As filed with the Securities and Exchange Commission on 6 April 2017

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 20-F

(Mark One)

☐REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

or

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended 31 December 2016

or

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

or

☐SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report

For the transition period from to

Commission file number: 001-35785

Sibanye Gold Limited

(Exact name of registrant as specified in its charter)

Republic of South Africa

(Jurisdiction of incorporation or organization)

Libanon Business Park

1 Hospital Street (off Cedar Avenue)

Libanon, Westonaria, 1780

South Africa.

011-27-11-278-9600

(Address of principal executive offices)

With copies to:

Charl Keyter

Chief Financial Officer

Sibanye Gold Limited

Tel: 011-27-11-278-9700

Fax: 011-27-11-278-9863

Libanon Business Park

1 Hospital Street (off Cedar Avenue)

Libanon, Westonaria, 1780

South Africa

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

and

Thomas B. Shropshire, Jr.

Linklaters LLP

Tel: 011-44-20-7456-3223

Fax: 011-44-20-7456-2222

One Silk Street

London EC2Y 8HQ

United Kingdom

Securities registered or to be registered pursuant to Section 12(b) of the Act

| | |

Title of Each Class

Ordinary shares of no par value each

American Depositary Shares, each representing four ordinary shares | Name of Each Exchange on Which Registered

New York Stock Exchange*

New York Stock Exchange |

*Not for trading, but only in connection with the registration of the American Depositary Shares pursuant to the requirements of the Securities and Exchange Commission. Securities registered or to be registered pursuant to Section 12(g) of the Act None (Title of Class) Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act None (Title of Class) Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock

as of the close of the period covered by the Annual Report 929,004,342 ordinary shares of no par value each |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act: Yes ☒ No If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes No ☒ Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections. Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes No Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files)*. Yes No Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one): Large accelerated filer ☒Accelerated filer Non-accelerated filer Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing: |

US GAAP | International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ | Other |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: Item 17 Item 18 If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No ☒ (APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS) Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes No |

* This requirement does not apply to the registrant

FORM 20-F CROSS REFERENCE GUIDE

| | | | | | |

Item | | Form 20-F Caption | | Location in this document | | Page |

1 | | Identity of directors, senior management and advisers | | NA | | NA |

2 | | Offer statistics and expected timetable | | NA | | NA |

3 | | Key information | | | | |

| | (a) Selected financial data | | Annual Financial Report—Overview—Five-year financial performance | | 77-79 |

| | (b) Capitalisation and indebtedness | | NA | | NA |

| | (c) Reasons for the offer | | NA | | NA |

| | (d) Risk factors | | Further Information—Risk factors | | 176-190 |

4 | | Information on the Company | | | | |

| | (a) History and development of the Company | | Annual Financial Report—Administrative details—Administrative and corporate information | | 175 |

| | | | Integrated Annual Report—Introduction—Group profile | | 14-15 |

| | | | Integrated Annual Report—View from the top—Perspective from the Chair | | 18-19 |

| | | | Integrated Annual Report—View from the top—Chief Executive’s review | | 20-22 |

| | | | Integrated Annual Report—View from the top—CFO’s report | | 23 |

| | | | Annual Financial Report—Accountability—Directors’ report | | 112-116 |

| | | | Integrated Annual Report—View from the top—Material risks and opportunities—Stillwater Transaction | | 30 |

| | | | Integrated Annual Report—Performance review—Creating value from operations, projects and technology—Establishing the Platinum Division | | 35 |

| | | | Annual Financial Report—Overview—Five-year financial performance | | 77-79 |

| | | | Annual Financial Report—Overview—Management’s discussion and analysis of the financial statements—Recent platinum acquisitions | | 82-83 |

| | | | Annual Financial Report—Annual financial statements—Notes to the consolidated financial statements—Note 12: Acquisitions | | 147-149 |

| | (b) Business overview | | Integrated Annual Report—Introduction—Group profile | | 14-15 |

| | | | Integrated Annual Report—View from the top—Material risks and opportunities | | 24-33 |

| | | | Annual Financial Report—Overview—Five-year financial performance | | 77-79 |

| | | | Integrated Annual Report—Performance review—Health and safety focus | | 50-59 |

| | | | Integrated Annual Report—Performance review—Social upliftment and community development | | 60-64 |

| | | | Further Information—Environmental and regulatory matters | | 199-203 |

| | | | | | |

Item | | Form 20-F Caption | | Location in this document | | Page |

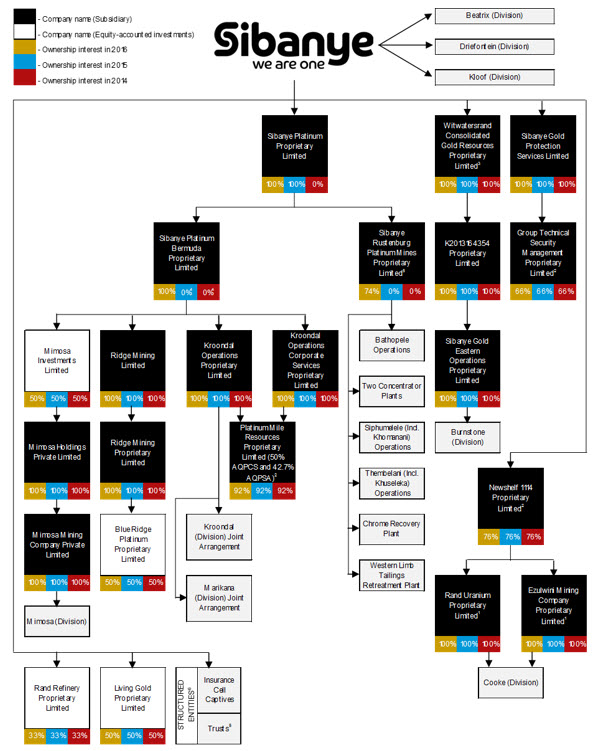

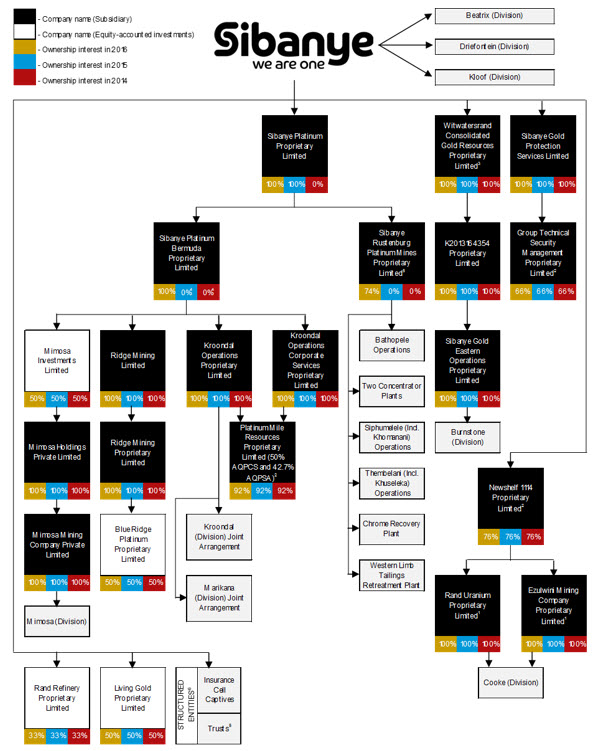

| | (c) Organisational structure | | Integrated Annual Report—Introduction—Group profile | | 14-15 |

| | | | Annual Financial Report—Annual financial statements—Notes to the consolidated financial statements—Note 1.3: Consolidation | | 126-127 |

| | (d) Property, plant and equipment | | Integrated Annual Report—Performance overview—Creating value from operations, projects and technology | | 34-41 |

| | | | Further Information—Reserves of Sibanye as of 31 December 2016 | | 191-198 |

| | | | Further Information—Environmental and regulatory matters | | 199-203 |

| | | | Annual Financial Report—Annual financial statements—Notes to the consolidated financial statements—Note 11: Property, plant and equipment | | 143-146 |

4A | | Unresolved staff comments | | NA | | NA |

5 | | Operating and financial review and prospects | | | | |

| | (a) Operating results | | Annual Financial Report—Overview—Management’s discussion and analysis of the financial statements | | 80-93 |

| | | | Annual Financial Report—Annual financial statements—Consolidated income statement | | 119 |

| | | | Annual Financial Report—Annual financial statements—Consolidated statement of financial position | | 120 |

| | | | Annual Financial Report—Annual financial statements—Consolidated statement of cash flows | | 122 |

| | (b) Liquidity and capital resources | | Annual Financial Report—Overview—Management’s discussion and analysis of the financial statements—Liquidity and capital resources | | 91-92 |

| | (c) Research and development, patents and licences, etc. | | NA | | NA |

| | (d) Trend information | | Annual Financial Report—Overview—Management’s discussion and analysis of the financial statements | | 80-93 |

| | (e) Off-balance sheet arrangements | | Annual Financial Report—Overview—Management’s discussion and analysis of the financial statements—Off balance sheet arrangements and contractual commitments | | 93 |

| | (f) Tabular disclosure of contractual obligations | | Annual Financial Report—Overview—Management’s discussion and analysis of the financial statements—Off balance sheet arrangements and contractual commitments | | 93 |

| | (g) Safe harbour | | Forward-looking statements | | 9 |

6 | | Directors, senior management and employees | | | | |

| | (a) Directors and senior management | | Annual Financial Report—Accountability—Board and executive committee | | 104-109 |

| | (b) Compensation | | Integrated Annual Report—Leadership and governance—Remuneration report | | 72-75 |

| | | | | | |

Item | | Form 20-F Caption | | Location in this document | | Page |

| | | | Annual Financial Report—Annual financial statements—Notes to the consolidated financial statements—Note 32: Related-party transactions | | 170-172 |

| | (c) Board practices | | Annual Financial Report—Accountability—Corporate governance report—Board—Rotation and retirement from the Board | | 97 |

| | | | Integrated Annual Report—Leadership and governance—Remuneration report—Executive directors’ contracts of employment | | 75 |

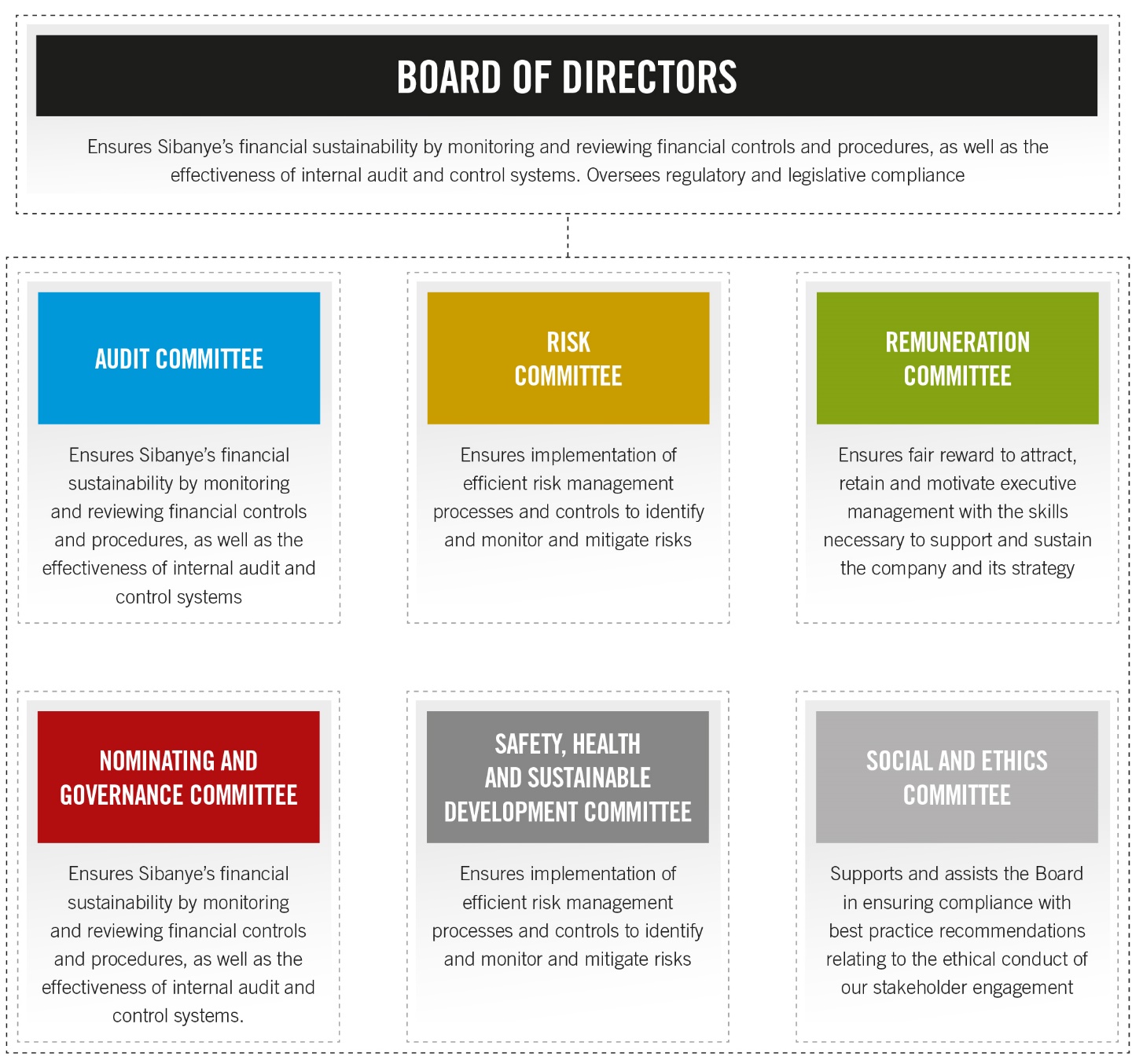

| | | | Annual Financial Report—Accountability—Corporate governance report—Board sub-committees—Audit Committee | | 99 |

| | | | Annual Financial Report—Accountability—Corporate governance report—Board sub-committees—Remuneration Committee | | 101 |

