Exhibit 99.21

VILLAGE FARMS INTERNATIONAL, INC.

– and –

EMERALD HEALTH BOTANICALS INC.

- and –

EMERALD HEALTH THERAPEUTICS INC.

- and –

1121371 B.C. LTD.

SHAREHOLDERS AGREEMENT

June 6, 2017

TABLE OF CONTENTS

ARTICLE 1 INTERPRETATION | 1 | |||||

1.1 | Defined Terms | 1 | ||||

1.2 | Rules of Construction | 15 | ||||

1.3 | Currency | 16 | ||||

1.4 | Schedules | 16 | ||||

1.5 | Additional Shares | 16 | ||||

1.6 | Company to Be Bound | 16 | ||||

ARTICLE 2 NATURE AND SCOPE OF AGREEMENT | 17 | |||||

2.1 | Purpose and Goal of Company | 17 | ||||

2.2 | Purposes of Agreement | 17 | ||||

2.3 | No Partnership or Agency; Ability to Pursue Business Interests | 17 | ||||

2.4 | Priority of Agreements | 17 | ||||

2.5 | Liability Several | 17 | ||||

2.6 | Implied Covenants | 18 | ||||

ARTICLE 3 REPRESENTATIONS AND WARRANTIES; CONDITIONS | 18 | |||||

3.1 | Representations and Warranties of Emerald and Emerald Therapeutics | 18 | ||||

3.2 | Representations and Warranties of Village Farms | 19 | ||||

3.3 | Survival | 21 | ||||

ARTICLE 4 TRANSITION PERIOD | 21 | |||||

4.1 | Administrative Services | 21 | ||||

4.2 | Emerald to Lead Licensing on Behalf of the Company | 22 | ||||

4.3 | Employee Matters | 23 | ||||

4.4 | [Redacted: Commercially Sensitive Information] | 25 | ||||

4.5 | Distribution | 25 | ||||

ARTICLE 5 CORPORATE MATTERS | 25 | |||||

5.1 | Board | 25 | ||||

5.2 | Meetings of the Board | 26 | ||||

5.3 | Powers and Functions of the Board | 27 | ||||

5.4 | Matters Requiring Approval | 28 | ||||

5.5 | Shareholder Approval | 30 | ||||

5.6 | [Redacted: Commercially Sensitive Information] | 30 | ||||

5.7 | Auditors | 30 | ||||

5.8 | Fiscal Year | 30 | ||||

5.9 | Legend | 30 | ||||

5.10 | Agreement to Take Corporate Actions | 30 | ||||

ARTICLE 6 MANAGEMENT OF OPERATIONS | 31 | |||||

6.1 | Designation of President | 31 | ||||

6.2 | Nature of Rights and Obligations of the President | 31 | ||||

6.3 | Specified Obligations of the President | 31 | ||||

6.4 | Reporting Requirements. | 32 | ||||

6.5 | Designation of Controller | 33 | ||||

6.6 | Designation of Head of Quality Assurance | 33 | ||||

6.7 | Designation of Senior Person in Charge | 33 | ||||

6.8 | Designation of Head of Quality Control | 33 | ||||

6.9 | Designation of Head Grower | 34 | ||||

6.10 | Inspection and Access | 34 | ||||

6.11 | Performance by President of Approved Operating Plans | 34 | ||||

- i -

ARTICLE 7 OPERATING PLANS; FUNDING | 34 | |||||

7.1 | Initial Funding | 34 | ||||

7.2 | Operating Plans | 36 | ||||

7.3 | Procedures Related to Operating Plans | 37 | ||||

7.4 | [Redacted: Commercially Sensitive Information] | 37 | ||||

7.5 | Funding Obligations | 37 | ||||

7.6 | Method of Funding | 38 | ||||

7.7 | Emergency or Unexpected Funding | 38 | ||||

ARTICLE 8 DEFAULTS AND REMEDIES | 38 | |||||

8.1 | Defaults | 38 | ||||

8.2 | Funding Default | 39 | ||||

8.3 | Dilution Mechanism | 40 | ||||

8.4 | Non-Funding Default | 40 | ||||

8.5 | Appraisers | 41 | ||||

8.6 | No Penalty | 41 | ||||

8.7 | Continuing Liabilities Upon Adjustment of Proportionate Interests | 42 | ||||

8.8 | Indemnities | 42 | ||||

ARTICLE 9 DISTRIBUTIONS | 42 | |||||

9.1 | Payment of Distributions | 42 | ||||

ARTICLE 10 TRANSFERS; PREFERENTIAL PURCHASE RIGHTS | 43 | |||||

10.1 | Restrictions on Transfer | 43 | ||||

10.2 | Transfers to Affiliates | 44 | ||||

10.3 | [Redacted: Commercially Sensitive Information] | 44 | ||||

10.4 | [Redacted: Commercially Sensitive Information] | 44 | ||||

10.5 | [Redacted: Commercially Sensitive Information] | 45 | ||||

10.6 | [Redacted: Commercially Sensitive Information] | 45 | ||||

10.7 | Tax Matters | 45 | ||||

10.8 | Shareholder Cross Pledge | 45 | ||||

ARTICLE 11 STANDSTILL | 45 | |||||

11.1 | Emerald Standstill | 45 | ||||

11.2 | Village Farms Standstill | 47 | ||||

ARTICLE 12 CONFIDENTIALITY; NON-SOLICITATION; PUBLIC DISCLOSURE | 48 | |||||

12.1 | Confidentiality of Transaction Confidential Information | 48 | ||||

12.2 | Use of Confidential Information | 49 | ||||

12.3 | Compelled Disclosure | 49 | ||||

12.4 | Return of Confidential Information | 49 | ||||

12.5 | Acknowledgments | 50 | ||||

12.6 | Equitable Relief | 50 | ||||

12.7 | Public Announcements | 50 | ||||

ARTICLE 13 INTELLECTUAL PROPERTY LICENCE | 50 | |||||

13.1 | Ownership and Licensing | 50 | ||||

13.2 | Infringement | 52 | ||||

ARTICLE 14 EXCLUSIVITY; OPTION TO PURCHASE | 53 | |||||

14.1 | Exclusivity | 53 | ||||

14.2 | Option to Purchase/Lease Other Projects | 53 | ||||

14.3 | Emerald Carve Outs | 54 | ||||

ARTICLE 15 TERM AND TERMINATION | 55 | |||||

15.1 | Term | 55 | ||||

- ii -

ARTICLE 16 GOVERNING LAW; DISPUTES | 57 | |||||

16.1 | Governing Law | 57 | ||||

16.2 | Disputes | 57 | ||||

16.3 | Amicable Resolution of Disputes | 57 | ||||

16.4 | Resolution by Mediation | 58 | ||||

16.5 | Arbitration | 58 | ||||

16.6 | Restrictions | 60 | ||||

ARTICLE 17 GENERAL PROVISIONS | 60 | |||||

17.1 | Guarantee of Emerald Therapeutics | 60 | ||||

17.2 | Notices | 60 | ||||

17.3 | Notice of Claims | 60 | ||||

17.4 | Force Majeure | 62 | ||||

17.5 | Assignment, Successors, etc. | 62 | ||||

17.6 | Entire Agreement | 62 | ||||

17.7 | Further Assurances | 63 | ||||

17.8 | Amendment and Waivers | 63 | ||||

17.9 | Severability | 63 | ||||

17.10 | References | 63 | ||||

17.11 | [Redacted: Commercially Sensitive Information] | 63 | ||||

17.12 | Time of Essence | 63 | ||||

17.13 | Currency | 63 | ||||

17.14 | Remedies; Specific Performance | 64 | ||||

17.15 | No Contra Proferentem | 64 | ||||

17.16 | Counterparts | 64 | ||||

Schedule A PROPERTY | 1 | |||||

Schedule B Initial Budget | 1 | |||||

Schedule C Illustration of Dilution Calculation | 1 | |||||

Schedule D Background intellectual property | 1 | |||||

Schedule E Accession Agreement | 1 | |||||

Schedule F [Redacted: Commercially Sensitive Information] | 1 | |||||

- iii -

SHAREHOLDERS AGREEMENT

THIS SHAREHOLDERS AGREEMENT made as of June 6, 2017 (the “Execution Date”)

AMONG:

EMERALD HEALTH BOTANICALS INC., a corporation existing under the laws of the Province of British Columbia (“Emerald”)

