UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-22811

Bridge Builder Trust

(Exact name of registrant as specified in charter)

Bridge Builder Trust

12555 Manchester Road

Des Peres, MO, 63131

(Address of principal executive offices)

Evan S. Posner, Secretary

Bridge Builder Trust

c/o 12555 Manchester Road

Des Peres, MO 63131

(Name and address of Agent for service)

Registrant’s telephone number, including area code: (314) 515-3289

Date of fiscal year end: June 30

Date of reporting period: June 30, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORT TO SHAREHOLDERS

The following is a copy of the Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”)(17 CFR 270.30e-1).

Annual Report

June 30, 2023

Bridge Builder Core Bond Fund

Bridge Builder Core Plus Bond Fund

Bridge Builder Municipal Bond Fund

Bridge Builder Municipal High-Income Bond Fund

Bridge Builder Large Cap Growth Fund

Bridge Builder Large Cap Value Fund

Bridge Builder Tax Managed Large Cap Fund

Bridge Builder Small/Mid Cap Growth Fund

Bridge Builder Small/Mid Cap Value Fund

Bridge Builder Tax Managed Small/Mid Cap Fund

Bridge Builder International Equity Fund

Bridge Builder Tax Managed International Equity Fund

Table of Contents

| | |

| | | Annual Report • June 30, 2023 |

Bridge Builder Mutual Funds

Letter to Shareholders (Unaudited)

Dear Shareholder,

It is our pleasure to provide you with the Bridge Builder Mutual Funds (“Funds” or individually a “Fund”) annual report for the fiscal year ended June 30, 2023. In this report you will find fund performance information, a summary schedule of investments, financial statements and other important information about each of the Funds.

For details about individual fund performance and market commentary, please refer to the Management’s Discussion of Fund Performance section of this report for each Fund.

The Funds are available exclusively through Edward Jones Advisory Solutions®, an asset allocation program providing investment advisory services. Each Fund uses a multi-manager sub-advised structure, where several leading asset management firms are selected to invest a portion of a fund’s assets. Each manager within a Fund brings a unique perspective and investment approach. The Funds are managed according to the key tenets of our investment philosophy: diversification, high quality and a long-term approach.

All of the Funds’ sub-advisers are selected by Olive Street Investment Advisers, LLC (“Olive Street” or “Adviser”), an affiliate of Edward Jones, and approved by the Funds’ Board of Trustees. Olive Street strives to combine complementary investment styles, performance patterns and portfolio characteristics that have generally demonstrated a track record of success.

Since the inception of the Funds, they have provided investors in Edward Jones Advisory Solutions® with several important benefits. These benefits include: manager selection with oversight by Edward Jones’ Portfolio Solutions and Investment Management Research teams, access to certain institutional managers and investment strategies that are not available in the retail mutual fund marketplace, the ability to make changes among managers within the Funds in a potentially more tax- and cost-efficient manner, and lower overall Fund costs compared to Morningstar® category averages. As a result, your ownership of the Funds as part of the Edward Jones Advisory Solutions® has played an important role in the performance of your account.

Over the course of the past 12-months, there have been changes to the Funds’ lineup of sub-advisers and a new Fund was added to the Bridge Builder Trust. In April of 2023, Bridge Builder launched the Bridge Builder Municipal High-Income Bond Fund. Assets from the Bridge Builder Municipal Bond Fund were transitioned to the new Fund as was the T. Rowe Price Associates investment advisory mandate. Capital International, Inc. was also named as a sub-adviser to the new Fund.

For additional information about the Funds, visit www.bridgebuildermutualfunds.com.

We look forward to playing an important role in helping you pursue your financial goals.

Sincerely,

| | |

|

|

John Tesoro Chairman, Bridge Builder Trust |

|

|

|

Tom Kersting President, Olive Street Investment Advisers, LLC Principal, Edward Jones Investment and Protection Products |

| | |

| Annual Report • June 30, 2023 | | 1 |

Bridge Builder Core Bond Fund

Management’s Discussion of Fund Performance (Unaudited)

Investment Objective

The investment objective of the Bridge Builder Core Bond Fund (the “Fund”) is to provide total return (capital appreciation plus income).

Summary of the Investment Strategy

The Fund invests, under normal market conditions, at least 80% of its net assets (plus the amount of borrowings for investment purposes) in fixed income securities and other instruments, such as derivatives and certain investment companies, with economic characteristics similar to fixed income securities. The Fund’s assets are allocated across different fixed-income market sectors and maturities. Most of the Fund’s investments are fixed-income securities issued or guaranteed by the U.S. government or its agencies, corporate bonds, asset-backed securities, privately issued securities, floating rate securities and mortgage-related and mortgage-backed securities. The Fund may invest in securities issued by foreign entities, including emerging market securities. The Fund may buy or sell futures or swaps to gain or hedge exposure to risk factors or to alter the Fund’s investment characteristics. The Fund employs a multi-manager sub-advised structure.

Investment Commentary

The Fund returned -0.30% during the fiscal year ended June 30, 2023. The Fund outperformed its benchmark, the Bloomberg U.S. Aggregate Bond Index (the “Agg”), which returned -0.94% over the same period.

The U.S. Federal Reserve (the “Fed”) continued to have a dominant impact on fixed income markets during the second half of 2022. Its hawkish stance to address elevated inflation resulted in four rate hikes totaling 275 basis points (“bps”, 1bps equal 0.01%), pushing all major fixed income sectors into negative territory and deepening losses for the full calendar year: the Agg, an index measuring the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, posted a -13.01% return in 2022, the worst calendar year result in its history. The first half of 2023 brought renewed optimism as year-over-year inflation prints continued trending lower, providing market participants some relief and confidence in the Fed’s ability to orchestrate a “soft landing” despite one of the most aggressive tightening cycles ever undertaken. The Fed slowed the pace of rate hikes to 25bps in each of the first three meetings of 2023 and opted to pause altogether in June as they observed the economy’s digestion of materially higher interest rates. Despite a generally positive sentiment on the path of inflation, fixed income markets faced new challenges in the second quarter due to uncertainty around the looming U.S. debt ceiling; ultimately a deal was struck, and the debt ceiling extended to January of 2025.

Altogether, the 10-Year U.S. Treasury rate rose from 2.98% on June 30, 2022, to 3.81% on June 30, 2023. Meanwhile, corporate credit spreads narrowed over the period, particularly within U.S. high-yield, leading to gains for U.S. corporate bonds and other credit-sensitive areas of the market. Emerging markets debt similarly rallied, while the developed non-U.S. bond market closed the fiscal year with modest losses, driven in part by Bank of Japan’s policy action and resulting increase in Japanese yields. The U.S. dollar depreciated marginally relative to most other developed-markets currencies.

Against this backdrop, the Fund outperformed its benchmark by 0.64% over the fiscal year. The outperformance was primarily driven by an underweight to U.S. Treasuries and an overweight to and selection within the corporate bond sector, particularly within the industrials sub-sector. Duration and curve positioning within the securitized sector, specifically asset-backed and commercial mortgage-backed securities, were detractors from relative performance.

Investment Sub-advisers

| | | | | | |

Robert W. Baird & Co. Inc. utilizes a structured, risk-controlled philosophy with a disciplined duration neutral approach to invest its allocated portion of the Fund’s assets. | | J.P. Morgan Investment Management, Inc. incorporates a bottom-up, value-oriented approach in managing its allocated portion of the Fund’s assets. | | Loomis, Sayles & Company, L.P. employs an investment philosophy that focuses on research-driven, relative value investing on a risk-adjusted basis, seeking to add value primarily through security selection while continually managing risk in the portfolio. | | PGIM, Inc. uses a team approach to attempt to add value by tilting toward fixed-income sectors that it believes are attractive and by utilizing its extensive research capabilities to choose attractive fixed-income securities within sectors. |

| | |

| 2 | | Annual Report • June 30, 2023 |

Bridge Builder Core Bond Fund

Management’s Discussion of Fund Performance (Unaudited) (Continued)

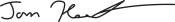

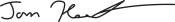

The following chart compares the value of a hypothetical $10,000 investment in the Bridge Builder Core Bond Fund from its inception (October 28, 2013) to June 30, 2023 as compared with the Bloomberg U.S. Aggregate Bond Index.

Growth of a Hypothetical $10,000 Investment as of June 30, 2023

vs.

Bloomberg U.S. Aggregate Bond Index

Average Annual Total Returns as of June 30, 2023

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | Since Inception (10/28/2013) | |

Bridge Builder Core Bond Fund | | | -0.30 | % | | | 1.29 | % | | | 1.85 | % |

Bloomberg U.S. Aggregate Bond Index | | | -0.94 | % | | | 0.77 | % | | | 1.42 | % |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. As of the latest prospectus, the gross and net expense ratios of the Fund were 0.34%(1) and 0.13%(2), respectively. Performance data current to the most recent month end may be obtained by calling 1.855.823.3611.

