2017 Annual Shareholder Meeting Prime Meridian Holding Company | OTCQX: PMHG Filed Pursuant to Rule 433 Registration No. 333-216974 May 4, 2017

Forward Looking Statements This Presentation, including information incorporated herein by reference, may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “may,” “could,” “should,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “intend,” “plan,” “project,” “is confident that,” and similar expressions are intended to identify these forward-looking statements. These forward-looking statements involve risk and uncertainty and a variety of factors could cause our actual results and experience to differ materially from the anticipated results or other expectations expressed in these forward-looking statements. We do not have a policy of updating or revising forward looking statements except as otherwise required by law, and silence by management over time should not be construed to mean that actual events are occurring as estimated in such forward-looking statements. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors that could have a material adverse effect on our operations and the operations of our subsidiary, Prime Meridian Bank, include, but are not limited to, changes in: risk factors named in the Prospectus general economic conditions legislative/regulatory changes monetary and fiscal policies of the U.S. Government the quality and composition of our loan or investment portfolios competition demand for loan and deposit products demand for financial services in our primary trade area litigation, tax, and other regulatory matters accounting principles and guidelines other economic, competitive, governmental, regulatory, or technological factors affecting us The factors listed above should not be construed as exhaustive. A number of important factors could cause actual results to differ materially from those indicated by the forward-looking statements. Information on these factors can be found in the Company’s Registration Statement on Form S-1, as amended, filed with the Securities and Exchange Commission on March 28, 2017, and other reports and statements Prime Meridian Holding Company has filed with the Securities and Exchange Commission which are available at its website (www.sec.gov). We do not have a policy of updating or revising forward-looking statements except as otherwise required by law, and silence by management over time should not be construed to mean that actual events are occurring as estimated in such forward-looking statements.

Financial Information 24

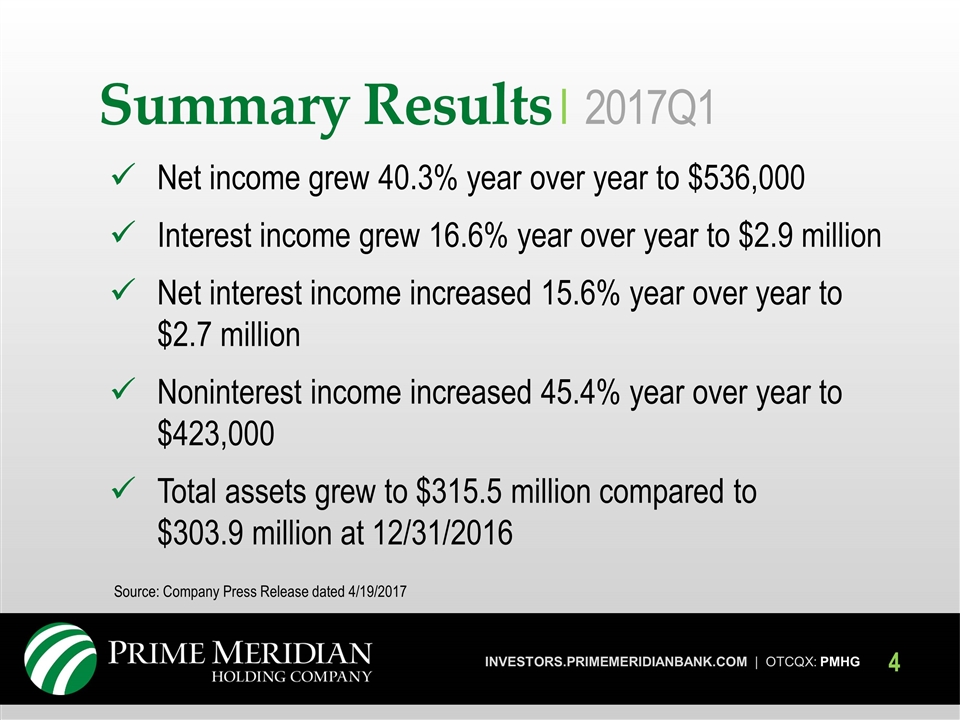

Net income grew 40.3% year over year to $536,000 Interest income grew 16.6% year over year to $2.9 million Net interest income increased 15.6% year over year to $2.7 million Noninterest income increased 45.4% year over year to $423,000 Total assets grew to $315.5 million compared to $303.9 million at 12/31/2016 Summary Results| 2017Q1 Source: Company Press Release dated 4/19/2017

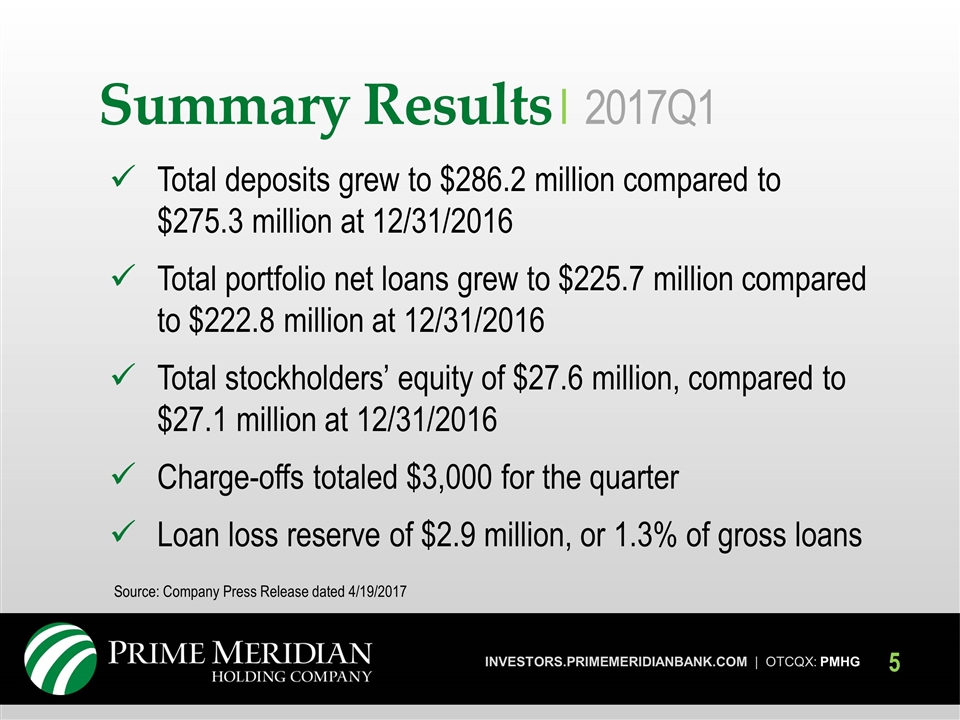

Total deposits grew to $286.2 million compared to $275.3 million at 12/31/2016 Total portfolio net loans grew to $225.7 million compared to $222.8 million at 12/31/2016 Total stockholders’ equity of $27.6 million, compared to $27.1 million at 12/31/2016 Charge-offs totaled $3,000 for the quarter Loan loss reserve of $2.9 million, or 1.3% of gross loans Summary Results| 2017Q1 Source: Company Press Release dated 4/19/2017

