united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22888

Wildermuth Endowment Strategy Fund

(Exact name of registrant as specified in charter)

11525 Park Woods Circle, Ste. 200, Alpharetta, GA 30005

(Address of principal executive offices) (Zip code)

Daniel Wildermuth, President

11525 Park Woods Circle, Ste. 200, Alpharetta, GA 30005

(Name and address of agent for service)

Registrant's telephone number, including area code: 678-222-1100

Date of fiscal year end: 12/31

Date of reporting period: 12/31/15

Item 1. Report to Shareholders.

ANNUAL REPORT

DECEMBER 31, 2015

WWW.WILDERMUTHENDOWMENTFUND.COM • 1-877-562-0856 •

DISTRIBUTED BY SQN SECURITIES, LLC (MEMBER FINRA/SIPC)

Dear Investor:

We are pleased to present this annual report for the Wildermuth Endowment Strategy Fund (the “Fund”) covering the 12-month period from January 2, 2015 to December 31, 2015.

During the year 12 months ended December 31, 2015, the Fund returned a 9.74% total return versus 1.0% for a 60% stock and 40% bond portfolio represented by a 1.4% annual return for the S&P 500 and 0.6% for the Barclays U.S. Aggregate Bond Index. The Fund’s relative and absolute performance resulted from several asset classes within its diversified strategy delivering strong performance during a challenging year for both stocks and bonds.

The asset classes that contributed to the Fund’s outperformance relative to U.S. stock and bonds included real estate, targeted contrarian holdings, and private equity. Within the real estate sector, nearly all categories enjoyed success, including multifamily, opportunistic, leisure, healthcare, and office. Returns were generated through both rental income and capital appreciation. Returns were also enhanced through the judicious purchase of some holdings from distressed sellers.

Portfolio returns were also improved through targeting specific contrarian holdings for short periods during particularly volatile market conditions. The positions minimized the impact of some of the severe market corrections and were particularly helpful in offsetting not just U.S. equity losses, but more severe corrections suffered by foreign developed and especially emerging markets.

Lastly, even though exposure to private equity with the Fund was below target in 2015, the sector’s total return contributed to the Fund’s performance through providing income from earnings of current holdings.

Several asset classes within the Fund experienced a difficult year and subsequently delivered negative returns to the portfolio. Emerging equity markets, developed foreign markets, oil and gas, high yield bonds, and convertible bonds all struggled in 2015 as various factors rattled global markets and commodities.

Emerging markets in aggregate started 2015 strongly before dropping sharply in May. Although the category briefly recovered some of its losses in October, the slide continued in fourth quarter and delivered significant double digit losses to the portfolio. Developed foreign stocks followed a similar pattern, but losses were far more muted on the year.

Oil and gas holdings in the form of Master Limited Partnerships were significantly impacted by the plunge in oil prices in 2015. Although most partnerships saw their dividend payout change little and many even increased dividends, concerns over the entire energy sector drove share prices down sharply.

High yield bonds were generally affected by concerns over exposure to riskier assets as worries increased regarding many areas of the economy. In particular, investors shunned junk bonds associated with oil and gas, driving down the sector. As equity markets struggled, convertible bonds also suffered losses.

Looking forward to 2016, we expect that global uncertainty and volatile markets are likely to present ongoing challenges to investors throughout the year. Furthermore, high uncertainty in commodities, particularly oil and gas, combined with heightened struggles of numerous large international economies will likely continue to destabilize a wide variety of asset values and related investment sectors.

Against this backdrop, we believe that investment selection is particularly important, and believe we are well positioned to seek opportunities.

Thank you for your continued confidence and support.

Sincerely,

Daniel Wildermuth

President and Chief Executive Officer, and

Chairman and Trustee of the Fund

February 2016

| Wildermuth Endowment Strategy Fund |

| Portfolio Review (Unaudited) |

| December 31, 2015 |

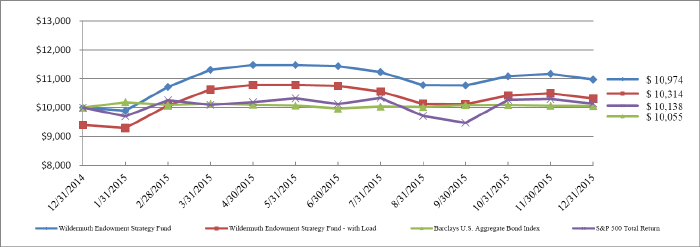

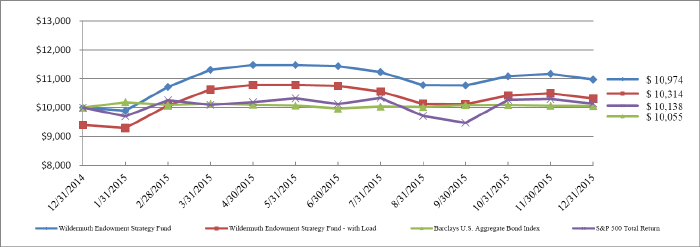

The Fund’s performance figures* for the period ended December 31, 2015, compared to its benchmarks:

| | Since Inception1 |

| Wildermuth Endowment Strategy Fund | 9.74% |

| Wildermuth Endowment Strategy Fund with load** | 3.14% |

| S&P 500 Total Return Index2 | 1.38% |

| Barclays U.S. Aggregate Bond Index3 | 0.55% |

| 60/40 Blend S&P 500 Total Return and Barclays U.S. Aggregate Bond Indices | 1.00% |

| * | The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. The Fund’s total annual operating expense is 3.70% per the prospectus dated January 2, 2015. |

| ** | Wildermuth Endowment Strategy Fund with load total return is calculated using the maximum sales charge of 6.00%. |

| 1 | Wildermuth Endowment Strategy Fund’s inception date is December 31, 2014. The Fund commenced operations on January 2, 2015. |

| 2 | The S&P 500 Total Return Index is an unmanaged market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an index. |

| 3 | The Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-through securities), ABS, and CMBS. Investors cannot invest directly in an index. |

Comparison of the Change in Value of a $10,000 Investment

| Holdings by type of Investment | | % of Net Assets | |

| U.S. Market | | | 17.80 | % |

| Real Estate | | | 15.55 | % |

| Emerging Market Equities | | | 14.60 | % |

| Foreign Dev Market Equities | | | 14.34 | % |

| Fixed Income | | | 11.97 | % |

| Natural Resources | | | 6.45 | % |

| Absolute Return/Hedge Fund | | | 5.64 | % |

| Private Equity | | | 3.46 | % |

| Cash/Cash Equivalents | | | 10.19 | % |

| | | | 100.00 | % |

Please refer to the Schedule of Investments in this Annual Report for detailed analysis of the Fund’s Holdings.

