UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

| |

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

| Check the appropriate box: |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under §240.14a-12 |

|

| | |

Priority Income Fund, Inc. Pathway Energy Infrastructure Fund, Inc. |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

PRIORITY INCOME FUND, INC.

PATHWAY ENERGY INFRASTRUCTURE FUND, INC.

10 East 40th Street, 42nd Floor

New York, New York 10016

September 15, 2016

Dear Stockholder:

You are cordially invited to attend the 2016 Joint Annual Meeting of Stockholders, or the Annual Meeting, of Priority Income Fund, Inc. and Pathway Energy Infrastructure Fund, Inc., each a Maryland corporation (each, the “Fund”), to be held on Friday, December 2, 2016, at 12:00 p.m., Eastern Time, at 10 East 40th Street, 44th Floor, New York, New York 10016.

The notice of Annual Meeting and proxy statement accompanying this letter provide an outline of the business to be conducted at the Annual Meeting. At the Annual Meeting, the stockholders of each Fund will be asked to elect one director for Priority Income Fund, Inc. and two directors for Pathway Energy Infrastructure Fund, Inc.

It is important that you be represented at the Annual Meeting. Please complete, sign, date and return your proxy card to us in the enclosed, postage-prepaid envelope at your earliest convenience, even if you plan to attend the Annual Meeting. If you prefer, you can authorize your proxy through the Internet or by telephone as described in the proxy statement and on the enclosed proxy card. If you attend the Annual Meeting, you may revoke your proxy prior to its exercise and vote in person at the Annual Meeting. Your vote is very important to us. I urge you to submit your proxy as soon as possible.

If you have any questions about the proposal to be voted on, please call AST Fund Solutions, LLC, our proxy solicitor, at (866) 387-0770.

Further, from time to time each Fund may repurchase a portion of its common shares and are notifying you of such intention as required by applicable securities law.

Sincerely yours,

M. Grier Eliasek

Chief Executive Officer

PRIORITY INCOME FUND, INC.

PATHWAY ENERGY INFRASTRUCTURE FUND, INC.

10 East 40th Street, 42nd Floor

New York, New York 10016

(212) 448-0702

NOTICE OF JOINT ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 2, 2016

To the Stockholders of Priority Income Fund, Inc. and Pathway Energy Infrastructure Fund, Inc.:

The 2016 Joint Annual Meeting of Stockholders, or the Annual Meeting, of Priority Income Fund, Inc. (“Priority”) and Pathway Energy Infrastructure Fund, Inc. (“Pathway” and together with Priority, each the “Fund”), each a Maryland corporation, will be held at 10 East 40th Street, 44th Floor, New York, New York 10016, on Friday, December 2, 2016, at 12:00 p.m., Eastern Time, for the following purposes:

Election of the following director for Priority:

| |

| • | To elect one Class I director of Priority to serve until the Joint Annual Meeting of Stockholders in 2019, until his successor is duly elected and qualifies. |

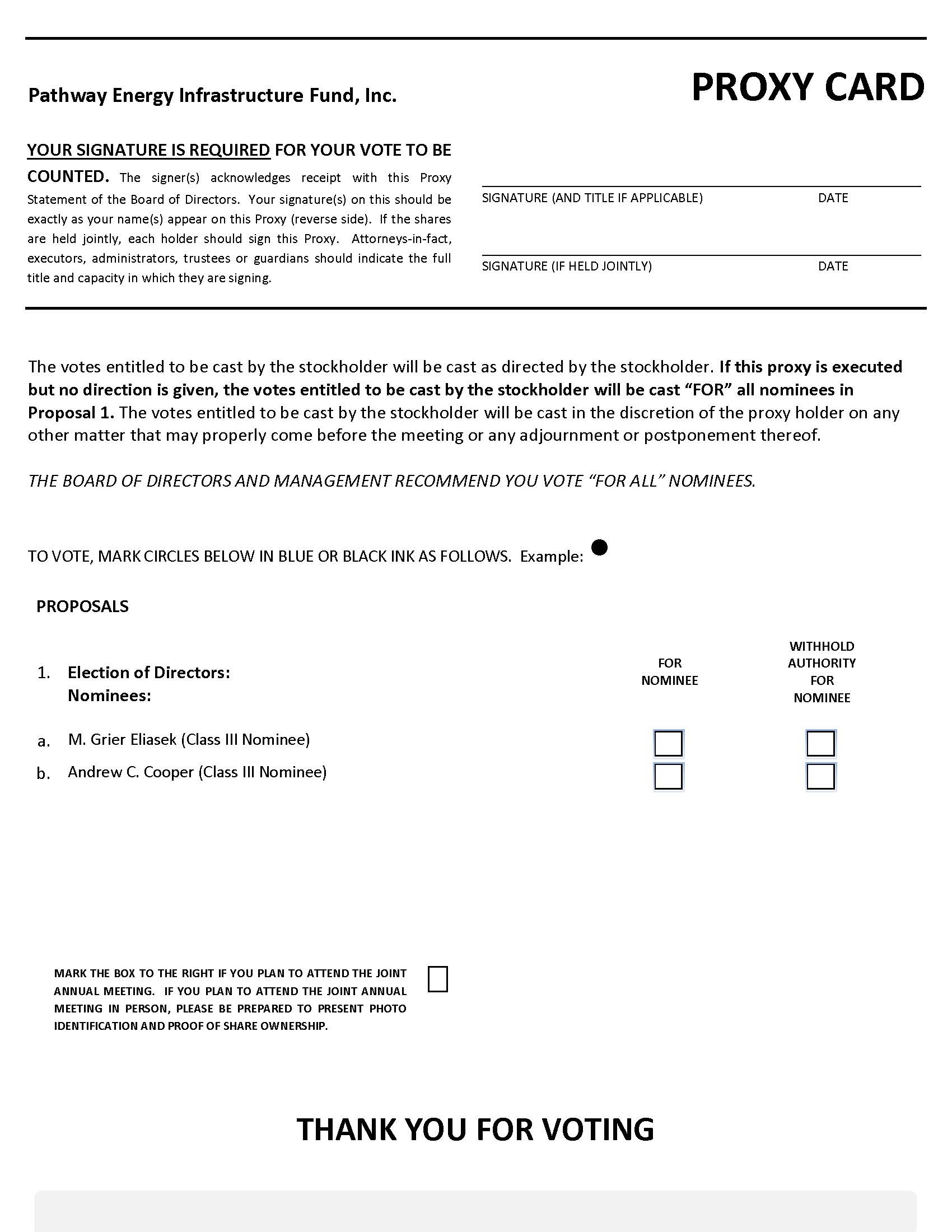

Election of the following directors for Pathway:

| |

| • | To elect two Class III directors of Pathway to serve until the Joint Annual Meeting of Stockholders in 2019, in each case until his successor is duly elected and qualifies. |

For each Fund:

| |

| • | To transact such other business as may properly come before the Annual Meeting and any adjournments, postponements or delays thereof. |

You have the right to receive notice of and to vote at the Annual Meeting if you were a stockholder of record of a Fund’s outstanding common stock at the close of business on September 14, 2016. Please complete, sign, date and return your proxy card to us in the enclosed, postage-prepaid envelope at your earliest convenience, even if you plan to attend the Annual Meeting. If you prefer, you can authorize your proxy through the Internet or by telephone as described in the combined proxy statement and on the enclosed proxy card(s). If you attend the Annual Meeting, you may revoke your proxy prior to its exercise and vote in person at the Annual Meeting. In the event that there are not sufficient stockholders present for a quorum or sufficient votes to approve a proposal at the time the Annual Meeting is convened, the Annual Meeting may be adjourned from time to time in order to permit further solicitation of proxies by each Fund.

If you have any questions about the proposals to be voted on, please call AST Fund Solutions, LLC, our proxy solicitor, at (866) 387-0770.

|

| |

| | By Order of the Boards of Directors, |

New York, New York September 15, 2016 |

Brian H. Oswald Chief Financial Officer, Chief Compliance Officer, Treasurer and Secretary |

|

|

| This is an important meeting. To ensure proper representation at the Annual Meeting, please complete, sign, date and return the proxy card in the enclosed, postage-prepaid envelope, or authorize a proxy to vote your shares by telephone or through the Internet. Even if you authorize a proxy prior to the Annual Meeting, you still may attend the Annual Meeting, revoke your proxy, and vote your shares in person. |

PRIORITY INCOME FUND, INC.

