UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-22811

Bridge Builder Trust

(Exact name of registrant as specified in charter)

Bridge Builder Trust

12555 Manchester Road

Des Peres, MO, 63131

(Address of principal executive offices)

Evan S. Posner, Secretary

Bridge Builder Trust

c/o 12555 Manchester Road

Des Peres, MO 63131

(Name and address of Agent for service)

Registrant’s telephone number, including area code: (314) 515-3289

Date of fiscal year end: June 30

Date of reporting period: June 30, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORT TO SHAREHOLDERS

The following is a copy of the Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”)(17 CFR 270.30e-1).

Bridge Builder Core Bond Fund Bridge Builder Core Plus Bond Fund Bridge Builder Municipal Bond Fund Bridge Builder Large Cap Growth Fund Bridge Builder Large Cap Value Fund Bridge Builder Tax Managed Large Cap Fund Bridge Builder Small/Mid Cap Growth Fund Bridge Builder Small/Mid Cap Value Fund Bridge Builder Tax Managed Small/Mid Cap Fund Bridge Builder International Equity Fund Bridge Builder Tax Managed International Equity Fund

Table of Contents

| | |

| | | Annual Report • June 30, 2022 |

Bridge Builder Mutual Funds

Letter to Shareholders (Unaudited)

Dear Shareholder,

It is our pleasure to provide you with the Bridge Builder Mutual Funds (“Funds” or individually a “Fund”) annual report for the fiscal year ended June 30, 2022. In this report you will find fund performance information, summaries of portfolio holdings, financial statements and other important information about each of the Funds.

For details about individual fund performance and market commentary, please refer to the Management’s Discussion of Fund Performance section of this report for each Fund.

The Funds are available exclusively through Edward Jones Advisory Solutions®, an asset allocation program providing investment advisory services. Each Fund uses a multi-manager sub-advised structure, where several leading asset management firms are selected to invest a portion of a Fund’s assets. Each manager within a Fund brings a unique perspective and investment approach. The Funds are managed according to the key tenets of our investment philosophy: diversification, high quality and a long-term approach.

All of the Funds’ sub-advisers are selected by Olive Street Investment Advisers, LLC (“Olive Street” or “Adviser”), an affiliate of Edward Jones, and approved by the Funds’ Board of Trustees. Olive Street strives to combine complementary investment styles, performance patterns and portfolio characteristics that have generally demonstrated a track record of success.

Since the inception of the Funds in 2013, they have provided investors in Edward Jones Advisory Solutions® with several important benefits. These benefits include: manager selection with oversight by Edward Jones’ Portfolio Solutions and Investment Management Research teams, access to certain institutional managers and investment strategies that are not available in the retail mutual fund marketplace, the ability to make changes among managers within the Funds in a cost-efficient manner, and lower overall Fund costs compared to Morningstar® category averages. As a result, your ownership of the Funds as part of Edward Jones Advisory Solutions® has played an important role in the performance of your account.

Over the course of the past 12-months, there have been certain changes to the Funds’ lineup of sub-advisers and addition of new Funds to the series. In September of 2021, Victory Capital Management, Inc. and Driehaus Capital Management were added as sub-advisers to the Bridge Builder Small/Mid Cap Growth Fund. In October of 2021, BlackRock Investment Management, LLC replaced T. Rowe Price Associates, Inc. as a sub-adviser to the Bridge Builder Core Plus Bond Fund. In June of 2022, Bridge Builder added three Funds to the series: the Bridge Builder Tax Managed Large Cap Fund, the Bridge Builder Tax Managed Small/Mid Cap Fund, and the Bridge Builder Tax Managed International Equity Fund.

For additional information about the Funds, visit www.bridgebuildermutualfunds.com.

We look forward to playing an important role in helping you pursue your financial goals.

Sincerely,

| | |

|

|

|

John Tesoro Chairman, Bridge Builder Trust |

|

|

|

Tom Kersting President, Olive Street Investment Advisers, LLC Principal, Edward Jones Investment and Protection Products |

| | |

| Annual Report • June 30, 2022 | | 1 |

Bridge Builder Core Bond Fund

Management’s Discussion of Fund Performance (Unaudited)

Investment Objective

The investment objective of the Bridge Builder Core Bond Fund (the “Fund”) is to provide total return (capital appreciation plus income).

Summary of the Investment Strategy

The Fund’s assets are allocated across different fixed-income market sectors and maturities. Most of the Fund’s investments are fixed-income securities issued or guaranteed by the U.S. government or its agencies, corporate bonds, asset-backed securities, privately-issued securities, floating rate securities and mortgage-related and mortgage-backed securities. The Fund may invest in securities issued by foreign entities, including emerging market securities. The Fund employs a multi-manager sub-advised structure.

Investment Commentary

The Fund returned -10.36% during the fiscal year ended June 30, 2022. The Fund marginally underperformed its benchmark, the Bloomberg U.S. Aggregate Bond Index, which returned -10.29% over the same period.

The fiscal year was a challenging period for fixed income assets, as U.S. Treasury rates rose materially throughout the period. The second half of 2021 and first half of 2022 saw the U.S. economy shift from record levels of monetary and fiscal policy support following the COVID-19 pandemic to the U.S. Federal Reserve (the “Fed”) seeking to control elevated inflation prints and rising inflation expectations, driven by supply and demand imbalances related to the pandemic and other events, including Russia’s invasion of Ukraine, and an attempted orchestration of a “soft-landing”. The Fed took an increasingly hawkish stance throughout the fiscal period, pulling forward its rate hike projections in response to persistently higher inflation expectations and ultimately introduced rate hikes beginning with a 25 basis points (“bps”, 1bps equals 0.01%) increase and then another 50bps in March and May, respectively. A particularly large year-over-year inflation print in early June 2022 spurred the Fed to take more dramatic action, raising rates by 75bps – marking the largest rate hike since 1994. Altogether, the 10-Year U.S. Treasury rate rose from 1.45% on June 30, 2021 to 2.98% at the end of the fiscal period on June 30, 2022, pushing all fixed income sectors into negative territory for the period.

As a result, the Bloomberg U.S. Aggregate Bond Index, an index measuring the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market marked its largest one-year loss in its history. At the same time, corporate credit spreads widened over the period, leading to larger losses in U.S. investment-grade and high-yield corporate bonds and other credit-sensitive areas of the market. Developed non-U.S. and emerging markets experienced similar, albeit deeper, drawdowns over the same period while the U.S. dollar appreciated relative to most other developed-markets currencies.

Against this backdrop, the Fund underperformed its benchmark by 0.07% over the fiscal year. The underperformance was primarily driven by an underweight to U.S. Treasuries and an overweight to corporate bonds. Security selection within those sectors in addition to commercial mortgage-backed securities were also detractors from relative performance. The Fund’s lower sensitivity to interest rates compared to the benchmark throughout most of the period amid a sell-off in interest-rate sensitive assets was the most significant contributor over the fiscal year, largely offsetting negative results realized elsewhere in the portfolio.

Investment Sub-advisers

| | | | | | |

Robert W. Baird & Co. Inc. utilizes a structured, risk-controlled philosophy with a disciplined duration approach to invest its allocated portion of the Fund’s assets. | | J.P. Morgan Investment Management, Inc. incorporates a bottom-up, value-oriented approach in managing its allocated portion of the Fund’s assets. | | Loomis, Sayles & Company, L.P. employs an investment philosophy that focuses on relative value investing on a risk-adjusted basis, seeking to add value for clients primarily through security selection while managing top-down risks in the portfolio. | | PGIM, Inc. uses a team approach to attempt to add value by tilting toward fixed-income sectors that it believes are attractive and by utilizing its extensive research capabilities to choose attractive fixed-income securities within sectors. |

| | |

| 2 | | Annual Report • June 30, 2022 |

Bridge Builder Core Bond Fund

Management’s Discussion of Fund Performance (Unaudited) (Continued)

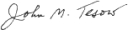

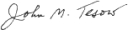

The following chart compares the value of a hypothetical $10,000 investment in the Bridge Builder Core Bond Fund

from its inception (October 28, 2013) to June 30, 2022 as compared with the Bloomberg Barclays U.S. Aggregate Bond Index.

Growth of a Hypothetical $10,000 Investment as of June 30, 2022

vs.

Bloomberg U.S. Aggregate Bond Index

Average Annual Total Returns as of June 30, 2022

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | Since Inception (10/28/2013) | |

Bridge Builder Core Bond Fund | | | -10.36 | % | | | 1.32 | % | | | 2.11 | % |

Bloomberg U.S. Aggregate Bond Index | | | -10.29 | % | | | 0.88 | % | | | 1.69 | % |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. As of the latest prospectus, the gross and net expense ratios of the Fund were 0.35%(1) and 0.14%(2), respectively. Performance data current to the most recent month end may be obtained by calling 1.855.823.3611.

