Exhibit 99.54

Village Farms International, Inc.

4700–80th Street

Delta, British Columbia

V4K 3N3

Annual Information Form

For the Year Ended December 31, 2017

April 2, 2018

TABLE OF CONTENTS

INTERPRETATION | 1 | |||

Glossary of Terms | 1 | |||

Interpretation | 3 | |||

Market and Industry Data | 3 | |||

Intercorporate Relationships | 3 | |||

GENERAL DEVELOPMENT OF THE COMPANY | 4 | |||

History | 4 | |||

Tomato Suspension Agreement – Mexico | 5 | |||

Refinancing | 5 | |||

Purchase of Maxim Power (B.C.) Inc. | 6 | |||

Formation of Pure Sunfarms Corp. | 6 | |||

INDUSTRY OVERVIEW | 8 | |||

Greenhouse Vegetable Industry Overview | 8 | |||

Cannabis Industry Overview | 9 | |||

DESCRIPTION OF THE BUSINESS | 11 | |||

Overview | 11 | |||

Core Operating Principle | 11 | |||

Greenhouse Facilities and Products | 12 | |||

Sales, Marketing and Distribution | 12 | |||

Production and Packaging Process | 14 | |||

Product Development and Specialization | 14 | |||

Product Pricing | 14 | |||

Intellectual Property | 15 | |||

Competition | 15 | |||

Employees | 15 | |||

Capital Expenditures | 15 | |||

Energy Management Strategy | 16 | |||

Foreign Exchange Strategy | 16 | |||

Environmental and Regulatory Matters | 16 | |||

British Columbia Vegetable Marketing Commission | 17 | |||

Agency and Producer Licenses | 17 | |||

Quota | 17 | |||

CAPITAL STRUCTURE | 18 | |||

Common Shares | 18 | |||

Special Shares | 18 | |||

Preferred Shares | 18 | |||

Warrants | 18 | |||

Retained Interest of Michael DeGiglio | 19 | |||

Book Entry System | 19 | |||

Financial Year End | 19 | |||

CREDIT FACILITIES | 19 | |||

Credit Facilities | 19 | |||

RISK FACTORS | 20 | |||

Risks Relating to the Company | 20 | |||

Risks Relating to the Joint Venture | 25 | |||

Risks Related to Tax | 30 | |||

- i -

DIVIDENDS | 31 | |||

Dividend Policy | 31 | |||

Historical Distributions | 31 | |||

MARKET FOR SECURITIES | 31 | |||

Trading Price and Volume | 31 | |||

DIRECTORS AND MANAGEMENT | 32 | |||

Board Committees | 33 | |||

Cease Trade Orders or Bankruptcies | 34 | |||

Penalties or Sanctions | 34 | |||

Personal Bankruptcies | 34 | |||

Conflicts of Interest | 35 | |||

LEGAL PROCEEDINGS AND REGULATORY ACTIONS | 35 | |||

TRANSFER AGENT AND REGISTRAR | 35 | |||

EXPERTS | 35 | |||

MATERIAL CONTRACTS | 35 | |||

AUDIT COMMITTEE INFORMATION | 36 | |||

Charter of the Audit Committee | 36 | |||

Composition of the Audit Committee | 36 | |||

Prior Approval Policies and Procedures | 36 | |||

External Auditor Service Fees | 36 | |||

ADDITIONAL INFORMATION | 36 | |||

- ii -

FORWARD-LOOKING STATEMENTS

Certain statements contained in this annual information form constitute forward-looking information within the meaning of applicable securities laws (“forward-looking statements”). Forward-looking statements may relate to the Company’s future outlook or financial position and anticipated events or results and may include statements regarding the financial position, business strategy, budgets, litigation, projected production, projected costs, capital expenditures, financial results, taxes, plans and objectives of or involving the Company. Particularly, statements regarding future results, performance, achievements, prospects or opportunities for the Company, the greenhouse vegetable industry or the cannabis industry are forward-looking statements. In some cases, forward-looking information can be identified by such terms as “outlook”, “may”, “might”, “will”, “could”, “should”, “would”, “occur”, “expect”, “plan”, “anticipate”, “believe”, “intend”, “estimate”, “predict”, “potential”, “continue”, “likely”, “schedule”, “objectives”, or the negative or grammatical variation thereof or other similar expressions concerning matters that are not historical facts. Some of the specific forward-looking statements in this annual information form include, but are not limited to, statements with respect to: product pricing; maintaining profitability; risks inherent in the agricultural business; natural catastrophes; retail consolidation; covenant risk; dependence upon credit facilities; competition; transportation disruptions; labour; governmental regulations; product liability; key executives; uninsured and underinsured losses; vulnerability to rising energy costs; risks of regulatory change; environmental, health and safety risk, foreign exchange exposure, risks associated with cross-border trade; technological advances; accounting estimates; growth; tax risks; and risks related to the Joint Venture, including the Joint Venture’s ability to obtain licenses under the ACMPR, risks relating to conversion of the Company’s greenhouses to cannabis production, and the ability to cultivate and distribute cannabis.

The Company has based these forward-looking statements on factors and assumptions about future events and financial trends that it believes may affect its financial condition, results of operations, business strategy and financial needs, including that the Canadian economy will remain stable over the next 12 months, that inflation will remain relatively low, that interest rates will remain stable, that tax laws remain unchanged, that conditions within the greenhouse vegetable and cannabis industries generally will be consistent with the current climate, that recreational cannabis consumption will be approved by the Canadian government during 2018 and that the Canadian capital markets will provide the Company with access to equity and/or debt at reasonable rates when required.

Although the forward-looking statements contained in this annual information form are based upon assumptions that management believes are reasonable based on information currently available to management, there can be no assurance that actual results will be consistent with these forward-looking statements. Forward-looking statements necessarily involve known and unknown risks and uncertainties, many of which are beyond the Company’s control, that may cause the Company’s or the industry’s actual results, performance, achievements, prospects and opportunities in future periods to differ materially from those expressed or implied by such forward-looking statements. These risks and uncertainties include, among other things, the factors contained in the Company’s filings with securities regulators, including this annual information form and management’s discussion and analysis.

When relying on forward-looking statements to make decisions, the Company cautions readers not to place undue reliance on these statements, as forward-looking statements involve significant risks and uncertainties and should not be read as guarantees of future results, performance, achievements, prospects and opportunities. The forward-looking statements made in this annual information form relate only to events or information as of the date on which the statements are made in this annual information form. Except as required by law, the Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

INTERPRETATION

Glossary of Terms

“ACMPR” means the Access to Cannabis for Medical Purposes Regulations;

“APDI” means Agro Power Development, Inc., a Delaware corporation;

“Bank” means the Canadian chartered bank referred to under “Credit Facilities”;

“BCVMC” means the British Columbia Vegetable Marketing Commission;

“Business” means the businesses carried on by the Company and its subsidiaries;

“CBCA” means the Canada Business Corporations Act, as amended;

“CDS” means CDS Clearing and Depository Services Inc.;

“CDS Participant” means a participant in the CDS depository service;

“Combination Transaction” means the combination transaction which closed on October 18, 2006 whereby the businesses of Hot House Growers Inc. and Village Farms were combined;

“Company” means Village Farms International, Inc. and, as the context requires, Village Farms International, Inc. together with its subsidiaries;

“Compensation Plan” means the share based compensation plan of the Company adopted on December 31, 2009;

“Common Shares” means the common shares in the capital of the Company;

“Conversion” means the plan of arrangement carried out under the CBCA and completed on December 31, 2009 whereby, among other things, the Fund was terminated and the ordinary unitholders of the Fund received Common Shares of the Company on a one for one basis;

“Credit Facilities” means the Term Loan, the Operating Loan and the VFCE Loan;

“CSA” has the meaning ascribed thereto under “General Development of the Company”;

“Delta 1 Greenhouse” has the meaning ascribed thereto under “General Development of the Company”;

“Delta 2 Greenhouse” has the meaning ascribed thereto under “General Development of the Company”;

“Delta 3 Greenhouse” has the meaning ascribed thereto under “General Development of the Company”;