PATHWAY ENERGY INFRASTRUCTURE FUND, INC.

10 East 40th Street, 42nd Floor

New York, New York 10016

(212) 448-0702

COMBINED PROXY STATEMENT

2016 Joint Annual Meeting of Stockholders

This combined proxy statement, or Proxy Statement, is furnished in connection with the solicitation of proxies by the Boards of Directors (the “Boards” and each, the “Board”) of each of Priority Income Fund, Inc. (“Priority”) and Pathway Energy Infrastructure Fund, Inc. (“Pathway” and together with Priority, each the “Fund”), each a Maryland corporation, for use at our 2016 Joint Annual Meeting of Stockholders, or the Annual Meeting, to be held on Friday, December 2, 2016, at 12:00 p.m., Eastern Time, at 10 East 40th Street, 44th Floor, New York, New York 10016, and at any postponements, adjournments or delays thereof. Although each Fund is a separate investment company that holds an annual meeting of stockholders, the Funds’ Proxy Statements have been combined into this Proxy Statement to reduce the Funds’ expenses for soliciting proxies for the Annual Meeting.

Each Board has fixed the close of business on September 14, 2016 as the record date (the “Record Date”) for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting. As of the Record Date, 14,087569 shares of Priority’s common stock and 504,266 shares of Pathway’s common stock were issued and outstanding. Each share of the common stock (regardless of share class) is entitled to one vote.

This Proxy Statement and the accompanying proxy cards are first being sent to stockholders on or about September 21, 2016. Stockholders can vote only on matters affecting the Fund(s) in which they hold shares. Because the proposals in the Notice of Joint Annual Meeting of Stockholders are separate for each Fund, it is essential that stockholders who own shares in both Funds authorize proxies by Internet, telephone or mail in accordance with the instructions on the enclosed proxy card(s), with respect to each proxy card they receive.

Unlike many companies where the majority of the outstanding shares are held by institutional investors, a majority of our stockholders are retail investors who generally hold smaller numbers of shares than institutional investors. As a result, it is important that every stockholder authorize a proxy so that we can achieve a quorum and hold the Annual Meeting. The presence at the Annual Meeting, in person or by proxy, of stockholders entitled to cast a majority of the votes entitled to be cast at the Annual Meeting for a Fund will constitute a quorum for the transaction of business for such Fund. If a quorum is not met by a Fund, then we will be required to adjourn the Annual Meeting for such Fund and incur additional expenses to continue to solicit additional votes.

We have engaged AST Fund Solutions, LLC as our proxy solicitor, who may call you and ask you to vote your shares. The proxy solicitor will not attempt to influence how you vote your shares, but only ask that you take the time to cast a vote. You may also be asked if you would like to authorize your proxy over the telephone and to have your voting instructions transmitted to our proxy tabulation firm.

We encourage you to vote, either by voting in person at the Annual Meeting or by granting a proxy (i.e., authorizing someone to vote your shares). If you properly sign and date the accompanying proxy card or authorize a proxy to vote your shares by telephone or through the Internet, and we receive it in time for the Annual Meeting, the persons named as proxies will vote the shares registered directly in your name in the manner that you specified. If you give no instructions on the proxy card, the shares covered by the proxy card will be voted FOR the election of the nominees as directors.

If you are a “stockholder of record” (i.e., you hold shares directly in your name), you may revoke a proxy at any time before it is exercised by notifying the Fund’s Secretary in writing, by submitting a properly executed, later-dated proxy, or by voting in person at the Annual Meeting. Any stockholder of record attending the Annual Meeting may vote in person whether or not he or she has previously authorized a proxy.

If your shares are held for your account by a broker, trustee, bank or other institution or nominee, you may vote such shares at the Annual Meeting only if you obtain proper written authority from your institution or nominee and present it at the Annual Meeting. Please bring with you a legal proxy or letter from the broker, trustee, bank or other institution or nominee confirming your beneficial ownership of the shares as of the Record Date. No stockholders of either fund have any dissenters’ or appraisal rights in connection with any of the proposals described herein.

If your shares are registered in the name of a bank or brokerage firm, you may be eligible to vote your shares electronically via the Internet or by telephone.

For information on how to obtain directions to attend the Annual Meeting in person, please contact AST Fund Solutions, LLC, our proxy solicitor, at (866) 387-0770.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDER MEETING TO BE HELD ON DECEMBER 2, 2016

The following materials relating to this Proxy Statement, as applicable, are available at www.priority-incomefund.com/proxymaterials and www.pathway-energyfund.com/proxymaterials:

| |

| • | the accompanying Notice of Annual Meeting; and |

| |

| • | the Funds’ Annual Reports for the fiscal year ended June 30, 2016. |

Purpose of Annual Meeting

The Annual Meeting has been called for the following purposes:

Election of the following director for Priority:

| |

| • | To elect one Class I director of Priority to serve until the Joint Annual Meeting of Stockholders in 2019, until his successor is duly elected and qualifies. |

Election of the following directors for Pathway:

| |

| • | To elect two Class III directors of Pathway to serve until the Joint Annual Meeting of Stockholders in 2019, in each case until his successor is duly elected and qualifies. |

For each Fund:

| |

| • | To transact such other business as may properly come before the Annual Meeting and any adjournments, postponements or delays thereof. |

Quorum Required

A quorum must be present at the Annual Meeting for any business to be conducted for a Fund. Each Fund’s Bylaws provide that the presence at the Annual Meeting, in person or by proxy, of the holders of shares of the Fund’s outstanding common stock, without regard to class, entitled to cast a majority of the votes entitled to be cast with respect thereto as of the Record Date will constitute a quorum, except with respect to any such matter that, under applicable statutes or regulatory requirements, requires approval by a separate vote of one or more classes of stock, in which case the presence in person or by proxy of the holders of shares entitled to cast a majority of the votes entitled to be cast by each such class on such a matter shall constitute a quorum.

Shares that are present at the Annual Meeting, but then abstain, including by reason of so called “broker non-votes,” will be treated as present for purposes of establishing a quorum. However, abstentions and “broker non-votes” on a matter are not treated as votes cast on such matter. A broker non-vote with respect to a matter occurs when a nominee holding shares for a beneficial owner is present at the meeting with respect to such shares, has not received voting instructions from the beneficial owner on the matter in question and does not have, or chooses not to exercise, discretionary authority to vote the shares on such matter.

If a quorum is not present at the Annual Meeting or if there are not sufficient votes to approve a proposal, the chairman of the Annual Meeting or, if a stockholder vote is called, the stockholders of a Fund who are present at the Annual Meeting, may adjourn the Annual Meeting for such Fund from time to time to permit further solicitation of proxies.

Vote Required

Elections of Directors. The election of a director requires the affirmative vote of the holders of a majority of shares of a Fund’s common stock outstanding and entitled to vote thereon. Each Fund’s three share classes vote together as one group. If you vote to “Withhold Authority” with respect to a nominee, your shares will not be voted with respect to the person indicated. Because directors are elected by vote of the holders of a majority of the outstanding shares, votes to “Withhold Authority,” abstentions and broker non-votes will have the effect of a vote against a nominee.

Additional Solicitation. If a quorum is not present or there are not enough votes to approve a proposal at the Annual Meeting, the chairman of the Annual Meeting or, if a stockholder vote is called, the stockholders of a Fund who are present in person or by proxy, may adjourn the Annual Meeting for such Fund with respect to any or all of the proposals, including to permit the further solicitation of proxies with respect to any proposal.

If a quorum is present, a stockholder vote may be called on the proposal described in this Proxy Statement prior to any such adjournment if there are sufficient votes for approval of such proposal(s).

Information Regarding This Solicitation

The Funds will bear the expense of the solicitation of proxies for the Annual Meeting, including the cost of preparing, printing and mailing this Proxy Statement, the accompanying Notice of Joint Annual Meeting of Stockholders and the proxy cards. If brokers, nominees, fiduciaries and other persons holding shares in their names, or in the name of their nominees, which are beneficially owned by others, forward the proxy materials to and obtain proxies from such beneficial owners, we will reimburse such persons for their reasonable expenses in so doing.