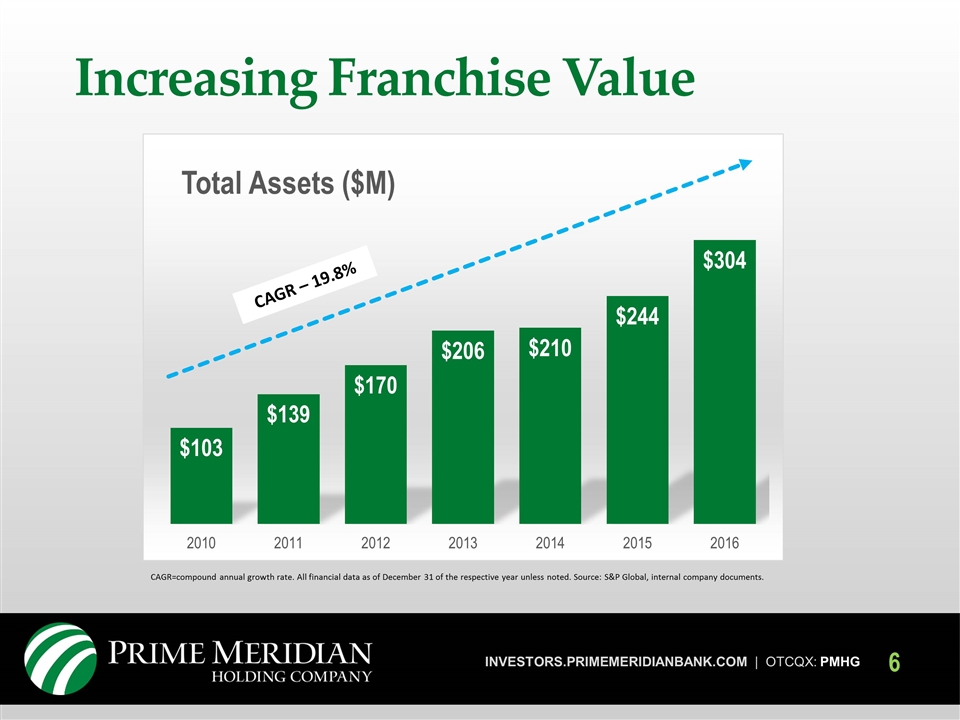

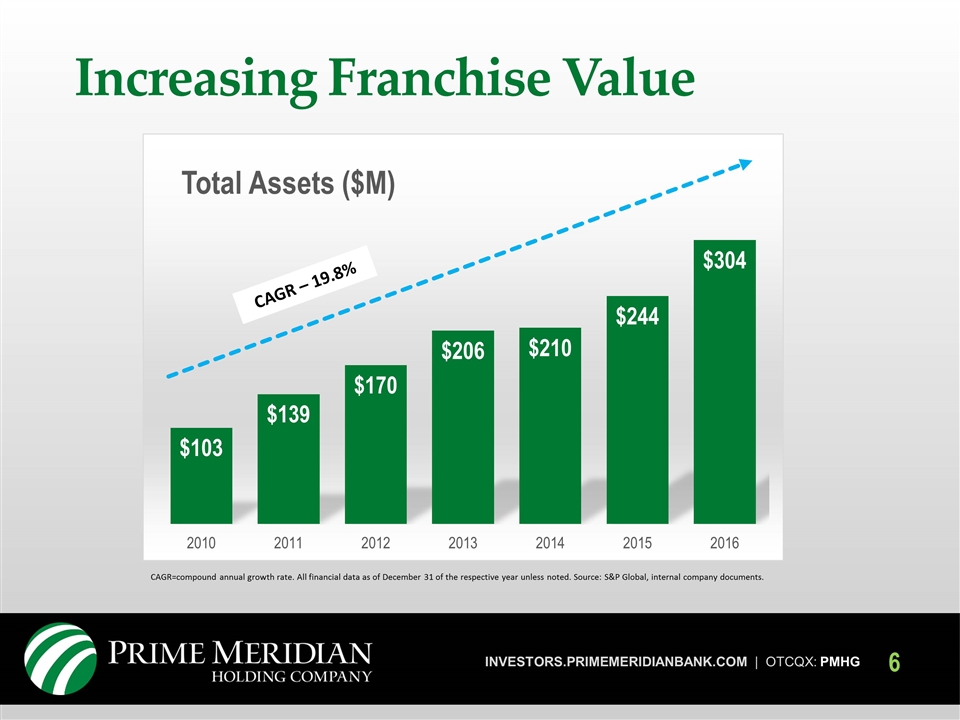

CAGR=compound annual growth rate. All financial data as of December 31 of the respective year unless noted. Source: S&P Global, internal company documents. CAGR – 19.8% Increasing Franchise Value

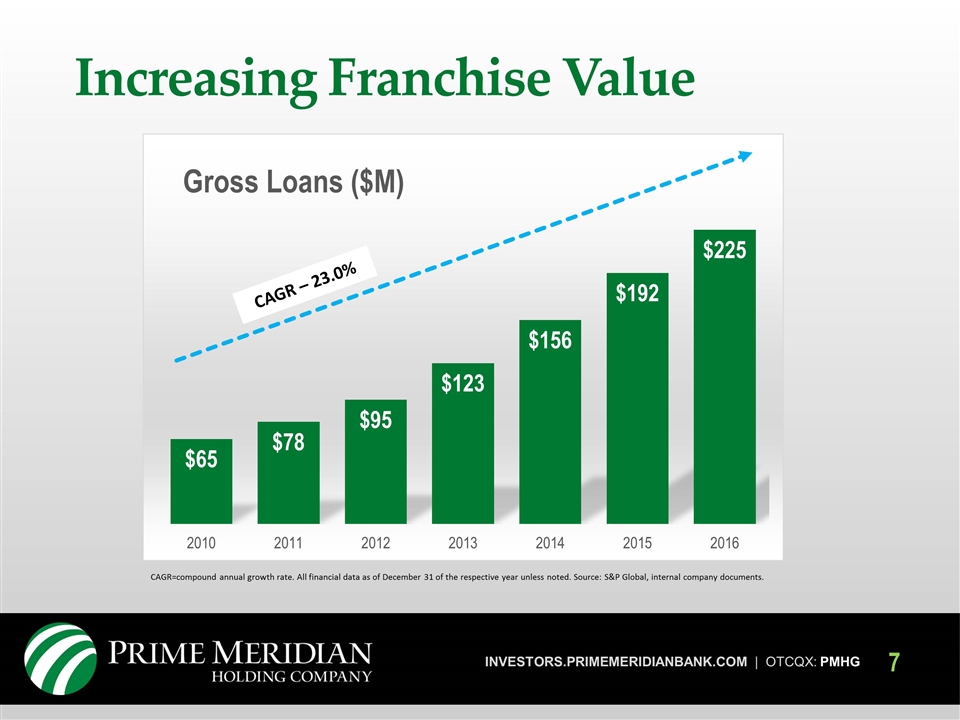

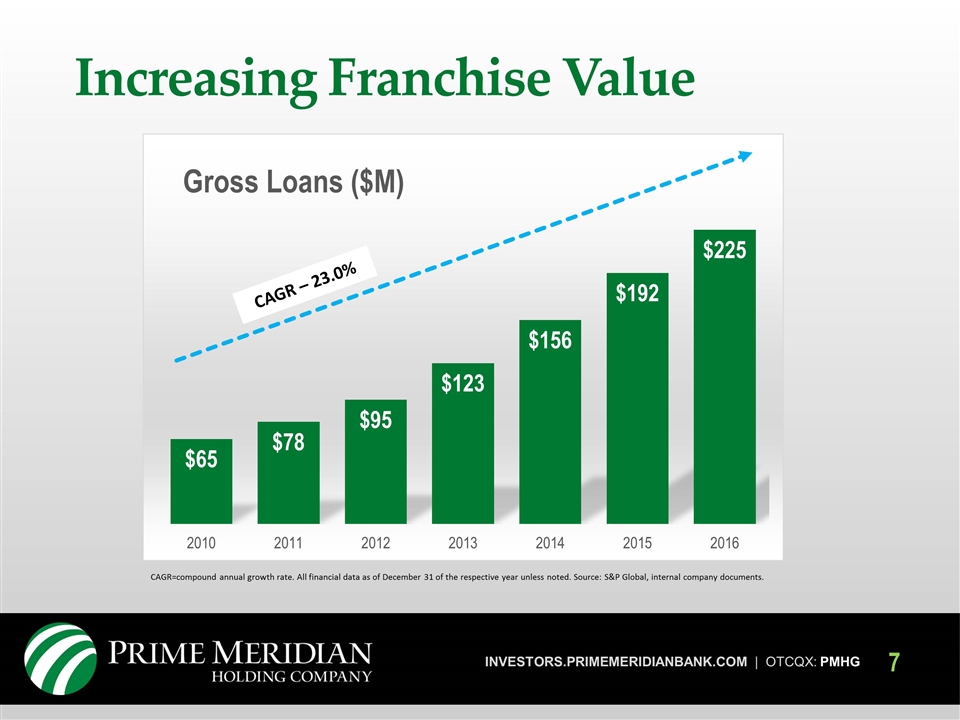

CAGR – 23.0% Increasing Franchise Value CAGR=compound annual growth rate. All financial data as of December 31 of the respective year unless noted. Source: S&P Global, internal company documents.