| Wildermuth Endowment Strategy Fund |

| Schedule of Investments |

| December 31, 2015 |

| Shares | | | | | Value | |

| | | | | COMMON STOCK - 29.9% | | | | |

| | | | | AGRICULTURE - 0.4% | | | | |

| | 1,448 | | | Swedish Match AB | | $ | 51,569 | |

| | | | | | | | | |

| | | | | AIRLINES - 0.4% | | | | |

| | 18,401 | | | Qantas Airways Ltd. * | | | 54,744 | |

| | | | | | | | | |

| | | | | APPAREL - 0.5% | | | | |

| | 10,238 | | | Iconix Brand Group, Inc. * | | | 69,926 | |

| | | | | | | | | |

| | | | | AUTO PARTS & EQUIPMENT - 0.9% | | | | |

| | 206 | | | Continental AG | | | 50,259 | |

| | 822 | | | Cooper-Standard Holding, Inc. * | | | 63,779 | |

| | 8,678 | | | SORL Auto Parts, Inc. * | | | 21,955 | |

| | | | | | | | 135,993 | |

| | | | | BANKS - 1.6% | | | | |

| | 769 | | | Capital One Financial Corp. | | | 55,506 | |

| | 872 | | | JPMorgan Chase & Co. | | | 57,578 | |

| | 10,164 | | | Mitsubishi UFJ Financial Group, Inc. - ADR | | | 63,220 | |

| | 4,310 | | | Yamaguchi Financial Group, Inc. | | | 51,600 | |

| | | | | | | | 227,904 | |

| | | | | BEVERAGES - 0.3% | | | | |

| | 634 | | | Heineken Holding NV | | | 48,908 | |

| | | | | | | | | |

| | | | | BIOTECHNOLOGY - 0.7% | | | | |

| | 249 | | | Biogen, Inc. * | | | 76,281 | |

| | 166 | | | China Biologic Products, Inc. * | | | 23,648 | |

| | | | | | | | 99,929 | |

| | | | | BUILDING MATERIALS - 0.3% | | | | |

| | 8,501 | | | Asahi Glass Co. Ltd. | | | 49,191 | |

| | | | | | | | | |

| | | | | CHEMICALS - 1.4% | | | | |

| | 1,157 | | | Croda International PLC | | | 51,889 | |

| | 879 | | | Innospec, Inc. | | | 47,738 | |

| | 3,219 | | | Kraton Performance Polymers, Inc. * | | | 53,468 | |

| | 14,053 | | | Teijin Ltd. | | | 48,487 | |

| | | | | | | | 201,582 | |

| | | | | COMMERCIAL SERVICES - 1.0% | | | | |

| | 501 | | | Equifax, Inc. | | | 55,796 | |

| | 2,014 | | | On Assignment, Inc. * | | | 90,529 | |

| | | | | | | | 146,325 | |

| | | | | COMPUTERS - 0.9% | | | | |

| | 660 | | | Apple, Inc. | | | 69,472 | |

| | 475 | | | IHS, Inc. - Cl. A * | | | 56,254 | |

| | | | | | | | 125,726 | |

| | | | | DIVERSIFIED FINANCIAL SERVICES - 1.4% | | | | |

| | 1,828 | | | Encore Capital Group, Inc. * | | | 53,158 | |

| | 1,011 | | | Euronext NV | | | 51,940 | |

| | 76,000 | | | Haitong International Securities Group Ltd. | | | 46,776 | |

| | 1,396 | | | World Acceptance Corp. * | | | 51,792 | |

| | | | | | | | 203,666 | |

See accompanying notes to financial statements.

| Wildermuth Endowment Strategy Fund |

| Schedule of Investments (Continued) |

| December 31, 2015 |

| Shares | | | | | Value | |

| | | | | COMMON STOCK - 29.9% (Continued) | | | | |

| | | | | ELECTRIC - 1.3% | | | | |

| | 1,614 | | | Brookfield Infrastructure Partners LP | | $ | 61,187 | |

| | 617 | | | Huaneng Power International, Inc. - ADR | | | 21,163 | |

| | 1,218 | | | Public Service Enterprise Group, Inc. | | | 47,124 | |

| | 2,740 | | | Spark Energy, Inc. - Cl. A | | | 56,773 | |

| | | | | | | | 186,247 | |

| | | | | ELECTRONICS - 0.2% | | | | |

| | 7,447 | | | AU Optronics Corp. - ADR | | | 21,671 | |

| | | | | | | | | |

| | | | | ENGINEERING & CONSTRUCTION - 0.3% | | | | |

| | 1,117 | | | Boskalis Westminster | | | 45,669 | |

| | | | | | | | | |

| | | | | ENTERTAINMENT - 0.2% | | | | |

| | 1,614 | | | Bona Film Group Ltd. - ADR * | | | 21,353 | |

| | | | | | | | | |

| | | | | FOOD - 1.9% | | | | |

| | 5,799 | | | Amplify Snack Brands, Inc. * | | | 66,804 | |

| | 13,272 | | | J Sainsbury PLC | | | 50,639 | |

| | 1,151 | | | Tyson Foods, Inc. - Cl. A | | | 61,383 | |

| | 2,266 | | | United Natural Foods, Inc. * | | | 89,190 | |

| | | | | | | | 268,016 | |

| | | | | HEALTHCARE-PRODUCTS - 0.5% | | | | |

| | 3,767 | | | Exactech, Inc. * | | | 68,371 | |

| | | | | | | | | |

| | | | | HEALTHCARE-SERVICES - 1.0% | | | | |

| | 504 | | | Chemed Corp. | | | 75,499 | |

| | 2,980 | | | Ensign Group, Inc. | | | 67,437 | |

| | | | | | | | 142,936 | |

| | | | | HOME FURNISHINGS - 1.0% | | | | |

| | 5,829 | | | Panasonic Corp. | | | 60,117 | |

| | 3,996 | | | Select Comfort Corp. * | | | 85,554 | |

| | | | | | | | 145,671 | |

| | | | | HOUSEHOLD PRODUCTS/WARES - 0.4% | | | | |

| | 663 | | | Helen of Troy Ltd. * | | | 62,488 | |

| | | | | | | | | |

| | | | | INSURANCE - 1.5% | | | | |

| | 902 | | | AmTrust Financial Services, Inc. | | | 55,545 | |

| | 3,118 | | | Greenlight Capital Re Ltd. - Cl. A * | | | 58,338 | |

| | 248 | | | Muenchener Rueckver AG | | | 49,727 | |

| | 523 | | | Swiss Re AG | | | 51,281 | |

| | | | | | | | 214,891 | |

| | | | | INTERNET - 1.0% | | | | |

| | 2,650 | | | eBay, Inc. * | | | 72,822 | |

| | 3,877 | | | Web.com Group, Inc. * | | | 77,579 | |

| | | | | | | | 150,401 | |

| | | | | LEISURE TIME - 0.4% | | | | |

| | 2,996 | | | TUI AG | | | 54,752 | |

| | | | | | | | | |

| | | | | LODGING - 0.1% | | | | |

| | 599 | | | Homeinns Hotel Group - ADR * | | | 20,462 | |

See accompanying notes to financial statements.

| Wildermuth Endowment Strategy Fund |

| Schedule of Investments (Continued) |

| December 31, 2015 |

| Shares | | | | | Value | |

| | | | | COMMON STOCK - 29.9% (Continued) | | | | |

| | | | | MACHINERY-DIVERSIFIED - 0.5% | | | | |

| | 939 | | | Hollysys Automation Technologies Ltd. | | $ | 20,827 | |

| | 522 | | | Middleby Corp. * | | | 56,308 | |

| | | | | | | | 77,135 | |

| | | | | OIL & GAS - 0.6% | | | | |

| | 1,723 | | | Murphy Oil Corp. | | | 38,681 | |

| | 1,730 | | | Neste Oyj | | | 51,935 | |

| | | | | | | | 90,616 | |

| | | | | OIL & GAS SERVICES - 0.8% | | | | |

| | 11,481 | | | Gulfmark Offshore, Inc. - Cl. A * | | | 53,616 | |

| | 1,846 | | | National Oilwell Varco, Inc. | | | 61,823 | |

| | | | | | | | 115,439 | |

| | | | | PHARMACEUTICALS - 2.2% | | | | |

| | 2,426 | | | Daiichi Sankyo Co. Ltd. | | | 50,636 | |

| | 2,861 | | | Mitsubishi Tanabe Pharma Corp. | | | 49,856 | |

| | 784 | | | Novartis AG - ADR | | | 67,455 | |

| | 448 | | | USANA Health Sciences, Inc. * | | | 57,232 | |

| | 1,633 | | | VCA, Inc. * | | | 89,815 | |

| | | | | | | | 314,994 | |

| | | | | REITS - 0.4% | | | | |

| | 4,037 | | | Tier REIT, Inc. | | | 59,546 | |

| | | | | | | | | |

| | | | | RETAIL - 1.4% | | | | |

| | 936 | | | Asbury Automotive Group, Inc. * | | | 63,124 | |

| | 416 | | | Pandora A/S | | | 52,812 | |

| | 872 | | | Target Corp. | | | 63,316 | |

| | 616 | | | World Fuel Services Corp. | | | 23,691 | |

| | | | | | | | 202,943 | |

| | | | | SEMICONDUCTORS - 2.2% | | | | |

| | 2,080 | | | Cabot Microelectronics Corp. * | | | 91,062 | |

| | 2,853 | | | Cirrus Logic, Inc. * | | | 84,249 | |

| | 809 | | | NXP Semiconductors NV * | | | 68,158 | |

| | 980 | | | Synaptics, Inc. * | | | 78,733 | |

| | | | | | | | 322,202 | |

| | | | | SOFTWARE - 0.6% | | | | |

| | 962 | | | Changyou.com Ltd. - ADR * | | | 23,877 | |

| | 762 | | | Fiserv, Inc. * | | | 69,693 | |

| | | | | | | | 93,570 | |

| | | | | TELECOMMUNICATIONS - 0.8% | | | | |

| | 2,032 | | | ARRIS International PLC. * | | | 62,118 | |

| | 13,023 | | | Koninklijke KPN NV | | | 49,410 | |

| | | | | | | | 111,528 | |

| | | | | TRANSPORTATION - 0.4% | | | | |

| | 3,443 | | | Ship Finance International Ltd. | | | 57,051 | |

| | | | | | | | | |

| | | | | TRUCKING & LEASING - 0.4% | | | | |

| | 145 | | | AMERCO | | | 56,478 | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCK (Cost - $4,386,431) | | | 4,319,893 | |

| | | | | | | | | |

| | | | | EXCHANGE TRADED FUNDS - 28.1% | | | | |

| | | | | ASSET ALLOCATION FUND - 1.0% | | | | |

| | 3,272 | | | SPDR Barclays Convertible Securities ETF | | | 141,612 | |

See accompanying notes to financial statements.