The performance table does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Returns shown for the Fund include the reinvestment of all dividends, if any. Total return calculations reflect the effect of the Adviser’s fee waiver agreement for the Fund. If such fee waivers had not occurred, the quoted performance would be lower.

Portfolio Characteristics (3)

| | | | |

| Security Type Breakdown | | (% of Investments) | |

Mortgage-Backed Obligations | | | 33.7 | % |

Corporate Bonds | | | 27.6 | |

Government Related | | | 23.5 | |

Asset-Backed Obligations | | | 10.9 | |

Short-Term Investments | | | 4.3 | |

Preferred Stocks | | | 0.0 | * |

| | |

| Annual Report • June 30, 2022 | | 3 |

Bridge Builder Core Plus Bond Fund

Management’s Discussion of Fund Performance (Unaudited)

Investment Objective

The investment objective of the Bridge Builder Core Plus Bond Fund (the “Fund”) is to provide total return (capital appreciation plus income).

Summary of the Investment Strategy

The Fund’s assets are allocated across different fixed-income market sectors and maturities. Most of the Fund’s investments are in fixed-income securities issued or guaranteed by the U.S. government or its agencies, corporate bonds, convertible securities, corporate commercial paper, asset-backed securities, including collateralized loan obligations and other collateralized debt obligations, privately-issued securities, floating rate securities, inflation-linked securities and other inflation-indexed bonds issued both by governments and corporations, structured securities, and mortgage-related and mortgage-backed securities. The Fund may invest in high-yield securities deemed below investment grade, and securities issued by foreign entities, including emerging market securities. The Fund may buy or sell futures, swaps, or forward contracts to gain or hedge exposure to risk factors or to alter the Fund’s investment characteristics. The Fund employs a multi-manager sub-advised structure.

Investment Commentary

The Fund returned -10.59% during the fiscal year ended June 30, 2022. The Fund modestly underperformed its benchmark, the Bloomberg U.S. Aggregate Bond Index, which returned -10.29% during the same period.

The fiscal year was a challenging period for fixed income assets, as U.S. Treasury rates rose materially throughout the period. The second half of 2021 and first half of 2022 saw the U.S. economy shift from record levels of monetary and fiscal policy support following the COVID-19 pandemic to the Fed seeking to control elevated inflation prints and rising inflation expectations, driven by supply and demand imbalances related to the pandemic and other events, including Russia’s invasion of Ukraine, and an attempted orchestration of a “soft-landing”. The Fed took an increasingly hawkish stance throughout the fiscal period, pulling forward its rate hike projections in response to persistently higher inflation expectations and ultimately introduced rate hikes beginning with a 25bps increase and then another 50bps in March and May, respectively. A particularly large year-over-year inflation print in early June 2022 spurred the Fed to take more dramatic action, raising rates by 75bps – marking the largest rate hike since 1994. Altogether, the 10-Year U.S. Treasury rate rose from 1.45% on June 30, 2021 to 2.98% at the end of the fiscal period on June 30, 2022, pushing all fixed income sectors into negative territory for the period.

As a result, the Bloomberg U.S. Aggregate Bond Index, an index measuring the investment grade, US dollar-denominated, fixed-rate taxable bond market marked its largest one-year loss in its history. At the same time, corporate credit spreads widened over the period, leading to larger losses in U.S. investment-grade and high-yield corporate bonds and other credit-sensitive areas of the market. Developed non-U.S. and emerging markets experienced similar, albeit deeper, drawdowns over the same period while the U.S. dollar appreciated relative to most other developed-markets currencies.

Against this backdrop, the Fund underperformed its benchmark by 0.30% over the fiscal year. The Fund’s overweight to credit sensitive sectors such as investment-grade and below-investment grade corporate bonds, emerging market bonds, as well as non-agency mortgage-backed securities and asset-backed securities weighed modestly on relative returns as spreads widened, particularly in the first half of 2022. The Fund’s lower duration compared to the benchmark helped offset losses elsewhere as interest rates rose materially and more interest-rate sensitive instruments sold off to a larger degree during the fiscal year.

| | |

| 4 | | Annual Report • June 30, 2022 |

Bridge Builder Core Plus Bond Fund

Management’s Discussion of Fund Performance (Unaudited) (Continued)

Investment Sub-advisers

| | | | | | |

| Pacific Investment Management Company LLC seeks to achieve the Fund’s investment objective by investing in a multi-sector portfolio of fixed-income instruments of varying maturities, which may be represented by derivatives such as futures, forwards or swap contracts. | | BlackRock Investment Management, LLC will buy or sell securities whenever its portfolio management team sees an appropriate opportunity. Under normal circumstances, BlackRock invests primarily in fixed income securities and derivatives with similar economic characteristics. | | Loomis, Sayles & Company, L.P. generally seeks fixed-income securities of issuers whose credit profiles it believes are improving. Loomis Sayles relies primarily on issue selection as the key driver to investment performance. Loomis Sayles also analyzes different sectors of the economy and differences in the yields of various fixed-income securities in an effort to find securities that it believes may produce attractive returns in comparison to these securities’ risks. | | Metropolitan West Asset Management, LLC employs a value-oriented fixed-income management philosophy and an investment process predicated on a long-term economic outlook. |

| | |

| Annual Report • June 30, 2022 | | 5 |

Bridge Builder Core Plus Bond Fund

Management’s Discussion of Fund Performance (Unaudited) (Continued)

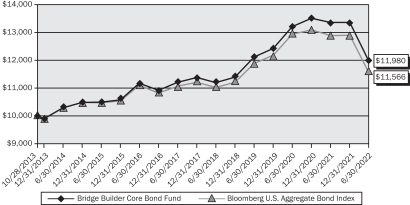

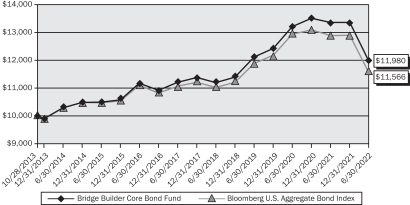

The following chart compares the value of a hypothetical $10,000 investment in the Bridge Builder Core Plus Bond

Fund from its inception (July 13, 2015) to June 30, 2022 as compared with the Bloomberg U.S. Aggregate Bond Index.

Growth of a Hypothetical $10,000 Investment as of June 30, 2022

vs.

Bloomberg U.S. Aggregate Bond Index

Average Annual Total Returns of June 30, 2022

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | Since Inception (7/13/2015) | |

Bridge Builder Core Plus Bond Fund | | | -10.59 | % | | | 1.63 | % | | | 2.06 | % |

Bloomberg U.S. Aggregate Bond Index | | | -10.29 | % | | | 0.88 | % | | | 1.48 | % |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. As of the latest prospectus, the gross and net expense ratios of the Fund were 0.38%(1) and 0.15%(2), respectively. Performance data current to the most recent month end may be obtained by calling 1.855.823.3611.

The performance table does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Returns shown for the Fund include the reinvestment of all dividends, if any. Total return calculations reflect the effect of the Adviser’s fee waiver agreement for the Fund. If such fee waivers had not occurred, the quoted performance would be lower.

Portfolio Characteristics (3)

| | | | |

| Security Type Breakdown | | (% of Investments) | |

Corporate Bonds | | | 29.2 | % |

Mortgage-Backed Obligations | | | 26.8 | |

Government Related | | | 21.6 | |

Asset-Backed Obligations | | | 10.4 | |

Short-Term Investments | | | 10.2 | |

Bank Loans | | | 1.2 | |

Convertible Securities | | | 0.2 | |

Convertible Preferred Stocks | | | 0.2 | |

Common Stocks | | | 0.1 | |

Preferred Stocks | | | 0.1 | |

Warrants | | | 0.0 | * |

Rights | | | — | ** |

| | |

| 6 | | Annual Report • June 30, 2022 |

Bridge Builder Municipal Bond Fund

Management’s Discussion of Fund Performance (Unaudited)

Investment Objective

The investment objective of the Bridge Builder Municipal Bond Fund (the “Fund”) is to provide current income exempt from federal tax, with a secondary goal of preservation of investment principal.

Summary of the Investment Strategy

The Fund invests, under normal conditions, at least 80% of its net assets (plus the amount of borrowings for investment purposes) in municipal securities of any maturity or duration whose interest is exempt from federal income tax. These municipal securities include debt obligations issued by or on behalf of a state or local entity or other qualifying issuer that pay interest that is, in the opinion of bond counsel to the issuer, generally excludable from gross income for federal income tax purposes. Interest may be includable in taxable income for certain non-corporate taxpayers subject to the federal alternative minimum tax. The Fund employs a multi-manager sub-advised structure.

