Exhibit 99.69

VILLAGE FARMS INTERNATIONAL, INC.

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 14, 2018

AND MANAGEMENT INFORMATION CIRCULAR

May 10, 2018

TABLE OF CONTENTS

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS | 3 | |||||

SOLICITATION OF PROXIES AND VOTING INSTRUCTIONS | 4 | |||||

| Solicitation of Proxies | 4 | ||||

| Registered Owners | 4 | ||||

| Non-Registered Owners | 5 | ||||

COMMON SHARES | 6 | |||||

PRINCIPAL HOLDERS OF VOTING SECURITIES | 6 | |||||

MATTERS TO BE CONSIDERED AT THE MEETING | 7 | |||||

| Financial Statements | 7 | ||||

| Appointment of Auditor | 7 | ||||

| Election of Directors | 7 | ||||

| Approval of the Compensation Plan Renewal | 10 | ||||

SHARE-BASED COMPENSATION PLAN | 11 | |||||

| Background | 11 | ||||

| “Rolling” Maximum Reserve | 11 | ||||

| Types of Awards | 11 | ||||

| Burn Rate Chart | 12 | ||||

| Other Terms | 12 | ||||

COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS | 14 | |||||

| Compensation Discussion and Analysis | 14 | ||||

| Programs and Objectives and Reward Philosophy | 14 | ||||

| Compensation of Named Executive Officers | 19 | ||||

| Compensation of Directors | 25 | ||||

| Composition of the Compensation and Corporate Governance Committee | 26 | ||||

INDEBTEDNESS | 27 | |||||

AUDIT COMMITTEE | 27 | |||||

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 27 | |||||

STATEMENT OF CORPORATE GOVERNANCE PRACTICES | 27 | |||||

SHAREHOLDER PROPOSALS FOR NEXT YEAR’S ANNUAL MEETING | 31 | |||||

ADDITIONAL INFORMATION | 32 | |||||

DIRECTORS’ APPROVAL | 32 | |||||

APPENDIX A | 33 | |||||

APPENDIX B | 41 | |||||

APPENDIX C | 55 | |||||

VILLAGE FARMS INTERNATIONAL, INC.

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the annual and special meeting (the “Meeting”) of the holders (the “Shareholders”) of common shares (the “Common Shares”) of Village Farms International, Inc. (“Village Farms” or the “Company”) will be held at 10:00 a.m., Pacific time, on the 14th day of June, 2018 at Village Farms, 4700—80th Street, Delta, British Columbia, V4K 3N3, for the following purposes:

| 1. | to receive the consolidated financial statements of the Company for the fiscal year ended December 31, 2017 together with the report of the auditors thereon; |

| 2. | to appoint the auditor and authorize the directors of the Company (the “Directors”) to fix the remuneration of the auditor for the ensuing year; |

| 3. | to elect the Directors for the ensuing year; |

| 4. | to consider, and if thought advisable, pass an ordinary resolution to approve the renewal of the Company’s Compensation Plan, as more particularly described in the accompanying management information circular (the “Information Circular”); and |

| 5. | to transact such other business as may properly come before the Meeting or any adjournment or postponement thereof. |

The accompanying Information Circular provides additional information relating to the matters to be dealt with at the Meeting and is deemed to form part of this notice. The Board of Directors has fixed May 10, 2018 as the record date for the Meeting (the “Record Date”). Only Shareholders of record at the close of business on the Record Date are entitled to vote at the Meeting or any adjournment or postponement thereof.

DATED at Delta, British Columbia this 10th day of May, 2018.

| By Order of the Board of Directors | ||

| By: | (signed) “John R. McLernon” | |

| Chairman of the Board of Directors | ||

If you are a Shareholder and you are not able to attend the Meeting in person, please exercise your right to vote either by (a) signing and returning the enclosed form of proxy to Computershare Investor Services Inc. at 100 University Avenue 8th Floor, Toronto, Ontario, M5J 2Y1 so as to arrive not later than 10:00 a.m., Pacific time, on June 12, 2018 or, if the Meeting is adjourned, 48 hours (excluding Saturdays, Sundays and holidays) prior to the commencement of the reconvened meeting, or (b) completing the request for voting instructions in accordance with the directions provided.

THIS PAGE INTENTIONALLY LEFT BLANK

VILLAGE FARMS INTERNATIONAL, INC.

MANAGEMENT INFORMATION CIRCULAR

DATED MAY 10, 2018

SOLICITATION OF PROXIES AND VOTING INSTRUCTIONS

Solicitation of Proxies

The information contained in this management information circular (the “Information Circular”) is furnished in connection with the solicitation of proxies from registered owners of common shares (the “Common Shares”) of Village Farms International, Inc. (“Village Farms” or the “Company”) (and of voting instructions in the case of non-registered owners of Common Shares) to be used at the annual and special meeting (the “Meeting”) of holders of Common Shares (“Shareholders”) of the Company to be held at 10:00 a.m., Pacific time, on the 14th day of June, 2018 at 4700 – 80th Street, Delta, British Columbia, V4K 3N3, and at all adjournments or postponements of the Meeting, for the purposes set forth in the accompanying notice of meeting (the “Notice of Meeting”). It is expected that the solicitation will be made primarily by mail, but proxies and voting instructions may also be solicited personally by management of the Company. The solicitation of proxies and voting instructions by this Information Circular is being made by or on behalf of management of the Company. The total cost of the solicitation of proxies will be borne by the Company. The information contained in this Information Circular is given as at the close of business on May 10, 2018, except where otherwise noted.

Registered Owners

Appointment of Proxies

The individuals named in the form of proxy are representatives of management of the Company and are officers or directors of the Company or its affiliates. A Shareholder has the right to appoint someone else, who need not be a Shareholder, to represent that Shareholder at the Meeting, by inserting that other person’s name in the blank space in the form of proxy.

To be valid, proxies must be deposited with Computershare Investor Services Inc. (“Computershare”) at 100 University Avenue 8th Floor, Toronto, Ontario, M5J 2Y1, so as to arrive not later than 10:00 a.m., Pacific time, on June 12, 2018 or, if the Meeting is adjourned, 48 hours (excluding Saturdays, Sundays and holidays) prior to the commencement of any reconvened meeting.

Revocation

A Shareholder who has submitted a proxy may revoke it by:

| A. | completing and signing a form of proxy bearing a later date and depositing it with Computershare as described above; |

| B. | depositing a document that is signed by that Shareholder (or by someone that the Shareholder has properly authorized to act on that Shareholder’s behalf) (i) at the registered office of the Company at any time up to the last business day preceding the day of the Meeting, or any adjournment of the Meeting, at which the proxy is to be used, or (ii) with the chairperson of the Meeting, prior to the commencement of the Meeting, on the day of the Meeting or any adjournment of the Meeting; |

4

| C. | electronically transmitting the revocation in a manner permitted by law, provided that the revocation is received (i) at the registered office of the Company at any time up to and including the last business day preceding the day of the Meeting, or any adjournment of the Meeting, at which the proxy is to be used, or (ii) by the chair of the Meeting, prior to the commencement of the Meeting, on the day of the Meeting or any adjournment of the Meeting; or |

| D. | following any other procedure that is permitted by law. |

Voting of Proxies

In connection with any ballot that may be called for, the management representatives designated in the enclosed form of proxy will vote or withhold from voting the Common Shares in accordance with the instructions of the Shareholder as indicated on the proxy and, if the Shareholder specifies a choice with respect to any matter to be acted upon, the Common Shares will be voted accordingly. In the absence of any direction, your Common Shares will be voted by the management representatives FOR the appointment of the auditor, FOR the election of each director of the Company and FOR the renewal of the Company’s Compensation Plan (as defined below) as indicated under those headings in this Information Circular.

The management representatives designated in the enclosed form of proxy have discretionary authority with respect to amendments to or variations of matters identified in the Notice of Meeting and with respect to other matters that may properly come before the Meeting. At the date of this Information Circular, the management of the Company knew of no such amendments, variations or other matters.

Non-Registered Owners

Shareholders who do not hold their Common Shares in their own name are referred to as non-registered owners. If your Common Shares are registered in the name of a depository (such as CDS Clearing and Depository Services Inc. (“CDS”)) or an intermediary (such as a bank, trust company, securities dealer or broker, or trustee or administrator of a self-administered Registered Retirement Savings Plan, Registered Retirement Income Fund, Registered Education Savings Plan or similar plan), you are a non-registered owner.