The performance table does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Returns shown for the Fund include the reinvestment of all dividends, if any. Total return calculations reflect the effect of the Adviser’s fee waiver agreement for the Fund. If such fee waivers had not occurred, the quoted performance would be lower.

Portfolio Characteristics (3)

| | | | |

| Security Type Breakdown | | (% of Investments) | |

Mortgage-Backed Obligations | | | 35.9 | % |

Corporate Bonds | | | 28.8 | |

Government Related | | | 20.0 | |

Asset-Backed Obligations | | | 12.1 | |

Short-Term Investments | | | 3.2 | |

Preferred Stocks | | | 0.0 | * |

| | |

| Annual Report • June 30, 2023 | | 3 |

Bridge Builder Core Plus Bond Fund

Management’s Discussion of Fund Performance (Unaudited)

Investment Objective

The investment objective of the Bridge Builder Core Plus Bond Fund (the “Fund”) is to provide total return (capital appreciation plus income).

Summary of the Investment Strategy

The Fund invests, under normal market conditions, at least 80% of its net assets (plus the amount of borrowings for investment purposes) in fixed income securities of any maturity or duration and other instruments, such as derivatives, with economic characteristics similar to fixed income securities, and certain investment companies that seek to track the performance of fixed income securities. The Fund’s assets are allocated across different fixed-income market sectors and maturities. Most of the Fund’s investments are fixed-income securities issued or guaranteed by the U.S. government or its agencies, corporate bonds, asset-backed securities, privately issued securities, floating rate securities, and mortgage-related and mortgage-backed securities. The Fund may invest in high-yield securities deemed below investment grade, and securities issued by foreign entities, including emerging market securities. The Fund employs a multi-manager sub-advised structure.

Investment Commentary

The Fund returned 0.55% during the fiscal year ended June 30, 2023. The Fund modestly outperformed its benchmark, the Bloomberg U.S. Aggregate Bond Index, which returned -0.94% during the same period.

The Fed continued to have a dominant impact on fixed income markets during the second half of 2022. Its hawkish stance to address elevated inflation resulted in four rate hikes totaling 275bps pushing all major fixed income sectors into negative territory and deepening losses for the full calendar year: the Agg, an index measuring the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, posted a -13.01% return in 2022, the worst calendar year result in its history. The first half of 2023 brought renewed optimism as year-over-year inflation prints continued trending lower, providing market participants some relief and confidence in the Fed’s ability to orchestrate a “soft landing” despite one of the most aggressive tightening cycles ever undertaken. The Fed slowed the pace of rate hikes to 25bps in each of the first three meetings of 2023 and opted to pause altogether in June as they observed the economy’s digestion of materially higher interest rates. Despite a generally positive sentiment on the path of inflation, fixed income markets faced new challenges in the second quarter due to uncertainty around the looming U.S. debt ceiling; ultimately a deal was struck, and the debt ceiling extended to January of 2025.

Altogether, the 10-Year U.S. Treasury rate rose from 2.98% on June 30, 2022, to 3.81% on June 30, 2023. Meanwhile, corporate credit spreads narrowed over the period, particularly within U.S. high-yield, leading to gains for U.S. corporate bonds and other credit-sensitive areas of the market. Emerging markets debt similarly rallied, while the developed non-U.S. bond market closed the fiscal year with modest losses, driven in part by Bank of Japan’s policy action and resulting increase in Japanese yields. The U.S. dollar depreciated marginally relative to most other developed-markets currencies.

Against this backdrop, the Fund outperformed its benchmark by 1.49% over the fiscal year. The Fund’s overweight to and selection within corporate bonds, particularly the industrials sub-sector, was the largest contributor to relative results. The Fund’s lower duration compared to the benchmark also contributed to relative results as interest rates rose materially and more interest-rate-sensitive instruments sold off to a larger degree during the fiscal year.

| | |

| 4 | | Annual Report • June 30, 2023 |

Bridge Builder Core Plus Bond Fund

Management’s Discussion of Fund Performance (Unaudited) (Continued)

Investment Sub-advisers

| | | | | | |

| Pacific Investment Management Company LLC seeks to achieve the Fund’s investment objective by investing in a multi-sector portfolio of fixed-income instruments of varying maturities, which may be represented by derivatives such as forwards, futures contracts or swap agreements. | | BlackRock Investment Management, LLC will buy or sell securities whenever its portfolio management team sees an appropriate opportunity. Under normal circumstances, BlackRock invests primarily in fixed income securities and derivatives with similar economic characteristics. | | Loomis, Sayles & Company, L.P. generally seeks fixed-income securities of issuers whose credit profiles it believes are improving. Loomis Sayles relies primarily on issue selection as the key driver to investment performance. Loomis Sayles also analyzes different sectors of the economy and differences in the yields of various fixed-income securities in an effort to find securities that it believes may produce attractive returns in comparison to these securities’ risks. | | Metropolitan West Asset Management, LLC employs a value-oriented fixed-income management philosophy and an investment process predicated on a long-term economic outlook. |

| | |

| Annual Report • June 30, 2023 | | 5 |

Bridge Builder Core Plus Bond Fund

Management’s Discussion of Fund Performance (Unaudited) (Continued)

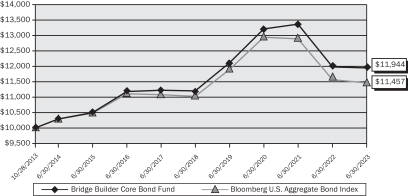

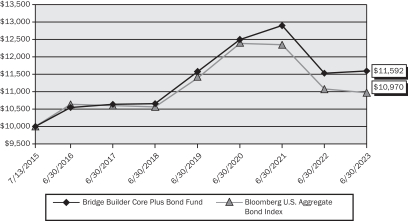

The following chart compares the value of a hypothetical $10,000 investment in the Bridge Builder Core Plus Bond Fund from its inception (July 13, 2015) to June 30, 2023 as compared with the Bloomberg U.S. Aggregate Bond Index.

Growth of a Hypothetical $10,000 Investment as of June 30, 2023

vs.

Bloomberg U.S. Aggregate Bond Index

Average Annual Total Returns as of June 30, 2023

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | Since Inception (7/13/2015) | |

Bridge Builder Core Plus Bond Fund | | | 0.55 | % | | | 1.70 | % | | | 1.87 | % |

Bloomberg U.S. Aggregate Bond Index | | | -0.94 | % | | | 0.77 | % | | | 1.17 | % |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. As of the latest prospectus, the gross and net expense ratios of the Fund were 0.41%(1) and 0.18%(2), respectively. Performance data current to the most recent month end may be obtained by calling 1.855.823.3611.

The performance table does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Returns shown for the Fund include the reinvestment of all dividends, if any. Total return calculations reflect the effect of the Adviser’s fee waiver agreement for the Fund. If such fee waivers had not occurred, the quoted performance would be lower.

Portfolio Characteristics (3)

| | | | |

| Security Type Breakdown | | (% of Investments) | |

Mortgage-Backed Obligations | | | 32.5 | % |

Corporate Bonds | | | 25.1 | |

Government Related | | | 20.0 | |

Asset-Backed Obligations | | | 10.8 | |

Short-Term Investments | | | 10.0 | |

Bank Loans | | | 1.0 | |

Convertible Securities | | | 0.3 | |

Convertible Preferred Stocks | | | 0.2 | |

Common Stocks | | | 0.1 | |

Warrants | | | 0.0 | * |

Preferred Stocks | | | 0.0 | * |

Rights | | | — | ** |

| | |

| 6 | | Annual Report • June 30, 2023 |

Bridge Builder Municipal Bond Fund

Management’s Discussion of Fund Performance (Unaudited)

Investment Objective

The investment objective of the Bridge Builder Municipal Bond Fund (the “Fund”) is to provide current income exempt from federal tax, with a secondary goal of preservation of investment principal.

Summary of the Investment Strategy

The Fund invests, under normal market conditions, at least 80% of its net assets (plus the amount of borrowings for investment purposes) in municipal securities of any maturity or duration whose interest is exempt from federal income tax. These municipal securities include debt obligations issued by or on behalf of a state or local entity or other qualifying issuer that pay interest that is, in the opinion of bond counsel to the issuer, generally excludable from gross income for federal income tax purposes. Interest may be includable in taxable income for certain non-corporate taxpayers subject to the federal alternative minimum tax. The Fund employs a multi-manager sub-advised structure.