Investment Commentary

The Fund returned -7.73% during the fiscal year ended June 30, 2022. The Fund underperformed its benchmark, the Bloomberg Municipal 1-15 Year Index, which returned -6.53% during the same period.

The fiscal year was a challenging period for fixed income assets, as U.S. Treasury rates rose materially throughout the period. The second half of 2021 and first half of 2022 saw the U.S. economy shift from record levels of monetary and fiscal policy support following the COVID-19 pandemic to the Fed seeking to control elevated inflation prints and rising inflation expectations, driven by supply and demand imbalances related to the pandemic and other events, including Russia’s invasion of Ukraine, and an attempted orchestration of a “soft-landing”. The Fed took an increasingly hawkish stance throughout the fiscal period, pulling forward its rate hike projections in response to persistently higher inflation expectations and ultimately introduced rate hikes beginning with a 25bps increase and then another 50bps in March and May, respectively. A particularly large year-over-year inflation print in early June 2022 spurred the Fed to take more dramatic action, raising rates by 75bps – marking the largest rate hike since 1994. Altogether, the 10-Year U.S. Treasury rate rose from 1.45% on June 30, 2021 to 2.98% at the end of the fiscal period on June 30, 2022, pushing all fixed income sectors into negative territory for the period. Municipal bond yields followed suit during the period, as reduced growth expectations, higher inflation and less advantageous supply and demand dynamics later in the period resulted in higher yields and losses across the municipal bond market.

Against this backdrop, the Fund underperformed its benchmark by 1.20% for the fiscal year. The Fund’s underperformance was largely driven by its overall longer duration positioning and overweight to lower quality municipal bonds relative to the Index. Both were headwinds as interest rates shifted meaningfully higher and lower-quality issues suffered greater losses compared to higher-quality segments of the market for the full period.

Investment Sub-advisers

| | | | | | |

| FlAM LLC allocates assets across different market sectors and maturities, normally investing in investment-grade municipal securities. When selecting investments, FlAM analyzes issuer credit quality, security-specific features, current and potential future valuation and trading opportunities. | | T. Rowe Price Associates Inc. uses an active investment management approach that emphasizes the value of in-depth fundamental credit research, diversification and risk management practices. By using fundamental research, T. Rowe Price seeks to add value through sector weights and issue selection over a full market cycle. | | MacKay Shields, LLC is a fundamental relative-value bond management boutique that believes strong long-term performance can be achieved through an actively managed, research-driven, relative-value approach. Their investment strategy combines a macroeconomic view coupled with credit research driven security selection. In doing so, the investment process seeks to identify mispricings and opportunities for total return with an emphasis on risk management. | | BlackRock Investment Management, LLC takes a top-down, bottom-up approach with a flexible investment framework. Their security selection process is based on the relative value outlook and the quantitative assessment of the security and portfolio. BlackRock seeks total return derived primarily from coupon interest, and secondarily, capital appreciation. |

| | |

| Annual Report • June 30, 2022 | | 7 |

Bridge Builder Municipal Bond Fund

Management’s Discussion of Fund Performance (Unaudited) (Continued)

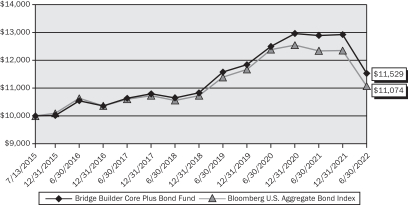

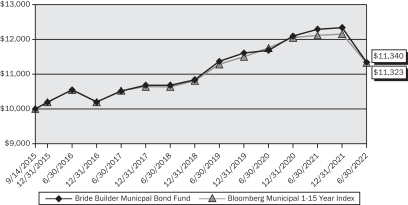

The following chart compares the value of a hypothetical $10,000 investment in the Bridge Builder Municipal Bond

Fund from its inception (September 14, 2015) to June 30, 2022 as compared with the Bloomberg Municipal 1-15 Year Index.

Growth of a Hypothetical $10,000 Investment as of June 30, 2022

vs.

Bloomberg Municipal 1-15 Year Index

Average Annual Total Returns as of June 30, 2022

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | Since Inception (9/14/2015) | |

Bridge Builder Municipal Bond Fund | | | -7.73 | % | | | 1.53 | % | | | 1.87 | % |

Bloomberg Municipal 1-15 Year Index | | | -6.53 | % | | | 1.47 | % | | | 1.85 | % |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. As of the latest prospectus, the gross and net expense ratios of the Fund were 0.38%(1) and 0.16%(2), respectively. Performance data current to the most recent month end may be obtained by calling 1.855.823.3611.

The performance table does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Returns shown for the Fund include the reinvestment of all dividends, if any. Total return calculations reflect the effect of the Adviser’s fee waiver agreement for the Fund. If such fee waivers had not occurred, the quoted performance would be lower.

Portfolio Characteristics (3)

| | | | |

| Security Type Breakdown | | (% of Investments) | |

General Revenue | | | 28.4 | % |

General Obligation | | | 17.6 | |

Transportation | | | 15.9 | |

Healthcare | | | 12.8 | |

Utilities | | | 8.7 | |

Education | | | 8.1 | |

Housing | | | 6.3 | |

Short-Term Investments | | | 2.2 | |

| | | | |

| Breakdown by State | | (% of Long-Term Investments) | |

New York | | | 10.6 | % |

Texas | | | 8.5 | |

Illinois | | | 8.4 | |

California | | | 7.4 | |

Florida | | | 5.6 | |

Pennsylvania | | | 4.2 | |

New Jersey | | | 4.0 | |

Michigan | | | 3.2 | |

Georgia | | | 3.0 | |

Washington | | | 3.0 | |

Other | | | 42.1 | |

| | |

| 8 | | Annual Report • June 30, 2022 |

Bridge Builder Large Cap Growth Fund

Management’s Discussion of Fund Performance (Unaudited)

Investment Objective

The investment objective of the Bridge Builder Large Cap Growth Fund (the “Fund”) is to provide capital appreciation.

Summary of the Investment Strategy

The Fund primarily invests in equity securities of large-capitalization companies, which are defined by the Fund as those companies whose market capitalizations at the time of purchase typically fall within the range of the Russell 1000® Index. The Fund follows an investing style that favors growth investments and employs a multi-manager sub-advised structure.

Investment Commentary

For the fiscal year ended June 30, 2022, the Fund returned -20.83%, underperforming its benchmark, the Russell 1000® Growth Index, which returned -18.77%.

For the year, within large-capitalization growth stocks, energy and consumer staples led the broad market and were the only two positive returning sectors. Conversely, communication services, consumer discretionary and materials were the worst-performing sectors, trailing the broader market over the past year. In addition, within the overall large-capitalization portion of the market, value stocks outperformed growth stocks for the one-year period.

Compared to its benchmark, the Fund’s relative underperformance was driven predominantly by stock selection within the technology sector. Stock selection within communication services was also another headwind to performance. Poor stock selection within these two sectors was meaningfully attributable to the strong performance of benchmark’s largest holdings. These holdings have become significantly concentrated relative to history, which has led to underweight positions within the Fund.

Investment Sub-advisers

| | | | | | |

| Lazard Asset Management LLC invests primarily in equity securities of U.S. companies that have strong and/or improving financial productivity and are undervalued based on their earnings, cash flow or asset values. | | Sustainable Growth Advisers, LP seeks to identify large- capitalization companies that exhibit characteristics such as pricing power, repeat revenue streams and global reach that seem to have the potential for long-term earnings growth within the context of low business risk. | | Jennison Associates LLC invests in companies that have strong capital appreciation potential. It follows a highly disciplined investment selection and management process of identifying companies that show superior absolute and relative earnings growth and are believed to be attractively valued. | | BlackRock Investment Management, LLC invests in equity securities with the objective of approximating the capitalization weighted total rate of return of the segment of the United States market for publicly traded equity securities represented by the 1,000 largest capitalized companies. |

| | |

| Annual Report • June 30, 2022 | | 9 |

Bridge Builder Large Cap Growth Fund

Management’s Discussion of Fund Performance (Unaudited) (Continued)

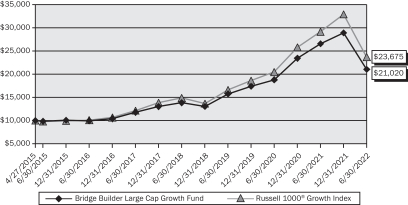

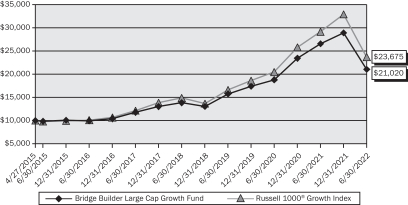

The following chart compares the value of a hypothetical $10,000 investment in the Bridge Builder Large Cap Growth Fund from its inception (April 27, 2015) to June 30, 2022 as compared with the Russell 1000® Growth Index

Growth of a Hypothetical $10,000 Investment as of June 30, 2022

vs.