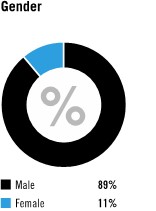

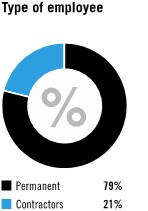

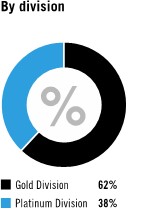

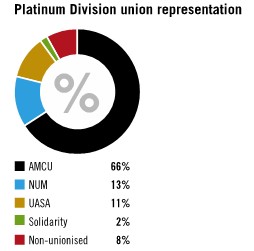

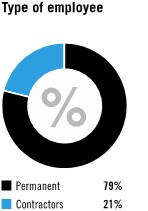

| | (d) Employees | | Integrated Annual Report—Performance overview—Superior value for the workforce | | 42-49 |

| | (e) Share ownership | | Annual Financial Report—Annual financial statements—Notes to the consolidated financial statements—Note 32: Related-party transactions | | 170-172 |

| | | | Annual Financial Report—Annual financial statements—Notes to the consolidated financial statements—Note 6: Share-based payments | | 133-138 |

7 | | Major Shareholders and Related Party Transactions | | | | |

| | (a) Major shareholders | | Annual Financial Report—Administrative details—Shareholders ownership | | 173-174 |

| | | | Integrated Annual Report—Introduction—Group profile | | 14 |

| | | | Further Information—The listing | | 205-206 |

| | (b) Related party transactions | | Annual Financial Report—Accountability—Directors’ report—Directors’ and officers’ disclosure of interests in contracts | | 112 |

| | | | Annual Financial Report—Annual financial statements—Notes to the consolidated financial statements—Note 32: Related-party transactions | | 170-172 |

| | (c) Interests of experts and counsel | | NA | | NA |

8 | | Financial information | | | | |

| | (a) Consolidated statements and other financial information | | Annual Financial Report—Overview—Management’s discussion and analysis of the financial statements | | 80-93 |

| | | | Annual Financial Report—Annual financial statements—Consolidated income statement | | 119 |

| | | | Annual Financial Report—Annual financial statements—Consolidated statement of other comprehensive income | | 119 |

| | | | Annual Financial Report—Annual financial statements—Consolidated statement of financial position | | 120 |

| | | | | | |

Item | | Form 20-F Caption | | Location in this document | | Page |

| | | | Annual Financial Report—Annual financial statements—Consolidated statement of changes in equity | | 121 |

| | | | Annual Financial Report—Annual financial statements—Consolidated statement of cash flows | | 122 |

| | | | Annual Financial Report—Annual financial statements—Notes to the consolidated financial statements | | 123-172 |

| | | | Annual Financial Report—Accountability—Directors’ report—Financial affairs—Dividend policy | | 112 |

| | | | Further Information—Additional information—Dividend policy and dividend distributions | | 204 |

| | (b) Significant changes | | NA | | NA |

9 | | The Offer and listing | | | | |

| | (a) Listing details | | Further Information—The listing | | 205-206 |

| | (b) Plan of distribution | | NA | | NA |

| | (c) Markets | | Further Information—The listing | | 205-206 |

| | (d) Selling shareholders | | NA | | NA |

| | (e) Dilution | | NA | | NA |

| | (f) Expenses of the issue | | NA | | NA |

10 | | Additional information | | | | |

| | (a) Share capital | | NA | | NA |

| | (b) Memorandum and articles of association | | Further Information—Additional information—Memorandum of Incorporation | | 207 |

| | (c) Material contracts | | Further Information—Additional information—Material contracts | | 207 |

| | (d) Exchange controls | | Further Information—Additional information—South African Exchange Control limitations affecting Security holders | | 212 |

| | | | Further Information—Environmental and regulatory matters—Exchange Controls | | 203 |

| | (e) Taxation | | Further Information—Additional information—Taxation | | 212-216 |

| | (f) Dividends and paying agents | | NA | | NA |

| | (g) Statement by experts | | NA | | NA |

| | (h) Documents on display | | Further Information—Additional information—Documents on display | | 216 |

| | (i) Subsidiary information | | NA | | NA |

11 | | Quantitative and qualitative disclosures about market risk | | Annual Financial Report—Annual financial statements—Notes to the consolidated financial statements—Note 29.2: Risk management activities | | 165-168 |

12 | | Description of securities other than equity securities | | | | |

| | (a) Debt securities | | NA | | NA |

| | (b) Warrants and rights | | NA | | NA |

| | (c) Other securities | | NA | | NA |

| | (d) American depositary shares | | Further Information—Additional information—American depositary shares | | 207-212 |

13 | | Defaults, dividend arrearages and delinquencies | | NA | | NA |

| | | | | | |

Item | | Form 20-F Caption | | Location in this document | | Page |

14 | | Material modifications to the rights of security holders and use of proceeds | | NA | | NA |

15 | | Controls and procedures | | Further Information—Controls and procedures | | 218 |

16A | | Audit Committee financial expert | | Annual Financial Report—Accountability—Corporate governance report—Board sub-committees—Audit Committee | | 99 |

16B | | Code of ethics | | Annual Financial Report—Accountability—Corporate governance report—Code of ethics | | 103 |

16C | | Principal accountant fees and services | | Annual Financial Report—Accountability—Report of the Audit Committee | | 110-111 |

16D | | Exemptions from the listing standards for audit committees | | NA | | NA |

16E | | Purchase of equity securities by the issuer and affiliated purchasers | | None | | |

16F | | Change in registrant’s certifying accountant | | NA | | NA |

16G | | Corporate governance | | Annual Financial Report—Accountability—Corporate governance report—JSE corporate governance practices compared with NYSE Listing Standards | | 103 |

16H | | Mine safety disclosure | | NA | | NA |

17 | | Financial statements | | NA | | NA |

18 | | Financial statements | | Financial Information—Report of independent registered public accounting firm | | 118 |

| | | | Annual Financial Report—Annual financial statements—Consolidated income statement | | 119 |

| | | | Annual Financial Report—Annual financial statements—Consolidated statement of other comprehensive income | | 119 |

| | | | Annual Financial Report—Annual financial statements—Consolidated statement of financial position | | 120 |

| | | | Annual Financial Report—Annual financial statements—Consolidated statement of changes in equity | | 121 |

| | | | Annual Financial Report—Annual financial statements—Consolidated statement of cash flows | | 122 |

| | | | Annual Financial Report—Annual financial statements—Notes to the consolidated financial statements | | 123-172 |

19 | | Exhibits | | Exhibits | | 219-220 |

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

Historical Consolidated Financial Statements

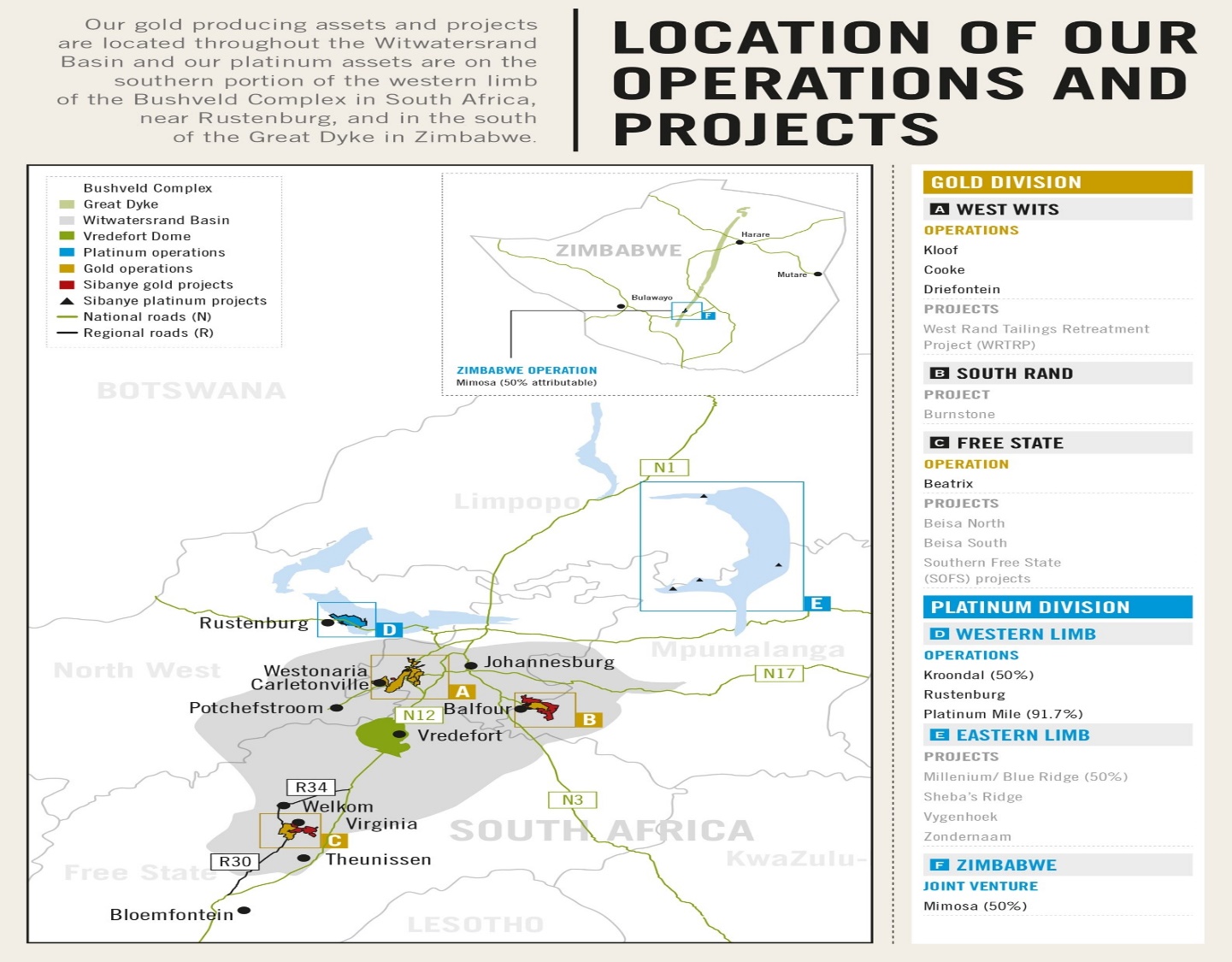

Sibanye Gold Limited (Sibanye) is a South African domiciled mining company, which currently owns and operates gold and uranium operations and projects throughout the Witwatersrand Basin in South Africa, as well as platinum group metal (PGM) operations in the Bushveld Igneous Complex in South Africa and the Great Dyke in Zimbabwe. See “Annual Financial Report—Overview—Management’s discussion and analysis of financial statements—Recent platinum acquisitions”. Accordingly, our books of account are maintained in South African Rand and our annual financial statements are prepared in accordance with International Financial Reporting Standards (IFRS), as issued by the International Accounting Standards Board, as prescribed by law. These financial statements are distributed to shareholders and are submitted to the Johannesburg Stock Exchange (JSE) and the New York Stock Exchange (NYSE).

The consolidated financial statements of Sibanye as at and for the fiscal years ended 31 December 2016, 2015 and 2014 (the Consolidated Financial Statements) have been prepared using the historical results of operations, assets and liabilities attributable to Sibanye and all of its subsidiaries (the Sibanye Group, or the Group). The Consolidated Financial Statements have been prepared under the historical cost convention, except for financial assets and financial liabilities (including derivative financial instruments), which are measured at fair value through profit or loss or through the fair value adjustment reserve in equity.

Non-IFRS Measures

The financial information in this annual report includes certain measures that are not defined by IFRS, including “operating costs”, “operating margin,”, “earnings before interest, tax, depreciation and amortisation” (EBITDA), “total cash cost”, “All-in sustaining cost”, “All-in cost”, “All-in cost margin”, “headline earnings per share”, “free cash flow” and “net debt” (each as defined below or in “Annual Financial Report—Overview—Five-year financial performance”. These measures are not measures of financial performance or cash flows under IFRS and may not be comparable to similarly titled measures of other companies. These measures have been included for the reasons described below or in “Annual Financial Report—Overview—Five-year financial performance” and should not be considered by investors as alternatives to costs of sales, net operating profit, profit before taxation, cash from operating activities or any other measure of financial performance presented in accordance with IFRS.

Operating costs is defined as cost of sales excluding amortisation and depreciation. Operating margin is defined as revenue minus operating costs, divided by revenue. Free cash flow is defined as cash flows from operating activities before dividends paid, less additions to property, plant and equipment. Management considers free cash flow to be an indicator of cash available for repaying debt, funding exploration and paying dividends.