- and –

EMERALD HEALTH THERAPEUTICS INC., a corporation existing under the laws of the Province of British Columbia (“Emerald Therapeutics”)

- and -

VILLAGE FARMS INTERNATIONAL, INC., a corporation existing under the Federal laws of Canada (“Village Farms”)

- and -

1121371 B.C. LTD., a corporation existing under the laws of the Province of British Columbia (the “Company”)

WHEREAS the Company was formed under the laws of the Province of British Columbia;

AND WHEREAS Emerald and Village Farms wish to enter into this Agreement to govern the business and affairs of the Company;

AND WHEREAS concurrent with the entering into of this Agreement, Village Farms, Emerald and/or the Company will enter into the Transaction Documents (as hereinafter defined), as applicable;

NOW THEREFORE THIS AGREEMENT WITNESSES THAT for good and valuable consideration (the receipt and sufficiency of which are hereby conclusively acknowledged), the parties hereby agree as follows:

ARTICLE 1

INTERPRETATION

| 1.1 | Defined Terms |

In this Agreement, the following terms shall have the respective meanings set out below and grammatical variations of such terms shall have the corresponding meanings:

| (a) | “2 Year Hold Period” means the period commencing on the Execution Date and ending on the date which is two (2) years following the Execution Date; |

| (b) | “ACMPR” means the Access to Cannabis for Medical Purposes Regulations which came into force on August 24, 2016, and as may be amended from time to time; |

| (c) | “Acting Jointly or In Concert” means a Party acting jointly or in concert with another Person within the meaning of National Instrument 62-104 – Take-Over Bids and Issuer Bids; |

| (d) | “Administrative Services” means the following services: |

| (i) | providing internal accounting and bookkeeping services, including reports and financial statements in accordance with Section 6.4; cash management services, including accounts payable and accounts receivable; |

| (ii) | communicating with the Auditor and audit administration; |

| (iii) | maintaining all required documentation required for the Company’s tax filings and compliance with all tax reporting obligations for the Company on a timely basis; |

| (iv) | providing services related to human resources, including, but not limited to: recruitment/selection of employees to provide services; managing payroll and employee benefits; services to cover employees and fixed term contractors; onboarding and induction service to new employees and contractors; organizational planning and advice; employee management and general administration to include workforce departure reports, management of employee data within agreed system of record, as well as, employee departure processing, leave management; and labour relations support-advice and policy management; |

| (v) | providing services related to the establishment of the Company’s own independent information technology systems, including, but not limited to: set-up, programming, maintenance, repairs, and troubleshooting on all hardware, software, and communications devices; back-up all data; set-up, maintenance, and troubleshooting of any web sites, email addresses, and other internet based applications; installation and maintenance or internet connection with appropriate firewalls; and any required training and ongoing support; |

| (vi) | providing assistance with transitioning the Administrative Services to the applicable officers of the Company pursuant to mandate descriptions at the expiry of the Administrative Services Period; and |

| (vii) | providing such other assistance, services or work related to the administration and general supervision of the Operations reasonably requested by the Company from time to time during the Administrative Services Period; |

| (e) | “Administrative Services Period” has the meaning given to such term in Section 4.1(a); |

| (f) | “Affiliate” of a Person means a Person which, directly or indirectly, is Controlled by such Person, or directly or indirectly Controls such Person or is directly or indirectly Controlled by a Person which also, directly or indirectly, Controls such Person; |

| (g) | “Agreement” means this shareholders agreement, as it may be amended or supplemented from time to time in accordance with the terms hereof; |

2

| (h) | “Applicable Law” means (a) any domestic or foreign statute, law (including common and civil law), treaty, code, ordinance, rule, regulation (including, but not limited to, the ACMPR) or by-law (zoning or otherwise); (b) any judgement, order, writ, injunction, decision, ruling, decree or award; (c) any regulatory instrument, policy, practice, protocol, guideline or directive; or (d) any franchise, licence, qualification, authorization, consent, exemption, waiver, right, permit or other approval, in each case, of any Governmental Authority and having the force of law, binding on or affecting the Person referred to in the context in which the term is used or binding on or affecting the property of such Person; |

| (i) | “Appraiser” means the qualified appraiser licensed in British Columbia or such other Province in which the Other Project is located, at Arm’s Length to the Shareholder appointing such appraiser and having a minimum of 10 years’ experience in agricultural business valuations as appointed in accordance with Section 8.5; |

| (j) | “Approved Operating Plan” means any Operating Plan that is approved by the Board; |

| (k) | “Arm’s Length” has the meaning set out in the Income Tax Act (Canada); |

| (l) | “Auditor” means ●; |

| (m) | “Available Cash” means cash generated from operations of the Company, cash available from lenders, cash previously provided to the Company by any Shareholder (including without limitation, in the form of a Shareholder Contribution pursuant to a previous Approved Operating Plan or a Shareholder Contribution pursuant to a current Approved Operating Plan), and cash available from other sources (excluding any cash allocated to contingencies and reserves established by the Board) which, as determined by the President can be prudently used for the payment of expenses without adversely affecting to a material extent ongoing Operations (including contingencies and reserves established by the Board) or the satisfaction of Applicable Law; |

| (n) | “Bankruptcy Proceeding” means, in respect of any Person: |

| (i) | the filing by the Person of a petition or similar originating process for bankruptcy, reorganization or protection under Applicable Law; |

| (ii) | the commencement against the Person, with or without its consent or approval, of any proceeding, seeking its bankruptcy, liquidation or reorganization, the appointment of a receiver of its assets, or comparable relief, that in each case, is not stayed or dismissed within 30 days; |

| (iii) | the entry by a court of competent jurisdiction of a final and unappealable order granting the Person relief of the type described in clause (i) or (ii) above; |

| (iv) | the admission in writing by the Person of its inability to pay its debts generally as they become due; or |

| (v) | the making by the Person of a general assignment for the benefit of its creditors; |

| (n) | “Board” means the board of directors of the Company; |

3

| (o) | “Budget” means the annual operating and capital budget of the Company once approved by the Board; |

| (p) | “Business Day” means any day other than a Saturday or Sunday or any other day which shall be a statutory or civic holiday or day on which banking institutions are closed in the City of Toronto, Ontario or Vancouver, British Columbia; |

| (q) | “Cannabis” means all living or dead material, plants, seeds, plant parts or plant cells from any cannabis species or subspecies (including sativa, indica and ruderalis), including wet and dry material, trichomes, oil and extracts from cannabis; |

| (r) | “Change of Control” means the occurrence of any change in the Control or Effective Control of a Person. For greater certainty, a change in either the equity ownership or the voting control of a Person which results in a decrease in the beneficial ownership of or control over the equity value or voting rights or interests, respectively, of that Person from more than 50% to 50% or less of the outstanding equity values or voting rights or interests, respectively, shall be considered a Change of Control; |

| (s) | “Chargeable Cost” means all costs and expenses incurred for or in connection with Operations to the extent reflected in a Budget or otherwise expressly permitted under this Agreement, including but not limited to, Section 7.7 and will include, without limitation and without duplication, the following attributable thereto: |

| (i) | the rent payments under the Lease; |

| (ii) | all costs and expenses incurred to retrofit the Property and Structures to grow commercial Cannabis crops; |

| (iii) | License Costs; and |

| (iv) | all reasonable legal, accounting and advisory fees incurred by the Company and the Shareholders including, without limitation, in connection with the formation of the Company. With respect to such legal fees, $● of Village Farms’ historical legal fees will constitute legal fees in connection with the formation of the Company. |

| (t) | “Company Assets” means all real and personal property owned by or on behalf of the Company, including all intangibles, contracts, the Lease, plans, drawings, specifications, trade-names, the leasehold interests in the Property and the structures and improvements located on the Property and all monies and other real or personal property of the Company; |

| (u) | “Company Confidential Information” means (i) all information and material of the Company, the Company’s affiliates, and/or their respective licensors, in oral, written, graphic, electronic or any other form or medium, that has or shall come into Village Farms’ or Emerald’s possession or knowledge in connection with or as a result of such party’s respective ownership interest in the Company, including information and material concerning the past, present or future customers, suppliers, technology, or business of the Company; (ii) any analyses, compilations, studies or other Documents prepared containing, incorporating or reflecting any Company Confidential Information; and (iii) all information about an identifiable individual or other information that is subject to any federal, provincial or other applicable statute, law or regulation of any governmental or regulatory authority in Canada relating to the collection, use, storage and/or disclosure of information about an identifiable individual, including the |