Russell 1000® Growth Index

Average Total Annual Returns as of June 30, 2022

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | Since Inception (4/27/2015) | |

Bridge Builder Large Cap Growth Fund | | | -20.83 | % | | | 12.32 | % | | | 10.91 | % |

Russell 1000® Growth Index | | | -18.77 | % | | | 14.29 | % | | | 12.76 | % |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. As of the latest prospectus, the gross and net expense ratios of the Fund were 0.45%(1) and 0.19%(2), respectively. Performance data current to the most recent month end may be obtained by calling 1.855.823.3611.

The performance table does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Returns shown for the Fund include the reinvestment of all dividends, if any. Total return calculations reflect the effect of the Adviser’s fee waiver agreement for the Fund. If such fee waivers had not occurred, the quoted performance would be lower.

Portfolio Characteristics (3)

| | | | |

| Sector Breakdown | | (% of Investments) | |

Information Technology | | | 30.0 | % |

Healthcare | | | 19.7 | |

Consumer Discretionary | | | 13.8 | |

Financials | | | 9.3 | |

Communication Services | | | 8.8 | |

Consumer Staples | | | 4.1 | |

Materials | | | 4.0 | |

Industrials | | | 3.8 | |

Short-Term Investments | | | 2.7 | |

Real Estate | | | 2.4 | |

Energy | | | 1.4 | |

Utilities | | | 0.0 | * |

| | | | |

| Top Ten Equity Holdings | | (% of Net Assets) | |

Microsoft Corp. | | | 6.7 | % |

Amazon.com, Inc. | | | 4.9 | |

Visa, Inc. – Class A | | | 3.7 | |

UnitedHealth Group, Inc. | | | 3.2 | |

Alphabet, Inc. Class A | | | 3.0 | |

Danaher Corp. | | | 2.7 | |

Apple, Inc. | | | 2.4 | |

Salesforce, Inc. | | | 2.4 | |

Alphabet, Inc. – Class C | | | 2.2 | |

Thermo Fisher Scientific, Inc. | | | 2.1 | |

| | |

| 10 | | Annual Report • June 30, 2022 |

Bridge Builder Large Cap Value Fund

Management’s Discussion of Fund Performance (Unaudited)

Investment Objective

The investment objective of the Bridge Builder Large Cap Value Fund (the “Fund”) is to provide capital appreciation.

Summary of the Investment Strategy

The Fund primarily invests in equity securities of large-capitalization companies, which are defined by the Fund as those companies whose market capitalizations at the time of purchase typically fall within the range of the Russell 1000® Index. The Fund follows an investing style that favors value investments and employs a multi-manager sub-advised structure.

Investment Commentary

For the fiscal year ended June 30, 2022, the Fund returned -5.27%, outperforming its benchmark, the Russell 1000® Value Index, which returned -6.82%.

For the year, within large-capitalization value stocks, energy, utilities, health care and consumer staples sectors performed best and were the only positive performing sectors during the time period. Conversely, communication services, technology and consumer discretionary were the worst-performing sectors over the trailing year. In addition, within the overall large-capitalization portion of the market, value stocks outperformed growth stocks for the one-year period.

Compared to its benchmark, the Fund’s relative outperformance was driven predominantly by strong stock selection within the industrials, technology and consumer discretionary sectors. An underweight allocation to energy and overweight allocation to consumer discretionary were the largest headwinds for the Fund during the year. Given the strong performance over the trailing year, cash drag was a meaningful headwind to relative performance versus the index.

Investment Sub-advisers

| | | | | | |

| Artisan Partners Limited Partnership employs a fundamental investment process to construct a diversified portfolio of equity securities that are undervalued, in solid financial condition and have attractive business economics. | | Barrow, Hanley, Mewhinney & Strauss, LLC invests in companies that are temporarily undervalued for reasons Barrow Hanley can identify, understand, and believe will improve over time. In its valuation framework, Barrow Hanley strives to construct portfolios that trade at levels below the market across multiple metrics, such as the price-to-earnings and the price-to-book ratios, while simultaneously delivering an above-market dividend yield. | | Wellington Management Company, LLP uses substantial proprietary, fundamental research resources to identify companies with superior prospects for dividend growth and capital appreciation that sell at reasonable valuation levels. Wellington Management believes that above-average growth in dividends is an effective and often overlooked indicator of higher quality, shareholder-oriented companies that have the ability to produce consistent, above-average returns over the long-term. | | BlackRock Investment Management, LLC invests in equity securities with the objective of approximating the capitalization weighted total rate of return of the segment of the United States market for publicly traded equity securities represented by the 1,000 largest capitalized companies. |

LSV Asset Management primarily invests in large and medium capitalization U.S. companies and uses a bottom-up investment style, seeking to identify companies that are trading at prices substantially below their intrinsic value. LSV follows an active investment strategy, focusing on using data and financial information and combining such information with the rigor of a quantitative model. | | T. Rowe Price Associates, Inc. active investment approach emphasizes the value of large-capitalization stocks that have a strong track record of paying dividends or that are believed to be undervalued. T. Rowe Price’s in-house research team seeks companies that appear to be undervalued by various measures and may be temporarily out of favor but have good prospects for capital appreciation and dividend growth. | | | | |

| | |

| Annual Report • June 30, 2022 | | 11 |

Bridge Builder Large Cap Value Fund

Management’s Discussion of Fund Performance (Unaudited) (Continued)

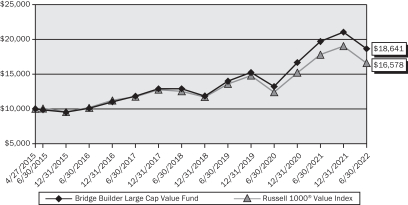

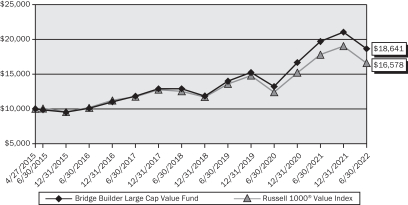

The following chart compares the value of a hypothetical $10,000 investment in the Bridge Builder Large Cap Value

Fund from its inception (April 27, 2015) to June 30, 2022 as compared with the Russell 1000® Value Index.

Growth of a Hypothetical $10,000 Investment as of June 30, 2022

vs.

Russell 1000® Value Index

Average Annual Total Returns as of June 30, 2022

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | Since Inception (4/27/2015) | |

Bridge Builder Large Cap Value Fund | | | -5.27 | % | | | 9.54 | % | | | 9.07 | % |

Russell 1000® Value Index | | | -6.82 | % | | | 7.17 | % | | | 7.30 | % |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. As of the latest prospectus, the gross and net expense ratios of the Fund were 0.45%(1) and 0.24%(2), respectively. Performance data current to the most recent month end may be obtained by calling 1.855.823.3611.

The performance table does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Returns shown for the Fund include the reinvestment of all dividends, if any. Total return calculations reflect the effect of the Adviser’s fee waiver agreement for the Fund. If such fee waivers had not occurred, the quoted performance would be lower.

Portfolio Characteristics (3)

| | | | |

| Sector Breakdown | | (% of Investments) | |

Healthcare | | | 17.0 | % |

Financials | | | 15.7 | |

Industrials | | | 14.5 | |

Information Technology | | | 9.9 | |

Consumer Discretionary | | | 9.0 | |

Consumer Staples | | | 8.0 | |

Communication Services | | | 7.2 | |

Energy | | | 5.0 | |

Materials | | | 4.6 | |

Utilities | | | 3.9 | |

Real Estate | | | 3.4 | |

Short-Term Investments | | | 1.8 | |

| | | | |

| Top Ten Equity Holdings | | (% of Net Assets) | |

Merck & Co., Inc. | | | 2.0 | % |

Comcast Corp. – Class A | | | 1.6 | |

Raytheon Technologies Corp. | | | 1.5 | |

Northrop Grumman Corp. | | | 1.5 | |

Medtronic Plc | | | 1.5 | |

UnitedHealth Group, Inc. | | | 1.5 | |

Philip Morris International, Inc. | | | 1.4 | |

Chubb Ltd. | | | 1.3 | |

Visa, Inc. – Class A | | | 1.2 | |

Johnson & Johnson | | | 1.1 | |

| | |

| 12 | | Annual Report • June 30, 2022 |

Bridge Builder Tax Managed Large Cap Fund

Management’s Discussion of Fund Performance (Unaudited)

Investment Objective

The investment objective of Bridge Builder Tax Managed Large Cap Fund (the “Fund”) is to seek to provide a tax-efficient investment return consisting of capital appreciation.

