UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-22888

Wildermuth Endowment Strategy Fund

(Exact name of registrant as specified in charter)

11525 Park Woods Circle, Ste. 200

Alpharetta, GA 30005

(Address of principal executive offices) (Zip code)

Daniel Wildermuth

Wildermuth Advisory, LLC

11525 Park Woods Circle, Ste. 200

Alpharetta, GA 30005

(Name and address of agent for service)

COPIES TO:

John H. Grady

DLA Piper (U.S.), LLP

1650 Market Street, Ste. 4900

Philadelphia, Pennsylvania 19103

Registrant's telephone number, including area code: (888) 889-8981

Date of fiscal year end: December 31

Date of reporting period: December 31, 2017

Item 1. Reports to Stockholders.

ANNUAL REPORT

December 31, 2017

WWW.WILDERMUTHENDOWMENTFUND.COM ● 1-888-889-8981 ●

DISTRIBUTED BY WILDERMUTH SECURITIES, LLC AND

UMB DISTRIBUTION SERVICES, LLC (MEMBERS OF FINRA)

Wildermuth Endowment Strategy Fund |

Table of Contents | |

| |

Letter to Shareholders | 2 |

Portfolio Review | 4 |

Portfolio Composition | 6 |

Schedule of Investments | 7 |

Statement of Assets and Liabilities | 15 |

Statement of Operations | 16 |

Statements of Changes in Net Assets | 17 |

Statement of Cash Flows | 18 |

Financial Highlights | 19 |

Notes to Financial Statements | 22 |

Report of Independent Registered Public Accounting Firm | 36 |

Trustees and Officers | 37 |

Additional Information | 40 |

Privacy Policy | 42 |

Wildermuth Endowment Strategy Fund Letter to Shareholders

December 31, 2017 |

Dear Investor:

We are pleased to present this annual report for the Wildermuth Endowment Strategy Fund (the “Fund”) covering the 12-month period from January 1, 2017 to December 31, 2017.

The asset classes that most contributed to the Fund’s performance included U.S. public equity, developed market equity, emerging market equity, private equity, real estate, and real estate debt. Asset classes such as absolute return (hedge funds), oil and gas, commodities, and fixed income also contributed to returns, but underperformed the broader Fund.

Public equity markets in the U.S. and abroad contributed to Fund’s total performance through delivering very strong overall returns. U.S. equities generated excellent returns with all of the Fund’s domestic strategies outperforming the overall Fund’s return. Similarly, international public equity investments in developed and emerging markets delivered even stronger returns than domestic markets.

Within private equity, successful company growth and development contributed to strong returns across the category. In the real estate sector, nearly all classifications enjoyed success, including multifamily, opportunistic, leisure, healthcare, and office. Returns were generated through both rental income and capital appreciation.

Absolute return as a category generated solid returns, with some positions creating substantial gains while others generated more muted performance.

Oil and gas enjoyed solid returns on the year after enduring a slow start. Commodities through the inclusion of equities operating within the commodities sector also added to the Fund’s returns although these returns were not as strong as others, reducing the Fund’s total return for the year.

A few other asset classes within the Fund experienced weak returns on the year. Fixed income’s contribution to Fund returns was muted and cash holdings generated near zero gains.

2

Wildermuth Endowment Strategy Fund Letter to Shareholders - Continued

December 31, 2017 |

As we move through 2018, we believe that equity market prices remain somewhat elevated in spite of the market’s pullback early in the year. Similarly, some asset prices in non-traditional asset classes have also risen over the past few years leaving fewer obvious opportunities. Yet, we believe much opportunity to add value remains through the intelligent investment selection in both public and non-public markets. Within public markets, we believe our approach emphasizing individual security selection is particularly relevant for today’s market environment. We also remain excited about individual investment opportunities within many of the non-traditional asset classes, particularly private equity, real estate and increasingly absolute return. We also believe the Fund is uniquely positioned to benefit from the current investment environment.

Thank you for your continued confidence and support.

Sincerely,

Daniel Wildermuth

President and Chief Executive Officer, and

Chairman and Trustee of the Fund

May 2018

Performance data quoted represents past performance and is not a guarantee of future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month-end, please call 1-888-889-8981.

The expense ratio for as of the most recent prospectus (5/1/2017) is 5.46% gross/ 3.23% net for the A shares & 5.21% gross/ 2.98% net for the I shares. The advisor has contractually waived certain fund expenses through April 30, 2019. In the absence of such waiver, the returns would be reduced.

1 | The Class I inception date was 4/28/2017. |

2 | Class A Shares have a maximum sales charge of 5.75%. |

3 | Morningstar’s annualized returns includes both income and capital gains or losses and is not adjusted for sales charges. Rankings are as of 12/31/17 and include the closed-end and open-end funds in the World Allocation Category. A fund with multiple share classes received a ranking for each eligible share class. 2018 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. |

4 | The Sortino ratio is a variation of the Sharpe ratio that differentiates harmful volatility from total overall volatility by using the asset’s standard deviation of negative asset returns, called downside deviation. |

5 | Alpha is a measure of an investment’s performance on a risk-adjusted basis. It takes the volatility (price risk) of a security or fund portfolio and compares its risk-adjusted performance to a benchmark index. The excess return of the investment relative to the return of the benchmark index is its alpha. |

3

Wildermuth Endowment Strategy Fund Portfolio Review

December 31, 2017 (Unaudited) |

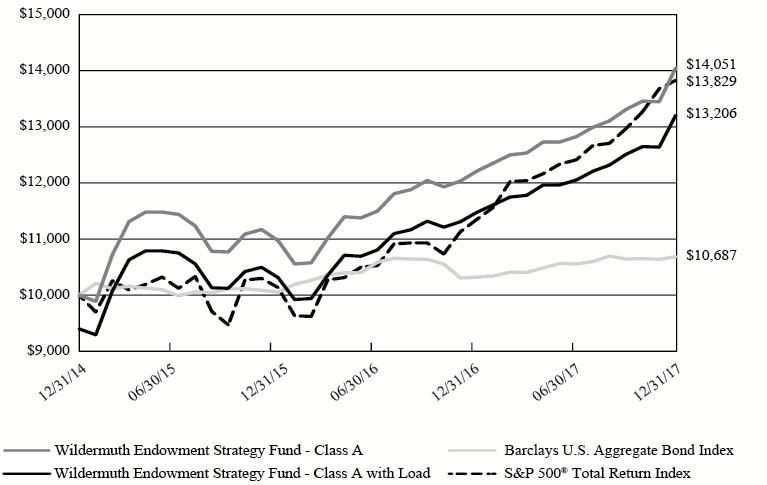

The Fund’s performance figures* for each of the periods ended December 31, 2017, compared to its benchmarks:

| Two

Years | One

Year | Annualized

Since Inception1 |

Class A | 13.16% | 15.07% | 12.00% |

Class A with Load2 | 9.70% | 8.20% | 9.71% |

S&P 500® Total Return Index** | 16.79% | 21.83% | 11.41% |

Barclays U.S. Aggregate Bond Index*** | 3.09% | 3.54% | 2.24% |

| | | | |

| | One

Year | Annualized

Since Inception3 |

Class C | | 14.23% | 14.15% |

Class C with Sales Charge | | 13.23%4 | 14.15% |

S&P 500® Total Return Index** | | 21.83% | 19.28% |

Barclays U.S. Aggregate Bond Index*** | | 3.54% | 2.41% |

| | | | |

| | | Cumulative

Since Inception5,6 |

Class I | | | 10.87% |

S&P 500® Total Return Index** | | | 13.70% |

Barclays U.S. Aggregate Bond Index*** | | | 1.92% |

1 | The Class A inception date is December 31, 2014. |

2 | Calculated using a maximum sales load. The maximum sales load was 6.00% from the Class A inception date through October 19, 2017. Effective October 20, 2017 the maximum sales load is 5.75%. |

3 | The Class C inception date is March 14, 2016. |

4 | Class C shares are subject to a Contingent Deferred Sales Charge of 1.00% on any shares redeemed within 365 days of purchase. |

5 | The Class I inception date is April 28, 2017. |

6 | Not annualized for periods less than one year. |

* | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Class A has a total annual operating expense of 5.46%, Class C has a total annual operating expense of 6.21%, and Class I has a total annual operating expense of 5.21%, respectively, per the prospectus dated May 1, 2017. |

** | The S&P 500® Total Return Index is an unmanaged market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an index. |

*** | The Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-through securities), ABS, and CMBS. Investors cannot invest directly in an index. |

4

Wildermuth Endowment Strategy Fund Portfolio Review - Continued

December 31, 2017 (Unaudited) |

Growth of a $10,000 Investment

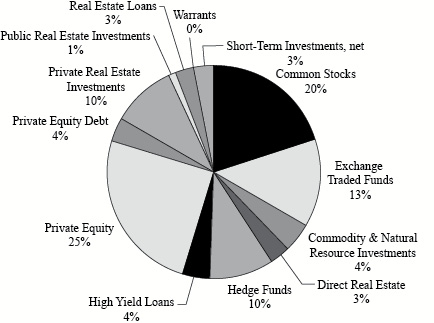

Holdings by type of Investment | % of

Net Assets |

|

Common Stocks | 20.2% |

Exchange Traded Funds | 13.4 |

Commodity & Natural Resource Investments | 4.4 |

Direct Real Estate | 3.0 |

Hedge Funds | 9.6 |

High Yield Loans | 4.2 |

Private Equity | 25.0 |

Private Equity Debt | 3.8 |

Private Real Estate Investments | 9.5 |

Public Real Estate Investments | 1.2 |

Real Estate Loans | 2.7 |

Warrants | 0.0 |

Short-Term Investments, net | 3.0 |

| | 100.0% |

| | |

Please refer to the Schedule of Investments in this Annual Report for detailed analysis of the Fund’s Holdings.

