Although June 30, 2014 marks the end of The Pennant 504 Fund’s first fiscal year, it nonetheless covers just a bit over six months of operations as the fund opened to investors on December 16, 2013.

During this period, the Fund –a non diversified closed end mutual fund, has seen its assets grow to just under $40 million, with approximately $16.7 million of this amount settled in new 504 first lien loans, which represent the non-guaranteed portion of a U.S. Small Business Administration Section 504 transaction. The Fund has an active pipeline of loans ready to settle, in the process of loan underwriting or in settlement abeyance awaiting construction loan take out.

The level of asset growth and deployment is remarkable in that the Fund went from creation in late 2013 to being a significant market place buyer of 504 first lien loans in a little over six months. We anticipate as the 504 first lien loan marketplace becomes increasingly familiar with the Fund, the pace of deployment in 504 first lien loans will likely increase.

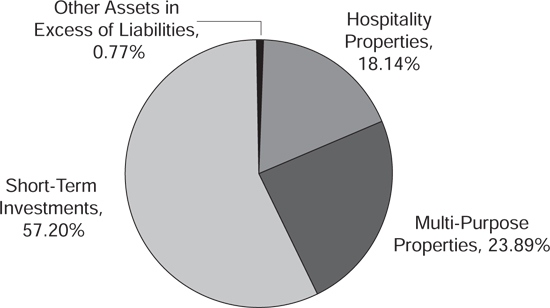

504 first lien loan deployment is essential as the low yield on cash equivalents is not helpful to investor total return potential. As of June 30, 2014, the Fund’s investment of 42.3% in 504 first lien loans had a stated yield-to-maturity of 5.53% based on the fair value of the loan portfolio. However, on that date, 57.7% was invested in a U.S. government obligations short term fund that has a stated 7-day yield of .01%. The blended pro forma return on the two primary portfolio components, 504 first lien loans and available cash equivalents, will not reach its full potential until we are approaching fully invested status.

To assist in the execution of full deployment, the Fund is in the process of evaluating the use of portfolio leverage as allowed under the Investment Company Act of 1940. The ability to utilize leverage will help the Fund’s portfolio management team to build a larger loan pipeline than is currently available, as the leverage assures that sufficient cash is available to settle a larger pipeline.

The Fund has entered into a fund wholesaling agreement with Sandler O’Neill & Partners, L.P. (“Sandler”), to offer the Fund to institutions across the United States that may request regulatory consideration of their investment under the Community Reinvestment Act of 1977. The Fund chose Sandler because of its national reputation in the banking marketplace. In addition to promoting the Fund to its banking clients, Sandler has facilitated a dialogue between the Fund and various federal financial regulators regarding potential Community Reinvestment Act benefits afforded by an investment in the Fund to institutions under their supervision.

Investors continue to operate within a prolonged environment of extremely low levels of general interest rates. For any investor in bonds or loans, this potentially poses significant interest rate risk as it seems likely that rates will move higher over time; only the timing is significantly debatable. Nonetheless, maintaining large balances in cash equivalents poses an equally challenging environment in which to address reinvestment rate risk – the opportunity cost for cash equivalents has been high. Interest rate risk and reinvestment rate risk are mutually exclusive and, therein, is the root of the problem set in constructing any bond or loan portfolio in today’s environment.

The Fund’s portfolio management team is keenly sensitized to these two competing risks and is likewise aware of the Joint Agency Policy Statement on Interest Rate Risk issued by federal banking agencies that addresses this exact issue. Accordingly, the Fund’s portfolio team is actively targeting a short effective portfolio duration of between 2 to 3.5 years.

The next twelve months promises to be an exciting period for the Fund and its shareholders as the Fund’s profile continues to advance. Our team would like to thank you for your investment and the confidence you placed in us.

Mark A. Elste, CFA

The Pennant 504 Fund is distributed by Foreside Fund Services LLC.

There can be no assurance that the Fund will achieve its investment objectives. An investment in the Fund is an appropriate investment only for those investors who can tolerate a high degree of risk and do not require a liquid investment. Investors may lose some or all of their investment in the Fund. The Fund is not designed to be a complete investment program and may not be a suitable investment for all investors. The risk factors described are the principal risk factors associated with an investment in the Fund, as well as those factors associated with an investment in an investment company with similar investment objectives and investment policies.

This report is submitted for the general information of the shareholders of the Fund. It is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus, which includes information regarding the Fund’s risks, objectives, fees, expenses and experience of its management and other considerations.

Per share income and capital changes for a share outstanding throughout the period.

1. Organization

The Pennant 504 Fund (the “Fund”) was organized as a Delaware statutory trust on July 29, 2013 and is registered with the Securities and Exchange Commission (the “SEC”) as a closed-end, non-diversified management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”) that operates as an “interval fund.” The Fund is managed by Pennant Management, Inc. (the “Adviser”), a Wisconsin corporation registered under the Investment Advisers Act of 1940, as amended. Certain trustees and officers of the Fund are also directors and officers of the Adviser, which is a wholly owned subsidiary of U.S. Fiduciary Services, Inc. 504 Fund Advisors, LLC, an affiliate of the Adviser, provides assistance with credit analysis and ongoing consulting with respect to the Fund’s investments to the Adviser, and is compensated for such services by the Adviser. The offering of the Fund’s shares of beneficial interest in the Fund (the “Shares”) is registered under the Securities Act of 1933, as amended (the “Securities Act”). Shares are offered at the offering price plus the sales load (up to 2.00%) and are expected to be offered on a continuous basis monthly (generally as of the last business day of each month) at the net asset value (“NAV”) per share plus the sales load. There are an unlimited number of authorized Shares.

The Fund’s investment objectives are to provide current income, consistent with the preservation of capital, and to enable institutional Fund investors that are subject to regulatory examination for CRA compliance to claim favorable regulatory consideration of their investment under the Community Reinvestment Act of 1977, as amended (the “CRA”). The Fund seeks to achieve its objectives by investing primarily in a portfolio of 504 First Lien Loans secured by owner-occupied commercial real estate which represent the non-guaranteed portions of U.S. Small Business Administration Section 504 transactions (“504 First Lien Loans”).