“Emerald” means Emerald Health Therapeutics, Inc.;

“Emerald Contribution” has the meaning ascribed thereto under “General Development of the Company”;

“EBITDA” means earnings before interest, taxes, depreciation, amortization, foreign currency exchange gains and losses on translation of long term debt, and unrealized gains on the changes in the value of derivative instruments and non-controlling interest;

“Federal Court” has the meaning ascribed thereto under “Industry Overview”;

“Forward-looking statements” has the meaning ascribed thereto under “Forward-Looking Statements”;

- 1 -

“Fund” means Village Farms Income Fund, which was terminated on December 31, 2009 as part of the Conversion;

“IRS” means the Internal Revenue Service;

“Joint Venture” has the meaning ascribed thereto under “General Development of the Company”;

“Joint Venture Agreement” has the meaning ascribed thereto under “General Development of the Company”;

“License” has the meaning ascribed thereto under “Risk Factors”;

“Management” means the management of the Company and its subsidiaries who operate the Business;

“Material Decisions” has the meaning ascribed thereto under “General Development of the Company”;

“MMPR” has the meaning ascribed thereto under “Industry Overview”;

“Operating Loan” has the meaning ascribed thereto under “Credit Facilities”;

“Offeree” has the meaning ascribed thereto under “General Development of the Company”;

“Offeror” has the meaning ascribed thereto under “General Development of the Company”;

“PACA license” means a license issued by the United States Department of Agriculture, established by the Perishable Agricultural Commodities Act; this license is required for any business selling fresh and frozen fruits and vegetables.

“Preferred Shares” the preferred shares in the capital of the Company;

“Prime Rate” means the floating annual rate of interest (based on a 365/366 day year) established and recorded by the Bank from time to time as a reference rate for purposes of determining rates of interest it will charge on loans denominated in Canadian dollars;

“Pure Sunfarms” means Pure Sunfarms Corp.;

“QA” has the meaning ascribed thereto under “General Development of the Company”;

“RPIC” has the meaning ascribed thereto under “General Development of the Company”;

“SPIC” has the meaning ascribed thereto under “General Development of the Company”;

“Staff Notice” has the meaning ascribed thereto under “General Development of the Company”;

“Securityholders’ Agreement” means the agreement that was entered into on the completion of the Combination Transaction between, among others, the Fund, VF Opco and Michael A. DeGiglio as amended and restated on December 31, 2009 by, among others, the Company, VF Opco and Michael A. DeGiglio;

“Special Shares” means the special voting shares in the capital of the Company;

“Term Loan” has the meaning ascribed thereto under “Credit Facilities”;

“TSX” means Toronto Stock Exchange;

“Units” means the former ordinary units of the Fund, which were cancelled on December 31, 2009 in connection with the Conversion;

- 2 -

“U.S. Holdings” means VF U.S. Holdings Inc., a Delaware corporation;

“VF Canada GP” means Village Farms Canada GP Inc., a corporation incorporated under the laws of Canada that is the general partner of VF Canada LP;

“VF Canada LP” means Village Farms Canada Limited Partnership;

“VFCE” means VF Clean Energy, Inc.;

“VFCE Loan” has the meaning ascribed thereto under “Credit Facilities”;

“VFLP” means Village Farms, L.P.;

“VF Opco” means VF Operations Canada Inc., a corporation incorporated under the laws of Canada; and

“Village Farms” means, collectively, APDI and its subsidiary entities, as these entities existed prior to the completion of the Combination Transaction.

Words importing the singular number only include the plural and vice versa and words importing any gender include all genders. All dollar amounts set forth in this annual information form are in United States dollars, except where otherwise indicated.

Interpretation

Unless otherwise noted or the context otherwise requires: (i) the term “cannabis” has the meaning given to the term “marihuana” under the ACMPR; and (ii) the term “Licensed Producer” means a person licensed by Health Canada under Section 35 of the ACMPR.

Market and Industry Data

Unless otherwise indicated, information contained in this annual information form concerning the Company’s industry and the markets in which it operates or seeks to operate is based on information from third party sources, industry reports and publications, websites and other publicly available information, and management studies and estimates. Unless otherwise indicated, the Company’s estimates are derived from publicly available information released by third party sources as well as data from the Company’s own internal research, and include assumptions which the Company believes to be reasonable based on management’s knowledge of the Company’s industry and markets. The Company’s internal research and assumptions have not been verified by any independent source, and the Company has not independently verified any third party information. While the Company believes that such third party information to be generally reliable, such information and estimates are inherently imprecise. In addition, projections, assumptions and estimates of the Company’s future performance or the future performance of the industry and markets in which the Company operates are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in this annual information form under “Risk Factors”.

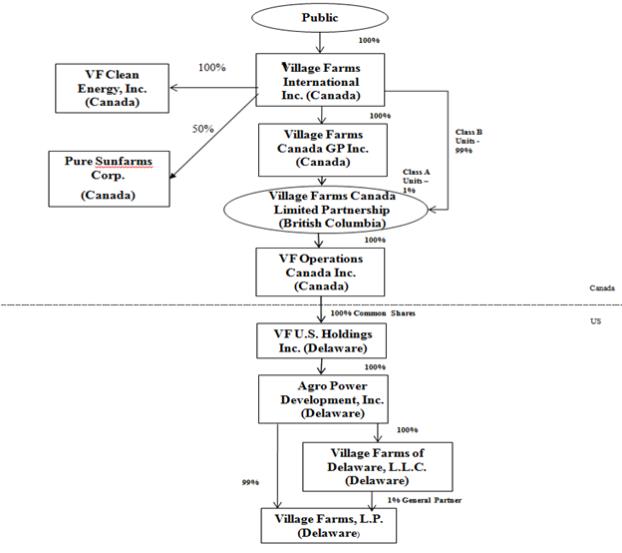

STRUCTURE OF THE COMPANY

The Company is a corporation incorporated under the CBCA. The head and registered office of the Company and each of its Canadian subsidiaries is located at 4700 80th Street, Delta, British Columbia, V4K 3N3.

Intercorporate Relationships

The following chart illustrates the structure of the Company and its subsidiaries (including jurisdiction of establishment/incorporation and percentage of voting securities owned) as of December 31, 2017 and April 2, 2018.

- 3 -

GENERAL DEVELOPMENT OF THE COMPANY

History

The Company’s predecessor, the Fund, completed its initial public offering as an income trust on December 23, 2003. The Company converted from an income trust to a publicly-traded company on December 31, 2009 as part of the Conversion. In connection with the Conversion, the Company changed its name to Village Farms International, Inc.

As of the date hereof, the Company has 42,447,613 Common Shares and no Special Shares issued and outstanding.

The Company’s premium product is grown in sophisticated, highly intensive agricultural greenhouse facilities located in British Columbia and Texas and is marketed and distributed under its Village Farms® brand name and other brand names, primarily to retail supermarkets and dedicated fresh food distribution companies. The Company also markets and distributes produce under exclusive arrangements for other greenhouse producers primarily located in British Columbia, central Mexico and the north eastern part of the United States. The Company markets and distributes its products throughout the United States and Canada. It currently operates four distribution centres located across the United States and Canada. Since its inception, the Company has been guided by a sustainable agriculture policy which integrates three main goals – environmental health, economic profitability and social and economic equality

- 4 -

Certain of the Company’s subsidiaries have operated vegetable producing greenhouses in British Columbia since 1989 and in Texas since 1995.

Tomato Suspension Agreement – Mexico

On June 22, 2012, a group of U.S. tomato growers, including VFLP, petitioned the U.S. Department of Commerce to withdraw their petition and requested termination of the 1996 Tomato Suspension Agreement (“1996 Agreement”) with Mexico. The basis of the petition was that Mexican tomato growers were ‘dumping’ tomatoes into the U.S. market which is a violation of U.S. regulations. Dumping is defined as an importer who is selling product in the U.S. market for less than their costs. Mexican producers claimed they were not dumping and were adhering to the 1996 Agreement, but U.S. tomato producers who represented more than 85% of all U.S. tomato production (the threshold for U.S. Department of Commerce intervention) stipulated that the 1996 Agreement was outdated, it should be terminated and an investigation into Mexican tomato dumping should ensue. Due to the high volume of Mexican imports of produce, in particular tomatoes (field, shade and greenhouse), the issue was raised at the highest levels of both countries governments.