4

| Personal Information and Protection of Electronic Documents Act (Canada) and equivalent provincial legislation, whether or not such information is confidential. For the purposes of this definition, “information” and “material” includes Know-How, data, patents, copyrights, trade secrets, processes, business rules, tools, business processes, techniques, programs, designs, formulae, marketing, advertising, financial, commercial, sales or programming materials, equipment configurations, system access codes and passwords, written materials, compositions, drawings, diagrams, computer programs, studies, works in progress, visual demonstrations, ideas, concepts, and other data. Notwithstanding the foregoing, with respect to Emerald or Village Farms, “Company Confidential Information” does not include information or material: |

| (i) | that is or becomes publicly available other than as a result of disclosure by such Party in violation of its obligations under this Agreement; |

| (ii) | that is already in such Party’s possession at the time of disclosure, provided that the source of such information was not known to such Party to be subject to a duty of confidentiality in respect of such information; |

| (iii) | that such Party independently develops without any use of or reference to the Company Confidential Information and which such independent development can be established by evidence that would be acceptable to a court of competent jurisdiction; or |

| (iv) | that such Party receives in good faith from a source (other than Company) which is not known by such Party to have made the disclosure in violation of any confidentiality obligations; |

| (v) | “Company Improvement Intellectual Property” has the meaning set out in Section 13.1(d); |

| (w) | “Company Proposed Acquisition Notice” has the meaning set out in Section 14.2(b); |

| (x) | “Confidential Documents” means any embodiment, in written, graphic, audio, video, electronic, or any other form or medium, which contains any Confidential Information, including any and all copies, papers, reproductions, slides and microfilms and any electronic media such as disks, tapes, other magnetic media, computer software and computer storage systems and, where this agreement calls for Confidential Documents to be destroyed, in the case of electronic media that can be permanently erased, such obligation means that such Confidential Documents shall be permanently erased. Notwithstanding the foregoing, the obligation to return or destroy Confidential Information shall not apply to Confidential Information that is maintained on routine computer system backup tapes, disks or other backup storage devices as long as such backed-up Confidential Information is not used, disclosed, or otherwise recovered from such backup devices; |

| (y) | “Confidential Information” means, collectively, the Company Confidential Information, Emerald Confidential Information and the Village Farms Confidential Information; |

| (z) | “Contribution Notice” has the meaning set out in Section 7.5(b); |

5

| (aa) | “Control” means: |

| (i) | when applied to the relationship between a Person and a corporation, the beneficial ownership by such Person at the relevant time of shares of such corporation: (A) carrying more than 50% of the voting rights ordinarily exercisable at meetings of shareholders of such corporation, or (B) representing more than 50% of the equity value of the corporation; |

| (ii) | when applied to the relationship between a Person and a partnership or joint venture, (A) the beneficial ownership by such Person at the relevant time of: (1) more than 50% of the voting interests of the partnership or joint venture, or (2) partnership or joint venture interests representing more than 50% of the equity value of the partnership or joint venture and (B) it can be reasonably expected that the Person directs the affairs of the partnership or joint venture; or |

| (iii) | when applied to the relationship between a person and a limited partnership, the beneficial ownership at the relevant time of: (A) shares of the general partner or general partners of such limited partnership carrying more than 50% of the voting rights ordinarily exercisable at meetings of shareholders of such general partner or general partners such that it can reasonably be expected that the Person directs the affairs of the limited partnership, or (B) partnership interests representing more than 50% of the equity value of the limited partnership; and |

| (i) | the term “Controlled by” has a corresponding meaning; provided that a Person (the “first-mentioned Person”) who Controls a corporation, partnership, limited partnership or joint venture (the “second-mentioned Person”) shall be deemed to Control a corporation, partnership, limited partnership or joint venture which is Controlled by the second-mentioned Person and so on. |

| (bb) | “Cost of the Administrative Services” has the meaning set forth in Section 4.1(c); |

| (cc) | “Cultivation License” means a license issued to the Company (i) pursuant to paragraph 35 of the ACMPR, as such paragraph may be revised or modified from time to time, and (ii) pursuant to any Applicable Laws granting the Company the authority to produce, possess and destroy Cannabis at the Property for medical uses and if permitted under Applicable Laws, non-medical uses; |

| (dd) | “Deadlock” means the members of the Board are unable to reach a decision with respect to a Vote in respect of an action listed in Section 5.4 of this Agreement, despite considering the matter at three (3) meetings of the Board; |

| (ee) | “Defaulted Amount” has the meaning set out in Section 8.2(a)(i); |

| (ff) | “Defaulting Shareholder” has the meaning set out in Section 8.1; |

| (gg) | “Delta 1 Assets and Operations” has the meaning ascribed thereto in the Delta 1 Call Agreement; |

6

| (hh) | “Delta 2 Assets and Operations” has the meaning ascribed thereto in the Delta 2 Call Agreement; |

| (ii) | “Delta 3 Assets and Operations” means the Lands, the Greenhouses and the Personal Property, as such terms are defined in the Lease; |

| (jj) | “Delta 1 Call Agreement” means the agreement entered into contemporaneous herewith between Village Farms, as vendor, and the Company, as purchaser, pursuant to which the Company, has the right to acquire the Delta 1 Assets and Operations, as the agreement may be amended, amended and restated, supplemented, replaced or otherwise modified from time to time; |

| (kk) | “Delta 2 Call Agreement” means the agreement entered into contemporaneous herewith between Village Farms, as vendor, and the Company, as purchaser, pursuant to which the Company, has the right to acquire the Delta 2 Assets and Operations, as the agreement may be amended, amended and restated, supplemented, replaced or otherwise modified from time to time; |

| (ll) | “Dilution Day” has the meaning set out in Section 8.2(a)(i); |

| (mm) | “Director” means a director of the Company; |

| (nn) | “Disclosing Party” means a Party disclosing information as contemplated by this Agreement; |

| (oo) | “Dispute Resolution Procedures” has the meaning set out in Section 16.2(a); |

| (pp) | “Disputes” means all differences, disagreements, questions, controversies or claims (including claims for indemnification) between the Shareholders as to the interpretation, application or administration of this Agreement, any aspect of the performance by a Shareholder of its obligation under this Agreement, any failure of the Board to reach agreement on any matter despite considering the matter at three (3) meetings of the Board or where agreement is otherwise called for under this Agreement or any other matter or question arising out of or relating to this Agreement; |

| (qq) | “Distribution License” means a license issued to the Company (i) pursuant to the ACMPR, and (ii) pursuant to any Applicable Laws granting the Company the authority to sell, provide, ship, deliver and transport Cannabis for medical uses and if permitted under Applicable Laws, non-medical uses; |

| (rr) | “Distributions” means dividends, share purchase and redemption moneys and distributions paid to the Shareholders by the Company; |

| (ss) | “Documents” has the meaning set out in Section 16.2(b); |

| (tt) | “Effective Control” means control in fact by one Person, together with its Affiliates and those with whom it is acting in concert, exercising effective control over another Person or over the decision-making of that other Person either directly or indirectly, whether through the holding of shares of the corporation or of any other corporation or through the holding of a significant portion of any class of shares of the corporation or through the holding of units in a partnership or limited partnership or the outstanding debt of the corporation, the partnership or limited partnership or of any shareholder or member of the corporation, partnership or limited |