2. Accounting Policies

The preparation of the financial statements in accordance with accounting principles generally accepted in the United States (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates. In the normal course of business, the Fund has entered into contracts that contain a variety of representations which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund expects the risk of loss to be remote.

Investment Valuation – Investments for which market quotations are readily available are valued at current fair value, and all other investments are valued at fair value as determined in good faith by the Fund’s Board of Trustees (“the Board”), in accordance with the policies and procedures (the “Valuation Procedures”) adopted by the Board. The Board has a standing valuation committee (the “Valuation Committee”) that is composed of members of the Adviser, as appointed by the Board. The Valuation Committee operates under the Valuation Procedures approved by the Board. The Fund’s Valuation Committee makes regular reports to the Board concerning investments for which market quotations are not readily available. Investments in money market funds (short term investments) are valued at the closing NAV per share.

| THE PENNANT 504 FUND NOTES TO FINANCIAL STATEMENTS JUNE 30, 2014 |

2. Accounting Policies (continued)

504 First Lien Loans – The fair values of 504 First Lien Loans are analyzed using a pricing methodology designed to incorporate, among other things, the present value of the projected stream of cash flows on such investments (the “discounted cash flow” methodology). This pricing methodology takes into account a number of relevant factors, including changes in prevailing interest rates, yield spreads, the borrower’s creditworthiness, the debt service coverage ratio, lien position, delinquency status, frequency of previous late payments and the projected rate of prepayments. Newly purchased loans are initially fair valued at cost and subsequently analyzed using the discounted cash flow methodology. Loans with a pending short payoff will be fair valued at the anticipated recovery rate. Valuations of 504 First Lien Loans are determined no less frequently than weekly by the Board’s Valuation Committee.

Income – Interest income is recorded on the basis of interest accrued, adjusted for amortization of premium or accretion of discount. Fees associated with loan amendments are recognized immediately. Dividend income is recorded on the ex-dividend date for dividends received in cash and/or securities. 504 First Lien Loans will be placed in non-accrual status and related interest income reduced by ceasing current accruals and writing off interest receivables when the collection of all or a portion of interest has become doubtful as identified by the Adviser as part of the valuation process.

Distributions to Shareholders – The Fund expects to declare and pay dividends of net investment income quarterly and net realized capital gains annually. Unless shareholders specify otherwise, dividends will be reinvested in shares of the Fund. For the period ended June 30, 2014, no distributions were paid.

Use of Estimates – The preparation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expense during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes - The Fund intends to elect and to qualify each year to be treated as a regulated investment company under the provisions of Subchapter M of the Internal Revenue Code of 1986, as amended. In order to so qualify, the Fund must meet certain requirements with respect to the sources of its income, the diversification of its assets and the distribution of its income. If the Fund qualifies as a regulated investment company, it will not be subject to federal income or excise tax on income it distributes in a timely manner to its shareholders in the form of investment company taxable income or net capital gain distributions.

Accounting for Uncertainty in Income Taxes (the “Income Tax Statement”) requires an evaluation of tax positions taken (or expected to be taken) in the course of preparing a Fund’s tax return to determine whether these positions meet a “more-likely-than-not” standard that, based on the technical merits, have a more than fifty percent likelihood of being sustained by a taxing authority upon examination. A tax position that meets the “more-likely-than-not” recognition threshold is measured to determine the amount of benefit to recognize in the financial statements. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations.

The Income Tax Statement requires management of the Fund to analyze all open tax years for all major jurisdictions, which the Fund considers to be its federal income tax filings. The open tax years include the current year plus the prior three tax years, or all years if the Fund has been in existence for less than three years. As of and during the period ended June 30, 2014, the Fund did not record a liability for any unrecognized tax benefits. The Fund has no examination in progress and is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Expenses – Fund expenses that are specifically attributed to the Fund are charged to the Fund and recorded on an accrual basis.

| THE PENNANT 504 FUND NOTES TO FINANCIAL STATEMENTS JUNE 30, 2014 |

2. Accounting Policies (continued)

Fair Value Measurements – Under generally accepted accounting principles for fair value measurements, a three-tier hierarchy to prioritize the assumptions, referred to as inputs, is used in valuation techniques to measure fair value. The three-tier hierarchy of inputs is summarized in the three broad levels listed below.

| | • | Level 1 – Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| | • | Level 2 – Other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.); and |

| | • | Level 3 – Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investment). |

The following table sets forth information about the levels within the fair value hierarchy at which the Fund’s investments are measured as of June 30, 2014:

| | | | | | | | | | | | |

| | $ | — | | | $ | — | | | $ | 7,237,560 | | | $ | 7,237,560 | |

| | | — | | | | — | | | | 9,532,161 | | | | 9,532,161 | |

| | | 22,820,912 | | | | — | | | | — | | | | 22,820,912 | |

| | $ | 22,820,912 | | | $ | — | | | $ | 16,769,721 | | | $ | 39,590,633 | |

For the period ended June 30, 2014, there were no transfers into or out of Level 1, Level 2 or Level 3.

Should a transfer between Levels occur, it is the Fund’s Policy to recognize transfers in and out of all Levels at the end of reporting period.