Negotiations for a revised agreement began and resulted in a new agreement (the “Suspension Agreement”) which became effective on March 4, 2013. All signatories have agreed that they will not sell product at prices below the established reference prices in the new Suspension Agreement. The Suspension Agreement has two reference price periods: October 23 – June 30 (“winter”) and July 1 – October 22 (“summer”), and distinguishes between “Open Field/Adapted Environment” and “Controlled Environment”, although “specialty” tomatoes is a separate category from the growing environments. Each environment and category has different reference prices depending on the period and the packaging.

While VFLP and some other U.S. greenhouse growers would have preferred that there was a definitive definition of “greenhouse” – the definition of “Controlled Environment” uses the Certified Greenhouse Growers Association definition which essentially is a modern glass greenhouse.

All signatories must ensure that they and/or their initial U.S. selling agent adhere to the Suspension Agreement and must hold a valid and effective PACA license. It is a violation of the Suspension Agreement to sell at a new price below the minimum reference price and doing so could result in financial fines or loss of the seller’s or importer’s PACA license, which is required to buy or sell produce in the United States. Additionally, the Mexican government is requiring Mexican growers to formally register with the Mexican authorities in order to export to the U.S., and failing to do so will result in the denial of export rights.

The net result of the Suspension Agreement is positive for the Company as it has curtailed the ongoing issue of mislabeling Mexican field tomatoes as greenhouse tomatoes and sets a minimum floor price for selling to U.S. importers or retailers, if they buy directly. In the long run, the Company believes that the Suspension Agreement should slow down the rapid growth of tomato production in Mexico as real economics – selling for a profit – is brought to bear on Mexican growers. If the market price for U.S. tomatoes drops below the reference price, Mexican growers would be unable to export to the United States.

Refinancing

The Company completed a refinancing of its Term Loan and Operating Loan in 2013, and subsequent amendments to each facility in 2016. The Company’s Term Loan is with a lender that understands and appreciates the cyclical nature of agriculture and in particular the hydroponic greenhouse industry. The March 2016 amendment extended the maturity date on the Term Loan to May 1, 2021 and changed the amortization of principal to be spread over 15 years from the previous 14 years on a lower outstanding principal balance. This amendment provided the Company with greater flexibility in satisfying its debt services covenant under its Operating Loan due to lower annual principal payments.

- 5 -

In addition, the Company agreed to an amendment with the Bank which extends the term of its Operating Loan to May 31, 2021. The Operating Loan is a revolving facility of up to CA$13,000,000 is based on up to 90% of the Company’s accounts receivable. The Operating Loan is subject to a debt service coverage ratio that changes over rolling 12-month periods.

Purchase of Maxim Power (B.C.) Inc.

On July 17, 2014, the Company purchased Maxim Power (B.C.) Inc., a wholly-owned subsidiary of Maxim Power Corp., for approximately CA$5.2 million, which included a closing adjustment of CA$0.7 million for working capital. Maxim Power (B.C.) Inc. is a 7 megawatt power generation facility that is located on existing Village Farms property. The Company subsequently changed the name of this acquired company to VF Clean Energy, Inc. The facility that Village Farms acquired as part of the acquisition continues generating power under an existing long term power purchase agreement with British Columbia Hydro and Power Authority and improves the sustainability profile of Village Farms’ greenhouse operations in Delta, B.C.

Formation of Pure Sunfarms Corp.

In June 2017, the Company entered into a joint venture (the “Joint Venture”) with Emerald for the objective of seeking to achieve large-scale, low-cost, high quality cannabis production. The Joint Venture was formed by way of a corporation named “Pure Sunfarms Corp.”, which is 50% owned by the Company and 50% owned by Emerald, and has the purpose of carrying on the business of the Joint Venture. Under the terms of the agreement governing the Joint Venture (the “Joint Venture Agreement”), the Company initially contributed rights to a 1.1 million square foot greenhouse facility in Delta, British Columbia (the “Delta 3 Greenhouse”) which the Joint Venture will seek to convert to ACMPR compliant production and, if permitted by applicable laws, production for the nontherapeutic adult-use cannabis market under the proposed Cannabis Act (the “Cannabis Act”). Under the terms of the Joint Venture Agreement Emerald is contributing an aggregate of $20 million (the “Emerald Contribution”). On the formation of the Joint Venture, $2 million of the Emerald Contribution was contributed to Pure Sunfarms.

The Joint Venture Agreement includes a list of material decisions (the “Material Decisions”), including, among others the decision to no longer pursue any cultivation or distribution license which Pure Sunfarms was pursuing, a decision to fundamentally change the purpose or operations of Pure Sunfarms, any proposed response to investigations, audits or inspections by governmental authorities in relation to the licenses, any proposed response to proposed corrective action, voluntary or involuntary, in relation to the licenses, any proposed response to a governmental authority in connection with a threatened or actual suspension or cancellation of the licences and approval of the annual operating and capital budgets for Pure Sunfarms. Material Decisions require the affirmative vote of a majority of the votes cast at a board of directors meeting, at which a quorum is present. The board of directors of Pure Sunfarms currently consists of six directors – three appointed by Emerald and three appointed by the Company. If either Emerald or the Company’s ownership interest in Pure Sunfarms falls below 35%, such entity will lose one of the board of director members appointed by it. Voting rights will also be lost if a party is in default of its obligations under the Joint Venture Agreement or in the case of a decision in respect of which a party has a conflict of interest. The Joint Venture Agreement includes customary events of default and remedies for the non-defaulting party (including a dilution mechanism). The Joint Venture Agreement also includes restrictions against transfer of the shares of Pure Sunfarms, rights of first refusal, drag along rights and a buy-sell provision (the “Buy-Sell”). The Buy-Sell can only be exercised by Emerald or the Company (the “Offeror”) on or after the second anniversary of the formation of the Joint Venture if it is not in default of its obligations under the Joint Venture Agreement and: (a) the operating or capital budget for Pure Sunfarms for a subject year has not been approved by the board of directors by March 1 of such year; or (b) the board of directors is deadlocked with respect to a Material Decision. The recipient of the buy-sell notice (the “Offeree”) has 60 days to determine whether to sell its shares at the price offered in Pure Sunfarms to the Offeror or to purchase the Offeror’s shares in Pure Sunfarms at that price.

Subject to certain carve-outs in favour of Emerald, each of Emerald and the Company have committed to being the exclusive joint venture partner of the other party for all greenhouse-grown cannabis activities in Canada. It is a requirement of the Joint Venture Agreement that, should the option on the Delta 2 Greenhouse, an additional 1.1 million square foot greenhouse facility in Delta, British Columbia (the “Delta 2 Greenhouse”), or the Delta 1 Greenhouse, an additional 2.6 million square foot greenhouse facility in Delta, British Columbia (the “Delta 1 Greenhouse”), be exercised by the Joint Venture, the Delta 2 Greenhouse or the Delta 1 Greenhouse, as the case may be, would be contributed to the Joint Venture by the Company on an unencumbered basis.