Currently, most issued and outstanding Common Shares are in a book-based system administered by CDS. Consequently, most of the Common Shares are currently registered under the name of “CDS & Co.” (the registration name for CDS). CDS also acts as nominee for brokerage firms through which beneficial holders hold their Common Shares. Common Shares held by CDS can only be voted upon the instructions of the beneficial holder of the Common Shares.

Only registered owners of Common Shares, or the persons they appoint as their proxies, are permitted to attend and vote at the Meeting. If you are a non-registered owner, you are entitled to direct how the Common Shares beneficially owned by you are to be voted or you may obtain a form of legal proxy that will entitle you to attend and vote at the Meeting.

In accordance with Canadian securities law, the Company has mailed copies of its 2017 Audited Consolidated Financial Statements to requesting shareholders and has distributed copies of the Notice of Meeting and this Information Circular (collectively, the “Meeting Materials”) to the intermediaries for onward distribution to non-registered shareholders who have not waived their right to receive them. Typically, intermediaries will use a service company (such as Broadridge Financial Solutions, Inc.) to forward the Notice of Meeting and this Information Circular to non-registered shareholders.

If you are a non-registered shareholder and have not waived your right to receive the Meeting Materials, you will receive either a request for voting instructions or a form of proxy with your Meeting Materials. The purpose of these documents is to permit you to direct the voting of the Common Shares you beneficially own. You should follow the procedures set out below, depending on which type of document you receive.

5

Request for Voting Instructions.

If you do not wish to attend the Meeting (or have another person attend and vote on your behalf), you should complete the enclosed request for voting instructions in accordance with the directions provided. You may revoke your voting instructions at any time by written notice to your intermediary, except that the intermediary is not required to honour the revocation unless it is received at least seven (7) days before the Meeting.

If you wish to attend the Meeting and vote in person (or have another person attend and vote on your behalf), you must complete the enclosed request for voting instructions in accordance with the directions provided and a form of proxy will be sent to you giving you (or the other person) the right to attend and vote at the Meeting. You (or the other person) must register with the Company’s transfer agent, Computershare, when you arrive at the Meeting.

or

Form of Proxy.

The form of proxy has been signed by the intermediary (typically by a facsimile, stamped signature) and completed to indicate the number of Common Shares beneficially owned by you. Otherwise, the form of proxy is incomplete.

If you do not wish to attend the Meeting, you should complete the form of proxy in accordance with the instructions set out in the section titled “Registered Owners” above.

If you wish to attend the Meeting and vote in person, you must strike out the names of the persons named in the proxy and insert your name in the blank space provided. To be valid, proxies must be deposited with Computershare at 100 University Avenue 8th Floor, Toronto, Ontario, M5J 2Y1 not later than 10:00 a.m., Pacific time, on June 12, 2018 or, if the Meeting is adjourned, 48 hours (excluding Saturdays, Sundays and holidays) prior to the commencement of any reconvened meeting. You must register with the Company’s transfer agent, Computershare, when you arrive at the Meeting.

You should follow the instructions on the document that you have received and contact your intermediary promptly if you need assistance.

COMMON SHARES

At the close of business on May 10, 2018, the Company had outstanding 42,485,946 Common Shares, each of which carries the right to one vote at a meeting of the Shareholders of the Company, which represent all the outstanding voting shares of the Company. Each Shareholder of record at the close of business on May 10, 2018, the record date established for the Meeting, will be entitled to vote on all matters proposed to come before the Meeting on the basis of one vote for each Common Share.

PRINCIPAL HOLDERS OF VOTING SECURITIES

To the knowledge of the directors and officers of the Company, the following are the only persons or companies who beneficially own, directly or indirectly, or exercise control or direction over, more than 10% of the outstanding Common Shares of the Company:

6

NAME | NUMBER OF COMMON SHARES OWNED OR CONTROLLED | PERCENTAGE OF THE OUTSTANDING COMMON SHARES | ||||||

MICHAEL A. DEGIGLIO | 9,671,649 | 22.8 | % | |||||

MATTERS TO BE CONSIDERED AT THE MEETING

Financial Statements

The consolidated financial statements of the Company for the fiscal year ended December 31, 2017, together with the report of the auditors thereon, were mailed to requesting Shareholders separately from this Information Circular. These financial statements are also available electronically on SEDAR at www.sedar.com.

Appointment of Auditor

The management representatives designated in the enclosed form of proxy (or voting instruction form) intend to vote FOR the reappointment of PricewaterhouseCoopers LLP as auditor of the Company to hold office until the next annual general meeting of Shareholders and to authorize the board of directors of the Company (the “Board”) to fix the remuneration of the auditor for the ensuing year. PricewaterhouseCoopers LLP has served as auditor of the Company and its predecessor, Village Farms Income Fund (the “Fund”), since its inception on November 10, 2003. The reappointment of PricewaterhouseCoopers LLP as auditor of the Company must be confirmed by a resolution of a majority of the votes cast by Shareholders at the Meeting.

Election of Directors

The Board currently consists of seven directors. Management proposes to nominate the persons listed below for election as directors. The Company’s articles of arrangement provide that the number of directors of the Company will be a minimum of three and a maximum of ten. Shareholders will vote on each individual director separately.

Accordingly, the number of directors to be elected at the Meeting is seven. The management representatives designated in the enclosed form of proxy (or voting instruction form) intend to vote FOR the election as directors of each of the proposed nominees whose names are set out below. All nominees are now directors and have been directors since the dates indicated below. Management does not contemplate that any of the proposed nominees will be unable to serve as a director but, if that should occur for any reason before the Meeting, the management representatives designated in the enclosed form of proxy (or voting instruction form) reserve the right to vote for another nominee at their discretion. The Company adopted a majority voting policy in April 2013, which was amended on May 10, 2017, pursuant to which directors who are not elected by at least a majority (50% +1) of the votes cast with respect to his or her election in an uncontested election are required to tender their resignation, absent exceptional circumstances. Each director elected will hold office until the next annual meeting of Shareholders or until his/her successor is elected or appointed, unless his/her office is vacated earlier in accordance with the Company’s articles of arrangement and applicable law.

7

The following table sets forth the names of, and certain additional information for, the seven persons nominated for election as directors.

Name and Province or State | Position with the Company | Principal | Director | Ownership or Control Over | ||||

| Michael A. DeGiglio Florida, USA | Director and Chief Executive Officer | Chief Executive Officer of the Company | October 18, 2006 | 9,671,649 | ||||

| John P. Henry3 Florida, USA | Director | Retired Senior Executive | October 18, 2006 | 35,000 | ||||

| John R. McLernon4 British Columbia, Canada | Chair of the Board of Directors | Honourary Chairman and Co-Founder of the Colliers Macaulay Nicolls Group Inc. | January 18, 2005 | 106,500 | ||||

| Christopher C. Woodward3,4 British Columbia, Canada | Director | President, Woodcorp Investments Ltd. | November 10, 2003 | 165,000 | ||||

| David Holewinski3,4 Michigan, USA | Director | Management Consultant | June 21, 2011 | 145,000 | ||||

Stephen C. Ruffini Florida, USA | Director and Chief Financial Officer | Chief Financial Officer of the Company | March 19, 2014 | 500,000 | ||||

Dr. Roberta Cook California, USA | Director | Marketing Consultant | January 4, 2016 | 20,000 | ||||

| 1 | The information as to residence and principal occupation, where not within the knowledge of the Company, has been furnished by the respective individuals listed in the table above. |

| 2 | The information as to Common Shares beneficially owned or over which a director exercises control or direction, not being within the knowledge of the Company, has been furnished by the respective directors. |

| 3 | Member of the audit committee of the Company (the “Audit Committee”). |

| 4 | Member of the compensation and corporate governance committee of the Company (the “Compensation and Corporate Governance Committee”). |

| 5 | Prior to December 31, 2009, the Company was a subsidiary of the Fund. Accordingly, the dates presented in this column include the period of time during which each individual served as a director of the Company while it was a subsidiary of the Fund, or alternatively, as a trustee of the Fund. |

Biographies of Directors

The following are brief profiles of the directors of the Company.

