UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

| |

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

| Check the appropriate box: |

| x | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under §240.14a-12 |

|

| | |

| Pathway Energy Infrastructure Fund, Inc. |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

PATHWAY ENERGY INFRASTRUCTURE FUND, INC.

10 East 40th Street, 42nd Floor

New York, New York 10016

August [ ], 2017

Dear Stockholder:

You are cordially invited to attend a Special Meeting of Stockholders, or the Special Meeting, of Pathway Energy Infrastructure Fund, Inc., a Maryland corporation (the “Company”), to be held on [Day of the week], [Month], [Date], at [Time], Eastern Time, at 10 East 40th Street, 44th Floor, New York, New York 10016.

The notice of Special Meeting and proxy statement accompanying this letter provide an outline of the business to be conducted at the Special Meeting. At the Special Meeting, the stockholders of the Company will be asked to vote on several proposals described further in the accompanying notice of special meeting and proxy statement.

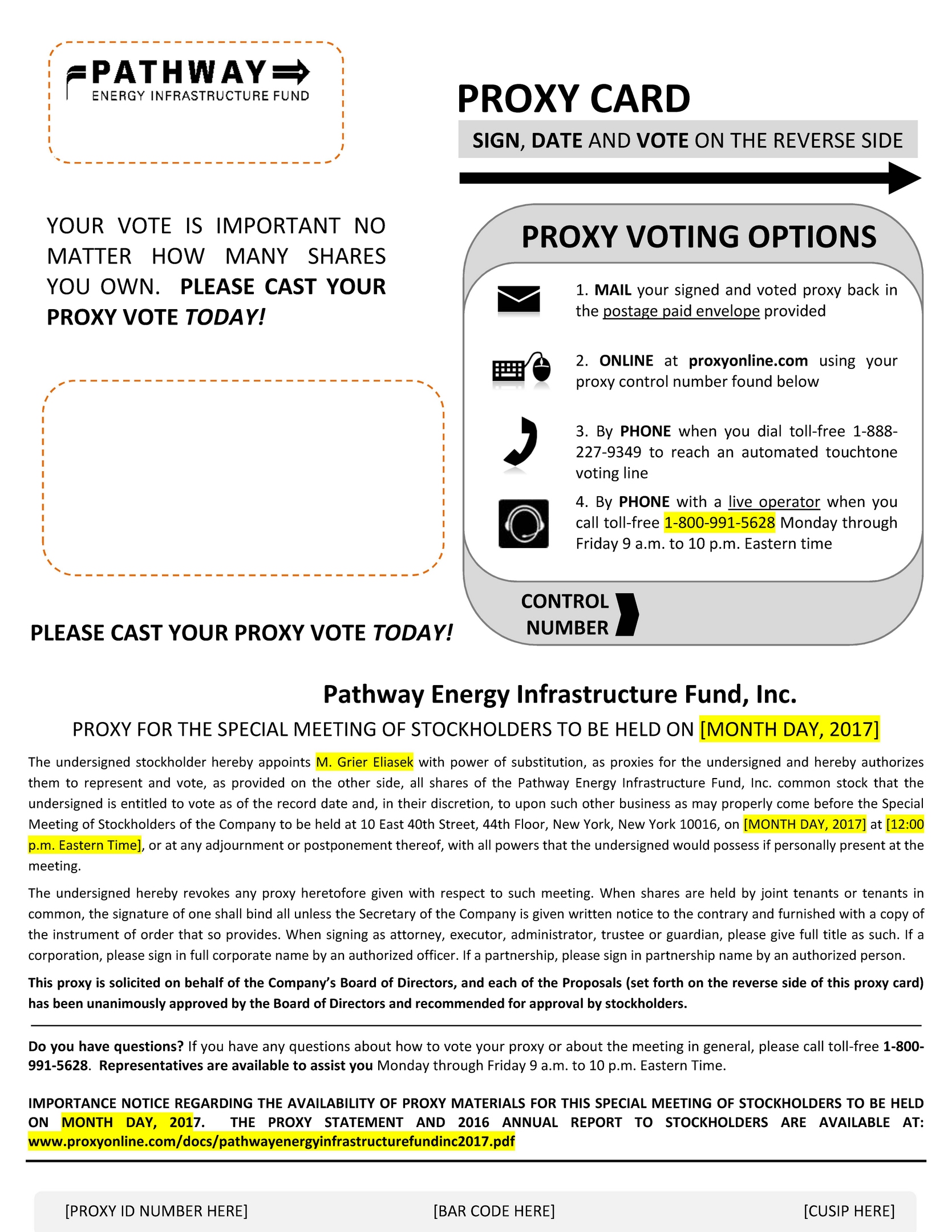

It is important that you be represented at the Special Meeting. Please complete, sign, date and return your proxy card to us in the enclosed, postage-prepaid envelope at your earliest convenience, even if you plan to attend the Special Meeting. If you prefer, you can authorize your proxy through the Internet or by telephone as described in the proxy statement and on the enclosed proxy card. If you attend the Special Meeting, you may revoke your proxy prior to its exercise and vote in person at the Special Meeting. Your vote is very important to us. I urge you to submit your proxy as soon as possible. If you have any questions about the proposal to be voted on, please call AST Fund Solutions, LLC, the proxy solicitor, at (866) 387-0770.

Further, from time to time the Company may repurchase a portion of its common shares and are notifying you of such intention as required by applicable securities law.

Sincerely yours,

M. Grier Eliasek

Chief Executive Officer

PATHWAY ENERGY INFRASTRUCTURE FUND, INC.

10 East 40th Street, 42nd Floor

New York, New York 10016

(212) 448-0702

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON [MONTH] [DATE], 2017

To the Stockholders of Pathway Energy Infrastructure Fund, Inc.:

A Special Meeting of Stockholders, or the Special Meeting, of Pathway Energy Infrastructure Fund, Inc. (“Pathway” or the “Company”), a Maryland corporation, will be held at 10 East 40th Street, 44th Floor, New York, New York 10016, on [Day of the week], [Month] [Date], 2017, at [Time]., Eastern Time, for the following purposes:

| |

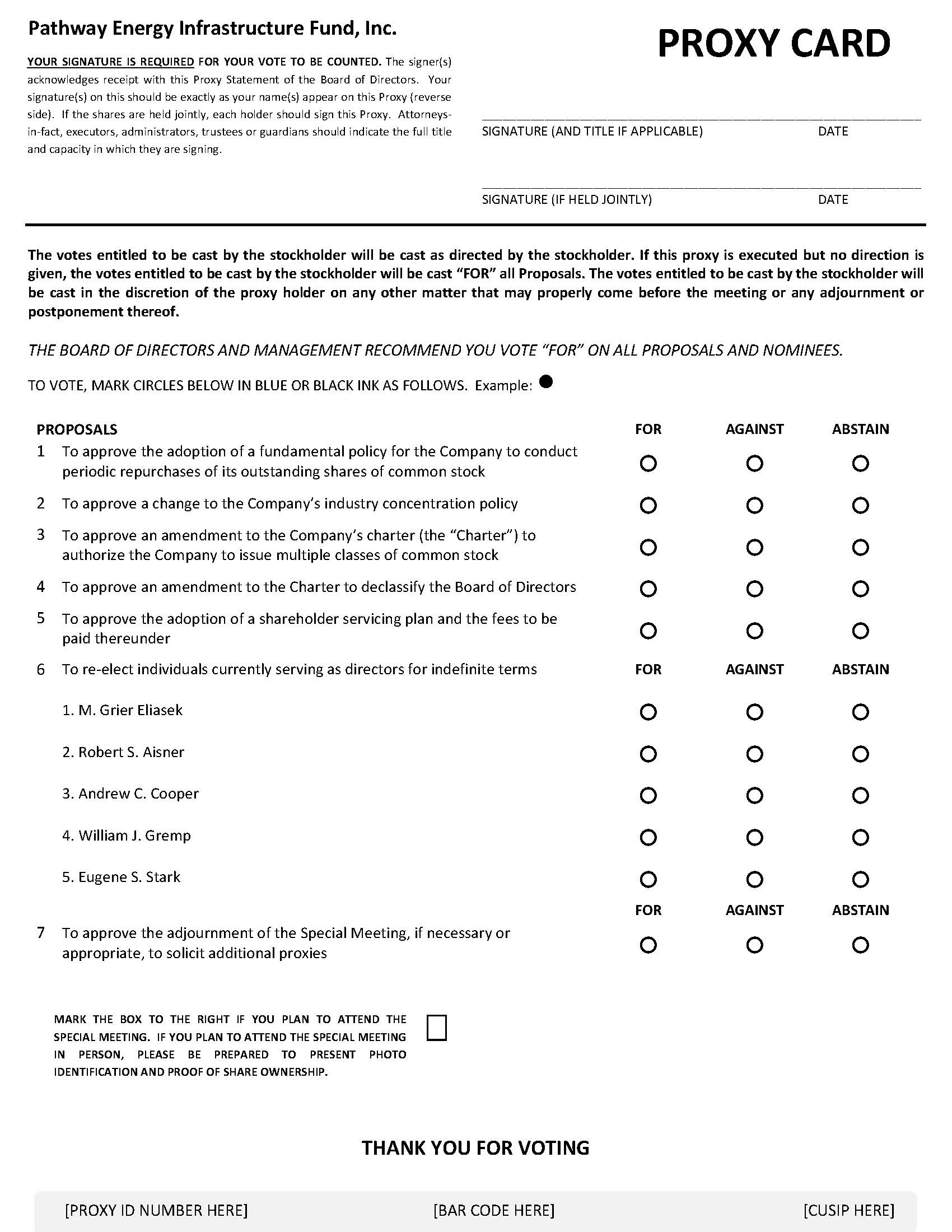

| • | To approve the adoption of a fundamental policy for the Company to conduct periodic repurchases of its outstanding shares of common stock; |