In addition to the solicitation of proxies by the use of the mails, proxies may be solicited in person and by telephone or facsimile transmission by directors or officers of the Funds and officers or employees of Priority Senior Secured Income Management, LLC (“PSSIM”), Pathway Energy Infrastructure Management, LLC (“PEIM” and together with PSSIM, the “Funds’ investment advisers”), Prospect Capital Management L.P. (“PCM”), a 50% owner of each Fund’s investment adviser, Behringer Harvard Holdings, LLC (“Behringer”), a 50% owner of each Fund’s investment adviser, and/or Prospect Administration LLC (“Prospect Administration”), the Funds’ administrator. No additional compensation will be paid to directors, officers or employees for such services.

The Funds have also retained AST Fund Solutions, LLC to assist in the solicitation of proxies for a fee of approximately $24,000 plus out-of-pocket expenses.

Stockholders may provide their voting instructions by telephone or through the Internet. These options require stockholders to input the control number which is located on each proxy card. After inputting this number, stockholders will be prompted to provide their voting instructions. Stockholders will have an opportunity to review their voting instructions and make any necessary changes before submitting their voting instructions and terminating their telephone call or Internet link. Stockholders who authorize a proxy via the Internet, in addition to confirming their voting instructions prior to submission, will also receive an e-mail confirming their instructions upon request.

Any proxy given pursuant to this solicitation may be revoked by notice from the person giving the proxy at any time before it is exercised. Any such notice of revocation should be provided in writing and signed by the stockholder in the same manner as the proxy being revoked and delivered to our proxy tabulator.

Investment Advisers and Administrator

PSSIM serves as Priority’s investment adviser, PEIM serves as Pathway’s investment adviser, and Prospect Administration serves as the Funds’ administrator. PSSIM, PEIM and Prospect Administration are located at 10 East 40th Street, 42nd Floor, New York, New York 10016.

Security Ownership of Certain Beneficial Owners and Management

Each Fund’s directors are divided into two groups - interested directors and independent directors. Interested directors are “interested persons” of the Funds, as defined in the Investment Company Act of 1940, as amended (the “1940 Act”).

The following table sets forth, as of September 14, 2016, certain ownership information with respect to each Fund’s common stock for those persons who may, insofar as is known to us, directly or indirectly own, control or hold with the power to vote, 5% or more of each Fund’s outstanding common stock and the beneficial ownership of each current director, the nominees for director, each Fund’s executive officers, and the executive officers and directors as a group.

Ownership information for those persons, if any, who own, control or hold the power to vote, 5% or more of a Fund’s shares of common stock is based upon Schedule 13D or Schedule 13G filings by such persons with the Securities and Exchange Commission (the “Commission”) and other information obtained from such persons, if available. Such information is as of the date of the applicable filing and may no longer be accurate.

Unless otherwise indicated, we believe that each person set forth in the table below has sole voting and investment power with respect to all shares of each Fund’s common stock he or she beneficially owns and has the same address as the Funds. The Funds’ address is 10 East 40th Street, 42nd Floor, New York, New York 10016.

|

| | | | | | | | | | | | |

| | | Priority | | Pathway |

Name and Address of Beneficial Owner(1) | | Number of Shares Beneficially Owned | | Percentage of

Shares Outstanding(2) | | Number of Shares

Beneficially Owned | | Percentage of

Shares Outstanding(2) |

| 5% or more holders | | | | | | | |

Behringer Harvard Holdings LLC 15601 Dallas Parkway, Suite 600 Addison, TX 75001 | — |

| | — |

| | 35,870 |

| | 7.1 | % |

Pathway Energy Infrastructure Management, LLC Priority Senior Secured Income Management, LLC 10 East 40th Street, 42nd Floor New York, NY 10016 | 17,865 |

| | * |

| | 16,233 |

| | 3.2 | % |

| Interested Directors | | | | | | | |

M. Grier Eliasek(3) | — |

| | — |

| | — |

| | — |

|

| Robert S. Aisner | — |

| | — |

| | — |

| | — |

|

| Independent Directors | | | | | | | |

| Andrew C. Cooper | — |

| | — |

| | — |

| | — |

|

| William J. Gremp | — |

| | — |

| | — |

| | — |

|

| Eugene S. Stark | — |

| | — |

| | — |

| | — |

|

| Executive Officers | | | | | | | |

| Brian H. Oswald | — |

| | — |

| | — |

| | — |

|

| Michael D. Cohen | 5,435 |

| | * |

| | — |

| | — |

|

| Executive officers and directors as a group | 5,435 |

| | * |

| | — |

| | — |

|

_______________________________

| |

| * | Represents less than one percent. |

| |

| (1) | The business address of each director and executive officer of the Funds is c/o Priority Senior Fund, Inc. or Pathway Energy Infrastructure Fund, Inc., as applicable, 10 East 40th Street, 42nd Floor, New York, New York 10016. |

| |

| (2) | Based on a total of 14,087,569 shares of Priority’s common stock and 504,266 shares of Pathway’s common stock issued and outstanding as of September 14, 2016. |

| |

| (3) | Mr. Eliasek also serves as the Chief Executive Officer and President of the Funds. |

The following table sets forth the dollar range of equity securities beneficially owned by each director and each nominee for election as a director of the Funds and equity securities beneficially owned by each director and each nominee for election as a director within the same family of investment companies as of September 14, 2016. Information as to beneficial ownership is based on information furnished to the Fund by the directors. The Funds are not part of a “family of investment companies” as that term is defined in the 1940 Act.

|

| | | | |

| Name of Director | | Dollar Range of Equity

Securities in Priority(1)(2) | | Dollar Range of Equity

Securities in Pathway(1)(2) |

| Interested Directors | | | |

| M. Grier Eliasek | None | | None |

| Robert S. Aisner | None | | None |

| Independent Directors | | | |

| Andrew C. Cooper | None | | None |

| William J. Gremp | None | | None |

| Eugene S. Stark | None | | None |

_______________________________

| |

| (1) | Beneficial ownership has been determined in accordance with Rule 16a-1(a)(2) under the Securities Exchange Act of 1934, which requires pecuniary interest. |

| |

| (2) | The dollar ranges are: none, $1-$10,000, $10,001-$50,000, $50,001-$100,000, or over $100,000. |

Elections of Directors

The Boards of each Fund are the same. Pursuant to each Fund’s Bylaws, the Board of each Fund may change the number of directors constituting the Board, provided that the number thereof shall never be less than three nor more than eight. In accordance with each Fund’s Bylaws, each Fund currently has five directors on its Board. Members of each Board have been divided into three staggered classes of directors, with directors in each class elected to hold office for a term expiring at the annual meeting of stockholders held in the third year following their election and until their successors are duly elected and qualify.

Priority’s Class I director and Pathway’s Class III directors are standing for election this year.

A stockholder can vote for or withhold his or her vote from any nominee. In the absence of instructions to the contrary, it is the intention of the persons named as proxies to vote such proxy FOR the election of the nominees named below. If a nominee should decline or be unable to serve as a director, it is intended that the proxy will be voted for the election of such person as is nominated by the Board as a replacement. Each Board has no reason to believe that the persons named below will be unable or unwilling to serve, and such persons have consented to being named in this Proxy Statement and to serve if elected.

The Board of each Fund recommends that you vote FOR the election of the nominees named in this Proxy Statement.

Information about the Nominees and Continuing Directors

Certain information with respect to the Class I nominee of Priority and the Class III nominees of Pathway for election at the Annual Meeting, as well as each of the other continuing directors, is set forth below, including their names, ages, a brief description of their recent business experience, including present occupations and employment, certain directorships that each person holds, and the year in which each person became a director of the Funds.