7

| partnership or by any other means; any Person which holds voting or equity securities (as defined in the Securities Act (Ontario)) representing, in the aggregate, 50% or more of the outstanding voting securities of the Person shall be deemed to have “Effective Control” of that Person; |

| (uu) | “Emerald Background Intellectual Property” means the Intellectual Property detailed in Part 1 of Schedule D; |

| (vv) | “Emerald Confidential Information” means (i) all information and material of Emerald and Emerald’s affiliates, and/or their respective licensors, in oral, written, graphic, electronic or any other form or medium, that has or shall come into Village Farms’ possession or knowledge in connection with or as a result of its ownership interest in the Company, including information and material concerning the past, present or future customers, suppliers, technology, or business of Emerald and Emerald’s affiliates; (ii) any analyses, compilations, studies or other Documents prepared by Village Farms or for Village Farms’ use containing, incorporating or reflecting any Emerald Confidential Information; and (iii) all information about an identifiable individual or other information that is subject to any federal, provincial or other applicable statute, law or regulation of any governmental or regulatory authority in Canada relating to the collection, use, storage and/or disclosure of information about an identifiable individual, including the Personal Information and Protection of Electronic Documents Act (Canada) and equivalent provincial legislation, whether or not such information is confidential. For the purposes of this definition, “information” and “material” includes Know-How, data, patents, copyrights, trade secrets, processes, business rules, tools, business processes, techniques, programs, designs, formulae, marketing, advertising, financial, commercial, sales or programming materials, equipment configurations, system access codes and passwords, written materials, compositions, drawings, diagrams, computer programs, studies, works in progress, visual demonstrations, ideas, concepts, and other data. Notwithstanding the foregoing, “Emerald Confidential Information” does not include information or material: |

| (i) | that is or becomes publicly available other than as a result of disclosure by Village Farms or the Company in violation of their respective obligations under this Agreement; |

| (ii) | that is already in Village Farms’ possession at the time of disclosure, provided that the source of such information was not known to Village Farms to be subject to a duty of confidentiality in respect of such information; |

| (iii) | that Village Farms independently develops without any use of or reference to the Emerald Confidential Information and which such independent development can be established by evidence that would be acceptable to a court of competent jurisdiction; or |

| (iv) | that Village Farms receives in good faith from a source (other than Emerald) which is not known by Village Farms to have made the disclosure in violation of any confidentiality obligations; |

| (ww) | “Emerald Improvement Intellectual Property” means all Improvements made solely by Emerald to the Emerald Background Intellectual Property after the Execution Date; |

8

| (xx) | “Emerald Initial Capital Contribution” means the capital contribution to be made by Emerald to the Company in the aggregate amount of $20,000,000 which capital contribution will be advanced in accordance with Section 7.1; |

| (yy) | “Employees” means those of the employees employed by Village Farms, selected and determined by Village Farms in its sole discretion; |

| (zz) | “Encumbrance” means any lien, charge, hypothec, pledge, mortgage, title retention agreement, covenant, condition, lease, license, security interest of any nature, claim, exception, reservation, easement, encroachment, right of occupation, right-of-way, right-of-entry, matter capable of registration against title, option, assignment, right of pre-emption, royalty, right, privilege or any other encumbrance or title defect of any nature whatsoever, regardless of form, whether or not registered or registrable and whether or not consensual or arising by any Applicable Law, and includes any contract to create any of the foregoing; |

| (aaa) | “Escrow Agreement” means the escrow agreement in respect of the $10,000,000 Portion of the Initial Contribution and the Escrowed Shares among Emerald, Village Farms and Torys LLP entered into on the date hereof; |

| (bbb) | “Escrowed Shares” has the meaning set out in Section 7.1(c); |

| (ccc) | “Expert” has the meaning set out in Section 16.5(a); |

| (ddd) | “Expert Appointment Deadline” has the meaning set out in Section 16.5(b); |

| (eee) | “Fair Market Value” means the fair market value of the Company or a Proportionate Interest or an Other Project, as the case may be, as determined by an Appraiser assuming that the Company or a Proportionate Interest or the Other Project, as the case may be, is offered for sale in a competitive and open market under all conditions requisite to a fair sale, the buyer and seller each acting prudently and knowledgeably, and assuming the price is not affected by undue stimulus. Implicit in this definition is the consummation of a sale as of the appraisal date and the passing of title from the seller to the buyer whereby: (i) the buyer and seller are typically motivated; (ii) both parties are well informed or well advised and acting in what they consider their own best interests; (iii) a reasonable time is allowed for exposure in the open market; (iv) payment is made in terms of cash in Canadian dollars or in terms of financial arrangements comparable thereto; and (v) the price represents the normal consideration for the Company unaffected by special or creative financing or sales concessions granted by anyone associated with the sale, but taking into account the assumption by the buyer of any financing to the extent that it may be assumed by the buyer. For clarity, there shall be no premium for a control position or discount for a minority position; and the Company shall be valued on a going-concern basis; |

| (fff) | “Force Majeure” means an event beyond the reasonable control of the applicable Party and not due to the act or omission by such Party and which by the exercise of reasonable diligence of the Party, the Party is unable to prevent or provide against (but does not include a failure by a Party to fund) that prevents or delays it from conducting the activities and performing the obligations contemplated by this Agreement, provided that the affected Party makes a good faith effort to resolve or avoid such delay; such events shall include, but not be limited to any fire or other casualty, acts of God, war, civil commotion, strike, lockout, picketing or other industrial disturbances, insurrection, terrorism, riots or action or inaction of any Governmental Authorities; |

9

| (ggg) | “Geographic Area” means anywhere in Canada; |

| (hhh) | “Governmental Authorities” means any municipal, regional, provincial or federal governments and their agencies, authorities, branches, departments, commissions, boards, having or claiming jurisdiction over the applicable Person or subject matter and any stock exchange on which the shares of the applicable Person are listed and “Governmental Authority” shall mean any one of the Governmental Authorities as the context requires; |

| (iii) | “Greenhouse” means a fully-enclosed permanent aluminum or fixed steel structure clad in glass, impermeable plastic, or polycarbonate used for the growing of crops utilizing direct sunlight; |

| (jjj) | “Hired Employee” has the meaning set out in Section 4.3(b); |

| (kkk) | “Improvements” means any and all improvements, variations, updates, modifications, extensions, enhancements or other changes made to Intellectual Property at any time after the Execution Date; |

| (lll) | “Indemnified Parties” has the meaning set forth in Section 4.3(f); |

| (mmm) | “Initial Budget” means, collectively the initial capital Budget of the Company as set forth in Schedule B; |

| (nnn) | “Intellectual Property” means (i) agricultural products, such as plants, seeds and germplasm of Cannabis, that have been characterized prior to the Execution Date, all trade secrets, Confidential Information, Know-How, standard operating procedures, processes, business rules, tools, business processes, techniques, specifications, designs and industrial designs, works of authorship, trade-marks (whether registered or unregistered), inventions and improvements and modifications thereto (including all related designs, technical information, models, drawings, specifications, formulas, schemas, prototypes, and architectural plans), patents, copyrights, software, computer programs, programming code, data, compilations of data, computer databases, system access codes and passwords, designs, marketing, advertising, financial, commercial, sales or programming materials, equipment configurations, written materials, compositions, drawings, diagrams, studies, works in progress, visual demonstrations, ideas, concepts, and all other related material and data, (ii) all drawings and proposed or implemented retrofitting of the Delta 3 Assets and Operations, or the assets and operations of an Other Project, and (iii) all vested, contingent and future rights, in any jurisdiction, to all of the foregoing under any applicable statutory provision or common law principle, and all rights of action, powers and benefits relating thereto, including the right to bring proceedings and claim or recover damages or other remedies in relation to any infringement; |

| (ooo) | “Know-How” means all information not publicly known or not independently developed by a third party that is used or required to be used in or in connection with any product existing in any form (including, but not limited to that comprised in or derived from horticultural, engineering, chemical and other data, specifications, formulae, experience, drawings, manuals, component lists, instructions, designs and circuit diagrams, brochures, catalogues and other descriptions) and relating to: |

| (i) | the design, development, manufacture or production of any products; |

10

| (ii) | the design or retrofitting of any building; |

| (iii) | the operation of any process; |

| (iv) | the provision of any services; |

| (v) | the selection, procurement, construction, installation, maintenance or use of raw materials, plant, machinery or other equipment or processes; |

| (vi) | the rectification, repair or service or maintenance of products, plant, machinery or other equipment; |

| (vii) | the supply, storage, assembly or packing of raw materials, components or partly manufactured or finished products; or |

| (viii) | quality control, testing or certification; |

| (ppp) | “Lease” means the agreement entered into contemporaneous herewith with Village Farms and Village Farms Canada Limited Partnership, as the landlord and the Company, as the tenant, constituting a lease of the Property and the Structures, as the agreement may be amended, amended and restated, supplemented, replaced or otherwise modified from time to time; |

| (qqq) | “License Costs” has the meaning set out in Section 4.2; |

| (rrr) | “License Termination Date” means the date on which there is an affirmative Vote of at least a majority of the votes cast at a Board meeting at which a quorum is present that the Company cease pursuing a Cultivation License and/or Distribution License in connection with the Delta 3 Assets and Operations; |

