UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-22888

Wildermuth Endowment Strategy Fund

(Exact name of registrant as specified in charter)

11525 Park Woods Circle, Ste. 200

Alpharetta, GA 30005

(Address of principal executive offices) (Zip code)

Daniel Wildermuth

Wildermuth Advisory, LLC

11525 Park Woods Circle, Ste. 200

Alpharetta, GA 30005

(Name and address of agent for service)

COPIES TO:

John H. Grady

DLA Piper, LLP

1650 Market Street, Suite 4900

Philadelphia, PA 19103

(215) 656-3365

Registrant's telephone number, including area code: (888) 889-8981

Date of fiscal year end: December 31

Date of reporting period: June 30, 2017

Item 1. Reports to Stockholders.

SEMI-ANNUAL REPORT

JUNE 30, 2017

WWW.WILDERMUTHENDOWMENTFUND.COM ● 1-888-889-8981 ●

DISTRIBUTED BY UMB DISTRIBRUTION SERVICES, LLC (MEMBER FINRA)

Wildermuth Endowment Strategy Fund

| Table of Contents | |

| | |

| Letter to Shareholders | 2 |

| Portfolio Review | 4 |

| Schedule of Investments | 6 |

| Statement of Assets and Liabilities | 14 |

| Statement of Operations | 15 |

| Statements of Changes in Net Assets | 16 |

| Statement of Cash Flows | 17 |

| Financial Highlights | 18 |

| Notes to Financial Statements | 21 |

| Additional Information | 32 |

Wildermuth Endowment Strategy Fund

Letter to Shareholders

June 30, 2017

Dear Investor:

We are pleased to present this annual report for the Wildermuth Endowment Strategy Fund (the “Fund”) covering the 6-month period from January 1, 2017 to June 30, 2017.

During this period, the Fund generated a total return of 5.65% versus 9.34% for the S&P 500® Total Return Index and 2.27% for the Barclays U.S. Aggregate Bond Index. We are pleased that we continue to deliver strong performance with monthly volatility that consistently remains well below that of a 60 percent stock and 40 percent bond portfolio (as represented by a 60 percent S&P 500 and 40 percent Barclays Aggregate Bond portfolio).

The Fund’s performance resulted from several asset classes within its diversified strategy delivering strong returns including private equity, U.S. equity, emerging market equity, developed market equity, real estate, and hedge funds. Both global and domestic equity markets enjoyed a very strong first half of the year, with both emerging markets and developed markets outperforming a strong US market.

Private equity holdings continue to thrive. Ongoing growth and progress by some of the directly held companies resulted in solid increases in value, and in one case, income through some additional financing activities. Holdings in private equity funds also fared well with several recognized increases in value across different funds.

Real estate holdings continue to perform well. Value was recognized across the sector in various ways ranging from increases in the value of holdings to interest received to fees for financing activities. Overall, the sector provided solid and consistent returns to the portfolio.

During the most recent six-month period, the fund increased its exposure to Hedge Funds. Increased exposure to the asset class has been purposefully slow giving us ample time to identify opportunities that we believe will contribute both returns and stability to the fund. During the first half of the year, the funds performed as hoped, adding gains and diversification.

For the first half of the year in 2017, no asset classes experienced severe downtowns, but a few turned in losses and inevitably, some lagged the portfolio’s overall performance. Most notably, managed futures experienced losses and several oil and gas holdings dragged down the category average into negative territory.

Managed Futures losses were fairly minor. During the second quarter, we exited all managed futures holdings and replaced them with hedge funds that we believe offer a more attractive combination of return potential and diversification. Overall, we felt the mediocre performance expectations for the category no longer warranted inclusion in the portfolio.

Oil and gas holdings struggled through the year as energy prices again sagged. While the largest holdings in funds saw very limited price declines, some of the traded positions experienced losses that more than negated their significant dividend income.

Fixed income contributed positive returns to the portfolio with performance surprisingly strong given very tepid bond market returns. Still, the category as a whole acted as a drag on total performance. Cash holdings predictably contributed very little to portfolio returns.

Looking forward to the second half of 2017, we expect that global equity market performance will cool somewhat. The performance of equities over the past 12 months has been exceptionally strong and remarkably steady. Recent strong returns have resulted in fairly rich valuations for equities which we believe pose challenges for future equity market returns. The growing strength of various global economies is leading us to look overseas for more opportunities and we believe emerging markets still offer good potential. In other asset classes, the relative calm across many market segments combined with historically low interest rates has also lead to fairly strong valuations in other asset classes including real estate and even private equity.

2

Wildermuth Endowment Strategy Fund

Letter to Shareholders - Continued

June 30, 2017

Against this backdrop which we feel offers investors far fewer tailwinds than were available just a few years ago, we feel that investment selection is particularly important. We believe we are well positioned to find and add attractive investments to the portfolio which should contribute to portfolio returns while limiting overall portfolio volatility.

Thank you for your continued confidence and support.

Sincerely,

Daniel Wildermuth

President and Chief Executive Officer, and

Chairman and Trustee of the Fund

3

Wildermuth Endowment Strategy Fund

Portfolio Review

June 30, 2017 (Unaudited)

The Fund’s performance figures* for the period ended June 30, 2017, compared to its benchmarks:

| Two

Year | One

Year | Annualized

Since Inception1 |

| Class A | 5.87% | 11.52% | 10.48% |

Class A with Load2 | 2.65% | 4.86% | 7.77% |

S&P 500® Total Return Index** | 10.73% | 17.90% | 9.04% |

| Barclays U.S. Aggregate Bond Index*** | 2.79% | -0.31% | 2.19% |

| | | |

| | One

Year | Annualized

Since Inception3 |

| Class C | | 10.65% | 12.31% |

| Class C with Sales Charge | | 9.65%4 | 12.31% |

S&P 500® Total Return Index** | | 17.90% | 17.51% |

| Barclays U.S. Aggregate Bond Index*** | | -0.31% | 2.39% |

| | | | |

| | | Cumulative

Since Inception5,6 |

| Class I | | | 0.73% |

S&P 500® Total Return Index** | | | 2.04% |

| Barclays U.S. Aggregate Bond Index*** | | | 0.67% |

1 | The Class A inception date is December 31, 2014. |

2 | Calculated using the maximum sales load of 6.00% |

3 | The Class C inception date is March 14, 2016. |

4 | Class C shares are subject to a Contingent Deferred Sales Charge of 1.00% on any shares redeemed within 365 days of purchase. |

5 | The Class I inception date is April 28, 2017. |

6 | Not annualized for periods less than one year. |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Class A has a total annual operating expense of 5.46%, Class C has a total annual operating expense of 6.21%, and Class I has a total annual operating expense of 5.21%, respectively, per the prospectus dated May 1, 2017. |

| ** | The S&P 500® Total Return Index is an unmanaged market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an index. |

| *** | The Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-through securities), ABS, and CMBS. Investors cannot invest directly in an index. |

4

Wildermuth Endowment Strategy Fund

Portfolio Review - Continued

June 30, 2017 (Unaudited)

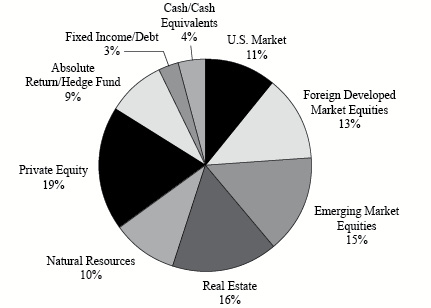

| Holdings by type of Investment | % of

Net Assets | |

| U.S. Market | 11.36% |

| Foreign Developed Market Equities | 13.15% |

| Emerging Market Equities | 15.10% |

| Real Estate | 15.96% |

| Natural Resources | 9.84% |

| Private Equity | 18.93% |

| Absolute Return/Hedge Fund | 8.84% |

| Fixed Income/Debt | 2.57% |

| Cash/Cash Equivalents | 4.25% |

| | 100.00% |

| | |

| | |

Please refer to the Schedule of Investments in this Semi-Annual Report for a detailed analysis of the Fund’s Holdings.