| Wildermuth Endowment Strategy Fund |

| Schedule of Investments (Continued) |

| December 31, 2015 |

| Shares | | | | | Value | |

| | | | | EXCHANGE TRADED FUNDS - 28.1% (Continued) | | | | |

| | | | | CLOSED-END FUND - 1.0% | | | | |

| | 17,020 | | | PIMCO High Income Fund | | $ | 139,224 | |

| | | | | | | | | |

| | | | | DEBT FUNDS - 6.1% | | | | |

| | 2,149 | | | iShares Core U.S. Aggregate Bond ETF | | | 232,113 | |

| | 2,010 | | | iShares iBoxx $ Investment Grade Corporate Bond ETF | | | 229,160 | |

| | 1,345 | | | iShares JP Morgan USD Emerging Markets Bond ETF | | | 142,274 | |

| | 5,218 | | | PowerShares Emerging Markets Sovereign Debt Portfolio | | | 142,504 | |

| | 5,537 | | | SPDR Barclays Short Term High Yield Bond ETF | | | 142,245 | |

| | | | | | | | 888,296 | |

| | | | | EQUITY FUNDS - 20.0% | | | | |

| | 37,763 | | | Global X MLP ETF | | | 392,358 | |

| | 4,689 | | | Global X MSCI Argentina ETF | | | 84,777 | |

| | 3,170 | | | iShares MSCI Chile Capped ETF | | | 101,186 | |

| | 9,607 | | | iShares MSCI EAFE ETF | | | 564,411 | |

| | 3,287 | | | iShares MSCI India ETF | | | 90,524 | |

| | 13,120 | | | iShares MSCI Malaysia ETF | | | 101,549 | |

| | 2,498 | | | iShares MSCI Philippines ETF | | | 84,283 | |

| | 6,599 | | | iShares MSCI Taiwan ETF | | | 84,269 | |

| | 1,592 | | | iShares MSCI Thailand Capped ETF | | | 93,355 | |

| | 2,302 | | | Market Vectors Vietnam ETF | | | 34,047 | |

| | 38,641 | | | Vanguard FTSE Emerging Markets ETF | | | 1,263,947 | |

| | | | | | | | 2,894,706 | |

| | | | | | | | | |

| | | | | TOTAL EXCHANGE TRADED FUNDS (Cost - $4,273,022) | | | 4,063,838 | |

| | | | | | | | | |

| | | | | EXCHANGE TRADED NOTES - 3.7% | | | | |

| | | | | EQUITY FUNDS - 3.7% | | | | |

| | 10,442 | | | ETRACS Alerian MLP Infrastructure Index ETN | | | 273,476 | |

| | 9,237 | | | JPMorgan Alerian MLP Index ETN | | | 267,596 | |

| | | | | TOTAL EXCHANGE TRADED NOTES (Cost - $625,331) | | | 541,072 | |

| | | | | | | | | |

| | | | | HEDGE FUNDS - 5.6% | | | | |

| | | | | PHI Single Index Option Fund, LP + # | | | 450,000 | |

| | | | | Semper Midas Fund LP + # | | | 365,628 | |

| | | | | TOTAL HEDGE FUNDS (Cost - $825,000) | | | 815,628 | |

| | | | | | | | | |

| | | | | PRIVATE EQUITY - 3.5% | | | | |

| | 10 | | | GPB Automotive Portfolio LP + # | | | 500,000 | |

| | | | | TOTAL PRIVATE EQUITY (Cost - $500,000) | | | 500,000 | |

| | | | | | | | | |

| | | | | PUBLIC NON-TRADED BUSINESS DEVELOPMENT COMPANIES - 3.9% | | | | |

| | 22,462 | | | Corporate Capital Trust, Inc. + # | | | 207,995 | |

| | 23,217 | | | CION + # | | | 207,910 | |

| | 18,605 | | | HMS Income Fund, Inc. + # | | | 146,605 | |

| | | | | TOTAL PUBLIC NON-TRADED BUSINESS DEVELOPMENT COMPANIES (Cost - $580,026) | | | 562,510 | |

See accompanying notes to financial statements.

| Wildermuth Endowment Strategy Fund |

| Schedule of Investments (Continued) |

| December 31, 2015 |

| Shares | | | | | Value | |

| | | | | PUBLIC NON-TRADED REAL ESTATE INVESTMENT TRUSTS - 14.7% | | | | |

| | 74,069 | | | Behringer Harvard Opportunity + # | | $ | 265,167 | |

| | 90,192 | | | CNL Lifestyle Properties + # | | | 351,750 | |

| | 34,440 | | | Cottonwood Residential, Inc. + # | | | 530,032 | |

| | 18,060 | | | Dividend Capital Diversified + # | | | 134,912 | |

| | 136,771 | | | Inventrust Properties Corp. + # | | | 547,084 | |

| | 74,531 | | | KBS REIT + # | | | 293,652 | |

| | 1,000 | | | Landmark Apartment Trust, Inc. + # | | | 8,150 | |

| | | | | TOTAL PUBLIC NON-TRADED REAL ESTATE INVESTMENT TRUSTS (Cost - $1,689,767) | | | 2,130,747 | |

| | | | | | | | | |

| | | | | REAL ESTATE LIMITED PARTNERSHIPS - 0.4% | | | | |

| | 56 | | | Shopoff Land Fund III LP + # | | | 50,680 | |

| | 1,000 | | | Uniprop Manufactured Housing Communities Income Fund II + # | | | 8,930 | |

| | | | | TOTAL REAL ESTATE LIMITED PARTNERSHIPS (Cost - $58,955) | | | 59,610 | |

| | | | | | | | | |

| | | | | SHORT-TERM INVESTMENTS - 10.4% | | | | |

| | 1,509,762 | | | Blackrock Liquidity Funds T-Fund Portfolio, 0.10% ^ | | | | |

| | | | | TOTAL SHORT-TERM INVESTMENTS (Cost - $1,509,762) | | $ | 1,509,762 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 100.2% (Cost - $14,448,294) (a) | | $ | 14,503,060 | |

| | | | | OTHER LIABILITIES LESS ASSETS - (0.2)% | | | (36,086 | ) |

| | | | | NET ASSETS - 100.0% | | $ | 14,466,974 | |

| * | Non-income producing security. |

| ^ | Rate shown represents the rate at December 31, 2015, is subject to change and resets daily. |

| + | Illiquid security. Total illiquid securities represent 28.81% of net assets as of December 31, 2015. |

| # | Market Value estimated using Fair Valuation Procedures adopted by the Board of Trustees. Total of such securities is $4,068,495, or 28.12%, of net assets. |

ADR - American Depositary Receipt

LP - Limited Partnership

PLC - Public Liability Company

REIT - Real Estate Investment Trust

| (a) | Represents cost for financial reporting purposes. Aggregate cost for federal income tax purposes is $14,509,784 and differs from market value by net unrealized appreciation (depreciation) of securities as follows: |

| Unrealized appreciation: | | $ | 618,801 | |

| Unrealized depreciation: | | | (625,525 | ) |

| Net unrealized depreciation: | | $ | (6,724 | ) |

See accompanying notes to financial statements.

| Wildermuth Endowment Strategy Fund |

| Statement of Assets and Liabilities, December 31, 2015 |

| ASSETS | | | | |

| Investment securities: | | | | |

| At cost | | $ | 14,448,294 | |

| At value | | $ | 14,503,060 | |

| Cash | | | 855 | |

| Receivable for securities sold | | | 79,117 | |

| Dividend and interest receivable | | | 146,985 | |

| Funded Commitment | | | 100,000 | |

| Receivable from Adviser | | | 42,753 | |

| Receivable from affiliate | | | 2,719 | |

| Prepaid expenses and other assets | | | 32,172 | |

| TOTAL ASSETS | | | 14,907,661 | |

| | | | | |

| LIABILITIES | | | | |

| Payable for investments purchased | | | 371,835 | |

| Payable for shareholder servicing fees | | | 6,192 | |

| Payable for administration fees | | | 5,899 | |

| Payable for fund accounting fees | | | 4,113 | |

| Payable for transfer agent fees | | | 3,186 | |

| Payable for trustee fees | | | 13,246 | |

| Accrued expenses and other liabilities | | | 36,216 | |

| TOTAL LIABILITIES | | | 440,687 | |

| NET ASSETS | | $ | 14,466,974 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Paid in capital | | $ | 14,581,525 | |

| Undistributed net investment income | | | 11,209 | |

| Accumulated net realized loss from investments | | | (180,526 | ) |

| Net unrealized appreciation on investments | | | 54,766 | |

| NET ASSETS | | $ | 14,466,974 | |

| | | | | |

| NET ASSET VALUE PER SHARE: | | | | |

| Net Assets | | $ | 14,466,974 | |

| Shares of beneficial interest outstanding [$0 par value, 25,000,000 shares authorized] | | | 1,340,191 | |

| Net asset value (Net Assets ÷ Shares Outstanding) and redemption price per share 1 | | $ | 10.79 | |

| Maximum offering price per share (maximum sales charge of 6.00%) | | $ | 11.48 | |

| 1 | Redemptions made within 90 days of purchase my be assessed a redemption fee of 2.00%. |

