UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-22882

BMO LGM Frontier Markets Equity Fund

(Exact name of registrant as specified in charter)

111 East Kilbourn Avenue, Suite 200

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

John M. Blaser

BMO Asset Management Corp.

111 East Kilbourn Avenue, Suite 200

Milwaukee, WI 53202

(Name and address of agent for service)

Copies to:

Michael P. O’Hare, Esq.

Stradley, Ronon, Stevens & Young, LLP

2005 Market Street, Suite 2600

Philadelphia, PA 19103

Registrant’s telephone number, including area code: (800) 236-3863

Date of fiscal year end: August 31

Date of reporting period: August 31, 2016

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR 270.30e-1).

Annual report

LGM Frontier Markets Equity Fund

Table of Contents

| | | | |

Not FDIC Insured | | No Bank Guarantee | | May Lose Value |

| | |

| Annual Report — Commentary | | BMO LGM Frontier Markets Equity Fund |

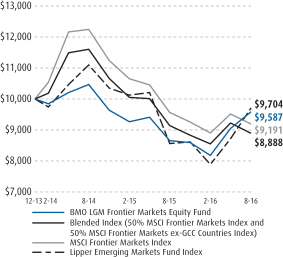

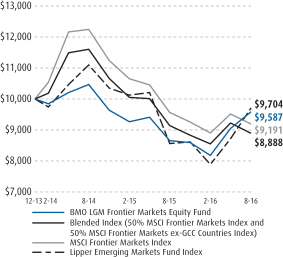

The BMO LGM Frontier Markets Equity Fund—Investor Class (the Fund) returned 10.89% for the fiscal year ended August 31, 2016 versus the Blended Index, the Morgan Stanley Capital International (MSCI) Frontier Markets Index and the Lipper Emerging Markets Fund Index, which returned -2.75%, -3.84%, and 13.36%, respectively. The Fund’s primary benchmark is a blended index comprised of 50% MSCI Frontier Markets Index and 50% MSCI Frontier Markets ex-Gulf Cooperation Council (GCC) Countries Index.

Frontier markets have noticeably underperformed emerging markets over the last 12 months which in itself is not surprising given their significant outperformance over the preceding 3 years. However, the absolute performance of the asset class has been hampered this year by the significant globally led drawdown in January and also the large depreciation of some frontier market currencies. In this environment it has been very pleasing to see the Fund has delivered a strong absolute return and outperformed the benchmark by close to 14%.

Vietnam Dairy Products JSC (10.2% of the Fund, 96.4%) remains the Fund’s largest investment and was also the largest contributor to the Fund’s strong performance over the year. The company benefited from the lower raw material prices which filtered through to strong margin improvement. The government’s decision to allow Vietnamese companies to increase their foreign ownership limits also helped performance. Although removed for the company towards the end of the year, it has historically been one of the reasons such a high quality company traded on low valuations.

During the year we saw a number of frontier market currencies continue to come under pressure, particularly in Nigeria. The much needed, and anticipated, devaluation of the Naira had a large impact on the performance of frontier markets. The Fund’s Nigerian holdings were amongst the largest detractors from absolute performance; however, the impact of the devaluation was limited by the Fund’s relatively low investment in the country. The majority of the Fund’s investment in Nigeria is in Guaranty Trust Bank PLC (3.2% of the Fund, -13.8%), which with a significant long dollar position was well positioned for such an event.

As bottom up investors, it is pleasing to see throughout the last 12 months that despite the top down volatility our companies are still moving in the right direction. This trend has been best evidenced by the strong results that we have seen and only continues to increase our confidence in the companies we hold and their ability to generate strong long-term returns for our investors. Valuations also remain attractive and the frontier markets asset class are trading amongst their largest valuation discount to emerging markets since 2009.

| | | | | | | | |

Average annual total returns (%) | |

| | | 1-year | | | Since

inception | |

| Investor Class | | | 10.89 | | | | (1.55 | ) |

| Blended Index (50% MSCI Frontier Markets Index and 50% MSCI Frontier Markets ex-GCC Countries Index) | | | (2.75 | ) | | | (4.26 | ) |

| MSCI Frontier Markets Index | | | (3.84 | ) | | | (3.07 | ) |

| Lipper Emerging Market Funds Index | | | 13.36 | | | | (1.10 | ) |

The performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor's shares, when redeemend, may be worth more or less than their original costs. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. To receive current performance to the most recent month-end, please call 1-800-236-3863 or visit www.bmofunds.com.

The Fund's benchmark is a blended benchmark consisting of 50% Morgan Stanley Capital International (MSCI) Frontier Markets Index and 50% MSCI Frontier Markets ex Gulf Cooperation Council (GCC) Countries Index. The MSCI Frontier Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of frontier markets. This index consists of the following 24 frontier market country indices: Argentina, Bahrain, Bangladesh, Bulgaria, Croatia, Estonia, Jordan, Kenya, Kuwait, Lebanon, Lithuania, Morocco, Kazakhstan, Mauritius, Nigeria, Oman, Pakistan, Romania, Serbia, Slovenia, Sri Lanka, Tunisia, Ukraine and Vietnam. The MSCI GCC Countries Index aims to represent the universe of companies in 6 GCC equity markets: Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and United Arab Emirates.

Lipper indices measure the performance of the 30 largest mutual funds in each respective fund category.

Investment Adviser:

BMO Asset Management Corp.

Sub-adviser:

LGM Investment Limited

Fund Managers; Investment Experience

Thomas Vester, CFA; since 2005

Dafydd Lewis, CFA; since 2005

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Inception

date | | | Expenses (%) | |

| Share class | | Ticker | | | Cusip | | | | Gross | | | Net | |

| Investor (Y) | | | BLGFX | | | | 05578V102 | | | | 12/18/2013 | | | | 2.94 | | | | 2.01 | |

The net expense ratio shown reflects contractual expense limitations made by the Adviser, currently through December 31, 2016. The Adviser has committed to continue this arrangement through December 31, 2017. The Fund's return would have been lower without these contractual expense limitations.

| | | | |

Portfolio Sector Allocation | |

| Sector | | Fund (%) | |

| Consumer Discretionary | | | 6.7 | |

| Consumer Staples | | | 42.1 | |

| Financials | | | 30.7 | |

| Healthcare | | | 0.6 | |

| Industrials | | | 4.9 | |

| Materials | | | 2.0 | |

| Telecommunication Services | | | 3.9 | |

| Participation Notes | | | 3.9 | |

| Other Assets & Liabilities, Net | | | 5.2 | |

| Total | | | 100.0 | |

Portfolio composition will change due to the ongoing management of the Fund. The percentages are based on net assets as of August 31, 2016 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement processes.

Growth of an assumed $10,000 investment

This graph illustrates the hypothetical investment of $10,000 from the Fund's inception date, December 18, 2013, to August 31, 2016.

2

| | |

| | | Expense Example (Unaudited) |

For the Six Months Ended August 31, 2016

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, which may include repurchase fees; and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six month period ended August 31, 2016 (3/1/16-8/31/16).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

account

value

3/1/16 | | | Ending

account

value

8/31/16 | | | Annualized

Expense

Ratio(1) | | | Expenses

paid during

period

3/1/16-

8/31/16(1) | |

| Actual | | $ | 1,000.00 | | | $ | 1,173.20 | | | | 2.00 | % | | $ | 10.95 | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,015.00 | | | | 2.00 | | | | 10.13 | |

| (1) | Expenses are equal to the Fund’s annualized expense ratios for the period March 1, 2016 through August 31, 2016, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). |