5

Wildermuth Endowment Strategy Fund

Schedule of Investments

June 30, 2017 (Unaudited)

Shares or Principal Amount | | | | Value | |

| | | COMMON STOCKS — 28.4% | | | |

| | | ADVERTISING — 0.3% | | | |

| | 13,734 | | Havas SA | | $ | 144,201 | |

| | | | | | | | |

| | | | AGRICULTURE — 0.9% | | | | |

| | 2,469 | | Bunge, Ltd. | | | 184,187 | |

| | 2,117 | | Sipef SA | | | 152,111 | |

| | 4,098 | | Swedish Match AB | | | 144,154 | |

| | | | | | | 480,452 | |

| | | | AIRLINES — 0.3% | | | | |

| | 35,701 | | Qantas Airways, Ltd. | | | 156,639 | |

| | | | | | | | |

| | | | AUTO MANUFACTURERS — 0.5% | | | | |

| | 13,700 | | Nissan Motor Co., Ltd. | | | 136,317 | |

| | 3,100 | | Suzuki Motor Corp. | | | 147,054 | |

| | | | | | | 283,371 | |

| | | | AUTO PARTS & EQUIPMENT — 0.2% | | | | |

| | 2,600 | | American Axle & Manufacturing Holdings, Inc.(a) | | | 40,560 | |

| | 1,701 | | Tenneco, Inc. | | | 98,369 | |

| | | | | | | 138,929 | |

| | | | BANKS — 2.5% | | | | |

| | 16,657 | | Bendigo & Adelaide Bank, Ltd. | | | 141,566 | |

| | 1,218 | | Capital One Financial Corp. | | | 100,631 | |

| | 19,000 | | Chiba Bank, Ltd. | | | 137,647 | |

| | 4,000 | | Customers Bancorp, Inc.(a) | | | 113,120 | |

| | 3,943 | | Erste Group Bank AG | | | 150,763 | |

| | 6,945 | | FNB Corp. | | | 98,341 | |

| | 1,036 | | JPMorgan Chase & Co. | | | 94,690 | |

| | 11,114 | | Mitsubishi UFJ Financial Group, Inc., ADR | | | 75,020 | |

| | 18,000 | | Oversea-Chinese Banking Corp., Ltd. | | | 141,056 | |

| | 3,900 | | Sumitomo Mitsui Trust Holdings, Inc. | | | 139,499 | |

| | 1,586 | | Wells Fargo & Co. | | | 87,880 | |

| | 2,100 | | Western Alliance Bancorp(a) | | | 103,320 | |

| | | | | | | 1,383,533 | |

| | | | BEVERAGES — 0.2% | | | | |

| | 1,514 | | Heineken Holding NV | | | 138,570 | |

| | | | | | | | |

| | | | BIOTECHNOLOGY — 0.2% | | | | |

| | 769 | | United Therapeutics Corp.(a) | | | 99,762 | |

| | | | | | | | |

| | | | BUILDING MATERIALS — 1.0% | | | | |

| | 3,300 | | Asahi Glass Co., Ltd. | | | 138,928 | |

| | 10,300 | | Nihon Flush Co., Ltd. | | | 139,521 | |

| | 4,126 | | Owens Corning | | | 276,112 | |

| | | | | | | 554,561 | |

See accompanying notes to financial statements.

6

Wildermuth Endowment Strategy Fund

Schedule of Investments - Continued

June 30, 2017 (Unaudited)

Shares or Principal Amount | | | | Value | |

| | | COMMON STOCKS (CONTINUED) | | | |

| | | CHEMICALS — 0.6% | | | |

| | 2,747 | | Croda International PLC | | $ | 138,616 | |

| | 415 | | LyondellBasell Industries NV, Class A | | | 35,022 | |

| | 7,210 | | Teijin, Ltd. | | | 138,669 | |

| | | | | | | 312,307 | |

| | | | COMMERCIAL SERVICES — 1.3% | | | | |

| | 1,673 | | Groupe Crit | | | 155,508 | |

| | 4,098 | | Intrum Justitia AB | | | 138,955 | |

| | 13,046 | | McMillan Shakespeare, Ltd. | | | 134,092 | |

| | 884 | | S&P Global, Inc. | | | 129,055 | |

| | 1,294 | | United Rentals, Inc.(a) | | | 145,847 | |

| | | | | | | 703,457 | |

| | | | COMPUTERS — 0.2% | | | | |

| | 622 | | International Business Machines Corp. | | | 95,682 | |

| | | | | | | | |

| | | | DISTRIBUTION/WHOLESALE — 0.2% | | | | |

| | 13,292 | | Inchcape PLC | | | 130,261 | |

| | | | | | | | |

| | | | DIVERSIFIED FINANCIAL SERVICES — 0.7% | | | | |

| | 5,700 | | Ally Financial, Inc. | | | 119,130 | |

| | 7,840 | | Enova International, Inc.(a) | | | 116,424 | |

| | 26,000 | | Mitsubishi UFJ Lease & Finance Co., Ltd. | | | 142,079 | |

| | | | | | | 377,633 | |

| | | | ELECTRIC — 0.2% | | | | |

| | 2,800 | | Brookfield Renewable Partners LP | | | 89,432 | |

| | | | | | | | |

| | | | ELECTRICAL COMPONENTS & EQUIPMENT — 0.3% | | | | |

| | 1,998 | | OSRAM Licht AG | | | 158,942 | |

| | | | | | | | |

| | | | ELECTRONICS — 0.4% | | | | |

| | 61,700 | | Japan Display, Inc.(a) | | | 116,415 | |

| | 4,000 | | Orbotech, Ltd.(a) | | | 130,480 | |

| | | | | | | 246,895 | |

| | | | ENERGY-ALTERNATE SOURCES — 0.2% | | | | |

| | 12,846 | | Innergex Renewable Energy, Inc. | | | 141,052 | |

| | | | | | | | |

| | | | ENGINEERING & CONSTRUCTION — 0.2% | | | | |

| | 2,176 | | Argan, Inc. | | | 130,560 | |

| | | | | | | | |

| | | | ENTERTAINMENT — 0.2% | | | | |

| | 2,328 | | Cinemark Holdings, Inc. | | | 90,443 | |

| | | | | | | | |

| | | | FOOD — 1.1% | | | | |

| | 14,010 | | Darling Ingredients, Inc.(a) | | | 220,517 | |

| | 635 | | Fresh Del Monte Produce, Inc. | | | 32,328 | |

See accompanying notes to financial statements.

7

Wildermuth Endowment Strategy Fund

Schedule of Investments - Continued

June 30, 2017 (Unaudited)

Shares or Principal Amount | | | | Value | |

| | | COMMON STOCKS (CONTINUED) | | | |

| | | FOOD (Continued) | | | |

| | 3,967 | | Hain Celestial Group, Inc.(a) | | $ | 153,999 | |

| | 1,580 | | Performance Food Group Co.(a) | | | 43,292 | |

| | 23,872 | | Synlait Milk, Ltd. - Australia (a) | | | 74,526 | |

| | 23,500 | | Synlait Milk, Ltd. - New Zealand (a) | | | 72,953 | |

| | | | | | | 597,615 | |

| | | | FOREST PRODUCTS & PAPER — 0.1% | | | | |

| | 3,260 | | Mercer International, Inc. | | | 37,490 | |

| | | | | | | | |

| | | | GAS — 0.3% | | | | |

| | 4,832 | | Enagas SA | | | 135,294 | |

| | 760 | | UGI Corp. | | | 36,791 | |

| | | | | | | 172,085 | |

| | | | HEALTHCARE-PRODUCTS — 0.2% | | | | |

| | 4,194 | | Exactech, Inc.(a) | | | 124,981 | |

| | | | | | | | |

| | | | HEALTHCARE-SERVICES — 1.2% | | | | |

| | 874 | | Chemed Corp. | | | 178,759 | |

| | 1,621 | | Fresenius SE & Co. KGaA | | | 138,769 | |

| | 7,157 | | HealthSouth Corp. | | | 346,399 | |

| | | | | | | 663,927 | |

| | | | HOME FURNISHINGS — 0.3% | | | | |

| | 10,829 | | Panasonic Corp. | | | 146,880 | |

| | | | | | | | |

| | | | INSURANCE — 1.0% | | | | |

| | 9,840 | | State National Cos., Inc. | | | 180,859 | |

| | 433 | | Swiss Life Holding AG (a) | | | 146,308 | |

| | 1,548 | | Swiss Re AG | | | 141,675 | |

| | 2,117 | | Unum Group | | | 98,716 | |

| | | | | | | 567,558 | |

| | | | INTERNET — 0.2% | | | | |

| | 578 | | Iliad SA | | | 136,523 | |

| | | | | | | | |

| | | | LEISURE TIME — 0.3% | | | | |

| | 3,044 | | Norwegian Cruise Line Holdings, Ltd.(a) | | | 165,259 | |

| | | | | | | | |

| | | | LODGING — 0.8% | | | | |

| | 1,650 | | Marriott International, Inc., Class A | | | 165,511 | |

| | 41,300 | | Rezidor Hotel Group AB | | | 152,771 | |

| | 1,119 | | Wyndham Worldwide Corp. | | | 112,359 | |

| | | | | | | 430,641 | |

| | | | MACHINERY-DIVERSIFIED — 1.0% | | | | |

| | 648 | | Cummins, Inc. | | | 105,119 | |

| | 340 | | Deere & Co. | | | 42,021 | |

| | 8,700 | | Eagle Industry Co., Ltd. | | | 146,729 | |

See accompanying notes to financial statements.