| |

| • | To approve a change to the Company’s industry concentration policy; |

| |

| • | To approve an amendment to the Company’s charter (the “Charter”) to authorize the Company to issue multiple classes of common stock; |

| |

| • | To approve an amendment to the Charter to declassify the Board of Directors; |

| |

| • | To approve the adoption of a shareholder servicing plan and the fees to be paid thereunder; |

| |

| • | To re-elect individuals currently serving as directors for indefinite terms; and |

| |

| • | To approve the adjournment of the Special Meeting, if necessary or appropriate, to solicit additional proxies. |

You have the right to receive notice of and to vote at the Special Meeting if you were a stockholder of record of the Company’s outstanding common stock at the close of business on [Month] [Day], 2017. Please complete, sign, date and return your proxy card to us in the enclosed, postage-prepaid envelope at your earliest convenience, even if you plan to attend the Special Meeting. If you prefer, you can authorize your proxy through the Internet or by telephone as described in the combined proxy statement and on the enclosed proxy card(s). If you attend the Special Meeting, you may revoke your proxy prior to its exercise and vote in person at the Special Meeting. In the event that there are not sufficient stockholders present for a quorum or sufficient votes to approve a proposal at the time the Special Meeting is convened, the Special Meeting may be adjourned from time to time in order to permit further solicitation of proxies by the Company.

If you have any questions about the proposals to be voted on, please call AST Fund Solutions, LLC, our proxy solicitor, at (866) 387-0770.

|

| |

| | By Order of the Board of Directors, |

New York, New York [Month] [Date], 2017 |

Brian H. Oswald Chief Financial Officer, Chief Compliance Officer, Treasurer and Secretary |

|

|

This is an important meeting. To ensure proper representation at the Special Meeting, please complete, sign, date and return the proxy card in the enclosed, postage-prepaid envelope, or authorize a proxy to vote your shares by telephone or through the Internet. Even if you authorize a proxy prior to the Special Meeting, you still may attend the Special Meeting, revoke your proxy, and vote your shares in person.

|

TABLE OF CONTENTS

|

| | |

| |

| Purpose of Special Meeting | 2 |

|

| Quorum Required | 2 |

|

| Information Regarding This Solicitation | 4 |

|

| Investment Advisor and Administrator | 5 |

|

| Security Ownership of Certain Beneficial Owners and Management | 5 |

|

| Proposal 1: Approval of Fundamental Policy to Conduct Share Repurchases | 6 |

|

| Proposal 2: Change to Industry Concentration Policy | 9 |

|

| Proposal 3: Approval of First Charter Amendment | 10 |

|

| Proposal 4: Approval of Charter Amendment | 12 |

|

| Proposal 5: Approval of Shareholder Servicing Plan | 13 |

|

| Proposal 6: Election of Directors | 15 |

|

| Proposal 7: Adjournment of the Special Meeting to Solicit Additional Proxies | 25 |

|

| Additional Information | 25 |

|

| Financial Statements and Other Information | 28 |

|

| Householding of Proxy Materials | 28 |

|

| Other Business | 28 |

|

PATHWAY ENERGY INFRASTRUCTURE FUND, INC.

10 East 40th Street, 42nd Floor

New York, New York 10016

(212) 448-0702

PROXY STATEMENT

Special Meeting of Stockholders

This proxy statement, is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Pathway Energy Infrastructure Fund, Inc. (“Pathway” or the “Company”), a Maryland corporation, for use at a Special Meeting of Stockholders, or the Special Meeting, to be held on [Day of the week], [Month] [Date], 2017, at [Time], Eastern Time, at 10 East 40th Street, 44th Floor, New York, New York 10016, and at any postponements, adjournments or delays thereof.

The Board has fixed the close of business on [Month] [Date], 2017 as the record date (the “Record Date”) for the determination of stockholders entitled to notice of, and to vote at, the Special Meeting. As of the Record Date, [Number of shares] shares of Pathway’s common stock were issued and outstanding. Each share of the common stock (regardless of share class) is entitled to one vote.

This proxy statement and the accompanying proxy cards are first being sent to stockholders on or about [Month][Day], 2017.

Unlike many companies where the majority of the outstanding shares are held by institutional investors, a majority of the Company’s stockholders are retail investors who generally hold smaller numbers of shares than institutional investors. As a result, it is important that every stockholder authorize a proxy so that we can achieve a quorum and hold the Special Meeting. The presence at the Special Meeting, in person or by proxy, of stockholders entitled to cast a majority of the votes entitled to be cast at the Special Meeting for the Company will constitute a quorum for the transaction of business for the Company. If a quorum is not met by the Company, then we will be required to adjourn the Special Meeting and incur additional expenses to continue to solicit additional votes.

We have engaged AST Fund Solutions, LLC as the proxy solicitor, who may call you and ask you to vote your shares. You may also be asked if you would like to authorize your proxy over the telephone and to have your voting instructions transmitted to the proxy tabulation firm.

We encourage you to vote, either by voting in person at the Special Meeting or by granting a proxy (i.e., authorizing someone to vote your shares). If you properly sign and date the accompanying proxy card or authorize a proxy to vote your shares by telephone or through the Internet, and we receive it in time for the Special Meeting, the persons named as proxies will vote the shares registered directly in your name in the manner that you specified. If you give no instructions on the proxy card, the shares covered by the proxy card will be voted FOR the election of the nominees as directors and FOR each other proposal listed in the Notice of the Special Meeting.

If you are a “stockholder of record” (i.e., you hold shares directly in your name), you may revoke a proxy at any time before it is exercised by notifying the Company’s Secretary in writing, by submitting a properly executed, later-dated proxy, or by voting in person at the Special Meeting. Any stockholder of record attending the Special Meeting may vote in person whether or not he or she has previously authorized a proxy.

If your shares are held for your account by a broker, trustee, bank or other institution or nominee, you may vote such shares at the Special Meeting only if you obtain proper written authority from your institution or nominee and present it at the Special Meeting. Please bring with you a legal proxy or letter from the broker, trustee, bank or other institution or nominee confirming your beneficial ownership of the shares as of the Record Date. No stockholders of the Company have any dissenters’ or appraisal rights in connection with any of the proposals described herein.

If your shares are registered in the name of a bank or brokerage firm, you may be eligible to vote your shares electronically via the Internet or by telephone.

For information on how to obtain directions to attend the Special Meeting in person, please contact AST Fund Solutions, LLC, the proxy solicitor, at (866) 387-0770.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDER MEETING TO BE HELD ON [MONTH] [DATE], 2017

The following materials relating to this proxy statement, as applicable, are available at www.pathway-energyfund.com/proxymaterials:

| |

| • | this proxy statement; and |

| |

| • | the accompanying Notice of Special Meeting. |

Purpose of Special Meeting

The Special Meeting has been called for the following purposes:

| |

| • | To approve the adoption of a fundamental policy for the Company to conduct periodic repurchases of its outstanding shares of common stock; |

| |

| • | To approve a change to the Company’s industry concentration policy; |

| |

| • | To approve an amendment to the Company’s charter (the “Charter”) to authorize the Company to issue multiple classes of common stock; |

| |

| • | To approve an amendment to the Charter to declassify the Board of Directors; |

| |

| • | To approve the adoption of a shareholder servicing plan and the fees to be paid thereunder; |

| |

| • | To re-elect individuals currently serving as directors for indefinite terms; and |

| |

| • | To approve the adjournment of the Special Meeting, if necessary or appropriate, to solicit additional proxies. |

Quorum Required

A quorum must be present at the Special Meeting for any business to be conducted at the Special Meeting. The Company’s Bylaws provide that the presence at the Special Meeting, in person or by proxy, of the holders of shares of the Company’s outstanding common stock, without regard to class, entitled to cast a majority of the votes entitled to be cast with respect thereto as of the Record Date will constitute a quorum, except with respect to any such matter that, under applicable statutes or regulatory requirements, requires approval by a separate vote of one or more classes of stock, in which case the presence in person or by proxy of the holders of shares entitled to cast a majority of the votes entitled to be cast by each such class on such a matter shall constitute a quorum.

