Under the Amended and Restated By-Laws of the Company, the presence in person or by proxy of the holders of a majority of the total outstanding shares of common stock of the Company entitled to vote shall be necessary and sufficient to constitute a quorum for the transaction of business at the Special Meeting. In the event that a quorum is not present at the Special Meeting, or in the event that a quorum is present but sufficient votes to approve any of the proposals are not received, the Chair of the Special Meeting may adjourn the Special Meeting without notice other than announcement at the Special Meeting.

The Company has outstanding one class of capital stock, consisting of common stock, par value $0.001 per share. Pursuant to the Company’s Amended and Restated Certificate of Incorporation, the Board is authorized to provide for the issuance from time to time of up to 40,000,000 shares of common stock, par value $0.001 per share, and 10,000,000 shares of preferred stock, par value $0.001 per share, consisting of one or more series. The Company currently has no shares of preferred stock outstanding. Each share of common stock of the Company is entitled to one vote at the Special Meeting with respect to each matter to be voted on, with pro rata voting rights for any fractional shares. Each share of common stock of the Company entitles the holder to cast one vote for as many individuals as there are directors to be elected and for whose election the shares of common stock of the Company are entitled to be voted. No shares of common stock of the Company have cumulative voting rights. On the Record Date, there were 6,559,010 shares of common stock of the Company issued and outstanding.

ADDITIONAL INFORMATION

Investment Adviser, Administrator, and Custodian

The Company’s investment adviser is StoneCastle Asset Management LLC, an indirect subsidiary of SCP. The principal executive office of the Current Adviser is 152 West 57th Street, 35th Floor, New York, NY 10019. The Current Adviser is a Delaware limited liability company and is an investment adviser registered under the 1940 Act. Upon the closing of the Transaction, SCP will transfer the assets of the Current Adviser and the StoneCastle Investment Platform to StoneCastle-ArrowMark, as the successor to the Current Adviser, and StoneCastle-ArrowMark will serve as the Company’s investment adviser.

The Bank of New York Mellon, located at 4400 Computer Drive, Westborough, MA 01581, serves as administrator to the Company.

The Bank of New York Mellon, located at 2 Hanson Place, Brooklyn, NY 11217, serves as custodian to the Company.

Information About Attending the Special Meeting

Attendance at the Special Meeting is limited to Stockholders (or their authorized representatives) as of the Record Date. All attendees should pre-register and obtain an admission ticket. Pre-registration is intended to facilitate entry through security at the Special Meeting. Valid, government-issued photographic identification is required to enter the meeting. Cameras, audio and video recorders and similar electronic recording devices will not be allowed in the meeting room. The use of cellular phones, smartphones, tablets, pagers and laptops during the Special Meeting is prohibited, and such devices must be turned off.

If you would like to attend the Special Meeting, please follow the instructions below to pre-register by emailing ir@stonecastle-financial.com or calling StoneCastle Financial Investor Relations at 347-887-0324.

Pre-Registration Instructions. If you are a registered Stockholder (your shares are held in your name), you may pre-register and obtain an admission ticket by contacting us and providing your name as it appears on your stock ownership records and your mailing address. If a family member is attending with you, please indicate that when you pre-register.

If you are a beneficial owner (your shares are held through a broker or bank) you may pre-register and obtain an admission ticket by contacting us and providing your name and mailing address, and evidence of your stock ownership as of the Record Date. A copy of your brokerage or bank statement will suffice as evidence of ownership, or you can obtain a letter from your broker or bank. If a family member is attending with you, please indicate that when you pre-register.

If you are a Stockholder as of the Record Date and intend to appoint an authorized representative to attend the meeting on your behalf, you may pre-register and obtain an admission ticket by submitting a request to us and providing: your name and mailing address, the name and mailing address of your authorized representative, evidence of stock ownership as of the Record Date, and a signed authorization appointing such individual to be your authorized representative at the meeting.

To pre-register for the meeting and obtain an admission ticket, you can write to us at StoneCastle Financial Corp., Attn. Investor Relations, 152 West 57th Street, 35th Floor, New York, NY 10019, email us at IR@stonecastle-financial.com, or call us at (347) 887-0324.

Other Matters to Come Before the Special Meeting

In addition to Proposal 1 and Proposal 2, you may be asked to consider and vote upon proposals to adjourn the Special Meeting or any adjournments or postponements thereof with respect to proposals for which insufficient votes to approve were cast, and, with respect to such proposals, to permit further solicitation of additional proxies by the Company. No other business will be presented at the Special Meeting.

33

Voting Results

The Company expects to announce the preliminary voting results at the Special Meeting and publish the final voting results in a Form 8-K filed with the SEC within four business days after the date of the Special Meeting.

Notice to Banks, Broker/Dealers and Voting Trustees and their Nominees

Please advise the Company whether other persons are the beneficial owners of shares for which proxies are being solicited from you, and, if so, the number of copies of this Proxy Statement and other soliciting material you wish to receive in order to supply copies to the beneficial owners of shares.

This Proxy Statement has been prepared for Stockholders of the Company. The Company will mail one Proxy Statement to each Stockholder address upon request. If you would like to obtain an additional paper copy of the Proxy Statement, please contact Julie Muraco at (347) 887-0324 or write to StoneCastle Financial Corp. at 152 West 57th Street, 35th Floor, New York, NY 10019, Attn: Investor Relations.

Delivery of Proxy Materials

Please note that only one Proxy Statement or proxy card may be delivered to two or more Stockholders of the Company who share an address, unless the Company has received instructions to the contrary. To request a separate copy of these documents, for instructions on how to request a separate copy of these documents or for instructions on how to request a single copy if multiple copies of these documents are received, Stockholders should contact the Company at 1 (347) 887-0324 or write to StoneCastle Financial Corp. at 152 West 57th Street, 35th Floor, New York, NY 10019, Attn: Investor Relations.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the 1934 Act and Section 30(h) of the 1940 Act require the Company’s directors and executive officers, certain persons affiliated with the Company and persons who beneficially own more than 10% of a registered class of the Company’s securities to file reports of ownership and changes of ownership with the SEC, Nasdaq and the Company. Directors, officers and greater-than-10% Stockholders are required by SEC regulations to furnish the Company with copies of such forms they file. To the Company’s knowledge, based solely on review of the copies of such reports furnished to the Company during the fiscal year ended December 31, 2018, all Section 16(a) filing requirements applicable to the such reporting persons were complied with.

Security Ownership of Certain Beneficial Owners

To the knowledge of the Company and the Board, no Stockholder, or “group” as that term is defined in Section 13(d) of the 1934 Act, was the beneficial owner of more than 5% of a class of Company common stock as of the Record Date, except that, based on Schedule 13G filings through the date of this proxy statement, the following information with respect to beneficial ownership of more than 5% of the outstanding voting shares has been reported:

| | | | | | |

Title of Class | | Name and Address | | Percentage Ownership

of Fund | | Total Number of

Shares |

Shares of

Beneficial Interest | | Punch & Associates Investment

Management, Inc.

7701 France Avenue South, Suite 300

Edina, MN 55435 | | | | 6.321 | % | | | | | 413,786 | |

The following table sets forth the dollar range of equity securities in the Company beneficially owned by each director and executive officer as of the Record Date. As of that date, the Company’s

34

directors and executive officers, as a group, owned approximately 1.2% of the outstanding shares of common stock of the Company:

| | | | |

Name of Directors and Executive Officers | | Dollar Range of Equity Securities

Held in the Company(1) | | Aggregate Dollar Range

of Equity Securities in All Funds

Overseen or to be Overseen

by Director in the Company |

Independent Directors | | | | |

Alan Ginsberg | | None | | None |

Emil W. Henry, Jr. | | Over $100,000 | | Over $100,000 |

Clara Miller | | $10,000 - $50,000 | | $10,000 - $50,000 |

Interested Directors | | | | |

Joshua S. Siegel(2) | | Over $100,000 | | Over $100,000 |

George Shilowitz(2) | | Over $100,000 | | Over $100,000 |

Executive Officers | | | | |

Joshua S. Siegel(2) | | Over $100,000 | | Over $100,000 |

George Shilowitz(2) | | Over $100,000 | | Over $100,000 |

Patrick J. Farrell | | $10,000 - $50,000 | | $10,000 - $50,000 |

Rachel Schatten | | None | | None |

|

| | (1) | | This information has been furnished by each director and executive officer. |

|

| | (2) | | Includes shares of the Company held by SCP, of which Messrs. Siegel and Shilowitz are partners. |

None of the Independent Directors or their family had any interest in the Current Adviser or any person directly or indirectly controlling, controlled by or under common control with the Current Adviser as of December 31, 2019.