8

Wildermuth Endowment Strategy Fund

Schedule of Investments - Continued

June 30, 2017 (Unaudited)

Shares or Principal Amount | | | | Value | |

| | | COMMON STOCKS (CONTINUED) | | | |

| | | MACHINERY-DIVERSIFIED (Continued) | | | |

| | 3,286 | | Hollysys Automation Technologies, Ltd. | | $ | 54,580 | |

| | 2,000 | | Zebra Technologies Corp., Class A(a) | | | 201,040 | |

| | | | | | | 549,489 | |

| | | | MINING — 0.4% | | | | |

| | 4,565 | | Coeur Mining, Inc.(a) | | | 39,168 | |

| | 19,439 | | Hudbay Minerals, Inc. | | | 111,774 | |

| | 470 | | Kaiser Aluminum Corp. | | | 41,605 | |

| | 13,380 | | Yamana Gold, Inc. | | | 32,513 | |

| | | | | | | 225,060 | |

| | | | OIL & GAS — 1.0% | | | | |

| | 2,395 | | Marathon Oil Corp. | | | 28,381 | |

| | 2,529 | | Murphy Oil Corp. | | | 64,818 | |

| | 3,505 | | Neste Oyj | | | 137,873 | |

| | 8,020 | | Rowan Cos. Plc, Class A(a) | | | 82,125 | |

| | 1,614 | | Tesoro Corp. | | | 151,070 | |

| | 1,650 | | Unit Corp.(a) | | | 30,905 | |

| | 835 | | Valero Energy Corp. | | | 56,329 | |

| | | | | | | 551,501 | |

| | | | OIL & GAS SERVICES — 0.4% | | | | |

| | 10,299 | | Subsea 7 SA | | | 138,071 | |

| | 5,447 | | World Point Terminals LP | | | 94,124 | |

| | | | | | | 232,195 | |

| | | | PHARMACEUTICALS — 1.9% | | | | |

| | 9,700 | | Astellas Pharma, Inc. | | | 118,660 | |

| | 530 | | Bayer AG | | | 68,426 | |

| | 6,126 | | Daiichi Sankyo Co., Ltd. | | | 144,318 | |

| | 920 | | Johnson & Johnson | | | 121,707 | |

| | 6,161 | | Mitsubishi Tanabe Pharma Corp. | | | 142,346 | |

| | 864 | | Novartis AG, ADR | | | 72,118 | |

| | 2,809 | | Novo Nordisk A/S, ADR | | | 120,478 | |

| | 7,170 | | Omega Protein Corp. | | | 128,343 | |

| | 2,041 | | UCB SA | | | 140,202 | |

| | | | | | | 1,056,598 | |

| | | | PIPELINES — 1.5% | | | | |

| | 5,200 | | Boardwalk Pipeline Partners LP | | | 93,652 | |

| | 1,306 | | Buckeye Partners LP | | | 83,493 | |

| | 2,495 | | DCP Midstream LP | | | 84,406 | |

| | 6,540 | | Energy Transfer Equity LP | | | 117,458 | |

| | 1,360 | | Enterprise Products Partners LP | | | 36,829 | |

| | 2,437 | | Genesis Energy LP | | | 77,326 | |

| | 1,340 | | ONEOK, Inc. | | | 69,894 | |

| | 1,813 | | Phillips 66 Partners LP | | | 89,599 | |

| | 1,896 | | Spectra Energy Partners LP | | | 81,338 | |

See accompanying notes to financial statements.

9

Wildermuth Endowment Strategy Fund

Schedule of Investments - Continued

June 30, 2017 (Unaudited)

Shares or Principal Amount | | | | Value | |

| | | COMMON STOCKS (CONTINUED) | | | |

| | | PIPELINES (CONTINUED) | | | |

| | 2,275 | | TC PipeLines LP | | $ | 125,125 | |

| | | | | | | 859,120 | |

| | | | RETAIL — 1.0% | | | | |

| | 1,687 | | Asbury Automotive Group, Inc.(a) | | | 95,400 | |

| | 850 | | CVS Health Corp. | | | 68,391 | |

| | 4,242 | | Michaels Cos., Inc.(a) | | | 78,562 | |

| | 3,925 | | MTY Food Group, Inc. | | | 140,112 | |

| | 1,202 | | Target Corp. | | | 62,852 | |

| | 1,312 | | Wal-Mart Stores, Inc. | | | 99,292 | |

| | | | | | | 544,609 | |

| | | | SEMICONDUCTORS — 2.0% | | | | |

| | 501 | | Broadcom, Ltd. | | | 116,758 | |

| | 3,131 | | Cirrus Logic, Inc.(a) | | | 196,376 | |

| | 2,940 | | Intel Corp. | | | 99,196 | |

| | 1,513 | | Lam Research Corp. | | | 213,984 | |

| | 809 | | NXP Semiconductors NV(a) | | | 88,545 | |

| | 1,473 | | Skyworks Solutions, Inc. | | | 141,335 | |

| | 34,689 | | Telit Communications PLC | | | 140,576 | |

| | 1,424 | | Texas Instruments, Inc. | | | 109,548 | |

| | | | | | | 1,106,318 | |

| | | | SOFTWARE — 1.0% | | | | |

| | 2,280 | | Cerner Corp.(a) | | | 151,552 | |

| | 759 | | Check Point Software Technologies, Ltd.(a) | | | 82,792 | |

| | 1,517 | | Dassault Systemes | | | 135,800 | |

| | 1,540 | | Fiserv, Inc.(a) | | | 188,403 | |

| | | | | | | 558,547 | |

| | | | TELECOMMUNICATIONS — 1.2% | | | | |

| | 23,007 | | CenturyLink, Inc. | | | 549,407 | |

| | 2,431 | | Millicom International Cellular SA | | | 143,417 | |

| | | | | | | 692,824 | |

| | | | TRANSPORTATION — 0.5% | | | | |

| | 3,650 | | Golar LNG Partners LP | | | 73,255 | |

| | 8,490 | | Ship Finance International, Ltd. | | | 115,464 | |

| | 2,190 | | Teekay LNG Partners LP | | | 33,617 | |

| | 15,426 | | Teekay Offshore Partners LP | | | 44,273 | |

| | | | | | | 266,609 | |

| | | | TRUCKING & LEASING — 0.4% | | | | |

| | 5,222 | | Greenbrier Cos., Inc. | | | 241,517 | |

| | | | | | | | |

| | | | TOTAL COMMON STOCKS (Cost $14,372,416) | | | 15,784,028 | |

See accompanying notes to financial statements.

10

Wildermuth Endowment Strategy Fund

Schedule of Investments - Continued

June 30, 2017 (Unaudited)

Shares or Principal Amount | | | | Value | |

| | | EXCHANGE TRADED FUNDS — 17.3% | | | |

| | | DEBT FUNDS — 2.5% | | | |

| | 5,690 | | iShares Emerging Markets High Yield Bond | | $ | 285,411 | |

| | 5,780 | | iShares Global High Yield Corporate Bond | | | 291,832 | |

| | 2,190 | | iShares iBoxx $High Yield Corporate Bond | | | 193,574 | |

| | 1,294 | | iShares iBoxx $Investment Grade Corporate Bond | | | 155,940 | |

| | 4,542 | | iShares J.P. Morgan Emerging Markets Local Currency Bond(a) | | | 211,657 | |

| | 1,340 | | iShares TIPS Bond | | | 151,996 | |

| | 2,100 | | PowerShares International Corporate Bond Portfolio | | | 55,167 | |

| | 1,247 | | SPDR Citi International Government Inflation-Protected Bond | | | 69,284 | |

| | | | | | | 1,414,861 | |

| | | | EQUITY FUNDS — 14.8% | | | | |

| | 51,500 | | Global X MSCI Colombia | | | 498,005 | |

| | 24,654 | | iShares MSCI All Peru Capped | | | 835,031 | |

| | 22,497 | | iShares MSCI Brazil Capped | | | 768,048 | |

| | 19,268 | | iShares MSCI Chile Capped | | | 802,898 | |

| | 26,765 | | iShares MSCI India | | | 859,156 | |

| | 22,532 | | iShares MSCI Philippines | | | 807,321 | |

| | 38,896 | | iShares MSCI Poland Capped | | | 944,395 | |

| | 29,656 | | iShares MSCI Taiwan | | | 1,060,498 | |

| | 10,798 | | iShares MSCI Thailand Capped | | | 841,812 | |

| | 40,792 | | VanEck Vectors Russia | | | 781,983 | |

| | | | | | | 8,199,147 | |

| | | | | | | | |

| | | | TOTAL EXCHANGE TRADED FUNDS (Cost $9,256,021) | | | 9,614,008 | |

| | | | | | | | |

| | | | COMMODITY & NATURAL RESOURCE INVESTMENTS — 4.4% | | | | |

| | 857 | | Casillas Petroleum Resource Partners, LLC(b) | | | 856,834 | |

| | 1,575,000 | | Kayne Anderson Energy Fund VII LP(b) | | | 1,588,313 | |

| | | | TOTAL COMMODITY & NATURAL RESOURCE INVESTMENTS (Cost $2,324,037) | | | 2,445,147 | |

| | | | | | | | |

| | | | HEDGE FUNDS — 8.7% | | | | |

| | 1,000 | | Condire Resource Partners LP(b) | | | 1,000,000 | |

| | 1,625,000 | | Direct Lending Income Fund LP(b) | | | 1,723,375 | |

| | 1,000 | | Esulep LLC Permo Fund(b) | | | 1,000,000 | |

| | 1,020,000 | | Rosebrook Opportunities Fund LP(b)(c) | | | 1,132,860 | |

| | | | TOTAL HEDGE FUNDS (Cost $4,645,000) | | | 4,856,235 | |

| | | | | | | | |

| | | | PRIVATE DEBT — 4.7% | | | | |

| $ | 500,000 | | Atlanta Healthcare Property Consultants, LLC, 12.00%, 8/19/2017(b) | | | 530,000 | |

| | 1,000,000 | | Doctor's Hospice of Georgia, Inc., 12.00%, 9/13/2017(b) | | | 1,060,000 | |

| | 1,000,000 | | Tout, Inc. - Convertible Promissory Note, 8.00%, 5/12/2018(b) | | | 1,000,000 | |

| | | | TOTAL PRIVATE DEBT (Cost $2,518,860) | | | 2,590,000 | |

See accompanying notes to financial statements.