Investment Commentary

The Fund returned 3.03% during the fiscal year ended June 30, 2023. The Fund outperformed its benchmark, the Bloomberg Municipal 1-15 Year Index, which returned 2.78% during the same period.

The Fed continued to have a dominant impact on fixed income markets during the second half of 2022. Its hawkish stance to address elevated inflation resulted in four rate hikes totaling 275bps pushing all major fixed income sectors into negative territory and deepening losses for the full calendar year: the Agg, an index measuring the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, posted a -13.01% return in 2022, the worst calendar year result in its history. The first half of 2023 brought renewed optimism as year-over-year inflation prints continued trending lower, providing market participants some relief and confidence in the Fed’s ability to orchestrate a “soft landing” despite one of the most aggressive tightening cycles ever undertaken. The Fed slowed the pace of rate hikes to 25bps in each of the first three meetings of 2023 and opted to pause altogether in June as they observed the economy’s digestion of materially higher interest rates. Despite a generally positive sentiment on the path of inflation, fixed income markets faced new challenges in the second quarter due to uncertainty around the looming U.S. debt ceiling; ultimately a deal was struck, and the debt ceiling extended to January of 2025. Altogether, the 10-Year U.S. Treasury rate rose from 2.98% on June 30, 2022, to 3.81% on June 30, 2023.

Within the municipal bond market, the second half of 2022 saw municipal bond yields shift higher as a result of Fed policy action. This, combined with technical pressures of material outflows from the asset class overall, weighed on municipal bond returns. Conversely, during the first half of 2023 municipal bonds rebounded modestly, as investors reentered the space while new issuance was constrained, pushing yields, particularly on the long end of the curve, down to levels similar to the beginning of the fiscal year on June 30, 2022.

Against this backdrop, the Fund outperformed its benchmark by 0.25% for the fiscal year. The Fund’s outperformance was largely driven by its overall longer duration positioning relative to the benchmark.

Investment Sub-advisers

| | | | |

| FlAM LLC uses a municipal bond index as a guide in structuring and selecting its investments for its allocated portion of the Fund’s assets. FIAM considers a variety of factors when selecting investments, including the credit quality of issuers, security-specific features, current valuations relative to alternatives in the market, short-term trading opportunities resulting from market inefficiencies, and potential future valuations. | | MacKay Shields, LLC believes strong long-term performance can be achieved through an actively managed, research-driven, relative-value approach. Their investment strategy combines a top-down macro view with bottom-up credit research driven security selection. In doing so, the investment process seeks to identify mispricings and opportunities for total return with an emphasis and focus on risk management. | | BlackRock Investment Management, LLC takes a top-down, bottom-up approach with a flexible investment framework. Their security selection process is based on the relative value outlook and the quantitative assessment of the security and portfolio. BlackRock seeks total return derived primarily from coupon interest, and secondarily, capital appreciation. |

| | |

| Annual Report • June 30, 2023 | | 7 |

Bridge Builder Municipal Bond Fund

Management’s Discussion of Fund Performance (Unaudited) (Continued)

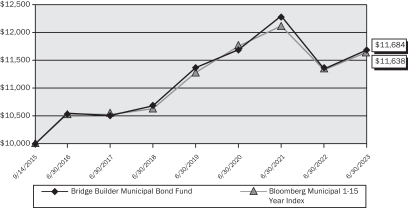

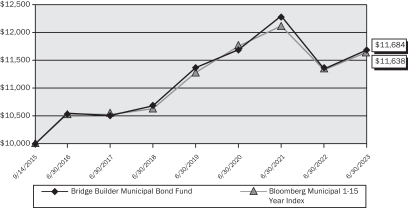

The following chart compares the value of a hypothetical $10,000 investment in the Bridge Builder Municipal Bond

Fund from its inception (September 14, 2015) to June 30, 2023 as compared with the Bloomberg Municipal 1-15 Year Index.

Growth of a Hypothetical $10,000 Investment as of June 30, 2023

vs.

Bloomberg Municipal 1-15 Year Index

Average Annual Total Returns as of June 30, 2023

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | Since Inception (9/14/2015) | |

Bridge Builder Municipal Bond Fund | | | 3.03 | % | | | 1.81 | % | | | 2.02 | % |

Bloomberg Municipal 1-15 Year Index | | | 2.78 | % | | | 1.83 | % | | | 1.97 | % |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. As of the latest prospectus, the gross and net expense ratios of the Fund were 0.38%(1) and 0.15%(2), respectively. Performance data current to the most recent month end may be obtained by calling 1.855.823.3611.

The performance table does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Returns shown for the Fund include the reinvestment of all dividends, if any. Total return calculations reflect the effect of the Adviser’s fee waiver agreement for the Fund. If such fee waivers had not occurred, the quoted performance would be lower.

Portfolio Characteristics (3)

| | | | |

| Security Type Breakdown | | (% of Investments) | |

General Revenue | | | 26.1 | % |

General Obligation | | | 23.0 | |

Transportation | | | 15.5 | |

Utilities | | | 10.8 | |

Healthcare | | | 9.6 | |

Education | | | 7.4 | |

Housing | | | 5.3 | |

Short-Term Investments | | | 2.3 | |

| | | | |

| Breakdown by State | | (% of Long-Term Investments) | |

New York | | | 11.3 | % |

Texas | | | 10.1 | |

Illinois | | | 8.8 | |

California | | | 7.3 | |

Florida | | | 6.0 | |

New Jersey | | | 3.9 | |

Pennsylvania | | | 3.9 | |

Michigan | | | 3.5 | |

Georgia | | | 3.5 | |

Washington | | | 3.2 | |

Other | | | 38.5 | |

| | |

| 8 | | Annual Report • June 30, 2023 |

Bridge Builder Municipal High-Income Bond Fund

Management’s Discussion of Fund Performance (Unaudited)

Investment Objective

The investment objective of the Bridge Builder Municipal High-Income Bond Fund (the “Fund”) is to provide current income exempt from federal tax.

Summary of the Investment Strategy

The Fund invests, under normal market conditions, at least 80% of its net assets (plus the amount of borrowings for investment purposes) in municipal securities of any maturity or duration whose interest is exempt from federal income tax. These municipal securities include debt obligations issued by or on behalf of a state or local entity or other qualifying issuer that pay interest that is, in the opinion of bond counsel to the issuer, generally excludable from gross income for federal income tax purposes. Interest may be includable in taxable income for certain taxpayers subject to the federal alternative minimum tax. Additionally, the Fund invests at least 50% of its assets in municipal securities rated Baa1 or lower by Moody’s Investors Service, Inc., BBB+ or lower by Standard & Poor’s Corporation, or an equivalent rating by another nationally recognized securities rating organization, or in unrated securities that a sub-adviser of the Fund believes are of comparable quality. The Fund employs a multi-manager sub-advised structure.

Investment Commentary

The Fund returned 0.01% from its inception on April 13, 2023, through its fiscal period ended June 30, 2023. The Fund outperformed its benchmark, the Bloomberg Municipal 65% High-Grade/35% High-Yield Index, which returned -0.83% during the same period.

Investment Sub-advisers

| | |

| T. Rowe Price Associates Inc. uses an active investment management approach that emphasizes the value of in-depth fundamental credit research, diversification and risk management practices. By using fundamental research, T. Rowe Price seeks to add value through sector weights and issue selection over a full market cycle. | | Capital International, Inc. utilizing a system of multiple portfolio managers in managing its allocated portion of the Fund’s assets, seeks to invest in attractively priced securities that, in its opinion, represent good, long-term investment opportunities. |

| | |

| Annual Report • June 30, 2023 | | 9 |

Bridge Builder Municipal High-Income Bond Fund

Management’s Discussion of Fund Performance (Unaudited) (Continued)

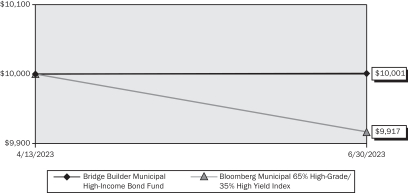

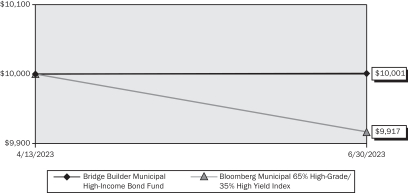

The following chart compares the value of a hypothetical $10,000 investment in the Bridge Builder Municipal High-Income Bond Fund from its inception (April 13, 2023) to June 30, 2023 as compared with the Bloomberg Municipal 65% High-Grade/35% High Yield Index.

Growth of a Hypothetical $10,000 Investment as of June 30, 2023

vs.