Submission of Stockholder Proposals for the 2020 Annual Meeting of Stockholders of the Company

All proposals by Stockholders of the Company that are intended to be presented at the 2020 Annual Meeting of Stockholders of the Company must be received by the Company for consideration for inclusion in the Company’s proxy statement relating to the meeting no later than 5:00 p.m., Eastern Time, on December 31, 2019 and must satisfy the requirements of the federal securities laws, including Rule 14a-8 under the 1934 Act.

Stockholders who do not wish to submit a proposal for inclusion in the Company’s proxy statement and form of proxy for the 2020 Annual Meeting of Stockholders of the Company in accordance with Rule 14a-8 under the 1934 Act may submit a proposal for consideration at the 2020 Annual Meeting of Stockholders of the Company in accordance with the Company’s Amended and Restated By-Laws, which currently require Stockholders wishing to nominate directors or propose other business to be brought before the 2020 Annual Meeting of Stockholders of the Company to provide timely notice of the proposal in writing to the Secretary of the Company and, in the case of such other business, such other business must otherwise be a proper matter for action by the Stockholders. To be considered timely, any such notice must be delivered to the principal executive offices of StoneCastle Financial Corp. at 152 West 57th Street, 35th Floor, New York, NY 10019 not earlier than February 4, 2020, nor later than 5:00 p.m., Eastern Time, on March 6, 2020. If such proposals are not “timely,” then proxies solicited by the Board for the 2020 Annual Meeting of Stockholders of the Company may confer discretionary authority to such proxies to vote on such proposals at their discretion. Any such notice by a Stockholder must set forth all information required by the Company’s Amended and Restated By-Laws with respect to each nominee or other matter the Stockholder proposes to bring before the 2020 Annual Meeting of Stockholders of the Company.

Where You Can Find More Information

Stockholders may obtain a copy of this Proxy Statement, the Company’s Annual Report for the fiscal year ended December 31, 2018, including Audited Financial Statements for the fiscal year ended December 31, 2018, which was previously mailed to the Company’s Stockholders, and/or the Company’s Semi-Annual Report for the period ended June 30, 2019, without charge, on the SEC’s

35

website, www.sec.gov. In addition, this Proxy Statement is available at www.stonecastle-financial.com, and the Company’s latest Annual Reports and Semi-Annual Reports are available on the Company’s website, www.stonecastle-financial.com. References to these websites do not incorporate the content of these websites into this Proxy Statement. This Proxy Statement, the Company’s Annual Report for the fiscal year ended December 31, 2018 and the Company’s Semi-Annual Report for the period ended June 30, 2019 are also available upon request, without charge, by calling Investor Relations at 347-887-0324. Stockholders who wish to send communications to the Board should send them to the Secretary of the Company at 152 West 57th Street, 35th Floor, New York, NY 10019. All such communications will be directed to the Board’s attention.

IT IS IMPORTANT THAT YOUR PROXY CARD BE COMPLETED PROMPTLY. EVEN IF YOU EXPECT TO PARTICIPATE IN THE SPECIAL MEETING, YOU ARE REQUESTED TO COMPLETE, SIGN, DATE AND RETURN THE PROXY CARD AS SOON AS POSSIBLE.

36

| | |

| | PROXY CARD |

| | SIGN, DATE ANDVOTE ON THE REVERSE SIDE |

YOUR VOTE IS IMPORTANT NO MATTER HOW MANY SHARES YOU OWN. PLEASE CAST YOUR PROXY VOTETODAY! | |

|

|

PLEASE CAST YOUR PROXY VOTETODAY! |

StoneCastle Financial Corp.

PROXY FOR THE SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON February 7, 2020

The undersigned stockholder hereby appoints Joshua S. Siegel and Rachel Schatten, with power of substitution, as proxy and attorney in-fact and hereby authorizes him to represent and vote, as provided on the other side, all shares of the StoneCastle Financial Corp. common stock that the undersigned is entitled to vote as of the record date and, in his discretion, upon such other business as may properly come before the Special Meeting of Stockholders of the Company to be held at NASDAQ Market Site, 4 Times Square, New York, NY 10036, on February 7, 2020 at 2:00 p.m. Eastern Time, or at any adjournment or postponement thereof, with all powers that the undersigned would possess if present at the meeting.

The undersigned hereby revokes any proxy heretofore given with respect to such meeting. When shares are held by joint tenants or tenants in common, the signature of one shall bind all unless the Secretary of the Company is given written notice to the contrary and furnished with a copy of the instrument of order that so provides. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by an authorized officer. If a partnership, please sign in partnership name by an authorized person.

This proxy is solicited on behalf of the Company’s Board of Directors, and the Proposals (set forth on the reverse side of this proxy card) have been unanimously approved by the Board of Directors and recommended for approval by stockholders.

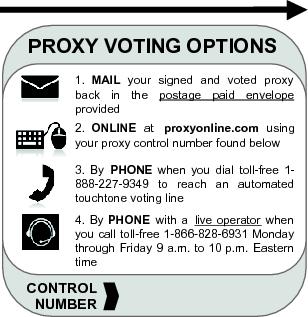

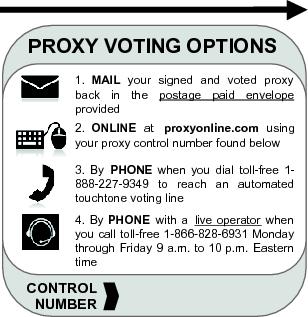

Do you have questions?If you have any questions about how to vote your proxy or about the meeting in general, please call toll-free1-866-828-6931.Representatives are available to assist you Monday through Friday 9 a.m. to 10 p.m. Eastern Time.IMPORTANCE NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THIS SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON FEBRUARY 7, 2020. THE PROXY STATEMENT IS AVAILABLE AT: www.proxyonline.com/docs/stonecastlefinancialcorp2020.pdf

| | | | |

[PROXY ID NUMBER HERE] | | [BAR CODE HERE] | | [CUSIP HERE] |

| | | | |

StoneCastle Financial Corp. | | PROXY CARD |

YOUR SIGNATURE IS REQUIRED FOR YOUR VOTE TO BE COUNTED. The signer(s) acknowledges receipt with this Proxy Statement of the Board of Directors. Your signature(s) on this should be exactly as your name(s) appear on this Proxy (reverse side). If the shares are held jointly, each holder should sign this Proxy. Attorneys-in-fact, executors, administrators, trustees or guardians should indicate the full title and capacity in which they are signing. | | | | |

| | | | |

| |

| | SIGNATURE (AND TITLE IF APPLICABLE) | | DATE |

| |

| | SIGNATURE (IF HELD JOINTLY) | | DATE |

The votes entitled to be cast by the stockholder will be cast as directed by the stockholder.If this proxy is executed but no direction is given, the votes entitled to be cast by the stockholder will be cast “FOR” the proposals.The votes entitled to be cast by the stockholder will be cast in the discretion of the proxy holder on any other matter that may properly come before the meeting or any adjournment or postponement thereof.

THE BOARD OF DIRECTORS AND MANAGEMENT RECOMMEND YOU VOTE “FOR” ON THE PROPOSALS.