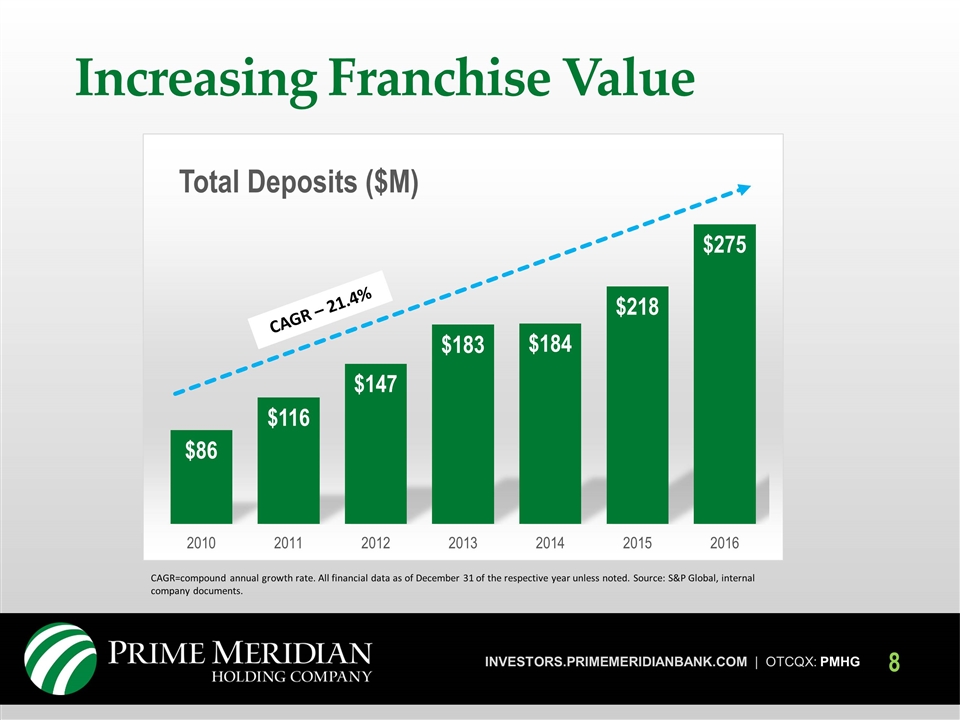

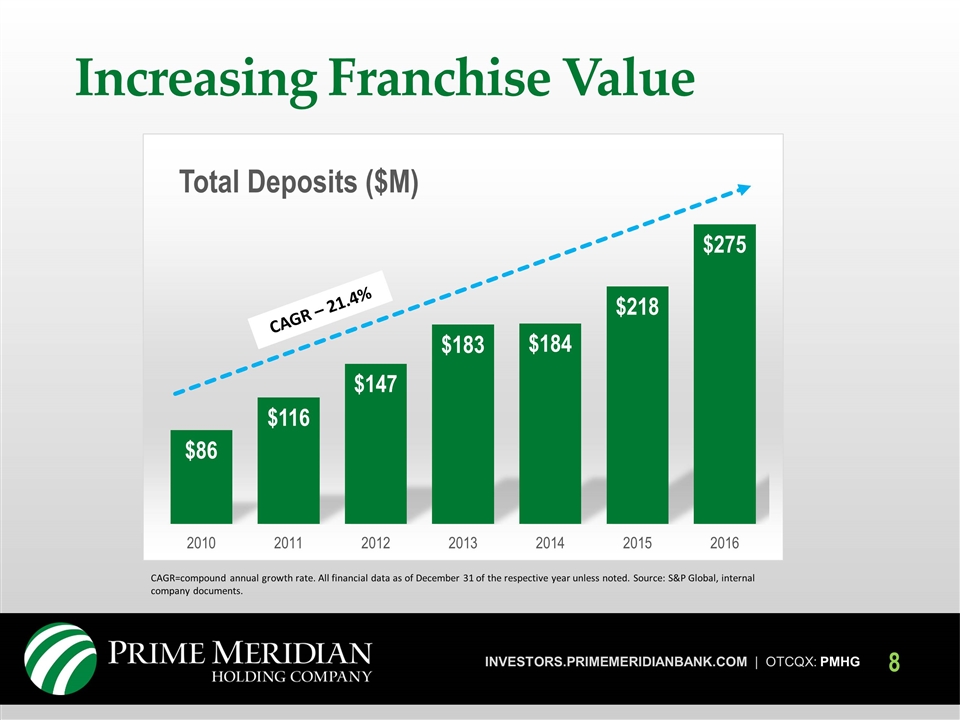

CAGR – 21.4% Increasing Franchise Value CAGR=compound annual growth rate. All financial data as of December 31 of the respective year unless noted. Source: S&P Global, internal company documents.

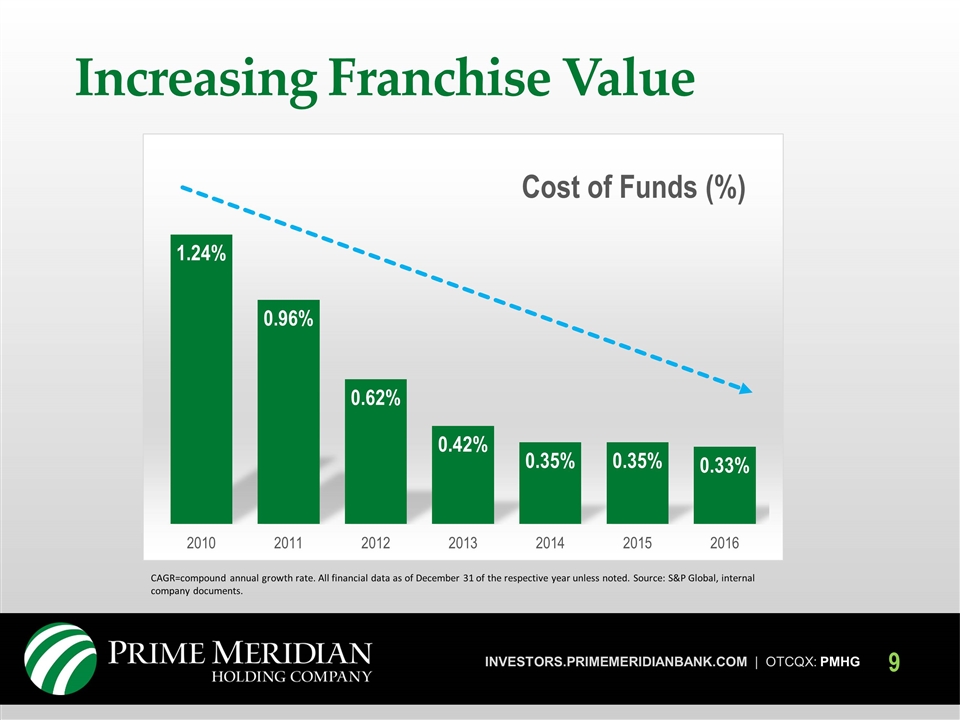

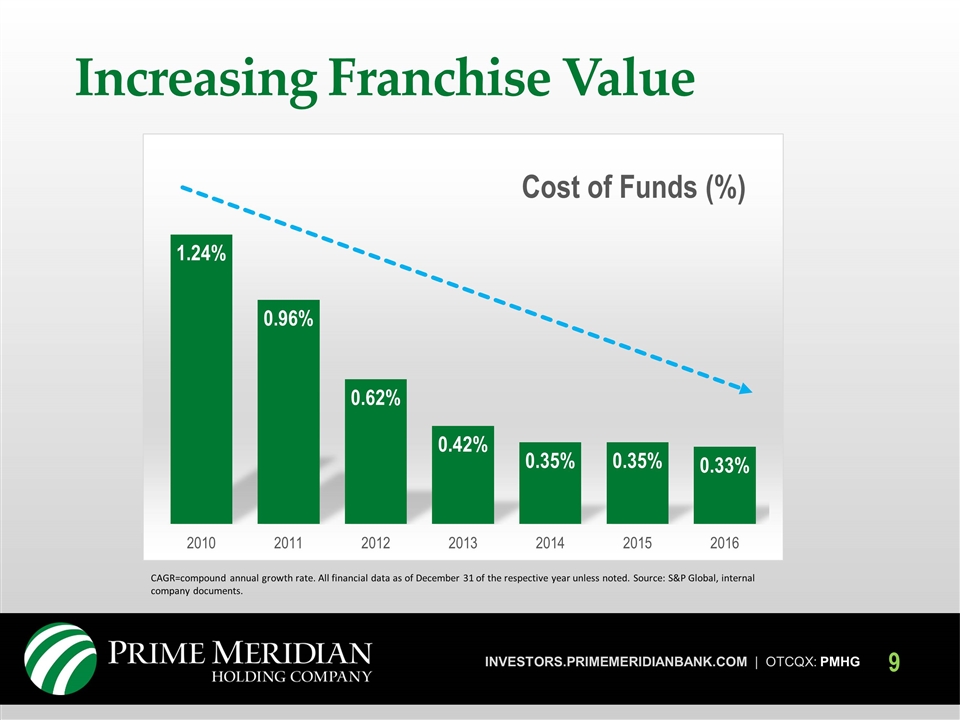

Increasing Franchise Value CAGR=compound annual growth rate. All financial data as of December 31 of the respective year unless noted. Source: S&P Global, internal company documents.