| (sss) | “Licenses” means all licenses required from Governmental Authorities to grow, cultivate, and produce Cannabis at the Property and, if applicable, at the Delta 1 Assets and Operations, at the Delta 2 Assets and Operations and any other property leased or owned by the Company for the Operations, and to sell, provide, ship, deliver and transport Cannabis in Canada and all other licenses required by the Company to carry on the Operations, including but not limited to the Cultivation License and the Distribution License; |

| (ttt) | “Losses” means damages, fines, penalties, deficiencies, losses, liabilities, including settlements and judgments, costs and expenses of any kind, character or description (including payments, refunds and delivery of additional goods and/or services, interest, reasonable fees and expenses of legal counsel, or other professionals); |

| (uuu) | “Marketable Securities” means any equity securities which are listed on the TSX Venture Exchange, Toronto Stock Exchange, the New York Stock Exchange, the NASDAQ National Market, the NASDAQ Small Cap Market or, NYSE MKT and in respect of which (1) the amount to be distributed to a Shareholder amounts to less than 25% of the average daily trading volume of such securities on the relevant exchange or market for the immediately preceding 30 trading day period, and (2) such equity securities are not subject to any statutory, regulatory, contractual, or other hold period or resale restriction other than a restriction requiring the filing of a notice only (without requiring any approval); |

| (vvv) | “Minister” means the Minister of Health; |

11

| (www) | “Non-Defaulting Shareholder” has the meaning set out in Section 8.1; |

| (xxx) | “Notice of Dispute” has the meaning set out in Section 16.3(c); |

| (yyy) | “Operating Plan” means for each calendar year: (a) a description of the proposed Operations for such year; (b) an estimate of revenue to be received by the Company from the sale of Cannabis products; (c) the Budget, including a description of the sources of funding to be utilized in the implementation of an Operating Plan, the particulars of the methods of funding from such sources and estimates of when the funds will be needed for the Operating Plan; and (d) such other matters as the President may reasonably consider to be necessary to illustrate the results intended to be achieved by the Operating Plan; |

| (zzz) | “Operations” means the growth, cultivation, extraction, production, sale and distribution of Cannabis and Cannabis-related products from Greenhouse facilities in Canada for therapeutic, and if permitted by Applicable Law, non-therapeutic use purposes, together with ancillary activities in connection therewith; |

| (aaaa) | “Option Notice” has the meaning set out in Section 14.2(a); |

| (bbbb) | “Option Period” has the meaning set out in Section 14.2(a); |

| (cccc) | “Other Project” has the meaning set out in Section 14.2; |

| (dddd) | “Other Shareholder” has the meaning set out in Section 10.3(a); |

| (eeee) | “Panel” has the meaning set out in Section 16.5(a); |

| (ffff) | “Parties” means, collectively, Emerald, Emerald Therapeutics, Village Farms and the Company, and their respective successors and permitted assigns; |

| (gggg) | “Person” means any individual, corporation or other body corporate, partnership, trustee, trust or unincorporated association, joint venture, syndicate, sole proprietorship, other form of business enterprise, executor, administrator or other legal representatives, regulatory body or agency or Governmental Authority, however designated or constituted; |

| (hhhh) | “Prime Rate” means, for any day, the annual rate of interest equal to the rate which The Bank of Montreal establishes at its principal office in Toronto as the reference rate of interest to determine interest rates it will charge on such day for commercial loans in Canadian dollars made to its customers in Canada and which it refers to as its “prime rate of interest”; |

| (iiii) | “Property” means the lands and premises municipally known as 4431 80th Street, Delta, British Columbia and legally described in 0 but expressly excluding the Greenhouses and the other structures and improvements located thereon; |

| (jjjj) | “Proportionate Interest” means, at any time, for a Shareholder, the amount (expressed as a percentage) determined by the formula A ÷ B, where: |

| A | is the total Shares of the Company held by the Shareholder |

| B | is the total Shares of the Company held by all Shareholders at that time. |

12

The Parties acknowledge that a Shareholder’s Proportionate Interest may be recalculated from time to time in accordance with Section 8.3;

| (kkkk) | “Prospective Seller” has the meaning set out in Section 10.3(a); |

| (llll) | “Prospective Seller’s Offer” has the meaning set out in Section 10.3(a); |

| (mmmm) | “Purchase Notice” has the meaning set out in Section 8.4(b); |

| (nnnn) | “Purpose” means the purpose of growing, cultivating, extracting, producing, selling and distributing Cannabis grown in a Greenhouse for medical, and if permitted by Applicable Law, non-medical purposes; |

| (oooo) | “Receiving Party” means a Party receiving confidential information as contemplated by this Agreement; |

| (pppp) | “Redaction Requirement” has the meaning set forth in Section 12.1(a); |

| (qqqq) | “Related Party” means an Affiliate of a Shareholder and any other Person that is not at Arm’s Length to a Shareholder; |

| (rrrr) | “Representative” means, in the case of either Party, such Party’s and its Affiliates’ respective directors, officers, employees, lawyers, accountants, consultants, agents or financial advisors; |

| (ssss) | “Required Documents” has the meaning set out in Section 8.4(c)(ii); |

| (tttt) | “Security Clearance” means a security clearance granted by the Minister under Section 112 of the ACMPR, as such section may be revised or modified from time to time , or pursuant to Applicable Laws; |

| (uuuu) | “Security Discharge Termination Notice” has the meaning set forth in Section 4.4; |

| (vvvv) | “Severance Costs” has the meaning set forth in Section 4.3(h); |

| (wwww) | “Share Capital” means payments made to the Company for the issue of Shares in the capital of the Company; |

| (xxxx) | “Shareholder Contributions” means funds provided to the Company by the Shareholders as Share Capital; |

| (yyyy) | “Shareholder Loan” has the meaning set out in Section 8.2(a)(ii); |

| (zzzz) | “Shareholders” at any particular time means, individually, any Person who at that time owns any Shares and who, in accordance with the provisions hereof or by operation of law, becomes bound by the provisions of this Agreement, and its respective successors and permitted assigns hereunder, and “Shareholders” means the Shareholders collectively; |

| (aaaaa) | “Shares” means the common shares in the Company, any securities into which those common shares may be converted, exchanged, reclassified, redesignated, subdivided, consolidated or otherwise changed from time to time and any securities of any successor corporation to or corporation continuing from the Company into which those common shares or such other securities may be changed or converted as a result of any merger, recapitalization or reorganization, statutory or otherwise; |

13

| (bbbbb) | “Structures” means the Greenhouses and other structures and improvements located on the Property; |

| (ccccc) | “Third Party” has the meaning set out in Section 10.3(a); |

| (ddddd) | “Third Party Offer” has the meaning set out in Section 10.3(a); |

| (eeeee) | “Transaction Confidential Information” means the terms of this Agreement and any other information and Intellectual Property concerning any matters affecting or relating to the business, Operations, assets, results or prospects of any Party, including information regarding plans, budgets, costs, processes, results of experimentation and other data, except to the extent that such information has already been publicly released by a Party as allowed herein or that the Party providing such information can demonstrate was previously publicly released by a Person who did not do so in violation or contravention of any duty or agreement; |

| (fffff) | “Transaction Documents” means the Lease, Delta 1 Call Agreement, Delta 2 Call Agreement, and Escrow Agreement; |

| (ggggg) | “Transfer” means to sell, transfer, grant, assign, donate, create an Encumbrance or otherwise convey or dispose of (including by way of an earn-in, back-in right or any synthetic disposal of economic rights), or commit to do any of the foregoing; |

| (hhhhh) | “Village Farms Confidential Information” means: (i) all information and material of Village Farms and Village Farms’ affiliates, and/or their respective licensors, in oral, written, graphic, electronic or any other form or medium, that has or shall come into Emerald’s possession or knowledge in connection with or as a result of its ownership interest in the Company, including information and material concerning the past, present or future customers, suppliers, technology, or business of Village Farms and Village Farms’ affiliates; (ii) any analyses, compilations, studies or other Documents prepared by Emerald or for Emerald’s use containing, incorporating or reflecting any Village Farms Confidential Information; and (iii) all information about an identifiable individual or other information that is subject to any federal, provincial or other applicable statute, law or regulation of any governmental or regulatory authority in Canada relating to the collection, use, storage and/or disclosure of information about an identifiable individual, including the Personal Information and Protection of Electronic Documents Act (Canada) and equivalent provincial legislation, whether or not such information is confidential. For the purposes of this definition, “information” and “material” includes Know-How, data, patents, copyrights, trade secrets, processes, business rules, tools, business processes, techniques, programs, designs, formulae, marketing, advertising, financial, commercial, sales or programming materials, equipment configurations, system access codes and passwords, written materials, compositions, drawings, diagrams, computer programs, studies, works in progress, visual demonstrations, ideas, concepts, and other data. Notwithstanding the foregoing, “Village Farms Confidential Information” does not include information or material: |

| (i) | that is or becomes publicly available other than as a result of disclosure by Emerald or the Company in violation of their respective obligations under this Agreement; |