Michael A. DeGiglio, Director and Chief Executive Officer of the Company. Mr. DeGiglio is a founder of Village Farms International through predecessor companies and has served as its Chief Executive Officer since its inception in 1989. Mr. DeGiglio joined EcoScience Corporation (NASDAQ) a bio-technology company, in November 1992 upon its acquisition of Agro-Dynamics Inc., a company Mr. DeGiglio founded in 1984 and where he served as President since its inception. Additionally, he served as President and Chief Executive Officer of EcoScience from 1995 until its merger with Village Farms in 1999. Prior to commencing his business career in 1983, Mr. DeGiglio served on active duty in the United States Navy from 1976 through 1983, and in the Naval Air reserves from 1983 through 2001, retiring at the rank of Captain. Throughout his Naval career, Captain DeGiglio held multiple Department head positions, successfully completed a tour as Commanding Officer of a jet squadron, performed multiple tours overseas, accumulated over 5,000 hours of military flight time, and completed numerous senior management and military courses. Mr. DeGiglio received a Bachelor of Science degree in Aeronautical Science from Embry Riddle Aeronautical University (ERAU) in Daytona Beach, Florida. He has served as the former Chairman of the Presidential Advisory Board of ERAU.

8

John P. Henry, Director of the Company. Mr. Henry has served as a director of the Company since 2006. From 1981 to 2000, Mr. Henry was employed by Ocean Spray Cranberries, Inc. (“Ocean Spray”), retiring as Senior Vice-President of Grower Relations and Chief Financial Officer in 2000. Ocean Spray grew from $400 million to $1.3 billion in revenues during his tenure. Mr. Henry also served as a Director of Nantucket Allserve Inc., a majority owned subsidiary of Ocean Spray. From 1980 to 1981, he was Chief Financial Officer of Castle Toy Co, Inc., and prior to that, Mr. Henry was employed by Laventhol and Horwath providing auditing, consulting and tax services to large public and private companies. He received a Bachelor of Science degree in Business Administration and a Masters in Taxation degrees from Bryant College in Smithfield, Rhode Island. Mr. Henry is a non-practicing Certified Professional Accountant in the State of Rhode Island.

John R. McLernon, Chairman and Director of the Company. Mr. McLernon is President of McLernon Consultants Ltd. He is Honourary Chairman and Co-Founder of Colliers International (“Colliers”), a global commercial real estate services company operating from 485 offices in 65 countries. He served as Chairman and Chief Executive Officer of Colliers from 1977 to 2002 and as Chairman until December 2004. Mr. McLernon also serves as a director of several public and private companies as well as major nonprofit organizations, and is Chairman of A&W Revenue Royalties Income Fund and City Office REIT, Inc.

Christopher C. Woodward, Director of the Company. Mr. Woodward serves as chair or director of a number of private and public companies as well as charitable institutions. These include the P.A. Woodward Medical Foundation, Brentwood College, the Sea to Sky Gondola Corp. and Great Western Brewery. He is currently Chair of the Vancouver Coastal Health Authority and Chair of the Keg Royalty Trust. Mr. Woodward received his Bachelor of Arts (Economics) degree from the University of Western Ontario.

David Holewinski, Director of the Company. Mr. Holewinski is a Management Consultant. He served as a director of Agro Power Development Inc. (“APDI”) from 2004 until October 2006. Between 1995 and 2000, Mr. Holewinski served as Senior Vice President of Business Development for APDI. Mr. Holewinski has co-founded two biotechnology companies, co-founded a company with computer and internet security, as well as co-founded a company with novel precast concrete technology for the construction industry. Between 1983 and 1988, Mr. Holewinski was a Manager of Business Development for ConAgra Foods, Inc. Mr. Holewinski has a Bachelor of Arts degree from Pennsylvania State University and a Master of Business Administration degree from Harvard University.

9

Stephen C. Ruffini, Director and Chief Financial Officer of the Company. Mr. Ruffini joined Village Farms Income Fund in January 2009. He joined the Board of Directors of Village Farms International, Inc. in March 2014. From 2001 to 2005, Mr. Ruffini was a Director and Chief Financial Officer of HIT Entertainment, Ltd., which was the preeminent young children’s entertainment company listed on the London Stock Exchange. From 2006 to 2008, he was the Chief Financial Officer of Performing Brands, which was a publicly listed U.S. company in the beverage industry. He was a Tax Manager with Arthur Andersen from 1984 to 1993. Mr. Ruffini has a Masters of Business Administration degree from the University of Texas and a Bachelor of Business Administration degree from Southern Methodist University.

Dr. Roberta Cook, Director of the Company. On July 1, 2016, Dr. Cook retired from her 31-year position as a Cooperative Extension Marketing Economist in the Department of Agricultural and Resource Economics (ARE) at the University of California, Davis. She is currently an Emerita faculty member, and consults on a broad range of fresh produce marketing issues. She has a PhD in Agricultural Economics from Michigan State University. She serves on the board of directors of Ocean Mist Farms, and has been a board member of Naturipe Farms and Sunkist, as well as numerous other advisory boards in the produce industry. For nearly a decade, Dr. Cook was Faculty Director of the California Agribusiness Executive Seminar co-sponsored by University of California, Davis and Wells Fargo Bank. In 2011, The Packer honoured her as one of the top 25 produce industry leaders.

Corporate Cease Trade Orders, Bankruptcies and Court Proceedings

Mr. McLernon was a director of Syscan International Inc. (“Syscan”), a public company whose shares were listed on the TSX Venture Exchange. Mr. McLernon resigned as a director of Syscan within the year preceding Syscan making an assignment to a trustee pursuant to the Bankruptcy and Insolvency Act (Canada) in December 2008.

On March 12, 1998, the United States District Judge for the Central District of California entered a Final Consent Judgment of Permanent Injunction, Disgorgement, and Civil Penalty against Mr. Holewinski relating to allegations of insider trading in the securities of Chantal Pharmaceutical Corporation. Mr. Holewinski, without admitting or denying the allegations, consented to a Judgment that permanently enjoined him from future violations of the antifraud provisions of the federal securities laws and ordered Mr. Holewinski to disgorge losses avoided in the amount of US$28,162, plus prejudgment interest in the amount of US$4,921 and to pay a civil penalty in the amount of US$28,162.

Mr. Ruffini was an officer of Performing Brands, Inc. (“Performing”), a public company whose shares were listed on NASDAQ. Performing filed a voluntary petition in the U.S. Bankruptcy Court (North Texas District) under Chapter 7 of the United States Bankruptcy Code, in December 2008.

Approval of the Compensation Plan Renewal

The Shareholders will be asked to consider, and if thought advisable, pass an ordinary resolution (the “Compensation Plan Resolution”), the full text of which is set forth in Appendix C to this Information Circular, approving the renewal of the Company’s Compensation Plan, as defined below.

Reference should be made to the full text of the Compensation Plan attached hereto as Appendix B. The TSX requires that the Compensation Plan be approved by the Shareholders on a periodic basis. The full text of the Compensation Plan Resolution, approving the renewal of the Compensation Plan and unallocated Options and share-based awards, is attached hereto as Appendix C. This approval will be effective for three years from the date of the Meeting. If approval is not obtained at the Meeting, Options and share-based awards which have not been allocated as of June 14, 2018 and Options and share-based awards which are outstanding as of June 14, 2018 and are subsequently cancelled, terminated or exercised will not be available for a new grant of Options or share-based awards. Previously awarded Options and share–based awards will not be affected by the approval or disapproval of the Compensation Plan Resolution. To be effective, the Compensation Plan Resolution must be approved by at least 50% of the votes cast in person or by proxy by the Shareholders at the Meeting. A summary of the Compensation Plan is below under “Share-Based Compensation Plan”.

10

The management representatives designated in the enclosed form of proxy intend to vote FOR the renewal of the Compensation Plan and approval of the unallocated share-based awards and Options, unless the Shareholder has specified in his or her proxy that his or her Shares are to be voted against the Compensation Plan Resolution.

SHARE-BASED COMPENSATION PLAN

Background

The Company adopted a compensation plan (the “Compensation Plan”), effective January 1, 2010, on completion of its conversion into a corporation, in order to attract and retain directors, officers, employees and service providers to the Company and to motivate them to advance the interests of the Company by affording them with the opportunity to acquire an equity interest in the Company. The Compensation Plan has been drafted to comply with the policies of the Toronto Stock Exchange (the “TSX”) as they exist at the date of this Information Circular. The Compensation Plan was most recently approved by the Shareholders on June 24, 2015. The following information is intended as a summary of the Compensation Plan.