See accompanying notes to financial statements.

| Wildermuth Endowment Strategy Fund |

| Statement of Operations |

| | | Period Ended | |

| | | December 31, 20151 | |

| INVESTMENT INCOME | | | | |

| Dividends | | $ | 148,940 | |

| Interest | | | 92 | |

| Less: Foreign withholding taxes | | | (381 | ) |

| TOTAL INVESTMENT INCOME | | | 148,651 | |

| | | | | |

| EXPENSES | | | | |

| Investment advisory fees | | | 73,716 | |

| Shareholder servicing fees | | | 12,286 | |

| Offering costs | | | 378,599 | |

| Legal fees | | | 105,282 | |

| Trustees’ fees and expenses | | | 69,613 | |

| Administration services fees | | | 32,603 | |

| Compliance officer fees | | | 27,972 | |

| Professional fees | | | 23,732 | |

| Accounting services fees | | | 23,468 | |

| Audit fees | | | 23,012 | |

| Insurance expense | | | 22,727 | |

| Transfer agent fees | | | 19,229 | |

| Custodian fees | | | 7,246 | |

| Printing and postage expenses | | | 5,032 | |

| Registration fees | | | 2,059 | |

| Other expenses | | | 1,365 | |

| TOTAL EXPENSES | | | 827,941 | |

| | | | | |

| Less: Fees waived/reimbursed by the Adviser | | | (703,853 | ) |

| | | | | |

| NET EXPENSES | | | 124,088 | |

| | | | | |

| NET INVESTMENT INCOME | | | 24,563 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | | | | |

| Net realized gain (loss) from: | | | | |

| Investments | | | (217,212 | ) |

| Distributions of realized gains by underlying investment companies | | | 25,810 | |

| Net increase from payments by affiliates for pricing error (Note 4) | | | 10,876 | |

| Foreign currency transactions | | | (2,365 | ) |

| | | | (182,891 | ) |

| Net change in unrealized appreciation of: | | | | |

| Investments | | | 54,766 | |

| | | | | |

| NET REALIZED AND UNREALIZED LOSS FROM INVESTMENTS | | | (128,125 | ) |

| | | | | |

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (103,562 | ) |

| 1 | The Wildermuth Endowment Strategy Fund commenced operations on January 2, 2015. |

See accompanying notes to financial statements.

| Wildermuth Endowment Strategy Fund |

| Statement of Changes in Net Assets |

| | | Period Ended | |

| | | December 31, 20151 | |

| FROM OPERATIONS | | | | |

| Net investment income | | $ | 24,563 | |

| Net realized loss from investments | | | (208,701 | ) |

| Distributions of realized gains by underlying investment companies | | | 25,810 | |

| Net change in unrealized appreciation on investments | | | 54,766 | |

| Net decrease in net assets resulting from operations | | | (103,562 | ) |

| | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | |

| From net investment income | | | (10,989 | ) |

| From return of capital | | | (135,124 | ) |

| Net decrease in net assets resulting from distributions to shareholders | | | (146,113 | ) |

| | | | | |

| FROM SHARES OF BENEFICIAL INTEREST | | | | |

| Proceeds from shares sold | | | 14,121,176 | |

| Net asset value of shares issued in reinvestment of distributions | | | 95,473 | |

| Net increase in net assets from shares of beneficial interest | | | 14,216,649 | |

| | | | | |

| NET INCREASE IN NET ASSETS | | | 13,966,974 | |

| | | | | |

| NET ASSETS | | | | |

| Beginning of Period | | | 500,000 | |

| End of Period* | | $ | 14,466,974 | |

| * Includes undistributed net investment income of: | | $ | 11,209 | |

| | | | | |

| SHARE ACTIVITY | | | | |

| Shares Sold | | | 1,281,421 | |

| Shares Reinvested | | | 8,770 | |

| Net increase in shares of beneficial interest outstanding | | | 1,290,191 | |

| 1 | The Wildermuth Endowment Strategy Fund commenced operations on January 2, 2015. |

See accompanying notes to financial statements.

| Wildermuth Endowment Strategy Fund |

| Statement of Cash Flows |

| | | Period Ended | |

| | | December 31, 20151 | |

| Cash flows from operating activities: | | | | |

| Net decrease in net assets resulting from operations | | $ | (103,562 | ) |

| Adjustments to reconcile net decrease in net assets resulting from operations to net cash used in operating activities: | | | | |

| Purchases of investments | | | (18,023,615 | ) |

| Purchase of short term investments, net | | | (1,509,762 | ) |

| Proceeds from sales of investments | | | 4,752,205 | |

| Net realized loss from investments | | | 217,212 | |

| Return of capital and non-income distributions received | | | 141,476 | |

| Distributions of realized gains by underlying investment companies | | | (25,810 | ) |

| Net unrealized depreciation on investments | | | (54,766 | ) |

| | | | | |

| Changes in assets and liabilities | | | | |

| (Increase)/Decrease in assets: | | | | |

| Receivable from Investment Adviser | | | (42,753 | ) |

| Interest receivable | | | (146,985 | ) |

| Receivable for fund shares sold | | | — | |

| Receivable for securities sold | | | (79,117 | ) |

| Receivable from affiliate | | | (2,719 | ) |

| Funded commitment | | | (100,000 | ) |

| Prepaid expenses and other assets | | | (32,172 | ) |

| Increase/(Decrease) in liabilities: | | | | |

| Payable for securities purchased | | | 371,835 | |

| Payable for fund administration fees | | | 5,899 | |

| Payable for fund accounting fees | | | 4,113 | |

| Payable for transfer agent fees | | | 3,186 | |

| Payables to trustees | | | 13,246 | |

| Shareholder servicing fees payable | | | 6,192 | |

| Accrued expenses and other liabilities | | | 36,216 | |

| Net cash used in operating activities | | | (14,569,681 | ) |

| | | | | |

| Cash flows from financing activities: | | | | |

| Proceeds from shares sold | | | 14,121,176 | |

| Cash distributions paid, net of reinvestment | | | (50,640 | ) |

| Net cash provided by financing activities | | | 14,070,536 | |

| | | | | |

| Net decrease in cash | | | (499,145 | ) |

| Cash at beginning of period | | | 500,000 | |

| Cash at end of period | | $ | 855 | |

| | | | | |

| Supplemental disclosure of non-cash activity: | | | | |

| Non-cash financing activities not included herein consist of reinvestment of distributions | | $ | 95,473 | |

| 1 | The Wildermuth Endowment Strategy Fund commenced operations on January 2, 2015. |

See accompanying notes to financial statements.

| Wildermuth Endowment Strategy Fund |

| Financial Highlights |

Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout the Period

| | | Period Ended | |

| | | December 31, 2015 1 | |

| | | | |

| Net asset value, beginning of period | | $ | 10.00 | |

| Activity from investment operations: | | | | |

| Net investment income 2 | | | 0.05 | |

| Net realized and unrealized gain on investments | | | 0.93 | 3 |

| Total from investment operations | | | 0.98 | |

| Less distributions from: | | | | |

| Net investment income | | | (0.03 | ) |

| Return of capital | | | (0.16 | ) |

| Total distributions | | | (0.19 | ) |

| Net asset value, end of period | | $ | 10.79 | |

| Total return 4,5 | | | 9.74 | % |

| Net assets, at end of period (000s) | | $ | 14,467 | |

| Ratio of gross expenses to average net assets 6,7 | | | 16.65 | % |

| Ratio of net expenses to average net assets 6,7,8 | | | 2.50 | % |

| Ratio of net investment income to average net assets 6,7,9 | | | 0.49 | % |

| Portfolio Turnover Rate 5 | | | 107 | % |

| 1 | The Wildermuth Endowment Strategy Fund commenced operations on January 2, 2015. |

| 2 | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. |

| 3 | Realized and unrealized gain per share does not correlate to the aggregate of the net realized and unrealized gains on the Statement of Operations for the period ended December 31, 2015, primarily due to the timing of sales and repurchases of the Fund’s shares in relation to fluctuating market values for the Fund’s portfolio. |

| 4 | Total returns shown exclude the effect of applicable sales loads/redemption fees. If the Adviser did not reimburse/waive a portion of the Fund’s expenses, total return would have been lower. |

| 7 | The ratios of expenses and net investment income to average net assets do not reflect the Fund’s proportionate share of income and expenses of underlying investment companies in which the Fund invests. |

| 8 | Represents the ratio of expenses to average net assets net of fee waivers and/or expense reimbursements by adviser. |

| 9 | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

See accompanying notes to financial statements.

| Wildermuth Endowment Strategy Fund |

| Notes to Financial Statements |

| December 31, 2015 |

Wildermuth Endowment Strategy Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, closed-end management investment company that is operated as an interval fund. The Fund was organized as a Delaware statutory trust on August 28, 2013, and did not have any operations from that date until December 31, 2014, other than those relating to organizational matters and registration of its shares under applicable securities law. The Fund commenced operations on January 2, 2015. The Fund’s investment objective is to seek total return through a combination of long-term capital appreciation and income generation. The Fund will pursue its objective by investing in assets that Wildermuth Advisory, LLC (the “Adviser”) believes provide favorable long-term capital appreciation and risk-adjusted return potential, as well as in income-producing assets that the Adviser believes will provide consistent income generation and liquidity.