14

| (ii) | that is already in Emerald’s possession at the time of disclosure, provided that the source of such information was not known to Emerald to be subject to a duty of confidentiality in respect of such information; |

| (iii) | that Emerald independently develops without any use of or reference to the Village Farms Confidential Information and which such independent development can be established by evidence that would be acceptable to a court of competent jurisdiction; or |

| (iv) | that Emerald receives in good faith from a source (other than Village Farms) which is not known by Emerald to have made the disclosure in violation of any confidentiality obligations. |

| (iiiii) | “Village Farms Background Intellectual Property” means the Intellectual Property detailed in Part 2 of Schedule D; |

| (jjjjj) | “Village Farms Improvement Intellectual Property” means all Improvements made solely by Village Farms to the Village Farms Background Intellectual Property after the Execution Date; |

| (kkkkk) | “Village Farms Indemnified Parties” has the meaning set out in Section 4.1(f); and |

| (lllll) | “Vote” has the meaning set out in Section 5.2(f). |

| 1.2 | Rules of Construction |

In this Agreement:

| (a) | the terms “Agreement”, “this Agreement”, “the Agreement”, “hereto”, “hereof”, “herein”, “hereby”, “hereunder” and similar expressions refer to this Agreement in its entirety and not to any particular provision hereof; |

| (b) | references to an “Article”, “Section” or “Schedule” followed by a number or letter refer to the specified Article or Section of or Schedule to this Agreement; |

| (c) | the division of this Agreement into articles and sections and the insertion of headings are for convenience of reference only and shall not affect the construction or interpretation of this Agreement; |

| (d) | words importing the singular number only shall include the plural and vice versa and words importing the masculine gender shall include the feminine and neuter genders and vice versa; |

| (e) | unless otherwise indicated, any reference to a statute, regulation or rule shall be construed to be a reference thereto as the same may from time to time be amended, re-enacted or replaced, and any reference to a statute shall include any regulations or rules made thereunder; |

| (f) | the words “include”, “includes” and “including” mean “include”, “includes” or “including”, in each case, “without limitation”; |

15

| (g) | reference to any agreement or other instrument in writing means such agreement or other instrument in writing as amended, modified, replaced or supplemented from time to time; |

| (h) | unless otherwise indicated, time periods within which a payment is to be made or any other action is to be taken hereunder shall be calculated excluding the day on which the period commences and including the day on which the period ends; and |

| (i) | whenever any payment to be made or action to be taken hereunder is required to be made or taken on a day other than a Business Day, such payment shall be made or action taken on the next following Business Day. |

| 1.3 | Currency |

Unless otherwise indicated, all dollar amounts in this Agreement are expressed in Canadian dollars.

| 1.4 | Schedules |

The following Schedules are attached to and form an integral part of this Agreement:

| 0 | – | Property | ||

| Schedule B | – | Initial Budget | ||

| 0 | – | Illustration of Dilution Calculation | ||

| Schedule D | – | Background Intellectual Property | ||

| Schedule E | – | Accession Agreement | ||

| 0 | – | [Redacted: Commercially Sensitive Information] | ||

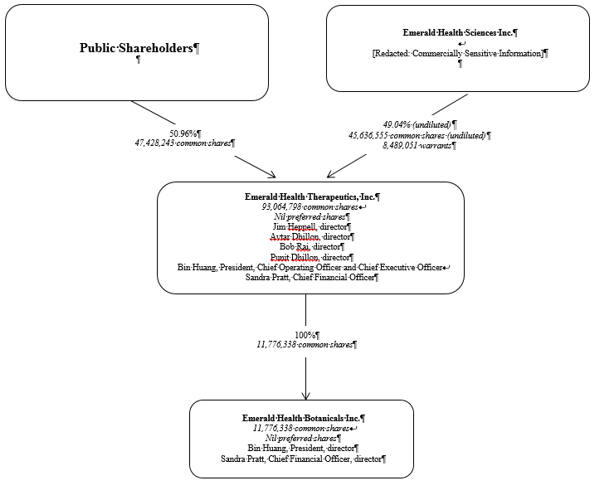

| Schedule G | – | Emerald Organizational Chart |

| 1.5 | Additional Shares |

Each Shareholder agrees that all Shares hereafter acquired by such Shareholder shall be subject in all respects to the provisions of this Agreement.

| 1.6 | Company to Be Bound |

The Company covenants and agrees that to the full extent it has the capacity and power at law to do so, it will carry on its business and operations in accordance with the provisions of this Agreement and take no action which would constitute a contravention of any of the terms or provisions hereof.

16

ARTICLE 2

NATURE AND SCOPE OF AGREEMENT

| 2.1 | Purpose and Goal of Company |

The Shareholders formed the Company with the principal purpose of undertaking the Purpose. The goal of the Company is to operate as the lowest cost Greenhouse producer of Cannabis in the Canadian industry without sacrificing product quality. The Company will have the exclusive responsibility to develop Intellectual Property as it relates to the Purpose.

| 2.2 | Purposes of Agreement |

In addition to the other matters set forth herein, the Shareholders have entered into this Agreement to establish terms for the governance of the Company, the ownership of the Shares, the funding of the Company and the conduct of Operations.

| 2.3 | No Partnership or Agency; Ability to Pursue Business Interests |

(a) Nothing in this Agreement will be deemed to constitute Emerald or Village Farms as the partner, agent or legal representative of the other or to create any fiduciary relationship between them. It is not the intention of the Parties to create, nor shall this Agreement be construed to create, any commercial or other partnership.

(b) Except as expressly provided herein to the contrary or in the Transaction Documents, nothing in this Agreement shall be deemed or construed to restrict, in any way, the freedom of either of Village Farms or its Affiliates or Emerald or its Affiliates to conduct or engage in any other business or activity whatsoever, without any accountability whatsoever to the other Parties hereto, and without requiring the consent of the other Parties hereto.

| 2.4 | Priority of Agreements |

The Shareholders agree that to the extent permitted by Applicable Law, in the event of any conflict between the terms of this Agreement and the constating documents of the Company, the terms of this Agreement are intended to govern and shall prevail, and the Shareholders shall use their best efforts and vote their Shares from time to time to cause the constating documents of the Company, as applicable, to be amended to remove such conflict, ambiguity or inconsistency and to permit the Company and its affairs to be carried out in accordance with this Agreement to the greatest extent possible.

| 2.5 | Liability Several |

Except as otherwise provided herein, the rights, duties, obligations and liabilities of the Shareholders under the Company’s constating documents and this Agreement shall be several and not joint or collective. Except as otherwise provided herein or in the Transaction Documents, each Shareholder shall be responsible only for its obligations as set out in the Company’s constating documents, in this Agreement and in the Transaction Documents and shall be liable only for its share of costs and expenses as provided herein.

17

| 2.6 | Implied Covenants |

There are no implied covenants contained in this Agreement other than those of good faith and honest dealing. In deliberating matters before the Board, each Director will act in good faith and in the best interests of the Company provided that he or she may also consider the interests of the Shareholder that nominated such Director.

ARTICLE 3

REPRESENTATIONS AND WARRANTIES; CONDITIONS

| 3.1 | Representations and Warranties of Emerald and Emerald Therapeutics |

As of the Execution Date, each of Emerald and Emerald Therapeutics represents and warrants to Village Farms and the Company as follows, and each of Emerald and Emerald Therapeutics acknowledges that Village Farms and the Company are relying upon such representations and warranties in connection with the execution and delivery of this Agreement:

(a) Organization; Status; Formation and Organization Documents. Each of Emerald and Emerald Therapeutics is duly formed and organized and validly subsisting under the laws of Province of British Columbia, is qualified to do business in the Province of British Columbia and has all requisite power and authority to execute, deliver and perform its obligations under this Agreement and the Transaction Documents to which Emerald is a party.