- 6 -

On September 15, 2017, Emerald Health Botanicals Inc., a Licensed Producer under the ACMPR (License No. 10MM0005/2017), submitted an application to Health Canada for the expansion of its facilities to include a second cultivation site. The application for the second site was made in the name of Emerald Health Farms Inc., a wholly-owned and controlled subsidiary of Emerald Health Botanicals Inc., for the Delta 3 Greenhouse, located at 4431-80th Street, Delta, British Columbia. The application was subsequently accepted for review by Health Canada on September 18, 2017. The application for the second site named a senior person in charge (“SPIC”), a responsible person in charge (“RPIC”) and an alternate responsible person in charge (“A/RPIC”) as required by the ACMPR. A quality assurance person (“QA”), who will be responsible for assuring the quality of the product that is cultivated at the site, is yet to be appointed for this second site. Security clearances for each of the SPIC, RPIC, and A/RPIC were also submitted to Health Canada as required by the ACMPR. The application sought to obtain approval for the possession, production, sale, shipping, transportation, delivery and destruction of dried cannabis, cannabis plants, seeds and fresh marihuana, with an expected production capacity of 18,750 kilograms of dried cannabis annually. There is no intent to engage in the production and sale of cannabis oil at this time. On March 2, 2018 a cultivation license was issued by Health Canada under the ACMPR in respect of the Delta 3 Greenhouse. Upon receipt of the cultivation license, Emerald Health Farms changed its name to Pure Sunfarms Canada Corp. The Joint Venture hopes to receive a sales license under the ACMPR by July 1, 2018. Once the sales license has been issued in the name of Pure Sunfarms Canada Corp., the Joint Venture intends to exercise its irrevocable option to buy the shares of Pure Sunfarms Canada Corp. for $1.00 in order to possess the issued producer license and lawfully operate the facility.

Subsequent to acceptance by Health Canada to review the application, the Joint Venture commenced physical conversion of the Delta 3 Greenhouse and expects to complete conversion of the first 250,000 square foot quadrant by April 2018, at which time the Joint Venture is expected to commence production. Subject to the receipt of a sales license from Health Canada, and subject to inspection and approval by Health Canada, it expects to begin selling dried cannabis on or before July 2018 and to have all four quadrants of the Delta 3 Greenhouse commercially producing in the first quarter of 2019. The Joint Venture conservatively forecasts annual production from the Delta 3 Greenhouse to be a minimum of 75,000 kilograms of dried cannabis, which it expects to achieve in 2020.

On October 26, 2017, the Canadian Securities Administrators (the “CSA”) issued CSA Staff Notice 51-352 – Issuers with U.S. Marijuana-Related Activities (the “Staff Notice”) which sets out, among other things, certain disclosure expectations of the CSA regarding issuers who have direct, indirect or ancillary involvement in the U.S. cannabis industry. The Staff Notice was issued resulting from concerns regarding the lack of a uniform national framework for cannabis regulation in the United States, which currently has a conflict between state and federal law relating to cannabis, with certain U.S. states permitting the use and sale of cannabis, notwithstanding that cannabis continues to be listed as a controlled substance under U.S. federal law. The Company and the Joint Venture do not have, and do not intend to engage in, any direct, indirect or ancillary involvement in the U.S. cannabis industry (as described in the Staff Notice) until it is federally legal to do so.

Potential Future Developments

The Company is constantly exploring and evaluating whether to produce certain higher margin alternative crops, as well as whether to market and distribute other fresh produce grown by third parties to the Company’s retail customer base.

At this time the Company has no plans to grow cannabis at its U.S. facilities or to participate in any cannabis business activity or investment in the U.S. until such time that it is federally legal to do so in the U.S.. The Company intends to provide further updates with respect to these matters should relevant additional information become available. See “Forward Looking Statements”.

- 7 -

INDUSTRY OVERVIEW

Greenhouse Vegetable Industry Overview

The North American Industry

The greenhouse vegetable industry in North America has experienced rapid growth over the past 20 years, particularly in the western regions of the United States, southwest British Columbia and southern Ontario in Canada, and concentrated areas in Mexico.

Mexico is the largest producer of greenhouse tomatoes, accounting for 57% of North American greenhouse vegetable sales, followed by Canada and the United States. Based on figures from 2016, greenhouse tomatoes accounted for over 45% tomato volume sold at retail stores in the United States. It is estimated that retail sales represent over 50% of the total fresh tomato market, including both field and hothouse grown. The balance of fresh tomato sales are to the food service industry, which is primarily serviced by field tomato producers.

The following table illustrates estimated greenhouse tomato area and production for the U.S., Mexico and Canada in 2016 (the most recent date for which this information is available):

| Item | United States | Canada | Mexico1 | Total North America | ||||||||||||

Greenhouse tomato production (millions of pounds) | 645 | 609 | 2,400 | 4,312 | ||||||||||||

Greenhouse tomato area (hectares) | 680 | 591 | 14,000 | 15,271 | ||||||||||||

Conversion: 1 hectare = 2.471 acres | ||||||||||||||||

| 1 | The figures for Mexico include all protected crop most of which is a shadehouse rather than a greenhouse and is based on management estimates. |

Sources: The State of the N. American Hothouse Vergetable Industry, by Dr. Roberta Cook, March 2018; Greenhouse Consultants; and Perishables Group Freshfact, Nielsen Business Media, Inc.

Greenhouse Industry — United States

The majority of greenhouse vegetable producers in the United States are located in the southwestern and western states, where the growing conditions are more ideal for winter growing operations and in some areas year-round production. New greenhouse facilities have recently been completed in the Midwest region of the United States and more are planned for this area. These facilities will have lights to allow them to produce in the winter months. Producing in the winter months is advantageous as produce prices are generally higher, although with increasing Mexican production, seasonal fluctuations are decreasing. The majority of greenhouse tomatoes produced in the United States are used for domestic consumption. In addition, the United States imports a significant portion of its supply of greenhouse tomatoes from Canada and Mexico to meet domestic demand, it is estimated that Mexican greenhouse vegetables comprise between 40 to 60% of consumption in the United States. Producers in the United States benefit from high yields, consistent product quality, year-round supply and closer proximity to its customers.

Greenhouse Industry — Canada

Among the North American greenhouse vegetable producers, Canada is the largest supplier from April to October of each year. Several factors, including climatic advantages (cooler summer temperatures) and the proximity of greenhouse producers to consumer markets, contribute to Canada’s favourable positioning relative to the United States during that time period. The primary markets for greenhouse produce grown in British Columbia include the west and northwest regions of the United States, as well as western Canada, while the primary markets for Ontario produce include the east and central regions of the United States, as well as eastern Canada.

- 8 -

The strengths of the Canadian greenhouse vegetable industry include its high yields and consistent product quality. The main weakness of the Canadian greenhouse industry relates to its lack of production during the historically higher priced winter months. However, because of the high volume of tomatoes produced in Canada during the April to October growing season, profits generated during this time period generally are sufficient to sustain producers through the full year.

Greenhouse Industry — Mexico

Although Mexico was the last to enter the greenhouse tomato industry in North America, it has more greenhouse tomato acreage than the United States and Canada combined. It should be noted there is no formal definition of a “greenhouse” and a significant portion of the greenhouse acreage in Mexico is very low-tech, employing shade field structures. The product from the shade facilities is in some instances marketed as greenhouse-grown, which until the recent update on the Suspension Agreement between the United States and Mexico (as described above) was not in violation of any regulations, but for the State of California regulations, which has a definition of greenhouse for produce sold within the state. Average yields and product quality in Mexico are comparatively low, due to the wide range of greenhouse technologies. Currently, Mexican producers tend to grow and market during the winter months as they have sufficient light levels to grow and cooler temperatures during these months, although the trend towards more sophisticated greenhouses is permitting a longer growing season, as well as increased yields.

Management believes that Mexico’s industry, however, is often challenged by high heating costs, less experienced management, less developed infrastructure, higher distribution costs, inconsistent product quality and the lack of an experienced sales and marketing organization. Over the last several years, the greenhouse industry in Mexico has continued to make significant advances with respect to its growing expertise and ability to extend its growing season, which continues to put pressure on produce pricing.

Pricing

Prices for vegetables fluctuate depending upon availability of supply and consumer demand. Greenhouse vegetable producers typically command a higher price for their products compared to field producers, as a result of the vegetables’ consistent quality, taste, appearance and year-round availability. This higher price, combined with higher production yields for greenhouse produce, typically offset the higher costs associated with greenhouse production relative to field production. Production costs for greenhouse grown produce are generally higher due to greater energy, labour, infrastructure, technological requirements and more intense crop yields per acre. As the fresh produce market share of big box retailers increases, pricing is moving towards more contract pricing for six, nine or even twelve month periods reducing some of the traditional seasonal pricing. Contract pricing does not provide volume guaranties. Average pricing over the last five years has continued to slowly decrease in large part due to the increasing supply of greenhouse tomatoes.