3

August 31, 2016

| | | | | | | | |

| Description | | Shares | | | Value | |

| Common Stocks — 89.4% | | | | |

| |

| Argentina — 2.8% | | | | |

BBVA Banco Frances SA ADR | | | 100,394 | | | $ | 2,022,939 | |

| |

| Bangladesh — 1.3% | | | | |

British American Tobacco Bangladesh Co., Ltd. | | | 30,488 | | | | 950,053 | |

| |

| Botswana — 0.5% | | | | |

Letshego Holdings, Ltd. | | | 1,966,140 | | | | 365,387 | |

| |

| Cambodia — 3.5% | | | | |

NagaCorp, Ltd. | | | 3,572,000 | | | | 2,527,896 | |

| |

| Colombia — 1.8% | | | | |

Almacenes Exito SA | | | 99,167 | | | | 487,111 | |

Bolsa de Valores de Colombia | | | 125,294,303 | | | | 805,141 | |

| | | | | | | | |

| | | | | | | 1,292,252 | |

| |

| Costa Rica — 4.0% | | | | |

Florida Ice & Farm Co. SA | | | 1,956,263 | | | | 2,875,917 | |

| |

| Croatia — 1.5% | | | | |

Ledo DD | | | 701 | | | | 1,113,636 | |

| |

| Egypt — 10.4% | | | | |

Commercial International Bank Egypt SAE GDR | | | 1,370,519 | | | | 5,758,921 | |

Eastern Tobacco | | | 50,913 | | | | 1,232,698 | |

Edita Food Industries SAE GDR | | | 19,754 | | | | 126,425 | |

Juhayna Food Industries | | | 739,142 | | | | 409,527 | |

| | | | | | | | |

| | | | | | | 7,527,571 | |

| |

| Georgia — 5.7% | | | | |

BGEO Group PLC | | | 96,740 | | | | 3,643,337 | |

Georgia Healthcare Group PLC (1) | | | 124,700 | | | | 474,874 | |

| | | | | | | | |

| | | | | | | 4,118,211 | |

| |

| Ghana — 1.3% | | | | |

Fan Milk Ltd. | | | 355,900 | | | | 852,530 | |

Unilever Ghana, Ltd. | | | 30,000 | | | | 64,147 | |

| | | | | | | | |

| | | | | | | 916,677 | |

| |

| Kenya — 5.4% | | | | |

Barclays Bank of Kenya, Ltd. | | | 5,214,600 | | | | 504,722 | |

British American Tobacco

Kenya, Ltd. | | | 173,393 | | | | 1,421,394 | |

East African Breweries, Ltd. | | | 783,000 | | | | 1,917,867 | |

Uchumi Supermarkets, Ltd. (1) | | | 595,500 | | | | 19,703 | |

| | | | | | | | |

| | | | | | | 3,863,686 | |

| |

| Mauritius — 2.3% | | | | |

MCB Group, Ltd. | | | 286,910 | | | | 1,691,302 | |

| |

| Nigeria — 4.0% | | | | |

Cadbury Nigeria PLC | | | 816,291 | | | | 36,251 | |

Guaranty Trust Bank PLC | | | 15,196,284 | | | | 1,277,404 | |

Guaranty Trust Bank PLC GDR | | | 245,000 | | | | 1,041,250 | |

Nestle Nigeria PLC | | | 92,125 | | | | 241,088 | |

Nigerian Breweries PLC | | | 620,850 | | | | 275,754 | |

| | | | | | | | |

| | | | | | | 2,871,747 | |

| |

| Pakistan — 4.8% | | | | |

Lucky Cement, Ltd. | | | 218,600 | | | | 1,447,592 | |

United Bank, Ltd. | | | 1,025,800 | | | | 1,993,809 | |

| | | | | | | | |

| | | | | | | 3,441,401 | |

| |

| Peru — 5.2% | | | | |

Alicorp SA | | | 1,204,169 | | | | 2,662,520 | |

BBVA Banco Continental SA | | | 935,293 | | | | 1,072,609 | |

| | | | | | | | |

| | | | | | | 3,735,129 | |

| |

| Philippines — 3.1% | | | | |

Universal Robina Corp. | | | 566,110 | | | | 2,271,973 | |

| |

| Senegal — 3.9% | | | | |

Sonatel | | | 71,978 | | | | 2,784,556 | |

| | | | | | | | |

| Description | | Shares or

Participation

Units | | | Value | |

| Common Stocks (continued) | | | | |

| |

| South Africa — 2.1% | | | | |

Famous Brands, Ltd. | | | 148,300 | | | $ | 1,533,234 | |

| |

| Sri Lanka — 2.1% | | | | |

Ceylon Tobacco Co. PLC | | | 95,730 | | | | 579,085 | |

Commercial Bank of Ceylon PLC | | | 958,748 | | | | 916,075 | |

| | | | | | | | |

| | | | | | | 1,495,160 | |

| |

| Tunisia — 1.2% | | | | |

Delice Holding | | | 148,095 | | | | 843,749 | |

| |

| United Arab Emirates — 4.9% | | | | |

Aramex PJSC | | | 3,264,401 | | | | 3,554,927 | |

| |

| United States — 4.7% | | | | |

PriceSmart, Inc. (2) | | | 41,008 | | | | 3,425,398 | |

| |

| Vietnam — 11.2% | | | | |

Phu Nhuan Jewelry JSC | | | 235,040 | | | | 742,897 | |

Vietnam Dairy Products JSC | | | 1,049,438 | | | | 7,339,714 | |

| | | | | | | | |

| | | | | | | 8,082,611 | |

| |

| Zimbabwe — 1.7% | | | | |

Delta Corp., Ltd. | | | 1,865,995 | | | | 1,203,567 | |

| | | | | | | | |

Total Common Stocks

(identified cost $63,406,087) | | | | | | | 64,508,979 | |

| |

| Mutual Funds — 1.5% | | | | |

| |

| Romania — 1.5% | | | | |

Fondul Proprietatea SA (1) | | | 5,255,220 | | | | 1,045,239 | |

| | | | | | | | |

Total Mutual Funds

(identified cost $1,029,973) | | | | | | | 1,045,239 | |

| |

| Participation Notes — 3.9% | | | | |

| |

| Luxembourg — 0.4% | | | | |

Jarir Marketing Co., Issued by Merrill Lynch International & Co., Maturity Date 3/2/2017 (3) | | | 10,480 | | | | 293,493 | |

| |

| United Kingdom — 3.5% | | | | |

Herfy Food Services Co., Issued by HSBC Bank PLC, Maturity Date 7/6/2017 (3) | | | 64,658 | | | | 1,249,921 | |

Saudia Dairy & Foodstuff Co., Issued by HSBC Bank PLC, Maturity Date 6/4/2018 (3) | | | 33,783 | | | | 1,257,134 | |

| | | | | | | | |

| | | | | | | 2,507,055 | |

| | | | | | | | |

Total Participation Notes

(identified cost $3,352,054) | | | | | | | 2,800,548 | |

| |

| Short-Term Investments — 8.8% | | | | |

|

| Collateral Investment for Securities on Loan — 4.8% | |

State Street Navigator Securities Lending Prime Portfolio Fund, 0.443% (4) | | | | | | | 3,506,184 | |

| |

| Mutual Funds — 4.0% | | | | |

State Street Institutional Liquid Reserves Fund — Premier Class, 0.430% | | | 2,861,839 | | | | 2,861,839 | |

| | | | | | | | |

Total Short-Term Investments

(identified cost $6,368,023) | | | | | | | 6,368,023 | |

| | | | | | | | |

Total Investments — 103.6%

(identified cost $74,156,137) | | | | | | | 74,722,789 | |

| Other Assets and Liabilities — (3.6)% | | | | (2,596,070 | ) |

| | | | | | | | |

| Total Net Assets — 100.0% | | | | | | $ | 72,126,719 | |

| | | | | | | | |

(See Notes which are an integral part of the Financial Statements)