Summary of the Investment Strategy

The Fund primarily invests in equity securities of large-capitalization companies, which are defined as those whose market capitalizations typically fall within the range of the Russell 1000® Index. The Fund seeks to manage the impact of taxes through its use of a tax overlay manager. The Fund employs a multi-manager sub-advised structure and implements the investment recommendations of the Fund’s sub-advisers through the use of Parametric Portfolio Associates LLC (“Parametric”) as overlay manager, as described in greater detail below. As overlay manager, Parametric has limited authority to vary from the model portfolios provided by the Fund’s sub-advisers, primarily for the purpose of efficient tax management of the Fund’s securities transactions.

Investment Commentary

For the period June 1, 2022 thru June 30, 2022 on a pre-tax basis, the Fund returned -6.90%, outperforming its benchmark, the S&P 500 Index, which returned -7.57% for the period.

For the one month period, within domestic equities, large-capitalization companies outperformed both mid- and small-capitalization companies. In addition, growth stocks outperformed value stocks across the market-cap spectrum. Value’s underperformance was predominantly driven by the underperformance of energy relative to the broader market. The Fund’s underweight position to this sector was a tailwind during the period. Further supporting the outperformance, active management performed better in June’s market downturn as the Morningstar Category average outperformed the S&P 500 Index. Strong stock selection within the technology sector further aided the Fund’s outperformance.

Investment Sub-advisers

| | | | | | |

T. Rowe Price Associates, Inc. seeks long-term capital appreciation and recommends primarily large-capitalization companies with above-average rate of earnings and cash flow growth, as well as companies that T. Rowe Price believes have the ability to sustain earnings momentum even during times of slow economic growth. | | ClearBridge Investments, LLC seeks long-term appreciation of capital with individual company selection and management of cash reserves. ClearBridge recommends primarily medium capitalization and large-capitalization U.S. companies, but may also recommend small-capitalization companies and foreign companies, selecting from among a strong core of growth and value stocks consisting primarily of blue-chip companies dominant in their industries. ClearBridge may also recommend companies with prospects for sustained earnings growth and/or a cyclical earnings record. | | Barrow, Hanley, Mewhinney & Strauss, LLC invests in companies that are temporarily undervalued for reasons Barrow Hanley can identify, understand, and believe will improve over time. In its valuation framework, Barrow Hanley strives to construct portfolios that trade at levels below the market across multiple metrics (e.g., price/earnings, price/book value) while simultaneously delivering an above-market dividend yield. | | Parametric Portfolio Associates LLC serves as the Fund’s overlay manager and also serves as the Fund’s direct indexing manager. As the Fund’s direct indexing manager, Parametric manages one or more allocated portions of the Fund pursuant to a strategy that is designed to provide similar exposure to the S&P 500® Growth Index and S&P 500® Value Index. As the Fund’s overlay manager, Parametric implements a portfolio that represents the aggregation of the model portfolios of the Fund’s sub-advisers, including with respect to each direct indexing portion of the Fund, at weightings set by Olive Street Investment Advisers, LLC, the Fund’s investment adviser. In this role, Parametric manages the impact of taxes by, among other things, selling stocks with the lowest tax cost first, opportunistically harvesting losses and deferring recognition of taxable gains, where possible. |

| | |

| Annual Report • June 30, 2022 | | 13 |

Bridge Builder Tax Managed Large Cap Fund

Management’s Discussion of Fund Performance (Unaudited) (Continued)

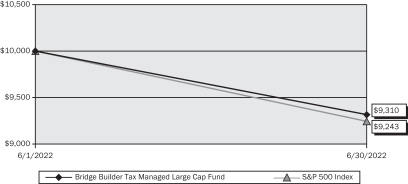

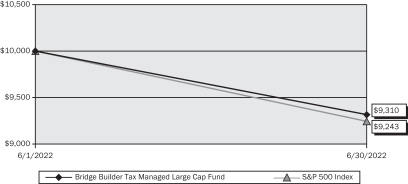

The following chart compares the value of a hypothetical $10,000 investment in the Bridge Builder Tax Managed Large Cap Fund from its inception (June 1, 2022) to June 30, 2022 as compared with the S&P 500 Index.

Growth of a Hypothetical $10,000 Investment as of June 30, 2022

vs.

S&P 500 Index

Average Total Annual Returns as of June 30, 2022

| | | | |

| | | Since Inception (6/1/2022) | |

Bridge Builder Tax Managed Large Cap Fund | | | -6.90 | % |

S&P 500 Index | | | -7.57 | % |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. As of the latest prospectus, the gross and net expense ratios of the Fund were 0.49%(1) and 0.34%(2), respectively. Performance data current to the most recent month end may be obtained by calling 1.855.823.3611.

The performance table does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Returns shown for the Fund include the reinvestment of all dividends, if any. Total return calculations reflect the effect of the Adviser’s fee waiver agreement for the Fund. If such fee waivers had not occurred, the quoted performance would be lower.

Portfolio Characteristics (3)

| | | | |

| Sector Breakdown | | (% of Investments) | |

Information Technology | | | 23.8 | % |

Healthcare | | | 15.4 | |

Consumer Discretionary | | | 10.9 | |

Financials | | | 9.9 | |

Communication Services | | | 9.8 | |

Industrials | | | 8.2 | |

Materials | | | 4.6 | |

Energy | | | 4.3 | |

Short-Term Investments | | | 4.1 | |

Consumer Staples | | | 3.9 | |

Real Estate | | | 2.6 | |

Utilities | | | 2.5 | |

| | | | |

| Top Ten Equity Holdings | | (% of Net Assets) | |

Microsoft Corp. | | | 6.0 | % |

Apple, Inc. | | | 4.1 | |

Amazon.com, Inc. | | | 3.1 | |

Alphabet, Inc. – Class A | | | 2.9 | |

UnitedHealth Group, Inc. | | | 2.9 | |

Alphabet, Inc. – Class C | | | 1.5 | |

Visa, Inc. – Class A | | | 1.5 | |

Merck & Co., Inc. | | | 1.4 | |

Raytheon Technologies Corp. | | | 1.3 | |

Berkshire Hathaway, Inc. – Class B | | | 1.2 | |

| | |

| 14 | | Annual Report • June 30, 2022 |

Bridge Builder Small/Mid Cap Growth Fund

Management’s Discussion of Fund Performance (Unaudited)

Investment Objective

The investment objective of the Bridge Builder Small/Mid Cap Growth Fund (the “Fund”) is to provide capital

appreciation.

Summary of the Investment Strategy

The Fund primarily invests in equity securities of small- and mid-capitalization companies, which are defined by the Fund as those companies whose market capitalizations at the time of purchase typically fall within the range of the Russell MidCap® Index and the Russell 2000® Index. The Fund follows an investing style that favors growth investments and employs a multi-manager sub-advised structure.

Investment Commentary

For the fiscal year ended June 30, 2022, the Fund returned -27.88%, while its benchmark, the Russell 2500® Growth Index, returned -31.81% for the period, which resulted in overall outperformance.

For the year, mid-capitalization stocks outperformed small-capitalization stocks. Within the investment universe, strongest performers included the energy and utilities sectors. The healthcare sector was the weakest performer. Within both mid-capitalization and small-capitalization segments of the market, value stocks outperformed growth stocks.

Compared to its benchmark, the Fund’s relative outperformance was driven by the overweight to mid-cap stocks, favorable sector allocation and strong stock selection within certain sectors. An overweight to financials and an underweight to health care contributed to performance, which was partially offset by an underweight to energy and real estate. Stock selection within health care, financials, and consumer staples sectors also contributed to performance. Cash exposure was also a tailwind to the Fund’s performance over the year.