Bloomberg Municipal 65% High-Grade/35% High Yield Index

Average Annual Total Returns as of June 30, 2023

| | | | |

| | | Since Inception (4/13/2023) | |

Bridge Builder Municipal High-Income Bond Fund | | | 0.01 | % |

Bloomberg Municipal 65% High-Grade/35% High Yield Index | | | -0.83 | % |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. As of the latest prospectus, the gross and net expense ratios of the Fund were 0.37%(1) and 0.16%(2), respectively. Performance data current to the most recent month end may be obtained by calling 1.855.823.3611.

The performance table does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Returns shown for the Fund include the reinvestment of all dividends, if any. Total return calculations reflect the effect of the Adviser’s fee waiver agreement for the Fund. If such fee waivers had not occurred, the quoted performance would be lower.

Portfolio Characteristics (3)

| | | | |

| Security Type Breakdown | | (% of Investments) | |

General Revenue | | | 39.3 | % |

Healthcare | | | 17.2 | |

Transportation | | | 15.8 | |

Education | | | 7.9 | |

General Obligation | | | 7.4 | |

Housing | | | 6.1 | |

Utilities | | | 5.6 | |

Short-Term Investments | | | 0.7 | |

Common Stocks | | | 0.0 | * |

| | | | |

| Breakdown by State/Territory | | (% of Long-Term Investments) | |

Puerto Rico | | | 10.2 | % |

California | | | 9.4 | |

Illinois | | | 6.3 | |

Texas | | | 5.8 | |

New York | | | 5.4 | |

Pennsylvania | | | 4.9 | |

Ohio | | | 4.9 | |

Florida | | | 4.8 | |

New Jersey | | | 4.7 | |

Virginia | | | 4.4 | |

Other | | | 39.2 | |

| | |

| 10 | | Annual Report • June 30, 2023 |

Bridge Builder Large Cap Growth Fund

Management’s Discussion of Fund Performance (Unaudited)

Investment Objective

The investment objective of the Bridge Builder Large Cap Growth Fund (the “Fund”) is to provide capital appreciation.

Summary of the Investment Strategy

The Fund invests, under normal market conditions, at least 80% of its net assets (plus the amount of borrowings for investment purposes) in the securities of large capitalization companies and other instruments, such as certain investment companies that seek to track the performance of securities of large capitalization companies. Large capitalization companies are defined by the Fund as those companies whose market capitalizations at the time of purchase typically fall within the range of the Russell 1000® Index. The Fund follows an investing style that favors growth investments and employs a multi-manager sub-advised structure.

Investment Commentary

For the fiscal year ended June 30, 2023, the Fund returned 20.76%, underperforming its benchmark, the Russell 1000® Growth Index, which returned 27.11%.

For the year, large-capitalization growth stocks experienced two distinct halves of performance, where performance was negative for the first six months and lagged value stocks compared to a second half, where there was a strong reversal towards growth, returning 29% and outperforming value by nearly 24% during the period, versus 15% for the year. For the fiscal year, performance within large-capitalization growth stocks was largely driven by the technology sector, returning nearly 44% for the year and contributing roughly 17% of the benchmark’s 27.11% return. Given the technology sector’s weight in the benchmark and the magnitude of outperformance during the year, all other sectors lagged overall benchmark performance.

Compared to its benchmark, the Fund’s relative underperformance was driven predominantly by the underweight allocation to, and stock selection within, the technology sector. Overweight positioning and weak stock selection within health care and financials were also headwinds to performance. Stock selection within communication services was also another headwind to performance. Given the strong market performance over the trailing year, the Fund’s cash position also created a drag on relative performance versus the benchmark.

Two of the biggest headwinds for markets in 2022 – inflation and Federal Reserve policy – have started to turn favorably, while the economy has proved surprisingly resilient. Looking forward, we think inflation will continue to moderate, but growth is likely to downshift as the impact of the Fed’s rate hikes filters through the economy. While inflation remains high, progress has been made. As time passes, we think the impact of higher interest rates will be felt, and growth could weaken. However, the healthy starting point for the labor market should provide some cushion, and it is possible that just as consumption becomes less supportive, the slump in manufacturing and housing may start to reverse.

Investment Sub-advisers

| | | | | | |

| Lazard Asset Management LLC invests primarily in equity securities of U.S. companies that it believes have strong and/or improving financial productivity and are undervalued based on their earnings, cash flow or asset values. | | Sustainable Growth Advisers, LP seeks to identify large-capitalization companies that exhibit characteristics such as pricing power, repeat revenue streams and global reach that, in SGA’s judgement, have the potential for long-term earnings growth within the context of low business risk. | | Jennison Associates LLC invests in equity and equity-related companies that have strong capital appreciation potential. It follows a highly disciplined investment selection and management process of identifying companies that show superior absolute and relative earnings growth and are believed to be attractively valued. | | BlackRock Investment Management, LLC invests in equity securities with the objective of approximating as closely as practicable the capitalization weighted total rate of return of the segment of the United States market for publicly traded equity securities represented by the 1,000 largest capitalized companies. |

| | |

| Annual Report • June 30, 2023 | | 11 |

Bridge Builder Large Cap Growth Fund

Management’s Discussion of Fund Performance (Unaudited) (Continued)

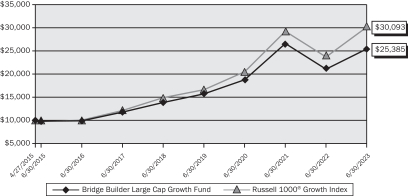

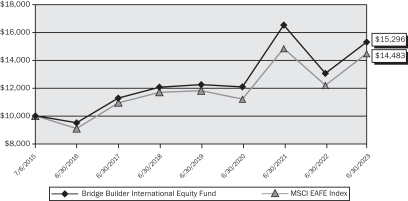

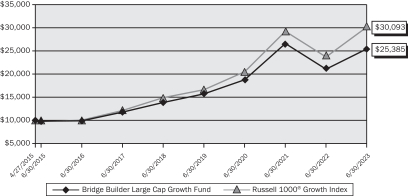

The following chart compares the value of a hypothetical $10,000 investment in the Bridge Builder Large Cap Growth Fund from its inception (April 27, 2015) to June 30, 2023 as compared with the Russell 1000® Growth

Growth of a Hypothetical $10,000 Investment as of June 30, 2023

vs.

Russell 1000® Growth Index

Average Annual Total Returns as of June 30, 2023

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | Since Inception (4/27/2015) | |

Bridge Builder Large Cap Growth Fund | | | 20.76 | % | | | 12.91 | % | | | 12.07 | % |

Russell 1000® Growth Index | | | 27.11 | % | | | 15.14 | % | | | 14.43 | % |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. As of the latest prospectus, the gross and net expense ratios of the Fund were 0.46%(1) and 0.19%(2), respectively. Performance data current to the most recent month end may be obtained by calling 1.855.823.3611.

The performance table does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Returns shown for the Fund include the reinvestment of all dividends, if any. Total return calculations reflect the effect of the Adviser’s fee waiver agreement for the Fund. If such fee waivers had not occurred, the quoted performance would be lower.

Portfolio Characteristics (3)

| | | | |

| Sector Breakdown | | (% of Investments) | |

Information Technology | | | 27.8 | % |

Financials | | | 16.0 | |

Healthcare | | | 15.4 | |

Consumer Discretionary | | | 15.0 | |

Communication Services | | | 8.1 | |

Consumer Staples | | | 4.6 | |

Industrials | | | 3.8 | |

Materials | | | 3.5 | |

Real Estate | | | 2.3 | |

Energy | | | 1.8 | |

Short-Term Investments | | | 1.7 | |

Utilities | | | 0.0 | * |

| | | | |

| Top Ten Equity Holdings | | (% of Net Assets) | |

Microsoft Corp. | | | 7.9 | % |

Amazon.com, Inc. | | | 5.6 | |

Visa, Inc. – Class A | | | 3.7 | |

Apple, Inc. | | | 3.1 | |

Alphabet, Inc. – Class A | | | 3.0 | |

NVIDIA Corp. | | | 2.7 | |

UnitedHealth Group, Inc. | | | 2.7 | |

Alphabet, Inc. – Class C | | | 2.0 | |

Thermo Fisher Scientific, Inc. | | | 1.9 | |

Salesforce, Inc. | | | 1.9 | |

| | |

| 12 | | Annual Report • June 30, 2023 |

Bridge Builder Large Cap Value Fund

Management’s Discussion of Fund Performance (Unaudited)

Investment Objective

The investment objective of the Bridge Builder Large Cap Value Fund (the “Fund”) is to provide capital appreciation.

Summary of the Investment Strategy

The Fund invests, under normal market conditions, at least 80% of its net assets (plus the amount of borrowings for investment purposes) in the securities of large capitalization companies and other instruments, such as certain investment companies, with economic characteristics that seek to track the performance of securities of large capitalization companies. Large capitalization companies are defined by the Fund as those companies whose market capitalizations at the time of purchase typically fall within the range of the Russell 1000® Index. The Fund follows an investing style that favors value investments and employs a multi-manager sub-advised structure.

