to comply with requirements that it operate in a sustainable manner; |

| · | | the ability to achieve anticipated efficiencies and other cost savings in connection with past and future acquisitions, as well as at existing operations; |

| · | | the completion of the Acquisitions of the Rustenburg Operations and Aquarius and the risks associated with platinum mining; |

| · | | supply chain shortages and increases in the price of production inputs; |

| · | | changes in the market price of gold and/or uranium; |

| · | | fluctuations in exchange rates, currency devaluations, inflation and other macro-economic monetary policies; |

| · | | failure of Sibanye’s information technology and communications systems; |

| · | | changes in assumptions underlying Sibanye’s estimation of its current mineral reserves; |

| · | | the success of Sibanye’s business strategy, exploration and development activities; |

| · | | the availability, terms and deployment of capital or credit; |

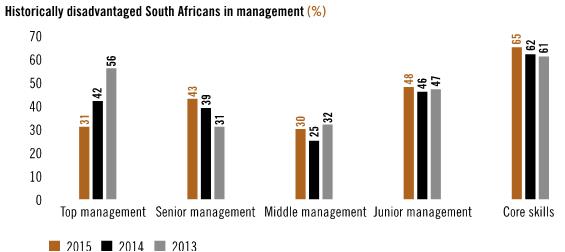

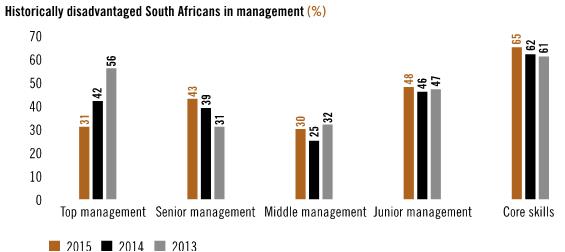

| · | | Sibanye’s ability to hire and retain senior management or sufficient technically skilled employees, as well as its ability to achieve sufficient representation of historically disadvantaged South Africans in its management positions; |

| · | | the adequacy of Sibanye’s insurance coverage; |

| · | | any social unrest, sickness or natural or man-made disaster at informal settlements in the vicinity of some of Sibanye’s operations; and |

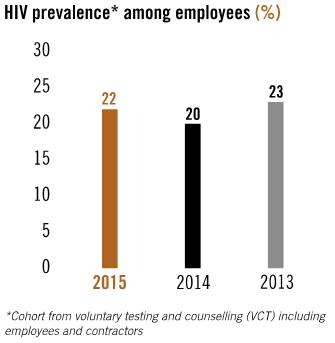

| · | | the impact of HIV, tuberculosis and other contagious diseases. |

We undertake no obligation to update publicly or release any revisions to these forward-looking statements to reflect events or circumstances after the date of this annual report or to reflect the occurrence of unanticipated events.

Integrated annual report

Contents

| |

Sibanye Gold Integrated Annual Report 2015 | 11 |

ABOUT SIBANYE’S REPORTS

THE 2015 SUITE OF REPORTS

covers the financial year

from 1 January 2015 to 31 December 2015.

Sibanye Gold Limited (Sibanye or the Group) is listed on the Main Board of the Johannesburg Stock Exchange (JSE) (ordinary shares) and on the New York Stock Exchange (NYSE) through an American Depositary Receipt (ADR) programme.

REPORTING PHILOSOPHY

The reports are produced to provide stakeholders with transparent insight into the Group’s strategy, the business and its performance over the past year. Stakeholders are thus able to make informed decisions on Sibanye’s ability to create and sustain value.

In this integrated report, Sibanye has endeavoured to build on the information provided in last year’s report. The Group has also sought to be more focused and concise in its reporting. In this regard, Sibanye has produced its annual financial statements as a separate document, the

Annual Financial Report 2015. This report is focused on Sibanye’s strategy, its most material risks and issues, and its related performance and outlook.