5

Wildermuth Endowment Strategy Fund Portfolio Composition

December 31, 2017 |

| Country of Investment | | Value | | | % of Net

Assets | |

| Australia | | $ | 473,782 | | | | 0.6 | % |

| Belgium | | | 376,443 | | | | 0.5 | |

| Bermuda | | | 62,365 | | | | 0.1 | |

| Canada | | | 841,549 | | | | 1.0 | |

| Denmark | | | 164,713 | | | | 0.2 | |

| Finland | | | 246,955 | | | | 0.3 | |

| France | | | 777,064 | | | | 1.0 | |

| Germany | | | 367,782 | | | | 0.5 | |

| Ireland | | | 3,366,643 | | | | 4.2 | |

| Israel | | | 240,923 | | | | 0.3 | |

| Japan | | | 2,419,069 | | | | 3.0 | |

| South Korea | | | 150,063 | | | | 0.2 | |

| Luxembourg | | | 140,575 | | | | 0.2 | |

| Netherlands | | | 287,905 | | | | 0.4 | |

| New Zealand | | | 243,381 | | | | 0.3 | |

| Norway | | | 106,795 | | | | 0.1 | |

| Singapore | | | 328,484 | | | | 0.4 | |

| Spain | | | 129,381 | | | | 0.2 | |

| Sweden | | | 185,147 | | | | 0.2 | |

| Switzerland | | | 119,979 | | | | 0.1 | |

| United Arab Emirates | | | 41,529 | | | | 0.1 | |

| United Kingdom | | | 382,556 | | | | 0.5 | |

| United States | | | 68,833,208 | | | | 85.6 | |

| | | $ | 80,286,291 | | | | 100.0 | % |

6

Wildermuth Endowment Strategy Fund Schedule of Investments

December 31, 2017 |

Shares,

Principal

Amount,

or Units | | | | | Value | |

| | | | COMMON STOCKS — 20.2% | | | |

| | | | AGRICULTURE — 0.3% | | | |

| | 839 | | | Bunge, Ltd. | | $ | 56,280 | |

| | 2,367 | | | Sipef SA | | | 178,491 | |

| | | | | | | | 234,771 | |

| | | | | AIRLINES — 0.3% | | | | |

| | 35,701 | | | Qantas Airways, Ltd. | | | 140,737 | |

| | 2,075 | | | Southwest Airlines Co. | | | 135,809 | |

| | | | | | | | 276,546 | |

| | | | | APPAREL — 0.2% | | | | |

| | 6,350 | | | Hanesbrands, Inc. | | | 132,779 | |

| | | | | | | | | |

| | | | | AUTO MANUFACTURERS — 0.5% | | | | |

| | 18,200 | | | Nissan Motor Co., Ltd. | | | 181,515 | |

| | 3,300 | | | Suzuki Motor Corp. | | | 191,409 | |

| | | | | | | | 372,924 | |

| | | | | AUTO PARTS & EQUIPMENT — 0.3% | | | | |

| | 7,950 | | | American Axle & Manufacturing Holdings, Inc.(a) | | | 135,389 | |

| | 1,371 | | | Tenneco, Inc. | | | 80,258 | |

| | | | | | | | 215,647 | |

| | | | | BANKS — 2.1% | | | | |

| | 1,414 | | | Capital One Financial Corp. | | | 140,806 | |

| | 23,000 | | | Chiba Bank, Ltd. | | | 191,514 | |

| | 5,030 | | | Customers Bancorp, Inc.(a) | | | 130,730 | |

| | 10,600 | | | Deutsche Bank AG | | | 202,059 | |

| | 9,419 | | | FNB Corp. | | | 130,171 | |

| | 1,246 | | | JPMorgan Chase & Co. | | | 133,247 | |

| | 18,614 | | | Mitsubishi UFJ Financial Group, Inc., ADR | | | 135,324 | |

| | 20,800 | | | Oversea-Chinese Banking Corp., Ltd. | | | 192,840 | |

| | 4,600 | | | Sumitomo Mitsui Trust Holdings, Inc. | | | 182,652 | |

| | 2,222 | | | Wells Fargo & Co. | | | 134,809 | |

| | 2,300 | | | Western Alliance Bancorp(a) | | | 130,226 | |

| | | | | | | | 1,704,378 | |

| | | | | BEVERAGES — 0.2% | | | | |

| | 746 | | | Constellation Brands, Inc., Class A | | | 170,513 | |

| | | | | | | | | |

| | | | | BIOTECHNOLOGY — 0.1% | | | | |

| | 719 | | | United Therapeutics Corp.(a) | | | 106,376 | |

| | | | | | | | | |

| | | | | BUILDING MATERIALS — 1.1% | | | | |

| | 4,500 | | | Asahi Glass Co., Ltd. | | | 194,940 | |

| | 11,800 | | | Nihon Flush Co., Ltd. | | | 353,005 | |

| | 3,326 | | | Owens Corning | | | 305,792 | |

| | | | | | | | 853,737 | |

See accompanying notes to financial statements.

7

Wildermuth Endowment Strategy Fund Schedule of Investments - Continued

December 31, 2017 |

Shares,

Principal

Amount,

or Units | | | | | Value | |

| | | | COMMON STOCKS (CONTINUED) | | | |

| | | | CHEMICALS — 0.1% | | | |

| | 559 | | | LyondellBasell Industries NV, Class A | | $ | 61,669 | |

| | | | | | | | | |

| | | | | COMMERCIAL SERVICES — 0.6% | | | | |

| | 15,046 | | | McMillan Shakespeare, Ltd. | | | 203,830 | |

| | 789 | | | S&P Global, Inc. | | | 133,657 | |

| | 1,044 | | | United Rentals, Inc.(a) | | | 179,474 | |

| | | | | | | | 516,961 | |

| | | | | COMPUTERS — 0.2% | | | | |

| | 853 | | | International Business Machines Corp. | | | 130,867 | |

| | | | | | | | | |

| | | | | DISTRIBUTION/WHOLESALE — 0.2% | | | | |

| | 16,016 | | | Inchcape PLC | | | 169,542 | |

| | | | | | | | | |

| | | | | DIVERSIFIED FINANCIAL SERVICES — 0.7% | | | | |

| | 4,600 | | | Ally Financial, Inc. | | | 134,136 | |

| | 4,998 | | | Intrum Justitia AB | | | 185,147 | |

| | 32,000 | | | Mitsubishi UFJ Lease & Finance Co., Ltd. | | | 190,608 | |

| | 3,225 | | | Pzena Investment Management, Inc., Class A | | | 34,411 | |

| | | | | | | | 544,302 | |

| | | | | ELECTRIC — 0.2% | | | | |

| | 6,100 | | | Atlantica Yield PLC | | | 129,381 | |

| | | | | | | | | |

| | | | | ELECTRONICS — 0.3% | | | | |

| | 40,700 | | | Japan Display, Inc.(a) | | | 82,376 | |

| | 3,230 | | | Orbotech, Ltd.(a) | | | 162,275 | |

| | | | | | | | 244,651 | |

| | | | | ENERGY-ALTERNATE SOURCES — 0.2% | | | | |

| | 14,846 | | | Innergex Renewable Energy, Inc. | | | 170,616 | |

| | | | | | | | | |

| | | | | ENGINEERING & CONSTRUCTION — 0.2% | | | | |

| | 2,956 | | | Argan, Inc. | | | 133,020 | |

| | | | | | | | | |

| | | | | FOOD — 1.1% | | | | |

| | 9,959 | | | Amira Nature Foods, Ltd.(a) | | | 41,529 | |

| | 12,510 | | | Darling Ingredients, Inc.(a) | | | 226,806 | |

| | 2,521 | | | Fresh Del Monte Produce, Inc. | | | 120,176 | |

| | 35,000 | | | Huon Aquaculture Group, Ltd. | | | 129,214 | |

| | 23,872 | | | Synlait Milk, Ltd. - Australia(a) | | | 123,048 | |

| | 23,500 | | | Synlait Milk, Ltd. - New Zealand(a) | | | 120,333 | |

| | 2,709 | | | United Natural Foods, Inc.(a) | | | 133,472 | |

| | | | | | | | 894,578 | |

| | | | | FOREST PRODUCTS & PAPER — 0.1% | | | | |

| | 3,949 | | | Mercer International, Inc. | | | 56,471 | |

See accompanying notes to financial statements.

