As filed with the Securities and Exchange Commission on September 21, 2017

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22842

FORUM FUNDS II

Three Canal Plaza, Suite 600

Portland, Maine 04101

Jessica Chase, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end: July 31

Date of reporting period: August 1, 2016 – July 31, 2017

ITEM 1. REPORT TO STOCKHOLDERS.

| ABR DYNAMIC BLEND EQUITY & VOLATILITY FUND |

Annual Report

July 31, 2017

|

ABR DYNAMIC BLEND EQUITY & VOLATILITY FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) JULY 31, 2017 |

|

Dear Shareholder,

ABR Dynamic Funds, LLC is pleased to review the performance of the ABR Dynamic Blend Equity & Volatility Fund (the "Fund") from August 1, 2016 through July 31, 2017. This period is the first full year of performance for the Fund. During this period, the Institutional Shares of the Fund returned 5.99%.

The investment objective of the Fund is to seek investment results that correspond generally to the performance, before the Fund's fees and expenses are deducted, of a benchmark index that measures the investment returns of a dynamic ratio of large-capitalization stocks and the volatility of large-capitalization stocks. The benchmark index is the ABR Dynamic Blend Equity & Volatility Index Powered by Wilshire ("ABRVXX Index" or the "Index").

The Fund pursues its investment objective by following a rules-based strategy that is fully systematic, repeatable, and scalable. Although not guaranteed, we believe that by investing in both securities and derivatives that give exposure to both the S&P 500 Total Return Index and the S&P 500 VIX Short-Term Futures Total Return Index, the Fund will be subject to less risk, over the long term, than the risk associated with investing in either one of the underlying index exposures taken by itself. This may be due to what are, in some cases, contrary risks associated with the relationships between strategies with equity and equity volatility exposures.

Under normal circumstances, the Fund will invest at least 80% of the value of its net assets (plus borrowing for investment purposes) in investments in equity securities and derivative instruments that provide exposure to equity securities, including volatility in the equity markets. For purposes of this policy, the notional value of the Fund's investments in derivative instruments that provide exposure comparable to investments in equity securities, including volatility in the equity markets, may be counted toward satisfaction of the 80% policy. The Fund employs a model-driven investment approach to determine an allocation among equities (via instruments that track the S&P 500® Total Return Index), equity volatility (via instruments that track the S&P 500® VIX Short-Term Futures Total Return Index), and cash (via cash instruments). The Fund's investment model is designed to hold each security in approximately the same proportion as its weighting in the ABRVXX Index. The Fund may also invest in Exchange Traded Products ("ETPs").

The Fund's performance can be largely attributed to the gains seen in equities partially offset by large underperformance of equity volatility over the past year. For instance, the S&P 500 VIX Short-Term Futures Total Return Index returned -72.38%, for the period August 1, 2016 to July 31, 2017. This is one of the Fund's two allocations, and the Fund delivered on its performance target of partial equity participation during a bull market, which enabled the Fund to have a positive return. We believe this is a good example of how the Fund's blend of two allocation strategies may have lowered overall risk.

In conclusion, although it has been a tough year for strategies that allocate capital to long equity volatility, the Fund, using a long-only blend of equity and volatility, was still able to achieve positive returns of 5.99%.

For more detailed information on ABR Dynamic Funds, LLC, visit our website at www.abrfunds.com.

All investing involves risk including the possible loss of principal. The Fund's achievement of its objective is not guaranteed. The Fund's strategies for managing volatility entail their own unique risks and it may not be suitable for some investors due to their financial circumstances and risk tolerance. Futures can be volatile and may cause the Fund's performance to be volatile. The Fund may be non-diversified, and fluctuations in individual holdings will have a greater impact on the Fund's performance. The Fund is not actively managed and so will not otherwise take defensive positions in declining markets unless such positions are reflected in the Fund's benchmark index.

|

ABR DYNAMIC BLEND EQUITY & VOLATILITY FUND PERFORMANCE CHART AND ANALYSIS (Unaudited) JULY 31, 2017 |

|

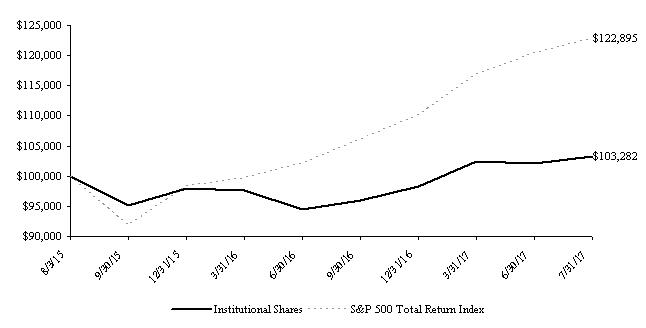

The following chart reflects the change in the value of a hypothetical $100,000 investment in Institutional Shares, including reinvested dividends and distributions, in the ABR Dynamic Blend Equity & Volatility Fund (the "Fund") compared with the performance of the benchmark, the S&P 500 Total Return Index (the "S&P 500"), since inception. The S&P 500 is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. The total return of the S&P 500 includes the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the S&P 500 does not include expenses. The Fund is professionally managed, while the S&P 500 is unmanaged and is not available for investment.