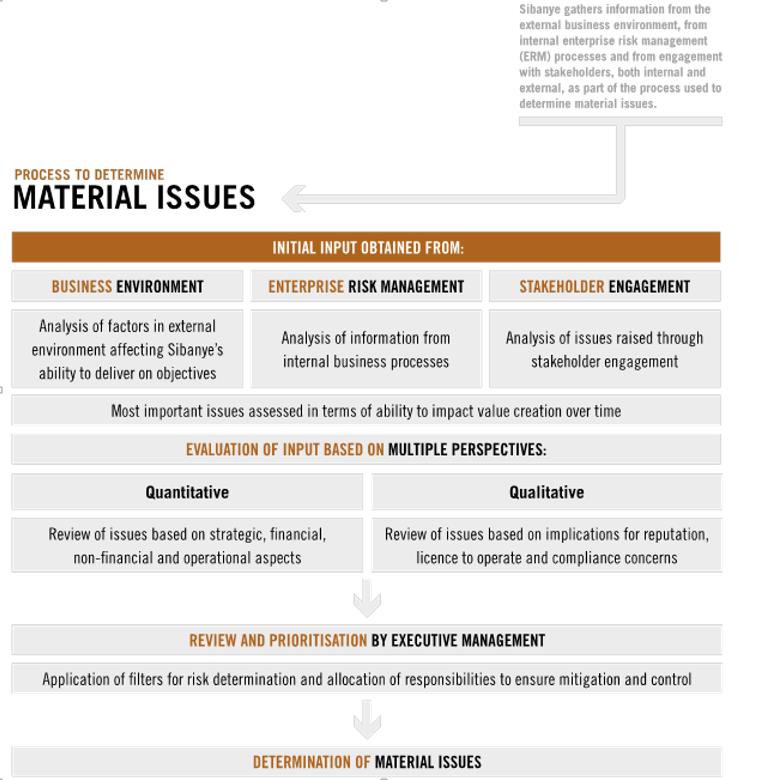

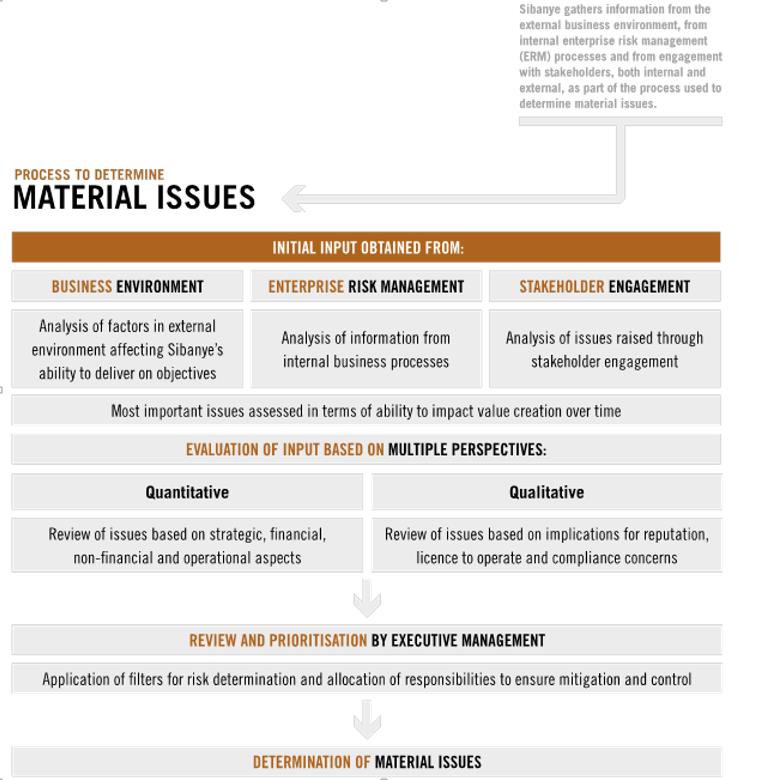

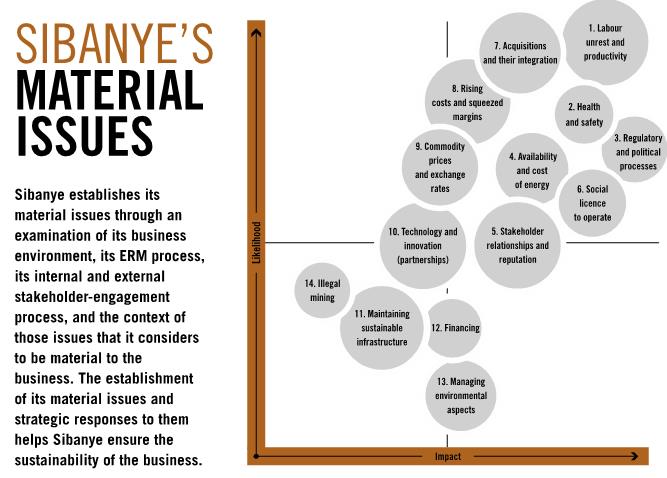

The theme of this year’s integrated annual report is based on the strategic enablers ‘optimise, sustain and grow’, illustrating how Sibanye has optimised its business so as to sustain and grow the value it creates, and its dividends in particular. The integrated annual report provides an account of Sibanye’s most material risks and opportunities. The Group’s materiality determination process is explained in Integrated Annual Report–Material issues. Sibanye considers an issue to be material if it substantially affects the Group’s ability to create and sustain value in the short, medium and long term. Where external entities substantially influence Sibanye’s business, their real and potential impacts are also discussed in the report.

| |

Sibanye Gold Integrated Annual Report 2015 | 12 |

Group PROFILE

Sibanye is a primarily South Africa-focused mining company committed to paying industry-leading dividends.

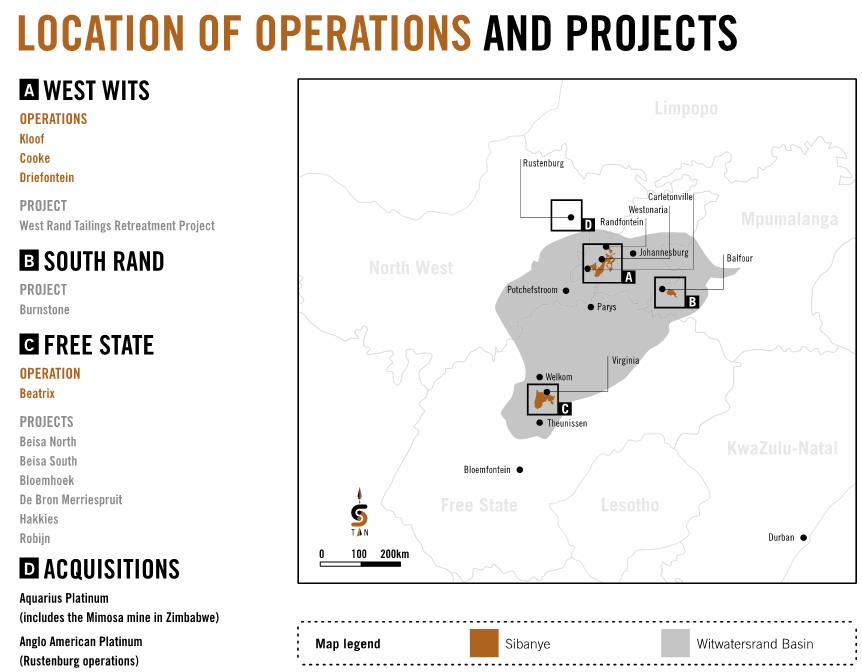

Sibanye is an independent mining group – domiciled in and focused on South Africa – which currently owns and operates high-quality gold and uranium operations and projects throughout the Witwatersrand Basin. The Group’s corporate office is located close to Westonaria, in the province of Gauteng, near its West Wits operations.

As a responsible corporate citizen, Sibanye fosters and maintains constructive engagement with all stakeholders in order to deliver on its vision to deliver superior value to all of its stakeholders, to maintain its licence to operate, and ultimately for the long-term success and sustainability of the business.

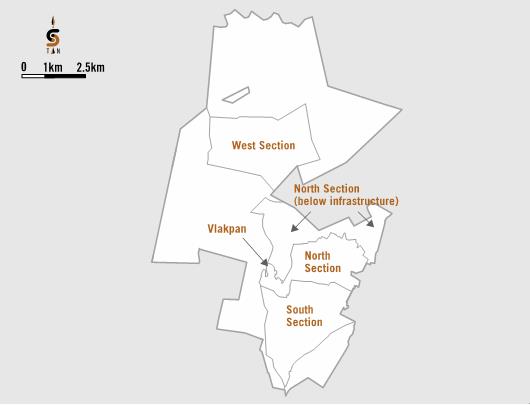

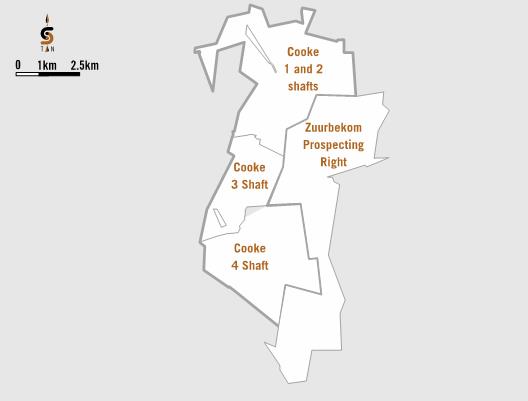

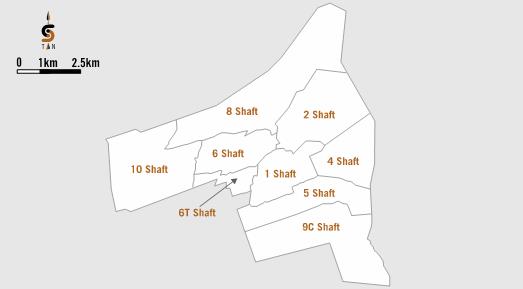

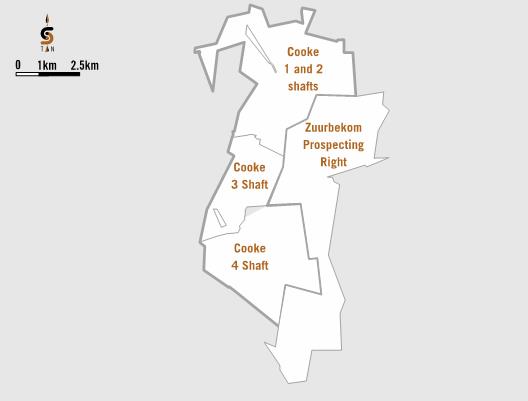

The Group currently owns and operates four underground and surface gold operations in South Africa – the Cooke, Driefontein and Kloof operations in the West Witwatersrand region, and the Beatrix Operation in the southern Free State province. In addition to its mining activities, Sibanye owns and manages significant extraction and processing facilities at its operations, where gold-bearing ore is treated and beneficiated to produce gold doré.