Shares that are present at the Special Meeting but then abstain will be treated as present for purposes of establishing a quorum. Shares for which brokers have not received voting instructions from the beneficial owner of the shares and do not have discretionary authority to vote the shares on certain proposals (which are considered “broker non-votes” with respect to such proposals) will be treated as shares not present for quorum purposes.

If a quorum is not present at the Special Meeting or if there are not sufficient votes to approve a proposal, the chairman of the Special Meeting or, if a stockholder vote is called, the stockholders of the Company who are present at the Special Meeting, may adjourn the Special Meeting from time to time to permit further solicitation of proxies.

Votes Required

The following table sets forth each proposal before the Special Meeting and the votes required in order for each proposal to pass. The Company’s three share classes vote together as one group. The approval of each of Proposals 1 through 5 set forth herein is conditioned upon the approval of Proposals 1 through 5.

|

| | | | | | |

| Proposal | | Vote Required | | Broker Discretionary Voting Allowed? | | Effect of Abstentions, Votes Withheld and Broker Non-Votes |

Proposal 1 - To approve the adoption of a fundamental policy for the Company to conduct periodic repurchases of its outstanding shares of common stock | | Affirmative vote of: (i) a majority of outstanding shares of common stock entitled to vote at the Special Meeting; and (ii) a majority of the outstanding shares of common stock entitled to vote at the Special Meeting which are not held by affiliated persons of the Company. Under the 1940 Act, a majority of outstanding voting shares of common stock is defined as the lesser of (1) 67% of the outstanding shares represented at a meeting at which more than 50% of the outstanding shares are present in person or represented by proxy or (2) more than 50% of the outstanding voting shares of common stock. | | No | | Votes withheld and broker non-votes will have the effect of a vote against this proposal. |

Proposal 2 - To approve a change to the Company’s industry concentration policy | | Affirmative vote of: (i) a majority of outstanding shares of common stock entitled to vote at the Special Meeting; and (ii) a majority of the outstanding shares of common stock entitled to vote at the Special Meeting which are not held by affiliated persons of the Company. Under the 1940 Act, a majority of outstanding voting shares of common stock is defined as the lesser of (1) 67% of the outstanding shares represented at a meeting at which more than 50% of the outstanding shares are present in person or represented by proxy or (2) more than 50% of the outstanding voting shares of common stock. | | No | | Votes withheld and broker non-votes will have the effect of a vote against this proposal. |

Proposal 3 - To approve a Charter Amendment to authorize the Company to issue new classes of common stock and convert outstanding shares in such new shares | | Affirmative vote of the holders of a majority of shares outstanding and entitled to vote on the proposal | | No | | Votes withheld and broker non-votes will have the effect of a vote against this proposal. |

Proposal 4 - To approve a Charter Amendment to declassify the Board of Directors and provide for directors to serve for indefinite terms | | Affirmative vote of the holders of a majority of the shares outstanding and entitled to vote on the proposal | | No | | Votes withheld and broker non-votes will have the effect of a vote against this proposal. |

|

| | | | | | |

Proposal 5 - To approve the adoption of a Shareholder Servicing Plan and the fees to be paid thereunder | | Affirmative vote of: (i) a majority of outstanding shares of common stock entitled to vote at the Special Meeting; and (ii) a majority of the outstanding shares of common stock entitled to vote at the Special Meeting which are not held by affiliated persons of the Company. Under the 1940 Act, a majority of outstanding voting shares of common stock is defined as the lesser of (1) 67% of the outstanding shares represented at a meeting at which more than 50% of the outstanding shares are present in person or represented by proxy or (2) more than 50% of the outstanding voting shares of common stock. | | No | | Votes withheld and broker non-votes will have the effect of a vote against this proposal. |

Proposal 6 - To elect M. Grier Eliasek, Robert S. Aisner, Andrew C. Cooper, William J. Gremp and Eugene S. Stark as directors of the Company, each to serve an indefinite term or until their successors are duly elected and qualify | | Affirmative vote of the holders of a majority of the shares outstanding and entitled to vote on the election of directors | | Yes | | Votes withheld and broker non-votes will have no effect on the result of the vote. |

Proposal 7 - To approve the adjournment of the Special Meeting, if necessary or appropriate, to solicit additional proxies. | | Affirmative vote of the holders of a majority of the shares present in person or represented by proxy at the Special Meeting and entitled to vote on the proposal | | No | | Votes withheld and broker non-votes will have no effect on the result of the vote. |

Information Regarding This Solicitation

The Company will bear the expense of the solicitation of proxies for the Special Meeting, including the cost of preparing, printing and mailing this proxy statement, the accompanying Notice of Special Meeting of Stockholders and the proxy cards. If brokers, nominees, fiduciaries and other persons holding shares in their names, or in the name of their nominees, which are beneficially owned by others, forward the proxy materials to and obtain proxies from such beneficial owners, we will reimburse such persons for their reasonable expenses in so doing.

In addition to the solicitation of proxies by the use of the mails, proxies may be solicited in person and by telephone or facsimile transmission by directors or officers of the Company and officers or employees of Pathway Energy Infrastructure Management, LLC (“PEIM”, the “Adviser”), Prospect Capital Management L.P. (“PCM”), a 50% owner of the Company’s investment adviser, Stratera Holdings, LLC and its affiliates (“Stratera”), a 50% owner of the Company’s investment adviser, and/or Prospect Administration LLC (“Prospect Administration”), the Company’s administrator. No additional compensation will be paid to directors, officers or employees for such services.

The Company has also retained AST Fund Solutions, LLC to assist in the solicitation of proxies for a fee of approximately $[ ] plus out-of-pocket expenses.

Stockholders may provide their voting instructions by telephone or through the Internet. These options require stockholders to input the control number which is located on the proxy card. After inputting this number, stockholders will be prompted to provide their voting instructions. Stockholders will have an opportunity to review their voting instructions and make any necessary changes before submitting their voting instructions and terminating their telephone call or Internet link. Stockholders who authorize a proxy via the Internet, in addition to confirming their voting instructions prior to submission, will also receive an e-mail confirming their instructions upon request.

Any proxy given pursuant to this solicitation may be revoked by notice from the person giving the proxy at any time before it is exercised. Any such notice of revocation should be provided in writing and signed by the stockholder in the same manner as the proxy being revoked and delivered to the proxy tabulator.

Investment Adviser and Administrator

PEIM serves as Pathway’s investment adviser, and Prospect Administration serves as the Company’s administrator. PEIM and Prospect Administration are located at 10 East 40th Street, 42nd Floor, New York, New York 10016.

Security Ownership of Certain Beneficial Owners and Management

The Company’s directors are divided into two groups - interested directors and independent directors. Interested directors are “interested persons” of the Company, as defined in the Investment Company Act of 1940, as amended (the “1940 Act”).

The following table sets forth, as of [August] [8], 2017, certain ownership information with respect to the Company’s common stock for those persons who may, insofar as is known to us, directly or indirectly own, control or hold with the power to vote, 5% or more of the Company’s outstanding common stock and the beneficial ownership of each current director, the nominees for director, the Company’s executive officers, and the executive officers and directors as a group.

Ownership information for those persons, if any, who own, control or hold the power to vote, 5% or more of a Fund’s shares of common stock is based upon Schedule 13D or Schedule 13G filings by such persons with the Securities and Exchange Commission (the “Commission”) and other information obtained from such persons, if available. Such information is as of the date of the applicable filing and may no longer be accurate.