The following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining value:

| | Balance as of December 16, 2013* | | | Purchase and funding of investments | | | Proceeds from principal payments and sales of portfolio investments | | | Unrealized Appreciation (Depreciation) on investments | | | Amortization of discount and premium | | | Balance as of June 30, 2014 | |

| | $ | — | | | $ | 7,288,470 | | | $ | (25,413 | ) | | $ | (25,360 | ) | | $ | (137 | ) | | $ | 7,237,560 | |

| | | — | | | | 9,607,454 | | | | (30,835 | ) | | | (42,942 | ) | | | (1,516 | ) | | | 9,532,161 | |

| | $ | — | | | $ | 16,895,924 | | | $ | (56,248 | ) | | $ | (68,302 | ) | | $ | (1,653 | ) | | $ | 16,769,721 | |

| * | Commenced operations on December 16, 2013. |

| THE PENNANT 504 FUND NOTES TO FINANCIAL STATEMENTS JUNE 30, 2014 |

2. Accounting Policies (continued)

The following is a summary of quantitative information about significant unobservable valuation inputs for Level 3 Fair Value Measurements for investments held as of June 30, 2014:

Type of Level 3 Investments | | Fair Value as of June 30, 2014 | | | | | | | | | | | Impact to Fair Value from an Increas in Input | |

| | $ | 7,237,560 | | | | | $ | 100.47 | | | $ | 100-102 | | | | |

| | | | | | Debt Service Coverage Ratio | | | 2.45 | | | | 1.35-4.30 | | | N/A* | |

| | | | | | Effective Loan To Value Ratio | | | 51 | % | | | 51 | % | | | |

| | | | | | | | | 731.83 | | | | 700-764 | | | N/A* | |

| | | 9,532,161 | | | | | $ | 103.09 | | | $ | 100-105 | | | | |

| | | | | | Debt Service Coverage Ratio | | | 1.79 | | | | 1.17-2.74 | | | N/A* | |

| | | | | | Effective Loan To Value Ratio | | | 54 | % | | | 48%-63 | % | | | |

| | | | | | | | | 735.80 | | | | 660-785 | | | N/A* | |

| | $ | 16,769,721 | | | | | | | | | | | | | | | |

| * | A decrease in the input would result in a decrease in fair value. |

| THE PENNANT 504 FUND NOTES TO FINANCIAL STATEMENTS JUNE 30, 2014 |

3. Concentration of Risk

504 First Lien Loans Risk – The Fund predominantly invests in fixed or variable rate 504 First Lien Loans arranged through private negotiations between a small business borrower (the “Borrower”) and one or more 504 First Lien Loan lenders. 504 First Lien Loans are secured by collateral and have a claim on the assets of the Borrower that is senior to the second lien held by a certified development company and any claims held by unsecured creditors. The 504 First Lien Loans the Fund will invest in are not rated. 504 First Lien Loans are subject to a number of risks, including credit risk, liquidity risk, valuation risk and interest rate risk. Although the 504 First Lien Loans in which the Fund will invest will be secured by collateral, there can be no assurance that such collateral can be readily liquidated or that the liquidation of such collateral would satisfy the Borrower’s obligation in the event of non-payment of scheduled interest or principal, which could result in substantial loss to the Fund.In the event of the bankruptcy or insolvency of a Borrower, the Fund could experience delays or limitations with respect to its ability to realize the benefits of the collateral securing a 504 First Lien Loan. In the event of a decline in the value of the already pledged collateral, the Fund will be exposed to the risk that the value of the collateral will not at all times equal or exceed the amount of the Borrower’s obligations under the 504 First Lien Loan.In general, the secondary trading market for 504 First Lien Loans is not fully-developed. No active trading market may exist for certain 504 First Lien Loans, which may make it difficult to value them. Illiquidity and adverse market conditions may mean that the Fund may not be able to sell certain 504 First Lien Loans quickly or at a fair price. To the extent that a secondary market does exist for certain 504 First Lien Loans, the market for them may be subject to irregular trading activity, wide bid/ask spreads and extended trade settlement periods.

Credit Risk – Credit risk is the risk that one or more debt instruments in the Fund’s portfolio will decline in price or fail to pay interest or principal when due because the borrower experiences a decline in its financial status. Losses may occur because the market value of a debt security is affected by the creditworthiness of the borrower and by general economic and specific industry conditions.

Valuation Risk – Unlike publicly traded equity securities that trade on national exchanges, there is no central place or exchange for fixed income instruments or 504 First Lien Loans to trade. Fixed income instruments and 504 First Lien Loans generally trade on an ‘‘over-the-counter’’ market which may be anywhere in the world where the buyer and seller can settle on a price. Due to the lack of centralized information and trading, the Adviser’s judgment plays a greater role in the valuation process and the valuation of fixed income instruments and 504 First Lien Loans. Uncertainties in the conditions of the financial market, unreliable reference data, lack of transparency and inconsistency of valuation models and processes may lead to inaccurate asset pricing. In addition, other market participants may value instruments differently than the Fund. As a result, the Fund may be subject to the risk that when a fixed income instrument is sold in the market, the amount received by the Fund is less than the value that such fixed income instrument is carried at on the Fund’s financial statements.

For other risks associated with the Fund and its investments please refer to the Risks section in the prospectus.

4. Periodic Repurchase Offers

The Fund will make periodic offers to repurchase a portion of its outstanding shares at NAV per share. The Fund has adopted a fundamental policy to make repurchase offers once every twelve months. The Fund will offer to repurchase 5% of its outstanding shares, unless the Board has approved a higher amount (but not more than 25%) of the outstanding shares. The Fund does not currently expect to charge a repurchase fee. The Fund expects the first repurchase offer to be issued on or about December 15, 2014.

| THE PENNANT 504 FUND NOTES TO FINANCIAL STATEMENTS JUNE 30, 2014 |

5. Administration, Distribution, Transfer Agency and Custodian Agreements.

The Fund and its administrator, UMB Fund Services, Inc. (“UMBFS” or the “Administrator”), are parties to an administration agreement under which the Administrator provides administrative and fund accounting services.

UMBFS also serves as the transfer agent and dividend disbursing agent for the Fund.

UMB Bank, N.A. acts as custodian (the “Custodian”) for the Fund. The Custodian plays no role in determining the investment policies of the Fund or which securities are to be purchased and sold by the Fund.

The Adviser and Foreside Fund Services, LLC, the Fund’s distributor, are parties to a distribution agreement with the Fund.