Sibanye is currently investing in a number of organic projects. Those currently being developed include the Kloof and Driefontein below infrastructure projects on the West Rand and the Burnstone project on the South Rand of Gauteng province. Engineering design is underway on the West Rand Tailings Retreatment Project (WRTRP) and financing options are being considered for this project, which awaits environmental permits before it is submitted to the Board for approval. A dedicated projects team continues to assess and refine plans for projects, including Beisa, Bloemhoek and De Bron Merriespruit in the Free State. For a more detailed account of these projects, see Integrated Annual Report–Sustain–Project Development and Capital Allocation.

In line with Sibanye’s strategy to create value for stakeholders and enhance or sustain its dividend, it entered into two separate transactions to acquire the Rustenburg platinum assets from Anglo American Platinum Limited (Rustenburg Operations) and Aquarius Platinum Limited (Aquarius) in 2015. These transactions are expected to be finalised during the course of 2016.

Shareholder base and information

The Group’s primary listing is on the JSE, trading under the share code SGL, where it is a constituent of the FTSE/JSE Responsible Investment Index. The Group has a secondary ADR listing on the NYSE, trading under the ticker code SBGL. Each ADR is equivalent to four ordinary shares.

At 31 December 2015, Sibanye had issued share capital of 916,140,552 shares (2014: 898,840,196) –1,000,000,000 authorised – and market capitalisation of approximately R20.9 billion (2014: R20.3 billion) or US$1.3 billion (2014: US$1.8 billion).

The Group’s diverse shareholder base predominantly comprises institutional investors in China (20%), South Africa (32%), the United States (35%), the United Kingdom (5%), the rest of Europe (5%) and the rest of the world (3%) at 31 December 2015. Sibanye has 80% free float and its three largest institutional shareholders (holding 23% of the Group) at 31 December 2015 were the Public Investment Corporation (SOC) Limited (PIC) (8%), Allan Gray Proprietary Limited (Allan Gray) (8%) and Van Eck Associates Corporation (7%).

The Group is committed to transformation and is guided by the Broad-Based Socio-Economic Empowerment Charter for the South African Mining and Minerals Industry (Mining Charter). In 2004, Gold Fields of South Africa Limited (Gold Fields) undertook a black economic empowerment (BEE) transaction, transferring an amount equivalent to 15% of its equity from Sibanye, formerly GFI Mining South Africa Proprietary Limited (GFI Mining South Africa), to Mvelaphanda Gold Proprietary Limited (Mvelaphanda Gold). In 2010, a further 10% of equity was allocated to an employee share ownership plan (ESOP) and another 1% in an empowerment deal. At the end of 2015, 26,444 employees were participants in the ESOP.

OUR PRODUCTS AND MARKETS

Sibanye mines, extracts and processes gold ore to produce a beneficiated product, doré, which is then further refined at Rand Refinery Proprietary Limited (Rand Refinery) into gold bars with a purity of at least 99.5% in accordance with the Good Delivery standards determined by the London Bullion Market Association. The refined gold is then sold on international markets. Sibanye holds a 33% interest in Rand Refinery, one of the largest global refiners of gold, and the largest in Africa. Rand Refinery markets gold to customers around the world.

In addition, Sibanye derives uranium ore as a by-product of gold production from the Cooke operation and keeps it separate from other gold ores by way of a dedicated stream into the uranium section of the Ezulwini gold and uranium plant. The uranium ore is first treated for uranium and then subsequently to recover gold. Production of uranium as a by-product enables Cooke’s gold Mineral Resources to be optimised. Revenue from the sale of uranium is offset against gold production costs, thereby allowing lower-grade gold resources to be mined profitably.