“Rolling” Maximum Reserve

The TSX permits the adoption of a “rolling” type of share-based compensation plan whereby the number of shares available for issuance under the plan will not be greater than a rolling maximum percentage of the outstanding shares. The Compensation Plan provides that the number of Common Shares reserved for issuance upon the exercise or redemption of awards granted under the Compensation Plan is a rolling maximum of ten percent (10%) of the outstanding Common Shares at any point in time. Currently, the Company has 42,485,946 Common Shares outstanding. Therefore, up to 4,248,595 Common Shares may be reserved for issuance under the Compensation Plan. The purpose of adopting a “rolling” type of share based compensation plan is to ensure that a sufficient number of Common Shares remain issuable under the Compensation Plan to meet the overall objective of the Compensation Plan. Any exercise, redemption, expiry or lapse of awards will make new grants available under the Compensation Plan effectively resulting in a “re-loading” of the number of awards available to be granted. The Compensation Plan must be approved by shareholders every three years.

Types of Awards

The Compensation Plan is an omnibus share-based compensation plan, pursuant to which the Company is authorized to award Options, stock appreciation rights, deferred share units, restricted share units, restricted stock and other share-based awards, which may be settled in shares issued from the treasury or in cash. To date, only Options have been awarded under the Compensation Plan. As of December 31, 2017, Options to purchase 2,337,732 Common Shares were outstanding, and 128,000 Performance-based restricted share units were outstanding, which together represented approximately 5.8% of the issued and outstanding Common Shares as at such date. As of December 31, 2017, the Company had 1,758,529 Common Shares available for future grants under the Compensation Plan, which represented approximately 4.2% of the issued and outstanding Common Shares as at such date.

An Option is a right to purchase a Common Share for a fixed exercise price. A stock appreciation right is a right to either a cash payment or the issuance of Common Shares with a market price equal in value to the difference between the exercise price and the fair market value of a Common Share. A stock appreciation right may be granted in relation to an option or on a stand-alone basis. A deferred share unit is a right to a Common Share or a cash payment equal to the fair market value of a Common Share redeemable only after the participant has ceased to hold all positions with the Company and its affiliates. A restricted share unit is a right to a Common Share or a

11

cash payment equal to the fair market value of a Common Share redeemable after the passage of time, the achievement of performance targets or both. A restricted share unit is a Common Share issued to a participant subject to conditions which may include the passage of time, the achievement of performance targets or both. Any voting rights and entitlements to dividends in respect of restricted shares will be determined by the Board on the date of grant and will be set out in the applicable award agreement. Other share based awards are awards which provide for the issuance of a Common Share or a payment equal to the fair market value of a Common Share on such terms and conditions as the Company determines.

When dividends are paid on the Common Shares, an additional number of restricted share units and deferred share units, as the case may be, will be credited to the eligible holder thereof. The additional units credited will be determined as the amount of the dividend multiplied by the number of restricted share units or deferred share units, as the case may be, credited to the eligible holder thereof at the dividend payment date, and divided by the market price of a Common Share on the dividend payment date.

Burn Rate Chart

| 2017 | 2016 | 2015 | ||||||||||

# of Awards Granted in the Fiscal Year | 1,216,000 | 300,000 | 195,000 | |||||||||

Weighted Average Number of Shares Outstanding for the Fiscal Year | 40,308,000 | 39,176,000 | 38,868,000 | |||||||||

Burn Rate for Compensation Plan | 3.0 | % | 0.8 | % | 0.5 | % | ||||||

Other Terms

The Compensation Plan authorizes the Board (or a committee of the Board if so authorized by the Board) to grant awards to “Eligible Persons”. Eligible Persons are directors, officers, employees, consultants, management company employees and any other service providers of the Company or its affiliates.

The aggregate number of Common Shares issued to insiders of the Company within any one (1) year period under the Compensation Plan, together with any other security based compensation arrangement, cannot exceed 10% of the outstanding Common Shares. In addition, the aggregate number of Common Shares issuable to insiders of the Company at any time under the Compensation Plan, together with any other security based compensation arrangement, cannot exceed ten percent (10%) of the outstanding Common Shares. There are otherwise no limits on the maximum number of awards that may be issued to any single Eligible Person.

The date of grant, the number of Common Shares, the term, the vesting period and any other terms and conditions of awards granted pursuant to the Compensation Plan are determined by the Board, subject to the express provisions of the Compensation Plan.

The exercise price of an Option and a stock appreciation right will be the closing price of the Common Shares on the TSX for the trading day immediately preceding the date of the grant. There is no exercise price for other awards. The purchase price for restricted stock will generally be nil, although past service may be treated as consideration for the grant of restricted stock.

12

Unless otherwise specified by the Board at the time an Option is granted under the Compensation Plan, (i) the term of the Option will be ten (10) years from the date of the grant (which is the maximum allowable term under the Compensation Plan), unless the expiry of the term falls during a blackout (or within ten (10) days following the end of a blackout) from trading in the securities of the Company imposed on certain persons including the optionee pursuant to any policies of the Company; and where such a blackout applies, the expiry of the term of the Option shall automatically be extended to ten (10) business days following the end of the blackout; and (ii) the Option will vest as to one-third (1⁄3) on each of the first three anniversaries of the date of grant.

Subject to the terms of the award agreement and the discretion of the Company to accelerate the vesting of an award, or extend the term of an award (but not to later that the original expiry date of the awards), awards will terminate immediately upon the holder ceasing to be an Eligible Person, provided however, in the event of: (i) death, the vested award continues to be exercisable or redeemable for a period up to six (6) months from the date of death, or (ii) termination without cause or resignation, the vested award continues to be exercisable or redeemable for a period up to ninety (90) days from the date of termination. No award is exercisable following expiry of the term.

For stock appreciation rights, the market appreciation is the fair market value of a Common Share, based on the closing price on the date prior to the exercise date, minus the exercise price. Stock appreciation rights can be granted in relation to an Option either at the date of grant or at a later date.

For stock appreciation rights which are granted in relation to an Option, the vesting, term and other terms and conditions will be the same as for the related Option and the exercise of the stock appreciation right will result in a cancellation of the related Option and vice versa.

For stock appreciation rights which are not granted in relation to an Option and for all other awards, the vesting, redemption and expiry terms will be set out in the award agreement and the terms and conditions of the award will be as set out in the award agreement, or as otherwise set out in the Compensation Plan.

Performance-based restricted share units vest as certain performance related events are achieved. Once the Participant is vested, the Participant may elect to receive the vested units in the form of Common Shares. If the performance related event does not occur or does not occur in the time provided in the grant, the Performance-based restricted share units expire and will be cancelled.

In the event an offer is made for the Common Shares which would result in the offeror exercising control of the Company within the meaning of applicable securities laws, the Board may, in its discretion, provide that any Options then outstanding which are not otherwise exercisable may be exercised, in whole or in part, so as to allow the optionee to tender the Common Shares received upon such an exercise.

Awards are non-assignable. No financial assistance is provided to any Eligible Person to facilitate the purchase of Common Shares under the Compensation Plan.

The Compensation Plan contains a formal amendment procedure. The Board may amend certain terms of the Compensation Plan without requiring the approval of the Company shareholders, subject to those provisions of applicable law and regulatory requirements (including the rules, regulations and policies of the TSX), if any, that require the approval of Shareholders. Amendments not requiring shareholder approval include, without limitation: altering, extending or accelerating Option vesting terms and conditions; amending the termination provisions of an Option; accelerating the expiry date of an Option; determining adjustments pursuant to the provisions of the Compensation Plan concerning corporate changes; amending the definitions contained in the Compensation Plan; amending or modifying the mechanics of exercising or redeeming awards; amending provisions relating to the administration of the Compensation Plan; making “housekeeping” amendments, such as those necessary to cure errors or ambiguities contained in the Compensation Plan; effecting amendments necessary to comply with the provisions of applicable laws; and suspending or terminating the Compensation Plan.

13

The Compensation Plan specifically provides that the following amendments require shareholder approval: increasing the number of Common Shares issuable under the Compensation Plan, except by operation of the “rolling” maximum reserve; amending the Compensation Plan which amendment could result in the aggregate number of Common Shares issued to insiders within any one year period or issuable to insiders at any time under the Compensation Plan, together with any other security based compensation arrangement, exceeding 10% of the outstanding Common Shares; extending the term of any award beyond the expiry of the original term of the award; reducing the exercise price of an Option or cancelling and replacing Options with Options having a lower exercise price; amending the class of Eligible Persons which would have the potential of broadening or increasing participation in the Compensation Plan by insiders; amending the formal amendment procedures; and making any amendments required to be approved by the Company’s shareholders under applicable law.

COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS

Compensation Discussion and Analysis

This Compensation Discussion and Analysis (“CD&A”) describes the major elements of the Company’s compensation program for the Named Executive Officers (defined below, in the Summary Compensation Table). This CD&A also discusses the objectives, philosophy and decisions underlying the compensation of the Named Executive Officers. This CD&A should be read together with the executive compensation tables and related footnotes found later in this Information Circular.

The Compensation and Corporate Governance Committee is responsible for decisions respecting compensation of the Company’s senior executives. The Compensation and Corporate Governance Committee is composed entirely of independent directors and reviews and approves executive compensation programs and specific compensation arrangements for the executive officers of the Company. The Compensation and Corporate Governance Committee reports to the Board, and all compensation decisions with respect to the Chief Executive Officer are reviewed and approved by the entire Board, without participation by the Chief Executive Officer or the President.

The principal elements of the Company’s executive compensation program for 2015, 2016 and 2017 were:

| • | Base salary; |

| • | Annual, performance-based cash incentives (“Bonus”); |

| • | Long-term equity incentives, including Options and Performance-based restricted share units; and |

| • | Severance pay arrangements for certain Named Executive Officers as set forth in their employment agreements. |

The Board of Directors fully understands the need to continuously and rigorously manage risk. Risk assessment and analysis is an integral part of Board and committee meetings and decisions, including compensation.

Programs and Objectives and Reward Philosophy

The Compensation and Corporate Governance Committee is guided by the following key objectives and reward philosophies in the design and implementation of the Company’s executive compensation program:

| • | Competitive Pay. Competitive compensation programs are required to attract and retain a high-performing executive team. |

14

| • | Pay for performance. The Company’s compensation program is designed to motivate its executive officers to drive the Company’s business and financial results and to reward near-term performance. The “at risk” portion of total compensation (i.e., the incentive programs under which the amount of compensation realized by the executive is not guaranteed, and increases with higher levels of performance) should be a significant component of an executive’s compensation. |

| • | Alignment with shareholders. The interests of the Company’s executives must be aligned with the interests of the Company’s shareholders. The Company’s compensation program should motivate and reward its executives to drive performance which leads to the enhancement of long-term shareholder value. |

Key Considerations

In applying these program objectives and reward philosophies, the Compensation and Corporate Governance Committee takes into account the key considerations discussed below:

Competitive Market Assessment. The Company periodically conducts a competitive market assessment for each of the primary elements of the Company’s executive compensation program. In setting executive compensation levels, the Compensation and Corporate Governance Committee reviews market data from the following sources:

| • | Peer Group Information. The Compensation and Corporate Governance Committee considers information from the management information circular of “peer group” public companies. The peer group is composed primarily of food and related companies of similar size in terms of number of employees or revenue in Canada and the United States. The peer group was selected by the Compensation and Corporate Governance Committee in 2014 based on input from Towers Watson, an independent consulting firm retained by the Compensation and Corporate Governance Committee and from management. Compensation at the peer group companies is considered by the Compensation and Corporate Governance Committee, but compensation is not benchmarked to any particular level. The following companies were included in the Company’s peer group: |

Alico Inc. Boulder Foods Corp. Calavo Growers, Inc. | Annie’s Inc. Bridgford Foods Corp. Coffee Holding Company | |

Diamond Foods, Inc. | Farmer Brothers Co. | |

Golden Enterprises Inc. | Inventure Foods, Inc. | |

John B Sanfilippo & Son Lifeway Foods Inc. | Legumex Walker Inc. Limoneira Foods Inc. | |

Omega Protein | Rogers Sugar Inc. | |

SunOpta, Inc. | Ten Peaks Coffee |

| • | The Company’s Financial and Strategic Objectives. Each year, the Company’s management team develops an annual operating plan or budget for review and approval by the Board. The Compensation and Corporate Governance Committee uses the financial plan in the development of compensation plans and performance goals for the Company’s Named Executive Officers for the next year. |

15

Additional Information and Considerations

The Role of the Compensation and Corporate Governance Committee and Its Use of Advisors. A summary of the role of the Compensation and Corporate Governance Committee is found in the section entitled “Composition of the Compensation and Corporate Governance Committee” in this Information Circular. For more information on the role and responsibilities of the Compensation and Corporate Governance Committee, we encourage you to review the Compensation and Corporate Governance Committee charter, which is available on the Company’s website at www.villagefarms.com.

The Compensation and Corporate Governance Committee charter permits the Compensation and Corporate Governance Committee to engage independent outside advisors to assist it in the fulfillment of its responsibilities. The Compensation and Corporate Governance Committee may engage an independent executive compensation consultant for information, advice and counsel. The consultant may assist the Compensation and Corporate Governance Committee by providing an independent review of:

| • | The Company’s executive compensation policies, practices and designs; |

| • | The mix of compensation established for the Company’s Named Executive Officers as compared to external benchmarks; |

| • | Market trends and competitive practices in executive compensation; and |

| • | The specific compensation package for Mr. DeGiglio and other Named Executive Officers. |

Executive Compensation Related Fees

In 2014, the Compensation and Corporate Governance Committee engaged Towers Watson as its independent compensation and benefit consultant. The Compensation and Corporate Governance Committee directly retained and instructed Towers Watson and Towers Watson reported directly to the Compensation and Corporate Governance Committee. In 2014, Towers Watson charged approximately $16,000 for its advice to the Compensation and Corporate Governance Committee. The Compensation and Corporate Governance Committee previously retained Towers Watson for a similar study in 2009. The Compensation and Corporate Governance Committee did not engage a compensation and benefit consultant in 2015, 2016 or 2017.

16

The Role of Executive Management in the Process of Determining Executive Compensation

Mr. Ruffini, the Company’s Chief Financial Officer, is responsible for administering the Company’s executive compensation programs and provides information and analysis on various aspects of the Company’s executive compensation plans, including financial analysis relevant to the process of establishing performance targets for the Company’s annual cash incentive plan and the cost of long-term equity incentive plans. Mr. DeGiglio makes recommendations to the Compensation and Corporate Governance Committee regarding executive compensation decisions for the other Named Executive Officers.

Hedging

The Company does not currently have any policies in place that would prevent Named Executive Officers or directors from purchasing financial instruments that might be designed to hedge or offset a decrease in market value of equity securities granted as compensation or held by Named Executive Officers or directors.

Elements of Compensation

The compensation program is comprised of salary, benefits and short term and long term compensation incentives based on the achievement of corporate and individual objectives. The key components of the short term compensation program are salary and the short term annual bonus incentive program. The long term compensation program is comprised of Options and Performance-based restricted share units.

Base Salary and Benefits

Base salaries for executives are based on positions with equivalent responsibilities in the peer company group. However, the Compensation and Corporate Governance Committee took into account the substantial holdings of Common Shares of Mr. DeGiglio at the time his 2017 base salary was determined. The Compensation and Corporate Governance Committee reviews annually and approves any changes in base salary for the Chief Executive Officer and considers and, if thought fit, approves changes in base salaries recommended by the Chief Executive Officer for the other Named Executive Officers.

The Company provides a comprehensive benefit program to senior management. The program provides all employees (including senior management) with medical and dental benefits and life insurance coverage. The Company is responsible for all costs associated with the benefit program; however, senior management is responsible for the co-payments under the Company benefits plan.

Short Term Incentive Plan Bonus

The Company uses annual cash bonus plans to motivate and reward individual executives for the direct contribution which they make to the Company. Overall, senior management is responsible for achieving the annual business plan.

The executive is required to be employed through December 31 of the respective calendar year in order to earn a bonus. Each Named Executive Officer can earn 20% to 80% of their base salary depending on their position, subject to reduction at the Compensation and Corporate Governance Committee’s discretion.

In determining the bonus plan for 2017, the Compensation and Corporate Governance Committee took into account the industry in which the Company operates, as well as the performance of the Company and its subsidiaries over the past three years. The Compensation and Corporate Governance Committee also took into account the contributions of the individual executives and board members towards the implementation of special projects, such as the formation, implementation and execution of the Company’s cannabis initiative. The Compensation and Corporate Governance Committee determined the amount of the incentive award for the Chief Executive Officer and determined the amount of the incentive award for the other Named Executive Officers based on the recommendations made by the Chief Executive Officer. Due to missing the Company’s financial performance target during 2017, no cash bonuses were paid for the calendar year 2017.