See “Annual Financial Report—Overview—Five-year financial performance—Footnote 1”, “Annual Financial Report—Overview—Five-year financial performance—Footnote 2”, “Annual Financial Report—Overview—Five-year financial performance—Footnote 3”, “Annual Financial Report—Overview—Five-year financial performance—Footnote 6” and “Annual Financial Report—Overview—Five-year financial performance—Footnote 7” for more information.

Conversion Rates

Certain information in this annual report presented in Rand has been translated into US dollars. Unless otherwise stated, the conversion rate for these translations is R13.69/US$1.00 which was the closing rate on 31 December 2016. By including the US dollar equivalents, Sibanye is not representing that the Rand amounts actually represent the US dollar amounts shown or that these amounts could be converted into US dollars at the rates indicated.

The Acquisitions of the Rustenburg Operations and Aquarius

On 9 September 2015, Sibanye announced that it entered into an agreement with Rustenburg Platinum Mines Limited (RPM), a wholly owned subsidiary of Anglo American Platinum Limited (Anglo American Platinum) to acquire the Bathopele, Siphumelele (including Khomanani), and Thembelani (including Khuseleka) mining operations, two concentrating plants, an on-site chrome recovery plant, the Western Limb Tailings Retreatment Plant, associated surface infrastructure and related assets and liabilities on a going concern basis (the Rustenburg Operations) (the Rustenburg Operations Transaction). On 19 October 2016, Sibanye obtained consent in terms of section 11 of the Mineral and Petroleum Resources Development Act for the transfer of the mining right and prospecting right pursuant to the Rustenburg Operations Transaction, and control of the Rustenburg Operations on this date. The effective date of the implementation of the transaction was 1 November 2016, when Sibanye took over legal ownership and management of the Rustenburg Operations.

On 6 October 2015, Sibanye announced a cash offer of US$0.195 per share for the entire issued share capital of Aquarius Platinum Limited (Aquarius) (the Aquarius Transaction and, together with the Rustenburg Operations Transaction, the Acquisitions). Aquarius owns stakes in the Kroondal mine and Platinum Mile retreatment facilities near Rustenburg in South Africa and the Mimosa joint venture with Impala Platinum in Zimbabwe. The Aquarius Transaction was subject to the fulfilment of various conditions precedent which were completed on 12 April 2016, when Sibanye paid R4,301.5 million to the Aquarius shareholders and obtained control of Aquarius.

market information

This annual report includes industry data about Sibanye’s markets obtained from industry surveys, industry publications, market research and other publicly available third-party information. Industry surveys and industry publications generally state that the information they contain has been obtained from sources believed to be reliable but that the accuracy and completeness of such information is not guaranteed. Sibanye and its advisers have not independently verified this data.

In addition, in many cases statements in this annual report regarding the gold mining industry and Sibanye’s position in that industry have been made based on internal surveys, industry forecasts, market research, as well as Sibanye’s own experiences. While these statements are believed by Sibanye to be reliable, they have not been independently verified.

DEFINED TERMS AND CONVENTIONS

In this annual report, all references to “we”, “us” and “our” refer to Sibanye and the Sibanye Gold Group, as applicable.

In this annual report, all references to “fiscal 2017” and “2017” are to the fiscal year ending 31 December 2017, all references to “fiscal 2016” and “2016” are to the audited fiscal year ended 31 December 2016, all references to “fiscal 2015” and “2015” are to the audited fiscal year ended 31 December 2015 and all references to “fiscal 2014” and “2014” are to the audited fiscal year ended 31 December 2014.

In this annual report, all references to “South Africa” are to the Republic of South Africa, all references to the “United States” and “US” are to the United States of America, its territories and possessions and any state of the United States and the District of Columbia, all references to the “United Kingdom” and “UK” are to the United Kingdom of Great Britain and Northern Ireland and all references to “Zimbabwe” are to the Republic of Zimbabwe.

In this annual report, all references to the “DMR” are references to the South African Department of Mineral Resources, the government body responsible for regulating the mining industry in South Africa.

This annual report contains descriptions of gold mining and the gold mining industry, including descriptions of geological formations and mining proceeds. In order to facilitate a better understanding of these descriptions, this annual report contains a glossary defining a number of technical and geological terms.

In this annual report, gold production figures are provided in kilograms, which are referred to as “kg”, or in troy ounces, which are referred as “ounces” or “oz”. Ore grades are provided in grams per metric ton, which are referred to as “grams per ton” or “g/t.” All references to “tons”, “tonnes” or “t” in this annual report are to metric tons.

In this annual report, “R”, “Rand” and “rand” refer to the South African Rand and “Rand cents” and “SA cents” refers to subunits of the South African Rand, “$”, “US$”, “US dollars” and “dollars” refer to United States dollars and “US cents” refers to subunits of the US dollar, “£”, “GBP” and “pounds sterling” refer to British pounds and “pence” refers to the subunits of the British pound.

FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the US Securities Exchange Act of 1934, as amended (the Exchange Act) with respect to our financial condition, results of operations, business strategies, operating efficiencies, competitive position, growth opportunities for existing services, plans and objectives of management, markets for stock and other matters.

These forward-looking statements, including, among others, those relating to our future business prospects, revenues and income, the potential benefit of the Acquisitions (including statements regarding growth, cost savings, benefits from and access to international financing and financial re-ratings), PGM pricing expectations, levels of output, supply and demand, information relating to the Stillwater's underground Blitz PGM project adjacent to the east of the existing Stillwater Mine designed to explore, define and extract the PGM resource along the far eastern extent of the J-M Reef (Blitz Project), and estimations or expectations of enterprise value, EBITDA and net asset values wherever they may occur in this annual report and the exhibits to this annual report, are necessarily estimates reflecting the best judgement of our senior management and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. As a consequence, these forward-looking statements should be considered in light of various important factors, including those set forth in this annual report. Important factors that could cause actual results to differ materially from estimates or projections contained in the forward-looking statements include, without limitation:

| · | | changes in the market price of the minerals that it mines and sells; |

| · | | fluctuations in exchange rates, currency devaluations, inflation and other macro-economic monetary policies; |

| · | | the occurrence of labor disruptions and industrial actions; |

| · | | changes in relevant government regulations, particularly environmental, tax, health and safety regulations and new legislation affecting water, mining, mineral rights and business ownership, including any interpretation thereof which may be subject to dispute; |

| · | | power disruption, constraints and cost increases; |

| · | | the outcome and consequence of any potential or pending litigation or regulatory proceedings or environmental, health or safety issues; |

| · | | the occurrence of temporary stoppages of mines for safety incidents and unplanned maintenance; |

| · | | the occurrence of hazards associated with underground and surface mining; |

| · | | the ability to achieve anticipated efficiencies and other cost savings in connection with, and the ability to successfully integrate, past and future acquisitions, as well as at existing operations; |

| · | | operating in new geographies and regulatory environments where Sibanye had no previous experience; |

| · | | Sibanye’s ability to implement its strategy and any changes thereto; |

| · | | Sibanye’s future financial position, plans, strategies, objectives, capital expenditures, projected costs and anticipated cost savings and financing plans; |

| · | | changes in assumptions underlying Sibanye’s estimation of its current mineral reserves; |

| · | | supply chain shortages and increases in the price of production inputs; |

| · | | economic, business, political and social conditions in South Africa, Zimbabwe, the United States and elsewhere; |

| · | | the ability of Sibanye to comply with requirements that it operates in a sustainable manner; |

| · | | failure of Sibanye’s information technology and communications systems; |

| · | | the success of Sibanye’s business strategy, exploration and development activities; |

| · | | the availability, terms and deployment of capital or credit; |

| · | | Sibanye’s ability to hire and retain senior management or sufficient technically skilled employees, as well as its ability to achieve sufficient representation of HDSAs in its management positions; |

| · | | the adequacy of Sibanye’s insurance coverage; |

| · | | uncertainty regarding the title to Sibanye’s properties; |

| · | | social unrest, sickness or natural or man-made disaster at informal settlements in the vicinity of Sibanye’s African operations; |

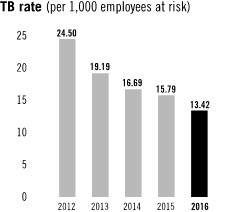

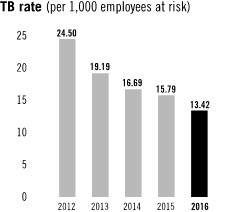

| · | | the impact of HIV, tuberculosis and other contagious diseases; and |

| · | | Sibanye’s intention to issue debt securities, which may not be available on commercially reasonable terms, or at all, which will be structurally senior to our ordinary shares and ADRs and which may limit our ability to respond to changes in market conditions or pursue business opportunities. |

The foregoing factors and others described under “Risk Factors” should not be construed as exhaustive. There are other factors that may cause our actual results to differ materially from the forward-looking statements. Moreover, new risk factors emerge from time to time and it is not possible for us to predict all such risk factors. We cannot assess the impact of all risk factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, you should not place undue reliance on forward-looking statements as a prediction of actual results.

We undertake no obligation to update publicly or release any revisions to these forward-looking statements to reflect events or circumstances after the date of this annual report or to reflect the occurrence of unanticipated events.

| |

Sibanye Integrated Annual Report 2016 | 11 |

ABOUT SIBANYE’S REPORTS

Our 2016 suite of reports, covering the financial year from 1 January 2016 to 31 December 2016, comprises the following:

| · | | Integrated Annual Report 2016 |

| · | | Summarised Report 2016 and Notice of Annual General Meeting |

| · | | Annual Financial Report 2016 |

| · | | Company Financial Statements 2016 |

These reports collectively cover the operational, financial and non-financial performance of the operations and activities of Sibanye Gold Limited (Sibanye or the Group) and provide stakeholders with transparent insight into our strategy, our business and our performance over the past year. No separate sustainable development report is produced as this information is presented in the integrated report. These reports also take note of any material events that have arisen between year-end and the date of their approval by the Board. In producing this suite of reports and the Form 20-F, Sibanye complies with the requirements of the exchanges on which it is listed, namely the Johannesburg Stock Exchange (JSE) and the New York Stock Exchange (NYSE).

SCOPE AND BOUNDARY OF REPORTS

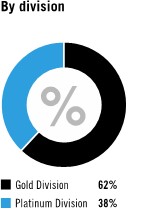

During the course of 2016, Sibanye revised its organisational structure and the management of its business in order to ensure continued delivery on its strategic objectives. Following this restructuring, Sibanye comprises two operating divisions:

| · | | Gold Division, incorporating the gold mining operations and projects |

| · | | Platinum Division, incorporating the platinum group metal (PGM) mining operations and projects |

Annual comparative data is provided where applicable from 2013, the year Sibanye was established and listed as a separate entity on the JSE. For the 2016 financial year, annual data is provided where possible by division and at group level.

Please note that the annual data provided at group-level for 2013 to 2015 is comparable to data for the Gold Division in 2016. Where data for previous years, has been restated, this is indicated.

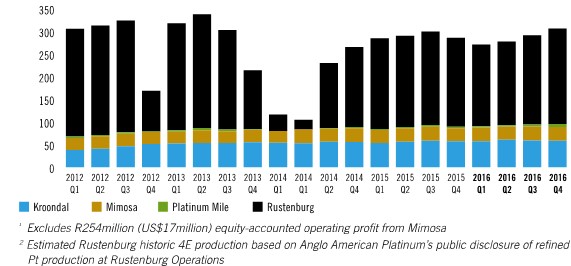

The data reported for the Platinum Division for the 2016 financial year includes the assets of Aquarius Platinum Limited (Aquarius) acquired with effect from 12 April 2016, while the assets acquired from Anglo American Platinum Limited (Anglo American Platinum) (now Sibanye’s Rustenburg Operations) are included from 1 November 2016. The data for the Platinum Division is thus effectively for the nine months from April 2016 to December 2016, unless otherwise indicated.

REPORTING PHILOSOPHY

In this integrated report, our primary report, the information provided is intended to inform stakeholders about Sibanye’s operating and financial performance and progress made in delivering on its strategy. While the principal audience for our integrated report is investors and shareholders, we acknowledge that there are other stakeholders who have varied and specific information requirements, many of which we aim to fulfil. This is particularly so since we do not produce a separate sustainable development report. Instead all non-financial reporting is either included in this integrated report or is available on the website, where referenced.