Investment Commentary

For the fiscal year ended June 30, 2023, the Fund returned 13.52%, outperforming its benchmark, the Russell 1000® Value Index, which returned 11.54%.

For the fiscal year, within large-capitalization value stocks, six of the sectors led the broad market, while five lagged. Industrials, consumer discretionary, and energy were the top performing sectors, while utilities, real estate and health care were the three worst performers for the period. In addition, within the overall large-capitalization portion of the market, value stocks underperformed growth stocks for the one-year period.

Compared to its benchmark, the Fund’s relative outperformance was driven predominantly by the overweight allocation to, and stock selection within, the consumer discretionary sector. Stock selection within technology was an additional tailwind to performance. The Fund’s underweight position in energy and weak stock selection within consumer staples were the largest headwinds to relative performance for the year.

Two of the biggest headwinds for markets in 2022 – inflation and Federal Reserve policy – have started to turn favorably, while the economy has proved surprisingly resilient. Looking forward, we think inflation will continue to moderate, but growth is likely to downshift as the impact of the Fed’s rate hikes filters through the economy. While inflation remains high, progress has been made. As time passes, we think the impact of higher interest rates will be felt, and growth could weaken. However, the healthy starting point for the labor market should provide some cushion, and it is possible that just as consumption becomes less supportive, the slump in manufacturing and housing may start to reverse.

Investment Sub-advisers

| | | | | | |

| Artisan Partners Limited Partnership employs a fundamental investment process to construct a diversified portfolio of equity securities that are undervalued, in solid financial condition and have attractive business economics. | | Barrow, Hanley, Mewhinney & Strauss, LLC searches for companies that are temporarily undervalued for reasons Barrow Hanley can identify, understand, and believe will improve over time. In its valuation framework, Barrow Hanley strives to construct portfolios that trade at levels below the market across multiple metrics, such as the price-to-earnings and the price-to-book ratios, while simultaneously delivering an above-market dividend yield. | | Wellington Management Company, LLP uses substantial proprietary, fundamental research resources to identify companies with superior prospects for dividend growth and capital appreciation that sell at reasonable valuation levels. Wellington Management believes that above-average growth in dividends is an effective and often overlooked indicator of higher quality, shareholder-oriented companies that have the ability to produce consistent, above-average returns over the long-term. | | BlackRock Investment Management, LLC invests in equity securities with the objective of approximating as closely as practicable the capitalization weighted total rate of return of the segment of the United States market for publicly traded equity securities represented by the 1,000 largest capitalized companies. |

| | |

| Annual Report • June 30, 2023 | | 13 |

Bridge Builder Large Cap Value Fund

Management’s Discussion of Fund Performance (Unaudited) (Continued)

| | | | | | |

LSV Asset Management primarily invests in large and medium capitalization U.S. companies and uses a bottom-up investment style, seeking to identify companies that are trading at prices substantially below their intrinsic value. LSV follows an active investment strategy, focusing on using data and financial information and combining such information with the rigor of a quantitative model. | | T. Rowe Price Associates, Inc. active investment approach emphasizes the value of large-capitalization stocks that have a strong track record of paying dividends or that are believed to be undervalued. T. Rowe Price’s in-house research team seeks companies that appear to be undervalued by various measures and may be temporarily out of favor but have good prospects for capital appreciation and dividend growth. | | | | |

| | |

| 14 | | Annual Report • June 30, 2023 |

Bridge Builder Large Cap Value Fund

Management’s Discussion of Fund Performance (Unaudited) (Continued)

The following chart compares the value of a hypothetical $10,000 investment in the Bridge Builder Large Cap Value

Fund from its inception (April 27, 2015) to June 30, 2023 as compared with the Russell 1000® Value Index.

Growth of a Hypothetical $10,000 Investment as of June 30, 2023

vs.

Russell 1000® Value Index

Average Annual Total Returns as of June 30, 2023

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | Since Inception (4/27/2015) | |

Bridge Builder Large Cap Value Fund | | | 13.52 | % | | | 10.43 | % | | | 9.60 | % |

Russell 1000® Value Index | | | 11.54 | % | | | 8.11 | % | | | 7.81 | % |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. As of the latest prospectus, the gross and net expense ratios of the Fund were 0.46%(1) and 0.23%(2), respectively. Performance data current to the most recent month end may be obtained by calling 1.855.823.3611.

The performance table does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Returns shown for the Fund include the reinvestment of all dividends, if any. Total return calculations reflect the effect of the Adviser’s fee waiver agreement for the Fund. If such fee waivers had not occurred, the quoted performance would be lower.

Portfolio Characteristics (3)

| | | | |

| Sector Breakdown | | (% of Investments) | |

Financials | | | 18.8 | % |

Industrials | | | 15.2 | |

Healthcare | | | 14.5 | |

Consumer Discretionary | | | 8.9 | |

Information Technology | | | 8.4 | |

Consumer Staples | | | 7.9 | |

Communication Services | | | 7.2 | |

Energy | | | 5.6 | |

Materials | | | 4.5 | |

Utilities | | | 3.3 | |

Short-Term Investments | | | 3.0 | |

Real Estate | | | 2.7 | |

| | | | |

| Top Ten Equity Holdings | | (% of Net Assets) | |

Medtronic Plc | | | 1.6 | % |

Merck & Co., Inc. | | | 1.5 | |

Philip Morris International, Inc. | | | 1.3 | |

Comcast Corp. – Class A | | | 1.3 | |

Alphabet, Inc. – Class C | | | 1.2 | |

Visa, Inc. – Class A | | | 1.2 | |

Meta Platforms, Inc. – Class A | | | 1.2 | |

Microsoft Corp. | | | 1.2 | |

UnitedHealth Group, Inc. | | | 1.2 | |

Chubb Ltd. | | | 1.1 | |

| | |

| Annual Report • June 30, 2023 | | 15 |

Bridge Builder Tax Managed Large Cap Fund

Management’s Discussion of Fund Performance (Unaudited)

Investment Objective

The investment objective of Bridge Builder Tax Managed Large Cap Fund (the “Fund”) is to seek to provide a tax-efficient investment return consisting of capital appreciation.

Summary of the Investment Strategy

The Fund invests, under normal market conditions, at least 80% of its net assets (plus the amount of borrowings for investment purposes) in the securities of large-capitalization companies and other instruments, such as certain investment companies, with economic characteristics that seek to track the performance of securities of large capitalization companies. Large capitalization companies are defined by the Fund as those companies whose market capitalizations at the time of purchase typically fall within the range of the Russell 1000® Index. The Fund implements the investment recommendations of the Fund’s sub-advisers through the use of Parametric Portfolio Associates LLC (“Parametric”) as overlay manager, as described in greater detail below. As overlay manager, Parametric has limited authority to vary from the model portfolios provided by the Fund’s sub-advisers, primarily for the purpose of efficient tax management of the Fund’s securities transactions. The Fund employs a multi-manager sub-advised structure.

Investment Commentary

For the fiscal year ended June 30, 2023, the Fund returned 19.07%, underperforming its benchmark, the S&P 500 Index, which returned 19.59% for the period.

For the year, within large-capitalization stocks, approximately half of the benchmark’s performance came from the technology sector’s roughly 42% return, contributing nearly 10% of the benchmark’s 19.59% return. The technology sector’s significant outperformance and its 25% weight in the benchmark created a challenging market environment for other sectors to keep up with the performance of the benchmark overall. Only two other sectors, consumer discretionary and industrials, were able to outperform the broader market, while the other eight lagged. Utilities, real estate, and health care were the worst performing sectors for the year. In addition, within the overall large-capitalization portion of the market, value stocks underperformed growth stocks for the 1-year period.

Compared to its benchmark, the Fund’s relative underperformance was driven predominantly by weak stock selection within the financials and communication services sectors and an underweight to technology. Underperformance was partially offset by the Fund’s underweight to consumer staples and strong stock selection within industrials and health care.