4

| | |

| | | BMO LGM Frontier Markets Equity Fund |

| | | | | | | | |

| Industry Allocation as of August 31, 2016 | |

| Industry | | Value | | | % of

Total

Net Assets | |

Agriculture | | $ | 4,183,231 | | | | 5.8 | % |

Banks | | | 18,231,065 | | | | 25.3 | |

Beverages | | | 5,913,287 | | | | 8.2 | |

Building Materials | | | 1,447,592 | | | | 2.0 | |

Commercial Services | | | 474,874 | | | | 0.6 | |

Diversified Financial Services | | | 2,861,830 | | | | 4.0 | |

Food | | | 15,073,368 | | | | 20.9 | |

Holding Companies-Diversified | | | 1,203,567 | | | | 1.7 | |

Household Products/Wares | | | 64,147 | | | | 0.1 | |

Lodging | | | 2,527,896 | | | | 3.5 | |

Retail | | | 6,188,639 | | | | 8.6 | |

Telecommunications | | | 2,784,556 | | | | 3.8 | |

Transportation | | | 3,554,927 | | | | 4.9 | |

| | | | | | | | |

Total Common Stocks | | | 64,508,979 | | | | 89.4 | |

Participation Notes | | | 2,800,548 | | | | 3.9 | |

Collateral Investment for Securities on Loan | | | 3,506,184 | | | | 4.8 | |

Mutual Funds | | | 3,907,078 | | | | 5.5 | |

| | | | | | | | |

Total Investments | | | 74,722,789 | | | | 103.6 | |

Other Assets and Liabilities | | | (2,596,070 | ) | | | (3.6 | ) |

| | | | | | | | |

Total Net Assets | | $ | 72,126,719 | | | | 100.0 | % |

| | | | | | | | |

| | |

| Notes to Schedules of Investments | | |

The categories of investments are shown as a percentage of total net assets for the Fund as of August 31, 2016.

| (2) | Certain shares are temporarily on loan to unaffiliated brokers-dealers. |

| (3) | Participation notes are issued by banks or broker-dealers and are designed to offer a return linked to the performance of a particular underlying equity security or market. |

| (4) | Please refer to Note 2, subsection Securities Lending, in the Notes to Financial Statements. |

(See Notes which are an integral part of the Financial Statements)

5

August 31, 2016

| | |

| Statement of Assets and Liabilities | | BMO LGM Frontier Markets Equity Fund |

| | | | |

Assets: | | | | |

Investments in unaffiliated issuers, at value | | $ | 74,722,789 | (1) |

Cash denominated in foreign currencies | | | 724,434 | (2) |

Dividends and interest receivable | | | 121,127 | |

Receivable for investments sold | | | 323,528 | |

Prepaid expenses | | | 13,303 | |

Other receivables | | | 339 | |

| | | | |

Total assets | | | 75,905,520 | |

| |

Liabilities: | | | | |

Payable for return of securities lending collateral | | | 3,506,184 | |

Payable for foreign tax expense | | | 131,200 | |

Payable to affiliates, net (Note 5) | | | 88,083 | |

Other liabilities | | | 53,334 | |

| | | | |

Total liabilities | | | 3,778,801 | |

| | | | |

Total net assets | | $ | 72,126,719 | |

| | | | |

| |

Net assets consist of: | | | | |

Paid-in capital | | $ | 73,185,566 | |

Net unrealized appreciation on investments and foreign currency translation | | | 515,951 | |

Accumulated net realized loss on investments and foreign currency transactions | | | (2,103,374 | ) |

Undistributed net investment income | | | 528,576 | |

| | | | |

Total net assets | | $ | 72,126,719 | |

| | | | |

| |

Net asset value, offering price and redemption proceeds per investor class of shares (unlimited shares authorized, no par value) | | $ | 9.21 | |

| | | | |

| |

Total investor class of shares outstanding | | | 7,834,660 | |

| | | | |

Total investments in unaffiliated issuers, at cost: | | $ | 74,156,137 | |

| | | | |

| (1) | Including $3,425,398 of securities on loan. |

| (2) | Identified cost of cash denominated in foreign currencies is $775,082. |

(See Notes which are an integral part of the Financial Statements)

6

Year Ended August 31, 2016

| | |

| Statement of Operations | | BMO LGM Frontier Markets Equity Fund |

| | | | |

Investment income: | | | | |

Dividend income, unaffiliated issuers | | $ | 1,455,970 | (1) |

Securities lending income | | | 3,269 | |

| | | | |

Total income | | | 1,459,239 | |

| |

Expenses: | | | | |

Investment advisory fees (Note 5) | | | 582,963 | |

Shareholder servicing fees (Note 5) | | | 97,161 | |

Administration fees (Note 5) | | | 58,296 | |

Portfolio accounting fees | | | 45,498 | |

Recordkeeping fees | | | 54,640 | |

Custodian fees | | | 133,431 | |

Registration fees | | | 29,537 | |

Professional fees | | | 32,379 | |

Printing and postage | | | 35,659 | |

Directors’ fees | | | 13,562 | |

Miscellaneous | | | 13,224 | |

| | | | |

Total expenses | | | 1,096,350 | |

| |

Deduct: | | | | |

Expense waivers (Note 5) | | | (315,789 | ) |

| | | | |

Net expenses | | | 780,561 | |

| | | | |

Net investment income | | | 678,678 | |

| |

Net realized and unrealized gain (loss) on investments and foreign currency: | | | | |

Net realized loss on transactions from: | | | | |

Investments in unaffiliated issuers | | | (1,213,623 | )(2) |

Foreign currency transactions | | | (133,484 | ) |

| | | | |

Total net realized loss | | | (1,347,107 | ) |

Net change in unrealized appreciation on: | | | | |

Investments in unaffiliated issuers | | | 5,238,370 | |

Foreign currency translations | | | (48,085 | ) |

| | | | |

Total net change in unrealized appreciation | | | 5,190,285 | |

| | | | |

Net realized and unrealized gain on investments and foreign currency | | | 3,843,178 | |

| | | | |

Change in net assets resulting from operations | | $ | 4,521,856 | |

| | | | |

| (1) | Net of foreign taxes of $75,374. |

| (2) | Net of foreign taxes of $145,885, $129,502 of which is related to appreciated investments held at year end. |

(See Notes which are an integral part of the Financial Statements)

7

| | |

| Statements of Changes in Net Assets | | BMO LGM Frontier Markets Equity Fund |

| | | | | | | | |

| | | Year Ended

August 31,

2016 | | | Year Ended

August 31,

2015 | |

Change in net assets resulting from: | | | | | | | | |

| | |

Operations: | | | | | | | | |

Net investment income | | $ | 678,678 | | | $ | 672,459 | |

Net realized loss on investments and foreign currency transactions | | | (1,347,107 | ) | | | (920,595 | ) |

Net change in unrealized appreciation (depreciation) on investments and foreign currency translation | | | 5,190,285 | | | | (6,031,934 | ) |

| | | | | | | | |

Change in net assets resulting from operations | | | 4,521,856 | | | | (6,280,070 | ) |

| | |

Distributions to shareholders: | | | | | | | | |

Distributions to shareholders from net investment income | | | (512,899 | ) | | | (509,777 | ) |

Distributions to shareholders from net realized gain on investments | | | — | | | | (204,869 | ) |

| | | | | | | | |

Change in net assets resulting from distributions to shareholders | | | (512,899 | ) | | | (714,646 | ) |

| | |

Capital stock transactions: | | | | | | | | |

Proceeds from sale of shares | | | 42,071,941 | | | | 15,834,152 | |

Net asset value of shares issued to shareholders in payment of distributions declared | | | 371,461 | | | | 344,104 | |

Cost of shares redeemed | | | (7,987,132 | ) | | | (10,518,537 | ) |

Repurchase fees | | | 159,743 | | | | 208,605 | |

| | | | | | | | |

Change in net assets resulting from capital stock transactions | | | 34,616,013 | | | | 5,868,324 | |

| | | | | | | | |

Change in net assets | | | 38,624,970 | | | | (1,126,392 | ) |

| | |

Net assets: | | | | | | | | |

Beginning of period | | | 33,501,749 | | | | 34,628,141 | |

| | | | | | | | |

End of period | | $ | 72,126,719 | | | $ | 33,501,749 | |

| | | | | | | | |

Undistributed net investment income included in net assets at end of period | | $ | 528,576 | | | $ | 512,663 | |

| | | | | | | | |

| | |

Capital stock transactions in shares: | | | | | | | | |

Sale of shares | | | 4,781,643 | | | | 1,750,725 | |

Shares issued to shareholders in payment of distributions declared | | | 45,355 | | | | 37,607 | |