TO VOTE, MARK CIRCLES BELOW IN BLUE OR BLACK INK AS FOLLOWS. Example:˜

| | | | | | | | |

PROPOSAL(S): | | FOR | | AGAINST | | ABSTAIN |

1. | | To approve a new management agreement (the “New Investment Advisory Agreement”) between the Company and the current adviser’s successor company, StoneCastle-ArrowMark Asset Management, LLC (the “StoneCastle-ArrowMark”) (Proposal 1); and | | ™ | | ™ | | ™ |

2. | | To elect eight directors, (A) Alan Ginsberg, Emil W. Henry, Jr. and Karen Reidy to serve as Class I Directors until the 2020 Annual Meeting of the Company, Michael Van Praag and Michael Stolper to serve as Class II Directors until the 2021 Annual Meeting of the Company, and (C) Guy Arnold, John Scott Emrich and Sanjai Bhonsle to serve as Class III Directors until the 2022 Annual Meeting of the Company, and in each case until his or her successor is duly elected and qualifies (Proposal 2). | | FOR | | AGAINST | | ABSTAIN |

| | 2a. Alan Ginsberg | | ™ | | ™ | | ™ |

| | 2b. Emil W. Henry Jr. | | ™ | | ™ | | ™ |

| | 2c. Karen Reidy | | ™ | | ™ | | ™ |

| | 2d. Michael Van Praag | | ™ | | ™ | | ™ |

| | 2e. Michael Stolper | | ™ | | ™ | | ™ |

| | 2f. Guy Arnold | | ™ | | ™ | | ™ |

| | 2g. John Scott Emrich | | ™ | | ™ | | ™ |

| | 2h. Sanjai Bhonsle | | ™ | | ™ | | ™ |

THANK YOU FOR VOTING

| | | | |

[PROXY ID NUMBER HERE] | | [BAR CODE HERE] | | [CUSIP HERE] |

Appendix A

Form of New Investment Advisory Agreement

MANAGEMENT AGREEMENT

BETWEEN

STONECASTLE FINANCIAL CORP.

AND STONECASTLE-ARROWMARK ASSET MANAGEMENT, LLC

THIS MANAGEMENT AGREEMENT (the “Agreement”), dated [•] (the “Effective Date”), is entered into between StoneCastle Financial Corp., a Delaware corporation (the “Company”) and StoneCastle-ArrowMark Asset Management, LLC, a Delaware limited liability company (the “Advisor”).

WHEREAS, the Company is Delaware corporation registered as a non-diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the “Investment Company Act”); and

WHEREAS, the Advisor is an investment advisor that has registered under the Investment Advisers Act of 1940, as amended (the “Advisers Act”); and

WHEREAS, each of the board of directors of the Company (the “Board”), including a majority of directors that are not “interested persons” of the parties hereto, and the stockholders of the Company have approved the entry by the Company into this Agreement in the manner required under the Investment Company Act; and

WHEREAS, the Company desires to retain the Advisor to furnish investment advisory and administrative services to the Company on the terms and conditions hereinafter set forth, and the Advisor desires to be retained to provide such services;

NOW THEREFORE, in consideration of the mutual covenants herein contained and other good and valuable consideration, the receipt of which is hereby acknowledged, the parties agree as follows:

1. Appointment of Advisor.

The Company appoints the Advisor to act as the investment advisor of and to provide certain administrative services to the Company for the period and on the terms herein set forth. The Advisor accepts such appointment and agrees to render the investment advisory and administrative services herein set forth, for the compensation herein provided.

2. Investment Duties of the Advisor.

The Company hereby employs the Advisor to act as the investment advisor to the Company and to manage the investment and reinvestment of the assets of the Company, subject to the supervision of the Board, for the period and upon the terms herein set forth, (a) in accordance with the investment objective, policies and restrictions of the Company that were initially set forth in the Company’s registration statement on Form N-2 first filed with the Securities and Exchange Commission on June 14, 2013 (the “Registration Statement”), as it has been amended from time to time in the Company’s annual reports on Form N-CSR and subsequent registration statements filed by the Company on Form N-2, as the same may be amended from time to time, (b) in accordance with the Investment Company Act, the Advisers Act and all other applicable federal and state laws, and (c) in accordance with the Company’s Amended and Restated Certificate of Incorporation and Bylaws as the same may be amended from time to time. Consistent with the foregoing, the Advisor will regularly provide the Company with investment research, advice and supervision and will furnish continuously an investment program for the Company, consistent with the investment objective and policies of the Company. The Advisor will determine from time to time what securities shall be purchased for the Company, what securities shall be held or sold by the Company and what portion of the Company’s assets shall be held as cash or in other liquid assets. Subject to the supervision of the Board, the Advisor shall have the power and authority on behalf of the Company to effectuate

its investment decisions for the Company, including the execution and delivery of all documents relating to the Company’s investments and the placing of orders for other securities purchase or sale transactions on behalf of the Company. In the event that the Company determines to acquire debt financing, the Advisor will arrange for such financing on the Company’s behalf, subject to the approval of the Board. If the Company determines it is necessary or appropriate for the advisor to make investments on behalf of the Company through a special purpose vehicle, the Advisor shall have the authority to create or arrange for the creation of such special purpose vehicle and to make such investments through such special purpose vehicle in accordance with the Investment Company Act. Without limiting the generality of the foregoing, the Advisor shall, during the term and subject to the provisions of this Agreement, (i) determine the composition of the portfolio of the Company, the nature and timing of the changes therein and the manner of implementing such changes; (ii) identify, evaluate and negotiate the structure of the investments made by the Company; (iii) perform due diligence on prospective portfolio companies; (iv) close and monitor the Company’s investments; and (v) provide the Company with such other investment advisory, research and related services as the Company may, from time to time, reasonably require for the investment of its assets.

3. Administrative Duties of the Advisor.

Subject to the overall supervision and review of the Board, the Advisor will perform (or oversee or arrange for the performance of) the administrative services necessary for the operation of the Company. Without limiting the generality of the foregoing, the Advisor will furnish or arrange for the furnishing of office facilities and clerical and administrative services necessary to the operation of the Company (other than services provided by the Company’s custodian, accounting agent, administrator, dividend and interest paying agent and other service providers). The Advisor will also, on behalf of the Company, arrange for the services of, and oversee, custodians, depositaries, transfer agents, dividend disbursing agents, underwriters, brokers, dealers, placement agents, banks, insurers, accountants, attorneys, pricing agents, and other persons as it may deem necessary or desirable. The Advisor shall, on behalf of the Company (a) oversee the performance of, and payment of the fees to, the Company’s service providers, and make such reports and recommendations to the Board concerning such matters as the parties deem desirable; (b) respond to inquiries and otherwise assist such service providers in the preparation and filing of regulatory reports, proxy statements, shareholder communications and the preparation of Board materials and reports; (c) establish and oversee the implementation of borrowing facilities or other forms of leverage authorized by the Board; and (d) supervise any other aspect of the Company’s administration as may be agreed upon by the Board on behalf of the Company and the Advisor.

4. Delegation of Responsibilities.

Subject to the requirements of the Investment Company Act, the Advisor is hereby authorized, but not required, to enter into one or more sub-advisory agreements with other investment advisors (each, a “Sub-Advisor”) pursuant to which the Advisor may obtain the services of the Sub-Advisor(s) to assist the Advisor in fulfilling its responsibilities hereunder. Specifically, the Advisor may retain a Sub-Advisor to recommend specific securities or other investments based upon the Company’s investment objective and policies, and work, along with the Advisor, in structuring, negotiating, arranging or effecting the acquisition or disposition of such investments and monitoring investments on behalf of the Company, subject in all cases to the oversight of the Advisor and the Company. The Advisor, and not the Company, shall be responsible for any compensation payable to any Sub-Advisor. Any sub-advisory agreement entered into by the Advisor shall be in accordance with the requirements of the Investment Company Act, the Advisers Act and other applicable federal and state laws.