Two of the biggest headwinds for markets in 2022 – inflation and Federal Reserve policy – have started to turn favorably, while the economy has proved surprisingly resilient. Looking forward, we think inflation will continue to moderate, but growth is likely to downshift as the impact of the Fed’s rate hikes filters through the economy. While inflation remains high, progress has been made. As time passes, we think the impact of higher interest rates will be felt, and growth could weaken. However, the healthy starting point for the labor market should provide some cushion, and it is possible that just as consumption becomes less supportive, the slump in manufacturing and housing may start to reverse.

| | |

| 16 | | Annual Report • June 30, 2023 |

Bridge Builder Tax Managed Large Cap Fund

Management’s Discussion of Fund Performance (Unaudited) (Continued)

Investment Sub-advisers

| | | | | | |

| T. Rowe Price Associates, Inc. seeks long-term capital appreciation and recommends primarily large capitalization companies with above-average rate of earnings and cash flow growth, as well as companies that T. Rowe Price believes have the ability to sustain earnings momentum even during times of slow economic growth. | | ClearBridge Investments, LLC seeks long-term appreciation of capital with individual company selection and management of cash reserves. ClearBridge typically recommends medium and large capitalization U.S. companies, but may also recommend small capitalization companies and foreign companies, selecting from among a strong core of growth and value stocks consisting primarily of blue-chip companies dominant in their industries. ClearBridge may also recommend companies with prospects for sustained earnings growth and/or a cyclical earnings record. | | Barrow, Hanley, Mewhinney & Strauss, LLC recommends companies that are temporarily undervalued for reasons Barrow Hanley can identify, understand, and believe will improve over time. In its valuation framework, Barrow Hanley strives to construct portfolios that trade at levels below the market across multiple metrics (e.g., price/earnings, price/book value) while simultaneously delivering an above-market dividend yield. | | Parametric Portfolio Associates LLC serves as the Fund’s overlay manager and also serves as the Fund’s direct indexing manager. As the Fund’s direct indexing manager, Parametric manages one or more allocated portions of the Fund pursuant to a strategy that is designed to provide similar exposure to the S&P 500 Growth Index and S&P 500 Value Index. As the Fund’s overlay manager, Parametric constructs a portfolio that represents the aggregation of the model portfolios of the Fund’s sub-advisers, including with respect to each direct indexing portion of the Fund, at weightings set by Olive Street Investment Advisers, LLC, the Fund’s investment adviser. In this role, Parametric manages the impact of taxes through active tax management strategies, including tax lot management, which impacts tax loss harvesting, capital gain deferral, and the minimization of wash sales. |

| | |

| Annual Report • June 30, 2023 | | 17 |

Bridge Builder Tax Managed Large Cap Fund

Management’s Discussion of Fund Performance (Unaudited) (Continued)

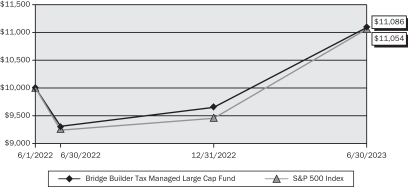

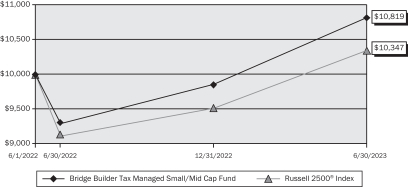

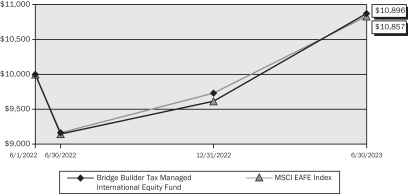

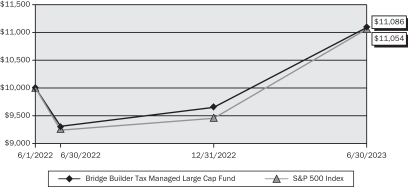

The following chart compares the value of a hypothetical $10,000 investment in the Bridge Builder Tax Managed Large Cap Fund from its inception (June 1, 2022) to June 30, 2023 as compared with the S&P 500 Index.

Growth of a Hypothetical $10,000 Investment as of June 30, 2023

vs.

S&P 500 Index

Average Annual Total Returns as of June 30, 2023

| | | | | | | | |

| Bridge Builder Tax Managed Large Cap Fund | | 1 Year | | | Since Inception (6/1/2022) | |

Return Before Taxes | | | 19.07 | % | | | 10.02 | % |

Return After Taxes on Distributions | | | 18.96 | % | | | 9.93 | % |

Return After Taxes on Distributions and Sale of Fund Shares | | | 11.32 | % | | | 7.61 | % |

S&P 500 Index | | | 19.59 | % | | | 9.73 | % |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. As of the latest prospectus, the gross and net expense ratios of the Fund were 0.49%(1) and 0.34%(2), respectively. Performance data current to the most recent month end may be obtained by calling 1.855.823.3611.

The returns presented in this table reflect the return before taxes; the return after taxes on dividends and capital gain distributions; and the return after taxes on dividends, capital gain distributions, and gains (or losses) from the redemption of shares held for 1 year or since-inception periods, as applicable. After-tax returns reflect the highest federal income tax rates but exclude state and local taxes. The after-tax returns reflect the rates applicable to ordinary and qualified dividends and capital gains that were in effect for the period(s) presented in the table. During periods when the Fund incurs a loss, the post-liquidation after-tax return may exceed the Fund’s other returns because the loss generates a tax benefit that is factored into the result. An investor’s actual after-tax return will likely differ from those shown and depend on his or her tax situation. The Fund’s past returns (before and after taxes) do not necessarily indicate future performance. Returns shown for the Fund include the reinvestment of all dividends, if any. Total return calculations reflect the effect of the Adviser’s fee waiver agreement for the Fund. If such fee waivers had not occurred, the quoted performance would be lower.

Portfolio Characteristics (3)

| | | | |

| Sector Breakdown | | (% of Investments) | |

Information Technology | | | 24.8 | % |

Healthcare | | | 13.8 | |

Financials | | | 13.4 | |

Industrials | | | 10.1 | |

Consumer Discretionary | | | 9.5 | |

Communication Services | | | 8.8 | |

Materials | | | 4.9 | |

Energy | | | 4.4 | |

Consumer Staples | | | 4.0 | |

Short-Term Investments | | | 2.4 | |

Utilities | | | 2.1 | |

Real Estate | | | 1.8 | |

| | | | |

| Top Ten Equity Holdings | | (% of Net Assets) | |

Microsoft Corp. | | | 7.1 | % |

Apple, Inc. | | | 5.5 | |

Amazon.com, Inc. | | | 2.9 | |

UnitedHealth Group, Inc. | | | 2.4 | |

Alphabet, Inc. – Class A | | | 2.4 | |

NVIDIA Corp. | | | 2.2 | |

Berkshire Hathaway, Inc. – Class B | | | 1.9 | |

Visa, Inc. – Class A | | | 1.6 | |

Merck & Co., Inc. | | | 1.3 | |

Meta Platforms, Inc. – Class A | | | 1.3 | |

| | |

| 18 | | Annual Report • June 30, 2023 |

Bridge Builder Small/Mid Cap Growth Fund

Management’s Discussion of Fund Performance (Unaudited)

Investment Objective

The investment objective of the Bridge Builder Small/Mid Cap Growth Fund (the “Fund”) is to provide capital appreciation.

Summary of the Investment Strategy

The Fund invests, under normal market conditions, at least 80% of its net assets (plus the amount of borrowings for investment purposes) in the securities of small- and mid-capitalization companies and other instruments, such as certain investment companies, that seek to track the performance of small- and mid- capitalization companies. Small- and mid-capitalization companies are defined by the Fund as those companies whose market capitalizations at the time of purchase typically fall within the range of the Russell MidCap® Index and the Russell 2000® Index. The Fund follows an investing style that favors growth investments and employs a multi-manager sub-advised structure.

Investment Commentary

For the fiscal year ended June 30, 2023, the Fund returned 15.65%, while its benchmark, the Russell 2500® Growth Index, returned 18.58% for the period, which resulted in overall underperformance.

For the year, mid-capitalization stocks outperformed small-capitalization stocks. Within the investment universe, strongest performers included the information technology, industrials and consumer discretionary sectors. The utilities and real estate sectors were the weakest performers. Within both mid-capitalization and small-capitalization segments of the market, growth stocks outperformed value stocks.

Compared to its benchmark, the Fund’s relative underperformance was driven by weak stock selection within certain sectors. Stock selection within health care, financials, and consumer discretionary sectors detracted from performance. Cash exposure was also a headwind to the Fund’s performance over the year, which was offset by the overweight in information technology and underweights in materials, energy, utilities and real estate.

Two of the biggest headwinds for markets in 2022 – inflation and Federal Reserve policy – have started to turn favorably, while the economy has proved surprisingly resilient. Looking forward, we think inflation will continue to moderate, but growth is likely to downshift as the impact of the Fed’s rate hikes filters through the economy. While inflation remains high, progress has been made. As time passes, we think the impact of higher interest rates will be felt, and growth could weaken. However, the healthy starting point for the labor market should provide some cushion, and it is possible that just as consumption becomes less supportive, the slump in manufacturing and housing may start to reverse.