Unless otherwise indicated, we believe that each person set forth in the table below has sole voting and investment power with respect to all shares of the Company’s common stock he or she beneficially owns and has the same address as the Company. The Company’s address is 10 East 40th Street, 42nd Floor, New York, New York 10016.

|

| | | | | | |

Name and Address of Beneficial Owner(1) | | Number of Shares

Beneficially Owned | | Percentage of

Shares Outstanding(2) |

| 5% or more holders | | | |

Stratera Holdings LLC 14675 Dallas Parkway, Suite 600 Addison, TX 75254 | 30,332 |

| | 4.8 | % |

Pathway Energy Infrastructure Management, LLC 10 East 40th Street, 42nd Floor New York, NY 10016 | 16,233 |

| | 2.6 | % |

| Interested Directors | | | |

M. Grier Eliasek(3) | — |

| | — |

|

Robert S. Aisner(4) | 5,538 |

| | * |

|

| Independent Directors | | | |

| Andrew C. Cooper | — |

| | — |

|

| William J. Gremp | — |

| | — |

|

| Eugene S. Stark | — |

| | — |

|

| Executive Officers | | | |

| Brian H. Oswald | — |

| | — |

|

Michael D. Cohen(5) | 4,354 |

| | * |

|

| Executive officers and directors as a group | — |

| | — |

|

_______________________________

| |

| * | Represents less than one percent. |

| |

| (1) | The business address of each director and executive officer of the Company is c/o Pathway Energy Infrastructure Fund, Inc., as applicable, 10 East 40th Street, 42nd Floor, New York, New York 10016. |

| |

| (2) | Based on a total of 632,182 shares of Pathway’s common stock issued and outstanding as of August 8, 2017. |

| |

| (3) | Mr. Eliasek also serves as the Chief Executive Officer and President of the Company. |

| |

| (4) | A portion of these shares are held by family trusts; Mr. Aisner disclaims beneficial ownership of such shares. |

| |

| (5) | Represents the portion of the shares beneficially owned by Stratera Holdings, LLC in which Mr. Cohen has a pecuniary interest as a member of Stratera Holdings, LLC. In addition, a portion of these shares are reported because they are held by a trust in which Mr. Cohen’s spouse is a co-trustee, and Mr. Cohen disclaims ownership of such shares. |

The following table sets forth the dollar range of equity securities beneficially owned by each director and each nominee for election as a director of the Company and equity securities beneficially owned by each director and each nominee for election as a director within the same family of investment companies as of [August] [8], 2017. Information as to beneficial ownership is based on information furnished to the Company by the directors. The Company is not part of a “family of investment companies” as that term is defined in the 1940 Act.

|

| | |

| Name of Director | | Dollar Range of Equity

Securities in Pathway(1)(2) |

| Interested Directors | |

| M. Grier Eliasek | None |

| Robert S. Aisner | $50,001-$100,000 |

| Independent Directors | |

| Andrew C. Cooper | None |

| William J. Gremp | None |

| Eugene S. Stark | None |

_______________________________

| |

| (1) | Beneficial ownership has been determined in accordance with Rule 16a-1(a)(2) under the Securities Exchange Act of 1934, which requires pecuniary interest. |

| |

| (2) | The dollar ranges are: none, $1-$10,000, $10,001-$50,000, $50,001-$100,000, or over $100,000. |

PROPOSAL 1: APPROVAL OF FUNDAMENTAL POLICY TO CONDUCT SHARE REPURCHASES

On July 26, 2017, the Board unanimously deemed it advisable and in the best interests of the Company to convert the Company to an interval fund. An interval fund is a closed-end management investment company that has adopted a fundamental policy to conduct periodic repurchases of its outstanding shares of common stock pursuant to Rule 23c-3 of the Investment Company Act of 1940. Rule 23c-3 requires that any change to such a fundamental policy be adopted by a majority of the stockholders of such investment company. Therefore, the Board is seeking your approval to adopt a fundamental policy to conduct periodic repurchases of the Company’s common stock as described below (the “Fundamental Policy”).

Background and Reasons

The Board recommends a vote FOR the proposal to approve the adoption of the Fundamental Policy because such repurchase offers will ensure greater and more consistent liquidity for the Company’s stockholders. As described in greater detail below, upon adopting the Fundamental Policy, the Company will be required to conduct quarterly repurchase offers unless limited exceptions apply. Although the Company currently conducts voluntary share repurchases pursuant to the tender offer process, adopting the Fundamental Policy will allow the Company to take advantage of the more efficient and less costly repurchase offer process pursuant to Rule 23c-3. Stockholders will benefit from the lower cost burden on the Company and assurance that repurchases are conducted in each calendar quarter.

Pursuant to the Fundamental Policy, the Company intends to offer to make one repurchase offer of no less than 5% and no more than 25% of its shares outstanding in each calendar quarter of each year at a price equal to the net asset value per share (“NAV”). Such repurchases are referred to as “Mandatory Repurchases” because the Company is required to conduct the repurchase offer unless certain limited circumstances occur. There is no guarantee that stockholders will be able to sell all of the shares they desire in a Mandatory Repurchase offer because stockholders, in total, may wish to sell more than the percentage of the Company’s shares being repurchased. The Company intends to maintain liquid securities, cash or access to a bank line of credit in amounts sufficient to meet the quarterly redemption offer requirements.

If the Fundamental Policy is adopted, the offer to repurchase shares will be a fundamental policy that may not be changed without the vote of the holders of a majority of the Company’s outstanding voting securities (as defined in the 1940 Act). Stockholders will be notified in writing of each Mandatory Repurchase and the date the repurchase offer ends (the “Mandatory Repurchase Request Deadline”). Shares will be repurchased at the NAV per share determined as of the close of regular trading on the NYSE no later than the 14th day after the Mandatory Repurchase Request Deadline, or the next business day if the 14th day is not a business day (each a “Mandatory Repurchase Pricing Date”).

Stockholders will be notified in writing about each Mandatory Repurchase offer and how they may request that the Company repurchase their shares and the Mandatory Repurchase Request Deadline, which is the date the repurchase offer ends. Shares tendered for repurchase by stockholders prior to any Repurchase Request Deadline will be repurchased subject to the aggregate repurchase amounts established for that Repurchase Request Deadline. The time between the notification to stockholders and the Repurchase Request Deadline is generally 30 days, but may vary from no more than 42 days to no less than 21 days. Payment pursuant to the repurchase will be made by checks to the stockholder’s address of record, or credited directly to a predetermined bank account on the Purchase Payment Date, which will be no more than seven days after the Mandatory Repurchase Pricing Date. The Board of Directors may establish other policies for repurchases of shares that are consistent with the 1940 Act, regulations thereunder and other pertinent laws.

Determination of Mandatory Repurchase Offer Amount

The Board, in its sole discretion, will determine the number of shares that the Company will offer to repurchase (the “Mandatory Repurchase Offer Amount”) for a given the Mandatory Repurchase Request Deadline. The Mandatory Repurchase Offer Amount will be no less than 5% and no more than 25% of the total number of shares outstanding on the Mandatory Repurchase Request Deadline. However, investors should not rely on Mandatory Repurchases being made in amounts in excess of 5% of the total number of shares outstanding. If stockholders tender for repurchase more than the Mandatory Repurchase Offer Amount for a given Mandatory Repurchase, the Company will repurchase the shares on a pro rata basis. However, the Company may accept all shares tendered for Mandatory Repurchase by stockholders who own less than one hundred shares and who tender all of their shares, before prorating other amounts tendered. In addition, the Company will accept the total number of shares tendered in connection with required minimum distributions from an IRA or other qualified retirement plan. It is the stockholder’s obligation to both notify and provide the Company supporting documentation of a required minimum distribution from an IRA or other qualified retirement plan.

Notice to Stockholders

Approximately 30 days (but no less than 21 days and more than 42 days) before each Mandatory Repurchase Request Deadline, the Company shall send to each stockholder of record and to each beneficial owner of the shares that are the subject of the repurchase offer a notification (“Stockholder Notification”). The Stockholder Notification will contain information stockholders should consider in deciding whether or not to tender their shares for Mandatory Repurchase. The notice also will include detailed instructions on how to tender shares for the Mandatory Repurchase, state the Mandatory Repurchase Offer Amount and identify the dates of the Mandatory Repurchase Request Deadline, the scheduled Mandatory Repurchase Pricing Date, and the date the repurchase proceeds are scheduled for payment (the “Mandatory Repurchase Payment Deadline”). The notice also will set forth the NAV that has been computed no more than seven days before the date of notification, and how stockholders may ascertain the NAV after the notification date.

Repurchase Price

The repurchase price of the shares will be the NAV as of the close of regular trading on the NYSE on the Mandatory Repurchase Pricing Date. You may call 888-655-3650 to learn the NAV each of the five days before the Mandatory Repurchase Pricing Date. The notice of the repurchase offer also will provide information concerning the NAV, such as the NAV as of a recent date or a sampling of recent NAVs, and a toll-free number for information regarding the Mandatory Repurchase.