Shares redeemed | | | (961,748 | ) | | | (1,128,006 | ) |

| | | | | | | | |

Net change resulting from fund share transactions in shares | | | 3,865,250 | | | | 660,326 | |

| | | | | | | | |

(See Notes which are an integral part of the Financial Statements)

8

| | | | |

| Financial Highlights (For a share outstanding throughout the period) | | BMO LGM Frontier Markets Equity Fund |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Period

Ended

August 31, | | Net asset

value,

beginning

of period | | Net

investment

income | | Net realized

and unrealized

gain (loss) | | Total from

investment

operations | | Distributions to

shareholders

from net

investment

income | | Distributions to

shareholders

from net

realized gain | | Total

distributions | | Repurchase

fees | | Net asset

value, end

of period | | Total

return (1)(3) | | Ratios to Average Net Assets (4) | | Net assets,

end of period

(000 omitted) | | Portfolio

turnover

rate (3) |

| | | | | | | | | | | | Gross

Expenses | | Net

Expenses (2) | | Net

investment

income (2) | | |

| 2016 | | | $ | 8.44 | | | | $ | 0.09 | | | | $ | 0.79 | | | | $ | 0.88 | | | | $ | (0.13 | ) | | | $ | — | | | | $ | (0.13 | ) | | | $ | 0.02 | | | | $ | 9.21 | | | | | 10.89 | % | | | | 2.82 | % | | | | 2.00 | % | | | | 1.74 | % | | | $ | 72,127 | | | | | 24 | % |

| 2015 | | | | 10.46 | | | | | 0.18 | | | | | (2.03 | ) | | | | (1.85 | ) | | | | (0.16 | ) | | | | (0.06 | ) | | | | (0.22 | ) | | | | 0.05 | | | | | 8.44 | | | | | (17.34 | ) | | | | 2.88 | | | | | 2.00 | | | | | 1.94 | | | | | 33,502 | | | | | 31 | |

| 2014 (5) | | | | 10.00 | | | | | 0.13 | | | | | 0.31 | | | | | 0.44 | | | | | — | | | | | — | | | | | — | | | | | 0.02 | | | | | 10.46 | | | | | 4.60 | | | | | 3.01 | | | | | 2.00 | | | | | 2.33 | | | | | 34,628 | | | | | 9 | |

| (1) | Based on net asset value as of end of period date. |

| (2) | The contractual and voluntary expense waivers pursuant to Note 5 of the financial statements are reflected in both the net expense and net investment income ratios. |

| (3) | Not annualized for periods less than one year. |

| (4) | Annualized for periods less than one year. |

| (5) | Reflects operations for the period from December 18, 2013 (inception date) through August 31, 2014. |

(See Notes which are an integral part of the Financial Statements)

9

August 31, 2016

| | |

| Notes to Financial Statements | | BMO LGM Frontier Markets Equity Fund |

BMO LGM Frontier Markets Equity Fund (the “Fund”) was established as a Delaware statutory trust on July 3, 2013. The Fund is registered with the Securities and Exchange Commission (the “SEC”) as a non-diversified, closed-end management investment company that operates as an “Interval Fund” under the Investment Company Act of 1940, as amended (the “1940 Act”). An Interval Fund continuously offers its shares to the public, but only offers to repurchase its shares at predetermined intervals. The Fund has set quarterly repurchase intervals. The Fund’s inception date is December 18, 2013.

The Fund’s investment objective is to provide capital appreciation. The Fund invests at least 80% of its assets in equity securities of foreign companies located in frontier markets or whose primary business activities or principal trading markets are in frontier markets. Frontier markets are considered to be those markets in any country that is included in the Morgan Stanley Capital International (“MSCI”) Frontier Markets Index, certain countries in the MSCI Emerging Markets Index, and certain other countries that are not included in those indices, as described in the Fund’s Prospectus.

| 2. | | Significant Accounting Policies |

The Fund is an investment company and follows the accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services—Investment Companies. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements.

Use of Estimates—The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates.

Investment Valuations—Listed equity securities are valued each trading day at the last sale price or official closing price reported on a national securities exchange, including NASDAQ. Securities listed on a foreign exchange are valued each trading day at the last closing price on the principal exchange on which they are traded immediately prior to the time for determination of Net Asset Value (“NAV”) or at fair value as discussed below. Equity securities without a reported trade, U.S. government securities, listed corporate bonds, other fixed income and asset-backed securities with maturities of 60 days or more, unlisted securities, and private placement securities are generally valued at the mean of the latest bid and asked price as furnished by an independent pricing service. Fixed income securities that are not exchange traded are valued by an independent pricing service, taking into consideration yield, liquidity, risk, credit quality, coupon, maturity, type of issue, and any other factors or market data the pricing service deems relevant. Fixed income securities with remaining maturities of 60 days or less at the time of purchase are valued at amortized cost, which approximates fair value. Investments in other open-end registered investment companies are valued at net asset value.

Securities or other assets for which market valuations are not readily available, or are deemed to be inaccurate, are valued at fair value as determined in good faith using methods approved by the Board of Trustees (the “Trustees”). The Trustees have established a Pricing Committee, which is responsible for determinations of fair value, subject to the supervision of the Trustees. In determining fair value, the Pricing Committee takes into account all information available and any factors it deems appropriate. Consequently, the price of securities used by the Fund to calculate its NAV may differ from quoted or published prices for the same securities. Fair value pricing involves subjective judgments and it is possible that the fair value determined for a security is materially different than the value that would be realized upon the sale of that security and the differences may be material to the NAV of the Fund or the financial statements presented.

Securities held in the Fund may be listed on foreign exchanges that do not value their listed securities at the same time the Fund calculates its NAV. Most foreign markets close well before the Fund values its securities, generally 3:00 p.m. (Central Time). The earlier close of these foreign markets gives rise to the possibility that significant events, including broad market moves, may have occurred in the interim.

The Pricing Committee may determine that a security needs to be fair valued if, among other things, it believes the value of the security might have been materially affected by events occurring after the close of the market in which the security was principally traded, but before the time for determination of the NAV (“a subsequent event”). A subsequent event might include a company-specific development (for example, announcement of a merger that is made after the close of the foreign market), a development that might affect an entire market or region (for example, weather related events) or a potentially global development (such as a terrorist attack that may be expected to have an effect on investor expectations worldwide). The Fund has retained an independent fair value pricing service to assist in fair valuing foreign securities. The service utilizes statistical data based on historical performance of securities, markets, and other data in developing factors used to estimate a fair value.

Investment Income, Expenses, and Distributions—Interest income and expenses are accrued daily. The Fund distributes net investment income, if any, and net realized gains (net of any capital loss carryovers) annually. Dividend income, realized gain distributions from underlying funds, and distributions to shareholders are recorded on the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at fair market value.

Federal Income Taxes—The policies and procedures of the Fund require compliance with Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), and distribution to shareholders each year substantially all of its income. Accordingly, no provisions for federal tax are necessary. Withholding taxes on foreign dividends and unrealized appreciation on investments have been provided for in accordance with the applicable country’s tax rules and rates.

10

| | |

| | | BMO LGM Frontier Markets Equity Fund |

Foreign Exchange Contracts—The Fund may enter into foreign currency exchange contracts as a way of managing foreign exchange rate risk. The Fund may enter into these contracts for the purchase or sale of a specific foreign currency at a fixed price on a future date as a hedge or cross hedge against either specific transactions or portfolio positions. The objective of the Fund’s foreign currency hedging transactions is to reduce the risk that the U.S. dollar value of the Fund’s foreign currency denominated securities will decline in value due to changes in foreign currency exchange rates. All foreign currency exchange contracts are marked-to-market daily at the applicable translation rates resulting in unrealized gains or losses. Realized gains or losses are recorded at the time the foreign currency exchange contract is offset by entering into a closing transaction, or by the delivery, or receipt, of the currency. Risk may arise upon entering into these contracts from the potential inability of counterparties to meet the terms of their contracts and from unanticipated movements in the value of a foreign currency relative to the U.S. dollar.