11

Wildermuth Endowment Strategy Fund

Schedule of Investments - Continued

June 30, 2017 (Unaudited)

Shares or Principal Amount | | | | Value | |

| | | PRIVATE EQUITY — 14.1% | | | |

| | 350,000 | | Abbott Secondary Opportunities LP(b) | | $ | 363,611 | |

| | 100 | | Atlas Fintech Holdings Corp.(b) | | | 1,150,000 | |

| | 2,500 | | Clear Guide Medical, Inc.(b)(c) | | | 2,989,100 | |

| | 288,560 | | Committed Advisors Secondary Fund III(b) | | | 382,042 | |

| | 10 | | GPB Automotive Portfolio LP(b) | | | 500,696 | |

| | 500 | | Gravity Ranch Fund I LP(b)(c) | | | 500,000 | |

| | 438,000 | | Star Mountain Diversified Small Business Access Fund II LP(b) | | | 479,215 | |

| | 337,207 | | Tout, Inc. - Series C Preferred Stock(b) | | | 1,448,180 | |

| | | | TOTAL PRIVATE EQUITY (Cost $6,512,298) | | | 7,812,844 | |

| | | | | | | | |

| | | | PUBLIC NON-TRADED BUSINESS DEVELOPMENT COMPANIES — 1.3% | | | | |

| | 95,638 | | Franklin Square Energy & Power Fund(b) | | | 741,191 | |

| | | | TOTAL PUBLIC NON-TRADED BUSINESS DEVELOPMENT COMPANIES (Cost $642,607) | | | 741,191 | |

| | | | | | | | |

| | | | PRIVATE REAL ESTATE INVESTMENTS — 10.6% | | | | |

| | 95,075 | | ARCTRUST, Inc.(b) | | | 1,348,168 | |

| | 101,470 | | Cottonwood Residential, Inc.(b) | | | 1,714,843 | |

| | 621,841 | | Harbert Seniors Housing Fund I LP(b) | | | 701,743 | |

| | 800 | | PCG Select Series I LLC - Series A Preferred Stock(b) | | | 800,000 | |

| | 56 | | Shopoff Land Fund III LP(b) | | | 50,680 | |

| | 884,883 | | Stonehill Strategic Hotel Credit Opportunity Fund II LP(b) | | | 963,132 | |

| | 2,522 | | Walton Real Estate Fund VIII LP(b) | | | 281,193 | |

| | | | TOTAL PRIVATE REAL ESTATE INVESTMENTS (Cost $5,261,748) | | | 5,859,759 | |

| | | | | | | | |

| | | | PUBLIC REAL ESTATE INVESTMENTS — 2.2% | | | | |

| | | | PUBLIC NON-TRADED REAL ESTATE INVESTMENT TRUSTS — 2.1% | | | | |

| | 111,521 | | Behringer Harvard Opportunity(b) | | | 209,659 | |

| | 18,060 | | Dividend Capital Diversified(b) | | | 135,454 | |

| | 136,771 | | Highlands REIT, Inc.(b) | | | 47,870 | |

| | 153,283 | | Inventrust Properties Corp.(b) | | | 504,301 | |

| | 102,130 | | KBS REIT II, Inc.(b) | | | 252,773 | |

| | 3,330 | | Phillips Edison Grocery Center(b) | | | 33,964 | |

| | | | | | | 1,184,021 | |

| | | | PUBLIC NON-TRADED REAL ESTATE LIMITED PARTNERSHIP — 0.1% | | | | |

| | 1,725 | | Uniprop Manufactured Housing Communities Income Fund II(b) | | | 22,511 | |

| | | | TOTAL PUBLIC REAL ESTATE INVESTMENTS (Cost $971,394) | | | 1,206,532 | |

| | | | | | | | |

| | | | REAL ESTATE LOANS — 3.1% | | | | |

| $ | 400,000 | | Airport Center Development Partners, LLC, 9.50%, 9/17/2018(b) | | | 400,000 | |

| | 400,000 | | Dog Wood Park of Northeast Florida, LLC, 3.50%, 3/21/2018(b) | | | 400,000 | |

| | 400,000 | | Hauiki Hui, LLC, 9.50%, 1/1/2018(b) | | | 400,000 | |

| | 500,000 | | Saratoga Springs Partners, LLC, 9.50%, 11/1/2017(b) | | | 500,000 | |

| | | | TOTAL REAL ESTATE LOANS (Cost $1,624,500) | | | 1,700,000 | |

See accompanying notes to financial statements.

12

Wildermuth Endowment Strategy Fund

Schedule of Investments - Continued

June 30, 2017 (Unaudited)

Shares or Principal Amount | | | | Value | |

| | | SHORT-TERM INVESTMENTS — 4.2% | | | |

| | 2,332,987 | | Fidelity Institutional Government Portfolio - Institutional Class, 0.85%(d) | | $ | 2,332,987 | |

| | | | TOTAL SHORT-TERM INVESTMENTS (Cost $2,332,987) | | | 2,332,987 | |

| | | | | | | | |

| | | | TOTAL INVESTMENTS — 99.0% (Cost $50,461,868) | | | 54,942,731 | |

| | | | Other assets less liabilities — 1.0% | | | 579,665 | |

| | | | | | | | |

| | | | TOTAL NET ASSETS —100.0% | | $ | 55,522,396 | |

ADR – American Depositary Receipt

LLC – Limited Liability Company

LP – Limited Partnership

PLC – Public Limited Company

REIT – Real Estate Investment Trust

(b) | Illiquid Security. Total illiquid securities represent 49.01% of net assets as of June 30, 2017. |

(c) | Denotes an investment in an affiliated entity. Please refer to Note 8, Investments in Affiliated Issuers, in the Notes to the Financial Statements. |

(d) | Represents the current rate as of June 30, 2017. |

See accompanying notes to financial statements.

13

Wildermuth Endowment Strategy Fund

Statement of Assets and Liabilities

As of June 30, 2017 (Unaudited)

| Assets: | | | |

| Investments in unaffiliated issuers at value (cost $46,691,868) | | $ | 50,320,771 | |

| Investments at affiliated issuers at value (cost $3,770,000) | | | 4,621,960 | |

| Cash | | | 1,141 | |

| Receivables: | | | | |

| Investment securities sold | | | 255,355 | |

| Due from Adviser | | | 24,973 | |

| Dividends and interest | | | 146,980 | |

| Fund shares sold | | | 161,850 | |

| Prepaid expenses | | | 55,697 | |

| Total assets | | | 55,588,727 | |

| | | | | |

| Liabilities: | | | | |

| Payables: | | | | |

| Professional fees | | | 11,450 | |

| Shareholder servicing fees | | | 19,298 | |

| Transfer agent fees and expenses | | | 11,143 | |

| Fund accounting & administration | | | 12,017 | |

| Custody fees | | | 4,103 | |

| Distribution fees | | | 6,555 | |

| Accrued other liabilities | | | 1,765 | |

| Total liabilities | | | 66,331 | |

| Net Assets | | $ | 55,522,396 | |

| | | | | |

| Net Assets Consist of: | | | | |

| Paid in capital (unlimited shares authorized, 25,000,000 shares registered, no par value) | | $ | 50,809,927 | |

| Accumulated net investment loss | | | (135,516 | ) |

| Accumulated net realized gain on investments | | | 367,049 | |

| Net unrealized appreciation on: | | | | |

| Investments | | | 4,480,863 | |

| Foreign currency translations | | | 73 | |

| Net Assets | | $ | 55,522,396 | |

| | | | | |

| Net Assets: | | | | |

| Class A | | $ | 44,511,216 | |

| Class C | | | 10,997,082 | |

Class I(1) | | | 14,098 | |

| Net Assets | | $ | 55,522,396 | |

| | | | | |

| Shares of Beneficial Interest Issued and Outstanding: | | | | |

| Class A shares | | | 3,628,789 | |

| Class C shares | | | 905,902 | |

Class I shares(1) | | | 1,149 | |

| Total Shares Outstanding | | | 4,535,840 | |

| | | | | |

Net Asset Value, Offering Price and Redemption Proceeds per Share(2) | | | | |

| Class A | | $ | 12.27 | |

Class C(3) | | $ | 12.14 | |

Class I(1) | | $ | 12.27 | |

Class A - Maximum offering price per share (Net asset value per share divided by 0.94)(4) | | $ | 13.05 | |

(1) | Class I inception date was April 28, 2017. |

(2) | Redemptions made within 90 days of purchase may be assessed a redemption fee of 2.00%. |

(3) | Class C Shares of the Fund are subject to a Contingent Deferred Sales Charge (“CDSC”) of 1.00% on any shares sold within 365 days of purchase. |

(4) | Reflects a maximum sales charge of 6.00%. |

See accompanying notes to financial statements.