| |

Sibanye Gold Integrated Annual Report 2015 | 13 |

| |

Sibanye Gold Integrated Annual Report 2015 | 14 |

STRATEGY

| |

Sibanye Gold Integrated Annual Report 2015 | 15 |

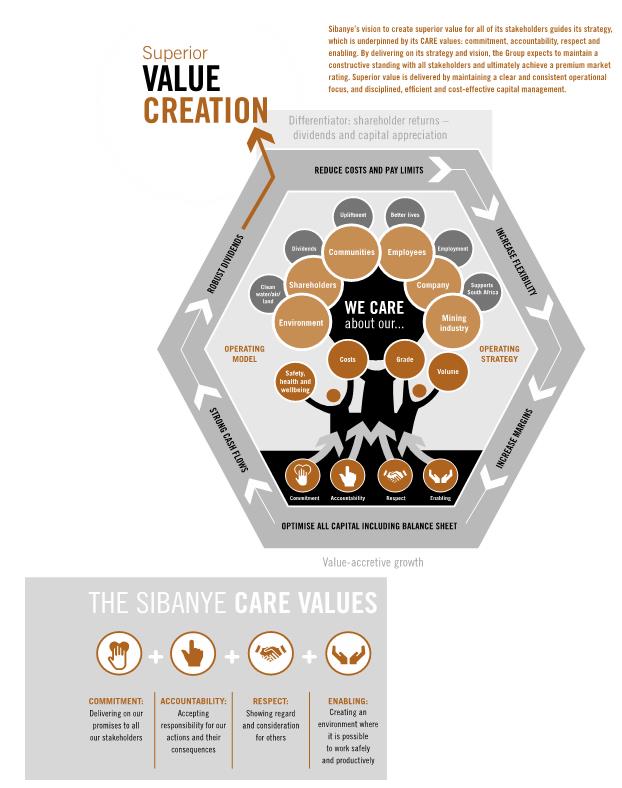

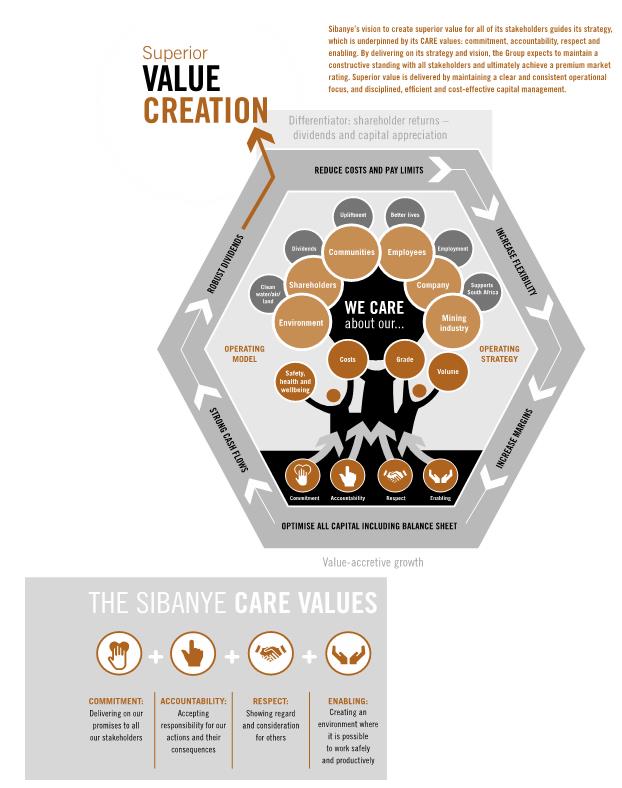

Sibanye’s care values underpin its strategy, how it conducts its business and interacts with stakeholders.

In living these values, we show that we care about safe production, our stakeholders, our environment, our company and our future.

Our approach is holistic with clear focus on delivery of all strategic imperatives critical to Sibanye’s long-term success.

Sibanye recognises that:

| · | | safety, costs, volumes and grade are the primary operational deliverables underpinning our business |

| · | | strong cash flow supports the dividend paid to shareholders and underpins our growth |

| · | | growth (organic and acquisitive) ensures the long-term delivery of sustainable value to all stakeholders. |

Holistic and integrated strategy

Sibanye strives to deliver value to shareholders through consistent, industry-leading dividends and capital appreciation by applying its holistic, efficient operating model at its operations and by investing in value-accretive growth.

Sibanye’s commitment to paying industry-leading dividends underpins and informs its corporate strategy and decisions, and is supported by an inclusive approach to stakeholder relations.

Sibanye’s strategy is not limited to the gold sector – it will pursue value-accretive opportunities in other mining sectors.

Responding to shareholders

Sibanye’s shareholder base is broad and diverse, and its shares were actively traded in 2015. An average of 3,024,491 ordinary shares and 1,110,883 ADRs were traded daily on the JSE and NYSE respectively. As at 31 December 2015, the top eight shareholders (including ADR depositary) held around 60% of the issued capital.

Engagement with shareholders is regular and proactive, which is consistent with Sibanye’s strategy and vision to deliver value to all stakeholders.

What Sibanye offers investors:

| · | | leverage to commodity prices |

| · | | capital expedience and discipline |

| · | | industry-leading sustainable dividends and capital appreciation |

Continuous interaction and communication with investors on Sibanye’s performance against its strategic objectives is essential. Its aim is to ensure that they are appropriately and timeously informed and aware of plans to transform Sibanye into a multi-commodity mining company without falling foul of regulatory authorities or compromising the transactions.

In this report, Sibanye’s performance is measured and considered in the context of the following strategic factors:

| |

Sibanye Gold Integrated Annual Report 2015 | 16 |

| |

Sibanye Gold Integrated Annual Report 2015 | 17 |

PERSPECTIVE FROM THE CHAIR

There is an old Latin saying, ex Africa semper aliquid novi, that roughly translates as ‘out of Africa, there is always something new’. This is what it has felt like as we have undergone the dynamic changes that are core to Sibanye’s activities.

In just two years, the Group and its mature gold assets, which were spun out of Gold Fields, have developed more deeply into gold and organically into uranium. During the latter part of 2015, Sibanye positioned itself to naturally leverage its regional advantages and extend its tabular, hard-rock mining skills into the platinum sector. The developments have been imaginative, well-considered and founded firmly on the precepts of extending the lives of our operations and growing the business in support of our vision to create superior value for all the Group’s stakeholders.

As with the gold operations we acquired in 2014, on conclusion of the transactions, the smooth integration of the platinum assets into the Group will be the primary focus of the executive management team with the aim of realising synergies between the platinum assets and Sibanye’s existing assets. To manage this complex process while retaining our operational focus, the Group has been restructured into focused operating divisions that are serviced by a central CEO’s office and central shared services. Although management at the gold and uranium division will remain largely the same, we will be appointing people to critical positions in the platinum division and, in anticipation of these corporate developments, we have been building capacity at senior management level. I am confident that Sibanye’s diverse and technically competent team, headed by Neal Froneman, is one on which Sibanye stakeholders can depend for the continued delivery of value.

In my role as Chairman, I continue to have the benefit of a Board with a vast assortment of skills and experience, not only in mining but also in such areas of expertise as finance, human resources, corporate governance and general business management. This balance of skills and experience means that the Board can effectively and robustly interrogate the strategic and operating plans of the executive management team, and has the capacity to deal competently with risk, which proved to be particularly effective during the year as we considered the strategic basis for, and probed the opportunities and risks of, entering the platinum sector.

The Board has also adopted a considered approach to the prospect of obtaining a more secure electricity supply with independent power producers (IPPs) to support the low-risk strategy of developing a solar power plant at Driefontein and Kloof.

As was the case in 2014, we continued to maintain a conservative approach to our financing, ensuring at all times that, whatever debt we carry on our balance sheet, can be managed with little stress no matter what direction metal prices take. We shall not deviate from this strategy, which will be co-ordinated with our commitment to paying industry-leading dividends.

The macro-economic environment in which we operate remained increasingly challenging. Globally, sluggish economic growth, in China in particular, the resultant decline in demand for commodities and the impending increase in interest rates in the US have played havoc with the currencies of emerging and resource-based economies such as South Africa’s. Not even increased geopolitical uncertainty has helped boost the dollar price of gold. The dollar gold price continued to decline, falling by 14% between January and December while, at the same time, our operations were exposed to cost pressures well in excess of inflation. It is only the weakening of the local currency, the rand, against the dollar, which provided some relief with the average rand gold price increasing 8% to R475,508/kg in 2015 compared with 2014.

In South Africa, these challenges are not limited to the macro-economic environment. The global financial crisis and downturn in commodity prices has resulted in the mining sector and the economy as a whole contracting. Growth rates continue to be revised downwards and unemployment levels are increasing as the mining sector restructures and cuts back so as to limit and contain cost increases. This has resulted in various socio-economic challenges, particularly in the vicinity of mining operations with knock-on effects that could potentially have a significant impact on the future of the South African mining industry.

The labour environment in South Africa remains challenging and, while we continue to engage directly with our unions and employees so as to maintain harmonious relations, we experienced relatively limited disruptions during 2015. Aside from the clashes between two prominent unions, the Association of Mineworkers and Construction Union (AMCU) and the NUM, at Beatrix early in the year, the biggest disappointment was our inability to achieve a broad-reaching economic and social agreement with labour as part of a three-year wage agreement with all unions. Nevertheless, we continue to engage proactively with our employees, having implemented the final three-year wage agreement reached with three of the unions across all our operations. We will continue to do whatever we can to maintain harmonious labour relations and to limit disruptions in the workplace.