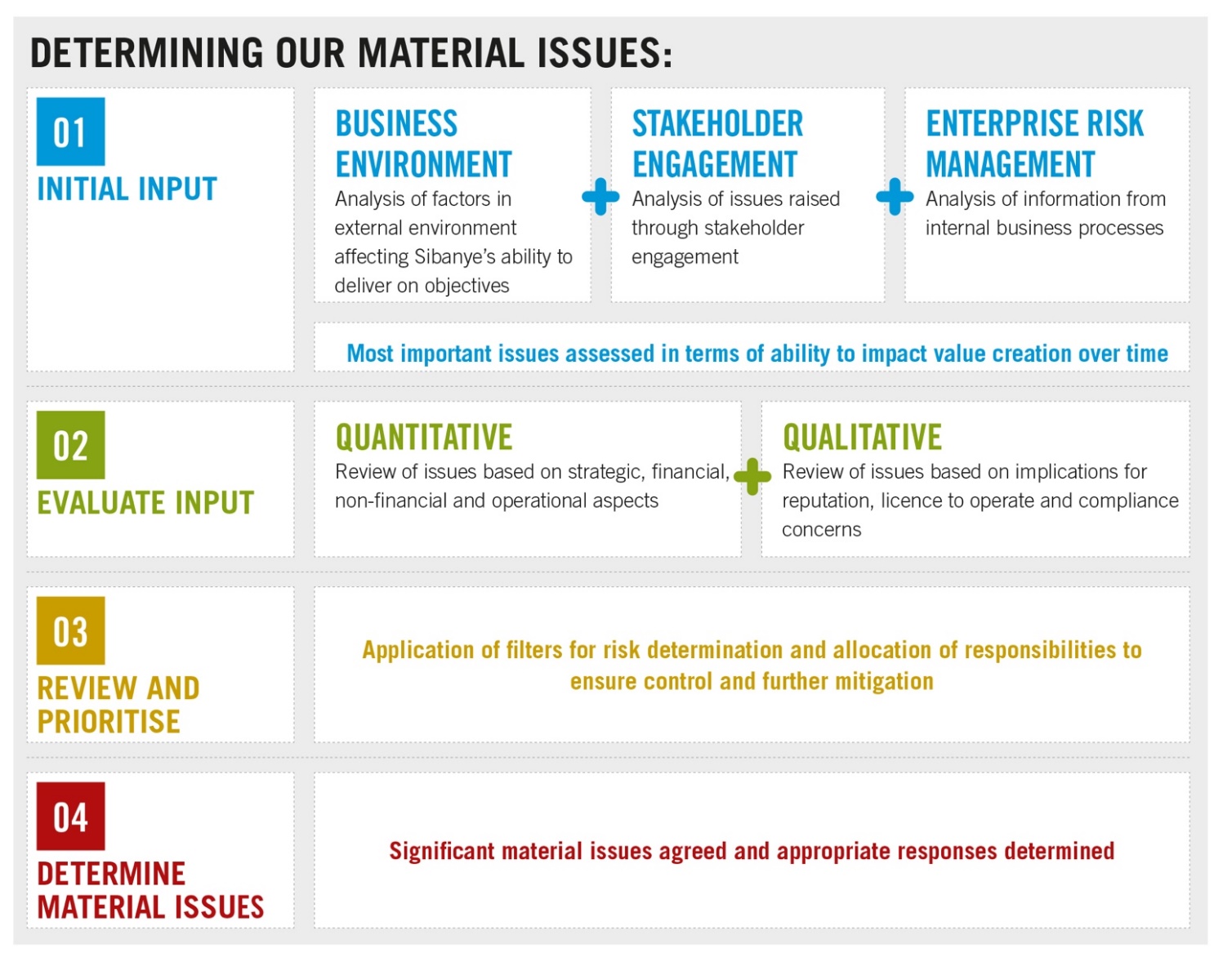

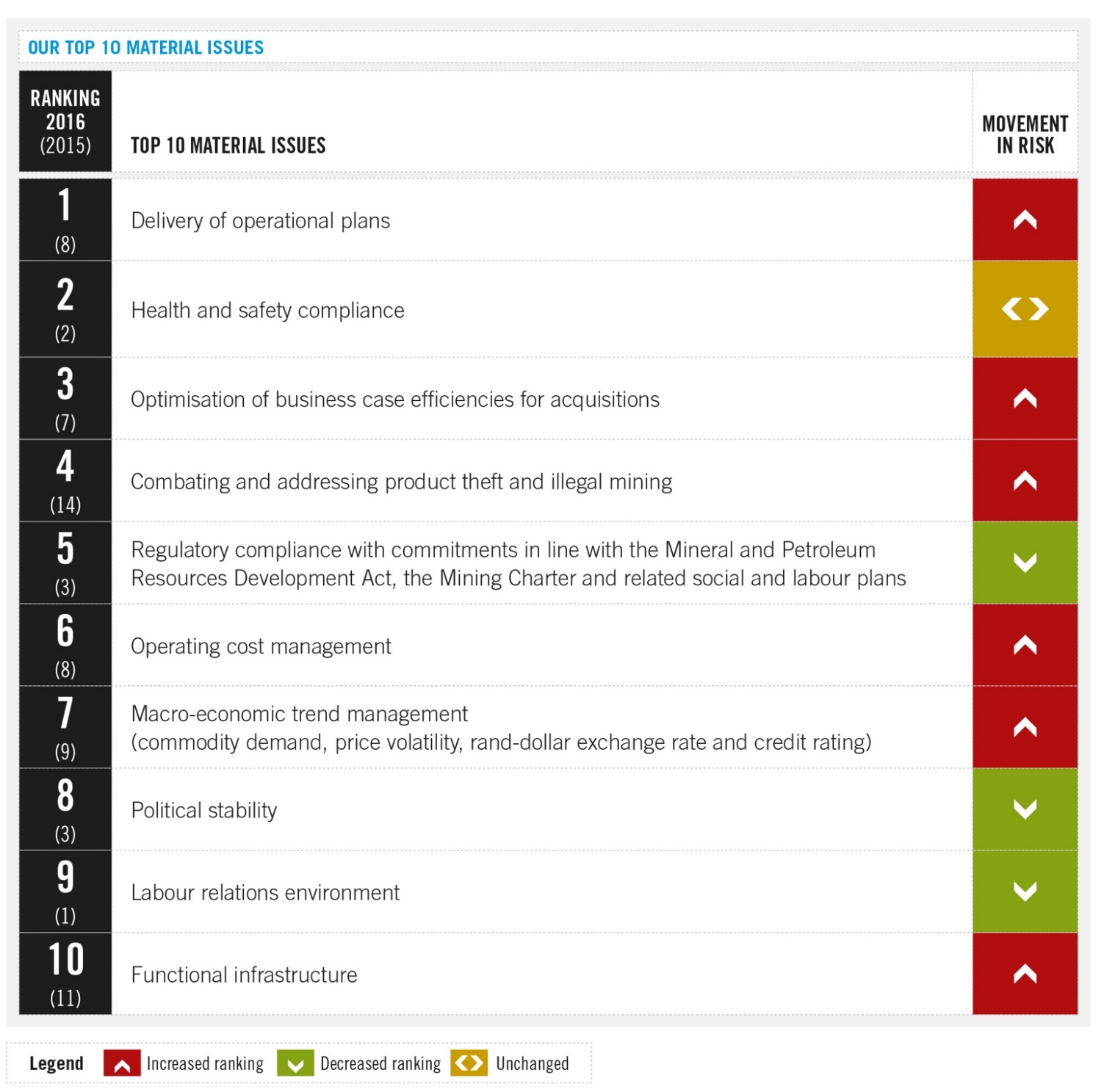

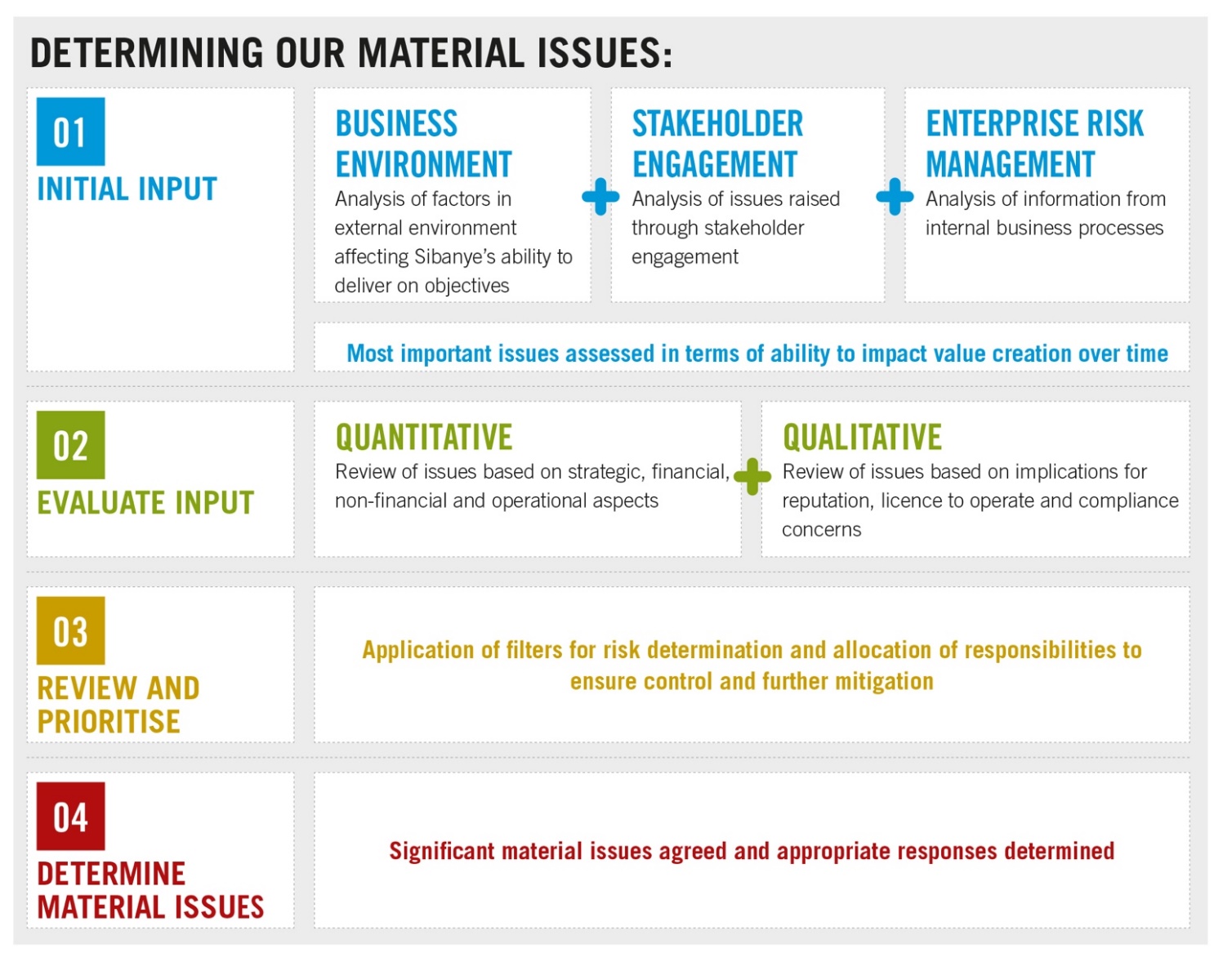

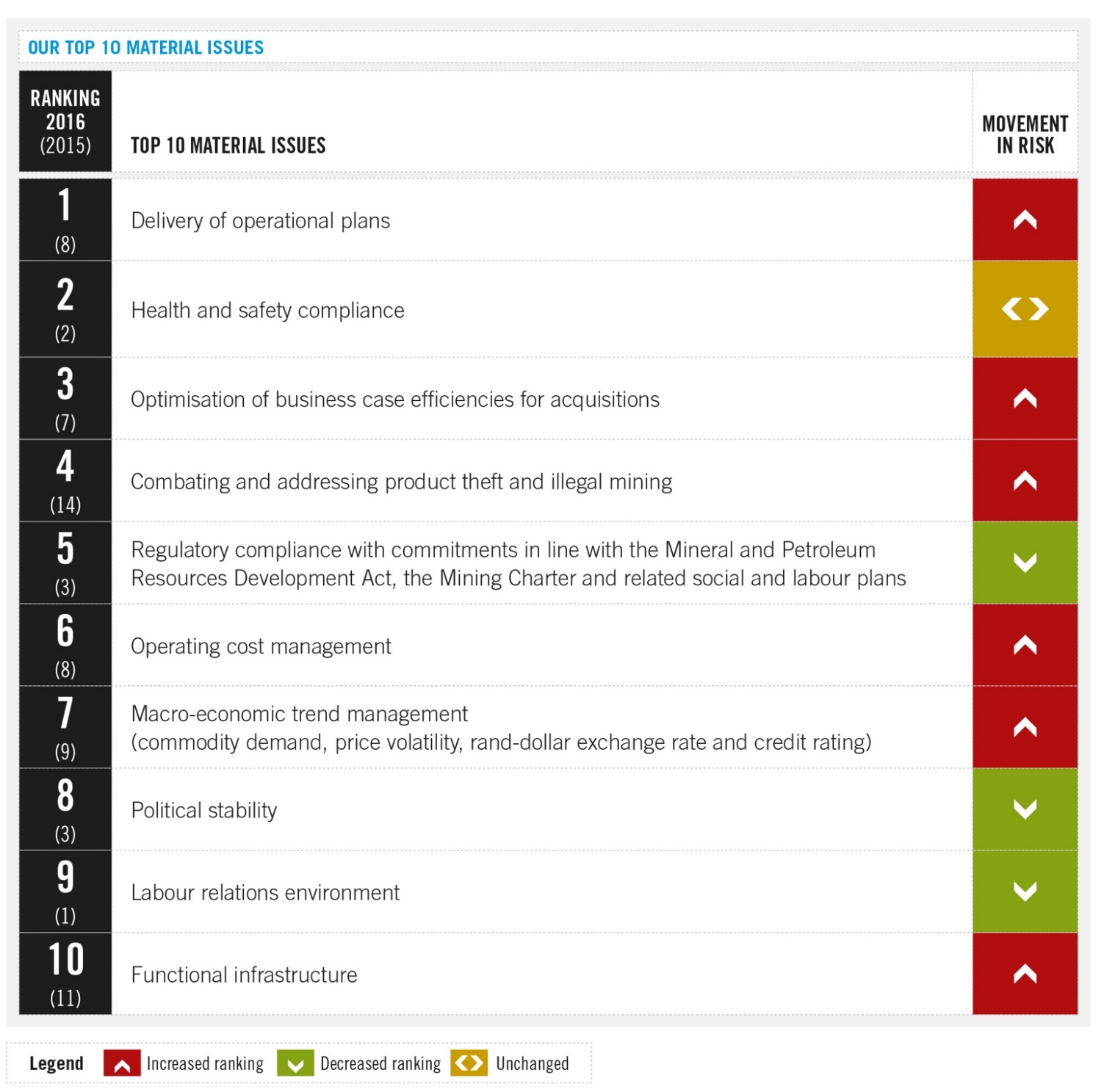

We have endeavoured to build on the information provided in last year’s integrated report. This report discusses what we did in 2016 to create value, to improve lives and to achieve our strategic objectives. In so doing, we give an account of the impact of our activities and, more importantly, of those factors and risks, both in the external environment and internally, that have had an impact on our ability to achieve our strategic objectives and to create superior value in the past year. The process to determine the most material of these is described in “—View from the top—Material risks and opportunities”. Sibanye considers an issue to be material if it substantially affects our ability to create and sustain value in the short, medium and long term.