The 1940 Act rules require that the Boards consist of at least a majority of independent directors. Under the 1940 Act, in order for a director to be deemed independent, he or she, among other things, generally must not: own, control or hold power to vote, 5% or more of the voting securities or be an officer or employee of the Funds or of an investment adviser or principal underwriter to the Funds; control the Funds or an investment adviser or principal underwriter to the Funds; be an officer, director or employee of an investment adviser or principal underwriter to the Funds; be a member of the immediate family of any of the foregoing persons; knowingly have a direct or indirect beneficial interest in, or be designated as an executor, guardian or trustee of an interest in, any security issued by an investment adviser or principal underwriter to the Funds; be a partner or employee of any firm that has acted as legal counsel to the Funds or an investment adviser or principal underwriter to the Funds during the last two years; or have certain relationships with a broker-dealer or other person that has engaged in agency transactions, principal transactions, lent money or other property to, or distributed shares on behalf of the Funds. In order to evaluate the materiality of any such relationship, the Boards use the definition of director independence set forth in the rules promulgated by the NASDAQ Stock Market. NASDAQ Rule 5605(a)(2) provides that a director, shall be considered to be independent if he or she is not an “interested person” of the Funds, as defined in Section 2(a)(19) of the 1940 Act. Under NASDAQ rules, in order for a director to be deemed independent, the Boards must determine that the individual does not have a relationship that would interfere with the director’s exercise of independent judgment in carrying out his or her responsibilities.

Each Board, in connection with the 1940 Act and NASDAQ rules, has considered the independence of members of each Board who are not employed by PSSIM, PEIM, Prospect Administration, PCM, Behringer or any of their affiliates and has concluded that Andrew C. Cooper, William J. Gremp and Eugene S. Stark are not “interested persons” as defined by the 1940 Act and therefore qualify as independent directors under the standards promulgated by the 1940 Act and the NASDAQ rules. In reaching this conclusion, each Board concluded that Messrs. Cooper, Gremp and Stark had no relationships with PSSIM, PEIM, Prospect Administration, PCM, Behringer or any of their affiliates, other than their positions as directors of the Funds and, if applicable, investments in us that are on the same terms as those of other stockholders.

Eugene S. Stark has been nominated for election as a Class I director of the Priority Board to serve until the Joint Annual Meeting of Stockholders in 2019 and until his successor is duly elected and qualifies. M. Grier Eliasek and Andrew C. Cooper have each been nominated for election as a Class III director of the Pathway Board to serve until the Joint Annual Meeting of Stockholders in 2019, and in each case until his successor is duly elected and qualifies. Messrs. Stark and Cooper are not being proposed for election pursuant to any agreement or understanding with any other director or the Funds. Each of Messrs. Eliasek, Cooper and Stark has agreed to stand for such nomination and to serve as a director if elected.

|

| | | | | | |

Name (Age) Position(s) with the Funds (Since) Address(1) | | Priority: Class Term Expires(2) | | Pathway: Class Term Expires(2) | | Principal

Occupation(s) and Other Public Company Directorships Held During the Past 5 Years(3) |

Interested Directors(4) | | | | | | |

M. Grier Eliasek (43) Chairman of the Board, Director, Chief Executive Officer and President (Priority - July 2012; Pathway - February 2013) | | Class III Continuing 2018 | | Class III Nominee Director 2019 | | President and Chief Executive Officer of PSSIM and PEIM, President and Chief Operating Officer of the Funds, Managing Director of PCM and Prospect Administration, President and Chief Operating Officer of Prospect Capital Corporation. Director of Prospect Capital Corporation (June 2004-present). |

Robert S. Aisner (69) Director (Priority - July 2012; Pathway - February 2013) | | Class II Continuing Director 2017 | | Class II Continuing 2018 | | Executive positions of the following entities: TIER REIT, Inc., Behringer Harvard Opportunity REIT I, Inc., Behringer Harvard Opportunity REIT II, Inc., Monogram Residential Trust, Inc. and Behringer. Director of TIER REIT, Inc. (June 2003-present), Behringer Harvard Opportunity REIT I, Inc. (November 2004-May 2014), Behringer Harvard Opportunity REIT II, Inc. (January 2007-present), and Monogram Residential Trust, Inc. (August 2006-present) |

| Independent Directors | | | | | | |

Andrew C. Cooper (54) Director (Priority - October 2012; Pathway - February 2013) | | Class III Continuing 2018 | | Class III Nominee Director 2019 | | Mr. Cooper is an entrepreneur, who over the last 15 years has founded, built, run and sold three companies. He is Co-Chief Executive Officer of Unison Energy, LLC, a company that develops, owns and operates, distributed combined heat and power co-generation solutions. Director of Prospect Capital Corporation (February 2009-present). |

William J. Gremp (73) Director (Priority - October 2012; Pathway - February 2013) | | Class II Continuing Director 2017 | | Class II Continuing 2018 | | Mr. Gremp is responsible for traditional banking services, credit and lending, private equity and corporate cash management with Merrill Lynch & Co. from 1999 to present. Director of Prospect Capital Corporation. (June 2006-present) |

Eugene S. Stark (58) Director (Priority - October 2012; Pathway - February 2013) | | Class I Nominee Director 2019 | | Class I Continuing Director 2017 | | Principal Financial Officer, Chief Compliance Officer and Vice President—Administration of General American Investors Company, Inc. from May 2005 to present. Director of Prospect Capital Corporation (September 2008-present). |

_______________________________

| |

| (1) | The business address of each director of the Funds is c/o Priority Senior Fund, Inc. or Pathway Energy Infrastructure Fund, Inc., as applicable, 10 East 40th Street, 42nd Floor, New York, New York 10016. |

| |

| (2) | For the Nominees, the term stated assumes election by stockholders at the Annual Meeting. |

| |

| (3) | The Fund Complex consists of the Funds and Prospect Capital Corporation. Each of Messrs. Eliasek, Cooper, Gremp and Stark are directors of all three entities in the Fund Complex. Mr. Aisner is a director of two entities in the Fund Complex. |

| |

| (4) | Mr. Eliasek is an interested director as defined in the 1940 Act because of his positions with PCM and the Funds. Mr. Aisner is an interested director as defined in the 1940 Act because of his position as an officer of Behringer. |

Committees of the Board

Each Board has established an Audit Committee and a Nominating and Corporate Governance Committee. The Boards do not have a compensation committee because the Funds’ executive officers do not receive any direct compensation from the Funds. For the fiscal year ended June 30, 2016, the Priority Board held nine Board meetings, eight Audit Committee meetings, and one Nominating and Corporate Governance Committee meeting, and the Pathway Board held eight Board meetings, eight Audit Committee meetings, and one Nominating and Corporate Governance Committee meetings. All directors attended at least 75% of the aggregate number of meetings of the Boards and of the respective committees on which they served. We require each director to make a diligent effort to attend all board and committee meetings, as well as each annual meeting of stockholders. One director attended last year’s annual meeting of stockholders in person.

The Audit Committees. Each Audit Committee operates pursuant to a charter approved by the Boards. Each charter sets forth the responsibilities of each Board’s Audit Committee, which include selecting or retaining each year an independent registered public accounting firm, or independent accountants, to audit the accounts and records of the Fund; reviewing and discussing with management and the independent accountants the annual audited financial statements of the Fund, and recommending to the Board whether the audited financial statements should be included in the Fund’s annual report; pre-approving the independent accountants’ engagement to render audit and/or permissible non-audit services; and evaluating the qualifications, performance and independence of the independent accountants. Each Audit Committee is presently composed of three persons: Messrs. Cooper, Gremp and Stark, each of whom is not an “interested person” as defined in the 1940 Act and is considered independent under applicable NASDAQ rules, with Mr. Stark serving as chairman of the committee. Each Board has determined that Mr. Stark is an “audit committee financial expert” as that term is defined under Item 407 of Regulation S-K. Each Audit Committee may delegate its pre-approval responsibilities to one or more of its members. The member(s) to whom such responsibility is delegated must report, for informational purposes only, any pre-approval decisions to each Audit Committee at its next scheduled meeting. Messrs. Cooper, Gremp and Stark were added to the Audit Committees concurrent with their election or appointment to the Board of Priority on October 28, 2012 and the Board of Pathway on February 21, 2013. Each Audit Committee Charter is available at www.priority-incomefund.com/governance and www.pathway-energyfund.com/governance.

The function of each Audit Committee is oversight. Each Fund’s management is primarily responsible for maintaining appropriate systems for accounting and financial reporting principles and policies and internal controls and procedures that provide for compliance with accounting standards and applicable laws and regulations. The independent accountants are primarily responsible for planning and carrying out a proper audit of each Fund’s annual financial statements in accordance with generally accepted accounting standards. The independent accountants are accountable to the Board and the Audit Committee, as representatives of each Fund’s stockholders. Each Board and its Audit Committee have the ultimate authority and responsibility to select, evaluate and, where appropriate, replace our independent accountants (subject, if applicable, to stockholder ratification).