(b) Approval. This Agreement and the Transaction Documents to which each of Emerald and Emerald Therapeutics is a party have been duly approved, executed and delivered by each of Emerald and Emerald Therapeutics, as applicable, and constitute legal, valid and binding obligations of each of Emerald and Emerald Therapeutics, as applicable, enforceable against each of Emerald and Emerald Therapeutics, as applicable, in accordance with their terms, subject to bankruptcy, insolvency, reorganization, fraudulent transfer, moratorium and other Applicable Laws relating to or affecting the availability of equitable remedies and the enforcement of creditors’ rights generally and general principles of equity and public policy and to the qualification that equitable remedies such as specific performance and injunction may be granted only in the discretion of a court of competent jurisdiction.

(c) Corporate Organization. The chart attached hereto as Schedule G accurately sets out the ownership structure of Emerald and Emerald Therapeutics as of the Execution Date.

(d) No Breach. All material indentures, mortgages, deeds of trust, agreements or other instruments to which either of Emerald or Emerald Therapeutics is party are valid and subsisting and no breach exists in respect thereof on the part of either Emerald or Emerald Therapeutics, in each case, which would or could have a material adverse effect upon the Company or its business or, to the best of its knowledge, information and belief, the Company Assets.

(e) No Conflicts. The execution, delivery and performance of this Agreement and each Transaction Document to which each of Emerald and Emerald Therapeutics is a party by each of Emerald and Emerald Therapeutics does not and will not: (i) in any material way, conflict with or result in or cause any violation under any Applicable Law; (ii) in any material way, conflict with or result or cause a breach of any of the terms or provisions of, or constitute a default under, any indenture, mortgage, deed of trust, loan agreement, partnership agreement, operating agreement or other agreement or instrument to which each of Emerald and Emerald Therapeutics is party; or (iii) result in the creation or imposition of any Encumbrance upon any Company Assets.

18

(f) Governmental Consents. No consent, approval, authorization or order of, or qualification with, any court or Governmental Authority is required in connection with the execution, delivery or performance by any of Emerald or Emerald Therapeutics of this Agreement or any of the Transaction Documents to which Emerald or Emerald Therapeutics is a party.

(g) No Litigation. There are no actions, suits or proceedings at law or in equity by or before any Governmental Authority or other Person now pending or threatened against or affecting any of Emerald or Emerald Therapeutics, which would or could have a material adverse effect upon the Company or its business or, to the best of its knowledge, information and belief, the Company Assets.

(h) Charges and Convictions. Neither Emerald nor Emerald Therapeutics has been charged, threatened to be charged or convicted under any Applicable Law nor disbarred by any Governmental Authority. Neither Emerald nor Emerald Therapeutics has been and, to the best of its knowledge, is not under investigation by any Governmental Authority.

(i) Solvency. Each of Emerald and Emerald Therapeutics is solvent as of the Execution Date. Neither Emerald nor Emerald Therapeutics is a debtor in any outstanding action or proceeding pursuant to any Bankruptcy Proceeding and neither Emerald nor Emerald Therapeutics is: (i) contemplating either the filing of a petition or application by Emerald under any Bankruptcy Proceeding or the liquidation of all or any portion of its assets or property; or (ii) aware that any other Person is contemplating the filing against Emerald of a petition or application under any Bankruptcy Proceeding.

(j) Residency. Each of Emerald and Emerald Therapeutics is not and at all times during the term of this Agreement shall not be a non-resident of Canada for purposes of the Tax Act.

(k) Intellectual Property. Emerald holds all right, title and interest in and to all of the Emerald Background Intellectual Property and has the right to grant to the Company the licenses to the Emerald Background Intellectual Property as set forth in this Agreement. No other Person has infringed, misappropriated, violated or otherwise conflicted with or harmed any of the Emerald Background Intellectual Property. The Emerald Background Intellectual Property does not comprise any royalty-bearing Intellectual Property licenses to Emerald or Emerald Therapeutics. To the best of Emerald’s knowledge, use of the Emerald Background Intellectual Property for the Purpose does not infringe, misappropriate, violate or otherwise conflict with or harm the intellectual property rights of any other Person and no related actions or proceedings have been instituted or are pending or threatened. To the best of Emerald’s knowledge, the Emerald Background Intellectual Property is the only Intellectual Property owned by Emerald or Emerald Therapeutics (or to which Emerald or Emerald Therepeutics’ has a right to use) as of the Execution Date that is required to fulfill the Purpose.

(l) Current Health Canada Cannabis Licenses. Emerald holds license 10-MM0005/201 issued by Health Canada to grow, produce, cultivate, extract and sell Cannabis and such license is in good standing and in full force and effect. To the best of the knowledge of Emerald there are no pending or threatened actions by Health Canada in relation to such license.

19

| 3.2 | Representations and Warranties of Village Farms |

As of the Execution Date, Village Farms represents and warrants to Emerald and the Company as follows, and Village Farms acknowledges that Emerald and the Company are relying upon such representations and warranties in connection with the execution and delivery of this Agreement:

(a) Organization; Status; Formation and Organization Documents. Village Farms is duly formed and organized and validly subsisting under the Federal laws of Canada, is qualified to do business in the Province of British Columbia and has all requisite power and authority to execute, deliver and perform its obligations under this Agreement and the Transaction Documents to which Village Farms is a party.

(b) Approval. This Agreement and the Transaction Documents to which Village Farms is a party have been duly approved, executed and delivered by Village Farms and constitute legal, valid and binding obligations of Village Farms enforceable against Village Farms in accordance with their terms, subject to bankruptcy, insolvency, reorganization, fraudulent transfer, moratorium and other Applicable Laws relating to or affecting the availability of equitable remedies and the enforcement of creditors’ rights generally and general principles of equity and public policy and to the qualification that equitable remedies such as specific performance and injunction may be granted only in the discretion of a court of competent jurisdiction.

(c) Share Ownership and Management Control. The ownership structure of Village Farms is, as of the Execution Date, as set out in its current annual information form dated March 31, 2017, which is available under Village Farms’ profile on SEDAR at www.sedar.com.

(d) [Redacted: Commercially Sensitive Information]

(e) No Breach. All material indentures, mortgages, deeds of trust, agreements or other instruments to which Village Farms is party are valid and subsisting and no breach exists in respect thereof on the part of Village Farms, in each case, which would or could have a material adverse effect upon the Company or its business or, to the best of its knowledge, information and belief, the Company Assets.

(f) Governmental Consents. No consent, approval, authorization or order of, or qualification with, any court or Governmental Authority is required in connection with the execution, delivery or performance by Village Farms of this Agreement or any of the Transaction Documents to which Village Farms is a party.

(g) No Litigation. There are no actions, suits or proceedings at law or in equity by or before any Governmental Authority or other Person now pending or threatened against or affecting Village Farms, the Property or the Structures which would or could have a material adverse effect upon the Company or its business or, to the best of its knowledge, information and belief, the Company Assets.

(h) Charges and Convictions. Village Farms has not been charged, threatened to be charged or convicted under any Applicable Law nor disbarred by any Governmental Authority. Village Farms has not been and is not under investigation by any Governmental Authority.

(i) Solvency. Village Farms is solvent as of the Execution Date. Village Farms is not a debtor in any outstanding action or proceeding pursuant to any Bankruptcy Proceeding and Village Farms is not: (i) contemplating either the filing of a petition or application by Village Farms under any Bankruptcy Proceeding or the liquidation of all or any portion of its assets or property; and (ii) aware that any other Person is contemplating the filing against Village Farms of a petition or application under any Bankruptcy Proceeding.

(j) Residency. Village Farms is not and at all times during the term of this Agreement shall not be a non-resident of Canada for purposes of the Tax Act.

20

(k) Intellectual Property. Village Farms holds all right, title and interest in and to all of the Village Farms Background Intellectual Property and has the right to grant to the Company the licenses to the Village Farms Background Intellectual Property as set forth in this Agreement. No other Person has infringed, misappropriated, violated or otherwise conflicted with or harmed any of the Village Farms Background Intellectual Property. The Village Farms Background Intellectual Property does not comprise any royalty-bearing Intellectual Property licenses to Village Farms. To the best of Village Farms’ knowledge, use of the Village Farms Background Intellectual Property for the Purpose does not infringe, misappropriate, violate or otherwise conflict with or harm the intellectual property rights of any other Person and no related actions or proceedings have been instituted or are pending or threatened. To the best of Village Farms’ knowledge, the Village Farms Background Intellectual Property is the only Intellectual Property owned by Village Farms (or which Village Farms has a right to use) as of the Execution Date that is required to fulfill the Purpose.

| 3.3 | Survival |

(a) The foregoing representations and warranties made by Emerald in Section 3.1 and Village Farms in Section 3.2 shall survive the execution and delivery of this Agreement and shall not merge on the Execution Date.