A primary concern is, and will remain, the health and safety of our employees and members of our communities with the aim of zero fatalities on our mines and diminishing accident rates so it was pleasing to note a further improvement in our safety performance.

Regrettably, there were seven fatalities during the year and it is with a heavy heart that I extend the condolences of the Sibanye Board to the families, colleagues and associates of those who were fatally injured in the workplace during the year. These employees (David Matsie, Bonno Keiditswe, Thomas Ndzimande, Sikoko Vuyosile, Sejakgomo Mokhali, Kagiso Rabola and Alberto Constantino) were our colleagues and we will take cognisance of the events that led to their deaths, and work harder to prevent their recurrence in future. Nevertheless, the fatal injury frequency rate (FIFR) continued to fall during the year, declining by 50% in 2015 to 0.06 fatalities per million man hours worked. This is comparable with average fatality rates in the US mining industry of 2014, and is a credible performance considering the depth at which our mines operate and the number of employees who work daily at our operations.

A critical programme to ensure the safety of our employees, particularly as our mines become ever deeper and more complex, is the development of appropriate new technology. Our Safe Technology programme is advancing technical innovation by designing and developing machines to be deployed underground to make mining at depth safer. This machinery, to be operated remotely,

| |

Sibanye Gold Integrated Annual Report 2015 | 18 |

will enable us to work and mine safely at greater depths and in more onerous conditions than has previously been possible. This will have longer-term benefits for our operations and for the country as a whole.

Stakeholder engagement is essential to the sustainability of our business. Beyond the mine gates, we continue to engage with our communities on issues as wide ranging as housing, the environment, and the provision of utilities and infrastructure. Our policy is to buy as much as possible from businesses in our host communities and, as far as is feasible, buy products from local businesses. On this basis we have, for example, made direct interventions to assist with the establishment of farming ventures that can sell and deliver food to the mines or to local people. Less directly, we offer programmes to improve the financial knowledge of our employees and their families to facilitate their escape from or avoidance of the traps of injudicious indebtedness. These financial-wellness programmes are long-term and open to all, and we encourage our unions to bring their members onto the programme.

And, as changes to the regulatory environment are mooted or implemented, we maintain relations with government authorities directly and indirectly (through the Chamber of Mines). We are determined that our voice is heard and clearly understood in any debate over legislative change. In particular, we have engaged on matters that include the ownership principle in the Mining Charter and the proposed carbon tax.

It would be remiss of me not to recognise the part played by Neal and his team in taking Sibanye forward. The Group is South Africa’s largest producer of gold, it ranks high on the list of uranium producers, it is heavily engaged in reprocessing residue dumps, thereby helping to improve the environment, and it will soon be moving in the direction of a new commodity, platinum. This would not have been possible without the wholehearted commitment of the entire workforce with whom it is a privilege to be associated. My gratitude goes to all of my Sibanye colleagues.

Sello Moloko

Chairman

18 March 2016

| |

Sibanye Gold Integrated Annual Report 2015 | 19 |

CHIEF EXECUTIVE’S REVIEW

I am very pleased to recommend to shareholders and other stakeholders our third integrated annual report.

While it is perhaps customary to thank stakeholders in the business at the end of a report, it is my view that this must be our starting point. And I do so with humility because we share Sibanye’s success with all of our stakeholders.

Strategy remains in place

Despite the volatility and flux in the global mining sector over the past few years, and despite Sibanye’s own significant corporate developments, our strategy continues to be guided by our vision:

To create superior value for all of our stakeholders through a culture of caring.

As we stated in our 2014 integrated report, our strategy is underpinned by our commitment to pay our shareholders sustainable, industry-leading dividends, and we will achieve this vision by optimising our current operations and extending their operating lives, and by using existing infrastructure to enhance the inherent value of brownfields and greenfields projects.

In addition, we have consistently said that we would pursue acquisitive growth options if they were value accretive and enhanced our ability to pay or sustain the dividend to shareholders.

Reporting theme

Our theme for this year’s report – optimise, sustain and grow – reflects the implementation of our strategy since listing in February 2013 and, through this report, we provide shareholders with insight into the progress we have made, despite the mining industry having to adapt to some of the most challenging times experienced in the global commodities markets.

Sibanye’s values, which underpin our caring culture, are an integral part of the way we do business and the way in which we create superior value for all of our stakeholders, and are captured in the acronym CARE – commitment, accountability, respect and enabling. These are the values we would like all Sibanye employees to internalise and live by – see Integrated Annual Report–Strategy.

Our corporate strategy, culture and values are symbolised by the indigenous Umdoni tree (Syzygium cordatum). The fundamental roots of Sibanye are in our values and CARE culture, which provide a solid basis for the way we do business. The trunk of the tree represents the material strength that holds Sibanye together (our intellectual capital and the support provided by employees in upholding our operating model and business strategy), which is underpinned by the fundamentals of safety, health and wellbeing, costs, grade and volume. The leaves on the branches of the tree represent all our stakeholders, who rely on and influence the future success of Sibanye. The tree’s seeds and fruits signify the varying benefits that our success will bring to all stakeholders.

Health and safety

It is an incontrovertible fact that, at their workplaces and beyond them, healthy employees are more aware of safety and are more productive than would otherwise be the case. I have deliberately placed the words ‘safety’ and ‘productive’ in that particular order.

It is pleasing therefore to note that, despite the incidence of events such as underground fires and seismicity at our mines, in 2015 we achieved a 50% reduction in the FIFR per million man hours worked across our mines. Comparisons such as these are invidious but our safety performance, insofar as our FIFR is concerned, is now comparable with the US mining industry averages despite their mines generally being shallower, and less hazardous and labour-intensive. I regret to report though that, despite this improvement, at Sibanye we mourn the loss of seven of our colleagues at work during the year. The safety of our employees is paramount and we continually strive to improve our health and safety standards in order to achieve our goal of zero harm.

An area of concern and one which will receive significant management attention is the continued incidence of disabling accidents that lead to lost working time and which has regressed during the year. Every accident is one accident too many, and we will continue to examine the situations that lead to each accident as well as to near-accidents in order to devise ways to prevent recurrences.

Accidents at work are not only injurious to our employees but also result in lost working time, which can have a significant effect on our performance. While we continue to try and reduce accidents in the workplace, we have also revised our approach to healthcare.