8

Wildermuth Endowment Strategy Fund Schedule of Investments - Continued

December 31, 2017 |

Shares,

Principal

Amount,

or Units | | | | | Value | |

| | | | COMMON STOCKS (CONTINUED) | | | |

| | | | GAS — 0.1% | | | |

| | 1,153 | | | UGI Corp. | | $ | 54,133 | |

| | | | | | | | | |

| | | | | HEALTHCARE-PRODUCTS — 0.2% | | | | |

| | 1,975 | | | Henry Schein, Inc.(a) | | | 138,013 | |

| | | | | | | | | |

| | | | | HEALTHCARE-SERVICES — 0.6% | | | | |

| | 2,121 | | | Fresenius SE & Co. KGaA | | | 165,722 | |

| | 6,841 | | | HealthSouth Corp. | | | 338,014 | |

| | | | | | | | 503,736 | |

| | | | | HOME FURNISHINGS — 0.2% | | | | |

| | 12,229 | | | Panasonic Corp. | | | 179,066 | |

| | | | | | | | | |

| | | | | INSURANCE — 0.1% | | | | |

| | 2,297 | | | Unum Group | | | 126,082 | |

| | | | | | | | | |

| | | | | INTERNET — 0.2% | | | | |

| | 678 | | | Iliad SA | | | 162,621 | |

| | | | | | | | | |

| | | | | IRON/STEEL — 0.2% | | | | |

| | 4,450 | | | Ternium SA, ADR | | | 140,576 | |

| | | | | | | | | |

| | | | | LEISURE TIME — 0.4% | | | | |

| | 8,000 | | | Basic-Fit NV(a)(b) | | | 193,180 | |

| | 2,494 | | | Norwegian Cruise Line Holdings, Ltd.(a) | | | 132,805 | |

| | | | | | | | 325,985 | |

| | | | | LODGING — 0.4% | | | | |

| | 1,350 | | | Marriott International, Inc., Class A | | | 183,235 | |

| | 1,170 | | | Wyndham Worldwide Corp. | | | 135,568 | |

| | | | | | | | 318,803 | |

| | | | | MACHINERY-DIVERSIFIED — 0.7% | | | | |

| | 763 | | | Cummins, Inc. | | | 134,777 | |

| | 394 | | | Deere & Co. | | | 61,665 | |

| | 9,300 | | | Eagle Industry Co., Ltd. | | | 174,029 | |

| | 1,615 | | | Zebra Technologies Corp., Class A(a) | | | 167,637 | |

| | | | | | | | 538,108 | |

| | | | | MEDIA — 0.1% | | | | |

| | 450 | | | FactSet Research Systems, Inc. | | | 86,742 | |

| | | | | | | | | |

| | | | | MINING — 0.4% | | | | |

| | 7,665 | | | Coeur Mining, Inc.(a) | | | 57,487 | |

| | 16,172 | | | Hudbay Minerals, Inc. | | | 142,314 | |

| | 558 | | | Kaiser Aluminum Corp. | | | 59,622 | |

See accompanying notes to financial statements.

9

Wildermuth Endowment Strategy Fund Schedule of Investments - Continued

December 31, 2017 |

Shares,

Principal

Amount,

or Units | | | | | Value | |

| | | | COMMON STOCKS (CONTINUED) | | | |

| | | | MINING (Continued) | | | |

| | 20,580 | | | Yamana Gold, Inc. | | $ | 64,210 | |

| | | | | | | | 323,633 | |

| | | | | OIL & GAS — 1.0% | | | | |

| | 1,347 | | | Andeavor | | | 154,016 | |

| | 7,450 | | | Enerplus Corp. | | | 72,936 | |

| | 2,663 | | | Marathon Oil Corp. | | | 45,085 | |

| | 4,719 | | | Murphy Oil Corp. | | | 146,525 | |

| | 3,855 | | | Neste Oyj | | | 246,955 | |

| | 1,800 | | | PBF Energy, Inc., Class A | | | 63,810 | |

| | 2,538 | | | Unit Corp.(a) | | | 55,836 | |

| | 685 | | | Valero Energy Corp. | | | 62,958 | |

| | | | | | | | 848,121 | |

| | | | | OIL & GAS SERVICES — 0.2% | | | | |

| | 10,299 | | | Subsea 7 SA | | | 154,874 | |

| | | | | | | | | |

| | | | | PHARMACEUTICALS — 1.5% | | | | |

| | 7,826 | | | Daiichi Sankyo Co., Ltd. | | | 204,039 | |

| | 939 | | | Johnson & Johnson | | | 131,197 | |

| | 5,000 | | | Lannett Co., Inc.(a) | | | 116,000 | |

| | 7,661 | | | Mitsubishi Tanabe Pharma Corp. | | | 158,592 | |

| | 1,429 | | | Novartis AG, ADR | | | 119,979 | |

| | 3,069 | | | Novo Nordisk A/S, ADR | | | 164,713 | |

| | 7,000 | | | Owens & Minor, Inc. | | | 132,160 | |

| | 2,491 | | | UCB SA | | | 197,952 | |

| | | | | | | | 1,224,632 | |

| | | | | PIPELINES — 1.3% | | | | |

| | 6,809 | | | Boardwalk Pipeline Partners LP | | | 87,904 | |

| | 2,014 | | | Buckeye Partners LP | | | 99,794 | |

| | 3,564 | | | DCP Midstream LP | | | 129,480 | |

| | 3,500 | | | Enbridge, Inc. | | | 136,885 | |

| | 5,540 | | | Energy Transfer Equity LP | | | 95,620 | |

| | 2,360 | | | Enterprise Products Partners LP | | | 62,564 | |

| | 4,016 | | | Genesis Energy LP | | | 89,758 | |

| | 2,413 | | | Phillips 66 Partners LP | | | 126,321 | |

| | 2,684 | | | Spectra Energy Partners LP | | | 106,125 | |

| | 2,380 | | | TC PipeLines LP | | | 126,378 | |

| | | | | | | | 1,060,829 | |

| | | | | RETAIL — 0.8% | | | | |

| | 1,362 | | | Asbury Automotive Group, Inc.(a) | | | 87,168 | |

| | 1,845 | | | CVS Health Corp. | | | 133,762 | |

| | 3,442 | | | Michaels Cos., Inc.(a) | | | 83,262 | |

| | 4,425 | | | MTY Food Group, Inc. | | | 198,119 | |

See accompanying notes to financial statements.

10

Wildermuth Endowment Strategy Fund Schedule of Investments - Continued

December 31, 2017 |

Shares,

Principal

Amount,

or Units | | | | | Value | |

| | | | COMMON STOCKS (CONTINUED) | | | |

| | | | RETAIL (Continued) | | | |

| | 1,369 | | | Wal-Mart Stores, Inc. | | $ | 135,189 | |

| | | | | | | | 637,500 | |

| | | | | SEMICONDUCTORS — 1.7% | | | | |

| | 528 | | | Broadcom, Ltd. | | | 135,643 | |

| | 2,531 | | | Cirrus Logic, Inc.(a) | | | 131,258 | |

| | 3,399 | | | Intel Corp. | | | 156,898 | |

| | 1,223 | | | Lam Research Corp. | | | 225,118 | |

| | 17,000 | | | NEPES Corp.(a) | | | 150,063 | |

| | 809 | | | NXP Semiconductors NV(a) | | | 94,726 | |

| | 2,420 | | | Qorvo, Inc.(a) | | | 161,172 | |

| | 1,188 | | | Skyworks Solutions, Inc. | | | 112,800 | |

| | 2,400 | | | Synaptics, Inc.(a) | | | 95,856 | |

| | 1,417 | | | Texas Instruments, Inc. | | | 147,991 | |

| | | | | | | | 1,411,525 | |

| | | | | SOFTWARE — 0.5% | | | | |

| | 1,920 | | | Cerner Corp.(a) | | | 129,389 | |

| | 759 | | | Check Point Software Technologies, Ltd.(a) | | | 78,648 | |

| | 1,240 | | | Fiserv, Inc.(a) | | | 162,601 | |

| | | | | | | | 370,638 | |

| | | | | TRANSPORTATION — 0.3% | | | | |

| | 2,550 | | | Golar LNG Partners LP | | | 58,140 | |

| | 6,890 | | | Ship Finance International, Ltd. | | | 106,795 | |

| | 26,426 | | | Teekay Offshore Partners LP | | | 62,365 | |

| | | | | | | | 227,300 | |

| | | | | TRUCKING & LEASING — 0.3% | | | | |

| | 4,365 | | | Greenbrier Cos., Inc. | | | 232,654 | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $13,615,052) | | | 16,185,300 | |

| | | | | | | | | |

| | | | | EXCHANGE TRADED FUNDS — 13.4% | | | | |

| | | | | DEBT FUNDS — 2.8% | | | | |

| | 6,865 | | | iShares Emerging Markets High Yield Bond | | | 343,113 | |

| | 8,680 | | | iShares Global High Yield Corporate Bond | | | 437,906 | |

| | 1,118 | | | iShares iBoxx $High Yield Corporate Bond | | | 97,557 | |

| | 2,278 | | | iShares iBoxx $Investment Grade Corporate Bond | | | 276,914 | |

| | 7,792 | | | iShares J.P. Morgan Emerging Markets Local Currency Bond(a) | | | 375,574 | |

| | 2,450 | | | iShares TIPS Bond | | | 279,496 | |

| | 8,400 | | | PowerShares International Corporate Bond Portfolio | | | 231,756 | |

| | 1,860 | | | SPDR Bloomberg Barclays International Corporate Bond | | | 65,732 | |

| | 2,156 | | | SPDR Citi International Government Inflation-Protected Bond | | | 124,013 | |

| | | | | | | | 2,232,061 | |

See accompanying notes to financial statements.