14

Wildermuth Endowment Strategy Fund

Statement of Operations

For the six months ended June 30, 2017 (Unaudited)

| Investment Income: | | | |

| Dividends from unaffiliated issuers (net of foreign withholding taxes of $7,733) | | $ | 372,191 | |

| Interest | | | 87,308 | |

| Total investment income | | | 459,499 | |

| | | | | |

| Expenses: | | | | |

| Advisory fees (see Note 4) | | | 339,635 | |

| Legal fees | | | 98,178 | |

| Accounting & administration servicing fees | | | 54,590 | |

| Shareholder servicing fees - Class A | | | 46,946 | |

| Transfer agent fees | | | 42,148 | |

| Distribution fees - Class C | | | 28,963 | |

| Registration fees | | | 26,537 | |

| Trustees' fees | | | 26,282 | |

| Printing and postage expenses | | | 23,066 | |

| Chief compliance officer fees | | | 21,908 | |

| Chief financial officer fees | | | 19,412 | |

| Miscellaneous Expenses | | | 16,791 | |

| Custodian fees | | | 12,784 | |

| Insurance expense | | | 12,704 | |

| Audit fees | | | 11,258 | |

| Shareholder servicing fees - Class C | | | 9,654 | |

| Total expenses | | | 790,856 | |

| Expenses waived and reimbursed from Adviser (see Note 4) | | | (195,841 | ) |

| Net expenses | | | 595,015 | |

| Net investment loss | | | (135,516 | ) |

| | | | | |

| Realized and Unrealized Gain (Loss) on Investments and Foreign Currency: | | | | |

| Net realized gain (loss) on: | | | | |

| Investments in unaffiliated issuers | | | 391,744 | |

| Foreign currency transactions | | | (3,924 | ) |

| Total net realized gain | | | 387,820 | |

| Net change in unrealized appreciation/depreciation on: | | | | |

| Investments in unaffiliated issuers | | | 1,739,945 | |

| Investments in affiliated issuers | | | 101,574 | |

| Foreign currency translations | | | 98 | |

| Total net change in unrealized appreciation/depreciation | | | 1,841,617 | |

| Net realized and unrealized gain on investments and foreign currency | | | 2,229,437 | |

| | | | | |

| Net Increase in Net Assets from Operations | | $ | 2,093,921 | |

See accompanying notes to financial statements.

15

Wildermuth Endowment Strategy Fund

Statements of Changes in Net Assets

| | | For the six

months ended

June 30, 2017

(Unaudited) | | | For the

year ended

December 31,

2016 | |

| Change in Net Assets From: | | | | | | |

| Operations: | | | | | | |

| Net investment loss | | $ | (135,516 | ) | | $ | (123 | ) |

| Net realized gain on investments | | | 387,820 | | | | 3,643 | |

| Distributions of realized gains by underlying investment companies | | | — | | | | 12,670 | |

| Net change in unrealized appreciation/depreciation on investments | | | 1,841,617 | | | | 2,584,553 | |

| Net increase in net assets resulting from operations | | | 2,093,921 | | | | 2,600,743 | |

| | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | |

| From return of capital - Class A | | | (448,435 | )(2) | | | (351,953 | ) |

| From return of capital - Class C | | | (104,344 | )(2) | | | (27,113 | )(3) |

From return of capital - Class I(1) | | | (91 | )(2) | | | — | |

| Total distributions to shareholders | | | (552,870 | ) | | | (379,066 | ) |

| | | | | | | | | |

| Capital Share Transactions: | | | | | | | | |

| Net proceeds from Class A shares sold | | | 12,492,426 | | | | 15,811,022 | |

| Net proceeds from Class C shares sold | | | 5,820,645 | | | | 4,773,737 | (3) |

Net proceeds from Class I shares sold(1) | | | 13,982 | | | | — | |

| Reinvestment of distributions from Class A shares | | | 274,876 | | | | 224,283 | |

| Reinvestment of distributions from Class C shares | | | 96,675 | | | | 24,899 | (3) |

Reinvestment of distributions from Class I shares(1) | | | 91 | | | | — | |

| Cost of Class A shares redeemed | | | (1,275,376 | ) | | | (867,149 | ) |

| Cost of Class C shares redeemed | | | (80,325 | ) | | | (20,000 | )(3) |

Cost of Class I shares redeemed(1) | | | — | | | | — | |

| Redemption fees | | | 1,465 | | | | 1,443 | |

| Net increase from capital share transactions | | | 17,344,459 | | | | 19,948,235 | |

| | | | | | | | | |

| Net change in net assets | | | 18,885,510 | | | | 22,169,912 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 36,636,886 | | | | 14,466,974 | |

| End of period | | $ | 55,522,396 | | | $ | 36,636,886 | |

| | | | | | | | | |

| Accumulated net investment loss | | $ | (135,516 | ) | | $ | — | |

| | | | | | | | | |

| Transactions in Shares: | | | | | | | | |

| Issuance of Class A shares | | | 1,028,171 | | | | 1,399,946 | |

| Issuance of Class C shares | | | 482,619 | | | | 421,583 | (3) |

Issuance of Class I Shares(1) | | | 1,142 | | | | — | |

| Class A shares reinvested | | | 22,542 | | | | 20,041 | |

| Class C shares reinvested | | | 8,003 | | | | 2,177 | (3) |

Class I shares reinvested(1) | | | 7 | | | | — | |

| Class A shares redeemed | | | (105,014 | ) | | | (77,088 | ) |

| Class C shares redeemed | | | (6,739 | ) | | | (1,741 | )(3) |

Class I shares redeemed(1) | | | — | | | | — | |

| Net increase in shares of beneficial interest outstanding | | | 1,430,731 | | | | 1,764,918 | |

(1) | Reflects operations for the period from April 28, 2017 (inception date) to June 30, 2017. |

(2) | The amounts and sources of distributions reported in this report reflect the estimates in order to comply with SEC regulations and are not being provided for tax reporting purposes. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the Fund’s investment experience during the remainder of its fiscal year and may be subject to changes based on tax regulations. The Fund will send you a Form 1099-DIV in early 2018 for the 2017 calendar year that will tell you how to report these distributions for federal income tax purposes (e.g., ordinary income, long-term capital gain or return of capital). |

(3) | Reflects operations for the period from March 14, 2016 (inception date) to December 31, 2016. |

See accompanying notes to financial statements.

16

Wildermuth Endowment Strategy Fund

Statement of Cash Flows (Unaudited)

| | | For the six

months ended

June 30, 2017 | |

| Cash flows from operating activities: | | | |

| Net change in net assets resulting from operations | | $ | 2,093,921 | |

| Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities: | | | | |

| Purchases of investments | | | (28,266,944 | ) |

| Purchase of short term investments, net | | | (563,746 | ) |

| Proceeds from sale of investments | | | 10,977,255 | |

| Net realized gain from investments | | | (391,744 | ) |

| Net unrealized appreciation on investments | | | (1,841,519 | ) |

| Return of capital and non-income distributions received | | | 1,066,648 | |

| | | | | |

| Changes in assets and liabilities | | | | |

| (Increase)/Decrease in assets: | | | | |

| Receivable from Tax Credit | | | 244,927 | |

| Receivable for securities sold | | | (255,355 | ) |

| Due from Investment Adviser | | | 25,864 | |

| Dividend and interest receivable | | | (77,586 | ) |

| Prepaid expenses and other assets | | | (10,971 | ) |

| Funded commitment | | | 300,000 | |

| Increase/(Decrease) in liabilities: | | | | |

| Payable for professional fees | | | (15,950 | ) |

| Payable for shareholder servicing fees | | | 3,622 | |

| Payables for transfer agent fees and expenses | | | (422 | ) |

| Payable for fund accounting and administration fees | | | 2,564 | |

| Payable for custody fees | | | 185 | |

| Payable for distribution fees | | | 3,625 | |

| Accrued expenses and other liabilities | | | (10,222 | ) |

| Net cash used in operating activities | | | (16,715,848 | ) |

| | | | | |

| Cash flows from financing activities: | | | | |

| Proceeds from shares sold | | | 18,251,501 | |

| Cost of shares redeemed, net of redemption fees | | | (1,354,236 | ) |

| Cash distributions paid, net of reinvestment | | | (181,228 | ) |

| Net cash provided by financing activities | | | 16,716,037 | |

| | | | | |

| Net increase in cash | | | 189 | |

| Cash at beginning of period | | | 952 | |

| Cash at end of period | | $ | 1,141 | |

| | | | | |

| Supplemental disclosure of non-cash activity: | | | | |

| Non-cash financing activities not included herein consist of reinvestment of distributions | | $ | 371,642 | |

See accompanying notes to financial statements.