Investment Sub-advisers

| | | | | | | | |

| Eagle Asset Management, Inc. invests primarily in small-capitalization companies. The team generally focuses on investing in small-capitalization companies that demonstrate growth potential at a price that does not appear to reflect the company’s true underlying value. The portfolio managers use a three-pronged investment philosophy: quality, valuation and balance. | | Champlain Investment Partners, LLC seeks capital appreciation by investing mainly in common stocks of medium-sized companies that it believes have strong long-term fundamentals, superior capital appreciation potential and attractive valuations. Champlain expects to identify a diversified universe of medium-sized companies that trade at a discount to their estimated or intrinsic fair values. | | BlackRock Investment Management, LLC invests in equity securities with the objective of approximating the capitalization-weighted total rate of return of the segments of the United States market for publicly traded equity securities represented by the Russell Midcap® Growth Index, which tracks the performance of mid-capitalization companies, and the Russell 2000® Growth Index, which tracks the performance of small-capitalization companies. | | Driehaus Capital Management LLC primarily invests in the equity securities of U.S. small-capitalization and U.S. medium capitalization companies. Driehaus believes that fundamentally strong companies are more likely to generate superior earnings growth on a sustained basis and are more likely to experience positive earnings revisions. Investment decisions involve evaluating a company’s competitive position and industry dynamics, identifying potential growth catalysts and assessing the financial position of the company. | | Victory Capital Management Inc. primarily invests in the equity securities of U.S. small-capitalization companies. Victory Capital employs both fundamental analysis and quantitative screening in seeking to identify companies that it believes will produce sustainable earnings growth over a multi-year horizon. Valuation is an integral part of the growth investment process and decisions are based on the team’s expectation of the potential reward relative to risk of each security. |

| Stephens Investment Management Group, LLC employs a disciplined, bottom-up investment selection process that combines rigorous fundamental analysis with quantitative screening in an effort to identify companies that exhibit potential for superior earnings growth that is unrecognized by the markets. | | Artisan Partners Limited Partnership invests primarily in U.S. mid-capitalization growth companies. The team seeks to identify companies that possess franchise characteristics, are benefiting from an accelerating profit cycle and are trading at a discount to its estimate of private market value. | | | | | | |

| | |

| Annual Report • June 30, 2022 | | 15 |

Bridge Builder Small/Mid Cap Growth Fund

Management’s Discussion of Fund Performance (Unaudited) (Continued)

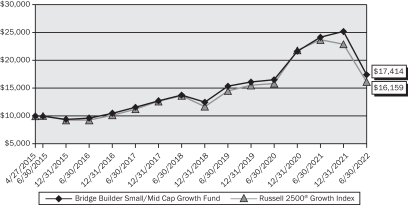

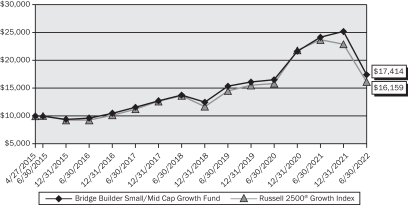

The following chart compares the value of a hypothetical $10,000 investment in the Bridge Builder Small/Mid Cap Growth Fund from its inception (April 27, 2015) to June 30, 2022 as compared with the Russell 2500® Growth Index.

Growth of a Hypothetical $10,000 Investment as of June 30, 2022

vs.

Russell 2500® Growth Index

Average Annual Total Returns as of June 30, 2022

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | Since Inception (4/27/2015) | |

Bridge Builder Small/Mid Cap Growth Fund | | | -27.88 | % | | | 8.54 | % | | | 8.04 | % |

Russell 2500® Growth Index | | | -31.81 | % | | | 7.53 | % | | | 6.92 | % |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. As of the latest prospectus, the gross and net expense ratios of the Fund were 0.66%(1) and 0.37%(2), respectively. Performance data current to the most recent month end may be obtained by calling 1.855.823.3611.

The performance table does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Returns shown for the Fund include the reinvestment of all dividends, if any. Total return calculations reflect the effect of the Adviser’s fee waiver agreement for the Fund. If such fee waivers had not occurred, the quoted performance would be lower.

Portfolio Characteristics (3)

| | | | |

| Sector Breakdown | | (% of Investments) | |

Healthcare | | | 22.9 | % |

Information Technology | | | 22.6 | |

Industrials | | | 15.5 | |

Financials | | | 10.7 | |

Consumer Discretionary | | | 10.1 | |

Consumer Staples | | | 4.3 | |

Communication Services | | | 3.7 | |

Short-Term Investments | | | 3.5 | |

Materials | | | 3.1 | |

Energy | | | 2.5 | |

Real Estate | | | 1.0 | |

Utilities | | | 0.1 | |

| | | | |

| Top Ten Equity Holdings | | (% of Net Assets) | |

Veeva Systems, Inc. – Class A | | | 1.5 | % |

Catalent, Inc. | | | 1.3 | |

Argenx SE – ADR | | | 1.0 | |

Tradeweb Markets, Inc. – Class A | | | 1.0 | |

Generac Holdings, Inc. | | | 1.0 | |

Zscaler, Inc. | | | 1.0 | |

Synopsys, Inc. | | | 1.0 | |

Fortive Corp. | | | 1.0 | |

SVB Financial Group | | | 0.9 | |

Ulta Beauty, Inc. | | | 0.8 | |

ADR – American Depositary Receipt

| | |

| 16 | | Annual Report • June 30, 2022 |

Bridge Builder Small/Mid Cap Value Fund

Management’s Discussion of Fund Performance (Unaudited)

Investment Objective

The investment objective of the Bridge Builder Small/Mid Cap Value Fund (the “Fund”) is to provide capital

appreciation.

Summary of the Investment Strategy

The Fund primarily invests in equity securities of small- and mid-capitalization companies, which are defined by the Fund as those companies whose market capitalizations at the time of purchase typically fall within the range of the Russell MidCap® Index and the Russell 2000® Index. The Fund follows an investing style that favors value investments and employs a multi-manager sub-advised structure.

Investment Commentary

For the fiscal year ended June 30, 2022, the Fund returned -10.21%, outperforming its benchmark, the Russell 2500® Value Index, which returned -13.19% for the period.

For the year, mid-capitalization stocks outperformed small-capitalization stocks. Within the investment universe, strongest performers included the energy and utilities sectors. The communication services sector was the weakest performer. Within both mid-capitalization and small-capitalization segments of the market, value stocks outperformed growth stocks.

Compared to its benchmark, the Fund’s relative outperformance was driven by the overweight to mid-cap stocks, favorable sector allocation, and strong stock selection within certain sectors. An underweight to communication services and an overweight to utilities contributed to performance, which was partially offset by an overweight to consumer discretionary. Stock selection within consumer discretionary, health care and industrials sectors also contributed to performance. Cash exposure was also a tailwind to the Fund performance over the year.

Investment Sub-advisers

| | | | | | |

| Vaughan Nelson Investment Management, LP uses a bottom- up value-oriented investment process. Vaughan Nelson seeks companies than typically possess one or more of the following attributes: companies earning a positive return on capital with stable-to-improving returns, valued at a discount to their asset value and/or having an attractive and sustainable dividend level. | | Boston Partners Global Investors, Inc. primarily invests in medium-capitalization companies and uses bottom-up fundamental analysis to make investment decisions. Boston Partners’ strategy seeks to add value through bottom-up stock selection. The strategy is designed to identify companies with attractive valuation, sound business fundamentals and improving business momentum. | | Silvercrest Asset Management Group LLC invests in small- capitalization companies that typically possess one or more of the following attributes: business that results in relatively consistent longer-term earnings and cash flow growth, franchise/asset value that may make the company attractive to potential acquirers, cyclically depressed earnings and/or cash flow that has potential for improvement, or a catalyst that will promote recognition of the company’s undervalued status. | | BlackRock Investment Management, LLC invests in equity securities with the objective of approximating the capitalization-weighted total rate of return of the segments of the United States market for publicly traded equity securities represented by the Russell Midcap® Value Index, which tracks the performance of mid-capitalization companies, and the Russell 2000® Value Index, which tracks the performance of small-capitalization companies. |

| LSV Asset Management primarily invests in medium-capitalization companies. LSV uses a bottom-up investment style, seeking to identify companies that are trading at prices substantially below their intrinsic value. | | Diamond Hill Capital Management, Inc. typically invests in U.S. equity securities of small to medium market capitalization companies measured at the time of purchase. Diamond Hill’s objective is to seek long-term capital appreciation by investing in companies selling for less than Diamond Hill’s estimate of intrinsic value. | | MFS Investment Management primarily invests in securities of companies with small-capitalization MFS focuses on investing in the stocks of companies that it believes are undervalued compared to their perceived worth (value companies). MFS uses an active bottom-up investment approach to buying and selling investments. Investments are selected primarily based on fundamental analysis of individual issuers and their potential in light of their financial condition, and market, economic, political, and regulatory conditions. | | American Century Investment Management, Inc. looks for equity securities of smaller companies whose stock price may not reflect the company’s value. The managers attempt to purchase the stocks of these undervalued companies and hold each stock until the price has increased to, or is higher than, a level the managers believe more accurately reflects the value of the company. |

| | |

| Annual Report • June 30, 2022 | | 17 |

Bridge Builder Small/Mid Cap Value Fund

Management’s Discussion of Fund Performance (Unaudited) (Continued)

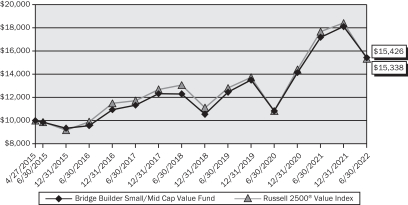

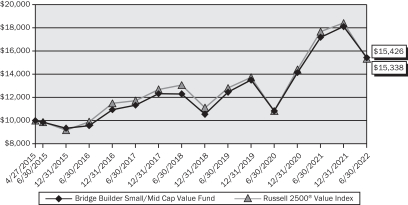

The following chart compares the value of a hypothetical $10,000 investment in the Bridge Builder Small/Mid Cap Value Fund from its inception (April 27, 2015) to June 30, 2022 as compared with the Russell 2500® Value Index.