In fulfilling their responsibilities, it is recognized that members of each Audit Committee are not full-time employees or management of the Fund and are not, and do not represent themselves to be, accountants or auditors by profession. As such, it is not the duty or the responsibility of each Audit Committee or its members to conduct “field work” or other types of auditing or accounting reviews or procedures, to determine that the financial statements are complete and accurate and are in accordance with generally accepted accounting principles, or to set auditor independence standards. Each member of each Audit Committee shall be entitled to rely on (a) the integrity of those persons within and outside us and management from which it receives information; (b) the accuracy of the financial and other information provided to each Audit Committee absent actual knowledge to the contrary (which shall be promptly reported to the Board); and (c) statements made by the Fund’s officers and employees, investment adviser or other third parties as to any information technology, internal audit and other non-audit services provided by the independent accountants to the Fund.

The Nominating and Corporate Governance Committees. Each Nominating and Corporate Governance Committee, or Nominating and Governance Committee, is responsible for selecting qualified nominees to be elected to the Board by stockholders of the Fund; selecting qualified nominees to fill any vacancies on the Board or a committee thereof; developing and recommending to the Board a set of corporate governance principles applicable to the Fund; overseeing the evaluation of the Board and management; and undertaking such other duties and responsibilities as may from time to time be delegated by the Board to the Nominating and Governance Committee. Each Nominating and Governance Committee takes into consideration the educational, professional and technical backgrounds and diversity of each nominee when evaluating such nominees to be elected to the Board. Each Nominating and Governance Committee does not have a formal policy with respect to diversity. Each Nominating and Governance Committee is presently composed of three persons: Messrs. Cooper, Gremp and Stark, each of whom is not an “interested person” as defined in the 1940 Act and is considered independent under applicable NASDAQ rules, with Mr. Gremp serving as chairman of the committee. Messrs. Cooper, Gremp and Stark were added to the Nominating and Governance Committee concurrent with their election or appointment to the Board of Priority on October 28, 2012 and the Board of Pathway on February 21, 2013.

Each Nominating and Governance Committee will consider stockholder recommendations for possible nominees for election as directors when such recommendations are submitted in accordance with the Fund’s Bylaws and any applicable law, rule or regulation regarding director nominations. Nominations should be sent to the Corporate Secretary c/o Priority Income

Fund, Inc. or Pathway Energy Infrastructure Fund, Inc., as applicable, 10 East 40th Street, 42nd Floor, New York, New York 10016. When submitting a nomination to a Fund for consideration, a stockholder must provide all information that would be required under applicable Commission rules to be disclosed in connection with election of a director, including the following minimum information for each director nominee: full name, age and address; principal occupation during the past five years; current directorships on publicly held companies and investment companies; number of shares of our common stock owned, if any; and, a written consent of the individual to stand for election if nominated by the Board and to serve if elected by the stockholders. Criteria considered by each Nominating and Governance Committee in evaluating the qualifications of individuals for election as members of the Board include compliance with the independence and other applicable requirements of the NASDAQ rules and the 1940 Act and all other applicable laws, rules, regulations and listing standards, the criteria, policies and principles set forth in the Nominating and Corporate Governance Committee Charter, and the ability to contribute to the effective management of the Fund, taking into account our needs and such factors as the individual’s experience, perspective, skills, expertise and knowledge of the industries in which the Fund operates, personal and professional integrity, character, business judgment, time availability in light of other commitments, dedication, and conflicts of interest. Each Nominating and Governance Committee also may consider such other factors as it may deem to be in our best interests and those of the stockholders. Each Board also believes it is appropriate for certain key members of our management to participate as members of the Board. The Nominating and Corporate Governance Committee Charter is available at www.priority-incomefund.com/governance and www.pathway-energyfund.com/governance.

Compensation Committee. The Funds do not have a compensation committee because their executive officers do not receive any direct compensation from the Funds. However, the compensation payable to each Fund’s investment adviser pursuant to the investment advisory and management agreement is separately approved by a majority of the Independent Directors in accordance with Section 15(c) of the 1940 Act.

Corporate Governance

Board Leadership Structure

Each Board believes that the combined position of Chief Executive Officer of the Fund and Chairman of the Board of the Fund is a superior model that results in greater efficiency regarding management of the Fund, reduced confusion due to the elimination of the need to transfer substantial information quickly and repeatedly between a chief executive officer and chairman, and business advantages to the Fund arising from the specialized knowledge acquired from the duties of the dual roles. The need for efficient decision making is particularly acute in the line of business of the Funds, whereby multiple factors including market factors, interest rates and innumerable other financial metrics change on an ongoing and daily basis. Each Board has not identified a lead independent director of the Board of the Fund in as much as the Board consists of only five individuals.

Director Independence

The 1940 Act rules require that each Board consist of at least 40% of independent directors. Under the 1940 Act, in order for a director to be deemed independent, he or she, among other things, generally must not: own 5% or more of the voting securities or be an officer or employee of a Fund or of an investment adviser or principal underwriter to such Fund; control such Fund or an investment advisor or principal underwriter to such Fund; be an officer, director or employee of an investment adviser or principal underwriter to such Fund; be a member of the immediate family of any of the foregoing persons; knowingly have a direct or indirect beneficial interest in, or be designated as an executor, guardian or trustee of an interest in, any security issued by an investment adviser or principal underwriter to such Fund; be a partner or employee of any firm that has acted as legal counsel to such Fund or an investment adviser or principal underwriter to such Fund during the last two years; or have certain relationships with a broker-dealer or other person that has engaged in agency transactions, principal transactions, lent money or other property to, or distributed shares on behalf of such Fund. In order to evaluate the materiality of any such relationship, each Board uses the definition of director independence set forth in the rules promulgated by the NASDAQ Stock Market. NASDAQ Rule 5605(a)(2) provides that a director, shall be considered to be independent if he or she is not an “interested person” of us, as defined in Section 2(a)(19) of the 1940 Act. Under NASDAQ rules, in order for a director to be deemed independent, each Board must determine that the individual does not have a relationship that would interfere with the director’s exercise of independent judgment in carrying out his or her responsibilities. On an annual basis, each member of each Board is required to complete an independence questionnaire designed to provide information to assist the Board in determining

whether the director is independent under the 1940 Act and the NASDAQ rules. Each Board has determined that each of its directors, other than Messrs. Eliasek and Aisner, is independent under the 1940 Act and the applicable NASDAQ rules.

Role of the Chairman and Chief Executive Officer

As Chairman of each Board and Chief Executive Officer of each Fund, Mr. Eliasek assumes a leading role in mid- and long-term strategic planning and supports major transaction initiatives of the Funds. Mr. Eliasek also manages the day-to-day operations of the Funds, with the support of the other executive officers. As Chief Executive Officer, Mr. Eliasek has general responsibility for the implementation of the policies of the Funds, as determined by the Boards, and for the management of the business and affairs of the Funds. Each Board has determined that its leadership structure, in which the majority of the directors are not affiliated with the Funds, PSSIM, PEIM, Prospect Administration, PCM, Behringer or their affiliates, is appropriate in light of the services that PSSIM, PEIM and Prospect Administration and their affiliates provide to the Fund and the potential conflicts of interest that could arise from these relationships.

Experience, Qualifications, Attributes and/or Skills that Led to each Board’s Conclusion that such Members Should Serve as Directors of the Fund

Each Board believes that, collectively, the directors have balanced and diverse experience, qualifications, attributes and skills, which allow the Board to operate effectively in governing the Fund and protecting the interests of its stockholders. Below is a description of the various experiences, qualifications, attributes and/or skills with respect to each director considered by the Board.