17

Wildermuth Endowment Strategy Fund

Financial Highlights – Class A

Per share income and capital changes for a share outstanding throughout the period.

| | | For the six

months ended

June 30, 2017(1)(2)

(Unaudited) | | | For the

year ended

December 31,

2016(1)(2) | | | For the

period ended

December 31,

2015(12) | |

| | | | | | | | | | |

| Net asset value, beginning of period | | $ | 11.81 | | | $ | 10.79 | | | $ | 10.00 | |

| | | | | | | | | | | | | |

| Income from Investment Operations: | | | | | | | | | | | | |

Net investment income(3) | | | 0.00 | (4) | | | 0.01 | | | | 0.05 | |

| Net realized and unrealized gain on investments | | | 0.59 | | | | 1.19 | | | | 0.93 | (13) |

| Total from investment operations | | | 0.59 | | | | 1.20 | | | | 0.98 | |

| Less Distributions: | | | | | | | | | | | | |

| From net investment income | | | — | | | | — | | | | (0.03 | ) |

| From return of capital | | | (0.13 | )(5) | | | (0.18 | ) | | | (0.16 | ) |

| Total distributions | | | (0.13 | ) | | | (0.18 | ) | | | (0.19 | ) |

| | | | | | | | | | | | | |

| Net asset value, end of period | | $ | 12.27 | | | $ | 11.81 | | | $ | 10.79 | |

| | | | | | | | | | | | | |

Total return(6) | | | 5.02 | %(7) | | | 11.27 | % | | | 9.74 | %(7) |

| | | | | | | | | | | | | |

| Ratios and Supplemental Data: | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 44,511 | | | $ | 31,686 | | | $ | 14,467 | |

Ratio of expenses before waivers to average net assets(9) | | | 3.37 | %(8) | | | 4.73 | % | | | 16.65 | %(8) |

Ratio of net expenses to average net assets(9)(10) | | | 2.50 | %(8) | | | 2.50 | % | | | 2.50 | %(8) |

Ratio of net investment income (loss) to average net assets(9)(11) | | | (0.03 | %)(8) | | | 0.07 | % | | | 0.49 | %(8) |

| Portfolio turnover rate | | | 26 | %(7) | | | 55 | % | | | 107 | %(7) |

(1) | Includes adjustments in accordance with accounting principles generally accepted in the United States and consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder processing. |

(2) | Redemption fees consisted of per share amounts of less than $0.01. |

(3) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. |

(4) | This amount represents less than $0.01 per share. |

(5) | The amounts and sources of distributions reported in this report reflect the estimates in order to comply with SEC regulations and are not being provided for tax reporting purposes. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the Fund’s investment experience during the remainder of its fiscal year and may be subject to changes based on tax regulations. The Fund will send you a Form 1099-DIV in early 2018 for the 2017 calendar year that will tell you how to report these distributions for federal income tax purposes (e.g., ordinary income, long-term capital gain or return of capital). |

(6) | Total returns would have been lower had certain expenses not been waived or absorbed by the Adviser. Returns shown do not include payment of a maximum sales load of 6.00% of offering price. If the sales charge was included total returns would be lower. |

(9) | The ratios of expenses and net investment income to average net assets do not reflect the Fund’s proportionate share of income and expenses of underlying investment companies in which the Fund invests. |

(10) | Represents the ratio of expenses to average net assets net of fee waivers and/or expense reimbursements by adviser. |

(11) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

(12) | The Wildermuth Endowment Strategy Fund commenced operations on January 2, 2015 (inception date 12/31/2014). |

(13) | Realized and unrealized gain per share does not correlate to the aggregate of the net realized and unrealized gains on the Statement of Operations for the period ended December 31, 2015, primarily due to the timing of sales and repurchases of the Fund’s shares in relation to fluctuating market values for the Fund’s portfolio. |

See accompanying notes to financial statements.

18

Wildermuth Endowment Strategy Fund

Financial Highlights – Class C

Per share income and capital changes for a share outstanding throughout the period.

| | | For the six

months ended

June 30, 2017(1) (Unaudited) | | | For the

period ended

December 31,

2016(1)(10) | |

| | | | | | | |

| Net asset value, beginning of period | | $ | 11.73 | | | $ | 10.68 | |

| | | | | | | | | |

| Income from Investment Operations: | | | | | | | | |

Net investment loss(2) | | | (0.05 | ) | | | (0.07 | ) |

| Net realized and unrealized gain on investments | | | 0.59 | | | | 1.25 | |

| Total from investment operations | | | 0.54 | | | | 1.18 | |

| Less Distributions: | | | | | | | | |

| From return of capital | | | (0.13 | )(3) | | | (0.13 | ) |

| Total distributions | | | (0.13 | ) | | | (0.13 | ) |

| | | | | | | | | |

| Net asset value, end of period | | $ | 12.14 | | | $ | 11.73 | |

| | | | | | | | | |

Total return(4)(5) | | | 4.63 | % | | | 11.10 | % |

| | | | | | | | | |

| Ratios and Supplemental Data: | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 10,997 | | | $ | 4,951 | |

Ratio of expenses before waivers to average net assets(6)(7) | | | 4.09 | % | | | 5.63 | % |

Ratio of net expenses to average net assets(6)(7)(8) | | | 3.25 | % | | | 3.25 | % |

Ratio of net investment loss to average net assets(6)(7)(9) | | | (0.76 | %) | | | (0.77 | %) |

Portfolio turnover rate(5) | | | 26 | % | | | 55 | % |

(1) | Includes adjustments in accordance with accounting principles generally accepted in the United States and consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder processing. |

(2) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. |

(3) | The amounts and sources of distributions reported in this report reflect the estimates in order to comply with SEC regulations and are not being provided for tax reporting purposes. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the Fund’s investment experience during the remainder of its fiscal year and may be subject to changes based on tax regulations. The Fund will send you a Form 1099-DIV in early 2018 for the 2017 calendar year that will tell you how to report these distributions for federal income tax purposes (e.g., ordinary income, long-term capital gain or return of capital). |

(4) | Total returns would have been lower had certain expenses not been waived or absorbed by the Adviser. Returns shown do not include payment of a Contingent Deferred Sales Charge (“CDSC”) of 1.00% on any shares sold within 365 days of purchase. If the sales charge was included total returns would be lower. |

(7) | The ratios of expenses and net investment income to average net assets do not reflect the Fund’s proportionate share of income and expenses of underlying investment companies in which the Fund invests. |

(8) | Represents the ratio of expenses to average net assets net of fee waivers and/or expense reimbursements by adviser. |

(9) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

(10) | Reflects operations for the period from March 14, 2016 (inception date) to December 31, 2016. |

See accompanying notes to financial statements.

19

Wildermuth Endowment Strategy Fund

Financial Highlights – Class I

Per share income and capital changes for a share outstanding throughout the period.

| | | For the

period ended

June 30, 2017(1)(2)

(Unaudited) | |

| | | | |

| Net asset value, beginning of period | | $ | 12.26 | |

| | | | | |

| Income from Investment Operations: | | | | |

Net investment income(3) | | | 0.01 | |

| Net realized and unrealized gain on investments | | | 0.08 | |

| Total from investment operations | | | 0.09 | |

| Less Distributions: | | | | |

| From return of capital | | | (0.08 | )(4) |

| Total distributions | | | (0.08 | ) |

| | | | | |

| Net asset value, end of period | | $ | 12.27 | |

| | | | | |

Total return(5) | | | 0.73 | % |

| | | | | |

| Ratios and Supplemental Data: | | | | |

| Net assets, end of period (in thousands) | | $ | 14 | |

Ratio of expenses before waivers to average net assets(6)(7) | | | 3.65 | % |

Ratio of net expenses to average net assets(6)(7)(8) | | | 2.25 | % |

Ratio of net investment Income to average net assets(6)(7)(9) | | | 0.34 | % |

Portfolio turnover rate(5) | | | 26 | % |

(1) | Reflects operations for the period from April 28, 2017 (inception date) to June 30, 2017. |

(2) | Includes adjustments in accordance with accounting principles generally accepted in the United States and consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder processing. |

(3) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. |

(4) | The amounts and sources of distributions reported in this report reflect the estimates in order to comply with SEC regulations and are not being provided for tax reporting purposes. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the Fund’s investment experience during the remainder of its fiscal year and may be subject to changes based on tax regulations. The Fund will send you a Form 1099-DIV in early 2018 for the 2017 calendar year that will tell you how to report these distributions for federal income tax purposes (e.g., ordinary income, long-term capital gain or return of capital). |

(7) | The ratios of expenses and net investment income to average net assets do not reflect the Fund’s proportionate share of income and expenses of underlying investment companies in which the Fund invests. |

(8) | Represents the ratio of expenses to average net assets net of fee waivers and/or expense reimbursements by adviser. |

(9) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

See accompanying notes to financial statements.

20

Wildermuth Endowment Strategy Fund

Notes to Financial Statements

June 30, 2017 (Unaudited)

1. ORGANIZATION

Wildermuth Endowment Strategy Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, closed-end management investment company that is operated as an interval fund. The Fund was organized as a Delaware statutory trust on August 28, 2013, and did not have any operations from that date until December 31, 2014, other than those relating to organizational matters and registration of its shares under applicable securities law. The Fund commenced operations on January 2, 2015. The Fund’s investment objective is to seek total return through a combination of long-term capital appreciation and income generation. The Fund will pursue its objective by investing in assets that Wildermuth Advisory, LLC (the “Adviser”) believes provide favorable long-term capital appreciation and risk-adjusted return potential, as well as in income-producing assets that the Adviser believes will provide consistent income generation and liquidity.