We aim to provide employees who are injured or fall ill with treatment or medication as quickly and conveniently as possible. As such, we have moved away from the conventional industry approach of running centralised mine hospitals, which is not our core business or expertise, in favour of establishing primary health and safety clinical facilities, which are located at each shaft. In this way, minor injuries and other less serious illnesses can be treated promptly and efficiently. Employees with more serious traumas or illnesses are transferred to regional hospitals (some of which used to be owned by Sibanye) where they are assured of first-rate treatment at facilities run by dedicated healthcare experts – our people know that, when they are in need, they can count on receiving the best possible medical care.

| |

Sibanye Gold Integrated Annual Report 2015 | 20 |

Our commitment to safety, health and employee wellness, and our CARE culture, also encompasses the way in which we are seeking to address occupational health issues such as noise induced hearing loss (NIHL) and occupational lung disease (OLD), which includes silicosis. We have introduced some of the most innovative and consistent measures to limit occupational health issues, which has resulted in the prevalence of NIHL and OLD (see Integrated Annual Report–Sustain–Health and safety focus) declining dramatically, and we ensure that employees have access to appropriate treatment where required. Yet we know that exposure to silica dust over long periods of time may only manifest as silicosis decades after first exposure and often long after employees have left our employ or indeed the industry. To assist past employees who may suffer from silicosis and other forms of OLD, we are working closely with other gold companies to address the shortcomings in the existing publicly run compensation system, the Occupational Diseases in Mines and Works Act, 1973 (Act 78 of 1973) (ODMWA) and, for current and future employees, we are engaged with government about their transfer to the better compensation system, the Compensation for Occupational Injuries and Diseases Act, 1993 (Act No 130 of 1993) (COIDA).

2015 IN REVIEW

At the beginning of the year under review, we anticipated that the operating environment would be challenging – a view which proved to be correct.

A number of operational issues in the first two months resulted in production for the first quarter falling well short of our forecasts and, despite the operations delivering more representative and consistent results for the rest of the year, we were unable to claw back production lost in the first quarter. Other factors which contributed to operational targets not being met included load shedding during the first and second quarters as Eskom attempted to catch up on maintenance, and the wage negotiations which, while not resulting in direct operational disruptions, require significant time and focus from management and serve to distract employees from their primary jobs.

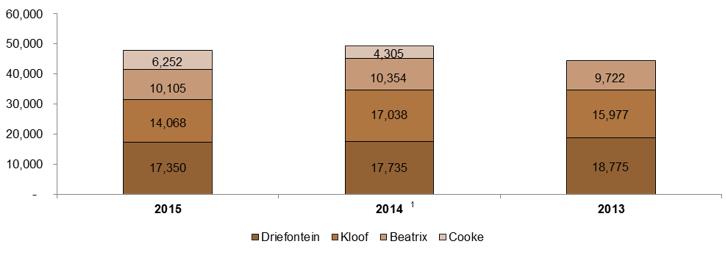

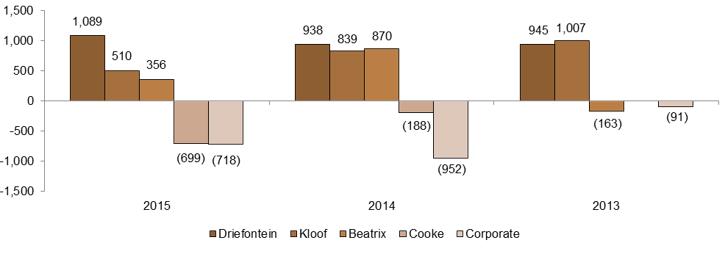

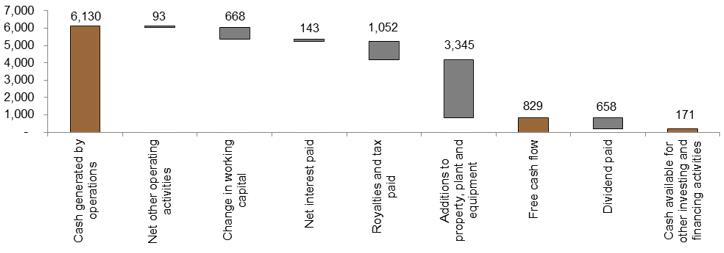

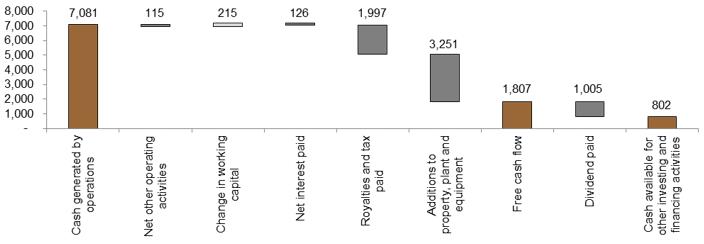

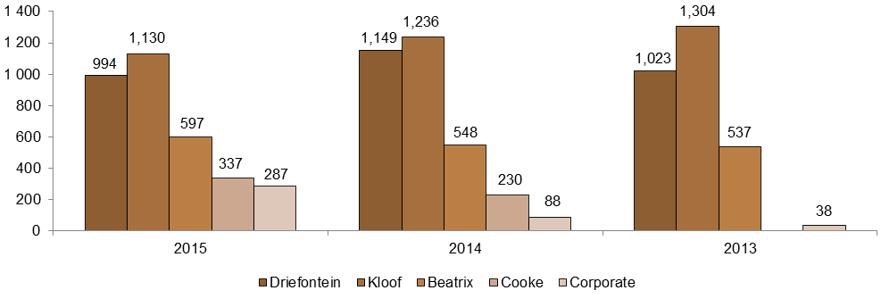

Gold production for the year of 47,775kg (1.54Moz) was as a result of the lower-than-forecast production at the beginning of the year with All-in sustaining cost of R422,472/kg or US$1,031/oz (based on the year’s average R:$ exchange rate) commensurately higher than forecast. While there was some relief from a higher gold price in the second half of the year, as the rand weakened by 28% between 30 June 2015 and 31 December 2015, lower production in the first half of the year resulted in cash generated from operating activities decreasing 24% to R5,420 million compared with 2014 from which R3,345 million was disbursed on the capital projects that underpin the Group’s longer-term future and R658 million or 72 cents per share (ZAR) was paid as dividends to shareholders.

challenges in 2015

Conflict between members of AMCU and NUM at Beatrix in February 2015, which resulted in injuries to nine employees, was a portent of the difficulties we would experience during the wage negotiations scheduled for mid-year. Management’s reaction was swift and unequivocal. We suspended operations at the Beatrix North and South shafts until calm had been restored, and the rival groups had been successfully reintegrated.

Gold-industry wage negotiations, which are undertaken centrally under the auspices of the Chamber of Mines, began in June 2015 and finally concluded in September – taking longer than we had expected. While there were no formal work stoppages, these negotiations served to distract employees from their jobs, thereby negatively affecting our operational performance. While the eventual agreement reached with three of the unions was not optimal, it was affordable and, we believe, satisfactory.

In consideration of the significant headwinds our industry continues to face – a stagnant or falling gold price, fast-rising operating costs, steadily declining ore tonnages and grades, changing union dynamics and rising stakeholder expectations – we sought to approach wage negotiations differently in 2015.