M. Grier Eliasek

Mr. Eliasek brings to each Board business leadership and experience and knowledge of senior secured loans, including the equity and debt tranches of collateralized loan obligations, and other debt, private equity and venture capital investments, as well as a knowledge of diverse management practices. Mr. Eliasek is the President and Chief Executive Officer of each Fund, President and Chief Operating Officer of PSSIM and PEIM, and a Managing Director of PCM and Prospect Administration. He is also responsible for leading the origination and assessment of investments for the Funds. Each Board also benefits from Mr. Eliasek’s experience as a consultant with Bain & Company, a global strategy consulting firm, where he managed engagements for companies in several different industries, by providing each Fund with unique views on investment and management issues. At Bain & Company, Mr. Eliasek analyzed new lines of businesses, developed market strategies, revamped sales organizations, and improved operational performance for Bain & Company clients. Mr. Eliasek’s service as director, Chairman of the Board, President and Chief Executive Officer of each Fund, President and Chief Operating Officer of PSSIM and PEIM, and as a Managing Director of PCM and Prospect Administration provide him with a specific understanding of each Fund, its operation, and the business and regulatory issues facing each Fund.

Robert S. Aisner

Mr. Aisner serves as a director of TIER REIT, Inc. (formerly Behringer Harvard REIT I, Inc.), as Chairman of the Board and a director of Behringer Harvard Opportunity REIT II, Inc., and as Chief Executive Officer, President and as a director of Monogram Residential Trust, Inc. (formerly Behringer Harvard Multifamily REIT I, Inc.). Mr. Aisner is also a member of the Board of Managers and Chief Executive Officer and President of Behringer. All of the foregoing entities are affiliates of the Funds’ investment advisers.

Mr. Aisner was selected as a director based on his familiarity with the Funds’ dealer manager’s operations and extensive investment management experience. From 1996 until joining Behringer in 2003, Mr. Aisner served as (1) Executive Vice President of AMLI Residential Properties Trust, formerly a NYSE-listed REIT focused on the development, acquisition and management of upscale apartment communities, which served as advisor and asset manager for institutional investors with respect to their multifamily real estate investment activities, (2) President of AMLI Management Company that oversaw all of AMLI’s apartment operations in 80 communities, (3) President of the AMLI Corporate Homes division that managed AMLI’s corporate housing properties, (4) Vice President of AMLI Residential Construction, a division of AMLI that performed real estate construction services, and (5) Vice President of AMLI Institutional Advisors, the AMLI division that served as institutional advisor and asset manager for institutional investors with respect to their multifamily real estate activities. Mr. Aisner also served on AMLI’s Executive Committee and Investment Committee. From 1994 until 1996, Mr. Aisner owned

and operated Regents Management, Inc., which had both a multifamily development and construction group and a general commercial property management group. From 1984 to 1994, he was employed by HRW Resources, Inc., a real estate development and management company, where he served as Vice President. Mr. Aisner is a member of the Board of Directors of the Folsom Institute of Real Estate, the Investment Company Institute, the Board of Directors of the Association of Foreign Investors in Real Estate, the Board of Directors of the National Multi-Housing Council, the Urban Land Institute and the Pension Real Estate Association. Mr. Aisner received a Bachelor of Arts degree from Colby College and a Masters of Business Administration degree from the University of New Hampshire. Each Board believes that this experience allows Mr. Aisner to offer valuable insight and advice with respect to raising capital and implementing each Fund’s investment strategies.

Andrew C. Cooper

Mr. Cooper’s over 30 years of experience in venture capital management, venture capital investing and investment banking provides each Board with a wealth of leadership, business investing and financial experience. Mr. Cooper’s experience as the co-founder, Co-CEO, and director of Unison Energy, a co-generation company that engineers, installs, owns, and operates cogeneration facilities as well as the former co-CEO of Unison Site Management LLC, a leading cellular site owner with over 4,000 cell sites under management, and as co-founder, former CFO and VP of business development for Avesta Technologies, an enterprise, information and technology management software company bought by Visual Networks in 2000, provides each Board with the benefit of leadership and experience in finance and business management. Further, Mr. Cooper’s time as a director of CSG Systems, Protection One Alarm, LionBridge Technologies Weblink Wireless, Aquatic Energy and the Madison Square Boys and Girls Club of New York provides each Board with a wealth of experience and an in-depth understanding of management practices. Mr. Cooper’s knowledge of financial and accounting matters qualifies him to serve on each Fund’s Audit Committee and his independence from each Fund, PSSIM, PEIM, PCM, Behringer and Prospect Administration enhances his service as a member of the Nominating and Governance Committees.

William J. Gremp

Mr. Gremp brings to each Board a broad and diverse knowledge of business and finance as a result of his career as an investment banker, spanning over 40 years working in corporate finance and originating and executing transactions and advisory assignments for energy and utility related clients. Since 1999, Mr. Gremp has been responsible for traditional banking services, credit and lending, private equity and corporate cash management with Merrill Lynch & Co. From 1996 to 1999, he served at Wachovia as senior vice president, managing director and co-founder of the utilities and energy investment banking group, responsible for origination, structuring, negotiation and successful completion of transactions utilizing investment banking, capital markets and traditional commercial banking products. From 1989 to 1996, Mr. Gremp was the managing director of global power and project finance at JPMorgan Chase & Co., and from 1970 to 1989, Mr. Gremp was with Merrill Lynch & Co., starting out as an associate in the mergers and acquisitions department, then in 1986 becoming the senior vice president, managing director and head of the regulated industries group. Mr. Gremp’s knowledge of financial and accounting matters qualifies him to serve on each Fund’s Audit Committee and his independence from each Fund, PSSIM, PEIM, PCM, Behringer and Prospect Administration enhances his service as a member of the Nominating and Governance Committees.

Eugene S. Stark

Mr. Stark brings to each Board over 25 years of experience in directing the financial and administrative functions of investment management organizations. Each Board benefits from his broad experience in financial management; SEC reporting and compliance; strategic and financial planning; expense, capital and risk management; fund administration; due diligence; acquisition analysis; and integration activities. Since May 2005, Mr. Stark’s position as the Principal Financial Officer, Chief Compliance Officer and Vice President of Administration at General American Investors Company, Inc., where he is responsible for operations, compliance, and financial functions, allows him to provide the Boards with added insight into the management practices of other financial companies. From January to April of 2005, Mr. Stark was the Chief Financial Officer of Prospect Capital Corporation, prior to which he worked at Prudential Financial, Inc. between 1987 and 2004. His many positions within Prudential include 10 years as Vice President and Fund Treasurer of Prudential Mutual Funds, 4 years as Senior Vice President of Finance of Prudential Investments, and 2 years as Senior Vice President of Finance of Prudential Amenities. Mr. Stark is also a Certified Public Accountant (inactive status). Mr. Stark’s knowledge of financial and accounting matters qualifies him to serve on each Fund’s Audit Committee and his independence from each Fund, PSSIM, PEIM, PCM, Behringer and Prospect Administration enhances his service as a member of the Nominating and Governance Committees.

Means by Which Each Board Supervises Executive Officers

Each Board is regularly informed on developments and issues related to the Fund’s business, and monitors the activities and responsibilities of the executive officers in various ways.

At each regular meeting of each Board, the executive officers report to the Board on developments and important issues. Each of the executive officers, as applicable, also provide regular updates to the members of the Board regarding the Fund’s business between the dates of regular meetings of the Board.

Executive officers and other members of PSSIM, PEIM, PCM and Prospect Administration, at the invitation of each Board, regularly attend portions of meetings of the Board and its committees to report on the financial results of the Fund, its operations, performance and outlook, and on areas of the business within their responsibility, including risk management and management information systems, as well as other business matters.

The Board’s Role in Risk Oversight

Each Board performs its risk oversight function primarily through (a) its two standing committees, which report to the entire Board and are comprised solely of independent directors and (b) monitoring by the Fund’s Chief Compliance Officer in accordance with its compliance policies and procedures.

As set forth in the descriptions regarding the Audit Committees and the Nominating and Governance Committees, the Audit Committees and the Nominating and Governance Committees assist the Boards in fulfilling their risk oversight responsibilities. Each Audit Committee’s risk oversight responsibilities include reviewing and discussing with management and the independent accountants the annual audited financial statements of the Fund; reviewing and discussing with management the Fund’s financial statements included in the Fund’s semi-annual reports; pre-approving the independent accountants�� engagement to render audit and/or permissible non-audit services; and evaluating the qualifications, performance and independence of the independent accountants. Each Nominating and Governance Committee’s risk oversight responsibilities include selecting qualified nominees to be elected to the Board by stockholders; selecting qualified nominees to fill any vacancies on the Board or a committee thereof; developing and recommending to the Board a set of corporate governance principles applicable to the Fund; and overseeing the evaluation of the Board and management. Each of the Audit Committees and the Nominating and Governance Committees consist solely of independent directors.