Comparison of Change in Value of a $100,000 Investment

ABR Dynamic Blend Equity & Volatility Fund - Institutional Shares vs. S&P 500 Total Return Index

| Average Annual Total Returns | | | | |

| Periods Ended July 31, 2017 | | One Year | | Since Inception(1) |

| ABR Dynamic Blend Equity & Volatility Fund — Institutional Shares | | 5.99 | % | | 1.63 | % |

| ABR Dynamic Blend Equity & Volatility Fund — Investor Shares | | 5.79 | % | | 1.49 | % |

| S&P 500 Total Return Index | | 16.04 | % | | 10.89 | % |

| | | | | | | |

(1) Institutional Shares commenced operations on August 3, 2015, and Investor Shares commenced operations on August 14, 2015. The return shown for the S&P 500 Total Return Index is as of August 3, 2015.

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance, please call (855) 422-4518. As stated in the Fund's prospectus, the annual operating expense ratio (gross) for Institutional Shares and Investor Shares is 21.80% and 41.71%, respectively. However, the Fund's Adviser has agreed to contractually waive its fees and/or reimburse Fund expenses to limit total annual Fund operating expenses (excluding all taxes, interest, portfolio transaction expenses, proxy expenses and extraordinary expenses) of Institutional Shares and Investor Shares to 2.00% and 2.25%, respectively, through at least November 30, 2017. The Fund may repay the Adviser for fees waived and expenses reimbursed pursuant to the expense cap if such payment is made within three years of the fee waiver or expense reimbursement, is approved by the Fund's Board of Trustees, and the reimbursement does not cause the Fund's net annual operating expenses of that class to exceed the lesser of (i) the current expense cap, or (ii) the expense cap in place at the time the fees were waived. During the period, certain fees were waived and/or expenses reimbursed, otherwise returns would have been lower. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized.

|

ABR DYNAMIC BLEND EQUITY & VOLATILITY FUND SCHEDULE OF INVESTMENTS JULY 31, 2017 |

|

Total Investments - 0.0% (Cost $0)* | | $ | - | |

| Other Assets & Liabilities, Net – 100.0% | | 16,643,189 | |

| Net Assets – 100.0% | | $ | 16,643,189 | |

* Cost for federal income tax purposes is $0.

At July 31, 2017, the Fund held the following exchange traded futures contract:

| Contracts | | Type | | Expiration Date | | Notional Contract Value | | Net Unrealized Appreciation |

| 134 | | | S&P 500 E-mini Future | | 09/19/17 | | $ | 16,467,535 | | | $ | 68,065 | |

The following is a summary of the inputs used to value the Fund's investments as of July 31, 2017.

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in Note 2 of the accompanying Notes to Financial Statements.

| Valuation Inputs | | Other Financial Instruments* |

| Level 1 - Quoted Prices | | $ | 68,065 | |

| Level 2 - Other Significant Observable Inputs | | | - | |

| Level 3 - Significant Unobservable Inputs | | | - | |

| Total | | $ | 68,065 | |

*Other Financial Instruments are derivatives not reflected in the Schedule of Investments, such as futures, which are valued at the unrealized appreciation (depreciation) at year end.

The Level 1 value displayed in this table is a future.

The Fund utilizes the end of period methodology when determining transfers. There were no transfers among Level 1, Level 2 and Level 3 for the year ended July 31, 2017.

| PORTFOLIO HOLDINGS | | |

| % of Net Assets | | |

| Other Assets & Liabilities, Net | 100.0 | % |

| | 100.0 | % |

ITEM 2. CODE OF ETHICS.

| (a) | As of the end of the period covered by this report, Forum Funds II (the "Registrant") has adopted a code of ethics, which applies to its Principal Executive Officer and Principal Financial Officer (the "Code of Ethics"). |

| (c) | There have been no amendments to the Registrant's Code of Ethics during the period covered by this report. |

(d) There have been no waivers to the Registrant's Code of Ethics during the period covered by this report.