The Fund did not hold any foreign currency exchange contracts during, or at, the year ended August 31, 2016.

Foreign Currency Translation—The accounting records of the Fund are maintained in U.S. dollars. All assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the rate of exchange of such currencies against U.S. dollars on the date of valuation. Purchases and sales of securities, income, and expenses are translated at the rate of exchange quoted on the respective date that such transactions are recorded. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

Reported net realized foreign exchange gains or losses arise from sales of portfolio securities, sales and maturities of short-term securities, sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments in securities at each reporting period, resulting from changes in the exchange rate.

Restricted Securities—Restricted securities are securities that may be resold only upon registration under federal securities laws or in transactions exempt from such registration. In some cases, the issuer of restricted securities has agreed to register such securities for resale at the issuer’s expense either upon demand by the Fund or in connection with another registered offering of the securities. Many restricted securities may be resold in the secondary market in transactions exempt from registration. Such restricted securities may be determined to be liquid under criteria established by the Trustees. The restricted securities are valued at the price provided by dealers in the secondary market or, if no market prices are available, the fair value as determined in good faith using methods approved by the Trustees.

Securities Lending—The Fund participates in a securities lending program, providing for the lending of equity securities to qualified brokers, in exchange for the opportunity to earn additional income for participating. State Street Bank & Trust Company serves as the securities lending agent. The Fund receives cash as collateral in return for the securities and records a corresponding payable for collateral due to the respective broker. The amount of cash collateral received is maintained at a minimum level of 100% of the prior day’s market value on securities and accrued interest loaned. Collateral is reinvested in the State Street Navigator Securities Lending Prime Portfolio money market fund. The valuation of collateral is discussed in “Investment Valuations” in Note 2 of the Notes to the Financial Statements. When the Fund lends its portfolio securities, it is subject to the risk that it may not be able to get the portfolio securities back from the borrower on a timely basis, in which case the Fund may lose certain investment opportunities. The Fund also is subject to the risks associated with the investments of cash collateral received from the borrower. Cash collateral received as part of the Fund’s securities lending program invested in the State Street Navigator Securities Lending Prime Portfolio as of August 31, 2016 was $3,506,184.

Commitments and Contingencies—In the normal course of business, the Fund enters into contracts that provide general indemnifications to other parties. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund has not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote.

Other—Investment transactions are accounted for on a trade date basis. Net realized gains and losses on securities are computed on the basis of specific security lot identification.

| 3. | | Fair Value Measurement |

Fair Valuation Measurement defines fair value, establishes a framework for measuring fair value in accordance with GAAP, and requires disclosure about fair value measurements. It establishes a fair value hierarchy that distinguishes between (1) market participant assumptions developed based on market data obtained from sources independent of the reporting issuer (observable inputs), and (2) the reporting issuer’s own assumptions about market participant assumptions developed based on the best information available in the circumstances (unobservable inputs). It also provides guidance on determining when there has been a significant decrease in the volume and level of activity for an asset or liability, when a transaction is not orderly, and how that information must be incorporated into fair value measurement.

11

| | |

| Notes to Financial Statements (continued) | | |

Various inputs are used in determining the value of the Fund’s investments. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. These inputs are summarized in the three broad levels listed below:

Level 1—quoted prices in active markets for identical securities. An active market for the security is a market in which transactions occur with sufficient frequency and volume to provide pricing information on an ongoing basis. Common and preferred stocks, options and futures contracts, and U.S. registered mutual funds are generally categorized as Level 1.

Level 2—other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). Fixed income securities, repurchase agreements and securities valued by an independent fair value pricing service are generally categorized as Level 2.

Level 3—significant unobservable inputs, including management’s own assumptions in determining the fair value of investments.

In May 2015, the Financial Accounting Standards Board (the “FASB”) issued Accounting Standard Update (“ASU”) 2015-07, Disclosures for Investments in Certain Entities that Calculate Net Asset Value per Unit (or its Equivalent), modifying ASC 820. Under the modifications, investments in private investment funds valued at net asset value are no longer included in the fair value hierarchy. For the period ended August 31, 2016, the Fund had no investments in private investment funds, and there were no investments excluded from the fair value hierarchy. The Fund did not hold any Level 3 securities as of August 31, 2016.

The following is a summary of the inputs used, as of August 31, 2016, in valuing the Fund’s assets:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Common Stocks (1) | | $ | 64,508,979 | | | $ | — | | | $ | — | | | $ | 64,508,979 | |

Mutual Funds | | | 1,045,239 | | | | — | | | | — | | | | 1,045,239 | |

Participation Notes | | | — | | | | 2,800,548 | | | | — | | | | 2,800,548 | |

Short-Term Investments | | | 6,368,023 | | | | — | | | | — | | | | 6,368,023 | |

| | | | | | | | | | | | | | | | |

Total | | $ | 71,922,241 | | | $ | 2,800,548 | | | $ | — | | | $ | 74,722,789 | |

| | | | | | | | | | | | | | | | |

| | (1) | All sub-categories within Common Stocks represent Level 1 evaluation status. |

It is the Fund’s policy to recognize transfers between category levels at the end of the period. As described in Note 2, the Fund has retained an independent pricing service to fair value foreign equity securities for events occurring after the close of the market in which the security is principally traded. These valuations occurred on August 31, 2015, but not on August 31, 2016, resulting in transfers between categorization levels.

The following is a reconciliation of transfers between category levels from August 31, 2015 to August 31, 2016:

| | | | |

Transfers into Level 1 | | $ | 45,755,015 | |

Transfers out of Level 1 | | | — | |

| | | | |

Net Transfers into Level 1 | | $ | 45,755,015 | |

| | | | |

| |

Transfers into Level 2 | | $ | — | |

Transfers out of Level 2 | | | (45,755,015 | ) |

| | | | |

Net Transfers out of Level 2 | | $ | (45,755,015 | ) |

| | | | |

The shares of beneficial interest of the Fund (the “Shares”) will be continuously offered under Rule 415 under the Securities Act of 1933, as amended. As of August 31, 2016, the Fund had registered a total of 11,200,000 shares with no par value. Investors may purchase shares each business day without any sales charge at a price equal to the NAV per share next determined after receipt of an order to purchase.

The Shares are not redeemable each business day, are not listed for trading on an exchange, and no secondary market currently exists for Fund shares.

Repurchase Offer Policy—The Fund has a policy of making quarterly repurchase offers of between 5% and 25% of the Fund’s outstanding Shares (“Repurchase Offers”) pursuant to Rule 23c-3 of the 1940 Act. If shareholders tender more than the repurchase offer amount for any given Repurchase Offer, the Fund may repurchase up to an additional 2% of the outstanding Shares. If Fund shareholders tender more shares than the Fund decides to repurchase, the Fund will repurchase the shares on a pro rata basis, subject to limited exceptions. These periodic Repurchase Offers will be made in intervals of three calendar months with the repurchase pricing date occurring on the last business day of March, June, September and December. The maximum number of days between the repurchase request deadline and the repurchase pricing date shall be no more than 14 days (provided that if the 14th day of such period is not a business day, the repurchase pricing date shall occur on the next business day). A repurchase fee equal to 2% of the value of the Shares repurchased will be applied to offset repurchase expenses.

12

| | |

| | | BMO LGM Frontier Markets Equity Fund |

During the year ended August 31, 2016, the Fund had Repurchase Offers as follows:

| | | | | | | | | | | | |

Repurchase Date | | Repurchase

Offer

Amount | | | % of

Shares

Tendered | | | Number

of Shares

Tendered | |

| September 30, 2015 | | | 5 | % | | | 2.7 | % | | | 107,953 | |

| December 31, 2015 | | | 5 | | | | 5.0 | | | | 195,523 | |

| March 31, 2016 | | | 15 | | | | 11.5 | | | | 426,814 | |

| June 30, 2016 | | | 5 | | | | 3.0 | | | | 231,458 | |

| 5. | | Investment Adviser Fee and Other Transactions with Affiliates |

Investment Adviser Fee—The Fund has entered into an Investment Advisory Agreement with the Adviser, pursuant to which the Adviser will provide general investment advisory services for the Fund. As compensation for its advisory services under the investment advisory agreement with the Fund, the Fund pays the Adviser, on a monthly basis, an annual management fee equal to 1.50% of the average daily net assets of the Fund. The Fund’s sub-adviser is LGM Investments Limited, an affiliate of the Adviser. It is the Adviser’s responsibility to select sub-advisers for the Fund and to review each sub-adviser’s performance. The Adviser compensates the sub-adviser based on the level of average daily net assets of the Fund.