Cannabis Industry Overview

Legal History of Medical Cannabis in Canada

The Marihuana for Medical Purposes Regulations (“MMPR”) established a legal regime for licensing producers and permitting the sale of dried cannabis to registered patients pursuant to a medical document provided by a health care practitioner. The overarching purposes of the MMPR was to ensure that Canadians with a medical need could access quality-controlled cannabis grown under secure and sanitary conditions. The MMPR were repealed on August 24, 2016 and were replaced by the ACMPR as a result of a decision by the Federal Court of Canada (the “Federal Court”) in Allard v. Canada. The Federal Court held that requiring individuals to obtain cannabis only from Licensed Producers violated liberty and security rights protected by section 7 of the Canadian Charter of Rights and Freedoms. The Federal Court found that individuals who require cannabis for medical purposes did not have “reasonable access” under the MMPR regime. Accordingly, the ACMPR contemplates both access to medical cannabis through a Licensed Producer or through personal production exemptions, thereby giving patients reasonable access to, and choice of, cannabis product.

- 9 -

Current Applicable Regulatory Regime

The ACMPR are the current governing regulations regarding the production, sale and distribution of cannabis products, including cannabis oil, in Canada. The ACMPR provide for three possible alternatives for Canadian residents who have been authorized by their health care practitioner to access cannabis for medical purposes:

| • | they can continue to access quality-controlled cannabis by registering with Licensed Producers; |

| • | they can register with Health Canada to produce a limited amount of cannabis for their own medical purposes (starting materials must be obtained from a Licensed Producer); or |

| • | they can designate someone else who is registered with Health Canada to produce cannabis on their behalf (starting materials must be obtained from a Licensed Producer). |

The ACMPR sets out, among other things, the authorized activities and general responsibilities of Licensed Producers, including:

| • | the requirement to obtain and maintain a licence from Health Canada prior to commencing any activities; |

| • | calculating the quantity of cannabis, other than dried cannabis, that is equivalent to a given quantity of dried cannabis; |

| • | security measures relating to facilities and personnel; |

| • | Good Product Practices (“GPPs”) |

| • | packaging, shipping, labelling, import and export and record-keeping requirements; and |

| • | patient registration and ordering requirements. |

Authorized activities under the ACMPR include the production and sale of starting materials (i.e., cannabis seeds and plants) to those individuals who have registered to produce a limited amount of cannabis for their own medical purposes, or to have it produced by a designated person, and the ability to sell an interim supply of fresh or dried cannabis or cannabis oil to registered persons while they wait for their plants to grow. Licences and licence applications under the ACMPR consolidate the MMPR licence requirements for the production and sale of dried cannabis, the requirements for supplemental licences under the exemption in section 56 of the Controlled Drugs and Substances Act (Canada), and the new requirements for the sale of cannabis seeds and plants.

Expected Legalization of Recreational Cannabis in Canada: The Cannabis Act

In connection with the current Government of Canada’s platform advocating for the legalization and regulation of recreational cannabis in order to dismantle the illegal market and restrict access by under-age individuals, on April 13, 2017, the Government of Canada released Bill C-45 which, if implemented, would enact the Cannabis Act. The Cannabis Act would provide a licensing and permitting scheme for the production, testing, packaging, labelling, sending, delivery, transportation, sale, possession and disposal of cannabis for non-medicinal (i.e., recreational) use, to be implemented by regulations made under the Cannabis Act.

The Government of Canada has advised that it intends to bring the Cannabis Act into force no later than July, 2018. The provincial and territorial governments have indicated that there must be a sufficient period of time between Royal Assent (i.e. approval by Parliament) of the Cannabis Act and the date that the law comes into force, and that a minimum of 8 to 12 weeks is necessary for an orderly transition. The Government of Canada has indicated that it would prioritize an orderly transition to the new legal framework, and provide for this 8-12 week period of time. Given this time frame, it is expected that recreational cannabis will not be available through authorized provincial/territorial retailers until at least August 2018.

The Cannabis Act proposes to maintain separate access to cannabis for medical purposes, including providing that import and export licences and permits will only be issued in respect of cannabis for medical or scientific purposes.

On October 3, 2017, the Parliamentary Standing Committee on Health proposed amendments to the Cannabis Act including, among other things, an amendment that would permit cannabis edibles and concentrates to be sold, to come into force no later than 12 months after the Cannabis Act comes into force.

- 10 -

On November 10, 2017, the Government of Canada proposed that federal tax on cannabis for recreational purposes should not exceed $1 per gram or 10% of the producer’s price, whichever is higher, with retail sales taxes levied on top of that amount.

While the Cannabis Act provides for the regulation of the commercial production of cannabis for recreational purposes and related matters by the federal government, it proposes that the provinces and territories of Canada will have authority to regulate other aspects of recreational cannabis (similar to what is currently the case for liquor and tobacco products), such as sale and distribution, minimum age requirements, places where cannabis can be consumed, and a range of other matters. To date, the Governments of Ontario, Manitoba, Alberta, New Brunswick, Québec and British Columbia have announced partial regulatory regimes for the distribution and sale of cannabis for recreational purposes within those provinces. Other provinces, namely Prince Edward Island and Nova Scotia, and the Yukon territory, have engaged in public consultation but have yet to announce a proposed approach to the sale and distribution model for recreational cannabis in their respective jurisdictions.

On November 22, 2017, Health Canada also launched public consultations (together with consultation proposals) on the proposed regulatory approach for the proposed Cannabis Act. The consultations were open until January 20, 2018, and on March 19, 2018, Health Canada published a Summary of Comments Received during the Public Consultation. This Summary document provides direction on the packaging and labelling provisions of the proposed regulations under the Cannabis Act to help licensed producers, provinces and territories and others prepare for the coming into force of the proposed Act. Regulations under the Cannabis Act (if it is approved by Parliament) are expected to be published in final form (i.e. without an opportunity for further consultation) shortly following Royal Assent of the Cannabis Act and before its coming into force.

DESCRIPTION OF THE BUSINESS

Overview

The Company is one of the largest and longest operating vertically integrated greenhouse growers in North America. The Company’s vegetables are grown hydroponically (without the use of soil) in a glass enclosed, high technology environment using sophisticated computer systems to control irrigation, fertilizers, carbon dioxide, light, temperature, ventilation, humidity and other climatic factors. The Company’s tomatoes are produced by plants that have been selected for their taste, quality and other characteristics and are not genetically modified. The Company owns and currently operates a total of six produce greenhouse facilities, four in Texas and two in British Columbia. The Company operates an industry leading sales, distribution and marketing organization. In particular, the Company’s strategy focuses on forging strong customer relationships by servicing retailers on a year-round basis, and maintaining the highest standards of food safety.

At this time, the Company is leasing a third British Columbia facility to Pure Sunfarms which received its cultivation license on March 2, 2018. Pure Sunfarms has the right to continue to lease the facility from the Company or purchase it for $1.

The Company, through its subsidiary VFCE, owns and operates a 7 megawatt power plant that generates electricity.

Core Operating Principle

The Company’s core operating principle is to deliver fairness and satisfaction in its customer brand promise. Management strives to operate the business for optimal success by endeavoring to be:

| • | a leading supplier of greenhouse grown produce in North America; |

| • | a producer of the highest quality product which adheres to the highest food safety standards; |

| • | a low cost producer; |

| • | a daily supplier to customers; |

- 11 -

| • | a provider of excellence in customer service and logistics; |

| • | enhancing investor value; and |

| • | an employer with a dynamic environment in which employees can grow and prosper. |

Greenhouse Facilities and Products

All of the Company’s greenhouses use state of the art hydroponic technology and produce a combined estimated 90 to 100 million pounds of premium quality greenhouse tomatoes and cucumbers annually. All of the greenhouses are constructed of glass, aluminum and steel, and are located on land owned or leased by the Company. The Company continually evaluates its production facilities and has devised a planting strategy that optimizes its product mix.