The Fund is engaged in a continuous offering, up to a maximum of 25 million shares of beneficial interest, and will operate as an interval fund that will offer to make quarterly repurchases of shares at the Fund’s net asset value (“NAV”). The initial NAV was $10.00 per share and the shares are offered subject to a maximum sales charge of 6.00% of the offering price. The Adviser initially capitalized the Fund on December, 1 2014 at $10.00 per share. The sales charge was waived in the initial funding.

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates. The Fund follows the specialized accounting and reporting requirements under GAAP that are applicable to investment companies.

Security Valuation – Securities listed on an exchange are valued at the last reported sale price at the close of the regular trading session of the exchange on the business day the value is being determined, or in the case of securities listed on NASDAQ at the NASDAQ Official Closing Price (“NOCP”). In the absence of a sale such securities shall be valued at the mean of the closing bid and asked prices for the day of valuation. The Funds may invest in portfolios of open-end or closed-end investment companies (the “open-end funds”). Open-end funds are valued at their respective net asset values as reported by such investment companies. The underlying funds value securities in their portfolios for which market quotations are readily available at their market values (generally the last reported sale price) and all other securities and assets at their fair value by the methods established by the Boards of the open-end funds. The shares of many closed-end investment companies, after their initial public offering, frequently trade at a price per share, which is different than the net asset value per share. The difference represents a market premium or market discount of such shares. There can be no assurances that the market discount or market premium on shares of any closed-end investment company purchased by the Funds will not change.

When price quotations for certain securities are not readily available, or if the available quotations are not believed to be reflective of market value by the Adviser, those securities will be valued at “fair value” as determined in good faith by the Adviser and the fair value team using procedures adopted by and under the supervision of the Fund’s Board of Trustees (the “Board”). There can be no assurance that the Fund could purchase or sell a portfolio security at the price used to calculate the Fund’s NAV.

Investments in Private Funds, Non-Traded REITs (“Non-Traded Funds”) and BDCs will be difficult to value, particularly to the extent that their underlying investments are not publicly traded. In the event a Non-Traded Fund does not report a value to the Fund on a timely basis, the Adviser, acting under the Board’s supervision and pursuant to policies implemented by the Board, will determine the fair value of the Fund’s investment based on the most recent value reported by the Non-Traded Fund, as well as any other relevant information available at the time the Fund values its investments. Following procedures adopted by the Board, in the absence of specific transaction activity in a particular investment fund, the Adviser will consider whether it is appropriate, in light of all relevant circumstances, to value the Fund’s investment at the NAV reported by the Non-Traded Fund at the time of valuation or to adjust the value to reflect a premium or discount.

| Wildermuth Endowment Strategy Fund |

| Notes to Financial Statements (Continued) |

| December 31, 2015 |

There is no single standard for determining fair value of a security. Rather, the Adviser’s fair value calculations will involve significant professional judgment in the application of both observable and unobservable attributes, and as a result, the calculated net asset values of the Non-Traded Funds’ assets may differ from their actual realizable value or future fair value. In determining the fair value of a security for which there are no readily available market quotations, the Adviser, acting under the Board’s supervision and pursuant to policies implemented by the Board, may consider several factors, including, but not limited to: (i) the nature and pricing history (if any) of the security; (ii) whether any dealer quotations for the security are available; (iii) possible valuation methodologies that could be used to determine the fair value of the security; (iv) the recommendation of the portfolio manager of the Fund with respect to the valuation of the security; (v) whether the same or similar securities are held by other accounts managed by the Adviser and the method used to price the security in those accounts; (vi) the extent to which the fair value to be determined for the security will result from the use of data or formula produced by third parties independent of the Adviser; and (vii) the liquidity or illiquidity of the market for the security. As part of its due diligence of Non-Traded Fund investments, the Adviser will attempt to obtain current information on an ongoing basis from market sources, asset managers and/or issuers to value all fair valued securities. However, it is anticipated that portfolio holdings and other value information of the Non-Traded Funds could be available on no more than a quarterly basis. Based on its review of all relevant information, the Adviser may conclude in certain circumstances that the information provided by the asset manager and/or issuer of a Non-Traded Fund does not represent the fair value of the Fund’s investment in such security. Private Funds that invest primarily in publicly traded securities are more easily valued because the values of their underlying investments are based on market quotations.

The Fund utilizes various methods to measure the fair value of most of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of input are:

Level 1 – Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access.

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument in an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

| Wildermuth Endowment Strategy Fund |

| Notes to Financial Statements (Continued) |

| December 31, 2015 |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following is a summary of the valuation inputs, representing 100% of the Fund’s investments, used to value the Fund’s assets and liabilities as of December 31, 2015:

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stock | | $ | 4,319,893 | | | $ | — | | | $ | — | | | $ | 4,319,893 | |

| Exchange Traded Funds | | | 4,063,838 | | | | — | | | | — | | | | 4,063,838 | |

| Exchange Traded Notes | | | 541,072 | | | | — | | | | — | | | | 541,072 | |

| Hedge Funds | | | — | | | | — | | | | 815,628 | | | | 815,628 | |

| Private Equity | | | — | | | | — | | | | 500,000 | | | | 500,000 | |

| Public Non-Traded Business Development Companies | | | — | | | | — | | | | 562,510 | | | | 562,510 | |

| Public Non-Traded Real Estate Investment Trusts | | | — | | | | — | | | | 2,130,747 | | | | 2,130,747 | |

| Real Estate Limited Partnerships | | | — | | | | — | | | | 59,610 | | | | 59,610 | |

| Short-Term Investments | | | 1,509,762 | | | | — | | | | — | | | | 1,509,762 | |

| Total Assets | | $ | 10,434,565 | | | $ | — | | | $ | 4,068,495 | | | $ | 14,503,060 | |

There were no transfers into or out of Level 1 and Level 2 during the current period presented. It is the Fund’s policy to record transfers into or out of Level 1 and Level 2 at the end of the period.

The following is a reconciliation of assets in which Level 3 inputs were used in determining value:

| | | Hedge | | | Private | | | Public Non- | | | Public Non- | | | Real Estate Limited | | | | |

| | | Funds | | | Equity | | | Traded BDC | | | Traded REIT | | | Partnerships | | | Total | |

| Beginning balance | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Total realized gain/(loss) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Change in unrealized appreciation | | | (9,372 | ) | | | — | | | | (17,516 | ) | | | 440,980 | | | | 655 | | | | 414,747 | |

| Purchases | | | 825,000 | | | | 500,000 | | | | 580,026 | | | | 1,774,392 | | | | 58,955 | | | | 3,738,373 | |

| Tax basis adjustment | | | — | | | | — | | | | — | | | | (84,625 | ) | | | — | | | | (84,625 | ) |

| Net transfers in/(out) of Level 3 | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Ending balance | | $ | 815,628 | | | $ | 500,000 | | | $ | 562,510 | | | $ | 2,130,747 | | | $ | 59,610 | | | $ | 4,068,495 | |

Quantitative disclosures of unobservable inputs and assumptions used by the Fund are set forth below.

| Investment Type | | Fair Value | | | Techniques | | Unobservable Input |

| | | | | | | | | |

| Hedge Funds | | $ | 815,628 | | | Cost/

Monthly NAV | | N/A |

| | | | | | | | | |

| Private Equity | | $ | 500,000 | | | PrivateTransaction

Cost | | N/A |

| | | | | | | | | |

| Public Non-Traded Business Development Companies | | $ | 562,510 | | | Periodic NAV | | N/A |

| | | | | | | | | |

| Public Non-Traded REITs | | $ | 2,130,747 | | | Periodic NAV | | N/A |

| | | | | | | | | |

| Real Estate Limited Partnerships | | $ | 59,610 | | | Periodic NAV | | N/A |

Security Transactions and Related Income – Security transactions are accounted for on trade date basis. Interest income is recognized on an accrual basis. Discounts are accreted and premiums are amortized on securities purchased over the lives of the respective securities. Dividend income is recorded on the ex-dividend date. Realized gains or losses from sales of securities are determined by comparing the identified cost of the security lot sold with the net sales proceeds.

| Wildermuth Endowment Strategy Fund |

| Notes to Financial Statements (Continued) |

| December 31, 2015 |

Dividends and Distributions to Shareholders – Dividends from net investment income are declared and distributed quarterly. Distributable net realized capital gains are declared and distributed annually. Dividends from net investment income and distributions from net realized gains are recorded on ex dividend date and determined in accordance with federal income tax regulations, which may differ from GAAP. These “book/tax” differences are considered either temporary (i.e., deferred losses, capital loss carry forwards) or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the composition of net assets based on their federal tax-basis treatment; temporary differences do not require reclassification.