APPROVAL AND ASSURANCE

Sibanye’s internal audit function provides an independent evaluation of the Group’s internal control processes and systems that have been devised to mitigate business risks and has ensured the accuracy of the information presented in these reports.

REPORTING COMPLIANCE

The following frameworks, guidelines and requirements have been applied, where relevant in compiling this integrated report and the entire suite of 2016 reports:

| · | | International Integrated Reporting Framework |

| · | | Global Reporting Initiative (GRI) G4 |

| · | | King Report on Governance for South Africa 2009 (King III) |

| · | | South African Companies Act, 71 of 2008 (the Companies Act) |

| · | | JSE Listings Requirements |

| · | | South African Code for Reporting of Exploration Results, Mineral Resources and Mineral Reserves (SAMREC Code) |

| · | | Broad-Based Socio-Economic Empowerment Charter for the South African Mining and Minerals Industry (Mining Charter) (2002) and related scorecard (2004) |

| · | | Amendments to the Mining Charter (2010) and related scorecard (2010) |

| · | | Social and Labour Plans (SLPs) – in terms of the requirements of the Mineral and Petroleum Resources Development Act 28 of 2002 (MPRDA) |

| |

Sibanye Integrated Annual Report 2016 | 12 |

| · | | International Council on Mining and Metals (ICMM) |

| · | | United Nations Global Compact (UNGC) |

| · | | Greenhouse Gas (GHG) Protocol |

| · | | Sustainability Accounting Standards Board’s (SASB) standards |

| · | | FTSE/JSE Responsible Investment Index |

| · | | International Financial Reporting Standards (IFRS) |

| · | | South African Institute of Chartered Accountants (SAICA) Financial Reporting Guides |

| · | | US Securities and Exchange Commission regulations, including the Industry Guide 7 for the Reporting of Mineral Reserves |

The required disclosure is included in this integrated report or in the supplementary reports and documents available online, http://reports.sibanyegold.co.za

| |

Sibanye Integrated Annual Report 2016 | 13 |

Group PROFILE

Sibanye is an independent mining group domiciled in South Africa, which owns and operates a portfolio of high-quality gold and platinum group metals (PGMs) operations and projects.

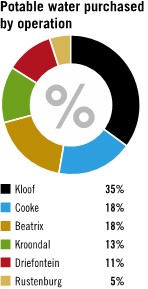

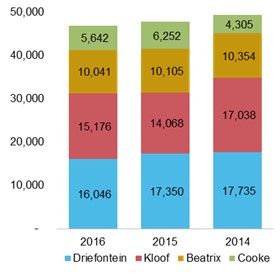

Our assets

At financial year end, Sibanye’s gold assets included four underground and surface gold mining operations in South Africa – the Cooke, Driefontein and Kloof operations in the West Witwatersrand (West Wits) region of Gauteng and the Beatrix operation in the southern Free State. Sibanye also owns and manages significant extraction and processing facilities at its operations where gold-bearing ore is treated and beneficiated to produce gold doré. In addition, Sibanye is currently investing in a number of organic projects to sustain it in the long term.

During 2016, Sibanye acquired Aquarius Platinum Limited (effective 12 April 2016). The Aquarius assets include a 50% stake in each of the Kroondal and Mimosa mines, and associated infrastructure and concentrating facilities, as well as Platinum Mile (91.7%).

The assets acquired from Anglo American Platinum Limited (effective 1 November) are the Bathopele, Siphumelele, and Thembelani (including Khuseleka) shafts, two concentrating plants, an on-site chrome recovery plant, the western limb tailings retreatment plant and all associated surface infrastructure, referred to as the Rustenburg Operations.

Towards year end, Sibanye announced the proposed acquisition of Stillwater Mining Company (Stillwater), which has palladium and platinum producing operations in Montana in the United States.

black economic empowerment

The Group is committed to transformation and is guided by the Broad-Based Socio-Economic Empowerment Charter for the South African Mining and Minerals Industry (Mining Charter). In 2004, Gold Fields of South Africa Limited (Gold Fields) undertook a broad-based black economic empowerment (BBBEE) transaction, transferring an amount equivalent to 15% of its equity in Sibanye, formerly GFI Mining South Africa Proprietary Limited (GFI Mining South Africa), to Mvelaphanda Gold Proprietary Limited (Mvelaphanda Gold).

In 2010, a further 10% of equity was allocated to an employee share ownership plan (ESOP) and another 1% in an empowerment deal. At the end of 2016, 24,523 Sibanye employees were participants in the Thusano Trust, our ESOP.

With the acquisition of the Rustenburg operations, Sibanye concluded a 26% BBBEE transaction with a consortium comprising: Rustenburg Mine Employees Trust (30.4%), Rustenburg Mine Community Development Trust (24.8%), Bakgatla-Ba-Kgafela Investment Holdings (24.8%) and Siyanda Resources Proprietary Limited (20%).

listing information

The Group’s primary listing is on the JSE, trading under the share code SGL, where it is a constituent of the FTSE/JSE Responsible Investment Index. The Group has a secondary American Depositary Receipts (ADR) listing on the NYSE, trading under the ticker code SBGL. Each ADR is equivalent to four ordinary shares.

At 31 December 2016, Sibanye had issued share capital of 929,004,342 shares and a market capitalisation of R23.6 billion (US$1.7 billion) (2015: R20.9 billion (US$1.3 billion)).

Our products

Gold

Sibanye mines, extracts and processes gold-bearing ore to produce a beneficiated product, doré, which is then refined further at Rand Refinery Proprietary Limited (Rand Refinery) into gold bars with a purity of at least 99.5% in accordance with the London Bullion Market Association’s standards of Good Delivery. Sibanye holds a 33% interest in Rand Refinery, one of the largest global refiners of gold, and the largest in Africa, which then markets and sells the refined gold on international markets to customers around the world.

Platinum group metals

Sibanye mines PGM-bearing ore at its newly acquired assets that is processed to produce PGMs-in-concentrate. The primary PGMs produced are platinum, palladium and rhodium, which together with the gold occurring as a co-product, are referred to as 4E (3PGM+Au).

By-products

Sibanye derives uranium ore as a by-product of gold production and, up until it ceased underground production from the Cooke 4 mine, produced ammonium diuranate from a dedicated uranium stream at the Ezulwini plant. The underground ore was processed to recover the uranium and then subsequently to recover gold.

At our platinum operations, the minor PGMs produced are iridium and ruthenium, which, together with the three primary PGMs, are referred to as 6E (5PGM+Au). In addition, nickel, copper and chrome, among other minerals are produced as by-products at these operations.

| |

Sibanye Integrated Annual Report 2016 | 14 |

| |

Sibanye Integrated Annual Report 2016 | 15 |

OUR VISION AND STRATEGY EXPLAINED

Our vision

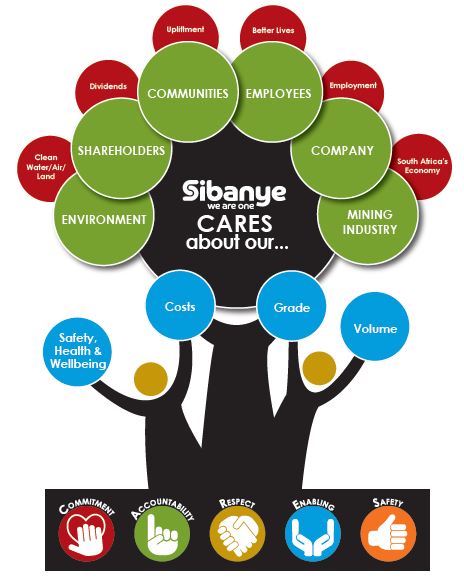

Superior value creation for all our stakeholders through mining our multi-commodity resources in a safe and healthy environment.

Superior value is delivered by:

| · | | maintaining a clear and consistent operational focus and applying a holistic, efficient operating model |

| · | | disciplined, efficient and cost-effective capital management to enable investment in value-accretive growth |

Our STRATEGY

By delivering on its strategy and vision to create superior value and improve lives, Sibanye expects to maintain mutually constructive relationships with all stakeholders and, ultimately, to achieve a premium market rating.

| |

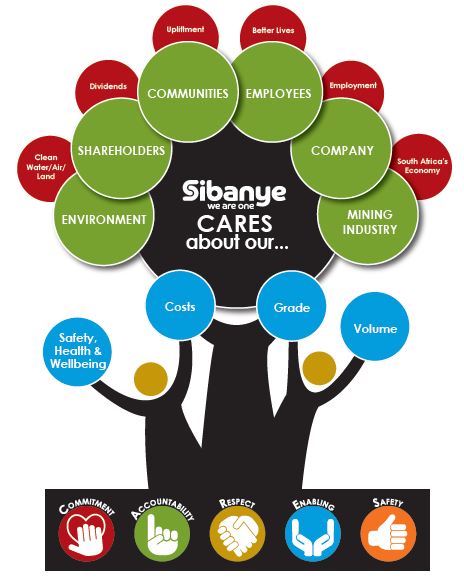

OUR VALUE PROPOSITION – DELIVERING SUPERIOR VALUE TO STAKEHOLDERS • EMPLOYEES Sibanye provides employment enabling those employed to earn an income, to acquire skills and advance through training and development, in an environment where their safety, health and welbeing are priorities. • COMMUNITIES In turning to account our resources and reserves, Sibanye contributes to host and labour-sending communities as well as to society and the economy at large by investing in socio-economic development initiatives, employing those who reside in the vicinity of our operations and through preferential local procurement. • GOVERNMENT Sibanye contributes directly to the national fiscus by way of taxes and royalties paid, enabling government to provide social infrastructure and services. Sibanye also contributes indirectly through the payment, in turn, by employees of personal income tax. • SHAREHOLDERS Sibanye delivers value to shareholders by the payment of consistent dividends and by capital appreciation spurred by operational efficiency and organic and acquisitive growth. Sibanye’s commitment to paying industry-leading dividends underpins and informs our strategy. Sibanye recognises that: • safety, costs, volumes and grade are the primary operational deliverables underpinning our business • strong cash flow supports the dividend paid to shareholders and is vital to growth • growth (organic and acquisitive) ensures the long-term delivery of sustainable value to all stakeholders |

In living our values of commitment, accountability, respect, enabling and safety, we show that we care about safe production, our stakeholders, our environment, our company and our future. Our approach is holistic with a clear focus to deliver on all strategic imperatives critical to Sibanye’s long-term success. |

| |

Sibanye Integrated Annual Report 2016 | 16 |

how we create value

Below we describe how Sibanye operates, the inputs that are required for the conduct of the business and how these are transformed into value for stakeholders.

Sibanye's

PRIMARY BUSINESS activities are:

| · | | Mine development and mining operations, primarily underground ore bodies |

| · | | Developing organic growth projects |

| · | | Beneficiation and further refining as required |

| · | | Sale of end products produced |

| · | | Exploring for and/or acquiring new ventures |

Allied to these activities are:

| · | | Community and social development initiatives |

| · | | Environmental management and rehabilitation |

business model:

Sibanye’s business model is to optimise its operations by managing the fundamental inputs of safety cost, grade and tonnes and, by leveraging its low-cost operating expertise, to realise additional value from new acquisitions. Sustainability is achieved by investing in organic projects and making value-accretive acquisitions which support the ability to continue paying industry leading dividends. Sibanye views proactive stakeholder engagement as a critical factor in ensuring business stability and sustainability.

operating context and risk:

In conducting our business, various factors in our external operating environment have an effect on our business and ability to create superior value. In monitoring and managing our operating environment, we have identified the top material risks, both internal and external, to our ability to create value, and steps taken to mitigate these risks.