11

Wildermuth Endowment Strategy Fund Schedule of Investments - Continued

December 31, 2017 |

Shares,

Principal

Amount,

or Units | | | | | Value | |

| | | | EXCHANGE TRADED FUNDS (CONTINUED) | | | |

| | | | EQUITY FUNDS — 10.6% | | | |

| | 20,854 | | | iShares MSCI All Peru Capped | | $ | 854,597 | |

| | 21,197 | | | iShares MSCI Brazil Capped | | | 857,419 | |

| | 18,618 | | | iShares MSCI Chile Capped | | | 971,115 | |

| | 24,600 | | | iShares MSCI Frontier 100 | | | 814,752 | |

| | 23,465 | | | iShares MSCI India | | | 846,383 | |

| | 22,132 | | | iShares MSCI Philippines | | | 859,164 | |

| | 31,146 | | | iShares MSCI Poland Capped | | | 843,745 | |

| | 22,856 | | | iShares MSCI Taiwan | | | 827,616 | |

| | 9,128 | | | iShares MSCI Thailand Capped | | | 844,340 | |

| | 37,992 | | | VanEck Vectors Russia | | | 805,810 | |

| | | | | | | | 8,524,941 | |

| | | | | | | | | |

| | | | | TOTAL EXCHANGE TRADED FUNDS (Cost $9,650,326) | | | 10,757,002 | |

| | | | | | | | | |

| | | | | COMMODITY & NATURAL RESOURCE INVESTMENTS — 4.4% | | | | |

| | — | | | Casillas Petroleum Resource Partners, LLC(c) | | | 1,411,506 | |

| | — | | | Kayne Anderson Energy Fund VII LP(c) | | | 2,109,349 | |

| | | | | TOTAL COMMODITY & NATURAL RESOURCE INVESTMENTS (Cost $2,512,102) | | | 3,520,855 | |

| | | | | | | | | |

| | | | | DIRECT REAL ESTATE — 3.0% | | | | |

| | — | | | Brookwood SFL Investor Co-Investment Vehicle, LLC(c)(d) | | | 1,401,882 | |

| | — | | | RS17 Rexburg Preferred LLC(c)(d) | | | 1,000,000 | |

| | | | | TOTAL DIRECT REAL ESTATE (Cost $2,220,000) | | | 2,401,882 | |

| | | | | | | | | |

| | | | | HEDGE FUNDS — 9.6% | | | | |

| | — | | | Condire Resource Partners LP(c) | | | 1,773,681 | |

| | — | | | EJF Trust Preferred Fund LP(c) | | | 1,076,235 | |

| | — | | | Esulep LLC Permo Fund(c) | | | 1,773,568 | |

| | — | | | LJM Fund LP(c) | | | 2,034,250 | |

| | — | | | Rosebrook Opportunities Fund LP(c)(d) | | | 1,067,583 | |

| | | | | TOTAL HEDGE FUNDS (Cost $7,520,946) | | | 7,725,317 | |

| | | | | | | | | |

| | | | | HIGH YIELD LOANS — 4.2% | | | | |

| $ | 500,000 | | | Atlanta Healthcare Property Consultants, LLC, 18.00%, 3/18/2018(c) | | | 530,000 | |

| | — | | | Direct Lending Income Fund LP(c) | | | 1,808,196 | |

| | 1,000,000 | | | Doctor's Hospice of Georgia, Inc., 18.00%, 3/18/2018(c) | | | 1,060,000 | |

| | | | | TOTAL HIGH YIELD LOANS (Cost $3,143,860) | | | 3,398,196 | |

| | | | | | | | | |

| | | | | PRIVATE EQUITY — 25.0% | | | | |

| | — | | | Abbott Secondary Opportunities LP(c) | | | 294,233 | |

| | 144 | | | Atlas Fintech Holdings Corp.(c) | | | 1,656,000 | |

| | 2,500 | | | Clear Guide Medical, Inc.(c)(d) | | | 3,479,225 | |

| | — | | | Committed Advisors Secondary Fund III(c) | | | 614,443 | |

See accompanying notes to financial statements.

12

Wildermuth Endowment Strategy Fund Schedule of Investments - Continued

December 31, 2017 |

Shares,

Principal

Amount,

or Units | | | | | Value | |

| | | | PRIVATE EQUITY (CONTINUED) | | | |

| | 2,033,849 | | | DSI Digital, LLC - Series A Convertible Preferred Units(c) | | $ | 3,000,000 | |

| | — | | | EJF Sidecar Fund, Series LLC - Small Financial Equities Series(c) | | | 396,813 | |

| | 10 | | | GPB Automotive Portfolio LP(c) | | | 457,313 | |

| | — | | | Gravity Ranch Fund I LP(c)(d) | | | 500,000 | |

| | 3,500,000 | | | Metro Diner, LLC - Series B Units(c) | | | 3,500,000 | |

| | 1,880,968 | | | Metro Diner, LLC - Series II Common Units(c) | | | 0 | |

| | — | | | PineBridge Secondary Partners IV SLP(c) | | | 200,154 | |

| | — | | | Star Mountain Diversified Small Business Access Fund II LP(c) | | | 727,513 | |

| | — | | | Tout, Inc. - Series C Preferred Stock(c) | | | 1,842,086 | |

| | 560,748 | | | Waratek Ltd. - Series B-2 Shares(c)(d) | | | 3,366,643 | |

| | | | | TOTAL PRIVATE EQUITY (Cost $17,007,786) | | | 20,034,423 | |

| | | | | | | | | |

| | | | | PRIVATE EQUITY DEBT — 3.8% | | | | |

| $ | 500,000 | | | Clear Guide Medical, Inc. - Convertible Note, 0.05%, 9/1/2018(c) | | | 620,544 | |

| | 250,000 | | | Clear Guide Medical, Inc. - Convertible Note, 10.00%, 7/6/2018(c) | | | 260,000 | |

| | 1,200,000 | | | Tout, Inc. - Convertible Promissory Note, 5.00%, 1/1/2018(c) | | | 1,200,000 | |

| | 1,000,000 | | | Tout, Inc. - Convertible Promissory Note, 8.00%, 5/12/2018(c) | | | 1,000,000 | |

| | | | | TOTAL PRIVATE EQUITY DEBT (Cost $2,950,000) | | | 3,080,544 | |

| | | | | | | | | |

| | | | | PRIVATE REAL ESTATE INVESTMENTS — 9.5% | | | | |

| | 95,075 | | | ARCTRUST, Inc.(c) | | | 1,348,168 | |

| | 101,470 | | | Cottonwood Residential, Inc.(c) | | | 1,943,150 | |

| | — | | | Harbert Seniors Housing Fund I LP(c) | | | 1,028,046 | |

| | — | | | PCG Select Series I LLC - Series A Preferred Stock(c) | | | 800,000 | |

| | 418,410 | | | PRISA III Fund LP(c) | | | 433,739 | |

| | — | | | RRA Credit Opportunity Fund LP(c)(d) | | | 659,333 | |

| | 56 | | | Shopoff Land Fund III LP(c) | | | 45,282 | |

| | — | | | Stonehill Strategic Hotel Credit Opportunity Fund II LP(c) | | | 998,345 | |

| | — | | | Walton Street Real Estate Fund VIII LP(c) | | | 365,541 | |

| | | | | TOTAL PRIVATE REAL ESTATE INVESTMENTS (Cost $6,590,197) | | | 7,621,604 | |

| | | | | | | | | |

| | | | | PUBLIC REAL ESTATE INVESTMENTS — 1.2% | | | | |

| | | | | PUBLIC NON-TRADED REAL ESTATE INVESTMENT TRUSTS — 1.2% | | | | |

| | 111,521 | | | Behringer Harvard Opportunity(c) | | | 217,466 | |

| | 18,060 | | | Black Creek Diversified Property Fund, Inc.(c) | | | 134,189 | |

| | 136,771 | | | Highlands REIT, Inc.(c) | | | 45,135 | |

| | 153,283 | | | Inventrust Properties Corp.(c) | | | 504,301 | |

| | 3,330 | | | Phillips Edison Grocery Center(c) | | | 36,628 | |

| | | | | | | | 937,719 | |

| | | | | PUBLIC NON-TRADED REAL ESTATE LIMITED PARTNERSHIP — 0.0% | | | | |

| | 1,725 | | | Uniprop Manufactured Housing Communities Income Fund II(c) | | | 22,511 | |

| | | | | TOTAL PUBLIC REAL ESTATE INVESTMENTS (Cost $779,384) | | | 960,230 | |

See accompanying notes to financial statements.

13

Wildermuth Endowment Strategy Fund Schedule of Investments - Continued

December 31, 2017 |

Shares,

Principal

Amount,

or Units | | | | | Value | |

| | | | REAL ESTATE LOANS — 2.7% | | | |

| $ | 388,097 | | | Airport Center Development Partners, LLC, 9.50%, 9/17/2018(c) | | $ | 388,097 | |

| | 400,000 | | | Dog Wood Park of Northeast Florida, LLC, 9.50%, 3/21/2018(c) | | | 400,000 | |

| | 500,000 | | | Dot Square Partners II, LLC, 9.50%, 7/7/2018(c) | | | 500,000 | |

| | 400,000 | | | Hauiki Hui, LLC, 9.50%, 1/1/2018(c) | | | 400,000 | |

| | 500,000 | | | Saratoga Springs Partners, LLC, 9.50%, 11/1/2017(c)(e) | | | 500,000 | |

| | | | | TOTAL REAL ESTATE LOANS (Cost $2,090,752) | | | 2,188,097 | |

| | | | | | | | | |

| | | | | WARRANTS — 0.0% | | | | |

| | 100 | | | Atlas Fintech Holdings Corp., Exercise Price $13,000, Notional: $1,300,000, 12/20/2021(a)(c) | | | 0 | |

| | 44 | | | Atlas Fintech Holdings Corp., Exercise Price $14,950, Notional: $657,800, 8/9/2022(a)(c) | | | 0 | |

| | | | | TOTAL WARRANTS (Cost $0) | | | 0 | |

| | | | | | | | | |

| | | | | SHORT-TERM INVESTMENTS — 5.8% | | | | |

| | 4,678,090 | | | Fidelity Institutional Government Portfolio - Institutional Class, 1.18%(f) | | | 4,678,090 | |

| | | | | TOTAL SHORT-TERM INVESTMENTS (Cost $4,678,090) | | | 4,678,090 | |

| | | | | | | | | |

| | | �� | | TOTAL INVESTMENTS — 102.8% (Cost $72,758,495) | | | 82,551,540 | |

| | | | | Liabilities less other assets — (2.8)% | | | (2,265,249 | ) |

| | | | | | | | | |

| | | | | TOTAL NET ASSETS —100.0% | | $ | 80,286,291 | |

ADR – American Depositary Receipt

LLC – Limited Liability Company

LP – Limited Partnership

PLC – Public Limited Company

REIT – Real Estate Investment Trust

SLP – Special Limited Partnership

(b) | 144A Restricted Security |

(c) | Illiquid Security. Total illiquid securities represent 63.44% of net assets as of December 31, 2017. |

(d) | Denotes an investment in an affiliated entity. Please refer to Note 8, Investments in Affiliated Issuers, in the Notes to the Financial Statements. |

(e) | Security is in default |

(f) | Represents the current rate as of December 31, 2017. |

See accompanying notes to financial statements.