Repurchase Amounts and Payment of Proceeds

Shares tendered for Mandatory Repurchase by stockholders prior to any Mandatory Repurchase Request Deadline will be repurchased subject to the aggregate Mandatory Repurchase Offer Amount established for that Mandatory Repurchase Request Deadline. Payment pursuant to the Mandatory Repurchase will be made by check to the stockholder’s address of record, or credited directly to a predetermined bank account on the Purchase Payment Date, which will be no more than seven days after the Mandatory Repurchase Pricing Date. The Board of Directors may establish other policies for repurchases of shares that are consistent with the 1940 Act, regulations thereunder and other pertinent laws.

If stockholders tender for repurchase more than the Mandatory Repurchase Offer Amount for a given Mandatory Repurchase, the Company may, but is not required to, repurchase an additional amount of shares not to exceed 2.0% of the outstanding shares of the Company on the Mandatory Repurchase Request Deadline. If the Company determines not to repurchase more than the Repurchase Offer Amount, or if stockholders tender shares in an amount exceeding the Repurchase Offer Amount plus 2.0% of the outstanding shares on the Mandatory Repurchase Request Deadline, the Company will repurchase the shares on a pro rata basis. However, the Company may accept all shares tendered for repurchase by stockholders who own less than one hundred shares and who tender all of their shares, before prorating other amounts tendered. In addition, the Company will accept the total number of shares tendered in connection with required minimum distributions from an IRA or other qualified retirement plan.

Suspension or Postponement of Mandatory Repurchase

The Company may suspend or postpone a Mandatory Repurchase only: (a) if making or effecting the Mandatory Repurchase would cause the Company to lose its status as a RIC under the Code; (b) for any period during which the NYSE or any market on which the securities owned by the Company are principally traded is closed, other than customary weekend and holiday closings, or during which trading in such market is restricted; (c) for any period during which an emergency exists as a result of which disposal by the Company of securities owned by it is not reasonably practicable, or during which it is not reasonably practicable for the Company fairly to determine the value of its net assets; or (d) for such other periods as the SEC may by order permit for the protection of stockholders of the Company.

Liquidity Requirements

The Company must maintain liquid assets equal to the Mandatory Repurchase Offer Amount from the time that the notice is sent to stockholders until the Mandatory Repurchase Pricing Date. The Company will ensure that a percentage of its net assets equal to at least 100% of the Mandatory Repurchase Offer Amount consists of assets that can be sold or disposed of in the ordinary course of business at approximately the price at which the Company has valued the investment within the time period between the Mandatory Repurchase Request Deadline and the Mandatory Repurchase Payment Deadline. The Board of Directors will adopt procedures that are reasonably designed to ensure that the Company’s assets are sufficiently liquid so that the Company can comply with the Mandatory Repurchase and the liquidity requirements described in the previous paragraph. If, at any time, the Company falls out of compliance with these liquidity requirements, the Board of Directors will take whatever action it deems appropriate to ensure compliance.

Consequences of Mandatory Repurchases

Mandatory Repurchases will typically be funded from available cash or access to a bank line of credit in amounts sufficient to meet the quarterly redemption offer requirements. Payment for repurchased shares, however, may require the Company to liquidate portfolio holdings earlier than the Adviser otherwise would, thus increasing the Company’s portfolio turnover and potentially causing the Company to realize losses. The Adviser intends to take measures to attempt to avoid or minimize such potential losses and turnover, and instead of liquidating portfolio holdings, may borrow money to finance repurchases of shares. If the Company borrows to finance repurchases, interest on that borrowing will negatively affect stockholders who do not tender their shares in a Mandatory Repurchase by increasing the Company’s expenses and reducing any net investment income. To the extent the Company finances repurchase amounts by selling Company investments, the Company may hold a larger proportion of its assets in less liquid securities. The sale of portfolio securities to fund Mandatory Repurchases also could reduce the market price of those underlying securities, which in turn would reduce the Company’s NAV.

In addition, the Company may sell portfolio securities at an inopportune time and may suffer losses or unexpected tax liabilities.

Repurchase of the Company’s shares will tend to reduce the amount of outstanding shares and, depending upon the Company’s investment performance, its net assets. A reduction in the Company’s net assets would increase the Company’s expense ratio, to the extent that additional shares are not sold and expenses otherwise remain the same (or increase). In addition, the repurchase of shares by the Company will be a taxable event to stockholders.

The Company is intended as a long-term investment. The Mandatory Repurchase will be the only means of liquidity through which stockholders have a right to redeem their shares, subject to a limited number of extenuating circumstances. Because the Company will provide liquidity through the Mandatory Repurchases, it does not anticipate seeking to complete a liquidation event in the future. Stockholders have no rights to redeem or transfer their shares, other than limited rights of a stockholder’s descendants to redeem shares in the event of such stockholder’s death pursuant to certain conditions and restrictions. The Company’s shares are not traded on a national securities exchange and no secondary market exists for the shares, nor does the Company expect a secondary market for its shares to exist in the future.

Vote Required

Approval of the Fundamental Policy requires the affirmative vote of a majority of the outstanding voting common stock. Under the 1940 Act, a majority of outstanding voting securities is defined as the lesser of (1) 67% of the outstanding shares represented at a meeting at which more than 50% of the outstanding shares are present in person or represented by proxy or (2) more than 50% of the outstanding voting securities.

The Board of Directors recommends a vote “FOR” Proposal 1.

PROPOSAL 2: CHANGE TO INDUSTRY CONCENTRATION POLICY

The Company’s current industry concentration policy requires it to concentrate, or invest greater than 25% of its total assets, in investments in the energy and related infrastructure and industrial sectors. Further, the Company is required pursuant to Rule 35d-1 under the 1940 Act to invest at least 80% of its total assets in securities of companies that operate primarily in energy and related infrastructure and industrial sectors. In connection with the proposed restructuring of the Company to an interval fund, the Board intends to change the Company’s investment strategy and the name of the Company to “Pathway Capital Opportunity Fund, Inc.” The Board may change the Company’s investment strategy by providing stockholders 60 days’ notice, which it has already provided via prospectus supplement. However, the approval of a majority vote of the Company’s outstanding stockholders is required to approve a change to the Company’s industry concentration policy because the industry concentration policy is listed in the Company’s prospectus as a fundamental policy.

Background and Reasons

The Company commenced its public offering of common stock in September of 2014 with the Fundamental policy to concentrate its investments in the energy and related infrastructure and industrial sectors. While Pathway is positioned to continue to pursue an investment strategy that will both exploit the attractive longer term trends influencing the energy sector and take advantage of current capital dislocation, the Company is expanding the fundamental industry policy to include all infrastructure sub-sectors, which will allow the Company to take advantage of a broader set of investment opportunities that also have attractive longer term trends and require a significant need for investment. Under the Company's broadened investment strategy, it expects to invest at least 50% of its total assets in securities of companies that support the operation, function, growth or development of a community or economy, which includes transportation, transportation equipment, electric utilities and power, energy, communication networks and equipment, water and sewage treatment, social infrastructure, and metals, industrials, materials, mining, and other resources and services (including manufacturing) related to infrastructure assets (e.g., cement, chemical, paper, forest product companies). Additionally, although the Company is party to an exemptive order issued by the Commission permitting it to co-invest with other funds managed by PEIM and its affiliates, including Prospect Capital Corporation, the Company is currently unable to participate in a majority of these opportunities because of its existing industry concentration policy. The revised industry concentration policy will allow the Company to participate in a broader set of these opportunities.

The Board has reviewed the Company’s current industry concentration policy and deemed it in the best interests of the Company to expand this policy to provide that the Company will invest more than 25% of our assets in companies conducting their principal business in industries with exposure to infrastructure assets. The Board and management believe that this revised investment concentration policy will allow the Company to take advantage of the efficiencies discussed above. In addition, the Board believes that the revised investment objective will position the Company to take advantage of a greater set of market opportunities.

Required Vote

Approval of change to the Company’s industry concentration policy requires the affirmative vote of a majority of the outstanding voting securities of each class of common stock. Under the 1940 Act, a majority of outstanding voting securities is defined as the lesser of (1) 67% of the outstanding shares represented at a meeting at which more than 50% of the outstanding shares are present in person or represented by proxy or (2) more than 50% of the outstanding voting securities.

The Board of Directors recommends a vote “FOR” Proposal 2.