For additional information on our operating environment and risks, see “—View from the top—Material risks and opportunities”.

| |

Sibanye Integrated Annual Report 2016 | 17 |

PERSPECTIVE FROM THE CHAIR

The past year has been particularly significant for Sibanye. We concluded the acquisitions of Aquarius Platinum Limited and the Rustenburg assets, establishing Sibanye as a leading PGM producer.

I am pleased to present this report to all the stakeholders at a time when we have positioned Sibanye to be a company of real stature in our sector. The past year has been particularly significant with Sibanye’s entry into the PGM industry resulting in the company transitioning from a top ten gold producer to a leading precious metals enterprise. The conclusion of the acquisitions of Aquarius Platinum Limited and the Rustenburg assets, established Sibanye as a leading PGM producer.

The proposed acquisition of the low-cost, high-grade Stillwater operations and downstream processing and refining operations is likely to cement Sibanye’s position as a globally influential, top tier precious metals company, if approved by shareholders. This strategy has the full support of the Sibanye Board. We are confident that the longer-term fundamentals for platinum and palladium supply and demand remain sound and we are convinced that Sibanye’s considered entry into this industry, at a favourable point in the commodity price cycle, will deliver significant value for stakeholders.

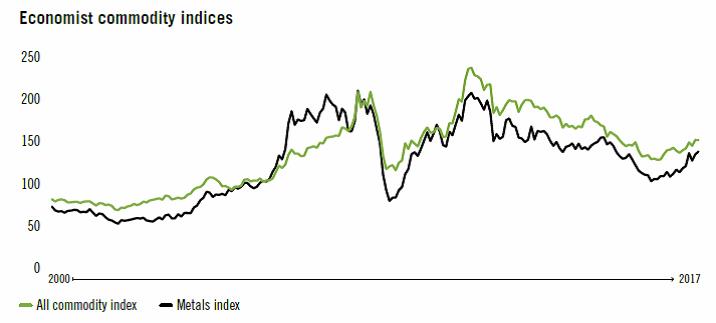

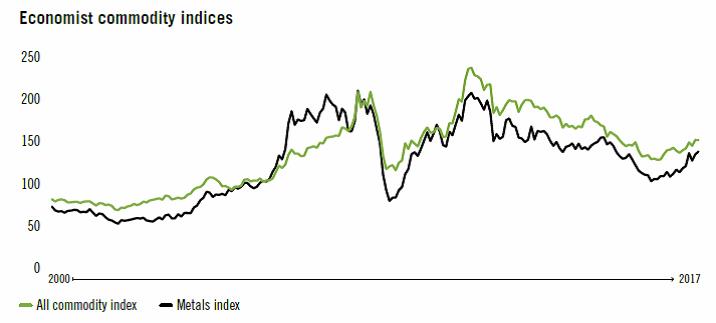

The global political and economic outlook in the beginning of 2016 was poor and with the demand outlook for commodities uncertain and little evidence of supply discipline, commodity prices in general were depressed, reaching lows not seen since 2009, just after the global financial crisis.

Uncertainty of this nature is generally positive for gold demand, and the dollar gold price rose steadily in the first quarter of 2016, supported by a muted US economic outlook and the threat of an interest rate hike becoming more remote. Local gold producers, after years of restructuring and cost cutting, were already benefiting from higher rand gold prices following the abrupt depreciation of the rand in November and December 2015, due to unexpected political disquiet in the Finance Ministry of South Africa. These astonishing political actions, seemed to set the scene for a number of unpredictable global economic and political events, which caused considerable market instability and volatility.

The first of these implausible global events in 2016 was the unanticipated pro-Brexit victory in June, which threw global markets into turmoil. The resultant increase in speculative demand for gold as a hedge against uncertainty, boosted the dollar gold price to over US$1,360/oz and the rand gold price to new all-time highs of over R650,000/kg in July 2016, significantly boosting operating margins for the local industry.

Somewhat surprisingly though, following the initial reaction to the pro-Brexit vote, the global markets appeared to shrug off any major economic consequences. The commodity prices in fact continued to build on price gains made since the beginning of the year, signalling expectations of a recovery in demand. With economic concerns abating, expectations of interest rate hikes in the US again began to weigh on the gold price, which declined steadily toward year end, dragging the platinum price with it. Even the widely unanticipated election of Donald Trump as President of the US in November 2016, which many market commentators had predicted to be positive for the gold price, did little to arrest the steady decline in the gold price and other precious metals.

South Africa has never been immune from political excitement and the groundswell of activism for change grew into 2016. The student campaigns, the Constitutional Court rulings seeking to protect the sanctity of the country’s constitution and the prominent losses suffered by the ANC in local municipal elections were highlights of 2016. With the leadership shown by the National Treasury, South Africa managed to reduce the prospect of a ratings downgrade.

With the risk of a sovereign ratings downgrade diminishing and the rand strengthening against the US dollar, the rand gold price retraced most of its gains to end the year flat at R509,000/kg. With operating margins again under pressure, Sibanye’s share price lost gains previously made, along with rand gold and PGM prices, and, just prior to the announcement of the Stillwater transaction, had fallen from a peak of R70 to approximately R28 a share.

While the longer-term political and economic ramifications of events such as the pro-Brexit vote in the United Kingdom and the election of Donald Trump in the United States of America, are difficult to predict and market uncertainty and volatility are likely to persist for some time, the consensus outlook for precious metal prices in the near term remains subdued. This is particularly so in rand terms, with the rand remaining surprisingly resilient and market consensus increasingly biased towards a stronger for longer local currency. The strong currency will significantly impact industry margins, particularly when considering that local mining cost inflation is higher than general CPI or PPI due to above inflation electricity cost increases and above inflation wages increases. Management at Sibanye in preparation for a strong rand environment, have already deferred non-critical growth capital expenditure at some projects and are reviewing operating costs and reassessing operating plans in order to ensure sustainability.

| |

Sibanye Integrated Annual Report 2016 | 18 |

In addition to the prevailing economic uncertainty, the business environment in South Africa has become more challenging in the last year, due to continued policy uncertainty, heightened regulatory intervention and an unsettled political environment. These political and economic challenges and their possible future impact on the operating environment need to be acknowledged and regularly considered by the board and management of Sibanye and factored into the Group strategic thinking. We remain committed to building a sustainable mining company which creates superior value for all stakeholders and we will continue to respond to challenges by managing our assets as efficiently and cost effectively as possible and, without compromising our strategic fundamentals, adapting our strategy in order to protect shareholder value.

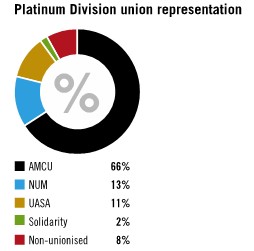

We have pledged to deliver superior value to all stakeholders and we continue to engage with our employees, the unions, our host communities and the authorities, to ensure that all stakeholders benefit from our activities. We have had some notable successes, with constructive engagement with the unions averting a threatened strike early in the 2016 year, and securing the three-year gold wage agreement struck in October 2015. In October 2016 too, a three-year wage settlement was peacefully agreed in the Platinum Sector including our Rustenburg Operations, which I believe represents a maturing of the multi-union relationship in the industry and displays a refreshing pragmatism on employment and remuneration by employees as well as employers. We are also actively engaging with our communities to ensure that our social expenditure results in sustainable and value enhancing community development.

Looking forward, we continue to face policy and regulatory uncertainty, particularly the effects that the eventual passing of the Mineral and Petroleum Resources Development Act (MPRDA) Amendment Bill might have on the industry’s voluntarily agreed Mining Charter and the discretionary powers proposed for the Minister of Mineral Resources. As a major employer and listed company, we need to understand the terms and cost of doing business in South Africa to make informed decisions and commit to what is fair. The Industry through the Chamber of Mines has attempted to engage constructively with the Department of Mineral Resources (DMR) on some of the more punitive and ambiguous aspects of both the MPRDA and the Mining Charter, but at this stage the outcome remains unclear.

Another issue which has arisen between the industry and the DMR has been imposition of work stoppages in terms Section 54 of the Mine Health and Safety Act, in the event of accidents or safety transgressions in localised sections of a mine. While our commitment to safety remains firm and we apply significant resources to improving safety at our operations, these stoppages can have a significant impact on the economic viability of operations and hence, on future employment. The industry continues to engage with the DMR on this issue and is hoping to agree on a set of clear procedures and guidelines governing the application of Section 54s.

The integration of the Aquarius PGM operations, since the transaction was concluded in April 2016, has proceeded according to plan. Transitions of this nature and scale are always difficult, but it has been pleasing to note that the operational excellence that characterised the Aquarius operations has been maintained under Sibanye’s management. The outstanding regulatory approvals for the acquisition of the Rustenburg Operations were finally received towards the end 2016 enabling Sibanye to take operational control from 1 November. It was again pleasing to note the operational turnaround achieved at the Rustenburg Operations during the final quarter of 2016, after a challenging first nine months. During the two months under Sibanye operational control, the Rustenburg Operations delivered to plan and contributed R74 million in operating profit to the Group after recording significant losses earlier in the year. As previously indicated, management expects to realise over R800 million of identified annual synergies as the Platinum Division is fully integrated over the next three years. The initial steps have been taken and management expects to achieve approximately R400 million of these synergies by the end of 2017.

The proposed acquisition of Stillwater Mining Company (Stillwater) was announced on 9 December 2016 following extensive due diligence by management. The Board is confident that this transaction is value accretive and will uniquely and strategically position Sibanye as an influential and globally-competitive precious metals producer. The proposed transaction is consistent with Sibanye’s strategy of pursuing value-accretive growth which will sustain its status as an industry-leading dividend-paying company and offers the additional strategic benefits of commodity and geographical diversification as well as a potential market rerating over time.

Sibanye remains committed to growth in South Africa and other geographies, and is well positioned to pursue further value-accretive opportunities in the near and medium term. The Board and management of Sibanye will also be mindful of the prevailing risks however, when considering further significant long-term capital investment in the local and international mining industry.

Our primary focus in the coming year will be on bedding down our platinum acquisitions, making progress on reducing our financial leverage in line with our long-term targets and on fulfilling our vision to establish the Sibanye as a premier, globally competitive precious metals mining company and in so doing to improve the lives of all. For this, our executive management team, led by Neal Froneman, are to be commended. Appreciation is also due to the entire Sibanye workforce, whose commitment to the company has been critical to what we have achieved in the past year. My thanks also go to my fellow directors on the Board, for their invaluable guidance and whole hearted support.

Sello Moloko

Chairman

30 March 2017

| |

Sibanye Integrated Annual Report 2016 | 19 |

chief executive’s review

Our strategic vision at Sibanye is to create superior value for all of our stakeholders, and as a company, if we are to deliver value in a sustainable manner, we need to ensure delivery through all the phases of the economic and commodity cycles.

As such, our strategy needs to be sound and consistent in order to deliver in the long term, yet flexible enough to respond to sudden changes in our operating environment.

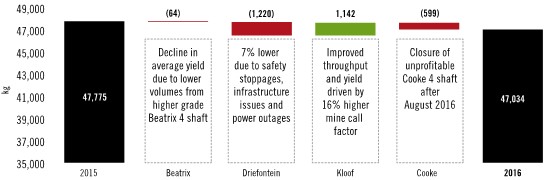

This requires optimising our operations and ensuring that we continue to deliver on the operational deliverables of safety, volume, cost and grade and by extending, as far as is profitably possible, the lives of our operations. Sibanye’s foundation remains firmly rooted in its South African gold operations and we continue to explore ways to reduce costs and ensure sustainable operational delivery, including continued capital investment in organic growth projects. It is sometimes necessary to make tough decisions however, with the restructuring or closure of loss making operations necessary, to secure a more certain future for the Group. The cessation of mining at Cooke 4 in the latter half of 2016 was one such difficult decision. This had followed unsuccessful engagement with key stakeholders in an attempt to restore the mine to profitability. Subsidising loss-making production by profitable operations is value destructive for all stakeholders and will not be done at Sibanye.

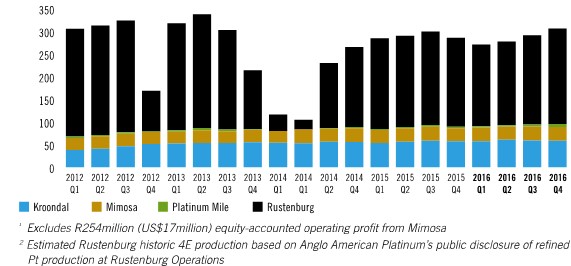

We continue to see merit in industry consolidation. Significant value can be realised by removing unnecessary overhead costs and by optimising the use of infrastructure and resources. We remain confident that this will be borne out at our Platinum Division in coming years, where we anticipate realising over R800 million in annual cost and operational synergies between the Aquarius assets (Kroondal, Mimosa and Platinum Mile) acquired in April 2016 and the Rustenburg Operations, which we assumed control of in November 2016. Despite a relatively short period under Sibanye’s management, the performance from both the Aquarius assets and the Rustenburg Operations have been pleasing, and in line with our expectations.

Value-accretive acquisitive growth remains strategically important and, while the South African gold and PGM sectors continue to offer opportunities, value-accretive prospects in other commodities and geographies will be considered. The proposed US$2.2 billion cash offer for Stillwater announced in December 2016 is consistent with this strategy. Stillwater offers high grade, low cost operations and significant low cost growth potential, as well as world class processing facilities and a strategically relevant recycling business, which is the largest in the world. The acquisition would transform Sibanye, making it globally competitive, lowering its cost of capital and providing significant upside through a potential rerating in the market.