5. Independent Contractors.

The Advisor and any Sub-Advisors shall for all purposes herein be deemed to be independent contractors and shall, except as expressly provided or authorized, have no authority to act for or represent the Company in any way or otherwise be deemed to be an agent of the Company.

A-2

6. Compliance with Applicable Requirements.

In carrying out its obligations under this Agreement, the Advisor shall at all times comply with:

|

| | a. | | all applicable provisions of the Investment Company Act, the Advisers Act, the Securities Exchange Act of 1934, as amended, and the Securities Act of 1933, as amended, and any applicable rules and regulations adopted thereunder; |

|

| | b. | | the provisions of the Registration Statement of the Company, as the same has been amended from time to time in the Company’s annual reports on Form N-CSR and in subsequent registration statements filed by the Company on Form N-2, including without limitation, the investment objectives set forth therein; |

|

| | c. | | the provisions of the Company’s Amended and Restated Certificate of Incorporation and its By-Laws as the same may be amended from time to time; |

|

| | d. | | all policies, procedures and directives adopted by the Board; and |

|

| | e. | | any other applicable provisions of state, federal or foreign law, or rules promulgated by any applicable self-regulating organization or exchange. |

7. Policies and Procedures.

The Advisor shall provide the Company, at such times as the Company shall reasonably request, with a copy of all policies and procedures adopted by the Advisor as may reasonably be required to comply with Rule 38a-1 under the Investment Company Act, if applicable, and a copy of the Advisor’s report to the Company in sufficient scope and detail to comply with the Advisor’s obligations under Rule 38a-1 under the Investment Company Act.

8. Brokerage.

The Advisor is responsible for decisions to buy and sell securities for the Company, broker-dealer selection, and negotiation of brokerage commission rates. The Advisor’s primary consideration in effecting a security transaction (including purchases and sales) will be to obtain best execution. In selecting a broker-dealer to execute a particular transaction, the Advisor will take the following into consideration: the best net price available; the reliability, integrity and financial condition of the broker-dealer; the size of and the difficulty in executing the order; and the value of the expected contribution of the broker-dealer to the investment performance of the Company on a continuing basis. Accordingly, the price to the Company in any transaction may be less favorable than that available from another broker-dealer if the difference is reasonably justified by other aspects of the execution services offered.

Subject to such policies as the Board may from time to time determine, the Advisor shall not be deemed to have acted unlawfully, or to have breached any duty created by this Agreement or otherwise, solely by reason of its having caused the Company to pay a broker or dealer that provides brokerage and research services to the Advisor an amount of commission for effecting a Company investment transaction in excess of the amount of commission another broker or dealer would have charged for effecting that transaction, if the Advisor determines in good faith that such amount of commission was reasonable in relation to the value of the brokerage and research services provided by such broker or dealer, viewed in terms of either that particular transaction or the Advisor’s overall responsibilities with respect to the Company and to other clients of the Advisor as to which the Advisor exercises investment discretion. The Advisor is further authorized to allocate the orders placed by it on behalf of the Company to such brokers and dealers who also provide research or statistical material or other services to the Company, the Advisor or to any sub-advisor. Such allocation shall be in such amounts and proportions as the Advisor shall determine and the Advisor will report on said allocations regularly to the Board indicating the brokers to whom such allocations have been made and the basis therefor.

A-3

9. Books and Records.

Subject to review by and the overall control of the Board, the Advisor shall keep and preserve for the period required by the Investment Company Act and the Advisers Act any books and records relevant to the provision of its investment advisory services to the Company and shall specifically maintain all books and records with respect to the Company’s portfolio transactions and shall render to the Board such periodic and special reports as the Board may reasonably request. The Advisor agrees that all records that it maintains for the Company are the property of the Company and shall surrender promptly to the Company any such records upon the Company’s request, provided that the Advisor may retain a copy of such records.

10. Compensation.

|

| | a. | | For the services, payments and facilities to be furnished hereunder by the Advisor, the Advisor shall receive from the Company the following compensation: |

|

| | i. | | Management Fee. The Advisor shall receive a management fee (the “Management Fee”) calculated quarterly and paid quarterly in arrears, based on Managed Assets at the end of each calendar quarter, within fifteen (15) days of the end of each calendar quarter. Subject to Section 16, the Management Fee will be prorated for any partial calendar quarter and, if more than one rate applies during a calendar quarter, the Management Fee will be adjusted on a pro rata basis based on the number of calendar days and/or category of assets for which each rate applies. The Management Fee shall equal 0.4375% per quarter (1.75% annualized) of the Company’s Managed Assets. |

|

| | ii. | | Incentive Fee. The Advisor shall not receive any incentive compensation from the Company. |

|

| | b. | | For purposes of this Agreement, “Managed Assets” means the total assets of the Company (including any assets purchased with or attributable to any borrowed funds and cash and cash equivalents except where otherwise expressly provided herein), which shall be computed in accordance with any applicable policies and determinations of the Board. |

|

| | c. | | The Advisor may, from time to time, waive or defer all or any part of the compensation described in this Section 10. The parties do hereby expressly authorize and instruct the Company’s officers or any third-party administrator to calculate the fee payable hereunder and to remit all payments specified herein to the Advisor. |

11. Expenses of the Advisor.

The compensation paid by the Advisor to its investment professionals and the allocable routine overhead expenses of the Advisor and its affiliates, when and to the extent engaged in providing the investment advisory services described in Section 2 hereof, will be provided and paid for by the Advisor and its affiliates and not by the Company. It is understood that the Company will pay all expenses other than those expressly stated to be payable by the Advisor hereunder, which expenses payable by the Company shall include, without limitation, the following (collectively, “Operating Expenses”):

|

| | a. | | other than as set forth in the first sentence of this Section 11, expenses of maintaining the existence of the Company and related overhead, including, to the extent such services are provided by personnel of the Advisor or its affiliates, an allocable portion of the overhead and other expenses incurred by the Advisor in performing its administrative obligations under this Agreement, including without limitation furnishing office space and facilities and administrative and compliance personnel compensation, training and benefits, provided that the reimbursement of any expenses incurred by the Advisor or its affiliates pursuant to this clause (a) that would exceed 0.05% of Managed Assets shall be subject to the approval by a majority of the members of the Board who are not “interested persons” of the Company as defined in Section 2(a)(19) of the Investment Company Act (“Independent Directors”), or in lieu thereof a committee of the Board comprised solely of Independent Directors; |

A-4

|

| | b. | | the fees, expenses and disbursements of any third party administrator or compliance firm retained by the Company or the Advisor to provide any of the administrative services referenced in clause (a) above, to the extent not provided by personnel of the Advisor or its affiliates; |

|

| | c. | | commissions, spreads, fees and other expenses connected with the acquisition, holding, monitoring and disposition of securities and the Company’s other investments, including placement and similar fees in connection with direct placements entered into by or on behalf of the Company or any subsidiary thereof, and travel or other expenses incurred in connection with performing due diligence on its prospective portfolio companies or monitoring and overseeing its existing portfolio companies, provided that the reimbursement of any travel expenses incurred by the Advisor or its affiliates pursuant to this clause (c) shall be subject to the approval by a majority of the Independent Directors, or in lieu thereof a committee of the Board comprised solely of Independent Directors; |

|

| | d. | | auditing, accounting and legal expenses; |

|

| | e. | | taxes and interest; |

|

| | f. | | governmental fees; |

|

| | g. | | expenses of listing shares of the Company with a stock exchange, and expenses of issue, sale, repurchase and redemption (if any) of interests in the Company, including expenses of conducting tender offers for the purpose of repurchasing Company securities; |

|

| | h. | | expenses of registering and qualifying the Company and its securities under federal and state securities laws and of preparing and filing registration statements and amendments for such purposes; |

|

| | i. | | expenses of communicating with shareholders, including website expenses and the expenses of preparing, printing, and mailing press releases, reports and other notices to shareholders and of meetings of shareholders and proxy solicitations therefor; |