Each Board also performs its risk oversight responsibilities with the assistance of the Chief Compliance Officer. the Chief Compliance Officer prepares a written report annually discussing the adequacy and effectiveness of the compliance policies and procedures of each Fund and certain of its service providers. Each Chief Compliance Officer’s report, which is reviewed by the Board, addresses at a minimum (a) the operation of the compliance policies and procedures of the Fund and certain of its service providers since the last report; (b) any material changes to such policies and procedures since the last report; (c) any recommendations for material changes to such policies and procedures as a result of the Chief Compliance Officer’s annual review; and (d) any compliance matter that has occurred since the date of the last report about which the Board would reasonably need to know to oversee the Fund’s compliance activities and risks. In addition, the Chief Compliance Officer meets separately in executive session with the independent directors at least once each year.

Each Fund believes that its Board’s role in risk oversight is effective and appropriate given the extensive regulation to which it is already subject as an investment company under the 1940 Act. In addition, each Fund elected to be treated as a regulated investment company, or RIC, under Subchapter M of the Internal Revenue Code of 1986, as amended. As a RIC, each Fund must, among other things, meet certain income source, asset diversification and income distribution requirements.

Each Fund believes that the extent of its Board’s (and its committees’) role in risk oversight complements its Board’s leadership structure because it allows the Fund’s independent directors to exercise oversight of risk without any conflict that might discourage critical review through the two fully independent board committees, auditor and independent valuation providers, and otherwise.

Each Fund believes that a board’s role in risk oversight must be evaluated on a case by case basis and that the Board’s practices concerning risk oversight is appropriate. However, each Fund continually re-examines the manner in which the Board administers its oversight function on an ongoing basis to ensure that they continue to meet the Fund’s needs.

Corporate Governance Guidelines

Upon the recommendation of each Nominating and Governance Committee, the Board has adopted Corporate Governance Guidelines on behalf of the Fund. These Corporate Governance Guidelines address, among other things, the following key corporate governance topics: director responsibilities; the size, composition, and membership criteria of the Board; composition and responsibilities of directors serving on committees of the Board; director access to officers, employees, and independent advisors; director orientation and continuing education; director compensation; and an annual performance evaluation of the Board.

Internal Reporting and Whistle Blower Protection Policy

Each Fund’s Audit Committee has established guidelines and procedures regarding the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters (collectively, “Accounting Matters”), and the confidential, anonymous submission by personnel of concerns regarding questionable Accounting Matters. Persons with complaints or concerns regarding Accounting Matters may submit their complaints to the Chief Compliance Officer. Persons who are uncomfortable submitting complaints to the Chief Compliance Officer, including complaints involving the Chief Compliance Officer, may submit complaints directly to the Audit Committee Chairman. Complaints may be submitted on an anonymous basis.

The Chief Compliance Officers may be contacted at:

Priority Income Fund, Inc. Pathway Energy Infrastructure Fund, Inc.

Chief Compliance Officer Chief Compliance Officer

10 East 40th Street, 42nd Floor 10 East 40th Street, 42nd Floor

New York, New York 10016 New York, New York 10016

The Audit Committee Chairmen may be contacted at:

Priority Income Fund, Inc. Pathway Energy Infrastructure Fund, Inc.

Audit Committee Chairman Audit Committee Chairman

10 East 40th Street, 42nd Floor 10 East 40th Street, 42nd Floor

New York, New York 10016 New York, New York 10016

Communication with the Boards

Stockholders with questions about a Fund are encouraged to contact the Fund. Stockholders may communicate with a Fund or its Board by sending their communications to Priority Income Fund, Inc. or Pathway Energy Infrastructure Fund, Inc., as applicable, Chief Compliance Officer, 10 East 40th Street, 42nd Floor, New York, New York 10016. All stockholder communications received in this manner will be delivered as appropriate to one or more members of the applicable Board.

Information about Executive Officers Who Are Not Directors

|

| | | | | | |

| Name, Address and Age | | Position(s) Held with the Funds | | Term at Office and Length of Time Served | | Principal Occupation(s) During Past 5 Years |

Brian H. Oswald, 55(1) | | Chief Financial Officer, Chief Compliance Officer, Treasurer and Secretary | | Since December 2014 | | Mr. Oswald is the Chief Financial Officer, Chief Compliance Officer, Treasurer and Secretary of Prospect Capital Corporation and a Managing Director of Prospect Administration since November 2008. Mr. Oswald is also the Chief Financial Officer, Chief Compliance Officer, Treasurer and Secretary of PSSIM and PEIM. |

Michael D. Cohen, 42(1) | | Executive Vice President | | Since July 2012 | | Mr. Cohen is also the Executive Vice President of PSSIM and PEIM and has served in numerous executive roles with other entities affiliated with Behringer since 2005. |

_______________________________

| |

| (1) | The business address of Messrs. Oswald and Cohen is c/o Priority Income Fund, Inc. and Pathway Energy Infrastructure Fund, Inc., as applicable, 10 East 40th Street, 42nd Floor, New York, New York 10016. |

Compensation of Executive Officers and Directors

The following table sets forth information regarding the compensation received by the directors and executive officers for PRIS for the fiscal year ended June 30, 2016. The directors of PWAY did not receive any compensation for the fiscal year ended June 30, 2016. No compensation is paid to the interested directors by the Funds.

Compensation Table

|

| | | | | | | | | | |

| Name and Position | | Aggregate

Compensation from the Funds | | Pension or

Retirement Benefits

Accrued as Part of

the Funds’ Expenses(1) | | Total

Compensation from Funds and Fund Complex |

| Interested Directors | | | | | | |

M. Grier Eliasek(2) | | None |

| | None | | None |

|

Robert S. Aisner(2) | | None |

| | None | | None |

|

| Independent Directors | | | | | | |

Andrew C. Cooper(3) | |

| $26,682 |

| | None | |

| $26,682 |

|

William J. Gremp(3) | |

| $26,682 |

| | None | |

| $26,682 |

|

Eugene S. Stark(3) | |

| $26,682 |

| | None | |

| $26,682 |

|

| Executive Officers | | | | | | |

Brian H. Oswald(2) | | None |

| | None | | None |

|

Michael D. Cohen(2) | | None |

| | None | | None |

|

_______________________________

| |

| (1) | The Funds do not have a bonus, profit sharing or retirement plan, and directors do not receive any pension or retirement benefits. |

| |

| (2) | The Funds have not paid, and do not intend to pay, any annual cash compensation to its executive officers for their services as executive officers. Messrs. Eliasek and Cohen are compensated by PCM and Behringer, respectively, from the income PCM and Behringer receive as distributions from PSSIM and PEIM of fees received under the investment advisory agreements between PSSIM and Priority and between PEIM and Pathway, respectively. Mr. Oswald is compensated from the income Prospect Administration receives under the administration agreements. |

| |

| (3) | Messrs. Cooper, Gremp and Stark joined the Priority Board on October 28, 2012 and the Pathway Board on February 21, 2013, |

The independent directors did not receive any fees during the fiscal year ended June 30, 2016 from PWAY. The independent directors are entitled to receive annual cash retainer fees, determined based on each Fund’s net asset value as of the end of each fiscal quarter. These directors are Messrs. Cooper, Gremp and Stark. Amounts payable by each Fund under the arrangement will be determined and paid quarterly in arrears as follows:

|

| | | | |

| Net Asset Value | | Annual Cash Retainer |

| $0 million - $100 million | |

| $0 |

|

| $100 million - $300 million | |

| $35,000 |

|

| $300 million - $500 million | |

| $50,000 |

|

| $500 million - $1 billion | |

| $75,000 |

|

| >$1 billion | |

| $100,000 |

|

Section 16(a) Beneficial Ownership Reporting Compliance

Pursuant to Section 16(a) of the Securities Exchange Act of 1934, or the Exchange Act, our directors and executive officers, and any persons holding more than 10% of a Fund’s common stock, are required to report their beneficial ownership and any changes therein to the Commission and to the Funds. Specific due dates for those reports have been established, and we are required to report herein any failure to file such reports by those due dates. Based on our review of Forms 3, 4 and 5 filed by such persons, and information provided by our directors and officers, we believe that during the fiscal year ended June 30, 2016, all Section 16(a) filing requirements applicable to such persons were met in a timely manner.