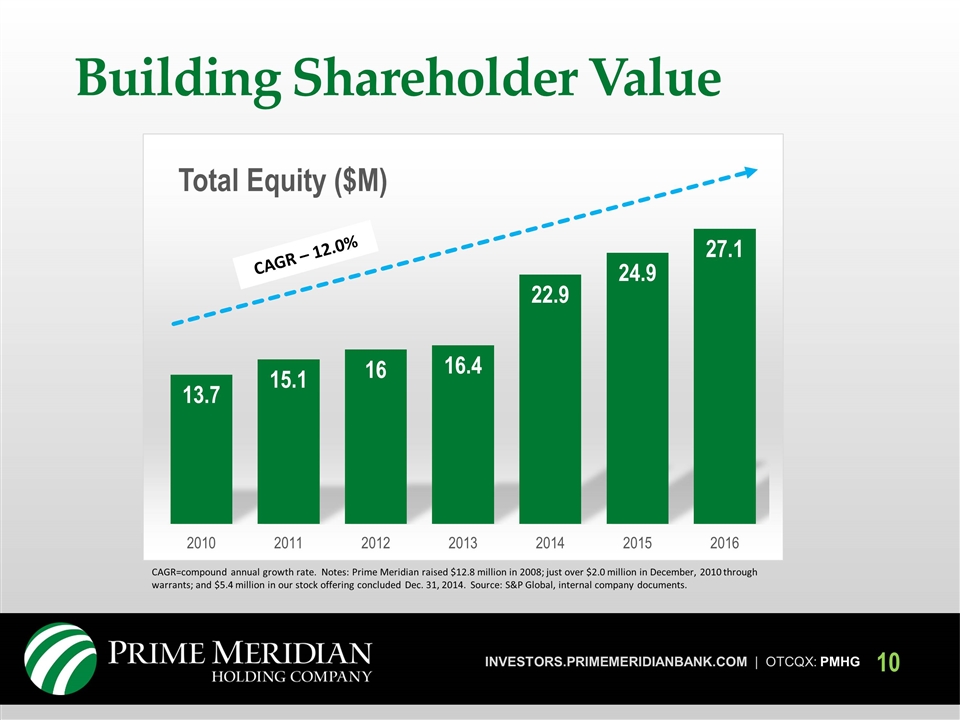

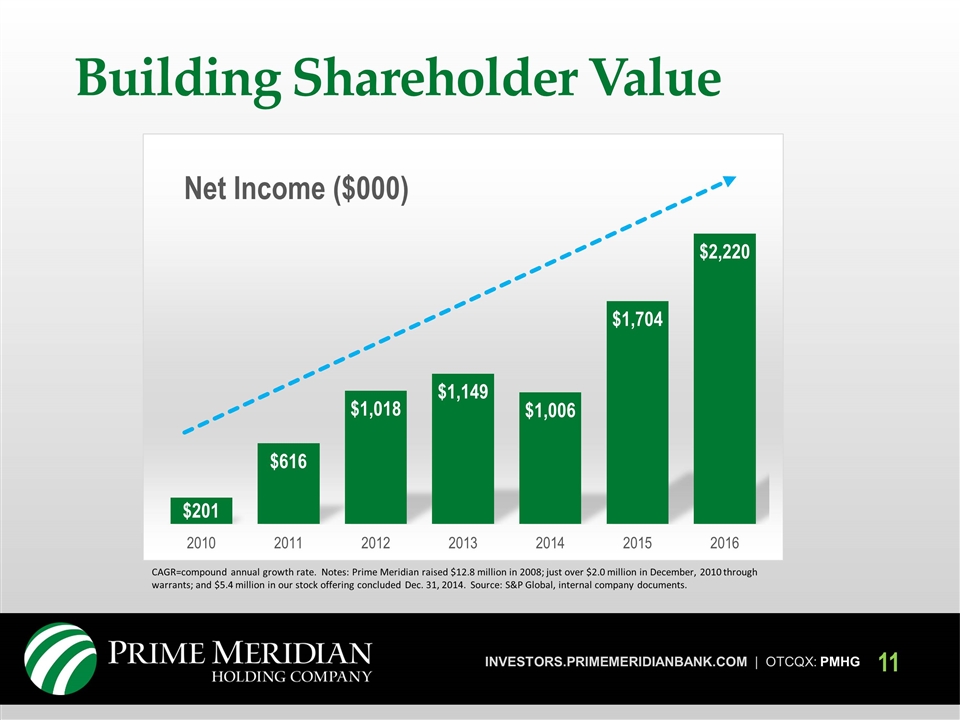

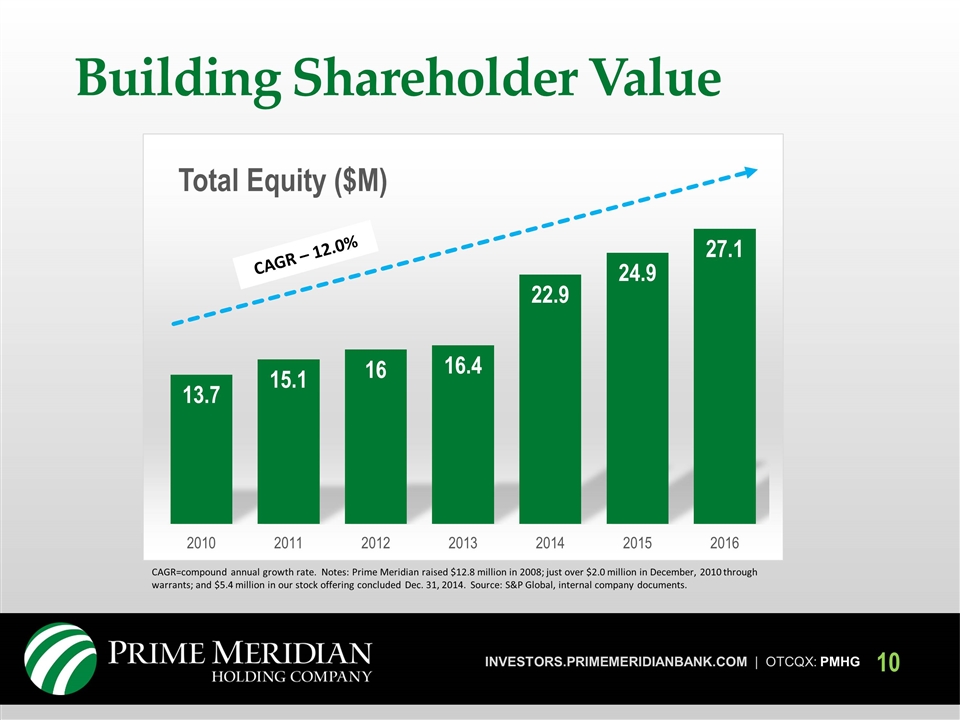

CAGR=compound annual growth rate. Notes: Prime Meridian raised $12.8 million in 2008; just over $2.0 million in December, 2010 through warrants; and $5.4 million in our stock offering concluded Dec. 31, 2014. Source: S&P Global, internal company documents. CAGR – 12.0% Building Shareholder Value