|

| | j. | | expenses of preparing and filing reports with governmental officers and commissions, including but not limited to those incurred in connection with compliance by the Company with its reporting obligations under the Investment Company Act and other federal securities laws; |

|

| | k. | | insurance expenses; |

|

| | l. | | association membership dues; |

|

| | m. | | fees, expenses and disbursements of custodians and subcustodians for all services to the Company (including without limitation safekeeping of funds, securities and other investments, keeping of books, accounts and records, and determination of net asset values); |

|

| | n. | | fees, expenses and disbursements of transfer agents, dividend and interest paying agents, stockholder servicing agents and registrars for all services to the Company; |

|

| | o. | | fees, expenses and disbursements, including travel expenses, incurred in connection with the marketing and promotion of the Company, including the fees, expenses and disbursements of any person with whom the Company (or the Advisor on behalf of the Company) enters into an endorsement relationship, provided that the reimbursement of any expenses incurred by the Advisor or its affiliates pursuant to this clause (o) shall be subject to the approval by a majority of the Independent Directors, or in lieu thereof a committee of the Board comprised solely of Independent Directors; |

|

| | p. | | compensation and expenses of the Company’s Independent Directors; |

|

| | q. | | pricing, valuation, and other consulting, due diligence or analytical services employed in considering and valuing the actual or prospective investments of the Company; |

|

| | r. | | all expenses incurred in leveraging of the Company’s assets through a line of credit or other indebtedness or issuing and maintaining preferred shares; |

A-5

|

| | s. | | all expenses incurred in connection with the organization of the Company and any offering of common or preferred shares, including underwriting discounts and commissions; and |

|

| | t. | | such non-recurring items as may arise, including expenses incurred in litigation, proceedings and claims and the obligation of the Company to indemnify its directors, officers and shareholders with respect thereto. |

12. Covenants of the Advisor.

The Advisor represents and warrants to the Company that it is, and covenants to the Company that it shall remain during the term of this Agreement, registered as an investment advisor under the Advisers Act. The Advisor agrees that its activities will at all times be in compliance in all material respects with all applicable federal and state laws governing its operations and investments.

13. Non-Exclusivity.

The Company understands that the services of the Advisor to the Company are not exclusive and the persons employed by the Advisor to assist in the performance of the Advisor’s duties under this Agreement may not devote their full time to such services. Nothing contained in this Agreement shall be deemed to limit or restrict the right of the Advisor or any affiliate of the Advisor to engage in and devote time and attention to other businesses or to render services of whatever kind or nature. Furthermore, the Advisor may furnish the same or similar investment advisory or administrative services described herein to one or more clients other than the Company, including businesses that may directly or indirectly compete with the Company. It is possible that the Advisor may allocate investment opportunities to such other clients, which may reduce the Company’s access to such investment opportunities. The Advisor shall allocate investment opportunities between the Company and such other clients in a fair and equitable manner in accordance with its internal allocation policies and procedures (the “Allocation Policy”). The Allocation Policy and all amendments thereto will be subject to Board approval.

The Company further understands and agrees that managers and employees of the Advisor and its affiliates may serve as officers or directors of the Company, and that officers or directors of the Company may serve as managers of the Advisor to the extent permitted by law; and that the managers of the Advisor are not prohibited from engaging in any other business activity or from rendering services to any other person, or from serving as partners, officers or directors of any other firm or company, including other investment advisory companies. Notwithstanding the foregoing, the Advisor acknowledges and agrees that its investment professionals shall devote that amount of their respective business time as is reasonably necessary to manage the affairs and activities of the Advisor as they relate to the performance of the Advisor’s duties and obligations to the Company under this Agreement. If any person who is a manager, partner, officer or employee of the Advisor is or becomes a director, officer and/or employee of the Company and acts as such in any business of the Company, then such manager, partner, officer or employee of the Advisor shall be deemed to be acting in such capacity solely for the Company and not as a manager, partner, officer or employee of the Advisor or under the control or direction of the Advisor, even if paid by the Advisor.

Subject to any restrictions prescribed by law, by the provisions of the Code of Ethics of the Company and the Advisor and by the Advisor’s Allocation Policy, the Advisor and its members, officers, employees and agents shall be free from time to time to acquire, possess, manage and dispose of securities or other investment assets for their own accounts, for the accounts of their family members, for the account of any entity in which they have a beneficial interest or for the accounts of others for whom they may provide investment advisory, brokerage or other services (collectively, “Managed Accounts”), in transactions that may or may not correspond with transactions effected or positions held by the Company or to give advice and take action with respect to Managed Accounts that differs from advice given to, or action taken on behalf of, the Company. The Advisor is not, and shall not be, obligated to initiate the purchase or sale for the Company of any security that the Advisor and its members, officers, employees or agents may purchase or sell for its or their own accounts or for the account of any other client if, in the opinion

A-6

of the Advisor, such transaction or investment appears unsuitable or undesirable for the Company. Moreover, it is understood that when the Advisor determines that it would be appropriate for the Company and one or more Managed Accounts to participate in the same investment opportunity, the Advisor shall seek to execute orders for the Company and for such Managed Account(s) on a basis that the Advisor considers to be fair and equitable over time. In such situations, the Advisor may (but is not required to) place orders for the Company and each Managed Account simultaneously or on an aggregated basis. If all such orders are not filled at the same price, the Advisor may cause the Company and each Managed Account to pay or receive the average of the prices at which the orders were filled for the Company and all relevant Managed Accounts on each applicable day. If all such orders cannot be fully executed under prevailing market conditions, the Advisor may allocate the investment opportunities among participating accounts in a manner that the Advisor considers equitable, taking into account, among other things, the size of each account, the size of the order placed for each account and any other factors that the Advisor deems relevant.

14. Consent of the Use of Name.

The Company has obtained the consent of StoneCastle Partners, LLC to the royalty free use by the Company of the name “StoneCastle” as part of the Company’s name and the royalty free use of the related “StoneCastle” logo. The Company acknowledges that the name “StoneCastle” and the related “StoneCastle” logo or any variation thereof may be used from time to time in other connections and for other purposes by the Advisor and its affiliates and other investment companies that have obtained consent to the use of the name “StoneCastle”. The Company shall cease using the name “StoneCastle” as part of the Company’s name, shall change its legal name so as to not contain the word “StoneCastle” or any variant thereof (and, if required, shall use best efforts to obtain consent of the stockholders of the Company with respect to the foregoing), and shall cease using the related “StoneCastle” logo if the Company ceases, for any reason, to employ the Advisor or one of its approved affiliates as the Company’s investment advisor. Future names adopted by the Company for itself, insofar as such names include any trademark of the Advisor or any mark with the potential for confusion with the Advisor may only be used by the Company with the approval of the Advisor. The provisions of this Section 14 shall survive the termination of this Agreement.

15. Closing Date, Term and Approval.

This Agreement shall become effective as of the date first written above. This Agreement shall continue in force and effect for two years from the date of this Agreement, and thereafter shall be automatically renewed for successive one year terms so long as such renewal is specifically approved by (a) the Board or the vote of a majority of the Company’s voting securities, in each case as determined in accordance with the Investment Company Act, and (b) the vote of a majority of the Company’s Independent Directors, in each case in accordance with the requirements of the Investment Company Act.

16. Effectiveness, Duration and Termination of Agreement.

This Agreement may be terminated at any time, without the payment of any penalty, upon not less than 60 days’ written notice, by the vote of a majority of the outstanding voting securities of the Company, or by the vote of the Company’s Board or by the Advisor. This Agreement shall automatically terminate in the event of its “assignment” (as such term is defined for purposes of Section 15(a)(4) of the Investment Company Act). The provisions of Section 18 of this Agreement shall remain in full force and effect, and the Advisor shall remain entitled to the benefits thereof, notwithstanding any termination of this Agreement. Further, notwithstanding the termination of this Agreement as aforesaid, the Advisor shall be entitled to any amounts owed under Section 10 through the date of termination and Sections 16, 18 and 21 shall continue in force and effect and apply to the Advisor and its representatives as and to the extent applicable.