The following table outlines the Company’s operating greenhouse facilities.

| Growing Area | ||||||||||||||

Greenhouse Facility | Square Feet | Square Metres | Acres | Products Grown | ||||||||||

Marfa, TX (2 greenhouses) | 2,527,312 | 234,795 | 60 | Tomatoes on-the-vine, beefsteak tomatoes, specialty tomatoes | ||||||||||

Fort Davis, TX (1 greenhouse) | 1,684,874 | 156,530 | 40 | Specialty tomatoes | ||||||||||

Monahans, TX (1 greenhouse) | 1,272,294 | 118,200 | 30 | Tomatoes on-the-vine, long English cucumbers | ||||||||||

Delta, BC (2 greenhouses) | 3,664,390 | 340,433 | 85 | Tomatoes on-the-vine, beefsteak tomatoes, specialty tomatoes | ||||||||||

Delta, BC (1 greenhouse) | 1,077,758 | 100,172 | 25 | Leased to Pure Sunfarms for cultivation of cannabis | ||||||||||

|

|

|

|

|

| |||||||||

Total | 10,226,628 | 950,085 | 240 | |||||||||||

The Company embraces sustainable agriculture and environmentally friendly growing practices by:

| • | utilizing integrated pest management techniques that use “beneficial bugs” to control unwanted pests. The use of natural biological control technology keeps plants and their products virtually free of chemical agents. This process includes regular monitoring techniques for threat identification, development of appropriate, tailored response strategies and the execution of these strategies; |

| • | capturing rainwater from some of its greenhouse roofs for irrigation purposes; |

| • | recycling water and nutrients during the production process; |

| • | growing plants in natural medium including coconut fibre and rock wool as opposed to growing in the soil and depleting nutrients; and |

| • | using dedicated environmental control computer systems which monitor and control almost all aspects of the growing environment thereby maximizing the efficient use of energy. |

Sales, Marketing and Distribution

The Company is a leading marketer of premium-quality, value-added, branded greenhouse-grown produce in North America, and is a significant producer of tomatoes on-the-vine, beefsteak, cocktail, grape, cherry tomatoes, roma, Mini San Marzano (a tomato variety for which the Company currently has an exclusive agreement with the seed

- 12 -

provider to be the sole grower in North America) and cucumbers at its facilities. The Company, from its supply partners, also distributes and purchases premium tomatoes, bell peppers and cucumbers in the United States and Canada produced by other greenhouse growers located in Canada and Mexico. The Company maintains high standards of food safety and requires the same of its contract growers, while providing on-time, effective and efficient distribution.

The Company strives to continually exceed the expectations of its customers by consistently providing superior product, including adding new product varieties and packaging innovations.

With leased distribution centres in Texas and British Columbia, the Company provides its customers with flexibility in purchasing. For the year ended December 31, 2017, the Company had an on-time delivery record of 98.5%, while maintaining competitive freight rates that management of the Company believes to be among the best in the industry.

The Company’s marketing strategy is to strategically position the Company to be the supplier of choice for retailers offering greenhouse produce by focusing on the following:

Year-Round Supplier. Year-round production capability of the Company enhances customer relationships, resulting in more consistent pricing.

Quality and Food Safety. Sales are made directly to retailers which ensures control of the product from seed to customer and results in higher levels of food safety, shelf life and quality control. Food safety is an integral part of the Company’s operations, and management believes that it has led, and currently leads, the industry in adopting Good Agricultural Practices. This program is modeled after the U.S. Food and Drug Administration’s Good Manufacturing Practices using the Primus Labs® format and third party auditors. All of the Company’s packing facilities undergo comprehensive food safety audits by Primus Labs®.

Quality Packaging and Presentation. Product is selected at a uniform size and picked at the same stage of vine ripeness. The packaging for the product is “display ready”, ensuring retail customers have a full view of the product on the supermarket shelf.

Exclusive Varieties. The Company expands its product profile to create and drive exclusive varietal relationships in North America that enable the Company to present consumers with an enhanced eating experience with the Village Farms brand.

Direct Sale to Retail Customers. Greenhouse produce (produce grown by the Company plus supply partner produce) is sold directly to supermarket chains, including Associated Wholesale Grocers, BJ’s Wholesale Club Inc., Costco Wholesale, Fred Meyer, The Fresh Market, Inc., Giant Eagle, Harris Teeter Supermarkets, HEB Grocery Company, The Kroger Co., Loblaw Companies Limited, Market Basket, Publix Super Markets, Inc., Safeway Inc., Sobeys Inc., Sam’s Club, Trader Joe’s, Wakefern Food Corp., Wal-Mart Stores, Inc., Whole Foods Market and Winco Foods LLC.

Excellence in Customer Service and Logistics. Logistics and distribution capability are key factors in ensuring fresh high quality product meets consumer demands. Management of the Company believes it has a competitive advantage through its logistics and distribution networks, which includes strategically located distribution centres.

The Company markets, sells and distributes all of its products, including products sold under exclusive marketing arrangements with its U.S., Canadian and Mexican greenhouse operations.

- 13 -

Production and Packaging Process

The production process for the Company’s west Texas facilities (Marfa and Fort Davis) starts in the spring. Raw materials purchased by the Company for its greenhouse operations include seeds, fertilizers and growing media purchased from several different suppliers. From May to June, the seeds purchased by the Company are grown by an independent third party contractor, which has specialized equipment and growing space, until the plants are approximately four to six weeks old, at which time they are transported to the Company’s Texas facilities. None of the Company’s plants or products are genetically modified. June through September, planting occurs in the greenhouses. From this point on, until the end of the season, plants are pruned to ensure that the optimal number of tomatoes are grown on each plant. Harvesting commences in September/October and generally continues until June of the following year.

The Company’s newest facility in Monahans, Texas, completed in December 2011, is based on the Company’s proprietary GATES® technology which is a state of the art technology that allows for a 12-month per year production. The greenhouse is fully enclosed and uses a proprietary system to cool the greenhouse even in the hot summer months. This facility grows cucumbers and tomatoes and is constantly planting and replanting to ensure a consistent level of production year-round, although as with any greenhouse summer production is higher due to longer daylight hours.

The production process in Canada for tomatoes is similar to the Company’s west Texas operations, although the timing for growing the seeds, planting, and harvesting occur at different times during the year. Specifically, from October to December, the seeds purchased by the Company’s Canadian operations are grown by an independent third party contractor. In December, planting occurs in the Company’s greenhouses. Harvesting commences in March and generally continues until late November of each year.

The tomatoes and cucumbers are vine-ripened and hand-picked for optimum taste and quality, at all of the Company’s facilities. Once harvested, products are sorted by grade and weight and packed for distribution to customers. The Company offers a variety of packaging for its tomatoes that are product and customer specific.

Product Development and Specialization

The Company is engaged in ongoing testing of new technologies and advanced growing systems, including test trials of new tomato varieties to determine whether they improve product quality, taste and production yields, or lower the cost of production. The Company tests these tomato varieties for their maturation period, resistance to disease, the size and quality of the tomatoes as well as the tomatoes’ shelf life and adaptability to seasonal changes in light. If a new variety shows promising characteristics, the Company will conduct a commercial trial where the new variety is planted on a larger scale, with performance results compared to the Company’s existing tomato varieties.

The Company launched its first exclusive tomato varieties in select retail accounts in late 2012. The initial reception, of one in particular – Mini San Marzano – has been well received and the Company has been expanding its production space to meet increasing retailer and consumer demand. Since 2012, the Company has entered into additional exclusive seed agreements in addition to Mini San Marzano with the latest in 2017 for an initial launch in the first quarter of 2018. While none of the other exclusive tomato seed agreements has had the same success as Mini San Marzano, they have added to the uniqueness of the Company’s product offerings, which has resulted in new retail business.

Product Pricing

Prices for the Company’s products have historically followed a seasonal trend of higher prices during the first and fourth quarters of the calendar year and lower prices in the summer months. This historical trend is rapidly changing with the ever-increasing supply of Mexican production, which due to Mexican climate conditions is concentrated in the winter months, as well the increasing influence of big box retailers who operate off partial to full year pricing contracts. Going forward, assuming these trends continue, pricing is likely to become less seasonal than it has been in the past. The Company’s goal is to exceed industry average prices by continuing to develop long-term customer relationships, providing a favourable product mix, developing exclusive varieties and delivering logistic efficiencies.