6. Investment Advisory Agreement

The Fund has entered into an investment advisory agreement (the “Investment Advisory Agreement”) with the Adviser. Under the Investment Advisory Agreement, the Adviser makes investment decisions for the Fund and continuously reviews, supervises and administers the investment program of the Fund, subject to the supervision of, and policies established by, the Board. For providing these services, the Adviser will receive a fee from the Fund, accrued daily and paid monthly, at an annual rate equal to 2.00% of the Fund’s average daily net assets. However, the Adviser has contractually agreed to waive or reduce its management fees and/or reimburse expenses of the Fund to ensure that total annual Fund operating expenses after fee waiver and/or expense reimbursement (exclusive of any interest, taxes, brokerage commissions, acquired fund fees and expenses and extraordinary expenses and inclusive of organizational and offering costs) will not exceed 2.50% of the average net assets of the Fund (the “Operating Expenses Limitation Agreement”). Under the terms of the Investment Advisory Agreement and the Operating Expenses Limitation Agreement, any such reductions made by the Adviser in its fees or payment of expenses which are the Fund’s obligation are subject to reimbursement by the Fund to the Adviser for a period of three fiscal years following the end of the fiscal year in which such reduction or payment was accrued. For the period ended June 30, 2014, fees and expenses amounting to $372,327 (which excludes organizational costs expensed in the current period) are subject to reimbursement through June 30, 2017. Organization costs amounting to $213,643 are also subject to reimbursement by the Fund to the Adviser for a period of three years from the date on which such expenses were incurred, if so requested by the Adviser, if the aggregate amount actually paid by the Fund toward the operating expenses for such fiscal year (taking into account the reimbursement) does not exceed the applicable limitation on Fund expenses. Such reimbursement may not be paid prior to the Fund’s payment of current ordinary operating expenses, and would expire by December 2016. The Operating Expenses Limitation Agreement is in effect through at least December 31, 2015, and may be terminated only by, or with the consent of, the Board.

At June 30, 2014, offering costs of $338,502 have been amortized to expense over twelve months on a straight-line basis since December 16, 2013, commencement of operations. During the period ended June 30, 2014, $181,771 of the total offering costs was amortized to expense.

7. Investment Transactions

For the period ended June 30, 2014, there were long term purchases of $16,895,924 and no sales in the Fund.

| THE PENNANT 504 FUND NOTES TO FINANCIAL STATEMENTS JUNE 30, 2014 |

8. Federal Tax Information

At June 30, 2014, gross unrealized appreciation/depreciation of investments owned by the Fund, based on cost for federal income tax purposes were as follows:

| Cost of investments | | $ | 39,658,935 | |

| Gross unrealized appreciation | | $ | 1,559 | |

| Gross unrealized depreciation | | | (69,861 | ) |

| Net unrealized appreciation on investments | | $ | (68,302 | ) |

GAAP requires that certain components of net assets be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. For the fiscal period ended June 30, 2014 permanent differences in book and tax accounting have been reclassified to paid in capital, accumulated net investment income and accumulated net realized loss on investments as follows:

| Accumulated Net Investment Income (Loss) | Accumulated Net Realized Gain (Loss) |

| $ (222,980) | $ 223,961 | $ (981) |

As of June 30, 2014 the components of accumulated earnings (deficit) on a tax basis for the Fund were as follows:

| Undistributed ordinary income | | $ | — | |

| Undistributed long-term gains | | | — | |

| Tax accumulated earnings | | | — | |

| Accumulated capital and other losses | | $ | (981 | ) |

| Unrealized depreciation on investments | | | (68,302 | ) |

| Total accumulated earnings (deficit) | | $ | (69,283 | ) |

Losses incurred after October 31 (“post-October” losses) within the taxable year are deemed to arise on the first day of the Fund’s next taxable year. As of June 30, 2014, the Fund had $981 of post-October capital losses which are deferred until July 1, 2014 for tax purposes.

9. Control Ownership

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities creates a presumption of control of the Fund, under Section 2(a)(9) of the 1940 Act. As of June 30, 2014, Northwest Federal Credit Union had ownership in the Fund in the amount of 74.55%.

10. Subsequent Events

The Fund has evaluated the need for additional disclosures and/or adjustments resulting from subsequent events through the date the financial statements were issued, except for the following:

The due from Adviser receivable balance of $122,153 as stated on the Statement of Assets and Liabilities has been paid to the Fund by the Adviser.

| THE PENNANT 504 FUND REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

To the Shareholders and Board of Trustees of

The Pennant 504 Fund

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of The Pennant 504 Fund (the “Fund”) as of June 30, 2014, and the related statements of operations, changes in net assets, and cash flows, and the financial highlights for the period December 16, 2013 (commencement of operations) through June 30, 2014. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of June 30, 2014, by correspondence with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of The Pennant 504 Fund as of June 30, 2014, the results of its operations, changes in net assets, and cash flows, and the financial highlights for the period December 16, 2013 (commencement of operations) through June 30, 2014, in conformity with accounting principles generally accepted in the United States of America.

As discussed in Note 2 to the financial statements, the financial statements include investments valued at $16,769,721 (42% of net assets) as of June 30, 2014, whose fair values have been estimated by management in accordance with policies approved by and under the general oversight of the Board of Trustees in the absence of readily determinable fair values.

COHEN FUND AUDIT SERVICES, LTD.

Cleveland, Ohio

August 29, 2014

| THE PENNANT 504 FUND OTHER INFORMATION (UNAUDITED) JUNE 30, 2014 |

Proxy Voting

For a description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, please call 800-996-2862 and request a Statement of Additional Information. One will be mailed to you free of charge. The Statement of Additional Information is also available on the SEC’s website at http://www.sec.gov.

Information on how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 will be available without charge, upon request, by calling 877-997-9971 or by accessing the SEC’s website at http://www.sec.gov.