Investment Sub-advisers

| | | | | | |

| Eagle Asset Management, Inc. invests primarily in small-capitalization companies. The team generally focuses on investing in small-capitalization companies that demonstrate growth potential at a price that does not appear to reflect the company’s true underlying value. Eagle uses a three-pronged investment philosophy: quality, valuation and balance. | | Champlain Investment Partners, LLC seeks capital appreciation by investing mainly in equity securities of medium-sized companies that it believes have strong long-term fundamentals, superior capital appreciation potential and attractive valuations. Champlain expects to identify a diversified universe of medium-sized companies that trade at a discount to their estimated or intrinsic fair values. | | BlackRock Investment Management, LLC invests in equity securities with the objective of approximating as closely as practicable the capitalization-weighted total rate of return of the segments of the United States market for publicly traded equity securities represented by the Russell Midcap® Growth Index, which tracks the performance of mid-capitalization companies, and the Russell 2000® Growth Index, which tracks the performance of small-capitalization companies. | | Driehaus Capital Management LLC primarily invests in the equity securities of U.S. small capitalization and U.S. medium capitalization companies. Driehaus believes that fundamentally strong companies are more likely to generate superior earnings growth on a sustained basis and are more likely to experience positive earnings revisions. Investment decisions involve evaluating a company’s competitive position and industry dynamics, identifying potential growth catalysts and assessing the financial position of the company. |

| | |

| Annual Report • June 30, 2023 | | 19 |

Bridge Builder Small/Mid Cap Growth Fund

Management’s Discussion of Fund Performance (Unaudited) (Continued)

| | | | | | |

Victory Capital Management Inc. primarily invests in the equity securities of U.S. small capitalization companies. Victory Capital employs both fundamental analysis and quantitative screening in seeking to identify companies that it believes will produce sustainable earnings growth over a multi-year horizon. Valuation is an integral part of the growth investment process and purchase decisions are based on the team’s expectation of the potential reward relative to risk of each security. | | Stephens Investment Management Group, LLC employs a disciplined, bottom-up investment selection process that combines rigorous fundamental analysis with quantitative screening in an effort to identify companies that exhibit potential for superior earnings growth that is unrecognized by the markets. | | Artisan Partners Limited Partnership employs a fundamental investment process to construct a diversified portfolio of U.S. mid-capitalization growth companies. The team seeks to invest in companies that it believes possess franchise characteristics, are benefiting from an accelerating profit cycle and are trading at a discount to its estimate of private market value. | | |

| | |

| 20 | | Annual Report • June 30, 2023 |

Bridge Builder Small/Mid Cap Growth Fund

Management’s Discussion of Fund Performance (Unaudited) (Continued)

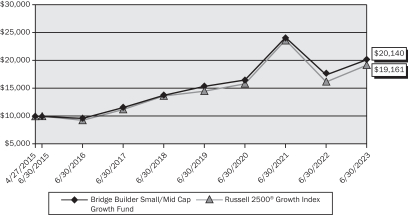

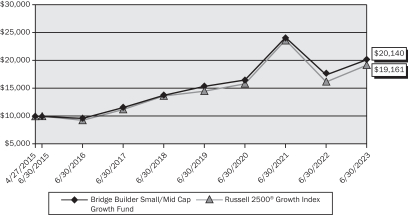

The following chart compares the value of a hypothetical $10,000 investment in the Bridge Builder Small/Mid Cap

Growth Fund from its inception (April 27, 2015) to June 30, 2023 as compared with the Russell 2500® Growth Index.

Growth of a Hypothetical $10,000 Investment as of June 30, 2023

vs.

Russell 2500® Growth Index

Average Annual Total Returns as of June 30, 2023

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | Since Inception (4/27/2015) | |

Bridge Builder Small/Mid Cap Growth Fund | | | 15.65 | % | | | 7.93 | % | | | 8.94 | % |

Russell 2500® Growth Index | | | 18.58 | % | | | 7.00 | % | | | 8.28 | % |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. As of the latest prospectus, the gross and net expense ratios of the Fund were 0.67%(1) and 0.38%(2), respectively. Performance data current to the most recent month end may be obtained by calling 1.855.823.3611.

The performance table does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Returns shown for the Fund include the reinvestment of all dividends, if any. Total return calculations reflect the effect of the Adviser’s fee waiver agreement for the Fund. If such fee waivers had not occurred, the quoted performance would be lower.

Portfolio Characteristics (3)

| | | | |

| Sector Breakdown | | (% of Investments) | |

Information Technology | | | 25.2 | % |

Healthcare | | | 21.2 | |

Industrials | | | 19.4 | |

Consumer Discretionary | | | 10.1 | |

Financials | | | 8.9 | |

Consumer Staples | | | 4.8 | |

Short-Term Investments | | | 3.0 | |

Communication Services | | | 2.7 | |

Energy | | | 2.2 | |

Materials | | | 1.3 | |

Real Estate | | | 1.1 | |

Utilities | | | 0.1 | |

| | | | |

| Top Ten Equity Holdings | | (% of Net Assets) | |

Veeva Systems, Inc. – Class A | | | 1.7 | % |

Lattice Semiconductor Corp. | | | 1.3 | |

ON Semiconductor Corp. | | | 1.3 | |

Fortive Corp. | | | 1.2 | |

DexCom, Inc. | | | 1.2 | |

HubSpot, Inc. | | | 1.1 | |

West Pharmaceutical Services, Inc. | | | 1.0 | |

Zscaler, Inc. | | | 1.0 | |

Synopsys, Inc. | | | 0.9 | |

Tradeweb Markets, Inc. – Class A | | | 0.9 | |

| | |

| Annual Report • June 30, 2023 | | 21 |

Bridge Builder Small/Mid Cap Value Fund

Management’s Discussion of Fund Performance (Unaudited)

Investment Objective

The investment objective of the Bridge Builder Small/Mid Cap Value Fund (the “Fund”) is to provide capital appreciation.

Summary of the Investment Strategy

The Fund invests, under normal market conditions, at least 80% of its net assets (plus the amount of borrowings for investment purposes) in the securities of small- and mid-capitalization companies and other instruments, such as certain investment companies, that seek to track the performance of securities of small- and mid-capitalization companies. Small- and mid-capitalization companies are defined by the Fund as those companies whose market capitalizations at the time of purchase typically fall within the range of the Russell MidCap® Index and the Russell 2000® Index. The Fund follows an investing style that favors value investments and employs a multi-manager sub-advised structure.

Investment Commentary

For the fiscal year ended June 30, 2023, the Fund returned 11.65%, outperforming its benchmark, the Russell 2500® Value Index, which returned 10.37% for the period.

For the year, mid-capitalization stocks outperformed small-capitalization stocks. Within the investment universe, strongest performers included the information technology, industrials and consumer discretionary sectors. The utilities, financials and real estate sectors were the weakest performers. Within both mid-capitalization and small-capitalization segments of the market, value stocks underperformed growth stocks.

Compared to its benchmark, the Fund’s relative outperformance was driven by the overweight to mid-cap stocks, favorable sector allocation, and strong stock selection within certain sectors. An underweight to real estate contributed to performance, which was partially offset by an overweight to utilities. Stock selection within the consumer discretionary, information technology and industrials sectors also contributed to performance. Given strong market returns, cash exposure was a headwind to the Fund’s performance over the year.

Two of the biggest headwinds for markets in 2022 – inflation and Federal Reserve policy – have started to turn favorably, while the economy has proved surprisingly resilient. Looking forward, we think inflation will continue to moderate, but growth is likely to downshift as the impact of the Fed’s rate hikes filters through the economy. While inflation remains high, progress has been made. As time passes, we think the impact of higher interest rates will be felt, and growth could weaken. However, the healthy starting point for the labor market should provide some cushion, and it is possible that just as consumption becomes less supportive, the slump in manufacturing and housing may start to reverse.