The Fund is engaged in a continuous offering, up to a maximum of 25 million shares of beneficial interest, and will operate as an interval fund that will offer to make quarterly repurchases of shares at the Fund’s net asset value (“NAV”). The Fund currently offers three different classes of shares: Class A, Class C, and Class I shares.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates. The Fund is an investment company and follows the accounting and reporting requirements under Financial Accounting Standards Board (“FASB”) Accounting Standards (“ASC”) Topic 946, Financials Services – Investment Companies.

Investment Valuation – For purposes of determining the NAV of the Fund, and as applicable, readily marketable portfolio securities listed on the NYSE are valued, except as indicated below, at the last sale price reflected on the consolidated tape at the close of the NYSE on the business day as of which such value is being determined. If there has been no sale on such day, the securities are valued at the mean of the closing bid and asked prices on such day. If no bid or asked prices are quoted on such day or if market prices may be unreliable because of events occurring after the close of trading, then the security is valued by such method as the Fair Value Committee shall determine in good faith to reflect its fair market value. Readily marketable securities not listed on the NYSE but listed on other domestic or foreign securities exchanges are valued in a like manner. Portfolio securities traded on more than one securities exchange are valued at the last sale price on the business day as of which such value is being determined as reflected on the consolidated tape at the close of the exchange representing the principal market for such securities. Securities trading on NASDAQ are valued at the closing price, or, in the case of securities not reported by NASDAQ, a comparable source, as the Fair Value Committee deems appropriate to reflect their fair market value. If there has been no sale on such day, the securities are valued at the mean of the closing bid and asked prices for the day, or if no asked price is available, at the bid price. However, certain debt securities may be valued on the basis of prices provided by a pricing service based on broker or dealer supplied valuations or matrix pricing, a method of valuing securities by reference to the value of other securities with similar characteristics, such as rating, interest rate and maturity.

The “last reported” trade price or sale price or “closing” bid price of a security on any trading day shall be deemed to be: (a) with respect to securities traded primarily on the NYSE, the American Stock Exchange or NASDAQ, the last reported trade price or sale price, as the case may be, as of 4:00 p.m., Eastern Time, on that day, and (b) for securities listed, traded or quoted on any other exchange, market, system or service, the market price as of the end of the “regular hours” trading period that is generally accepted as such by such exchange, market, system or service. If, in the future, the benchmark times generally accepted in the securities industry for determining the market price of a stock as of a given trading day shall change from those set forth above, the fair market value of a security shall be determined as of such other generally accepted benchmark times.

Non-dollar-denominated securities, if any, are valued as of the close of the NYSE at the closing price of such securities in their principal trading market, but may be valued at fair value if subsequent events occurring before the computation of NAV have materially affected the value of the securities. Trading may take place in foreign issues held by the Fund, if any, at times when the Fund is not open for business. As a result, the Fund’s NAV may change at times when it is not possible to purchase or sell shares of the Fund.

21

Wildermuth Endowment Strategy Fund

Notes to Financial Statements - Continued

June 30, 2017 (Unaudited)

If market quotations are not readily available, securities are valued at fair values as determined in good faith by the Board of Trustees (the “Board”). The Board has delegated the day-to-day responsibility for determining these fair values in accordance with the policies it has approved to the Fair Value Committee, subject to Valuation Committee and ultimately Board oversight. The Fair Value Committee will provide the Board with periodic reports, no less frequently than quarterly, that discuss the functioning of the valuation process, if applicable to that period, and that identify issues and valuations problems that have arisen, if any. As appropriate, the Valuation Committee and the Board will review any securities valued by the Fair Value Committee in accordance with the Fund’s valuation policies during these periodic reports.

Investments in privately placed debt instruments initially will be valued at cost (purchase price plus all related acquisition costs and expenses, such as legal fees and closing costs) and thereafter will be revalued quarterly at fair value.

Investment Funds that are Private Funds and Non-Traded REITs (“Non-Traded Funds”) will be difficult to value, particularly to the extent that their underlying investments are not publicly traded. In the event a Non-Traded Fund does not report a value to the Fund on a timely basis, the Fair Value Committee, acting under the Valuation Committee and ultimately the Board’s supervision and pursuant to policies implemented by the Board, will determine the fair value of the Fund’s investment based on the most recent value reported by the Non-Traded Fund, as well as any other relevant information available at the time the Fund values its investments. Following procedures adopted by the Board, in the absence of specific transaction activity in a particular investment fund, the Fair Value Committee will consider whether it is appropriate, in light of all relevant circumstances, to value the Fund’s investment at the NAV reported by the Non-Traded Fund at the time of valuation or to adjust the value to reflect a premium or discount.

There is no single standard for determining fair value of a security. Rather, the Fair Value Committee’s fair value calculations will involve significant professional judgment in the application of both observable and unobservable attributes. In determining the fair value of a security for which there are no readily available market quotations, the Fair Value Committee, acting under the Valuation Committee and ultimately the Board’s supervision and pursuant to policies implemented by the Board, may consider several factors, including, but not limited to: (i) the nature and pricing history (if any) of the security; (ii) whether any dealer quotations for the security are available; (iii) possible valuation methodologies that could be used to determine the fair value of the security; (iv) the recommendation of the portfolio manager of the Fund with respect to the valuation of the security; (v) whether the same or similar securities are held by other accounts managed by the Adviser and the method used to price the security in those accounts; (vi) the extent to which the fair value to be determined for the security will result from the use of data or formula produced by third parties independent of the Fund; and (vii) the liquidity or illiquidity of the market for the security. Based on its review of all relevant information, the Fair Value Committee may conclude in certain circumstances that the information provided by the asset manager and/or issuer of a Non-Traded Fund does not represent the fair value of the Fund’s investment in such security.

Because any Corporate Subsidiary through which the Fund invests in private equity investments or private oil and gas funds is treated as a regular taxable corporation, for U.S. federal income tax purposes any Corporate Subsidiary will incur tax expenses. Any Corporate Subsidiary used by the Fund will accrue, in accordance with generally accepted accounting principles, a deferred income tax liability balance at the currently effective maximum statutory U.S. federal income tax rate (currently 35%) plus an assumed state and local income tax rate, for its future tax liability associated with the capital appreciation of its investments and the distributions received on equity securities considered to be return of capital. In calculating its Daily NAV, the Fund will, among other things, account for any Corporate Subsidiary’s deferred tax liability and/or asset balances. Any deferred tax liability balance of any Corporate Subsidiary used by the Fund will reduce the Fund’s NAV.

GAAP defines fair value, establishes a three-tier framework for measuring fair value based on a hierarchy of inputs, and expands disclosure about fair value measurements. It also provides guidance on determining when there has been a significant decrease in the volume and level of activity for an asset or liability, when a transaction is not orderly and how that information must be incorporated into a fair value measurement. The hierarchy distinguishes between market data obtained from independent sources (observable inputs) and the Fund’s own market assumptions (unobservable inputs). These inputs are used in determining the fair value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| | ● | Level 1 – quoted prices in active markets for identical securities. An active market for the security is a market in which transactions occur with sufficient frequency and volume to provide pricing information on an ongoing basis. A quoted price in an active market provides the most reliable evidence of fair value. |

22

Wildermuth Endowment Strategy Fund

Notes to Financial Statements - Continued

June 30, 2017 (Unaudited)

| | ● | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc. and quoted prices for identical or similar assets in markets that are not active.) Inputs that are derived principally from or corroborated by observable market data. An adjustment to any observable input that is significant to the fair value may render the measurement a Level 3 measurement. |

| | ● | Level 3 – significant unobservable inputs, including the Fund’s own assumptions in determining the fair value of investments. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following is a summary of the valuation inputs, representing 100% of the Fund’s investments, used to value the Fund’s assets and liabilities as of June 30, 2017:

| | | | | | Fair Value Measurements at the

End of the Reporting Period Using | | | | |

| Investment in Securities | | Practical

Expedient** | | | Level 1

Quoted Prices | | | Level 2

Other Significant Observable Inputs | | | Level 3

Significant Unobservable Inputs | | | Total | |

| Security Type | | | | | | | | | | | | | | | |

| Common Stock* | | $ | — | | | $ | 15,784,028 | | | $ | — | | | $ | — | | | $ | 15,784,028 | |

| Exchange Traded Funds* | | | — | | | | 9,614,008 | | | | — | | | | — | | | | 9,614,008 | |

| Commodity & Natural Resource Investments | | | 1,588,313 | (1)(6)(7) | | | — | | | | — | | | | 856,834 | | | | 2,445,147 | |

| Hedge Funds | | | 4,856,235 | (2)(6)(7) | | | — | | | | — | | | | — | | | | 4,856,235 | |

| Private Debt | | | — | | | | — | | | | — | | | | 2,590,000 | | | | 2,590,000 | |

| Private Equity | | | 842,826 | (3)(6)(7) | | | — | | | | — | | | | 6,970,018 | | | | 7,812,844 | |

| Public Non-Traded Business Development Companies | | | — | | | | — | | | | — | | | | 741,191 | | | | 741,191 | |

| Private Real Estate Investments | | | 1,501,743 | (4)(6)(7) | | | — | | | | — | | | | 4,358,016 | | | | 5,859,759 | |

| Public Real Estate Investments* | | | — | | | | — | | | | — | | | | 1,206,532 | | | | 1,206,532 | |

| Real Estate Loans | | | 1,700,000 | (5)(7) | | | — | | | | — | | | | — | | | | 1,700,000 | |

| Short Term Investments | | | — | | | | 2,332,987 | | | | — | | | | — | | | | 2,332,987 | |

| Total | | $ | 10,489,117 | | | $ | 27,731,023 | | | $ | — | | | $ | 16,722,591 | | | $ | 54,942,731 | |

| * | All sub-categories within the security type represent their respective evaluation status. For a detailed breakout by industry, please refer to the Schedule of Investments. |

| ** | Certain investments that are measured at fair value using the net asset value per share (or its equivalent) practical expedient have not been categorized in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the schedule of investments. |