Distributions received from investments in securities that represent a return of capital or capital gains are recorded as a reduction of cost of investment or as a realized gain, respectively. The calendar year-end amounts of ordinary income, capital gains, and return of capital included in distributions received from the Fund’s investments in real estate investment trusts (“REITs”) are reported to the Fund after the end of the calendar year; accordingly, the Fund estimates these amounts for accounting purposes until the characterization of REIT distributions is reported to the Fund after the end of the calendar year. Estimates are based on the most recent REIT distribution information available.

Investment Companies – The Fund may obtain investment exposure to various asset classes by investing in other investment companies, including registered investment companies, such as ETFs, mutual funds and closed-end funds, as well as hedge funds, private equity funds or other privately offered pooled investment vehicles that are not registered under the 1940 Act (collectively “Investment Funds”). Each Investment Fund is subject to specific risks, depending on the nature of the fund. These risks could include liquidity risk, sector risk, and foreign currency risk, as well as risks associated with fixed income securities and commodities among others. Also, the Fund’s performance depends in part upon the performance of the Investment Fund managers and selected strategies, the adherence by such Investment Fund managers to such selected strategies, the instruments used by such Investment Fund managers and the Adviser’s ability to select Investment Funds and strategies and effectively allocate Fund assets among them. By investing in Investment Funds indirectly through the Fund, the investor bears asset-based fees at the Fund level, in addition to any asset-based fees and/or performance-based fees and allocations at the Investment Fund level. Moreover, an investor in the Fund bears a proportionate share of the fees and expenses of the Fund (including organizational and offering expenses, operating costs, sales charges, brokerage transaction expenses, and administrative fees) and, indirectly, similar expenses of the Investment Funds. Thus, an investor in the Fund may be subject to higher fees and operating expenses than if he or she invested in an Investment Fund directly.

Federal Income Taxes – It is the Fund’s policy to qualify as a regulated investment company by complying with the provisions of the Internal Revenue Code that are applicable to regulated investment companies and to distribute substantially all of its taxable income and net realized gains to shareholders. Therefore, no federal income tax provision has been recorded.

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions expected to be taken on returns to be filed for open tax year 2015. The Fund identifies its major tax jurisdictions as U.S. federal, and foreign jurisdictions where the Fund makes significant investments; however, the Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

Redemption Fee – For shares held for 90 days or less, the Fund will deduct a 2% redemption fee from the redemption amount if the shares are sold pursuant to the Fund’s quarterly repurchase program. Shares held longest will be treated as being repurchased first and shares held shortest as being repurchased last. The redemption fee does not apply to shares that were acquired through reinvestment of distributions. Shares held for more than 90 days are not subject to the 2% fee. Redemption fees are paid to the Fund directly and are designed to offset costs associated with fluctuations in Fund asset levels and cash flow caused by short-term shareholder trading. The Fund did not have any redemptions fees during the period ended December 31, 2015.

Indemnification – The Fund indemnifies its officers and trustees for certain liabilities that may arise from the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on industry experience, the risk of loss due to these warranties and indemnities appears to be remote.

| Wildermuth Endowment Strategy Fund |

| Notes to Financial Statements (Continued) |

| December 31, 2015 |

| 3. | INVESTMENT TRANSACTIONS |

The cost of purchases and proceeds from the sale of securities, other than short-term investments, for the period ended December 31, 2015, amounted to $18,023,615 and $4,752,205, respectively.

| 4. | ADVISORY FEE AND OTHER RELATED PARTY TRANSACTIONS |

Advisory Fees – The Adviser is entitled to receive a monthly fee equal to the annual rate of 1.50% of the Fund’s average daily net assets. For the period ended December 31, 2015, the Adviser earned $73,716 in advisory fees.

The Adviser and the Fund have entered into an expense limitation and reimbursement agreement (the “Expense Limitation Agreement”) under which the Adviser has agreed contractually to waive its fees and to pay or absorb the direct, ordinary operating expenses of the Fund (including offering and organizational expenses but excluding front-end or contingent deferred loads, brokerage fees and commissions, acquired fund fees and expenses, borrowing costs (such as interest and dividend expenses on securities sold short), taxes and extraordinary expenses such as litigation)), to the extent that they exceed 2.50% per annum of the Fund’s average daily net assets (the “Expense Limitation”) through March 31, 2016. In consideration of the Adviser’s agreement to limit the Fund’s expenses, the Fund has agreed to repay the Adviser in the amount of any fees waived and Fund expenses paid or absorbed. Any waiver or reimbursement of fees by the Adviser is subject to repayment by the Fund within three years following such waiver or reimbursement; provided, however, that (i) the Fund is able to make such repayment without exceeding the expense limitation in place at the time the fees being repaid were waived or the Fund’s current expense limitation, whichever is lower, and (ii) such repayment is approved by the Board. The Expense Limitation Agreement will remain in effect for at least one year from the effective date of the Prospectus, unless and until the Board approves its modification or termination. The Expense Limitation Agreement may be terminated only by the Fund’s Board on 60 days’ written notice to the Adviser. The Adviser waived and or reimbursed expenses on the Fund for organizational costs and other expenses incurred during the period ended December 31, 2015 in the amount of $73,173 and $703,853 which may be recaptured no later than December 31, 2017 and December 31, 2018, respectively.

The Fund has adopted a Shareholder Services Plan (the “Plan”). The Plan provides that a monthly service and/or distribution fee is calculated by the Fund at an annual rate not to exceed 0.25% of the average daily net asset value of the Fund and was paid to Realty Capital Securities, LLC (the “Distributor”).

Through December 31, 2015, the Distributor acted as the Fund’s principal underwriter in a continuous public offering of the Fund’s shares. For the period ended December 31, 2015, the Distributor received $420,545 in underwriting commissions for sales of shares, of which $24,238 was retained by the principal underwriter or other affiliated broker-dealers.

Offering costs - Offering costs include legal fees pertaining to shares offered for sale by the Fund, SEC and State registration fees and cost of printing prospectuses that are incurred by the Fund and are treated as deferred charges until operations commence and were amortized into expense over a 12 month period using the straight line method.

Trustees - Each Independent Trustee will receive a retainer of $5,000 per year, plus $2,500 for each board or board committee meeting the trustee attends in person ($3,000 for attendance by the chairperson of the audit committee at each meeting of the audit committee), $500 for each meeting the trustee attends telephonically. If there is a meeting of the Board and one or more committees in a single day, the fees will be limited to $3,000 per day ($3,500 for the chairperson of the audit committee if there is a meeting of such committee) for an in person meeting and $750 ($1,000 for the chairperson of the audit committee if there is a meeting of such committee) for meetings attended telephonically. No “interested persons” who serve as Trustees of the Fund will receive any compensation for their services as Trustees. None of the executive officers receive compensation from the Fund.

Pursuant to an agreement with Vigilant Compliance, LLC (“Vigilant”), an employee of Vigilant serves as the Chief Compliance Officer and Chief Financial Officer of the Fund. For the provision of these services, Vigilant receives compensation for these services. For the period ended December 31, 2015, the amounts accrued for payment to Vigilant for these services were $27,972 for Chief Compliance Officer and $23,732 for Chief Financial Officer. These amounts are shown in the Statement of Operations under “Compliance officer fees” and “Professional fees.”

| Wildermuth Endowment Strategy Fund |

| Notes to Financial Statements (Continued) |

| December 31, 2015 |

Pursuant to a separate servicing agreement with RCS Advisory Services, LLC (“RCSAS”), the Administrator of the Fund and an affiliate of the Distributor, the Fund pays RCSAS customary fees for providing administration and fund accounting services to the Fund. RCSAS has entered into a contract with Gemini Fund Services (“GFS”) pursuant to which GFS serves as sub-administrator and provides sub-fund accounting services and performs many of the administrative services for the Trust. RCSAS pays Gemini from the fees received from the Fund. For the period ended December 31, 2015, $56,071 was accrued for payment to RCSAS as shown in the Fund’s Statement of Operations under “Administration services fees” and “Accounting services fees.”