Disclosure of Portfolio Holdings

The Fund files a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available on the SEC’s website at www.sec.gov, and may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

| THE PENNANT 504 FUND TRUSTEES AND OFFICERS (UNAUDITED) JUNE 30, 2014 |

Information pertaining to the Trustees and officers of the Fund is set forth below. Trustees who are not “interested persons” of the Fund as that term is defined in the 1940 Act are referred to as “Independent Trustees.” The business address of each Trustee or officer is c/o The Pennant 504 Fund, 11270 West Park Place, Suite 1025, Milwaukee, Wisconsin 53224. The Statement of Additional Information includes additional information about the Trustees and is available, without charge, upon request by calling 1-800-996-2862.

Name and Year of Birth | Position with Fund and Length of Term | Principal Occupations in the Past 5 Years | Number of Portfolios in Fund Complex2 Overseen By Trustee | Other Directorships Held in the Past 5 Years |

Interested Trustee1 | | | | |

Mark A. Elste, CFA Born: 1954 | Chairman of the Board of Trustees, Interested Trustee, President and Principal Executive Officer (Indefinite term; since 2013) | Chief Executive Officer, Pennant Management, Inc. (since 1992); Senior Executive Vice President, Chief Operating Officer and Director, U.S. Fiduciary Services, Inc. (financial services holding company) (since 2004); Director, Waretech, Inc. (wholly-owned subsidiary of U.S. Fiduciary Services, Inc.) (since 2006); Director, USF Affiliate Services, Inc. (wholly-owned subsidiary of U.S. Fiduciary Services, Inc.) (since 2006); Director, Salem Trust Company (Florida trust company) (since 2006); Director, GreatBanc Trust Company (Illinois trust company) (since 2004); Chief Executive Officer and Managing Member, 504 Fund Advisors, LLC (investment advisory firm) (since 2013) | 3 | CIB Marine Bancshares, Inc. (bank holding company) (since 2011) |

| Independent Trustees | | | | |

J. Clay Singleton, Ph.D., CFA Born: 1947 | Trustee (Indefinite term; since 2013) | Professor of Finance, Crummer Graduate School of Business, Rollins College (since 2002); Consultant, Director of Indexes, PCE Investment Bankers (2005 to 2011) | 3 | None |

| THE PENNANT 504 FUND TRUSTEES AND OFFICERS (UNAUDITED) JUNE 30, 2014 |

Name and Year of Birth | Position with Fund and Length of Term | Principal Occupations in the Past 5 Years | Number of Portfolios in Fund Complex2 Overseen By Trustee | Other Directorships Held in the Past 5 Years |

Cornelius J. Lavelle Born: 1944 | Trustee (Indefinite term; since 2013) | Retired; Director-Institutional Equities, Citigroup Global Markets Inc. (multinational financial services firm) (1997 to 2009) | 3 | Independent Trustee, Broadview Funds Trust (an open-end investment company with one series) (since 2013) |

George Stelljes, III Born: 1961 | Trustee (Indefinite term; since 2013) | Retired; President, Chief Investment Officer and Director of the Gladstone Companies (family of public and private investment funds) (2002 to 2013) | 1 | Director, Gladstone Capital Corporation (business development company) (resigned 2013); Director, Gladstone Commercial Corporation (real estate investment trust) (resigned 2013); Director, Gladstone Investment Corporation (business development company (resigned 2013); Director, Gladstone Land Corporation (real estate investment company) (resigned 2012) |

| Other Officers | | | | |

Scott M. Conger Born: 1968 | Secretary, Chief Compliance Officer and AML Compliance Officer (Indefinite term; since 2013) | Senior Vice President and Chief Compliance Officer, Pennant Management, Inc. (since 2011); Chief Compliance Officer, 504 Fund Advisors LLC (investment advisory team) (since 2013); Director, Treasury Analysis, Stone Pillar Advisors, Ltd. (financial services) (2010 to 2011); Vice President, Amcore Bank, N.A. (2006 to 2010) | N/A | N/A |

| THE PENNANT 504 FUND TRUSTEES AND OFFICERS (UNAUDITED) JUNE 30, 2014 |

Name and Year of Birth | Position with Fund and Length of Term | Principal Occupations in the Past 5 Years | Number of Portfolios in Fund Complex2 Overseen By Trustee | Other Directorships Held in the Past 5 Years |

Walter J. Yurkanin Born: 1965 | Treasurer and Principal Financial Officer (Indefinite term; since 2013) | Chief Legal Officer, Chief Risk Officer and Secretary, U.S. Fiduciary Services, Inc. (since 2012); Director, President, Chief Executive Officer, Chief Legal Officer, Chief Risk Officer and Secretary, USF Affiliate Services, Inc. (wholly-owned subsidiary of U.S. Fiduciary Services, Inc.) (since 2013); Director and Chief Executive Officer, Waretech, Inc. (wholly-owned subsidiary of U.S. Fiduciary Services, Inc.) (since 2013); Secretary of GreatBanc Trust Company (Illinois trust company), Salem Trust Company (Florida trust company) and Pennant Management, Inc. (since 2013); Senior Vice President and General Counsel, U.S. Fiduciary Services, Inc. (2012 to 2013); General Counsel and Compliance Officer, Breakwater Trading, LLC (financial services) (2006 to 2012) | N/A | N/A |

| 1 | Mr. Elste is deemed to be an “interested person” of the Fund as that term is defined in the 1940 Act by virtue of his positions with the Adviser. |

| 2 | The Fund Complex includes the USFS Funds Trust, which is advised by Pennant Management, Inc. and has two funds: the USFS Funds Limited Duration Government Fund and the USFS Funds Tactical Asset Allocation Fund. |

THE PENNANT 504 FUND

11270 West Park Place, Suite 1025

Milwaukee, WI 53224

INVESTMENT ADVISOR

Pennant Management, Inc.

11270 West Park Place, Suite 1025

Milwaukee, WI 53224

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Cohen Fund Audit Services

1350 Euclid Ave., Suite 800

Cleveland, OH 44115

LEGAL COUNSEL

Godfrey & Kahn S.C.