The relative attractiveness and risk associated with investing in South Africa is also an important consideration, and heightened political and regulatory uncertainty recently has added to investment risk. It is clear that a new, more co-operative approach involving all stakeholders is required if the mining industry is to continue to play its critical role in the development and transformation of the South African economy. I will explore this in a bit more detail later in this review.

Stillwater Transaction rationale

| · | | It is value accretive on a net asset value basis and cash flow accretive as the Blitz project ramps up |

| · | | The Blitz project brings near-term, organic and low-cost growth |

| · | | Stillwater will add two low-cost, low-risk, steady state producing PGM mines to Sibanye’s portfolio |

| · | | It will position the Platinum Division further down the global cost curve, with potential for further cost reductions |

| · | | It will improve access to lower-cost global financing |

| · | | It will balance the portfolio operationally and geographically with the addition of world-class assets in an attractive mining jurisdiction |

| - | | a high-grade (20g/t), palladium-biased (78% palladium), long-life (+25 years), low-cost (< $500/2E oz), mechanised operation |

| - | | a mine-to-market PGM business |

| - | | a large, PGM-recycling business providing a steady margin and strategic insight into the market |

More information on the Blitz Project:

The Blitz project is basically an extension of the current Stillwater mine’s orebody which is scheduled to start first production in early 2018. Blitz will add 270,000 – 330,000 2E ounces to the complex and aims to reach steady state production in 2021. US$140 million of total planned capital expenditure of US$250 million remains to be spent.

SAFETY

Sibanye’s commitment to its vision of “creating superior value for all stakeholders” defines and guides all aspects of the business. Employees are key stakeholders, and the health, wellbeing and safety of Sibanye’s employees is of primary importance. Workplace accidents are not an inescapable factor of mining. They are preventable and can even be eliminated through coordinated action by everyone involved within Sibanye, across all occupations.

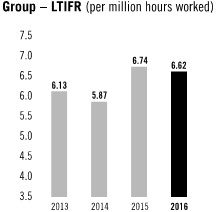

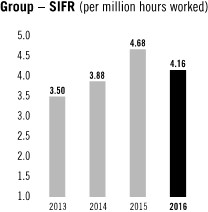

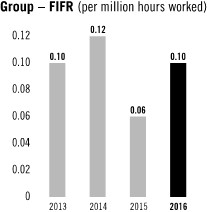

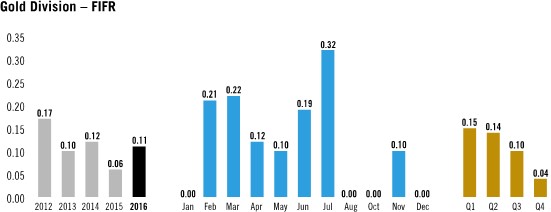

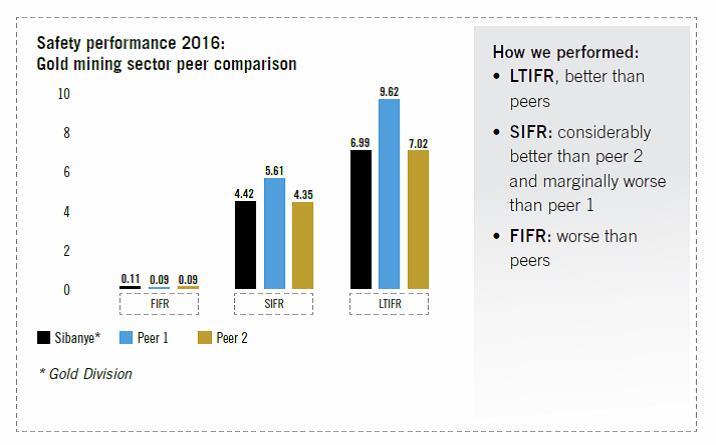

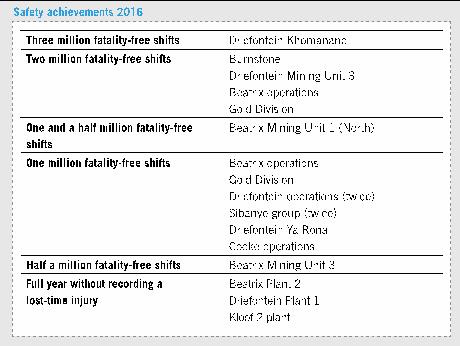

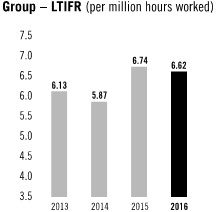

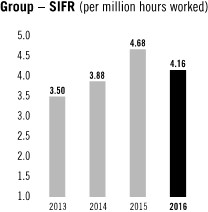

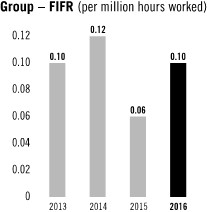

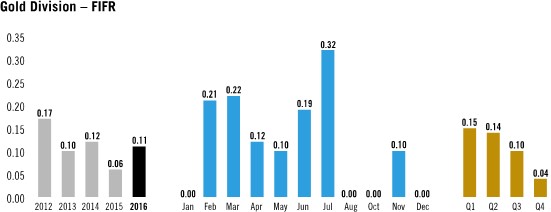

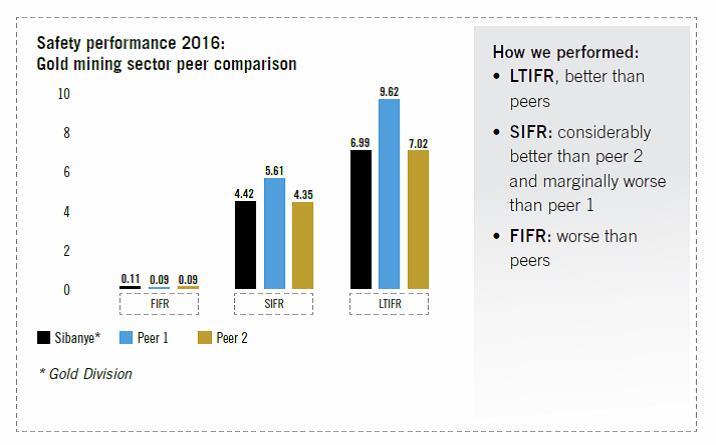

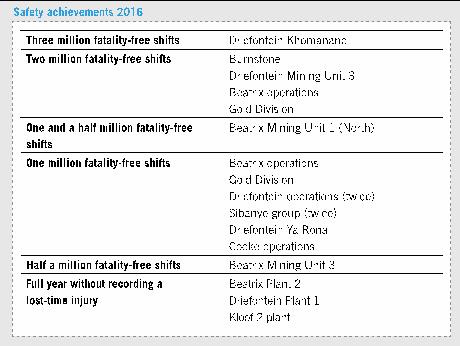

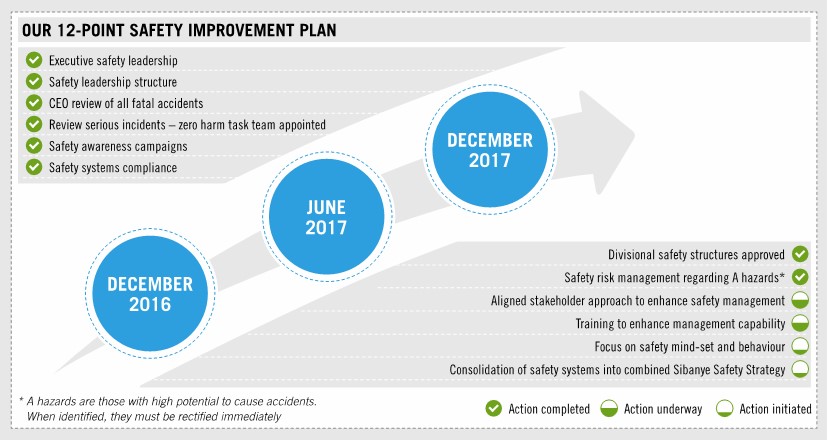

Our gold operations showed an improved safety trend in terms of the fatal injury frequency rate (FIFR) since 2012. Our performance compared favourably with that of the US mining industry’s safety benchmark.

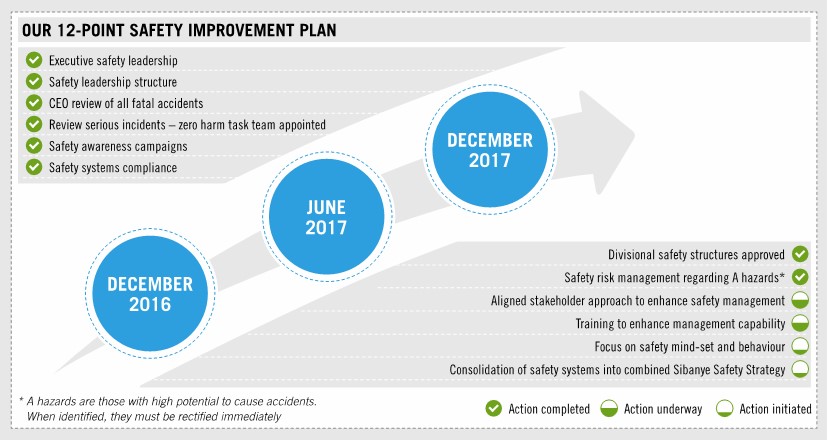

Regrettably there was a regression in the Gold Division’s safety performance during the first six months of the year, when there were eight fatalities compared with four during the comparative period in 2015. Sibanye management implemented urgent action to address this regression in safety, appointing Peter Turner, who has exemplary qualifications and significant mining experience in the role of Senior Vice President: Safety, Health and Environment. Sibanye’s executive management, together with senior safety specialists, completely reviewed the Group's safety principles and, following the review, rolled out an extensive safety awareness campaign, elevating safety as a core value in the Group “CARES” values.

It was therefore pleasing to note the significant improvement in safety from August 2016, in particular at the Gold Division, which recorded a significantly improved safety performance for the second half of 2016: the FIFR improved by 50% to 0.07 per million hours worked; the

| |

Sibanye Integrated Annual Report 2016 | 20 |

SIFR by 27% to 3.72 per million hours worked; and the LTIFR by 19% to 6.25 per million hours worked. The Platinum Division ended the year as follows: FIFR 0.09, SIFR 2.88 and LTIFR 4.84.

Nonetheless, any loss of life is extremely distressing and my deepest condolences and those of Sibanye’s management team go to the families, friends and colleagues of employees who passed away in 2016. Sibanye will continue to strive to achieve our goal of Zero Harm in the workplace and we have a structured, workable plan to achieve this. Further detail on the safety performance and strategy is provided in “—Performance overview—Health and safety focus—Safety”.

OPERATING AND FINANCIAL SUMMARY

The Group operating result and financial performance was on the whole solid, with the Gold Division benefiting from the relatively high rand gold price for most of the year, and the newly incorporated Platinum Division performing well, resulting in record Group operating profit of R10.5 billion (US$717 million), 66% higher than for the year ended 31 December 2015. Operating profit from the Gold Division of R10.2 billion (US$692 million), was 60% higher than for the previous year, with the Platinum Division contributing R376 million (US$26 million), reflecting a positive contribution from the Rustenburg Operations from 1 November 2016 and continued good performances at the Kroondal and Mimosa Operations.

Normalised earnings of R3.7 billion (US$249 million) were also significantly higher than in 2015 (R1.2 billion (US$96 million)), allowing the Board to declare a total dividend of 145 cents per share (R1.4 billion) for the year ended 31 December 2016, representing a dividend yield of 5%. Sibanye has declared a dividend with a yield of more than 5% every year since listing, which is more than double the average of our gold peers globally.

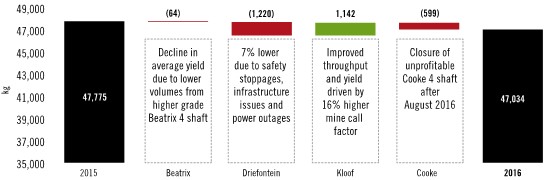

Production from Sibanye’s Gold Division was 47,034/kg (1,512,200oz), marginally lower than in 2015. This was primarily due to safety stoppages in the first half of the year, which disrupted production and the cessation of underground mining operations at Cooke 4 mine in the second half of the year.

A stronger US dollar gold price, together with a weaker rand/dollar exchange rate, resulted in a 23% year-on-year increase in the average rand gold price from R475,508/kg (US$1,160/oz) to R586,319/kg (US$1,242/oz). Revenue from the Gold Division increased by 36% year-on-year, to R27.5 billion (US$1.9 billion) from R22.7 billion (US$1.8 billion).