Growth of a Hypothetical $10,000 Investment as of June 30, 2022

vs.

Russell 2500® Value Index

Average Annual Total Returns as of June 30, 2022

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | Since Inception (4/27/2015) | |

Bridge Builder Small/Mid Cap Value Fund | | | -10.21 | % | | | 6.39 | % | | | 6.23 | % |

Russell 2500® Value Index | | | -13.19 | % | | | 5.54 | % | | | 6.14 | % |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. As of the latest prospectus, the gross and net expense ratios of the Fund were 0.66%(1) and 0.40%(2), respectively. Performance data current to the most recent month end may be obtained by calling 1.855.823.3611.

The performance table does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Returns shown for the Fund include the reinvestment of all dividends, if any. Total return calculations reflect the effect of the Adviser’s fee waiver agreement for the Fund. If such fee waivers had not occurred, the quoted performance would be lower.

Portfolio Characteristics (3)

| | | | |

| Sector Breakdown | | (% of Investments) | |

Financials | | | 20.1 | % |

Industrials | | | 15.9 | |

Consumer Discretionary | | | 11.1 | |

Healthcare | | | 9.5 | |

Information Technology | | | 9.2 | |

Materials | | | 6.8 | |

Utilities | | | 6.6 | |

Real Estate | | | 6.0 | |

Energy | | | 5.8 | |

Consumer Staples | | | 4.1 | |

Short-Term Investments | | | 2.7 | |

Communication Services | | | 1.8 | |

Exchange Traded Funds | | | 0.4 | |

| | | | |

| Top Ten Equity Holdings | | (% of Net Assets) | |

Nexstar Media Group, Inc. – Class A | | | 0.8 | % |

Motorola Solutions, Inc. | | | 0.8 | |

Vistra Corp. | | | 0.7 | |

Evergy, Inc. | | | 0.7 | |

Ameriprise Financial, Inc. | | | 0.6 | |

Avantor, Inc. | | | 0.6 | |

Pioneer Natural Resources Co. | | | 0.6 | |

WillScot Mobile Mini Holdings Corp. – Class A | | | 0.6 | |

Ameren Corp. | | | 0.6 | |

CMS Energy Corp. | | | 0.6 | |

| | |

| 18 | | Annual Report • June 30, 2022 |

Bridge Builder Tax Managed Small/Mid Cap Fund

Management’s Discussion of Fund Performance (Unaudited)

Investment Objective

The investment objective of Bridge Builder Tax Managed Small/Mid Cap Fund (the “Fund”) is to seek to provide a tax-efficient investment return consisting of capital appreciation.

Summary of the Investment Strategy

The Fund primarily invests in equity securities of small and mid-capitalization companies, which are defined as those whose market capitalizations typically fall within the range of the Russell Midcap® Index and the Russell 2000® Index. The Fund seeks to manage the impact of taxes through its use of a tax overlay manager. The Fund employs a multi-manager sub-advised structure and implements the investment recommendations of the Fund’s sub-advisers through the use of Parametric Portfolio Associates LLC (“Parametric”) as overlay manager, as described in greater detail below. As overlay manager, Parametric has limited authority to vary from the model portfolios provided by the Fund’s sub-advisers, primarily for the purpose of efficient tax management of the Fund’s securities transactions.

Investment Commentary

For the period June 1, 2022 thru June 30, 2022 on a pre-tax basis, the Fund returned -7.10%, outperforming its benchmark, the Russell 2500® Index, which returned -8.90% for the period.

For the one month period within domestic equities, results were mixed within the small-, small/mid and mid-capitalization companies during the period. The modest outperformance of mid-capitalization companies relative to small/mid provided a tailwind for the Fund. Growth stocks outperformed value stocks across the market-cap spectrum. Like the large-capitalization companies, energy was the worst performing sector within the Russell 2500® Index during the period. The Fund’s underweight position in energy was an additional tailwind during the period.

Investment Sub-advisers

| | | | | | |

| Goldman Sachs Asset Management, L.P. seeks long-term growth of capital and recommends primarily small-capitalization and medium capitalization U.S. companies, but may also recommend foreign companies. Goldman Sachs utilizes a fundamental process to evaluate companies based on specific characteristics it believes indicate a high-quality business with sustainable growth. These specific characteristics include strong business franchises, favorable long-term prospects, and excellent management. Goldman Sachs also considers the valuation of a company in recommending its purchase or sale. | | J.P. Morgan Investment Management Inc. recommends investments primarily in medium capitalization companies and seeks growth companies with leading competitive positions that can achieve sustainable growth. J.P. Morgan employs a fundamental bottom-up investment process that combines research, valuation, and stock selection to identify companies that have a history of above-average growth or which it believes will achieve above-average growth in the future. | | Neuberger Berman Investment Advisers LLC seeks to recommend investments mainly in small and medium capitalization U.S. companies, but may also recommend foreign companies. Neuberger Berman focuses on companies that it believes to be high quality companies that have strong current market shares and balance sheets, and whose financial strength is largely based on existing business lines rather than future business prospects. Factors in identifying these companies may include: a history of above-average returns, an established market niche, circumstances that would make it difficult for new competitors to enter the market, the ability to finance their own growth, and/or a belief by Neuberger Berman that the company has sound future business prospects. | | AllianceBernstein L.P. recommends primarily small and medium capitalization U.S. companies that it believes are undervalued by using AllianceBernstein’s fundamental value approach. In making recommendations, AllianceBernstein uses its fundamental and quantitative research to identify companies whose long-term earnings power is not reflected in the current market price of their securities. |

| | | | | Neuberger Berman seeks to diversify among many companies and industries, but, at times, may emphasize certain sectors that it believes will benefit from market or economic trends. | | |

| | |

| Annual Report • June 30, 2022 | | 19 |

Bridge Builder Tax Managed Small/Mid Cap Fund

Management’s Discussion of Fund Performance (Unaudited) (Continued)

| | | | | | |

| Allspring Global Investments, LLC recommends primarily medium capitalization companies that it believes are undervalued, have the potential for above average capital appreciation with below average risk, and that possess a long-term competitive advantage provided by a durable asset base, strong balance sheets, and sustainable cash flows. Typical recommendations by Allspring include stocks of companies that are generally out of favor in the marketplace or are undergoing reorganization or other corporate action that may create above-average price appreciation. | | Parametric Portfolio Associates LLC serves as the Fund’s overlay manager and also serves as the Fund’s direct indexing manager. As the Fund’s direct indexing manager, Parametric manages one or more allocated portions of the Fund pursuant to a strategy that is designed to provide similar exposure to the Russell Midcap® Growth Index, Russell Midcap® Value Index, Russell 2000® Growth Index and Russell 2000® Value Index. As the Fund’s overlay manager, Parametric implements a portfolio that represents the aggregation of the model portfolios of the Fund’s sub-advisers, including with respect to each direct indexing portion of the Fund, at weightings set by Olive Street Investment Advisers, LLC, the Fund’s investment adviser. In this role, Parametric manages the impact of taxes by, among other things, selling stocks with the lowest tax cost first, opportunistically harvesting losses and deferring recognition of taxable gains, where possible. | | | | |

| | |

| 20 | | Annual Report • June 30, 2022 |

Bridge Builder Tax Managed Small/Mid Cap Fund

Management’s Discussion of Fund Performance (Unaudited) (Continued)

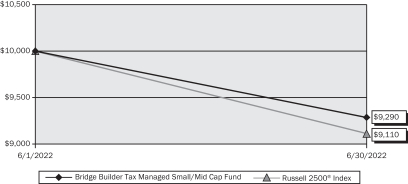

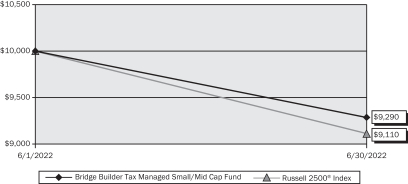

The following chart compares the value of a hypothetical $10,000 investment in the Bridge Builder Tax Managed Small/Mid Cap Fund from its inception (June 1, 2022) to June 30, 2022 as compared with the Russell 2500® Index.

Growth of a Hypothetical $10,000 Investment as of June 30, 2022

vs.