14

Wildermuth Endowment Strategy Fund Statement of Assets and Liabilities

As of December 31, 2017 |

| Assets: | | | |

| Investments in unaffiliated issuers at fair value (cost $63,240,252) | | $ | 71,076,874 | |

| Investments in affiliated issuers at value (cost $9,518,243) | | | 11,474,666 | |

| Cash | | | 120,000 | |

| Receivables: | | | | |

| Investment securities sold | | | 245,113 | |

| Miscellaneous receivable | | | 1,609 | |

| Dividends and interest | | | 222,575 | |

| Fund shares sold | | | 31,344 | |

| Prepaid expenses | | | 23,771 | |

| Total assets | | | 83,195,952 | |

| | | | | |

| Liabilities: | | | | |

| Payables: | | | | |

| Due to custodian | | | 2,747,180 | |

| Investment Advisor fees | | | 10,690 | |

| Professional fees | | | 52,270 | |

| Shareholder servicing fees | | | 24,358 | |

| Transfer agent fees and expenses | | | 19,255 | |

| Fund accounting & administration | | | 14,399 | |

| Custody fees | | | 5,167 | |

| Distribution fees | | | 11,081 | |

| Accrued other liabilities | | | 25,261 | |

| Total liabilities | | | 2,909,661 | |

| Net Assets | | $ | 80,286,291 | |

| | | | | |

| Net Assets Consist of: | | | | |

| Paid in capital (unlimited shares authorized, 25,000,000 shares registered, no par value) | | $ | 69,758,678 | |

| Accumulated net investment loss | | | (37,069 | ) |

| Accumulated net realized gain on investments | | | 797,654 | |

| Net unrealized appreciation (depreciation) on: | | | | |

| Investments | | | 9,793,045 | |

| Foreign currency translations | | | (26,017 | ) |

| Net Assets | | $ | 80,286,291 | |

| | | | | |

| Net Assets: | | | | |

| Class A | | $ | 61,568,247 | |

| Class C | | | 18,434,883 | |

Class I(1) | | | 283,161 | |

| Net Assets | | $ | 80,286,291 | |

| | | | | |

| Shares of Beneficial Interest Issued and Outstanding: | | | | |

| Class A shares | | | 4,661,842 | |

| Class C shares | | | 1,415,697 | |

Class I shares(1) | | | 21,339 | |

| Total Shares Outstanding | | | 6,098,878 | |

| | | | | |

Net Asset Value, Offering Price and Redemption Proceeds per Share(2) | | | | |

| Class A | | $ | 13.21 | |

Class C(3) | | $ | 13.02 | |

Class I(1) | | $ | 13.27 | |

Class A - Maximum offering price per share (Net asset value per share divided by 0.9425)(4) | | $ | 14.02 | |

(1) | Class I inception date was April 28, 2017. |

(2) | Redemptions made within 90 days of purchase may be assessed a redemption fee of 2.00%. |

(3) | Class C Shares of the Fund are subject to a Contingent Deferred Sales Charge (“CDSC”) of 1.00% on any shares sold within 365 days of purchase. |

(4) | Reflects a maximum sales charge of 5.75%. |

See accompanying notes to financial statements.

15

Wildermuth Endowment Strategy Fund Statement of Operations

For the year ended December 31, 2017 |

| Investment Income: | | | |

| Dividends from unaffiliated issuers (net of foreign withholding taxes of $15,917) | | $ | 829,676 | |

| Dividends from affiliated issuers (net of foreign withholding taxes of $0) | | | 660 | |

| Interest | | | 385,372 | |

| Total investment income | | | 1,215,708 | |

| | | | | |

| Expenses: | | | | |

| Advisory fees (see Note 4) | | | 844,430 | |

| Legal fees | | | 237,001 | |

| Transfer agent fees | | | 130,109 | |

| Accounting & administration servicing fees | | | 127,652 | |

| Shareholder servicing fees - Class A | | | 112,642 | |

| Distribution fees - Class C | | | 84,029 | |

| Printing and postage expenses | | | 75,181 | |

| Registration fees | | | 56,601 | |

| Trustees' fees | | | 52,250 | |

| Chief compliance officer fees | | | 44,370 | |

| Miscellaneous expenses | | | 39,295 | |

| Chief financial officer fees | | | 39,144 | |

| Custodian fees | | | 31,367 | |

| Shareholder servicing fees - Class C | | | 28,010 | |

| Insurance expense | | | 25,619 | |

| Audit fees | | | 22,500 | |

| Total expenses | | | 1,950,200 | |

| Expenses waived from Adviser (see Note 4) | | | (458,874 | ) |

| Net expenses | | | 1,491,326 | |

| Net investment loss | | | (275,618 | ) |

| | | | | |

| Realized and Unrealized Gain (Loss) on Investments and foreign currency: | | | | |

| Net realized gain (loss) on: | | | | |

| Investments in unaffiliated issuers | | | 1,654,173 | |

| Foreign currency transactions | | | (3,624 | ) |

| Realized gain distributions from investment companies | | | 1,016 | |

| Total net realized gain | | | 1,651,565 | |

| Net change in unrealized appreciation (depreciation) on: | | | | |

| Investments in unaffiliated issuers | | | 5,947,664 | |

| Investments in affiliated issuers | | | 1,206,037 | |

| Foreign currency translations | | | (25,992 | ) |

| Total net change in unrealized appreciation (depreciation) | | | 7,127,709 | |

| Net realized and unrealized gain on investments and foreign currency | | | 8,779,274 | |

| | | | | |

| Net Increase in Net Assets from Operations | | $ | 8,503,656 | |

See accompanying notes to financial statements.

16

Wildermuth Endowment Strategy Fund Statements of Changes in Net Assets

|

| | | For the

year ended

December 31,

2017 | | | For the

year ended

December 31,

2016 | |

| Change in Net Assets From: | | | | | | |

| Operations: | | | | | | |

| Net investment loss | | $ | (275,618 | ) | | $ | (123 | ) |

| Net realized gain on investments | | | 1,650,549 | | | | 3,643 | |

| Distributions of realized gains by underlying investment companies | | | 1,016 | | | | 12,670 | |

| Net change in unrealized appreciation (depreciation) on investments | | | 7,127,709 | | | | 2,584,553 | |

| Net increase in net assets resulting from operations | | | 8,503,656 | | | | 2,600,743 | |

| | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | |

| From return of capital - Class A | | | (635,374 | ) | | | (351,953 | ) |

| From return of capital - Class C | | | (158,005 | ) | | | (27,113 | )(2) |

From return of capital - Class I(1) | | | (181 | ) | | | — | |

| From net realized gains - Class A | | | (841,001 | ) | | | — | |

| From net realized gains - Class C | | | (254,006 | ) | | | — | (2) |

From net realized gains - Class I(1) | | | (3,838 | ) | | | — | |

| Total distributions to shareholders | | | (1,892,405 | ) | | | (379,066 | ) |

| | | | | | | | | |

| Capital Share Transactions: | | | | | | | | |

| Net proceeds from Class A shares sold | | | 27,369,426 | | | | 15,811,022 | |

| Net proceeds from Class C shares sold | | | 12,129,974 | | | | 4,773,737 | (2) |

Net proceeds from Class I shares sold(1) | | | 271,389 | | | | — | |

| Reinvestment of distributions from Class A shares | | | 978,879 | | | | 224,283 | |

| Reinvestment of distributions from Class C shares | | | 389,638 | | | | 24,899 | (2) |

Reinvestment of distributions from Class I shares(1) | | | 3,736 | | | | — | |

| Cost of Class A shares redeemed | | | (3,788,422 | ) | | | (867,149 | ) |

| Cost of Class C shares redeemed | | | (319,132 | ) | | | (20,000 | )(2) |

Cost of Class I shares redeemed(1) | | | — | | | | — | |

| Redemption fees | | | 2,666 | | | | 1,443 | |

| Net increase from capital share transactions | | | 37,038,154 | | | | 19,948,235 | |

| | | | | | | | | |

| Net change in net assets | | | 43,649,405 | | | | 22,169,912 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 36,636,886 | | | | 14,466,974 | |

| End of year | | $ | 80,286,291 | | | $ | 36,636,886 | |

| | | | | | | | | |

| Accumulated net investment income (loss) | | $ | (37,069 | ) | | $ | — | |

| | | | | | | | | |

| Transactions in Shares: | | | | | | | | |

| Issuance of Class A shares | | | 2,205,487 | | | | 1,399,946 | |

| Issuance of Class C shares | | | 988,431 | | | | 421,583 | (2) |

Issuance of Class I Shares(1) | | | 21,051 | | | | — | |

| Class A shares reinvested | | | 77,225 | | | | 20,041 | |

| Class C shares reinvested | | | 31,088 | | | | 2,177 | (2) |

Class I shares reinvested(1) | | | 288 | | | | — | |

| Class A shares redeemed | | | (303,960 | ) | | | (77,088 | ) |

| Class C shares redeemed | | | (25,841 | ) | | | (1,741 | )(2) |

Class I shares redeemed(1) | | | — | | | | — | |

| Net increase in shares of beneficial interest outstanding | | | 2,993,769 | | | | 1,764,918 | |

(1) | Reflects operations for the period from April 28, 2017 (inception date) to December 31, 2017. |

(2) | Reflects operations for the period from March 14, 2016 (inception date) to December 31, 2016. |

See accompanying notes to financial statements.