780 North Water Street

Milwaukee, WI 53202

CUSTODIAN

UMB Bank, N.A.

1010 Grand Boulevard

Kansas City, MO 64106

DISTRIBUTOR

Foreside Fund Services, LLC

Three Canal Plaza, Suite 100

Portland, Maine 04101

TRANSFER AGENT

UMB Fund Services, Inc.

235 West Galena Street

Milwaukee, WI 53212

ITEM 2. CODE OF ETHICS.

(a) The Pennant 504 Fund (the “registrant” or the “Fund”), as of the end of the period covered by this report, has adopted a code of ethics (the “code of ethics”) that applies to the registrant's principal executive officer, principal financial officer, principal accounting officer and controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party.

(c) There have been no amendments, during the period covered by this report, to

(d) The registrant has not granted any waivers, during the period covered by this report, including an implicit waiver, from any provision of the code of ethics.

A copy of the registrant’s code of ethics is filed herewith.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

The registrant’s board of trustees has determined that there are two audit committee financial experts serving on its audit committee. Mr. George Stelljes, III and Dr. J. Clay Singleton are each qualified to serve as audit committee financial experts serving on its audit committee and each is "independent," as defined by Item 3 of Form N-CSR.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

This is the registrant’s first fiscal year of operations.

The registrant has engaged Cohen Fund Audit Services, Ltd. to perform audit services, audit-related services, tax services and other services during the fiscal year ended June 30, 2014. “Audit services” refer to performing an audit of the registrant's annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. The following table details the aggregate fees billed or expected to be billed for the fiscal year 2014 for audit fees, audit-related fees, tax fees and other fees by Cohen Fund Audit Services, Ltd.

| | FYE 6/30/2014 |

| Audit Fees | $35,000 |

| Audit-Related Fees | $0 |

| Tax Fees | $3,000 |

| All Other Fees | $0 |

The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any entity affiliated with the registrant.

The percentage of fees billed by Cohen Fund Audit Services, Ltd. applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| | FYE 6/30/2014 |

| Audit-Related Fees | 0% |

| Tax Fees | 0% |

| All Other Fees | 0% |

All of the principal accountant’s hours spent on auditing the registrant’s financial statements were attributed to work performed by full-time permanent employees of the principal accountant.

The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (and any other controlling entity, etc.) for the last fiscal year.

The amount of fees billed by Cohen Fund Audit Services, Ltd. applicable to non-audit fees were as follows:

| | FYE 6/30/2014 |

| Registrant | $3,000(1) |

| Registrant’s Investment Adviser | $0 |

| | (1) | The aggregate non-audit fees were for tax services rendered to the registrant. As disclosed above, the amount of fees billed for such services were $3,000 for the fiscal year ended June 30, 2014. |

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable.

ITEM 6. INVESTMENTS.

Schedule of Investments in securities of unaffiliated issuers as of the close of the reporting period is included as part of the report to shareholders filed under Item 1 of this Form.

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END

MANAGEMENT INVESTMENT COMPANIES.

The Fund’s Board of Trustees (the “Board”) has delegated authority to vote proxies on behalf of the Fund to Pennant Management, Inc. (“Pennant Management”, the “Adviser” or the “Company”), subject to the supervision of the Board. The Board has approved the Adviser’s proxy voting policies and procedures. In the event of a conflict between the Adviser and the Fund, the Adviser’s policies provide that the conflict shall be disclosed to the Fund, who shall provide written direction to vote the proxies. In the event such a conflict arises, the Fund will instruct the Adviser to provide notices to the Board. The Board has delegated its authority to provide proxy voting direction to the disinterested trustees, and the proxy voting direction in such case shall be determined by a majority of the disinterested trustees.

When Pennant Management has discretion to vote the proxies of its clients, as a matter of policy and as a fiduciary to our clients, Pennant Management is responsible for voting proxies for portfolio securities consistent with the best economic interests of the clients. Our firm maintains written policies and procedures as to the handling, research, voting and reporting of proxy voting and makes appropriate disclosures about our firm’s proxy policies and practices. Our policy and practice includes the responsibility to monitor corporate actions, receive and vote client proxies and disclose any potential conflicts of interest as well as making information available to clients about the voting of proxies for their portfolio securities and maintaining relevant and required records.

As a general rule, Pennant Management does not vote proxy ballots. As such, custodial agents are directed to send such data directly to clients.

Proxy voting is an important right of shareholders and reasonable care and diligence must be undertaken to ensure that such rights are properly and timely exercised. When the Company has discretion to vote the proxies of its clients, it will vote those proxies in the best interest of its clients and in accordance with these procedures and policies.

| | 1. | The Investment Committee, which is the committee consisting of all the Portfolio Managers, is designated as the Company’s policy-making body with respect to proxy voting. In this capacity, the Investment Committee will be aided by the Heads of the Administration Group, the Operations Group and the General Counsel, with whom the Investment Committee may consult as and when needed. |

| | 2. | The Investment Committee may delegate decisions with respect to specific proxy issues to one of the Portfolio Managers who is most familiar with the issuer and its business. |

| | 3. | The Investment Committee may designate staff to receive proxies, reconcile them with security ownership positions as of the specified record dates and to separate proxies with respect to issues designated by the Investment Committee for further review. |

| | 4. | The Investment Committee will designate the staff responsible for monitoring corporate actions, making voting decisions in accordance with this policy, and for ensuring that proxies are submitted timely. |

| | 5. | The Investment Committee shall determine, on a case-by-case basis, the need to contact an issuer or other security holders to gather additional information with respect to a proposal. |

Notwithstanding the foregoing, the Company may retain a service provider to administer this policy. Copies of the proxy materials received and a record reflecting how such proxies were voted may be maintained by such service provider if such service provider has given an undertaking to maintain such records and to provide copies to the Company promptly upon request.