At the start of negotiations, we and other gold companies represented by the Chamber attempted to introduce a fresh approach, founded on the concept of an economic and social compact, which took the impact on all stakeholders into account. While many of the ideas we proposed found resonance with our union counterparts, they were not prepared to abandon the traditional positional-bargaining approach and, while we will continue to try and engage on the compact, it will be some time before the precepts underlying the sustainability of the industry will be fully embedded in our ongoing engagement.

Despite significant attempts on our part to reach a single settlement with all four representative unions, we were only able to reach agreement for a period of three years with three of the unions – the NUM, Solidarity and UASA – who collectively represented around 49% of employees in the collective bargaining units at our operations. AMCU leadership remained obdurate throughout the process and did not move from its initial demands. It was clear that we were not going to reach agreement with AMCU and, in the interests of fairness and maintaining a harmonious and safe working environment, we elected to implement the agreed wage increases for all employees irrespective of their union membership. To have excluded those who were members of AMCU (42% of employees in the collective-bargaining unit) would, in our view, have been unjust and could have sparked further inter-union rivalry and violence.

AMCU’s leadership has reserved its position and ended the year repeating that it would consider embarking on industrial action ‘at the appropriate time’. Our view remains that there is little appetite for industrial action by the members of any union and this has been borne out to date.

I personally believe that there is a realisation that unrealistic demands are unsustainable and more likely to lead to job losses than to permanent improvements for all. This was illustrated in the platinum sector where the losses from the five-month strike of 2014 remain fresh in the minds of those who participated.

Having said this, I should add that, while we do not expect a strike at our gold operations in 2016, we have detailed and robust plans to deal with such an eventuality. We will maintain our approach to the social and economic consequences that surround these issues, and we will not allow the threat of industrial action to distract us from our primary focus areas.

| |

Sibanye Gold Integrated Annual Report 2015 | 21 |

A critical and growing imperative for sustainability is community relations and engagement. We will be placing great emphasis on improving engagement with local and labour-sending communities, and ensuring delivery of high-impact, sustainable projects in these communities. We are confident that the support of our communities and the commitment of our employees will underpin our development into the South African mining champion.

Another challenge relates to the legal suit brought by the Chamber on the industry’s behalf on the continuing consequences of BEE transactions post 2004. Sibanye is supportive of the Chamber’s initiative to seek clarity through a declaratory order by the courts although we are confident of the validity of the BEE transactions. Policy and regulatory certainty is critical for our industry and our stakeholders, and continued dilution (should the consequences of previous BEE transactions not be recognised) will severely undermine the value of an already struggling sector.

An issue that does need addressing by the industry as a whole is the extent to which the DMR imposes Section 54 closures in the event of accidents. We, at Sibanye, fully agree with the need for operational closures when the causes of accidents need to be investigated, and when it is necessary to ensure that safety conditions and procedures are rigorous. But we believe that the Section 54 stoppages should be restricted to the immediate area of an accident’s occurrence and not involve the complete closure of a shaft, which can have a detrimental impact on the viability of an entire mine.

achievements of 2015

Turning to our achievements in the past year, the most far-reaching was our entry into the platinum sector – a sector we had already identified as offering potential value in early 2014. Our moves to acquire Anglo American Platinum’s Rustenburg Operations and Aquarius were well-considered investment decisions and, we believe, are transactions that are sufficiently robust to withstand all likely vagaries of the platinum sector at market and operational levels.

The acquisitions will deliver a substantial amount of PGMs (4E) reserves. By 2017, Sibanye will rank as the world’s fourth largest PGM producer. More importantly, the Rustenburg Operations and Aquarius’ Kroondal mine are contiguous, which will allow for significant realisation of operational synergies in addition to cost savings we expect from rationalising replicated services and other overhead costs.

We maintain a conservative and innovative approach to financing acquisitions and, before making the decision to advance the platinum acquisitions, we made sure that our balance sheet was sufficiently robust and flexible, and that our cash flows would be more than adequate to service any debt we would be taking on. The Rustenburg transaction has been defensively structured to give us downside protection from lower PGM prices until 31 December 2018 and has limited recourse to the central balance sheet. Debt reduction will continue to be central to our approach after we take control of the platinum interests, just as it was when Sibanye first became an independent group.

On 31 December 2015, Sibanye’s net debt was a modest 0.21 times multiple of EBITDA. Even taking into account the expected US$250 million partial draw on our US$350 million revolving credit facilities and the US$150 million additional financing facility provided by HSBC for the Aquarius acquisition, the approximate multiple will remain 1.0 times, indicating how conservatively we have managed the financing of these acquisitions. In order to maintain financing flexibility, however, we will consider restructuring our financial position soon after concluding both transactions. Further financial detail and other parameters relating to the acquisitions are contained elsewhere in this report.

Through these proposed acquisitions, we are increasing our footprint in South Africa and this is with good reason. We are comfortable with the operating environment and confident that there will be further opportunities, which will allow us to continue delivering sustainable value for all of our stakeholders.

SUSTAINABLE VALUE FOR STAKEHOLDERS

| · | | We have significant experience operating in South Africa and understand the regulatory environment |

| · | | South Africa contains one of the most valuable resource endowments in the world |

| · | | Our geology is well-understood and simple |

| · | | There is an abundance of skilled and experienced mining practitioners |

| · | | The areas in which we operate are supported by first-class infrastructure |

| · | | The established mining industry is serviced by well-developed and innovative supply as well as associated industries |

While policy uncertainty and regulatory inefficiency have been signalled by investors as factors which have inhibited investment in recent years, the country also has sound financial and judicial systems and a world-class Constitution, which protects individual and corporate rights.

There are various conditions to be met before our acquisitions are finally consummated. However, we shall become engaged operationally, particularly in the platinum sector’s wage-negotiating round, to ensure that we shall have a sound labour-relations foundation when we start what will be the synergistic merger of the Aquarius and Rustenburg properties.

Energy

The reliability of supply and cost of electricity has become a primary risk factor for industry in South Africa. It is our policy to minimise the risk factors beyond our direct control. We have developed an integrated and co-ordinated strategy to mitigate the associated risk for the near term and for the longer term.

In 2013, we identified the risk that Eskom, the state-owned power monopoly, would be unlikely to supply the entire power needs of the country reliably, affordably and without interruption. Electricity costs have been rising annually at rates significantly higher

| |

Sibanye Gold Integrated Annual Report 2015 | 22 |

than inflation since 2007 with power costs at Sibanye increasing from about 9% in 2007 to some 18% of our 2015 costs. With supply remaining inconsistent and further above-inflation increases highly likely in coming years in order to finance Eskom’s capital programmes, it is clear that alternatives are required in order to ensure the sustainability of our mines. The more we can reduce our reliance on Eskom power, the more secure and more cost-efficient will be our core operations.

In late 2013, we began to investigate the potential of solar photovoltaic generation to reduce our reliance on Eskom, and have demonstrated the technical and economic feasibility of constructing a 150MW plant. We have now launched the development phase of the project, which encompasses applications for all the required permits, basic engineering design and establishment of the most appropriate commercial model to optimise the financial benefits. We expect this will require significant involvement of financial partners to fund the project capital. We remain on track to start generating electricity late in 2017. Solar photovoltaic electricity remains only a partial solution and we have continued to explore other alternative sources of electricity.