PROPOSAL NO. 3: APPROVAL OF FIRST CHARTER AMENDMENT

Background and Reasons

If Proposal 1 is approved and upon restructuring to an interval fund, the Company will be entitled to rely on an exemptive order issued to a subsidiary of Stratera that will allow the Company to offer multiple classes of common stock (the “Multiclass Relief”). The Board has deemed it advisable for the Company to amend its Charter to provide for an initial classification of its Common Stock consistent with the Multiclass Relief and customary practice among interval funds. The Board believes that adoption of this Charter amendment will allow the Company the greatest flexibility to continue to raise the capital needed to permit the Company to carry out its investment objective. Under a multi-class system, an investor can choose the method of purchasing shares that is most beneficial given the amount of his or her purchase, the length of time the investor expects to hold his or her shares and other relevant circumstances. The proposed arrangements would permit the Company to facilitate both the distribution of its securities and provide investors with a broader choice of stockholder services. Under the proposal, owners of each class of shares may be relieved under the multi-class system of a portion of the fixed costs normally associated with investing in investment companies as the Company grows because these costs potentially would be spread over a greater number of shares than they would be otherwise. As the Company grows in volume of assets, the investors will derive benefits from economies of scale that would not be available at smaller volumes.

Principal Change

The following discussion summarizes the principal change the Company is asking its stockholders to approve in connection with Proposal 3. This summary description is qualified in its entirety by the complete text of the proposed Articles of Amendment and Restatement, a copy of which is attached hereto as Exhibit A to this proxy statement (the “Articles”). The Articles attached hereto as Exhibit A reflect the modifications proposed to be made by Proposals 3 and 4 (as more fully described below). If approved by stockholders at the Special Meeting, the amendments reflected in the Articles and described in this proxy statement will be effected by the Company’s filing of the Articles with the State Department of Assessment and Taxation of the State of Maryland (the “SDAT”), and will become effective upon filing and acceptance for record by the SDAT.

Share Classification

The Company is currently authorized to issue three classes of common stock: Class I, Class R and Class RIA. The Company anticipates that it will continue its continuous public offering of its common shares. If Proposal 3 is approved, the Company will be authorized to issue four classes of common stock: Class A, Class C, Class I and Class L. Additionally, upon the effectiveness of the Articles, each existing share of common stock of each current class will be converted into one Class A share. Furthermore, existing stockholders who invested through the Company’s Class R, Class RIA or Class I fee structure will have their shares further automatically converted to “Class I Shares” if they meet the investment criteria for that class. Additionally, if Proposal 3 is approved, the Company intends to continuously offer its Class A Shares and three additional

classes of shares (“Class I Shares”, “Class C Shares” and “Class L Shares”), with each class having its own fee and expense structure. Shares of the Company’s common stock are not expected to be listed on any securities exchange, nor quoted on any quotation medium, and the Company does not expect there to be a secondary trading market for its shares.

Only the Company’s Class A and Class L Shares will be subject to a front-end sales load, with breakpoints generally based on the size of investment. The Company’s Class A Shares are subject to other expenses, including a service fee, subject to stockholder approval of Proposal 5, but will not be subject to a distribution fee. The Company’s Class C Shares will be subject to a distribution and service fee and other expenses, and an early withdrawal charge, or EWC. The Company’s Class I Shares will be subject to other expenses, but will not be subject to a distribution and service fee, nor will they be subject to an EWC. The Company’s Class L Shares will be subject to a service fee, a distribution fee and other expenses, but will not be subject to an EWC. The Company may in the future offer additional classes of shares and/or another sales charge structure.

From time to time the Company may create additional classes of shares, the terms of which may differ from the Class A, Class I, Class C and Class L Shares in the following respects: (i) the amount of fees permitted by different distribution plans or different service fee arrangements; (ii) voting rights with respect to a distribution plan of a class; (iii) different class designations; (iv) the impact of any class expenses directly attributable to a particular class of shares allocated on a class basis as described in this application; (v) any differences in dividends and net asset value resulting from differences in fees under a distribution plan or in class expenses; (vi) any EWC or other sales load structure; and (vii) exchange or conversion privileges of the classes as permitted under the Act.

The Company will allocate all expenses incurred by it among the various classes of shares based on the net assets of the Company attributable to each such class, except that the net asset value and expenses of each class will reflect the expenses associated with the distribution plan of that class (if any), services fees attributable to that class (if any), including transfer agency fees, and any other incremental expenses of that class. Incremental expenses of the Company attributable to a particular class are limited to (i) incremental transfer agent fees identified by the transfer agent as being attributable to that class of shares; (ii) printing and postage expenses relating to preparing and distributing materials such as shareholder reports, prospectuses and proxies to current stockholders of that class of shares; (iii) federal registration fees incurred with respect to shares of that class of shares; (iv) blue sky fees incurred with respect to sales of that class of shares; (v) expenses of administrative personnel and services as required to support the stockholders of that class; (vi) auditors’ fees, litigation expenses and other legal fees and expenses relating solely to that class of shares; (vii) additional directors’ fees incurred as a result of issues relating to that class of shares; (viii) additional accounting expenses relating solely to that class of shares; (ix) expenses incurred in connection with shareholder meetings as a result of issues relating to that class of shares; and (x) any other incremental expenses subsequently identified that should be properly allocated to that class of shares consistent with Rule 18f-3 under the Act. Because of the different distribution fees, services and any other class expenses that may be attributable to the Class A Shares, Class I Shares, Class C Shares and Class L Shares, the net income attributable to, and the dividends payable on, each class of shares may differ from each other. As a result, the net asset value per share of the classes may differ at times. Expenses of the Company allocated to a particular class of shares will be borne on a pro rata basis by each outstanding share of that class. Distribution fees will be paid pursuant to a distribution plan with respect to a class.

Summary of Specific Change

Listed below, in summary form, is the specific change that will be made to the current Charter pursuant to Proposal 3 if it is approved by stockholders at the Special Meeting. The below summary does not identify certain immaterial changes to the Charter or changes that are described as part of Proposal 3. Please see the Charter attached hereto as Exhibit A, which reflects all the proposed changes to the Charter.

|

| | |

| | | Revisions to Section 6.1 to provide for the designation of new classes of common stock. |

|

| | |

| | | Revisions to Section 6.2 to provide for the conversion of outstanding shares of common stock to Class A Shares and the further automatic conversion of shares held by certain investors into Class I Shares and setting forth the rights, restrictions and preferences of each of the new classes of shares of common stock. |

Vote Required

Proposal 3 requires the approval of the majority of our outstanding shares of common stock. You may vote for or against or abstain on Proposal 3. Abstentions and broker non-votes will have the same effect as votes against Proposal 3. Proxies received will be voted “FOR” the approval of Proposal 3 unless stockholders designate otherwise.

Appraisal Rights

Under Maryland law and the Charter, you will not be entitled to rights of appraisal with respect to Proposal 3. Accordingly, to the extent that you object to Proposal 3, you will not have the right to have a court judicially determine (and you will not receive) the fair value for your shares under the provisions of Maryland law governing appraisal rights.

The Board of Directors recommends a vote “FOR” Proposal 3.

PROPOSAL NO. 4: APPROVAL OF CHARTER AMENDMENT

Background and Reasons

In connection with the restructuring of the Company into an interval fund, the Board has deemed it advisable and recommended that certain additional amendments to the Charter and governing documents of the Company to ensure the efficient operation of the Company. The Company’s Bylaws, as currently drafted, require that the Company hold an annual meeting of stockholders, despite the provisions of Maryland law excepting investment companies registered under the 1940 Act from the requirement to hold an annual meeting. Upon the restructuring of the Company into an interval fund, the Board intends to adopt amendments to the Company’s bylaws to remove this requirement, allowing the Company to avoid incurring the unnecessary expenses associated with conducting an annual stockholders’ meeting. In connection with this change to the Company’s bylaws, the Board has deemed it advisable to amend the Charter to declassify the Board. This amendment to the Charter is necessary to completely remove the requirement to hold an annual stockholders’ meeting. The effect of this Charter amendment removing the requirement that a class of directors be elected at each annual meeting, combined with the bylaw amendment removing the requirement for holding an annual meeting, will be that the directors will be elected for an indefinite term.

Principal Change

The following discussion summarizes the principal change the Company is asking its stockholders to approve in connection with Proposal 4. This summary description is qualified in its entirety by the complete text of the proposed Articles, a copy of which is attached hereto as Exhibit A to this proxy statement. The Articles attached hereto as Exhibit A reflect the modifications proposed to be made by Proposals 3 (as described above) and 4. If approved by stockholders at the Special Meeting, the amendments reflected in the Articles and described in this proxy statement will be effected by the Company’s filing of the Articles with the State Department of Assessment and Taxation of the State of Maryland (the “SDAT”), and will become effective upon filing and acceptance for record by the SDAT.

Classified Board and Director Terms

In order to completely remove the requirement to hold an annual stockholders’ meeting and thus to avoid incurring the additional expense of conducting an annual meeting, the Charter must be amended to remove the requirement to reelect one class of directors at an annual meeting. If approved by stockholders, the amendment would allow the Company to forego expenses related to the drafting and filing of an annual meeting proxy statement, proxy solicitation and fees related to conducting the annual meeting itself. Stockholders, however, will no longer have the option to vote on director nominees each year.