The Adviser has agreed to waive or reduce its investment advisory fee or reimburse expenses to the extent necessary to prevent total annual operating expenses (excluding taxes, interest, brokerage commissions, other investment related costs, Acquired Fund Fees and Expenses and extraordinary expenses, such as litigation and other expenses not incurred in the ordinary course of the Fund’s business) from exceeding 2.00% of the average daily net assets of the Fund. The Adviser may not terminate this arrangement prior to December 31, 2017 unless the investment advisory agreement is terminated. In addition, the Adviser may voluntarily waive any portion of its management fee for the Fund. Any such voluntary waiver by the Adviser may be terminated at any time in the Adviser’s sole discretion. Additionally, the agreement does not provide for recoupment by the Adviser of waived fees or reimbursed expenses.

Shareholder Servicing Fee—Under the terms of a Shareholder Services Agreement with the Adviser, the Fund pays the Adviser at the annual rate of 0.25% of average daily net assets for the period. The fee paid to the Adviser is used to finance certain services for shareholders and to maintain shareholder accounts. The Adviser also may voluntarily choose to waive any additional portion of its fee. The Adviser can modify or terminate this voluntary waiver at any time in its sole discretion.

Administration Fee—The fee paid by the Fund to the Adviser, as Administrator, is 0.15% of the Fund’s average daily net assets.

Investment Transactions—The Fund, on occasion, may purchase or sell a security with another fund or client of the Adviser pursuant to procedures approved by the Trustees.

General—Certain of the Officers and Trustees of the Fund are also Officers and Directors of one or more portfolios within the Fund complex, which are affiliates of the Fund. None of the Fund Officers or interested Trustees receives any compensation from the Fund. Certain Officers and Trustees of the Fund are also Officers of the Adviser.

Through January 14, 2016, the Fund participated in a $25 million unsecured, committed revolving line of credit (“LOC”) agreement with State Street Bank and Trust Company. The LOC was made available for extraordinary or emergency purposes. Borrowings were charged interest at a rate of 1.25% per annum over the greater of the Federal Funds rate or the London Interbank Offered Rate (“LIBOR”) and included a commitment fee of 0.15% per annum on the daily unused portion and an administrative fee of 0.025% per annum on the entire LOC. Effective January 15, 2016, the Fund entered into a $25 million unsecured, committed revolving LOC agreement with UMB Bank, n.a. Borrowings are charged interest at a rate of LIBOR plus 1.25% and a commitment fee of 0.20% per annum on the daily unused portion with no administrative fee. The Fund did not utilize either LOC during the period ended August 31, 2016.

| 7. | | Investment Transactions |

Purchases and sales of investments, excluding short-term U.S. government securities and short-term obligations, for the period ended August 31, 2016, were $40,357,582 and $9,317,280, respectively.

| 8. | | Federal Tax Information |

The timing and character of income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. These differences are due in part to differing treatments for wash sales, the realization for tax purposes of unrealized gains on investments in passive foreign investment companies and foreign currency transactions.

To the extent that differences arise that are permanent in nature, such amounts are reclassified within the capital accounts, on the Statement of Assets and Liabilities, based on their Federal tax basis treatment; temporary differences do not require reclassification and had no impact on the NAV of the Fund.

The Fund complied with FASB interpretation Accounting for Uncertainty in Income Taxes which provides guidance for how uncertain tax provisions should be recognized, measured, presented and disclosed in the financial statements. Accounting for Uncertainty in Income Taxes requires the affirmative evaluation of tax positions taken or expected to be taken in the course

13

Notes to Financial Statements (continued)

of preparing the Fund’s tax returns to determine whether it is “more-likely-than-not,” (i.e., greater than 50 percent) of being sustained by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold may result in a tax benefit or expense in the current year.

Accounting for Uncertainty in Income Taxes requires management of the Fund to analyze all open tax years, as defined by the statutes of limitations, for all major jurisdictions, which includes federal and certain states. Open tax years are those that are open for exam by the taxing authorities (i.e., the last four tax years and the interim tax period since then). The Fund had no examination in progress. For all open tax years and all major taxing jurisdictions through the end of the reporting period, management of the Fund reviewed all tax positions taken or expected to be taken in the preparation of the Fund’s tax returns and concluded that Accounting for Uncertainty in Income Taxes resulted in no effect on the Funds’ reported net assets or results of operations as of and during the period ended August 31, 2016. Management of the Fund also is not aware of any tax positions for which it is reasonably possible that the total amounts of recognized tax benefits will significantly change in the next twelve months.

The difference between book basis and tax basis unrealized appreciation/depreciation is attributable in part to the tax deferral of losses on wash sales, the realization for tax purposes of unrealized gains on investments in passive foreign investment companies, unrealized foreign capital gains tax and foreign currency.

| | | | | | | | | | | | | | |

Cost of Investments for Federal Tax Purposes | | | Gross

Unrealized

Appreciation

for Federal

Tax Purposes | | | Gross

Unrealized

(Depreciation)

for Federal

Tax Purposes | | | Net

Unrealized

Appreciation

for Federal

Tax Purposes | |

| $ | 74,457,569 | | | $ | 6,483,997 | | | $ | (6,218,777 | ) | | $ | 265,220 | |

The tax character of distributions reported on the Statement of Changes in Net Assets for the year ended August 31, 2016 and August 31, 2015, respectively, were as follows:

| | | | | | | | | | | | | | |

| 2016 | | | 2015 | |

Ordinary

Income (1) | | | Long-Term

Capital Gains | | | Ordinary

Income (1) | | | Long-Term

Capital Gains | |

| $ | 512,899 | | | $ | — | | | $ | 714,646 | | | $ | — | |

| | (1) | For tax purposes, short-term capital gain distributions are considered ordinary income. |

As of August 31, 2016, the components of distributable earnings on a tax basis are as follows:

| | | | | | | | | | | | | | | | |

Undistributed Ordinary Income | | Undistributed

Long-Term

Capital Gains | | | Accumulated

Capital and

Other Losses | | | Foreign

Currency

and Other

Adjustments | | | Unrealized

Appreciation | |

| $579,195 | | $ | — | | | $ | (1,723,059 | ) | | $ | (180,203 | ) | | $ | 265,220 | |

As of August 31 2016, the Fund had long-term post-October losses of $873,261, which are deferred until fiscal year 2017 for tax purposes. Net capital losses incurred after October 31, and within the taxable year are deemed to arise on the first day of the Fund’s next taxable year.

As of August 31, 2016, the Fund had non-expiring capital loss carryforwards of $621,932 and $227,866, for short-term and long-term, respectively.

| 9. | | Shareholder Tax Information (Unaudited) |

Of the ordinary income (including short-term capital gain) distributions made by the Fund during the year ended August 31, 2016, the percentage which qualifies for the dividend received deduction, available to corporate shareholders, is 1.50%

Of the ordinary income (including short-term capital gain) distributions made by the Fund during the year ended August 31, 2016, the percentage which is designated as qualified dividend income is 66.24%.

Pursuant to Section 853 of the Internal Revenue Code of 1986, the Fund designates $1,506,332 of income derived from foreign sources and $89,592 of foreign taxes paid, or the amounts determined to be necessary, for the year ended August 31, 2016.

Of the ordinary income (including short-term capital gain) distributions made during the year ended August 31, 2016, the proportionate share of income derived from foreign sources and foreign taxes paid attributable to one share of stock are:

| | | | | | |

Foreign

Source Income | | | Foreign

Taxes Paid | |

| $ | 0.1923 | | | $ | 0.0114 | |

On September 30, 2016, the Fund completed its next quarterly repurchase event. Shares totaling 30,270, or 0.4% of the Fund, were repurchased at a value of $275,156.