17

Wildermuth Endowment Strategy Fund Statement of Cash Flows

|

| | | For the

year ended

December 31,

2017 | |

| Cash flows from operating activities: | | | | |

| Net increase in net assets from operations | | $ | 8,503,656 | |

| Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities: | | | | |

| Purchases of investments | | | (63,784,325 | ) |

| Purchase of short term investments, net | | | (2,908,849 | ) |

| Proceeds from sale of investments | | | 27,433,678 | |

| Net realized gain from investments | | | (1,654,173 | ) |

| Distributions of realized gains by underlying investment companies | | | (1,016 | ) |

| Net unrealized appreciation on investments | | | (7,153,701 | ) |

| Return of capital and non-income distributions received | | | 1,439,527 | |

| | | | | |

| Changes in assets and liabilities | | | | |

| (Increase)/Decrease in assets: | | | | |

| Receivable from tax credit | | | 244,927 | |

| Due from Investment Adviser | | | 50,837 | |

| Dividend and interest receivable | | | (153,181 | ) |

| Receivable for investment securities sold | | | (245,113 | ) |

| Miscellaneous receivable | | | (1,609 | ) |

| Funded commitment | | | 300,000 | |

| Prepaid expenses and other assets | | | 20,955 | |

| Increase/(Decrease) in liabilities: | | | | |

| Payable to custodian | | | 2,747,180 | |

| Payable to Investment Adviser | | | 10,690 | |

| Payable for professional fees | | | 24,870 | |

| Payable for shareholder servicing fees | | | 8,682 | |

| Payable for fund accounting and administration fees | | | 4,946 | |

| Payable for custody fees | | | 1,249 | |

| Payables for transfer agent fees and expenses | | | 7,690 | |

| Payable for distribution fees | | | 8,151 | |

| Accrued expenses and other liabilities | | | 13,274 | |

| Net cash used in operating activities | | | (35,081,655 | ) |

| | | | | |

| Cash flows from financing activities: | | | | |

| Proceeds from shares sold | | | 39,825,743 | |

| Cost of shares redeemed, net of redemption fees | | | (4,104,888 | ) |

| Cash distributions paid, net of reinvestment | | | (520,152 | ) |

Net cash provided by financing activities | | | 35,200,703 | |

| | | | | |

| Net increase in cash | | | 119,048 | |

| Cash at beginning of year | | | 952 | |

| Cash at end of period | | $ | 120,000 | |

| | | | | |

| Supplemental disclosure of non-cash activity: | | | | |

| Reinvestment of distributions | | $ | 1,372,253 | |

See accompanying notes to financial statements.

18

Wildermuth Endowment Strategy Fund Financial Highlights – Class A

|

Per share income and capital changes for a share outstanding throughout each period.

| | | For the

year ended

December 31,

2017(1) | | | For the

year ended

December 31,

2016(1) | | | For the

period ended

December 31,

2015(7) | |

| | | | | | | | | | |

| Net asset value, beginning of period | | $ | 11.81 | | | $ | 10.79 | | | $ | 10.00 | |

| | | | | | | | | | | | | |

| Income from Investment Operations: | | | | | | | | | | | | |

Net investment income (loss)(2) | | | (0.04 | ) | | | 0.01 | | | | 0.05 | |

| Net realized and unrealized gain | | | 1.80 | | | | 1.19 | | | | 0.93 | (8) |

| Total from investment operations | | | 1.76 | | | | 1.20 | | | | 0.98 | |

| Less Distributions: | | | | | | | | | | | | |

| From net investment income | | | — | | | | — | | | | (0.03 | ) |

| From return of capital | | | (0.18 | ) | | | (0.18 | ) | | | (0.16 | ) |

| From net realized gains | | | (0.18 | ) | | | — | | | | — | |

| Total distributions | | | (0.36 | ) | | | (0.18 | ) | | | (0.19 | ) |

| | | | | | | | | | | | | |

| Net asset value, end of period | | $ | 13.21 | | | $ | 11.81 | | | $ | 10.79 | |

| | | | | | | | | | | | | |

Total return(3) | | | 15.07 | % | | | 11.27 | % | | | 9.74 | %(9) |

| | | | | | | | | | | | | |

| Ratios and Supplemental Data: | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 61,568 | | | $ | 31,686 | | | $ | 14,467 | |

Ratio of expenses before waivers to average net assets(4) | | | 3.32 | % | | | 4.73 | % | | | 16.65 | %(10) |

Ratio of net expenses to average net assets(4)(5) | | | 2.50 | % | | | 2.50 | % | | | 2.50 | %(10) |

Ratio of net investment income (loss) to average net assets(4)(6) | | | (0.35 | )% | | | 0.07 | % | | | 0.49 | %(10) |

| Portfolio turnover rate | | | 51 | % | | | 55 | % | | | 107 | %(9) |

(1) | Redemption fees consisted of per share amounts of less than $0.01 |

(2) | Per share amounts calculated using the average shares method. |

(3) | Total returns would have been lower had certain expenses not been waived or absorbed by the Adviser. Returns shown do not include payment of a maximum sales load of offering price. If the sales charge was included total returns would be lower. The maximum sales load in 2016 and 2015 was 6.00% of offering price. Effective October 20, 2017 the maximum sales load was changed to 5.75% of offering price. |

(4) | The ratios of expenses and net investment income (loss) to average net assets do not reflect the Fund’s proportionate share of income and expenses of underlying investment companies in which the Fund invests. |

(5) | Represents the ratio of expenses to average net assets net of fee waivers and/or expense reimbursements by Adviser. |

(6) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

(7) | The Wildermuth Endowment Strategy Fund commenced operations on January 2, 2015 (inception date 12/31/2014). |

(8) | Realized and unrealized gain per share does not correlate to the aggregate of the net realized and unrealized gains on the Statement of Operations for the period ended December 31, 2015, primarily due to the timing of sales and repurchases of the Fund’s shares in relation to fluctuating market values for the Fund’s portfolio. |

See accompanying notes to financial statements.

19

Wildermuth Endowment Strategy Fund Financial Highlights – Class C

|

Per share income and capital changes for a share outstanding throughout each period.

| | | For the

year ended

December 31,

2017 | | | For the

period ended

December 31,

2016(6) | |

| | | | | | | |

| Net asset value, beginning of period | | $ | 11.73 | | | $ | 10.68 | |

| | | | | | | | | |

| Income from Investment Operations: | | | | | | | | |

Net investment loss(1) | | | (0.13 | ) | | | (0.07 | ) |

| Net realized and unrealized gain | | | 1.78 | | | | 1.25 | |

| Total from investment operations | | | 1.65 | | | | 1.18 | |

| Less Distributions: | | | | | | | | |

| From return of capital | | | (0.18 | ) | | | (0.13 | ) |

| From net realized gains | | | (0.18 | ) | | | — | |

| Total distributions | | | (0.36 | ) | | | (0.13 | ) |

| | | | | | | | | |

| Net asset value, end of period | | $ | 13.02 | | | $ | 11.73 | |

| | | | | | | | | |

Total return(2) | | | 14.23 | % | | | 11.10 | %(7) |

| | | | | | | | | |

| Ratios and Supplemental Data: | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 18,435 | | | $ | 4,951 | |

Ratio of expenses before waivers to average net assets(3) | | | 4.07 | % | | | 5.63 | %(8) |

Ratio of net expenses to average net assets(3)(4) | | | 3.25 | % | | | 3.25 | %(8) |

Ratio of net investment loss to average net assets(3)(5) | | | (1.08 | )% | | | (0.77 | )%(8) |

| Portfolio turnover rate | | | 51 | % | | | 55 | %(7) |

(1) | Per share amounts calculated using the average shares method. |

(2) | Total returns would have been lower had certain expenses not been waived or absorbed by the Adviser. Returns shown do not include payment of a Contingent Deferred Sales Charge (“CDSC”) of 1.00% on any shares sold within 365 days of purchase. If the sales charge was included total returns would be lower. |

(3) | The ratios of expenses and net investment loss to average net assets do not reflect the Fund’s proportionate share of income and expenses of underlying investment companies in which the Fund invests. |

(4) | Represents the ratio of expenses to average net assets net of fee waivers and/or expense reimbursements by Adviser. |

(5) | Recognition of net investment loss by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

(6) | Reflects operations for the period from March 14, 2016 (inception date) to December 31, 2016. |

See accompanying notes to financial statements.

20

Wildermuth Endowment Strategy Fund Financial Highlights – Class I

|

Per share income and capital changes for a share outstanding throughout the period.

| | | For the

period ended

December 31, 2017(1) | |

| | | | |

| Net asset value, beginning of period | | $ | 12.26 | |

| | | | | |

| Income from Investment Operations: | | | | |

Net investment income(2) | | | 0.02 | |

| Net realized and unrealized gain | | | 1.30 | |

| Total from investment operations | | | 1.32 | |

| Less Distributions: | | | | |

| From return of capital | | | (0.13 | ) |

| From net realized gains | | | (0.18 | ) |

| Total distributions | | | (0.31 | ) |

| | | | | |

| Net asset value, end of period | | $ | 13.27 | |

| | | | | |

Total return(3) | | | 10.87 | % |

| | | | | |

| Ratios and Supplemental Data: | | | | |

| Net assets, end of period (in thousands) | | $ | 283 | |

Ratio of expenses before waivers to average net assets(4)(5) | | | 3.24 | % |

Ratio of net expenses to average net assets(4)(5)(6) | | | 2.25 | % |

Ratio of net investment income to average net assets(4)(5)(7) | | | 0.26 | % |

Portfolio turnover rate(3) | | | 51 | % |

(1) | Reflects operations for the period from April 28, 2017 (inception date) to December 31, 2017. |

(2) | Per share amounts calculated using the average shares method. |

(5) | The ratios of expenses and net investment income to average net assets do not reflect the Fund’s proportionate share of income and expenses of underlying investment companies in which the Fund invests. |

(6) | Represents the ratio of expenses to average net assets net of fee waivers and/or expense reimbursements by Adviser. |

(7) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

See accompanying notes to financial statements.