17

In administering the annual incentive bonus plan, the Compensation and Corporate Governance Committee may, in its judgment, vary incentive awards payable to executives to award exceptional performance or for other reasons determined by that committee.

Performance-Based Restricted Share Units

In determining the 2017 incentive plans for Named Executive Officers and other key employees of the Company, the Compensation and Corporate Governance Committee issued Performance-based restricted share units to individuals who were involved in designing, creating, implementing and executing the Company’s new cannabis strategy. The Company’s cannabis strategy involved identifying and partnering with an existing public Licensed Producer who was willing to enter into a joint venture with the Company pursuant to the terms put forth by the Company, which involved forming an new entity, contributing one of the Company’s existing greenhouse facilities, converting it to grow cannabis, obtaining the necessary governmental licenses to cultivate and sell cannabis in Canada and growing a large scale high-quality low cost cannabis crop. The Company’s existing produce business was not generating sufficient cash to create a cash bonus incentive plan. Accordingly Performance-based restricted share units were granted.

Retirement Savings

The Company sponsors a retirement savings plan that is qualified under section 401(k) of the United States Internal Revenue Code and provides that participating employees are eligible to make contributions of 1% to 15% of their total salaries, subject to prescribed limits. The Company matches up to 25% of the first 6% of employee contributions.

The Company also sponsors a nonqualified deferred compensation plan for its named executive officers and executives under section 409A of the United States Internal Revenue Code and provides that participating employees are eligible to defer up to 80% of their salaries and annual cash bonuses on an annual basis. The Company may match up to 25% of the first 4% of employee salary deferrals. Since the summer of 2012 due to the under performance of the Company, the Company suspended the Company match on the nonqualified deferred compensation plan.

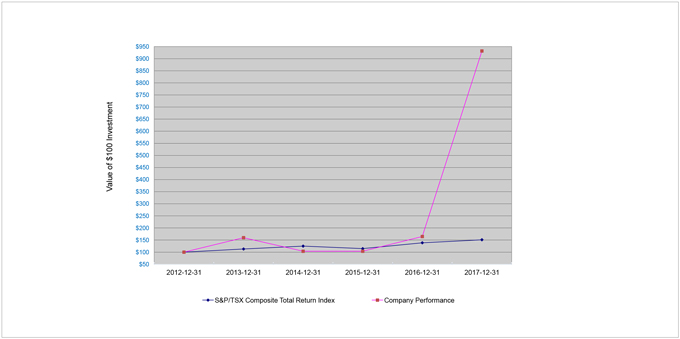

Performance Graph

The following graph shows the total cumulative return on a $100 investment made on December 31, 2012 in Common Shares, with the cumulative total return of the S&P/TSX Composite Total Return Index, for the period commencing on December 31, 2012 and ending on December 31, 2017, assuming reinvestment of all dividends, for which there were none.

18

As a reflection of the Company’s 2017 produce performance, no cash bonus was declared for the Executives for the 2017 calendar year. The Company believes that its EBITDA performance and its historical pre-2017 share performance were closely aligned, as reflected in the Company’s share performance and bonus payments over the five year period (2012-2016). In June 2017, subsequent to the announcement of the conversion of a portion of the Company’s Canadian assets to a cannabis growing facility, the Company’s share performance was much higher than it has been historically and no longer reflects the Company’s produce EBITDA performance. Rather it is more closely associated with the anticipation by the equity markets of higher future year EBITDA performance related to a higher margin product in the form of cannabis. Recognizing that the traditional cash bonus plan was not the optimal form of incentive compensation for the new crop strategy, the Company awarded Performance-based restricted share units and Options to certain Named Executive Officers who are working on the cannabis venture. As a result of granting the Performance-based restricted share units, in 2017, some of the Named Executive Officers received higher compensation in 2017 than in prior years. A similar trend is also reflected in the Company’s significantly improved 2017 stock performance.

Compensation of Named Executive Officers

The Summary Compensation Table below provides a summary of compensation earned by each person who held the position of Chief Executive Officer and Chief Financial Officer of the Company in 2017 and the next three most highly compensated executive officers of the Company (collectively, the “Named Executive Officers”).

19

SUMMARY COMPENSATION TABLE

(in United States dollars)

Name and Principal Position | Year | Salary | Share- Based Awards(1) | Option- Based Awards(2) | Non-Equity Incentive Plan Compensation | Pension Value | All Other Compensation | |||||||||||||||||||||||||||||

| Annual Incentive Plans | Long-Term Incentive Plans | Total Compensation | ||||||||||||||||||||||||||||||||||

Michael A. DeGiglio | 2017 | $ | 575,000 | $ | 495,865 | — | — | — | — | $ | 25,498 | (3) | $ | 1,096,363 | ||||||||||||||||||||||

Chief Executive | 2016 | $ | 575,000 | — | $ | 73,800 | — | — | — | $ | 117,827 | (3) | $ | 766,627 | ||||||||||||||||||||||

Officer | 2015 | $ | 575,000 | — | $ | 53,900 | 260,167 | (3) | — | — | $ | 29,630 | (3) | $ | 918,697 | |||||||||||||||||||||

Stephen C. Ruffini | 2017 | $ | 350,000 | $ | 495,865 | — | — | — | — | $ | 3,500 | (4) | $ | 849,364 | ||||||||||||||||||||||

Executive Vice President and | 2016 | $ | 350,000 | — | — | — | — | — | $ | 3,500 | (4) | $ | 353,500 | |||||||||||||||||||||||

Chief Financial Officer | 2015 | $ | 350,921 | — | — | — | — | — | $ | 25,571 | (4) | $ | 376,492 | |||||||||||||||||||||||

Paul Selina | 2017 | $ | 208,000 | $ | 99,173 | $ | 61,804 | — | — | — | $ | 3,120 | (5) | $ | 372,097 | |||||||||||||||||||||

Vice President of Applied | 2016 | $ | 208,000 | — | — | — | — | — | $ | 3,120 | (5) | $ | 211,120 | |||||||||||||||||||||||

Research | 2015 | $ | 207,333 | — | — | — | — | — | $ | 3,110 | (5) | $ | 210,443 | |||||||||||||||||||||||

Michael Minerva | ||||||||||||||||||||||||||||||||||||

Senior Vice President Grower | 2017 | $ | 236,900 | — | $ | 61,804 | — | — | — | $ | 1,777 | (6) | $ | 300,481 | ||||||||||||||||||||||

Relations & | 2016 | $ | 236,900 | — | — | — | — | — | $ | 1,777 | (6) | $ | 238,677 | |||||||||||||||||||||||

Supply Development | 2015 | $ | 236,900 | — | — | — | — | — | $ | 1,777 | (6) | $ | 238,677 | |||||||||||||||||||||||

Douglas Kling Senior Vice President | 2017 | $ | 295,000 | — | — | — | — | — | $ | 2,950 | (7) | $ | 297,950 | |||||||||||||||||||||||

and Chief Marketing | 2016 | $ | 295,000 | — | — | — | — | — | $ | 2,950 | (7) | $ | 297,950 | |||||||||||||||||||||||

Officer | 2015 | $ | 272,883 | — | — | — | — | — | $ | 2,729 | (7) | $ | 275,612 | |||||||||||||||||||||||

| (1) | The amounts listed in this column represent the grant date fair value of the Performance-based restricted share units granted to Named Executive Officers in June 2017, some of which have vested based on the execution of a cannabis joint venture agreement and have been settled in Common Shares and some of which are still unvested and will only vest if certain performance events are achieved. The grant date fair value is calculated based on the number of Performance-based restricted share units granted multiplied by the price of the Common Shares on the date of grant. |

| (2) | The amounts listed in this column represent the grant date fair value of the Options granted to Named Executive Officers as calculated using the Black-Scholes option pricing model using the following assumptions for 2017 (which are the same method and assumptions used to calculate the accounting fair value) – expected volatility – 52.7%, risk free rate – 2.05%, expected life – 6.5 years – resulting in a fair value of $3.09/Option for Messrs. Selina and Minerva. For 2016 – expected volatility – 52.5%, risk free rate – 1.52%, expected life – 6.5 years – resulting in a fair value of $0.738/Option for Mr. DeGiglio. For 2015—expected volatility – 59.6%, risk free rate – 1.47%, expected life – 6.5 years – resulting in a fair value of $0.539/Option for DeGiglio. |