(e) Not applicable.

(f) (1) A copy of the Code of Ethics is being filed under Item 12(a) hereto.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

The Board of Trustees has determined that Mr. Mark Moyer is an "audit committee financial expert" as that term is defined under applicable regulatory guidelines. Mr. Moyer is a non- "interested" Trustee (as defined in Section 2(a)(19) under the Investment Company Act of 1940, as amended (the "Act")), and serves as Chairman of the Audit Committee.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

(a) Audit Fees - The aggregate fees billed for each of the last two fiscal years (the "Reporting Periods") for professional services rendered by the Registrant's principal accountant for the audit of the Registrant's annual financial statements, or services that are normally provided by the principal accountant in connection with the statutory and regulatory filings or engagements for the Reporting Periods, were $11,200 in 2016 and $14,000 in 2017.

(b) Audit-Related Fees – The aggregate fees billed in the Reporting Periods for assurance and related services rendered by the principal accountant that were reasonably related to the performance of the audit of the Registrant's financial statements and are not reported under paragraph (a) of this Item 4 were $0 in 2016 and $0 in 2017.

(c) Tax Fees - The aggregate fees billed in the Reporting Periods for professional services rendered by the principal accountant to the Registrant for tax compliance, tax advice and tax planning were $3,000 in 2016 and $3,000 in 2017. These services consisted of review or preparation of U.S. federal, state, local and excise tax returns.

(d) All Other Fees - The aggregate fees billed in the Reporting Periods for products and services provided by the principal accountant to the Registrant, other than the services reported in paragraphs (a) through (c) of this Item, were $0 in 2016 and $0 in 2017.

(e) (1) The Audit Committee reviews and approves in advance all audit and "permissible non-audit services" (as that term is defined by the rules and regulations of the Securities and Exchange Commission) to be rendered to a series of the Registrant (each, a "Series"). In addition, the Audit Committee reviews and approves in advance all "permissible non-audit services" to be provided to an investment adviser (not including any sub-adviser) of a Series, or an affiliate of such investment adviser, that is controlling, controlled by or under common control with the investment adviser and provides on-going services to the Registrant ("Affiliate"), by the Series' principal accountant if the engagement relates directly to the operations and financial reporting of the Series. The Audit Committee considers whether fees paid by a Series' investment adviser or an Affiliate to the Series' principal accountant for audit and permissible non-audit services are consistent with the principal accountant's independence.

(e) (2) No services included in (b) - (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Not applicable

(g) The aggregate non-audit fees billed by the principal accountant for services rendered to the Registrant for the Reporting Periods were $0 in 2016 and $0 in 2017. There were no fees billed in either of the Reporting Periods for non-audit services rendered by the principal accountant to the Registrant's investment adviser or any Affiliate.

(h) During the Reporting Period, the Registrant's principal accountant provided no non-audit services to the investment advisers or any entity controlling, controlled by or under common control with the investment advisers to the series of the Registrant to which this report relates.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable

ITEM 6. INVESTMENTS.

| (a) | Included as part of report to shareholders under Item 1. |

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END

MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 9. PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS.

Not applicable.

ITEM 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

The Registrant does not accept nominees to the board of trustees from shareholders.

ITEM 11. CONTROLS AND PROCEDURES

(a) The Registrant's Principal Executive Officer and Principal Financial Officer have concluded that the Registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Act are effective, based on their evaluation of the controls and procedures required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934, as of a date within 90 days of the filing date of this report.

(b) There were no changes in the Registrant's internal control over financial reporting (as defined in

Rule 30a-3(d) under the Act) that occurred during the second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the Registrant's internal control over financial reporting.

ITEM 12. EXHIBITS.

(a)(1) Code of Ethics (Exhibit filed herewith).

(a)(2) Certifications pursuant to Rule 30a-2(a) of the Act, and Section 302 of the Sarbanes-Oxley Act of 2002. (Exhibits filed herewith)

(a)(3) Not applicable.

(b) Certifications pursuant to Rule 30a-2(b) of the Act, and Section 906 of the Sarbanes-Oxley Act of 2002. (Exhibit filed herewith)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Registrant Forum Funds II

| By: | /s/ Jessica Chase | |

| | Jessica Chase, Principal Executive Officer | |

| | | |

| Date: | September 20, 2017 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

| By: | /s/ Jessica Chase | |

| | Jessica Chase, Principal Executive Officer | |

| | | |

| Date: | September 20, 2017 | |

| By: | /s/ Karen Shaw | |

| | Karen Shaw, Principal Financial Officer | |

| | | |

| Date: | September 20, 2017 | |