Investment Sub-advisers

| | | | | | |

| Vaughan Nelson Investment Management, LP uses a bottom- up value-oriented investment process. Vaughan Nelson seeks companies with the following characteristics: companies earning a positive return on capital with stable-to-improving returns, valued at a discount to their asset value and/or having an attractive and sustainable dividend level. | | Boston Partners Global Investors, Inc. primarily invests in medium-capitalization companies and uses bottom-up fundamental analysis to make investment decisions. Boston Partners’ strategy seeks to add value through bottom-up stock selection. The strategy is designed to identify companies with attractive valuation, sound business fundamentals and improving business momentum. | | Silvercrest Asset Management Group LLC primarily invests in small- capitalization companies that typically possess, in the opinion of the portfolio manager, one or more of the following attributes: business that results in relatively consistent longer-term earnings and cash flow growth, franchise/asset value that may make the company attractive to potential acquirers, cyclically depressed earnings and/or cash flow that has potential for improvement, or a catalyst that will promote recognition of the company’s undervalued status. | | BlackRock Investment Management, LLC invests in equity securities with the objective of approximating as closely as practicable the capitalization-weighted total rate of return of the segments of the United States market for publicly traded equity securities represented by the Russell Midcap® Value Index, which tracks the performance of mid-capitalization companies, and the Russell 2000® Value Index, which tracks the performance of small-capitalization companies. |

| | |

| 22 | | Annual Report • June 30, 2023 |

Bridge Builder Small/Mid Cap Value Fund

Management’s Discussion of Fund Performance (Unaudited) (Continued)

| | | | | | |

LSV Asset Management primarily invests in medium-capitalization companies. LSV uses a bottom-up investment style, seeking to identify companies that are trading at prices substantially below their intrinsic value. | | Diamond Hill Capital Management, Inc. typically invests in U.S. equity securities of small to medium market capitalization companies measured at the time of purchase. Diamond Hill’s objective is to seek long-term capital appreciation by investing in companies selling for less than Diamond Hill’s estimate of intrinsic value. | | MFS Investment Management primarily invests in securities of companies with small capitalizations. MFS focuses on investing in the stocks of companies that it believes are undervalued compared to their perceived worth (value companies). MFS uses an active bottom-up investment approach to buying and selling investments. Investments are selected primarily based on fundamental analysis of individual issuers. Quantitative screening tools that systematically evaluate issuers may also be considered. | | American Century Investment Management, Inc. looks for equity securities of smaller companies whose stock price may not reflect the company’s value. The portfolio managers attempt to purchase the stocks of these undervalued companies and hold each stock until the price has increased to, or is higher than, a level the portfolio managers believe more accurately reflects the value of the company. |

| | |

| Annual Report • June 30, 2023 | | 23 |

Bridge Builder Small/Mid Cap Value Fund

Management’s Discussion of Fund Performance (Unaudited) (Continued)

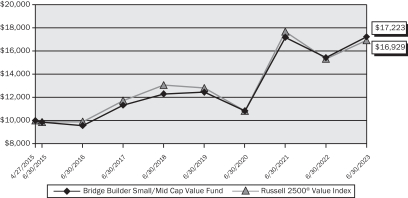

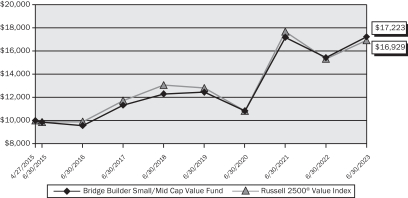

The following chart compares the value of a hypothetical $10,000 investment in the Bridge Builder Small/Mid Cap

Value Fund from its inception (April 27, 2015) to June 30, 2023 as compared with the Russell 2500® Value Index.

Growth of a Hypothetical $10,000 Investment as of June 30, 2023

vs.

Russell 2500® Value Index

Average Annual Total Returns as of June 30, 2023

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | Since Inception (4/27/2015) | |

Bridge Builder Small/Mid Cap Value Fund | | | 11.65 | % | | | 6.97 | % | | | 6.88 | % |

Russell 2500® Value Index | | | 10.37 | % | | | 5.32 | % | | | 6.65 | % |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. As of the latest prospectus, the gross and net expense ratios of the Fund were 0.67%(1) and 0.41%(2), respectively. Performance data current to the most recent month end may be obtained by calling 1.855.823.3611.

The performance table does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Returns shown for the Fund include the reinvestment of all dividends, if any. Total return calculations reflect the effect of the Adviser’s fee waiver agreement for the Fund. If such fee waivers had not occurred, the quoted performance would be lower.

Portfolio Characteristics (3)

| | | | |

| Sector Breakdown | | (% of Investments) | |

Industrials | | | 20.8 | % |

Financials | | | 17.7 | |

Consumer Discretionary | | | 12.1 | |

Information Technology | | | 8.6 | |

Healthcare | | | 8.1 | |

Materials | | | 7.0 | |

Real Estate | | | 6.1 | |

Utilities | | | 5.4 | |

Energy | | | 5.2 | |

Consumer Staples | | | 4.1 | |

Short-Term Investments | | | 3.1 | |

Communication Services | | | 1.4 | |

Exchange Traded Funds | | | 0.4 | |

| | | | |

| Top Ten Equity Holdings | | (% of Net Assets) | |

AmerisourceBergen Corp. – Class A | | | 1.2 | % |

AutoZone, Inc. | | | 0.9 | |

AMETEK, Inc. | | | 0.8 | |

Parker-Hannifin Corp. | | | 0.8 | |

Republic Services, Inc. – Class A | | | 0.7 | |

Ameriprise Financial, Inc. | | | 0.7 | |

WESCO International, Inc. | | | 0.6 | |

Allstate Corp. | | | 0.6 | |

Arthur J. Gallagher & Co. | | | 0.6 | |

CACI International, Inc. – Class A | | | 0.6 | |

| | |

| 24 | | Annual Report • June 30, 2023 |

Bridge Builder Tax Managed Small/Mid Cap Fund

Management’s Discussion of Fund Performance (Unaudited)

Investment Objective

The investment objective of Bridge Builder Tax Managed Small/Mid Cap Fund (the “Fund”) is to seek to provide a tax-efficient investment return consisting of capital appreciation.

Summary of the Investment Strategy

The Fund invests, under normal market conditions, at least 80% of its net assets (plus the amount of borrowings for investment purposes) in the securities of small- and mid-capitalization companies and other instruments, such as certain investment companies, with economic characteristics that seek to track the performance of securities of small- and mid-capitalization companies. Small- and mid-capitalization companies are defined by the Fund as those companies whose market capitalizations at the time of purchase typically fall within the range of the Russell MidCap® Index and the Russell 2000® Index. The Fund implements the investment recommendations of the Fund’s sub-advisers through the use of Parametric Portfolio Associates LLC (“Parametric”) as overlay manager, as described in greater detail below. As overlay manager, Parametric has limited authority to vary from the model portfolios provided by the Fund’s sub-advisers, primarily for the purpose of efficient tax management of the Fund’s securities transactions. The Fund employs a multi-manager sub-advised structure.

Investment Commentary

For the fiscal year ended June 30, 2023, the Fund returned 16.46%, outperforming its benchmark, the Russell 2500® Index, which returned 13.58% for the period.

For the year, mid-capitalization stocks outperformed small-capitalization stocks. Within the investment universe, strongest performers included the industrials and technology sectors. The utilities, financials and real estate sectors were the weakest performers. Within both mid-capitalization and small-capitalization segments of the market, growth stocks outperformed value stocks.

Compared to its benchmark, the Fund’s relative outperformance benefited from its overweight to mid-capitalization stocks, favorable sector allocation, and strong stock selection within certain sectors. Relative performance was balanced across sectors as 8 of the 11 aided in outperformance for the year. The largest detractor for the year was driven by weak stock selection within consumer staples.

Two of the biggest headwinds for markets in 2022 – inflation and Federal Reserve policy – have started to turn favorably, while the economy has proved surprisingly resilient. Looking forward, we think inflation will continue to moderate, but growth is likely to downshift as the impact of the Fed’s rate hikes filters through the economy. While inflation remains high, progress has been made. As time passes, we think the impact of higher interest rates will be felt, and growth could weaken. However, the healthy starting point for the labor market should provide some cushion, and it is possible that just as consumption becomes less supportive, the slump in manufacturing and housing may start to reverse.

| | |

| Annual Report • June 30, 2023 | | 25 |

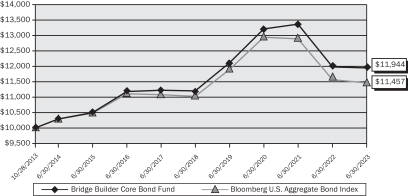

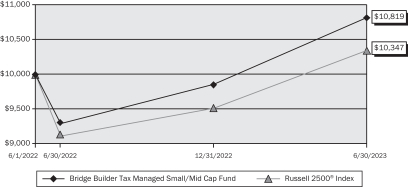

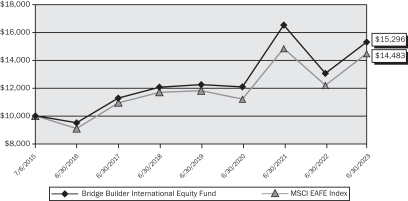

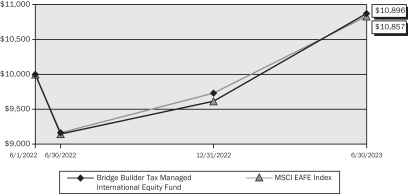

Bridge Builder Tax Managed Small/Mid Cap Fund