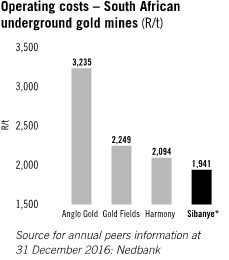

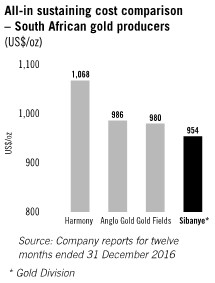

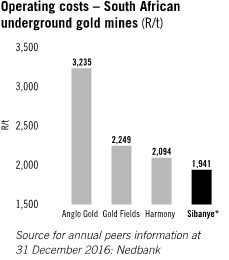

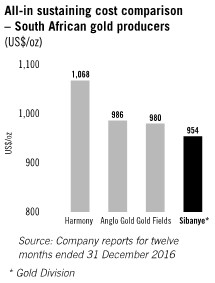

Costs were well managed, with unit costs only increasing 4% to R862/t (US$59/t), and all-in sustaining costs increasing 6.6% to R450,152/kg (US$954/oz). Sibanye is by some margin the lowest cost producer among the majors in South Africa on both cost measures, reflecting the relative efficiency of its mining.

Integration of the Platinum Division proceeded according to plan, with the Aquarius operations, Kroondal and Mimosa, continuing to consistently outperform and the Rustenburg Operations delivering as expected for the first two months under Sibanye's management. The Platinum Division reported attributable production of 420,763oz (4E) at an average operating cost of R10,296/4Eoz (US$701/4Eoz), resulting in a 10% operating margin, despite the average PGM basket price remaining subdued at R12,209/4Eoz (US$832/4Eoz).

Following the successful integration of the Aquarius Operations, the integration of the Rustenburg Operations is now underway and proceeding according to schedule. We have previously highlighted that we expect to realise operational synergies of approximately R800 million per annum from the combined Aquarius and Rustenburg operations over the next three years. The first steps in realising these synergies have begun, with approximately R400 million in synergies expected to be realised by year-end. In this regard, a restructuring of the Platinum Division was announced on 26 January 2017.

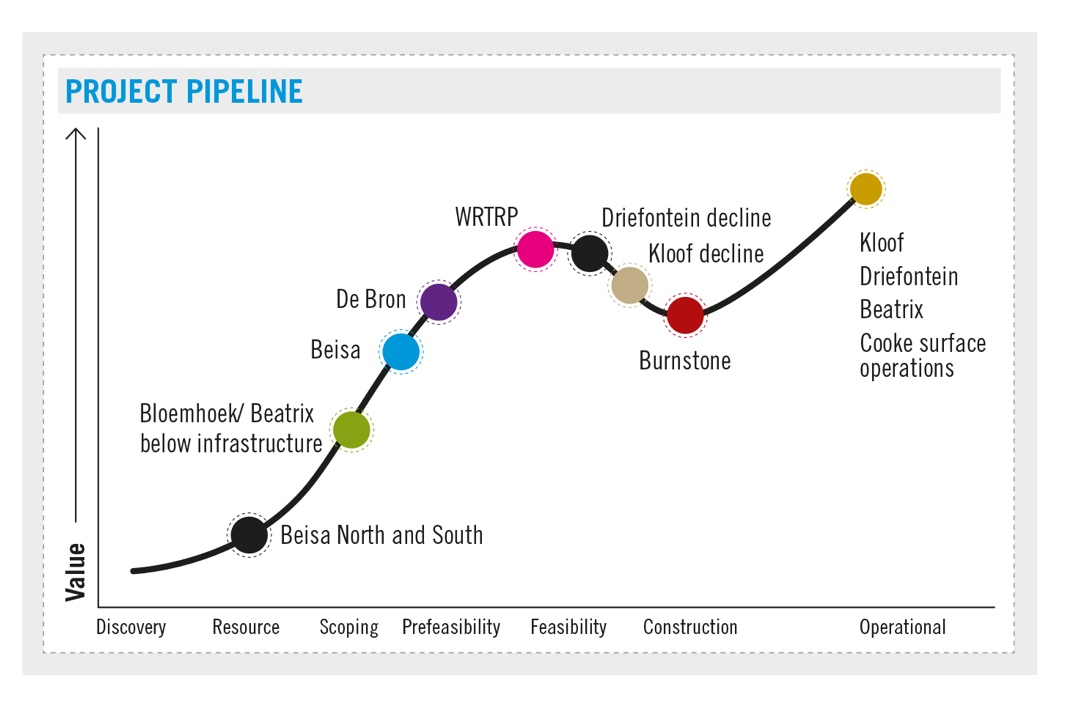

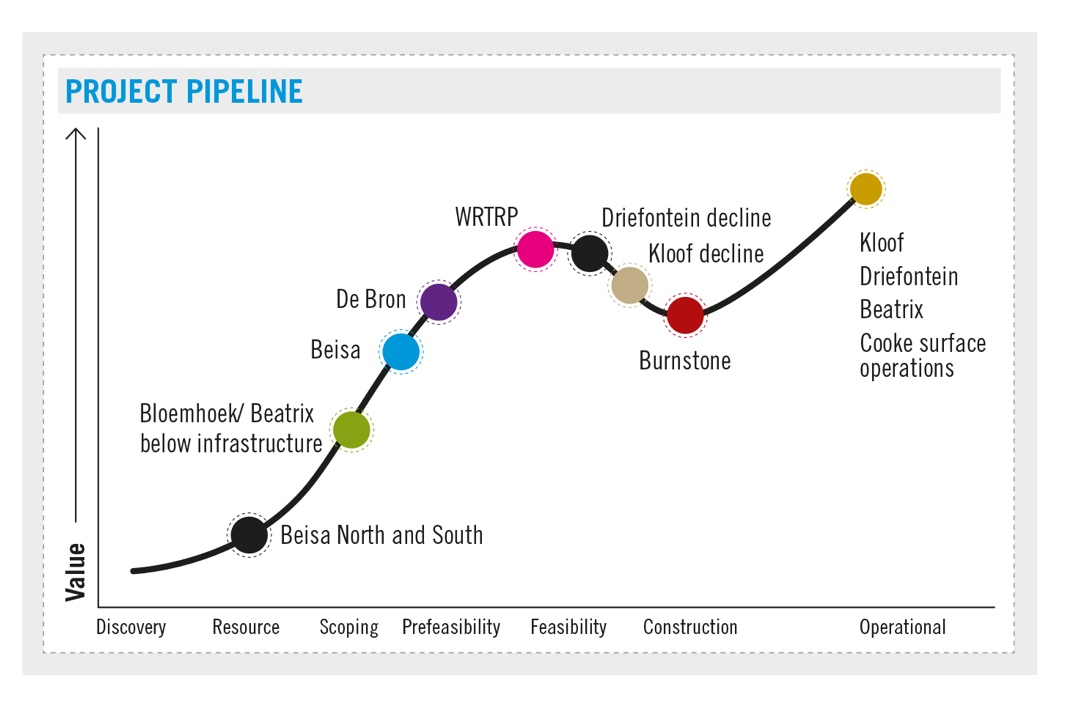

INTERNAL GROWTH PROJECTS

Expenditure on organic growth projects for the year ended 31 December 2016 was R762 million (US$52 million), 70% of which was spent at the Burnstone project. As a result of the recent strength in the rand and its impact on operating margins for the gold industry, organic project capital expenditure at the non-essential projects has been reviewed. This includes reducing planned expenditure at the Burnstone project by R300 million and only committing enough capital to the UG2 project at the Rustenburg Operations to sustain current planned production levels. A decision on the West Rand Tailings Retreatment Project (WRTRP) has also been deferred while alternative financing options are evaluated. Committing to further investment in long lead time capital intensive projects in South Africa is complicated by continued delays to, and uncertainty around, policy and regulations in South Africa. Despite continued attempts by the mining industry to co-operate with the authorities and contribute to legislation and regulations which will benefit all stakeholders, while ensuring the sustainability of the industry, finding common ground has been difficult and the future remains uncertain.

A VISION FOR THE FUTURE

As an industry we have called for a re-evaluation of the mining industry and what, if any, changes are needed to ensure its sustainability and profitability so that benefits are realised by all stakeholders. The Mining Phakisa (refer to the glossary, available online at http://reports.sibanyegold.co.za, for an explanation of the Mining Phakisa) called by the President of South Africa at the end of 2015 was, we believed, an honest attempt to bring all stakeholders together to define what was required to ensure the sustainability of the industry and the flow of benefits to stakeholders. While the Mining Phakisa has resulted in some very positive initiatives, commitment from stakeholders has been wanting. The lack of co-operation among different stakeholders continues to hamper efforts to progress many of the initiatives arising from the Phakisa.

Sibanye’s future, and that of the entire South African mining industry, depends on all stakeholders working together to develop a new frame of mind based on mutual trust. This, I firmly believe, will need to be based on the mining industry itself recognising its past – the good and the bad legacies of its many decades of operation. It calls for honest introspection.

Our future success depends on mutually respectful relationships with our employees, our unions, our host communities, educational and research institutions, government and the state’s regulatory authorities and requires a foundation of trust to be developed between the industry and its stakeholders.

This was the underlying precept of the Zambezi Protocol, which was the fruit of a meeting in April 2016 on the banks of the Zambezi River,

| |

Sibanye Integrated Annual Report 2016 | 21 |

convened by the Brenthurst Foundation and chaired by former Nigerian president Olusegun Obasanjo and devised to give direction to sustainable mining across the African continent. A suggested “roadmap” of how this could be achieved was developed, with the roles of each stakeholder defined to some extent.

| · | | The first step is that we in the industry acknowledge our past, which is necessary to build a relationship of trust between the industry and other stakeholders and is a mandatory precondition for the next two steps |

| · | | The second step is that we need to agree a vision for the mining industry |

| · | | The third and final step in our roadmap, once we have an agreed vision for the industry, is the development of a social and economic compact that creates superior value for all stakeholders |

By means of example, some of the commitments required from key stakeholders would be:

Business: will be required to commit to open and transparent disclosure of information as the basis for meaningful engagement with all stakeholders. It will need to adhere to exemplary standards of environmental and social performance and governance, including, as priorities, aspiring to zero harm in respect of safety and health. The development of local economies and communities will be imperative, with the establishment of a sustainable local economy post mining critical. More importantly business will have to ensure that value flows equitably to all stakeholders according to an agreed and specific framework, including employee benefits, profit sharing, taxes, social expenditure and dividends to shareholders. We know that sustainable viable businesses attract investment, grow, create significant economic benefits and employ large numbers of people. They are also key drivers of transformation.

Unions: should focus on promoting their members’ interests first and not a narrower political agenda. They should engage pro-actively around the sustainability of the industry and avoid actions which unnecessarily threaten the viability of employment.

Employees: will be required to apply themselves responsibly to safely deliver required operational performance, recognising the role that a strong and sustainable business plays in achieving their personal life ambitions. Employees should also align themselves to the fortunes of the business by securing an increasing portion of their remuneration through profit sharing arrangements, so that they benefit alongside shareholders and management from positive upticks in the economic cycles, but also contribute to the industry’s survival through economic downturns.

Community organisations: should ideally represent the needs of their constituencies and understand and appreciate the implications of up- and down- cycles in the minerals economy, and the impact on the affordability of social programmes, as well as the shared responsibility of Government and business in delivering these.

Government: should provide clear policy and a regulatory guidelines that provide the level of certainty that is required for confident investment in mining projects. Increased incentives for investment in mining growth projects and a fair taxation regime will promote investment, both from industry as well as from local and foreign investors. Fair and efficient administrative processes will be in place, and adhered to, as enshrined in legislation without impeding business operations.

Our vision for the future is for a “modernised” industry run in a sustainable manner for the benefit of all stakeholders. This was well defined at the Joburg Mining Indaba in 2015 as follows:

“A modern mining industry will optimally extract and beneficiate the country’s natural resources, causing no harm to people or the planet. It benefits both the local community as well as the national economy. It procures locally, it is a preferred employer of well skilled people and creates appropriate risk adjusted returns for investors. Regulations, taxation and incentives are consistent, transparent and recognise mining as a long- term driver of economic growth.”

From Sibanye’s perspective, the concept of modernisation resonated with what we had already embraced, through our corporate vision, established in 2013, of creating superior value for all stakeholders. We continue to pursue this vision with passion, knowing that it is an imperative for the success and sustainability of our business.

RECOGNITION AND APPRECIATION

In conclusion, I extend my gratitude to all my colleagues throughout the company for their commitment and co-operation in making Sibanye the premier, precious metals producer globally, and to the members of the Board for their support and guidance over the past year.

Neal Froneman

Chief executive officer

30 March 2017

| |

Sibanye Integrated Annual Report 2016 | 22 |

CHIEF FINANCIAL OFFICER'S REPORT

Our net asset value per share has increased by 40% since Sibanye’s listing in 2013.

The 2016 financial year was positively impacted by a 15% weakening in the rand/US dollar exchange rate, which declined from an average of R12.75/US$ in 2015 to R14.68/US$. The weaker rand/US dollar exchange rate and a 7% increase in the average US dollar gold price resulted in record operating profit and net operating profit in excess of R10.5 billion and R6.5 billion respectively. All-in sustaining costs for the Gold Division of R450,152/kg (US$954/oz) in 2016 increased by 7% compared to R422,472/kg (US$1,031/oz) in 2015. In comparison, the all-in sustaining cost in rands per kilogram of our major peers in South Africa increased by 25%, 13% and 8%.

Increased revenue and cost control resulted in headline earnings for 2016 of R2.5 billion which represents a 269% increase year on year. The group declared a dividend of 145 cents per share for the year, the highest since listing in February 2013. This equated to a 36% dividend payout ratio for 2016, which is consistent with our strategy of being a leading dividend payer.