ADDITIONAL INFORMATION

The 1940 Act requires that each Fund’s independent registered public accounting firm be selected by a majority of the independent directors of the Fund. One of the purposes of the Audit Committee is to recommend to the Fund’s Board the selection, retention or termination of the independent registered public accounting firm for the Fund. Each Fund’s independent registered public accounting firm for the fiscal year ended June 30, 2016 was BDO USA, LLP (“BDO”). At meetings held on July 26, 2016, Priority’s and Pathway’s Fund’s Audit Committee recommended and the Fund’s Board, including a majority of the independent directors, approved the selection of BDO as the Fund’s independent registered public accounting firm for the fiscal year ending June 30, 2017. Neither the 1940 Act nor the NASDAQ rules require that each Board’s selection of BDO be submitted for ratification by stockholders of the Fund. We expect that a representative of BDO will be present at the Annual Meeting and will have an opportunity to make a statement if he or she so chooses and will be available to respond to appropriate questions. After reviewing each Fund’s audited financial statements for the fiscal year ending June 30, 2016, each Fund’s Audit Committee recommended to each Fund’s Board that such statements be included in each Fund’s Annual Report to stockholders. A copy of the Audit Committees’ joint report appears below.

Each Audit Committee and each Board have considered the independence of BDO and have concluded that BDO is independent as required by Independence Standards Board Standard No. 1. In connection with their determination, BDO has advised each Fund that neither the firm nor any present member or associate of it has any material financial interest, direct or indirect, in the Fund or its affiliates.

Audit Fees. The aggregate fees billed for professional services rendered by BDO for services that are normally provided by BDO in connection with statutory and regulatory filings or engagements for the fiscal years ended June 30, 2016 and 2015 were approximately $325,000 and $248,400 for Priority and $105,000 and $58,600 for Pathway, respectively.

Audit-Related Fees. There were no fees billed for assurance and related services rendered by BDO that are reasonably related to the performance of the audit of the Registrant’s financial statements and not reported under paragraph (a) of this Item 4 in the fiscal years ended June 30, 2016 and June 30, 2015.

Tax Fees. The aggregate fees billed for professional services by BDO for tax compliance, tax advice and tax planning in the fiscal years ended June 30, 2016 and 2015 were approximately $12,000 and $10,865 for Priority and $11,000 and $4,175 for Pathway, respectively.

All Other Fees. The aggregate fees billed for services rendered by BDO that are not included in the categories above in the fiscal years ended June 30, 2016 and June 30, 2015 were approximately $88,000 and $0 for Priority and $36,000 and $5,000 for Pathway, respectively.

Non-Audit Fees. For the fiscal years ended June 30, 2016 and 2015, the aggregate fees billed by BDO for non-audit services rendered to the Funds and for non-audit services rendered to Funds’ investment advisers (not including any sub-advisor whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser) and/or to any entity controlling, controlled by or under common control with the Funds’ investment adviser that provides ongoing services to Funds and the Funds’ investment advisers were approximately $105,000 and $14,040 for Priority and $57,000 and $11,763 for Pathway, respectively.

Audit Committee Pre-Approval Policies and Procedures. Each Audit Committee pre-approves BDO’s engagements for audit and non-audit services to the Fund or the Fund’s investment adviser. Pre-approval considerations include whether the proposed services are compatible with maintaining BDO’s independence. No services described above were approved by the Audit Committees pursuant to the “de minimis exception” set forth in Rule 2-01(c)(7)(i)(C) of Regulation S-X. Each Audit Committee has considered and concluded that the provision of non-audit services rendered by BDO to the Fund’s investment adviser and any entity controlling, controlled by, or under common control with the Fund’s investment adviser that were not required to be pre-approved by the Audit Committee is compatible with maintaining BDO’s independence.

There were no non-audit services rendered to the Funds’ investment advisers (not including any sub-advisor whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and/or to any entity controlling, controlled by, or under common control with the Fund’s investment adviser that provides ongoing services to the Funds.

Joint Audit Committee Report

The following is the joint report of the Audit Committees with respect to each of the Fund’s audited financial statements for the fiscal year ended June 30, 2016.

Each Audit Committee has reviewed and discussed the Fund’s audited financial statements with management and BDO, with and without management present. Each Audit Committee included in its review results of BDO’s examinations, the Fund’s disclosure controls and procedures, and the quality of the Fund’s financial reporting. Each Audit Committee also reviewed the Fund’s procedures and disclosure controls designed to ensure full, fair and adequate financial reporting and disclosures, including procedures for certifications by the Fund’s chief executive officer and chief financial officer that are required in periodic reports filed by the Fund with the Commission.

Each Audit Committee also has discussed with BDO matters relating to BDO’s judgments about the quality, as well as the acceptability, of the Fund’s accounting principles as applied in its financial reporting as required by Public Company Accounting Oversight Board (“PCAOB”) Statement on Auditing Standards No. 16 (“AS 16”). In addition, each Audit Committee has discussed with BDO their independence from management and the Fund, as well as the matters in the written disclosures received from BDO and required by AS 16 and PCAOB Rule 3526, “Communication with Audit Committees Concerning Independence”. Each Audit Committee received oral communications from BDO confirming their independence and discussed the matter with BDO. Each Audit Committee discussed and reviewed with BDO the Fund’s critical accounting policies and practices, disclosure controls, other material written communications to management, and the scope of BDO’s audits and all fees paid to BDO during the fiscal year. Pursuant to each Audit Committee charter, each Audit Committee may review and pre-approve audit and permissible non-audit services performed by BDO for the Fund. Each Audit Committee may delegate pre-approval authority to one or more of its members. The member or members to whom such authority is delegated shall report any pre-approval decisions to the Audit Committee at its next scheduled meeting. Each Audit Committee does not delegate its responsibilities to pre-approve services performed by the independent registered public accounting firm to management. Each Audit Committee has reviewed and considered the compatibility of BDO’s performance of non-audit services with the maintenance of BDO’s independence as the Fund’s independent registered public accounting firm.

Based on each Audit Committee’s review and discussions referred to above, each Audit Committee recommended to the Board that the Fund’s audited financial statements for the fiscal year ended June 30, 2016 be included in the Fund’s Annual Report on Form N-CSR for the same fiscal year for filing with the Commission. In addition, each Audit Committee has engaged BDO to serve as the Fund’s independent registered public accounting firm for the fiscal year ending June 30, 2017.

Respectfully Submitted,

The Audit Committees

Eugene S. Stark, Chairman

Andrew C. Cooper

William J. Gremp

August 29, 2016

Financial Statements and Other Information

Each Fund will furnish, without charge, a copy its annual report and most recent semi-annual report succeeding the annual report to any stockholder upon request. Requests should be directed to each Fund at Priority Income Fund, Inc. or Pathway Energy Infrastructure Fund, Inc., as applicable, 10 East 40th Street, 42nd Floor, New York, New York 10016 (telephone number (212) 448-0702).

Householding of Proxy Materials

The Commission has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement and annual report addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies.

Please note that only one Proxy Statement and/or annual report may be delivered to two or more stockholders who share an address, unless a Fund has received instructions to the contrary. To request a separate copy of this Proxy Statement and/or annual report or for instructions as to how to request a separate copy of this document and/or annual report or as to how to request a single copy if multiple copies of this document and/or annual report are received, stockholders should contact the applicable Fund at the address and phone number set forth below.

Requests should be directed to Priority Income Fund, Inc. or Pathway Energy Infrastructure Fund, Inc., as applicable, 10 East 40th Street, 42nd Floor, New York, New York 10016 (telephone number: 212-448-0702). Copies of these documents may also be accessed electronically by means of the Commission’s home page on the Internet at www.sec.gov.

Other Business

Each Board knows of no other matters that may be presented for stockholder action at the Annual Meeting. If any other matters properly come before the Annual Meeting, the persons named as proxies will vote upon them in their discretion.

Submission of Stockholder Proposals