| (3) | Mr. DeGiglio received a $24,000 auto allowance and $1,498 in employer 401(k) matches during 2017, a $24,000 auto allowance, $1,498 in employer 401(k) matches and $2,932 in disability insurance during fiscal 2016 and a $24,000 auto allowance, $2,698 in employer 401(k) matches and $2,932 in disability insurance during fiscal 2015. In addition, in prior years, Mr. DeGiglio voluntarily took a lower salary than he was entitled to pursuant to his employment agreement, as well as agreed to voluntarily forego his 2012 bonus payment. In 2015, due to improvements in the Company’s operations, the Board approved payments to Mr. DeGiglio of $260,167 to compensate him for his reduced compensation in prior years. Additionally, Mr. DeGiglio received a distribution from the Company’s 409(a) deferral plan of $90,895 in 2016, which represents prior year wages that Mr. DeGiglio deferred into a future period pursuant to the executive deferral plan. |

| (4) | Mr. Ruffini received $3,500, $3,500 and $3,646 in employer 401(k) matches during fiscal 2017, 2016 and 2015, respectively. Additionally, Mr. Ruffini received a distribution from the Company’s 409(a) deferral plan of $21,925, in 2015, which represents prior year wages that Mr. Ruffini deferred into a future period pursuant to the executive deferral plan. |

| (5) | Mr. Selina received $3,120, $3,120 and $3,110 in employer 401(k) matches during fiscal 2017, 2016 and 2015, respectively. |

| (6) | Mr. Minerva received $1,777, $1,777 and $1,777 in employer 401(k) matches during fiscal 2017, 2016 and 2015, respectively. |

| (7) | Mr. Kling received $2,950, $2,950 and $2,729 in employer 401(k) matches during fiscal 2017, 2016 and 2015, respectively. |

20

Option-Based Awards

The following table sets out the Option and Performance-based restricted share unit awards outstanding for the Named Executive Officers as at December 31, 2017.

| Option-based Awards | Share-based Awards | |||||||||||||||||||||||||||

Name | Number of Common Shares Underlying Unexercised Options | Option Exercise Price (C$) | Option Expiration Date | Value of Unexercised In-The-Money Options (US$)(1) | Number of Units of Shares that have not Vested | Market Value of Share-based Awards that have not vested (US$)(2) | Market Value of Share-based Vested Awards that have not paid out or distributed (US$) | |||||||||||||||||||||

Michael A. DeGiglio | 100,000 | $ | 1.27 | March 14, 2022 | $ | 507,772 | ||||||||||||||||||||||

Michael A. DeGiglio | 100,000 | $ | 1.48 | March 18, 2024 | $ | 491,032 | ||||||||||||||||||||||

Michael A. DeGiglio | 100,000 | $ | 0.94 | March 19, 2025 | $ | 534,077 | ||||||||||||||||||||||

Michael A. DeGiglio | 100,000 | $ | 1.43 | March 29, 2026 | $ | 495,018 | ||||||||||||||||||||||

Stephen C. Ruffini | 99,399 | $ | 0.70 | January 13, 2020 | $ | 549,883 | ||||||||||||||||||||||

Stephen C. Ruffini | 50,000 | $ | 1.24 | May 20, 2021 | $ | 255,082 | ||||||||||||||||||||||

Stephen C. Ruffini | 50,000 | $ | 1.27 | March 13, 2022 | $ | 253,886 | ||||||||||||||||||||||

Stephen C. Ruffini | 100,000 | $ | 0.85 | March 14, 2023 | $ | 541,251 | ||||||||||||||||||||||

Stephen C. Ruffini | 75,000 | $ | 1.48 | March 18, 2024 | $ | 368,274 | ||||||||||||||||||||||

Douglas Kling | 50,000 | $ | 0.70 | January 13, 2020 | $ | 284,575 | ||||||||||||||||||||||

Michael Minerva | 100,000 | $ | 1.24 | May 20, 2021 | $ | 510,163 | ||||||||||||||||||||||

Michael Minerva | 20,000 | $ | 6.00 | December 22, 2027 | $ | 26,146 | ||||||||||||||||||||||

Paul Selina | 50,000 | $ | 1.24 | May 20, 2021 | $ | 255,082 | 40,000 | $ | 243,603 | |||||||||||||||||||

Paul Selina | 20,000 | $ | 6.00 | December 22, 2027 | $ | 26,146 | ||||||||||||||||||||||

| (1) | The value is calculated by multiplying the number of outstanding Options by the difference between the exercise price of the Options and the closing price of the Common Shares on the TSX on December 29, 2017, which was C$7.64. The value was converted into United States dollars based on the Bank of Canada closing exchange rate on December 29, 2017 of $0.79713. |

| (2) | The value is calculated by multiplying the number of outstanding share-based awards by the closing price of the Common Shares on the TSX on December 29, 2017, which was C$7.64. The value was converted into United States dollars based on the Bank of Canada closing exchange rate on December 29, 2017 of $0.79713. |

The number of Options and Performance-based restricted share units granted in 2017 to the Named Executive Officers was determined by the Compensation and Corporate Governance Committee.

21

Incentive Plan Awards

The following table sets out the value of all incentive plan awards that vested during 2017.

Named | Option-Based Awards – Value Vested During 2017 ($)(1) | Share-Based Awards – Value Vested During 2017 ($)(1) | Non-Equity Incentive Plan Compensation – Value earned during 2017 ($)(1) | |||||||||

Michael A. DeGiglio | $ | 34,183 | $ | 495,865 | — | |||||||

Stephen C. Ruffini | $ | 4,117 | $ | 495,865 | — | |||||||

Paul Selina | — | $ | 33,058 | — | ||||||||

Michael Minerva | — | — | — | |||||||||

Doug Kling | — | — | — | |||||||||

| (1) | The value is calculated using the closing price of the Common Shares on the TSX on the vesting date. The value was converted into United States dollars based on the Bank of Canada closing exchange rate on the vesting date. |

Security-Based Compensation Arrangements

The following table sets forth certain information relating to the Compensation Plan as at December 31, 2017.

Plan Category | Name of Plan | Number of Common Shares to be Issued Upon Exercise of Outstanding Options, Warrants and Rights | Weighted- Average Exercise Price of Outstanding Options, Warrants and Rights | Number of Securities Remaining for Future Issuance Under Equity Compensation Plans | ||||||||||

Equity compensation plans approved by shareholders | Share-Based Compensation Plan | 2,465,732 | C$ | 1.59 | 1,758,529 | |||||||||

Equity compensation plans not approved by shareholders | — | — | — | |||||||||||

|

|

|

|

|

| |||||||||

Total: | 2,465,732 | C$ | 1.59 | 1,758,529 | ||||||||||

|

|

|

|

|

| |||||||||

Termination and Change of Control Benefits

Mr. DeGiglio entered into an employment agreement with Village Farms, L.P., the material terms of which are summarized below:

Michael A. DeGiglio. Village Farms, L.P. entered into an employment agreement with Mr. DeGiglio, dated as of January 1, 2017, for his services as Chief Executive Officer and President of the Company and its affiliates. The agreement is for a term of three years and provides for, among other things, an annual salary of US$575,000. The agreement provides standard confidentiality, non-solicitation and non-competition covenants in favour of Village Farms, L.P. and its parent and affiliates, which apply during the term of each agreement and for a specific period

22

of time following the termination of the agreement. Mr. DeGiglio’s employment contract provides, among other things, that (i) if it is not renewed by the Company for an additional three year term, is terminated by the Company without cause, or is terminated by Mr. DeGiglio for good reason (as defined in his employment agreement, including a change in control), he will be paid severance compensation at his then-current base salary when it would be payable to him if his employment had continued for another three years from the effective date of termination, and (ii) if Mr. DeGiglio’s employment is terminated due to death or disability, he shall continue to receive salary payments at his then-current salary (or to Mr. DeGiglio’s heirs in the case of his death), reimbursed for expenses incurred prior to such death or disability and benefits shall continue in the event of disability, and to the extent then applicable to heirs of Mr. DeGiglio in the event of his death, until the remaining months of the current term or twelve months, whichever is greater. Mr. DeGiglio is subject to a three year non-competition and non-solicitation obligation in respect of employees who were employed with the Company within the year preceding the termination of his employment, customers and suppliers of the Company, as well as a confidentiality obligation. If Mr. DeGiglio breaches these obligations, the Company is entitled to injunctive and equitable relief.