| II. | PROXY VOTING PROCEDURES |

All proxies received by the Company will be sent to the Investment Committee. The Investment Committee will:

| | 1. | Keep a record of each proxy received. |

| | 2. | Determine which accounts managed by the Company hold the security to which the proxy relates. |

| | 3. | Compile a list of accounts that hold the security, together with the number of votes each account controls (reconciling any duplications), and the date by which the Company must vote the proxy in order to allow enough time for the completed proxy to be returned to the issuer prior to the vote taking place. |

| | 4. | Identify Routine Items, Non-Routine Items and Conflict of Interest Items on the proxy and determine whether a specific policy of the Company applies to the Non-Routine Items and Conflict of Interest Items. |

Conflicts of Interest

| | a. | If the Company has a direct or indirect interest in any issue that is the subject of a proxy to be voted for a client’s account, the Company shall disclose to the client in writing the substance of the Company’s interest in the issue and shall seek from the client written direction on how such issue is to be voted. |

| | b. | If the Company does not receive written direction from a client on how to vote on an issue on which the Company has a direct or indirect interest, the Company may resolve the conflict by voting client securities based upon the recommendations of the issuer’s management. |

| | c. | This existence of an issue on which the Company has a direct or indirect issue shall not prevent the Company from voting on other issues on the same proxy on which the Company does not have a conflict of interest. |

| | 5. | Vote a Routine Item (with no corporate governance implications) according to the Company’s specific policy and, if applicable, vote the Non-Routine Item or Conflict of Interest Item according to the Company’s specific policy. The Investment Committee should vote these proxies by completing them and submitting them in a timely and appropriate manner. |

| | 6. | If no specific policy applies to a Non-Routine Item or Conflict of Interest Item, follow the general policy for voting of Non-Routine Items and Conflict of Interest Items. |

| | 7. | The Company may retain a third party to assist it in coordinating and voting proxies with respect to client securities. If so, the Investment Committee shall monitor the third party to assure that all proxies are being properly voted and appropriate records are being retained. |

| III. | PROXY VOTING POLICIES |

In the absence of specific voting guidelines from a client, the Company will vote proxies in the best interests of each particular client, which may result in different voting results for proxies for the same issuer. The Company believes that voting proxies in accordance with the following policies is in the best interests of its clients.

| | 1. | Specific Voting Policies |

| | · | The Company will generally vote FOR the election of directors (where no corporate governance issues are implicated). |

| | · | The Company will generally vote FOR the selection of independent auditors. |

| | · | The Company will generally vote FOR increases in or reclassification of common stock. |

| | · | The Company will generally vote FOR management recommendations adding or amending indemnification provisions in charter or by-laws. |

| | · | The Company will generally vote FOR changes in the board of directors. |

| | · | The Company will generally vote FOR outside director compensation. |

| | B. | Non-Routine and Conflict of Interest Items: |

| | · | The Company will generally vote FOR management proposals for merger or reorganization if the transaction appears to offer fair value. |

| | · | The Company will generally vote FOR measures intended to increase long-term stock ownership by executives. |

| | · | The Company will generally vote AGAINST shareholder resolutions that consider non-financial impacts of mergers. |

| | · | The Company will generally vote AGAINST anti-greenmail provisions. |

| | · | The Company will generally vote AGAINST proposals to lower barriers to shareholder action. |

| | · | The Company will generally vote AGAINST proposals to impose super-majority requirements. |

If the proxy includes a Routine Item that implicates corporate governance changes, a Non-Routine Item where no specific policy applies or a Conflict of Interest Item where no specific policy applies, then the Investment Committee will engage the appropriate parties to determine how the proxies should be voted.

ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

| (a)(1) | Identification of Portfolio Manager(s) and Description of Role of Portfolio Manager(s) |

The following table provides biographical information about the Portfolio Managers, who are primarily responsible for the day-to-day portfolio management of the Fund as of the date hereof:

| Name of Portfolio Manager | Title | Length of Time of Service to the Fund | Business Experience During the Past 5 Years |

Mark A. Elste | Chief Executive Officer of the Adviser | Since Inception | Mark A. Elste, CFA®, has been Chief Executive Officer, Pennant Management, Inc. (since 1992); Senior Executive Vice President, Chief Operating Officer and Director, U.S. Fiduciary Services, Inc. (financial services holding company) (since 2004); Director, Waretech, Inc. (wholly-owned subsidiary of U.S. Fiduciary Services, Inc.) (since 2006); Director, USF Affiliate Services, Inc. (wholly-owned subsidiary of U.S. Fiduciary Services, Inc.) (since 2006); Director, Salem Trust Company (Florida trust company) (since 2006); Director, GreatBanc Trust Company (Illinois trust company) (since 2004); Chief Executive Officer and Managing Member, 504 Fund Advisors, LLC (investment advisory firm) (since 2013) |

Jordan M. Blanchard | Portfolio Manger | Since Inception | Mr. Blanchard also is currently a Managing Director of 504 Secondary Markets for Government Loan Solutions, Inc. (“GLS”), a consulting firm specializing in the SBA secondary market. Mr. Blanchard has worked for GLS since 2011. Prior to joining GLS, Mr. Blanchard was Senior Vice President of Capital Markets for CDC Direct Capital (“CDC Direct”) from 2009 to 2011. CDC Direct is a subsidiary of CDC Small Business Finance Corp., the nation’s largest community development corporation. While at CDC Direct, Mr. Blanchard oversaw the development of two major SBA 504 secondary market programs. Prior to CDC Direct, Mr. Blanchard was the head of a 504 wholesale department for Excel National Bank from 2008 to 2009. |

Robert O. Judge | Portfolio Manger | Since Inception | Mr. Judge also is currently a partner of GLS, which he co-founded in 2006 for the purpose of bringing greater transparency, efficiency, and productivity to the SBA marketplace through the use of technology. GLS also assists lenders in compliance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 820 (“ASC 820”) regarding the proper valuation of their SBA servicing portfolios. Mr. Judge is the editor of the CPR Report®, a monthly publication that tracks SBA loan default, prepayment and secondary market activity. |

| (a)(2) | Other Accounts Managed by Portfolio Manager(s) or Management Team Member and Potential Conflicts of Interest |