- 14 -

Intellectual Property

The Company owns and has registered many trademarks and service marks in the United States as well as some in Canada and other jurisdictions. The following is a list of the key trademarks registered in the United States, the Company’s primary distribution market: Village Farms®, Delectable TOV®, Baby Beefs®, From Our House To Your Home®, Hydrobites®, Mini Sensations®, Sinfully Sweet Campari®, Savory Roma®, Lip-Smackn’ Grape®, Heavenly Villagio Marzano®, Cherry No. 9®, Cabernet Estate Reserve®, BC Grown Logo®, Texas Grown Logo®, Good for the Earth ®, Village Farms Greenhouse Grown ®, Scrumptious Mini®, and Sweet Bells®.

Competition

The market for premium greenhouse grown produce is highly competitive. In addition to other domestic and foreign greenhouse producers, the Company competes with producers of field grown tomatoes that generally have prices substantially below those of greenhouse-grown tomatoes. Competition from producers in Mexico has increased due to increased acreage and improved yields due to the use of improved technology as well as a result of the North American Free Trade Agreement. Newly elected U.S. President has stated his intent to “renegotiate” NAFTA but as of the date of this filing no specifics have been announced. See “General Development of the Company” for further information on Mexican tomato supplies.

The Company’s greenhouse vegetable competitors are located primarily in the United States, Canada and Mexico. Four of the larger North American greenhouse producers/distributors competing with the Company are Mastronardi Produce Ltd., Windset Farms Inc., Houweling Nurseries Ltd and Mucci Farms Ltd.

Offsetting the competitive pressures faced by the Company are substantial barriers to entry in North America related to the sizeable initial capital outlay requirements of a modern greenhouse, significant ramp up time, the need for operational expertise and capable sales, marketing and distribution abilities.

Employees

The Company has approximately 1,000 employees and contract workers, the majority of whom are employed in the Company’s greenhouse operations. None of the employees are covered by a collective bargaining agreement. In the opinion of Management, the Company enjoys a good working relationship with its employees.

Capital Expenditures

During the year ended December 31, 2017, the Company spent approximately $1.7 million on capital assets (2016—$2.2 million). During the year ended December 31, 2017, the capital expenditures were used for improvements to existing facilities, distribution centres or information technology systems or hardware.

For the foreseeable future, Management estimates that average annual maintenance capital expenditures on its tomato greenhouse facilities will be approximately $2.0-$3.0 million per year. This amount will consist mainly of technological upgrades, ongoing repairs of growing systems and improvements to existing facilities. In addition to maintenance capital expenditures, the Company incurs ongoing repair and maintenance costs which are expensed as incurred and therefore not included in capital expenditures. These expenses averaged $2.2 million per year during the last three fiscal years.

During 2018, Management anticipates capital investment spending for its produce facilities to be between $2.0 million and $3.0 million. The Company may make additional equity contributions to Pure Sunfarms of cash in the next twelve months depending on the final completion timeline for the Delta 3 Greenhouse and whether or not Pure Sunfarms obtains financing.

- 15 -

Energy Management Strategy

The Company employs the following energy management strategy:

when feasible, contract for forward purchases of natural gas at favourable rates. At this time, due to the expectation of low natural gas pricing for the foreseeable future, no forward purchase contracts are in place;

develop techniques to reduce the use of natural gas. The Company has installed energy screens in all of its U.S. greenhouse facilities and most of its Canadian greenhouse facilities and has experienced a substantial reduction in gas usage;

continue to investigate methods to extract food grade CO2 from the landfill gas at the Delta, BC greenhouse facilities;

continue to investigate alternate fuels, such as biomass or woodwaste; and

continue to investigate the concept of closed greenhouses and the use of geothermal energy.

Foreign Exchange Strategy

The Company’s reporting currency is the U.S. dollar to more accurately represent the economic environment in which it operates.

For the 2018 fiscal year, it is expected that approximately 80% of the Company’s costs will be incurred in U.S. dollars, and approximately 85% of its revenues will be earned in U.S. dollars. As a result, Management believes that the Company is benefiting from a “matching” of revenues and expenses by currency. The Company also has the ability to enter into foreign exchange contracts and foreign exchange options for the purchase of Canadian dollars in order to reduce the risks of exchange rate fluctuations affecting the level of Canadian dollars needed for Canadian operations, as well as the purchase of Euros affecting both its Canadian and U.S. operations.

Environmental and Regulatory Matters

Greenhouse operations in the United States are subject to numerous environmental laws and regulations, including the Food Quality Protection Act of 1996, the Clean Air Act, the Clean Water Act, the Resource Conservation and Recovery Act, the Federal Insecticide, Fungicide and Rodenticide Act, the Toxic Substances Control Act and the Comprehensive Environmental Response, Compensation and Liability Act.

The Company’s U.S. greenhouse operations are subject to regulations enforced by, among others, the U.S. Food and Drug Administration (“FDA”) and the United States Department of Agriculture (“USDA”). The FDA enforces statutory standards regarding the branding and safety of food products and determines the safety of food substances in the United States. The USDA sets standards for raw produce and governs its inspection and certification. Under the Perishable Agricultural and Commodities Act, the USDA exercises broad control over the marketing of produce in domestic and foreign commerce, sets standards of fair conduct as to representations, sales, delivery, shipment and payment for goods, and regulates the licensing of produce merchants and brokers. The Company’s U.S. growing operations are also subject to oversight by the U.S. Environmental Protection Agency regarding the use of fertilizers and pesticides protection.

Similar to the U.S. regulatory requirements described above, the Company’s Canadian operations are subject to various general commercial regulations, including those relating to food safety, packaging and labelling, occupational health and safety, phyto sanitary certificates for cross border shipments, product source and re call capability, and anti bioterrorism measures for cross border shipments.

- 16 -

The Company is committed to protecting the health and safety of employees and the general public, and to sound environmental stewardship. The Company believes that prevention of incidents and injuries, and protection of the environment, benefits everyone and delivers increased value to its shareholders, customers and employees. The Company has health and safety and environmental management and systems and has established policies, programs and practices for conducting safe and environmentally sound operations. Regular reviews and audits are conducted to assess compliance with legislation and Company policy.

The Natural Products Marketing (BC) Act (the “Act”) and certain federal orders issued under the Agricultural Products Act (Canada) give the British Columbia provincial government the authority to regulate the marketing and production of specific agricultural products. The British Columbia Marketing Board (“BCMB”) was created in 1935 to supervise and regulate marketing boards and commissions created under the Act. Independent of government, the BCMB’s primary mandate today is to administer the regulated marketing legislation in the public interest. The BCMB has three principal responsibilities: supervising all marketing boards and commissions; hearing appeals from organizations or persons who are dissatisfied or aggrieved by a decision of a marketing board or commission; and acting as a signatory to federal provincial agreements that govern the marketing of some regulated products.

British Columbia Vegetable Marketing Commission

The BCVMC has responsibility for promoting and regulating the production, transportation, packing, storage and marketing of regulated vegetables in British Columbia. It also requires greenhouse growers to market through agencies licensed by the BCVMC to encourage the orderly distribution of regulated products. The BCVMC has the right to regulate the time and place at which, and to designate the agency through which, a regulated product must be produced, packed, stored, transported or marketed, and can also determine the manner of distribution, the quantity and the quality, grade or class of these products. It can also (but in the case of greenhouse tomatoes and bell peppers currently does not) set the prices at which a regulated product or a grade or class of it may be bought or sold in British Columbia.

Agency and Producer Licenses

The BCVMC issues licenses to agencies and producers in British Columbia on an annual basis by way of general orders passed by the BCVMC. Licensed agencies are authorized to purchase greenhouse vegetables from licensed producers and to market those vegetables within British Columbia and for interprovincial or export trade. The Company, through one its Canadian subsidiaries, has been authorized to buy and sell produce grown in British Columbia since February 6, 2007.

Licensed producers, such as VF Canada LP, operate the facilities in which greenhouse vegetables are produced and must be a member of an agency licensed by the BCVMC. Only producers licensed by the BCVMC can sell their products to an agency licensed by the BCVMC.