Pursuant to a separate servicing agreement with American National Stock Transfer, LLC (“ANST”), ANST serves as the Transfer Agent for the Fund and is an affiliate of the Distributor and the Administrator. ANST has entered into an agreement with GFS to serve as sub-transfer agent to the Fund. ANST pays Gemini from the fees received from the Fund. For the period ended December 31, 2015, $19,229 was accrued for payment to ANST as shown in the Fund’s Statement of Operations under “Transfer agent fees.”

The Fund received a reimbursement from the Adviser related to a net loss incurred on a pricing error. The losses realized by the Fund from the pricing error totaled $10,876 and the Adviser and RCSAS reimbursed the Fund in full for these losses.

| 5. | DISTRIBUTIONS TO SHAREHOLDERS AND TAX COMPONENTS OF CAPITAL |

The tax character of Fund distributions for the period ended December 31, 2015 was as follows:

| | | Fiscal Period Ended | |

| | | December 31, 2015 | |

| Ordinary Income | | $ | 10,989 | |

| Return of Capital | | | 135,124 | |

| | | $ | 146,113 | |

As of December 31, 2015, the components of accumulated earnings/(deficit) on a tax basis were as follows:

| Undistributed | | | Undistributed | | | Post October Loss | | | Capital Loss | | | Other | | | Unrealized | | | Total | |

| Ordinary | | | Long-Term | | | and | | | Carry | | | Book/Tax | | | Appreciation/ | | | Accumulated | |

| Income | | | Gains | | | Late Year Loss | | | Forwards | | | Differences | | | (Depreciation) | | | Earnings/(Deficits) | |

| $ | — | | | $ | — | | | $ | — | | | $ | (107,827 | ) | | $ | — | | | $ | (6,724 | ) | | $ | (114,551 | ) |

The difference between book basis and tax basis undistributed net investment income and unrealized appreciation (depreciation) is primarily attributable to the tax deferral of losses on wash sales and adjustments for partnerships and return of capital distributions from C-Corporations.

At December 31, 2015, the Fund had capital loss carry forwards for federal income tax purposes available to offset future capital gains, if any as follows:

| Non-Expiring | | | Non-Expiring | | | | |

| Short-Term | | | Long-Term | | | Total | |

| $ | 107,827 | | | $ | — | | | $ | 107,827 | |

| Wildermuth Endowment Strategy Fund |

| Notes to Financial Statements (Continued) |

| December 31, 2015 |

Permanent book and tax differences, primarily attributable to foreign currency exchange gains (losses), resulted in reclassification for the fiscal period ended December 31, 2015 as follows:

| Paid | | | Undistributed | | | Accumulated | |

| In | | | Net Investment | | | Net Realized | |

| Capital | | | Income (Loss) | | | Gains (Loss) | |

| $ | — | | | $ | (2,365 | ) | | $ | 2,365 | |

| 6. | NEW ACCOUNTING PRONOUNCEMENTS |

In May 2015, the FASB issued Accounting Standards Update (“ASU”) No. 2015-07 “Disclosure for Investments in Certain Entities that Calculate Net Asset Value per Share (or Its Equivalent)”. The amendments in ASU No. 2015-07 remove the requirement to categorize within the fair value hierarchy investments measured using the NAV practical expedient. The ASU also removes certain disclosure requirements for investments that qualify, but do not utilize, the NAV practical expedient. The amendments in the ASU are effective for fiscal years beginning after December 15, 2015, and interim periods within those fiscal years. The practical expedient allows entities to estimate the fair value of certain investments by using the NAV per share as of their measurement date. Management is currently evaluating the impact these changes will have on the Fund’s financial statements and related disclosures.

Pursuant to Rule 23c 3 under the Investment Company Act of 1940, as amended, the Fund offers shareholders on a quarterly basis the option of redeeming shares, at net asset value, of no less than 5% and no more than 25% of the shares outstanding. There is no guarantee that shareholders will be able to sell all of the shares they desire in a quarterly repurchase offer, although each shareholder will have the right to require the Fund to purchase up to and including 5% of such shareholder’s shares in each quarterly repurchase. Limited liquidity will be provided to shareholders only through the Fund’s quarterly repurchases.

During the period ended December 31, 2015, the Fund completed three quarterly repurchase offers. In those offers, the Fund offered to repurchase up to 5% of the number of its outstanding shares as of the Repurchase Pricing Dates. The results of those repurchase offers were as follows:

| | | Repurchase Offer #1 | | | Repurchase Offer #2 | | | Repurchase Offer #3 | |

| Commencement Date | | | June 30, 2015 | | | | September 30, 2015 | | | | December 29, 2015 | |

| Repurchased Request Deadline | | | July 31, 2015 | | | | October 30, 2015 | | | | February 1, 2016 | |

| Repurchased Pricing Date | | | July 31, 2015 | | | | October 30, 2015 | | | | February 1, 2016 | |

| Net Asset Value as of Repurchase | | | | | | | | | | | | |

| Offer Date | | $ | — | | | $ | — | | | $ | — | |

| Amount Repurchased | | $ | — | | | $ | — | | | $ | — | |

| Percentage of Outstanding Shares | | | | | | | | | | | | |

| Repurchased | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % |

| 8. | INVESTMENT IN RESTRICTED SECURITIES |

Restricted securities include securities that have not been registered under the Securities Act of 1933, as amended, and securities that are subject to restrictions on resale. The Fund may invest in restricted securities that are consistent with the Fund’s investment objectives and investment strategies. Investments in restricted securities are valued at fair value as determined in good faith in accordance with procedures adopted by the Board of Trustees. It is possible that the estimated value may differ significantly from the amount that might ultimately be realized in the near term, and the difference could be material.

| Wildermuth Endowment Strategy Fund |

| Notes to Financial Statements (Continued) |

| December 31, 2015 |

As of December 31, 2015, the Fund was invested in the following restricted securities:

| | | Initial | | | | | | | | | | | % of Net | |

| Security | | Acquisition Date | | Shares | | | Cost | | | Value | | | Assets | |

| Behringer Harvard Opportunity | | 2/17/2015 | | | 74,069 | | | $ | 164,456 | | | $ | 265,167 | | | | 1.83 | % |

| CION | | 11/16/2015 | | | 23,217 | | | | 210,000 | | | | 207,910 | | | | 1.44 | % |

| CNL Lifestyle Properties | | 2/2/2015 | | | 90,192 | | | | 320,334 | | | | 351,750 | | | | 2.43 | % |

| Corporate Capital Trust, Inc. | | 10/30/2015 | | | 22,462 | | | | 210,026 | | | | 207,995 | | | | 1.44 | % |

| Cottonwood Residential, Inc. | | 2/17/2015 | | | 34,440 | | | | 480,840 | | | | 530,032 | | | | 3.66 | % |

| Dividend Capital Diversified | | 6/2/2015 | | | 18,060 | | | | 110,503 | | | | 134,912 | | | | 0.93 | % |

| GPB Automotive Portfolio LP | | 3/13/2015 | | | 10 | | | | 500,000 | | | | 500,000 | | | | 3.46 | % |

| HMS Income Fund, Inc. | | 11/11/2015 | | | 18,605 | | | | 160,000 | | | | 146,605 | | | | 1.01 | % |

| Inventrust Properties Corp. | | 3/2/2015 | | | 136,771 | | | | 386,970 | | | | 547,084 | | | | 3.78 | % |

| KBS REIT | | 3/12/2015 | | | 74,531 | | | | 220,695 | | | | 293,652 | | | | 2.03 | % |

| Landmark Apartment Trust, Inc. | | 8/19/2015 | | | 1,000 | | | | 5,969 | | | | 8,150 | | | | 0.06 | % |

| PHI Single Index Option Fund, LP | | 12/23/2015 | | | — | | | | 450,000 | | | | 450,000 | | | | 3.11 | % |

| Semper Midas Fund LP | | 8/1/2015 | | | — | | | | 375,000 | | | | 365,628 | | | | 2.53 | % |

| Shopoff Land Fund III LP | | 4/29/2015 | | | 56 | | | | 50,680 | | | | 50,680 | | | | 0.35 | % |

| Uniprop Manufactured Housing Communities Inc. Fund I | | 8/31/2015 | | | 1,000 | | | | 8,275 | | | | 8,930 | | | | 0.06 | % |

| | | | | | | | | $ | 3,653,748 | | | $ | 4,068,495 | | | | | |

Subsequent events after the balance sheet date have been evaluated through the date the financial statements were issued.

The Fund completed a quarterly repurchase offer on February 1, 2016, and no shares were tendered.