Summary of Specific Change

Listed below, in summary form, is the specific change that will be made to the current Charter pursuant to Proposal 4 if it is approved by stockholders at the Special Meeting. The below summary does not identify certain immaterial changes to the Charter or changes that are described as part of Proposals 3 and 4. Please see the Charter attached hereto as Exhibit A, which reflects all the proposed changes to the Charter.

|

| | |

| | | Revisions to Section 5.1 to remove the classified board provisions. |

Vote Required

Proposal 4 requires the approval of the majority of our outstanding shares of common stock. You may vote for or against or abstain on Proposal 4. Abstentions and broker non-votes will have the same effect as votes against Proposal 4. Proxies received will be voted “FOR” the approval of Proposal 4 unless stockholders designate otherwise.

Appraisal Rights

Under Maryland law and the Charter, you will not be entitled to rights of appraisal with respect to Proposal 4. Accordingly, to the extent that you object to Proposal 4, you will not have the right to have a court judicially determine (and you will not receive) the fair value for your shares under the provisions of Maryland law governing appraisal rights.

The Board of Directors recommends a vote “FOR” Charter Amendment Proposal 4.

PROPOSAL 5: APPROVAL OF SHAREHOLDER SERVICING PLAN

On August [ ], 2017, the Board voted to approve a shareholder servicing plan in compliance with Rule 12b-1 under the 1940 Act (the “Shareholder Servicing Plan”) for the Company, and to recommend that stockholders of the Company approve the Shareholder Servicing Plan. Under the Shareholder Servicing Plan, Class A Shares, including those shares of common stock currently outstanding that will be reclassified into Class A Shares, will be subject to an ongoing shareholder servicing fee at an annual rate of 0.25% of the Company’s average net assets. This fee will be paid by the Company to compensate the Dealer Manager, for services rendered to certain of the Company’s existing stockholders. Similar services are currently being provided by the Dealer Manager and the expenses related to these services are indirectly borne by the stockholders through reimbursements from the Company to the Dealer Manager. However, because the Company plans to issue multiple classes of common stock upon approval of Proposal 3, the Company may no longer be permitted to make such payments directly, except pursuant to a plan that complies with Rule 12b-1. The adoption of the Shareholder Servicing Plan is necessary for the Company to continue to be able to pay the Dealer Manager for providing such services. The Company expects that the shareholder servicing fee will be offset by the reduction in expenses currently borne indirectly by the Company’s stockholders. In addition, under the expense limitation agreement between the Company and its Adviser, the Company’s total annual operating expenses, after expense reimbursements, are not expected to increase as a result of the new shareholder servicing fee.

Background and Reasons

Subject to stockholder approval of Proposals 1 through 4 of this proxy statement, the Company will be restructured into an interval fund. In connection with the interval fund restructuring and the authorization of multiple share classes pursuant to the Multiclass Relief, the Company will reclassify its outstanding shares of common stock as Class A Shares, which pursuant to the Multiclass Relief, pay an ongoing shareholder servicing fee. In accordance with Rule 12b-1, the Company is seeking stockholder approval for the Shareholder Servicing Plan, pursuant to which the Company will pay the shareholder servicing fee on Class A Shares.

Rule 12b-1 under the 1940 Act only directly applies to open-end funds. However, one of the conditions of the Multiclass Relief is that a closed-end fund relying on such relief must comply with Rule 12b-1 as if the rule applied to closed-end funds. Rule 12b-1 under the 1940 Act prohibits a fund from engaging directly or indirectly in financing any activity which is primarily intended to result in the sale of the Company’s shares unless the Company does so in accordance with the terms and conditions set forth in the Rule. Rule 12b-1 requires any fund bearing distribution expenses to adopt a written plan. The

Shareholder Servicing Plan is being adopted under Rule 12b-1 of the 1940 Act to provide that, in the event that any fees for the services provided by the Dealer Manager or any other servicing organization are later characterized as primarily intended to finance distribution activities, then those fees would be eligible to be paid under the Shareholder Servicing Plan.

A shareholder servicing plan must initially be approved by the board of directors of a fund, including a majority of the directors who are not “interested persons” of the Company and who have no direct or indirect financial interest in the operation of the plan or in any agreement related to the plan. A shareholder servicing plan must also be approved by the affirmative vote of a majority of outstanding voting securities if it is adopted after any public offering of the Company’s voting securities.

In evaluating, approving, and recommending to the Company’s stockholders that they approve the Shareholder Servicing Plan, the Board requested and evaluated information provided by the Adviser and the Dealer Manager which, in the Board’s view, constituted information necessary for the Board to form a judgment as to whether approving the Shareholder Servicing Plan would be in the best interests of the Company’s stockholders. The Board considered all the criteria separately with respect to the Company and the stockholders.

The Directors considered that the current size of the Company was relatively small, and that they could benefit from increased asset levels. In the competitive closed-end fund market, the Company must provide certain compensation to brokers and other parties in order for the Company’s shares to be sold. The Directors noted that higher asset levels could help the Company achieve economies of scale. The Directors also noted that the shareholder servicing fees to be paid by stockholders of the Company would be partially offset by the reduction of expenses currently borne indirectly by the Company. Furthermore, under the expense limitation agreement between the Company and the Adviser, the Company’s total annual operating expenses, after expense reimbursements, are not expected to increase as a result of the new fee under the Shareholder Servicing Plan.

In addition, the Board considered, among other things:

|

| | |

| 1. | | the fact that the Shareholder Servicing Plan would require that the Directors be provided, and that they review, on at least a quarterly basis, a written report describing the amounts expended under the Shareholder Servicing Plan and the purposes for which such expenditures were made; and |

| | | |

| 2. | | the fact that the adoption of the Shareholder Servicing Plan would make expenditures intended to promote distribution of the Company’s shares more transparent to the stockholders. |

After consideration of the factors noted above, together with other factors and information considered to be relevant, while recognizing that there can be no assurance that the expected benefits would be recognized, the Board concluded that there was a reasonable likelihood that the Shareholder Servicing Plan would benefit the Company and the stockholders. Consequently, they approved the Shareholder Servicing Plan and directed that the Plan be submitted to stockholders of the Company for approval.

Summary of the Shareholder Servicing Plan

A copy of the proposed Shareholder Servicing Plan is attached to this proxy statement as Exhibit B. The following description of the Shareholder Servicing Plan is only a summary. You should refer to Exhibit B for the complete Shareholder Servicing Plan.

Pursuant to the Shareholder Servicing Plan, the Company will compensate the Dealer Manager under the Dealer Manager Agreement from assets attributable to the Company’s shares for services described below rendered to holders of the Company’s Class A Shares.

The Shareholder Servicing Plan provides that the Company, may pay annually 0.25% of the average net assets attributable to the Company’s Class A Shares. Under the terms of the Shareholder Servicing Plan and the related Dealer Manager Agreement, the Company is authorized to make payments monthly to the Dealer Manager that may be used to pay or reimburse entities providing shareholder servicing with respect to the Company’s Class A Shares for such entities’ fees or expenses incurred or paid in that regard.

The Shareholder Servicing Plan is of a type known as a “compensation” plan because payments are made for services rendered to the Company with respect to a class of shares regardless of the level of expenditures by the Dealer Manager. The Board will, however, take into account such expenditures for purposes of reviewing operations under the Shareholder Servicing Plan and in connection with their annual consideration of the Shareholder Servicing Plan’s renewal. The Dealer Manager has indicated that it expects its expenditures to include, without limitation: (i) responding to customer inquiries of a general nature regarding the Company; (ii) crediting distributions from the Company’s to customer accounts; (iii) arranging for bank wire transfer of funds to or from a customer's account; (iv) responding to customer inquiries and requests regarding Statements of Additional information, stockholder reports, notices, proxies and proxy statements, and other Company documents; (v) forwarding prospectuses, Statements of Additional Information, tax notices and annual and semi-annual reports to beneficial owners of the Company’s shares; (vi) assisting the Company in establishing and maintaining stockholder accounts and records; (vii) providing sub-accounting for Company share transactions at the stockholder level; (viii) forwarding to customers proxy statements and proxies; (ix) determining amounts to be reinvested in the Company; (x) assisting customers in changing account options, account designations and account addresses, and (xi) providing such other similar services as the Company may reasonably request to the extent the Dealer Manager is permitted to do so under applicable statutes, rules, or regulations.

The Shareholder Servicing Plan provides that any person authorized to direct the disposition of monies paid or payable by the shares of the Company pursuant to the Plan or any related agreement must provide to the Board, and the Board must review, at least quarterly, a written report of the amounts so expended and the purposes for which such expenditures were made.