A-7

17. Amendment.

This Agreement may be amended by mutual consent, but the consent of the Company must be obtained in conformity with the requirements of the Investment Company Act.

18. Limitation of Liability of the Advisor; Indemnification.

The Advisor (and its officers, managers, partners, agents, employees, controlling persons, members and any other person or entity affiliated with the Advisor, including without limitation its general partner) shall not be liable to the Company for any action taken or omitted to be taken by the Advisor in connection with the performance of any of its duties or obligations under this Agreement or otherwise as an investment advisor of the Company, except to the extent specified in Section 36(b) of the Investment Company Act concerning loss resulting from a breach of fiduciary duty (as the same is finally determined by judicial proceedings) with respect to the receipt of compensation for services, and the Company shall indemnify, defend and protect the Advisor (and its officers, managers, partners, agents, employees, controlling persons, members and any other person or entity affiliated with the Advisor) (collectively, the “Indemnified Parties”) and hold them harmless from and against all third party damages, liabilities, costs and expenses (including reasonable attorneys’ fees and amounts reasonably paid in settlement) incurred by the Indemnified Parties in or by reason of any pending, threatened or completed action, suit, investigation or other proceeding (including an action or suit by or in the right of the Company or its security holders) arising out of or otherwise based upon the performance of any of the Advisor’s duties or obligations under this Agreement or otherwise as an investment advisor of the Company. Notwithstanding the preceding sentence of this Paragraph 18 to the contrary, nothing contained herein shall protect or be deemed to protect the Indemnified Parties against or entitle or be deemed to entitle the Indemnified Parties to indemnification in respect of, any liability to the Company or its security holders to which the Indemnified Parties would otherwise be subject by reason of willful misfeasance, bad faith or gross negligence in the performance of the Advisor’s duties or by reason of the reckless disregard of the Advisor’s duties and obligations under this Agreement (as the same shall be determined in accordance with the Investment Company Act, the Advisers Act and any interpretations or guidance by the Securities and Exchange Commission or its staff thereunder).

19. Proxy Voting.

The Advisor shall be responsible for voting any proxies solicited by an issuer of securities held by the Company in the best interest of the Company and in accordance with the Advisor’s proxy voting policies and procedures, as any such proxy voting policies and procedures may be amended from time to time. The Advisor’s proxy voting policies and procedures, and any amendment thereto will be subject to Board approval. The Company has been provided with a copy of the Advisor’s proxy voting policies and procedures and has been informed as to how it can obtain further information from the Advisor regarding proxy voting activities undertaken on behalf of the Company. In accordance with its provisions of administrative services to the Company hereunder, the Advisor shall be responsible for reporting the Company’s proxy voting activities, as required, through periodic filings on Form N-PX.

20. Notices.

Any notices under this Agreement shall be in writing, addressed and delivered, telecopied or mailed postage paid, to the other party entitled to receipt thereof at such address as such party may designate for the receipt of such notice. Until further notice to the other party, it is agreed that the address of the Company and that of the Advisor shall be 100 Fillmore Street, Suite 325, Denver, CO 80206.

21. Questions of Interpretation.

This Agreement contains the entire agreement of the parties and supersedes all prior agreements, understandings and arrangements with respect to the subject matter hereof. If the

A-8

application of any provision(s) of this Agreement to any particular circumstances shall be held to be invalid or unenforceable by any court of competent jurisdiction, then the validity and enforceability of other provisions of this Agreement shall not in any way be affected or impaired thereby. The division of this Agreement into sections, clauses and other subdivisions and the insertion of headings are for convenience of reference only and shall not affect or be utilized in construing or interpreting this Agreement. Any question of interpretation of any term or provision of this Agreement having a counterpart in or otherwise derived from a term or provision of the Investment Company Act or the Advisers Act shall be resolved by reference to such term or provision of the Investment Company Act or the Advisers Act, as applicable, and to interpretations thereof, if any, by the United States courts or in the absence of any controlling decision of any such court, by rules, regulations or orders of the Commission issued pursuant to said Acts. In addition, where the effect of a requirement of the Investment Company Act or the Advisers Act reflected in any provision of this Agreement is revised by rule, regulation or order of the Commission, such provision shall be deemed to incorporate the effect of such rule, regulation or order. Subject to the foregoing, this Agreement shall be governed by and construed in accordance with the laws of the State of New York applicable to contracts formed and to be performed entirely within the State of New York, without regard to the conflicts of law provisions thereof, to the extent such provisions would require or permit the application of the laws of another jurisdiction. In furtherance of the intent and purpose of the foregoing, to the extent any applicable provision of New York law conflicts with any applicable provision of the Investment Company Act or the Advisers Act, the latter shall control.

22. Counterparts.

This Agreement may be executed in one or more counterparts with the same effect as if the parties executing the several counterparts had all executed one counterpart.

A-9

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed in duplicate by their respective duly authorized officers on the day and year first written above.

| | | |

STONECASTLE FINANCIAL CORP. |

By: | | |

Name: | | [•] |

Title: | | [•] |

STONECASTLE-ARROWMARK ASSET MANAGEMENT, LLC |

By: | | |

Name: | | [•] |

Title: | | [•] |

[Signature Page to Management Agreement]

Appendix B

Marked Copy of Current Investment Advisory Agreement

Exhibit 99.g.1

MANAGEMENT AGREEMENT

BETWEEN

STONECASTLE FINANCIAL CORP.

AND STONECASTLESTONECASTLE-ARROWMARK ASSET MANAGEMENT, LLC

THIS MANAGEMENT AGREEMENT (the “Agreement”), dated November 1, 2013[•] (the “Effective Date”), is entered into between StoneCastle Financial Corp., a Delaware corporation (the “Company”) and StoneCastleStoneCastle-ArrowMarkAsset Management, LLC, a Delaware limited liability company (the “Advisor”).

WHEREAS, the Company is a newly organizedDelaware corporation registered as a non-diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the “Investment Company Act”).; and

|

WHEREAS, the Advisor is a newly organizedan investment advisor that has registered under the Investment Advisers Act of 1940, as amended (the “Advisers Act”);and |

WHEREAS,each of the board of directors of the Company (the “Board”), including a majority of directors that are not “interested persons” of the parties hereto, and the stockholders of the Company have approved the entry by the Company into this Agreement in the manner required under the Investment Company Act; and |

WHEREAS, the Company desires to retain the Advisor to furnish investment advisory and administrative services to the Company on the terms and conditions hereinafter set forth, and the Advisor desires to be retained to provide such services; and

NOW THEREFORE, in consideration of the mutual covenants herein contained and other good and valuable consideration, the receipt of which is hereby acknowledged, the parties agree as follows:

1. 1. Appointment of Advisor.

The Company appoints the Advisor to act as the investment advisor of and to provide certain administrative services to the Company for the period and on the terms herein set forth. The Advisor accepts such appointment and agrees to render the investment advisory and administrative services herein set forth, for the compensation herein provided.

2. 2. Investment Duties of the Advisor.