Sibanye is also investigating various opportunities to support a coal-based IPP platform devoted exclusively to delivering power to our operations.

Gold production for the year ending 31 December 2016 is forecast to increase to approximately 50,000kg (1.61Moz) with total cash cost forecast at approximately R355,000/kg and All-in sustaining cost at approximately R425,000/kg. The recent sharp depreciation of the rand to over R16.00/US$ means that costs in dollar terms are likely to be significantly lower than in 2015, assuming an average exchange rate of R15.00/US$ for 2016. Total cash cost is forecast at US$735/oz and All-in sustaining cost at US$880/oz. All-in cost is forecast to be R440,000/kg.

(US$915/oz) due, inter alia, to the initiation of the Kloof and Driefontein below infrastructure projects, and the development of the Burnstone mine, which were approved in 2015. Costs in dollar terms are significantly lower at the current average exchange rate of over R16/US$.

Total capital expenditure for 2016 is planned at R3.9 billion (US$265 million).

Due to the weaker rand, and a recovery in the dollar gold price, the rand gold price year to date is on average approximately R100,000/kg higher than in 2015. While we provide no forecast of the future gold price, should this gold price persist throughout 2016, the Group total cash cost margin will increase to approximately 38% and the All-in sustaining cost margin to approximately 25%.

THE FUTURE

Following the significant changes that took place or were initiated in 2015, 2016 will be a year of considerable restructuring, integration and consolidation. At the most basic level, we will re-evaluate all our gold assets on a shaft-by-shaft basis with a view to determining whether the primary focus might be on gold or uranium. On a developmental level, the focus will be on incorporating the PGM assets into Sibanye so as to obtain the maximum possible cost and other synergies.

The successful integration of these substantial platinum assets will ensure that we continue to deliver acceptable and sustainable benefits to our shareholders in the form of dividends and capital appreciation in order to remain an investment of choice. For it is only by being an investment of choice that we can be sure to attract the rating and the funds needed to pursue further profitable growth prospects and projects.

We are aware, however, that in order to achieve our goals and re-establish the primacy of mining to South Africa’s economic development in the eyes of government and all the country’s people, we are going to have to adopt a prominent leadership role in the industry. I am confident that we have laid a sufficiently solid foundation in the past two years to allow this.

Neal Froneman

Chief Executive Officer

18 March 2016

| |

Sibanye Gold Integrated Annual Report 2015 | 23 |

CAPITALS OVERVIEW AND BUSINESS MODEL

Successful implementation of Sibanye’s strategy depends on effective management of various capitals, which include resources and relationships.

These capitals are necessary inputs into the business model and their judicious management enables Sibanye to deliver on its strategy. While this report is not structured according to the capitals, it does provide insight into Sibanye’s current capabilities in terms of these capitals as well as related challenges affecting delivering on its strategy to create superior value for all stakeholders. A discussion of the capitals follows, explaining how they affect Sibanye, including cross references to supplementary information.

financial CAPITAL

The management of financial capital is essential for the sustainability of any business. At Sibanye, financial-capital management will enable the generation of sustainable cash flow, which will support regular, consistent, industry-leading dividend payments and allow long-term capital value accretion. This is underpinned by profitable operations and growth, both organic and inorganic. Positive free cash flow is necessary to fund the dividends and growth.

In order to extend its operating life and sustain dividend payment for longer, Sibanye has not only committed to the development of organic projects but also made strategic, value-accretive acquisitions. Organic projects and acquisitions are predominantly funded through operational cash flow and, where necessary, by debt and other financial instruments. While the downturn in the commodity cycle and negative investor sentiment towards the resources sector can make accessing equity capital a challenge, Sibanye has sufficient debt facilities and the recent increase in the rand gold price will ensure that dividend payments to shareholders can be maintained. Should the opportunity arise, restructuring of debt or raising equity capital may be considered.

Similarly, revenue and earnings are used as the basis for value creation and derivatives of these determine what value will be distributed to stakeholders: salaries and wages (employees), dividends (shareholders), social and local economic development (communities), and taxation and royalties (government and the national fiscus).

Insights into

The management of financial capital, and Sibanye’s financial performance and position, are provided in Integrated Annual Report–Sustain–Project development and capital allocation.

human CAPITAL

Deep-level gold mining is labour-intensive and Sibanye’s employees play an integral part in the successful delivery on Sibanye’s operating model and strategy. Sibanye’s people work at great depth and under physically demanding conditions – their safety and wellbeing are priorities. We strive to develop a transformed, productive, skilled and engaged team of people at Sibanye. South Africa, and the mining sector specifically, has faced intense challenges regarding industry and labour relations due to legacy issues as well as the difficult socio-economic environment, inequality and unemployment in the country. South Africa has well-developed industrial-relations processes and practices with strong trade unions representing employees in different sectors on issues such as, inter alia, remuneration, other benefits and workplace issues. Employees are Sibanye’s most important asset and are key stakeholders in the business. Aligning employees with Sibanye’s values and strategy will ensure the sustainability of the business and that it is able to deliver superior value for all of its stakeholders.

Insights into

Sibanye’s people are provided in Integrated Annual Report–Optimise–Develop a productive, skilled and engaged workforce and Integrated Annual Report–Sustain–Health and safety focus.

intellectual CAPITAL

Allied to human capital is Sibanye’s intellectual capital. Its operating model is vital to its ability to turn around unprofitable mines and extend their economic lives. This is underpinned by its operating processes and employees’ expertise, which together contribute to the intellectual capital required to successfully operate its mining portfolio. Ultimately, Sibanye sees its strategy and operating model as its differentiators in the mining sector.

Sibanye’s ability to remain competitive depends on future innovations relating to Safe Technology and modernisation of its mines. Over the past two years, the Group has invested in research and development (R&D) in these two areas. Sibanye also works closely with suppliers on innovative development of identified technologies. Technological advances will make Sibanye’s workplaces safer, improve productivity and facilitate the conversion from resources to reserves of deeper-level and secondary ore bodies through the development of new products and technologies.

Insights into

Sibanye’s operating model are provided in Integrated Annual Report–Optimise–Optimise and integrate operations, Integrated Annual Report–Grow–Secure alternative energy sources and Integrated Annual Report–Grow–Modernisation and technological innovation.

| |

Sibanye Gold Integrated Annual Report 2015 | 24 |

social AND RELATIONSHIP CAPITAL

Proactive, positive and constructive stakeholder engagement is necessary to identify and manage stakeholder concerns and expectations, together with any associated material risks and opportunities, and to effectively respond to and address them. Sibanye’s stakeholder engagement programmes are vital in building relationships and maintaining a positive reputation with stakeholders by promoting and delivering on its value-creation proposition.

Sibanye is committed to creating shared value for its surrounding communities and labour-sending areas beyond its Mining Charter and Social and Labour Plan (SLP) commitments.

Insights into