23

Wildermuth Endowment Strategy Fund

Notes to Financial Statements - Continued

June 30, 2017 (Unaudited)

(1) | Security | Withdrawals Permitted | Redemption Notice Period | Investment Objective | Investment Strategy | Lock Up Period |

| | Kayne Anderson Energy Fund VII | Not

Applicable | Not

Applicable | Capital Gains | Purchase oil and gas; extraction and production companies. | None |

| | | | | | | |

(2) | Security | Withdrawals Permitted | Redemption Notice Period | Investment Objective | Investment Strategy | Lock Up Period |

| | Condire Resource Partners LP | Quarterly | 45 days | Capital Gains | Long/short mining and energy | 12 months |

| | Direct Lending Income Fund LP | Quarterly | 35 days | Current Income | Buying existing small business loans | None |

| | Esulep LLC Permo Fund | Monthly | 21 days | Capital Gains | S&P futures and options spreads | None |

| | Rosebrook Opportunities Fund LP | Quarterly | Not Applicable | Capital Appreciation | Buying distressed hedge fund assets | None |

| | | | | | | |

(3) | Security | Withdrawals Permitted | Redemption Notice Period | Investment Objective | Investment Strategy | Lock Up Period |

| | Abbot Secondary Opportunities LP | Not

Applicable | Not

Applicable | Capital Gains | Purchase private equity funds on secondary market | None |

| | Star Mountain Diversified Small Business Access Fund II LP | Not

Applicable | Not

Applicable | Capital Appreciation | Structured Credit | None |

| | | | | | | |

(4) | Security | Withdrawals Permitted | Redemption Notice Period | Investment Objective | Investment Strategy | Lock Up Period |

| | Harbert Seniors Housing Fund I LP | Quarterly | Not

Applicable | Income and Capital Appreciation | Real Estate | None |

| | PCG Select Series I LLC - Series A Preferred Stock | Not

Applicable | Not

Applicable | Income | Real Estate Loans | None |

| | | | | | | |

(5) | Security | Withdrawals Permitted | Redemption Notice Period | Investment Objective | Investment Strategy | Lock Up Period |

| | Airport Center Development Partners, LLC | Not

Applicable | Not

Applicable | Income | Real Estate Loans | None |

| | Dog Wood Park of Northeast Florida, LLC | Not

Applicable | Not

Applicable | Income | Real Estate Loans | None |

| | Hauiki Hui, LLC | Not

Applicable | Not

Applicable | Income | Real Estate Loans | None |

| | Saratoga Springs Partners, LLC | Not

Applicable | Not

Applicable | Income | Real Estate Loans | None |

(6) | Redemption frequency and redemption notice period reflect general redemption terms, and exclude liquidity restrictions. Different tranches may have different liquidity terms and may be subject to investor level gates. |

(7) | These investments are domiciled in the United States. |

For the period ended June 30, 2017, there were no transfers in and out of Level 1 and Level 2 or into Level 3. The transfers out of Level 3 in the following table represent securities now being valued using net asset value per share practical expedient, which is not included in the fair value measurement hierarchy. It is the Fund’s policy to recognize transfers into and out of all Levels at the end of the reporting period.

24

Wildermuth Endowment Strategy Fund

Notes to Financial Statements - Continued

June 30, 2017 (Unaudited)

The following is a roll forward of the activity in investments in which significant unobservable inputs (Level 3) were used in determining fair value on a recurring basis:

| | | Beginning balance January 1, 2017 | | | Transfers into

Level 3 during the period | | | Transfers out of

Level 3 during the period | | | Purchases | | | Sales or Conversions | | | Net realized gain | | | Return of Capital | | | Tax Basis Adjustments | | | Change

in net unrealized gain | | | Ending balance

June 30,

2017 | |

| Commodity & Natural Resource Investments | | $ | 856,834 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 856,834 | |

| Private Debt | | | — | | | | — | | | | — | | | | 2,518,860 | | | | — | | | | — | | | | — | | | | — | | | | 71,140 | | | | 2,590,000 | |

| Private Equity | | | 5,089,793 | | | | — | | | | — | | | | 1,314,399 | | | | — | | | | — | | | | — | | | | — | | | | 565,826 | | | | 6,970,018 | |

| Public Non-Traded Business Development Companies | | | 718,716 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (1,241 | ) | | | 23,716 | | | | 741,191 | |

| Private Real Estate Investments | | | 4,953,388 | | | | — | | | | (800,000 | ) | | | 252,191 | | | | — | | | | — | | | | (115,117 | ) | | | (50,009 | ) | | | 117,563 | | | | 4,358,016 | |

| Public Real Estate Investments | | | 1,776,721 | | | | — | | | | — | | | | — | | | | (334,163 | )* | | | — | | | | (102,131 | ) | | | (6,572 | ) | | | (127,323 | ) | | | 1,206,532 | |

| | | $ | 13,395,452 | | | $ | — | | | $ | (800,000 | ) | | $ | 4,085,450 | | | $ | (334,163 | ) | | $ | — | | | $ | (217,248 | ) | | $ | (57,822 | ) | | $ | 650,922 | | | $ | 16,722,591 | |

| * | Represents $334,163 in public real estate investments, which along with an accumulated loss of $36,432, was converted to common stock. |

The change in net unrealized gain included in the Statement of Operations attributable to Level 3 investments as of June 30, 2017 is $650,922.

The following is a summary of quantitative information about significant unobservable valuation inputs for Level 3 Fair Value Measurements for investments held as of June 30, 2017:

| Type of Level 3 Investment | | Fair Value as of

June 30, 2017 | | Valuation Technique | Unobservable Inputs |

Commodity & Natural

Resource Investments | | $ | 856,834 | | Private Transaction Cost | Not Applicable* |

| Private Equity | | $ | 6,970,018 | | Private Transaction Cost, Option Pricing Method** | Not Applicable* |

Public Non- Traded Business

Development Companies | | $ | 741,191 | | Current Value Method*** | Not Applicable* |

| Private Real Estate Investments | | $ | 4,358,016 | | Private Transaction Cost | Not Applicable* |

| Public Real Estate Investments | | $ | 1,206,532 | | Current Value Method*** | Not Applicable* |

| Private Debt | | $ | 2,590,000 | | Private Transaction Cost | Not Applicable* |

| * | Financial information is not prepared in accordance with GAAP or ASC Topic 946 |

| ** | Relies on financial option theory to allocate value among difference classes of members’ equity based upon a future option “claim” on value. Under this method, the values of the various classes of stock are estimated as the net value of a series of call options, representing the present value of the expected future returns to the shareholders. |

| *** | The Current Value Method, also referred to as the “Waterfall Method,” is based on allocating the Enterprise Value (individual assets net of liabilities) across the various classes of securities, in conformance with liquidation preferences and conversion values. |

Security Transactions and Related Income – Security transactions are accounted for on trade date basis. Interest income is recognized on an accrual basis. Discounts are accreted and premiums are amortized on securities purchased over the lives of the respective securities. Dividend income is recorded on the ex-dividend date. Realized gains or losses from sales of securities are determined by comparing the identified cost of the security lot sold with the net sales proceeds.

25

Wildermuth Endowment Strategy Fund

Notes to Financial Statements - Continued

June 30, 2017 (Unaudited)

Dividends and Distributions to Shareholders – Dividends from gross investment income are declared and distributed quarterly. Distributable net realized capital gains are declared and distributed annually. Dividends from gross investment income and distributions from net realized gains are recorded on ex- dividend date and determined in accordance with federal income tax regulations, which may differ from GAAP. These “book/tax” differences are considered either temporary (i.e., deferred losses, capital loss carry forwards) or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the composition of net assets based on their federal tax-basis treatment; temporary differences do not require reclassification.

Distributions received from investments in securities that represent a return of capital or capital gains are recorded as a reduction of cost of investment or as a realized gain, respectively. The calendar year-end amounts of ordinary income, capital gains, and return of capital included in distributions received from the Fund’s investments in real estate investment trusts (“REITs”) are reported to the Fund after the end of the calendar year; accordingly, the Fund estimates these amounts for accounting purposes until the characterization of REIT distributions is reported to the Fund after the end of the calendar year. Estimates are based on the most recent REIT distribution information available.