The Company hereby employs the Advisor to act as the investment advisor to the Company and to manage the investment and reinvestment of the assets of the Company, subject to the supervision of the Board, for the period and upon the terms herein set forth, (a) in accordance with the investment objective, policies and restrictions of the Company that arewereinitially set forth in the Company’s registration statement on Form N-2 first filed with the Securities and Exchange Commission on June 14, 2013 (the “Registration Statement”), as may beit has beenamended forfromtime to time in the Company’s annual reportreportson Form N-CSR/Aand subsequent registration statements filed by the Company on Form N-2, as the same may be amended from time to time, (b) in accordance with the Investment Company Act, the Advisers Act and all other applicable federal and state laws,and (c) in accordance with the Company’s certificate of incorporation and bylawsAmended and Restated Certificate of Incorporation and Bylawsas the same may be amended from time to time. Consistent with the foregoing, the Advisor will regularly provide the Company with investment research, advice and supervision and will furnish continuously an investment program for the Company, consistent with the investment objective and policies of the Company. The Advisor will determine from time to time what securities shall be purchased for the

Company, what securities shall be held or sold by the Company and what portion of the Company’s assets shall be held as cash or in other liquid assets. Subject to the supervision of the Board, the Advisor shall have the power and authority on behalf of the Company to effectuate its investment decisions for the Company, including the execution and delivery of all documents relating to the Company’s investments and the placing of orders for other securities purchase or sale transactions on behalf of the Company. In the event that the Company determines to acquire debt financing, the Advisor will arrange for such financing on the Company’s behalf, subject to the approval of the Board. If the Company determines it is necessary or appropriate for the advisor to make investments on behalf of the Company through a special purpose vehicle, the Advisor shall have the authority to create or arrange for the creation of such special purpose vehicle and to make such investments through such special purpose vehicle in accordance with the Investment Company Act. Without limiting the generality of the foregoing, the Advisor shall, during the term and subject to the provisions of this Agreement, (i) determine the composition of the portfolio of the Company, the nature and timing of the changes therein and the manner of implementing such changes; (ii) identify, evaluate and negotiate the structure of the investments made by the Company; (iii) perform due diligence on prospective portfolio companies; (iv) close and monitor the Company’s investments; and (v) provide the Company with such other investment advisory, research and related services as the Company may, from time to time, reasonably require for the investment of its assets.

3. 3. Administrative Duties of the Advisor.

Subject to the overall supervision and review of the Board, the Advisor will perform (or oversee or arrange for the performance of) the administrative services necessary for the operation of the Company. Without limiting the generality of the foregoing, the Advisor will furnishor arrange for the furnishing ofoffice facilities and clerical and administrative services necessary to the operation of the Company (other than services provided by the Company’s custodian, accounting agent, administrator, dividend and interest paying agent and other service providers). The Advisor will also, on behalf of the Company, arrange for the services of, and oversee, custodians, depositaries, transfer agents, dividend disbursing agents, underwriters, brokers, dealers, placement agents, banks, insurers, accountants, attorneys, pricing agents, and other persons as it may deem necessary or desirable. The Advisor shall, on behalf of the Company (a) oversee the performance of, and payment of the fees to, the Company’s service providers, and make such reports and recommendations to the Board concerning such matters as the parties deem desirable; (b) respond to inquiries and otherwise assist such service providers in the preparation and filing of regulatory reports, proxy statements, shareholder communications and the preparation of Board materials and reports; (c) establish and oversee the implementation of borrowing facilities or other forms of leverage authorized by the Board; and (d) supervise any other aspect of the Company’s administration as may be agreed upon by the Board on behalf of the Company and the Advisor.

4. 4. Delegation of Responsibilities.

Subject to the requirements of the Investment Company Act, the Advisor is hereby authorized, but not required, to enter into one or more sub-advisory agreements with other investment advisors (each, a “Sub-Advisor”) pursuant to which the Advisor may obtain the services of the Sub-Advisor(s) to assist the Advisor in fulfilling its responsibilities hereunder. Specifically, the Advisor may retain a Sub-Advisor to recommend specific securities or other investments based upon the Company’s investment objective and policies, and work, along with the Advisor, in structuring, negotiating, arranging or effecting the acquisition or disposition of such investments and monitoring investments on behalf of the Company, subject in all cases to the oversight of the Advisor and the Company. The Advisor, and not the Company, shall be responsible for any compensation payable to any Sub-Advisor. Any sub-advisory agreement entered into by the Advisor shall be in accordance with the requirements of the Investment Company Act, the Advisers Act and other applicable federal and state laws.

B-2

5. 5. Independent Contractors.

The Advisor and any Sub-Advisors shall for all purposes herein be deemed to be independent contractors and shall, except as expressly provided or authorized, have no authority to act for or represent the Company in any way or otherwise be deemed to be an agent of the Company.

6. 6. Compliance with Applicable Requirements.

In carrying out its obligations under this Agreement, the Advisor shall at all times comply with:

| | |

a. | | a. all applicable provisions of the Investment Company Act, the Advisers Act, the Securities Exchange Act of 1934, as amended, and the Securities Act of 1933, as amended, and any applicable rules and regulations adopted thereunder;

|

b. | | b. the provisions of the Registration Statement of the Company, as the same may behas beenamended from time to time in the Company’s annual reportreportson Form N-C5R/AN-CSR and in subsequent registration statements filed by the Companyon Form N-2, including without limitation, the investment objectives set forth therein;

|

c. | | c. the provisions of the Company’s Amended and Restated Certificate of Incorporation and its By-Lawsas the same may be amended from time to time;

|

d. | | d. all policies, procedures and directives adopted by the Board; and

|

e. | | e. any other applicable provisions of state, federal or foreign law, or rules promulgated by any applicable self-regulating organization or exchange.

|

7. 7. Policies and Procedures.

The Advisor shall provide the Company, at such times as the Company shall reasonably request, with a copy of all policies and procedures adopted by the Advisor as may reasonably be required to comply with Rule 38a-1 under the Investment Company Act, if applicable, and a copy of the Advisor’s report to the Company in sufficient scope and detail to comply with the Advisor’s obligations under Rule 38a-1 under the Investment Company Act.

8. 8. Brokerage.

The Advisor is responsible for decisions to buy and sell securities for the Company, broker-dealer selection, and negotiation of brokerage commission rates. The Advisor’s primary consideration in effecting a security transaction (including purchases and sales) will be to obtain best execution. In selecting a broker-dealer to execute a particular transaction, the Advisor will take the following into consideration: the best net price available; the reliability, integrity and financial condition of the broker-dealer; the size of and the difficulty in executing the order; and the value of the expected contribution of the broker-dealer to the investment performance of the Company on a continuing basis. Accordingly, the price to the Company in any transaction may be less favorable than that available from another broker-dealer if the difference is reasonably justified by other aspects of the execution services offered.

Subject to such policies as the Board may from time to time determine, the Advisor shall not be deemed to have acted unlawfully, or to have breached any duty created by this Agreement or otherwise, solely by reason of its having caused the Company to pay a broker or dealer that provides brokerage and research services to the Advisor an amount of commission for effecting a Company investment transaction in excess of the amount of commission another broker or dealer would have charged for effecting that transaction, if the Advisor determines in good faith that such amount of commission was reasonable in relation to the value of the brokerage and research services provided by such broker or dealer, viewed in terms of either that particular transaction or the Advisor’s overall responsibilities with respect to the Company and to other clients of the Advisor as to which the Advisor exercises investment discretion. The Advisor is further authorized to allocate the orders placed by it on behalf of the Company to such brokers and dealers who also provide research or statistical material or other services to the Company, the Advisor or to any sub-

B-3

advisor. Such allocation shall be in such amounts and proportions as the Advisor shall determine and the Advisor will report on said allocations regularly to the Board indicating the brokers to whom such allocations have been made and the basis therefor.

9. 9. Books and Records.

Subject to review by and the overall control of the Board, the Advisor shall keep and preserve for the period required by the Investment Company Act and the Advisers Act any books and records relevant to the provision of its investment advisory services to the Company and shall specifically maintain all books and records with respect to the Company’s portfolio transactions and shall render to the Board such periodic and special reports as the Board may reasonably request. The Advisor agrees that all records that it maintains for the Company are the property of the Company and shall surrender promptly to the Company any such records upon the Company’s request, provided that the Advisor may retain a copy of such records.