14

| | |

| | | Report of Independent Registered Public Accounting Firm |

The Board of Trustees and Shareholders

BMO LGM Frontier Markets Equity Fund:

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of BMO LGM Frontier Markets Equity Fund (the Fund) as of August 31, 2016, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the two-year period then ended and for the period from December 18, 2013 (inception date) to August 31, 2014. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of August 31, 2016, by correspondence with custodians and brokers. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Fund as of August 31, 2016, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the two-year period then ended and for the period from December 18, 2013 to August 31, 2014, in conformity with U.S. generally accepted accounting principles.

/s/ KPMG LLP

Milwaukee, WI

October 25, 2016

15

| | |

| Trustees and Officers of the Funds (Unaudited) |

The following tables provide information about each Trustee and Officer of the Fund as of August 31, 2016. The address of each Trustee is 111 East Kilbourn Avenue, Suite 200, Milwaukee, Wisconsin 53202. There are currently 45 separate portfolios or funds in the BMO Funds complex, of which 44 are registered as BMO Funds, Inc. and one is registered as BMO LGM Frontier Markets Equity Fund with the Securities and Exchange Commission. The Statement of Additional Information includes additional information about the trustees and is available, without charge and upon request, by calling 1-800-236-FUND (3863).

| | | | | | | | | | |

| INDEPENDENT TRUSTEES | | | | | | | | |

| Name and Age | | Position(s) Held

with the Corporation | | Term of Office and Length of Time Served* | | Principal Occupation(s) During Past 5 Years | | Number of Portfolios in Fund Complex Overseen by Trustee | | Other Directorships Held by Trustee |

Larry D. Armel Age: 74 | | Independent Trustee | | Since

August 2013 | | Retired; formerly, Chairman, Gold Bank Funds, from 2002 to 2005. | | 45 | | None |

| Ridge A. Braunschweig Age: 63 | | Independent Trustee | | Since

August 2013 | | President and Chief Executive Officer, CPL Industries, Inc. (a manufacturing holding company prior to May 2009 and a family office since May 2009), since January 2012; Executive Vice President and Chief Financial Officer, CPL Industries, Inc., from 2000 to 2012. | | 45 | | None |

Benjamin M. Cutler Age: 71 | | Independent Trustee | | Since

August 2013 | | Chairman, USHEALTH Group, Inc. (a health insurance company), since 2004; CEO and President, USHEALTH Group, Inc., from 2004 to 2016; Director, Freedom from Hunger (a non-profit organization), since 2016. | | 45 | | None |

John A. Lubs Age: 68 | | Independent Trustee | | Since

August 2013 | | Retired; formerly, Vice Chairman, Mason Companies, Inc. (a footwear distributor), from 2004 to 2010 and Chief Operating Officer, from 2003 to 2010. | | 45 | | None |

James Mitchell Age: 69 | | Independent Trustee | | Since

August 2013 | | Chairman, Ayrshire Precision Engineering (a precision machining company), since 1992; Chief Executive Officer, NOG, Inc. (a metal processing and consulting company), from 1999 to 2015. | | 45 | | None |

Barbara J. Pope Age: 68 | | Independent Trustee | | Since

August 2013 | | Retired; formerly, President of Barbara J. Pope, P.C. (a financial consulting firm), 1992-2015; President of Sedgwick Street Fund LLC (a private investment partnership), 1996-2015; Tax Partner, Price Waterhouse. | | 45 | | None |

| * | Each Trustee serves an indefinite term until he or she retires or otherwise resigns, is removed, dies, or until his or her successor is duly elected. Retirement for a Trustee occurs no later than August 31 following his or her 75th birthday. |

16

| | |

| | | Trustees and Officers of the Funds (Unaudited) (continued) |

| | | | | | | | | | |

| INTERESTED TRUSTEES | | | | | | | | |

| Name and Age | | Position(s) Held

with the Corporation | | Term of Office and Length of Time Served* | | Principal Occupation(s) During Past 5 Years | | Number of Portfolios in Fund Complex Overseen by Trustee | | Other Directorships Held by Trustee |

John M. Blaser** Age: 59 | | Trustee and President | | Since

August 2013 | | Managing Director of the Adviser, since June 2012; Vice President of the Adviser, from 1998 to 2012. | | 45 | | None |

| Christopher B. Begy** Age: 62 | | Trustee | | Since

August 2013 | | President, CEO and a Director of BMO Financial Corp. and U.S. Country Head, since August 2013; Chair, BMO Harris Bank N.A., since August 2013; Director of the Adviser, since August 2013; Chief Auditor of BMO Financial Group, from 2001 to 2013. | | 45 | | None |

| * | Each Trustee serves an indefinite term until he or she retires or otherwise resigns, is removed, dies or until his or her successor is duly elected. Retirement for a Trustee occurs no later than August 31 following his or her 75th birthday. |

| ** | Mr. Blaser is an “interested person” of the Fund (as defined in the 1940 Act) due to the positions that he holds with the Fund, and the Adviser. Mr. Begy is an “interested person” of the Fund due to the positions that he holds with the Adviser and BMO. |

| | | | | | |

| PRINCIPAL OFFICERS | | | | | | |

| Name and Age | | Position(s) Held with

the Fund | | Term of Office and Length of Time Served | | Principal Occupation(s) During Past 5 Years |

Timothy M. Bonin Age: 43 | | Vice President,

Chief Financial Officer and Treasurer | | Elected by the Board annually; since August 2013 | | Vice President of the Adviser, since February 2006. |

Stephen R. Oliver Age: 65 | | Chief Compliance Officer and Anti-Money Laundering Compliance Officer | | Elected by the Board annually; since August 2013 | | Vice President of BMO Harris Bank N.A., since March 2006, Vice President of BMO Investment Distributors, LLC (formerly M&I Distributors, LLC), 2007 to 2014. |

Michael J. Murphy Age: 37 | | Secretary | | Elected by the Board annually; since May 2016 | | Senior Counsel and Vice President of BMO Harris Bank N.A., since 2014; Associate, Vedder Price P.C., 2010 to 2014. |

17

| | |

Shareholder Report Disclosure of Trustees’ Approval of

Advisory and Subadvisory Contracts (Unaudited) |

Approval of Continuation of Advisory and Subadvisory Agreements

During the reporting period, the Board of Trustees (the “Board”) of BMO LGM Frontier Markets Equity Fund (the “Fund”), including the Trustees who are not “interested persons” of the Fund as defined in the Investment Company Act of 1940, as amended (the “Independent Trustees”), approved the continuation of the investment advisory agreement (the “Advisory Agreement”) between the Fund and BMO Asset Management Corp. (the “Adviser”) and the investment subadvisory agreement (the “Subadvisory Agreement”) with LGM Investments Limited (the “Subadviser”) on behalf of the Fund for an additional year ending August 31, 2017.

At Board meetings held on July 13, 2016 (“July Meeting”) and August 9-10, 2016 (“August Meeting”), the Board met with management of the Adviser regarding the annual approval of the continuation of the Fund’s Advisory and Subadvisory Agreements. In connection with its consideration of the Advisory and Subadvisory Agreements, the Board considered the information furnished and discussed throughout the year at regularly scheduled Board and Committee meetings, as applicable, and the information provided specifically in relation to the annual consideration of the approval of the Advisory Agreement and Subadvisory Agreement in response to requests of the Independent Trustees and their independent legal counsel. Information furnished in connection with Board or Committee meetings throughout the year included, among other things, presentations given by the portfolio managers of the Fund on the Fund’s investment strategies, risks and performance, comparative performance of the Fund against its benchmark indices; and various reports on the monitoring of the Fund’s compliance with the securities laws, regulations, policies and procedures. In preparation for the Board’s annual consideration of the approval of the Advisory and Subadvisory Agreements, the Trustees requested and received a wide variety of information and reports concerning the Adviser (and its affiliates) and the Subadviser, including information on: (1) the nature, extent and quality of services provided to the Fund by the Adviser (and its affiliates) and the Subadviser; (2) the investment performance of the Fund as compared to a group of comparable funds; (3) the level of the advisory and subadvisory fees charged to the Fund as compared to: (a) other clients of the Adviser and the Subadviser; and (b) a group of comparable funds; (4) the expense ratios of the Fund as compared to a group of comparable funds; (5) the profitability of the Adviser and its affiliates; and (6) the Adviser’s and Subadviser’s compliance programs. The Board also considered information related to potential “fall out” or ancillary benefits enjoyed by the Adviser (and its affiliates) and the Subadviser as a result of their relationships with the Fund. In addition to evaluating, among other things, the written information provided by the Adviser, the Board also considered the answers to questions posed by the Board to representatives of the Adviser at various meetings.