21

Wildermuth Endowment Strategy Fund Notes to Financial Statements

December 31, 2017 |

1. ORGANIZATION

Wildermuth Endowment Strategy Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, closed-end management investment company that is operated as an interval fund. The Fund was organized as a Delaware statutory trust on August 28, 2013, and did not have any operations from that date until December 31, 2014, other than those relating to organizational matters and registration of its shares under applicable securities law. The Fund commenced operations on January 2, 2015. The Fund’s investment objective is to seek total return through a combination of long-term capital appreciation and income generation. The Fund will pursue its objective by investing in assets that Wildermuth Advisory, LLC (the “Adviser”) believes provide favorable long-term capital appreciation and risk-adjusted return potential, as well as in income-producing assets that the Adviser believes will provide consistent income generation and liquidity.

The Fund is engaged in a continuous offering, up to a maximum of 25 million shares of beneficial interest, and will operate as an interval fund that will offer to make quarterly repurchases of shares at the Fund’s net asset value (“NAV”). The Fund currently offers three different classes of shares: Class A, Class C, and Class I shares.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates. The Fund is an investment company and follows the accounting and reporting requirements under Financial Accounting Standards Board (“FASB”) Accounting Standards (“ASC”) Topic 946, Financials Services – Investment Companies.

Investment Valuation – For purposes of determining the NAV of the Fund, readily marketable portfolio securities listed on the NYSE are valued, except as indicated below, at the last sale price reflected on the consolidated tape at the close of the NYSE on the business day as of which such value is being determined. If there has been no sale on such day, the securities are valued at the mean of the closing bid and asked prices on such day. If no bid or asked prices are quoted on such day or if market prices may be unreliable because of events occurring after the close of trading, then the security is valued by such method as the Fair Value Committee shall determine in good faith to reflect its fair market value. Readily marketable securities not listed on the NYSE but listed on other domestic or foreign securities exchanges are valued in a like manner. Portfolio securities traded on more than one securities exchange are valued at the last sale price on the business day as of which such value is being determined as reflected on the consolidated tape at the close of the exchange representing the principal market for such securities. Securities trading on NASDAQ are valued at the closing price, or, in the case of securities not reported by NASDAQ, a comparable source, as the Fair Value Committee deems appropriate to reflect their fair market value. If there has been no sale on such day, the securities are valued at the mean of the closing bid and asked prices for the day, or if no asked price is available, at the bid price. However, certain debt securities may be valued on the basis of prices provided by a pricing service based on broker or dealer supplied valuations or matrix pricing, a method of valuing securities by reference to the value of other securities with similar characteristics, such as rating, interest rate and maturity.

The “last reported” trade price or sale price or “closing” bid price of a security on any trading day shall be deemed to be: (a) with respect to securities traded primarily on the NYSE, the American Stock Exchange or NASDAQ, the last reported trade price or sale price, as the case may be, as of 4:00 p.m., Eastern Time, on that day, and (b) for securities listed, traded or quoted on any other exchange, market, system or service, the market price as of the end of the “regular hours” trading period that is generally accepted as such by such exchange, market, system or service. If, in the future, the benchmark times generally accepted in the securities industry for determining the market price of a stock as of a given trading day shall change from those set forth above, the fair market value of a security shall be determined as of such other generally accepted benchmark times.

Non U.S. dollar-denominated securities, if any, are valued as of the close of the NYSE at the closing price of such securities in their principal trading market, but may be valued at fair value if subsequent events occurring before the computation of NAV have materially affected the value of the securities. Trading may take place in foreign issues held by the Fund, if any, at times when the Fund is not open for business. As a result, the Fund’s NAV may change at times when it is not possible to purchase or sell shares of the Fund.

22

Wildermuth Endowment Strategy Fund Notes to Financial Statements - Continued

December 31, 2017 |

If market quotations are not readily available, securities are valued at fair values as determined in good faith by the Board of Trustees (the “Board”). The Board has delegated the day-to-day responsibility for determining these fair values in accordance with the policies it has approved to the Fair Value Committee, subject to Valuation Committee and ultimately Board oversight. The Fair Value Committee will provide the Board with periodic reports, no less frequently than quarterly, that discuss the functioning of the valuation process, if applicable to that period, and that identify issues and valuations problems that have arisen, if any. As appropriate, the Valuation Committee and the Board will review any securities valued by the Fair Value Committee in accordance with the Fund’s valuation policies during these periodic reports.

Investments in privately placed debt instruments initially will be valued at cost (purchase price plus all related acquisition costs and expenses, such as legal fees and closing costs) and thereafter will be revalued quarterly at fair value.

Investment Funds that are Hedge Funds, Private Equity Fund, Private Real Estate Funds and Non-Traded REITs (“Non-Traded Funds”), as a general matter, the fair value of the Fund’s interest in a Non-Traded Fund will represent the amount that the Fund could reasonably expect to receive from the Non-Traded Fund if the Fund’s interest was redeemed at the time of valuation, based on information reasonably available at the time the valuation is made and that the Fund believes to be reliable. Investments in Non-Traded Funds are recorded at fair value, using the Portfolio Fund’s net asset value as a practical expedient. Based on guidance provided by FASB, investments for which fair value is measured using the net asset value practical expedient are not required to be categorized in the fair value hierarchy. In the event a Non-Traded Fund does not report a value to the Fund on a timely basis, the Fair Value Committee, acting under the Valuation Committee and ultimately the Board’s supervision and pursuant to policies implemented by the Board, will determine the fair value of the Fund’s investment based on the most recent value reported by the Non-Traded Fund, as well as any other relevant information available at the time the Fund values its investments. Following procedures adopted by the Board, in the absence of specific transaction activity in a particular investment fund, the Fair Value Committee will consider whether it is appropriate, in light of all relevant circumstances, to value the Fund’s investment at the NAV reported by the Non-Traded Fund at the time of valuation or to adjust the value to reflect a premium or discount.

Securities for which market quotations are not readily available (including restricted securities and private placements, if any) are valued at their fair value as determined in good faith under consistently applied procedures approved by the Board of Trustees. Methodologies and factors used to fair value securities may include, but are not limited to, the analysis of current debt to cash flow, information of any recent sales, the analysis of the company’s financial statements, quotations or evaluated prices from broker-dealers, information obtained from the issuer or analysts and the nature of the existing market for securities with characteristics similar to such obligations. Valuations may be derived following a review of pertinent data (EBITDA, Revenue, etc.) from company financial statements, relevant market valuation multiples for comparable companies in comparable industries, recent transactions, and management assumptions. The Fund may use fair value pricing for foreign securities if a material event occurs that may affect the price of a security after the close of the foreign market or exchange (or on days the foreign market is closed) but before the Fund prices its portfolio, generally at 4:00 p.m. ET. Fair value pricing may also be used for securities acquired as a result of corporate restructurings or reorganizations as reliable market quotations for such issues may not be readily available. For securities valued in good faith, the value of an investment used to determine the Fund’s net asset value may differ from published or quoted prices for the same investment. The valuations for these good faith securities are monitored and reviewed in accordance with the methodologies described above by the Fund’s Pricing Committee on an ongoing basis as information becomes available but are evaluated at least quarterly. The good faith security valuations and fair value methodologies are reviewed and approved by the Fund’s Board of Trustees on a quarterly basis. There can be no assurance that the Fund could obtain the fair value assigned to an investment if it were to sell the investment at the same time which the Fund determines its net asset value per share. The market value of securities fair valued on December 31, 2017 was $6,999,974, which represents 2.30% of net assets.

GAAP defines fair value, establishes a three-tier framework for measuring fair value based on a hierarchy of inputs, and expands disclosure about fair value measurements. It also provides guidance on determining when there has been a significant decrease in the volume and level of activity for an asset or liability, when a transaction is not orderly and how that information must be incorporated into a fair value measurement. The hierarchy distinguishes between market data obtained from independent sources (observable inputs) and the Fund’s own market assumptions (unobservable inputs). These inputs are used in determining the fair value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| | ● | Level 1 – quoted prices in active markets for identical securities. An active market for the security is a market in which transactions occur with sufficient frequency and volume to provide pricing information on an ongoing basis. A quoted price in an active market provides the most reliable evidence of fair value. |

23

Wildermuth Endowment Strategy Fund Notes to Financial Statements - Continued

December 31, 2017 |

| | ● | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc. and quoted prices for identical or similar assets in markets that are not active.) Inputs that are derived principally from or corroborated by observable market data. An adjustment to any observable input that is significant to the fair value may render the measurement a Level 3 measurement. |

| | ● | Level 3 – significant unobservable inputs, including the Fund’s own assumptions in determining the fair value of investments. |