10. 10. Compensation.

| | |

a. | | a. For the services, payments and facilities to be furnished hereunder by the Advisor, the Advisor shall receive from the Company the following compensation:

|

| | |

i.

| | Management Fee. The Advisor shall receive a management fee (the “Management Fee”) calculated quarterly and paid quarterly in arrears, based on Managed Assets at the end of eachcalendarquarter, within fifteen (15) days of the end of each calendar quarter. Subject to Section 16, the Management Fee will be prorated for any partial calendar quarter and, if more than one rate applies during acalendarquarter, the Management Fee will be adjusted on a pro rata basis based on the number of calendar days and/or category of assets for which each rate applies. The Management Fee shall be calculated as follows: |

| | A) Base Management Fees.

|

i. | | (I) The Management Fee shall equal 0.4375% per quarter (1.75% annualized) of the Company’s Managed Assets, except as provided by(II) and (III) below.

|

| | |

(II)

| | Until the date on which the Company is Fully Invested, the Management Fee with respect to that portion of the Company’s Managed Assets that are held in cash and cash equivalents shall equal 0.0625% per quarter (0.25% annualized).

|

(III)

| | During the period from the Closing Date through the first anniversary of the Closing Date, subject to clause (II) above, the Management Fee shall equal 0.375% per quarter (1.5% annualized) of the Company’s Managed Assets.

|

| | |

ii. | | ii. Incentive Fee. The Advisor shall not receive any incentive compensation from the Company.

|

| | |

b. | | b. For purposes of this Agreement: (i),“Managed Assets” means the total assets of the Company (including any assets purchased with or attributable to any borrowed funds and cash and cash equivalents except where otherwise expressly provided herein), which shall be computed in accordance with any applicable policies and determinations of the Board; (ii) “Closing Date” means the date of the closing of the initial public offering of the Company’s common stock, par value $0,001 per share (“Common Stock”); and (iii) “Fully Invested” means that the Company has invested at least 85% of the net proceeds received by the Company from the sale of the Common Stock on the Closing Date (net of the Company’s organizational and offering expenses and Operating Expenses, including Management Fees, paid by the Company)..

|

| | |

B-4

| | |

c. | | c. The Advisor may, from time to time, waive or defer all or any part of the compensation described in this Section 10. The parties do hereby expressly authorize and instruct the Company’s officers or any third-party administrator to calculate the fee payable hereunder and to remit all payments specified herein to the Advisor.

|

11. 11. Expenses of the Advisor.

The compensation paid by the Advisor to its investment professionals and the allocable routine overhead expenses of the Advisor and its affiliates, when and to the extent notengaged in providing the investment advisory services described in Section 2 hereof, will be provided and paid for by the Advisor and its affiliates and not by the Company. It is understood that the Company will pay all expenses other than those expressly stated to be payable by the Advisor hereunder, which expenses payable by the Company shall include, without limitation,the following (collectively, “Operating Expenses”):

| | |

a. | | a. other than as set forth in the first sentence of this Section 11, expenses of maintaining the existence of the Company and related overhead, including, to the extent such services are provided by personnel of the Advisor or its affiliates, an allocable portion of the overhead and other expenses incurred by the Advisor in performing itsadministrativeobligations under this Agreement, including without limitationfurnishing office space and facilities and administrative and compliancepersonnel compensation, training and benefits, provided thatthe reimbursement ofany expenses set forth inincurred by the Advisor or its affiliates pursuant tothis clause (a) in excess ofthat would exceed0.05% of Managed Assets shall be approvedsubject to the approval by a majority of the members of the Board who are not “interested persons” of the Company as defined inSection 2(a)(19) ofthe Investment Company Act (“Independent Directors”),orin lieu thereofa committee of the Board comprised solely of Independent Directors;

|

b. | | the fees, expenses and disbursements of any third party administrator or compliance firm retained by the Companyor the Advisor to provide any of theadministrative services referenced in clause (a) above, to the extent not provided bypersonnel of the Advisoror its affiliates; |

c. | | b. commissions, spreads, fees and other expenses connected with the acquisition, holding, monitoring and disposition of securities and the Company’s other investments, including placement and similar fees in connection with direct placements entered into by or on behalf of the Company or any subsidiary thereof, andtravel or other expenses incurred in connection withperforming due diligence on its prospective portfolio companies;or monitoring and overseeing its existing portfolio companies, provided that the reimbursement of any travel expenses incurred by the Advisor or its affiliates pursuant to thisclause (c) shall be subject to the approval by a majority of the Independent Directors, or in lieu thereof a committee of the Board comprised solely of Independent Directors;

|

d. | | c. auditing, accounting and legal expenses;

|

e. | | d. taxes and interest;

|

f. | | e. governmental fees;

|

g.

| | f. expenses of listing shares of the Company with a stock exchange, and expenses of issue, sale, repurchase and redemption (if any) of interests in the Company, including expenses of conducting tender offers for the purpose of repurchasing Company securities;

|

h. | | g. expenses of registering and qualifying the Company and its securities under federal and state securities laws and of preparing and filing registration statements and amendments for such purposes;

|

i. | | h. expenses of communicating with shareholders, including website expenses and the expenses of preparing, printing, and mailing press releases, reports and other notices to shareholders and of meetings of shareholders and proxy solicitations therefor;

|

B-5

| | |

j. | | i. expenses ofpreparing and filingreports towithgovernmental officers and commissions, including but not limited to those incurred in connection with compliance by the Company with its reporting obligations under the Investment Company Act and otherfederal securities laws;

|

k. | | j. insurance expenses;

|

l. | | k. association membership dues;

|

m. | | l. fees, expenses and disbursements of custodians and subcustodians for all services to the Company (including without limitation safekeeping of funds, securities and other investments, keeping of books, accounts and records, and determination of net asset values);

|

n. | | m. fees, expenses and disbursements of transfer agents, dividend and interest paying agents, stockholder servicing agents and registrars for all services to the Company;

|

o. | | fees, expenses and disbursements, including travel expenses, incurred in connection with the marketing and promotion of the Company, including the fees, expenses and disbursements ofany person with whom the Company (or the Advisor on behalf of the Company) enters into an endorsement relationship, provided that the reimbursement of any expenses incurred by the Advisor or its affiliates pursuant to this clause (o) shall be subject to the approval by a majority of the Independent Directors, or in lieu thereof a committee of the Board comprised solely of Independent Directors; |

n.

| | fees, expenses and disbursements ofCAB Marketing, LLC and CAB, L.L.C. and any other person with whom the Company (or the Advisor on behalf of the Company) enters into an endorsement relationship;

|

p. | | o. compensation and expenses of directors who are not members of the Advisor’s organizationthe Company’s Independent Directors;

|

q. | | p. pricing, valuation, and other consulting, due diligenceor analytical services employed in considering and valuing the actual or prospective investments of the Company;

|

r. | | q. all expenses incurred in leveraging of the Company’s assets through a line of credit or other indebtedness or issuing and maintaining preferred shares;

|

s. | | r. all expenses incurred in connection with the organization of the Company and any offering of common or preferred shares, including underwriting discounts and commissions; and

|

t. | | s. such non-recurring items as may arise, including expenses incurred in litigation, proceedings and claims and the obligation of the Company to indemnify its directors, officers and shareholders with respect thereto.

|

12. 12. Covenants of the Advisor.

The Advisor represents and warrants to the Company that it is, and covenants to the Company that it shall remain during the term of this Agreement, registered as an investment advisor under the Advisers Act. The Advisor agrees that its activities will at all times be in compliance in all material respects with all applicable federal and state laws governing its operations and investments.

13. 13. Non-Exclusivity.

The Company understands that the services of the Advisor to the Company are not exclusive and the persons employed by the Advisor to assist in the performance of the Advisor’s duties under this Agreement may not devote their full time to such services. Nothing contained in this Agreement shall be deemed to limit or restrict the right of the Advisor or any affiliate of the Advisor to engage in and devote time and attention to other businesses or to render services of whatever kind or nature. Furthermore, the Advisor may furnish the same or similar investment advisory or administrative services described herein to one or more clients other than the Company, including businesses that may directly or indirectly compete with the Company. It is possible that the Advisor may allocate investment opportunities to such other clients, which may reduce the Company’s access

B-6