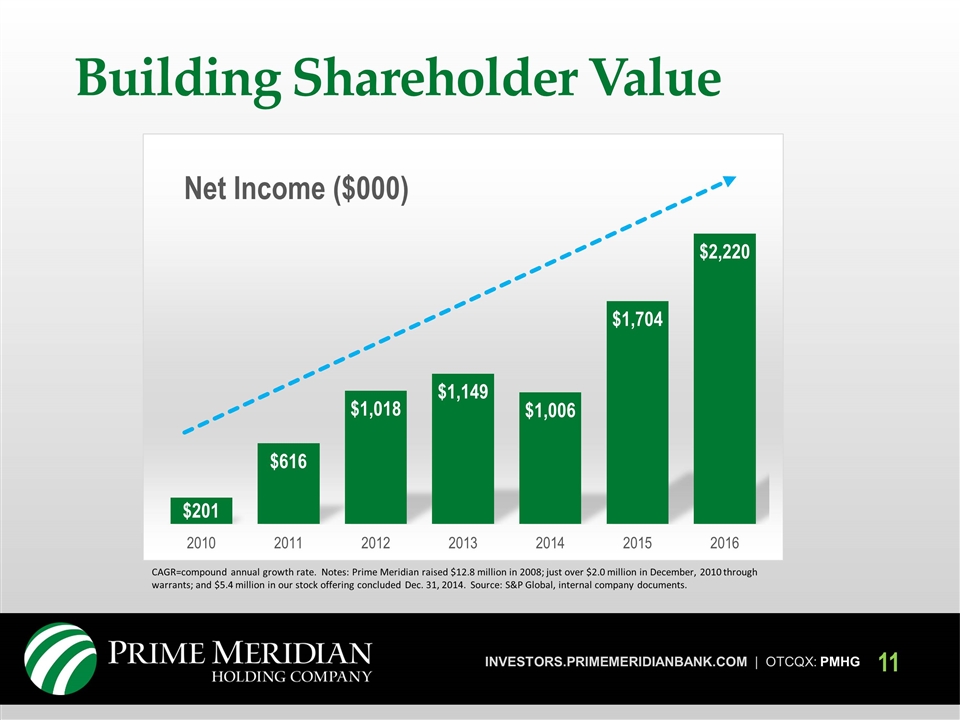

CAGR=compound annual growth rate. Notes: Prime Meridian raised $12.8 million in 2008; just over $2.0 million in December, 2010 through warrants; and $5.4 million in our stock offering concluded Dec. 31, 2014. Source: S&P Global, internal company documents. Building Shareholder Value

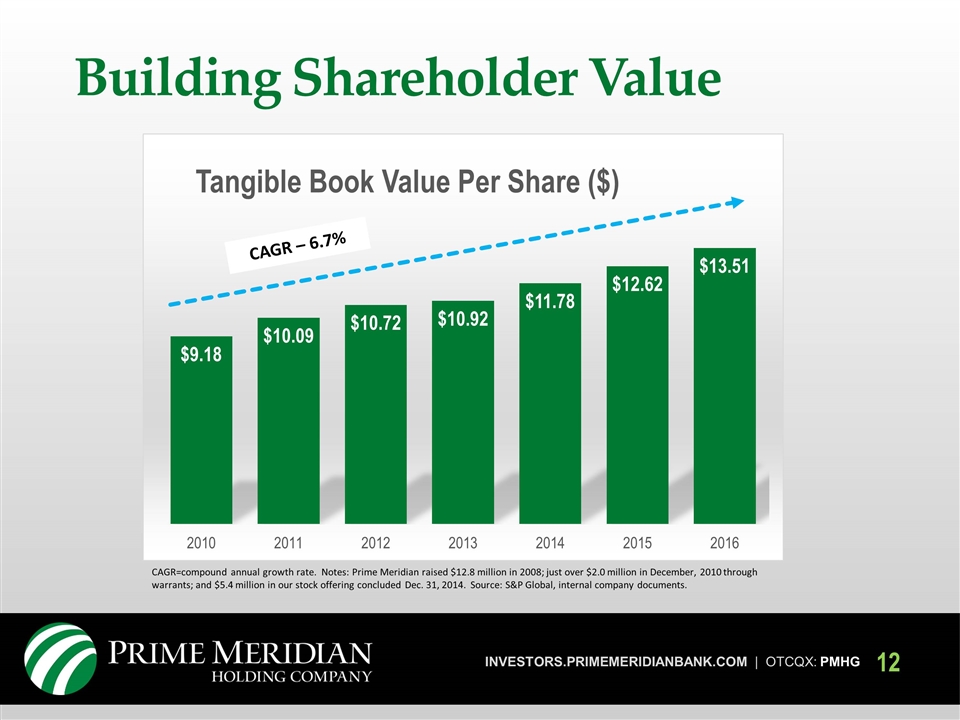

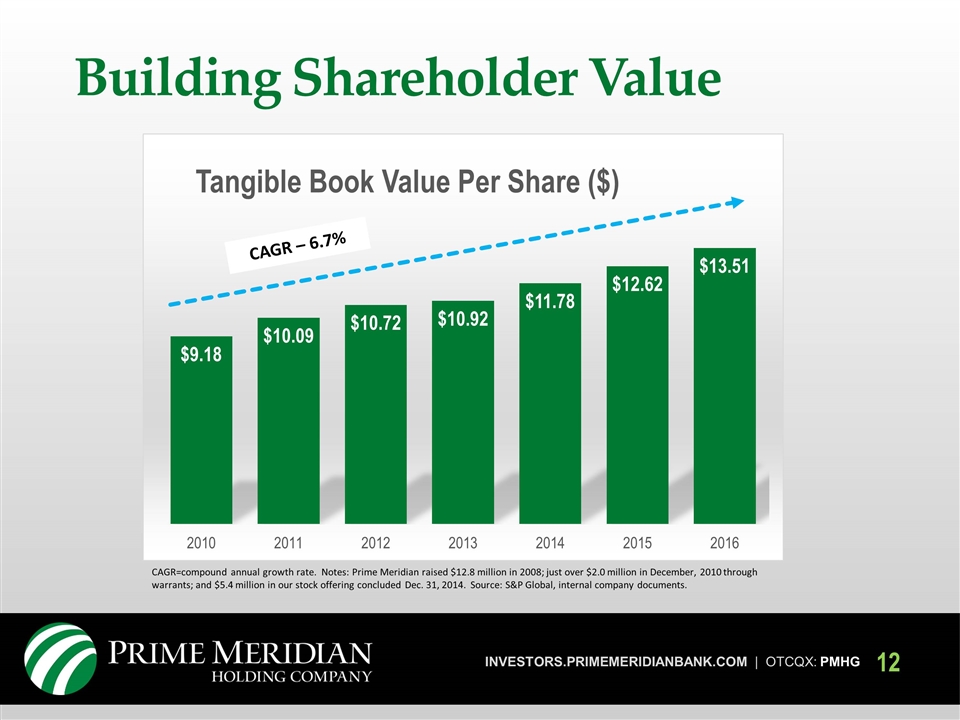

CAGR=compound annual growth rate. Notes: Prime Meridian raised $12.8 million in 2008; just over $2.0 million in December, 2010 through warrants; and $5.4 million in our stock offering concluded Dec. 31, 2014. Source: S&P Global, internal company documents. CAGR – 6.7% Building Shareholder Value