Investments in Non Traded Funds are recorded at fair value, using the Non Traded Funds net asset value as a practical expedient. Investments measured using the net asset value practical expedient are not required to be categorized in the fair value hierarchy.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following is a summary of the valuation inputs, representing 100% of the Fund’s investments, used to value the Fund’s assets and liabilities as of December 31, 2017:

| | | | | | Fair Value Measurements at the

End of the Reporting Period Using | | | | |

| Investment in Securities | | Practical

Expedient** | | | Level 1

Quoted Prices | | | Level 2

Other Significant Observable Inputs | | | Level 3

Significant Unobservable Inputs | | | Total | |

| Security Type | | | | | | | | | | | | | | | | | | | | |

| Common Stock* | | $ | — | | | $ | 16,185,300 | | | $ | — | | | $ | — | | | $ | 16,185,300 | |

| Exchange Traded Funds* | | | — | | | | 10,757,002 | | | | — | | | | — | | | | 10,757,002 | |

| Commodity & Natural Resource Investments | | | 2,109,349 | (1)(8)(9) | | | — | | | | — | | | | 1,411,506 | | | | 3,520,855 | |

| Direct Real Estate | | | 1,401,882 | (2)(8)(9) | | | — | | | | — | | | | 1,000,000 | | | | 2,401,882 | |

| Hedge Funds | | | 7,725,317 | (3)(8)(9) | | | — | | | | — | | | | — | | | | 7,725,317 | |

| High Yield Loans | | | 1,808,196 | (4)(8)(9) | | | — | | | | — | | | | 1,590,000 | | | | 3,398,196 | |

| Private Equity | | | 2,233,156 | (5)(8)(10) | | | — | | | | — | | | | 17,801,267 | | | | 20,034,423 | |

| Private Equity Debt | | | — | | | | — | | | | — | | | | 3,080,544 | | | | 3,080,544 | |

| Private Real Estate Investments | | | 4,285,004 | (6)(8)(9) | | | — | | | | — | | | | 3,336,600 | | | | 7,621,604 | |

| Public Real Estate Investments* | | | 549,436 | (7)(8)(9) | | | — | | | | — | | | | 410,794 | | | | 960,230 | |

| Real Estate Loans | | | — | | | | — | | | | — | | | | 2,188,097 | | | | 2,188,097 | |

| Warrants | | | — | | | | — | | | | — | | | | — | | | | — | |

| Short Term Investments | | | — | | | | 4,678,090 | | | | — | | | | — | | | | 4,678,090 | |

| Total | | $ | 20,112,340 | | | $ | 31,620,392 | | | $ | — | | | $ | 30,818,808 | | | $ | 82,551,540 | |

* | All sub-categories within the security type represent their respective evaluation status. For a detailed breakout by industry, please refer to the Schedule of Investments. |

** | Certain investments that are measured at fair value using the net asset value per share (or its equivalent) practical expedient have not been categorized in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the schedule of investments. |

24

Wildermuth Endowment Strategy Fund Notes to Financial Statements - Continued

December 31, 2017 |

(1) | Security | Withdrawals Permitted | Redemption Notice Period | Investment Objective | Investment Strategy | Lock Up Period |

| | Kayne Anderson Energy Fund VII LP | Not Applicable | Not Applicable | Capital Gains | Purchase oil and gas companies; extraction and production companies. | N/A |

| | | | | | | |

(2) | Security | Withdrawals Permitted | Redemption Notice Period | Investment Objective | Investment Strategy | Lock Up Period |

| | Brookwood SFL Investor Co-Investment Vehicle, LLC | Not Applicable | Not Applicable | Capital gains and Current income | Real Estate | N/A |

| | | | | | | |

(3) | Security | Withdrawals Permitted | Redemption Notice Period | Investment Objective | Investment Strategy | Lock Up Period |

| | Condire Resource Partners LP | Quarterly | 45 days | Capital Gains | Long/short mining and energy | 12 months |

| | EJF Trust Preferred Fund LP | Not Applicable | Not Applicable | Capital Gains and Income | Event driven with focus on financials | 3 years |

| | Esulep LLC Permo Fund | Monthly | 21 days | Capital Gains | S&P futures and options spreads | N/A |

| | LJM Fund LP | Monthly | 10 days | Income | Buy and sell options on the S&P futures index | N/A |

| | Rosebrook Opportunities Fund LP | Quarterly | Not Applicable | Capital Appreciation | Buying distressed hedge fund assets | N/A |

| | | | | | | |

(4) | Security | Withdrawals Permitted | Redemption Notice Period | Investment Objective | Investment Strategy | Lock Up Period |

| | Direct Lending Income Fund LP | Quarterly | 35 days | Current Income | Buying existing small business loans | N/A |

| | | | | | | |

(5) | Security | Withdrawals Permitted | Redemption Notice Period | Investment Objective | Investment Strategy | Lock Up Period |

| | Abbot Secondary Opportunities LP | Not Applicable | Not Applicable | Capital Gains | Purchase private equity funds on secondary market | N/A |

| | Committed Advisors Secondary Fund III | Not Applicable | Not Applicable | Capital Gains | Private equity fund with a global focus | N/A |

| | EJF Sidecar Fund, Series LLC - Small Financial Equities Series | Not Applicable | Not Applicable | Capital Gains and

Dividends | Invests in equity of small depository institutions, including without limitation financial institutions that are impacted directly or indirectly by: (1) bank and thrift recapitalizations and/or restructurings; (2) merger and acquisition activity; and (3) government financial reform related policies. | N/A |

| | Pinebridge Secondary Partners IV SLP | Not Applicable | Not Applicable | Capital Appreciation | Private equity fund of funds | N/A |

| | Star Mountain Diversified Small Business Access Fund II LP | Not Applicable | Not Applicable | Capital Appreciation | Structured Credit | N/A |

| | | | | | | |

(6) | Security | Withdrawals Permitted | Redemption Notice Period | Investment Objective | Investment Strategy | Lock Up Period |

| | Harbert Seniors Housing Fund I LP | Quarterly | Not Applicable | Capital Appreciation and Income | Real estate | None |

| | PCG Select Series I LLC - Series A Preferred Stock | Not Applicable | Not Applicable | Income | Real estate loans | N/A |

| | PRISA III Fund LP | Quarterly | 15 days | Capital Appreciation and Income | Diversified value-add real estate portfolio that targets above average real estate returns. | N/A |

| | RRA Credit Opportunity Fund LP | Not Applicable | Not Applicable | Current Income | Real estate backed lending | N/A |

| | Stonehill Strategic Hotel Credit Opportunity Fund II LP | Not Applicable | Not Applicable | Capital Gains | Value added lending to hospitality assets | N/A |

| | Walton Street Real Estate Fund VIII LP | Not Applicable | Not Applicable | Capital Gains | Value added Real Estate | N/A |

25

Wildermuth Endowment Strategy Fund Notes to Financial Statements - Continued

December 31, 2017 |

(7) | Security | Withdrawals Permitted | Redemption Notice Period | Investment Objective | Investment Strategy | Lock Up Period |

| | Highlands REIT, Inc. | Not Applicable | Not Applicable | Capital gains/Current income | Real Estate Investment Trust | N/A |

| | Inventrust Properties Corp. | Not Applicable | Not Applicable | Capital gains/Current income | Real Estate Investment Trust | N/A |

(8) | Redemption frequency and redemption notice period reflect general redemption terms, and exclude liquidity restrictions. Different tranches may have different liquidity terms and may be subject to investor level gates. |

(9) | These investments are domiciled in the United States. |

(10) | These investments are domiciled in the United States with the exception of Committed Advisors Secondary Fund III. |

For the year ended December 31, 2017, there were no transfers in and out of Level 1 and Level 2 or into Level 3. The transfers out of Level 3 in the following table represent securities now being valued using practical expedient, which is not included in the fair value measurement hierarchy. It is the Fund’s policy to recognize transfers into and out of all Levels at the end of the reporting period.

The following is a roll forward of the activity in investments in which significant unobservable inputs (Level 3) were used in determining fair value on a recurring basis:

| | | Beginning balance January 1, 2017 | | | Transfers into

Level 3 during the period | | | Transfers out of

Level 3 during the period | | | Purchases | | | Sales or Conversions | | | Net realized gain | | | Return of Capital | | | Change

in net unrealized appreciation (depreciation) | | | Ending balance December 31, 2017 | |

| Wildermuth Endowment Strategy Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Commodity & Natural Resource Investments | | $ | 856,834 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 554,672 | | | $ | 1,411,506 | |

| Direct Real Estate | | | — | | | | — | | | | — | | | | 1,000,000 | | | | — | | | | — | | | | (30,000 | ) | | | 30,000 | | | | 1,000,000 | |

| High Yield Loans | | | — | | | | — | | | | — | | | | 1,518,860 | | | | — | | | | — | | | | — | | | | 71,140 | | | | 1,590,000 | |

| Private Equity | | | 5,089,793 | | | | — | | | | — | | | | 10,727,042 | | | | — | | | | — | | | | (5,073 | ) | | | 1,989,505 | | | | 17,801,267 | |

| Private Equity Debt | | | — | | | | — | | | | — | | | | 2,950,000 | | | | — | | | | — | | | | — | | | | 130,544 | | | | 3,080,544 | |

| Public Non-Traded Business | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Development Companies | | | 718,716 | | | | — | | | | — | | | | — | | | | (688,590 | ) | | | 43,310 | | | | — | | | | (73,436 | ) | | | — | |

| Private Real Estate Investments | | | 4,953,388 | | | | — | | | | (1,800,000 | ) | | | — | | | | — | | | | — | | | | (4,243 | ) | | | 187,455 | | | | 3,336,600 | |

| Public Real Estate Investments | | | 1,776,721 | | | | — | | | | (393,559 | ) | | | — | | | | (503,731 | ) | | | 39,114 | | | | (102,130 | ) | | | (405,621 | ) | | | 410,794 | |

| Real Estate Loans | | | — | | | | — | | | | — | | | | 2,200,000 | | | | (11,248 | ) | | | — | | | | (98,000 | ) | | | 97,345 | | | | 2,188,097 | |

| Warrants | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | $ | 13,395,452 | | | $ | — | | | $ | (2,193,559 | ) | | $ | 18,395,902 | | | $ | (1,203,569 | ) | | $ | 82,424 | | | $ | (239,446 | ) | | $ | 2,581,604 | | | $ | 30,818,808 | |

The change in net unrealized appreciation (depreciation) included in the Statement of Operations attributable to Level 3 investments as of December 31, 2017 is $2,869,588.

26

Wildermuth Endowment Strategy Fund Notes to Financial Statements - Continued

December 31, 2017 |

The following is a summary of quantative information about significant unobservable valuation inputs determined by management for Level 3 Fair Measurements for investments held as of December 31, 2017:

Type of Level 3 Investment | Fair Value as of