The following table provides information about portfolios and accounts, other than the Fund, for which the Portfolio Managers are primarily responsible for the day-to-day portfolio management as of June 30, 2014:

| Name of Portfolio Manager | Type of Accounts | Total Number of Accounts Managed | Total Assets | Number of Accounts Managed for Which Advisory Fee is Based on Performance | Total Assets for Which Advisory Fee is Based on Performance |

| Mark A. Elste | Registered Investment Companies | 0 | $0 | 0 | $0 |

| | Other Pooled Investment Vehicles | 1 | $89,300,000 | 0 | $0 |

| | Other Accounts | 16 | $9,700,000 | 0 | $0 |

| | | | | | |

| Jordan M. Blanchard | Registered Investment Companies | 0 | $0 | 0 | $0 |

| | Other Pooled Investment Vehicles | 0 | $0 | 0 | $0 |

| | Other Accounts | 0 | $0 | 0 | $0 |

| | | | | | |

| Robert O. Judge | Registered Investment Companies | 0 | $0 | 0 | $0 |

| | Other Pooled Investment Vehicles | 0 | $0 | 0 | $0 |

| | Other Accounts | 0 | $0 | 0 | $0 |

Potential Conflicts of Interests

The Adviser serves as the Fund’s Investment Adviser. The Adviser and the portfolio managers will be subject to certain conflicts of interest in their management of the Fund. These conflicts will arise primarily from the involvement of the Adviser and the portfolio managers in other activities that may conflict with those of the Fund.

The Adviser believes that the portfolio managers have sufficient time and resources to discharge their responsibilities to the Fund. However, conflicts of interest may arise in allocating time, services or functions between the Fund and other entities or businesses to which a portfolio manager provides services. A portfolio manager will devote such time to the Fund as he believes is reasonably necessary to the conduct of the business of the Fund and its respective investments.

In the ordinary course of his business activities, a portfolio manager may engage in activities where the interests of the Fund and its shareholders conflict with the interest of other entities or businesses to which a portfolio manager provides services. Other present and future activities of the portfolio managers or such entities or businesses may give rise to additional conflicts of interest. In the event that a conflict of interest arises, a portfolio manager will attempt to resolve such conflicts in a fair and equitable manner and in accordance with the requirements and limitations of the Investment Company Act of 1940, as amended.

| (a)(3) | Compensation Structure of Portfolio Manager(s) |

Mr. Elste is compensated by the Adviser’s parent company, U.S. Fiduciary Services, Inc., with a fixed salary plus a bonus based on the profitability of the parent company. Mr. Blanchard and Mr. Judge are compensated by GLS with a fixed salary plus a bonus based upon the performance of GLS and do not receive compensation from the Adviser or the Fund.

| (a)(4) | Disclosure of Securities Ownership |

The following table sets forth the dollar range of equity securities beneficially owned by each Portfolio Manager in the Fund as of June 30, 2014:

| Portfolio Manager | Dollar Range of Fund Shares Beneficially Owned |

| Mark A Elste | None |

| Jordan M. Blanchard | None |

| Robert O. Judge | None |

ITEM 9. PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS.

There were no purchases made by or on behalf of the registrant or any “affiliated purchaser,” as defined in Rule 10b-18(a)(3) under the Exchange Act (17 CFR 240.10b-18(a)(3)), of shares or other units of any class of the registrant’s equity securities that is registered by the registrant pursuant to Section 12 of the Exchange Act (15 U.S.C. 781).

There were no purchases that do not satisfy the conditions of the safe harbor of Rule 10b-18 under the Exchange Act (17 CFR 240.10b-18), made in the period covered by this report.

ITEM 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

There have been no material changes to the procedures by which the shareholders may recommend nominees to the registrant's board of trustees, where those changes were implemented after the registrant last provided disclosure in response to the requirements of Item 407(c)(2)(iv) of Regulation S-K (17 CFR 229.407) (as required by Item 22(b)(15) of Schedule 14A (17 CFR 240.14a-101)), or this Item.

ITEM 11. CONTROLS AND PROCEDURES.

(a) The registrant's principal executive and principal financial officers, or persons performing similar functions, have concluded that the registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended (the "1940 Act") (17 CFR 270.30a-3(c))) are effective, as of a date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, based on their evaluation of these controls and procedures required by Rule 30a-3(b) under the 1940 Act (17 CFR 270.30a-3(b)) and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934, as amended (17 CFR 240.13a-15(b) or 240.15d-15(b)).

(b) There were no changes in the registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act (17 CFR 270.30a-3(d)) that occurred during the registrant's second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant's internal control over financial reporting.

ITEM 12. EXHIBITS.

(a)(1) Registrant’s Code of Ethics, is filed herewith.

(a)(2) Certifications pursuant to Rule 30a-2(a) under the 1940 Act and Section 302 of the Sarbanes-Oxley Act of 2002 are filed herewith.

(a)(3) Not applicable.

(b) Certifications pursuant to Rule 30a-2(b) under the 1940 Act and Section 906 of the Sarbanes-Oxley Act of 2002 are filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| (Registrant) | The Pennant 504 Fund | |

| | | |

| By (Signature and Title) | /s/ Mark A. Elste | |

| | Mark A. Elste, President | |

| | (principal executive officer) | |

| | | |

| Date | September 8, 2014 | |

| | | |

| Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated. |

| | | |

| By (Signature and Title) | /s/ Mark A. Elste | |

| | Mark A. Elste, President | |

| | (principal executive officer) | |

| | | |

| Date | September 8, 2014 | |

| | | |

| By (Signature and Title) | /s/ Walter J. Yurkanin | |

| | Walter J. Yurkanin, Treasurer | |

| | (principal financial officer) | |

| | | |

| Date | September 8, 2014 | |