The Shareholder Servicing Plan and any shareholder servicing related agreement that is entered into by the Company or the Dealer Manager of the shares in connection with the Shareholder Servicing Plan will continue in effect for a period of more than one year only so long as continuance is specifically approved at least annually by vote of a majority of the Company’s Board, and of a majority of the Independent Directors, cast in person at a meeting called for the purpose of voting on the Shareholder Servicing Plan or any shareholder servicing related agreement, as applicable. In addition, the Shareholder Servicing Plan and any shareholder servicing related agreement may be terminated as to a class of common stock at any time, without penalty, by vote of a majority of the outstanding shares of the class of common stock or by vote of a majority of the Independent Directors.

The Company’s Dealer Manager Agreement will remain in effect from year to year provided the Dealer Manager Agreement’s continuance is approved annually by (i) a majority of the Board who are not parties to such agreement or “interested persons” (as defined in the 1940 Act) of the Company and, if applicable, who have no direct or indirect financial interest in the operation of the Shareholder Servicing Plan or any such related agreement and (ii) either by vote of a majority of the Board or a majority of the outstanding voting securities (as defined in the 1940 Act) of the Company.

Required Vote

Approval of the Shareholder Servicing Plan requires the affirmative vote of a majority of the outstanding voting securities of each class of common stock, of which only Class A Shares will be outstanding, assuming the approval of Proposal 2. Under the 1940 Act, a majority of outstanding voting securities is defined as the lesser of (1) 67% of the outstanding shares represented at a meeting at which more than 50% of the outstanding shares are present in person or represented by proxy or (2) more than 50% of the outstanding voting securities. If the Shareholder Servicing Plan is not approved by the stockholders, the Class A Shares would not be subject to the new 0.25% Rule 12b-1 shareholder servicing fee.

The Board of Directors recommends a vote “FOR” Proposal 5.

PROPOSAL 6: ELECTION OF DIRECTORS

Pursuant to the Company’s Bylaws, the Company currently has five directors on its Board. All directors are standing for election at this Special Meeting. If Proposal 3 is approved, each director will serve an indefinite term or until their successors are duly elected and qualified.

A stockholder can vote for or withhold his or her vote from any nominee. In the absence of instructions to the contrary, it is the intention of the persons named as proxies to vote such proxy FOR the election of the nominees named below. If a nominee should decline or be unable to serve as a director, it is intended that the proxy will be voted for the

election of such person as is nominated by the Board as a replacement. The Board has no reason to believe that the persons named below will be unable or unwilling to serve, and such persons have consented to being named in this proxy statement and to serve if elected.

The Board of the Company recommends that you vote FOR the election of the nominees named in this proxy statement.

Information about the Nominees and Continuing Directors

Certain information with respect to the nominees for election at the Special Meeting is set forth below, including their names, ages, a brief description of their recent business experience, including present occupations and employment, certain directorships that each person holds, and the year in which each person became a director of the Company.

The 1940 Act rules require that the Board consist of at least a majority of independent directors. Under the 1940 Act, in order for a director to be deemed independent, he or she, among other things, generally must not: own, control or hold power to vote, 5% or more of the voting securities or be an officer or employee of the Company or of an investment adviser or principal underwriter to the Company; control the Company or an investment adviser or principal underwriter to the Company; be an officer, director or employee of an investment adviser or principal underwriter to the Company; be a member of the immediate family of any of the foregoing persons; knowingly have a direct or indirect beneficial interest in, or be designated as an executor, guardian or trustee of an interest in, any security issued by an investment adviser or principal underwriter to the Company; be a partner or employee of any firm that has acted as legal counsel to the Company or an investment adviser or principal underwriter to the Company during the last two years; or have certain relationships with a broker-dealer or other person that has engaged in agency transactions, principal transactions, lent money or other property to, or distributed shares on behalf of the Company. In order to evaluate the materiality of any such relationship, the Board uses the definition of director independence set forth in the rules promulgated by the NASDAQ Stock Market. NASDAQ Rule 5605(a)(2) provides that a director, shall be considered to be independent if he or she is not an “interested person” of the Company, as defined in Section 2(a)(19) of the 1940 Act. Under NASDAQ rules, in order for a director to be deemed independent, the Board must determine that the individual does not have a relationship that would interfere with the director’s exercise of independent judgment in carrying out his or her responsibilities.

The Board, in connection with the 1940 Act and NASDAQ rules, has considered the independence of members of the Board who are not employed by PEIM, Prospect Administration, PCM, Stratera or any of their affiliates and has concluded that Andrew C. Cooper, William J. Gremp and Eugene S. Stark are not “interested persons” as defined by the 1940 Act and therefore qualify as independent directors under the standards promulgated by the 1940 Act and the NASDAQ rules. In reaching this conclusion, the Board concluded that Messrs. Cooper, Gremp and Stark had no relationships with PEIM, Prospect Administration, PCM, Stratera or any of their affiliates, other than their positions as directors of the Company and, if applicable, investments in us that are on the same terms as those of other stockholders.

|

| | | | | | | | |

Name (Age) Position(s) with the Company (Since) Address(1) | | Term Expires(2) | | Principal

Occupation(s) Held During the Past 5 Years(3) | | Number of Companies in the Fund Complex Overseen by Director(3) | | Other Public Directorships Held by Director During the Past 5 Years |

Interested Directors(4) | | | | | | | | |

M. Grier Eliasek (44) Chairman of the Board, Director, Chief Executive Officer and President (since February 2013) | | 2019 | | President and Chief Executive Officer of Priority Senior Secured Income Management, LLC and PEIM, President and Chief Operating Officer of the Prospect Capital Corporation, Managing Director of PCM and Prospect Administration, Chief Executive Officer and President of Priority Income Fund, Inc. | | Three | | None |

|

| | | | | | | | |

Name (Age) Position(s) with the Company (Since) Address(1) | | Term Expires(2) | | Principal

Occupation(s) Held During the Past 5 Years(3) | | Number of Companies in the Fund Complex Overseen by Director(3) | | Other Public Directorships Held by Director During the Past 5 Years |

Robert S. Aisner (70) Director (since February 2013) | | 2018 | | Executive positions of the following entities: Stratera Holdings, Behringer Harvard Opportunity REIT I, Inc., Lightstone Value Plus Real Estate Investment Trust V, Inc., and Monogram Residential Trust | | Two | | Behringer Harvard Opportunity REIT I, Inc., Lightstone Value Plus Real Estate Investment Trust V, Inc., Monogram Residential Trust, Inc., TIER REIT, Inc. |

| Independent Directors | | | | | | | | |

Andrew C. Cooper (55) Director (since February 2013) | | 2019 | | Mr. Cooper is an entrepreneur, who over the last 15 years has founded, built, run and sold three companies. He is Co-Chief Executive Officer of Unison Energy, LLC, a company that develops, owns and operates, distributed combined heat and power co-generation solutions.

| | Three | | None |

William J. Gremp (74) Director (since February 2013) | | 2018 | | Mr. Gremp is responsible for traditional banking services, credit and lending, private equity and corporate cash management with Merrill Lynch & Co. from 1999 to present. | | Three | | None |

Eugene S. Stark (59) Director (since February 2013) | | 2017 | | Principal Financial Officer, Chief Compliance Officer and Vice President-Administration of General American Investors Company, Inc. from May 2005 to present. | | Three | | None |

_______________________________

| |

| (1) | The business address of each director of the Company is c/o Pathway Energy Infrastructure Fund, Inc., as applicable, 10 East 40th Street, 42nd Floor, New York, New York 10016. |

| |

| (2) | For the Nominees, the term stated assumes election by stockholders at the Special Meeting. |

| |

| (3) | The Fund Complex consists of the Company, Priority Income Fund, Inc., and Prospect Capital Corporation. |

| |

| (4) | Mr. Eliasek is an interested director as defined in the 1940 Act because of his positions with PCM and the Company. Mr. Aisner is an interested director as defined in the 1940 Act because of his position as an officer of Stratera. |

Corporate Governance

Director Independence

The Board of Directors annually determines each director’s independence. The Company does not consider a director independent unless our Board of Directors has determined that he or she has no material relationship with us. The Company monitors the relationships of our directors and officers through a questionnaire each director completes no less frequently than annually and updates periodically as information provided in the most recent questionnaire changes.

In order to evaluate the materiality of any such relationship, the Board of Directors uses the definition of director independence set forth in the rules promulgated by the NASDAQ Stock Market. Rule 5605(a)(2) provides that a director, shall be considered to be independent if he or she is not an “interested person” of us, as defined in Section 2(a)(19) of the 1940 Act.