On December 31, 2015, Realty Capital Securities, LLC (“RCS”) ceased its securities–related operations and filed a notice of inactivity with the Financial Industry Regulatory Authority, Inc. As a result, RCS ceased acting as the Fund’s principal underwriter and distributor. As of February 9, 2016, SQN Securities, LLC is the Fund’s principal underwriter and distributor. Additionally, effective March 14, 2016, UMB Fund Services, Inc. (“UMBFS”), 235 W. Galena St., Milwaukee, WI 53212, will replace RCS Advisory Services, LLC as the Fund’s administrator and Gemini Fund Services will no longer serve as the Fund’s sub-administrator and accounting agent. As of the same date, UMBFS will replace American National Stock Transfer, LLC as the Fund’s transfer agent, GFS will no longer serve as the Fund’s sub-transfer agent and UMB Bank, N.A., 1010 Grand Boulevard, Kansas City, Missouri 64106, will replace MUFG Union Bank, N.A. as the Fund’s custodian.

Management has concluded that there is no impact requiring adjustment or disclosure in the financial statements.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees and the Shareholders of

Wildermuth Endowment Strategy Fund

We have audited the accompanying statement of assets and liabilities of the Wildermuth Endowment Strategy Fund, including the schedule of investments, as of December 31, 2015, and the related statements of operations, cash flows and changes in net assets and the financial highlights for the period January 2, 2015 (commencement of operations) through December 31, 2015. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2015 by correspondence with the custodian, brokers and other appropriate parties. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

As explained in Note 2, the financial statements include investments valued at $4,068,495 (28% of net assets), whose fair values have been estimated under procedures established by the Board of Trustees in the absence of readily ascertainable fair values.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Wildermuth Endowment Strategy Fund as of December 31, 2015, and the results of its operations, cash flows, changes in its net assets and its financial highlights for the period January 2, 2015 through December 31, 2015, in conformity with accounting principles generally accepted in the United States of America.

| |  |

| | BBD, LLP |

Philadelphia, Pennsylvania

February 29, 2016

Approval of Advisory Agreement – Wildermuth Endowment Strategy Fund

At a meeting held on December 5, 2013 (the “Meeting”), the Board of Trustees (the “Board”) of Wildermuth Endowment Strategy Fund (the “Trust” or the “Fund”), including each of the Independent Trustees, considered the approval of an investment advisory agreement (the “Agreement”) between Wildermuth Advisory, LLC (“Wildermuth” or the “Adviser”) and the Trust, on behalf of the Wildermuth Endowment Strategy Fund.

In advance of the Meeting, the Board requested and received materials to assist them in considering the Agreement. The materials provided contained information with respect to the factors enumerated below, including the Agreement, a memorandum prepared by the Trust’s outside legal counsel discussing in detail the Trustees’ fiduciary obligations and the factors they should assess in considering the approval of the Agreement and comparative information relating to the advisory fee and other expenses of the Fund. The materials also included due diligence materials relating to Wildermuth (including a due diligence questionnaire completed by Wildermuth, selected financial information of Wildermuth, bibliographic information regarding Wildermuth’s key management and investment advisory personnel, and comparative fee information relating to the Fund) and other pertinent information. At the Meeting, the Independent Trustees were advised by counsel that is experienced in Investment Company Act of 1940 matters and that is independent of fund management and met with such counsel separately from fund management.

In its consideration of the Agreement, the Board relied upon the advice of independent legal counsel and their own business judgment in determining the material factors to be considered in evaluating the Agreement and the weight to be given to each such factor. The conclusions reached by the Board were based on a comprehensive evaluation of all of the information provided and were not the result of any one factor. Moreover, each Trustee may have afforded different weight to the various factors in reaching his conclusions with respect to the Agreement. In considering the approval of the Agreement, the Board reviewed and analyzed various factors that they determined were relevant, including the factors enumerated below:

Nature, Extent and Quality of Services. The Trustees reviewed materials provided by the Adviser that were included in the Board Materials relating to the approval of the proposed Management Agreement with the Trust, including the Adviser’s Form ADV, a description of the manner in which investment decisions are made and executed, a review of the professional personnel that would perform services for the Fund, including the team of individuals that primarily monitor and execute the investment process, and a certification from the Adviser stating that it has adopted a Code of Ethics containing provisions reasonably necessary to prevent Access Persons, as that term is defined in Rule 17j-1 under the 1940 Act, from engaging in conduct prohibited by Rule 17j-1(b) and that it has adopted procedures reasonably necessary to prevent Access Persons from violating such Codes of Ethics. The Board discussed the extent of the research capabilities, the quality of its compliance infrastructure and the experience of its fund management personnel. The Board considered that the Adviser is a newly registered entity formed to advise the Fund. The Board considered that the Adviser is an affiliate of Kalos Capital, Inc., an independent broker/dealer and Kalos Management, Inc. (“Kalos”) a registered investment adviser, and that each entity has a significant amount of expertise in distribution and

marketing and asset management, respectively, and considered the research capabilities, investment experience, compliance program and marketing efforts to be provided to the Fund by the Adviser. Additionally, the Board received satisfactory responses from the Adviser with respect to a series of important questions, including: whether it was involved in any pending regulatory actions; whether the management of other accounts would conflict with its management of the Fund; and whether there are procedures in place to adequately allocate trades among its respective clients. The Board then reviewed the capitalization of Adviser based on information provided by and representations made by the Adviser and concluded that the Adviser was sufficiently well-capitalized, or had the ability to make additional contributions in order to meet its obligations to the Fund. The Trustees then concluded that the Adviser had sufficient quality and depth of personnel, resources, investment methods and compliance policies and procedures essential to performing its duties under the Advisory Agreement and that the nature, overall quality and extent of the management services to be provided by the Adviser to the Trust were satisfactory and reliable.

Performance. The Trustees considered that the Adviser is newly formed and did not have a record of prior performance to submit at the Meeting. The Trustees noted that the Adviser had not managed a fund or separate account with a strategy similar to the Fund. The Board noted, however, that Fund’s portfolio management team had managed strategies that would comprise some of the components of the Fund’s overall diversified strategy at Kalos Management, an affiliate of the Adviser. Accordingly, the Trustees discussed the prior performance of these different component investment strategies. The Trustees concluded that the Adviser was expected to obtain an acceptable level of investment return for shareholders.

Fees and Expenses. As to the costs of the services to be provided and profits to be realized by the Adviser, the Trustees considered that the Adviser proposed to charge a management fee of 1.50% of the Fund’s average net assets. The Trustees compared the proposed fee and total operating expense data against a peer group comprised of funds selected by the Adviser with similar investment objectives and strategies and of similar anticipated size. The Trustees noted that the Adviser’s peer group was comprised of funds that offer similar investment strategies, but that the investment strategy offered by the Fund is an aggregate of several strategies, certain of which are not offered by a comparable mutual fund, and which employ a high degree of sophistication to manage successfully. The Board noted that the proposed management fee was higher than the median of the peer group, but was not the highest. The Trustees also reviewed the contractual expense limitation arrangements for the Fund, which stated that the Adviser has agreed to waive or limit its management fee and/or reimburse expenses to limit net annual operating expenses to 2.50% of the Fund’s net assets. After due consideration, the Trustees concluded that, based on the Adviser’s and portfolio management teams experience and expertise, the sophistication of the investment strategy and the services to be provided to the Fund, the management fee was reasonable and that the expense limitation arrangement was in the best interests of the Fund and its future shareholders.

Profitability. The Trustees also considered the level of profits that could be expected to accrue to the Adviser with respect to the Trust. The Trustees reviewed and considered an estimated profitability report and analysis and selected financial information provided by the Adviser. With respect to the Adviser, the Trustees concluded that based on the services provided

and the projected growth of the Trust, the anticipated profits from the Adviser’s relationship with the Trust were not excessive.

Economies of Scale. The Trustees considered whether the Fund will realize economies of scale and whether shareholders would benefit from those economies of scale. The Trustees considered that the Fund had not yet commenced operations and that material economies of scale may not be achieved in the near term, and so economies of scale was not a relevant consideration at this time. The Trustees took into account that economies of scale may be considered in the future.

Conclusion. Having requested and received such information from the Adviser as the Trustees believed to be reasonably necessary to evaluate the terms of the Management Agreement, and as assisted by the advice of independent counsel, the Board, including a majority of the Independent Trustees, determined that approval of the Management Agreement was in the best interests of the Trust and its future shareholders. In considering the Management Agreement, the Trustees did not identify any one factor as all important, but rather considered these factors collectively in light of the Trust’s surrounding circumstances.

| Wildermuth Endowment Strategy Fund |

| Trustees and Officers (Unaudited) |

| December 31, 2015 |

Trustees

Following is a list of the trustees of the Trust and their principal occupation over the last five years.

Independent Trustees

Name, Age,

Address* | Position/Term

of Office** | Principal Occupation(s)

During Past 5 Years | Number of Portfolios

Overseen in Fund

Complex*** | Other Directorships

Held by Trustee

During Last 5 Years |

Anthony

Lewis,