Quota

Each year, VF Canada LP is allocated a quota by the BCVMC to plant a specified number of square metres of its greenhouses with a particular crop. There are no restrictions on the amount of product that VF Canada LP can produce in its allocated quota area. The table below summarizes VF Canada LP’s allocations since 2016 at the start of each year:

| (square metres) | 2018 | 2017 | 2016 | |||||||||

Tomatoes on-the-vine | 89,082 | 165,082 | 165,082 | |||||||||

Beef tomatoes | 68,110 | 98,784 | 98,784 | |||||||||

Specialty tomatoes | 170,377 | 176,694 | 176,694 | |||||||||

|

|

|

|

|

| |||||||

Total | 327,569 | 440,560 | 440,560 | |||||||||

|

|

|

|

|

| |||||||

VF Canada LP retains the right to be allocated the same amount of quota for each subsequent crop year. However, VF Canada LP can, and often does, apply for changes in specific quota allocations to optimize product mix and improve financial returns.

- 17 -

CAPITAL STRUCTURE

Common Shares

The Company is authorized to issue an unlimited number of Common Shares. Each Common Share entitles the holder thereof to receive notice of and to attend all meetings of shareholders of the Company and to one vote per Common Share at such meetings (other than meetings at which only the holders of another class of shares are entitled to vote separately as a class). The Common Shares entitle the holders thereof to receive, in any year, dividends on the Common Shares as and when declared by the board of directors of the Company, provided that payment of such dividends is not prohibited under law and after payment of any applicable amounts to which holders of any Preferred Shares may be entitled. In the event of the liquidation, dissolution or winding-up of the Company, whether voluntary or involuntary, after payment of or other proper provision for all of the liabilities of the Company and the payment of any amounts payable to holders of the Preferred Shares, the holders of the Common Shares will be entitled to share pro rata in all remaining property or assets of the Company.

The ability of a beneficial owner of Common Shares to pledge such Common Shares or otherwise take action with respect to such shareholder’s interest in such Common Shares (other than through a CDS Participant) may be limited due to the lack of a physical Common Share certificate.

The Company has the option to terminate the registration of the Common Shares through the book entry system in which case definitive certificates for the Common Shares in fully registered form would be issued to beneficial owners of such Common Shares or their nominees.

Special Shares

The holders of Special Shares are entitled to one vote for each Special Share held at all meetings of shareholders of the Company other than meetings at which only the holders of another class of shares are entitled to vote separately as a class; provided that in no event shall the votes attached to the Special Shares exceed 45% of the votes otherwise attached to the Common Shares and Special Shares then outstanding. In certain circumstances, the holders of Special Shares will not be entitled to vote separately as a class and will not be entitled to dissent. The holders of Special Shares will not be entitled to share in any distribution of the property or assets of the Company upon the dissolution, liquidation or winding-up of the Company, whether voluntary or involuntary, or in the event of any other distribution of assets of the Company among its shareholders for the purpose of winding-up its affairs. The provisions of the Special Shares cannot be modified by the Company without first obtaining, by separate affirmative vote, two-thirds of the votes cast at a meeting of the holders of the shares of such class.

The holders of Special Shares are not entitled to receive any dividends. The Company has redeemed all of the Special Shares that were previously issued and outstanding.

Preferred Shares

The Company is authorized to issue an unlimited number of Preferred Shares. The Company’s board of directors will fix the number of Preferred Shares, as well as the designation, rights, privileges, restrictions and conditions for each series of Preferred Shares that may be issued, subject to the Company filing the applicable articles of amendment under the CBCA. Preferred Shares will have preference over Common Shares with respect to the payment of dividends and in the distribution of assets in the event of the liquidation, dissolution or winding-up of the Company, be it voluntary or involuntary, or any other distribution of the assets of the Company among its shareholders for the purpose of winding-up its affairs. Preferred Shares will have no right to vote on shareholder matters, subject to certain exceptions. No changes to the provisions of the Preferred Shares may be made without the approval of the holders of the Preferred Shares.

Warrants

In conjunction with the formation of Pure Sunfarms on June 27, 2017 the Company issued 300,000 common share purchase warrants to an affiliate of a Canadian financial institution as partial consideration for services provided in respect thereof. Each such warrant entitles the holder to purchase one Common Share at an exercise price of CA$2.07. Each such warrant is exercisable up to June 6, 2020.

- 18 -

Retained Interest of Michael DeGiglio

Pursuant to the terms of the Securityholders’ Agreement, the Company has granted to its Chief Executive Officer, Michael DeGiglio certain pre-emptive rights, as well as “demand” and “piggy back” registration rights, which will enable Mr. DeGiglio to require the Company to file a prospectus (in the case of a demand registration) and otherwise assist with a public offering of Common Shares, subject to certain limitations. In the event of a “piggy back” offering, the Company’s financing requirements are to take priority. Subject to the approval of the TSX, in the event that the Company decides to issue equity securities or securities convertible into or exchangeable for equity securities of the Company other than to officers, employees, consultants or directors of the Company or any subsidiary of the Company pursuant to a bona fide incentive compensation plan, the Securityholders’ Agreement provides, among other things, Michael DeGiglio with pre-emptive rights to purchase such number of newly issued equity securities in order to maintain his pro rata ownership interest in the Company.

Book Entry System

Registration of interests in and transfers of the Common Shares are made only through the book entry system administered by CDS. Common Shares must be purchased, transferred and surrendered for redemption through a shareholder’s applicable CDS Participant. All rights of shareholders must be exercised through, and all payments or other property to which such shareholder is entitled will be made or delivered by, CDS or the CDS Participant through which the shareholder holds such Common Shares. Upon the purchase of any Common Shares, a shareholder will typically receive only a customer confirmation from their applicable CDS Participant through which the Common Shares were purchased.

Financial Year End

The fiscal year end of the Company is December 31.

CREDIT FACILITIES

Credit Facilities

On March 28, 2013, the Company entered into a new term facility among VF Canada LP (the “Borrower”), certain affiliates of the Borrower, as guarantors, and Farm Credit Canada (the “Term Loan”). On March 24, 2016, the Term Loan was amended. The following summary describes the current provisions of the Term Loan. The Term Loan matures on May 1, 2021. The current balance of the Term Loan is US$36,694,544. Subject to acceleration upon an event of default, the outstanding balance of the Term Loan will be payable by way of monthly instalments of principal and interest based on an amortization period of 15 years, with the balance of the term loans and all unpaid accrued interest to be paid in full at maturity. The Term Loan is subject to annual financial covenants as well as other positive and negative covenants typical for this type of loan. The Term Loan is a LIBOR borrowing plus a margin based on the prevailing coverage ratio at each reporting date. The interest rate as at the date of this annual information form was 6.28698% per annum.

In addition to the Term Loan described above, the Company also has an operating credit facility with a Canadian chartered bank (the “Bank”). This revolving operating loan of up to CA$13,000,000 is at variable interest rates with a maturity date of October 12, 2021 (the “Operating Loan”). The borrowing base is based on 90% of current accounts receivable less priority claims. No amount was drawn on the Operating Loan as at December 31, 2017 (December 31, 2016 – $nil) which is available to a maximum of CA$13,000,000, less two outstanding letters of credit of US$320,000 and CA$38,500. Interest on amounts borrowed is calculated by way of Prime Rate, US Prime Rate, Base Rate or LIBOR plus a margin. It is the Company’s choice on how it will borrow, and all undrawn funds are charged a stand-by fee of 0.375% per annum. As of the date of this annual information form, the outstanding balance of the Operating Loan is $3,000,000.

- 19 -

On September 26, 2014, the Company’s subsidiary, VFCE, entered into a loan agreement with the Bank (the “VFCE Loan”). The VFCE Loan is a non-revolving fixed rate loan of CA$3.0 million, has a maturity date of June 30, 2023, a fixed interest rate of 4.98% per annum, and monthly payments of CA$36,000 which commenced in January 2015. As of the date of this annual information form, the outstanding balance of the VFCE Loan is approximately $1.85 million.