Any modification or renewal of the above-noted employment agreement will be subject to the prior review of the Compensation and Corporate Governance Committee.

Stephen C. Ruffini. Village Farms, L.P. has entered into an employment agreement with Mr. Ruffini, dated as of April 1, 2017, for his services as Executive Vice President and Chief Financial Officer of the Company and its subsidiaries. The agreement with Village Farms, L.P. outlines Mr. Ruffini’s day-to-day executive activities. The agreement is for a term of three years and provides for, among other things, an annual salary of US$350,000. The agreement provides standard confidentiality, non-solicitation and non-competition covenants in favour of Village Farms, L.P., which apply during the term of the agreement and for a specific period of time following the termination of the agreement. Mr. Ruffini’s employment agreement provides, among other things, that (i) if it is not renewed by the Company for an additional three year term, is terminated by the Company without cause, or is terminated by Mr. Ruffini for good reason (as defined in his employment agreement, including change in control), he will be paid severance compensation at his then-current base salary when it would be payable to him if his employment had continued for eighteen months from the effective date of termination, and (ii) if Mr. Ruffini’s employment is terminated due to death or disability, he shall continue to receive salary payments at his then-current salary (or to Mr. Ruffini’s heirs in the case of his death), reimbursed for expenses incurred prior to such death or disability and benefits shall continue in the event of disability, and to the extent then applicable to heirs of Mr. Ruffini in the event of his death, until the remaining months of the current term or twelve months, whichever is greater.

Douglas Kling. Village Farms, L.P. has entered into an employment agreement with Mr. Kling, dated as of January 1, 2012, for his services as Senior Vice President and Chief Marketing Officer of the Company and its subsidiaries. The agreement with Village Farms, L.P. outlines Mr. Kling’s day-to-day executive activities. The agreement provides for, among other things, an annual salary of US$255,000, which will be reviewed annually. In subsequent years, Mr. Kling received increases in his annual salary base to his current annual salary of US$295,000. The agreement provides standard confidentiality, non-solicitation and non-competition covenants in favour of Village Farms, L.P., which apply during the term of the agreement and for a specific period of time following the termination of the agreement. Mr. Kling’s employment agreement provides, among other things, that if Mr. Kling is terminated by the Company without cause or he resigns for good reason (as defined in his employment agreement, including change in control), he will be paid severance compensation at his then-current base salary when it would be payable to him if his employment had continued for eighteen months from the effective date of termination.

Paul Selina. Village Farms, L.P. has entered into an employment agreement with Mr. Selina, dated as of January 1, 2011, for his services as Vice President of Applied Research of the Company and its subsidiaries. The agreement with Village Farms, L.P. outlines Mr. Selina’s day-to-day executive activities. The agreement provides for, among other things, an annual salary of US$180,000, which will be reviewed annually. In subsequent years, Mr. Selina received increases in his annual salary base to his current annual salary of US$208,000. The agreement provides

23

standard confidentiality, non-solicitation and non-competition covenants in favour of Village Farms, L.P., which apply during the term of the agreement and for a specific period of time following the termination of the agreement. Mr. Selina’s employment agreement provides, among other things, that if Mr. Selina is terminated by the Company without cause or he resigns for good reason, he will be paid severance compensation at his then-current base salary when it would be payable to him if his employment had continued for twelve months from the effective date of termination.

Michael Minerva. Village Farms, L.P. has entered into an employment agreement with Mr. Minerva, dated as of October 1, 2012, for his services as Vice President Grower Relations and Supply Development of the Company and its subsidiaries. The agreement with Village Farms, L.P. outlines Mr. Minerva’s day-to-day executive activities. The agreement provides for, among other things, an annual salary of US$230,000, which will be reviewed annually. In 2014, Mr. Minerva received an increase in his annual salary to his current salary of US$236,900. The agreement provides standard confidentiality, non-solicitation and non-competition covenants in favour of Village Farms, L.P., which apply during the term of the agreement and for a specific period of time following the termination of the agreement. Mr. Minerva’s employment agreement provides, among other things, that if Mr. Minerva is terminated by the Company without cause or he resigns for good reason (as defined in his employment agreement, including change in control), he will be paid severance compensation at his then-current base salary when it would be payable to him if his employment had continued for twelve months from the effective date of termination.

The following table outlines the incremental values that would have been paid to the Named Executive Officers if they had separated from the Company on December 31, 2017.

Name | Separation Terms | Payment in the event of: | ||

| Michael A. DeGiglio Chief Executive Officer and President | 3 x base salary = US$1,725,000 for non-renewal of Agreement, Termination without Cause, Resignation for Good Reason or Change in Control. | The greater of:

1) The end of the contract term – December 31, 2019 or

2) 12-months (US$575,000) | ||

| Stephen C. Ruffini Executive Vice President and Chief Financial Officer | 1.5 x base salary = US$525,000 for non-renewal of Agreement, Termination without Cause, Resignation for Good Reason or Change in Control. | The greater of:

1) The end of the contract term – March 31, 2020 or

2) 12-months (US$350,000) | ||

| Douglas Kling Senior Vice President and Chief Marketing Officer | 1.5x base salary = US$442,500 for Termination without Cause, Resignation for Good Reason or Change in Control. | None | ||

| Paul Selina Vice President of Applied Research | 1.0x base salary = US$208,000 for Termination without Cause or Resignation for Good Reason. | None | ||

| Michael Minerva Senior Vice President Grower Relations & Supply Development | 1.0x base salary = US$236,900 for Termination without Cause, Resignation for Good Reason or Change in Control. | None | ||

24

Compensation of Directors

DIRECTOR COMPENSATION TABLE

(in United States dollars)

Name | Fees Earned | Share- Based Awards(3) | Option- Based Awards | Non-Equity Incentive Plan Compensation | Pension Value | All Other Compensation | Total | |||||||||||||||||||||

John R. McLernon(1) | $ | 33,871 | $ | 49,586 | — | — | — | — | $ | 83,457 | ||||||||||||||||||

Christopher C. Woodward(1) | $ | 28,612 | $ | 49,586 | — | — | — | — | �� | $ | 78,198 | |||||||||||||||||

John P. Henry(2) | $ | 30,403 | $ | 49,586 | — | — | — | — | $ | 79,989 | ||||||||||||||||||

Dave Holewinski(2) | $ | 29,190 | $ | 49,586 | — | — | — | — | $ | 78,776 | ||||||||||||||||||

Roberta Cook(2) | $ | 19,162 | $ | 49,586 | — | — | — | — | $ | 68,748 | ||||||||||||||||||

| (1) | Paid in Canadian dollars. The US dollar amount shown was converted monthly at the average exchange rate for each month as posted by the Bank of Canada. |

| (2) | Paid in US dollars. |

| (3) | The amounts listed in this column represent the grant date fair value of the Performance-based restricted share units granted to Directors and converted to US dollars. The grant date fair value is calculated based on the number of Performance-based restricted share units granted multiplied by the price of the Common Shares on the date of grant. The Performance-based restricted share unit performance criteria for vesting for the Directors was based on the execution of a cannabis joint venture agreement. |

Each non-management director of the Company receives a retainer of C$18,000 per year, payable in monthly installments of C$1,500, plus C$1,500 per meeting and C$750 per teleconference. The Chairman receives an additional annual fee of C$10,000 payable in monthly installments. The Audit Committee Chairman receives an additional C$5,000 per year, payable monthly. The Compensation Committee Chairman receives an additional C$3,000 per year, payable monthly. The Audit Committee members receive an annual fee of C$6,000, payable monthly, plus C$1,000 per meeting and C$500 per teleconference. The Compensation Committee members receive an annual fee of C$3,000, payable monthly, plus C$1,000 per meeting and C$500 per teleconference. Directors are also entitled to be reimbursed for reasonable out of pocket expenses incurred by them in connection with their services as directors. Directors of the Company are also eligible to participate in the Compensation Plan. Options were granted to non-management directors in 2016. In 2017, the non-management directors were each granted 30,000 Performance-based restricted share units. Vesting for the Performance-based restricted share units occurred on execution of the cannabis joint venture shareholder agreement. Ms. Cook elected to receive only 20,000 of her vested 30,000 Units and voluntarily forfeited the remaining 10,000 units.

Option-Based Awards

The following table sets out the option-based awards outstanding for the non-management Directors as at December 31, 2017. As at December 31, 2017, the Company did not have any share-based awards outstanding to non-management Directors.

25

| Option-Based Awards | ||||||||||||