ARTICLE 4

TRANSITION PERIOD

| 4.1 | Administrative Services |

(a) Village Farms covenants and agrees that it shall provide the Administrative Services without charge or fee (except in respect of the Cost of the Administrative Services) to the Company for a period of six months commencing on the Execution Date and ending at 5:00 p.m. (Vancouver time) on the six month anniversary of the Execution Date (the “Administrative Services Period”).

(b) Village Farms will use reasonable commercial efforts, skill and judgment in performing the Administrative Services. Without limiting the foregoing, Village Farms will perform, or cause to be performed, the Administrative Services in a timely and workmanlike manner and will furnish competent and adequate staff as is necessary to conduct the Administrative Services. Any staff engaged by Village Farms to provide the Administrative Services shall not be employees of the Company and, subject to Section 4.1(c), all costs relating to their employment, termination or severance shall be the sole responsibility of Village Farms. The withholding and payment of any amounts required to be withheld and paid to any Governmental Authority, including without limitation, workers compensation premiums, unemployment insurance premiums, Canada Pension Plan payments, federal or provincial income taxes, and employer’s health taxes, shall be withheld and paid by Village Farms.

(c) Village Farms shall be reimbursed by the Company for all properly documented reasonable costs and expenses incurred by Village Farms in connection with the provision of the Administrative Services including without limitation, a reasonable allocation (pro rata based on time spent) of any salaries, benefits and taxes (including without limitation, workers compensation premiums, unemployment insurance premiums, Canada Pension Plan payments, federal or provincial income taxes, and employer’s health taxes) paid to Village Farms’ employees who dedicate only a portion of their time to the provision of the Administrative Services and related payments/contributions to Governmental Authorities (collectively the “Cost of the Administrative Services”). There shall be no mark-up by Village Farms on the Cost of the Administrative Services.

21

(d) Village Farms will be entitled to submit to the Company monthly invoices together with reasonable supporting documentation for the Cost of the Administrative Services during the calendar month immediately preceding, which invoices will show the total amount due to Village Farms from the Company, any applicable credits, and applicable Taxes, each set out as specific line items. The Company will pay, and Village Farms will remit, taxes to all applicable Governmental Authorities as required by Applicable Law. The Company will pay all invoices within 30 days from date of receipt of the invoice together with reasonable supporting documentation. For clarity, Village Farms will not be entitled to withdraw funds from any bank account it shall establish on behalf of the Company in order to pay the said invoices. If there shall be an unresolved dispute concerning the monthly invoices, either Shareholder shall have the right to submit the matter to the Dispute Resolution Procedures; prior to resolution of the dispute, the Company shall not be required to pay Village Farms for the items on the invoice that are in dispute.

(e) Forthwith following the expiry of the Administrative Services Period, Village Farms shall promptly deliver all books and records maintained by Village Farms to the President or to such third party as directed by the President, including all information relating to the Operations which is stored by Village Farms in any computer, microfiche records or other information storage medium.

(f) The Company shall defend, indemnify and save Village Farms and its Affiliates and its and their directors, officers and employees (collectively, the “Village Farms Indemnified Parties”) harmless from and against any and all Losses incurred by the Village Farms Indemnified Parties of any nature in connection with, resulting from or relating to the provision of the Administrative Services, including as a result of personal injury including death and property damage and Losses suffered by third parties; provided that the Company shall not be required to reimburse or indemnify any Village Farms Indemnified Party for any Losses to the extent such Losses arise from the negligence or wilful misconduct of any Village Farms Indemnified Party or any breach or default under this Section 4.1(f). Notwithstanding any other provision in this Agreement, the Company shall not be required to indemnify the Village Farms Indemnified Parties, or to be liable to the Village Farms Indemnified Parties, for special, indirect, incidental, contingent or consequential damages, however occasioned, even if the Village Farms Indemnified Parties has advised the Company of the possibility of such damages.

| 4.2 | Emerald to Lead Licensing on Behalf of the Company |

(a) Immediately following the Execution Date, the Company will commence the process of applying for the Licenses in connection with the Delta 3 Assets and Operations with Emerald, subject to guidance and direction from the Board, taking the lead in this process. Emerald will act diligently and in good faith in pursuing the Licenses on behalf of the Company. Emerald covenants and agrees to:

| (i) | license to the Company all Emerald Background Intellectual Property and other assets in its control which are reasonably necessary to allow the Company to secure all Licences in connection with the Delta 3 Assets and Operations; and |

| (ii) | grant to the Company a right to cross-reference all regulatory submissions on file in connection with the Licenses in connection with the Delta 3 Assets and Operations, if such cross-reference facilitates the screening, review or issuance of the Licenses in connection with the Delta 3 Assets and Operations. |

(b) Emerald shall be reimbursed by the Company for all properly documented reasonable costs and expenses incurred by Emerald in connection with obtaining the Licenses in connection with the Delta 3 Assets and Operations including without limitation, a reasonable allocation (pro rata based on time spent) of any salaries, benefits and taxes (including without limitation, workers compensation premiums, unemployment insurance premiums, Canada Pension Plan payments, federal or provincial income taxes,

22

and employer’s health taxes) paid to Emerald’s employees who dedicate only a portion of their time to assisting the Company with obtaining the Licenses in connection with the Delta 3 Assets and Operations and related payments/contributions to Governmental Authorities (collectively the “License Costs”). There shall be no mark-up by Emerald on the License Costs.

(c) Emerald will be entitled to submit to the Company monthly invoices together with reasonable supporting documentation for the License Costs during the calendar month immediately preceding, which invoices will show the total amount due to Emerald from the Company, any applicable credits, and applicable Taxes, each set out as specific line items. The Company will pay, and Emerald will remit, taxes to all applicable Governmental Authorities as required by Applicable Law. The Company will pay all invoices within 30 days from date of receipt of the invoice together with reasonable supporting documentation. For clarity, Emerald will not be entitled to withdraw funds from any bank account it shall establish on behalf of the Company in order to pay the said invoices. If there shall be an unresolved dispute concerning the monthly invoices, either Shareholder shall have the right to submit the matter to the Dispute Resolution Procedures; prior to resolution of the dispute, the Company shall not be required to pay Emerald for the items on the invoice that are in dispute.

(d) After receiving the Licenses in connection with the Delta 3 Assets and Operations, which Licenses shall be owned by the Company, the Company shall plant, grow and distribute Cannabis in accordance with the terms of the Licenses, the Operating Plan and this Agreement as soon as possible.

| 4.3 | Employee Matters |

(a) Prior to the Company’s receipt of the initial Cultivation License in connection with the Delta 3 Assets and Operations (or earlier), Village Farms will identify the Employees to the Company and will provide the Company with the following information for each of the Employees: years of service; position; salary or wage rate; a description of any group insurance or retirement benefits arrangements; and bonus eligibility.

(b) Following the Company’s receipt of the initial Cultivation License in connection with the Delta 3 Assets and Operations and in any event no later than five Business Days thereafter, the Company will offer in writing continuation of employment to those Employees who it wishes to hire, subject to examination and approval by Emerald and subject further to each such Employee being eligible to receive the necessary Security Clearance with the Minister under the ACMPR or other approvals required under Applicable Laws in order to be employed by the Company and provide services pursuant to the Licences and Applicable Laws, in each case on terms and conditions no less favourable than the Employee holds with Village Farms as at such date and with recognition of all of the Employee’s prior service with Village Farms for all purposes. Each Employee who accepts an offer of employment with the Company will be a “Hired Employee”, and each such offer shall include an assignment to the Company of any and all Intellectual Property created by the Hired Employee during the course of the Hired Employee’s employment with the Company.

(c) Upon the commencement of each Hired Employee’s employment with the Company, the Company shall assume and be responsible for, and shall defend, indemnify and save Village Farms and its directors, officers and employees harmless from and against, all liabilities and obligations for, and any Losses arising out of or related to, the employment and any termination of employment of such Hired Employee, except as set out in Section 4.3(d) and Section 4.3(h).