In evaluating the Advisory and Subadvisory Agreements, the Board members took into account their accumulated experience in working with the Adviser on matters related to the Fund. The Independent Trustees also met separately in executive session with their independent legal counsel to review and consider the information provided regarding the Advisory Agreement and the Subadvisory Agreement.

Based on their review, the Independent Trustees and the full Board concluded that it was in the best interests of the Fund to approve the continuation of the Advisory Agreement and the Subadvisory Agreement. In their deliberations, the Board did not identify any single factor or group of factors as all-important or controlling, but considered all factors together. The material factors and conclusions that formed the basis for the Board’s determinations are discussed below.

Nature, Extent and Quality of Services

In evaluating the nature, extent and quality of the services provided by the Adviser and the Subadviser to the Fund, the Board reviewed information describing the financial strength, experience, resources and key personnel of the Adviser and the Subadviser, including the personnel who provide investment management services to the Fund. With respect to the Adviser, the Board considered the administrative services that are provided to the Fund, as well as other services performed by the Adviser, including the monitoring of the Subadviser; monitoring of the execution of portfolio transactions; monitoring adherence to the Fund’s investment restrictions; monitoring the Fund’s compliance with its compliance policies and procedures and with applicable securities laws and regulations; producing shareholder reports; providing support services for the Board and Board committees; communicating with shareholders; and overseeing the activities of other service providers. The Board also considered the Adviser’s experience in providing investment advisory services to funds and the differentiation of the advisory services provided by the management team versus the portfolio management services provided by the Subadviser. With respect to the Subadviser, the Board noted the Subadviser’s experience in managing the strategies of the Fund and the Subadviser’s compliance program as it relates to the Fund. The Board considered the other services provided by the Subadviser under the Subadvisory Agreements, including selecting broker-dealers for execution of portfolio transactions; monitoring adherence to the Fund’s investment restrictions; and assisting with portfolio compliance with securities laws, regulations, policies and procedures.

Based upon this review, the Board concluded that the nature, quality, and extent of the services provided to the Fund by the Adviser and the Subadviser are expected to be satisfactory.

Review of Fund Performance

The Board reviewed the investment performance of the Fund. While consideration was given to performance reports provided in connection with, and discussions held at, regular Board meetings throughout the year, particular attention was given to the performance reports provided specifically in connection with the July and August Meetings. In particular, the Trustees noted that the Fund’s performance ranked in the top quartile relative to its Lipper Inc. (“Lipper”) peer universe

18

| | |

| | | BMO LGM Frontier Markets Equity Fund |

(“peer group”) over the year-to-date and one-year periods through May 31, 2016 as provided by the Adviser. The Board determined that it was satisfied with the Fund’s performance.

Costs of Services Provided and Profits Realized by the Adviser and Subadviser

The Board considered the fees payable by the Fund under the Advisory Agreement and the Subadvisory Agreement. The Board first reviewed the management fees charged to comparable accounts managed by the Adviser, taking into consideration differences in style, size and services provided to such other accounts. The Board noted that the average fee for the investment strategy was higher than the net advisory fee charged to the Fund. The Board next reviewed information provided by the Adviser comparing the Fund’s contractual advisory fee to the median fee of its Morningstar peer category (“Morningstar peers”) and to the median and average of its Strategic Insight’s Simfund peer category (“Simfund peers”), noting that the Fund’s fee was significantly higher than the median of its Morningstar and Simfund peers. In addition, the Board reviewed information provided by the Adviser comparing the Fund’s net expense ratio to the median net expense ratio of the comparable Morningstar peer group and Lipper peer group (“Lipper peers”), noting that the Fund’s net expenses were significantly higher than its Morningstar and Lipper peer groups. In light of these comparisons, the Board considered the Adviser’s explanation that the Morningstar, Simfund and Lipper peer groups consist of emerging markets funds, rather than frontier markets funds, as each of Morningstar, Simfund or Lipper do not have a frontier markets category. The Adviser explained that research, custody and trading for frontier markets investments are more expensive than for more developed markets investments, which results in the Fund’s fees and expenses being higher than that of its emerging markets competitors. In addition, the Board considered the Adviser’s statement that the Fund’s investments are focused on more “pure” frontier markets countries (as opposed to those that are nearly emerging markets countries) than other frontier markets funds, which further increases the expenses for research, custody and trading for the Fund.

With respect to the Subadviser, the Board considered the fees payable under the Subadvisory Agreement, noting that the fees would be paid by the Adviser (not the Fund). Next, the Board considered that the Adviser has agreed to a contractual expense limitation for the Fund (the “Expense Limitation”), and that the net expense ratio for the Fund takes into account the effect of the Expense Limitation.

The Board considered the methodology used by the Adviser and Subadviser in determining compensation payable to its portfolio managers and the competitive environment for investment management talent. The Board also considered the financial condition of the Adviser and certain of its affiliates and the Subadviser, and particularly focused on the financial strength of the ultimate parent company of the Adviser, and the parent company’s commitment, financial and otherwise, to the global asset management business and the BMO Fund complex.

The Board reviewed profitability information it received from the Adviser in connection with the services provided to the Fund. The materials provided in this regard showed, and the Trustees acknowledged, that the Adviser experienced a positive net margin with respect to the Fund.

Economies of Scale

The Board considered the extent to which economies of scale would be realized as the Fund grows and whether the Fund’s fee levels reflect these economies of scale for the benefit of Fund shareholders. The Board considered the Fund’s fee structure, asset size and net expense ratio giving effect to the Fund’s Expense Limitation. The Board also considered the Adviser’s commitment to continue to evaluate advisory fee breakpoints in the future.

Other Benefits to the Adviser and Subadviser

The Board considered benefits that accrue to the Adviser and its affiliates from their relationships with the Fund, including revenue in the form of administration fees and securities lending revenue. In addition, the Board considered information relating to any soft dollar arrangements in connection with equity security brokerage transactions for the Fund and/or other clients. The Board noted that, other than the services provided by the Adviser and the Subadviser pursuant to the Advisory and Subadvisory Agreements and the related fees to be paid by the Fund, the Adviser and Subadviser may potentially benefit from their relationship with each other in other ways. The Board also considered that the success of the Fund could attract other business to the Adviser and that the success of the Adviser could enhance the Adviser’s ability to serve the Fund.

The Board concluded that, taking into account all of the information reviewed, the Fund’s advisory and subadvisory fee was reasonable.

Overall Conclusions

Based on all of the information considered and the conclusions reached, the Board determined that the terms of the Advisory and Subadvisory Agreements are fair and reasonable and that the approval of the continuation of the Advisory Agreement and the Subadvisory Agreement is in the best interests of the Fund.

19

20

This report is authorized for distribution to prospective investors only when preceded or accompanied by the Fund’s prospectus, which contain facts concerning its objective and policies, management fees, expenses, and other information.

Proxy Voting

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling toll free, 1-800-236-FUND (3863) and by accessing the Fund’s Statement of Additional Information, which is available on the Fund’s website at http://www.bmofunds.com and on the SEC’s website at http://www.sec.gov.

The Fund’s proxy voting record for the most recent 12-month period ended June 30 is available without charge, upon request, by calling toll free, 1-800-236-FUND (3863) and by accessing the SEC’s website at http://www.sec.gov.

Disclosure of Portfolio Holdings

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.