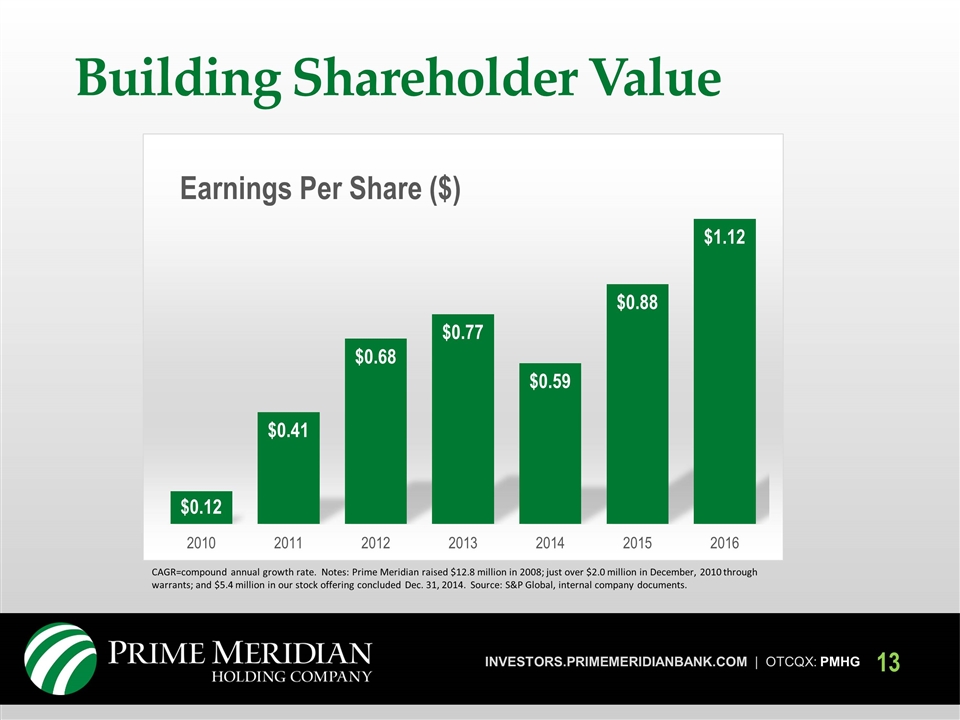

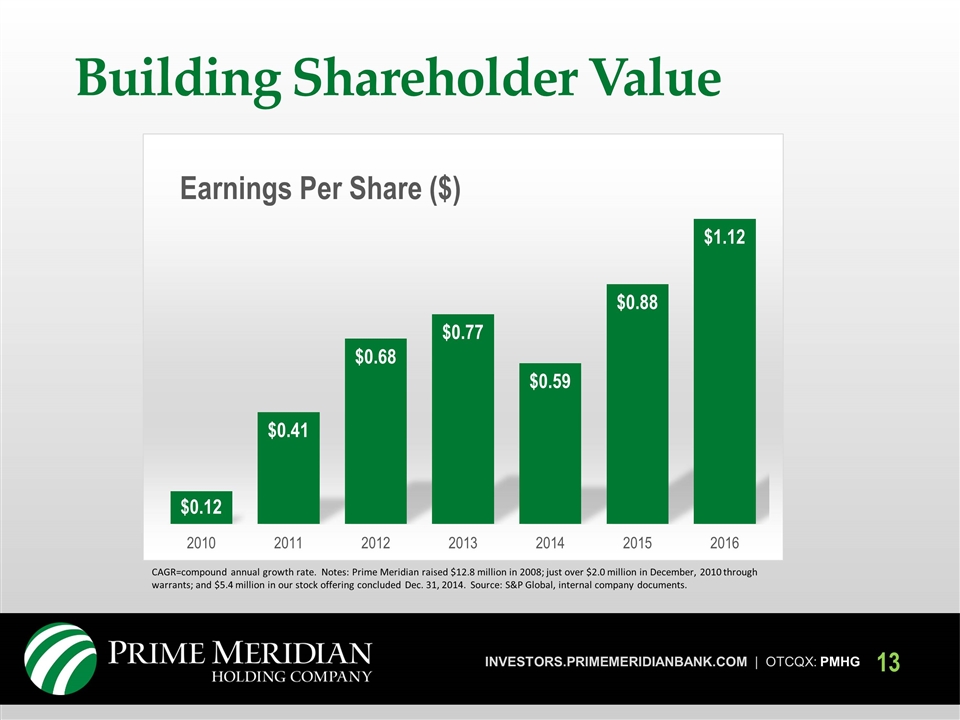

CAGR=compound annual growth rate. Notes: Prime Meridian raised $12.8 million in 2008; just over $2.0 million in December, 2010 through warrants; and $5.4 million in our stock offering concluded Dec. 31, 2014. Source: S&P Global, internal company documents. Building Shareholder Value

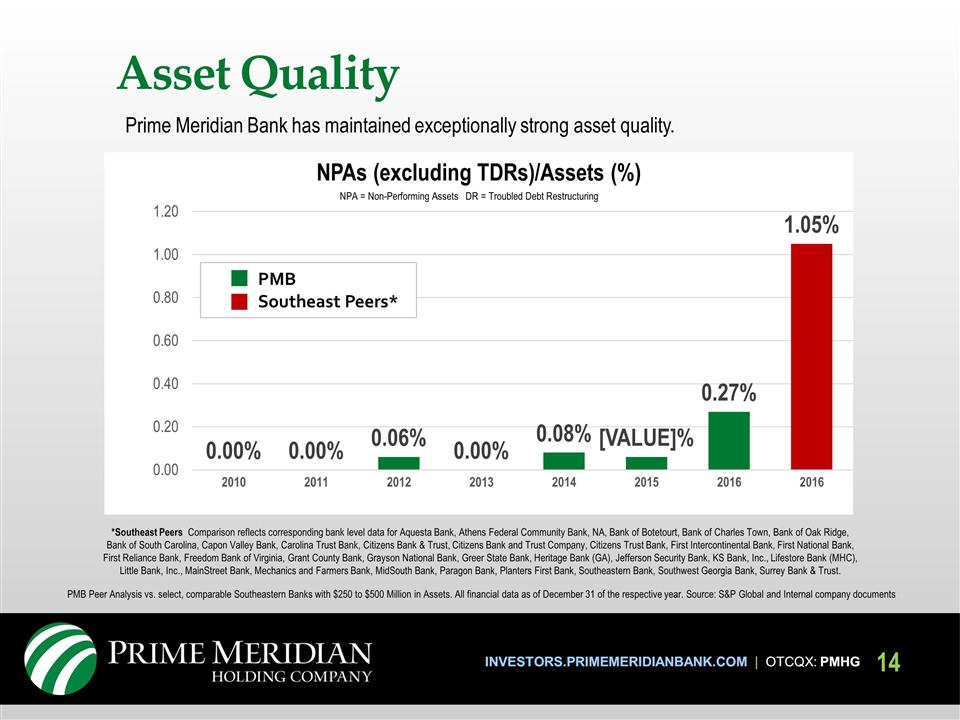

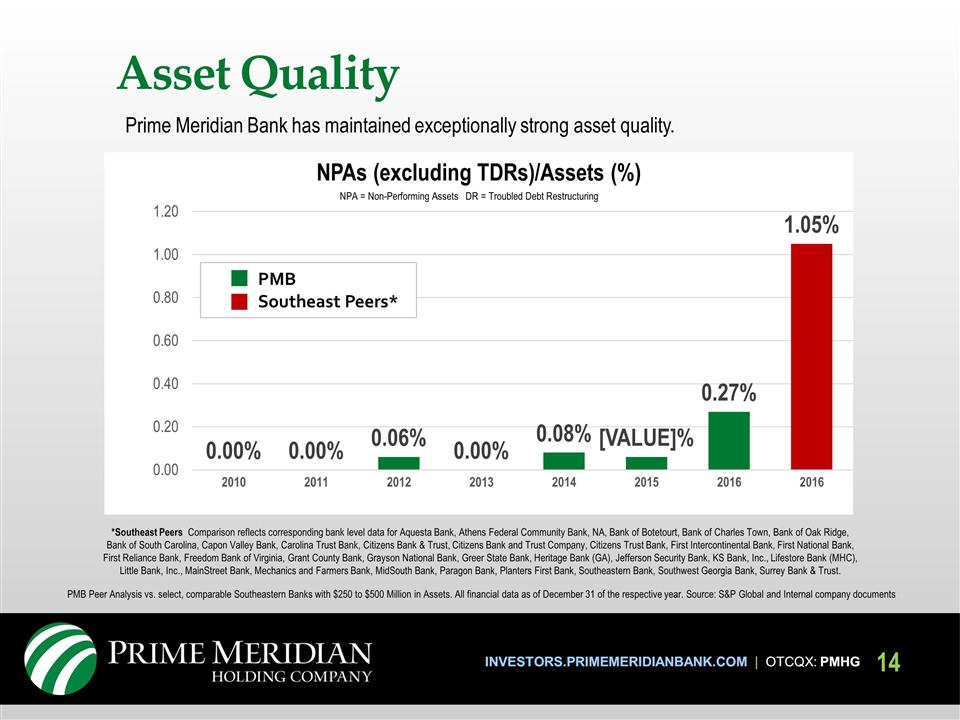

INVESTORS.PRIMEMERIDIANBANK.COM | OTCQX: PMHG Prime Meridian Bank has maintained exceptionally strong asset quality. PMB Peer Analysis vs. select, comparable Southeastern Banks with $250 to $500 Million in Assets. All financial data as of December 31 of the respective year. Source: S&P Global and Internal company documents NPAs (excluding TDRs)/Assets (%) *Southeast Peers Comparison reflects corresponding bank level data for Aquesta Bank, Athens Federal Community Bank, NA, Bank of Botetourt, Bank of Charles Town, Bank of Oak Ridge, Bank of South Carolina, Capon Valley Bank, Carolina Trust Bank, Citizens Bank & Trust, Citizens Bank and Trust Company, Citizens Trust Bank, First Intercontinental Bank, First National Bank, First Reliance Bank, Freedom Bank of Virginia, Grant County Bank, Grayson National Bank, Greer State Bank, Heritage Bank (GA), Jefferson Security Bank, KS Bank, Inc., Lifestore Bank (MHC), Little Bank, Inc., MainStreet Bank, Mechanics and Farmers Bank, MidSouth Bank, Paragon Bank, Planters First Bank, Southeastern Bank, Southwest Georgia Bank, Surrey Bank & Trust. Asset Quality NPA = Non-Performing Assets DR = Troubled Debt Restructuring PMB Southeast Peers*