Russell 2500® Index

Average Annual Total Returns as of June 30, 2022

| | | | |

| | | Since Inception (6/01/2022) | |

Bridge Builder Tax Managed Small/Mid Cap Fund | | | -7.10 | % |

Russell 2500® Index | | | -8.90 | % |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. As of the latest prospectus, the gross and net expense ratios of the Fund were 0.75%(1) and 0.54%(2), respectively. Performance data current to the most recent month end may be obtained by calling 1.855.823.3611.

The performance table does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Returns shown for the Fund include the reinvestment of all dividends, if any. Total return calculations reflect the effect of the Adviser’s fee waiver agreement for the Fund. If such fee waivers had not occurred, the quoted performance would be lower.

Portfolio Characteristics (3)

| | | | |

| Sector Breakdown | | (% of Investments) | |

Industrials | | | 19.5 | % |

Information Technology | | | 17.1 | |

Financials | | | 14.6 | |

Healthcare | | | 13.5 | |

Consumer Discretionary | | | 11.6 | |

Materials | | | 4.2 | |

Real Estate | | | 4.0 | |

Energy | | | 4.0 | |

Consumer Staples | | | 3.8 | |

Utilities | | | 2.7 | |

Short-Term Investments | | | 2.7 | |

Communication Services | | | 2.1 | |

Exchange Traded Funds | | | 0.2 | |

| | | | |

| Top Ten Equity Holdings | | (% of Net Assets) | |

Carlisle Companies, Inc. | | | 0.8 | % |

RBC Bearings, Inc. | | | 0.8 | |

Jacobs Engineering Group, Inc. | | | 0.7 | |

Arch Capital Group Ltd. | | | 0.7 | |

Novanta, Inc. | | | 0.7 | |

LKQ Corp. | | | 0.7 | |

Toro Co. | | | 0.7 | |

Church & Dwight Co., Inc. | | | 0.6 | |

Republic Services, Inc. – Class A | | | 0.6 | |

Lattice Semiconductor Corp. | | | 0.6 | |

| | |

| Annual Report • June 30, 2022 | | 21 |

Bridge Builder International Equity Fund

Management’s Discussion of Fund Performance (Unaudited)

Investment Objective

The investment objective of the Bridge Builder International Equity Fund (the “Fund”) is to provide capital appreciation.

Summary of the Investment Strategy

The Fund primarily invests in non-U.S. dollar denominated securities of large-capitalization companies that derive a majority of their revenues or profits from a country or countries other than the United States. The Fund employs a multi-manager sub-advised structure.

Investment Commentary

For the fiscal year ended June 30, 2022, the Fund returned -21.02%, underperforming its benchmark, the MSCI EAFE Index, which returned -17.77% for the period.

For the year, the U.S. dollar generally appreciated versus the currencies of other developed regions, detracting from the returns of international securities for U.S. investors. Emerging markets performance was weaker than developed markets. In developed markets, value stocks outperformed growth stocks and large-capitalization stocks outperformed small-capitalization stocks. Information technology and consumer discretionary struggled over the year, while energy and health care performed the strongest.

Compared to its benchmark, the Fund’s relative underperformance was driven by sector allocation, weak stock selection and an exposure to emerging markets. Overweight to consumer discretionary and information technology detracted from performance. Weak stock selection, particularly in consumer discretionary, materials and health care detracted from relative returns and offset the stronger stock selection in financials.

Investment Sub-advisers

| | | | |

| Baillie Gifford Overseas Limited primarily uses proprietary, fundamental research to identify companies for investment that can exhibit sustained, above-average growth with attractive financial characteristics and sustainable competitive advantages. When evaluating individual companies for investment, Baillie Gifford normally focuses on growth/quality, management, valuation and sell discipline. | | BlackRock Investment Management, LLC’s equity index strategies invest in portfolios of international equity securities with the objective of approximating as closely as practicable the capitalization weighted total rates of return of the markets in certain countries for value and growth equity securities traded outside the United States, as represented by the MSCI EAFE Growth and MSCI EAFE Value Indices. | | Marathon Asset Management LLP invests primarily in equity securities of non-U.S. issuers in developed and emerging market countries. Marathon-London focuses on identifying attractive long-term investment opportunities as a result of certain “capital cycle” conditions to invest in stocks in industries where consolidation has occurred and return on investment is expected to rise and/or where barriers to entry exist that may allow elevated return on investment to persist for longer than the market expects. Marathon-London’s portfolio is expected to have low turnover, to be well-diversified, and to have a bias towards the smaller capitalization segments of the market. |

| Pzena Investment Management, LLC focuses on deep value investing, seeking to identify international securities that are trading at prices substantially below their intrinsic value but have solid long term prospects. | | Mondrian Investment Partners Limited employs a long-only, value investment philosophy. Portfolio construction is primarily driven by detailed bottom-up stock selection, based on rigorous dividend discount valuation analysis. | | WCM Investment Management uses a bottom- up approach that seeks to identify companies with attractive fundamentals, such as long-term growth in revenue and earnings, and that show a high probability for superior future growth. WCM’s investment process focuses on seeking industry-leading companies that WCM believes possess growing competitive advantages; corporate cultures emphasizing strong, quality and experienced management; low or no debt; and attractive relative valuations. |

| | |

| 22 | | Annual Report • June 30, 2022 |

Bridge Builder International Equity Fund

Management’s Discussion of Fund Performance (Unaudited) (Continued)

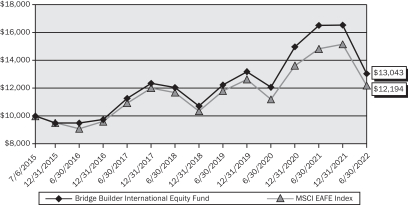

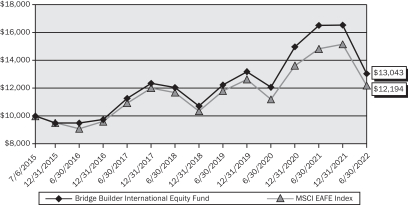

The following chart compares the value of a hypothetical $10,000 investment in the Bridge Builder International Equity Fund from its inception (July 6, 2015) to June 30, 2022 as compared with the MSCI EAFE Index.

Growth of a Hypothetical $10,000 Investment as of June 30, 2022

vs.

MSCI EAFE Index

Average Annual Total Returns as of June 30, 2022

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | Since Inception (7/06/2015) | |

Bridge Builder International Equity Fund | | | -21.02 | % | | | 2.95 | % | | | 3.88 | % |

MSCI EAFE Index | | | -17.77 | % | | | 2.20 | % | | | 2.88 | % |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. As of the latest prospectus, the gross and net expense ratios of the Fund were 0.63%(1) and 0.32%(2), respectively. Performance data current to the most recent month end may be obtained by calling 1.855.823.3611.

The performance table does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Returns shown for the Fund include the reinvestment of all dividends, if any. Total return calculations reflect the effect of the Adviser’s fee waiver agreement for the Fund. If such fee waivers had not occurred, the quoted performance would be lower

Portfolio Characteristics (3)

| | | | |

| Sector Breakdown | | (% of Investments) | |

Industrials | | | 16.1 | % |

Financials | | | 15.4 | |

Consumer Discretionary | | | 15.2 | |

Healthcare | | | 13.9 | |

Information Technology | | | 10.8 | |

Consumer Staples | | | 8.8 | |

Communication Services | | | 6.2 | |

Materials | | | 4.4 | |

Energy | | | 4.2 | |

Utilities | | | 2.9 | |

Short-Term Investments | | | 1.9 | |

Real Estate | | | 0.2 | |

| | | | |

| Top Ten Equity Holdings | | (% of Net Assets) | |

Shell Plc | | | 1.5 | % |

United Overseas Bank Ltd. | | | 1.3 | |

Sanofi | | | 1.2 | |

BP Plc | | | 1.2 | |

Honda Motor Co. Ltd. | | | 1.2 | |

AIA Group Ltd. | | | 1.2 | |

Takeda Pharmaceutical Co. Ltd. | | | 1.2 | |

Nippon Telegraph & Telephone Corp. | | | 1.1 | |

Tesco Plc | | | 1.1 | |

Novartis AG | | | 1.1 | |

| | |

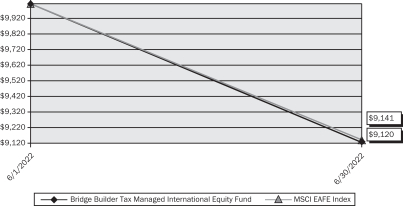

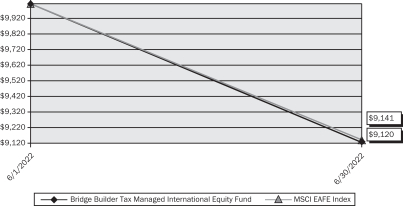

| Annual Report • June 30, 2022 | | 23 |