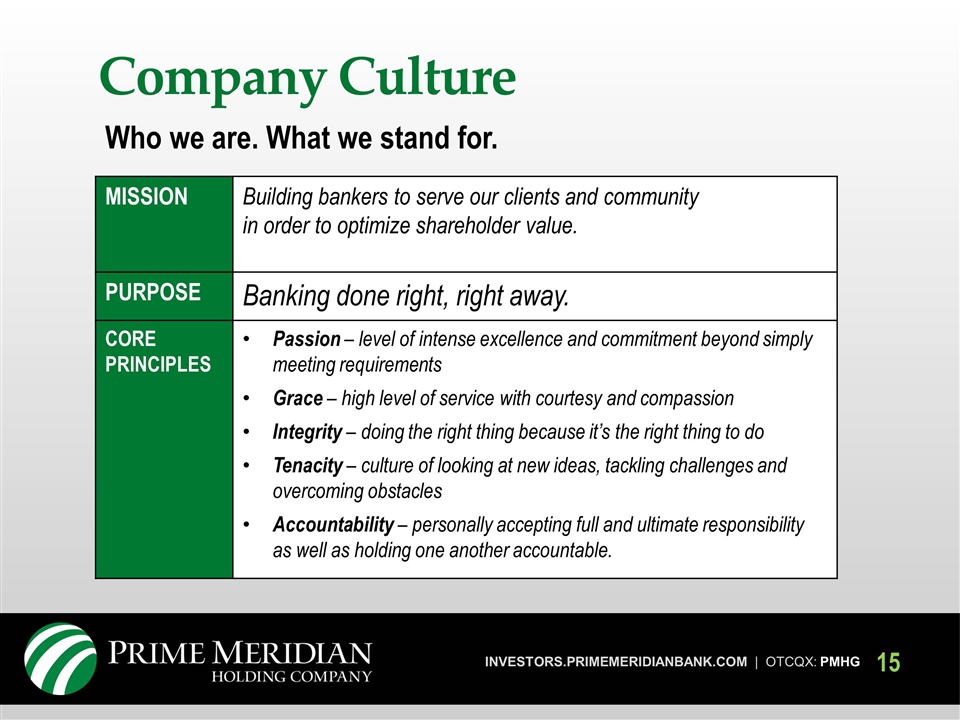

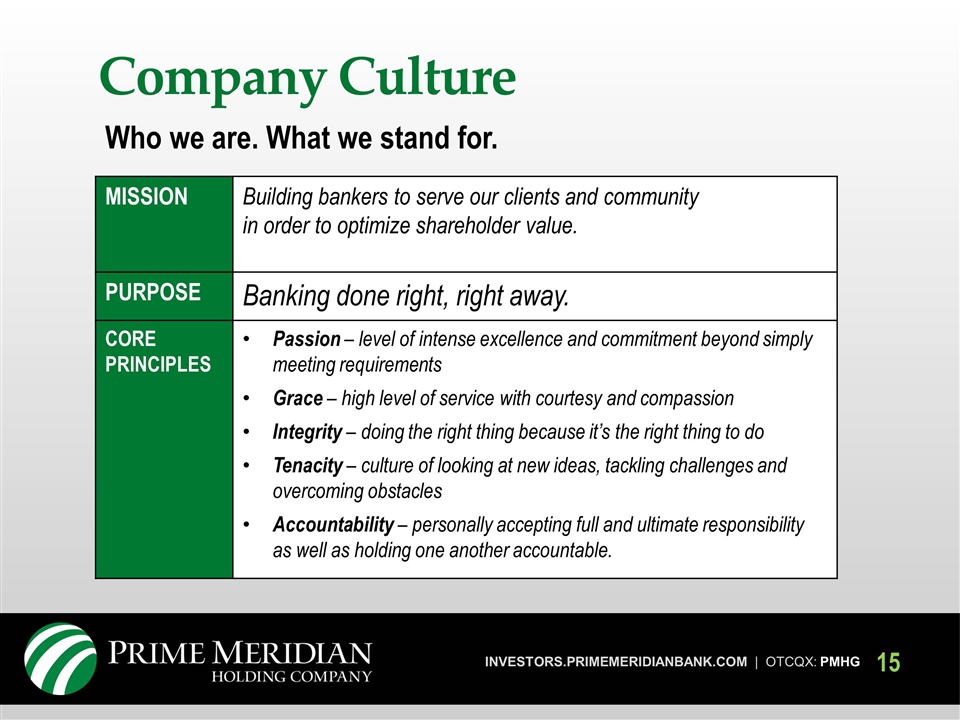

Company Culture MISSION Building bankers to serve our clients and community in order to optimize shareholder value. PURPOSE Banking done right, right away. CORE PRINCIPLES Passion – level of intense excellence and commitment beyond simply meeting requirements Grace – high level of service with courtesy and compassion Integrity – doing the right thing because it’s the right thing to do Tenacity – culture of looking at new ideas, tackling challenges and overcoming obstacles Accountability – personally accepting full and ultimate responsibility as well as holding one another accountable. Who we are. What we stand for.

Sep 2016PMB ranked #23 nationally in American Banker annual survey of Best Banks to Work For Dec 2016 Permanent office in Crawfordville completed. This market continues to fuel healthy deposit growth having collected over $30 million since opening in Sept. 2015 Mar 2017PMHG pays second annual dividend Mar 2017Company files registration statement with SEC for $15 million stock offering Achievements | 2016-2017

Successful capital raise Continue to evaluate acquisition and/or branching opportunities Grow our mortgage department to be the top originator in the market Assess current and emerging products and services that capitalize on market conditions Goals | 2017-2018

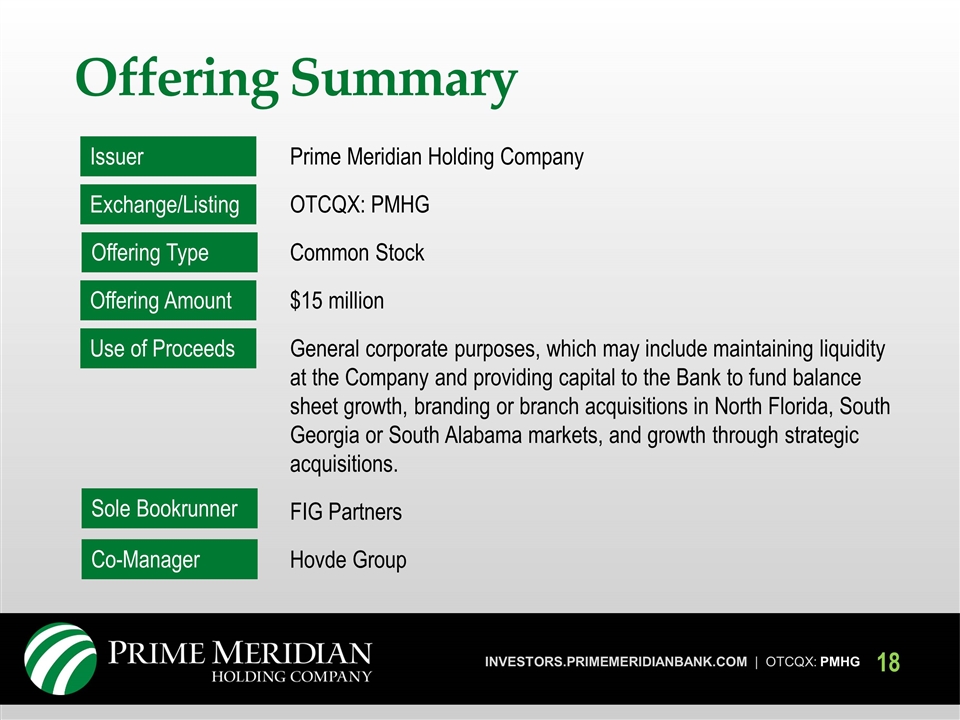

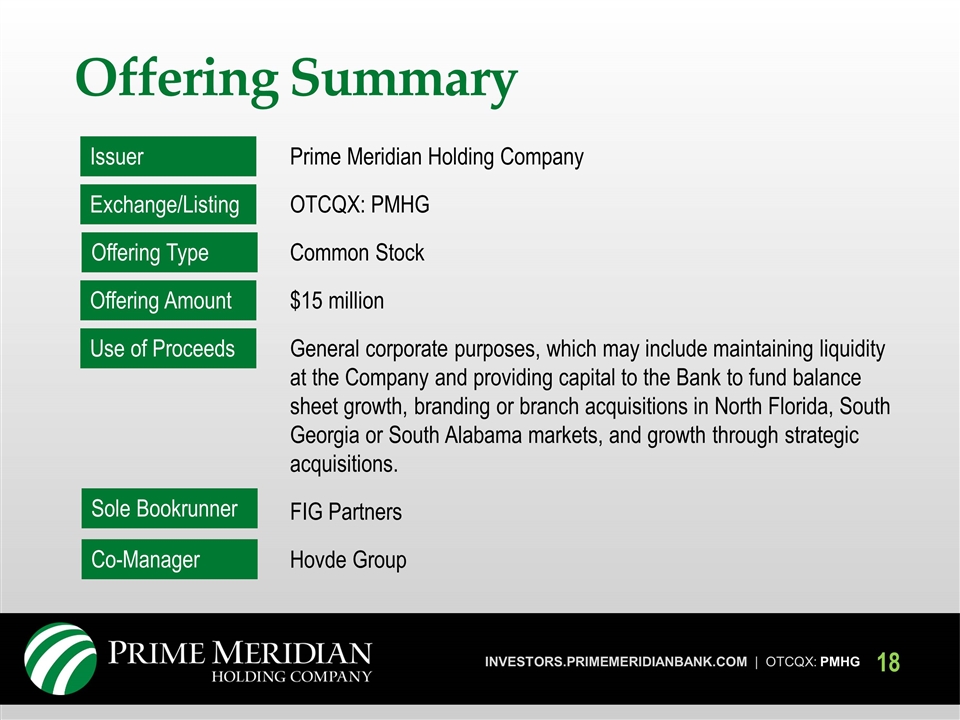

Offering Summary Prime Meridian Holding Company OTCQX: PMHG Common Stock $15 million General corporate purposes, which may include maintaining liquidity at the Company and providing capital to the Bank to fund balance sheet growth, branding or branch acquisitions in North Florida, South Georgia or South Alabama markets, and growth through strategic acquisitions. FIG Partners Hovde Group Issuer Exchange/Listing Offering Type Offering Amount Use of Proceeds Sole Bookrunner Co-Manager

24 Questions? Investors.PrimeMeridianBank.com OTCMarkets.com (PHMG) Neither of these websites, nor the information on the websites, is included or incorporated in or is otherwise a part of this presentation, the Registration Statement or any other offering documents.

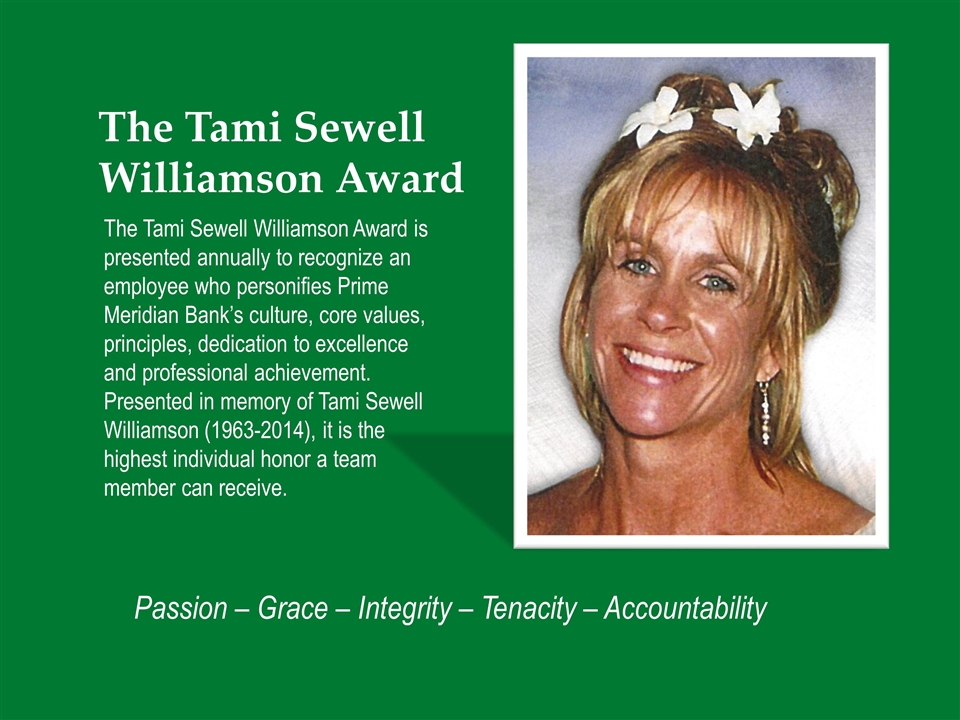

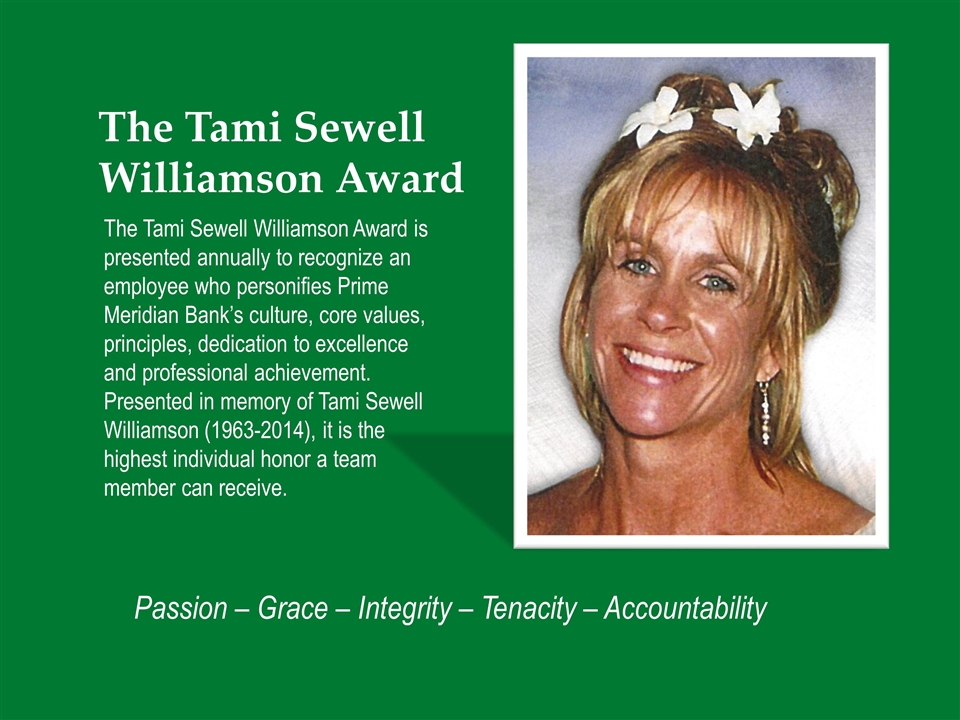

The Tami Sewell Williamson Award Passion – Grace – Integrity – Tenacity – Accountability The Tami Sewell Williamson Award is presented annually to recognize an employee who personifies Prime Meridian Bank’s culture, core values, principles, dedication to excellence and professional achievement. Presented in memory of Tami Sewell Williamson (1963-2014), it is the highest individual honor a team member can receive.

Monté Ward (2015) Arden Fernandez (2016) Previous Recipients Tami Award